1. Introduction

Sustainability is an indispensable element of the energy sector growth. This in turn entails the need to disclose non-financial information in three areas: environmental (E), social (S) and governance (G). Sustainability reporting has a relatively short track record, dating back to the beginning of the 20th century [

1]. However, intensive development of this form of communication with stakeholders has been on the rise since the 1990s.

In Poland, sustainability reporting became obligatory for major public interest entities in 2017. Soon, as a result the recently published new EU Corporate Sustainability Reporting Directive [

2], the non-financial reporting obligation will be imposed on all major entities, both listed and unlisted (since 2025), and later small and medium listed companies (since 2026) will also be obliged. Changes to non-financial reporting have been regularly introduced—for example, since 2021 it has been mandatory to publish concrete financial data such as revenues, OPEX (operating expenses) and CAPEX (capital expenditures). It therefore seems reasonable to expect that along with the development of the legal framework regarding non-financial reporting and the growing experience of the reporting companies, the extent of disclosed information should also be increasing. This is confirmed i.a. by [

3,

4,

5,

6].

The literature on the subject also identifies other factors that may affect the extent of presented non-financial information. According to [

7,

8], the extent of disclosures depends on the enterprise size measured by its balance sheet total, revenue amount, or employment size. Ali, Frynas, Mahmood [

9] looked for relations with other determinants such as political, social, and cultural factors. There are also voices that the market value of an enterprise has an impact on the extent of information disclosed in sustainability reports [

10,

11], even though not all of the researchers share the opinion [

12,

13]. In the case of energy companies, due to the specific nature of their operations, sustainability reporting focuses mainly on environmental disclosures. These have received extensive coverage in the literature [

14,

15,

16]. Much less attention has been given to social disclosures which after all are equally important in the sustainability context, and which should be addressed regardless of the sector/industry where the company operates. All the above inclined us to tackle this very issue in order to fill this research gap. Due to the lack of a single universal tool for sustainability reporting evaluation, which causes i.a. comparability difficulties [

17], we decided to use a methodology ensuring an objective and detailed assessment of social disclosures. Thus, we hope to contribute to the scientific discussion on sustainability reporting. A specific research procedure and tools were also applied, which allowed the (quantitative and qualitative) assessment of the extent of sustainability reporting. Moreover, we analyzed the relationship between the extent of disclosures, the experience in sustainability reporting, and the enterprise value. It is true that there have already been research studies focusing on the relationship between the enterprise value and the extent of their social disclosures. However, we—according to our knowledge—are examining it for the first time based on the example of the energy sector in Poland, and by additionally taking into account the companies’ experience in sustainability reporting.

The main objective of this paper is a multi-faceted evaluation of sustainability reports published by the Polish energy companies, from the perspective of social disclosures. The companies’ engagement in sustainability reporting responds, first of all, to the expectations and needs of stakeholders. Secondly, it is to meet the requirements set by regulatory institutions (e.g., GRI), which confirms that social disclosures are as important as other reporting areas (E and G). It is worth noticing that as many as 50% of companies take strategic measures in sustainability reporting [

18], which supports the claim about the relevance of social disclosures. To attain the main objective, it was necessary to formulate two subsidiary objectives:

A comparative analysis of social disclosures made by the WIG-Energia companies against the background of the WIG20 companies.

Evaluation of the correlation between the market value of the companies in the energy sector and the extent of social disclosures.

Sustainability reports provide stakeholders with valuable information, the importance of which can be justified by the legitimacy theory and the stakeholder theory [

19,

20]. Legitimacy in an enterprise relates to the subordination to social norms and the law [

21], and can be added as well to stakeholders’ expectations, because corporate decisions relating to social disclosures should be primarily focused on the information needs of stakeholders [

22]. It seems that both theories can underlie the hypotheses.

There is no universally applicable template for a sustainability report, therefore the scope and quality of disclosures presented by enterprises are to some extent voluntary. Therefore, in the light of the stakeholder theory, it can be stated that the desire to meet the growing expectations of stakeholders affects the scope of the presented disclosures and causes the number of disclosures to increase year by year, hence the following hypothesis was derived:

H1: The extent of social disclosures relates to the company’s experience in sustainability reporting.

Since the research confirmed the positive correlation between the size of the company and its drive to legitimacy [

23], and there are research studies confirming an impact of the market value of an enterprise on the extent of sustainability reporting disclosures [

10,

11], the following hypothesis was formulated:

H2: Companies with higher market values publish larger extents of social disclosures.

This article proceeds in five parts. The next part of this article overviews the outcomes of recent studies on sustainability reporting done by companies operating in the energy sector, and on the relationship between market value and extent of social disclosures. That section provides a research background explaining the trend in social disclosure research and justifying the need for our study. The third part of this paper presents the methodology of empirical research. That part describes the methodology of examining non-financial reports published by energy companies, i.e., the research sample, research stages subordinated to the attainment of the objectives, and hypothesis verification. The next (fourth) part provides the research results and discusses them, whereas the last one contains the conclusions of the research findings.

This study used the following research methods: a literature review, a content analysis, desk research, selected statistical methods, including a one-dimensional method of statistical analysis, multidimensional data visualization techniques, the Pearson correlation coefficient (r), and the methods of induction and synthesis used when formulating the conclusions. The term ‘sustainability report’ applied in the publication is also understood as a synonym of a ‘non-financial report’ and an ‘ESG report’.

2. The Literature Review

The concept of social disclosure reporting appeared between the 1980s and the 1990s and, ever since, has been the object of numerous research studies, e.g., by [

19,

24]. In subsequent years there have been many valuable studies in which the authors focused primarily on the motivations for such reporting, its determinants, the scientific theories applied, and the sectors covered.

Due to the strategic importance of the energy sector and dissemination of the sustainability concept, recent years have seen a multitude of publications in that regard. The literature review of the selected publications made it possible to distinguish three main research currents: (1) bibliometric analyses using keywords connected with the sustainability concept (e.g., ESG) or corporate social responsibility (CSR), and with the energy sector; (2) empirical studies results showing experiences of energy companies in sustainability reporting; (3) publications concerning the impact of various (e.g., financial) factors on the quantity and quality of reported information and the relationship between the extent of non-financial disclosures and the enterprise value.

In the first group of publications (bibliometric analysis), Latapí Agudelo, Johannsdottir, and Davidsdottir [

25] found that from 1990 to 2018 only fifty-five academic articles were published with a focus on CSR in the energy sector. Furthermore, they identified only twelve publications focused specifically on CSR implementation in the energy sector. Stuss, Makieła, Herdan, Kuźniarska [

26] in turn, first used keywords such as ‘CSR’ and ‘energy sector’ expanded the analysis using concepts of energy companies and sustainable development. Starting from 2011 and using ProQuest, Emerald, and SCOPUS, they found over 800 articles, out of which 73 articles were published in Poland.

The number of publications has been increasing year by year, which proves that the energy sector is very important and also interesting from the perspective of the sustainability concept. In view of the above, we carried out our own bibliometric analysis. According to Web of Science, there are 59 publications recorded on the topic of both the energy sector (or industry) and ESG published in the years 2011–2022. The number of papers is quite limited, but it is clearly visible that it has increased significantly over the last two years. However, it must be noted that in the publications of 2011 the phrase ‘socially responsible investing’ was used rather than ‘ESG’. The query also regarded publications with the key phrases: ‘energy sector’ and ‘sustainability reporting/reports’, in this case the database showed 63 publications which appeared in 2004–2022. In the years 2004–2012 these were single publications, their number increased slightly in the subsequent years to reach their highest levels in 2021–2022. The smallest number of publications included the key phrases: ‘energy sector’ and ‘non-financial reporting/reports’, where the produced database contained 32 records (

Table 1).

The highest number of papers about sustainability reporting in the energy sector were published by MDPI, Elsevier, and Emerald Group Publishing. The numbers of publications of the individual publishers are shown in

Table 2.

The second group of publications describes vast empirical studies presenting energy companies’ experiences in sustainability reporting. For example, Stocker, de Arruda, de Mascena, Boaventura [

27] analyzed 119 sustainability reports published by companies from 40 different countries operating in the energy sector. Raquiba and Ishak [

28] in turn, described sustainability reporting practices in 19 companies operating in the Bangladeshi energy sector, whereas Lu, Ren, Yao, Qiao, Strielkowski, Streimikis [

29] examined CSR reports of energy firms from Latvia, Lithuania, and Estonia. Studies of non-financial reporting in the energy sector were also carried out by: refs. [

30,

31,

32].

Similar studies were also conducted in Poland. Szczepankiewicz, Mućko [

33] for example, used content analyses of selected CSR reports of energy and mining companies to present and then assess the patterns and structure of the non-financial information disclosed in them. Stuss, Makieła, Herdan, Kuźniarska [

26], in turn, examined the level of standardization of CSR activities within Polish energy companies and explored the good practices developed by them. Studies on the quality of reports published by companies operating in the Polish energy sector were also carried out by: refs. [

34,

35,

36].

At this point it is worth noting that the object of the majority of the studies mentioned above was an analysis of all ESG disclosures or environmental disclosures, which in a way can be attributed to the specific nature of energy companies. However, what is it like in the case of social disclosures? Do energy companies account for their social disclosures equally well? This article will attempt to answer this question.

The third thematic group includes the publications in which company-specific aspects, such as leadership, employees, financial indicators, market value, and many others are significant for the effective implementation of CSR.

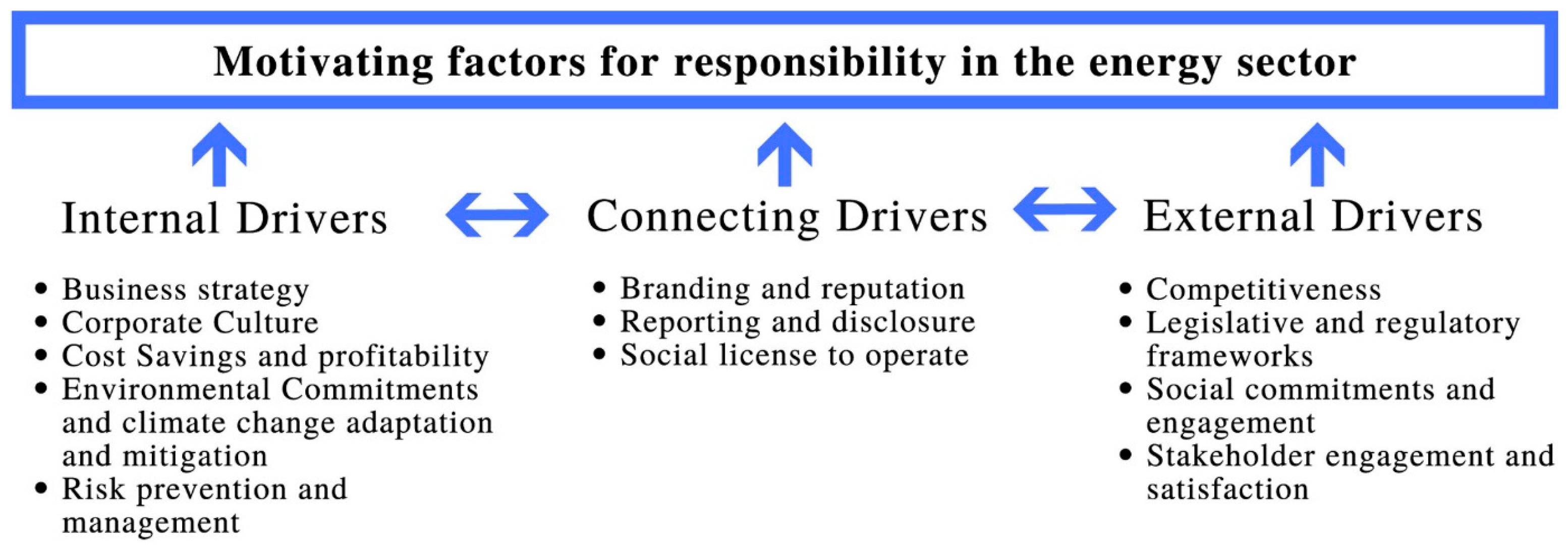

Latapí Agudelo et al. [

25] studied the literature in order to identify and categorize the factors that motivate energy companies to follow CSR principles. The effect of their work is presented in

Figure 1. Moreover, they found that energy companies had a responsive or proactive approach towards the implementation of CSR. Similar studies were conducted by Wieczorek-Kosmala, Marquardt, and Kurpanik [

37]. In their opinion, stakeholders’ pressure on firms’ transparency is an important driver of sustainable performance in the energy sector.

Kludacz-Alessandri, Cygańska [

38] examined the relationship between selected financial performance indicators and the scope of CSR adoption. Analyzing a sample of 219 companies from thirty-two countries, they observed the statistically significant relationships between financial performance and the implementation of the CSR strategy in the energy industry companies. Li, Gong, Zhang, Koh [

10], in turn examined a sample comprising of 350 FTSE listed firms and found a positive relationship between the disclosure level and the firm value, suggesting that improved transparency, accountability, and enhanced stakeholder trust play a role in boosting the firm value. Research on the relationship between the quality of voluntary environmental disclosures made by the firm and the firm’s value (expected future cash flows and cost of equity) was also conducted by Plumlee et al. [

39]. The research was based on a sample of US firms across five industries, and they confirmed a positive relationship between environmental disclosures and expected cash flows, and both negative and positive relationships with the firms’ cost of equity. Zhou et al. [

40] researched Chinese-listed companies, they constructed a linear regression model and a mediating effect model based on analyzing the relationship between ESG performance, financial performance, and company market value and their influencing mechanism. Fatemi et al. [

41], in turn, examined the effect of environmental, social, and governance (ESG) activities and their disclosure on the firm value. However, the results of their studies are ambiguous, as they indicated that ESG strengths increased the firm value and that ESG concerns decreased it, but in general terms ESG disclosures were also found to decrease the firm value. In turn, Broadstock et al. [

42] proved that the market value of companies that performed well in ESG was relatively stable, and their stock prices were more resilient.

In Poland, research in this respect was carried out i.a. by Baran et al. [

43]. They focused on the comparative analysis of ESG performance and accounting-based measures of profitability: return on equity (ROE), return on assets (ROA) and return on sales (ROS). The research covered data from eight companies, and the conclusions showed different correlations between ESG reporting and financial indicators, with results differing within the sample [

43]. Another research study was carried out among companies listed on the Warsaw Stock Exchange, and covered energy companies that applied ESG practices. The study was conducted from the perspective of the relationship between the company’s value and its fundamental strength. The results did not confirm the existence of a significant relationship between the company’s value and its fundamental strength [

44]. Relationships between the enterprises’ CSR activities and their profitability, and the level of stock market quotations and their stability in the Polish energy sector, were not found by Zieliński, Jonek-Kowalska [

45].

In sum, each energy company has specific motivations and a unique approach to sustainability reporting. Non-financial reports can be used by energy companies as a way for advancing their efforts for becoming sustainable, as well as an attempt to legitimize their activities. Issues related to sustainability reporting in the energy sector have been gaining importance. However, research studies carried out in that area rarely address social disclosures, therefore we decided to fill this research gap.

3. Research Methodology

Our research study focused on non-financial reports filed by companies listed on the Warsaw Stock Exchange and those included in the WIG-Energia index. The WIG-Energia index is a sectoral index covering companies in the energy sector. In addition to that, separate indices have been set for the fuel sector and the mining sector. Thus, the main area of operation of the majority of the companies included in the WIG-Energia index is in the production and distribution of electric power. The time scope of the study covers the 2017–2021 period.

Table 3 presents the composition of the WIG-Energia index as of the end of December of each year covered by the study. The index composition varied slightly over the years: in 2017 and 2020 it was made up by 10 companies, in the years 2018–2019 their number rose to 11, and in 2021 (the last year covered by the study)—to 12.

The sample was selected on a targeted basis, and it included selected companies making up the WIG-Energia index. The pre-requisite for being included in the research sample was by publishing non-financial reports in the years 2017–2021, for this reason not all the companies who were part of the WIG-Energia index were covered by the study. Moreover, three companies composing the WIG Energia index were at the same time qualified to be part of the WIG20 index (Tauron and PGE in 2017–2021, Energa in 2017–2018). The main characteristics of the research sample are contained in

Table 4.

Undoubtedly, the fact that published data are not standardized makes it considerably difficult to evaluate them, consequently hindering any comparisons. Therefore, as the starting point for a multi-faceted evaluation of non-financial reporting and social disclosures made by Polish listed companies from the energy sector, the study applied the research procedure developed by Czaja-Cieszyńska, Kordela, Zyznarska-Dworczak [

17]. The researchers designed a method for assessing the extent of published information in non-financial reporting. Based on the quantity and type of published disclosures, they evaluated social disclosures in non-financial reporting by assigning the companies making up the WIG20 index (i.e., the blue-chip index on the Warsaw Stock Exchange) a specific score for individual disclosures, which as a result of an expert analysis were classified as hardly, moderately, and very significant. Next, based on the obtained results, they created the ESG rating and developed an index of social disclosure in non-financial reporting (NFRs) INDEX. The devised index took the following form:

where:

NFRs INDEX—index of social disclosure in sustainability reporting

ni—the score of the i-th company, obtained in the individual assessment of the non-financial report for the given year

wi—weight of the i-th company in the WIG-Energia index

m—number of the companies

Taking the quoted research results as a model, in this article the analysis of the WIG20 companies was extended to include the years 2020–2021, and an analogical evaluation of the social disclosures extent was completed for the WIG-Energia companies. Fifty-four sustainability reports were analyzed in detail, and points were assigned for the individual disclosures. Based on zero-one sampling, social disclosures took the value of 0 (if the company did not report the specific disclosure category) or the value of 1 to indicate the presence of the social disclosure metrics. Similarly, as in the study by Czaja-Cieszyńska, Kordela, and Zyznarska-Dworczak [

17], the metrics were divided into three groups, each of them was assigned a multiplier: ‘1’ for hardly significant metrics, ‘1.5’ for moderately significant ones, and ‘2’ for very significant metrics. Next, the values were summed up.

Then, to present the obtained results, multidimensional data visualization techniques were applied. A scatter plot with LOESS was created, showing the regression curve of social disclosures for the WIG- Energia companies against the background of the WIG20 companies. Another way to visualize the obtained data was a heatmap with a dendrogram, where the color scale reflects the extent of social disclosures made by the individual WIG-Energia companies.

The last stage of the research study focused on the analysis of the correlation between the market values of the companies being part of the WIG-Energia index and the extent of their S category disclosures. To this end, the Pearson correlation coefficient (r) was applied to find out whether the two quantitative variables (number of S category disclosures and the company’s capitalization) were linearly correlated. The correlation strength was described using the scale suggested by Evans (1996): 0.00–0.19 ‘very weak’, 0.20–0.39 ‘weak’, 0.40–0.59 ‘moderate’, 0.60–0.79 ‘strong’, and 0.80–1.0 ‘very strong’.

4. Results and Discussion

The empirical studies’ results were divided into two main parts corresponding to the two subsidiary objectives. The first part of the study focused on a comparative analysis of social disclosures made by the WIG-Energia companies against the background of the WIG20 companies. To that end, a one-dimensional method of statistical analysis was used, an ESG rating was presented, and then multidimensional data visualization techniques were applied, and the NFRs INDEX was determined.

In accordance with the adopted methodology, on the basis of the number and kind of published social disclosures, the non-financial reporting was assessed, and the examined companies were assigned specific scores for the individual disclosures. We have studied 76 non-financial metrics in 19 disclosure categories in the social area, recommended by GRI standards. The companies from the sample disclosed mostly information about new employee hires and employee turnover (total number and rate of new employee hires during the reporting period, by age group and gender), work-related injuries, and diversity of governance bodies and employees (percentage of individuals within the organization’s governance bodies in each of the following diversity categories: gender, age group, percentage of employees per employee category in each of the following diversity categories: gender, age group).

Table 5 shows the basic metrics of descriptive statistics computed for the companies making up the WIG-Energia and WIG20 indices.

The average score awarded to the WIG-Energia companies fluctuates by around 28–37 points, and the mean score has been increasing year by year (except for 2021). Also, the maximum value, Quartile 1, and Quartile 3 show positive growth rates (here too except for 2021). The highest score (71 points) was obtained in 2020 by the report filed by the CEZ company, whereas the lowest score was attained by the OND company which was able to gain merely 12 points. It should be noted that this company was making its debut in the WIG-Energia index. Hence, the relatively small extent of published disclosures may be a result of a lack of experience in that respect. In the case of the WIG20 companies, the mean score was similar to that of the WIG-Energia companies. The highest score was 58 points, the lowest—merely 6.5, and this was the report of a company newly included in the WIG20 index. It is worth noting that the mean values for both WIG-Energia and WIG20 indices are similar, nevertheless, the WIG-Energia index shows higher mean values for all the years apart from 2021 (in that year two new companies were included in the index, and their non-financial reporting scores lowered the mean score for that index). Conversely, when it comes to the median value, it is the WIG20 companies that show higher medians of disclosure ratings for all the studied years. For both indices, the median value has been increasing year by year (as usual, apart from 2021 for WIG-Energia), nevertheless, the growth rate is bigger in the case of the WIG20 companies.

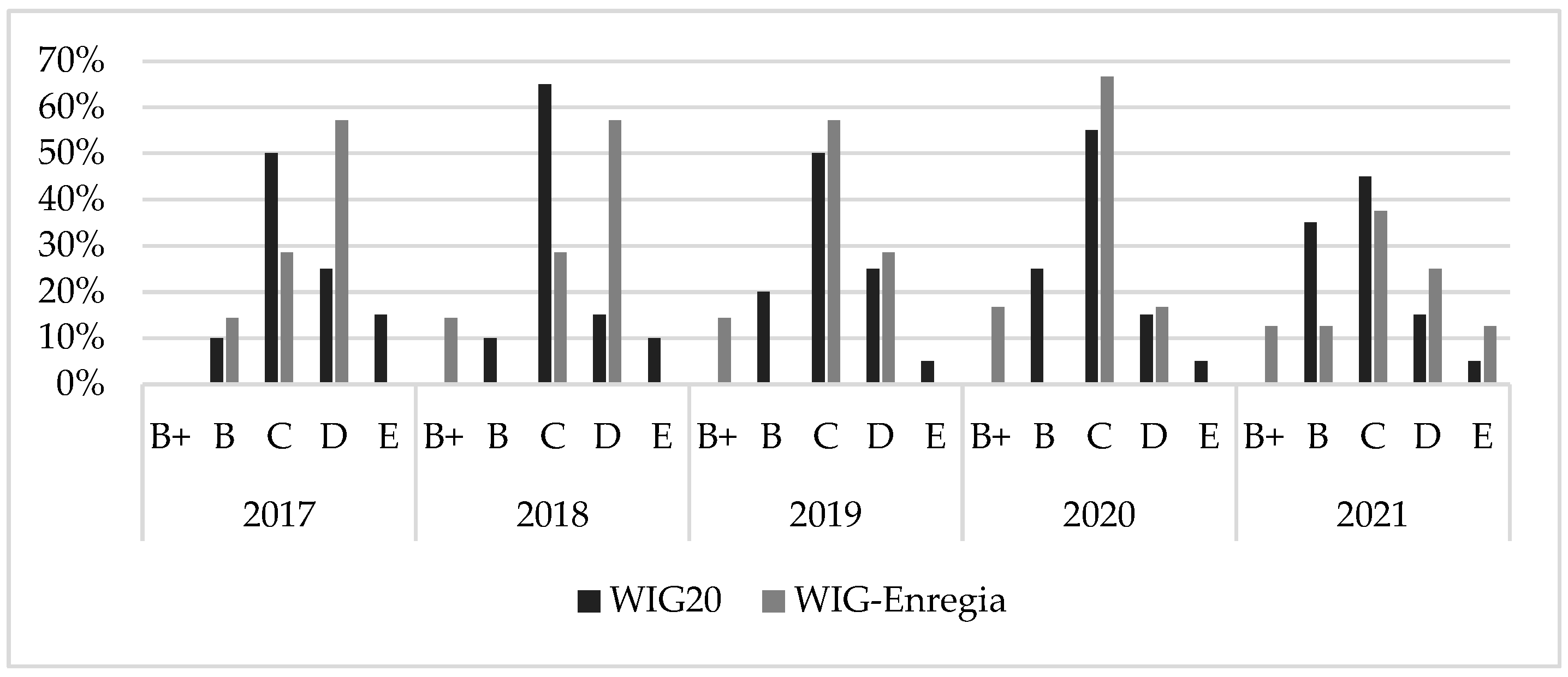

Based on the score obtained by a given company each year, in accordance with the methodology proposed by Czaja-Cieszyńska, Kordela, and Zyznarska-Dworczak [

17] the non-financial reports were rated and classified on a 5-grade scale from A+ to E. First and foremost, it should be noted that none of the analyzed companies (either WIG-Energia or WIG20) managed to obtain an A+ or A rating. The non-financial reports ratings in S category for the WIG-Energia and WIG20 companies are shown in

Figure 2.

The highest rating in the case of the WIG-Energia companies is a B+, but in the 2018–2021 period it was attained by only one company. The remaining energy companies usually obtained C and D ratings, with the exception of the OND company which was for the first time included in the index and whose non-financial report in 2021 received the lowest possible rating, i.e., E. As for the WIG20 companies, the highest rating was B. However, it should be stressed that the share of B-rated reports has been on the increase—back in 2017 they accounted for 10% of all the non-financial reports, while in 2021 their share exceeded 30%. Among the WIG20 companies, C-rated reports are predominant, with relatively small shares of D- and E-rated ones.

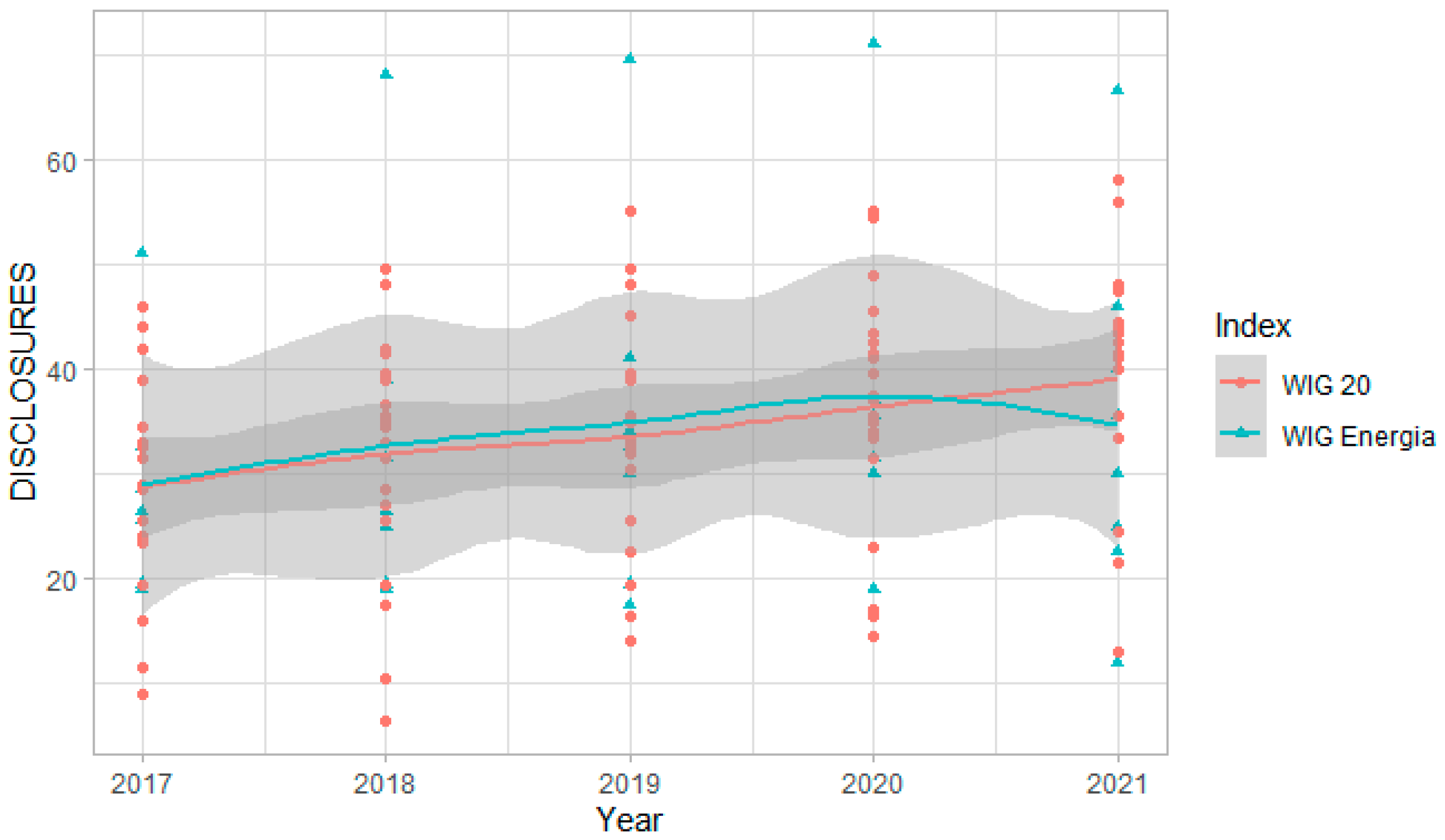

Using a scatter plot with LOESS to further assess the advancement level of non-financial reports filed by the studied companies (

Figure 3), it is possible to notice that there are not any statistically significant differences between the social disclosures made by the WIG20 and WIG-Energia companies. In both cases, an upward trend sustained up to 2020, which means that the energy companies year by year reported more and more disclosures. Only the last year covered by the study showed a slight drop in the mean value of the extent of disclosures made by the WIG-Energia companies. As mentioned before, the reason for this state of affairs may be the inclusion of two new companies in the WIG-Energia index in 2021, in whose case the extent of disclosures was smaller than that shown by the other companies making up the index.

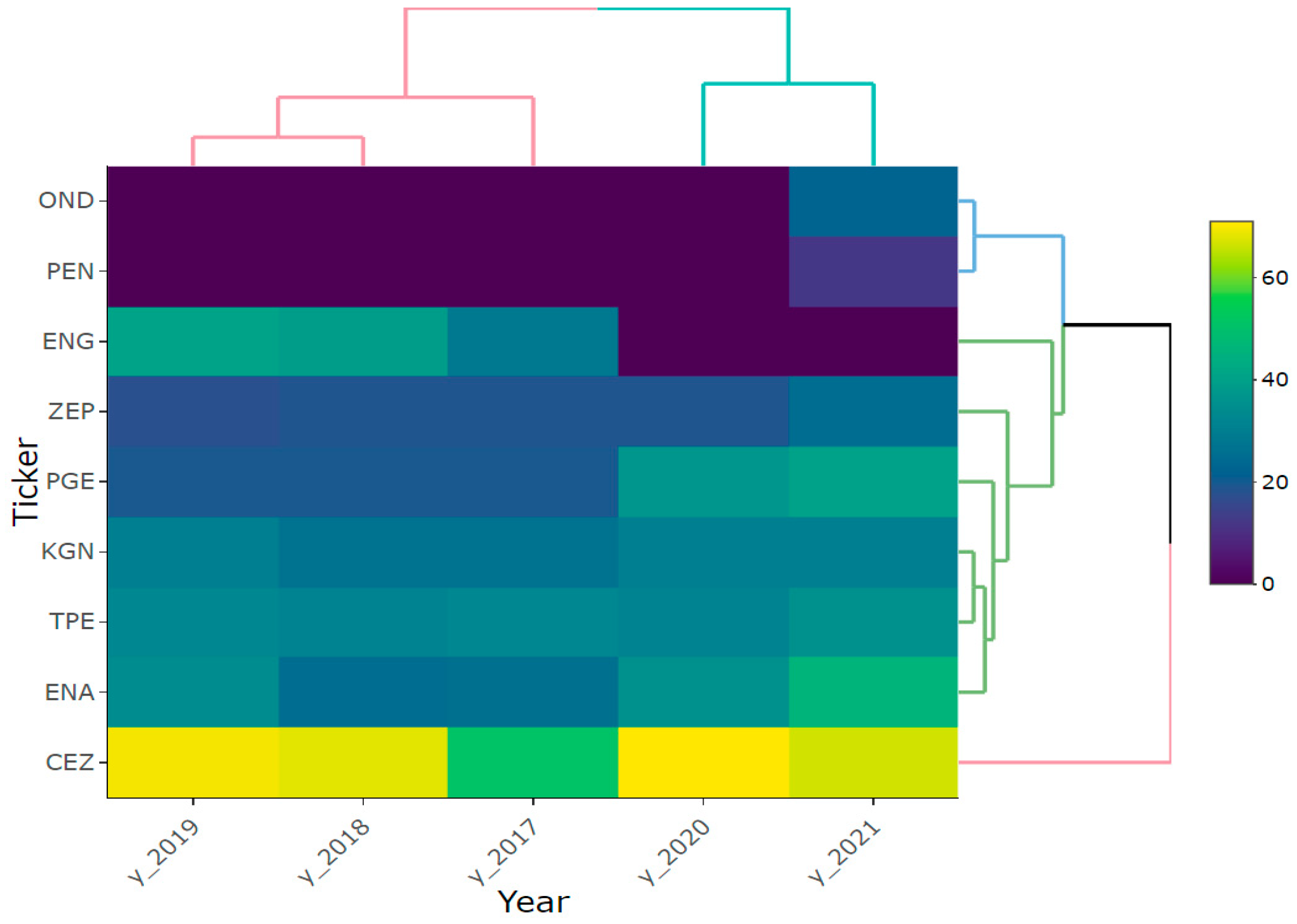

To visualize the research results, a heatmap with a dendrogram was also applied (

Figure 4), where the warm-to-cool color scheme shows the extent of disclosures made by the WIG-Energia companies (the ‘hot’ areas are marked red and show a very large extent of disclosures, whereas ‘cold’ areas are marked blue and denote a small extent of disclosures). In addition to that, dendrograms were also used, which on the one hand grouped the years in terms of their similarity for all the companies at the same time, and on the other hand they grouped the companies for which the extents of disclosures were the most alike throughout the studied period.

The upper part of the map is distinctly dominated by cold colors, which means that the corresponding companies made very few or no disclosures—these are e.g., the companies OND and PEN, which joined the WIG-Energia index as late as in 2021 (see

Table 3), so the previous years were not covered by the study (extent of disclosures equal to 0). The majority of companies are marked blue and green, which corresponds to the disclosure level of 20–40. The highest disclosure level was shown by the CEZ company (marked yellow). The heatmap does not show any red or orange colors, which means that none of the companies demonstrated a very high disclosure level.

A graphic summary of a heatmap is a dendrogram which shows the relationships between the disclosure extent and the individual years and the individual companies. For all the companies, the most similar years were 2018 and 2019, and then 2017. Another similarity was identified for the years 2020 and 2021. This confirms that in the first years after non-financial reporting became mandatory, the extents of disclosure were smaller, while in the last two years covered by the study, they turned out to be larger. As for the companies themselves, the most similar extents of disclosures throughout the study period were demonstrated by the companies KGN and TPE, followed by ENA, PGE, and ZEP. The most distinguished company turned out to be CEZ, which was characterized by the highest level of disclosures.

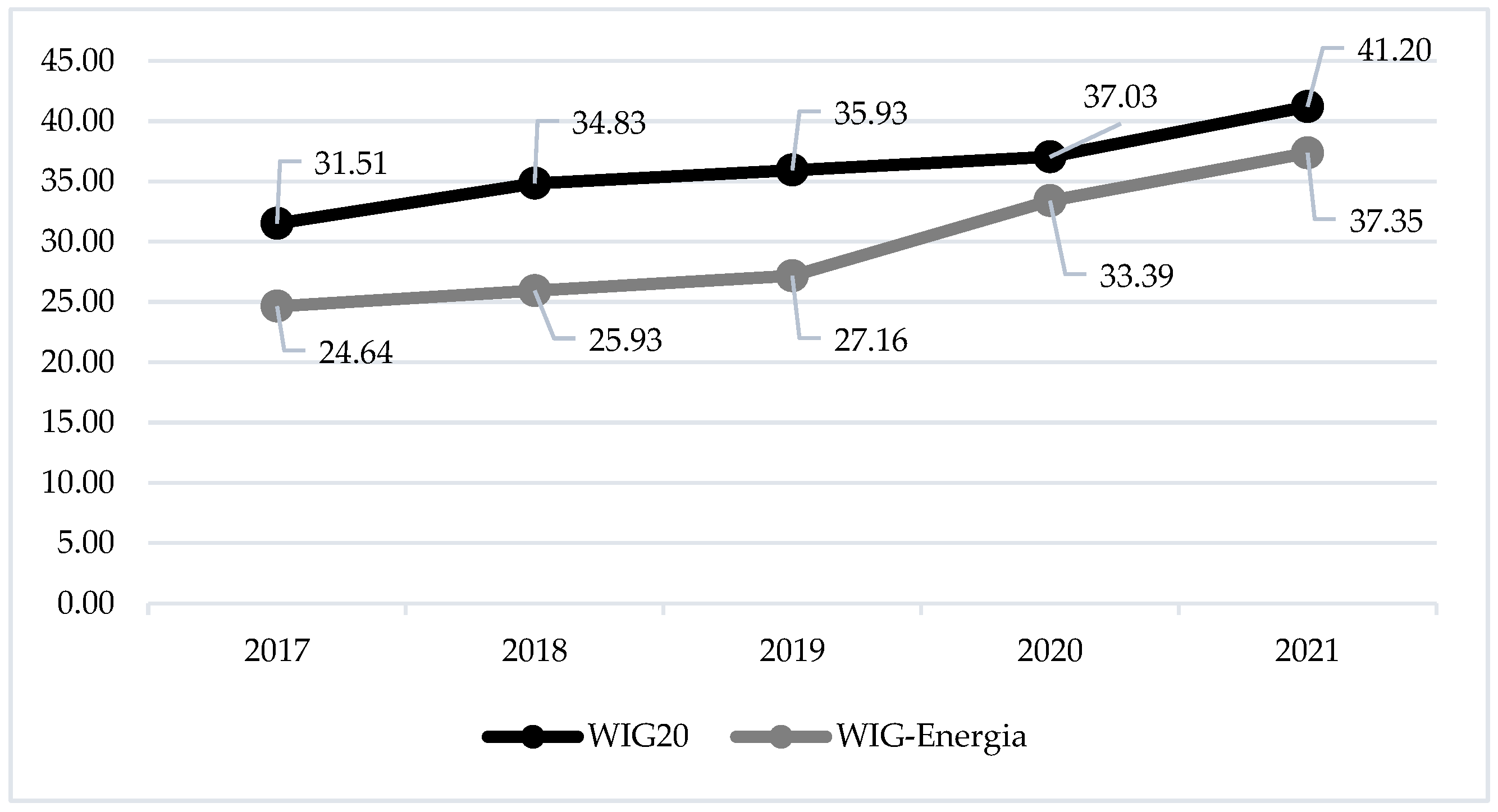

The crowning of this part of the research is the NFRs INDEX, i.e., an index of social disclosures in sustainability reporting. The NFRs INDEX is calculated for each year of the studied period and ranges from 0 to 110. The higher the index value, the higher the advancement level in S category non-financial reporting. NFR_S index values for the WIG-Energia and WIG20 companies are presented in

Figure 5.

The completed research has shown that in 2017 the NFR_S index value for the WIG-Energia companies was 24.64 points and it rose steadily year by year to reach 37.35 in 2021. A similar trend was observed in the case of the WIG20 companies. However, it should be stressed that the NFR_S index value for the WIG20 companies in each of the analyzed years was higher by several points in relation to the index value for the WIG-Energia companies. Nonetheless, Czaja-Cieszyńska, Kordela, and Zyznarska-Dworczak [

17] considered this index level to be satisfactory.

Summing up the first stage of the research, it is possible to conclude that, year by year, the energy companies have been presenting larger and larger extents of social disclosures in their non-financial reports. This is confirmed by the descriptive statistics metrics, ESG rating, as well as the NFR_S index value. Therefore, several different tools were used to examine the extent of the social disclosures. At the same time, it was observed that the companies making their first appearance in the WIG-Energia index in the first year demonstrated a very small extent of disclosures, which increased in the subsequent years. In turn, the companies that had been making up the index throughout the studied period presented a relatively large extent of disclosures, which was due to their experience in preparing the non-financial reports and which makes it possible to confirm our hypothesis H1.

The fact that the extent of social disclosures in Poland has been systematically growing was noticed by [

17], even though their study involved blue-chip (WIG20) companies rather than those from the energy sector. This was confirmed by the values of the individual ratings of the particular companies, the data analysis for the totality of companies, and the NFR_S index values.Matuszak and Różańska [

46] also applied an index to assess sustainability reporting in Poland. Using their authorial NFD extent total index, they investigated the characteristics in the scope of non-financial disclosure (NFD) across companies listed on the Warsaw Stock Exchange over the period surrounding the implementation of the Directive 2014/95/EU. The sample comprised 134 selected companies. In other parts of the world, similar studies were also conducted by Singhania and Gandhi [

47]. They constructed an index for Indian companies, which was focused on their social and environmental disclosures, in order to study the relationship between corporate l disclosures and chosen corporate attributes. Moreover, de Souza Gonçalves et al. [

48] used an index of 13 indicators, which evaluated only social disclosures relating to external social programs.

The second stage of the research consisted of the analysis of the correlations between the market value of the companies making up the WIG-Energia index and the extent of S category disclosures. To this end, the Pearson correlation coefficient (r) was applied. The coefficient values are presented in

Table 6.

The results of our statistical analyses regarding the correlation between the market value (capitalization) of energy companies and the extent of social disclosures have shown a regularity that companies with higher capitalization make more disclosures. In the years of 2017–2019, the correlation between capitalization and extent of disclosures was strong, and in 2020–2021 very strong, which confirms our hypothesis H2.

Janicka and Sajnóg [

49] arrived at similar conclusions. According to them, corporate financial performance of ESG reporting companies is better than that of others, and ESG reporting companies are valued higher by the market. Plumlee et al. [

39] also identified a positive correlation between the enterprise value and the extent of non-financial disclosures. However, their studies covered environmental disclosures, and they assumed expected future cash flows and the cost of equity as the enterprise value. Our research results are partially consistent also with those of Constantinescu et al. [

50] who analyzed the correlations between sustainability reporting and the value of energy enterprises in countries across different continents. In this case, the market value was applied to assess the firm value, and the study focused on the impact of both the totality of ESG disclosures and each individual disclosure. On the one hand, there is a positive and significant relationship between ESG factors disclosure and the firm value, and on the other hand a negative and significant relationship between the individual social factor and the value of the company [

50].

5. Conclusions

Non-financial reporting in Poland has been mandatory since 2017. In that year major public interest entities had to face the requirement to disclose information on their environmental, social, and governance impacts of their activities. From the perspective of the energy sector, it seems that E category reporting is of key importance, and as a matter of fact this sort of disclosure is extensively addressed in the literature. However, to meet stakeholders’ expectations, social disclosures became as important as accounting for environmental measures.

Based on the literature review and own research, we managed to attain the objective which was a multi-faceted evaluation of sustainability reports published by companies operating in the Polish energy sector, from the perspective of social disclosures. The study involved major Polish listed companies making up the WIG-Energia index with the time scope of the study covering the 2017–2021 period. In the first place, a comparative analysis was carried out to assess the social disclosures made by the WIG-Energia companies against the background of the WIG20 companies. All the applied tools: ESG rating, NFR_S index, and multidimensional data visualization, have confirmed that the energy companies year by year have been presenting larger and larger extents of social disclosures, even though the rate of these changes is evolutionary rather than revolutionary. At the same time, it was observed that the companies appearing for the first time in the WIG-Energia index showed a very small extent of disclosures, whereas the companies which figured in the index throughout the studied period presented a relatively large extent of disclosures, due to their experience in preparing sustainability reports.

To attain the main objective, it was also necessary to find an answer to the question whether there was a dependency between the energy companies’ market values and the extent of their social disclosures. To that end, the Pearson correlation coefficient (r) was applied. The results of the statistical analyses have validated the strong and very strong correlation between capitalization and the extent of disclosures. It is therefore possible to state that companies with higher market values are characterized by larger extents of social disclosures.

Summing up, the completed research study fits into the current trend of research conducted in the area of sustainability reporting [

51], as this article discusses the relevant and current issues and constitutes an original, practical study of social disclosures made by energy companies in Poland. The obtained results may prove to be of interest to both the academic circles and the examined entities. While most research studies carried out across the world use secondary sources of information on sustainability disclosures (Thomas Reuter database, data published by stock exchanges or data derived from other databases developed by institutions), we analyzed in detail the actual sustainability reports and then ran a multi-faceted evaluation of social disclosures made by companies from the Polish energy sector. The results of our research may also be useful for economic practitioners.

Finally, this study entails certain limitations. Firstly, the sample is small, composed of only 11 companies, and therefore the obtained results cannot be generalized. In future research, the scope of analysis should be expanded to include companies from other EU countries. Secondly, the study time scope is short—it was based on the non-financial reports for the years 2017–2021 (prior to 2017, non-financial reporting was not mandatory in Poland). Thirdly, the object of the research was only the social disclosures and the firm value measured with its capitalization. In future, inspiration for further research may involve an analysis of environmental and governance disclosures in relation to other indicators (for example balance sheet total, employment size, or ROA and ROE). Another direction of research may be the application of the tools used for international comparisons of non-financial reporting in the energy sector.