Abstract

Investments in green energy are necessary due to, among other reasons, the growing expectations of stakeholders, climate change, limited natural resources, and improved quality of life. Unfortunately, the costs of implementing pro-environmental activities related to investing in technologies using alternative methods of obtaining energy are significant, which is why more and more entities are analyzing their profitability. The aim of this study, as part of a case study, is to assess the energy investment in PV panels in the logistics center (LC) being built in Central Pomerania. The analyzed investment fits into the activities of the development perspective of the renewable energy sources sector and is also very important from the perspective of shaping the conditions and stable development of the energy industry in Poland. The study proved that such a large investment, taking into account various forms of financing, will pay off within 15 years, which is a very good result from the point of view of its durability. The best variant of capital involvement is the option 20 (own capital)/80 (outsourced capital), which, among other things, confirms (in thousands of euros) NPV = 4.43, NPV (TGeBase) = 0.04, and NPV (CAPEX) = 4.32.

1. Introduction

Climate change and technological and industrial development are increasingly influencing the investment decisions of market stakeholders. The search for optimization solutions, especially in the use of electricity, that do not interfere with the natural environment is becoming necessary, but, on the other hand, expensive. Therefore, it is important for all market stakeholders to increase their environmental awareness and take actions aimed at protecting and restoring the natural environment [1,2] These actions should also aim to improve the quality of life for society, organizational development and sustainable development, including agglomeration, in line with environmental safety [3,4,5,6,7]. One of the directions for such actions is the use of renewable energy sources (RES) [8,9]. The subject of this study concerns selected financial aspects in the field of renewable energy [10], particularly photovoltaics. Renewable energy is obtained from natural processes, allowing for the natural replenishment of resources, ensuring the repeatability of cycles. From an economic point of view, this is crucial information because it serves as an alternative to traditional energy sources, such as fossil fuels, and becomes a complement and in some cases the primary source of energy [11,12]. Nevertheless, the financial assessment of investment projects in the field of renewable energy requires consideration of multiple factors [13], such as investment costs, potential savings, local energy regulations, investment returns, and the prospects for the development of the renewable energy sector.

2. Literature Review

The topic of renewable sources, particularly solar energy, and the practical implementation supported by various financial projects and forms of support [9], indicate that it is of great interest to scientists, governments, entrepreneurs, and individual customers (consumers) [8,14,15,16]. This is due to the fact that renewable energy (energy sources) is obtained naturally or can be renewed through human actions [17]. It is also inexhaustible and can be used to any extent. Understanding the necessity of changing the way we obtain energy is difficult for some market stakeholders to accept [18,19,20,21]. However, due to global environmental changes (rising temperatures, climate change, etc.), increased environmental pollution (CO2, heavy metals, etc.), the depletion of other energy resources (coal, wood), and the elimination of natural air filters (deforestation, removal of green areas), it is necessary and irreversible [3,5,22,23]. The only question that remains is whether the source of renewable energy will be solar energy [24], wind energy, hydropower, geothermal energy, or biomass energy [25,26]. It is important that the implementation of energy production (Table 1) and utilization is ongoing (Table 2), which limits and mitigates environmental degradation [27].

Table 1.

Gross electricity in the EU-27 in GWh.

Table 2.

Supply, transformation, and consumption of electricity in the EU-27 in GWh.

The analysis of data (Table 1 and Table 2) and information from Eurostat indicate that the energy sector in the European Union is developing in a sustainable way. On the one hand, in the analyzed years 2017–2020, there is a visible increase in demand for energy, despite a decline in exports and some forms of energy production. On the other hand, the availability of energy in the European Union has increased, with a visible increase in the share of renewable energy sources, which has been constantly growing. The increase is particularly visible in 2018 and 2019, where the share of renewable energy sources exceeded solid fossil fuels. At this point, it is worth identifying and comparing the production of electricity from renewable energy sources in Poland (Table 3).

Table 3.

Share of renewable energy in electricity production from renewable sources in Poland and the average for EU-27 countries in the years 2017–2020.

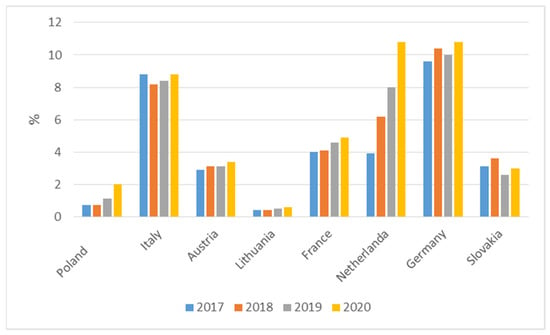

The presented data indicate that Poland achieved results in selected areas (e.g., “liquid biofuels” or “solid biofuels”) above the EU-27 average in terms of the use of the presented energy sources in the analyzed period. It is positive to note that almost everywhere the utilization of renewable energy sources has been increasing. However, it is unfortunate to observe that in the analyzed years, Poland performed poorly in comparison to some EU-27 countries outside Lithuania, particularly in the area of solar energy production [28], even when compared to neighboring countries (Figure 1).

Figure 1.

Share of renewable energy in electricity production from solar sources in Poland and selected EU-27 member countries in the years 2017–2020. Source: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Main_Page (accessed on 23 May 2023).

The presented compilation indicates that Poland has a significant growth potential, which should be accompanied by the creation of appropriate investment and legal conditions for both businesses and individual customers [29,30,31]. This is also confirmed by the indicator of the share of electricity from all renewable sources in gross final electricity consumption, which has been at the following levels in recent years: 13.4% (2015), 13.3% (2016), 13.1% (2017), 13.0% (2018), 14.4% (2019), 16.2% (2020), 17.2% (2021) [32]. It should be noted that the establishment of the possibility of “energy independence” requires significant financial and organizational investments, and the efficiency and return on investment are achieved over many years [33]. Therefore, legislative changes and investment financing facilitations have been essential elements supporting the development of electricity production from solar sources, especially photovoltaics [34,35]. This is necessary from the point of view of the development of this form of energy production in the EU (Table 4).

Table 4.

Electricity from solar photovoltaic in the EU-27 in GWh.

As part of the actions of the so-called sustainable energy policy, the energy policies of both the European Union and Poland [36,37] strongly promote the use of renewable energy technologies, especially photovoltaics [30,31,32,33,34,35,36,37,38,39]. In Poland, legal regulations have been established, including the Act of February 20, 2015 [40,41] on Renewable Energy Sources and the Energy Policy of Poland until 2040 (PEP2040) [42]. Within this policy framework, a strategic goal has been defined: energy security: while ensuring the competitiveness of the economy, energy efficiency, and reducing the environmental impact of the energy sector, taking into account the optimal utilization of domestic energy resources. Within the framework of PEP2040, eight policy directions were further specified, divided into areas, and additionally detailed into twelve strategic projects. These projects expand the list of projects from the Strategy for Responsible Development in the “Energy” area. Other government initiatives and regulations aimed at increasing the share of renewable energy in Poland have also been taken. Key actions to create a favorable investment environment include providing financial support, preferential taxation systems, implementing appropriate regulations for individual customers and businesses, establishing emission rights trading mechanisms, and promoting eco-friendly actions [43,44]. As a result of these efforts, photovoltaics, as one of the key sources of renewable energy [45], have become a significant area of interest driven by growing environmental awareness in society and economic benefits, such as reducing electricity costs and the opportunity to sell excess energy to the grid. This is confirmed by the installed photovoltaic capacity (giga watt GW) in 2022, which reached 4.9 GW. Comparatively, Poland ranks very high in comparison to countries like Germany (7.9 GW), Spain (7.5 GW), the Netherlands (4.0 GW), France (2.7 GW), and Italy (2.6 GW). The total capacity in Poland increased by 29% compared to 2021 [46]. Despite the growing need to strengthen the grid infrastructure for efficient connection and transmission of energy [47], grid connection development is ongoing [48,49]. These positive results in the photovoltaic sector are the outcome of financial support programs [50,51] such as “Prosument”, “Clean Air”, and “My Electricity”. With rising energy prices and well-presented policies highlighting the ecological and economic benefits, decision-making for solar panel investments has accelerated [52].

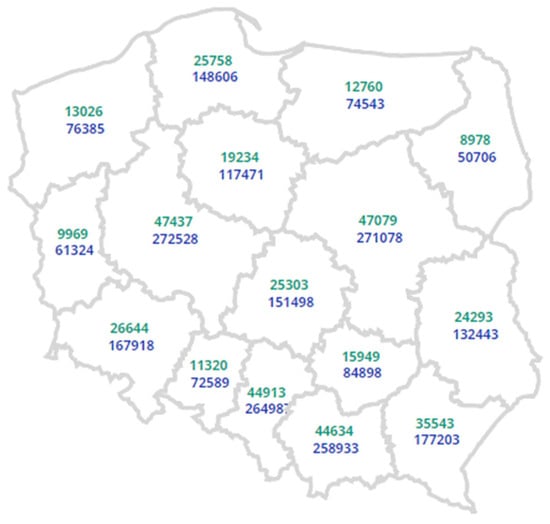

For example, the “My Electricity” program (a program for financing micro photovoltaic installations, currently in its fifth edition) allowed for the disbursement of a grant in the amount of 1,742,050,374 Polish Zloty (PLN). This includes amounts of PLN 1,262,552,156 for the “My Electricity 1.0” and “My Electricity 2.0” editions (years 2019–2020), PLN 485,017,549 for “My Electricity 3.0” (in 2021), and PLN 184,685,126 for “My Electricity 4.0” (in 2022). Visible fluctuations in the granting of funds resulted from the number of submitted applications, their assessment in terms of financing possibilities, and the availability of aid funds. It should be emphasized that this program is intended for individuals who want to generate electricity for their own use, with a maximum coverage of 50% of the investment costs. The distribution of realized investments in Poland under the “My Electricity” program is presented in Figure 2.

Figure 2.

Location of “My Electricity” project implementations. Legend: The number of grants awarded for PV installation projects. The total installed capacity in kW. Source: https://mojprad.gov.pl/#mp1-i-mp2 (accessed on 6 August 2023).

The analysis of the “My Electricity” program indicates significant economic potential for owners of micro photovoltaic installations. This is particularly evident due to substantial financial support, which reduces investment costs [53]. Figure 2 shows that the greatest interest is visible in central Poland (in the voivodeships: Wielkopolskie (47,437 applications) and Mazowieckie (47,079 applications)) and southern Poland (in the smaller voivodeships: Slaskie (44,913 applications), Malopolskie (44,634 applications), and Podkarpackie (35,543 requests)). The diversity of submitted applications and the funds awarded depends on many variables, e.g., local policy regarding environmental protection, field possibilities for large installations, atmospheric factors, and the resource capabilities of entities. Despite this, it can be observed that the demand is continually increasing because there are tangible benefits to investment implementation [54,55]. Utilizing one’s own source of energy enhances profitability and expedites the return on investment, since it reduces electricity bills (especially as energy prices continue to rise) and/or allows for the resale of excess generated energy to the grid. Additionally, it is worth noting that the development within the photovoltaic sector, especially in terms of technological advancements, has increased the efficiency and longevity of solar panels [56,57]. This directly translates into economic viability and the attractiveness of investments.

“Clean Air” is another a program in Poland aimed at improving energy efficiency and replacing heat sources in residential buildings. The program includes subsidies and loans for the modernization of heating systems, including the installation of heat pumps, replacement of old furnaces (coal-fired) with more ecological ones, and thermal insulation of single-family residential buildings or residential premises separated into single-family buildings. The aim of the program is to improve air quality and reduce pollutant emissions. The indicators of achieving the program goal are [58]:

- Number of buildings/residential premises with improved energy efficiency 3,030,000;

- Number of ineffective heat sources replaced with low-emission ones in residential buildings/premises 3,000,000;

- Additional capacity to generate electricity from installed photovoltaic micro-installations: 750 MWe;

- Reduction in final energy consumption: 38,100,000 MWh/year;

- Reduction in dust emissions with a diameter of less than 10 μm (PM10): 213,000 Mg/year;

- Reduction in benzo-α-pyrene emissions: 142 Mg/year;

- Reduction in CO2 emissions: 14,200,000 Mg/year.

The program is to last from 2018 to 2030, where funding agreements will be signed only until 31 December 2027. The budget allocated to support investments is PLN 103 billion. By March 2023, over PLN 320 million was spent because 14,582 applications for co-financing for the replacement of a source were submitted, as well as 18,840 applications for the replacement of a heat source and 4658 applications for a subsidy for a photovoltaic installation.

“Prosumer” is the name of the program created by the National Fund for Environmental Protection and Water Management in Poland, which provides funding for the purchase and installation of micro-installations of renewable energy sources. It is addressed to people who plan to build a small RES installation or micro-installation (renewable energy sources), producing electricity or heat for their own needs with the possibility of selling surplus energy. Financing can be obtained for the purchase and installation of electricity sources (maximum capacity) [59]:

- wind farms (power up to 40 kWe1)—using wind energy (electricity),

- photovoltaic panels (power up to 40 kWp)—using solar energy (electricity),

- solar collectors (power up to 300 kWt)—as above (electricity and heat),

- micro-cogeneration (power up to 40 kWe)—using primary energy contained in fuels,

- heat pumps (power up to 300 kWt)—a device that extracts energy from water, air, or the ground to heat water (thermal energy),

- biomass (power up to 300 kWt)—installations using plant biomass, organic waste, animal excrement, etc. (thermal energy).

Basic assumptions of the program: [60]

- the program budget is PLN 800 million,

- implementation deadline: 2014–2022 with the possibility of concluding loan agreements (credit) with a subsidy until 2020,

- installations for single-family and multi-family residential buildings (including newly built ones),

- maximum amount of eligible costs PLN 100–450 thousand, depending on the type of beneficiary and investment,

- specified maximum unit eligible cost for each type of installation,

- loan/credit interest rate—1% per annum,

- maximum loan/credit financing period—up to 15 years,

- exclusion of the possibility of obtaining co-financing of the project costs from other public funds,

- the project cannot be completed before submitting the application,

- for one residential building—one subsidy under the program,

- the maximum period of implementation of the project is 24 months from the date of concluding the co-financing agreement with the beneficiary.

3. Research Methodology

The broadly addressed topic of green energy, especially investment returns and the prospects of renewable energy sector development, is crucial in shaping the conditions for the stable development of the energy sector in Poland.

The aim of this case study is to assess an energy investment in photovoltaic panels (PV) within a logistics center (LC) located in the Pomorskie Voivodeship. As part of the logistics center, the construction of an automated warehouse covering an area of 11,000 square meters, nearly 1500 square meters of office space, and almost 6000 square meters of green areas has been planned.

For the purposes of this study, the hypothesis has been adopted that the analyzed investment in the LC facility, considering various forms of financing, will pay off within 15 years.

When establishing assumptions and identifying data, it is important to note that the implementation of the new billing system, Net-billing, is carried out in several stages, and Poland is currently in the second stage, which is in effect from 1 July 2022 to 30 June 2024. The value of electrical energy is determined for each calendar year and is the product of the sum of the amount of electrical energy introduced into the distribution network by the prosumer and the monthly market price of electrical energy for a given calendar month. Therefore, the price of electrical energy introduced by the prosumer into the network during this period is determined as the monthly market price (RCEm).

Therefore, to confirm the hypothesis and the objective of the study, an investment assessment model was utilized. This model takes into account the price of electrical energy on the commodity exchange in specific time intervals and the energy demand necessary for the construction of the logistics center in Pomorskie Voivodeship, Poland. It should be emphasized that the planned investment is solely intended to provide the investor with the appropriate amount of energy necessary to carry out the tasks of the logistics center. At the beginning of the investment, the investor must forecast the energy demand for future settlement periods in hourly intervals, the rate of changes in commodity and service prices (inflation), and the absence of investment-related actions. Identification of the power of a PV installation is expressed in units of megawatt peak (MWp). It shows how much electricity, calculated in megawatt hours (MWh), can be produced by the entire photovoltaic installation. MWh, on the other hand, is a unit of measurement of electricity determining the electricity consumption by users (e.g., households). For example: 10,000 PV panels with a power of 325 Wp = 3,250,000 Wp = 3250 kWp = 3250 MWp. In the analysis, the price of energy produced in specific periods was calculated as the product of the forecasted energy efficiency in a given year (decreasing due to the decline in cell efficiency) and the price of 1 kWh (kilowatt hour) of energy adjusted for inflation. Additionally, in the case of renewable energy investments, the capital return/profit generated for each period will also be reinvested at the same rate of return as the alternative form of secure energy investment. In simplified terms, this concept encompasses the expenses incurred by the purchasers related to the cost of adapting the facility.

The analysis took into account a constant inflation rate of 7% as well as three financing variants: the first entirely from equity capital, the second with 50% equity capital and preferential credit, and the third variant with 20% equity capital and 80% commercial credit, which is the most expensive but the fastest option in the investment.

4. Results

4.1. Results of the Technical and Economic Assumptions

The following assumptions were made for the analysis of the logistics center with an area of 12,500 m2, an installed capacity of 1.000 MWp, and an annual energy production of 1050.00 MWh, which should ensure a 100% share of energy production. The calculation of energy production took into account the productivity loss coefficients for PV panels provided by manufacturers (Table 5).

Table 5.

Changes in the productivity of PV panels.

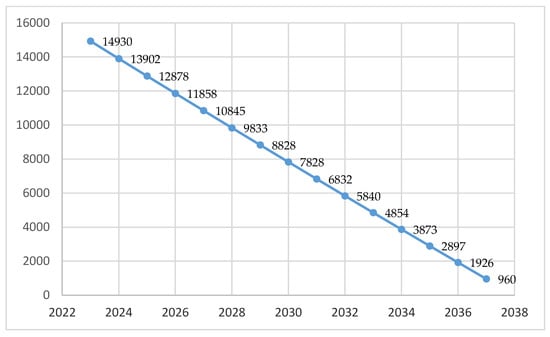

Research conducted by specialists from the National Renewable Energy Laboratory (NREL) and other panel manufacturers (e.g., Longi Green Energy, Jinko Solar, Trina Solar) prove that panel consumption varies, which directly affects the possibilities of obtaining energy. When assessing energy demand, the lifespan of photovoltaic panels and the durability of panels in terms of production possibilities were taken into account. Table 6 presents the amount of energy produced in relation to productivity loss during the analyzed period.

Table 6.

Amount of produced energy and productivity loss in the years 2023–2037.

The analysis assumed that the final efficiency of the panels would be approximately 91% (91,45%) (Table 6). The assumption was assessed based on the panels’ compliance with the durability standards specified by the IEC (International Electrotechnical Commission) regarding, among others, resistance to dust and sand, temperature and humidity, and mechanical loads. This safety guarantees that the PV panels can still be used after 15 years, as manufacturers assume a period of use (lifespan) of up to 25 years.

Table 7 indicates the necessary components of the PV installation for the implementation of the planned logistics center investment.

Table 7.

Net costs in thousands of euros for individual direct components of the PV installation for the logistics center.

For the analysis, the cost of photovoltaic panels per 1 Wp was assumed to be EUR 0.25, and the cost of the inverter per 1 Wp was EUR 0.034. These are the average prices of devices available on the market during the analyzed period for this type of investment.

Additionally, when analyzing the investment costs, it is necessary to take into account the applicable VAT (8%)—EUR 32,800.80 thousand, which the logistics center will settle over a period of 3 years.

For the total direct and indirect expenses of the PV panel installation project at the logistics center (Table 8), a CAPEX (capital expenditures) analysis was used. In economics, CAPEX refers to expenses directly related to product development. When applied to the PV panel installation project at the logistics center, it can be simplified as the expenses incurred by the clients related to the cost of adapting the facility. All conceptual work, designs, permitting documents, and implementation fall under capital expenditures.

Table 8.

Total direct and indirect expenses for the installation project of PV panels (1 MW) at LC based on CaPex.

Formula and calculation of CapEx:

where:

CapEx = ΔPP&E + Current Depreciation

CapEx = Capital expenditures

ΔPP&E = Change in property, plant, and equipment

Capital expenditures are also used in calculating the free cash flow to equity (FCFE). FCFE is the amount of cash available to equity shareholders. The formula for FCFE is:

where:

FCFE = EP − (CE − D) × (1 − DR) − ΔC × (1 − DR)

FCFE = Free cash flow to equity

EP = Earnings per share

CE = CapEx

D = Depreciation

DR = Debt ratio

ΔC = ΔNet capital, change in net working capital

Or:

where:

FCFE = NI − NCE − ΔC + ND − DR

NI = Net income

NCE = Net CapEx

ND = New debt

DR = Debt repayment

4.2. Results of Financing Assumption

An important aspect of every investment is determining the method of financing. The analysis assessed the possibility of using external financing, because in the long run it is more beneficial for investors and ensures the financial security of the investment. The analysis of investment financing possibilities showed that the most effective and safest share of capital is the 20/80 ratio. Table 9 presents the adopted structure of the cost of financing the implementation of the investment with 20% equity and 80% commercial loan.

Table 9.

Investment cost with a commercial loan.

The presented investment costs (in Table 9) should also include a 23% VAT, which amounts to a cost of EUR 132,135.00. Additionally, with a loan (depending on the selected bank) ranging from 9.8% to 15.0%, it constitutes a cost of EUR 45,080 to 69,000 without additional financing VAT, which would be financed from the company’s own liquidity capital. Considering VAT in commercial loan financing, the repayment amounts will increase from EUR 58,020 to 88,800.

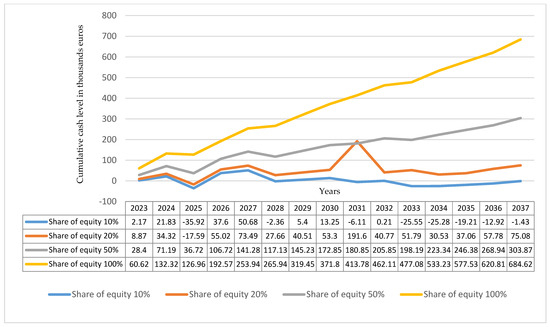

Additionally, equity levels and cash levels without VAT were calculated. A sensitivity analysis was conducted on the rising cash level due to changes in the project’s financing with equity capital in thousands of euros (Table 10). Four equity participation levels were applied: 10%, 20%, 50%, and 100%.

Table 10.

Sensitivity analysis of the cash level rising due to changes in the financing level of the PV panel project at LC for the period 2023–2037 in thousands of euros.

An important element for our calculations is the assumed increase in energy prices and capital costs at interest rates in short-term and long-term loans (Table 11). Of course, from the point of view of investment profitability, an increase in energy prices is more favorable for CL, as is a decrease in loan interest rates and commissions.

Table 11.

Energy prices and capital costs by loan duration.

5. Discussion

The analysis of the profitability of investments in the method of energy production began to take into account the possibility of obtaining additional financial benefits resulting from the reduction in CO2 emissions. The year 2021 was particularly important, when energy on the competitive market could be purchased almost twice as cheaply (an average of EUR 53.55/MWh). At that time, the difference between the over-the-counter market (OTC market) and the competitive market was greater, exceeding 1.34 EUR/MWh. In the investment analysis and evaluation, it should be emphasized that there is a reduction in CO2 emissions, where the logistics center (LC) does not incur costs related to emissions (Figure 3). Transaction costs for CO2 emission allowances (KTCO2) correspond to variable costs directly associated with the purchase/sale transaction of CO2 emission allowances on the exchange, in connection with the delivery or receipt of balancing the energy required on the balancing market. These costs in 2021 amounted to 1.00 PLN/Mg (0.21 EUR/Mg) of CO2, and, starting from 2022, they are subject to indexation based on the forecasted average annual price index for consumer goods and services recognized by the President of the Energy Regulatory Office, as justified within the approved VFB Tariff (Tariffs of Volunteer Fire Department) for a given calendar year. In the case of the LC investment mentioned above, during the analysis of the previous period, the company would have saved 9.8%. This means that, with the use of investment support (in accordance with Article 39 of the RES Act) and the production of 14,940 MWh in the first year, the LC would have generated an additional income of EUR 54.25 thousand.

Figure 3.

Amount of MWh subject to price adjustment. Source: In-house development.

The analysis allows us to conclude that even with changes in the auction price according to TGeBase (Table 12) and a decrease in panel productivity, but with additional financial support from external funds, the LC investment is profitable.

Table 12.

We will implement such activities in the future.

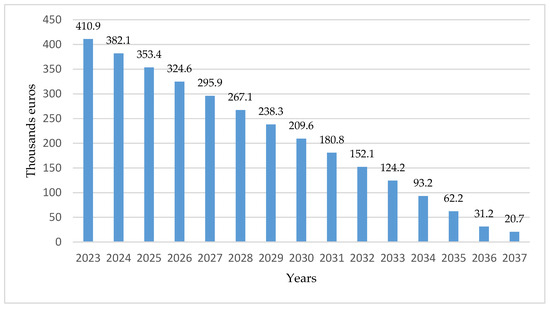

Depreciation is another important element in our analysis. The LC assumed depreciation of tangible and intangible assets at 20% over a 5-year period (2023–2027). In the case of energy equipment such as substations, a depreciation period of 10 years (10% each year) was assumed. Due to the high cost of installations like PV panels, inverters, cables, and installation, a depreciation period of 15 years was assumed, with 14 years at 7% and the final year at 2% (Figure 4).

Figure 4.

Presents the depreciation of these devices with installation from 2023 to 2037. Source: In-house development.

Additionally, in the LC investment, additional expenses were assumed:

- -

- insurance at a rate of 5% throughout the analyzed period,

- -

- maintenance services—4.5% in the first year, 4% in the second year, 3.5% in the third year, 2% in years 4–8, 1.5% in years 9–12, and 1% in the last 3 years.

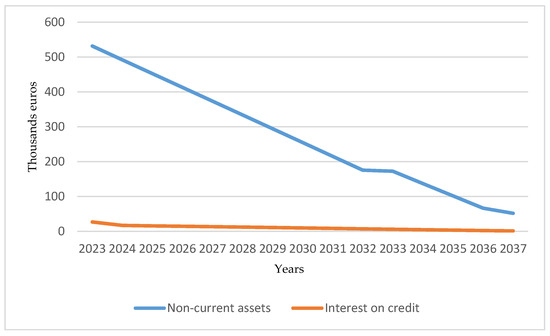

The LC investment in the Pomorskie region of Poland, when analyzing financial costs (Figure 5), shows the projected interest and loan fees as well as fixed assets from 2023 to 2037 in thousands of euros.

Figure 5.

Fixed assets for LC in the analysis of the cost of PV panel installation, including loan interest, from 2023 to 2037. Source: In-house development.

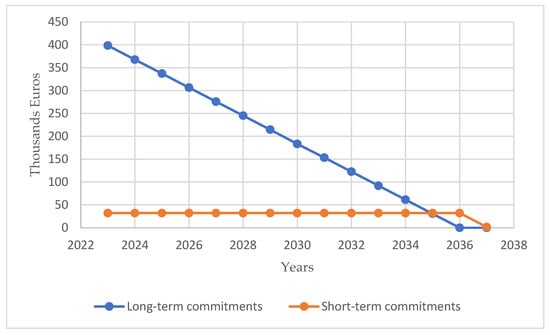

Short-term liabilities remain at a similar level of EUR 32.1 thousand throughout the entire period, while with long-term credit, the liabilities will decrease (Figure 6).

Figure 6.

Long-term and short-term liabilities in the analysis of the PV panel investment in LC. Source: In-house development.

The analysis shows a decrease in long-term liabilities from 2023 to 2037, with no credit servicing costs in the last 2 years. Not every logistics company, when building a logistics center, can afford to finance it solely from equity plus short-term liabilities. Typically, they must have accumulated equity capital of at least 65 percent, which companies often hesitate to do due to constantly changing market conditions and economic fluctuations in high-risk environments. They opt for long-term liabilities with 20 percent equity capital instead. In the financial analysis, the results of the company’s financial performance were taken into account, hence the negative values and the depreciation of LC automation, which have a significant impact on the financial result in years with a 10- and 20-percent equity capital share. Additionally, the analysis includes amortizations and costs, as well as projected profits, which are not presented in the article by the authors. This principle is also confirmed in the analyzed investment. The assessment of capital involvement (share of equity level) to cash level is presented in Figure 7.

Figure 7.

Equity share in the investment in PV panels at LC with different levels of equity capital from 2023 to 2037. Source: In-house development.

Sensitivity analysis, from the point of view of investment security and the possibility of financing the investor (cash), turned out to be the best option with an own share of 20%. It did not expose the entity to excessive financial burdens, guaranteeing the security of operations and repayment of liabilities. Additionally, the analysis of economic indicators indicated that this is good option:

| 1. | Level of equity capital | 10% | 20% | 50% | 100% |

| 2. | NPVR (net present value NPV) | 0.21 | 0.04 | −0.07 | −0.11 |

| 3. | NPV (net present value) (in thousand euros) | 12.66 | 4.32 | −21.41 | −64.75 |

| 4. | Equity (in thousand euros) | 61.36 | 120.73 | 306.82 | 613.64 |

| 5. | IRR (internal rate of return) of the investment 6.3% | ||||

This is true especially since the investment efficiency measurement index, NPVR, is greater than 0, reaching a value of 0.04, and the appropriate capital capabilities of the investor guarantee the success of the investment.

While analyzing and assessing the selection of the best variant of using equity capital, the impact of TGeBase (TGE) and CAPEX was also assessed. Impact analysis resulting from energy changes (TGE) has consequences, among others, in shaping the investment’s operating costs together with compensation and affecting the cash level. Of course, price increases enable a faster return on investment, while price decreases extend them, thus determining the profitability of the investment. In our research, we assumed a fixed price, even though we made calculations, which allowed us to omit additional risk assessment. However, it is worth noting that in the analysis we calculated the changes but did not subject them to further analyses. The analysis from the TGeBase level to the NPV level was expressed in installments:

| 1. | Increase or decrease—EUR/MWh | −10% | 0.0% | 10% |

| 2. | NPVR | −0.05 | 0.04 | 0.11 |

| 3. | NPV (in thousand euros) | −6.02 | 4.32 | 12.95 |

| 4. | TGeBase average over 15 years | 69.66 | 77.41 | 85.23 |

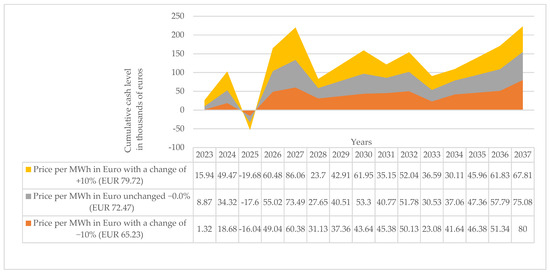

The analysis showed that the NPVR level of 0.0 was achieved with a −5% decrease in the TGeBase level. Price changes (TGeBase) also had an impact on the sensitivity of the cash level (Figure 8).

Figure 8.

Sensitivity analysis of TGeBase to cash flow levels for LC in the period 2023–2037 with a 10% decrease in energy prices, no change, and a 10% increase. Source: In-house development.

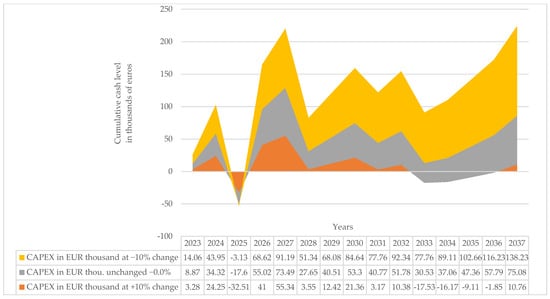

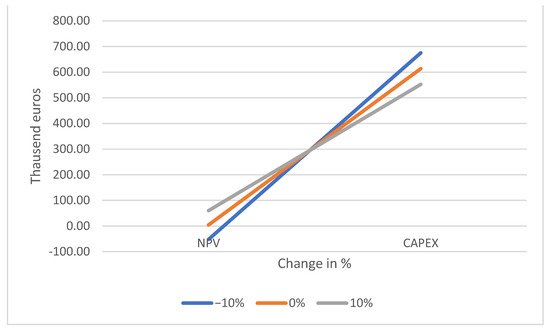

The analysis of the sensitivity of the cash level (cumulatively) to changes in capital expenditures (CAPEX) also shows that the best (optimal) solution is the situation when the equity capital expenditure amounts to 20% (Figure 9). This optimal choice of financing share (Figure 10) is confirmed by the following economic indicators assessing the CAPEX level to the NPV level:

| 1. | Increase or decrease—EUR/MWh | −10% | 0.0% | 10% |

| 2. | NPVR | −0.39 | 0.04 | 0.54 |

| 3. | NPV (in thousand euros) | −52.27 | 4.32 | 60.00 |

| 4. | CAPEX (in thousand euros) | 675 | 613.64 | 552.27 |

| Source: In-house development. | ||||

Figure 9.

CAPEX level and cash flow for LC from 2023 to 2037 with +10% change, no change, and −10% change. Source: In-house development.

Figure 10.

The impact of changes in CAPEX on the NPV. Source: In-house development.

The analysis conducted allows us to conclude that the energy investment in PV panels in the logistics center (LC) will pay off within 15 years using external financial resources. Attempts were made to demonstrate that the profitability of the investment and the payback period are influenced by both the loss of energy productivity (Table 6) as well as the financing possibilities (structure of equity share) and the amount for compensation.

6. Conclusions

Investments in photovoltaics, analyzing data on electricity generated in the EU (Table 4), indicate great interest in various production capacities. This means that the installations we analyzed will probably become “everyday”. This means that large economic entities, in order to achieve savings and guarantee energy security, will decide on pro-ecological investments, e.g., in photovoltaics. The analysis showed that this type of investment is profitable and, based on our assumption, pays off within 15 years. The study, among other things, took into account the selection of the best share of equity capital to external capital and the impact of variable prices. In the case of the TGeBase analysis, an increase in energy prices benefits the logistics company planning to install PV panels on the LC facility. In the CAPEX analysis, a decrease in expenditures results in a EUR 138.23 thousand benefit for the logistics company over the 15-year period.

When analyzing the investment project for PV panels at the LC facility in Pomorskie Voivodeship, the capital contribution, potential investment aid, change in loan interest rates, total value of the investment (direct and indirect costs CAPEX), and energy price fluctuations were taken into account. Unfortunately, the study did not identify the risks and methods of managing them.

6.1. Recommendations

In the future, the authors should take steps to expand our knowledge, both in terms of assessing other pro-environmental investments, in the area of developing the field of photovoltaic panels as an element of the energy mix. It is particularly important to examine trends—the authors have already taken the initiative in these areas (they are not yet systemic)—and to verify the energy obtained after installation and after several years of using the installation. These activities will help the authors to see the impact of such large investments and their profitability. Additionally, the authors will consider conducting analyses of the impact of this type of investment on the socio-economic environment of the region and the investors themselves, as well as identifying and managing investment risk. The authors’ future analytical activities will be complemented by the identification and assessment of the phenomenon of panel disposal, which may also significantly affect the assessment of the investment and its profitability.

6.2. Limitations

The key limitation of this analysis is the case study method, which focuses on only one investment (one company). We believe this is a good example, but in the future, it would be worth analyzing more similar companies to understand what factors determined the investments, what were the production and financial expectations, and what the process of achieving this looked like. The limitation also applies to information obtained from the investing entity. However, the financing activities for investments in photovoltaic installations presented by us are relatively universal and can be used in other organizations in this field.

6.3. Implications

The results of our research expanded the theoretical basis for assessing a large investment in photovoltaic installations used by a logistics center in Poland. This study fills the scientific gap regarding the analysis of the implementation of such investments in the field of generating electricity for own needs. Based on our research, we identified, among others, energy demand, loss of productivity, and, in particular, investment financing opportunities that can be applied to other similar logistics entities. The main business implication of the study is the possibility of using the results by other similar entities. In this way, they can reduce the level of pollution, organize pro-ecological activities, and start producing energy from renewable energies. It is worth noting that such activities [61,62] may also have an impact on building a positive image of the organization. In today’s market, as Rashid [63] noted, a green image can provide us with a more loyal customer and can be economically beneficial.

Author Contributions

The main activities of the team of authors can be described as follows: conceptualization, M.O., J.A.D. and A.M.O.; methodology, M.O., J.A.D. and A.M.O.; software, M.O., J.A.D. and A.M.O.; validation, M.O., J.A.D. and A.M.O.; formal analysis, M.O., J.A.D. and A.M.O.; investigation, M.O., J.A.D. and A.M.O.; resources, M.O., J.A.D. and A.M.O.; data curation, M.O., J.A.D. and A.M.O.; writing—original draft preparation, M.O., J.A.D. and A.M.O.; writing—review and editing, M.O., J.A.D. and A.M.O.; visualization, M.O., J.A.D. and A.M.O., supervision, M.O., J.A.D. and A.M.O.; funding acquisition, M.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Bansal, P.; Roth, K. Why Companies Go Green: A Model of Ecological Responsiveness. Acad. Manag. J. 2000, 43, 717–736. [Google Scholar] [CrossRef]

- Xue, B.; Geng, Y.; Müller, K.; Lu, C.; Ren, W. Understanding the causality between carbon dioxide emission, fossil energy consumption and economic growth in developed countries: An empirical study. Sustainability 2014, 6, 1037–1045. [Google Scholar] [CrossRef]

- Moghimi, F.H.; Fälth, H.E.; Reichenberg, L.; Siddiqui, A.S. Climate Policy and Strategic Operations in a Hydro-Thermal Power System. Energy J. 2023, 44, 67–93. [Google Scholar] [CrossRef]

- Christmann, P. Multinational companies and the natural environment: Determinants of global environment policy standardization. Acad. Manag. J. 2004, 47, 747–760. [Google Scholar] [CrossRef]

- Mentes, M. Sustainable development economy and the development of green economy in the European Union. Energy Sustain. Soc. 2023, 13, 32. [Google Scholar] [CrossRef]

- Olkiewicz, M.; Olkiewicz, A.; Wolniak, R.; Wyszomirski, A. Effects of Pro-Ecological Investments on an Example of the Heating Industry—Case Study. Energies 2021, 14, 5959. [Google Scholar] [CrossRef]

- Wyszomirski, A.; Olkiewicz, M. Environmental Corporate Social Responsibility as a tool for creating the future of environmental protection. Rocz. Ochr. Srodowiska 2020, 22, 1145–1161. [Google Scholar]

- Jose, A.; Lee, S.M. Environmental reporting of global corporations: A content analysis based on website disclosures. J. Bus. Ethics 2007, 72, 307–321. [Google Scholar] [CrossRef]

- Letcher, T.M. (Ed.) Comprehensive Renewable Energy, 2nd ed.; Elsevier Ltd.: London, UK, 2022. [Google Scholar]

- Hrazdil, K.; Anginer, D.; Li, J.; Zhang, R. Climate Reputation and Bank Loan Contracting. J. Bus. Ethics 2023, 1, 1–22. [Google Scholar] [CrossRef]

- Rani, T.; Wang, F.; Rauf, F.; Ain, Q.; Ali, H. Linking personal remittance and fossil fuels energy consumption to environmental degradation: Evidence from all SAARC countries. Environ. Dev. Sustain. 2023, 25, 8447–8468. [Google Scholar] [CrossRef]

- Sreenivasulu, A.; Subramanian, S.; Sangameswara, R.P. Design and simulation of advanced intelligent deep learning MPPT approach to enhance power extraction of 1000 W grid connected Photovoltaic System. J. Intell. Fuzzy Syst. 2023, 44, 3987–3998. [Google Scholar] [CrossRef]

- Zhang, Z.; Liao, H. A two-stage mathematical programming model for distributed photovoltaic project portfolio selection with incomplete preference information. Technol. Econ. Dev. Econ. 2022, 28, 1545–1571. [Google Scholar] [CrossRef]

- Bhujel, R.; Joshi, H.G. Women farmer’s perspectives on climate change and intention to adopt sustainable agriculture. Int. J. Prof. Bus. Rev. 2023, 8, e01210. [Google Scholar] [CrossRef]

- Bekheet, H.N.; Al-Sudany, N.K.; Najm, S.S. Iraqi economy and renewable energy projects between economic necessity and investment challenges. Int. J. Prof. Bus. Rev. 2023, 8, e03435. [Google Scholar] [CrossRef]

- Diaz-Rainey, I.; Griffin, P.A.; Lont, D.H.; Mateo-Márquez, A.J.; Zamora-Ramírez, C. Shareholder Activism on Climate Change: Evolution, Determinants, and Consequences. J. Bus. Ethics 2023, 1–30. [Google Scholar] [CrossRef]

- Boyle, G. Renewable Energy: Power for a Sustainable Future; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Everett, R.; Boyle, G.; Peake, S.; Ramage, J. (Eds.) Energy Systems and Sustainability: Power for a Sustainable Future, 2nd ed.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Bönke, T.; Dany-Knedlik, G.; Roeger, W. Meeting climate targets can only spur on economic growth with the right combination of measures. DIW Wkly. Rep. 2023, 13, 236–242. [Google Scholar] [CrossRef]

- Wolff, G. Systemic Rivalry of China and the West in Climate Policy. Econ. Voice 2023, 1, 1–6. [Google Scholar] [CrossRef]

- Gábor, V. International comparative analysis of prosumers in selected fields of energy use and further customer preferences in environmental issues. Hung. Stat. Rev. 2023, 6, 3–31. [Google Scholar]

- Hao, H.; Liu, Z.; Zhao, F.; Li, W.; Hang, W.; Lund, H.; Kaiser, M.J. Scenario analysis of energy consumption and greenhouse gas emissions from China’s passenger vehicles. Energy 2015, 91, 151–159. [Google Scholar] [CrossRef]

- Toh, M.Y.; Albada, A.; Ng, S.H. Effect of Country Governance on Cross-Border Renewable Energy Investment and Climate Actions in Emerging Countries. Emerg. Mark. Financ. Trade 2023, 58, 3813–3827. [Google Scholar] [CrossRef]

- Ridha, A.; Al-Baghdadi, A.; Maher, A.; Sadiq, R. A study of the effects of rising global summer heat on photovoltaic solar energy efficiency. Int. J. Energy Environ. Econ. 2023, 29, 397–410. [Google Scholar]

- Woo, T.H. Climate change analysis in energy-mix with non-carbon emission energy incorporated with pandemic society. Environ. Dev. Sustain. 2023, 25, 11723–11733. [Google Scholar] [CrossRef] [PubMed]

- BNetzA (Federal Network Agency). Statistics of Selected Renewable Energy Sources for Electricity Generation—August 2023. 2023. Available online: https://www.bundesnetzagentur.de/DE/Fachthemen/ElektrizitaetundGas/ErneuerbareEnergien/ZahlenDatenInformationen/EEG_Registerdaten/ArchivDatenMeldgn/start.html (accessed on 12 August 2023).

- Boqiang, L.; Yufang, C. Impact of the Feedin Tariff Policy on Renewable Innovation: Evidence from Wind Power Industry and Photovoltaic Power Industry in China. Energy J. 2023, 44, 29–46. [Google Scholar] [CrossRef]

- Solar Power Europe. EU Market Outlook for Solar Power 2022–2026. 2022. Available online: https://www.solarpowereurope.org/insights/market-outlooks/eu-market-outlook-for-solarpower-2022-2026-2 (accessed on 12 August 2023).

- Nowak, J.K. (Ed.) Energetyka Odnawialna: Stan i Perspektywy Rozwoju; Wydawnictwo Naukowe PWN: Warsaw, Poland, 2018. [Google Scholar]

- Możliwości Inwestycyjne w Energetyce Odnawialnej w Ramach Zgodnych z Europejskim Zielonym Ładem, Instytut Energetyki Odnawialnej, Warszawa. 2020. Available online: http://konfederacjalewiatan.pl/aktualnosci/2020/1/_files/2020_09/ieo_final_1_.pdf (accessed on 12 August 2023).

- Dyczkowska, J.A.; Reshetnikova, O. Logistics Centers in Ukraine: Analysis of the Logistics Center in Lviv. Energies 2022, 15, 7975. [Google Scholar] [CrossRef]

- Available online: https://bdm.stat.gov.pl (accessed on 14 August 2023).

- Cichosz, M.; Wierzbicki, M. Innowacyjne modele biznesowe w sektorze energetyki odnawialnej—Analiza przypadków z Polski. Probl. Zarz. 2016, 14, 105–116. [Google Scholar]

- Villar, E.M.; Barroso, C.; del Carmen, M. The need to review the role of tax incentives for self-consumption in the context of support schemes for pv solar energy. Crónica Tribut. 2023, 187, 139–168. [Google Scholar]

- Adams, R.; Jenkins, J.; Peck, D.; White, D. Renewable Energy Finance: Powering the Future; Palgrave Macmillan: London, UK, 2019. [Google Scholar]

- Redukcja Emisji Gazów Cieplarnianych: Cele I Działania Unii Europejskiej, Parlament Europejski. Available online: https://www.europarl.europa.eu/pdfs/news/expert/2018/3/story/20180305STO99003/20180305STO99003_pl.pdf (accessed on 13 August 2023).

- Olivier, J.G.J.; Peters, J.A.H.W. Trends in Global CO2 and Total Greenhouse Gas. Emissions: 2019 Report; PBL Netherlands Environmental Assessment Agency: The Hague, The Netherlands, 2020. [Google Scholar]

- European Parliament. Solar Energy Policy in the EU and the Member States, from the Perspective of the Petitions Received. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2016/556968/IPOL_STU(2016b)556968_EN.pdf (accessed on 12 August 2023).

- Jacksohn, A.; Grösche, P.; Rehdanz, K.; Schröder, C. Drivers of Renewable Technology Adoption in the Household Sector. Energy Econ. 2019, 81, 216–226. [Google Scholar] [CrossRef]

- Ustawa z Dnia 20 Lutego 2015 r. o Odnawialnych Źródłach Energii. (Dz. U. 2015 poz. 478). Available online: https://www.ure.gov.pl/pl/urzad/prawo/ustawy/6092,Ustawa-z-dnia-20-lutego-2015-r-o-odnawialnych-zrodlach-energii.html (accessed on 12 August 2023).

- Tomaszewska, B.; Grzesiak-Kopeć, A. Polskie regulacje prawne dotyczące rozwoju energetyki słonecznej—Perspektywa inwestora. Rocz. Kol. Anal. Ekon. 2018, 48, 227–239. [Google Scholar]

- Available online: https://www.gov.pl/web/ia/polityka-energetyczna-polski-do-2040-r-pep2040 (accessed on 14 August 2023).

- Rozporządzenie Ministra Gospodarki z Dnia 24 Grudnia 2015 r. w Sprawie Warunków, Jakie Muszą Spełniać Przedsięwzięcia z Zakresu Energetyki Odnawialnej, Aby Uzyskać Preferencje w Ramach Systemu Wsparcia (Dz.U. z 2015 r. poz. 2214). Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20190001298 (accessed on 12 August 2023).

- European Commission. R&D Tax Incentives: How to Make Them Most Effective? 2017. Available online: https://op.europa.eu/en/publication-detail/-/publication/d9ae78f3-9f41-11e7-b92d01aa75ed71a1/language-en (accessed on 12 August 2023).

- McKenna, E.; Pless, J.; Darby, S.J. Solar Photovoltaic Self-Consumption in the UK Residential Sector: New Estimates from a Smart Grid Demonstration Project. Energy Policy 2018, 118, 482–491. [Google Scholar] [CrossRef]

- Solar Power Europe. 2021. Available online: www.solarpowereurope.org/insights/market-outlooks-for-solarpower-2021–2024 (accessed on 14 August 2023).

- Ustawa z Dnia 20 Maja 2016 r. o Efektywności Energetycznej (Dz.U. z 2016 r. poz. 831). Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20160000831 (accessed on 12 August 2023).

- Mikulik, J.; Niekurzak, M. Impact of a photovoltaic installation on economic efficiency on the example of a company with high energy consumption. Sci. Pap. Sil. Univ. Technol. Organ. Manag. 2023, 169, 521–540. [Google Scholar] [CrossRef]

- Frondel, M.; Kaestner, K.; Sommer, S.; Vance, C. Photovoltaics and the Solar Rebound: Evidence from Germany. Land Econ. 2023, 99, 265–282. [Google Scholar] [CrossRef]

- European Parliament. Energy Efficiency for Low-Income Households. 2016. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2016/595339/IPOL_STU(2016)595339_EN.pdf (accessed on 12 August 2023).

- Simpson, G.; Clifton, J. Subsidies for Residential Solar Photovoltaic Energy Systems in Western Australia: Distributional, Procedural and Outcome Justice. Renew. Sustain. Energy Rev. 2016, 65, 262–273. [Google Scholar] [CrossRef]

- BNetzA (Federal Network Agency). EEG Register Data and Reference Values for Payment. 2020. Available online: https://www.bundesnetzagentur.de/DE/Fachthemen/ElektrizitaetundGas/ErneuerbareEnergien/ZahlenDatenInformationen/start.html (accessed on 12 August 2023).

- Pająk, K.; Szul, A. Analiza wsparcia finansowego dla inwestycji w panele fotowoltaiczne w Polsce. Gospod. Surowcami Miner. Miner. Resour. Manag. 2019, 35, 81–96. [Google Scholar]

- BMWK (Federal Ministry for Economic Affairs and Climate Action). Market Analysis Photovoltaic Roof Systems. 2014. Available online: https://www.bmwk.de/Redaktion/DE/Downloads/M-O/marktanalysephotovoltaikdachanlagen.pdf (accessed on 12 August 2023).

- Toroghi, S.O.; Oliver, M.E. Framework for Assessment of the Direct Rebound Effect for Residential Photovoltaic Systems. Appl. Energy 2019, 251, 113391. [Google Scholar] [CrossRef]

- Nowak, K.; Klimczak, E.; Łasica, W. Efektywność energetyczna w sektorze fotowoltaicznym w Polsce. Przegląd Elektrotechniczny 2020, 10, 98–104. [Google Scholar]

- Turek, A.; Ostrowski, M. Efektywność paneli fotowoltaicznych w warunkach polskiego klimatu. Zesz. Nauk. Politech. Śląskiej Elektr. 2017, 105, 135–144. [Google Scholar]

- Available online: https://www.bgk.pl/programy-i-fundusze/programy/program-termo/ (accessed on 5 November 2023).

- Available online: https://www.domoweklimaty.pl/czytelnia/prosument-bez-tajemnic/ (accessed on 5 November 2023).

- Available online: https://www.gov.pl/web/gov/szukaj?scope=nfosigw&query=prosument (accessed on 5 November 2023).

- Olkiewicz, M. Knowledge management as a determinant of innovation in enterprises. In Proceedings of the 9th International Management Conference Management and Innovation for Competitive Advantage, Bucharest, Romania, 5–6 November 2015; pp. 399–409. [Google Scholar]

- Reshetnikova, O.; Dyczkowska, J.A.; Olkiewicz, M.; Paszkowska, D. Promoting Pro-ecological Behavior with Logistics Operators in Poland and Ukraine. Rocz. Ochr. Srodowiska 2021, 23, 642–654. [Google Scholar] [CrossRef]

- Rashid, N.R.N.A.; Khalid, S.A.; Rahman, N.I.A. Environmental Corporate Social Responsibility (ECSR): Exploring its Influence on Customer Loyalty. Procedia Econ. Financ. 2015, 31, 705–713. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).