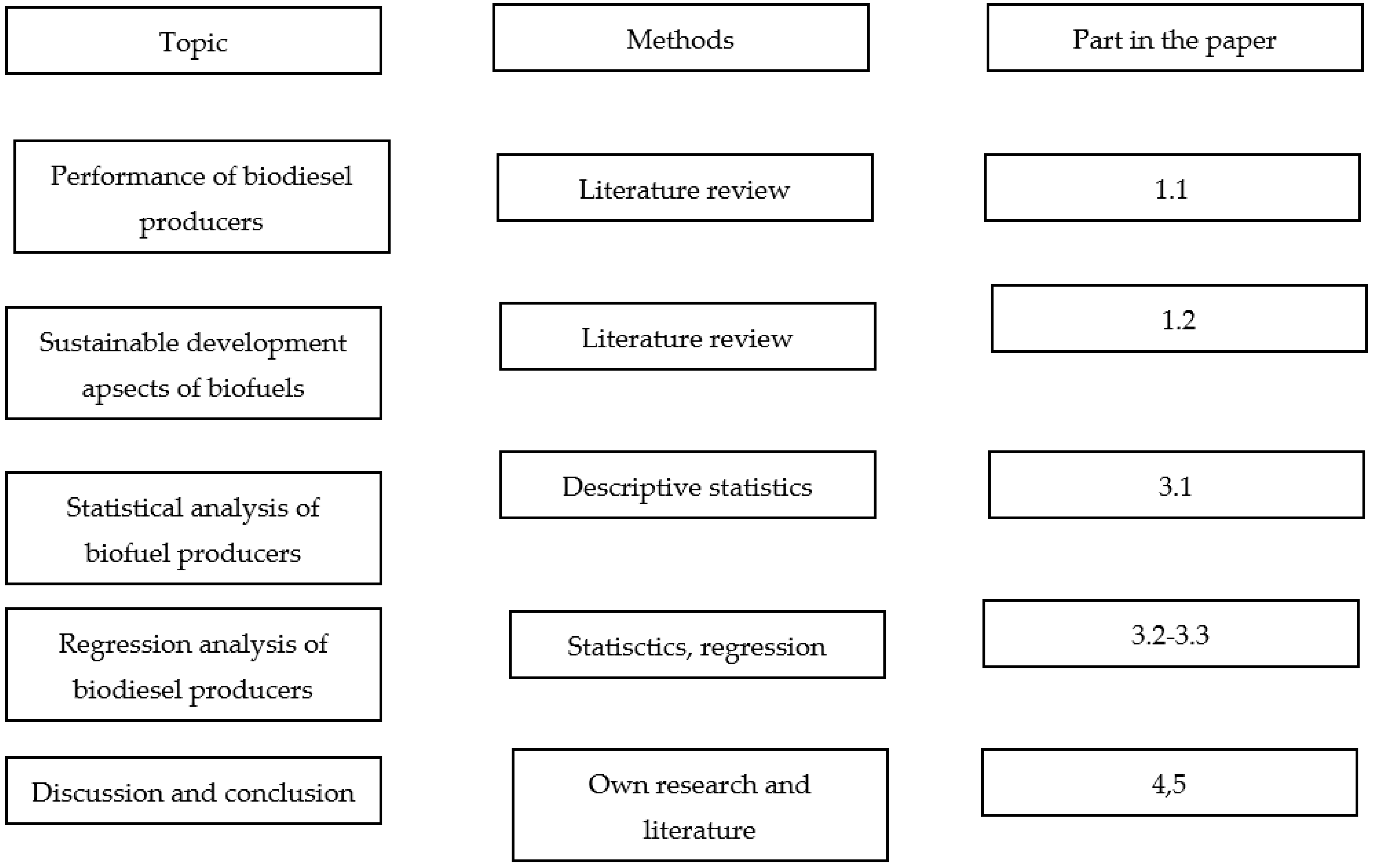

3.1. Performance of Polish Biofuel Producers

A balance sheet is a document containing a summary as of a specific date—in terms of value—of a company’s assets and the sources of its financing. This document is prepared in the form of a two-sided table. The left side shows—divided into basic items by type—the company’s assets, and the right side shows liabilities, e.g., sources of asset financing, which consist of equity.

All assets of an enterprise in terms of value are referred to as assets. However, the equity capital, external capital, and profit at the company’s disposal, which are the sources of asset financing, e.g., property, are called liabilities. So, the balance sheet is an important document for closing accounts of an entity’s reporting period. It is then called final [

52].

Tangible fixed assets are most often represented in an enterprise by owned and constructed fixed assets: buildings, structures, machines, devices, means of transport, tools, livestock, perpetual usufruct rights to land, and rights to residential premises. Tangible fixed assets are used in the enterprise for more than one year and are valued mainly at net value, i.e., the difference between gross value and the amount of depreciation.

At the same time, the closing balance is a document for the opening of the second, subsequent reporting period of the entity, for which it becomes the opening balance or initial balance. The closing balance of one reporting period, being, at the same time, the opening balance for the next period, allows for the maintenance of so-called balance sheet continuity, which is one of the main principles upon which accounting is based. If certain conditions are met—such as, for example, the unchanged structure and content of individual balance sheet items—balance sheet continuity allows for the comparison and assessment of the activity of an entity (company) and its financial effects in subsequent reporting periods [

52].

In 2021, the average value of fixed assets in the examined companies reached PLN 25,059 million, whereas current assets were estimated at PLN 14,775 million and accounted for nearly 31% of total assets (

Table 1). Between 2005 and 2021, fixed assets increased by nearly 122%, and current assets increased by around 155%.

In the analyzed period, the average return on fixed assets reached 11.7, ranging from 16.5 in 2005 to 2.12 in 2014 [

8]. These changes could be attributed to numerous factors, mostly long-term debt and investment. The observed fluctuations also resulted from the EU’s biofuel policy, which increased the demand for rapeseed oil and biofuels. The return on fixed assets was highest in 2005, 2007, 2017, and 2021, which could explain the observed increase in profits and changes in capital structure [

52].

The second group of enterprise assets is current assets, which are most often used up completely in one production process or in one financial year. Current assets change their form by participating in the production process and are transformed into finished products. Current assets are divided into inventories, short-term receivables, cash, and short-term investments [

53].

Current assets in the analyzed companies increased from PLN 5.8 million in 2005 to nearly PLN 14.7 million in 2021 (by 155.3%). Current assets accounted for 26.8% of total assets in 2005, 30.9% of total assets in 2017, and 29.6 in 2021 (

Table 1). The above increase had positive implications because it increased liquidity, decreased the costs of assets, and improved productivity [

53].

The production of biodiesel depends on many factors; among them, macroeconomics is important. Some of them are associated with increased demand. Another is changes in oil prices, and when they become expensive, the production of biofuels should increase. Another factor regards changes in gross domestic product (GDP), which are described as positively correlated. Moreover, interest rates are important; however, their relationship is negative. Inflation also has an impact, and it should be positively correlated with biofuel production. Currency exchange rates may also impact biofuel production, and expensive foreign raw materials may decrease the production of biofuels. The domestic consumption of rapeseed oil may increase competition and increase prices and production [

54].

Another group of factors with an impact on biodiesel production is associated with internal factors depending on enterprise equipment. Fixed assets comprise long-term receivables, long-term investments, and intangible assets (

Table 2). Businesses embark on long-term investments to purchase new equipment and machinery and to improve the production process.

Long-term receivables are receivables with a repayment period of more than one year from the balance sheet date. However, in balance sheets prepared in accordance with the Polish Accounting Act, there is a certain exception to this rule, because trade receivables are not recognized as long-term receivables, which are always included in short-term receivables but are treated separately. Long-term receivables peaked in 2010 at PLN 121,393,300.

Long-term investments include assets such as long-term deposits, long-term loans granted, and securities (stocks, shares, bonds, treasury bills). The main benefit of owning these assets is the increase in their value or revenues from the sale of these assets. Real estate and intangible assets not used by the entity but acquired to achieve economic benefits (income, increase in value, other benefits) in accordance with the Accounting Act are presented in the balance sheet in the group of long-term investments

Investments are important in the development of biodiesel enterprises. They depend on production technology, the production scale, and the market price of used materials [

21]. Moreover, the cost of labor, transportation, associated insurance, taxes, and other factors are important. Biodiesel companies need financial certainty and policy certainty because taxes may disturb the development of the sector. The policy should be flexible enough to allow for investments [

55].

In the first six years after Poland’s accession to the EU, the analyzed companies invested heavily in improving their production facilities and adapting them to EU standards. The value of long-term investments was highest in 2008 (PLN 878,680,80). This situation was the result of requirements that Polish enterprises had to fulfill. After accession, Polish enterprises had to invest significantly to meet European Union (EU) quality standards. The enterprises had to improve production safety and environmental issues. The recycling process had to be introduced to the companies. They had to limit emissions of CO2 and other greenhouse gases. Moreover, the enterprises had to invest in soundproofing silencers to reduce noise.

Intangible assets are important for biodiesel enterprises, as well as for others. Intangible assets are property rights acquired by an entity, classified as fixed assets, suitable for economic use, with a useful expected economic life longer than one year, intended for the entity’s needs. These include copyrights, rights to inventions, know-how, goodwill, and the costs of completed development work and other factors. The value of intangible assets continued to increase in the examined period. Intangible assets were highest in 2021, marking an increase of 306.4% from 2005.

3.2. Current Assets of Biofuels Industry

Current assets include inventories, short-term receivables, and short-term investments. Inventories are components of current assets, which include goods, materials, finished products, and work in progress. Materials are consumed in one production cycle and include basic materials, auxiliary materials, spare parts of machines and devices, fuel, and packaging. Finished products are goods produced in the production process and are sold on the market. The goods do not change their form and are intended for sale in trading companies. Work in progress includes semi-finished products that change their form during production. Short-term receivables are funds due to the company for the sale of products and goods, which should be transferred to it divided into periods: up to 12 months and over 12 months. Cash means funds in a bank account or on hand.

The value and structure of current assets determine a company’s liquidity. Inventories are an important component of current assets. High inventory levels are undesirable because they tie up capital in stocks. Inventory levels are influenced by two groups of factors. Firstly, agrifood producers are unable to fully synchronize their inventory levels (streams of produced vs. sold goods) because of seasonal differences in the supply and demand for plant-based products. The second group of factors is associated with supply chain uncertainty [

56]. In the investigated companies, inventory levels were highest in 2021 at PLN 6329 million. Inventory levels increased by more than 179.4% between 2005 and 2021 (

Table 3).

Short-term receivables generally increased in the analyzed period, with some variations. This parameter was highest in 2021 (PLN 5384 million), marking an increase of nearly 149.5% from 2005.

Greater fluctuations were observed in short-term investments, which were lowest in 2005 (PLN 1,362,263,000) and highest in 2021 (PLN 3806 million) (an increase of 179%). The value of short-term investments increased by nearly 114% between 2005 and 2021.

Liability levels are important measures not only of enterprise conditions but also of vulnerability to external crises and general conditions of development [

57].

Foreign capital constitutes another group of sources of financing for a company’s activities. They include the liabilities of enterprises toward other market participants, such as banks, institutions, other enterprises, and others. An important feature of modern enterprises is having liabilities at a specific level. Economically vibrant enterprises finance their current business activities using external capital, the availability of which on the market is systematically increasing. However, savings and the generated profit are allocated to other, more profitable ventures. Considering the criterion of the payment date, liabilities are divided into long-term (payment date longer than one year) and short-term (repayment does not exceed one year). In enterprises, it is advisable to have capital that remains at one’s disposal longer, so the more long-term capital there is, the more secure the company’s situation is [

52].

Investment projects often require external sources of funding. However, high debt can undermine a company’s financial stability. Long-term liabilities include loans with a payback period longer than one year. In the analyzed companies, long-term liabilities were lowest in 2005 (PLN 4,186,770,000) and highest in 2021 (PLN 10,142 million) (an increase of 142.3%). The value of long-term liabilities increased by nearly 80% between 2005 and 2021 (

Table 4).

Short-term liabilities consist of short-term loans that are obtained mainly to finance current production needs. Short-term liabilities peaked in 2021 (PLN 10,732 million), marking an increase of more than 110% from 2005.

Sales are a mainstream revenue in the biofuel industry. In the analyzed companies, sales revenues peaked in 2021, marking an increase of nearly 162% from 2005 (

Table 5). Biofuel sales decreased in the following years. Sales revenues increased by nearly 95% between 2005 and 2021.

Every business activity generates costs on the one hand and revenues and financial results on the other. When conducting non-agricultural business activities, an individual always incurs some costs.

Costs are one of the basic economic categories in accounting that occur in every business entity, and the type of business activity does not matter.

Market conditions and profitability have an impact on the biofuel industry. Cost production has an impact on the biofuel industry. The production and production costs of biofuels depend on technological risks [

58].

Production costs and raw material purchases, mainly rapeseed, are the key cost elements in the biofuel sector. These costs are higher in biofuel production than in the fossil fuel sector [

59]. Other costs in biofuel production are associated with technological processes, as well as waste and by-product management [

60]. In the analyzed companies, sales costs were highest in 2021, marking an increase of nearly 136% from 2005.

Net profits influence a company’s performance and growth. Net profits in the Polish biofuel sector fluctuated in the analyzed period. The examined companies reported losses in 2008 (−PLN 28,390,000) and 2014 (−PLN 879,383,000). In 2008, the reported losses were associated mainly with large-scale investments and the global financial crisis. In turn, the losses reported in 2014 resulted from high long-term and short-term debt (

Table 6).

Despite the losses sustained in 2008 and 2014, biofuel companies generated profits in the remaining years of the analysis. However, net profit varied across the examined years. In the analyzed companies, net profit reached PLN 3890 million in 2021, marking an increase of 50% from 2005.

An EBIT (earnings before deducting interest and taxes) analysis also delivers interesting results. In accountancy, this value can be calculated as sales minus operating costs and is a very good indicator for comparing results for various enterprises regardless of the costs of their use of financial leverage and tax burdens. It reached the highest value in 2021, PLN 4,885,178,3, which proves the improvement of the economic situation of biodiesel enterprises in the market.

3.3. Regression Analysis of Biofuel Industry

Biodiesel can be considered a potential replacement for fossil fuels. The potential of biodiesel was evaluated in the literature. A regression analysis helped to find out the strength of the impact of each variable. The regression and neural network technique was used. This is a powerful mathematical tool for prediction [

61].

The extent to which the situation in the rapeseed market influenced the performance of biofuel producers was evaluated based on net profits as the dependent variable Y

1. The dependent and independent variables are presented in the Methods section. The results of the analysis are presented in

Table 7,

Table 8 and

Table 9. The net profit of biofuel producers was influenced by the following variables: X

1—biodiesel production (%), X

2—cost of goods sold (%), X

3—monthly consumption of rapeseed oil (%), X

4—fixed assets (%), and X

5—rapeseed exports (%). The strongest impacts were X

2—cost of goods sold and X

1—biodiesel production. This can be explained by the increasing direct and indirect cost of costs of goods sold. They generally depend on the situation in the market. Transport is important because the costs of completing deliveries and collective packaging increase. Moreover, biodiesel companies need to have transport insurance and other protections. Indirect costs are also important because biodiesel enterprises have to cover marketing and advertisement. In addition, administrative costs increase with the requirements of the European Union (EU) because biodiesel enterprises have to employ specialists from the market. The net profit of biodiesel companies depended on biodiesel production, which was an effect of the scale economy. Fixed assets in the biodiesel enterprises also impacted the net profits. Their value has an impact on net profits because better-equipped entities can increase production and reduce costs. The net profits of biodiesel entities depend on the demand side, too. The consumption of both biodiesel and rapeseed oil increases prices and incomes. The export of biodiesel is increasing each year; however, the balance is still negative, suggesting major demand for biodiesel, which is an important renewable energy source in the market. The regression model fit well with the observed data (R

2 = 0.997;

p = 0.000).

Two hypotheses were analyzed in the model [

62]. The null hypothesis, H

0, postulates that none of the modeled variables influenced profits in the biofuel sector. In turn, hypothesis H

1 posits that at least one variable is significantly correlated with the profits reported by biofuel companies. The null hypothesis was rejected in the F-test because some independent variables were significantly correlated with gross profits in biofuel companies (

Table 8). Therefore, Student’s t-distribution was examined in the regression analysis.

The analysis revealed that there are no grounds for rejecting the null hypothesis at the significance level of α = 0.05, which implies that at least one independent variable is significantly correlated with gross profits in the biofuel sector and that the slope of the regression line is statistically significant (

Table 8).

The analysis revealed that gross profits in the biofuel sector are mainly affected by the following variables: X

2—cost of sales and X

1—biodiesel production (

Table 9).

Semi-partial correlations were calculated to determine the proportion of unexplained variance in the dependent variable that is explained by the first predictor [

63]. The results were used to estimate the individual effects of independent variables on the dependent variable.

Semi-partial correlations are smaller than partial correlations, but their distribution is similar. The highest

p-values were noted for two variables: X

5—rapeseed exports and X

4—fixed assets (

Table 9).