Abstract

Smart cities are aimed at connecting urban infrastructures to enhance the efficiency of their operation and services while taking sustainability goals into consideration. As a result of the intermittency associated with renewable generation, smart city systems such as smart grids and microgrids may not be able to ensure the security of supply. This can be mitigated by allowing these systems to trade surplus energy with other neighboring systems through local energy markets based on peer-to-peer schemes. Such an approach can play an important role on achieving sustainability due to the positive impacts at the economic, social, and environmental level. Therefore, this work explores the design of local energy markets to help determine how they are relevant to smart grid and microgrid applications and what their contributions are to sustainability in smart cities. Essentially, this is achieved by performing a literature review to address key characteristics related to the design of local energy markets while considering their relationship with urban sustainability. In addition, the concept of game theory and its potential to evaluate market designs are also introduced and discussed. Finally, the suitability of centralized, decentralized, and distributed market designs for each dimension of sustainability is estimated based on their design characteristics.

1. Introduction

Information and communication technologies (ICTs) provided the opportunity for cities to become digital, connected, structured, and in a way, more efficient and smarter. This paved the way for the introduction of a smart and sustainable urban environment, i.e., smart city, capable of improving the quality of life of its citizens and enhancing the efficiency of its operation and services through ICTs [1]. The commonly accepted definition of sustainable development defined by the United Nations in the Brundtland Report is applied to the concept of the smart city with an emphasis on an equilibrium among the dimensions of economic, social, and environmental sustainability [2,3]. Hence, this aspect of urban sustainability needs to be considered and embedded in the definition and various domains and subdomains of smart cities. The key indicators of a smart city vary widely in the literature, but generally include smart economy, smart people, smart governance, smart mobility, smart environment, and smart living [4,5]. These indicators are enabled by the smart infrastructure, which is the main domain of smart cities and serves as the foundation that supports the various subdomains. Smart grids (SGs) and microgrids (MGs) are an important part of the smart infrastructure, allowing cities to effectively meet their energy and transportation needs while taking into consideration various aspects at the economic, technical, social, and environmental level [6].

An MG is seen by the US Department of Energy as a smart and small-scale electrical power system incorporated with controllable loads, energy storage system (ESS), and microgeneration units such as renewable energy sources (RES) [7], being capable of operating in both grid-connected and islanded modes when allowed by the national regulatory agency (NRA). The ability to connect with the public grid at the point of common coupling (PCC) and successfully operate in both modes is mainly granted by the various control and protection devices that guarantee a safe, reliable, and optimal operation under all circumstances [7,8]. The mitigation of greenhouse gas (GHG) emissions is an important benefit of MGs due to the extensive use of RES, but this type of system has also been developed as an effective way of solving the power supply crisis in remote and isolated locations [9,10]. In general, single MGs are usually only applied at a small scale or at the individual or community level, while SGs encompass a more complex system at a much larger scale. Groups of interconnected MGs can also be seen as an SG [11].

Certain RES such as photovoltaic (PV) panels and wind turbines are considered non-dispatchable, variable, and heavily dependent on weather conditions [12]. As a result of this intermittency, it is increasingly difficult to ensure a reliable balance between power generation and consumption. In particularly, prosumers (i.e., individual consumers able to produce and share electricity) and certain systems such as MGs operating in a cluster of interconnected MGs may not be able to ensure the continuous supply of critical and essential loads during islanded operation mode (i.e., when the MG cluster is operating disconnected from the public grid), because they mostly rely on RES and ESS. This can be mitigated by allowing MGs to cooperate and trade energy with other neighboring MGs, as well as with any other peers (i.e., producers, prosumers, and consumers) in the same distribution grid [8]. A local energy market (LEM) based on a peer-to-peer (P2P) scheme facilitates this energy trading and provides benefits to both participants and utilities [12].

Recently, the ability to transact energy in a P2P manner has been a topic of interest among researchers, especially in the field of SGs and MGs. Because of this, many works in the literature have addressed the implementation of LEMs to enable P2P energy trading in a wide variety of applications [13]. Although, the practical implementation of P2P energy trading and collaboration between systems in SG and MG applications is still in the early stages. Some works in the literature have focused on providing a brief review of existing P2P energy trading projects [14,15], while others have provided an extensive overview of various aspects associated with the operation of energy trading markets and their design [16,17,18,19,20,21,22]. Many works are also strongly focused on the control and energy management of SGs or MG clusters [8,23]. However, these works have not addressed the potential of P2P energy trading and distinct market designs for achieving a level of sustainability in the context of smart cities. Therefore, the contents of this work aim to address key aspects related to the design and evaluation of LEMs for P2P energy trading as well as their relationship with urban sustainability in the smart city context. This is performed through a review of the most relevant works in the literature with the goal of contributing a potential answer to the research question: How can LEMs for P2P energy trading be enabled in SG and MG systems and what are the implications of different market designs for sustainability in smart city ecosystems? In order to tighten this literature gap, it is important to provide a comprehensive overview of the most important aspects of P2P energy trading in SG and MG systems, and at the same time, address the benefits and potential shortcomings of LEMs for sustainability and regulatory challenges brought by market decentralization and distributed ledger technology (DLT) such as blockchain technology. In addition, game theory is introduced and discussed due to its potential to effectively evaluate market designs and analyze decision-making behaviors of market players. Game-theoretic approaches can play a key role in SG and MG applications, allowing us to obtain fair and optimal outcomes in highly competitive market settings with distinct player goals and preferences.

This paper is organized as follows: Section 2 provides details on the systematic methodology used to perform the literature review. Section 3 introduces the concept of LEMs for P2P energy trading and its relationship with MGs while addressing potential barriers and value propositions of MG projects. Section 4 and Section 5 present a comprehensive comparison between the different market designs and trading platforms, including the use of blockchain technology. Section 6 addresses the importance of game theory and its role on SG and MG applications to provide adaptability and enable an effective and fair P2P energy trading among market participants. Section 7 presents a panoply of economic, social, environmental, technical, and legal or political implications associated with LEMs for P2P energy trading. Section 8 discusses the relative suitability of energy market designs for each dimension of sustainability and addresses the scalability and replicability of SG and MG projects. Finally, Section 9 presents the main conclusions based on the various aspects addressed throughout the paper.

2. Method

Literature Review Methodology

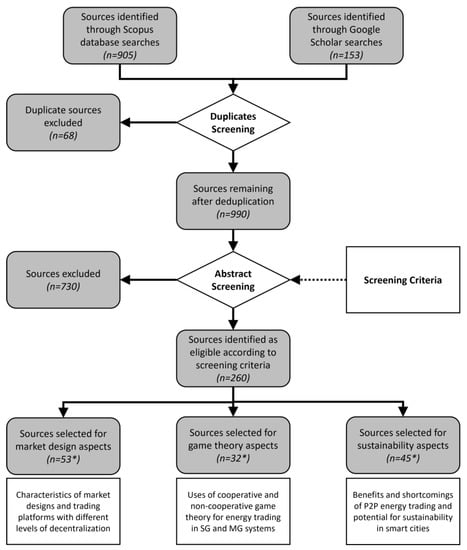

The key aspects related to the implementation of LEMs for P2P energy trading in SGs and MG systems, as well as their implications for sustainability in the topic of smart city ecosystems, have been addressed based on a literature review. Figure 1 shows the percentage of documents that address these aspects. The sources were identified through an article title, abstract, and keyword search using the Scopus database and through a secondary search using Google Scholar to identify potential commercial reports and other documents. The search performed for this work prioritized relevant documents published in recent years (i.e., after the year 2016 with special attention to publications from 2019 to 2022). Figure 2 provides details on the systematic methodology used to identify, select, and categorize English literature publications (i.e., journal articles, conference papers, book chapters, commercial reports, and working papers). After the removal of duplicate sources through a deduplication process, an abstract screening process was performed for the remaining set of documents in accordance with the following screening criteria:

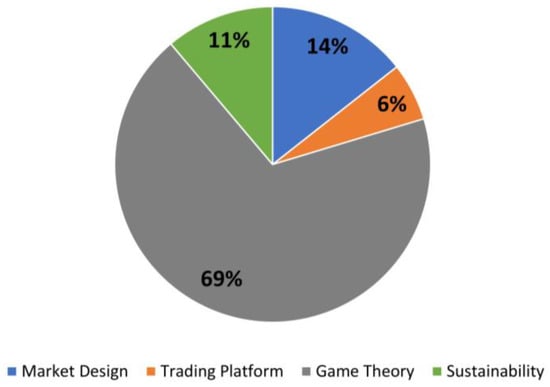

Figure 1.

Percentage of documents addressing LEMs for P2P energy trading in the topics of SGs, MGs, and smart cities with focus on market design, trading platform, game theory, and sustainability.

Figure 2.

Flowchart of the methodology used to identify, select, and categorize literature publications (* certain sources address aspects related to market design, game theory, and sustainability, being therefore counted in multiple categories).

- Sources in English language;

- Sources proposing centralized, decentralized, or distributed/hybrid market designs for LEMs and P2P energy trading;

- Sources proposing centralized or decentralized trading platforms to enable P2P energy trading;

- Sources addressing advantages and/or disadvantages of each market design and trading platform, as well as sources providing empirical evidence for comparison;

- Sources addressing the use and benefits of game-theoretic approaches in P2P energy trading applications;

- Sources proposing cooperative and/or non-cooperative game-theoretic models to improve transactions in SG and MG systems;

- Sources addressing economic, social, environmental, technical, and legal benefits and/or shortcomings of LEMs and P2P energy trading;

- Sources addressing the potential of LEMs and P2P energy trading for sustainability in the topic of smart and sustainable cities.

Then, the selection of potential documents to be used in this work was performed by undergoing a full-text analysis. This methodology allowed us to categorize the key aspects of LEMs into three main topics or categories:

3. Background to LEMs and MGs

The concept of P2P is not entirely new and has been used in a wide variety of applications, ranging from computer networks to energy management. In the context of MG systems, P2P energy trading allows each individual MG to share its resources and trade energy with other neighboring peers (i.e., other MGs or any producer and prosumer) in order to ensure the security of supply. Depending on the installed capacity and location, certain peers may be able to support and supply the loads of neighboring peers with deficit energy by exchanging their excess energy [8,14]. A LEM can facilitate this energy trade among individual MGs and offer transparency to each transaction between sellers and buyers. This can be particularly important for the concept of smart city to achieve a complete connection among the distinct city entities by allowing them to interact and share their resources with each other [24]. Implementing a LEM can provide numerous benefits to both the participant and the power system, being considered by IRENA as one of the 30 innovative solutions to enhance power system flexibility, grant increased access to renewable energy, empower consumers, and allow for a higher availability and more cost-effective use of RES [25].

A well-known and successful implementation of a LEM is the real-world case of the Brooklyn MG part of the TransActive Grid project, which uses blockchain technology to allow local P2P energy trading among the participants without relying on a central entity to manage the transactions [12,14]. Besides this case, several regional and national projects have been developed for P2P energy trading with some of the most relevant ones being Piclo in the United Kingdom, Vandebron in the Netherlands, and Yeloha and Masaic in the United States [14,15]. In a smaller scale, other projects have been developed for P2P energy trading in MG systems, including PeerEnergyCloud in Germany and TransActive Grid in the United States. The PeerEnergyCloud project was developed using a cloud-based trading platform for the local transaction of excess energy within a MG [12,14].

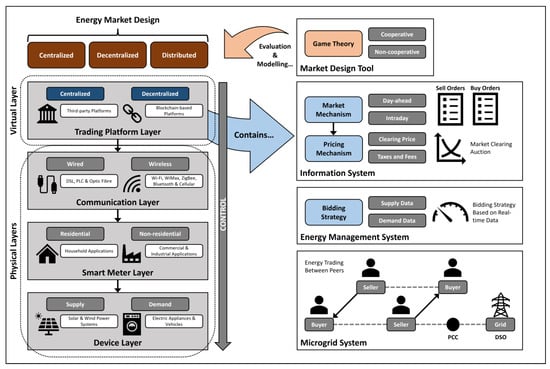

As represented in Figure 3, the market design, trading platform, and physical infrastructure are some of the key aspects of P2P energy trading in LEMs. In any of the designs, each upper layer is responsible for the control of the lower layer. The use of game theory, namely cooperative and non-cooperative games, is also an important aspect to consider when designing a P2P energy market to model the decision-making behaviors among market participants, being reflected in the sheer number of publications proposing game-theoretic approaches [16,17,18,19,20,21,22]. The energy trading platform is part of the virtual layer and contains an information system that interacts with the energy management system [12].

Figure 3.

Diagram of the typical structure of LEMs for P2P energy trading in MGs and its distinct virtual and physical layers.

This work is only focused on the aspects associated with the virtual layer and does not address the physical layer of LEMs, although it is worth mentioning that the physical layer mainly includes the physical infrastructure responsible for the power flow and data communication between peers or devices. Depending on the communication requirements and type of network (e.g., WAN, NAN, and HAN), the communication between the trading platform and smart meters and devices can be achieved through various communication protocols and standards using wired technologies (e.g., DSL, PLC, and optic fiber) or wireless technologies (e.g., Wi-Fi, WiMax, ZigBee, Bluetooth, and Cellular 3G/4G/5G) [26]. Many works have been specifically proposed for SGs and MG systems, but even the ones proposed for other applications such as electric vehicles (EV) and battery energy storage systems (BESS) can be effectively integrated into MG applications.

Table 1 presents relevant works available in the literature which propose market design models, trading platforms, and game-theoretic approaches for P2P energy trading in LEMs.

Table 1.

Selection of literature works proposing market design models, trading platforms, and game-theoretic approaches for P2P energy trading in LEMs.

3.1. Relationship between LEMs and MGs

LEMs can be seen as local energy communities, which are considered and treated as legal entities consisted of local system operators, generators, and consumers. Such communities aggregate DERs in a local area, allowing us to mitigate forecast errors of renewable energy generation and turn community members into active market players [63]. This is facilitated through consumer-centric schemes for P2P energy trading to enable the concept of P2P economy also known as sharing economy [64]. The active engagement from community members can lead to the provision of ancillary services to DSOs and reduction of additional costs associated with grid usage and expansion, extending the charging network for EVs in MGs and facilitating the transition to smarter, cleaner, and more flexible grid systems [63,65].

There is a close relationship between the concept of local energy community and the concept of MG or SG. According to [65], the definitions of local energy community available in the literature do not concern technology, unlike the definitions of MG. The concept of local energy community focuses solely on the community as space, as stakeholder, and as shared interest. It mainly concerns the area affected, who develops and runs the project, and who benefits from the project in socio-economic terms. MGs can be owned by a utility or any other private or public company, but in certain cases, the community can act as a stakeholder by implementing and operating an MG itself. In either case, the local energy community is electrically served by the MG, independently of the ownership [65].

MGs interact with the LEM or community as well as with the upper wholesale market layer in order to provide various ancillary services to both DSOs and TSOs [66]. These services can include black start capability, congestion management, reactive power and voltage control support, harmonics compensation, frequency regulation, load following, and spinning, non-spinning, and replacement reserves [67]. Depending on local or regional regulation, SGs and MGs can provide increased flexibility to TSOs as they can be treated as effective means of grid expansion. This has the potential to increase reliability and effectively extend the power supply to remote and isolated locations [66,68].

3.2. Barriers Associated with MGs

While MGs can provide various benefits and services to facilitate the implementation of LEMs [66], there are technical, social, institutional, economic, and regulatory challenges that constitute potential barriers to their widespread adoption [69,70].

Technical challenges may involve developments in control of MGs with meshed topology, improvements in islanding detection techniques, changes in fault currents by location and operation mode, lack of grounding systems for DC MGs, and difficulties in implementing controllers for plug-and-play capabilities and in managing, exchanging, and processing large amounts of data [64,69]. The islanded operation of MGs is associated with some challenges which may include the ability of DERs to locally change power output according to the frequency and voltage of the MG or the capability of grid-forming power inverters to provide synthetic inertia and regulation of frequency and voltage [71]. Another potential technical barrier can be related to the lack of conformity with communication protocols and standards or the inappropriate design of energy resources, energy market, infrastructure, and various systems, which can diminish the overall efficiency, reliability, and lifespan of SGs and MGs [69,70]. In particularly, user privacy and cybersecurity has received a lot of attention to ensure the privacy of users and the integrity and security of data [64]. The availability of secure and anonymous data is important to estimate grid constraints, determine the need for consumer-centric services, and guarantee a healthy growth of competition among market players in local flexibility markets [64,72].

Social challenges often include the ability of community members to be persuaded in being actively engaged in MG projects during the planning stage and accept the integration of various RES and smart devices, as well as the lack of qualified and experienced community members with adequate knowledge regarding energy management or system maintenance [69,70]. Moreover, other social challenges can be related to the identification of potential triggers for behavioral changes via incentives and the lack of mutual agreements or cooperation among all involved parties (e.g., community members, investors, or system planners and developers) [64,69,70]. The lack of engagement in MG projects and market activities is often a result of the lack of interest on the part of consumers or the lack of understanding and willingness to understand [64].

Institutional challenges are generally related to inertia in changing the structure of power systems and difficulties in decision-making and coordination among stakeholders. These challenges also encompass some economic barriers associated with lack of incentives, financial capacity, or capital to make significant high-risk investments in MG projects and uncertainty regarding future revenues and hidden costs [69,70]. From an economic perspective, it is important to overcome the challenge of defining common frameworks for profitable business models and identifying, evaluating, and comparing new or existing business models applicable to SGs and MGs from on-going project demonstrations [64].

Regulatory challenges include the assurance of user privacy and cybersecurity, lack of incentive for community members to provide flexibility, and uncertain contractual agreements between market players [69,73]. In certain cases, the existence of ineffective initiatives or lack of proper policy and frameworks may discourage stakeholders and players, preventing them from being interested in MG projects. This constitutes a potential barrier to the development of mechanisms and schemes (e.g., feed-in tariffs, net metering, net billing, and tax incentives), which are needed to promote and facilitate the integration of RES and trade of excess energy between community members in a SG or MG [70]. According to [64], some of the regulatory challenges in SGs and MGs can be associated with the provision of incentives for smart metering data, demand response (DR), and commercial arrangements, as well as the need to provide clear rules and set responsibilities regarding competition, ownership, and technical and financial conditions [64]. Regulation also plays a key role on allowing the use of blockchain technology for automated transactions between parties and increasing its potential in existing SG and MG applications [64].

Several European projects have been developing approaches to address some of these challenges. The proposed projects are mainly focused on upgrading the existing architecture (e.g., SmartNet and IDE4L projects) or based on introducing essential changes to the architecture through decentralized systems with local autonomy in the optimal management of resources (e.g., Web of Cells and LINK-Solution projects) [72].

3.3. Value Proposition of MGs

MG projects can support the implementation of LEMs and provide a panoply of services or value propositions to all involved market players [66,74]. This should be addressed to help understand the diversity of business models available for MG projects. Table 2 presents the importance ranking of value propositions offered by MGs to projects located in the United States, Canada, Germany, Denmark, Mozambique, India, South Korea, China, Singapore, and Japan [74,75].

Table 2.

Value proposition ranking for different MG projects (based on [74,75]).

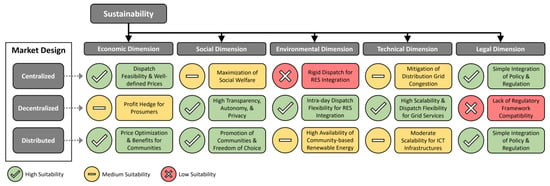

4. Energy Market Design

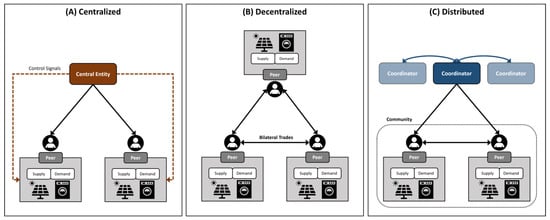

The implementation and operation of P2P energy trading in LEMs requires a market design capable of dealing with the increased penetration of RES and effectively enable participants to share their resources with other peers in the same network. Depending on how they are structured, these energy market designs can be categorized as centralized, decentralized, and distributed markets [16,17,18,19,20,21,22], as briefly represented in Figure 4. Table 3 presents a comparison among centralized, decentralized, and distributed market designs, summarizing the main characteristics and the most noticeable advantages and disadvantages of each design.

Figure 4.

Diagrams of market designs for P2P energy trading: (A) Centralized; (B) Decentralized; (C) Distributed.

Table 3.

Comparison among centralized, decentralized, and distributed market designs.

4.1. Centralized Market Designs

A centralized market design relies on pool market trading and involves a central entity to manage and coordinate the energy transactions between the participants [16,17], as represented in Figure 4A. The central entity is responsible for making decisions regarding prices and for directly managing the amount of energy exported and imported based on data collected from each peer [16,19,20].

Some works available in the literature have addressed the implementation of centralized market designs, mainly focusing on the optimization and reduction of energy costs. Alam et al. in [27] proposed a near-optimal cost algorithm, called “Energy Cost Optimization via Trade” (ECO-Trade), for the optimization of the energy trade and to avoid unfair cost distribution in a centralized market design by coordinating the P2P energy trade in smart homes with demand-side management (DSM) system. In [28], two centralized market designs, called “Flexi User” and “Pool Hub”, are proposed for P2P energy trading in a LEM incorporated with BESS to achieve energy cost savings. Long et al. in [29] proposed a two-stage aggregated control for P2P energy trading in community MGs by simply using one-way communication links and measurements at the PCC. The energy resources of each individual prosumer were controlled and managed using a central entity or third-party entity known as the energy sharing coordinator (ESC), being able to reduce the energy bills and costs of the community.

4.1.1. Advantages of Centralized Markets

This market design allows the central entity to maximize the social welfare of the entire P2P energy market and increase the overall market efficiency [21,78,79]. The study in [22] found that decentralized energy markets result in a small welfare loss of around 4.25% when compared to centralized energy markets, which can be a significant difference considering the annual trade volume occurring in large-scale markets. There is also less uncertainty of power generation and consumption patterns with a centralized market design, given the increased direct control of the central entity over the device operation of peers [16,21,80].

Ahlqvist et al. in [81] addresses and discusses wholesale electricity markets, providing a detailed comparison of the main advantages and disadvantages of adopting centralized and decentralized market designs. In wholesale electricity markets, a centralized design can ensure the technical and economic feasibility of the day-ahead dispatch by relying on the central entity to manage and coordinate electricity production. This coordination and decision making is achieved by taking into consideration several network aspects such as power plant location, costs, and ramp rates, which are submitted to the central entity as part of the bid [81]. Because centralized electricity markets use marginal or uniform pricing based on the variable costs of the marginal generation unit or power plant, they can set a clear and well-defined market price for all transactions at a specified location [78,81]. These well-defined market prices are only possible if there are no uplift payments or other form of compensation to help finance start-up and no-load costs, which often provide producers an incentive to exaggerate or overstate their variable costs [81]. Due to increased coordination, these markets can also help providing various grid services and delivery of high-quality energy [19].

4.1.2. Disadvantages of Centralized Markets

A centralized market design raises a few autonomy and privacy concerns because of the amount of data each peer sends to the central entity and its ability to directly influence their decisions and outcomes of deals [16]. Privacy can become a concern for market participants because sensitive information regarding personal preferences, load properties, and daily habits can easily be disclosed during the bidding processes [80]. In addition, the existence of a single central entity to manage the entire market makes it unable to scale and vulnerable to a single-point failure [78].

Another disadvantage of the centralized market design is the high computational and communication burden [17], especially in P2P energy markets with many distributed energy resources (DERs) and peers participating simultaneously in the energy trade [16,21,66]. This large number of market assets is likely to cause severe problems related to data collection and communication faults for the central entity, reducing the scalability of the centralized network [80]. More specifically, the presence of various dynamic costs, as well as network and production constraints in the bidding process, prevents the separation of the market clearing of adjacent supply periods in the optimization of day-ahead dispatch. This contributes to a significant increase of the computational burden required for a fast and transparent market clearing procedure free of faults, especially if the day-ahead market needs to be cleared within a short time frame (i.e., from 5 min to 1 h). For large-scale markets, the scalability of the network can be substantially reduced as the clearing procedure becomes more complex and challenging to perform in short time frames [80,81]. This constitutes a challenge to attain an optimal dispatch within such a short time frame in the day-ahead market, thus having to rely on approximations determined by an opaque iterative procedure which reduces market transparency and forces participants to place their trust on the central entity [81].

The response to grid events such as uncertain generation from RES, power outages, and network disturbances is usually slow in day-ahead markets with a centralized market design. This is a result of producers or prosumers being forced to wait for the real-time or hour-ahead market in order to correct or adjust their day-ahead dispatch [78,81]. Centralized markets are often rigid and offer low day-ahead dispatch flexibility, making intra-day market trading a difficult task for producers with day-ahead unit commitment and tailored-made contracts. In certain cases, penalties can be issued to prevent producers from revising and optimally adjusting their day-ahead dispatch. This inflexibility is also reflected in the ability to develop new bidding strategies to properly integrate ESS and DR programs, which require high costs and long periods of time [81].

4.2. Decentralized Market Designs

A decentralized market design discards the central entity and allows energy to be directly traded between the participants through bilateral trading [16,17], as represented in Figure 4B. Because there is no central entity to manage and coordinate the transactions, this market design is operated in a less organized and structured manner with lower market efficiency [16,19,20]. According to the literature, decentralized market designs are often considered as pure and full P2P networks.

There have been several works being proposed in the literature regarding decentralized market designs, being mostly focused on satisfying the preferences of participants and on maximizing social welfare. Sorin et al. in [30] introduced a P2P market structure based on a multi-bilateral economic dispatch (MBED) formulation in a fully decentralized manner. This allowed for a more pro-active participant behavior and enabled multi-bilateral trading with product differentiation in respect to participant preferences while maximizing social welfare. Morstyn et al. in [31] presented a new scalable decentralized market design for P2P energy trading using forward and real-time bilateral contract networks to satisfy full substitutability conditions and obtain a stable outcome. Khorasany et al. in [32] proposed a fully decentralized market design for P2P energy markets with high penetration of DERs. By using bilateral trading with product differentiation, the proposed design respected the preferences of participants and enabled them to trade energy while maximizing the social welfare and reducing the amount of data exchanged in the system. Antal et al. in [33] presented a blockchain-based decentralized market to enable prosumers to trade their energy profile flexibility in a fully P2P manner. The results of this decentralized market showed complete self-consumption of renewable energy generated in a small-scale urban MG, which facilitated the P2P transactions of DSM among prosumers. Khorasany et al. in [34] proposed an energy trading optimization framework for a decentralized market containing smart buildings with BESS and aggregated EVs. This framework was focused on maximizing social welfare through P2P energy cooperation among participants. Hu et al. in [35] relied on game theory to develop a decentralized energy trading framework for an oceanic islanded MG. This framework was able to maximize the revenue of the aggregator and minimize the energy costs for each participant.

4.2.1. Advantages of Decentralized Markets

This type of market provides a high level of autonomy and privacy for participants, because no data is sent to a central entity and each peer is directly responsible for their own decisions and has control over the outcomes of deals [79]. The absence of a central entity increases reliability as it eliminates problems associated with single-point failures [16,17]. This also offers high scalability, flexibility, and plug-and-play capability to the network, allowing peers to easily enter or leave the energy trading market if they so desire [16,21]. The fewer number of communication links compared to centralized energy markets is an important factor that contributes to the increased scalability [30].

As addressed by [81] in the context of wholesale electricity markets, a decentralized market design provides a more transparent and straightforward way to facilitate hedging and simplify market clearing, which can also increase the scalability of the network. This is achieved by performing a decoupling of supply periods in the day-ahead market. Market prices received by producers and paid by consumers are dependent on the respective zonal spot prices, being advantageous for investments and facilitating the hedge of profits for prosumers and optimal dispatch based on estimates [78,81].

4.2.2. Disadvantages of Decentralized Markets

The lack of a central entity to optimally manage and control each transaction deteriorates the social welfare of the P2P energy market and reduces its efficiency [21,22,78,79]. The reduction of social welfare is a result of producers and prosumers avoiding losses due to non-convexities by offering their electricity at a price higher than their marginal cost [78,81]. Moreover, the management of a decentralized market network is known to be relatively complex due to several hidden constraints (e.g., participant interests and device operation) that are difficult for the distribution system operator (DSO) to visualize and predict, which also contributes to the low overall efficiency of the market [16].

Decentralized market designs often rely on block orders, which can increase the complexity of the bidding process due to the large number of different block types or combinations of supply hours [81,82], although this complexity can be mitigated by applying block type restrictions on block orders [82]. While the increased complexity can be a drawback, block orders also provide additional flexibility in intra-day markets, allowing producers to increase their generation output during a certain period by simply selling more for that period in the intra-day market [78,81]. In addition, continuous intra-day trading in decentralized markets may suffer from problems related to the lack of full consideration for grid transmission constraints due to the fast and overwhelming market clearing process. Such problems cause zonal pricing inefficiencies in large networks, favoring fast traders rather than network owners. There is an incentive for automated high-frequency trading in continuous intra-day trading, resulting in a problematic large number of orders needed to be clearer in a short time frame [81]. This type of energy market can also induce a level of competition among participants, but without a central entity to coordinate the energy trade, it may be unable to provide or guarantee the delivery of high-quality energy to the consumers [19].

4.3. Distributed Market Designs

A distributed market design can be seen as a combination of the centralized and decentralized market designs, in which various central entities, in this case called coordinators or agents, are used to coordinate the transactions but participants can trade energy with each other without their direct influence [16,17], as represented in Figure 4C. The role of central entities or coordinators in a distributed market design is relatively limited compared to their role in centralized market designs because they cannot manage the amount of energy each peer exports or imports [16,19,20].

The works available in the literature encompassing distributed market designs are mainly focused on the development of pricing mechanisms to enable and facilitate P2P energy trading in SGs and MG systems. For instance, Long et al. in [36] proposed three distinct pricing mechanisms for P2P energy trading in a community MG to increase income for producers and reduce energy costs for consumers. These pricing mechanisms included bill sharing, mid-market rate, and auction-based pricing with specified detailed business models, energy trading prices, and individual participant energy costs. Liu et al. in [37] proposed a P2P energy trading model with price-based DR for MGs. This was achieved by using an equivalent cost model based on the energy consumption flexibility of prosumers and a dynamic internal pricing model based on the supply and demand ratio of PV energy traded. Furthermore, Nunna and Srinivasan in [38] proposed an agent-based transactive energy management framework for distribution systems with multiple MGs, enabling each MG to buy or sell energy in the internal auction-based market. In the context of social welfare in distributed market designs, Kang et al. in [39] proposed a P2P energy trading model to enable local electricity trading among plug-in hybrid electric vehicles (PHEVs) in SGs. This was achieved by using an iterative double-auction mechanism to determine the price and amount of electricity traded and thus maximize social welfare. Concerns associated with the security and privacy of the PHEVs are also considered in the proposed model, showing a relative improvement of the protection level. Wang et al. in [40] presented a model for a distributed energy trading market using game theory to study the cooperative benefits between several EV charging stations and integrated energy systems. This model was able to reduce energy costs for the integrated energy systems and increase profits for the EV charging stations by considering individual participant interests and various uncertainties associated with market prices, renewable energy generation, and DR. Khorasany et al. in [41] proposed a hybrid energy trading scheme for distributed energy trading markets, in which market participants could transact in different LEMs, neighborhood areas, or even transact with the grid. Each LEM relied on a central entity known as the community manager (CM) to facilitate the process of energy trading and negotiate with the other CMs for energy trading between distinct markets. Finally, Yao et al. in [85] proposed a strategy for distributed energy trading markets to determine the optimal trading decisions of competitive prosumers and enable successful transactions between them using prospect theory and adaptive learning process.

4.3.1. Advantages of Distributed Markets

Like decentralized designs, a distributed market design can enable a certain level of autonomy and privacy for participants by limiting the amount of data sent to the central entities and by not directly controlling the operation of devices. This allows peers to autonomously maximize their own individual benefits [16,70]. Distributed market designs can also provide increased network scalability for the ICT infrastructures and easier integration in existing infrastructure [17,20]. According to [40], distributed or hybrid market designs can provide a level of network scalability higher than centralized market design because the number of market participants is decreased as they are divided into groups or communities, which reduces the overall computational and communication requirement.

The existence of various coordinators encourages or promotes the development of these various groups or cooperative communities of like-minded peers with common interests and preferences, which form around each coordinator and contain their own market clearing price [19,40]. This could be referred to as an organized prosumer group, in which a group of prosumers share and combine their resources as denoted in [19]. Each coordinator can be a non-profit entity that interacts with the DSO and solely focused on serving and benefiting the members of its community by increasing the social welfare and optimizing prices for sellers and buyers [84]. Distributed market designs can also take into consideration network constraints to avoid congestion in distribution branches. As suggested in [40], this can be achieved by introducing a network utilization charge to integrate operating conditions of the network into each energy transaction and generate a local price signal based on the network constraints. Like centralized designs, a distributed energy market can also help providing various grid services and delivery of high-quality energy [19].

4.3.2. Disadvantages of Distributed Markets

The pricing mechanisms used in distributed market designs can be relatively complex due to the existence of multiple simultaneous markets and may require further development to be effective for P2P energy trading [16,17]. Moreover, this type of market design encompasses a challenge related to the high difficulty in integrating and managing data sets from the various prosumer groups or communities [17,19,20].

5. Energy Trading Platform

LEMs require an effective energy trading platform to successfully allow all the participants to trade energy with each other, as well as with retail and wholesale markets. In this context, participants are likely to be encouraged to first trade energy locally with each other before transacting with the wholesale and retail markets individually or in a community group [16]. The wholesale market operates to maintain the supply–demand balance and involves lower price energy transactions among large entities such as power generation companies, independent system operators (ISOs), distribution companies, and large consumers. On the other hand, the retail market involves higher price energy transactions between distribution companies and small consumers with energy purchased from the wholesale market or excess renewable energy from prosumers [86].

The market design mainly dictates how the general market architecture is structured or organized, whereas the trading platform is the interface that houses the necessary market mechanisms and enables the P2P transactions based on gathered data and information. The energy trading platforms also need to ensure that participants follow the market regulations and pay any fees associated with the use of the power distribution grid. An effective and reliable information system is required for the operation of the energy trading platform and provide access to the energy market, enabling participants to connect and transact energy with each other within a day or in near real time. As shown in Figure 3, the information system allocates two important mechanisms, namely the market mechanism and pricing mechanism [12]. Essentially, the market mechanism performs an allocation of traded energy by matching the buy and sell orders of the participants in different market stages, including day-ahead and intraday markets. The pricing mechanism allocates supply and demand with their respective market clearing prices while including applicable taxes and fees on the final traded energy price. Then, an energy management system is responsible for managing the amount of traded energy from sellers to buyers with a bidding strategy based on real-time supply and demand data of each market participant [12].

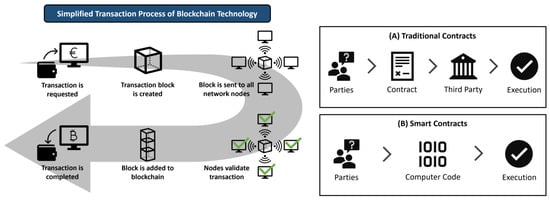

Blockchain has been a highly popular technology to meet the requirements of the information system and develop a decentralized platform for energy trading [87,88,89]. Essentially, it involves an incorruptible and secure digital ledger that contains interconnected blocks to permanently record every financial transaction in a fully decentralized manner, as briefly represented in Figure 5A. The use of DLTs such as blockchain technology provides high level of transparency and redundancy because every node or peer contains a copy of the ledger and thus anyone in the network can access it to verify the validity of each transaction, which can be verified and validated through consensus mechanisms such as proof-of-work (PoW) and proof-of-stake (PoS) [90,91]. Depending on the rights to access the network and on the authorization to verify and validate transactions, blockchain can be classified as private or public and as permissioned or permissionless [91,92].

Figure 5.

Diagrams of the transaction process of blockchain technology and comparison between: (A) traditional and (B) smart contracts.

A wide variety of benefits can be provided to energy trading markets in SG and MG applications. Most of these benefits come from the ability to enable smart contracts. Smart contracts rely on computer code that is stored in the blockchain to automatically execute the contract if a set of conditions are met between the two parties, as briefly shown in Figure 5B. In general, traditional contracts are slow (i.e., 1 to 3 days), manual, expensive, and require a third-party entity and physical signature. In contrast, smart contracts are fast (i.e., few seconds or minutes), automatic, cheap, and only require a digital signature [87,93].

According to the literature, several trading platforms have been proposed for successful P2P energy trading and can be divided into centralized and decentralized trading platforms [16,21]. Most of the energy trading platforms being proposed in the literature follow decentralized approaches and only a handful of works have opted for a centralized approach. The business model of energy trading platforms is similar to that of e-commerce or blockchain-based exchange platforms, and thus may share some of their characteristics [87]. Blockchain-based exchanges for cryptocurrency and tokens have been used as the basis for the development of energy trading platforms [94,95]. In particularly, a decentralized exchange operating on a public blockchain ecosystem was used in [94] to enable the transaction of energy by swapping specific tokens between VPPs. Blockchain technology has also been used in combination with game theory in [77] to create a centralized trading platform for interconnected MGs, which relied on Nash bargaining to guarantee fair agreements through the DSO. Other than blockchain technology, more recent and less mature DLTs such as direct acyclic graph (DAG) have also been suggested to enable energy trading [96,97], which included a DAG-based network for interconnected smart homes in [96].

Other projects such as the SOGNO platform aim at delivering a variety of management services to achieve network stability and security through a modular system for grid automation. This platform is a reference architecture selected by the Linux Foundation Energy (LFE), which improves distribution system monitoring and enables market interactions for DSOs to ensure an optimal operation when dealing with the high penetration of intermittent generation from RES [98]. The SOGNO reference architecture has been used as tool by the Platone project to integrate blockchain technology in market models with a potential for local energy trading [99].

5.1. Centralized Trading Platforms

Centralized or third-party trading platforms have not received much attention from authors. This trend may be due to the lack of trust, autonomy, and privacy associated with centralized or third-party platforms which are governed by an individual or company with the goal of creating a profit [77,94]. It is easier for centralized trading platforms to accept regulation and government approval due to the existence of a single central or third-party entity [12,88]. However, these platforms may be associated with high transaction and service fees due to the use of intermediaries [88].

Zhang et al. in [42] presented a centralized trading platform called “Elecbay” to enable P2P energy trading in a grid-connected MG through a four-layer system architecture. The Elecbay software platform allowed the participants to place orders based on their forecast of energy generation and consumption with different periods reserved for bidding, exchange, and settlement processes. Zepter et al. in [43] introduced the Smart elecTricity Exchange Platform (STEP) to provide an interface between wholesale electricity markets and communities of prosumers. The STEP allowed both prosumers and consumers to take profit from higher sell prices and lower buy prices instead of the prices from the wholesale market and the grid. In addition, Alvaro-Hermana et al. in [44] proposed an energy trading platform that used an aggregator of EVs as central entity to determine the optimal P2P energy prices, interconnecting EVs with an excess of energy and EVs with a deficit of energy in their batteries.

5.2. Decentralized Trading Platforms

Decentralized trading platforms have gained a lot of attention from authors, especially in the field of SGs and MG systems. Without a doubt, most works available in the literature rely on blockchain technology to develop effective decentralized trading platforms for P2P energy trading through smart contracts [94]. One advantage of decentralized trading platform for market participants may be the relatively low transaction and service fees because it avoids multiple layers of fees by allowing direct buyer and seller interaction without intermediary services [88]. However, decentralized trading platforms may be prone to face several regulatory challenges in the way they accept regulation and operate accordingly [88,89]. This is because most of the market control is redirected to the users and there is no central or third-party entity to ensure that market participants comply with regulations. The regulatory challenges are aggravated when dealing with blockchain technology in P2P energy trading applications due to a panoply of factors that play a key role in the operation of energy markets [88,95]. These factors give rise to certain concerns or questions such as whether excess energy should solely be used for ancillary services of the grid or traded for profit of a specific market participant [95].

An Australian blockchain-based platform called “Power Ledger” has recently emerged to provide a scalable and adaptable ecosystem for trading renewable energy, flexibility grid services, and environmental commodities (e.g., renewable energy certificates and carbon credits) in new energy markets. It uses a dual blockchain token system and allows users to trade their energy generated from PV systems with others, maximizing the profit and the benefits of integrating RES in communities [100]. In Germany, a platform called “Lition” is being developed to directly connect end users to renewable energy providers and producers using blockchain and enable P2P energy trading through smart contracts [101]. Other blockchain-based decentralized trading platforms using Ethereum are also proposed in [45,46] to enable smart contracts and ensure secure decentralized transactions of renewable energy within MGs in real time. Recently, Hassan et al. in [47] developed a blockchain-based energy auction called “DEAL” for MG systems to guarantee the privacy and security of participants when they buy or sell renewable energy. Esmat et al. in [48] developed a decentralized P2P energy trading platform called “DeTrade” to enhance economic efficiency and provide transaction privacy and security. This energy trading platform consisted of a market layer called “DeMarket” with uniform pricing mechanism and a permissioned blockchain layer with smart contracts. The authors also developed a decentralized market clearing method called “DACO” to enable the maximization of social welfare. Leeuwen et al. in [49] proposed a blockchain-based energy trading platform to optimize energy flows in a MG and implement a bilateral trading mechanism. The results showed that the costs and amount of the import energy are reduced for the MG community, but the social welfare also decreases with the implementation of the energy trading mechanism. Finally, Suthar and Pindoriya in [50] presented a blockchain-based energy trading platform to enable P2P energy trading with smart contracts and increase the use and security of renewable energy generation while providing transparency and energy affordability and self-sufficiency.

6. Game Theory

Game theory is considered a powerful and well-established mathematical tool to analyze decision-making behaviors in competitive settings and successfully solve complex problems associated with data security and privacy issues [102,103]. It has been extensively used to model the rational behavior of individuals and address energy management in a wide variety of data applications and signal processing techniques, being able to be effectively integrated with the domains of machine learning and the internet of things (IoT). Moreover, game theory enables the integration and development of frameworks for pricing mechanisms and incentive designs [104,105,106]. In electricity markets, game theory is often used to compare market equilibrium outcomes for the analysis and evaluation of market designs [81]. Players, in this case producers and prosumers, have an incentive to charge a price for electricity higher than the marginal cost to avoid potential losses due to non-convexities. Thus, game-theoretic models can be developed to evaluate these competitive markets by solving for the Nash equilibrium, in which all players simultaneously maximize their profits while having no incentive to deviate from this outcome [81]. The use of game theory, namely non-cooperative game, has also been widely applied in SG applications to study and model the behavior among groups of multiple MGs [107].

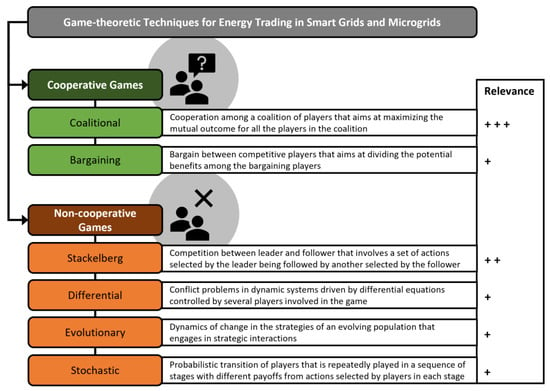

According to recent trends, most works being presented in the literature usually follow a cooperative or non-cooperative game theoretic approach, focusing on P2P energy trading among participants in a single MG and among interconnected MGs located in the same network [108]. Some of the most relevant works are summarized and listed in Table 4. A basic definition is given for the most common types of cooperative and non-cooperative games used in the literature works for P2P energy trading in SG and MG systems, as shown in Figure 6.

Table 4.

Relevant works on P2P energy trading in SG and MG systems using game theory.

Figure 6.

Most common game-theoretic techniques used in the literature for P2P energy trading in SG and MG systems (+ + + = high relevance, + + = medium relevance, + = low relevance).

6.1. Cooperative Game Theory

Cooperative game theory has been proven to be effective in dealing with energy management in P2P transactions and can be used to encourage the peers to cooperate in energy trading. It enables players to form groups (i.e., coalitions) in order to make more informed decisions and maximize the benefits. The outcome is mainly characterized by the joint actions of the coalition [8,108].

Tushar et al. in [51] proposed a P2P energy trading scheme using canonical coalition game (CCG), allowing prosumers to trade their energy within the coalition they formed and with other coalitions. This scheme has proven to be consumer-centric and able to endorse prosumer participation in P2P energy trading. Regarding MG systems, Du et al. in [52] used cooperative game theory to develop a coalitional model for the cooperation among multiple grid-connected MGs, achieving optimal local operation and guaranteeing a fair cost share among MGs and the economic stability of the entire coalition. Mei et al. in [53] proposed an energy trading algorithm using coalitional game to identify incentives for coalitional operation and facilitate local energy trading among neighboring MGs in the same network. The results from the algorithm showed an increase of expected individual MG utility and efficiency in the network. Regarding SGs, Tushar et al. in [54] proposed a motivational psychology framework to design P2P energy trading in a SG using coalitional game, which focused on increasing user participation in the market and reducing energy costs.

Other methods using coalitional game theory in SG applications are proposed in [55], which focused on minimizing energy costs and distributing the cost savings among the participants of the coalition according to the Shapley value. Zhou et al. in [56] used coalitional game to develop an energy trading model capable of improving the efficiency of interconnected MGs by maximizing the profit of the entire cluster. In this mode, the fair allocation of both total and individual MG gains was also done according to the Shapley value. Shapley value defines the solution of cooperative games that distributes the total gains and costs among all the players cooperatively participating in the coalition according to the contribution of each individual player. This means that each player has an incentive to collaborate in the coalition and players can gain at least as much as they would have if they acted non-cooperatively or alone. Essayeh et al. in [109] used coalitional game to optimize energy trading inside the coalition and reduce power losses during the exchange of energy in a network of interconnected MGs. Saad et al. in [110] used coalitional game to study cooperative strategies between interconnected MGs and enable them to form coalitions for coordinated energy trading. The MGs within the coalitions were able to cooperate and self-adapt to environmental changes, resulting in an overall reduction of power loss costs. Moreover, Huang et al. in [111] proposed a mechanism for P2P energy trading optimization and customer motivation in a MG using coalitional game. The proposed mechanism has potential to motivate customers to participate in P2P energy trading, reduce energy costs, and help grid operators with economic and social decision-making. Several works in the literature have proven that coalitional game can be effective at maximizing the mutual outcome for all the players in the coalition. On the other hand, Wang and Huang in [112] relied on bargaining game to study the interactions among interconnected MGs and develop a bargain-based energy trading and fair benefit sharing. This allowed the development of an incentive mechanism that was able to increase profits and reduce the total operation costs of the participating MGs. More specifically, the proposed mechanism achieved cost reduction up to around 13% in the case of interconnected MGs when compared to the scenario without cooperation. Bargaining game aims at dividing the potential benefits among the bargaining players [117,118]. Even though bargaining game has a large potential to ensure a fair division of benefits in LEMs for P2P energy trading, it has not received much attention from authors when compared to coalitional game.

6.2. Non-Cooperative Game Theory

Non-cooperative game theory can also be used to address complex P2P energy trading, although without coordination among the peers. Non-cooperative game theory is mostly used in strategic decision-making processes involving conflicting players and when it is impossible to combine the strategies of players or establish agreements between them. The outcome is only characterized by the actions and payoff of each individual player [8,108].

One of the approaches proposed by Kim et al. in [57] used non-cooperative game theory for energy trading among self-interested customers to maximize their profits by determining their energy trading and load scheduling with EVs. In the context of MGs, Liu et al. in [58] used non-cooperative game theory to enable distributed control and energy trading among multiple MGs in an electricity market environment. More specifically, differential game was used to effectively coordinate the benefits of each MG. Because of multiple conflicting beneficiaries associated with the MGs, a cooperative game would not be viable and the task of establishing agreements among them would be difficult to achieve in this case. Differential game studies problems of conflict in systems driven by differential equations controlled by several players involved in the game [58]. Paudel et al. [59] proposed a relatively diverse game-theoretic iterative pricing mechanism to enable P2P energy trading in a community MG. More specifically, non-cooperative game was used for the price competition, evolutionary game for the seller selection, and Stackelberg game for the buyer and seller interaction. Evolutionary game allows us to model the dynamics of changes in the strategies of an evolving population that engages in strategic interactions, being useful to study the dynamics of buyers and select potential sellers in energy trading markets [59]. Stackelberg game mainly involves a set of actions selected by the leader being followed by another set of actions selected by the followers [117,118]. Li et al. in [60] proposed two-stage stochastic game-theoretic model to deal with energy supply and demand uncertainty in a cluster of interconnected MGs and minimize the risk of overbidding for renewable energy. Essentially, stochastic game is seen as a probabilistic transition of one or more players that is repeatedly played in a sequence of stages with different payoffs from actions selected by players in each stage [117,118]. Kou et al. in [61] presented a non-cooperative game-theoretic approach using Stackelberg game to model the interactions between the utility and MG systems and provide support on energy price decisions during load restoration. Moreover, Belgana et al. in [62] used Stackelberg game to develop an analytic model capable of finding the optimal strategies that simultaneously lead to profit maximization and carbon emissions minimization. Lee et al. in [113] proposed a distributed mechanism for energy trading among interconnected MGs using Stackelberg game, which was able to achieve a unique equilibrium solution for the maximization of the payoff of all the MGs participating in the market. Wu et al. in [114] used Stackelberg game to propose a decentralized pool strategy for a MG. This strategy was able to create a fair and competitive market environment for all participants.

Other game-theoretic approaches using non-cooperative games have been proposed in [115,116]. These included a reverse auction model for a single MG and a contribution-based energy trading mechanism for interconnected MGs in a competitive market environment. When analyzing the literature, it is noticeable that non-cooperative game theory, namely Stackelberg game, appears to be the predominant choice to study and develop LEMs for P2P energy trading in SG and MG systems.

6.3. Potential of Game Theory in Energy Trading

The selection of game theory over other tools to address energy transactions and design energy markets is mainly because game theory is proven to be effective in analyzing decision-making behaviors, allowing us to properly justify, in a mathematical way, the strategic interactions among multiple independent players in a highly competitive environment and help predicting the outcome for their interactions. The heterogenous and dynamic nature of SGs and MG systems motivates the adoption of game-theoretic approaches due to the existence of various players with distinct goals or preferences, which often seek to maximize their own profits [119]. This calls for advanced techniques and approaches that can provide a robust and analytic framework to look for a fair and optimal outcome in collaborative and competitive scenarios by analyzing individual player strategies [105,119]. Such approaches can stimulate interaction between MGs and be successfully applied to the energy management domain in networks containing EVs, energy services, and buildings at the residential, commercial, and industrial level [105]. More importantly, game theory enables the easy integration of pricing mechanisms and incentive designs that can adapt to the heterogenous and dynamic nature of SGs and MG systems by modelling the behaviors of players [119]. This has the potential to establish social trust between players and encourage them to combine strategies and adopt cooperative behaviors with each other to obtain a fair and sustainable outcome [104,105].

In the context of smart cities, it is important to not overlook sustainable urban development because factors may change significantly when considering sustainability in the design of game-theoretic approaches. More specifically, economic, social, and environmental sustainability needs to be taken into consideration when modelling player behaviors to obtain a sustainable outcome. For this to be effective in practical applications, there also needs to be a way to ensure that these entities are motivated to participate in the energy trading market [51]. The introduction of an incentive and penalty mechanisms can strengthen the cooperative behavior in the P2P energy trading market and impose desired behaviors of the various entities, enabling them to contribute to the coalition value increase or penalizing them for choosing to defect [106]. This can be achieved through attractive energy trading prices practiced in the P2P market to encourage the players to participate, as proposed by Tushar et al. in [51].

There are a few limitations and challenges associated with the adoption of game-theoretic approaches for energy trading [119]. The practical deployment of a game-theoretic model can be difficult to implement when the optimization process is dependent on human behavior and other unpredictable variables (e.g., uncertain generation from RES). Furthermore, the performance of game-theoretic models in applications that involve large amounts of data is heavily dependent on the effectiveness of the communication infrastructure and its ability to manage network congestion [105]. This may constitute a potential problem because most of the players transacting energy are human users and there is also a high penetration of variable RES, which may result in unpredictable behavior driven by personal interests and uncertain renewable energy generation. In game theory, the assumption that players are rational in order to maximize their utility is not guaranteed in real-world scenarios when the game involves human entities, in which the decision-making process is heavily affected by personal interests and emotions [106].

Fortunately, several smart city technologies and various SG and MG systems driven by ICTs (e.g., automated energy management systems, smart meters, and smart appliances) enable the access to real-time information regarding energy consumption and provide the tools to optimize or reduce it, allowing human users to make more rational and informed decisions [120]. Furthermore, these smart technologies and infrastructures perform an active and constant optimization of the energy systems in buildings by relying exclusively on automated systems to optimize energy consumption and estimate energy needs [120,121]. Taking this level of automation into consideration, part of the problem of game theory being dependent on human behavior and variable RES can be mitigated or even eliminated in the context of smart cities as most of the human behavior is avoided with the use of automated systems.

7. Implications of P2P Energy Trading for Sustainability

The business models should enable most of the benefits provided by community-wide services which can be practiced in LEMs to improve the level of sustainability. In general, business models revolve around the provisions of flexibility services directly or indirectly by community members. These flexibility services may lead to communal cost savings related to the energy purchased from wholesale markets [122]. Flexibility service providers should be able to access and participate in all energy markets to increase the effectiveness of services and the heathy growth of market competition [64]. Moreover, the aggregation of DR allows communities to consume energy during lower energy prices when the access to market price signals is enabled. In few cases, the business model can be focused on allowing communities to generate a form of revenue by participating in mechanisms which provide flexibility services [64,122]. The islanded operation of MGs due to power system outages can also be made technically and economically possible by relying on flexibility services provided by LEMs [122].

Although communities may be interested in developing small-scale networks (e.g., MGs) to interconnect a group of community members and allow them to provide flexibility services and trade energy in a P2P manner, this constitutes a potential challenge for NRAs. The challenge is to ensure the benefits of MGs for power systems and local communities while making sure they are compatible with grid regulation principles [122].

A continuous exchange of energy under a consumer-centric P2P market scheme is also important to facilitate the transition of cities to a state of urban sustainability. Depending on the design of the energy market, this can help increase the effectiveness of intermittent RES in urban environments and ensure energy access and self-sufficiency of cities. The consumer-centric premise of P2P markets creates the sense that citizens are actively contributing to and benefiting from this transition to a more sustainable development [20,123].

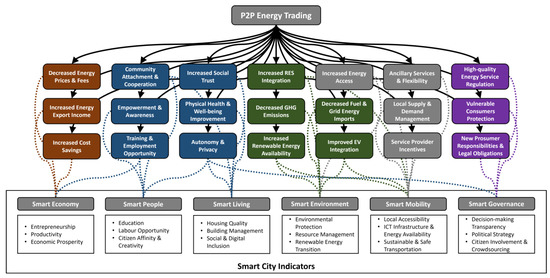

A smart city ecosystem is likely to rely on LEMs with distributed market designs as this hybrid model allows for various city districts and neighborhoods consisting of smart buildings and homes, MG systems, and EV aggregators to form groups or communities [19,24]. Such design structure operates in a similar way to a system of systems approach, in which these prosumer groups and communities can interact with different DSOs and provide benefits to their citizens by dynamically managing and balancing their energy needs in accordance with a common goal [8,19]. In a sense, each district and neighborhood of the smart city ecosystem encompasses a single part of the larger system of systems, benefiting from optimal energy transactions within their own communal marketplace as well as with marketplaces of other communities. While this is a possible direction for smart cities to enable energy interactions among distinct entities, the requirements for the operation of LEMs in urban environments are not yet clear and further developments are required in this context [24]. In both developing and developed regions, the direct and indirect benefit and value of LEMs for P2P energy trading goes beyond the monetization of surplus energy and reduction of carbon emissions from the increased use of on-site renewable generation [124]. In particularly, several benefits can be provided at the economic, social, and environmental level with the proper implementation of LEMs [125,126,127]. This makes P2P energy trading a tool capable of supporting those living in energy poverty and helping citizens shape society towards attaining broader sustainability goals [128].

Even though LEMs for P2P energy trading can provide various benefits to increase the overall level of urban sustainability, their implementation is also associated with some shortcomings that can negatively impact market participants as well as non-participating entities. As summarized in Table 5, these positive and negative impacts on sustainability can be categorized in accordance with economic, social, environmental, technical, and legal dimensions. Based on this, Figure 7 shows a brief representation of various benefits provided by P2P energy trading and their relationship with the main indicators of a smart city denoted in [4,5].

Table 5.

Economic, social, environmental, technical, and legal impacts of LEMs for P2P energy trading.

Figure 7.

Representation of economic, social, environmental, technical, and legal benefits of P2P energy trading and their relationship with smart city indicators.

7.1. Economic Impacts

Economic impacts of P2P energy trading denote effects and changes on energy prices and taxes paid by both participants and non-participants, grid costs for utilities, as well as any effects on the return of investment made in renewable generation. The initial investment costs and operation costs necessary for the development, implementation, and operation of an effective LEM for P2P energy trading can be significantly high due to the high requirements in smart meters, ICT infrastructure, RES, and BESS [129], although P2P energy trading can decrease energy prices for participants as they buy cheaper energy from other peers instead of purchasing energy from the grid at a higher cost. The decrease in energy prices can also be associated with donations or discounts offered by participants to friends, relatives, organizations, or even individuals at risk of energy poverty. While some of the study participants interviewed in [128] valued the ability to make donations to low-income households living under energy poverty, others described how the existence of formal support mechanisms in P2P energy markets are better suited to support vulnerable populations in benefiting from P2P energy trading. The criticism of making donations towards energy poverty revolve around the notion that it makes low-income households highly dependent on the altruism of others. Leaving vulnerable populations at the mercy of charity donations can have negative consequences and further aggravate energy poverty, especially when P2P energy markets involve a conflict of interests between maximization of profit and contributions to energy poverty [128]. Nevertheless, this can be mitigated through the implementation of mechanisms and policies that ensure engagement opportunity and continuous education for vulnerable populations while providing a layer of transparency on where and how donations are being spent [128].

Taxes and fees may not be applied at all or may not be as high, as the amount of energy purchased from the grid is reduced. The results presented in [130] showed that P2P energy trading was able to decrease expenses and increase income of participants while remaining within the operating limits of the network. On the other hand, energy prices, taxes, and other fees may increase for non-participants as utilities attempt to recover losses of revenue [126]. Depending on the business model of utilities, the loss of revenues due to increased P2P energy trading can be substantial for small utility companies with less diverse business models. According to [131], the P2P energy trading policy in China can benefit PV generation with an increase in revenues of around 6% to 11% and end-use cost savings of 6% to 12%, but the utility company can suffer a significant decrease in revenues of 32% to 55%. The government can see a decrease in subsidy costs of around 6% [131]. In contrast, the Lition energy trading platform is reporting a 30% increase in the revenues of power plants [132]. However, this significant increase is most likely because customers can select the preferred regional energy providers to buy renewable energy from in a P2P manner based on their sale offers. This can be a solution to strengthen the role of utilities in P2P energy trading and improve their margins. Fortunately, there is an opportunity for utilities to participate in P2P energy trading with competitive prices and treat it as an effective alternative to additional generation capacity and grid reinforcements that often result in high investment costs.

P2P energy trading can also lead to cost savings related to demand shifting as changes in the energy consumption of participants are induced due to energy price fluctuation or volatility associated with intermittent generation from RES [126]. However, the simultaneous price negotiations to match different preferences of consumers can make energy prices sub-optimal and more difficult to compare, resulting in less optimal trade deals for participants [20,126]. Grid costs in terms of operation, transmission, and distribution are reduced for participants due to a locally concentrated trade of energy with less grid usage and lower energy prices, but non-participants may have to pay a higher energy price as utilities charge more to cover operation, transmission, and distribution costs [125,126]. P2P energy trading can also increase the amount of income in exported renewable energy as participants are able to sell their excess energy to other peers at a higher price when compared to the price of energy sold to the grid. Although, the return on investment made in RES and ESS may be negatively affected if participants have a low sales revenue [126]. P2P energy trading is not just economically advantageous for individuals, but also for communities as demonstrated in a few studies in the literature [17,25]. In particularly, Long et al. in [29] showed through a case study that P2P energy trading can lead to a substantial energy cost reduction of around 30% for communities and around 12.4% for individual consumers, as well as an increase of annual income for individual prosumers.