Analysing the Economic Viability of Implicit Demand Response Control of Thermal Energy Storage in Hot Water Tanks

Abstract

1. Introduction

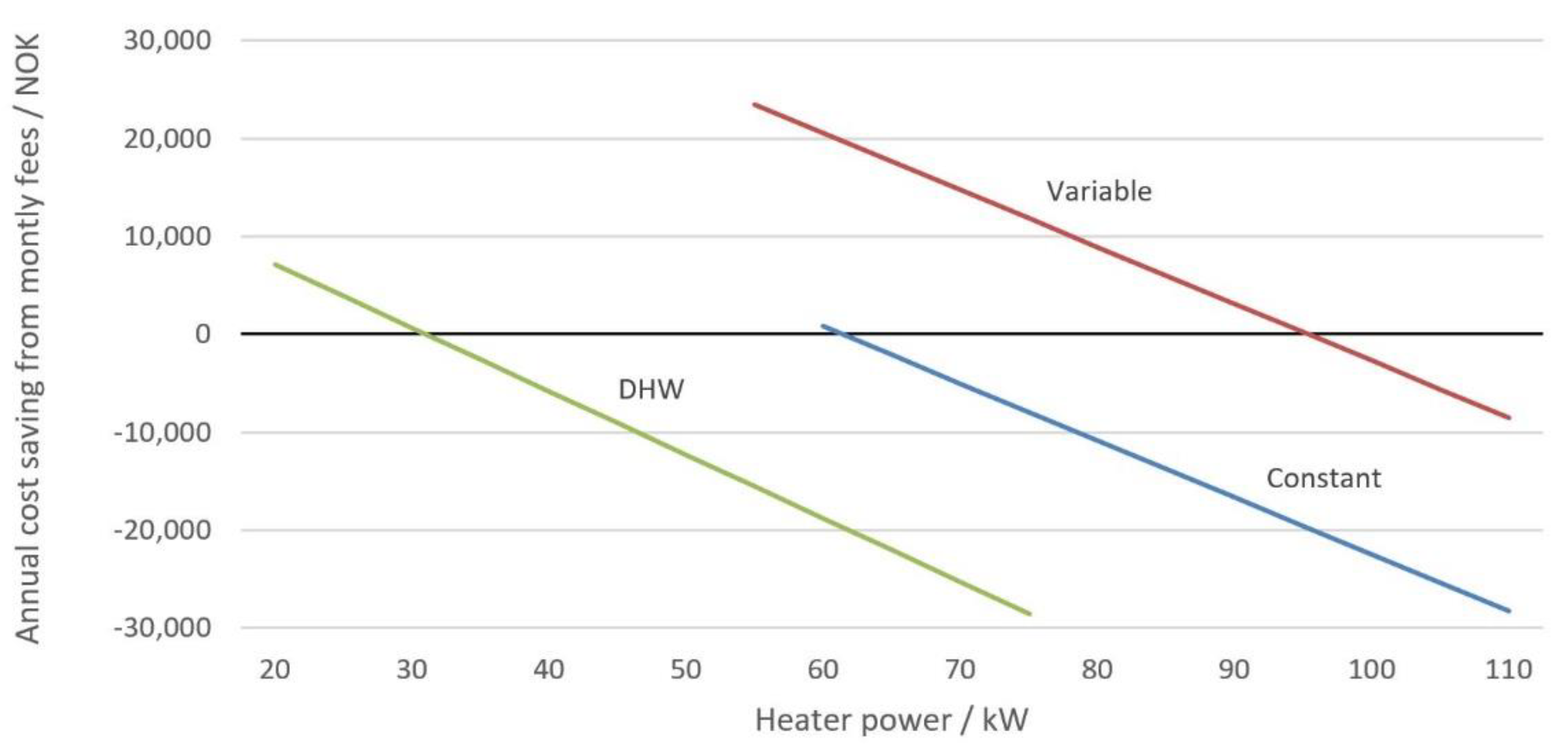

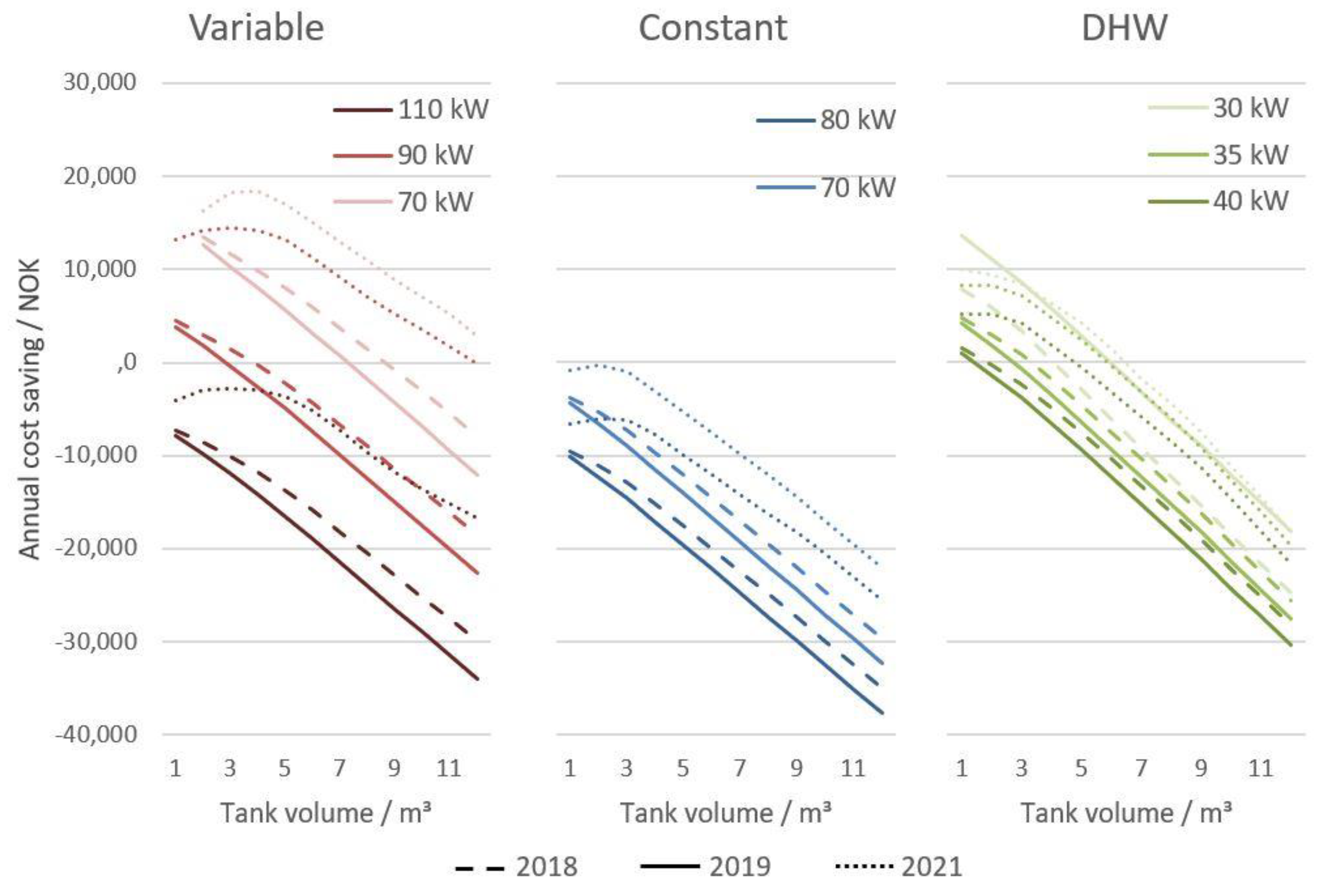

2. Methodologies

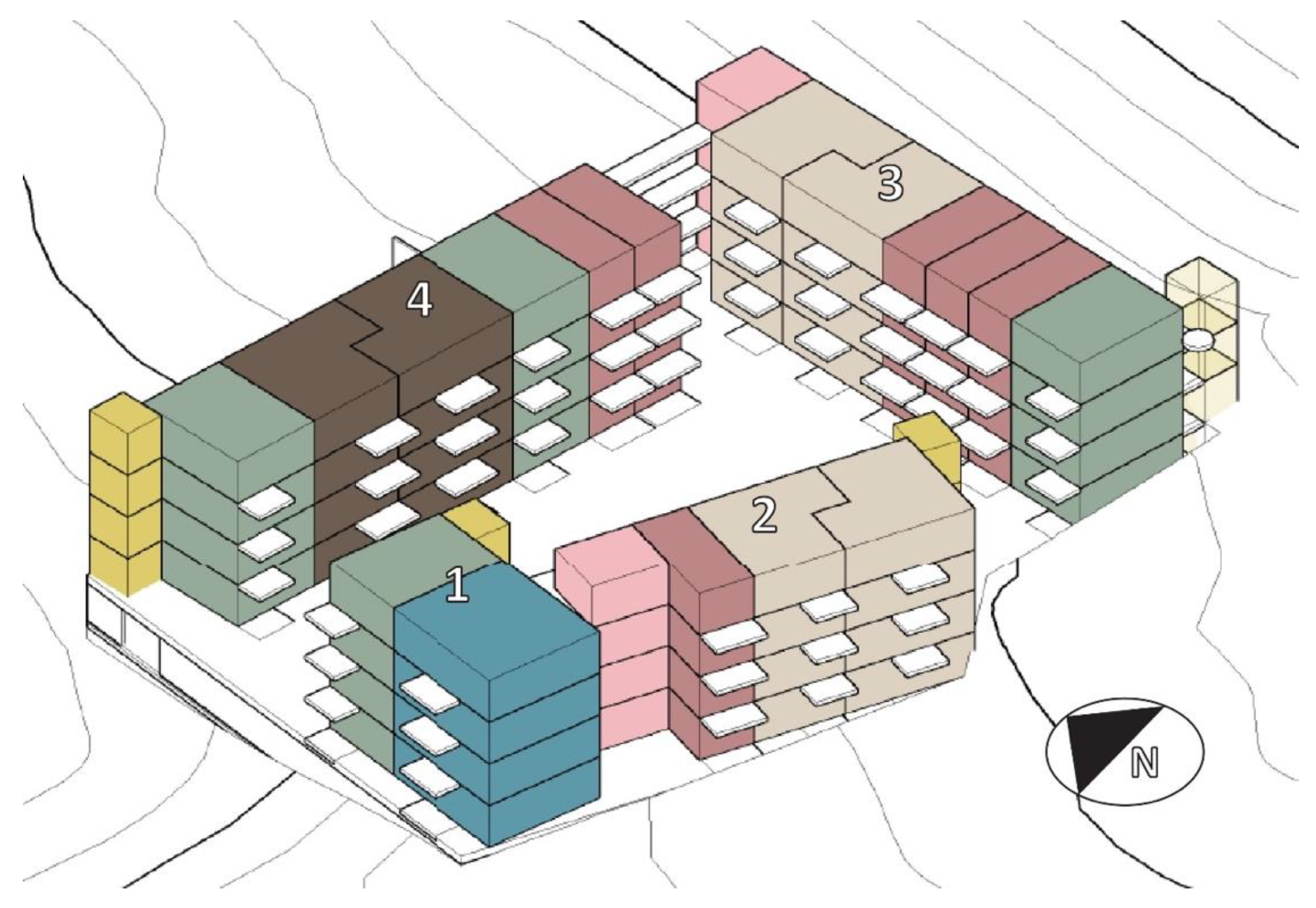

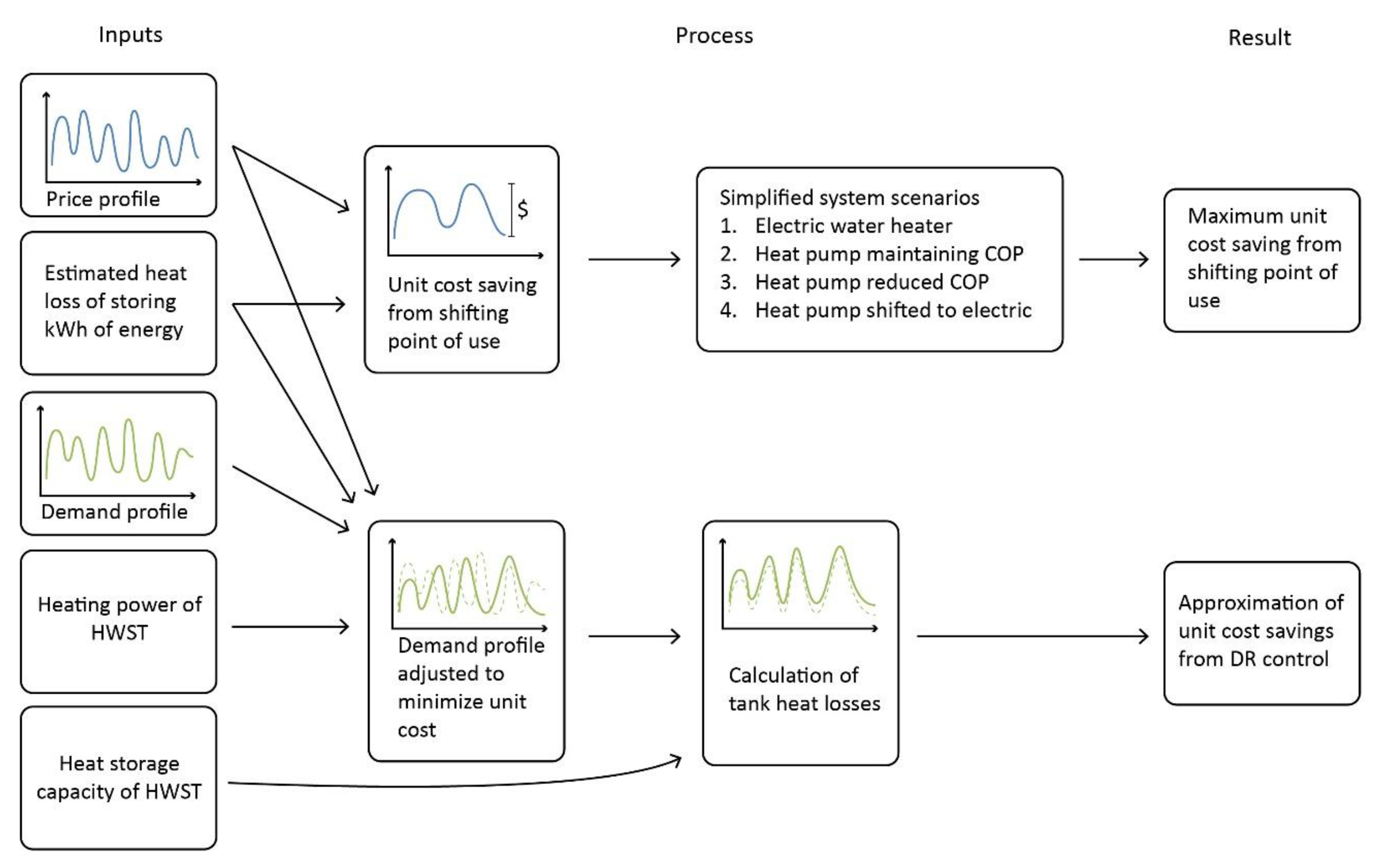

2.1. Inputs

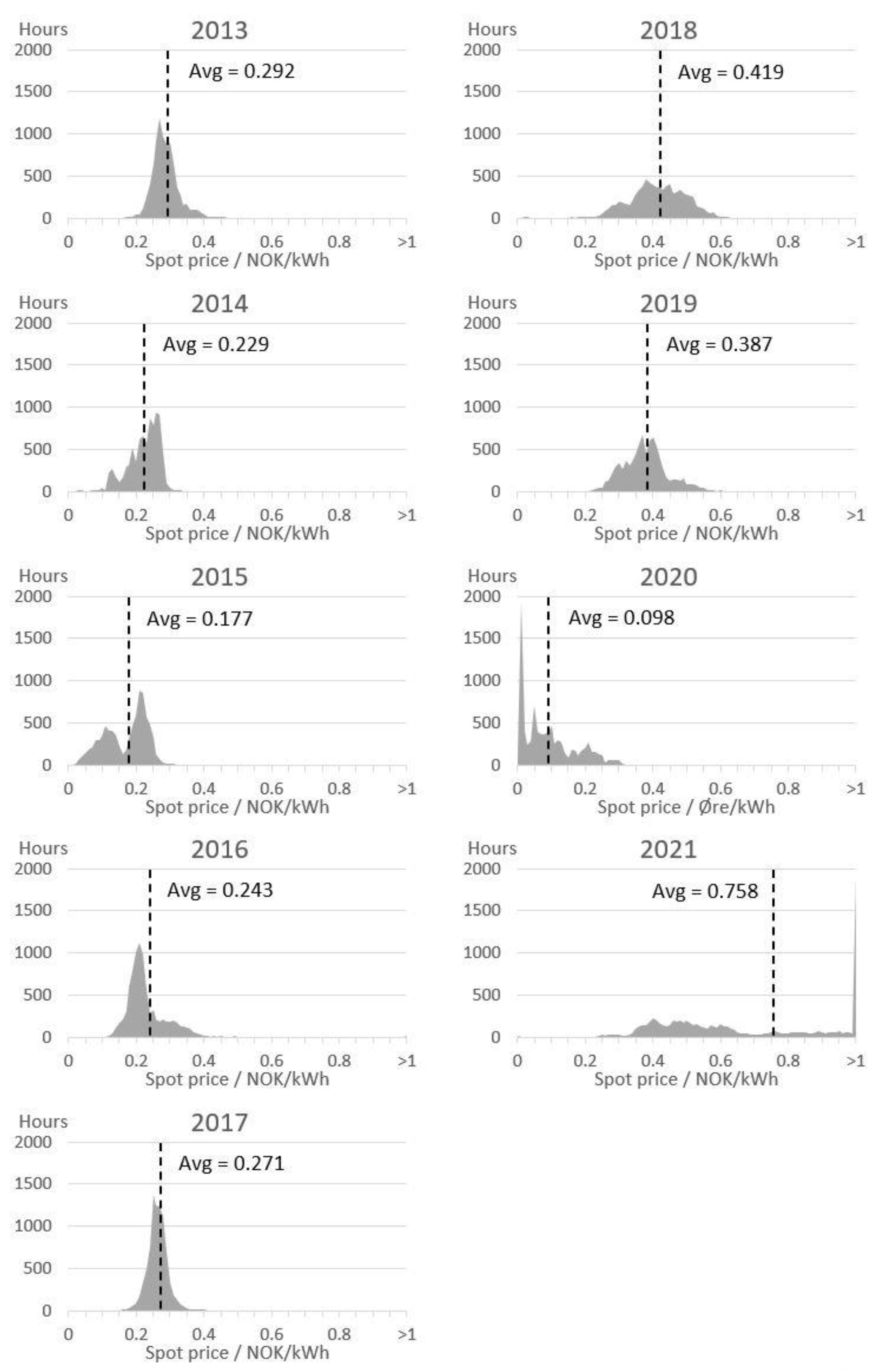

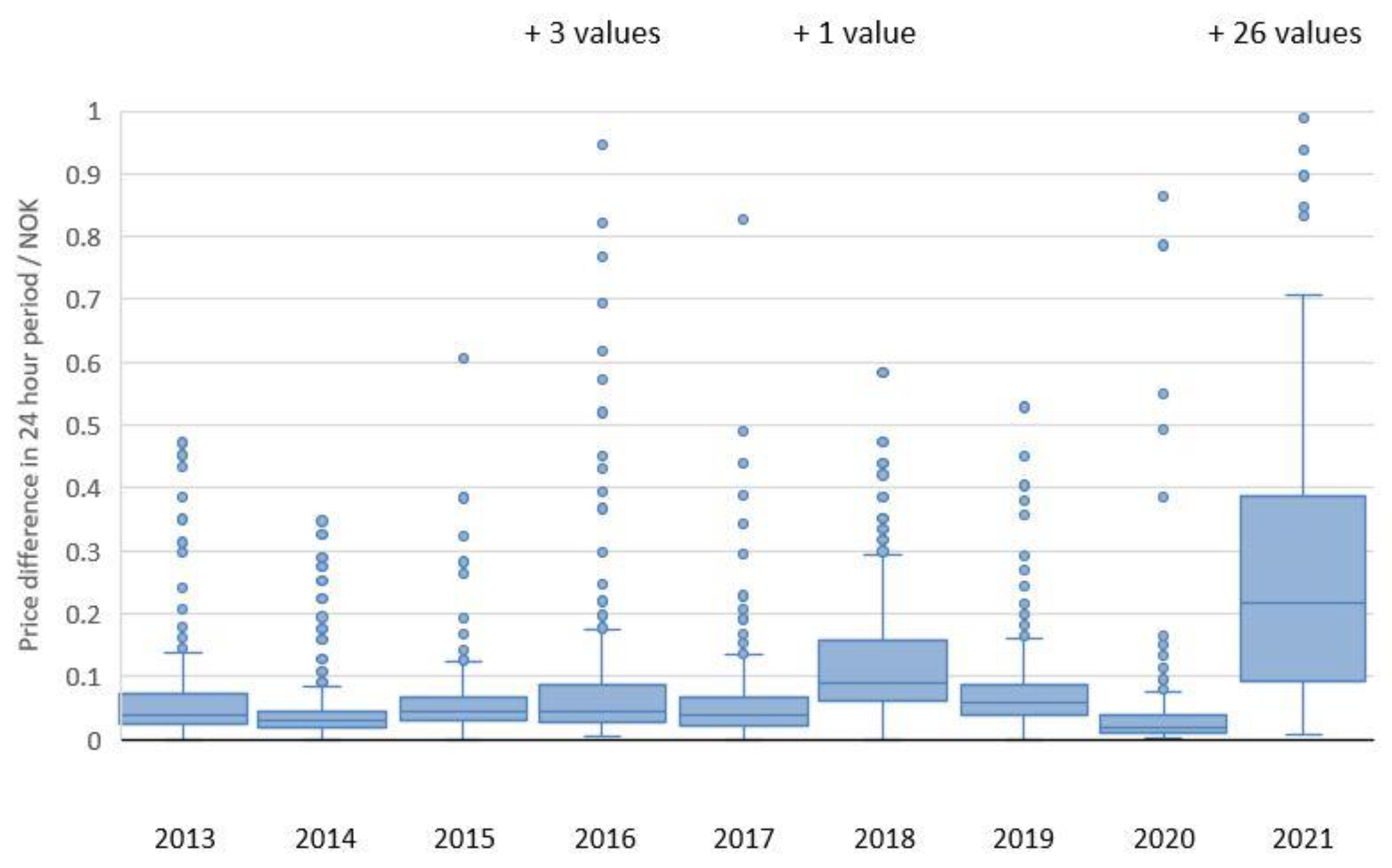

2.1.1. Electricity Prices

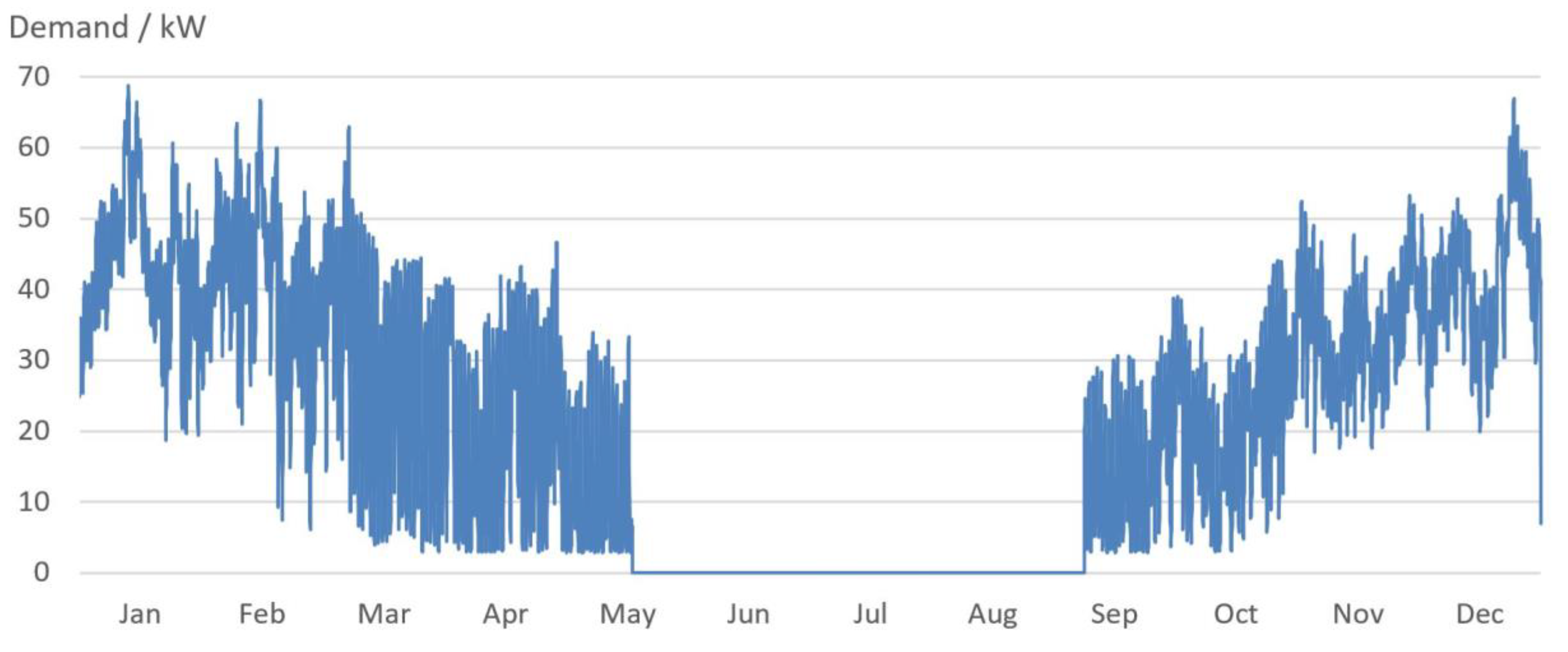

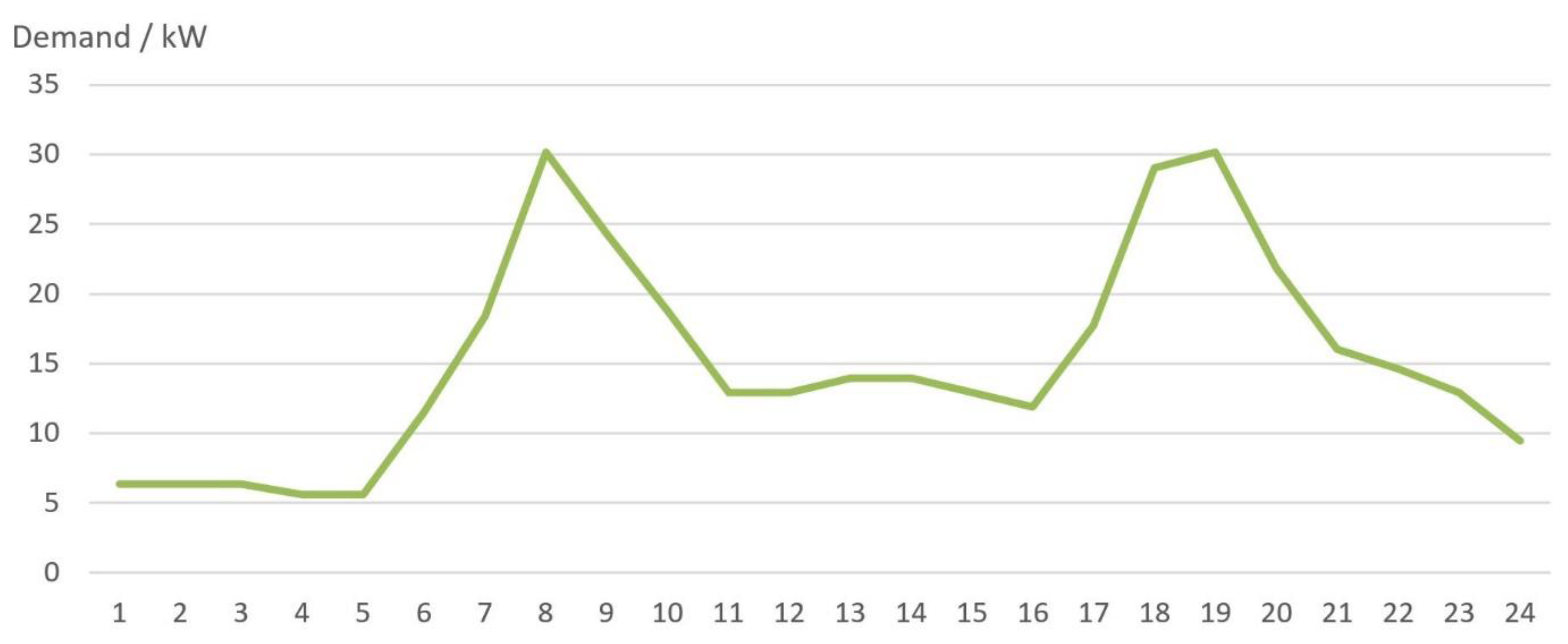

2.1.2. Thermal Energy Demand Profile

2.1.3. HWST

2.2. Cost Saving Analyses

2.2.1. Analysis of Unit Cost Savings Using Electricity Price Data

- Scenario 1: Electric water heater.

- Scenario 2: Shifting from heat pump to heat pump, maintaining COP. Unit cost savings are divided by the heat pump COP. For both heating profiles, a COP of 4 was used. For DHW, a COP of 3 was used. These values were fixed and based on measured seasonal values [49] as a simplification for this analysis.

- Scenario 3: Shifting from heat pump to heat pump with reduced COP. As the storage of thermal energy for later use often requires higher tank temperatures, the performance of the heat pump will likely be reduced. The reduced COP is half of those used in scenario 2.

- Scenario 4: Shifting from heat pump to electricity. Extending scenario 3 to a situation where the heat pump is no longer able to provide hot enough water temperature to charge the HWST and so an electric heating coil must be used. In other words, the COP is reduced to 1.

2.2.2. Approximation of an Optimal DR Control to Minimise Energy Cost

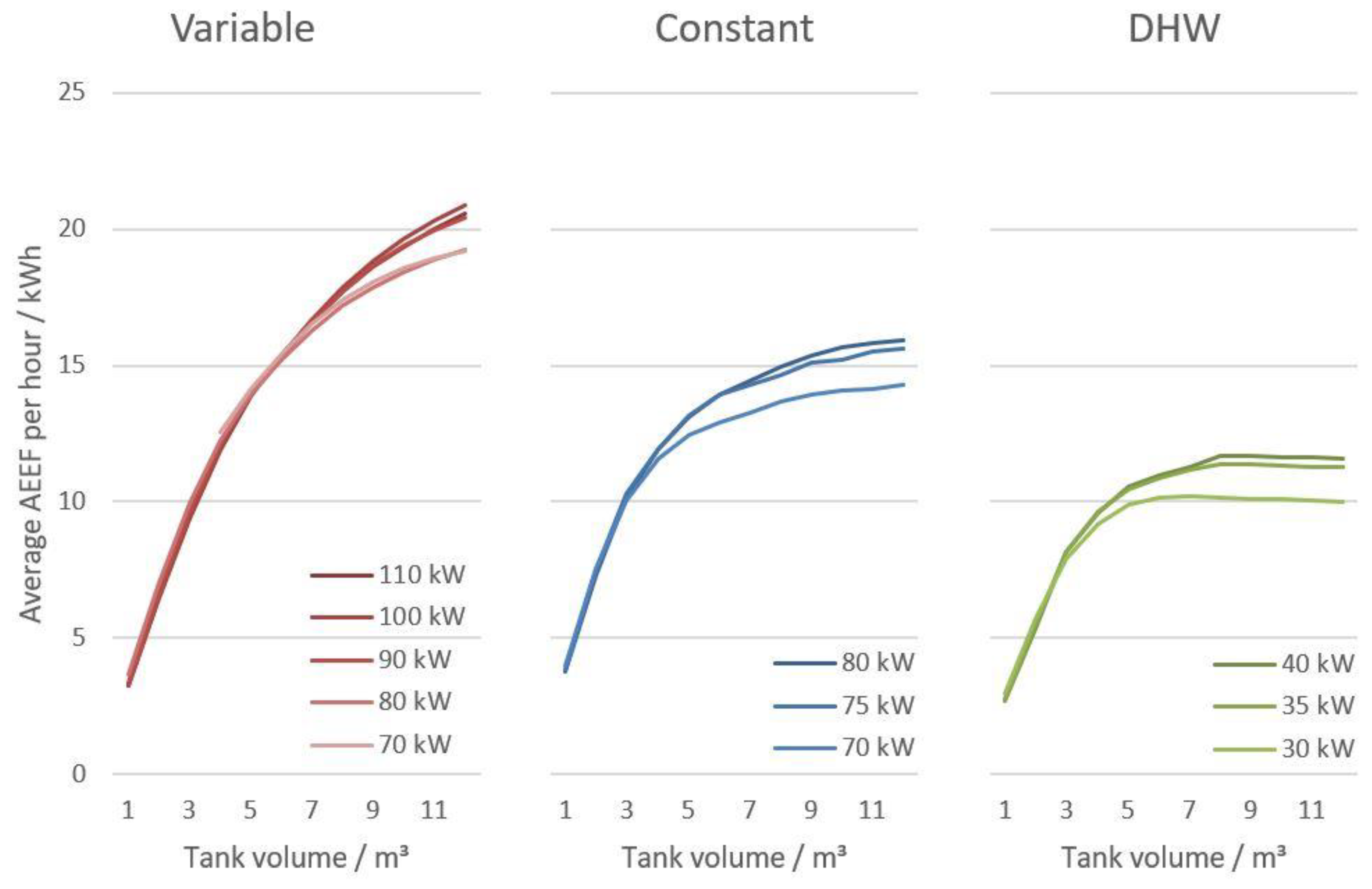

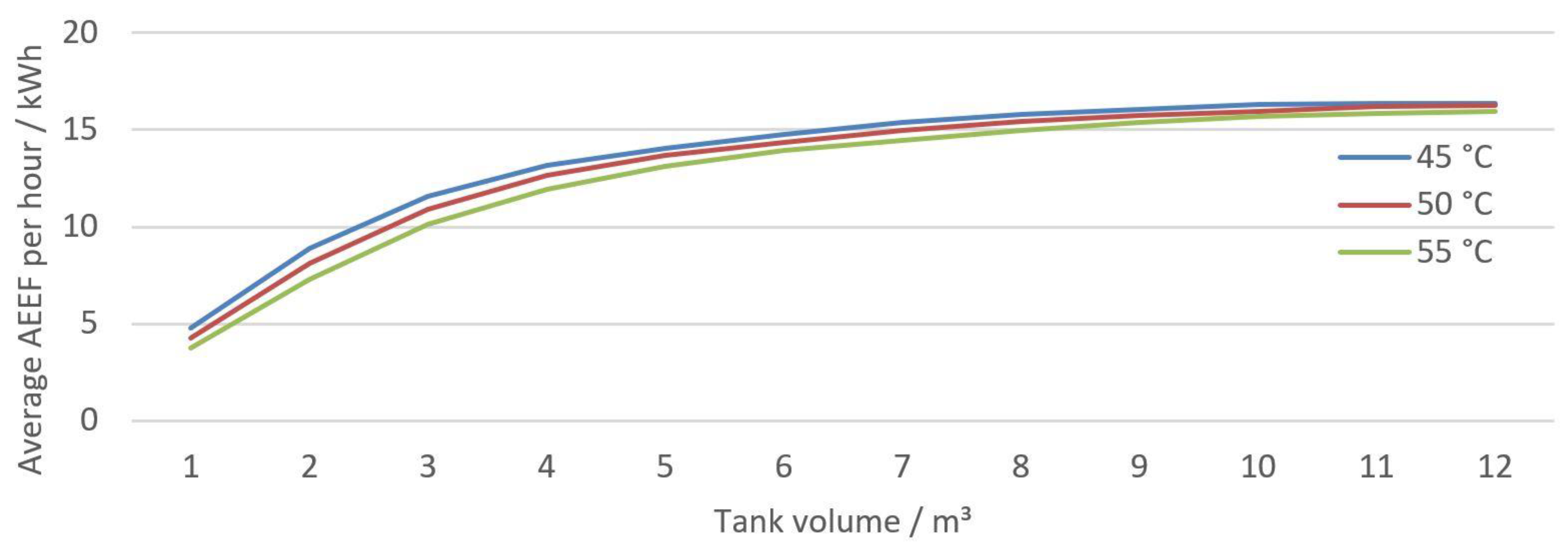

2.3. Performance Indicators

3. Results

3.1. Analysis of Spot Prices

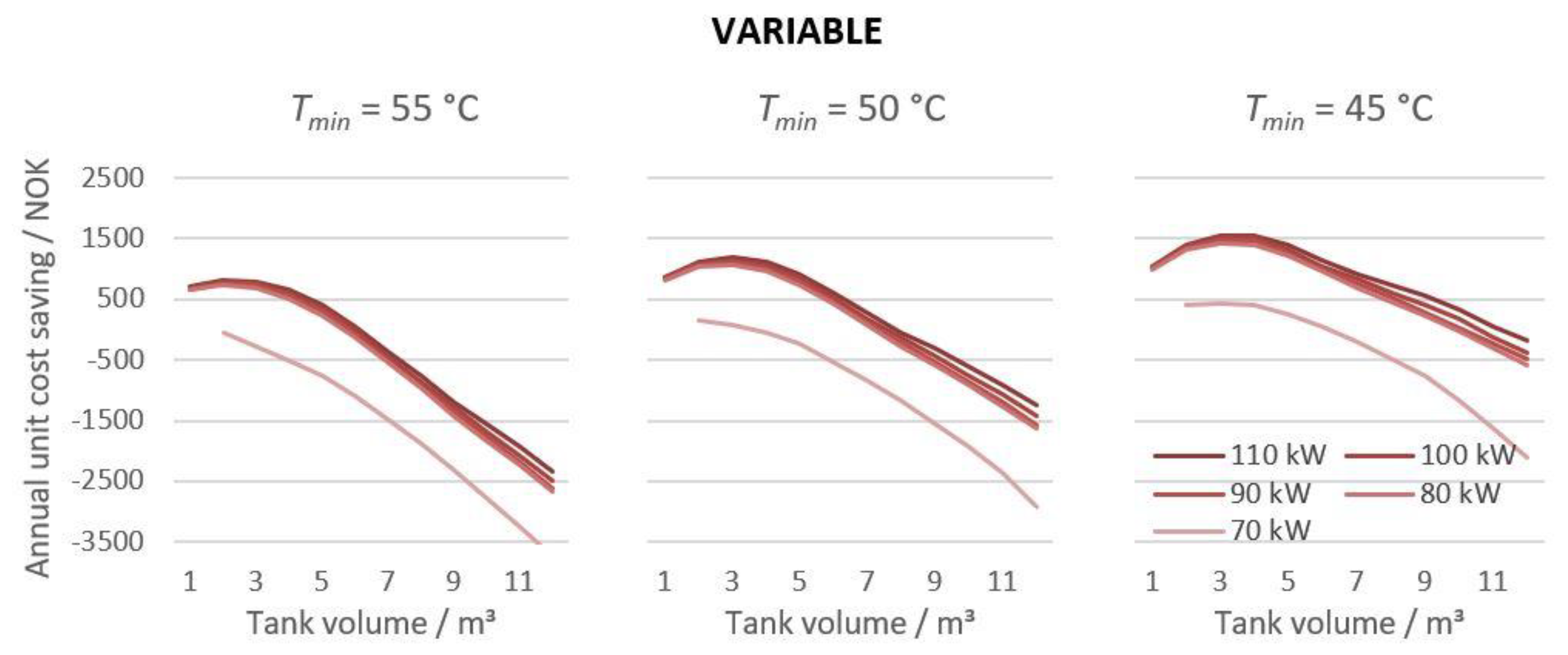

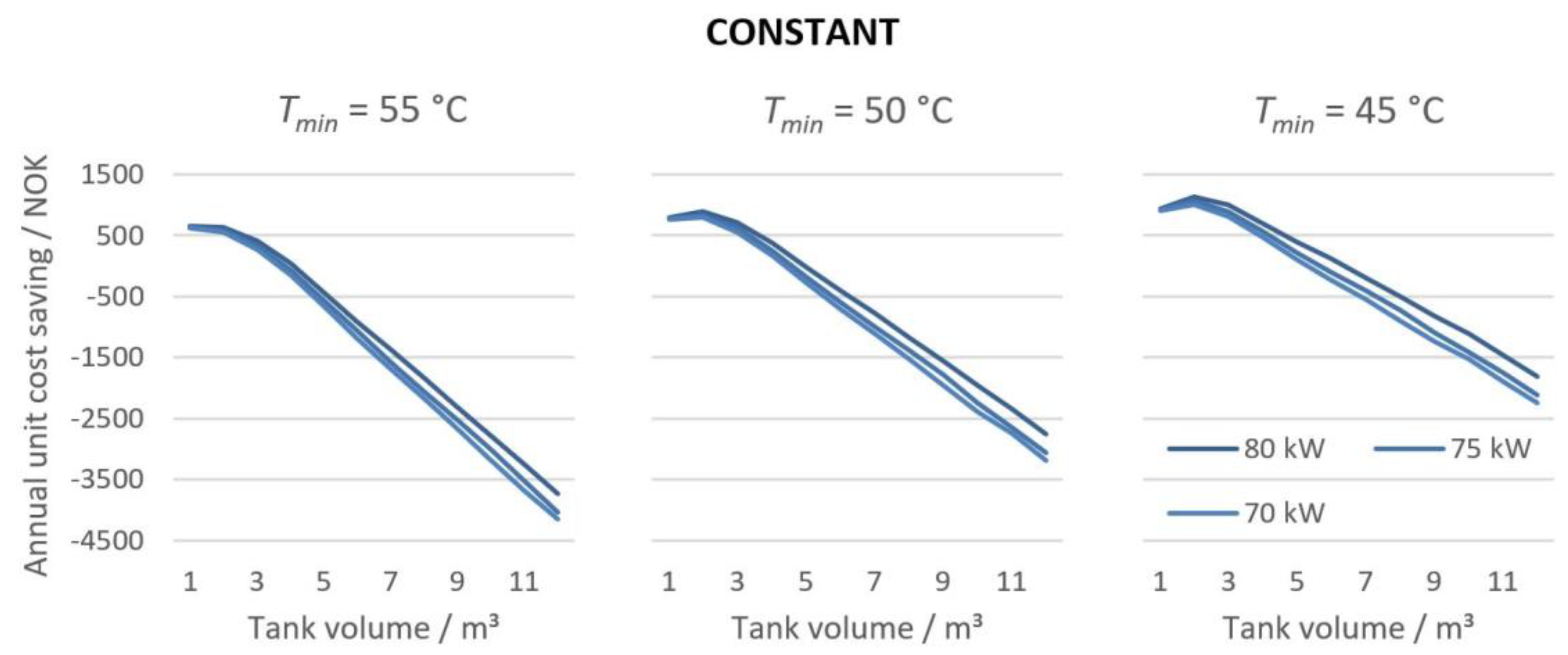

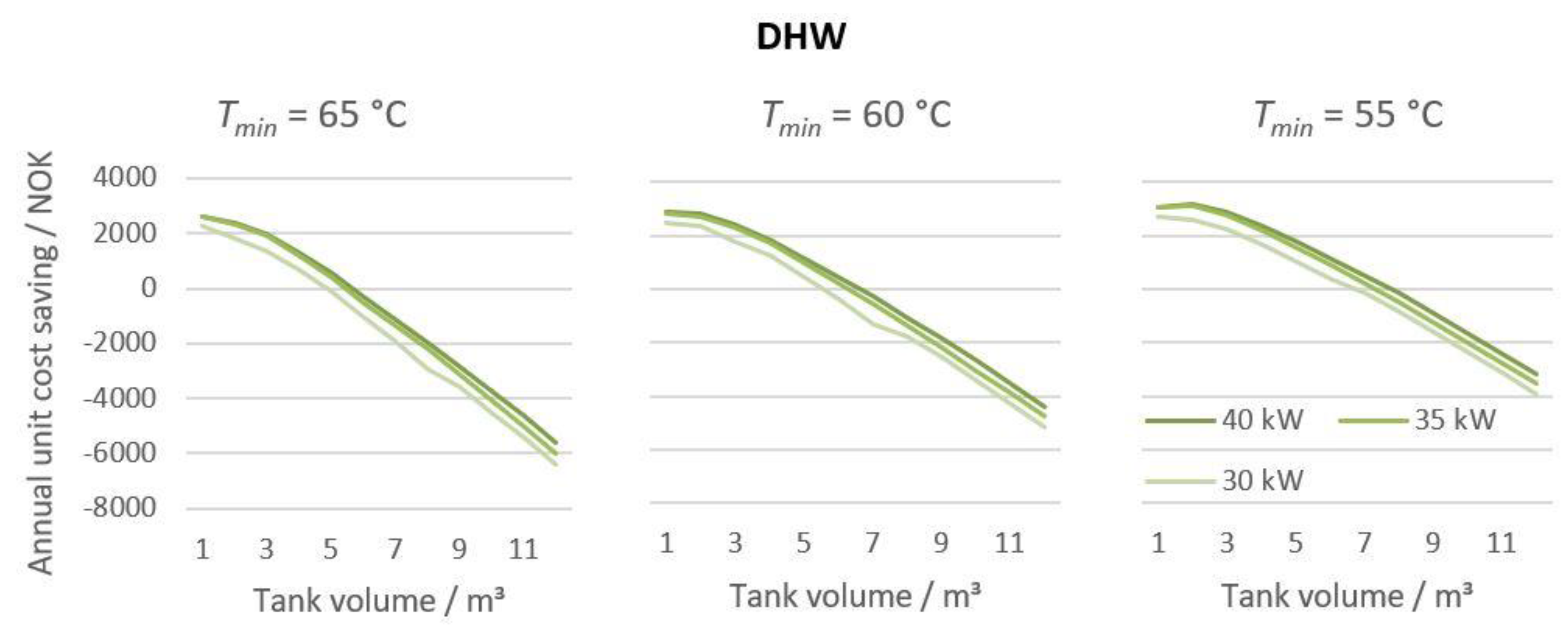

3.2. Potential Unit Cost Saving

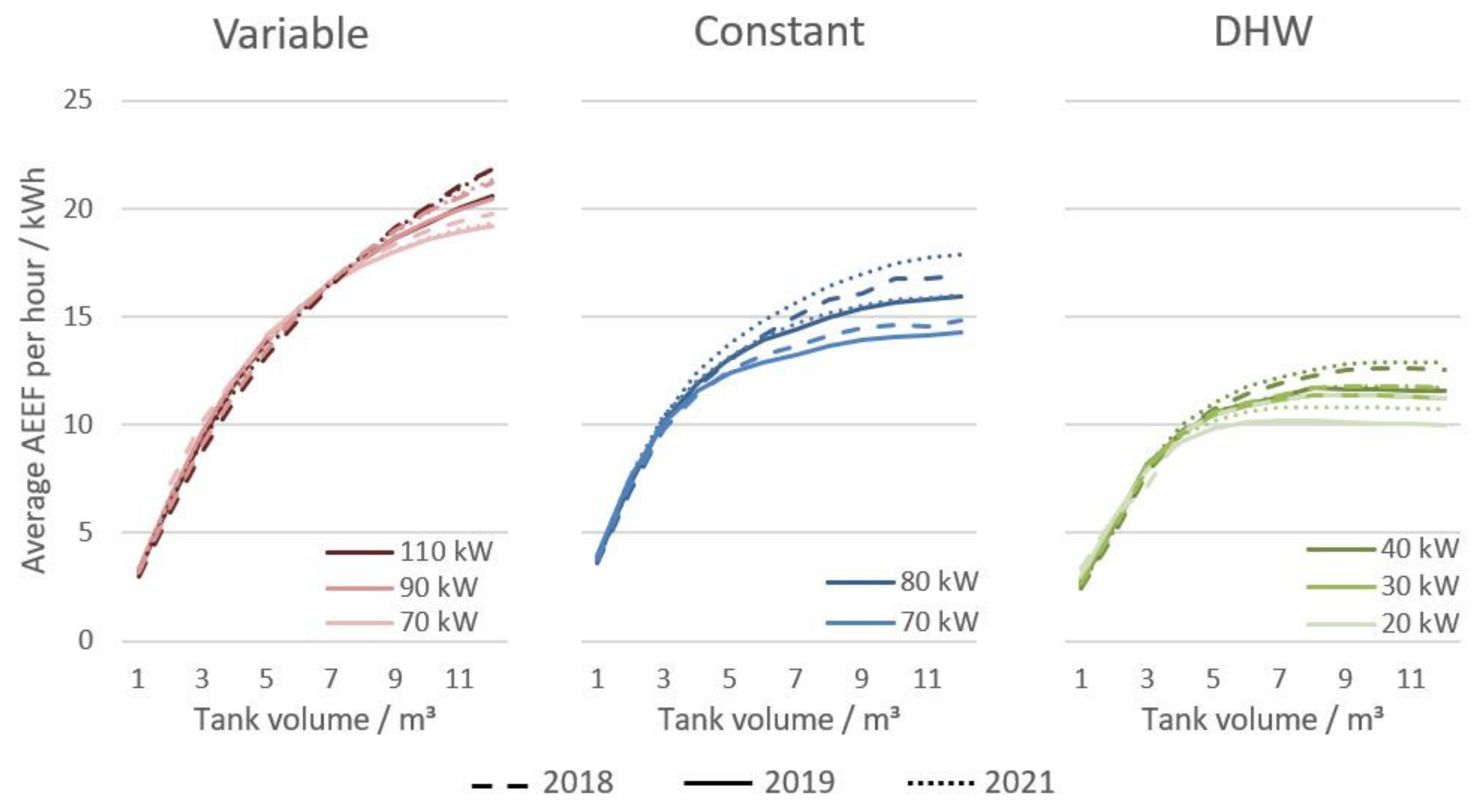

3.3. Demand Profile Optimisation

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| AEEF | Available Electric Energy Flexibility |

| COP | Coefficient of Performance |

| DHW | Domestic Hot Water |

| DR | Demand Response |

| HWST | Hot Water Storage Tank |

| MPC | Model Predictive Control |

| RTP | Real Time Pricing |

| TES | Thermal Energy Storage |

References

- Market Observatory for Energy. Quarterly Report on European Electricity Markets (Q1 2022); European Commission: Brussels, Belgium, 2022; Volume 15. [Google Scholar]

- European Commission, Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions Repowereu Plan REPowerEU Plan. 2022. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2022%3A230%3AFIN&qid=1653033742483 (accessed on 30 September 2022).

- Jensen, S.Ø.; Marszal-Pomianowska, A.; Lollini, R.; Pasut, W.; Knotzer, A.; Engelmann, P.; Stafford, A.; Reynders, G. IEA EBC Annex 67 Energy Flexible Buildings. Energy Build. 2017, 155, 25–34. [Google Scholar] [CrossRef]

- Lund, P.D.; Lindgren, J.; Mikkola, J.; Salpakari, J. Review of energy system flexibility measures to enable high levels of variable renewable electricity. Renew. Sustain. Energy Rev. 2015, 45, 785–807. [Google Scholar] [CrossRef]

- Clauß, J.; Stinner, S.; Solli, C.; Lindberg, K.B.; Madsen, H.; Georges, L. A generic methodology to evaluate hourly average CO2eq. intensities of the electricity mix to deploy the energy flexibility potential of Norwegian buildings. In Proceedings of the 10th International Conference on System Simulation in Buildings, Liege, Belgium, 10–12 December 2018. [Google Scholar]

- Mixergy. Mixergy Hot Water Tanks. 2021. Available online: https://www.mixergy.co.uk/ (accessed on 10 May 2021).

- SEDC. Explicit and Implicit Demand-Side Flexibility—Complementary Approaches for an Efficient Energy System. Smart Energy Demand Coalition. 2016. Available online: https://www.smarten.eu/wp-content/uploads/2016/09/SEDC-Position-paper-Explicit-and-Implicit-DR-September-2016.pdf#:~:text=Implicit%20Demand-Side%20Flexibility%20is%20the%20consumer%E2%80%99s%20reaction%20to,is%20often%20referred%20to%20as%20%E2%80%9Cprice-based%E2%80%9D%20Demand-Side%20Flexibility (accessed on 3 May 2021).

- Grünewald, P.; McKenna, E.; Thomson, M. Keep it simple: Time-of-use tariffs in high-wind scenarios. IET Renew. Power Gener. 2015, 9, 176–183. [Google Scholar] [CrossRef]

- Nolan, S.; O’Malley, M. Challenges and barriers to demand response deployment and evaluation. Appl. Energy 2015, 152, 1–10. [Google Scholar] [CrossRef]

- Smart Energy Demand Coalition (SEDC). Explicit Demand Response in Europe—Mapping the Markets 2017; Smart Energy Demand Coalition (SEDC): Brussels, Belgium, 2017. [Google Scholar]

- Pinto-Bello, A. The smartEn Map—Network Tariffs and Taxes; smartEN: Brussels, Belgium, 2019; Available online: https://smarten.eu/mapping-the-markets/ (accessed on 3 May 2021).

- Energifakta Norge. The Power Market. 2021. Available online: https://energifaktanorge.no/en/norsk-energiforsyning/kraftmarkedet/ (accessed on 3 May 2021).

- Statistisk sentralbyrå. 09364: Kraftpriser i sluttbrukermarkedet, etter kontraktstype, kvartal og statistikkvariabel. Statistikkbanken. 2021. Available online: https://www.ssb.no/statbank/table/09364 (accessed on 29 September 2021).

- lavere strømpris så langt i 2020 | Tibber Magazine. Available online: https://tibber.com/no/magazine/power-hacks/lavere-strompris-i-2020 (accessed on 29 September 2021).

- Wattever | Forstå strømprisene. Available online: https://www.wattever.no/forsta-stromprisene (accessed on 29 September 2021).

- Kathirgamanathan, A.; De Rosa, M.; Mangina, E.; Finn, D.P. Data-driven predictive control for unlocking building energy flexibility: A review. Renew. Sustain. Energy Rev. 2021, 135, 110120. [Google Scholar] [CrossRef]

- Afram, A.; Janabi-Sharifi, F. Theory and Applications of HVAC Control systems–A Review of Model Predictive Control (MPC). Build. Environ. 2014, 72, 343–355. [Google Scholar] [CrossRef]

- Prívara, S.; Cigler, J.; Váňa, Z.; Oldewurtel, F.; Sagerschnig, C.; Zacekova, E. Building modeling as a crucial part for building predictive control. Energy Build. 2013, 56, 8–22. [Google Scholar] [CrossRef]

- Nilsson, A.; Bergstad, C.J.; Thuvander, L.; Andersson, D.; Andersson, K.; Meiling, P. Effects of continuous feedback on households’ electricity consumption: Potentials and barriers. Appl. Energy 2014, 122, 17–23. [Google Scholar] [CrossRef]

- Ahlbom, H. Smarta fiaskot för prestigebygget i Norra Djurgårdsstaden. Ny Teknik. 14 February 2015. Available online: https://www.nyteknik.se/nyheter/smarta-fiaskot-for-prestigebygget-i-norra-djurgardsstaden-6336033 (accessed on 11 May 2021).

- O’Shaughnessy, E.; Cutler, D.; Ardani, K.; Margolis, R. Solar plus: A review of the end-user economics of solar PV integration with storage and load control in residential buildings. Appl. Energy 2018, 228, 2165–2175. [Google Scholar] [CrossRef]

- Romanchenko, D.; Kensby, J.; Odenberger, M.; Johnsson, F. Thermal energy storage in district heating: Centralised storage vs. storage in thermal inertia of buildings. Energy Convers. Manag. 2018, 162, 26–38. [Google Scholar] [CrossRef]

- Belz, K.; Kuznik, F.; Werner, K.; Schmidt, T.; Ruck, W. Thermal energy storage systems for heating and hot water in residential buildings. In Advances in Thermal Energy Storage Systems; Woodhead Publishing: Cambridge, UK, 2015; pp. 441–465. [Google Scholar] [CrossRef]

- Kemna, R.; van Elburg, M.; Aarts, S. Water heaters and storage tanks—Ecodesign and energy label. In Task 1 Scope—Policies & Standards; 2019; Available online: https://www.ecohotwater-review.eu/downloads/Water%20Heaters%20Task%201%20final%20report%20July%202019.pdf (accessed on 15 June 2022).

- Johra, H.; Heiselberg, P.; Le Dréau, J. Influence of envelope, structural thermal mass and indoor content on the building heating energy flexibility. Energy Build. 2019, 183, 325–339. [Google Scholar] [CrossRef]

- Hou, J.; Li, H.; Nord, N. Nonlinear model predictive control for the space heating system of a university building in Norway. Energy 2022, 253, 124157. [Google Scholar] [CrossRef]

- Medved, S.; Domjan, S.; Arkar, C. Sustainable Technologies for Nearly Zero Energy Buildings; Springer: Cham, Switzerland, 2019. [Google Scholar] [CrossRef]

- Hadorn, J.-C. Thermal Energy Storage for Solar and Low Energy Buildings—State of the Art; Servei de Publicacions de la Universitat de Lleida: Lleida, Spain, 2005. [Google Scholar]

- Cao, S.; Hasan, A.; Sirén, K. Analysis and solution for renewable energy load matching for a single-family house. Energy Build. 2013, 65, 398–411. [Google Scholar] [CrossRef]

- Avci, M.; Erkoc, M.; Rahmani, A.; Asfour, S. Model predictive HVAC load control in buildings using real-time electricity pricing. Energy Build. 2013, 60, 199–209. [Google Scholar] [CrossRef]

- Tennbakk, B.; Ryssdal, M.B.; Fiksen, K.; Ådnanes, O.-K.; Christiansen, C.H. Value of Flexibility from Electrical Storage Water Heaters; Thema: Oslo, Norway, 2020. [Google Scholar]

- Kepplinger, P.; Huber, G.; Petrasch, J. Autonomous optimal control for demand side management with resistive domestic hot water heaters using linear optimization. Energy Build. 2015, 100, 50–55. [Google Scholar] [CrossRef]

- Kepplinger, P.; Huber, G.; Petrasch, J. Field testing of demand side management via autonomous optimal control of a domestic hot water heater. Energy Build. 2016, 127, 730–735. [Google Scholar] [CrossRef]

- Ritchie, M.; Engelbrecht, J.; Booysen, M. Practically-Achievable Energy Savings with the Optimal Control of Stratified Water Heaters with Predicted Usage. Energies 2021, 14, 1963. [Google Scholar] [CrossRef]

- De Oliveira, V.; Jäschke, J.; Skogestad, S. Optimal operation of energy storage in buildings: Use of the hot water system. J. Energy Storage 2016, 5, 102–112. [Google Scholar] [CrossRef]

- Nord, N.; Ding, Y.; Ivanko, D.; Walnum, H.T. DHW tank sizing considering dynamic energy prices. E3S Web Conf. 2021, 246, 07005. [Google Scholar] [CrossRef]

- Sørensen, L.; Walnum, H.T.; Sartori, I.; Andresen, I. Energy flexibility potential of domestic hot water systems in apartment buildings. E3S Web Conf. 2021, 246, 11005. [Google Scholar] [CrossRef]

- Henze, G.P. Trade-Off Between Energy Consumption and Utility Cost in the Optimal Control of Active and Passive Building Thermal Storage Inventory. In Proceedings of the International Solar Energy Conference 2004, Portland, OR, USA, 11–14 July 2004; pp. 111–119. [Google Scholar] [CrossRef]

- Nord Pool. Market Data. 2022. Available online: https://www.nordpoolgroup.com/en/Market-data1/ (accessed on 13 February 2022).

- Elvia. Alt du må vite om ny nettleie for 2022. 2022. Available online: https://www.elvia.no/nettleie/alt-du-ma-vite-om-ny-nettleie-for-2022/ (accessed on 15 June 2022).

- Elvia. Nettleiepriser og effekttariff bedrift. 2021. Available online: https://www.elvia.no/nettleie/alt-om-nettleie/nettleiepriser-og-effekttariff-for-bedrifter-i-oslo-og-viken (accessed on 15 May 2021).

- ProgramByggerne. SIMIEN7; ProgramByggerne ANS: Skollenborg, Norway, 2021. [Google Scholar]

- EN ISO 13790:2008; Energy Performance of Buildings—Calculation of Energy Use for Space Heating and Cooling. CEN—European Committee for Standardization: Brussels, Belgium, 2008.

- EN 15265:2007; Energy Performance of Buildings—Calculation of Energy Needs for Space Heating and Cooling Using Dynamic Methods—General Criteria and Validation Procedures. CEN—European Committee for Standardization: Brussels, Belgium, 2007.

- Standard Norge. SN/NS 3031:2020—Bygningers energiytelse Beregning av energibehov og energiforsyning. 2020. Available online: https://www.standard.no/no/Nettbutikk/produktkatalogen/Produktpresentasjon/?ProductID=1124340 (accessed on 8 October 2021).

- Ahmed, K.; Pylsy, P.; Kurnitski, J. Hourly Consumption Profiles of Domestic Hot Water for Finnish Apartment Buildings. In Proceedings of the CLIMA 2016: 12th REHVA World CongressAt, Aalborg, Denmark, 22–25 May 2016. [Google Scholar] [CrossRef]

- Norconsult Informasjonssystemer AS. Norsk prisbok. 2021. Available online: https://www.norskprisbok.no/Home.aspx (accessed on 8 October 2021).

- Steinweg, J.; Kliem, F.; Rockendorf, G. Pipe Internal Recirculation in Storage Connections—Characteristics and Influencing Parameters. Energy Procedia 2014, 48, 664–673. [Google Scholar] [CrossRef][Green Version]

- Stene, J.; Justo Alonso, M. Field Measurements—Heat Pump Systems in NZEB. SINTEF. 2016. Available online: https://www.sintef.no/en/publications/publication/1359179/ (accessed on 13 June 2022).

- Pallonetto, F.; De Rosa, M.; D’Ettorre, F.; Finn, D.P. On the assessment and control optimisation of demand response programs in residential buildings. Renew. Sustain. Energy Rev. 2020, 127, 109861. [Google Scholar] [CrossRef]

- NVE. Kraftåret 2018: Fra tørke- og nedbørsrekord til forbruksrekord og høy kraftpris—NVE. 21 January 2019. Available online: https://www.nve.no/nytt-fra-nve/nyheter-energi/kraftaret-2018-fra-torke-og-nedborsrekord-til-forbruksrekord-og-hoy-kraftpris/ (accessed on 14 May 2021).

- NVE. Kraftsituasjonen—Andre kvartal 2021; NVE: Oslo, Norway, 2021. [Google Scholar]

- Armstrong, P.M.; Uapipatanakul, M.; Thompson, I.; Ager, D.; McCulloch, M. Thermal and sanitary performance of domestic hot water cylinders: Conflicting requirements. Appl. Energy 2014, 131, 171–179. [Google Scholar] [CrossRef]

- Bagge, H.; Johansson, D. Measurements of household electricity and domestic hot water use in dwellings and the effect of different monitoring time resolution. Energy 2011, 36, 2943–2951. [Google Scholar] [CrossRef]

- Henze, G.P.; Dodier, R.H.; Krarti, M. Development of a Predictive Optimal Controller for Thermal Energy Storage Systems. HVAC&R Res. 1997, 3, 233–264. [Google Scholar] [CrossRef]

- Ahmed, A.M.A.; Mihet-Popa, L.; Agert, C.; Zong, Y.; Bruna, J.; Xiao, X. Potential Energy Flexibility for a Hot-Water Based Heating System in Smart Buildings via Economic Model Predictive Control. In Proceedings of the 2017 International Symposium on Computer Science and Intelligent Controls, Budapest, Hungary, 20–22 October 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Arteconi, A.; Hewitt, N.J.; Polonara, F. Domestic demand-side management (DSM): Role of heat pumps and thermal energy storage (TES) systems. Appl. Therm. Eng. 2013, 51, 155–165. [Google Scholar] [CrossRef]

- Alimohammadisagvand, B.; Jokisalo, J.; Kilpeläinen, S.; Ali, M.; Sirén, K. Cost-optimal thermal energy storage system for a residential building with heat pump heating and demand response control. Appl. Energy 2016, 174, 275–287. [Google Scholar] [CrossRef]

- Gibbons, L.; Javed, S. A review of HVAC solution-sets and energy performace of nearly zero-energy multi-story apartment buildings in Nordic climates by statistical analysis of environmental performance certificates and literature review. Energy 2021, 238, 121709. [Google Scholar] [CrossRef]

- Walnum, H.T.; Sørensen, Å.L.; Stråby, K. Energibruk til varmt tappevann—Resultater fra prosjektet varmtvann2030; Sintef: Oslo, Norway, 2021. [Google Scholar]

- Ivanko, D.; Walnum, H.T.; Sørensen, L.; Nord, N. Analysis of monthly and daily profiles of DHW use in apartment blocks in Norway. E3S Web Conf. 2020, 172, 12002. [Google Scholar] [CrossRef]

- Berge, M.; Mathisen, H.M. Post-Occupancy Evaluation of Low-Energy and Passive House Apartments in the Løvåshagen Cooperative—Occupant Behavior and Satisfaction; Passivhus Norden: Gothenburg, Sweden, 2013; pp. 52–65. [Google Scholar]

- Killian, M.; Kozek, M. Ten questions concerning model predictive control for energy efficient buildings. Build. Environ. 2016, 105, 403–412. [Google Scholar] [CrossRef]

- Clauß, J.; Stinner, S.; Sartori, I.; Georges, L. Predictive rule-based control to activate the energy flexibility of Norwegian residential buildings: Case of an air-source heat pump and direct electric heating. Appl. Energy 2019, 237, 500–518. [Google Scholar] [CrossRef]

- Pitorac, L.; Vereide, K.; Lia, L. Technical Review of Existing Norwegian Pumped Storage Plants. Energies 2020, 13, 4918. [Google Scholar] [CrossRef]

- European Commission. ANNEX to the Report to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions—2020 Report on the State of the Energy Union pursuant to Regulation (EU) 2018/1999 on Governance of the Energy Union and Climate Action. 2020. Available online: https://webapi2016.eesc.europa.eu/v1/documents/com950-2020_part2_ext_EN.docx/content (accessed on 10 March 2022).

- Arteconi, A.; Patteeuw, D.; Bruninx, K.; Delarue, E.; D’Haeseleer, W.; Helsen, L. Active demand response with electric heating systems: Impact of market penetration. Appl. Energy 2016, 177, 636–648. [Google Scholar] [CrossRef]

- Hedegaard, R.E.; Pedersen, T.H.; Petersen, S. Multi-market demand response using economic model predictive control of space heating in residential buildings. Energy Build. 2017, 150, 253–261. [Google Scholar] [CrossRef]

- Peeters, M.; Compernolle, T.; van Passel, S. Simulation of a controlled water heating system with demand response remunerated on imbalance market pricing. J. Build. Eng. 2020, 27, 100969. [Google Scholar] [CrossRef]

| Spot Price | Grid Tariff | Energy Tax | VAT | |

|---|---|---|---|---|

| Electricity | Hourly spot price | 0.070 NOK (November through March) 0.039 NOK (April through October) | 0.1669 NOK | +25% |

| Period | Fixed Cost/NOK | Peak Cost (Max kW in the Month)/NOK/kW |

|---|---|---|

| December through February | 340 | 120 |

| March and November | 67 | |

| April through October | 22 |

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|

| Scenario 1: Shifting from electricity to electricity | |||||||||

| Constant | 3665 | 3714 | 3924 | 7596 | 4026 | 8859 | 4540 | 3477 | 35,835 |

| Variable | 4564 | 4435 | 4737 | 9144 | 4927 | 10,916 | 5646 | 4003 | 40,291 |

| DHW | 4125 | 2650 | 4107 | 5402 | 3798 | 9154 | 5049 | 2092 | 25,272 |

| Scenario 2: Shifting from heat pump to heat pump maintaining COP | |||||||||

| Constant (COP = 4) | 916 | 929 | 981 | 1899 | 1006 | 2215 | 1135 | 869 | 8959 |

| Variable (COP = 4) | 1141 | 1109 | 1184 | 2286 | 1232 | 2729 | 1412 | 1001 | 10,073 |

| DHW (COP = 3) | 1375 | 883 | 1369 | 1801 | 1266 | 3051 | 1683 | 697 | 8424 |

| Scenario 3: Shifting from heat pump to heat pump with reduced COP | |||||||||

| Con. (COP: 4 →2) | 10 | 0 | 1 | 203 | 5 | 98 | 12 | 38 | 709 |

| Var. (COP: 4 → 2) | 11 | 0 | 2 | 244 | 5 | 130 | 14 | 44 | 827 |

| DHW (COP: 3 → 1.5) | 14 | 0 | 2 | 156 | 4 | 122 | 17 | 24 | 818 |

| Scenario 4: Shifting from heat pump to electricity | |||||||||

| Con. (COP: 4 → 1) | 0 | 0 | 0 | 10 | 0 | 3 | 0 | 0 | 18 |

| Var. (COP: 4 → 1) | 0 | 0 | 0 | 14 | 0 | 4 | 0 | 0 | 16 |

| DHW (COP: 3 → 1) | 0 | 0 | 0 | 53 | 0 | 16 | 0 | 0 | 126 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gibbons, L.; Javed, S. Analysing the Economic Viability of Implicit Demand Response Control of Thermal Energy Storage in Hot Water Tanks. Energies 2022, 15, 9314. https://doi.org/10.3390/en15249314

Gibbons L, Javed S. Analysing the Economic Viability of Implicit Demand Response Control of Thermal Energy Storage in Hot Water Tanks. Energies. 2022; 15(24):9314. https://doi.org/10.3390/en15249314

Chicago/Turabian StyleGibbons, Laurence, and Saqib Javed. 2022. "Analysing the Economic Viability of Implicit Demand Response Control of Thermal Energy Storage in Hot Water Tanks" Energies 15, no. 24: 9314. https://doi.org/10.3390/en15249314

APA StyleGibbons, L., & Javed, S. (2022). Analysing the Economic Viability of Implicit Demand Response Control of Thermal Energy Storage in Hot Water Tanks. Energies, 15(24), 9314. https://doi.org/10.3390/en15249314