Electricity Usage Settlement System Based on a Cryptocurrency Instrument

Abstract

:1. Introduction

- reliance on cryptographic systems in the users’ network for storing account and balance information, authentication and verification of transactions, thus enabling management without a central authority,

- the existence of accessible and verifiable open source code,

- the availability of a project description (white paper).

- Decentralised power sector should correspond to a decentralised form of settlement for energy use.

- The energy flow should be linked to the simultaneous flow of monetary units, realising automatic settlements without unnecessary delays.

- Digital, DLT and fintech technologies can be used for energy settlement, including the tool of a cryptocurrency linked to the electricity system.

- The new cryptocurrency can reflect the value of energy in a given network of users.

- In the long term, electricity, as the most convenient and desirable form of energy, can be treated as a universal value equivalent and the associated cryptocurrency as a universal means of payment (synergy of energy and monetary systems in the field of digital integration).

2. Overlook

2.1. Evolution of Forms of Energy Use and Settlement

2.2. Blockchain and DLT for Energy Settlement

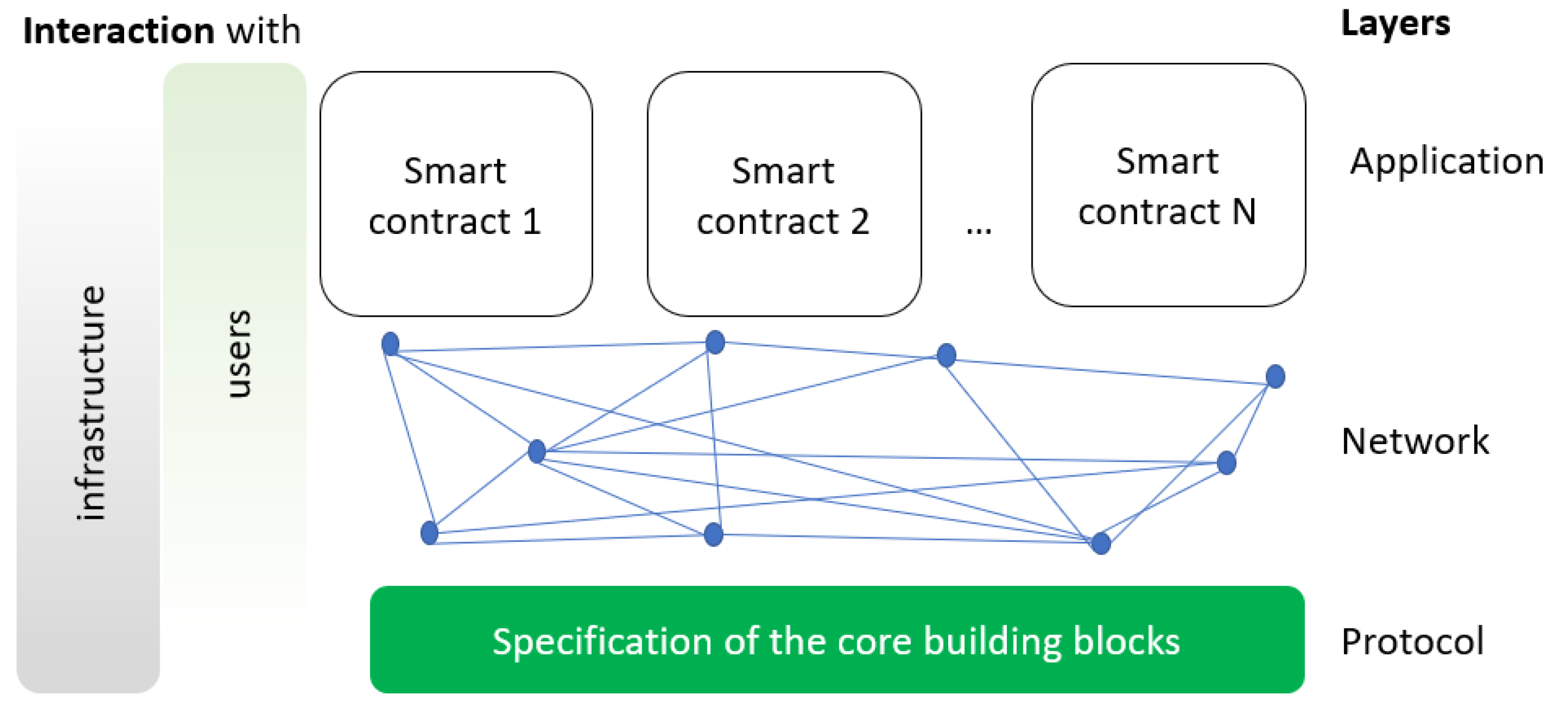

- Protocol Layer—the software implementation with all rules that manage the energy market, and the protocol for the actual blockchain creation process (initialisation, configuration, evolution, etc.);

- Network Layer—creating a peer-to-peer network of users (prosumers); and

- Application Layer—energy trading smart contracts, providing the possibility of defining and implementing energy using specific business rules.

- Simultaneous acquisition of information from energy meters with the execution of a settlement contract algorithm for energy use;

- Integration of energy consumption and cost signals with other parameters as input signals to various smart contracts;

- Integration of this activity with the automatic control of energy use processes at the level of:

- ○

- Customer/end-user installations;

- ○

- A structure that is a physical or virtual cooperative of users and/or prosumers/consumers (cooperatives, clusters, VPPs);

- ○

- Cooperation of the user with different energy suppliers (e.g., in an island system, contracts triggered by specific characteristics of the consumption profile); and

- ○

- Grid area.

- Achieving a high degree of reliability in the collection of current consumption and settlement data;

- Speeding up and automating the settlement execution process (blockchain-based currency can automatically transfer itself after each settlement time interval, e.g., every 15 min, with almost zero overhead);

- Stability and a high degree of certainty in transactions—participants cannot change the smart contract formula;

- The implementation of a settlement system based on a dedicated cryptocurrency to be exchanged for other units of value on a transparent basis; and

- Increasing the accessibility of the service to the mass user.

2.3. Cryptocurrencies and Energy Assets

3. Settlement System Concept

3.1. Motives

3.2. Basic Assumptions

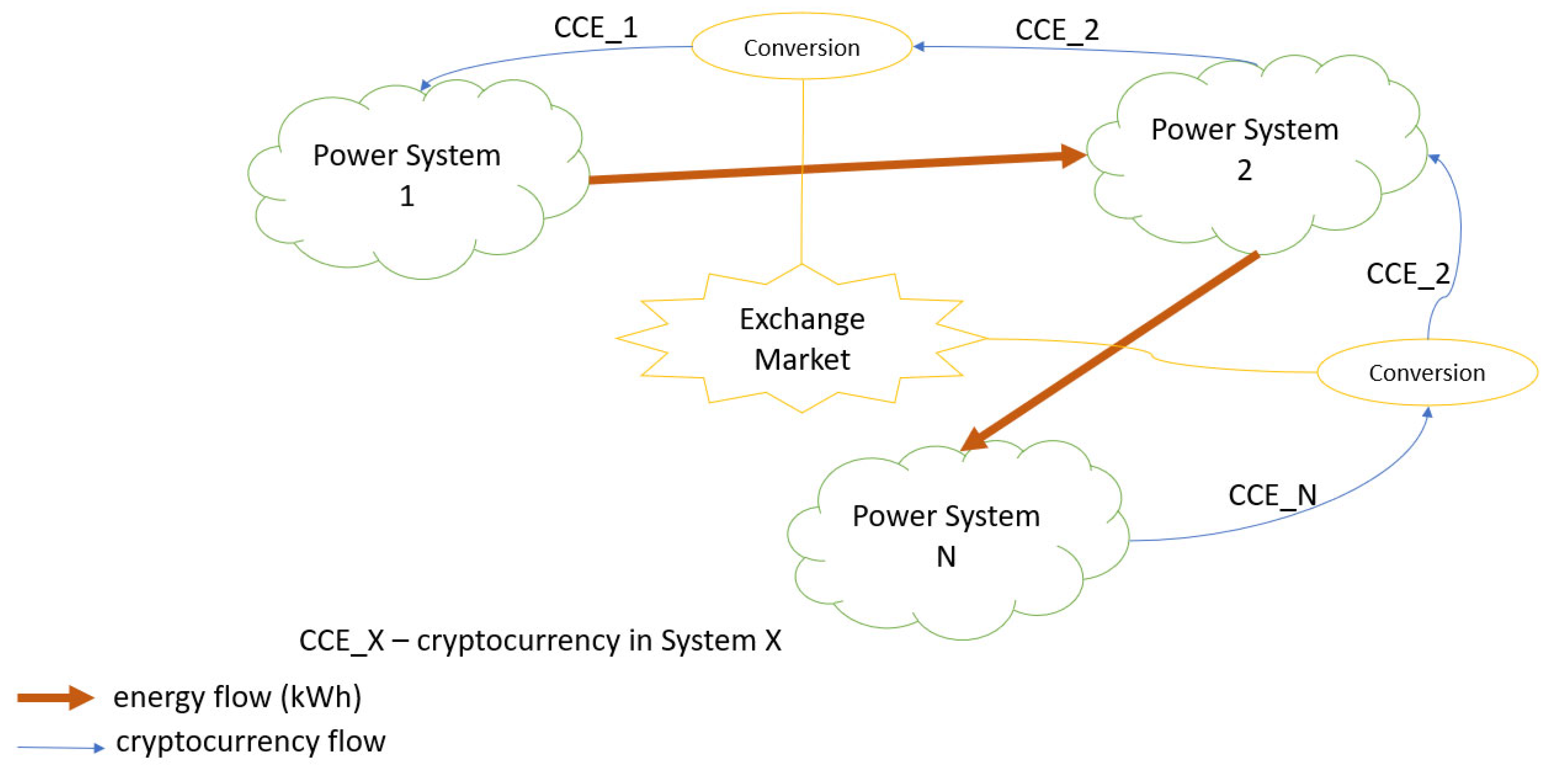

- Physical—related to the flow and recording of energy in a specific electricity grid; and

- Digital—related to the flow and recording of values stored on cryptocurrency tokens in the blockchain network.

- Market participants in a broad sense: grid operators, metering operators, settlement intermediaries, generators, energy sales intermediaries (independent sellers), service aggregators, energy cooperatives, energy clusters, virtual power plants, users, additional grid service providers (including prosumers and flexumers);

- Power grid infrastructure and IoT technology devices, also smart grid, smart building, smart city;

- Financial institutions, including entities that allow the conversion of cryptocurrency into another monetary unit (exchange offices); and

- State authorities (fulfilment of tax or other obligations arising from current legislation governing the power sector).

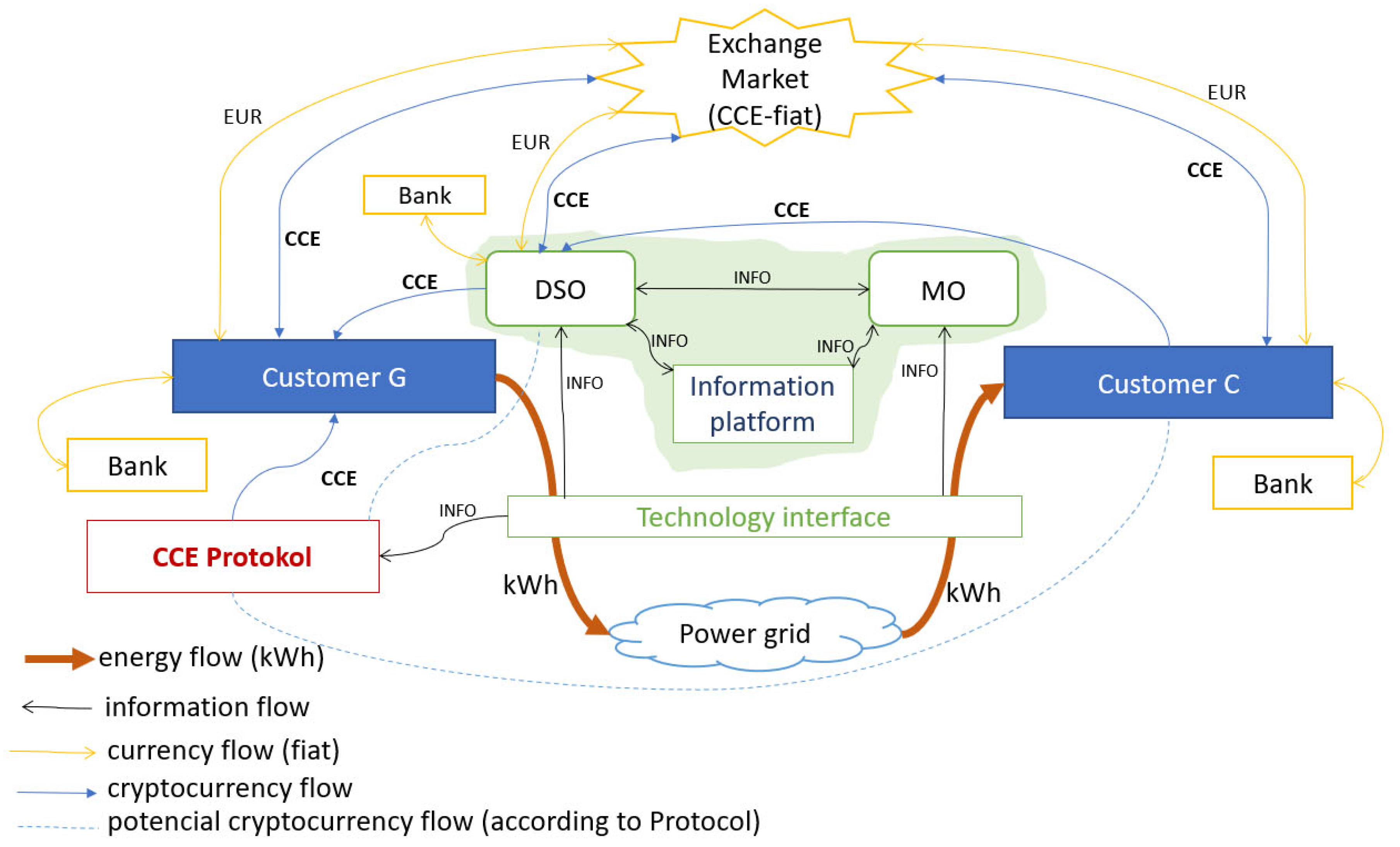

3.3. Participants

- -

- Customer group (entities)

- Energy generators (G)—in addition to the typical generators, this group includes prosumers and flexumers ready to feed surplus electricity back into the grid, as well as facilities with the generation and storage (including, for example, electric vehicles).

- Consumers (C)—typical (conservative) end-users, including prosumers who do not cover their entire demand themselves, including storage units used for arbitrage (stationary and mobile).

- -

- Intermediaries

- Distribution System Operator (DSO)—an entity that manages the technical operation of the power distribution grid, responsible in particular for infrastructure maintenance and grid operation.

- Metering Operator (MO)—depending on legal requirements, a separate entity or one that is within the DSO structure, dealing with customer meter service issues and managing metering on the grid.

- Platform for the exchange of cryptocurrency into other monetary units (exchange office)—a structure operating on a market basis allowing the exchange (purchase, sale) of cryptocurrency units into other currencies (including fiat currencies).

- -

- Additional elements

- Cryptocurrency protocol—a set of rules and an algorithm for the generation (also possible redemption) of cryptocurrency units, and also the creation of records (blocks) according to the Distributed Ledger Technologies (DLT) blockchain.

- Technological interface—providing connectivity between the physical layer (monitoring and recording of energy flows) and the digital informative layer (translation of energy use facts and events into the DLT settlement sphere, smart contract recording).

- Information platform—an area for the exchange and collection of information on the state of the network and the power system, aggregating data on the current generation and energy demand in the grid area, taking into account the current constraints; a place used by the grid operator to form the demand for ancillary services to the grid.

- The power grid as a medium for the transmission of energy between participants.

- Flexible, i.e., able to adapt their energy use position (supply and off-take respectively) to a certain extent to the current situation (signals) on the power grid; and

- Rigid, i.e., enforcing certain states of grid operation due to the technology used—forced generation (RES units without direct cooperation with storage) and rigid off-take (e.g., critical loads).

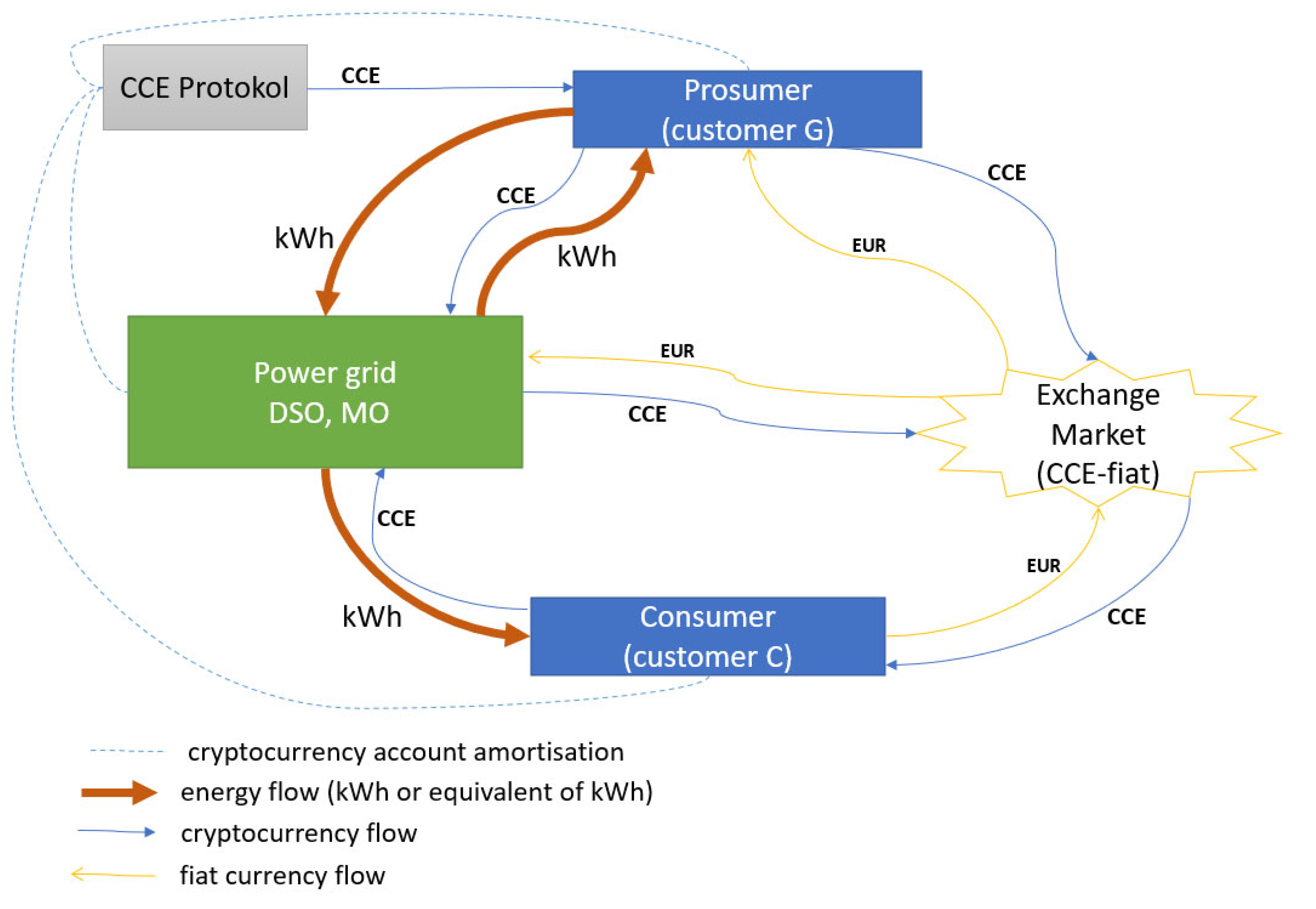

3.4. Outline of the General Concept of the CCE Cryptocurrency Settlement System

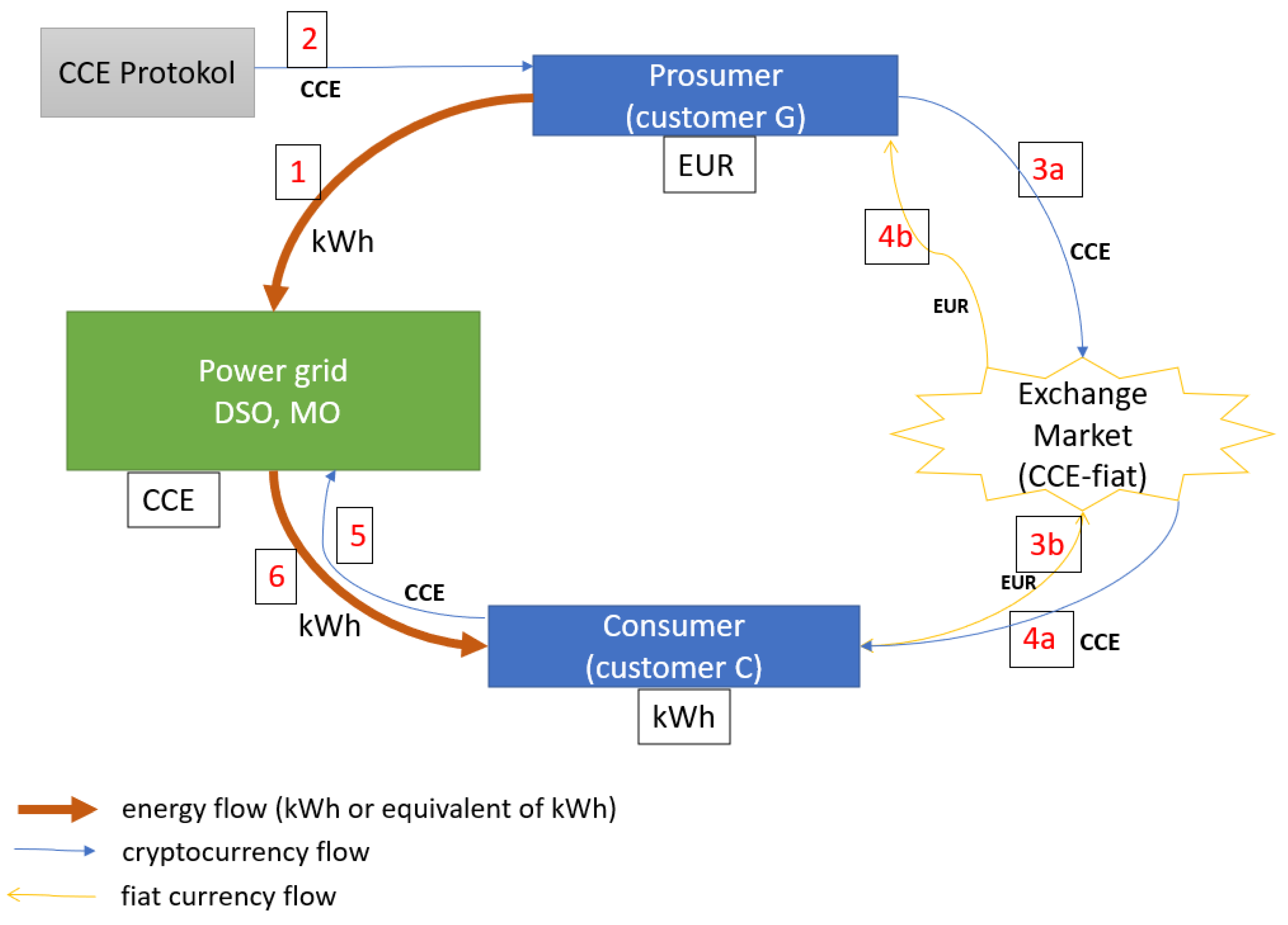

- Prosumer gives back to the grid the energy he/she has not consumed as a G generator (this is registered by the grid operator and/or metering operator, the technological interface initiates the start of the smart contract transaction).

- Prosumer, as generator G, is allocated an appropriate number of CCE units according to the protocol (in the general warrant, there is the possibility to vary the rates of CCE units/kWh allocated depending on the generation technology, promoting specific RES solutions).

- Prosumer, as generator G, puts the received CCE units up for sale on the CCE–fiat exchange market (in the form of a spot exchange or directly to another user in the form of a P2P); user C declares payment of a certain amount in the desired currency for the corresponding number of CCE units.

- Prosumer G receives payment in the desired currency; user C receives the desired number of CCE units.

- User C transfers the appropriate number of CCE units to the system operator.

- The system operator enables the delivery of the appropriate amount of energy according to the amount paid in the CCE. The technological interface records the flow and allows the transaction to be closed.

3.4.1. Net Metering with CCE

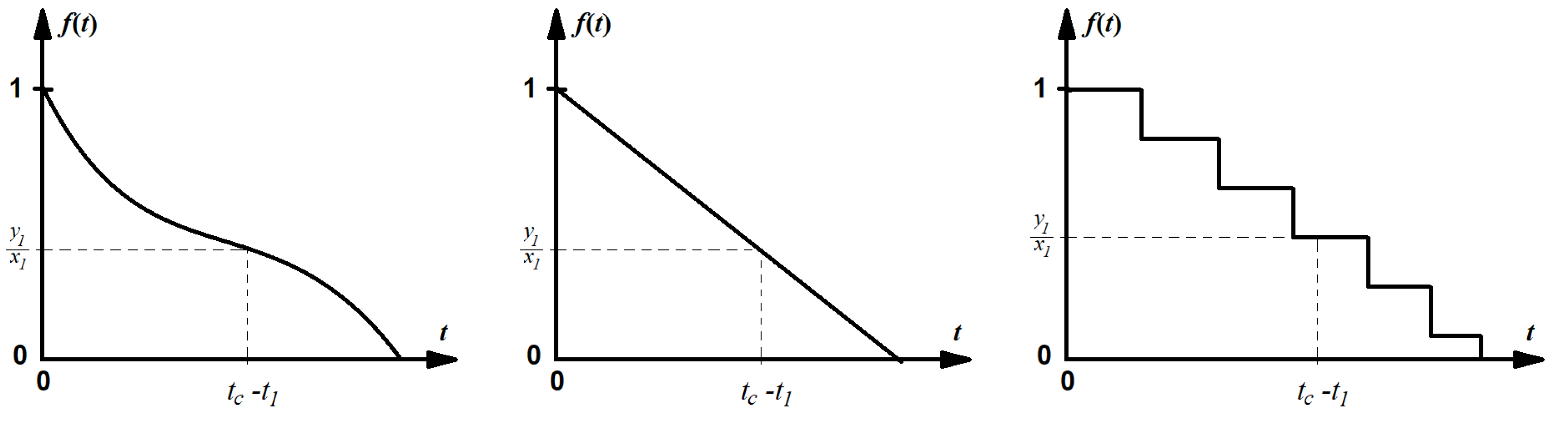

- The prosumer in the role of generator—customer G receives x1 units of CCE cryptocurrency (i.e., 1 CCE/1 kWh) for feeding x1 units of energy (x1 kWh) into the grid at time interval t1. The technological interface (which includes a two-way energy meter) generates a token with information about the amount of cryptocurrency and the time and date of the event, assigning it to the prosumer’s account (a block in the chain has been created). Thus, an ordered pair of numbers (t1,x1) is associated with the prosumer’s account, indicating that the prosumer has x1 units of CCE, which, at time t1, are worth x1 kWh.

- According to the net-metering principle, the amount of CCE units in the prosumer’s account is reduced over time—at time t > t1, there are actually y1 CCE units in the prosumer’s account; instead of (t1,x1), there is the state (t, y1), according to the relation:

- A prosumer injecting successive portions of energy x2,..., xi into the grid accumulates on his/her CCE account at time t worth y2,…, yi, respectively, according to the relationship (1), i.e., at the moment t, the account has y = (y1 + y2 + … + yi) CCE. Further blocks are added to the chain.

- The prosumer in the role of the user, customer C: by taking xc kWh of energy from the grid at time tc, he/she pays with his/her own cryptocurrency according to his/her account balance. If the number of CEEs is y < xc, the prosumer can buy the missing CCE units from another participant, particularly the DSO. The power purchase transaction is recorded in the blockchain.

- The prosumer can resell the accumulated units y1, y2,... in whole or in parts in the CCE–fiat currency exchange market, gaining income and defending against a loss in the value of the CCE account. The prosumer thus enters into a transaction whereby specific CCEs are transferred to another account without holding back the function f(t) on these values.

- An entity wishing to take energy from the grid would need to source (purchase) from the CCE currency exchange market the appropriate number of CCE units and then exchange them for kWh.

- The amount of CCE available on the market is derived from the amount of energy available in the system.

- CCE inflation is limited.

- The cost-effectiveness of the accumulation of CCE by users is reduced, limiting speculation on CCE–fiat values involving excessive profits while artificially creating a deficit of CCE in the exchange market.

- Limits the possibility of CCE to be used as a means of exchange in markets other than for energy trading.

- Incentivises the ongoing take-up of available produced energy (encourages self-balancing by participants).

- Can reflect the state of infrastructure related to energy storage efficiency and unit flexibility.

- Can encourage investment in storage units adapted to the prosumers’ capabilities.

- Can practically introduce time-varying pricing for energy users (including consumers); the CCE exchange market takes on the characteristics of a spot market for available energy on the grid.

- The potential for energy storage in the system (including available storage capacity depending on the technology, storage losses, response times);

- Possible strategies to be taken by prosumers and users (taking into account their specific motivations);

- The use of additional demand-side mechanisms (DSR);

- The possibility of using additional flexible DSO generation units;

- Investment and operating costs of system components affecting the maintenance and operation process;

- Public acceptance and assessment of the readability of the solution by the average user;

- The users’ preference for speed of response to changes in the value of the portfolio;

- The degree of expected simplicity of the settlement system; and

- The impact on future investments in the power system and energy management practices.

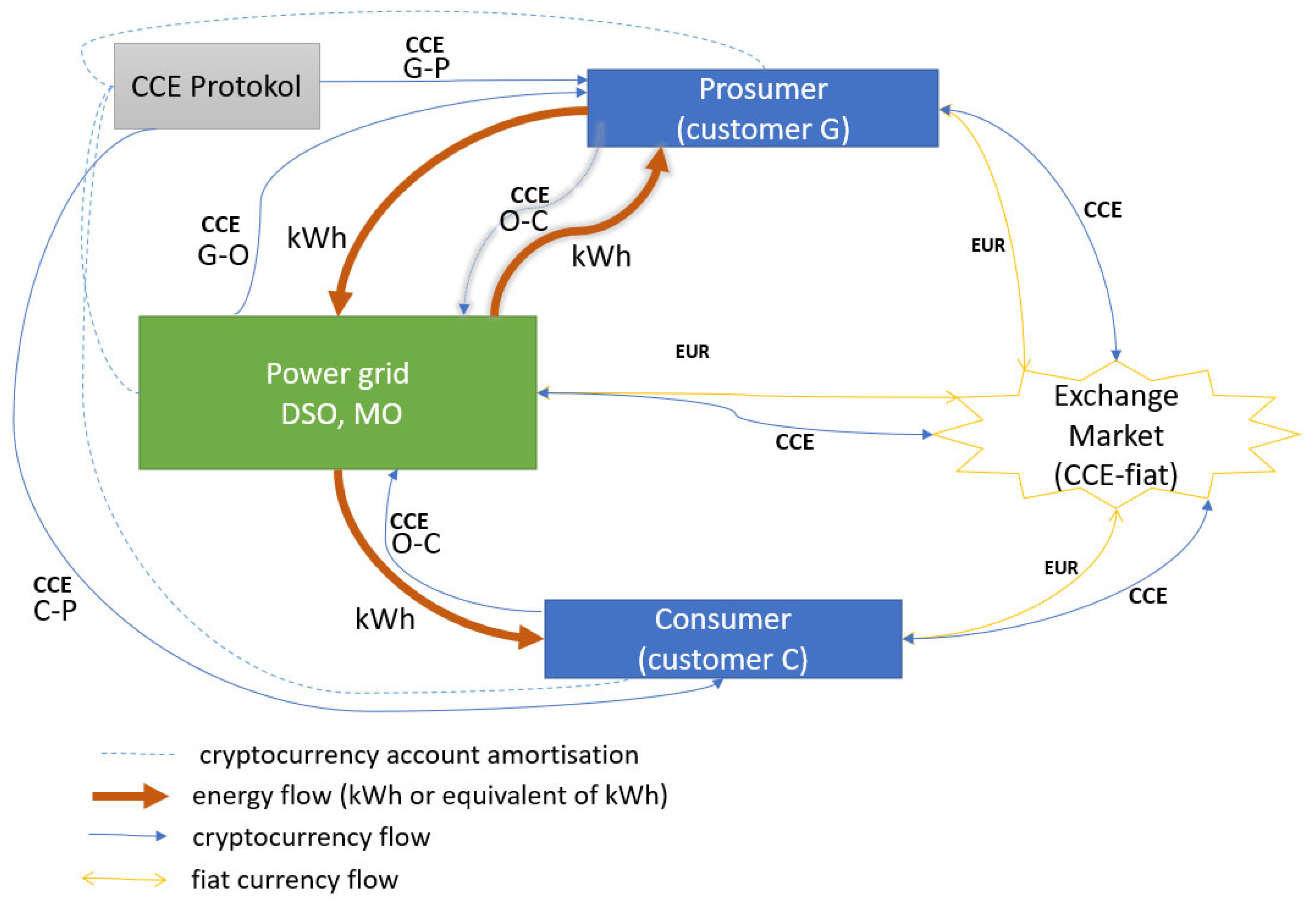

3.4.2. Net Billing with CCE

- xg, xc—prices for the sale and purchase of energy from the grid at time t, respectively;

- pg, pc—additional commissions to DSOs (operators) for the transmission service (maintenance of the system and grid infrastructure), unless the details of the settlement system provide for another mechanism, e.g., subscription outside the CCE system for connected users;

- fc, fg—functions determining the number of CCE units due;

- Ec—amount of energy taken from the grid by all users during the time interval;

- Eg—amount of energy supplied to the grid during the time interval;

- t—moment of energy use (time interval during the day); and

- uc, uG—user group or technology of use in consumption or generation, respectively (possibility to diversify participants to promote specific generation technologies or energy use objectives).

- The prosumer in the role of the generator—customer G for feeding units of energy (kWh) into the grid at time interval t1 receives xg units of CCE cryptocurrency from the operator and an additional generation technology bonus in the form of newly generated CCE units based on the CCE Protocol, i.e., xG-P. A technological interface (including a bi-directional energy meter) enables the initiation of a smart contract and the creation of a block in the CCE currency chain.

- The prosumer can put the accumulated CCE units for sale in whole or in part on the CCE–fiat exchange market or make an exchange for the amount of energy units taken from the grid at another time according to the applicable price in the CCE at the time of consumption (relation on xc), becoming a C participant. The effects of a transaction taking place in the form of a smart contact are recorded on the blockchain.

- The user in the role of a customer—customer C: when taking energy in the amount of Ec kWh from the grid at time t, he/she pays with the held cryptocurrency according to the applicable price xc. He/she should acquire the required CCE units in advance on the CCE–fiat exchange market. The transaction of purchasing CCEs and exchanging them for the corresponding amount of energy is recorded in the blockchain.

- The energy balance in the system (expressed as the absolute difference between the energy generated in the system and the demand during a given interval);

- The time of day, i.e., indirectly from the predicted energy demand profile in a given interval (which determines the current RES energy production in the interval); and

- User characteristics—rewarding attitudes towards sustainable energy use through a price reduction component for users who declare and implement certain attitudes and behaviours (e.g., using energy-efficient appliances) or as an instrument to help poorer, vulnerable or excluded users (social and safety policy mechanism).

4. Discussion

4.1. Potential Synergies of the Currency and Energy Systems

4.2. Energy Settlements through Cryptocurrencies (CCE)—Objectives and Means

4.3. Advantages and Disadvantages of Energy Settlements Using a Cryptocurrency Instrument

- Certainty and clarity of settlement rules—the smart contract cannot be changed by market actors; prosumers are guaranteed remuneration at the blockchain level, according to announced rules, and consumers have stable energy prices (especially from RES) in cryptocurrency units.

- Stability of energy values in a dedicated cryptocurrency—there is a decoupling of energy settlements from other markets, i.e., prices in a dedicated cryptocurrency can show users the value of a given energy activity from the point of view of the operation of the electricity grid, regardless of the macroeconomic situation; there is a derivation of the periodic volatility of the kWh price in fiat currency to an external cryptocurrency exchange market.

- Speeding up settlement—cryptocurrencies can be transferred when consumption is detected automatically every 15 min, for example; values are credited immediately to the user’s account; no transaction limits.

- Lower transaction handling costs—transactions are settled without intermediaries (banking sector), a kind of linking of energy flows with simultaneous flow of valuable settlement units.

- Security of transactions is guaranteed by DLT (blockchain) technology.

- With the consent of the users, improvements to the system can be implemented through a fork in the blockchain technology.

- Information on transactions, while remaining anonymous, is publicly available (to network users, who can thus compare their consumption and this can motivate savings).

- Coin convertibility—the possibility to exchange a unit of cryptocurrency for energy or another monetary unit (at an exchange office).

- Facilitation of market entry for small energy producers (prosumers)—conclusion of smart contracts and additional rewards according to the cryptocurrency protocol.

- In the long term, as the solution becomes more widespread (accepted), the possibility of increasing the use of CCE-type cryptocurrency as a means of exchange in other markets—a potential alternative to, for example, Bitcoin, not requiring such significant energy requirements associated with cryptocurrency mining.

- The emergence of a new business niche for advisory and intermediary activities for users who are less advanced or do not wish to participate directly in the system with cryptocurrencies.

- Until this solution becomes widespread, there will be a need to operate in different currency systems within the energy market (cryptocurrencies such as CCE and fiat currencies).

- Unidentified opportunities to speculate on the value of a unit of cryptocurrency denominated in another currency, especially fiat, depending on the size of the market (also user networks, grid infrastructure, generation and energy storage capacities) and possible strategies adopted by participants.

- Possible labile public perception of the solution due to incoming information on the situation in selected cryptocurrency markets and lack of understanding of the cryptocurrency topic.

- Unexplored effects of the potential for cryptocurrency inflation phenomenon—in some solutions generating cryptocurrency units for generating new amounts of electricity in specific technologies, e.g., NRGcoin, SolarCoin (electricity is converted to other forms of energy, while cryptocurrency units remain in circulation), hence the amortising function mechanism in the CCE concept.

- The possibility of too many competing versions of a cryptocurrency in one system, according to the hard fork process, if the original version was not properly refined; this can create confusion among participants.

- Limiting the operation of the tool to a defined network of users who accept its objectives.

- The individual solutions in Table 2 are dedicated to selected forms of energy generation, activities or networks and do not in principle constitute a comprehensive settlement system.

4.4. Scope of Research and Analysis Needed on the Issue

- Economy, finance and monetary systems

- Methodology for determining the value of a unit of energy in the system under given operating conditions, taking into account the technical possibilities and economics of the generating and consuming units, the technical state of the network, the storage technology and the intrinsic value of the energy from the point of view of the user’s needs.

- The question of the significance of the inflation/deflation phenomena of the cryptocurrency being introduced: how these phenomena may affect the efficiency and objectives of the system, the rules for the generation of new cryptocurrency units (the criterion of energy or power introduced), whether mechanisms should be provided for the redemption of these units, the mechanisms for the expiry time of the currency units, the nature and shape of the amortising function—the rationale for how the value of the accounts should be forced down (whether units withdrawn due to the passage of time should be taken over by someone or should be redeemed).

- Legitimate ranges and spread levels when transforming different cryptocurrencies.

- The problem of pricing ancillary services provided to the network and system.

- Justification of the relationship between the number of cryptocurrency units in circulation and the amount of energy or generation capacity available.

- The extent to which the introduced cryptocurrency system interacts with other currency systems and the economy.

- Opportunities for other financial engineering instruments and mechanisms based on the introduced cryptocurrency and their impact on the functioning of the system (e.g., derivatives, leverage, contracts, additional exchanges).

- Conditions for improving liquidity and reducing the negative effects of crypto-asset market shallowness.

- Special rules for the use of cryptocurrencies by a DSO or analogous institution (possible extent of impact on the cryptocurrency exchange market).

- Possible incentives and sources of funding for necessary investments in the power grid and system development.

- The extent and desirability of a possible decoupling of the cryptocurrency and energy market system from other markets and the macroeconomic situation.

- Detailed settlement formulas (shape of the function, amount of components and parameter values of these formulas), whether the different groups of formulas should be identical for a given activity or whether it would be advisable to vary the parameter values of these formulas according to the type of user (e.g., electric car, domestic, industrial, service, social, etc.); length of the settlement and balancing interval; catalogue of possible activities for which the user can be rewarded with the transfer of a certain amount in cryptocurrencies.

- Conditions under which a cryptocurrency used for settlement of electricity usage on the power grid can become a unit of settlement for other commodities and act as money in other markets.

- Special cryptocurrency as a tool of monetary autonomy for system users.

- Electricity as a measure of the value of goods and services and as a means of stable coverage of the value of cryptocurrency, studies of the change in the use value of 1 kWh in relation to technological progress (including improvements in energy efficiency), energy consumption patterns, equivalence with other forms of energy.

- Technical aspects

- The problem of standardisation of measurements, devices and protocols for communication and technological interfaces.

- System for monitoring the correct operation of technological interfaces.

- Tasks and requirements for automation systems.

- Optimisation of energy flows during contract execution.

- Reflecting grid constraints in the ability to establish smart contracts.

- Emergency procedures in the event of an inability to balance energy in a managed system.

- Division of competences between those acting as operators, managing infrastructure and maintenance.

- The scope of necessary system services (ancillary to the network) and the capabilities of system participants to deliver them, an assessment of the value of these services within the cryptocurrency system, additional requirements for technological interfaces.

- Issues of the choice of DLT technology on which the system would be based, the form of utility tokens, the possibility of other types of tokens, cryptocurrencies, the choice of FT and/or NFT-based solutions.

- List of generation sources (technologies) that are particularly desirable from an environmental (ecological), economic and technical point of view and that can be further rewarded for generation.

- Social factors

- Willingness and ability of the public to assimilate the techniques and rules of the system, openness and public acceptance of new solutions.

- Breakdown of system implementation into clear and comprehensible stages.

- The issue of user education.

- The problem of digital exclusion and fuel poverty of a part of the population—impact on the development of such systems.

- Range of expectations in terms of benefits, functionality and own involvement by the participant.

- Sources of motivation of participants to choose given solutions and activities.

- Impact on the strengthening and development of local, virtual communities (prosumer group).

- Network reach (how the number of participants affects the success of a cryptocurrency project as a carrier of value equivalent to fiat currency).

- Environmental factors

- The actual impact of the system operation options on the decarbonisation of energy sources, RES development and energy efficiency.

- Impact of the system on the structure of energy consumption at the individual, regional and global levels.

- Impact of whole-system infrastructure on the local and global environment.

- Legal environment

- The need to adapt legislation on cryptocurrencies, the use of blockchain technology and agreements between users of such systems.

- Status of possible intermediaries and user representatives who do not wish to participate directly in the system.

- Status of cryptocurrency markets and exchanges.

- Scopes and subjects of possible disputes between users of the system.

- Tax issues related to the use of cryptocurrencies and utility tokens and direct settlements.

- International common principles for the treatment of cryptocurrencies and cryptocurrency transactions.

5. Conclusions

- Efficient and strong access control;

- Transparency;

- Possibility of sharing knowledge and competencies among users;

- Possibility of widespread market implementation; and

- Possibly low costs for participants.

- Security and anonymity of users;

- Automatic settlement of transactions without the involvement of the banking sector;

- The possibility of making energy settlements independent of other markets, regardless of the macroeconomic situation;

- Derivation of the temporal volatility of the kWh price in fiat currency to an external cryptocurrency exchange market (exchange office);

- Linking energy flows to the simultaneous flow of valuable units of account; and

- Identifying energy as the primary carrier of value.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| BTC | Bitcoin currency |

| CCE | cryptocurrency for energy settlements |

| DLT | distributed ledger technologies |

| DSO | distributed system operator |

| DSR | demand-side response (program) |

| EU | European Union |

| EUR | Euro currency |

| fiat | fiduciary currency |

| kWh | kilowatt-hour |

| MO | measurement operator |

| P2P | peer-to-peer |

| RES | renewable energy sources |

| VPP | virtual power plant |

References

- Schich, S. Do Fintech and Cryptocurrency Initiatives Make Banks Less Special? Bus. Econ. Res. Macrothink Inst. 2019, 9, 86–116. [Google Scholar] [CrossRef]

- European Union. Proposal for a Regulation of the European Parliament and of the Council on Markets in Crypto-Assets, and Amending Directive (EU) 2019/1937 COM(2020) 593 Final—2020/0265 (COD). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52020AE4982&rid=1 (accessed on 2 September 2022).

- Gryshova, I.Y.; Shestakovska, T.L. FinTech Business and Prospects of Its Development in the Context of Legalizing the Cryptocurrency in Ukraine. Sci. Pap. Legis. Inst. Verkhovna Rada Ukr. 2018, 5, 77–78. [Google Scholar]

- Kopp, A.; Orlovskyi, D. Towards the Tokenization of Business Process Models Using the Blockchain Technology and Smart Contracts. CMIS 2022, 3137, 274–287. [Google Scholar]

- El Ioini, N.; Pahl, C. A Review of Distributed Ledger Technologies. In On the Move to Meaningful Internet Systems; Panetto, H., Debruyne, C., Proper, H., Ardagna, C., Roman, D., Meersman, R., Eds.; Springer: Berlin/Heidelberg, Germany, 2018; ISBN 9783030026714. [Google Scholar]

- Antal, C.; Cioara, T.; Anghel, I.; Antal, M.; Salomie, I. Distributed Ledger Technology Review and Decentralized Applications Development Guidelines. Future Internet 2021, 13, 62. [Google Scholar] [CrossRef]

- Ahmad, T.; Zhang, D. A Critical Review of Comparative Global Historical Energy Consumption and Future Demand: The Story Told so Far. Energy Rep. 2020, 6, 1973–1991. [Google Scholar] [CrossRef]

- Bielecki, S.; Skoczkowski, T.; Sobczak, L.; Buchoski, J.; Maciąg, Ł. Impact of the Lockdown during the COVID-19 Pandemic on Electricity Use by Residential Users. Energies 2021, 14, 980. [Google Scholar] [CrossRef]

- Akorede, M.F.; Hizam, H.; Pouresmaeil, E. Distributed Energy Resources and Benefits to the Environment. Renew. Sustain. Energy Rev. 2010, 14, 724–734. [Google Scholar] [CrossRef]

- Hatziargyriou, N.D.; Sakis Meliopoulos, A.P. Distributed Energy Sources: Technical Challenges. In Proceedings of the IEEE Power Engineering Society Winter Meeting, New York, NY, USA, 27–31 January 2002; pp. 1017–1022. [Google Scholar]

- Jee, Y.; Lee, E.; Baek, K.; Ko, W.; Kim, J. Data-Analytic Assessment for Flexumers Under Demand Diversification in a Power System. IEEE Access 2022, 10, 33313–33319. [Google Scholar] [CrossRef]

- Pipattanasomporn, M.; Kuzlu, M.; Rahman, S. A Blockchain-Based Platform for Exchange of Solar Energy: Laboratory-Scale Implementation. In Proceedings of the 2018 International Conference and Utility Exhibition on Green Energy for Sustainable Development (ICUE), Phuket, Thailand, 24–26 October 2018; pp. 1–8. [Google Scholar] [CrossRef]

- Olken, M. Transactive Energy. IEEE Power Energy Mag. 2016, 14, 4. [Google Scholar] [CrossRef]

- Huang, Q.; Amin, W.; Umer, K.; Gooi, H.B.; Eddy, F.Y.S.; Afzal, M.; Shahzadi, M.; Khan, A.A.; Ahmad, S.A. A Review of Transactive Energy Systems: Concept and Implementation. Energy Rep. 2021, 7, 7804–7824. [Google Scholar] [CrossRef]

- The GridWise Architecture. GridWise Transactive Energy Framework Version 1.0; Pacific Northwest National Laboratory: Richland, WA, USA, 2015. [Google Scholar]

- Mihaylov, M.; Jurado, S.; Avellana, N.; Van Moffaert, K.; de Abril, I.M.; Nowé, A.; Van Moffaert, K.; De Abril, I.M. NRGcoin: Virtual Currency for Trading of Renewable Energy in Smart Grids. In Proceedings of the 11th International Conference on the European Energy Market (EEM14), Krakow, Poland, 28–30 May 2014; pp. 1–6. [Google Scholar]

- Hosseinnezhad, V.; Hayes, B.; Member, S.; Regan, B.O. Practical Insights to Design a Blockchain-Based Energy Trading Platform. IEEE Access 2021, 9, 154827–154844. [Google Scholar] [CrossRef]

- Joseph, A.; Balachandra, P. Smart Grid to Energy Internet: A Systematic Review of Transitioning Electricity Systems. IEEE Access 2020, 8, 215787–215805. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; Mccallum, P.; Peacock, A. Blockchain Technology in the Energy Sector: A Systematic Review of Challenges and Opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Karaarslan, E.; Konacakli, E. Chapter 3: Data Storage in the Decentralized World: Blockchain and Derivatives. In Who Runs the World: DATA; Gulsecen, S., Sharma, S., Akadal, E., Eds.; Istanbul University Press: Istanbul, Turkiye, 2020; pp. 37–69. [Google Scholar]

- Bellaj, B.; Ouaddah, A.; Bertin, E.; Crespi, N.; Mezrioui, A.; Crespi, N. SOK: A Compre-Hensive Survey on Distributed Ledger Technologies. In Proceedings of the ICBC 2022: IEEE International Conference on Blockchain and Cryptocurrency, Shanghai, China, 2–5 May 2022; pp. 1–16. [Google Scholar]

- Hrga, A.; Capuder, T.; Zarko, I.P. Demystifying Distributed Ledger Technologies: Limits, Challenges, and Potentials in the Energy Sector. IEEE Access 2020, 8, 126149–126163. [Google Scholar] [CrossRef]

- Rehman, S.; Khan, B.; Arif, J.; Ullah, Z.; Aljuhani, A.J.; Alhindi, A.; Ali, S.M. Bi-Directional Mutual Energy Trade between Smart Grid and Energy Districts Using Renewable Energy Credits. Sensors 2021, 21, 3088. [Google Scholar] [CrossRef] [PubMed]

- Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC; European Union: Maastricht, The Netherlands, 2009.

- Castellanos, J.A.F.; Coll-Mayor, D.; Notholt, J.A. Cryptocurrency as Guarantees of Origin: Simulating a Green Certificate Market with the Ethereum Blockchain. In Proceedings of the 5th IEEE International Conference on Smart Energy Grid Engineering Cryptocurrency, Oshawa, ON, Canada, 14–17 August 2017. [Google Scholar]

- Li, H.; Xiao, F.; Yin, L.; Wu, F. Application of Blockchain Technology in Energy Trading: A Review. Front. Energy Res. 2021, 9, 671133. [Google Scholar] [CrossRef]

- Miyamae, T.; Kozakura, F.; Nakamura, M.; Zhang, S.; Hua, S.; Pi, B.; Morinaga, M. ZGridBC: Zero-Knowledge Proof Based Scalable and Private Blockchain Platform for Smart Grid. In Proceedings of the IEEE International Conference on Blockchain and Cryptocurrency (ICBC), Sydney, Australia, 3–6 May 2021; pp. 2021–2023. [Google Scholar]

- Chen, R.; Zhao, W.; Bao, J.; Zhang, J.; Kuang, L.; Zhan, S. A Power Market Transaction Management System Based on Blockchain. In Proceedings of the IEEE 2nd International Conference on Power, Electronics and Computer Applications (ICPECA), Shenyang, China, 21–23 January 2022; pp. 1235–1239. [Google Scholar]

- Ren, Y.; Zhao, Q.; Guan, H.; Lin, Z. A Novel Authentication Scheme Based on Edge Computing for Blockchain-Based Distributed Energy Trading System. EURASIP J. Wirel. Commun. Netw. 2020, 2020, 152. [Google Scholar] [CrossRef]

- Yahaya, A.S.; Javaid, N.; Member, S.; Gulfam, S.M.; Radwan, A.; Member, S. A Two-Stage Privacy Preservation and Secure Peer-to-Peer Energy Trading Model Using Blockchain and Cloud-Based Aggregator. IEEE Access 2021, 9, 143121–143137. [Google Scholar] [CrossRef]

- Singla, S.; Dua, A.; Kumar, N.; Tanwar, S. Blockchain-Based Efficient Energy Trading Scheme for Smart-Grid Systems. In Proceedings of the IEEE Globecom Workshops (GC Wkshps), Taipei, Taiwan, 7–11 December 2020. [Google Scholar]

- Long, Y.; Chen, Y.; Ren, W.; Dou, H.; Xiong, N.N. DePET: A Decentralized Privacy-Preserving Energy Trading Scheme for Vehicular Energy Network via Blockchain and K—Anonymity. IEEE Access 2020, 8, 192587–192596. [Google Scholar] [CrossRef]

- Karandikar, N.; Chakravorty, A.; Rong, C. Blockchain Based Transaction System with Fungible and Non-Fungible Tokens for a Community-Based Energy Infrastructure. Sensors 2021, 21, 3822. [Google Scholar] [CrossRef]

- Wang, G.; Nixon, M. SoK: Tokenization on Blockchain. In Proceedings of the IEEE/ACM 14th International Conference on Utility and Cloud Computing (UCC ’21), Leicester, UK, 6–9 December 2021; pp. 1–9. [Google Scholar]

- Bao, H.; Roubaud, D. Non-Fungible Token: A Systematic Review and Research Agenda. J. Risk Financ. Manag. 2022, 15, 215. [Google Scholar] [CrossRef]

- Sharma, P.; Senapati, R.; Swetapadma, A. Review of Blockchain-Based Energy Trading Models. In Proceedings of the IEEE International Conference in Advances in Power, Signal, and Information Technology (APSIT), Bhubaneswar, India, 8–10 October 2021. [Google Scholar]

- Foti, M.; Vavalis, M. What Blockchain Can Do for Power Grids? Blockchain Res. Appl. 2021, 2, 100008. [Google Scholar] [CrossRef]

- Mollah, M.B.; Zhao, J.; Niyato, D.; Lam, K.; Member, S.; Zhang, X.; Ghias, A.M.Y.M. Blockchain for Future Smart Grid: A Comprehensive Survey. IEEE Internet Things J. 2021, 8, 18–43. [Google Scholar] [CrossRef]

- Wang, X.; Yao, F.; Wen, F. Applications of Blockchain Technology in Modern Power Systems: A Brief Survey. Energies 2022, 15, 4516. [Google Scholar] [CrossRef]

- Wu, J.; Tran, N.K. Application of Blockchain Technology in Sustainable Energy Systems: An Overview. Sustainability 2018, 10, 3067. [Google Scholar] [CrossRef]

- Ahmed, M.; Farooq, M.S.; Ibrar-ul-Haque, M.; Ahmed, M.; Maqbool, H.; Yousaf, A. Application of Blockchain in Green Energy for Sustainable Future. In Proceedings of the 7th International Conference on Engineering and Emerging Technologies (ICEET), Istanbul, Turkey, 27–28 October 2021. [Google Scholar]

- Yapa, C.; Alwis, C.D.; Liyanage, M.; Ekanayake, J. Survey on Blockchain for Future Smart Grids: Technical Aspects, Applications, Integration Challenges and Future Research. Energy Rep. 2021, 7, 6530–6564. [Google Scholar] [CrossRef]

- Wang, N.; Zhou, X.; Lu, X.; Guan, Z.; Wu, L.; Du, X. When Energy Trading Meets Blockchain in Electrical Power System: The State of the Art. Appl. Sci. 2019, 9, 1561. [Google Scholar] [CrossRef]

- Jindal, A.; Aujla, G.S.; Kumar, N.; Villari, M. Blockchain-Based Secure Demand Response Management in Smart Grid System. IEEE Trans. Serv. Comput. 2019, 13, 613–624. [Google Scholar] [CrossRef]

- Sciumè, G.; Palacios-García, E.J.; Gallo, P.; Sanseverino, E.R.; Vasquez, J.C.; Guerrero, J.M. Demand Response Service Certification and Customer Baseline Evaluation Using Blockchain Technology. IEEE Access 2020, 8, 139313–139331. [Google Scholar] [CrossRef]

- Zhuang, P.; Zamir, T.; Liang, H. Blockchain for Cybersecurity in Smart Grid: A Comprehensive Survey. IEEE Trans. Ind. Inform. 2021, 17, 3–19. [Google Scholar] [CrossRef]

- Aitzhan, N.Z.; Svetinovic, D. Security and Privacy in Decentralized Energy Trading through Multi-Signatures, Blockchain and Anonymous Messaging Streams. IEEE Trans. Dependable Secur. Comput. 2016, 15, 840–852. [Google Scholar] [CrossRef]

- Szabo, N. Smart Contracts: Building Blocks for Digital Markets. EXTROPY J. Transhumanist Thought 1996, 18, 28. [Google Scholar]

- Kirli, D.; Couraud, B.; Robu, V.; Salgado-bravo, M.; Norbu, S.; Andoni, M.; Antonopoulos, I.; Negrete-pincetic, M.; Flynn, D. Smart Contracts in Energy Systems: A Systematic Review of Fundamental Approaches and Implementations. Renew. Sustain. Energy Rev. 2022, 158, 112013. [Google Scholar] [CrossRef]

- Kemmoe, V.Y.; Stone, W.; Kim, J.; Kim, D.; Son, J. Recent Advances in Smart Contracts: A Technical Overview and State of the Art. IEEE Access 2020, 8, 117782–117801. [Google Scholar] [CrossRef]

- Zheng, Z.; Xie, S.; Dai, H.; Chen, W.; Chen, X.; Weng, J.; Imran, M. An Overview on Smart Contracts: Challenges, Advances and Platforms. Futur. Gener. Comput. Syst. 2020, 105, 475–491. [Google Scholar] [CrossRef]

- Vieira, G.; Zhang, J. Peer-to-Peer Energy Trading in a Microgrid Leveraged by Smart Contracts. Renew. Sustain. Energy Rev. 2021, 143, 110900. [Google Scholar] [CrossRef]

- Abdelwahed, M.A.; Boghdady, T.A.; Madian, A.; Shalaby, R. Energy Trading Based on Smart Contract Blockchain Application. In Proceedings of the International Conference on Innovation and Intelligence for Informatics, Computing and Technologies (3ICT), Sakheer, Bahrain, 20–21 December 2020. [Google Scholar]

- Seven, S.; Yao, G.; Soran, A.; Onen, A.; Muyeen, S.M. Peer-to-Peer Energy Trading in Virtual Power PlantBased on Blockchain Smart Contracts. IEEE Access 2020, 8, 175713–175726. [Google Scholar] [CrossRef]

- Pop, C.; Antal, M.; Cioara, T.; Anghel, I. Trading Energy as a Digital Asset: A Blockchain based Energy Market. In Cryptocurrencies and Blockchain Technology Applications; Shrivastava, G., Le, D.-N., Sharma, K., Eds.; Wiley: Hoboken, NJ, USA, 2020; ISBN 9781119621201. [Google Scholar]

- Kutler, J. Digicash to Test Live Internet Cash System with Mo.Bank. Am. Bank. 1995, 160, 1–3. [Google Scholar]

- de Vries, A. Bitcoin’s Energy Consumption Is Underestimated: A Market Dynamics Approach. Energy Res. Soc. Sci. 2020, 70, 101721. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Owusu, P.A. Dataset on Bitcoin Carbon Footprint and Energy Consumption. Data Br. 2022, 42, 108252. [Google Scholar] [CrossRef]

- Schinckus, C.; Nguyen, C.P.; Hui Ling, F.C. Crypto-Currencies Trading and Energy Consumption. Int. J. Energy Econ. Policy 2020, 10, 355–364. [Google Scholar] [CrossRef]

- Milunovich, G. Assessing the Connectedness between Proof of Work and Proof of Stake/Other Digital Coins. Econ. Lett. 2022, 211, 110243. [Google Scholar] [CrossRef]

- Umar, A.; Kumar, D.; Ghose, T. Blockchain-Based Decentralized Energy Intra-Trading with Battery Storage Flexibility in a Community Microgrid System Point of Common Coupling Network Administrator or Network Provider Peak to Peak Average Ratio Supply to Demand Ratio. Appl. Energy 2022, 322, 119544. [Google Scholar] [CrossRef]

- Charg Coin. Available online: https://chgcoin.org/white-paper/ (accessed on 10 August 2022).

- Okoye, M. Cyclean: World’s First Green Blockchain Ecosystem. 2018. Available online: https://www.linkedin.com/pulse/cyiiikiiikkk-mary-okoye/ (accessed on 20 August 2022).

- Eco Coin. Available online: https://www.ecocoin.com/ (accessed on 19 August 2022).

- E2C. Whitepaper Electronic Energy Coin. 2020. Available online: https://www.allcryptowhitepapers.com/electronic-energy-coin-whitepaper/ (accessed on 19 August 2022).

- EnergiToken. Available online: https://energi-token.com/ (accessed on 1 August 2022).

- KWHCoin. Available online: https://medium.com/@kwhcoin-net-ze-ro/kwhcoin-cryptocur-ren-cy-as-a-libera-tion-technology-f3ef32fee49e (accessed on 19 August 2022).

- KWHCoin White Paper. 2018. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwjBxpWTz6r6AhVzgv0HHYYOCi8QFnoECAMQAQ&url=http%3A%2F%2Fww1.prweb.com%2Fprfiles%2F2018%2F01%2F19%2F15109995%2FKWHCoin-White-Paper-REVISED.pdf&usg=AOvVaw3abE3UtmlS11TDkLotHqEY (accessed on 19 August 2022).

- NRGcoin. Available online: https://nrgcoin.org/ (accessed on 5 August 2022).

- Mihaylov, M.; Razo-Zapata, I.; Nowé, A. NRGcoin—A Blockchain-based Reward Mechanism for Both Production and Consumption of Renewable Energy. In Transforming Climate Finance and Green Investment with Blockchains; Elsevier: Amsterdam, The Netherlands, 2018; ISBN 978-0128144473. [Google Scholar]

- Gabrich, Y.B.; Coelho, I.M.; Coelho, V.N. Sharing Electricity in Brazil: A Crypto-Currency for Micro/Mini-Grid Transactive Energy. In Proceedings of the 6th IEEE International Energy Conference (ENERGYCON) Sharing, Gammarth, Tunisia, 28 September–1 October 2020; pp. 973–978. [Google Scholar]

- Gabrich, Y.B. A Blockchain Application to Pave the Way for Transactive Energy at Brazilian Micro/Mini-Grids. Universidade do Estado do Rio de Janeiro: Rio de Janeiro, Brasil, 2019. [Google Scholar]

- SolarCoin. Available online: https://solarcoin.org/ (accessed on 10 August 2022).

- SolarCoin.org. SolarCoin. A Blockchain-Based Solar Energy Incentive. 2015. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwjTw-7z0Kr6AhUihv0HHSzFAK0QFnoECAcQAQ&url=http%3A%2F%2Fwww.smallake.kr%2Fwp-content%2Fuploads%2F2018%2F06%2FSolarCoin_Policy_Paper_FINAL.pdf&usg=AOvVaw0SgKj1Pi65V0gk4vwFEK3B (accessed on 18 August 2022).

- Johnson, L.P.; Isam, A.; Gogerty, N.; Zitoli, J. Connecting the Blockchain to the Sun to Save the Planet. SSRN Electron. J. 2015, 1–16. [Google Scholar] [CrossRef]

- TerraGreen. Available online: https://www.facebook.com/terragreen00 (accessed on 19 August 2022).

- Tokpie Blog What Is Terra Green (TGN) Coin. Available online: https://tokpie.io/blog/tgn-terragreen/ (accessed on 19 August 2022).

- Veridium Labs. Available online: https://twitter.com/veridiumlabs (accessed on 19 August 2022).

- Bradi, J. Veridium to Launch It’s New Crypto Token on Pancakeswape. Available online: https://thedial.co/news/331/veridium-to-launch-its-new-cryp-to-token-on-pancakeswape/ (accessed on 19 August 2022).

- DAJIE. Available online: http://www.dajie.eu/ (accessed on 19 August 2022).

- Küfeoğlu, S.; Liu, G.; Anaya, K.; Pollitt, M.G. Cambridge Working Papers in Economics 1956: Digitalisation and New Business Models in Energy Sector; EPRG Working Paper 1920; University of Cambridge: Cambridge, UK, 2019. [Google Scholar]

- Energy Web Foundation. The Energy Web Chain. 2019. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwi8z82F06r6AhXRwosKHR9QAZQQFnoECCIQAQ&url=https%3A%2F%2Fenergyweb.org%2Fwp-content%2Fuploads%2F2019%2F05%2FEWF-Paper-TheEnergyWebChain-v2-201907-FINAL.pdf&usg=AOvVaw2VqxJRma7KLOL5OwDnp6oz (accessed on 19 August 2022).

- LO3Energy. Available online: https://lo3energy.com/ (accessed on 19 August 2022).

- Greeneum. Available online: https://www.greeneum.net/ (accessed on 19 August 2022).

- ImpactPPA. Available online: https://www.impactppa.com/ (accessed on 19 August 2022).

- PowerLedger. Available online: https://www.powerledger.io/ (accessed on 19 August 2022).

- Pylon Network Blockchain. Available online: https://pylon-network.org/pylon-network-blockchain (accessed on 19 August 2022).

- Pylon Network. Pylon Network White Paper v.2.0. 2018. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwjKvt603qr6AhUOqIsKHT4MApYQFnoECBAQAQ&url=https%3A%2F%2Fpylon-network.org%2Fwp-content%2Fuploads%2F2019%2F02%2FWhitePaper_PYLON_v2_ENGLISH-1.pdf&usg=AOvVaw2-eIVrpHcELvKRDKdA16UC (accessed on 19 August 2022).

- Sunchain. Available online: https://www.sunchain.fr/ (accessed on 19 August 2022).

- SunContract. Available online: https://suncontract.org/ (accessed on 18 August 2022).

- Ryan Collins, J.; Schuster, L.; Greenham, T. Energising Money. An Introduction to Energy Currencies and Accounting; Report commissioned by The 40 Foundation; New Economics Foundation: London, UK, 2013. [Google Scholar]

- Gogerty, N.; Zitoli, J. DeKo—Currency Proposal Using a Portfolio of Electricity Linked Assets. SSRN Electron. J. 2011, 7, 37–72. [Google Scholar] [CrossRef]

- The Library of Congress Chronicling America. Available online: https://chroniclingamerica.loc.gov/lccn/sn83030214/1921-12-04/ed-1/seq-1/ (accessed on 30 December 2021).

- Hovorushko, T.; Sytnyk, I.; Rozvaga, L. Features of Money Origin and Its Evolution. Ukr. Food J. 2014, 3, 26–31. [Google Scholar]

- Gogerty, N.; Johnson, P. Network Capital Disclaimer: Value of Currency Protocols Bitcoin & Solar Coin Cases in Context; Columbia Business School Research Paper No. 19-2; SSRN: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Skoczkowski, T.; Bielecki, S.; Kochański, M.; Korczak, K. Climate-Change Induced Uncertainties, Risks and Opportunities for the Coal-Based Region of Silesia: Stakeholders’ Perspectives. Environ. Innov. Soc. Transit. 2020, 35, 460–481. [Google Scholar] [CrossRef]

- Skoczkowski, T.; Bielecki, S.; Węglarz, A.; Włodarczak, M.; Gutowski, P. Impact Assessment of Climate Policy on Poland’s Power Sector. Mitig. Adapt. Strateg. Glob. Chang. 2018, 23, 1303–1349. [Google Scholar] [CrossRef] [PubMed]

- Skoczkowski, T.; Bielecki, S.; Wojtyńska, J. Long-Term Projection of Renewable Energy Technology Diffusion. Energies 2019, 12, 4261. [Google Scholar] [CrossRef]

- Enescu, F.M.; Bizon, N.; Onu, A.; Raboaca, M.S.; Thounthong, P.; Mazare, A.G.; Serban, G. Implementing Blockchain Technology in Irrigation Systems That Integrate Photovoltaic Energy Generation Systems. Sustainability 2020, 12, 1540. [Google Scholar] [CrossRef]

- Kiluk, S. Klaster 3 × 20. Potencjalne Zastosowania Technologii Blockchain Na Rynku Energii Elektrycznej. (In Polish). 2019. Available online: http://klaster3x20.pl/cykl-raportow-bzep/ (accessed on 1 September 2022).

- Kubát, M. Virtual Currency Bitcoin in the Scope of Money Definition and Store of Value. Procedia Econ. Financ. 2015, 30, 409–416. [Google Scholar] [CrossRef]

- Ruan, J.; Liu, G.; Qiu, J.; Liang, G.; Zhao, J.; He, B.; Wen, F. Time-Varying Price Elasticity of Demand Estimation for Demand-Side Smart Dynamic Pricing. Appl. Energy 2022, 322, 119520. [Google Scholar] [CrossRef]

- Net Metering vs. Net Billing. Midwest Electric Local Pages; 20F-20G; Ohio Cooperative Living: St. Marys, OH, USA, February 2021.

- Trela, M.; Dubel, A. Perspective—Impacts of Changes in RES Financing in Poland on the Profitability of a Joint Photovoltaic Panels and Heat Pump System. Energies 2022, 15, 227. [Google Scholar] [CrossRef]

- Kahn, C.M.; Oordt, M.R.C.V.; Zhu, Y. Best Before? Expiring Central Bank Digital Currency and Loss Recovery; 2021-67; Staff Working Paper; Bank of Canada: Ottawa, ON, Canada, 2021. [Google Scholar]

- Cohen, B.J. The Future of Money; Princeton University Press: Princeton, NJ, USA; Oxford, UK, 2004. [Google Scholar]

- Nguyen, C.T.; Hoang, D.T.; Nguyen, D.N.; Niyato, D.; Nguyen, H.T.; Dutkiewicz, E. Proof-of-Stake Consensus Mechanisms for Future Blockchain Networks: Fundamentals, Applications and Opportunities. IEEE Access 2019, 7, 85727–85745. [Google Scholar] [CrossRef]

- Chen, L.; Xu, L.; Shah, N.; Gao, Z.; Lu, Y.; Shi, W. On Security Analysis of Proof-of-Elapsed-Time (PoET). Proc. Int. Symp. Stab. Saf. Secur. Distrib. Syst. 2017, 10616, 282–297. [Google Scholar]

- De Angelis, S.; Aniello, L.; Baldoni, R.; Lombardi, F.; Margheri, A.; Sassone, V. PBFT vs Proof-of-Authority: Applying the Cap Theorem to Permissioned Blockchain. In Proceedings of the Italian Conference on Cyber Security, Milan, Italy, January 2018; p. 11. [Google Scholar]

- Bentov, I.; Lee, C.; Mizrahi, A.; Rosenfeld, M. Proof of Activity: Extending Bitcoin’s Proof of Work via Proof of Stake. ACM Sigmetrics Perform. Eval. Rev. 2014, 42, 34–37. [Google Scholar] [CrossRef]

| Features | FT | NFT |

|---|---|---|

| Divisibility | Possible division of token value into smaller units | The value of a single token is indivisible |

| Price differentiation for energy assets | Ensures uniformity between tokens of the same type, there should be a finite set of possible token types for possible activities | Allows different prices to be set for different tokens of the same type, possibility to set different reward conditions for a given activity (depending on the current situation) |

| Access to information | The acquisition of all tokens for a customer can be performed on the chain | The acquisition of all NFTs may require off-chain operations |

| The problem of token capacity | A single token accepts multiple bids and the size of the token increases, which may degrade network efficiency. | There is no need to set a maximum number of unprocessed offers that the token can have at any given time |

| Problems for implementation |

|

|

| Refers to | Replaceable objects | Unique objects |

| Popular contract standards | ERC20 | ERC721 |

| Name | Description | References |

|---|---|---|

| Cryptocurrency or tokens | ||

| ATOM | Cosmos (ATOM) has been used as a cryptocurrency for energy trading in the proposed microgrid system. ATOM is one of the famous Asian cryptocurrencies. The pricing strategy of the microgrid for intra-trading purchase and sell is developed using the cryptocurrency “Cosmos Atom”. | [61] |

| Charg Coin | Serves as settlement for electric vehicle charging services on a dedicated network. | [38,62] |

| CyClean Coin | Rewarding platform users with coins for using the energy use products offered, including settlement for electric vehicle rental. | [63] |

| Eco coin | Its aim is to promote sustainable assets and activities, especially the smart use of energy. | [64] |

| Electronic Energy Coin (E2C) | Cryptocurrency for renewable energy trading and control over energy transactions. | [65] |

| EnergiToken | Rewarding energy-saving behaviours with their own tokens (including using low-carbon transport and buying energy-efficient appliances), the token can then be used for energy trading or EV charging. | [66] |

| KWHCoin | Virtual energy grid settlements between prosumers, consumers and distributed energy resources using the KWHCoin cryptocurrency. A KWHCoin represents a kilowatt-hour of delivered energy or its equivalent that has been generated and distributed within the platform. | [67,68] |

| NRGcoin | It is used for the purchase and sale of generated energy on the low-voltage grid, settlement of users and prosumers with DSO, and can replace traditional renewable support policies | [16,69,70] |

| SEB | Sharing Electricity in Brazil (SEB) is used to settle energy exchange operations between users within mini/microgrids in Brazil. | [71,72] |

| SolarCoin (SLR) | P2P settlement between user and PV energy producer. Units awarded for the generation of energy from solar sources, a transaction recording algorithm applied that uses a fraction of the energy required by Bitcoin. | [23,73,74,75] |

| TerraGreen (TGN) Coin | TGN tokens can be used to purchase electricity and heat as well as other products derived from biomass waste. TerraGreen is where renewable energy is tokenised and can be used by the community in exchange for fiat currency or payment for energy consumed. | [76,77] |

| Veridium—CARBON | Supports CO2 emission reduction. CARBON is a stable-coin token representing a unit of carbon reduction. | [78,79] |

| Trading and data exchange platforms | ||

| DAJIE | Distributed Autonomous Joint Internet Platform for microgrid where prosumers exchange energy in neighbourhood area. | [80,81] |

| Energy Web Chain | Platform to support decarbonisation-friendly transactions and end-user positioning. | [82] |

| EXERGY/LO3 Energy | Data platform for Transactive Energy operations. | [81,83] |

| Greeneum | Platform for renewable energy as incentive for contributing to CO2 emission reduction. | [84] |

| ImpactPPA | A platform to enable financing, distribution and payment for distributed energy. | [85] |

| PowerLedger | Energy trading platform, supporting cooperation with various energy markets worldwide. | [81,86] |

| Pylon Network Blockchain | Platform for collecting data on energy generation and consumption. | [87,88] |

| Sunchain | Platform for the management and exchange of solar energy. | [89] |

| SunContract | Initiative for P2P energy trading between households and prosumers. | [90] |

| WePower | Platform for renewable energy contracting and trading. | [81] |

| Attribute of CCE | Comment |

|---|---|

| Security | Technology: DLT (blockchain) |

| Circulation range | Within a specific electricity system (grid) |

| Interchangeability | According to user consensus: into energy units, into other currencies (via the exchange office), into other values (with the agreement of the parties to the transaction) |

| Issuer | Non-institutional (blockchain technology) |

| Value guarantor | Blockchain technology |

| Value-assessment function | kWh values under given conditions of network operation status |

| Exchange medium | As intended, it acts as an intermediary in energy purchase and sale transactions |

| Value medium | Functions limited by the purpose of the currency |

| Payment instrument | |

| Global money function | |

| Durability | Like the Internet |

| Portability | Like digital versions of documents |

| Divisibility | Made possible by digital records |

| Uniformity | According to the protocol |

| Limited supply | According to the protocol (defined cases of generation of new units after a certain energy activity, amortisation function mechanism) |

| Acceptability | Based on agreement and consensus of system users |

| Mechanism | Goal |

|---|---|

Mechanisms favouring cost-effective demand–supply matching:

| Enforcing self-balancing of the system. |

| Promoting specific manufacturing technologies through additional rewards. |

| Additional units of cryptocurrency generated for specific user activities (including from the recipient) and attributed to that user; participation in DSM, energy efficiency improvement activity, etc. | Promoting specific pro-efficiency behaviours and attitudes. |

| Revenue of DSO, MO or analogue entities. |

| Protecting vulnerable, excluded and poor users. |

| Development of local energy sources and energy user cooperatives. |

| Improving energy efficiency. |

| CCE account balance depreciation formula. |

|

| Transparency and speed of transactions. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bielecki, S.; Skoczkowski, T.; Sobczak, L.; Wołowicz, M. Electricity Usage Settlement System Based on a Cryptocurrency Instrument. Energies 2022, 15, 7003. https://doi.org/10.3390/en15197003

Bielecki S, Skoczkowski T, Sobczak L, Wołowicz M. Electricity Usage Settlement System Based on a Cryptocurrency Instrument. Energies. 2022; 15(19):7003. https://doi.org/10.3390/en15197003

Chicago/Turabian StyleBielecki, Sławomir, Tadeusz Skoczkowski, Lidia Sobczak, and Marcin Wołowicz. 2022. "Electricity Usage Settlement System Based on a Cryptocurrency Instrument" Energies 15, no. 19: 7003. https://doi.org/10.3390/en15197003

APA StyleBielecki, S., Skoczkowski, T., Sobczak, L., & Wołowicz, M. (2022). Electricity Usage Settlement System Based on a Cryptocurrency Instrument. Energies, 15(19), 7003. https://doi.org/10.3390/en15197003