The Study for Technical Analysis on the Development Potential of Multi-Zone Oil, Gas in Crossfield, Canada

Abstract

:1. Introduction

2. Exploitation Review

2.1. Crossfield

2.2. Cardium Exploitation Review

2.2.1. Geology of Cardium

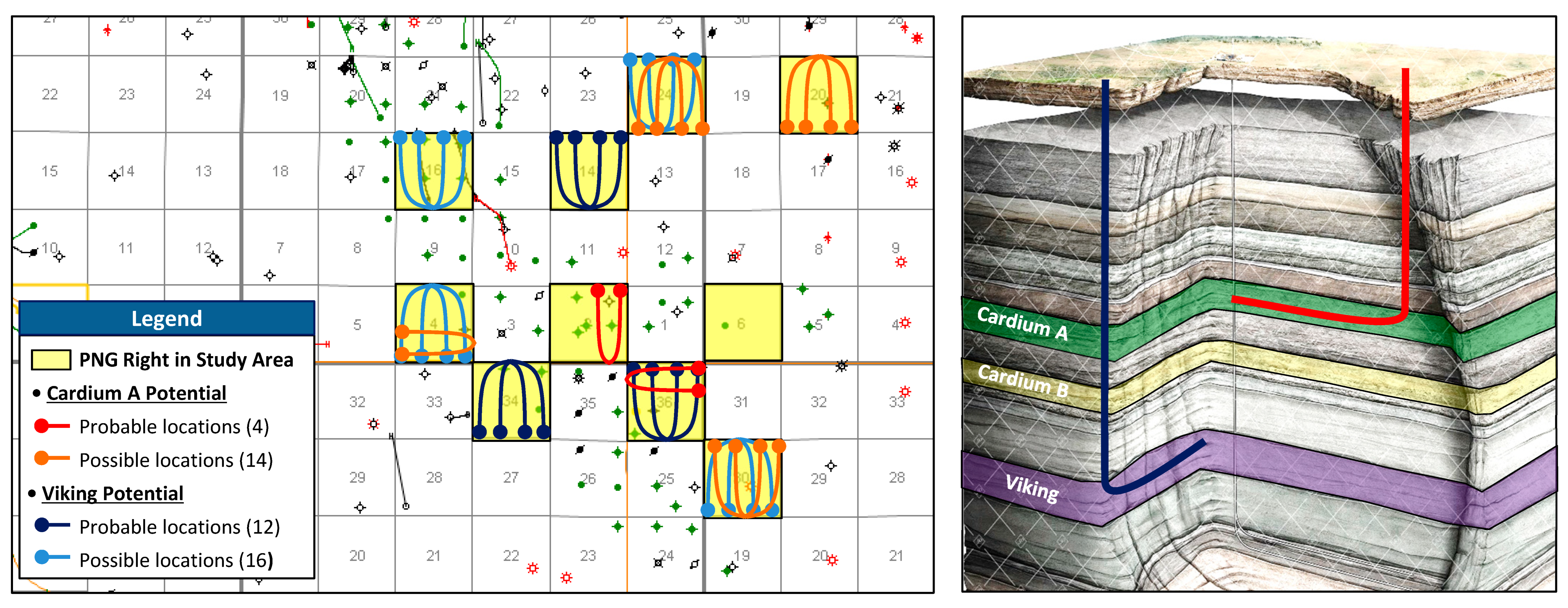

2.2.2. Cardium Exploitation Potential Analysis

2.2.3. Cardium Economics

2.3. Viking Exploitation Evaluation

2.3.1. Geology of Viking Formation

2.3.2. Viking Exploitation Potential Analysis

2.3.3. Viking Economics

2.4. Other Formations

2.5. Summary of the Crossfield Exploitation Potential Analysis

3. Conclusions

3.1. Cardium Formation

3.2. Viking Formation

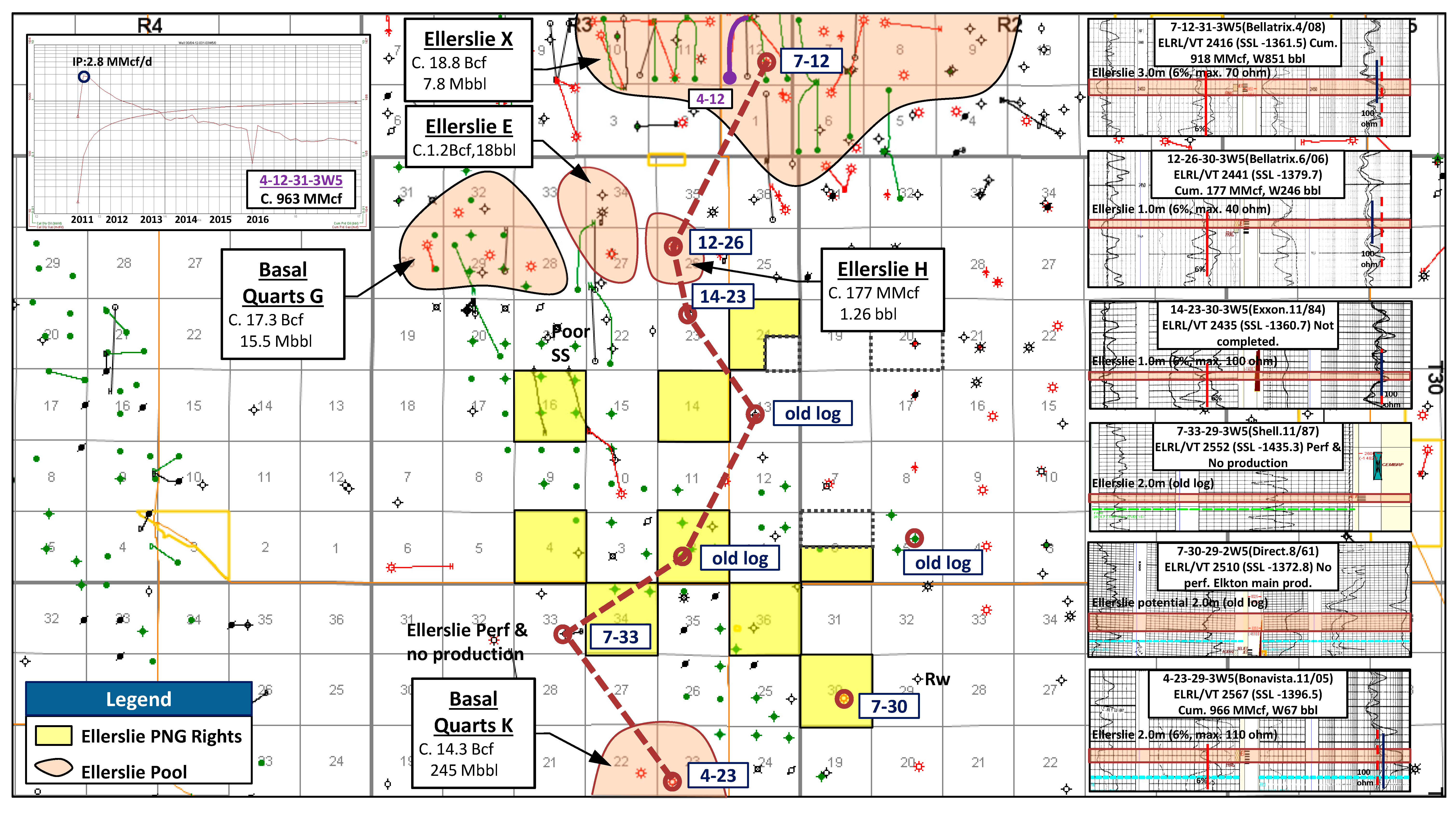

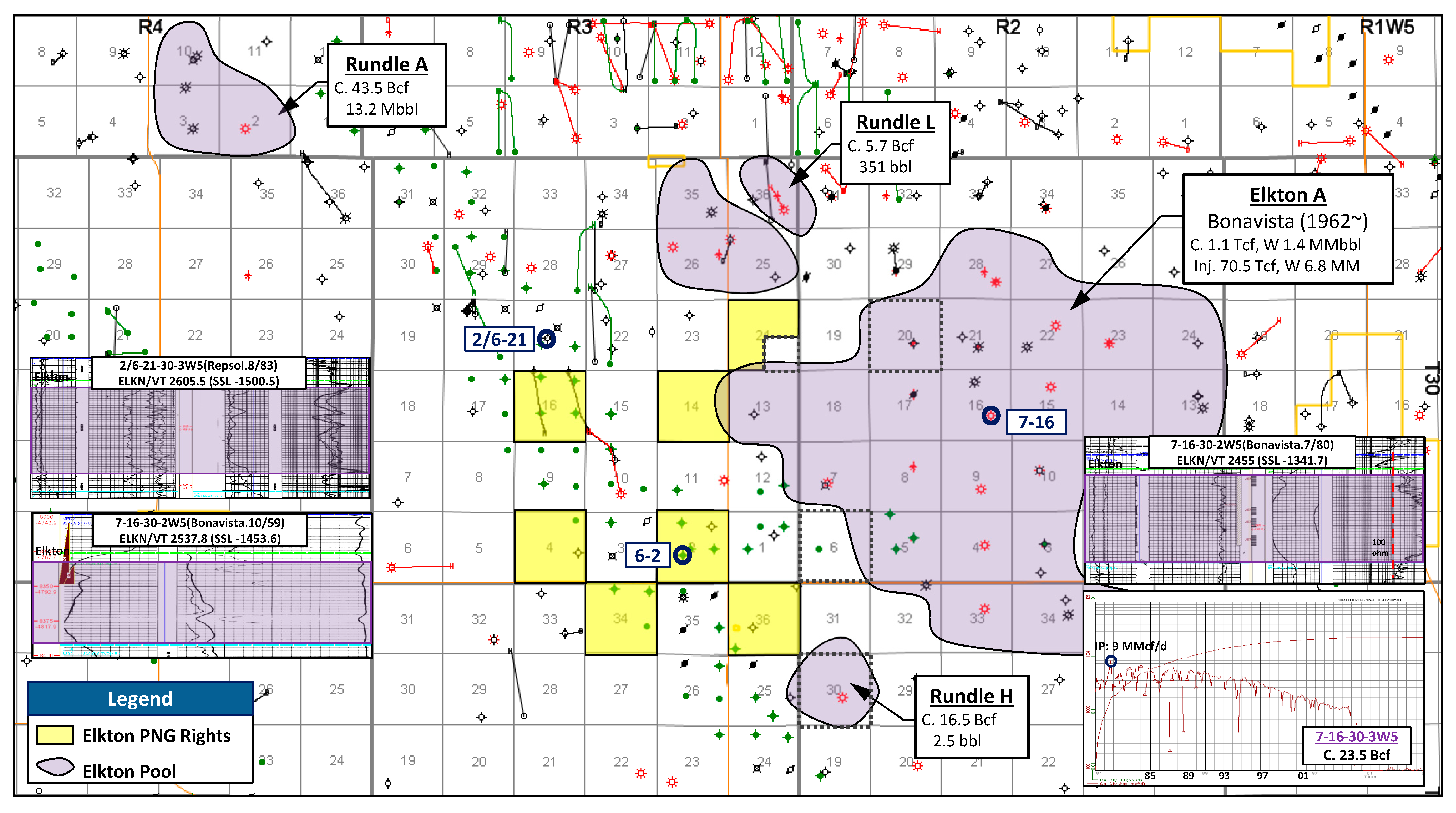

3.3. Ellerslie and Elkton

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- Seo, H.; Moon, B.; Kwon, S. The Recent Trend on Oil and Gas Industry in Canada. J. Korean Inst. Gas 2017, 21, 10–19. [Google Scholar]

- McKenzie, B. Multi-zone potential in Crossfield land sale. Canadian Discovery Digest Spark. Available online: https://library.mobile.canadiandiscovery.com/taxonomy/term/3091/all/%3A/feature-article/2019-western-canada-year-review-madison-group-subcrop-plays?page=8 (accessed on 1 September 2022).

- Moon, S.; Kim, Y.; Chang, S.; Kwon, S. Acquisition Procedure for Petroleum and Natural Gas (PNG) Rights in Alberta, Canada. J. Korean Soc. Miner. Energy Resour. Eng. 2017, 54, 268–279. [Google Scholar] [CrossRef]

- Mageau, L.; Zack, K.; Bouchard, J.; Stevenson, M.; Steppan, G.; Urness, V. Assessing the Cardium’s Second Generation-A Look at Horizontal Well Performance by Area; Raymond James Ltd.: Vancouver, BC, Canada, 2012; p. 19. [Google Scholar]

- HIS. ACCUMAP ver 27.10. 2017. Available online: https://ihsmarkit.com/products/oil-gas-tools-accumap.html (accessed on 1 September 2022).

- Pattison, S. Relative Sea Level Control of Incised Shoreface Sediments in the Burnstick Member, Cardium Formaiton, Upper Cretaceous Alberta. 1987. Available online: http://hdl.handle.net/11375/8722 (accessed on 1 September 2022).

- Bonavista Energy Corporation—Taber & Crossfield Assets. Available online: https://bonavistaenergy.com/ (accessed on 1 September 2022).

- TransGlobe Energy Corporation. Available online: https://www.trans-globe.com/operations/canada-western-canadian-sedimentary-basin/ (accessed on 1 September 2022).

- Macuarie Research. Viking Quest; Equities Research, 2011; pp. 1–33. Available online: www.macquarie.com.au/disclosures (accessed on 1 September 2022).

- Alberta Petroleum Royalty Guidelines: Principles and Procedures, Government of Alberta. 2013. Available online: https://open.alberta.ca/publications/alberta-petroleum-royalty-guidelines-principles-and-procedures#summary (accessed on 1 September 2022).

- Reinson, G.; Warters, W.; Cox, J.; Price, P. Cretaceous Viking formation of the western Canada sedimentary basin. In Geological Atlas of the Western Canada Sedimentary Basin; Canadian Society of Petroleum Geologists: Calgary, AB, Cannada, 2010. [Google Scholar]

- Peters & Co. Limited. Triaxon Oil Corporation Information Memorandum; Peters & Co. Limited: Calgary, AB, Canada, 2015. [Google Scholar]

| Zone of Interest | Well Specification (Spud over 100 Wells) | Ave. 3 m Cum. Total (Mboe) | Ave. 3 m Cum. Oil (Mbbls) | Ave. 3 m Cum. Cond. (Mbbls) | Ave. 3 m Cum. Gas (Mboe) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Spud | Dev/VT | HZ | Dev/VT | HZ | Dev/VT | HZ | Dev/VT | HZ | Dev/VT | HZ | |

| Cardium | 448 | 282 | 91 | 11.2 | 10.6 | 9.6 | 8.4 | 0 | 0 | 1.6 | 2.1 |

| Viking | 117 | 56 | 20 | 4.8 | 6.4 | 1.2 | 1.7 | 0 | 0 | 3.7 | 4.7 |

| Ellerslie | 149 | 58 | 33 | 7.6 | 23.1 | 1.1 | 0.9 | 0.2 | 0.1 | 6.3 | 22.2 |

| Elkton | 220 | 155 | 19 | 143.5 | 89.7 | 23.4 | 16.6 | 8.7 | 0.1 | 111.4 | 73.0 |

| Suunda | 124 | 13 | 5 | 807.2 | 28.3 | 371.7 | 21.1 | 393.5 | 0 | 42.0 | 7.2 |

| Measured Depth (Meters) | <2500 | <3000 | <3500 | <4000 | <4500 | >4500 |

| Cum. oil produced (Mbbls) | 50,000 | 60,000 | 70,000 | 80,000 | 90,000 | 100,000 |

| Production month (months) | 18 | 24 | 30 | 36 | 42 | 48 |

| IRR (%) | Oil Price (USD/bbl) | NPV (MCAD) | Oil Price (USD/bbl) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 60 | 70 | 80 | 60 | 70 | 80 | ||||

| DCET (MMCAD) | 3.0 | 20.7 | 47.1 | 113.6 | DCET (MMCAD) | 3.0 | 1188 | 2069 | 2927 |

| 3.5 | 9.3 | 23.3 | 46.6 | 3.5 | 688 | 1569 | 2427 | ||

| 4.0 | 2.8 | 12.4 | 25.2 | 4.0 | 188 | 1069 | 1927 | ||

| IRR (%) | Oil Price (USD/bbl) | NPV (MCAD) | Oil Price (USD/bbl) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 60 | 70 | 80 | 60 | 70 | 80 | ||||

| DCET (MMCAD) | 3.5 | 41.1 | 96.0 | 236.6 | DCET (MMCAD) | 3.5 | 1202 | 2204 | 3178 |

| 4.0 | 20.3 | 50.6 | 105.0 | 4.0 | 702 | 1704 | 2678 | ||

| 4.5 | 6.7 | 28.5 | 58.5 | 4.5 | 202 | 1204 | 2178 | ||

| Target Fm. | TVD (m) | PNG Right (Section) | Probable Location | Possible Location | ROR, NPV@10 | Note |

|---|---|---|---|---|---|---|

| Cardium A | 2000 | 5.5 | 4 | 14 | 12.4%, 0.8 MM$ | -HZ multi-fracs target |

| Cardium B | 2020 | 5.5 | - | - | - | -mature field with enhanced oil recovery |

| Viking | 2200 | 10.0 | 12 | 16 | 58.0%, 2.5 MM$ | -HZ multi-fracs target |

| Ellerslie | 2450 | 8.25 | - | - | - | -verified by drilling |

| Elkton | 2550 | 6.75 | - | - | - | -future exploration |

| Total | 16 | 32 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Moon, B.S.; Lee, W.; Lee, Y. The Study for Technical Analysis on the Development Potential of Multi-Zone Oil, Gas in Crossfield, Canada. Energies 2022, 15, 6860. https://doi.org/10.3390/en15186860

Moon BS, Lee W, Lee Y. The Study for Technical Analysis on the Development Potential of Multi-Zone Oil, Gas in Crossfield, Canada. Energies. 2022; 15(18):6860. https://doi.org/10.3390/en15186860

Chicago/Turabian StyleMoon, Bryan Sangho, Wangdo Lee, and Youngsoo Lee. 2022. "The Study for Technical Analysis on the Development Potential of Multi-Zone Oil, Gas in Crossfield, Canada" Energies 15, no. 18: 6860. https://doi.org/10.3390/en15186860

APA StyleMoon, B. S., Lee, W., & Lee, Y. (2022). The Study for Technical Analysis on the Development Potential of Multi-Zone Oil, Gas in Crossfield, Canada. Energies, 15(18), 6860. https://doi.org/10.3390/en15186860