Low-Carbon Supply Chain Decisions Considering Carbon Emissions Right Pledge Financing in Different Power Structures

Abstract

:1. Introduction

- What are the impacts of different power structures on the carbon emissions and profits of supply chains?

- How does the conversion coefficient of investments in carbon emissions reduction technologies affect the carbon emissions and equilibrium results of supply chains?

- When carbon trading prices fluctuate, how should supply chains adjust their decisions to adapt to these changes?

2. Literature Review

2.1. Supply Chain Carbon Emissions Reduction

2.2. Supply Chain Financing

2.2.1. Traditional Financing Model

2.2.2. Financing for Carbon Emissions Reduction

2.2.3. Supply Chain Carbon Financing

2.3. Supply Chain Power Structures

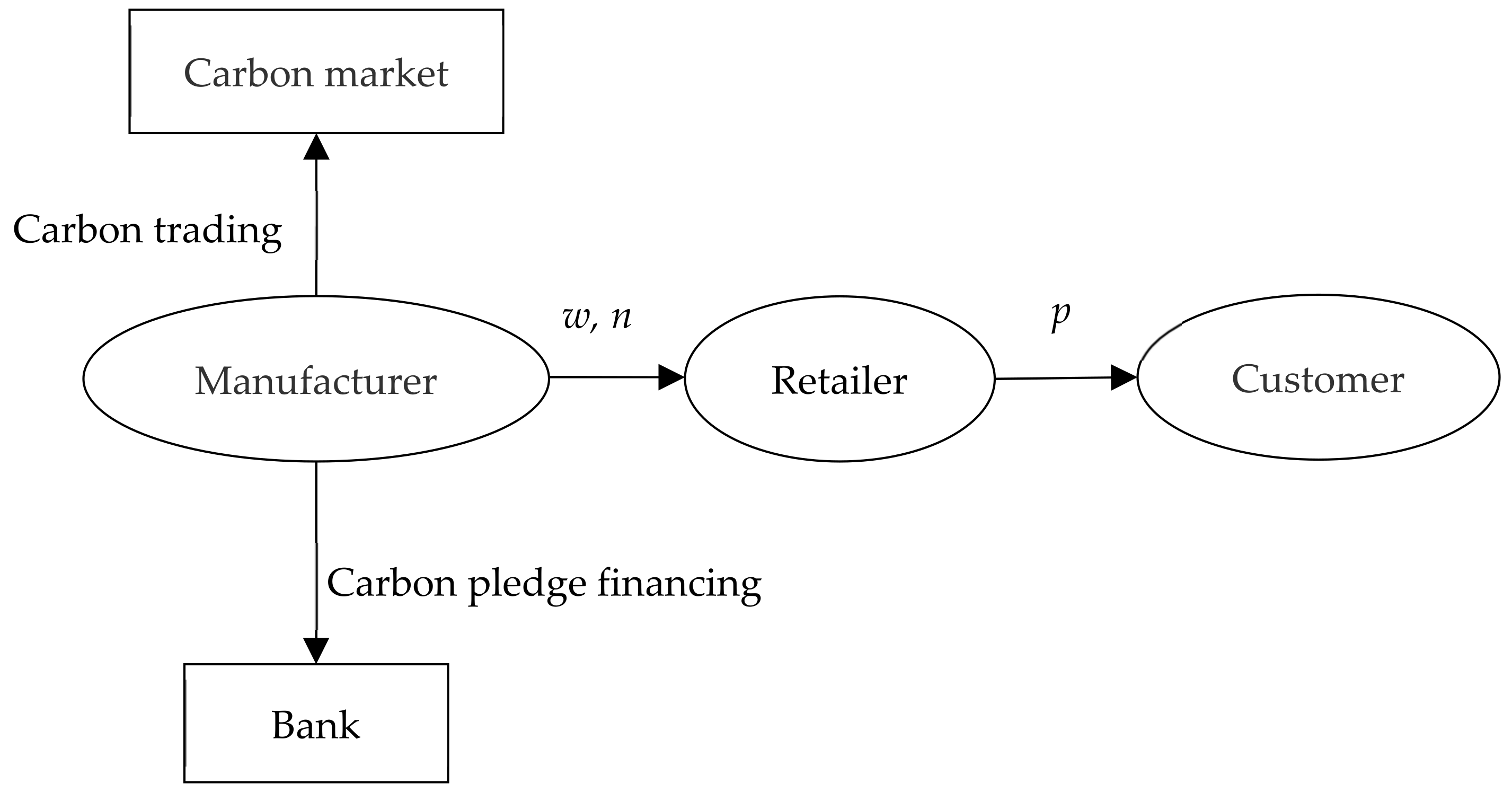

3. Model Mechanisms and Assumptions

3.1. Notations

3.2. Model Assumptions

4. Model Formulation and Analysis

4.1. The Nash (N) Model

4.2. The Retailer-Led Stackelberg (R) Model

4.3. The Manufacturer-Led Stackelberg (M) Model

5. Numerical Analysis

6. Sensitivity Analysis

6.1. Impact of the Conversion Coefficient of Investment in Carbon Emissions Reduction Technologies

6.2. Impact of Carbon Trading Prices

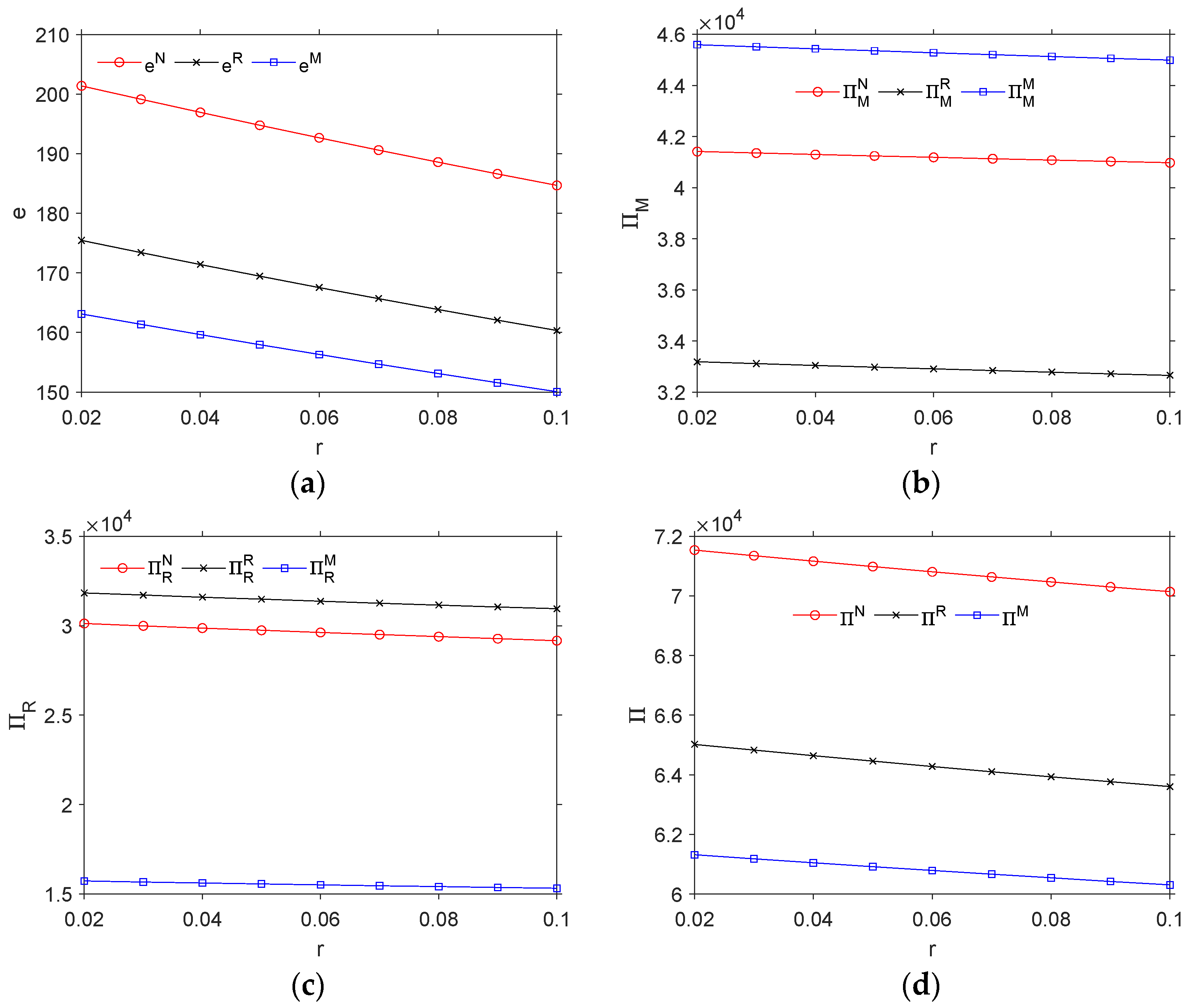

6.3. Impact of Bank Interest Rates

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Wang, J.; Zhang, Q.; Lu, X.; Ma, R.; Yu, B.; Gao, H. Emission Reduction and Coordination of a Dynamic Supply Chain with Green Reputation. Oper. Res. 2021, 1–44. [Google Scholar] [CrossRef]

- Konstantakopoulos, G.D.; Gayialis, S.P.; Kechagias, E.P. Vehicle Routing Problem and Related Algorithms for Logistics Distribution: A Literature Review and Classification. Oper. Res. 2022, 22, 2033–2062. [Google Scholar] [CrossRef]

- Gayialis, S.P.; Kechagias, E.P.; Konstantakopoulos, G.D. A City Logistics System for Freight Transportation: Integrating Information Technology and Operational Research. Oper. Res. 2022, 1–30. [Google Scholar] [CrossRef]

- Xu, X.; He, P.; Xu, H.; Zhang, Q. Supply Chain Coordination with Green Technology under Cap-and-Trade Regulation. Int. J. Prod. Econ. 2017, 183, 433–442. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain Technology and Its Relationships to Sustainable Supply Chain Management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef] [Green Version]

- Gayialis, S.P.; Kechagias, E.P.; Papadopoulos, G.A.; Masouras, D. A Review and Classification Framework of Traceability Approaches for Identifying Product Supply Chain Counterfeiting. Sustainability 2022, 14, 6666. [Google Scholar] [CrossRef]

- Du, S.; Zhu, J.; Jiao, H.; Ye, W. Game-Theoretical Analysis for Supply Chain with Consumer Preference to Low Carbon. Int. J. Prod. Res. 2014, 53, 3753–3768. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, C.; Yu, C.; Ren, Y. Governmental Cap Regulation and Manufacturer’s Low Carbon Strategy in a Supply Chain with Different Power Structures. Comput. Ind. Eng. 2019, 134, 27–36. [Google Scholar] [CrossRef]

- Almutairi, K.; Hosseini Dehshiri, S.J.; Hosseini Dehshiri, S.S.; Hoa, A.X.; Arockia Dhanraj, J.; Mostafaeipour, A.; Issakhov, A.; Techato, K. Blockchain Technology Application Challenges in Renewable Energy Supply Chain Management. Environ. Sci. Pollut. Res. 2022, 1–18. [Google Scholar] [CrossRef]

- An, S.; Li, B.; Song, D.; Chen, X. Green Credit Financing versus Trade Credit Financing in a Supply Chain with Carbon Emission Limits. Eur. J. Oper. Res. 2021, 292, 125–142. [Google Scholar] [CrossRef]

- Cao, E.; Yu, M. The Bright Side of Carbon Emission Permits on Supply Chain Financing and Performance. Omega 2019, 88, 24–39. [Google Scholar] [CrossRef]

- Qin, J.; Zhao, Y.; Xia, L. Carbon Emission Reduction with Capital Constraint under Greening Financing and Cost Sharing Contract. Int. J. Environ. Res. Public Health 2018, 15, 750. [Google Scholar] [CrossRef] [Green Version]

- Edirisinghe, N.C.P.; Bichescu, B.; Shi, X. Equilibrium Analysis of Supply Chain Structures under Power Imbalance. Eur. J. Oper. Res. 2011, 214, 568–578. [Google Scholar] [CrossRef]

- Chen, H.; Dong, Z.; Li, G.; He, K. Remanufacturing Process Innovation in Closed-Loop Supply Chain under Cost-Sharing Mechanism and Different Power Structures. Comput. Ind. Eng. 2021, 162, 107743. [Google Scholar] [CrossRef]

- Ji, J.; Huang, J. Research on Single/Cooperative Emission Reduction Strategy under Different Power Structures. Environ. Sci. Pollut. Res. 2022, 1–22. [Google Scholar] [CrossRef]

- Saavedra, M.R.; Cristiano, C.H.; Francisco, F.G. Sustainable and Renewable Energy Supply Chain: A System Dynamics Overview. Renew. Sustain. Energy Rev. 2018, 82, 247–259. [Google Scholar] [CrossRef]

- Xia, L.; Guo, T.; Qin, J.; Yue, X.; Zhu, N. Carbon Emission Reduction and Pricing Policies of a Supply Chain Considering Reciprocal Preferences in Cap-and-Trade System. Ann. Oper. Res. 2018, 268, 149–175. [Google Scholar] [CrossRef]

- Ma, S.; He, Y.; Gu, R.; Li, S. Sustainable Supply Chain Management Considering Technology Investments and Government Intervention. Transp. Res. Part E Logist. Transp. Rev. 2021, 149, 102290. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Q.; Ji, J. Pricing and Carbon Emission Reduction Decisions in Supply Chains with Vertical and Horizontal Cooperation. Int. J. Prod. Econ. 2017, 191, 286–297. [Google Scholar] [CrossRef]

- Xu, Z.; Pokharel, S.; Elomri, A. An Eco-Friendly Closed-Loop Supply Chain Facing Demand and Carbon Price Uncertainty. Ann. Oper. Res. 2022, 1–27. [Google Scholar] [CrossRef]

- Yu, Y.; Zhou, S.; Shi, Y. Information Sharing or Not across the Supply Chain: The Role of Carbon Emission Reduction. Transp. Res. Part E Logist. Transp. Rev. 2020, 137, 101915. [Google Scholar] [CrossRef]

- Bai, Q.; Gong, Y.; Jin, M.; Xu, X. Effects of Carbon Emission Reduction on Supply Chain Coordination with Vendor-Managed Deteriorating Product Inventory. Int. J. Prod. Econ. 2019, 208, 83–99. [Google Scholar] [CrossRef]

- Daryanto, Y.; Wee, H.M.; Astanti, R.D. Three-Echelon Supply Chain Model Considering Carbon Emission and Item Deterioration. Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 368–383. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Sun, Y.-F.; Huo, B.-F. The Optimal Product Pricing and Carbon Emissions Reduction Profit Allocation of CET-Covered Enterprises in the Cooperative Supply Chain. Ann. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Chen, J.; Zhou, Y.W.; Zhong, Y. A Pricing/Ordering Model for a Dyadic Supply Chain with Buyback Guarantee Financing and Fairness Concerns. Int. J. Prod. Res. 2017, 55, 5287–5304. [Google Scholar] [CrossRef]

- Ding, W.; Wan, G. Financing and Coordinating the Supply Chain with a Capital-Constrained Supplier under Yield Uncertainty. Int. J. Prod. Econ. 2020, 230, 107813. [Google Scholar] [CrossRef]

- Jin, W.; Zhang, Q.; Luo, J. Non-Collaborative and Collaborative Financing in a Bilateral Supply Chain with Capital Constraints. Omega 2019, 88, 210–222. [Google Scholar] [CrossRef]

- Fang, L.; Xu, S. Financing Equilibrium in a Green Supply Chain with Capital Constraint. Comput. Ind. Eng. 2020, 143, 106390. [Google Scholar] [CrossRef]

- Lu, C.; Zhao, M.; Khan, I.; Uthansakul, P. Financing Strategy of Low-Carbon Supply Chain with Capital Constraint under Cap-and-Trade Regulation. Comput. Mater. Contin. 2021, 66, 437–455. [Google Scholar] [CrossRef]

- Cong, J.; Pang, T.; Peng, H. Optimal Strategies for Capital Constrained Low-Carbon Supply Chains under Yield Uncertainty. J. Clean. Prod. 2020, 256, 120339. [Google Scholar] [CrossRef]

- Qin, J.; Han, Y.; Wei, G.; Xia, L. The Value of Advance Payment Financing to Carbon Emission Reduction and Production in a Supply Chain with Game Theory Analysis. Int. J. Prod. Res. 2020, 58, 200–219. [Google Scholar] [CrossRef]

- Cao, E.; Yu, M. Trade Credit Financing and Coordination for an Emission-Dependent Supply Chain. Comput. Ind. Eng. 2018, 119, 50–62. [Google Scholar] [CrossRef]

- Cao, E.; Du, L.; Ruan, J. Financing Preferences and Performance for an Emission-Dependent Supply Chain: Supplier vs. Bank. Int. J. Prod. Econ. 2019, 208, 383–399. [Google Scholar] [CrossRef]

- Wang, Y.; Lv, L.; Shen, L.; Tang, R. Manufacturer’s Decision-Making Model under Carbon Emission Permits Repurchase Strategy and Capital Constraints. Int. J. Prod. Res. 2021, 1–19. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, F. Effects of the Carbon Credits Buy-Back Policy on Manufacturing/Remanufacturing Decisions of the Capital-Constrained Manufacturer. J. Ind. Manag. Optim. 2021. [Google Scholar] [CrossRef]

- Yang, L.; Chen, Y.; Ji, J. Cooperation Modes of Operations and Financing in a Low-Carbon Supply Chain. Sustainability 2018, 10, 821. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.; Chen, Z.; Peng, J. How Does Emission Right-Based Lending Contribute to Sustainable Production and Green Financing? A Modelling Study. Environ. Dev. Sustain. 2021, 23, 13945–13972. [Google Scholar] [CrossRef]

- Wang, J.C.; Wang, Y.Y.; Lai, F. Impact of Power Structure on Supply Chain Performance and Consumer Surplus. Int. Trans. Oper. Res. 2019, 26, 1752–1785. [Google Scholar] [CrossRef]

- Li, Z.; Xu, Y.; Deng, F.; Liang, X. Impacts of Power Structure on Sustainable Supply Chain Management. Sustainability 2017, 10, 55. [Google Scholar] [CrossRef] [Green Version]

- Liu, Y.; Ren, W.; Xu, Q.; Liu, Z.-Y. Decision Analysis of Supply Chains Considering Corporate Social Responsibility and Government Subsidy under Different Channel Power Structures. Ann. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Chen, X.; Yang, H.; Wang, X.; Choi, T.M. Optimal Carbon Tax Design for Achieving Low Carbon Supply Chains. Ann. Oper. Res. 2020, 1–28. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Chan, H.K. Manufacturer and Retailer Coordination for Environmental and Economic Competitiveness: A Power Perspective. Transp. Res. Part E Logist. Transp. Rev. 2017, 97, 268–281. [Google Scholar] [CrossRef] [Green Version]

- Jiang, W.; Liu, M.; Gan, L.; Wang, C. Optimal Pricing, Ordering, and Coordination for Prefabricated Building Supply Chain with Power Structure and Flexible Cap-and-Trade. Mathematics 2021, 9, 2426. [Google Scholar] [CrossRef]

- Tang, R.; Yang, L. Impacts of Financing Mechanism and Power Structure on Supply Chains under Cap-and-Trade Regulation. Transp. Res. Part E Logist. Transp. Rev. 2020, 139, 101957. [Google Scholar] [CrossRef]

- Wang, M.; Wang, M.; Wang, S. Optimal Investment and Uncertainty on China’s Carbon Emission Abatement. Energy Policy 2012, 41, 871–877. [Google Scholar] [CrossRef]

- Mondal, C.; Giri, B.C. Retailers’ Competition and Cooperation in a Closed-Loop Green Supply Chain under Governmental Intervention and Cap-and-Trade Policy. Oper. Res. 2020, 22, 859–894. [Google Scholar] [CrossRef]

- Wang, J.C.; Lau, A.H.L.; Lau, H.S. Dollar vs. Percentage Markup Pricing Schemes under a Dominant Retailer. Eur. J. Oper. Res. 2013, 227, 471–482. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A Comparative Analysis of Greening Policies across Supply Chain Structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

| Author(s) | Carbon Emissions Reduction | Power Structures | Capital Constraints | Financing Mode | |

|---|---|---|---|---|---|

| Carbon Pledge Financing | Other | ||||

| Du et al. (2015) [7] | P | P | |||

| Ma et al. (2021) [18] | P | ||||

| Fang et al. (2020) [28] | P | P | |||

| Cong et al. (2020) [30] | P | P | P | ||

| Cao and Yu (2019) [11] | P | P | P | ||

| Chen et al. (2021) [37] | P | P | P | ||

| Yang et al. (2018) [36] | P | P | P | P | |

| Liu et al. (2021) [40] | P | ||||

| Ji et al. (2022) [15] | P | P | |||

| Tang et al. (2020) [44] | P | P | P | P | |

| Our model | P | P | P | P | |

| Decision Variables | |

|---|---|

| w | Product wholesale price for the manufacturer, w > 0 |

| p | Retail price of the product, p > w |

| n | Carbon quota pledge rate of the manufacturer |

| Model Parameters | |

| δ | The profit margin of the retailer, δ = p − w, δ > 0 |

| η | The sensitivity of consumers to the levels of carbon reduction, η > 0 |

| Q | Market demand function of the supply chain |

| a | Potential market demand |

| b | The sensitivity of consumers to the retail price of products |

| pe | Unit carbon trading price, pe > 0 |

| E | Carbon cap issued by the government for the manufacturer, E > 0 |

| e0 | Initial carbon emissions per product, e0 > 0 |

| F | Loans obtained by the manufacturer using pledges of carbon quotas |

| I | Amount of investment from the manufacturer in carbon emissions reduction technologies |

| α | Conversion coefficient of investment in carbon emissions reduction technologies |

| e | The carbon emissions reduction level of the manufacturer, e = αI1/2 |

| r | Bank interest rates |

| β | Bank pledge rates |

| Π | The total profit function of the supply chain |

| ΠM | The profit function of the manufacturer |

| ΠR | The profit function of the retailer |

| Power Structure | Set | w | n | p | e | ΠM | ΠR | Π |

|---|---|---|---|---|---|---|---|---|

| Nash Model | Set 1 | 233.469 | 0.354 | 386.939 | 80.816 | 38,068 | 23,553 | 61,621 |

| Set 2 | 241.797 | 0.594 | 403.593 | 130.779 | 39,504 | 26,178 | 65,682 | |

| Set 3 | 252.818 | 0.935 | 425.635 | 196.906 | 41,297 | 29,866 | 71,163 | |

| Set 4 | 268.14 | 0.841 | 436.28 | 208.84 | 44,713 | 28,271 | 72,984 | |

| Set 5 | 283.462 | 0.784 | 446.925 | 220.774 | 48,321 | 26,720 | 75,041 | |

| Retailer-Led Stackelberg Model | Set 1 | 198.737 | 0.257 | 415.66 | 68.794 | 29,432 | 25,757 | 55,189 |

| Set 2 | 207.672 | 0.438 | 428.489 | 112.323 | 30,961 | 28,192 | 59,153 | |

| Set 3 | 220.06 | 0.708 | 445.637 | 171.393 | 33,043 | 31,594 | 64,637 | |

| Set 4 | 236.269 | 0.653 | 455.74 | 184.017 | 36,901 | 29,907 | 66,808 | |

| Set 5 | 252.478 | 0.622 | 465.843 | 196.641 | 40,937 | 28,266 | 69,203 | |

| Manufacturer-Led Stackelberg Model | Set 1 | 306.734 | 0.243 | 420.101 | 66.935 | 41,146 | 12,852 | 53,998 |

| Set 2 | 316.829 | 0.4 | 435.243 | 107.316 | 43,013 | 14,022 | 57,035 | |

| Set 3 | 329.907 | 0.614 | 454.86 | 159.627 | 45,433 | 15,613 | 61,046 | |

| Set 4 | 343.143 | 0.575 | 464.714 | 172.57 | 48,628 | 14,780 | 63,408 | |

| Set 5 | 356.378 | 0.553 | 474.567 | 185.513 | 52,021 | 13,969 | 65,990 |

| Power Structure | r | w | n | p |

|---|---|---|---|---|

| Nash Model | 0.02 | 253.559 | 0.978 | 427.119 |

| 0.04 | 252.818 | 0.935 | 425.635 | |

| 0.06 | 252.108 | 0.895 | 424.216 | |

| 0.08 | 251.429 | 0.857 | 422.857 | |

| 0.1 | 250.777 | 0.822 | 421.554 | |

| Retailer-Led Stackelberg Model | 0.02 | 220.917 | 0.742 | 446.8 |

| 0.04 | 220.06 | 0.708 | 445.637 | |

| 0.06 | 219.242 | 0.677 | 444.525 | |

| 0.08 | 218.462 | 0.647 | 443.461 | |

| 0.1 | 217.716 | 0.62 | 442.443 | |

| Manufacturer-Led Stackelberg Model | 0.02 | 330.776 | 0.642 | 456.163 |

| 0.04 | 329.907 | 0.614 | 454.86 | |

| 0.06 | 329.074 | 0.589 | 453.612 | |

| 0.08 | 328.276 | 0.565 | 452.414 | |

| 0.1 | 327.509 | 0.543 | 451.264 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, C.; Gao, J.; Guo, J.; Wang, J. Low-Carbon Supply Chain Decisions Considering Carbon Emissions Right Pledge Financing in Different Power Structures. Energies 2022, 15, 5721. https://doi.org/10.3390/en15155721

Li C, Gao J, Guo J, Wang J. Low-Carbon Supply Chain Decisions Considering Carbon Emissions Right Pledge Financing in Different Power Structures. Energies. 2022; 15(15):5721. https://doi.org/10.3390/en15155721

Chicago/Turabian StyleLi, Changhong, Jiani Gao, Jiaqi Guo, and Jialuo Wang. 2022. "Low-Carbon Supply Chain Decisions Considering Carbon Emissions Right Pledge Financing in Different Power Structures" Energies 15, no. 15: 5721. https://doi.org/10.3390/en15155721

APA StyleLi, C., Gao, J., Guo, J., & Wang, J. (2022). Low-Carbon Supply Chain Decisions Considering Carbon Emissions Right Pledge Financing in Different Power Structures. Energies, 15(15), 5721. https://doi.org/10.3390/en15155721