Blockchain Technology for Renewable Energy: Principles, Applications and Prospects

Abstract

:1. Introduction

2. Literature Review

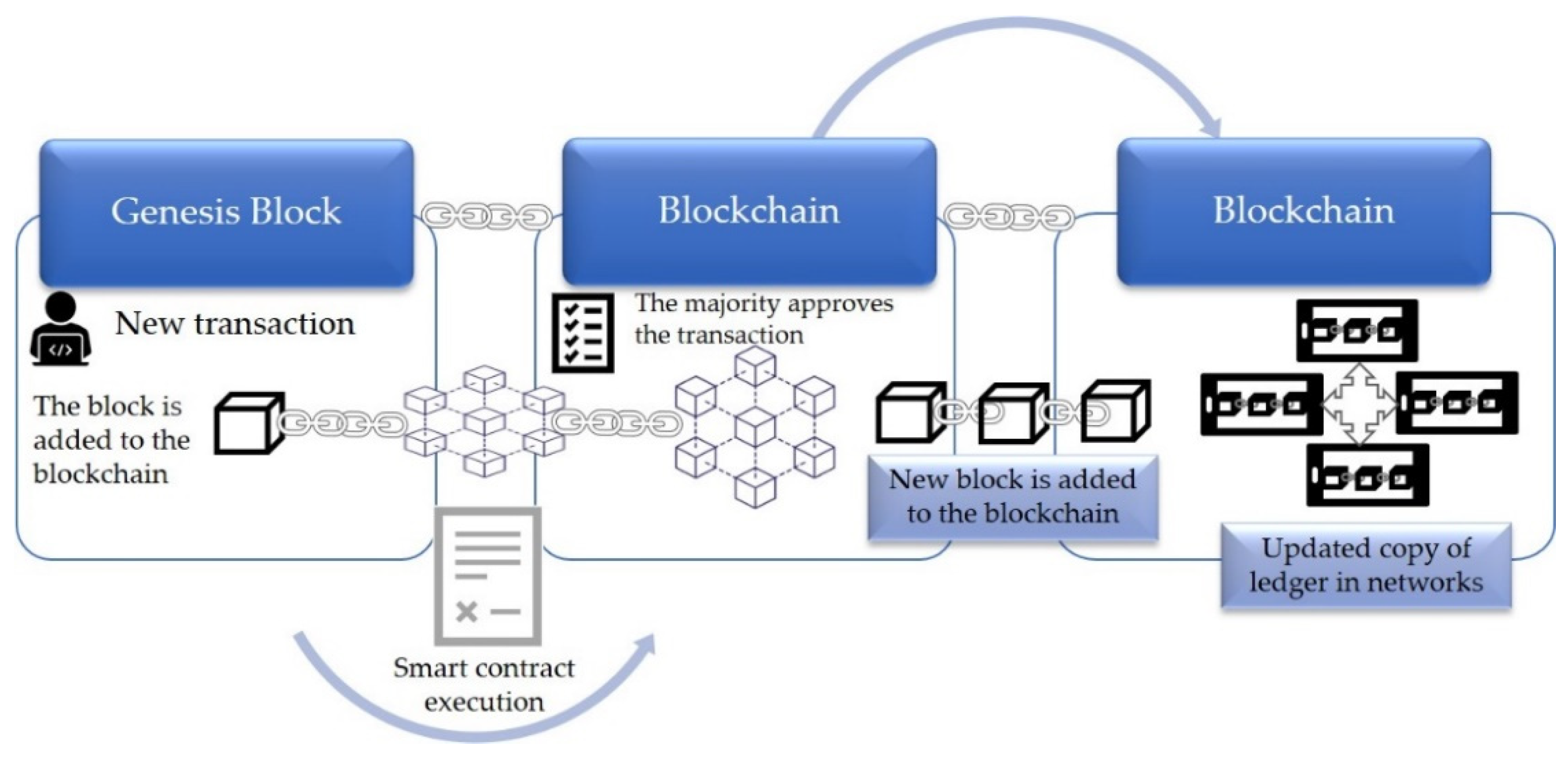

2.1. Basic Principles of Blockchain

2.2. Features and Applications of Blockchain Technology

2.3. Blockchain for Renewable Energy

2.3.1. Distributed Energy Trading—P2P Platforms and Energy Democratization

2.3.2. Cryptocurrencies and Energy Tokens

2.3.3. Enabling IoT and Asset Management

2.3.4. Smart Metering and Smart Grid Management

2.3.5. Green Certificates and Carbon Trading—Automation

2.3.6. Fostering Electric Transportation

2.3.7. Contribution to the Circular Economy

2.4. Barriers and Limitations

2.4.1. Scalability and Speed of Transactions

- Ultimate decentralization of block construction;

- System security (its resilience to cyberattacks);

- Scalability of the system (its capacity to process an ever-growing number of transactions during a certain period of time) [104].

2.4.2. Lack of Legal and Regulatory Compliance

2.4.3. Infancy Stage of Technological Development

3. Materials and Methods

4. Results

4.1. Initial Level of Know-How about Blockchain Technology

4.2. Biggest Benefits from the Experts’ Perspective

4.3. Application of Blockchain in Specific Business Areas or Departments

4.4. Impact on Business Models

4.5. Role in Fostering CSR, Sustainability, and Circular Economy

4.6. Most Challenging Barriers

4.7. Requirements for Improvement—“Roadmap for BC Adoption”

4.8. Future of Blockchain within the Finnish RET Industry

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

Appendix A. Blockchain Maturity Questionnaire

- What kind of renewable energy technology is your company focused on?

- Are you familiar with Blockchain technology and do you use it in your day-to-day business operations?

- If YES, please explain the main reason why.

- If NO, please explain the main reason why.

- If YES—What kind of factors convinced you to implement BC in your company? If NO what kind of BC features do you perceive as potentially beneficial for your company in future?

- If YES—In which departments of your company are you using Blockchain? If NO—in which departments of your company could you use BC in future (where exactly is the need in the company, in which department, or business area etc. and why?

- If—How significant was the influence of BC technology on your business model? If NOT—how would it influence your BM?

- [… on specific BM components, such as:

- 8.1

- key resources (infrastructure),

- 8.2

- value proposition,

- 8.3

- revenue streams,

- 8.4

- client interface,

- 8.5

- external value chain.

- How do you perceive the possible impact of BC on the issues such as Sustainability or Circular Economy in your organization and in overall?

- If YES—What kind of major barriers have you experienced so far while using BC? If NO—What are the main possible disadvantages coming from BC usage (factors that keep your company away from implementing BC)?

- In your opinion, what kind of measures should be taken to improve the current state of affairs—how to overcome the main possible barriers?

- How do you see the future of BC in the renewable energy sector? How do you foresee the role of blockchain in renewable energy sector and how would it impact on operational excellence, business models and value propositions?

- If YES—On a scale 1–5, how would you estimate your experience of using BC? if NO—On a scale 1–5, how is it likely that you will use Blockchain in future, and why?

References

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of the 21st Century; New Society Publishers: Hamilton, OH, Canada, 1998. [Google Scholar]

- Elkington, J. Enter the Triple Bottom Line. In The Triple Bottom Line: Does It All Add Up? Henriques, A., Richardson, J., Eds.; Earthscan: London, UK, 2004; pp. 1–16. [Google Scholar]

- Official Statistics of Finland (OSF). Energy Supply and Consumption [e-Publication]; Statistics Finland: Helsinki, Finland, 2020; Available online: http://www.stat.fi/til/ehk/2020/04/ehk_2020_04_2021-04-16_tie_001_en.html (accessed on 14 April 2022).

- Eid, C.; Codani, P.; Perez, Y.; Reneses, J.; Hakvoort, R. Managing electric flexibility from Distributed Energy Resources: A review of incentives for market design. Renew. Sustain. Energy Rev. 2016, 64, 237–247. [Google Scholar] [CrossRef]

- Juszczyk, O.; Juszczyk, J.; Juszczyk, S.; Takala, J. Barriers for Renewable Energy Technologies Diffusion: Empirical Evidence from Finland and Poland. Energies 2022, 15, 527. [Google Scholar] [CrossRef]

- Ahl, A.; Yarime, M.; Tanaka, K.; Sagawa, D. Review of blockchain-based distributed energy: Implications for institutional development. Renew. Sustain. Energy Rev. 2019, 107, 200–211. [Google Scholar] [CrossRef]

- Luo, X.; Wang, J.; Dooner, M.; Clarke, J. Overview of current development in electrical energy storage technologies and the application potential in power system operation. Appl. Energy 2015, 137, 511–536. [Google Scholar] [CrossRef] [Green Version]

- Zhou, S.; Brown, M.A. Smart meter deployment in Europe: A comparative case study on the impacts of national policy schemes. J. Clean. Prod. 2017, 144, 22–32. [Google Scholar] [CrossRef]

- Hirsch, A.; Parag, Y.; Guerrero, J. Microgrids: A review of technologies, key drivers, and outstanding issues. Renew. Sustain. Energy Rev. 2018, 90, 402–411. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Notheisen, B.; Beer, C.; Dauer, D.; Weinhardt, C. A blockchain-based smart grid: Towards sustainable local energy markets. Comput. Sci.-Res. Dev. 2017, 33, 207–214. [Google Scholar] [CrossRef]

- Abdella, J.; Shuaib, K. Peer to Peer Distributed Energy Trading in Smart Grids: A Survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef] [Green Version]

- Tapscott, D.; Tapscott, A. How blockchain will change organizations. MIT Sloan Manag. Rev. 2017, 58, 10–13. Available online: https://www.proquest.com/scholarly-journals/how-blockchain-will-change-organizations/docview/1875399260/se-2?accountid=14797 (accessed on 10 April 2022).

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2018, 100, 143–174. [Google Scholar] [CrossRef]

- Nowiński, W.; Kozma, M. How Can Blockchain Technology Disrupt the Existing Business Models? Entrep. Bus. Econ. Rev. 2017, 5, 173–188. [Google Scholar] [CrossRef]

- Bürer, M.J.; de Lapparent, M.; Pallotta, V.; Capezzali, M.; Carpita, M. Use cases for Blockchain in the Energy Industry Opportunities of emerging business models and related risks. Comput. Ind. Eng. 2019, 137, 106002. [Google Scholar] [CrossRef] [Green Version]

- Tiscini, R.; Testarmata, S.; Ciaburri, M.; Ferrari, E. The blockchain as a sustainable business model innovation. Manag. Decis. 2020, 58, 1621–1642. [Google Scholar] [CrossRef]

- Shahzad, K. Blockchain and Organizational Characteristics: Towards Business Model Innovation. In International Conference on Applied Human Factors and Ergonomics; Springer: Cham, Switzerland, 2020; Volume 1218, pp. 80–86. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2018, 57, 2117–2135. [Google Scholar] [CrossRef] [Green Version]

- Helo, P.; Shamsuzzoha, A. Real-time supply chain—A blockchain architecture for project deliveries. Robot. Comput. Manuf. 2019, 63, 101909. [Google Scholar] [CrossRef]

- Di Silvestre, M.L.; Favuzza, S.; Sanseverino, E.R.; Zizzo, G. How Decarbonization, Digitalization and Decentralization are changing key power infrastructures. Renew. Sustain. Energy Rev. 2018, 93, 483–498. [Google Scholar] [CrossRef]

- Ahl, A.; Yarime, M.; Goto, M.; Chopra, S.S.; Kumar, N.M.; Tanaka, K.; Sagawa, D. Exploring blockchain for the energy transition: Opportunities and challenges based on a case study in Japan. Renew. Sustain. Energy Rev. 2019, 117, 109488. [Google Scholar] [CrossRef]

- Upadhyay, A.; Mukhuty, S.; Kumar, V.; Kazancoglu, Y. Blockchain technology and the circular economy: Implications for sustainability and social responsibility. J. Clean. Prod. 2021, 293, 126130. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer electronic cash system. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 26 December 2018).

- Teufel, B.; Sentic, A.; Barmet, M. Blockchain energy: Blockchain in future energy systems. J. Electron. Sci. Technol. 2019, 17, 100011. [Google Scholar] [CrossRef]

- Tucker, C. Blockchain: The Insights You Need from Harvard Business Review; HBR Insights Series; Harvard Business Press: Boston, MA, USA, 2019. [Google Scholar]

- Cong, L.W.; He, Z. Blockchain Disruption and Smart Contracts. Rev. Financ. Stud. 2019, 32, 1754–1797. [Google Scholar] [CrossRef]

- Arora, A.; Arora, M. Digital-Information Tracking Framework Using Blockchain. J. Supply Chain Manag. Syst. 2018, 7, 1–7. [Google Scholar]

- Casino, F.; Dasaklis, T.K.; Patsakis, C. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telemat. Inform. 2018, 36, 55–81. [Google Scholar] [CrossRef]

- Wang, L.; Shen, X.; Li, J.; Shao, J.; Yang, Y. Cryptographic primitives in blockchains. J. Netw. Comput. Appl. 2018, 127, 43–58. [Google Scholar] [CrossRef]

- Hawlitschek, F.; Notheisen, B.; Teubner, T. The limits of trust-free systems: A literature review on blockchain technology and trust in the sharing economy. Electron. Commer. Res. Appl. 2018, 29, 50–63. [Google Scholar] [CrossRef]

- Yang, R.; Wakefield, R.; Lyu, S.; Jayasuriya, S.; Han, F.; Yi, X.; Yang, X.; Amarasinghe, G.; Chen, S. Public and private blockchain in construction business process and information integration. Autom. Constr. 2020, 118, 103276. [Google Scholar] [CrossRef]

- Allesie, D.; Sobolewski, M.; Vaccari, L.; Pignatelli, F. Blockchain for Digital Government; Publications Office of the European Union: Luxembourg, 2019; ISBN 978-92-76-00581-0. [Google Scholar] [CrossRef]

- Warkentin, M.; Orgeron, C. Using the security triad to assess blockchain technology in public sector applications. Int. J. Inf. Manag. 2020, 52, 102090. [Google Scholar] [CrossRef]

- Tan, E.; Mahula, S.; Crompvoets, J. Blockchain governance in the public sector: A conceptual framework for public management. Gov. Inf. Q. 2021, 39, 101625. [Google Scholar] [CrossRef]

- Hyvärinen, H.; Risius, M.; Friis, G. A Blockchain-Based Approach Towards Overcoming Financial Fraud in Public Sector Services. Bus. Inf. Syst. Eng. 2017, 59, 441–456. [Google Scholar] [CrossRef] [Green Version]

- Ølnes, S.; Ubacht, J.; Janssen, M. Blockchain in government: Benefits and implications of distributed ledger technology for information sharing. Gov. Inf. Q. 2017, 34, 355–364. [Google Scholar] [CrossRef] [Green Version]

- Taş, R.; Tanrıöver, Ö.Ö. A Systematic Review of Challenges and Opportunities of Blockchain for E-Voting. Symmetry 2020, 12, 1328. [Google Scholar] [CrossRef]

- Pawlak, M.; Poniszewska-Marańda, A.; Kryvinska, N. Towards the intelligent agents for blockchain e-voting system. Procedia Comput. Sci. 2018, 141, 239–246. [Google Scholar] [CrossRef]

- Helo, P.; Hao, Y. Blockchains in operations and supply chains: A model and reference implementation. Comput. Ind. Eng. 2019, 136, 242–251. [Google Scholar] [CrossRef]

- Biswas, B.; Gupta, R. Analysis of barriers to implement blockchain in industry and service sectors. Comput. Ind. Eng. 2019, 136, 225–241. [Google Scholar] [CrossRef]

- Wang, Q.; Zhu, X.; Ni, Y.; Gu, L.; Zhu, H. Blockchain for the IoT and industrial IoT: A review. Internet Things 2020, 10, 100081. [Google Scholar] [CrossRef]

- Pan, X.; Pan, X.; Song, M.; Ai, B.; Ming, Y. Blockchain technology and enterprise operational capabilities: An empirical test. Int. J. Inf. Manag. 2019, 52, 101946. [Google Scholar] [CrossRef]

- Meidute-Kavaliauskiene, I.; Yıldız, B.; Çiğdem, S.; Činčikaitė, R. An Integrated Impact of Blockchain on Supply Chain Applications. Logistics 2021, 5, 33. [Google Scholar] [CrossRef]

- Leng, J.; Ruan, G.; Jiang, P.; Xu, K.; Liu, Q.; Zhou, X.; Liu, C. Blockchain-empowered sustainable manufacturing and product lifecycle management in industry 4.0: A survey. Renew. Sustain. Energy Rev. 2020, 132, 110112. [Google Scholar] [CrossRef]

- Ali, O.; Ally, M.; Clutterbuck; Dwivedi, Y. The state of play of blockchain technology in the financial services sector: A systematic literature review. Int. J. Inf. Manag. 2020, 54, 102199. [Google Scholar] [CrossRef]

- Chang, V.; Baudier, P.; Zhang, H.; Xu, Q.; Zhang, J.; Arami, M. How Blockchain can impact financial services–The overview, challenges and recommendations from expert interviewees. Technol. Forecast. Soc. Chang. 2020, 158, 120166. [Google Scholar] [CrossRef]

- Yeoh, P. Regulatory issues in blockchain technology. J. Financ. Regul. Compliance 2017, 25, 196–208. [Google Scholar] [CrossRef]

- Walsh, C.; O’Reilly, P.; Gleasure, R.; McAvoy, J.; O’Leary, K. Understanding manager resistance to blockchain systems. Eur. Manag. J. 2020, 39, 353–365. [Google Scholar] [CrossRef]

- Lumineau, F.; Wang, W.; Schilke, O. Blockchain Governance—A New Way of Organizing Collaborations? Organ. Sci. 2021, 32, 500–521. [Google Scholar] [CrossRef]

- Gatteschi, V.; Lamberti, F.; Demartini, C.; Pranteda, C.; Santamaría, V. Blockchain and Smart Contracts for Insurance: Is the Technology Mature Enough? Future Internet 2018, 10, 20. [Google Scholar] [CrossRef] [Green Version]

- Kar, A.K.; Navin, L. Diffusion of blockchain in insurance industry: An analysis through the review of academic and trade literature. Telemat. Inform. 2020, 58, 101532. [Google Scholar] [CrossRef]

- Chen, J.; Cai, T.; He, W.; Chen, L.; Zhao, G.; Zou, W.; Guo, L. A Blockchain-Driven Supply Chain Finance Application for Auto Retail Industry. Entropy 2020, 22, 95. [Google Scholar] [CrossRef] [Green Version]

- Caldarelli, G.; Zardini, A.; Rossignoli, C. Blockchain adoption in the fashion sustainable supply chain: Pragmatically addressing barriers. J. Organ. Chang. Manag. 2021, 34, 507–524. [Google Scholar] [CrossRef]

- Choi, T.-M. Blockchain-technology-supported platforms for diamond authentication and certification in luxury supply chains. Transp. Res. Part E-Logist. Transp. Rev. 2019, 128, 17–29. [Google Scholar] [CrossRef]

- De Boissieu, E.; Kondrateva, G.; Baudier, P.; Ammi, C. The use of blockchain in the luxury industry: Supply chains and the traceability of goods. J. Enterp. Inf. Manag. 2021, 34, 1318–1338. [Google Scholar] [CrossRef]

- Berneis, M.; Winkler, H. Value Proposition Assessment of Blockchain Technology for Luxury, Food, and Healthcare Supply Chains. Logistics 2021, 5, 85. [Google Scholar] [CrossRef]

- Paliwal, V.; Chandra, S.; Sharma, S. Blockchain Technology for Sustainable Supply Chain Management: A Systematic Literature Review and a Classification Framework. Sustainability 2020, 12, 7638. [Google Scholar] [CrossRef]

- Park, A.; Li, H. The Effect of Blockchain Technology on Supply Chain Sustainability Performances. Sustainability 2021, 13, 1726. [Google Scholar] [CrossRef]

- Sivula, A.; Shamsuzzoha, A.; Helo, P. Requirements for Blockchain Technology in Supply Chain Management: An Exploratory Case Study. Oper. Supply Chain Manag. Int. J. 2020, 14, 39–50. [Google Scholar] [CrossRef]

- Queiroz, M.M.; Telles, R.; Bonilla, S.H. Blockchain and supply chain management integration: A systematic review of the literature. Supply Chain Manag. Int. J. 2019, 25, 241–254. [Google Scholar] [CrossRef]

- Santhi, A.R.; Muthuswamy, P. Influence of Blockchain Technology in Manufacturing Supply Chain and Logistics. Logistics 2022, 6, 15. [Google Scholar] [CrossRef]

- Abeyratne, S.A.; Monfared, R.P. Blockchain ready manufacturing supply chain using distributed ledger. Int. J. Res. Eng. Technol. 2016, 5, 1–10. [Google Scholar]

- Pournader, M.; Shi, Y.; Seuring, S.; Koh, S.L. Blockchain applications in supply chains, transport and logistics: A systematic review of the literature. Int. J. Prod. Res. 2019, 58, 2063–2081. [Google Scholar] [CrossRef]

- Kamilaris, A.; Fonts, A.; Prenafeta-Boldύ, F.X. The rise of blockchain technology in agriculture and food supply chains. Trends Food Sci. Technol. 2019, 91, 640–652. [Google Scholar] [CrossRef] [Green Version]

- Miglani, A.; Kumar, N.; Chamola, V.; Zeadally, S. Blockchain for Internet of Energy management: Review, solutions, and challenges. Comput. Commun. 2020, 151, 395–418. [Google Scholar] [CrossRef]

- Hwang, J.; Choi, M.-I.; Lee, T.; Jeon, S.; Kim, S.; Park, S.; Park, S. Energy Prosumer Business Model Using Blockchain System to Ensure Transparency and Safety. Energy Procedia 2017, 141, 194–198. [Google Scholar] [CrossRef]

- Wang, Q.; Su, M. Integrating blockchain technology into the energy sector–from theory of blockchain to research and application of energy blockchain. Comput. Sci. Rev. 2020, 37, 100275. [Google Scholar] [CrossRef]

- Teufel, S.; Teufel, B. The crowd energy concept. J. Electron. Sci. Technol. 2014, 12, 263–269. [Google Scholar]

- Johnson, L.; Isam, A.; Gogerty, N.; Zitoli, J. Connecting the Blockchain to the Sun to Save the Planet. Available online: https://www.ssrn.com/index.cfm/en/ (accessed on 9 April 2022). [CrossRef]

- Dispenza, J.; Garcia, C.; Molecke, R. Energy Efficiency Coin (EECoin) a Blockchain Asset Class Pegged to Renewable Energy Markets. EnLedger Corp Lewes, DE, USA, Tech. Rep, 1: 2017. Available online: https://www.enledger.io/Energy_Efficiency_Coin_Whitepaper_v1_0.pdf (accessed on 9 May 2022).

- The Eco Coin. Introducing a Digital Crypto Agora. Available online: https://www.ecocoin.com/blog-posts/the-return-of-direct-democracy-introducing-a-digital-agora-to-the-crypto-world (accessed on 9 May 2022).

- Mihaylov, M.; Jurado, S.; Narcis, A.; Van Moffaert, K.; Magrans, I.; Nowe, A. NRGcoin: Virtual currency for trading of renewable energy in smart grids. In Proceedings of the International Conference on the European Energy Market (EEM), Krakow, Poland, 28–30 May 2014; pp. 1–6. [Google Scholar]

- Mihaylov, M.; Razo-Zapata, I.; Nowé, A. NRGcoin—A Blockchain-based Reward Mechanism for Both Production and Consumption of Renewable Energy. In Transforming Climate Finance and Green Investment with Blockchains; Academic Press: Cambridge, MS, USA, 2018; pp. 111–131. [Google Scholar] [CrossRef]

- Hafeez, S.; Juszczyk, O.; Takala, J. A Roadmap for successful IoT implementation: Empirical evidence from the energy industry. Issues Inf. Syst. 2021, 22, 92–113. [Google Scholar] [CrossRef]

- Motlagh, N.H.; Mohammadrezaei, M.; Hunt, J.; Zakeri, B. Internet of Things (IoT) and the Energy Sector. Energies 2020, 13, 494. [Google Scholar] [CrossRef] [Green Version]

- Brilliantova, V.; Thurner, T.W. Blockchain and the future of energy. Technol. Soc. 2018, 57, 38–45. [Google Scholar] [CrossRef]

- Khatoon, A.; Verma, P.; Southernwood, J.; Massey, B.; Corcoran, P. Blockchain in Energy Efficiency: Potential Applications and Benefits. Energies 2019, 12, 3317. [Google Scholar] [CrossRef] [Green Version]

- Al-Ali, A. Internet of Things Role in the Renewable Energy Resources. Energy Procedia 2016, 100, 34–38. [Google Scholar] [CrossRef] [Green Version]

- Latif, S.; Idrees, Z.; Ahmad, J.; Zheng, L.; Zou, Z. A blockchain-based architecture for secure and trustworthy operations in the industrial Internet of Things. J. Ind. Inf. Integr. 2020, 21, 100190. [Google Scholar] [CrossRef]

- Wang, N.; Zhou, X.; Lu, X.; Guan, Z.; Wu, L.; Du, X.; Guizani, M. When Energy Trading Meets Blockchain in Electrical Power System: The State of the Art. Appl. Sci. 2019, 9, 1561. [Google Scholar] [CrossRef]

- Dutch Energy Company BAS Nederland Accepting Bitcoin Payments. Available online: https://www.newsbtc.com/news/dutch-energy-company-bas-nederland-accepting-bitcoin-payments/ (accessed on 9 May 2022).

- German Energy Company Enercity Enables Bitcoin Payments. Available online: https://www.newsbtc.com/news/bitcoin/german-energy-company-enercity-enables-bitcoin-payments/ (accessed on 9 May 2022).

- Japan-based Marubeni Agrees to Back Blockchain Power Purchasing Platform. Available online: https://www.asiablockchainreview.com/japan-based-marubeni-agrees-to-back-blockchain-power-purchasing-platform/ (accessed on 9 May 2022).

- Wang, Q.; Li, R.; Zhan, L. Blockchain technology in the energy sector: From basic research to real world applications. Comput. Sci. Rev. 2021, 39, 100362. [Google Scholar] [CrossRef]

- Macrinici, D.; Cartofeanu, C.; Gao, S. Smart contract applications within blockchain technology: A systematic mapping study. Telemat. Inform. 2018, 35, 2337–2354. [Google Scholar] [CrossRef]

- Truby, J. Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies. Energy Res. Soc. Sci. 2018, 44, 399–410. [Google Scholar] [CrossRef]

- Esmat, A.; de Vos, M.; Ghiassi-Farrokhfal, Y.; Palensky, P.; Epema, D. A novel decentralized platform for peer-to-peer energy trading market with blockchain technology. Appl. Energy 2020, 282, 116123. [Google Scholar] [CrossRef]

- Wu, Y.; Wu, Y.; Cimen, H.; Vasquez, J.C.; Guerrero, J.M. P2P energy trading: Blockchain-enabled P2P energy society with multi-scale flexibility services. Energy Rep. 2022, 8, 3614–3628. [Google Scholar] [CrossRef]

- Zhao, F.; Guo, X.; Chan, W.K. Individual Green Certificates on Blockchain: A Simulation Approach. Sustainability 2020, 12, 3942. [Google Scholar] [CrossRef]

- Domínguez-Navarro, J.; Dufo-López, R.; Yusta-Loyo, J.; Artal-Sevil, J.; Bernal-Agustín, J. Design of an electric vehicle fast-charging station with integration of renewable energy and storage systems. Int. J. Electr. Power Energy Syst. 2018, 105, 46–58. [Google Scholar] [CrossRef]

- Van Leeuwen, G.; AlSkaif, T.; Gibescu, M.; van Sark, W. An integrated blockchain-based energy management platform with bilateral trading for microgrid communities. Appl. Energy 2020, 263, 114613. [Google Scholar] [CrossRef]

- Martins, J.P.; Ferreira, J.C.; Monteiro, V.; Afonso, J.A.; Afonso, J.L. IoT and Blockchain Paradigms for EV Charging System. Energies 2019, 12, 2987. [Google Scholar] [CrossRef] [Green Version]

- Fu, Z.; Dong, P.; Ju, Y. An intelligent electric vehicle charging system for new energy companies based on consortium blockchain. J. Clean. Prod. 2020, 261, 121219. [Google Scholar] [CrossRef]

- Dierksmeier, C.; Seele, P. Blockchain and business ethics. Bus. Ethic Eur. Rev. 2019, 29, 348–359. [Google Scholar] [CrossRef]

- Liu, H.; Zhang, Y.; Yang, T. Blockchain-Enabled Security in Electric Vehicles Cloud and Edge Computing. IEEE Netw. 2018, 32, 78–83. [Google Scholar] [CrossRef]

- Lakhani, K.R.; Iansiti, M. The truth about blockchain. Harv. Bus. Rev. 2017, 95, 119–127. [Google Scholar]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A Review on Circular Economy: The Expected Transition to a Balanced Interplay of Environmental and Economic Systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Nyman, T. Increased Transparency and Prevention of Unethical Actions in the Textile Industry’s Supply Chain through Blockchain; Aalto University: Espoo, Finland, 2019. [Google Scholar]

- Yildizbasi, A. Blockchain and renewable energy: Integration challenges in circular economy era. Renew. Energy 2021, 176, 183–197. [Google Scholar] [CrossRef]

- Narayan, R.; Tidström, A. Tokenizing coopetition in a blockchain for a transition to circular economy. J. Clean. Prod. 2020, 263, 121437. [Google Scholar] [CrossRef]

- Hazari, S.S.; Mahmoud, Q.H. Improving Transaction Speed and Scalability of Blockchain Systems via Parallel Proof of Work. Futur. Internet 2020, 12, 125. [Google Scholar] [CrossRef]

- Zhou, Q.; Huang, H.; Zheng, Z.; Bian, J. Solutions to Scalability of Blockchain: A Survey. IEEE Access 2020, 8, 16440–16455. [Google Scholar] [CrossRef]

- Hafid, A.; Hafid, A.S.; Samih, M. Scaling Blockchains: A Comprehensive Survey. IEEE Access 2020, 8, 125244–125262. [Google Scholar] [CrossRef]

- Di Silvestre, M.L.; Gallo, P.; Guerrero, J.M.; Musca, R.; Sanseverino, E.R.; Sciumè, G.; Vasquez, J.C.; Zizzo, G. Blockchain for power systems: Current trends and future applications. Renew. Sustain. Energy Rev. 2020, 119, 109585. [Google Scholar] [CrossRef]

- Schot, J.; Geels, F.W. Strategic niche management and sustainable innovation journeys: Theory, findings, research agenda, and policy. Technol. Anal. Strat. Manag. 2008, 20, 537–554. [Google Scholar] [CrossRef]

- Geels, F.W. Regime Resistance against Low-Carbon Transitions: Introducing Politics and Power into the Multi-Level Perspective. Theory Cult. Soc. 2014, 31, 21–40. [Google Scholar] [CrossRef] [Green Version]

- Renewable Energy Companies in Finland. Available online: https://www.energy-xprt.com/companies/keyword-renewable-energy-658/location-finland (accessed on 10 May 2022).

- Top Renewable Energy Startups and Companies in Finland. 2021. Available online: https://beststartup.eu/47-top-renewable-energy-startups-and-companies-in-finland-2021/ (accessed on 10 May 2022).

- Voss, C. Case research in operations management. In Researching Operations Management; Routledge: London, UK, 2010; pp. 176–209. [Google Scholar]

- Eisenhardt, K.M. Building Theories from Case Study Research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods; Sage Publications: Thousand Oaks, CA, USA, 2019. [Google Scholar]

- Patton, M.Q. Qualitative Research & Evaluation Methods: Integrating Theory and Practice; Sage Publications: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Creswell, J.W.; Clark, V.L.P. Designing and Conducting Mixed Methods Research; Sage Publications: Thousand Oaks, CA, USA, 2017. [Google Scholar]

| Industrial Segment | Application of Blockchain | Authors |

|---|---|---|

| Government/Public sector |

| [32,33,34,35,36,37,38] |

| Industrial sector |

| [39,40,41,42,43,44] |

| Financial services |

| [45,46,47,48] |

| Insurance policy |

| [49,50,51] |

| Retail business |

| [52,53] |

| Luxury business |

| [54,55,56] |

| Sustainable and circular supply chains |

| [18,57,58,59] |

| Supply chain and logistics |

| [19,60,61,62,63,64] |

| Company | Technology Focus | Interviewee’s Role | Length of the Interview |

|---|---|---|---|

| A | Wind Power | Head of Project Development | 1 h 10 min |

| B | Wind Power | Vice President, Energy Management | 1 h |

| C | Automation and Electrification of Wind Power | Executive Vice President, Marketing and Sales | 55 min |

| D | Wind and Solar Power | CEO | 55 min |

| E | Solar PV | CEO | 1 h 20 min |

| F | Circular Economy, Waste to Energy | CEO | 1 h |

| G | Energy hub; Smart Grids, Energy Efficiency, Marine | Communications and Brand Manager | 1 h 10 min |

| H | Cluster management; Electricity from Wind and Hydrogen |

| 1 h 45 min |

| I | Smart energy solutions | CEO | 1 h |

| J | Electricity and district heating from renewables | Development Director | 1 h 20 min |

| Benefit Category | Favorable Implications | Mentioned by Companies |

|---|---|---|

| Decentralization of authority | Transparency, cost- and time-efficiency, P2P energy trading platforms, novel markets creation, energy democratization | A, B, C, D, F, G, H, J (80%) |

| Smart contracts, smart meters, IoE | Automation, integrity, trust, security, energy digitalization | A, B, C, D, E, F, G, H, I (90%) |

| Traceability | Energy provenance, auditability, green certification, CSR and image improvement, circular economy practices | C, D, E, F, G, H, J (70%) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Juszczyk, O.; Shahzad, K. Blockchain Technology for Renewable Energy: Principles, Applications and Prospects. Energies 2022, 15, 4603. https://doi.org/10.3390/en15134603

Juszczyk O, Shahzad K. Blockchain Technology for Renewable Energy: Principles, Applications and Prospects. Energies. 2022; 15(13):4603. https://doi.org/10.3390/en15134603

Chicago/Turabian StyleJuszczyk, Oskar, and Khuram Shahzad. 2022. "Blockchain Technology for Renewable Energy: Principles, Applications and Prospects" Energies 15, no. 13: 4603. https://doi.org/10.3390/en15134603

APA StyleJuszczyk, O., & Shahzad, K. (2022). Blockchain Technology for Renewable Energy: Principles, Applications and Prospects. Energies, 15(13), 4603. https://doi.org/10.3390/en15134603