Evaluating the Effect of Demand Response Programs (DRPs) on Robust Optimal Sizing of Islanded Microgrids

Abstract

:1. Introduction

- Robust optimal sizing along with a novel shiftable DRP;

- Most of the existing literature optimized the sizing problem without considering the uncertain nature of RESs, and the ones which have considered the uncertainties, have not used the RO along with DRPs; in this research, the uncertainties are considered using RO along with a shiftable DRP;

- Generating tradeoff scenarios by the robust optimal sizing method for simultaneous investor persuasion and covering the RESs uncertainty, as the main purpose of DRP application;

- In addition to considering uncertainty along with a shiftable DRP, a novelty of this work is investigating correlations between different sources.

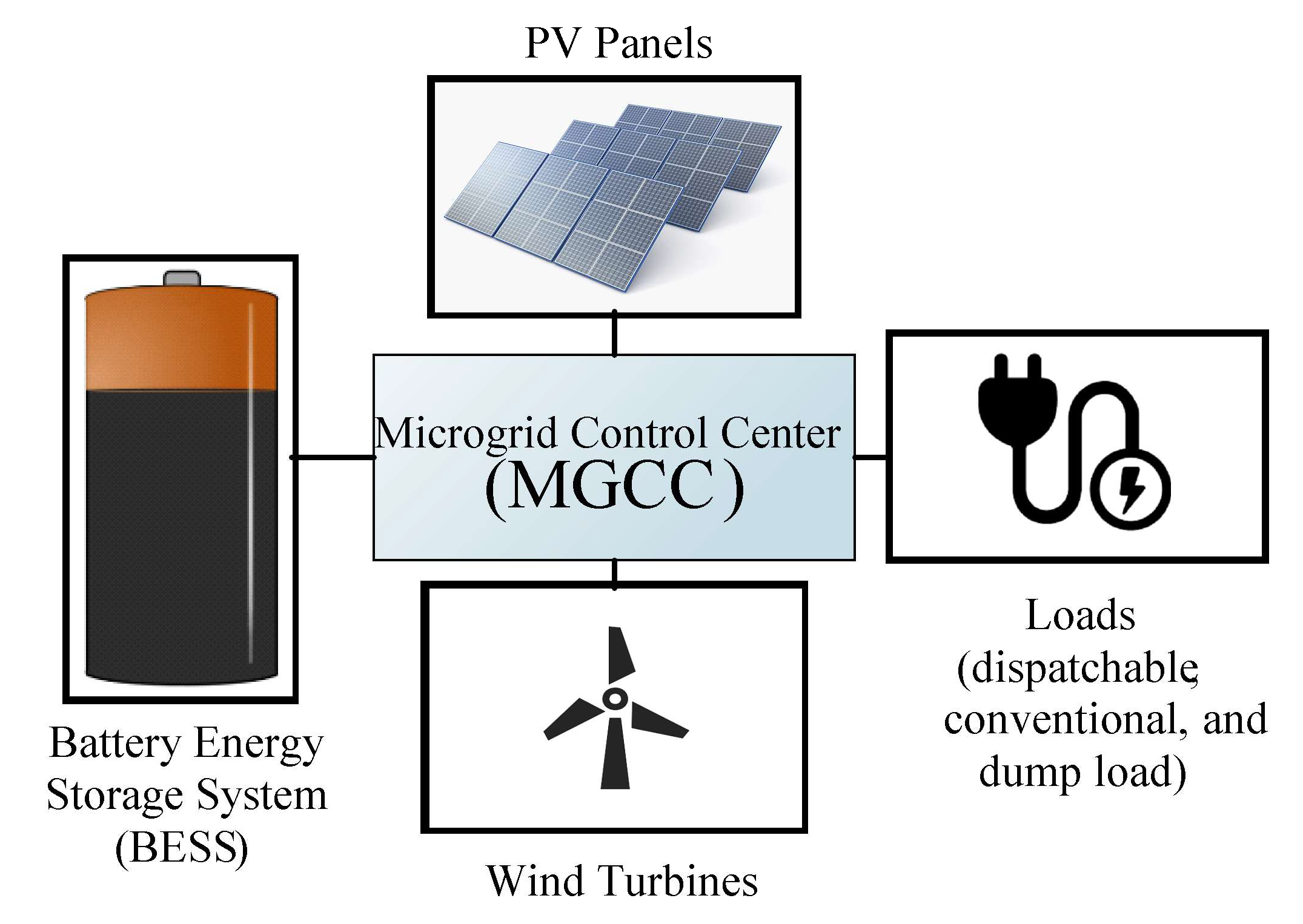

2. Model of Studied IMG

3. Sizing Problem Formulation

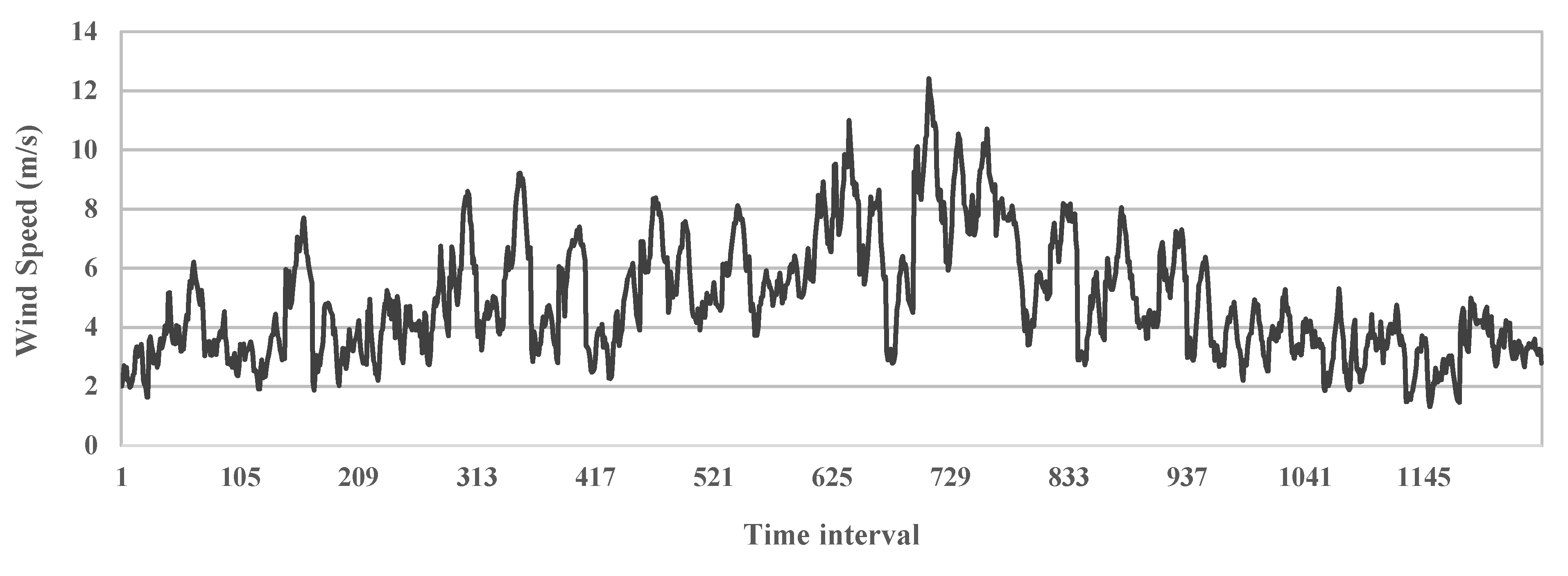

3.1. Wind Turbine Model

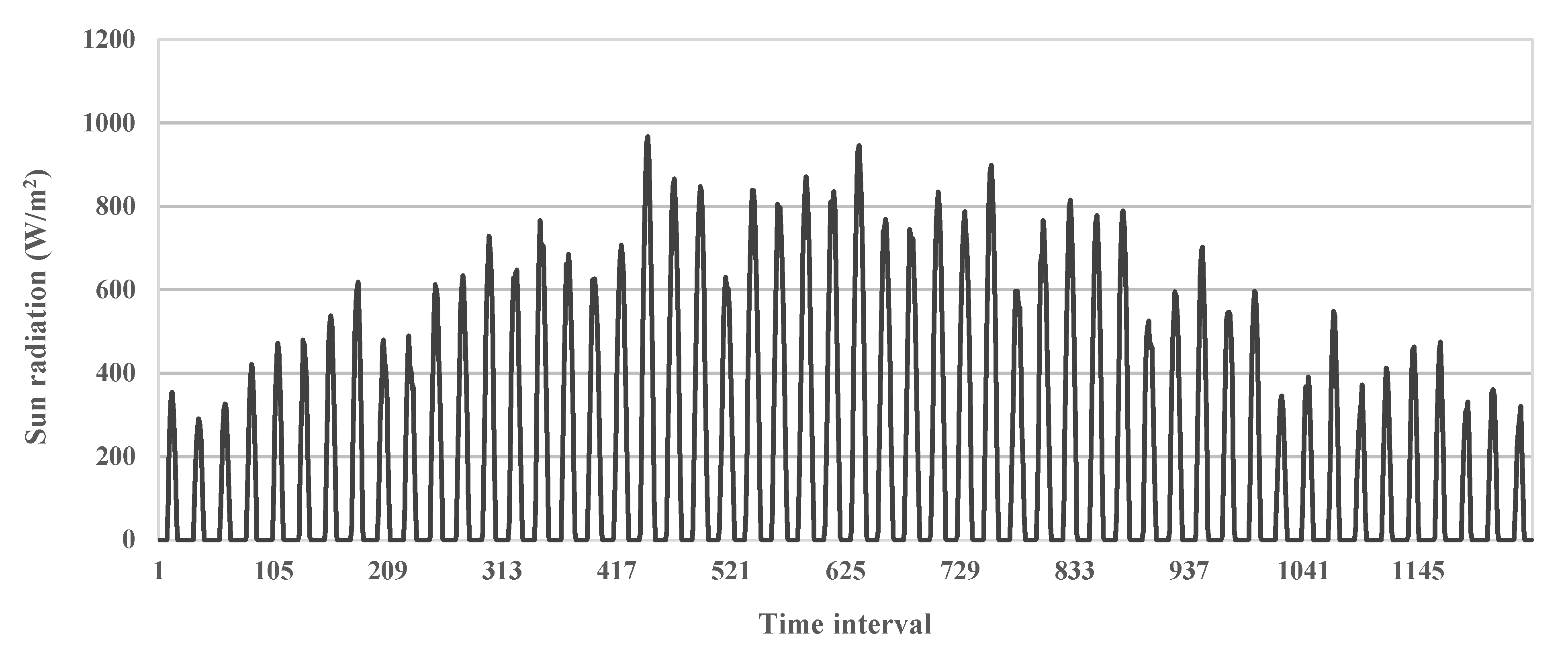

3.2. Solar Panel Model

3.3. BESS Model

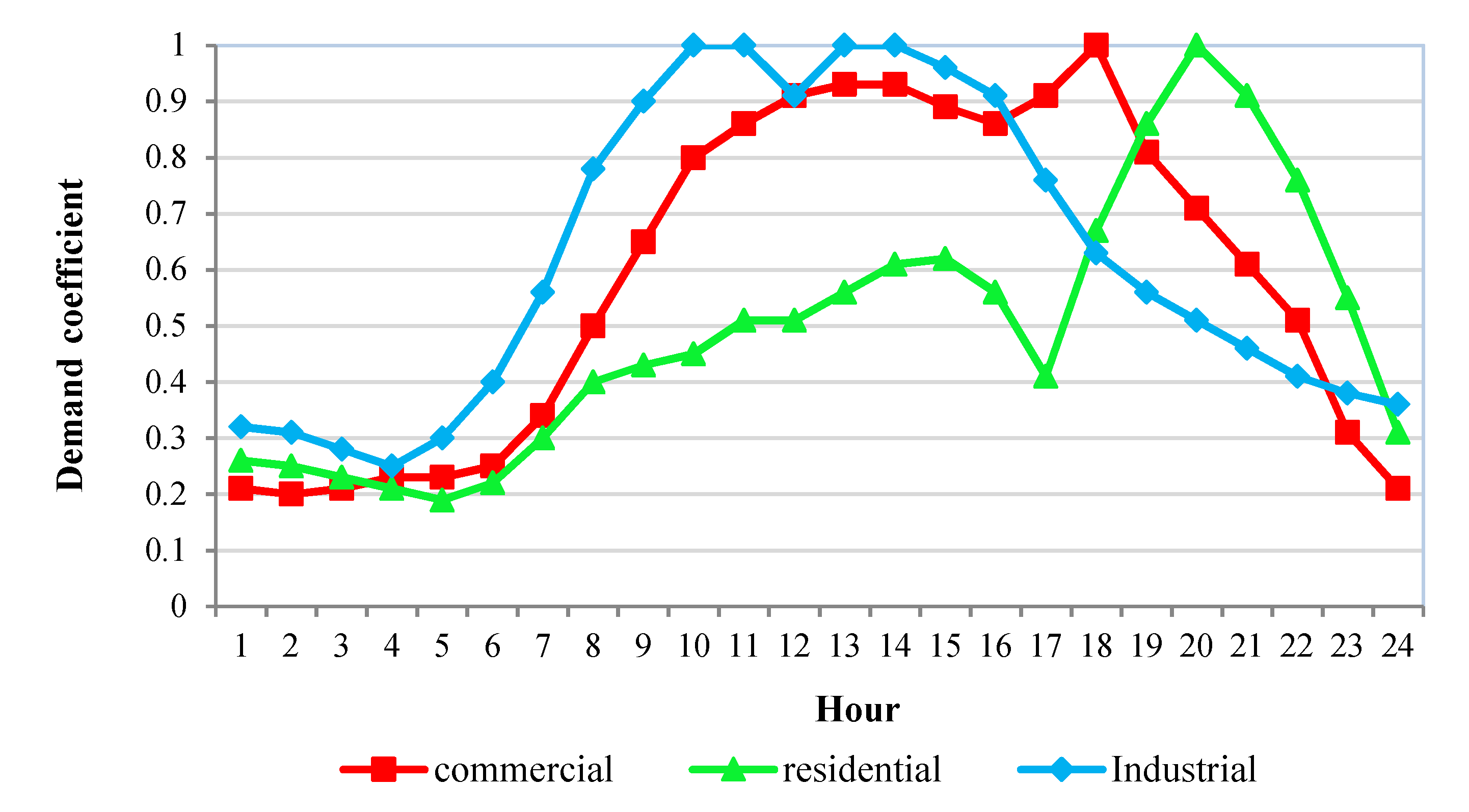

3.4. Demand Model

3.5. The Proposed DRP Model

3.6. Power Balance

3.7. Objective Function

4. RO Method

4.1. General Form of RO

4.2. Robust Form of IMG Sizing Problem

5. Case Study

6. Simulations and Sensitivity Analysis

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Abbreviations

| Nomenclature | |

| Operation and maintenance cost | |

| Replacement cost | |

| Residual value | |

| Lifetime of components | |

| Total lifetime of the project | |

| Investment cost | |

| Net present cost | |

| Objective function | |

| Size of components | |

| Discount rate | |

| Index for problem components | |

| Wind turbine output (kW) | |

| Wind turbine rated power (kW) | |

| Wind speed | |

| Wind turbine rated speed | |

| Wind turbine cut-in speed | |

| Wind turbine cut-out speed | |

| PV panels output (kW) | |

| PV panel rated power (kW) | |

| Sun radiant (w/m2) | |

| PV panels power reduction factor | |

| PV panels temperature coefficient | |

| PV panels cell standard test conditions (STC) temperature | |

| PV panels cell temperature | |

| Normal operation cell temperature | |

| Ambient temperature | |

| Seasonal demand effect | |

| Demand coefficient | |

| Peak demand coefficient | |

| Constant percentage of demand | |

| Hourly demand of islanded microgrid (IMG) | |

| BESS state of charge | |

| BESS self-discharge coefficient | |

| BESS efficiency | |

| BESS charged power | |

| BESS discharged power | |

| , | BESS charge and discharge binary variables |

| Maximum charge or discharge rate of battery energy storage system (BESS) | |

| , | Minimum and maximum capacity of BESS |

| BESS depth of discharge | |

| BESS rated capacity | |

| Shifted-in demand | |

| Shifted-out demand | |

| DRP participation percentage | |

| Demand after implementation of demand response programs (DRP) | |

| , | Integer and continuous coefficients of variables |

| , | Integer and continuous variables |

| ,, | Uncertain parameter matrices |

| The uncertain output power of renewable energy sources (RESs) | |

| , | Uncertainty upper and lower bounds for RESs |

| , | Uncertainty decision variables for lower and upper bounds of RESs |

| Robust uncertainty budget factor | |

| ,, | Duality variables for and lower and upper bounds for uncertainty decision variables (k |

References

- Ustun, T.S.; Ozansoy, C.; Zayegh, A. Recent developments in microgrids and example cases around the world—A review. Renew. Sustain. Energy Rev. 2011, 15, 4030–4041. [Google Scholar] [CrossRef]

- Chen, C.; Duan, S.; Cai, T.; Liu, B.; Hu, G. Smart energy management system for optimal microgrid economic operation. IET Renew. Power Gener. 2011, 5, 258. [Google Scholar] [CrossRef]

- Shen, J.; Jiang, C.; Liu, Y.; Qian, J. A microgrid energy management system with demand response for providing grid peak shaving. Electr. Power Compon. Syst. 2016, 44, 843–852. [Google Scholar] [CrossRef]

- Hosseini Imani, M.; Niknejad, P.; Barzegaran, M.R. The impact of customers’ participation level and various incentive values on implementing emergency demand response program in microgrid operation. Int. J. Electr. Power Energy Syst. 2018, 96, 114–125. [Google Scholar] [CrossRef]

- Palensky, P.; Dietrich, D. Demand side management: Demand response, intelligent energy systems, and smart loads. Ind. Inform. 2011, 7, 381–388. [Google Scholar] [CrossRef] [Green Version]

- U.S. Department of Energy. Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them; U.S. Department of Energy: Washington, DC, USA, 2006; p. 122.

- Kammen, D.M. Proceedings of the Renewable energy options for the emerging economy: Advances, opportunities and obstacles. Background paper for “The 10-50 Solution: Technologies and Policies for a Low-Carbon Future” Pew Center & NCEP Conference. Washington, DC, USA, 25–26 March 2004; Available online: https://scholar.google.com/scholar?cluster=2465164507733390681&hl=en&as_sdt=0,5 (accessed on 30 August 2021).

- Khodaei, A.; Bahramirad, S.; Shahidehpour, M. Microgrid planning under uncertainty. IEEE Trans. Power Syst. 2015, 30, 2417–2425. [Google Scholar] [CrossRef]

- Maleki, A.; Askarzadeh, A. Optimal sizing of a PV/wind/diesel system with battery storage for electrification to an off-grid remote region: A case study of Rafsanjan, Iran. Sustain. Energy Technol. Assess. 2014, 7, 147–153. [Google Scholar] [CrossRef]

- Katsigiannis, Y.A.; Georgilakis, P.S.; Karapidakis, E.S. Hybrid simulated annealing-Tabu search method for optimal sizing of autonomous power systems with renewables. IEEE Trans. Sustain. Energy 2012, 3, 330–338. [Google Scholar] [CrossRef]

- Maleki, A.; Ameri, M.; Keynia, F. Scrutiny of multifarious particle swarm optimization for finding the optimal size of a PV/Wind/Battery hybrid system. Renew. Energy 2015, 80, 552–563. [Google Scholar] [CrossRef]

- Akram, U.; Khalid, M.; Shafiq, S. Optimal sizing of a wind/solar/battery hybrid grid-connected microgrid system. IET Renew. Power Gener. 2018, 12, 72–80. [Google Scholar] [CrossRef]

- Moretti, L.; Meraldi, L.; Niccolai, A.; Manzolini, G.; Leva, S. An innovative tunable rule-based strategy for the predictive management of hybrid microgrids. Electronics 2021, 10, 1162. [Google Scholar] [CrossRef]

- Jafari, A.; Ganjehlou, H.G.; Khalili, T.; Mohammadi-Ivatloo, B.; Bidram, A.; Siano, P. A two-loop hybrid method for optimal placement and scheduling of switched capacitors in distribution networks. IEEE Access 2020, 8, 38892–38906. [Google Scholar] [CrossRef]

- Ramli, M.A.; Bouchekara, H.; Alghamdi, A.S. Optimal sizing of PV/Wind/Diesel hybrid microgrid system using multi-objective self-adaptive differential evolution algorithm. Renew. Energy 2018, 121, 400–411. [Google Scholar] [CrossRef]

- Jafari, A.; Ganjehlou, H.G.; Darbandi, F.B.; Mohammdi-Ivatloo, B.; Abapour, M. Dynamic and multi-objective reconfiguration of distribution network using a novel hybrid algorithm with parallel processing capability. Appl. Soft Comput. 2020, 90, 106146. [Google Scholar] [CrossRef]

- Ganjehlou, H.G.; Niaei, H.; Jafari, A.; Aroko, D.O.; Marzband, M.; Fernando, T. A novel techno-economic multi-level optimization in home-microgrids with coalition formation capability. Sustain. Cities Soc. 2020, 60, 102241. [Google Scholar] [CrossRef]

- Ahmad, F.; Alam, M.S. Optimal sizing and analysis of solar PV, wind, and energy storage hybrid system for campus microgrid. Smart Sci. 2018, 6, 150–157. [Google Scholar] [CrossRef]

- Amrollahi, M.H.; Bathaee, S.M.T. Techno-economic optimization of hybrid photovoltaic/wind generation together with energy storage system in a stand-alone micro-grid subjected to demand response. Appl. Energy 2017, 202, 66–77. [Google Scholar] [CrossRef]

- Belfkira, R.; Zhang, L.; Barakat, G. Optimal sizing study of hybrid wind/PV/diesel power generation unit. Sol. Energy 2011, 85, 100–110. [Google Scholar] [CrossRef]

- Khalili, T.; Ganjehlou, H.G.; Bidram, A.; Nojavan, S.; Asadi, S. Financial risk-based scheduling of micro grids accompanied by surveying the influence of the demand response program. In Proceedings of the 2021 IEEE/IAS 57th Industrial and Commercial Power Systems Technical Conference, Las Vegas, NV, USA, 27–30 April 2021; pp. 1–9. [Google Scholar]

- Diaf, S.; Diaf, D.; Belhamel, M.; Haddadi, M.; Louche, A. A methodology for optimal sizing of autonomous hybrid PV/wind system. Energy Policy 2007, 35, 5708–5718. [Google Scholar] [CrossRef] [Green Version]

- Moretti, L.; Polimeni, S.; Meraldi, L.; Raboni, P.; Leva, S.; Manzolini, G. Assessing the impact of a two-layer predictive dispatch algorithm on design and operation of off-grid hybrid microgrids. Renew. Energy 2019, 143, 1439–1453. [Google Scholar] [CrossRef]

- Jafari, A.; Ganjehlou, H.G.; Khalili, T.; Bidram, A. A fair electricity market strategy for energy management and reliability enhancement of islanded multi-microgrids. Appl. Energy 2020, 270, 115170. [Google Scholar] [CrossRef]

- Yazdani, A.; Bhuiyan, F.A.; Primak, S.L. Optimal sizing approach for islanded microgrids. IET Renew. Power Gener. 2015, 9, 166–175. [Google Scholar] [CrossRef]

- Wang, Z.; Chen, B.; Wang, J.; Kim, J.; Begovic, M.M. Robust optimization based optimal DG placement in microgrids. IEEE Trans. Smart Grid 2014, 5, 2173–2182. [Google Scholar] [CrossRef]

- Eltamaly, A.M.; Mohamed, M.A.; Alolah, A.I. A novel smart grid theory for optimal sizing of hybrid renewable energy systems. Sol. Energy 2016, 124, 26–38. [Google Scholar] [CrossRef]

- Jafari, A.; Khalili, T.; Ganjehlou, H.G.; Bidram, A. Optimal integration of renewable energy sources, diesel generators, and demand response program from pollution, financial, and reliability viewpoints: A multi-objective approach. J. Clean. Prod. 2020, 247, 119100. [Google Scholar] [CrossRef]

- Uluski, R.; Kumar, J.; Venkata, S.S.; Vishwakarma, D.; Schneider, K.; Mehrizi-Sani, A.; Terry, R.; Agate, W. Microgrid controller design, implementation, and deployment: A journey from conception to implementation at the philadelphia navy yard. IEEE Power Energy Mag. 2017, 15, 50–62. [Google Scholar] [CrossRef]

- Folmer, R.L.; Griest, S.E.; Meikle, M.B.; Martin, W.H. Tinnitus severity, loudness, and depression. Otolaryngol.—Head Neck Surg. 1999, 121, 48–51. [Google Scholar] [CrossRef]

- Li, L.; Wang, Y.; Liu, Y. Wind velocity prediction at wind turbine hub height based on CFD model. In Proceedings of the 2013 International Conference on Materials for Renewable Energy and Environment, Chengdu, China, 19–21 August 2013; volume 1, pp. 411–414. [Google Scholar]

- Lan, H.; Wen, S.; Hong, Y.Y.; Yu, D.C.; Zhang, L. Optimal sizing of hybrid PV/diesel/battery in ship power system. Appl. Energy 2015, 158, 26–34. [Google Scholar] [CrossRef] [Green Version]

- Park, C.S.; Kim, G.; Choi, S. Engineering Economics; Prentice Hall: Upper Saddle River, NJ, USA, 2007; Volume 22. [Google Scholar]

- Li, C.Z.; Shi, Y.M.; Huang, X.H. Sensitivity analysis of energy demands on performance of CCHP system. Energy Convers. Manag. 2008, 49, 3491–3497. [Google Scholar] [CrossRef]

- Mavrotas, G.; Diakoulaki, D.; Florios, K.; Georgiou, P. A mathematical programming framework for energy planning in services’ sector buildings under uncertainty in load demand: The case of a hospital in athens. Energy Policy 2008, 36, 2415–2429. [Google Scholar] [CrossRef]

- Siddiqui, A.S.; Marnay, C. Distributed generation investment by a microgrid under uncertainty. Energy 2008, 33, 1729–1737. [Google Scholar] [CrossRef] [Green Version]

- Rezvan, A.T.; Gharneh, N.S.; Gharehpetian, G.B. Robust optimization of distributed generation investment in buildings. Energy 2012, 48, 455–463. [Google Scholar] [CrossRef]

- Bertsimas, D.; Sim, M. The price of robustness. Oper. Res. 2004, 52, 35–53. [Google Scholar] [CrossRef]

- Gorissen, B.L.; Yanikoğlu, I.; den Hertog, D. A practical guide to robust optimization. Omega 2015, 53, 124–137. [Google Scholar] [CrossRef] [Green Version]

- Zheng, T.; Zhao, J.; Litvinov, E.; Zhao, F. Robust optimization and its application to power system operation. CIGRE Int. Counc. Large Electr. Syst. 2012, 1–8. Available online: https://e-cigre.org/publication/C2-110_2012-robust-optimization-and-its-application-to-power-system-operation (accessed on 30 August 2021).

- Soyster, A.L. Technical note—Convex programming with set-inclusive constraints and applications to inexact linear programming. Oper. Res. 1973, 21, 1154–1157. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.; Ding, R.; Floudas, C.A. A comparative theoretical and computational study on robust counterpart optimization: I. robust linear optimization and robust mixed integer linear optimization. Ind. Eng. Chem. Res. 2011, 50, 10567–10603. [Google Scholar] [CrossRef] [Green Version]

- Hussain, A.; Bui, V.H.; Kim, H.M. Robust optimization-based scheduling of multi-microgrids considering uncertainties. Energies 2016, 9, 278. [Google Scholar] [CrossRef] [Green Version]

- Hussain, A.; Bui, V.H.; Kim, H.M. Impact analysis of demand response intensity and energy storage size on operation of networked microgrids. Energies 2017, 10, 882. [Google Scholar] [CrossRef] [Green Version]

- Mehdizadeh, A.; Taghizadegan, N. Robust optimisation approach for bidding strategy of renewable generation-based microgrid under demand side management. IET Renew. Power Gener. 2017, 11, 1446–1455. [Google Scholar] [CrossRef]

- Sioshansi, R.; Conejo, A.J. Optimization Is Ubiquitous; Springer: Cham, Switzerland, 2017; Volume 120, ISBN 1931-6828. [Google Scholar]

- Mazidi, M.; Zakariazadeh, A.; Jadid, S.; Siano, P. Integrated scheduling of renewable generation and demand response programs in a microgrid. Energy Convers. Manag. 2014, 86, 1118–1127. [Google Scholar] [CrossRef]

- LAZARD. Lazard’S Levelized Cost of Storage Analysis—Version 3.0.; LAZARD: Hamilton, Bermuda, 2017. [Google Scholar]

- LAZARD. Lazard’s Levelized Cost of Energy Analysis—Version 11.0.; LAZARD: Hamilton, Bermuda, 2017. [Google Scholar]

- Corporation, G.D. General Algebraic Modeling System (GAMS). Release; General Algebraic Modeling System (GAMS): Washington, DC, USA, 2013. [Google Scholar]

- Tawarmalani, M.; Sahinidis, N.V. A polyhedral branch-and-cut approach to global optimization. Math. Program. 2005, 103, 225–249. [Google Scholar] [CrossRef]

| Type | ||||||

|---|---|---|---|---|---|---|

| Winter | Spring | Summer | Autumn | |||

| 5 | 1.1 | 1 | 1.1 | 1 | 0.25 | |

| 2 | 1.1 | 1 | 1.1 | 1 | ||

| 7.5 | 1.3 | 1 | 1.3 | 1 | ||

| PV Panels Specifications | Wind Turbine Specifications | BESS Specifications | |||

|---|---|---|---|---|---|

| Rated Power | 1 kW | Rated power ( | 3 kW | Rated Capacity () | 1 kW |

| 85% | 9 m/s | 80% | |||

| - | - | 20 m/s | Investment Cost () | 494 USD | |

| Lifetime () | 20 years | 2.1 m/s | Depth of Discharge ( | 80% | |

| Investment Cost () | 2500 USD | Lifetime () | 20 years | Self-Discharge () | 0.002 |

| - | - | Investment Cost () | 3900 USD | Lifetime () | 5 years |

| Project General Specifications | |||||

| Interest rate () | 6% | Replacement Cost ( | 90% | Residual Value () | 10% |

| 5% IC | Project Horizon () | 20 years | - | - | |

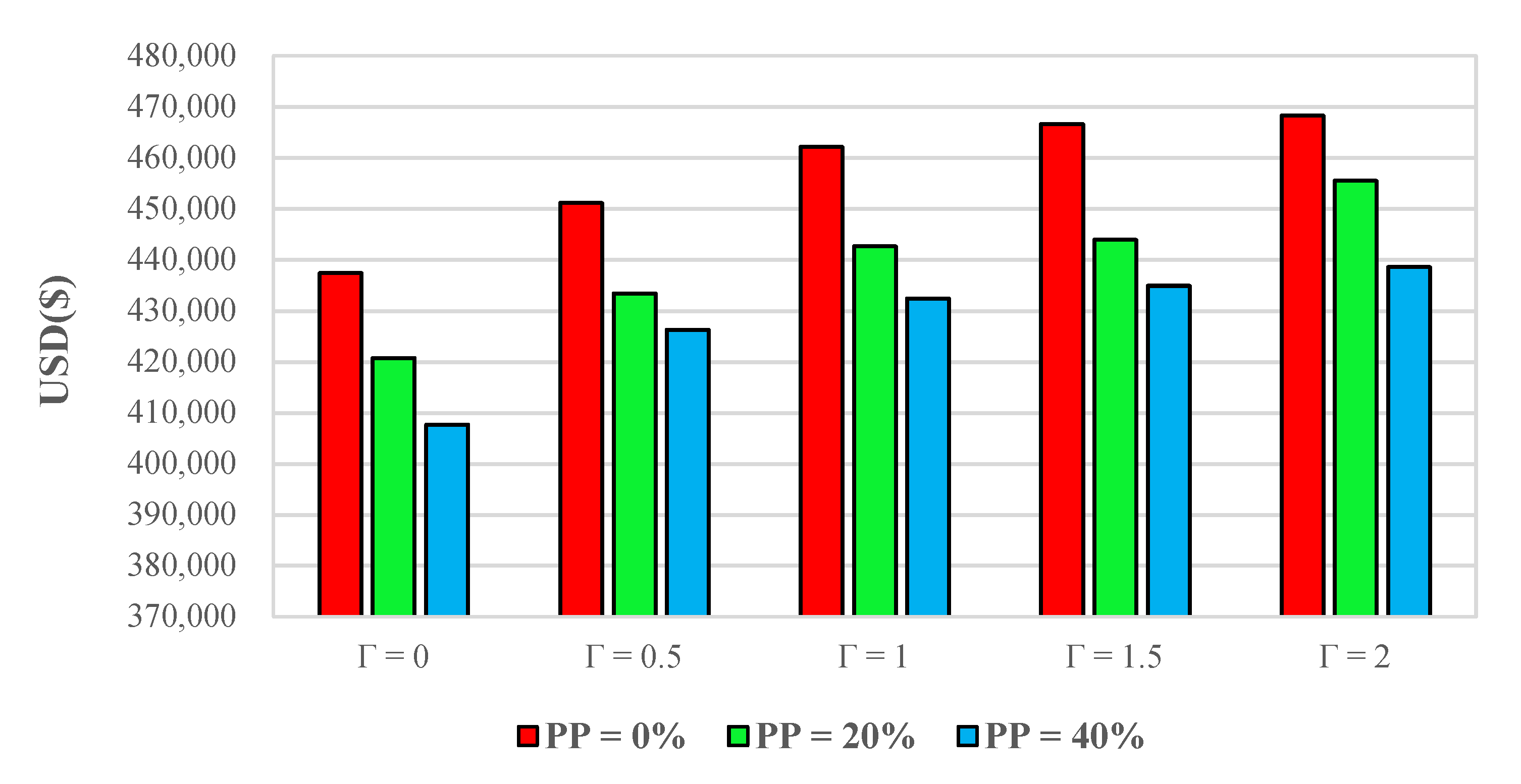

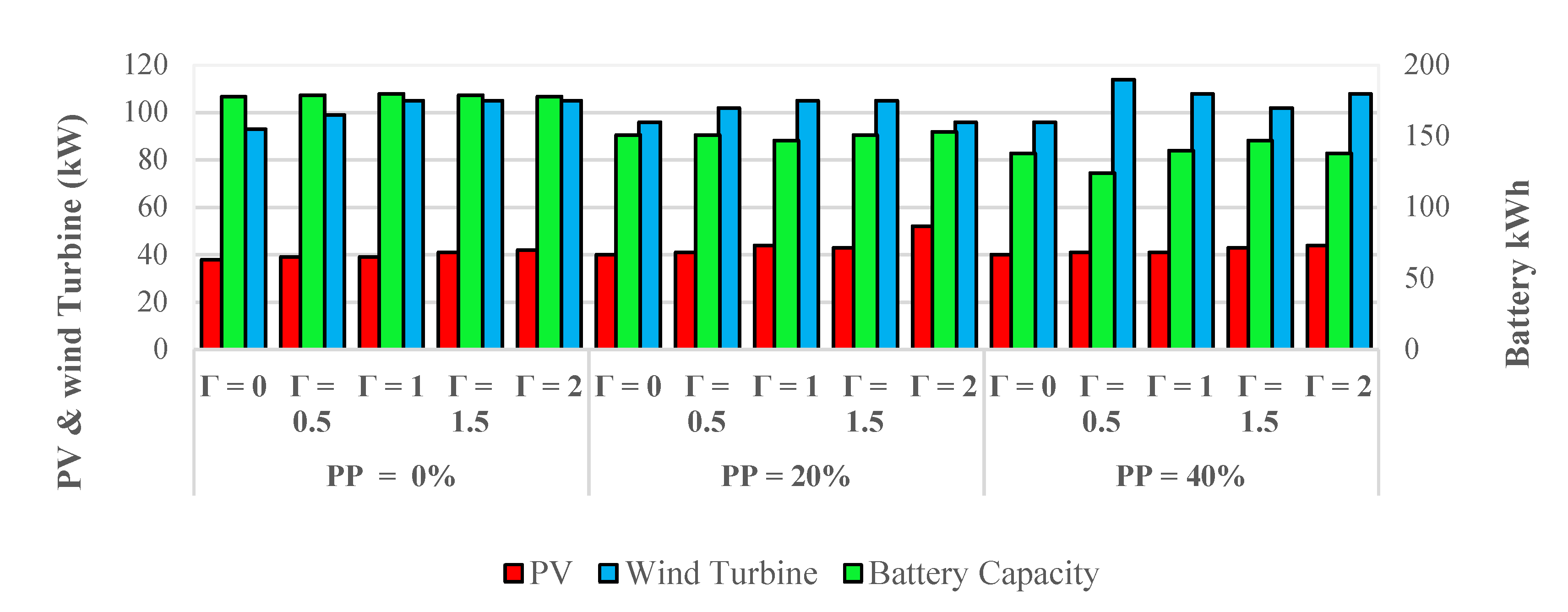

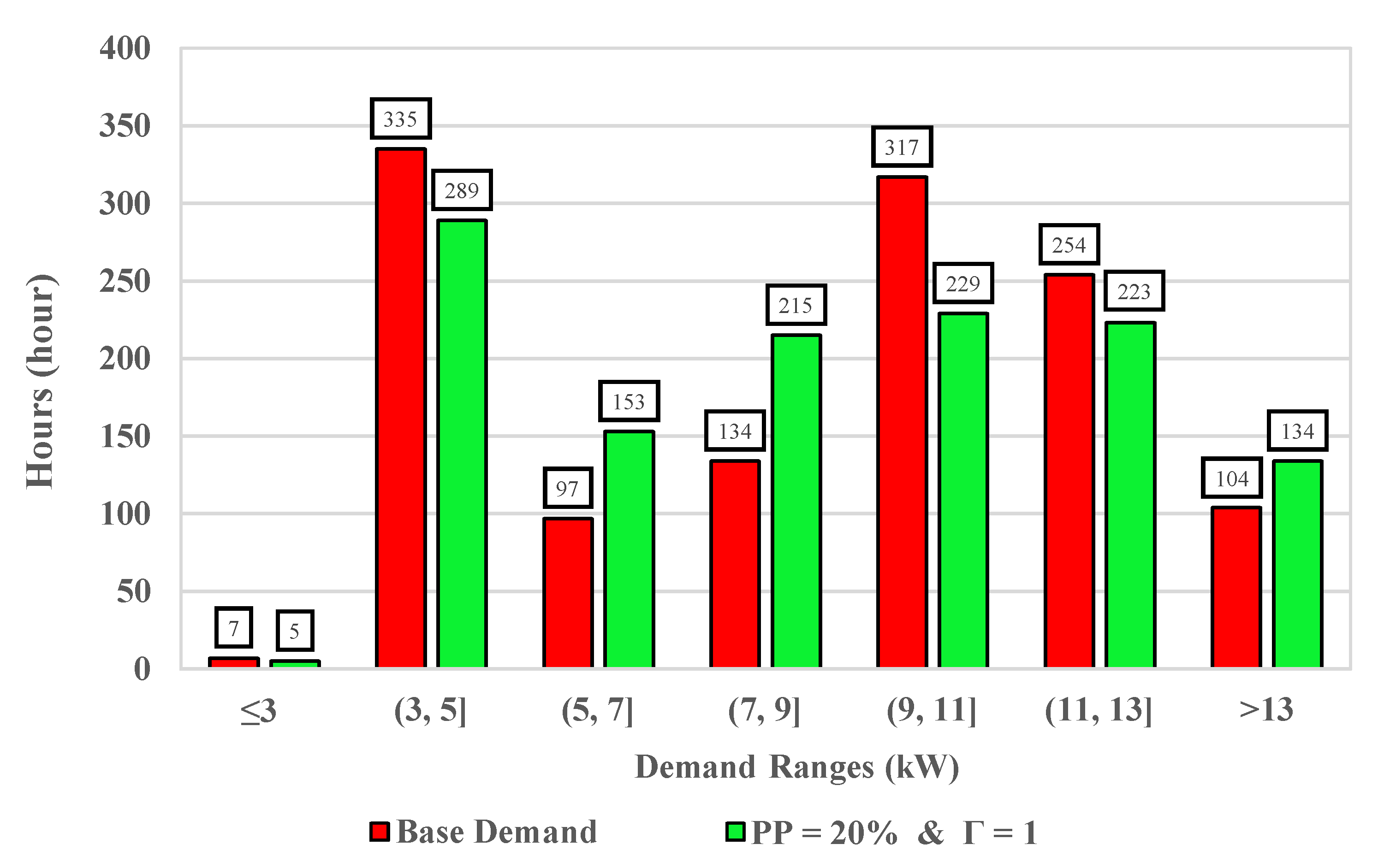

| Scenario | Uncertainty Set | NPC (USD) | ||

|---|---|---|---|---|

| 1 (BS) | - | 0 | 0% | 437,386.5 (BS) |

| 2 | - | 0 | 20% | 420,729.8 |

| 3 | - | 0 | 40% | 407,675.6 |

| 4 | %(90–110) | 0.5 | 0% | 451,116.7 |

| 5 | %(90–110) | 0.5 | 20% | 433,455.8 |

| 6 | %(90–110) | 0.5 | 40% | 426,338.4 |

| 7 | %(90–110) | 1 | 0% | 462,118.4 |

| 8 | %(90–110) | 1 | 20% | 442,623.4 |

| 9 | %(90–110) | 1 | 40% | 432,407.5 |

| 10 | %(90–110) | 1.5 | 0% | 466,571.3 |

| 11 | %(90–110) | 1.5 | 20% | 443,911.6 |

| 12 | %(90–110) | 1.5 | 40% | 434,896.2 |

| 13 | %(90–110) | 2 | 0% | 468,295.6 |

| 14 | %(90–110) | 2 | 20% | 455,480.1 |

| 15 | %(90–110) | 2 | 40% | 438,584.7 |

| 16 | %(80–120) | 0.5 | 0% | 462,118.4 |

| 17 | %(80–120) | 0.5 | 20% | 441,183.1 |

| 18 | %(80–120) | 0.5 | 40% | 432,407.5 |

| 19 | %(80–120) | 1 | 0% | 488,574.7 |

| 20 (TS) | %(80–120) | 1 | 20% | 470,913.8 (TS) |

| 21 | %(80–120) | 1 | 40% | 460,502.1 |

| 22 | %(80–120) | 1.5 | 0% | 495,756 |

| 23 | %(80–120) | 1.5 | 20% | 478,095.1 |

| 24 | %(80–120) | 1.5 | 40% | 466,373.2 |

| 25 (WS) | %(80–120) | 2 | 0% | 508,918.2 (WS) |

| 26 | %(80–120) | 2 | 20% | 488,004.9 |

| 27 | %(80–120) | 2 | 40% | 474,012.8 |

| GAMS Solver | BARON | ALPHAECP | LINDOGLOBAL | SCIP |

|---|---|---|---|---|

| Base Scenario’s Investment Cost (USD) | 437,386.5 | 441,381.1 | 444,283.8 | 442,123.3 |

| Scenario | Uncertainty Set | NPC (USD) | ||

|---|---|---|---|---|

| 1 (BS) | - | 0 | 0% | 437,386.5 (BS) |

| 25 (WS) | %(80–120) | 2 | 0% | 508,918.2 (WS) |

| 26 | %(80–120) | 2 | 20% | 488,004.9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Karami Darabi, M.; Ganjeh Ganjehlou, H.; Jafari, A.; Nazari-Heris, M.; B. Gharehpetian, G.; Abedi, M. Evaluating the Effect of Demand Response Programs (DRPs) on Robust Optimal Sizing of Islanded Microgrids. Energies 2021, 14, 5750. https://doi.org/10.3390/en14185750

Karami Darabi M, Ganjeh Ganjehlou H, Jafari A, Nazari-Heris M, B. Gharehpetian G, Abedi M. Evaluating the Effect of Demand Response Programs (DRPs) on Robust Optimal Sizing of Islanded Microgrids. Energies. 2021; 14(18):5750. https://doi.org/10.3390/en14185750

Chicago/Turabian StyleKarami Darabi, Mahdi, Hamed Ganjeh Ganjehlou, Amirreza Jafari, Morteza Nazari-Heris, Gevork B. Gharehpetian, and Mehrdad Abedi. 2021. "Evaluating the Effect of Demand Response Programs (DRPs) on Robust Optimal Sizing of Islanded Microgrids" Energies 14, no. 18: 5750. https://doi.org/10.3390/en14185750

APA StyleKarami Darabi, M., Ganjeh Ganjehlou, H., Jafari, A., Nazari-Heris, M., B. Gharehpetian, G., & Abedi, M. (2021). Evaluating the Effect of Demand Response Programs (DRPs) on Robust Optimal Sizing of Islanded Microgrids. Energies, 14(18), 5750. https://doi.org/10.3390/en14185750