A Minimal System Cost Minimization Model for Variable Renewable Energy Integration: Application to France and Comparison to Mean-Variance Analysis

Abstract

:1. Introduction

2. Optimal Long-Term Investment Problem

2.1. Problem Definition

2.1.1. Defining the System Total Cost

Conventional Mix

Introducing VRE

2.1.2. System Total Cost Minimization Problem

2.2. Optimal System Marginal Cost and Profits

- either the VRE producer i have a negative potential profit and no capacity is installed, , or

- the VRE producer i makes a non-negative profit and capacity is installed, . In this case,

- –

- either its profit is zero and its capacity is not capped, (the bounds may be reached but the corresponding constraints are inactive), or

- –

- i’s profit is positive (economic rent) and its capacity is maximal, .

2.3. Two Reduced Models Ignoring VRE Variability

2.3.1. Decoupled Problem

2.3.2. Constant Problem: Coupling without Variability

2.4. VRE Value and Adequacy Cost

2.4.1. System Total Value of VRE

2.4.2. System Marginal Value of VRE

2.5. With Quadratic Dispatch Costs

3. The Case of France

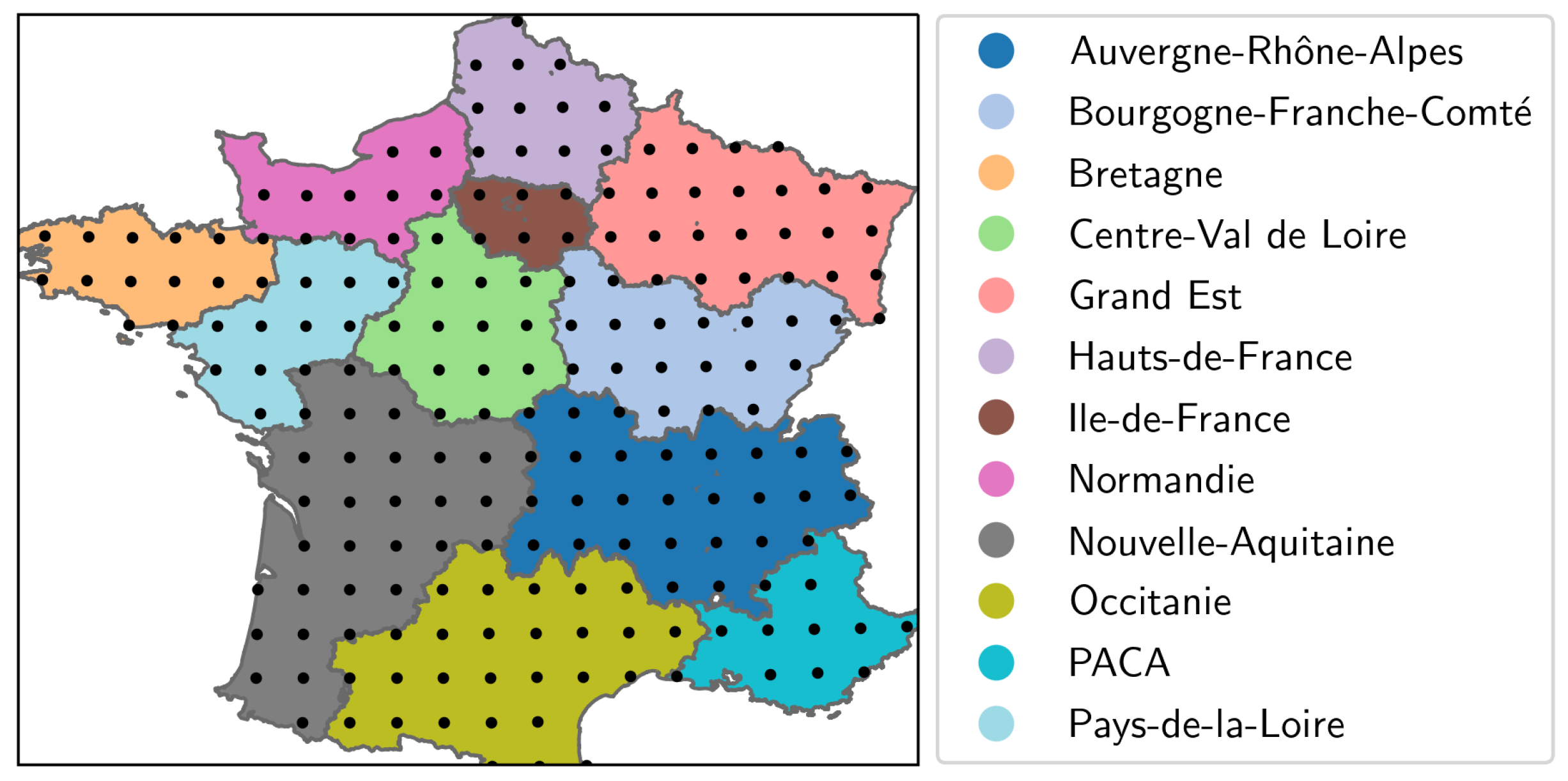

3.1. Domain

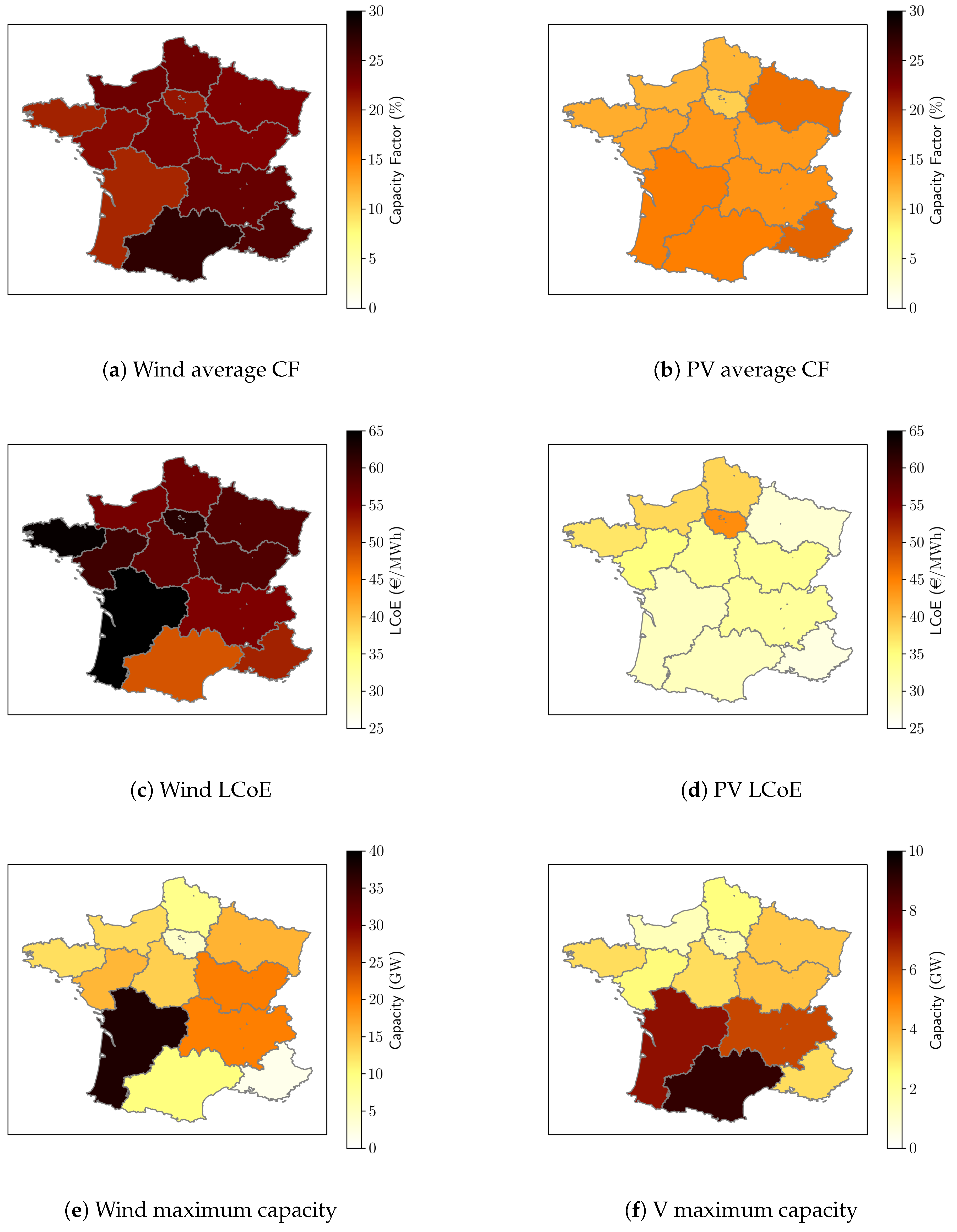

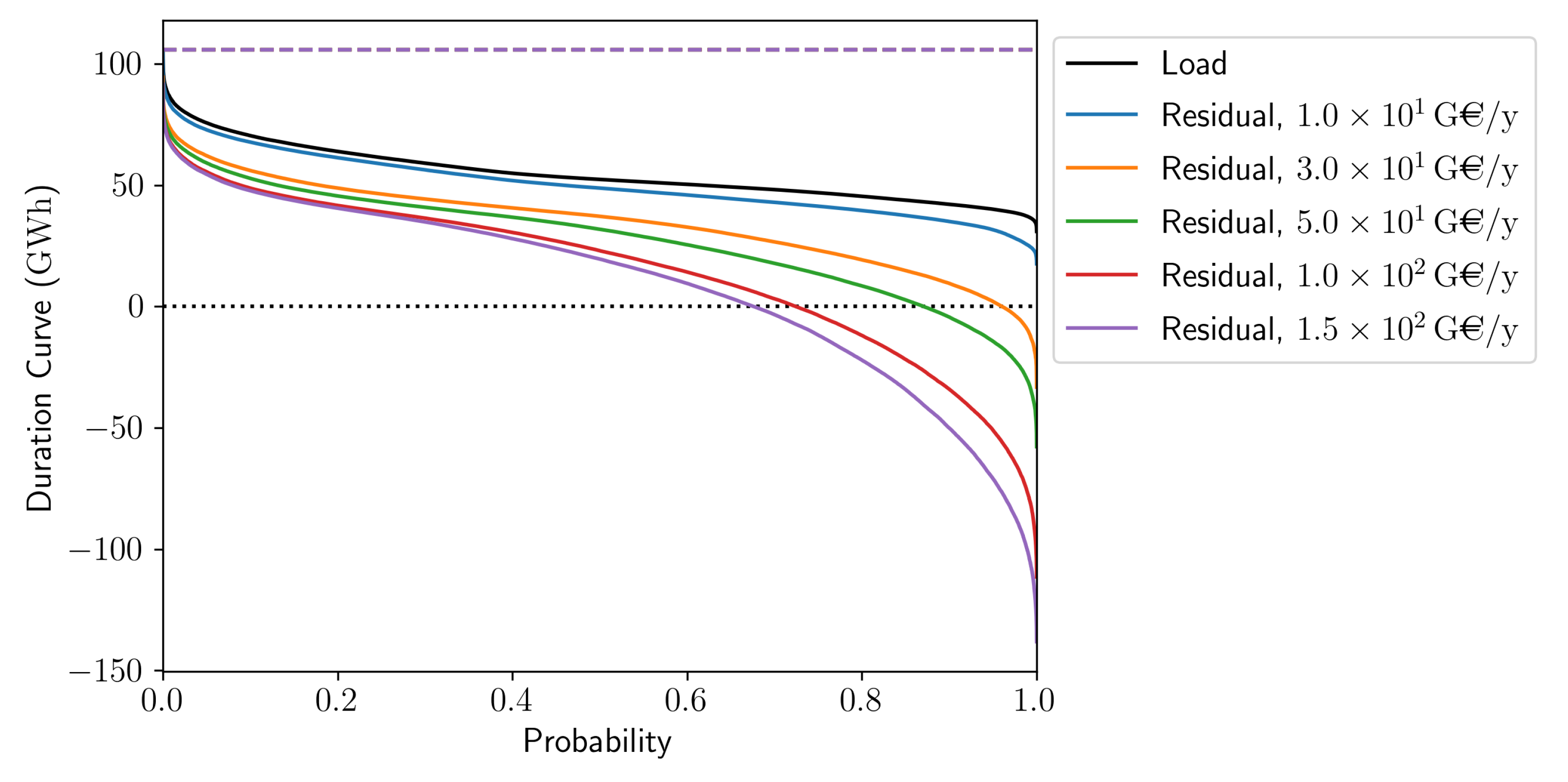

3.2. Load and CF Time Series

3.3. Rental Costs

3.4. Levelized Costs of Electricity

3.5. Maximum Dispatchable and VRE Capacities

3.6. Solver

4. Results

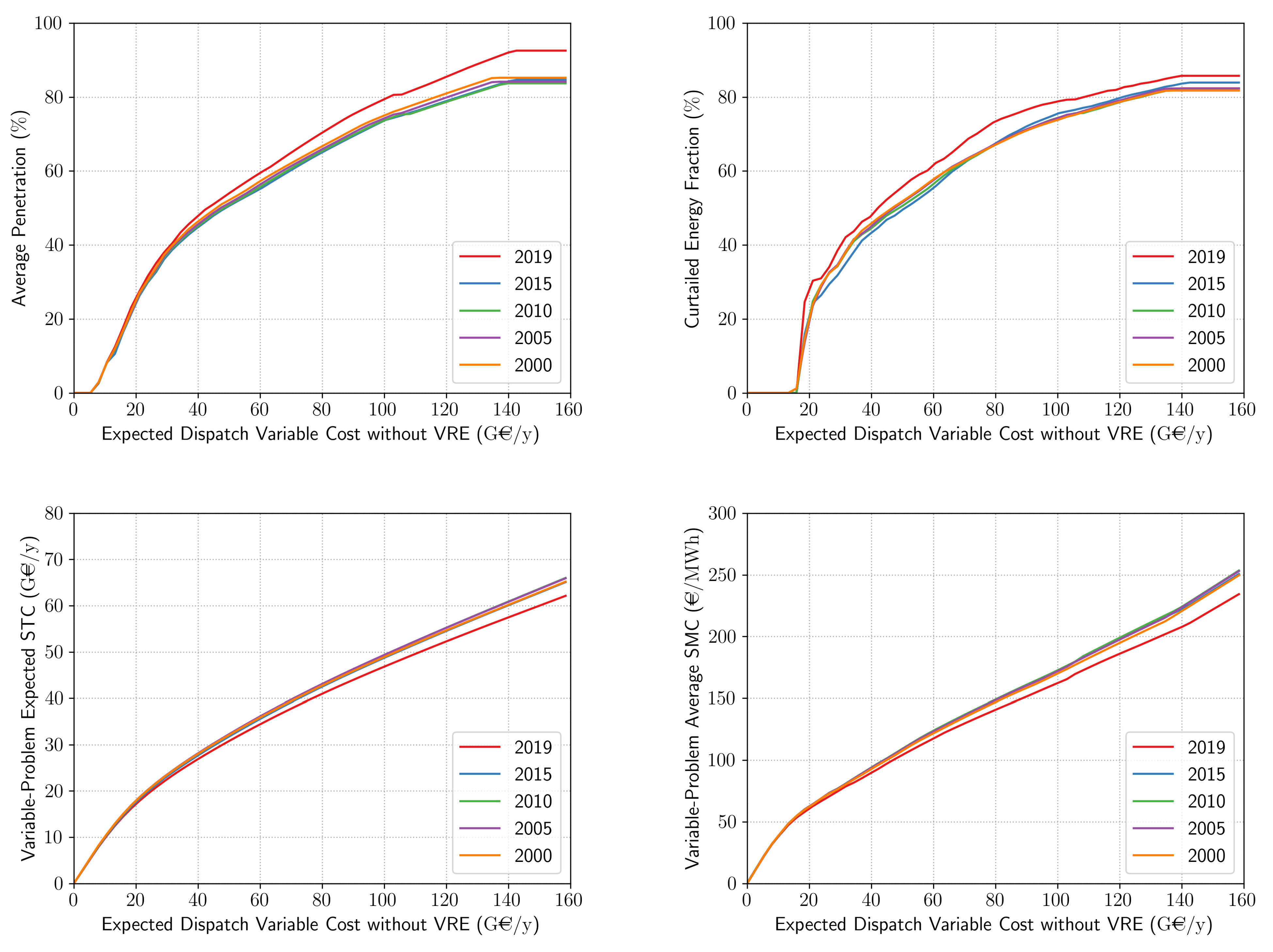

4.1. Variable-Problem Behavior

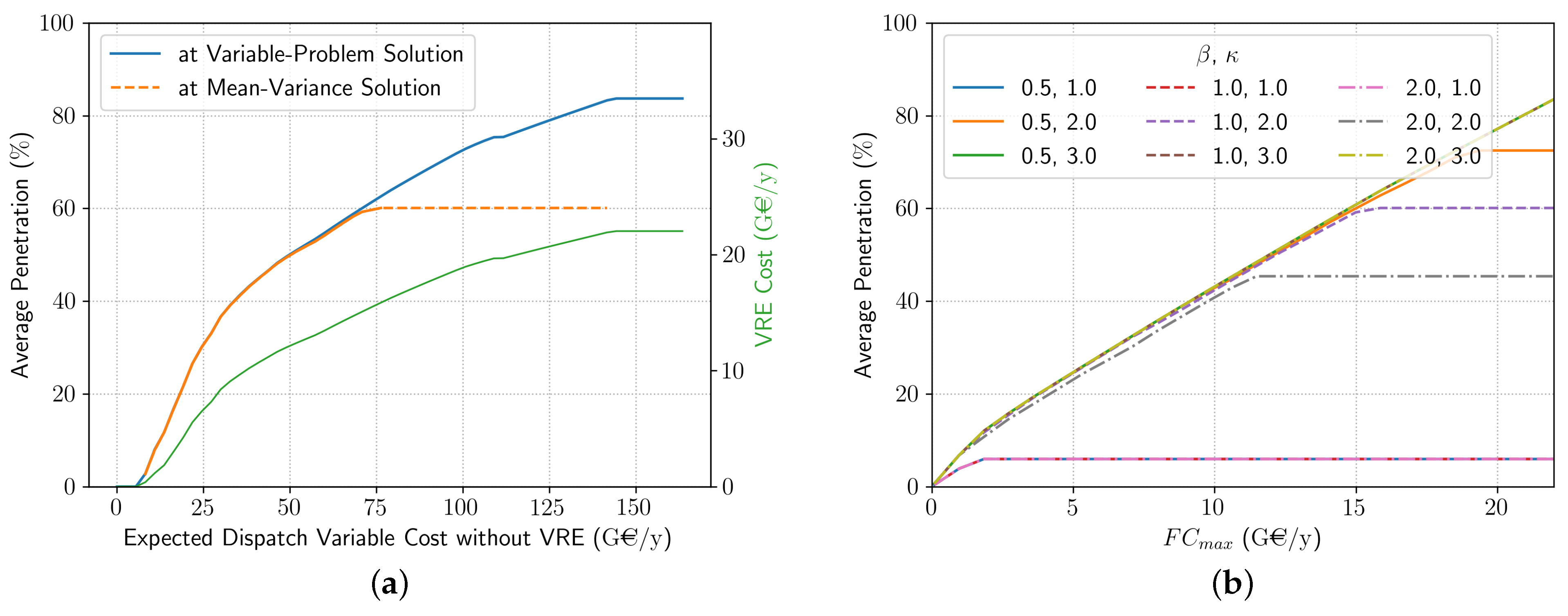

4.1.1. Average Penetration

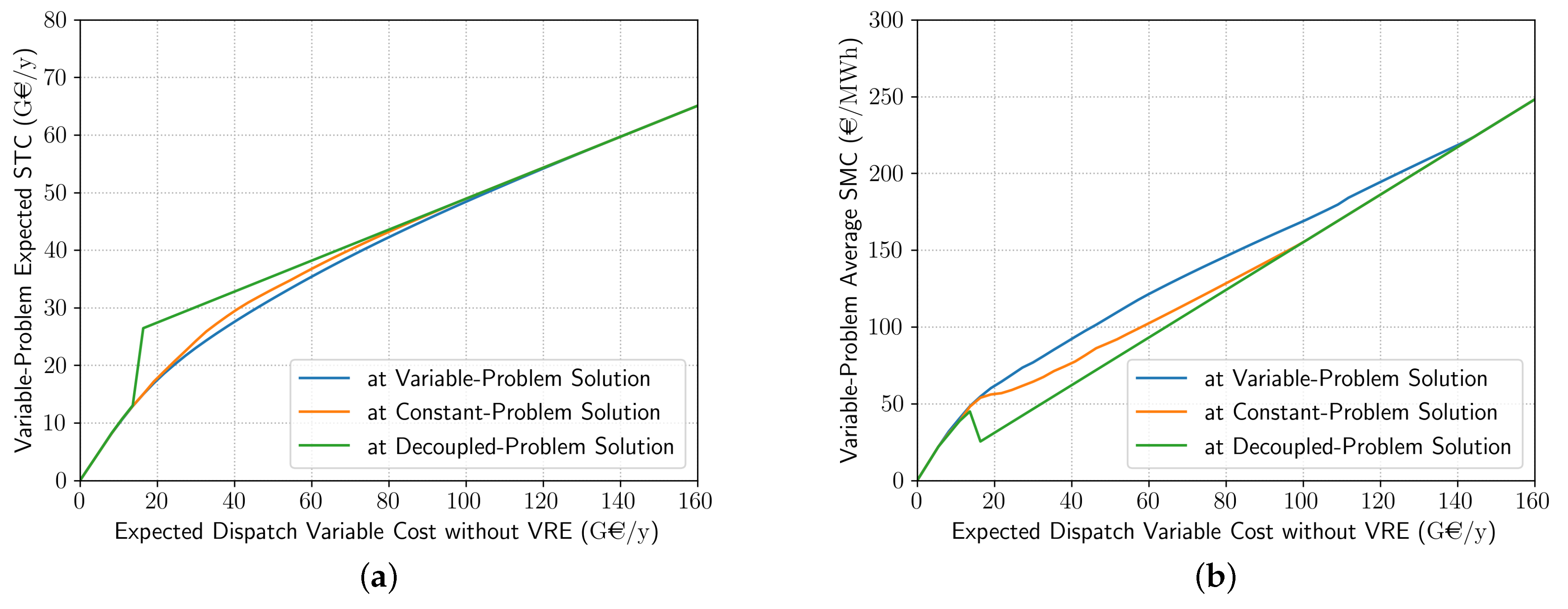

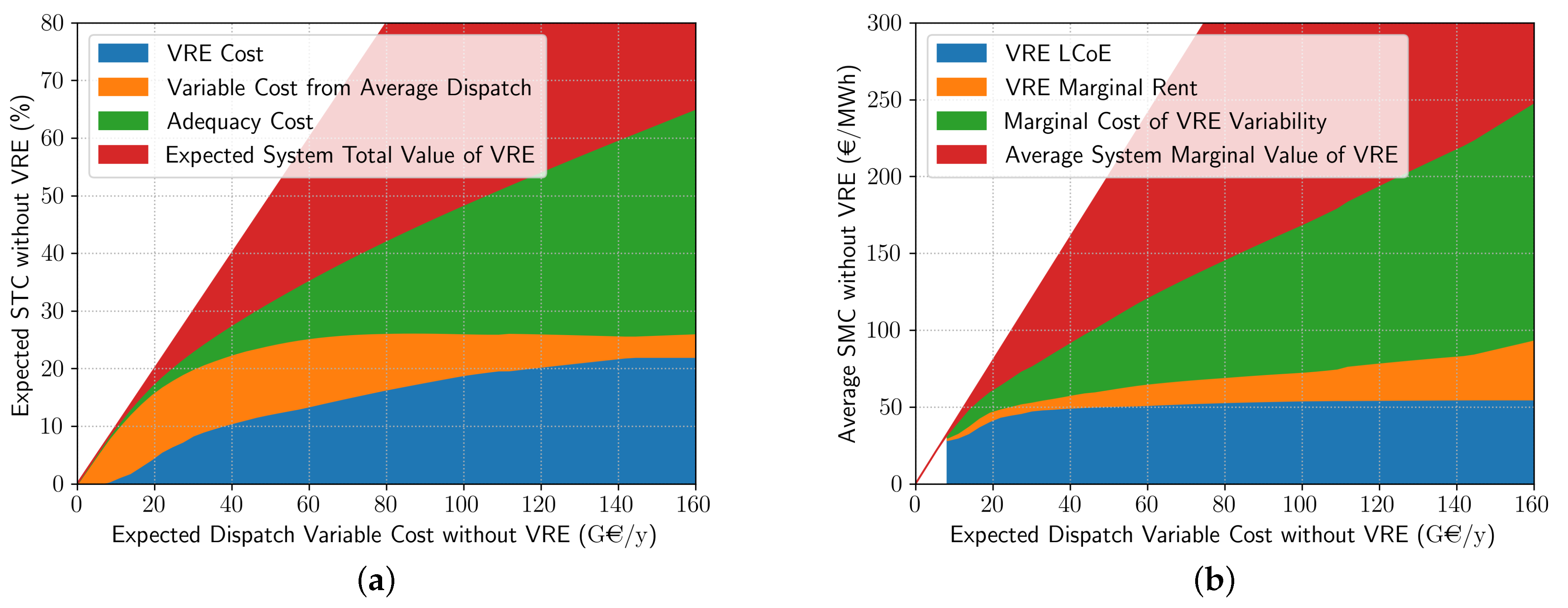

4.1.2. System Costs and Wholesale Price Effect

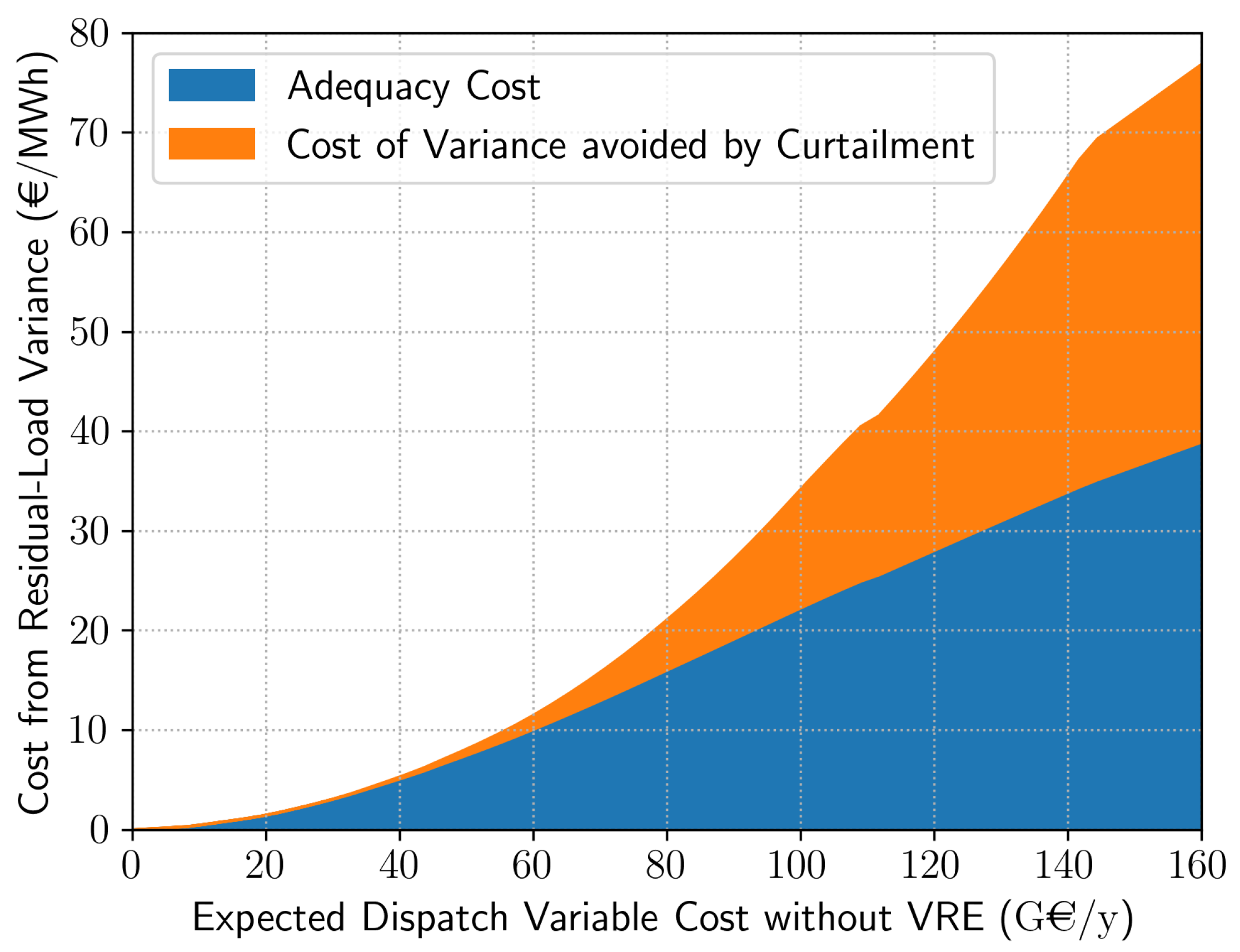

4.1.3. Curtailment

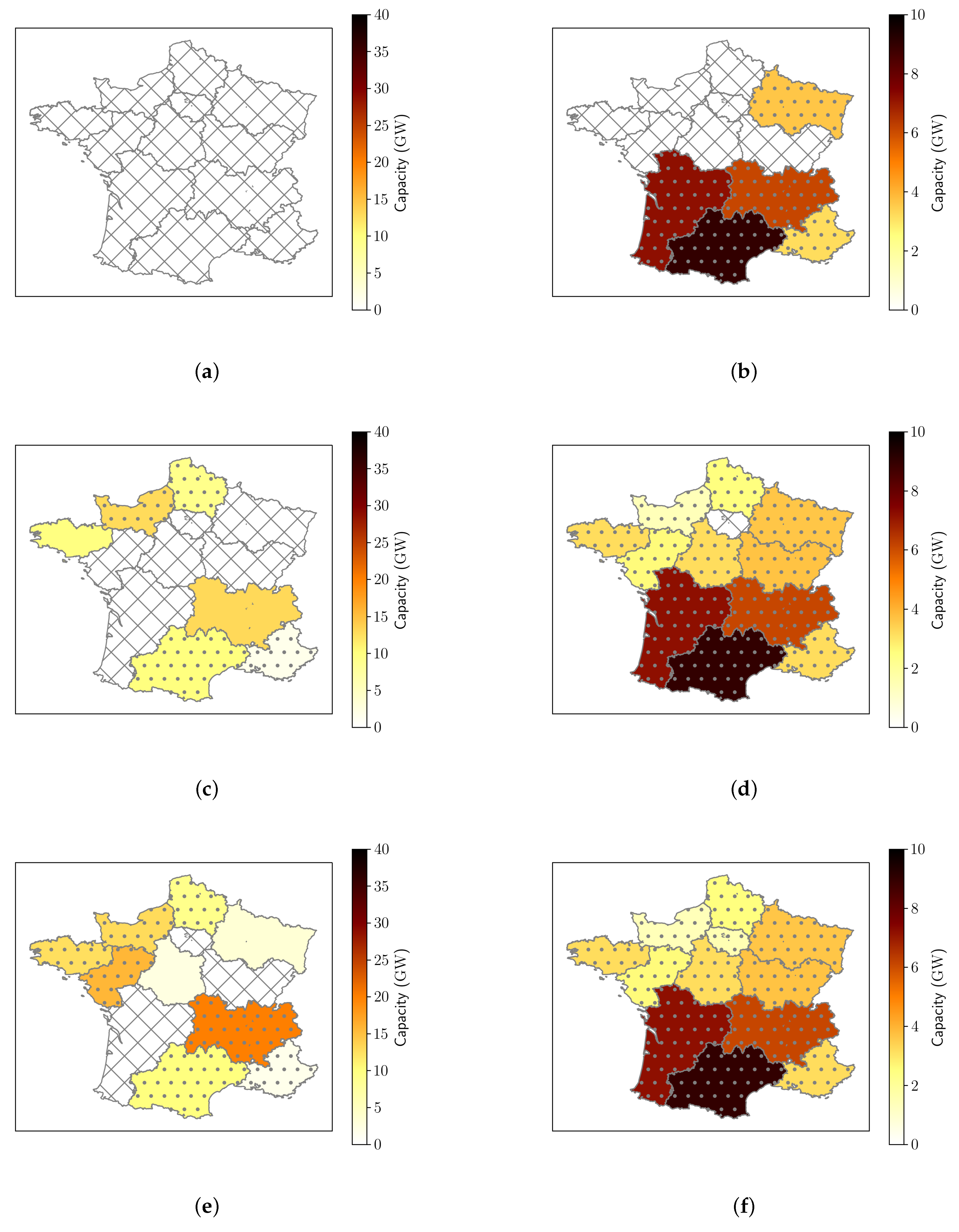

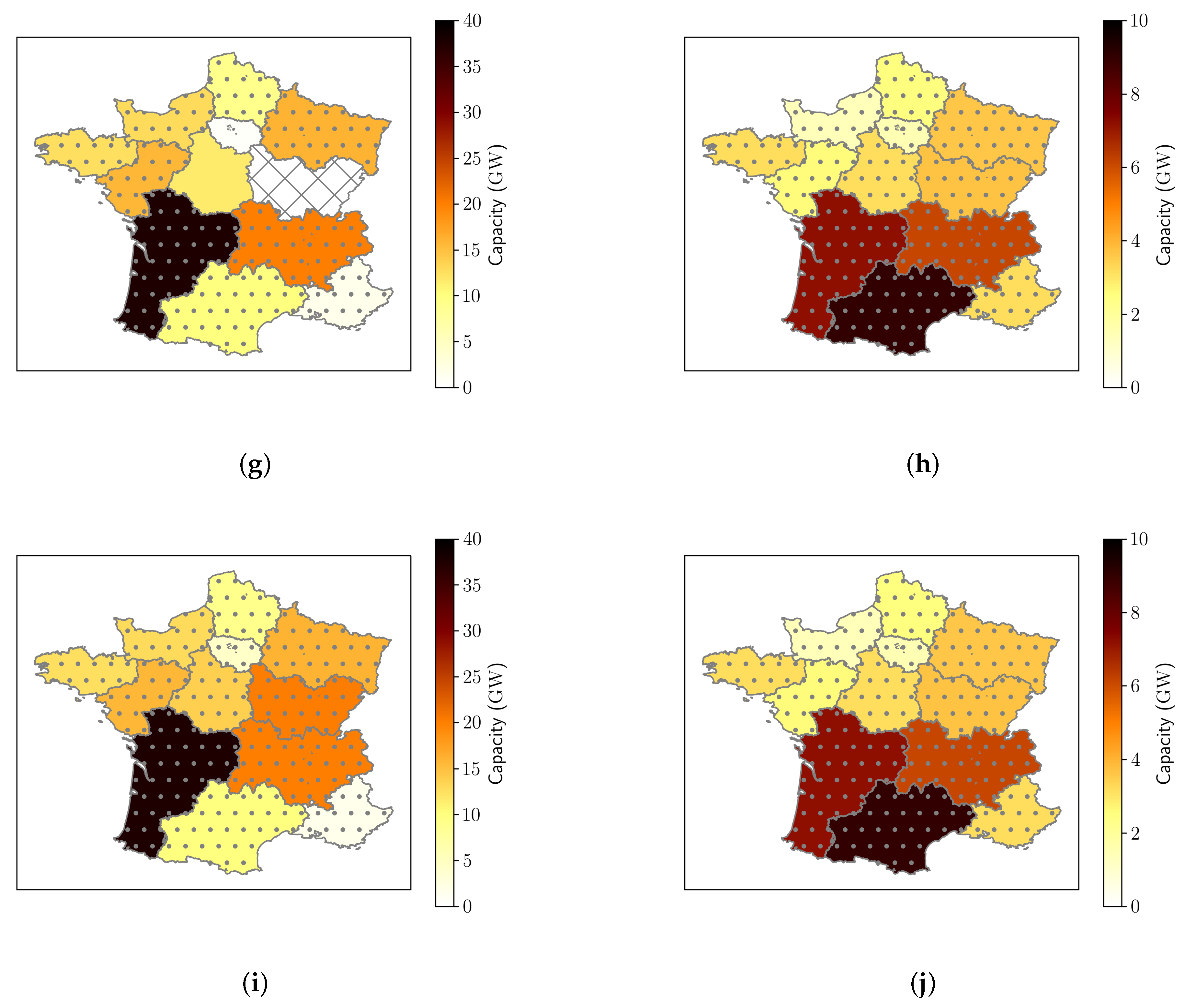

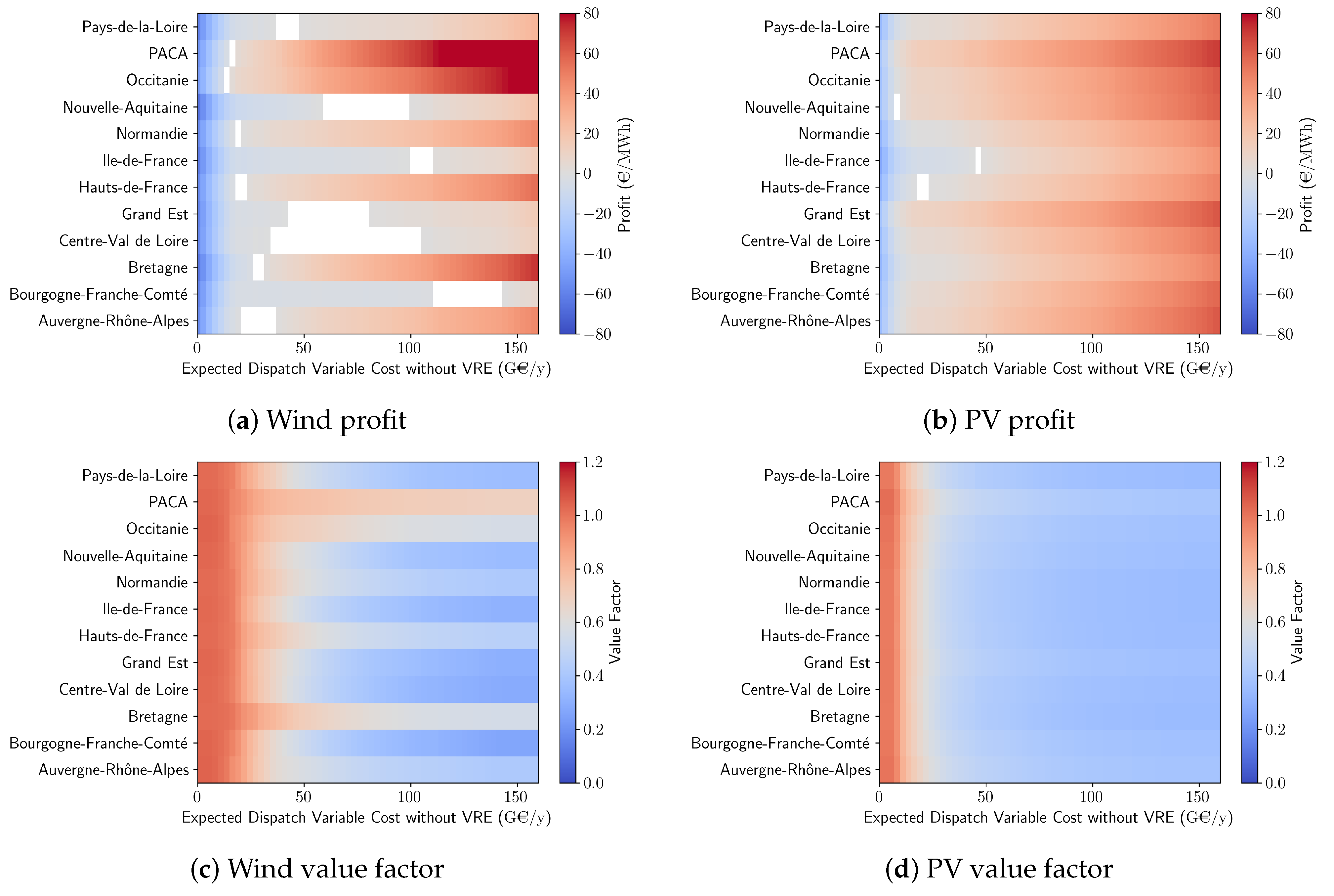

4.1.4. VRE Regional Capacities and Profits

4.1.5. Economic Rent at High Penetrations

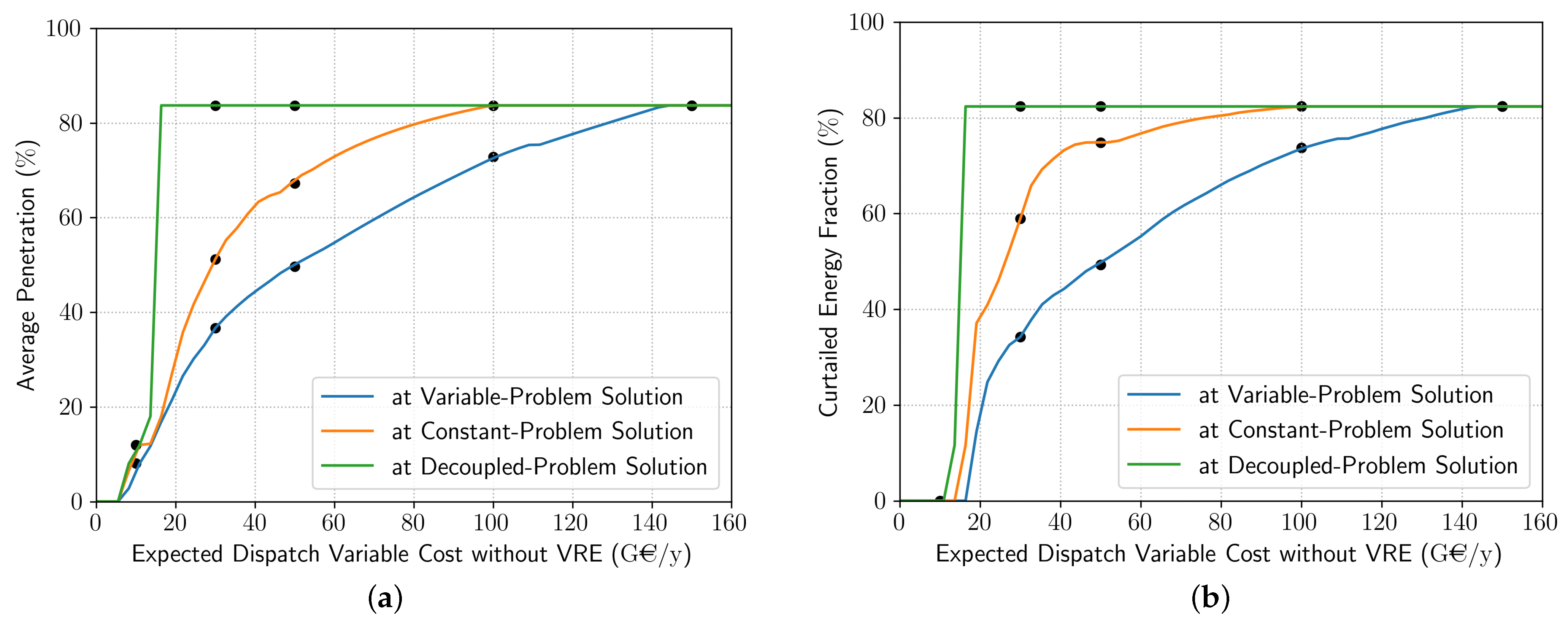

4.2. Optimizing Ignoring the Wholesale Price Effect and Variability

4.3. System Value of VRE and Adequacy Cost

5. Comparison with Mean-Variance Analyses

5.1. Cost Minimization without Curtailment

5.2. Differences in Formulation with Some Mean-Variance Applications to VRE Systems

- No curtailment of the residual load is performed in the mean-variance case.

- VRE rental costs are not included in the objective functions, but the (fractional) total capacity or rental cost is instead constrained. Apart from Beltran [19], who use generation costs in the mean and variance terms, and Bouramdane et al. [24], who use a total rental cost constraint, no economic costs appear in most mean-variance problems.

- As opposed to the mean-variance problems listed here, the mean of the residual load is squared in the cost minimization problem (Equation (25)).

- In the mean-variance problems, a coefficient weighs the objective for the variance with respect to the objective for the mean. In the cost minimization problem, instead weighs the mean of the squared residual (mean squared plus variance) with respect to the VRE rental cost.

5.3. A Formulation of Mean-Variance Analysis Akin to Cost Minimization

6. Summary and Discussion

- considers both the problem of long-term investment in VRE capacities and the optimal schedule of the dispatchable generation to satisfy an increasingly variable net load;

- minimizes the STC in order to include adequacy costs and estimate the system value of VRE; and

- avoids modeling the full system of dispatchable units by treating them as a fully-dispatchable aggregate.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| Sample space | |

| Set of hours in a year | |

| Noise outcome | |

| i | VRE producer index |

| q | Energy generated or load |

| t | Time index |

| Number of hours in a year | |

| m | Number of VRE producers |

| Total dispatchable generation capacity | |

| Vector of VRE capacities | |

| Capacity of VRE producer i | |

| Maximum capacity that VRE producer i can install | |

| Vector of VRE capacity factors at time t | |

| Constant aggregate dispatchable generation in the decoupled and constant problems | |

| Aggregate dispatchable generation at time t | |

| Load at time t | |

| Aggregate VRE generation at time t | |

| Constant version of SMC | |

| Decoupled version of SMC | |

| Variable version of SMC at time t | |

| Capacity factor of VRE producer i at time t | |

| Aggregate dispatch fixed cost | |

| Maximum total VRE cost in mean-variance problem | |

| Vector of VRE hourly rental costs | |

| Hourly rental cost of VRE producer i | |

| LCoE of VRE producer i | |

| LCoE of VRE mix | |

| Average optimal SMC without VRE | |

| Aggregate dispatch variable cost | |

| Mean penetration of VRE mix | |

| Value factor of VRE producer i | |

| Value factor of VRE mix | |

| Potential profit per unit of energy of VRE producer i | |

| System marginal value of VRE mix | |

| System total cost | |

| System total value of VRE mix | |

| Aggregate dispatch total cost | |

| Total cost of VRE producer i | |

| Aggregate total cost of VRE mix | |

| Aggregate dispatch variable cost | |

| Marginal rent of VRE mix | |

| Weight of residual-load variance in mean-variance problem | |

| Dispatch variable-cost coefficient in quadratic dispatch variable costs | |

| KKT multipler for the VRE rental-cost constraint in mean-variance problem | |

| Exponent of average residual load in mean-variance problem |

Appendix A. Mathematical Framework

Appendix A.1. Stochastic Processes

Appendix A.2. Cyclostationary

Appendix A.3. Convergence of Sample Means of Yearly Averages

Appendix A.4. One-Cycle Distribution Function and Load Duration Curve

Appendix A.5. Validity of the Mathematical Assumptions

Appendix B. Proof of Theorem 1

- For , it is necessary and sufficient that

- For , it is necessary and sufficient that

- Positive profit :

- Negative profit :

- Zero profit :

Appendix C. Robustness to Sampling of French-Case Results

References

- Ueckerdt, F.; Brecha, R.; Luderer, G. Analyzing Major Challenges of Wind and Solar Variability in Power Systems. Renew. Energy 2015, 81, 1–10. [Google Scholar] [CrossRef]

- Ringkjob, H.K.; Haugan, P.M.; Solbrekke, I.M. A Review of Modelling Tools for Energy and Electricity Systems with Large Shares of Variable Renewables. Renew. Sustain. Energy Rev. 2018, 96, 440–459. [Google Scholar] [CrossRef]

- Cretì, A.; Fontini, F. Economics of Electricity: Markets, Competition and Rules; Cambridge University Press: Cambridge, UK, 2019. [Google Scholar] [CrossRef]

- IEA. The Power of Transformation: Wind, Sun and the Economics of Flexible Power Systems; Technical Report; IEA: Paris, France, 2014. [Google Scholar]

- Labussière, O.; Nadaï, A. (Eds.) Energy Transitions: A Socio-Technical Inquiry; Palgrave Macmillan: London, UK, 2018. [Google Scholar] [CrossRef]

- Joskow, P.L. Comparing the Costs of Intermittent and Dispatchable Electricity Generating Technologies. Am. Econ. Rev. 2011, 101, 238–241. [Google Scholar] [CrossRef] [Green Version]

- Sijm, J. Cost and Revenue Related Impacts of Integrating Electricity from Variable Renewable Energy into the Power System—A Review of Recent Literature; Technical Report ECN–E-14-022; ECN: Petten, The Netherlands, 2014. [Google Scholar]

- Milligan, M.; Ela, E.; Hodge, B.M.; Kirby, B.; Lew, D.; Clark, C.; DeCesaro, J.; Lynn, K. Integration of Variable Generation, Cost-Causation, and Integration Costs. Electr. J. 2011, 24, 51–63. [Google Scholar] [CrossRef]

- Holttinen, H.; Meibom, P.; Orths, A.; Lange, B.; O’Malley, M.; Tande, J.O.; Estanqueiro, A.; Gomez, E.; Söder, L.; Strbac, G.; et al. Impacts of Large Amounts of Wind Power on Design and Operation of Power Systems, Results of IEA Collaboration. Wind. Energy 2011, 14, 179–192. [Google Scholar] [CrossRef]

- Hirth, L. Integration Costs and the Value of Wind Power; SSRN Scholarly Paper ID 2187632; Social Science Research Network: Rochester, NY, USA, 2012. [Google Scholar] [CrossRef]

- Ueckerdt, F.; Hirth, L.; Luderer, G.; Edenhofer, O. System LCOE: What are the Costs of Variable Renewables? Energy 2013, 63, 61–75. [Google Scholar] [CrossRef]

- Hirth, L.; Ueckerdt, F.; Edenhofer, O. Integration Costs Revisited—An Economic Framework for Wind and Solar Variability. Renew. Energy 2015, 74, 925–939. [Google Scholar] [CrossRef]

- Denny, E.; O’Malley, M. Quantifying the Total Net Benefits of Grid Integrated Wind. IEEE Trans. Power Syst. 2007, 22, 605–615. [Google Scholar] [CrossRef] [Green Version]

- Lamont, A.D. Assessing the Long-Term System Value of Intermittent Electric Generation Technologies. Energy Econ. 2008, 30, 1208–1231. [Google Scholar] [CrossRef] [Green Version]

- Mills, A.; Wiser, R. Changes in the Economic Value of Variable Generation at High Penetration Levels: A Pilot Case Study of California; Technical Report LBNL-5445E; Lawrence Berkeley National Lab. (LBNL): Berkeley, CA, USA, 2012. [CrossRef] [Green Version]

- Shirizadeh, B.; Quirion, P. EOLES_elec Model Description; Technical Report 2020-79; CIRED: Geneva, Switzerland, 2020. [Google Scholar]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Brazilian, M.; Roques, F. Analytical Methods for Energy Diversity and Security: Portfolio Optimization in the Energy Sector: A Tribute to the Work of Dr. Shimon Awerbuch; Elsevier: Amsterdam, The Netherlands, 2008. [Google Scholar]

- Beltran, H. Modern Portfolio Theory Applied To Electricity Generation Planning. Ph.D. Thesis, University of Illinois at Urbana-Champaign, Champaign, IL, USA, 2009. [Google Scholar]

- Roques, F.; Hiroux, C.; Saguan, M. Optimal Wind Power Deployment in Europe—A Portfolio Approach. Energy Policy 2010, 38, 3245–3256. [Google Scholar] [CrossRef] [Green Version]

- Thomaidis, N.S.; Santos-Alamillos, F.J.; Pozo-Vázquez, D.; Usaola-García, J. Optimal Management of Wind and Solar Energy Resources. Comput. Oper. Res. 2016, 66, 284–291. [Google Scholar] [CrossRef] [Green Version]

- Santos-Alamillos, F.J.; Thomaidis, N.S.; Usaola-García, J.; Ruiz-Arias, J.A.; Pozo-Vázquez, D. Exploring the Mean-Variance Portfolio Optimization Approach for Planning Wind Repowering Actions in Spain. Renew. Energy 2017, 106, 335–342. [Google Scholar] [CrossRef]

- Tantet, A.; Stéfanon, M.; Drobinski, P.; Badosa, J.; Concettini, S.; Cretì, A.; D’Ambrosio, C.; Thomopulos, D.; Tankov, P. E4clim 1.0: The Energy for a Climate Integrated Model: Description and Application to Italy. Energies 2019, 12, 4299. [Google Scholar] [CrossRef] [Green Version]

- Bouramdane, A.A.; Tantet, A.; Drobinski, P. Adequacy of Renewable Energy Mixes with Concentrated Solar Power and Photovoltaic in Morocco: Impact of Thermal Storage and Cost. Energies 2020, 13, 5087. [Google Scholar] [CrossRef]

- Maimó-Far, A.; Tantet, A.; Homar, V.; Drobinski, P. Predictable and Unpredictable Climate Variability Impacts on Optimal Renewable Energy Mixes: The Example of Spain. Energies 2020, 13, 5132. [Google Scholar] [CrossRef]

- MTES. Stratégie Nationale Bas-Carbone Révisée; Technical Report; Ministère de la Transition Écologique et Solidaire: Paris, Fance, 2020. [Google Scholar]

- Damm, A.; Köberl, J.; Prettenthaler, F.; Rogler, N.; Töglhofer, C. Impacts of +2 Degree C Global Warming on Electricity Demand in Europe. Clim. Serv. 2017, 7, 12–30. [Google Scholar] [CrossRef] [Green Version]

- Takriti, S.; Krasenbrink, B.; Wu, L.S.Y. Incorporating Fuel Constraints and Electricity Spot Prices into the Stochastic Unit Commitment Problem. Oper. Res. 2000, 48, 268–280. [Google Scholar] [CrossRef]

- Tsiropoulos, I.; Tarvydas, D.; Zucker, A. Cost Development of Low Carbon Energy Technologies—Scenario-Based Cost Trajectories to 2050; Technical Report EUR 29034 EN; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Shapiro, A.; Dentcheva, D.; Ruszczynski, A. Lectures on Stochastic Programming: Modeling and Theory; SIAM: Philadelphia, PA, USA, 2009. [Google Scholar]

- Birge, J.; Louveaux, F. Introduction to Stochastic Programming, 2nd ed.; Springer: New York, NY, USA, 2011. [Google Scholar]

- Phan, C.; Plouhinec, C. Chiffres Clés Des Énergies Renouvelables—Édition 2020; Technical Report; Ministère de la Transition Écologique: Paris, France, 2020. [Google Scholar]

- The e4clim Community. The Energy for CLimate Integrated Model. arXiv 2019, arXiv:1812.09181. [Google Scholar]

- Quinet, E. L’évaluation Socioéconomique Des Investissements Publics; Technical Report No. Halshs 01059484; PSL: Paris, France, 2014. [Google Scholar]

- ADEME. Un Mix Électrique 100% Renouvelable? Analyses et Optimisations; Technical Report; ADEME: Paris, France, 2015. [Google Scholar]

- Hart, W.E.; Watson, J.P.; Woodruff, D.L. Pyomo: Modeling and Solving Mathematical Programs in Python. Math. Program. Comput. 2011, 3, 219. [Google Scholar] [CrossRef]

- Hart, W.E.; Laird, C.D.; Watson, J.P.; Woodruff, D.L.; Hackebeil, G.A.; Nicholson, B.L.; Siirola, J.D. Pyomo—Optimization Modeling in Python, 2nd ed.; Springer International Publishing: Berlin/Heidelberg, Germany, 2017. [Google Scholar] [CrossRef]

- Wächter, A.; Biegler, L.T. On the Implementation of an Interior-Point Filter Line-Search Algorithm for Large-Scale Nonlinear Programming. Math. Program. 2006, 106, 25–57. [Google Scholar] [CrossRef]

- Shirizadeh, B.; Quirion, P. Low-Carbon Options for the French Power Sector: What Role for Renewables, Nuclear Energy and Carbon Capture and Storage? Energy Econ. 2021, 95, 105004. [Google Scholar] [CrossRef]

- Gardner, W.A.; Napolitano, A.; Paura, L. Cyclostationarity: Half a Century of Research. Signal Process. 2006, 86, 639–697. [Google Scholar] [CrossRef]

- Stachurski, J. Economic Dynamics; MIT Press: Cambridge, MA, USA, 2009. [Google Scholar]

- Tantet, A.; Dijkstra, H.A. An Interaction Network Perspective on the Relation between Patterns of Sea Surface Temperature Variability and Global Mean Surface Temperature. Earth Syst. Dyn. 2014, 5, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Tantet, A.; van der Burgt, F.R.F.; Dijkstra, H.A. An Early Warning Indicator for Atmospheric Blocking Events Using Transfer Operators. Chaos Interdiscip. Nonlinear Sci. 2015, 25, 036406. [Google Scholar] [CrossRef]

- Tantet, A.; Chekroun, M.; Neelin, J.D.; Dijkstra, H.A. Ruelle-Pollicott Resonances of Stochastic Systems in Reduced State Space. Part III: Application to the Cane–Zebiak Model of the El Niño–Southern Oscillation. J. Stat. Phys. 2020, 179, 1449–1476. [Google Scholar] [CrossRef] [Green Version]

- Tantet, A.; Lucarini, V.; Lunkeit, F.; Dijkstra, H.H.A. Crisis of the Chaotic Attractor of a Climate Model: A Transfer Operator Approach. Nonlinearity 2018, 31, 2221. [Google Scholar] [CrossRef] [Green Version]

- Chekroun, M.; Tantet, A.; Neelin, J.D.; Dijkstra, H.A. Ruelle-Pollicott Resonances of Stochastic Systems in Reduced State Space. Part I: Theory. J. Stat. Phys. 2020, 179, 1366–1402. [Google Scholar] [CrossRef] [Green Version]

- Tantet, A.; Chekroun, M.; Neelin, J.D.; Dijkstra, H.A. Ruelle-Pollicott Resonances of Stochastic Systems in Reduced State Space. Part II: Stochastic Hopf Bifurcation. J. Stat. Phys. 2020, 179, 1403–1448. [Google Scholar] [CrossRef] [Green Version]

- Boyd, S.; Vandenberghe, L. Convex Optimization; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar]

| Units | Onshore Wind | Photovoltaic | |

|---|---|---|---|

| Overnight Cost | €/kWe | 1.13 × 103 | 423 |

| Lifetime | y | 25 | 25 |

| Annuity | €/kWe/y | 81.2 | 30.7 |

| Fixed O&M Cost | €/kWe/y | 34.5 | 9.20 |

| Yearly Rental Cost | €/kWe/y | 116 | 39.9 |

| Reference | State | Mean of | Variance of | Total Constraint |

|---|---|---|---|---|

| Markowitz [17] | Relative amount invested | Return | Return | 100% invested |

| Beltran [19] | Capacity fraction | Generation cost | Generation cost | 100% installed |

| Thomaidis et al. [21] | Capacity fraction | Generation | Generation | 100% installed |

| Santos-Alamillos et al. [22] | Capacity fraction | Generation | Generation | 100% installed + bounds on capacity |

| Tantet et al. [23] | Capacity | Generation/load | Generation/load | Total capacity |

| Bouramdane et al. [24] | Capacity | Generation/load | Generation/load | VRE fixed cost |

| This study | Capacity | Squared mean net-load | Net load | VRE fixed cost |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tantet, A.; Drobinski, P. A Minimal System Cost Minimization Model for Variable Renewable Energy Integration: Application to France and Comparison to Mean-Variance Analysis. Energies 2021, 14, 5143. https://doi.org/10.3390/en14165143

Tantet A, Drobinski P. A Minimal System Cost Minimization Model for Variable Renewable Energy Integration: Application to France and Comparison to Mean-Variance Analysis. Energies. 2021; 14(16):5143. https://doi.org/10.3390/en14165143

Chicago/Turabian StyleTantet, Alexis, and Philippe Drobinski. 2021. "A Minimal System Cost Minimization Model for Variable Renewable Energy Integration: Application to France and Comparison to Mean-Variance Analysis" Energies 14, no. 16: 5143. https://doi.org/10.3390/en14165143

APA StyleTantet, A., & Drobinski, P. (2021). A Minimal System Cost Minimization Model for Variable Renewable Energy Integration: Application to France and Comparison to Mean-Variance Analysis. Energies, 14(16), 5143. https://doi.org/10.3390/en14165143