Transitioning of Steel Producers to the Steelworks 4.0—Literature Review with Case Studies

Abstract

:1. Introduction

- Present the key EU support for the steel industry.

- Compare steelworks 3.0 and steelworks 4.0.

- Describe the surroundings for the steelworks 4.0.

- Q1: To what extent are the surveyed organizations implementing changes that will transform them to steelworks 4.0?

- Q2: Which business areas are changing leading to the steelworks 4.0 being implemented?

- Q3: Is the extent of changes in the studied companies comparable?

2. Literature Review

2.1. European Union Support for Steelworks 4.0

2.2. Industrial Development of the Steelworks

- single plant as a cyber-physical production system (CPPS and vertical integration);

- full traceability of intermediate and end products in the value chain;

- “intelligent” product with knowledge of its quality and history of production (one of the aspects of end-to-end engineering);

- intensive communication of plants (integration within the company);

- intensive communication along the entire supply chain (integration outside the steelworks);

- proper handling and use of all data;

- decentralization of decisions (de-central) instead of central solutions; and

- self-organization of the system.

2.3. From Steelworks 3.0 to Steelworks 4.0—Key Fields of Changes

- Physical-digital interface technologies;

- Network technologies;

- Data-processing technologies; and

- Physical-digital process technologies.

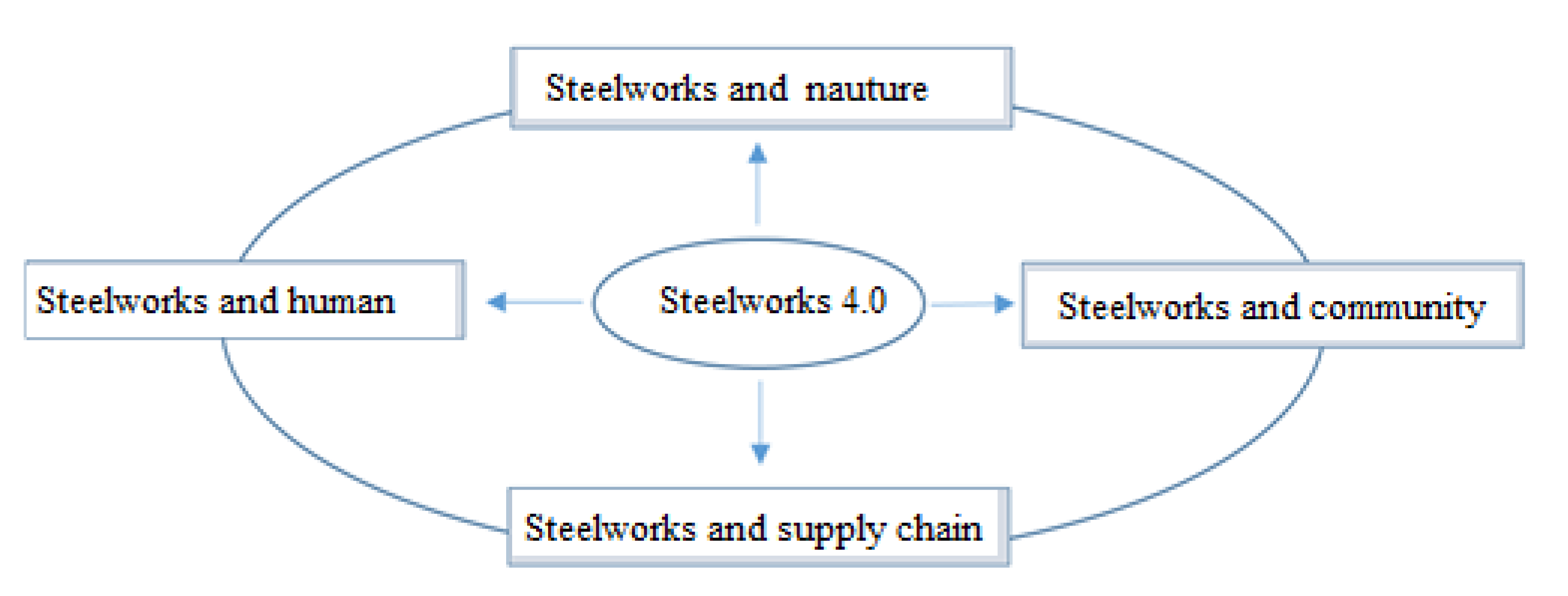

2.4. Surroundings of Steelworks 4.0

3. Materials and Methods

- Q1: To what extent are the surveyed organizations implementing changes that will transform them to the steelworks 4.0?

- Q2: Which business areas are changes leading to steelworks 4.0 being implemented?

- Q3: Is the extent of changes in the studied companies comparable?

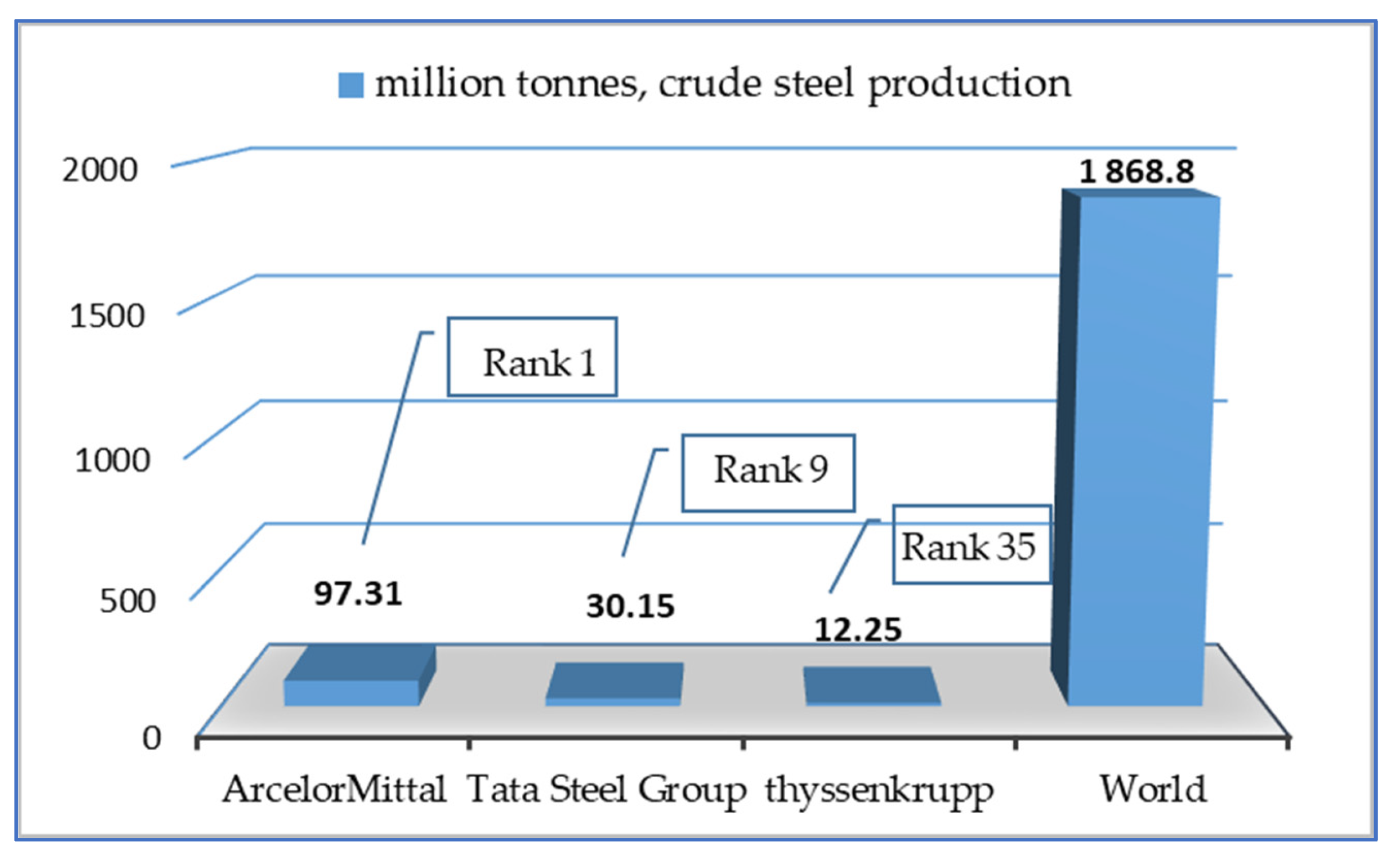

4. Cases of Changes in Steel Plants

5. Results of Analysis

6. Discussion

- −

- −

- big data and smart analytics: thousands of sensors on the production line and visibility of data obtained via IIoT and CPS collect and present the data to improve operational efficiency [90];

- −

- monitoring of devices work in real-time and process optimization: operations can be managed and maintained remotely via IIoT and by using modern technologies and systems, can suggest solutions for self-optimization and can be adapt to changing operational conditions [91];

- −

- −

- full automatization of repetitive operations to improve on efficiencies and improve on the quality of products and flexibility of the production—requirements without complex changeovers [83]; and

- −

- smart supply chains: an end-to-end integration of the product enables operations to manage the smart plant supply chain in terms of raw materials required, production produced and customer deliveries, mobility solutions enable the organization to manage and execute processes or decisions in real-time at the production operations—the operations must be able to adapt to dynamic changes (e g. changes in products specifications and orders) [83].

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Payment

References

- Schwab, K. The Fourth Industrial Revolution; World Economic forum: Cologny, Switzerland, 2016. [Google Scholar]

- Kagermann, H.; Wahlster, W.; Helbig, J. (Eds.) Recommendations for Implementing the Strategic Initiative Industrie 4.0: Final Report of the Industrie 4.0 Working Group. In Industrie 4.0: Mit Dem Internet Der Dinge Auf Dem Weg Zur 4 Industriellen Revolution; VDI-Nachrichten: Germany, Frankfurt, April 2011. [Google Scholar]

- Kagermann, H.; Helbig, J.; Hellinger, A.; Wahlster, W. Recommendations for Implementing the Strategic Initiative Industry 4.0: Securing the Future of German Manufacturing Industry. In Final Report of the Industry 4.0 Working Group Forschungsunion; 2013; Available online: http://www.acatech.de/fileadmin/user_upload/Baumstruktur_nach_Website/Acatech/root/de/Material_fuer_Sonderseiten/Industrie_4.0/Final_report__Industrie_4.0_accessible.pdf (accessed on 2 February 2020).

- Kagermann, H.; Wahlster, W.; Helbig, J. Final Report of the Industrie 4.0 Working Group; Acatech-National Academy of Science and Engineering: München, Germany, 2013; Available online: http://forschungsunion.de/pdf/industrie_4_0_final_report.pdf (accessed on 10 January 2020).

- Kagermann, H. Change through Digitization—Value Creation in the Age of Industry 4.0. In Management of Permanent Change; Albach, H., Meffert, H., Pinkwart, A., Reichwald, R., Eds.; Springer: Wiesbaden, Germany, 2015. [Google Scholar] [CrossRef]

- Peters, H. Application of Industry 4.0 concepts at steel production from an applied research perspective. In Proceedings of the 17th IFAC Symposium on Control, Optimization, and Automation in Mining, Mineral and Metal Processing, Wien, Austria, 1 September 2016; Available online: https://tc.ifac-control.org/6/2/files/symposia/vienna-2016/mmm2016_keynotes_peters (accessed on 10 January 2021).

- Peters, H. How could Industry 4.0 transform the Steel Industry? In Proceedings of the Future Steel Forum, Warsaw, Poland, 14–15 June 2017; PowerPoint-Präsentation. Available online: https://futuresteelforum.com/content-images/speakers/Prof.-Dr-Harald-Peters-Industry-4.0-transform-the-steel-industry.pdf (accessed on 10 January 2021).

- PwC-Global Industry 4.0 Survey. What We Mean by Industry 4.0/Survey Key Findings/Blueprint for Digital Success; PwC: London, UK, 2016; Available online: https://www.pwc.com/gx/en/industries/industries-4.0/landing-page/industry-4.0-building-your-digital-enterprise-april-2016.pdf (accessed on 20 August 2020).

- McKinsey. Industry 4.0: How to Navigate Digitization of the Manufacturing Sector; Report; McKinsey Company: Chicago, IL, USA, 2015; Available online: https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Operations/Our%20Insights/Industry%2040%20How%20to%20navigate%20digitization%20of%20the%20manufacturing%20sector/Industry-40-How-to-navigate-digitization-of-the-manufacturing-sector.pdf (accessed on 10 June 2020).

- Deloitte-Industry 4.0. The Industry 4.0 Paradox. Overcoming Disconnects on the Path to Digital Transformation; Deloitte Insights, Deloitte Development LLC: London, UK, 2018; Available online: https://www2.deloitte.com/content/dam/Deloitte/cn/Documents/energy-resources/deloitte-cn-er-industry-4.0-paradox-overcoming-disconnects-en-full-report-190225.pdf (accessed on 9 September 2020).

- Rüßmann, M.; Lorenz, M.; Gerbert, P.; Waldner, M.; Justus, J.; Engel, P.; Harnisch, M. Industry 4.0; The Boston Consulting Group: Boston, MA, USA, 2015; Available online: https://www.bcg.com/publications/2015/engineered_products_project_business_industry_4_future_productivity_growth_manufacturing_industries (accessed on 20 June 2021).

- Zeman, P. Industrie und Stahlbau 4.0—Ein paar Gedanken! Stahlbau 2017, 86, 84–86. [Google Scholar] [CrossRef]

- Santos, C.; Mehrsai, A.; Barros, A.C.; Araújo, M.; Ares, E. Towards Industry 4.0: An overview of European strategic roadmaps. In Proceedings of the Manufacturing Engineering Society International Conference 2017, MESIC 2017, Vigo (Pontevedra), Spain, 28–30 June 2017. [Google Scholar]

- Ittermann, P.; Niehaus, J. Industrie 4.0 und Wandel von Industriearbeit: Überblick Über Forschungsstand und Trendbestimmungen. In Digitalisierung Industrieller Arbeit: Die Vision Industrie 4.0 Und Ihre Sozialen Herausforderungen, 2nd ed.; Hirsch-Kreinsen, H., Niehaus, J., Ittermann, P., Eds.; Nomos Verlagsgesellschaft mbH & Co. KG: Baden Baden, Germany, 2018; pp. 33–51. [Google Scholar]

- Murri, M.; Streppa, E.; Colla, V.; Fornai, B.; Branca, T.A. Digital Transformation in European Steel Industry: State of Art and Future Scenario. Eur. Steel Ski. AgendaErasmus+ Programme Key Action 2019, 2022, 1–43. [Google Scholar]

- Snabe Hagemann, J.; Weinelt, B. Digital transformation of industries. World Econ. Forum 2016. Available online: https://reports.weforum.org/digital-transformation/wp-content/blogs.dir/94/mp/files/pages/files/wef1601-digitaltransformation-1401.pdf (accessed on 20 June 2021).

- Tihinen, M.; Kääriäinen, J.; Teppola, S.; Parviainen, P. Tackling the digitization challenge: How to benefit from digitization in practice. Int. J. Inf. Syst. Proj. Manag. 2017, 5, 63–77. [Google Scholar]

- Rojko, A. Industry 4.0 concept: Background and overview. Int. J. Interact. Mob. Technol. 2017, 11, 77–90. [Google Scholar] [CrossRef] [Green Version]

- Herzog, K.; Winter, G.; Kurka, G.; Ankermann, K.; Binder, R.; Ringhofer, M.; Maierhofer, A.; Flick, A. The Digitization of Steel Production. BHM BHM Berg Und Hüttenmännische Mon. 2017, 162, 504–513. [Google Scholar] [CrossRef]

- Gajdzik, B.; Grabowska, S.; Saniuk, S. A Theoretical Framework for Industry 4.0 and Its Implementation with Selected Practical Schedules. Energies 2021, 14, 940. [Google Scholar] [CrossRef]

- Zhou, K.; Liu, T.; Zhou, L. Industry 4.0: Towards Future Industrial Opportunities and Challenges. In Proceedings of the International Conference on Fuzzy Systems and Knowledge Discovery, Zhangjiajie, China, 15–17 August 2016; pp. 2147–2152. [Google Scholar]

- Berger, R. Industry 4.0—The New Industrial Revolution—How Europe Will Succeed. Roland Berger Strategy Consultants. 2014. Available online: http://www.iberglobal.com/files/Roland_Berger_Industry.pdf (accessed on 20 June 2021).

- Hermann, M.; Pentek, T.; Otto, B. Design Principles for Industrie 4.0 Scenarios; A Literature Review, Working Paper No. 01/2015; Technische Universität Dortmund Fakultät Maschinenbau. Available online: http://www.iim.mb.tu-dortmund.de/cms/de/forschung/Arbeitsberichte/Design-Principles-for-Industrie-4_0-Scenarios.pdf (accessed on 15 June 2021).

- Plattform Industrie 4.0, 2014: Industrie 4.0. Whitepaper FuE-Themen. Available online: http://www.plattform-i40.de/sites/default/files/Whitepaper_Forschung%20Stand%203%20April%202014_0.pdf (accessed on 30 November 2014).

- Advanced Technologies for Industry. Available online: https://ati.ec.europa.eu (accessed on 24 June 2021).

- Cluster Collaboration. Available online: https://www.clustercollaboration.eu/news/advanced-technologies-industry-ati-website-launched (accessed on 20 February 2021).

- Besiekierska, A.; Gorgol, M. Platformy dla Przemysłu 4.0 w Skali Polski i Niemiec. Available online: https://automatykaonline.pl/Artykuly/Prawo-i-normy/Platformy-dla-Przemyslu-4.0-w-skali-Polski-i-Niemiec (accessed on 26 November 2019).

- Stahlmarkt 2016. Stahl 2025—Quo vadis? PwCFrankf. Am. Main 2016, 10. Available online: https://www.pwc.at/de/branchen/assets/industrielle-produktion/folder-stahlmarkt-2016.pdf (accessed on 15 January 2020).

- European Commission. Steel: Preserving Sustainable Jobs and Growth in Europe; COM (2016) 155 Final; European Commission: Brussels, Belgium, 16 March 2016. [Google Scholar]

- European Commission. A New Industrial Strategy for Europe; COM (2020) 102 Final; European Commission: Brussels, Belgium, 10 March 2020. [Google Scholar]

- European Commission. Action Plan for a Competitive and Sustainable Steel Industry in Europe; COM (2013) 407 Final; European Commission: Brussels, Belgium, 11 June 2021. [Google Scholar]

- Digital Twin Technology in the Steel Industry. Available online: https://www.estep.eu/assets/Final-Programme-Digital-Twin-WS-21-22-November.pdf (accessed on 20 December 2019).

- Branca, T.A.; Fornai, B.; Colla, V.; Murri, M.M.; Streppa, E.; Schröder, A. The Challenge of Digitalisation in the Steel Sector. Metals 2020, 10, 288. Available online: https://www.mdpi.com/2075-4701/10/2/288/htm (accessed on 15 June 2021). [CrossRef] [Green Version]

- Hecht, M. Industrie 4.0 der Dillinger Weg. Stahl Eisen 2017, 137. Available online: https://pure.unileoben.ac.at/portal/files/5379849/AC15701207.pdf (accessed on 15 June 2021).

- Industry 4.0 in the European Iron and Steel Industry: Towards an Overview of Implementations and Perspectives (fraunhofer.de). Available online: https://www.isi.fraunhofer.de/content/dam/isi/dokumente/cce/2018/Industry-4-0-Implementation-and-Perspectives_Steel-Industry_Working%20document.pdf (accessed on 10 January 2021).

- Research Fund for Coal and Steel, RFCS, 2003–2014, Summaries of RFCS Projects: 2003–2014. Available online: http://ec.europa.eu/research/industrial_technologies/pdf/rfcs/summaries-rfcs_en.pdf (accessed on 8 January 2018).

- Research Fund for Coal and Steel, RFCS, 2015–2016, Synopsis of the RFCS projects 2015–2016. Available online: http://ec.europa.eu/research/industrial_technologies/pdf/rfcs/synopsis_projects_2015-16.pdf (accessed on 8 January 2018).

- European Commission. 2018 Community Research and Development Information Service CORDIS. Available online: https://cordis.europa.eu/projects (accessed on 5 March 2018).

- European Commission. Research and Innovation Funding 2014–2020. Available online: https://ec.europa.eu/research/fp7/index_en.cfm (accessed on 5 March 2018).

- Arens, M.; Neef, C.; Beckert, B.; Hirzel, S. Perspectives for digitising energy-intensive industries—findings from the European iron and steel industry. ECEEE Ind. Summer Study 2018, 259–268. Available online: https://www.eceee.org/library/conference_proceedings/eceee_Industrial_Summer_Study/2018/2-sustainable-production-towards-a-circular-economy/perspectives-for-digitising-energy-intensive-industries-findings-from-the-european-iron-and-steel-industry/2018/2-118-18_Arens.pdf/ (accessed on 15 January 2021).

- Neef, C.; Hirzel, S.; Arens, M. Industry 4.0 in the European Iron and Steel Industry: Towards an Overview of Implementation and Perspectives; Fraunhofer, Institute for Systems and Innovation Research ISI: Karlsruhe, Germany, 2018. [Google Scholar]

- Geetha Devi, K.V.; Thakur, S.S.; Singh, S.K. Assessing the performances of vendor firms by optimization technique industry 4.0 GSC architectures. Int. J. Soc. Ecol. Sustain. Dev. 2021, 12, 1–10. [Google Scholar] [CrossRef]

- Blueprint ‘New Skills Agenda Steel’: Industry-driven sustainable European Steel Skills Agenda and Strategy (ESSA). Available online: https://www.estep.eu/essa (accessed on 5 February 2021).

- Bielański, A. Podstawy Chemii Nieorganicznej; Wyd. 5. T. 2; PWN: Warsow, Poland, 2002; p. 921. [Google Scholar]

- Chirumalla, K. Building digitally-enabled process innovation in the process industries: A dynamic capabilities approach. Technovation 2021, 105, 102256. [Google Scholar] [CrossRef]

- Worldwide IT Industry 2016 Predictions: Leading Digital Transformation to Scale; IDC FutureScape: New York, NY, USA, 2016; p. 125.

- Adamczewski, P. Knowledge Management in Intelligent Organizations in the Times of the Digital Transformation—Findings of the Research on the Polish SME Sector. In Zeszyty Naukowe Wyższej Szkoły Bankowej w Poznaniu; Wyższa Szkoła Bankowa w Poznaniu: Poznań, Poland, 2017; pp. 53–68. [Google Scholar]

- Torn, I.A.R.; Vaneker, T.H.J. Mass Personalization with Industry 4.0 by SMEs: A concept for collaborative networks. Procedia Manuf. 2019, 135–141, 2351–9789. [Google Scholar] [CrossRef]

- KETs Information from European Parliament. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2014/536282/IPOL_STU%282014%29536282_EN.pdf (accessed on 15 June 2021).

- Senn, C. The Nine Pillars of Industry 4.0. Available online: https://www.idashboards.com/blog/2019/07/31/the-pillars-of-industry-4-0 (accessed on 5 January 2020).

- Erboz, G. How to Define Industry 4.0: Main Pillars of Industry 4.0. In Proceedings of the 7th International Conference on Management (ICoM 2017), Nitra, Slovakia, 1 June 2017; Available online: https://www.researchgate.net/publication/326557388_How_To_Define_Industry_40_Main_Pillars_Of_Industry_40 (accessed on 9 June 2019).

- Burrell, D. Principles of Industry 4.0 and the 9 Pillars. Available online: https://www.plextek.com/insights/insights-insights/industry-4-0-and-the-9-pillars (accessed on 7 February 2019).

- Culot, G.; Nassimbeni, G.; Orzes, G.; Sartor, M. Behind the Definition of Industry 4.0: Analysis and Open Questions. Int. J. Prod. Econ. 2020. [Google Scholar] [CrossRef]

- Sniderman, B.; Mahto, M.; Cotteleer, M.J. Industry 4.0 and manufacturing ecosystems. Exploring the world of connected enterprises. Deloitte Dev. LLC 2016, 1, 1–24. Available online: https://www2.deloitte.com/content/dam/insights/us/articles/manufacturing-ecosystems-exploring-world-connected-enterprises/DUP_2898_Industry4.0ManufacturingEcosystems.pdf (accessed on 5 January 2021).

- Saniuk, S.; Grabowska, S.; Gajdzik, B. Social Expectations and Market Changes in the Context of Developing the Industry 4.0 Concept. Sustainability 2020, 12, 1362. [Google Scholar] [CrossRef] [Green Version]

- Gajdzik, B.; Grabowska, S.; Saniuk, S.; Wieczorek, T. Sustainable Development and Industry 4.0: A Bibliometric Analysis Identifying Key Scientific Problems of the Sustainable Industry 4.0. Energies 2020, 13, 4254. [Google Scholar] [CrossRef]

- Gajdzik, B. Environmental aspects, strategies and waste logistic system based on the example of metallurgical company. Metalurgija 2009, 48, 63–67. [Google Scholar]

- Towards Competitive and Clean European Steel; Commission Staff Working Document, 353 Final; SWD: Brussels, Belgium, 2021; Available online: https://ec.europa.eu/info/sites/default/files/swd-competitive-clean-european-steel_en.pdf (accessed on 24 June 2021).

- Ocieczek, W.; Gajdzik, B. Social responsibility of business in Industry 4.0. WSHumanitas. Manag. 2019, 89–102. [Google Scholar] [CrossRef]

- Garbarz, B.; Szulc, W.; Rębiasz, B. Prognozy rozwoju popytu i podaży na rynku stalowych wyrobów hutniczych w Polsce (Forecasts of supply and demand development on the finished steel market in Poland). Hut. Wiadomości. Hut. 2007, 74, 125–132. [Google Scholar]

- World Economic Forum. Localized Microfactories—The New Face of Globalised Manufacturing. Available online: https://www.weforum.org/agenda/2019/06/localized-micro-factories-entrepreneurs-and-consumers (accessed on 11 June 2019).

- Blueprint for Sectoral Cooperation on Skills: Towards an EU Strategy Addressing the Skills Needs of the Steel Sector. In European Vision on Steel-Related Skills and Supporting Actions to Solve the Skills Gap Today and Tomorrow in Europe; European Commission Executive Agency for Small and Medium-sized Enterprises (EASME) Unit A1—COSME: Brussels, Belgium, 2020; p. 74.

- Gajdzik, B. Visions and Directions for the Development of Logistics 4.0 in Context 4.0 Industrial Revolution (level 4.0–L.4.0). In Production Management and Packaging. Food safety and Industry 4.0; Walaszczyk, A., Jałmużna, I., Lewandowski, J., Eds.; Politechnika Łódzka: Łódź, Poland, 2019; pp. 69–79. Available online: http://cybra.lodz.pl/publication/19228 (accessed on 15 June 2021).

- Gajdzik, B.; Grzybowska, K. Example models of building trust in supply chains of metalurgical enterprises. Metalurgija 2012, 51, 563–566. [Google Scholar]

- Grzybowska, K.; Gajdzik, B. SECI model and facilitation in change management in metallurgical enterprise. Metalurgija 2013, 52, 275–278. [Google Scholar]

- Cygler, J.; Gajdzik, B.; Sroka, W. Coopetition as a development stimulator of enterprises in the networked steel sector. Metalurgija 2014, 53, 383–386. [Google Scholar]

- Biały, W.; Gajdzik, B.; Jimeno, C.; Romanyshyn, L. Engineer 4.0 in a Metallurgical Enterprise. In Multidisciplinary Aspects of production Engineering. Monograph. Engineering and Technology. Pt. 1; Biały, W., Ed.; Sciendo: Warszawa, Poland, 2019; pp. 172–182. [Google Scholar] [CrossRef] [Green Version]

- Romero, D.; Noran, O.; Stahre, J.; Bernus, P.; Fast-Berglund, Å. Towards a human-centred reference architecture for next generation balanced automation systems: Human-automation symbiosis. Adv. Prod. Manag. Syst. 2015, 460, 556–566. [Google Scholar]

- Romero, D.; Bernus, P.; Noran, O.; Stahre, J.; Fast-Berglund, Å. The Operator 4.0: Human Cyber-Physical Systems & Adaptive Automation Towards Human-Automation Symbiosis Work Systems. In Proceedings of the IFIP International Conference on Advances in Production Management Systems—APMS. Proceedings of Advances in Production Management Systems: Initiatives for a Sustainable World, Novi Sad, Serbia, 3 September 2016; pp. 677–686. Available online: https://link.springer.com/chapter/10.1007/978-3-319-51133-7_80 (accessed on 20 February 2021).

- Ruppert, T.; Jaskó, S.; Holczinger, T.; Abonyi, J. Enabling Technologies for Operator 4.0: A Survey. Apply Sci. 2018, 8, 1650. Available online: https://www.mdpi.com/2076-3417/8/9/1650 (accessed on 15 June 2021). [CrossRef] [Green Version]

- Romero, D.; Stahre, J.; Wuest, T.; Noran, O.; Bernus, P.; Fast-Berglund, Å.; Gorecky, D. Towards an Operator 4.0 Typology: A Human-Centric Perspective on the Fourth Industrial Revolution Technologies. In Proceedings of the International Conference on Computers and Industrial Engineering (CIE46), Tianjin, China, 29 October 2016; pp. 1–11. [Google Scholar]

- Industry 5.0 Towards A Sustainable, Human Centric and Resilient European industry; European Commission: Brussels, Belgium, 2021; Available online: https://op.europa.eu/en/publication-detail/-/publication/aed3280d-70fe-11eb-9ac9-01aa75ed71a1/language-en/format-PDF/source-search (accessed on 15 June 2021).

- Colla, V.; Matino, R.; Schröder, A.J.; Schivalocchi, M.; Romaniello, L. Human-Centered Robotic Development in the Steel Shop: Poprawa zdrowia, bezpieczeństwa i umiejętności cyfrowych w miejscu pracy. Metals 2021, 11, 647. [Google Scholar] [CrossRef]

- Wagner, T.; Herrmann, C.; Thiede, S. Industry 4.0 impacts on lean production systems. Elsevier, 50-th CIRP Conference of manufacturing Systems. Preced. CIRP 2017, 63. [Google Scholar] [CrossRef]

- Branca, A.; Fornai, B.; Colla, V.; Murri, M.M.; Streppa, E.; Schröder, A.J. Current and future aspects of the digital transformation in the European Steel Industry. Matériaux Tech. 2020, 108, 508. [Google Scholar] [CrossRef]

- Stadnicka, D.; Antonelli, D. Discussion on lean approach implementation in a collaborative man-robot workstation. In Proceedings of the Sixth International Conference on Business Sustainability, Management, Technology and Learning for Individuals, Organisations and Society in Turbulent Environment, Povoa de Varzim, Portugal, 16–18 November 2016. [Google Scholar]

- 2020 World Steel in Figures. Data Finalised 30 April 2020. In Top Steel-Producing Companies 2019; World Steel Association: Brussels, Belgium, 2020; p. 8. [Google Scholar]

- Corporate ArcelorMittal Website. Available online: https://corporate.arcelormittal.com/media/case-studies/industry-4-0 (accessed on 20 February 2021).

- Company Thyssenkrupp Website. Available online: https://www.thyssenkrupp.com/en/company/innovation/industry-4-0 (accessed on 4 February 2021).

- TataSteel Website. Available online: https://www.tatasteeleurope.com/ts/automotive/industry-themes/digitalisation (accessed on 4 February 2021).

- Lee, J.; Bagheri, B.; Kao, H. Research Letters: A Cyber-Physical Systems architecture for Industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23. [Google Scholar] [CrossRef]

- Liu, Y.; Peng, Y.; Wang, B.; Yao, S.; Liu, Z. Review on cyber-physical systems. IEEE CAA J. Autom. Sin. 2017, 4, 27–40. [Google Scholar] [CrossRef]

- Govender, E.; Telukdarie, A.; Sishi, M.N. Approach for Implementing Industry 4.0 Framework in the Steel Industry. In Proceedings of the 2019 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Macao, China, 15–18 December 2019; Available online: https://ieeexplore.ieee.org/stamp/stamp.jsp?tp=&arnumber=8978492 (accessed on 21 June 2021). [CrossRef]

- Henning, K. Recommendations for Implementing the Strategic Initiative Industrie 4.0. 2013. Available online: https://www.din.de/blob/76902/e8cac883f42bf28536e7e8165993f1fd/recommendations-for-implementing-industry-4-0-data.pdf (accessed on 20 February 2021).

- Shrouf, F.; Ordieres, J.; Miragliotta, G. Smart factories in Industry 4.0: A review of the concept and of energy management approached in production based on the internet of things paradigm. In Proceedings of the 2014 IEEE International Conference on Industrial Engineering and Engineering Management, Selangor, Malaysia, 9–12 December 2014. [Google Scholar]

- Olalekan, O.; Afees, O.; Ayodele, S. An Empirical Analysis of the Contribution of Mining Sector to Economic Development in Nigeria. Khazar J. Humanit. Soc. Sci. 2016, 19, 1. [Google Scholar] [CrossRef]

- Patel, M. The Future of Maintenance; White Paper; Infosys: Bengaluru, India, 2018; Available online: https://www.infosys.com/industries/aerospace-defense/white-papers/Documents/enabled-predictive-maintenance.pdf (accessed on 16 July 2019).

- Rødseth, H.; Eleftheriadis, R.J.; Li, Z.; Li, J. Smart Maintenance in Asset Management—Application with Deep Learning. In International Workshop of Advanced Manufacturing and Automation. IWAMA 2019: Advanced Manufacturing and Automation IX; Springer: Singapore, 2020; pp. 608–615. [Google Scholar]

- Bousdekis, A.; Lepenioti, K.; Ntalaperas, D.; Vergeti, D.; Apostolou, D.; Boursinos, V. A RAMI 4.0 View of Predictive Maintenance: Software Architecture, Platform and Case Study in Steel Industry. In Advanced Information Systems Engineering Workshops. CAiSE 2019. Lecture Notes in Business Information Processing; Proper, H., Stirna, J., Eds.; Springer: Cham, Switzerland, 2019; Volume 349. [Google Scholar] [CrossRef]

- Lee, J.; Kao, H.-A.; Yang, S. Service Innovation and Smart Analytics for Industry 4.0 and Big Data Environment. In Procedia CIRP; Elsevier B.V.: Windsor, Ontario, Canada, 2014; pp. 3–8. [Google Scholar]

- Dellnitz, M.; Dumitrescu, R.; Flaßkamp, K.; Gausemeier, J.; Hartmann, P.; Iwanek, P.; Korf, S.; Krüger, M.; Ober-Blöbaum, S.; Porrmann, M.; et al. The Paradigm of Self-Optimization. In Design Methodology for Intelligent Technical Systems. Lecture Notes in Mechanical Engineering; Gausemeier, J., Rammig, F., Schäfer, W., Eds.; Springer: Heidelberg/Berlin, Germany, 2014; pp. 1–25. [Google Scholar] [CrossRef]

- Miśkiewicz, R.; Wolniak, R. Practical application of the Industry 4.0 concept in a steel company. Sustainability 2020, 12, 5776. [Google Scholar] [CrossRef]

- Wolniak, R.; Saniuk, S.; Grabowska, S.; Gajdzik, B. Identification of Energy Efficiency Trends in the Context of the Development of Industry 4.0 Using the Polish Steel Sector as an Example. Energies 2020, 13, 2867. [Google Scholar] [CrossRef]

- Gajdzik, B.; Sroka, W. Resource Intensity vs. Investment in Production Installations—The Case of the Steel Industry in Poland. Energies 2021, 14, 443. [Google Scholar] [CrossRef]

- Naujok, N.; Stamm, H. Industry 4.0 in Steel: Status, Strategy, Roadmap and Capabilities. 14-th June 2017. Keynote Presentation Future Steel Forum, Warsaw; PwC Strategy: London, UK, 2017; Available online: https://futuresteelforum.com/content-images/speakers/Dr-Nils-Naujok-Holger-Stamm-Industry-4.0-in-steel.pdf (accessed on 23 March 2021).

- PwC 20th Annual Global CEO Survey: Key Findings from the Global Metals Sector; PwC: London, UK, 2017.

- Platform Industrie 4.0. Available online: https://www.plattform-i40.de/I40/Navigation/EN/Home/home.html (accessed on 26 February 2019).

- Davies, R. Industry 4.0 digitalisation for productivity and growth. European Parliament PE 568.337. Eur. Parliam. Res. Serv. 2015, 1. Available online: https://www.europarl.europa.eu/RegData/etudes/BRIE/2015/568337/EPRS_BRI(2015)568337_EN.pdf (accessed on 20 June 2021).

- Gajdzik, B.; Wolniak, R. Digitalisation and Innovation in the Steel Industry in Poland—Selected Tools of ICT in an Analysis of Statistical Data and a Case Study. Energies 2021, 14, 334. [Google Scholar] [CrossRef]

- Ślusarczyk, B.; Tvaronavičienė, M.; Ul Haque, A.; Oláh, J. Predictors of industry 4.0 technologies affecting logistic enterprises’ performance: International perspective from economic lens. Technol. Econ. Dev. Econ. 2020, 26, 1263–1283. [Google Scholar] [CrossRef]

- Küpper, D.; Knizek, C.; Ryeson, D.; Noecker, J.; Quality 4.0 Takes More than Technology. ASQ 2019. Available online: https://image-src.bcg.com/Images/BCG-Quality-4.0-Takes-More-Than-Technology-Aug-2019_tcm9-224161.pdf (accessed on 21 June 2021).

- Gajdzik, B.; Sitko, J. An analysis of the causes of complaints about steel sheets in metallurgical product quality management systems. Metalurgija 2014, 53, 135–138. [Google Scholar]

- Vannocci, M.; Ritacco, A.; Castellano, A.; Galli, F.; Vannucci, M.; Iannino, V.; Colla, V. Flatness Defect Detection and Classification in Hot Rolled Steel Strips Using Convolutional NeuralNetworks. In Advances in Computational Intelligence, IWANN 2019, Lecture Notes in Computer Science; Rojas, I., Joya, G., Catala, A., Eds.; Springer: Cham, Switzerland, 2019; p. 11507. [Google Scholar]

- Duft, P. Durana, Algorytmy decyzyjne oparte na sztucznej inteligencji, zautomatyzowane systemy produkcyjne i innowacje oparte na big data w zrównoważonym przemyśle 4.0. Econ. Manag. Finan. Mark. 2020, 15, 9–18. [Google Scholar]

- Skobelev, P.; Borovik, S.Y. On the way from Industry 4.0 to Industry 5.0: From digital manufacturing to digital society. Industry 4.0 2017, 2, 307–311. [Google Scholar]

- Shelzer, R. What Is Industry 5.0—And How Will It Affect Manufacturers. 2017. Available online: https://gesrepair.com/industry-5-0-will-affect-manufacturers (accessed on 21 June 2021).

- Nahavandi, S. Industry 5.0—A Human-Centric Solution. Sustainability 2019, 11, 4371. [Google Scholar] [CrossRef] [Green Version]

- Gajdzik, B.; Wyciślik, A. Assessment of environmental aspects in a metallurgical enterprise. Metalurgija 2012, 51, 537–540. [Google Scholar]

- Conejo, A.N.; Birat, J.-P.; Dutta, A. A review of the current environmental challenges of the steel industry and its value chain. J. Environ. Manag. 2020, 259, 109782. [Google Scholar] [CrossRef] [PubMed]

| Field of Change | Direction of Change | Characteristics of Steelworks 3.0 | Characteristics of Steelworks 4.0 |

|---|---|---|---|

| Integration of technical processes and IC systems | ICT, IC systems, information flows | autonomous processes | autonomous decision processes, learning functions to adapt technical processes and IT systems |

| Processes organization | process visualization, process control, monitoring, process optimization | process optimization, digitalization of physical processes, virtualization, statistics and quality control systems, process monitoring | self-optimization, programmable logic controller (PLC), virtual assistance digital transformation end-end digital integration, simulation and virtualization, learning function, intelligent plant monitoring |

| Humans and machines | towards automatization and robots | operator of machine (P2M), Total Productive Maintenance | machine and machine (M2M), learning machines, artificial intelligence, smart maintenance, RFID (product-machine), smart sensors, self-organized, symbiosis of human and machine: Human CPS (H-CPPS) |

| Communication and connection | interconnection, networking, information sharing | Internet: broadband Internet, mobile Internet, websites networking, interoperability, vertical integration of production systems, horizontal integration of partners in value chain, integration inside and outside, collaboration network | IoT, IIoT, IoS, intensive networking, intensive communication, interoperability, networked and distributed data diffusion, vertical integration of production systems, horizontal integration of partners in value chain (via value creation networks), smart chains |

| Data process | integration of text data, video-/audio-streams and others, real time data, open data, smart data, integrated data coming from different sources | IT systems integration of IT systems, ERP | Big Data, Big Data Analytics, cloud computing, IoT (IoPeople, IoEverything, IoData), System of Systems (SoS), Web-Based Organization, smart product-RFID, product information management, High Performance Computing (HIP), DevOps |

| Decision | De-central instead of central solutions | decentralized decisions, process organization | decentralized decisions, decision support systems (DSS), networked, distributed data diffusion, online decisions |

| Automatization and robots | full automatization, robots, AI | classic automatization | process automation/control, collaborative robots, cobots, AI—Artificial Intelligence, Automated Guided Vehicles—AGV |

| Production and materials planning | smart production, CPPS | FMS, JiT, Lean, TQM, ERP, pull systems, embedded systems | CPPS, additive manufacturing (AM), 3D printing, process simulation and modeling, new materials, energy management solution personal design, simultaneous planning of products and production process, digital twin |

| Product and market | individualization, personalization | diversification, product innovation, services, sustainability | personal product, co-innovation, IoS, intelligent product with knowledge of its own quality and production history, end-to-end engineering, individual innovation for personal product, block chain technology, smart factory, ecosystem |

| Criteria | ArcelorMittal | Thyssenkrupp | Tata Steel |

|---|---|---|---|

| Digitalization | Organization want to digitalize the whole supply chain and all business processes. | Implementation of interactive value chain. | Applying of digital services across whole supply chain. |

| Examples of activities |

|

|

|

| Effects |

|

|

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gajdzik, B.; Wolniak, R. Transitioning of Steel Producers to the Steelworks 4.0—Literature Review with Case Studies. Energies 2021, 14, 4109. https://doi.org/10.3390/en14144109

Gajdzik B, Wolniak R. Transitioning of Steel Producers to the Steelworks 4.0—Literature Review with Case Studies. Energies. 2021; 14(14):4109. https://doi.org/10.3390/en14144109

Chicago/Turabian StyleGajdzik, Bożena, and Radosław Wolniak. 2021. "Transitioning of Steel Producers to the Steelworks 4.0—Literature Review with Case Studies" Energies 14, no. 14: 4109. https://doi.org/10.3390/en14144109

APA StyleGajdzik, B., & Wolniak, R. (2021). Transitioning of Steel Producers to the Steelworks 4.0—Literature Review with Case Studies. Energies, 14(14), 4109. https://doi.org/10.3390/en14144109