Will Electric Vehicles Be Killed (again) or Are They the Next Mobility Killer App?

Abstract

1. Introduction

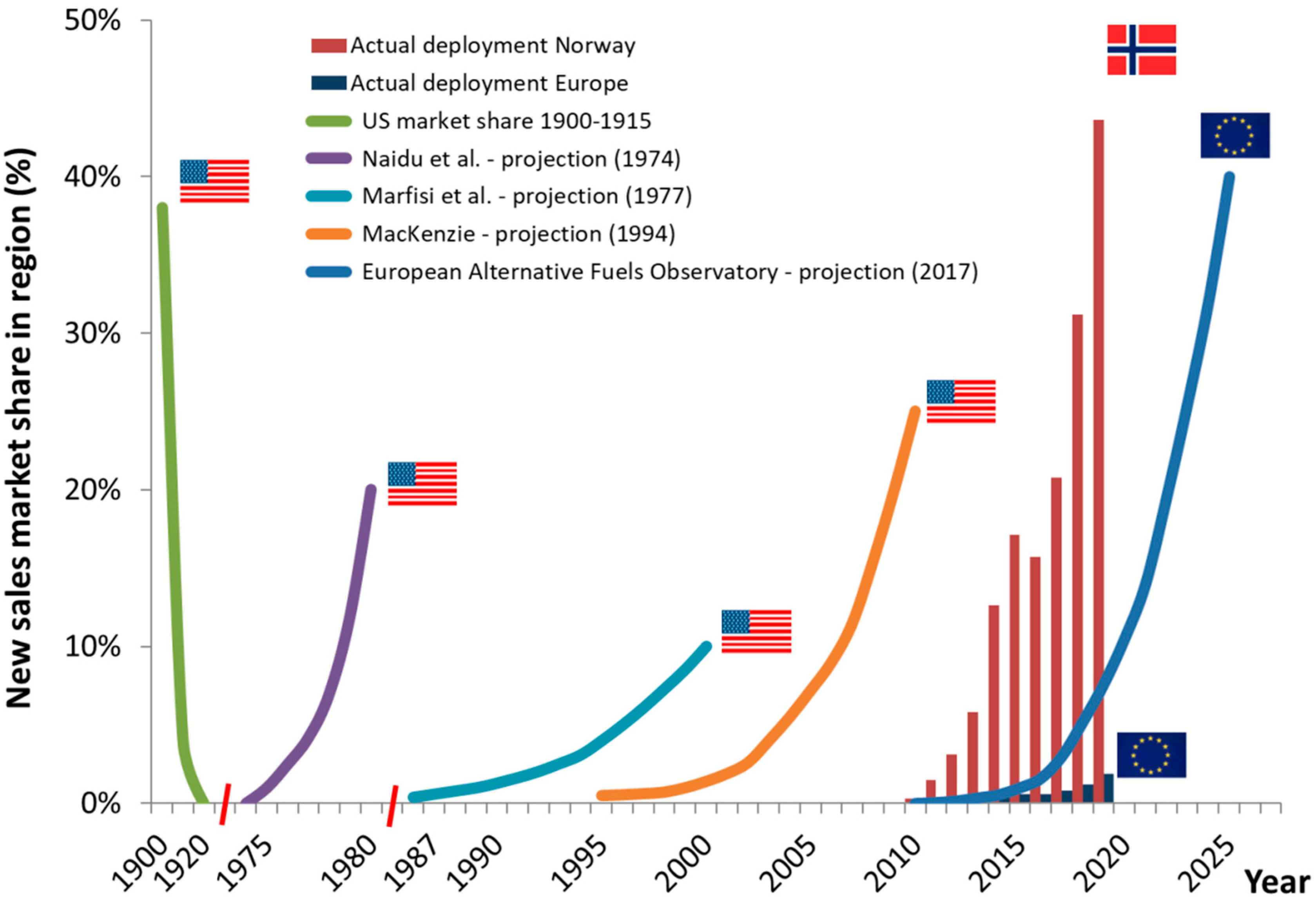

2. One Hundred and Twenty Years of EV Re-emergence

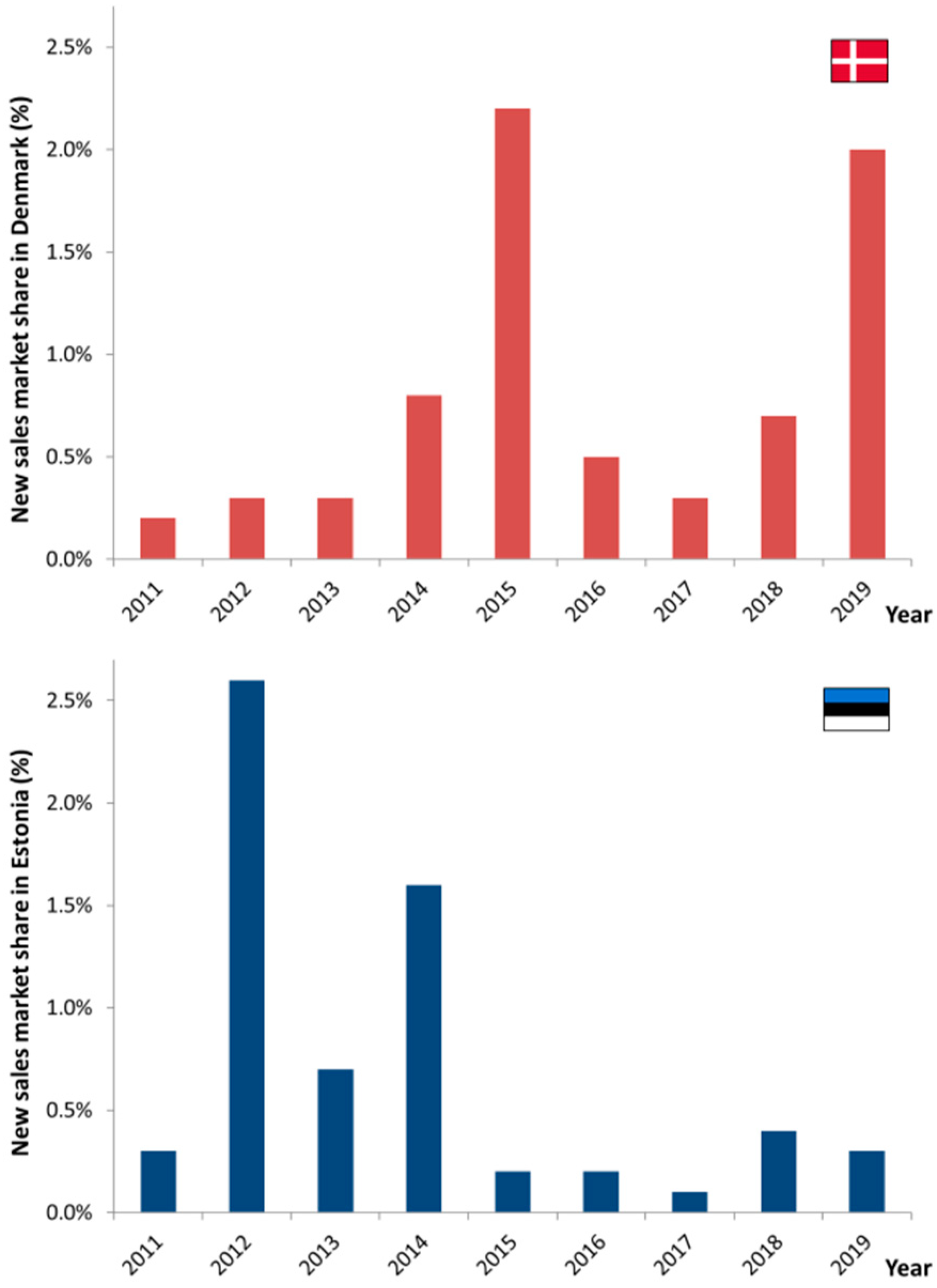

3. When the Economics Make Sense to Car Drivers, They Go Electric

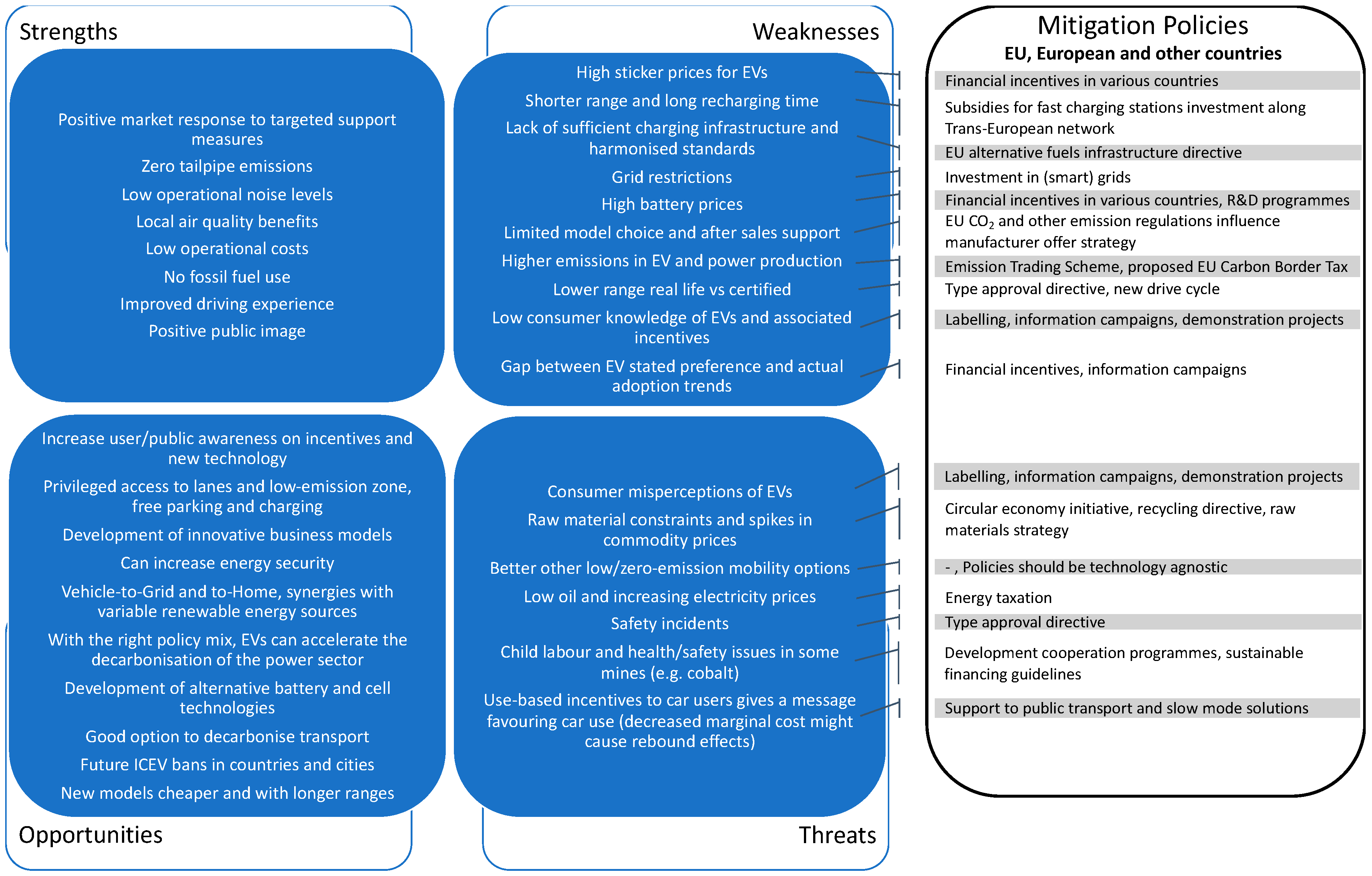

4. How Can Electric Vehicles Become a Sustainable Success?

5. Policy Implications

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Glossary

| CO2 | Carbon Dioxide |

| EU | European Union |

| EU28 | Group of 28 European Union Member States |

| EV | Electric Vehicle |

| ICEV | Internal Combustion Engine Vehicles |

| PHEV | Plug-in Hybrid Electric Vehicle |

| R&D | Research and Development |

| SWOT | Strengths, Weaknesses, Opportunities, Threats |

| TCO | Total Cost of Ownership |

| US | United States |

References

- Fréry, F. Un cas d’amnésie stratégique—l’éternelle émergence de la voiture électrique. In Proceedings of the IXème Conférence Internationale de Management Stratégique Montpellier, Montpellier, France, 24–26 May 2000. [Google Scholar]

- Paine, C. Who Killed the Electric Car? Available online: https://www.youtube.com/watch?v=r75lqbA0uMM&list=PL61382C9E67BA0781&index=9 (accessed on 4 January 2020).

- Clean Energy Ministerial EV30@30 campaign—Factsheet, June 2019. Available online: http://www.cleanenergyministerial.org/sites/default/files/2019-06/EV30%4030factsheet%28June2019%29.pdf (accessed on 4 January 2020).

- Tsakalidis, A.; Thiel, C. Electric Vehicles in Europe from 2010 to 2017: Is Full-Scale Commercialisation Beginning? Publications Office of the European Union: Luxembourg, 2018; ISBN 978-92-79-96719-1. [Google Scholar] [CrossRef]

- Consumers Union Inc. Consumer Reports; Consumers Union Inc.: Mount Vernon, NY, USA, 1975. [Google Scholar]

- Edwards, B.D. Creating the Traffic-Compatible Electric Vehicle Industry in the UK—The Chloride Approach; SAE International: Warrendale, PA, USA, 1981. [Google Scholar] [CrossRef]

- Editorial. Reality check. Nat. Energy 2018, 3, 245. [Google Scholar] [CrossRef]

- Nykvist, B.; Nilsson, M. Rapidly falling costs of battery packs for electric vehicles. Nat. Clim. Chang. 2015, 5, 329–332. [Google Scholar] [CrossRef]

- Seba, T. Clean Disruption—Why Energy & Transportation will be Obsolete by 2030, Swedbank Nordic Energy Summit 2016, Oslo, Norway. Available online: https://www.youtube.com/watch?v=Kxryv2XrnqM (accessed on 21 October 2019).

- Lévay, P.Z.; Drossinos, Y.; Thiel, C. The effect of fiscal incentives on market penetration of electric vehicles: A pairwise comparison of total cost of ownership. Energy Policy 2017, 105, 524–533. [Google Scholar] [CrossRef]

- European Alternative Fuels Observatory Passenger electric car sales & Zero emission vehicles fleet study (November 2017). Available online: www.eafo.eu (accessed on 21 October 2019).

- Turcheniuk, K.; Bondarev, D.; Singhal, V.; Yushin, G. Ten years left to redesign lithium-ion batteries. Nature 2018, 559, 467–470. [Google Scholar] [CrossRef] [PubMed]

- Figenbaum, E. Perspectives on Norway’s supercharged electric vehicle policy. Environ. Innov. Soc. Transit. 2017, 25, 14–34. [Google Scholar] [CrossRef]

- Government of Norway. Meld. St. 33 (2016–2017), National Transport Plan 2018–2029; Government of Norway: Oslo, Norway, 2017.

- Wang, N.; Tang, L.; Pan, H. A global comparison and assessment of incentive policy on electric vehicle promotion. Sustain. Cities Soc. 2019, 44, 597–603. [Google Scholar] [CrossRef]

- Nian, V.; Hari, M.P.; Yuan, J. A new business model for encouraging the adoption of electric vehicles in the absence of policy support. Appl. Energy 2019, 235, 1106–1117. [Google Scholar] [CrossRef]

- Jenn, A.; Springel, K.; Gopal, A.R. Effectiveness of electric vehicle incentives in the United States. Energy Policy 2018, 119, 349–356. [Google Scholar] [CrossRef]

- Tsakalidis, A.; Julea, A.; Thiel, C. The Role of Infrastructure for Electric Passenger Car Uptake in Europe. Energies 2019, 12, 4348. [Google Scholar] [CrossRef]

- Cansino, J.M.; Sánchez-Braza, A.; Sanz-Díaz, T. Policy instruments to promote electro-mobility in the EU28: A comprehensive review. Sustainability 2018, 10, 2507. [Google Scholar] [CrossRef]

- Langbroek, J.H.M.; Franklin, J.P.; Susilo, Y.O. The effect of policy incentives on electric vehicle adoption. Energy Policy 2016, 94, 94–103. [Google Scholar] [CrossRef]

- Abdul-Manan, A.F.N. Uncertainty and differences in GHG emissions between electric and conventional gasoline vehicles with implications for transport policy making. Energy Policy 2015, 87, 1–7. [Google Scholar] [CrossRef]

- Mahmoudzadeh Andwari, A.; Pesiridis, A.; Rajoo, S.; Martinez-Botas, R.; Esfahanian, V. A review of Battery Electric Vehicle technology and readiness levels. Renew. Sustain. Energy Rev. 2017, 78, 414–430. [Google Scholar] [CrossRef]

- Tran, M.; Banister, D.; Bishop, J.D.K.; McCulloch, M.D. Realizing the electric-vehicle revolution. Nat. Clim. Chang. 2012, 2, 328–333. [Google Scholar] [CrossRef]

- Campello-Vicente, H.; Peral-Orts, R.; Campillo-Davo, N.; Velasco-Sanchez, E. The effect of electric vehicles on urban noise maps. Appl. Acoust. 2017, 116, 59–64. [Google Scholar] [CrossRef]

- Figenbaum, E.; Assum, T.; Kolbenstvedt, M. Electromobility in Norway: Experiences and Opportunities. Res. Transp. Econ. 2015, 50, 29–38. [Google Scholar] [CrossRef]

- Haddadian, G.; Khodayar, M.; Shahidehpour, M. Accelerating the Global Adoption of Electric Vehicles: Barriers and Drivers. Electr. J. 2015, 28, 53–68. [Google Scholar] [CrossRef]

- Ullah, A.; Aimin, W.; Ahmed, M. Smart automation, customer experience and customer engagement in electric vehicles. Sustainability 2018, 10, 1350. [Google Scholar] [CrossRef]

- Skippon, S.M.; Kinnear, N.; Lloyd, L.; Stannard, J. How experience of use influences mass-market drivers’ willingness to consider a battery electric vehicle: A randomised controlled trial. Transp. Res. Part A Policy Pract. 2016, 92, 26–42. [Google Scholar] [CrossRef]

- Burgess, M.; King, N.; Harris, M.; Lewis, E. Electric vehicle drivers’ reported interactions with the public: Driving stereotype change? Transp. Res. Part F Traffic Psychol. Behav. 2013, 17, 33–44. [Google Scholar] [CrossRef]

- Coffman, M.; Bernstein, P.; Wee, S. Electric vehicles revisited: A review of factors that affect adoption. Transp. Rev. 2017, 37, 79–93. [Google Scholar] [CrossRef]

- Franke, T.; Rauh, N.; Günther, M.; Trantow, M.; Krems, J.F. Which Factors Can Protect Against Range Stress in Everyday Usage of Battery Electric Vehicles? Toward Enhancing Sustainability of Electric Mobility Systems. Hum. Factors 2016, 58, 13–26. [Google Scholar] [CrossRef] [PubMed]

- Seddig, K.; Jochem, P.; Fichtner, W. Integrating renewable energy sources by electric vehicle fleets under uncertainty. Energy 2017, 141, 2145–2153. [Google Scholar] [CrossRef]

- Dombrowski, U.; Engel, C. Impact of electric mobility on the after sales service in the automotive industry. Procedia CIRP 2014, 16, 152–157. [Google Scholar] [CrossRef]

- Pavlovic, J.; Tansini, A.; Fontaras, G.; Ciuffo, B.; Garcia Otura, M.; Trentadue, G.; Suarez Bertoa, R.; Millo, F. The Impact of WLTP on the Official Fuel Consumption and Electric Range of Plug-in Hybrid Electric Vehicles in Europe; SAE International: Warrendale, PA, USA, 2017; pp. 1–10. [Google Scholar] [CrossRef]

- Bohnsack, R.; Pinkse, J.; Kolk, A. Business models for sustainable technologies: Exploring business model evolution in the case of electric vehicles. Res. Policy 2014, 43, 284–300. [Google Scholar] [CrossRef]

- Plötz, P.; Axsen, J.; Funke, S.A.; Gnann, T. Designing car bans for sustainable transportation. Nat. Sustain. 2019, 2, 534–536. [Google Scholar] [CrossRef]

- Meckling, J.; Nahm, J. The politics of technology bans: Industrial policy competition and green goals for the auto industry. Energy Policy 2019, 126, 470–479. [Google Scholar] [CrossRef]

- Jochem, P.; Doll, C.; Fichtner, W. External costs of electric vehicles. Transp. Res. Part D Transp. Environ. 2016, 42, 60–76. [Google Scholar] [CrossRef]

- Thiel, C.; Julea, A.; Acosta Iborra, B.; De Miguel Echevarria, N.; Peduzzi, E.; Pisoni, E.; Gómez Vilchez, J.J.; Krause, J. Assessing the Impacts of Electric Vehicle Recharging Infrastructure Deployment Efforts in the European Union. Energies 2019, 12, 2409. [Google Scholar] [CrossRef]

- IEA. Global EV Outlook 2018; IEA: Paris, France, 2018; ISBN 9789264302365. [Google Scholar]

- Quak, H.; Nesterova, N.; Van Rooijen, T. Possibilities and Barriers for Using Electric-powered Vehicles in City Logistics Practice. Transp. Res. Procedia 2016, 12, 157–169. [Google Scholar] [CrossRef]

- Thiel, C.; Nijs, W.; Simoes, S.; Schmidt, J.; van Zyl, A.; Schmid, E. The impact of the EU car CO2 regulation on the energy system and the role of electro-mobility to achieve transport decarbonisation. Energy Policy 2016, 96, 153–166. [Google Scholar] [CrossRef]

- Figenbaum, E.; Kolbenstvedt, M. Norwegian user and usage profiles for BEVs and PHEVs -Results from a Norwegian survey of vehicle owners. In Proceedings of the 30th International Electric Vehicle Symposium (EVS30), Stuttgart, Germany, 9–11 October 2017; pp. 1084–1101. [Google Scholar]

- Kühl, N.; Goutier, M.; Ensslen, A.; Jochem, P. Literature vs. Twitter: Empirical insights on customer needs in e-mobility. J. Clean. Prod. 2019, 213, 508–520. [Google Scholar] [CrossRef]

- Donati, A.V.; Dilara, P.; Thiel, C.; Spadaro, A.; Gkatzoflias, D.; Drossinos, Y. Individual Mobility: From Conventional to Electric Cars; Publications Office of the European Union: Luxembourg, 2015; ISBN 978-92-79-51894-2. [Google Scholar] [CrossRef]

- Von Der Leyen, U. A Union that Strives for More My Agenda for Europe, Political Guidelines For The Next European Commission 2019–2024. Available online: https://ec.europa.eu/commission/sites/beta-political/files/political-guidelines-next-commission_en.pdf (accessed on 10 March 2020).

- Harrison, G.; Gómez Vilchez, J.J.; Thiel, C. Industry strategies for the promotion of E-mobility under alternative policy and economic scenarios. Eur. Transp. Res. Rev. 2018, 10, 19. [Google Scholar] [CrossRef]

- European Commission Weekly Oil Bulletin. Available online: https://ec.europa.eu/energy/en/data-analysis/weekly-oil-bulletin (accessed on 24 July 2019).

- Eurostat Electricity prices, tables nrg_pc_204 and nrg_pc_204_h. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 24 July 2019).

- Gómez Vilchez, J.; Harrison, G.; Kelleher, L.; Smyth, A.; Thiel, C.; Lu, H.; Rohr, C. Quantifying the Factors Influencing People’s Car Type Choices in Europe: Results of a Stated Preference Survey; Publications Office of the European Union: Luxembourg, 2017; ISBN 978-92-79-77201-6. [Google Scholar] [CrossRef]

- Moraga, G.; Huysveld, S.; Mathieux, F.; Blengini, G.A.; Alaerts, L.; Van Acker, K.; de Meester, S.; Dewulf, J. Circular economy indicators: What do they measure? Resour. Conserv. Recycl. 2019, 146, 452–461. [Google Scholar] [CrossRef] [PubMed]

- European Commission Commission action plan on financing sustainable growth. Available online: https://ec.europa.eu/info/publications/180308-action-plan-sustainable-growth_en (accessed on 10 March 2020).

- Kumar, R.R.; Alok, K. Adoption of electric vehicle: A literature review and prospects for sustainability. J. Clean. Prod. 2020, 253, 119911. [Google Scholar] [CrossRef]

- IEA. Global EV Outlook 2019; IEA: Paris, France, 2019. [Google Scholar]

- Jayakumar, A.; Chalmers, A.; Lie, T.T. Review of prospects for adoption of fuel cell electric vehicles in New Zealand. IET Electr. Syst. Transp. 2017, 7, 259–266. [Google Scholar] [CrossRef]

- Alonso Raposo, M.; Ciuffo, B.; Alves Dies, P.; Ardente, F.; Aurambout, J.-P.; Baldini, G.; Baranzelli, C.; Blagoeva, D.; Bobba, S.; Braun, R.; et al. The Future of Road Transport—Implications of Automated, Connected, Low-Carbon and Shared Mobility; Publications Office of the European Union: Luxembourg, 2019; ISBN 978-92-76-14318-5. [Google Scholar] [CrossRef]

- Alibakhshikenari, M.; Virdee, B.S.; Ali, A.; Limiti, E. A novel monofilar-Archimedean metamaterial inspired leaky-wave antenna for scanning application for passive radar systems. Microw. Opt. Technol. Lett. 2018, 60, 2055–2060. [Google Scholar] [CrossRef]

- Trentadue, G.; Pinto, R.; Salvetti, M.; Zanni, M.; Pliakostathis, K.; Scholz, H.; Martini, G. Assessment of Low-Frequency Magnetic Fields Emitted by DC Fast Charging Columns. Bioelectromagnetics 2020, bem.22254. [Google Scholar] [CrossRef]

- Pliakostathis, K.; Zanni, M.; Trentadue, G.; Scholz, H. Vehicle Electromagnetic Emissions: Challenges and Considerations. In Proceedings of the 2019 International Symposium on Electromagnetic Compatibility—EMC EUROPE, Barcelona, Spain, 2–6 September 2019 2019; pp. 1106–1111. [Google Scholar] [CrossRef]

| Type | Source | |

|---|---|---|

| Strengths | Positive market response to targeted support measures | [13,15,17,18,19,20] |

| Zero tailpipe emissions | [21,22,23] | |

| Low operational noise levels | [24,25,26] | |

| Local air quality benefits | [21,22] | |

| Low operational costs | [10,22] | |

| No fossil fuel use | [22,23] | |

| Improved driving experience | [27,28] | |

| Positive public image | [27,29] | |

| Weaknesses | High sticker prices for EVs | [10,13,19,21,22,30] |

| Shorter range and long recharging time | [19,21,30,31] | |

| Lack of sufficient charging infrastructure and harmonized standards | [15,21,22,23] | |

| Grid restrictions | [22,23,32] | |

| High battery prices | [12,21,22] | |

| Limited model choice and after sales support | [25,33] | |

| Higher emissions in EV and power production | [21,23] | |

| Lower range real life vs certified | [34] | |

| Low consumer knowledge of EVs and associated incentives | [17] | |

| Gap between EV stated preference and actual adoption trends | [30] | |

| Opportunities | Increase user/public awareness on incentives and new technology | [17,19,20,22,27,30] |

| Privileged access to lanes and low-emission zone, free parking and charging | [13,15,17,22,23] | |

| Development of innovative business models | [16,22,23,35] | |

| Can increase energy security | [19,22,23,32] | |

| Vehicle-to-Grid and to-Home, synergies with variable renewable energy sources | [19,22,32] | |

| With the right policy mix, EVs can accelerate the decarbonization of the power sector | [21,23,32] | |

| Development of alternative battery and cell technologies | [12,22,23] | |

| Good option to decarbonize transport | [23,32] | |

| Future ICEV bans in countries and cities | [36,37] | |

| New models cheaper and with longer ranges | [25] | |

| Threats | Consumer misperceptions of EVs | [19,22,30] |

| Raw material constraints and spikes in commodity prices | [12,22,23] | |

| Better other low/zero-emission mobility options | [21,23] | |

| Low oil and increasing electricity prices | [15] | |

| Safety incidents | [23] | |

| Child labor and health/safety issues in some mines (e.g., cobalt) | [12] | |

| Use-based incentives to car users gives a message favoring car use(decreased marginal cost may cause rebound effects) | [20] |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Thiel, C.; Tsakalidis, A.; Jäger-Waldau, A. Will Electric Vehicles Be Killed (again) or Are They the Next Mobility Killer App? Energies 2020, 13, 1828. https://doi.org/10.3390/en13071828

Thiel C, Tsakalidis A, Jäger-Waldau A. Will Electric Vehicles Be Killed (again) or Are They the Next Mobility Killer App? Energies. 2020; 13(7):1828. https://doi.org/10.3390/en13071828

Chicago/Turabian StyleThiel, Christian, Anastasios Tsakalidis, and Arnulf Jäger-Waldau. 2020. "Will Electric Vehicles Be Killed (again) or Are They the Next Mobility Killer App?" Energies 13, no. 7: 1828. https://doi.org/10.3390/en13071828

APA StyleThiel, C., Tsakalidis, A., & Jäger-Waldau, A. (2020). Will Electric Vehicles Be Killed (again) or Are They the Next Mobility Killer App? Energies, 13(7), 1828. https://doi.org/10.3390/en13071828