Dynamic Modelling of Causal Relationship between Energy Consumption, CO2 Emission, and Economic Growth in SE Asian Countries †

Abstract

1. Introduction

2. Literature Review

3. Material and Method

| Et | Energy consumption per capita (Et = Energyt/Popt) in Mtoe per million persons |

| Ct | CO2 emission per capita (Ct = COt/Popt) in Mt of CO2 emissions per million persons |

| Yt | GDP per capita (Yt = GDPt/Popt) in billion 2010 USD per million persons |

| Energyt | Energy consumption in Mtoe |

| COt | emission flux in Mt of CO2 emissions |

| GDPt | real GDP: defined and measured at constant price in billion 2010 USD |

| Popt | Population in million persons |

| t | Time |

| Note: | Et, Ct, and Yt are transformed into logarithm term. |

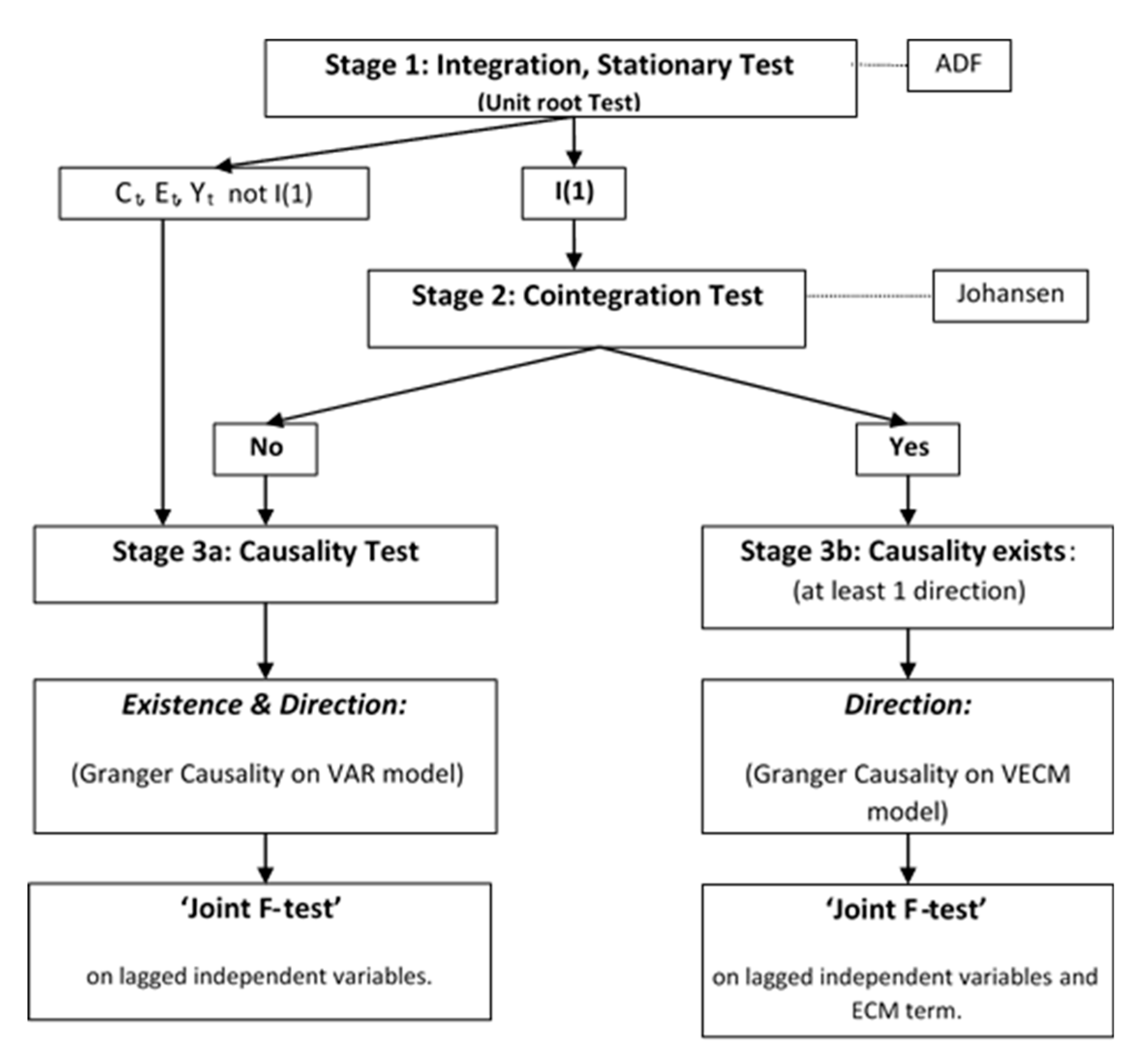

3.1. Unit Root Test

3.2. Cointegration Test

3.3. Causality Test

4. Results

4.1. Unit Root Results

4.2. Cointegration Results

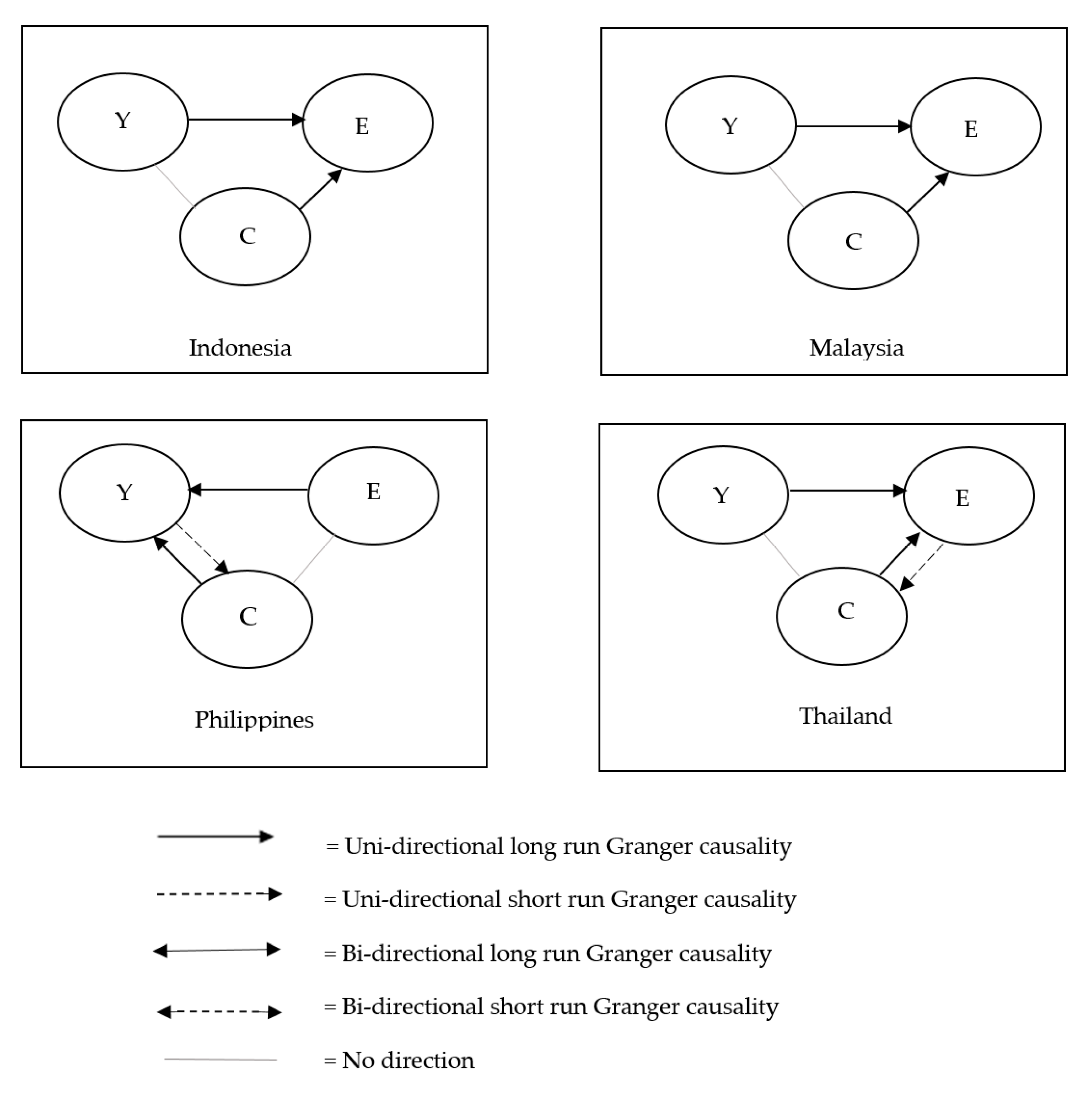

4.3. Causality Results

5. Conclusions and Policy Implications

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Author(s) | Period | Country | Methodology | Main Findings |

|---|---|---|---|---|

| Neutral Hypothesis: | ||||

| Yu and Choi [15] | 1950–1976 | 5 countries: (US, UK, Poland, Korea, Philippines) | Sims, Granger causality | Y─E (USA, UK, Poland) |

| Masih and Masih [16] | 1955–1990 | Asian regions: (Malaysia, India, Indonesia, Pakistan, Philippines, Singapore) | Johansen cointegration and Granger causality | Y─E (Malaysia, Philippines, Singapore) |

| Asafu-Adjaye [17] | 1971–1995 | Asian regions: (India, Indonesia, Philippines, Thailand) | Johansen cointegration and Granger causality | E─Y (SR) (India, Indonesia) |

| Soytas and Sari [18] | 1950–1994 | G7 and top emerging countries | Johansen cointegration and Granger causality | Y─E (Brazil, India, Indonesia, Mexico, Poland, S.Africa, USA, UK, Canada) |

| Altinay and Karagol [19] | 1950–2000 | Turkey | Hsiao’s Granger causality | Y─E |

| Wolde-Rufael [20] | 1971–2001 | 19 African countries | Toda and Yamamoto’s Granger causality | Y─E (Benin, Congo RP, Kenya, Senegal, S. Africa, Sudan, Togo, Tunisia, Zimbabwe) |

| Huang et al. [21] | 1972–2002 | panel 82 countries | panel VAR and GMM-SYS model | Y─E (low income group) |

| Chang et al. [22] | 1970–2010 | Asian regions: (China, Indonesia, India, Japan, Malaysia, Pakistan, Philippines, Singapore, S. Korea, Taiwan, Thailand, Vietnam) | Bootstrap panel causality | Y─E (China, Indonesia, Japan, Malaysia, Pakistan, Singapore, S. Korea, Taiwan) |

| Yildirim et al. [23] | 1971–2009 | ASEAN-5: (Indonesia, Malaysia, Philippines, Singapore, Thailand) | Bootstrap panel and time series causality | Y─E (Singapore) |

| Azam et al. [24] | 1980–2012 | ASEAN-5: (Indonesia, Malaysia, Philippines, Singapore, Thailand) | Johansen cointegration and Granger causality | Y─E (Indonesia, Philippines, Singapore, Thailand) |

| Destek and Aslan [25] | 1980–2012 | 17 emerging economies | Bootstrap panel causality | Y─E (Brazil, Chile, Greece, India, Indonesia, Malaysia, S. Africa, S. Korea, Thailand) |

| Tuna and Tuna [26] | 1980–2015 | ASEAN-5: (Indonesia, Malaysia, Philippines, Singapore, Thailand) | Hacker, Hatemi-J tests and causality | Y─E (Indonesia, Thailand) |

| Conservative Hypothesis: | ||||

| Kraft and Kraft [12] | 1947–1974 | USA | Sims causality | Y→E |

| Yu and Choi [15] | 1950–1976 | 5 countries: (US, UK, Poland, Korea, Philippines) | Sims, Granger causality | Y→E (Korea) |

| Masih and Masih [16] | 1955–1990 | Asian regions: (Malaysia, India, Indonesia, Pakistan, Philippines, Singapore) | Johansen cointegration and Granger causality | Y→E (Indonesia) |

| Soytas and Sari [18] | 1950–1994 | G7 and top emerging countries | Johansen cointegration and Granger causality | Y→E (Italy, Korea) |

| Jumbe [27] | 1970–1999 | Malawi (Electricity sector) | Standard Granger causality | NGDP→Elec (NGDP: Non-agriculture GDP) |

| Wolde-Rufael [20] | 1971–2001 | 19 African countries | Toda and Yamamoto’s Granger causality | Y→E (Algeria, Congo DR, Egypt, Ghana, Ivory Coast) |

| Yoo [28] | 1971–2002 | ASEAN-4: (Indonesia, Malaysia, Singapore, Thailand) (Electricity sector) | Hsiao’s Granger causality | Y→Elec (Indonesia, Thailand) |

| Lee and Chang [29] | 1971–2002 | 22 DCs and 18 LDCs | panel VARs and GMM technique | Y→E (LDCs) |

| Huang et al. [21] | 1972–2002 | panel 82 countries | panel VARs and GMM-SYS model | Y→E (middle income group) |

| Chang et al. [22] | 1970–2010 | Asian regions: (China, Indonesia, India, Japan, Malaysia, Pakistan, Philippines, Singapore, S. Korea, Taiwan, Thailand, Vietnam) | Bootstrap panel causality | Y→E (India) |

| Yildirim et al. [23] | 1971–2009 | ASEAN-5: (Indonesia, Malaysia, Philippines, Singapore, Thailand) | Bootstrap panel and time series causality | Y→E (Indonesia, Malaysia, Philippines) |

| Azam et al. [24] | 1980–2012 | ASEAN-5: (Indonesia, Malaysia, Philippines, Singapore, Thailand) | Johansen cointegration and Granger causality | Y→E (Malaysia) |

| Destek and Aslan [25] | 1980–2012 | 17 emerging economies | Bootstrap panel causality | Y→E (Egypt, Peru, Portugal) |

| Growth Hypothesis: | ||||

| Stern [30] | 1947–1990 | USA | VAR Granger causality | E→Y |

| Stern [31] | 1948–1994 | USA | Johansen cointegration and Granger causality | E→Y |

| Yu and Choi [15] | 1950–1976 | 5 countries: (US, UK, Poland, Korea, Philippines) | Sims, Granger causality | E→Y (Philippines) |

| Masih and Masih [16] | 1955–1990 | Asian regions: (Malaysia, India, Indonesia, Pakistan, Philippines, Singapore) | Johansen cointegration and Granger causality | E→Y (India) |

| Asafu-Adjaye [17] | 1971–1995 | Asian regions: (India, Indonesia, Philippines, Thailand) | Johansen cointegration and Granger causality | E→Y(Lr) (India, Indonesia) |

| Soytas and Sari [18] | 1950–1994 | G7 and top emerging countries | Johansen cointegration and Granger causality | E→Y (Turkey, France, Germany, Japan) |

| Wolde-Rufael [32] | 1952–1999 | Shanghai | Toda and Yamamoto’s Granger causality | E→Y |

| Wolde-Rufael [20] | 1971–2001 | 19 African countries | Toda and Yamamoto’s Granger causality | E→Y (Cameroon, Morocco, Nigeria) |

| Chontanawat, et al. [2] | 1971–2000 | OECD and non-OECD | Hsiao’s Granger causality | E→Y (Kenya, Nepal, Philippines) |

| Huang et al. [21] | 1972–2002 | panel 82 countries | panel VAR and GMM-SYS model | E→Y (high income group) |

| Chandran et al. [33] | 1971–2003 | Malaysia (Electricity sector) | ARDL cointegration and Granger causality | Elec→Y |

| Wang et al. [34] | 1972–2006 | China | ARDL cointegration and Granger causality | E→Y |

| Borozan [35] | 1992–2010 | Croatia | VAR Granger causality | E→Y |

| Chang et al. [22] | 1970–2010 | Asian regions: (China, Indonesia, India, Japan, Malaysia, Pakistan, Philippines, Singapore, S. Korea, Taiwan, Thailand, Vietnam) | Bootstrap panel causality | E→Y (Philippines) |

| Destek and Aslan [25] | 1980–2012 | 17 emerging economies | Bootstrap panel causality | E→Y (China, Colombia, Mexico, Philippines) |

| Tuna and Tuna [26] | 1980–2015 | ASEAN-5: (Indonesia, Malaysia, Philippines, Singapore, Thailand) | Hacker, Hatemi-J tests and causality | E→Y (Malaysia, Philippines, Singapore) |

| Feedback Hypothesis: | ||||

| Masih and Masih [16] | 1955–1990 | Asian regions: (Malaysia, India, Indonesia, Pakistan, Philippines, Singapore) | Johansen cointegration and Granger causality | E↔Y (Pakistan) |

| Masih and Masih [36] | 1955–1991 1952–1992 | East-Asian NICS: (S. Korea, Taiwan) | Cointegration and Granger causality | E↔Y |

| Asafu-Adjaye [17] | 1971–1995 | Asian regions: (India, Indonesia, Philippines, Thailand) | Cointegration and Granger causality | E↔GDP (Sr) (Philippines, Thailand) |

| Yang [37] | 1954–1997 | Taiwan | Hsiao’s Granger causality | E↔Y |

| Hondroyiannis et al. [38] | 1960–1996 | Greece | Johansen cointegration and Granger causality | E↔Y |

| Soytas and Sari [18] | 1950–1994 | G7 and top emerging countries | Johansen cointegration and Granger causality | E↔Y (Argentina) |

| Paul and Bhattacharya [39] | 1950–1996 | India | Johansen cointegration and Granger causality | E↔Y |

| Jumbe [27] | 1970–1999 | Malawi (electricity sector) | Standard Granger causality | Y↔Elec |

| Wolde-Rufael [20] | 1971–2001 | 19 African countries | Toda and Yamamoto’s Granger causality | E↔Y (Gabon, Zambia) |

| Yoo [28] | 1971–2002 | ASEAN-4: (Indonesia, Malaysia, Singapore, Thailand) (electricity sector) | Hsiao’s Granger causality | Y↔Elec (Malaysia, Singapore) |

| Lee and Chang [29] | 1965–2002 | 22 DCs and 18 LDCs | panel VARs and GMM technique | Y↔E (DCs) |

| Chang et al. [22] | 1970–2010 | Asian regions: (China, Indonesia, India, Japan, Malaysia, Pakistan, Philippines, Singapore, S. Korea, Taiwan, Thailand, Vietnam) | Bootstrap panel causality | Y↔E (Thailand, Vietnam) |

| Yildirim et al. [23] | 1971–2009 | ASEAN-5: (Indonesia, Malaysia, Philippines, Singapore, Thailand) | Bootstrap panel and time series causality | Y↔E (Thailand) |

| Destek and Aslan [25] | 1980–2012 | 17 emerging economies | Bootstrap panel causality | Y↔E (Turkey) |

| Author(s) | Period | Country | Methodology | Main Findings |

|---|---|---|---|---|

| Overall Countries: | ||||

| Ozturk and Acaravci [59] | 1968–2005 | Turkey | ARDL cointegration and Granger causality | Y─C, E─C, E─Y. |

| Alam et al. [60] | 1971–2006 | India | Toda and Yamamoto’s Granger causality | E↔C(Sr), E─Y(Lr), Y─C(Sr). |

| Alam et al. [61] | 1972–2008 | Bangladesh | Johansen cointegration and Granger causality | E→Y(Sr,Lr), Elec↔Y(Lr), E→C(Sr), C→Y(Lr), C→Y(Sr,Lr). |

| Farhani and Ben [62] | 1973–2008 | Panel MENA region | Panel cointegration and Granger causality | Y─E(Sr), E→C,Y(Sr), Y→E(Lr), C→E(Lr). |

| Hamit-Haggar [63] | 1990–2007 | Panel Canadian industrial sector | Panel FMOLS cointegration and Granger causality | E→C(Sr), Y→C(Sr), C→E(Sr), Y→E(Sr), E→C(Lr),Y→C(Lr). |

| Saboori et al. [64] | 1960–2008 | OECD (Road transport sector) | Panel FMOLS Cointegration and Granger causality | C↔Y, E↔Y, E↔C. |

| Alshehry and Belloumi [65] | 1971–2010 | Saudi Arabia | Johansen cointegration and Granger causality | E→Y(Lr), E→C(Lr), C↔Y(Lr), E→Y(Sr), C→Y(Sr). |

| Bastola and Sapkota [66] | 1980–2011 | Nepal | Johansen cointegration and Granger causality | E↔C(LR), Y→C(LR), Y→E(LR). |

| Chen et al. [67] | 1993–2010 | Global 188 countries Panel A (whole) Panel B (26 DCs) Panel C (162 LDCs) | Panel Cointegration and Granger causality | E→C (all panels) E→Y(-) (panel A,C) |

| Ahmad et al. [68] | 1971–2014 | India | ARDL cointegration and Granger causality | E↔C E↔Y C↔Y |

| Esso and Keho [69] | 1971–2010 | 12 selected African countries | Cointegration and Granger causality | Mixed results |

| Wang et al. [70] | 1990–2012 | China | ARDL cointegration and Granger causality | E↔Y (Sr), E→C (Sr), Y─C (Sr). |

| Wang et al. [71] | 1995–2012 | China’s provinces | Panel Cointegration and Granger causality | E↔Y (Sr,Lr), E↔C (Sr,Lr), Y→C (Sr,Lr). |

| ASEAN Countries | ||||

| Ang [72] | 1971–1999 | Malaysia | Johansen cointegration and Granger causality | Y→E (Sr, Lr). |

| Etokakpan et al. [73] | 1980–2014 | Malaysia (Natural gas sector) | ARDL cointegration and Granger causality | Y→Ng, Y─C. |

| Jafari et al. [74] | 1971–2007 | Indonesia | Toda-Yamamoto’s causality | Y─E, Y─C. |

| Hwang and Yoo [75] | 1965–2006 | Indonesia | Cointegration and Granger causality | Y→E, Y→C, E↔C. |

| Odugbesan and Rjoub [76] | 1993–2017 | MINT (Mexico, Indonesia, Nigeria, and Turkey) | ARDL cointegration and Granger causality | Y→E(Lr), C→E(Lr) (Indonesia). |

| Saboori and Sulaiman [77] | 1971–2009 | ASEAN-5 | ARDL cointegration and Granger causality | :E↔Y(Lr), E↔C(Lr), Y↔C(Lr), Y→C(Sr) (Indonesia). :E↔Y(Lr), E→Y(Sr), E↔C(Sr,Lr), Y↔C, (Malaysia). :E↔Y(Lr), E→Y(Sr), E↔C(Lr),Y↔C(Lr), C→Y(Sr) (Philippines). :Y→E(Lr) E→Y(Sr), E↔C (Sr,Lr), Y↔C(Sr), Y→C(Lr) (Thailand). :Y→E(Lr),E↔C(Sr,Lr), Y↔C(Sr), Y→C(Lr), (Singapore). |

| Munir et al. [78] | 1980–2016 | ASEAN-5 | Panel cointegration and Granger causality | :Y→E (Indonesia, Malaysia, Thailand). :Y→C (Malaysia, Philippines, Singapore, Thailand). :E↔Y (Philippines). :E→Y (Singapore). |

| Chontanawat [79] | 1971–2015 | ASEAN-8 | Johansen cointegration and Granger causality | Y→E (Lr), C→E (Lr) E→C (Sr). |

| Lean and Smyth [80] | 1980–2006 | ASEAN-5 (Electricity sector) | Johansen Fisher panel cointegration and Granger causality | Elec, C→Y(Lr) C→ Elec (Sr). |

| Chandran and Tang [81] | 1971–2008 | ASEAN-5 (Transportation sector) | Johansen cointegration and Granger causality | :Y↔C(Lr), Y→C(Sr), E→Y(Sr,Lr), E→C(Lr), C→E(Sr), C→Y(Sr,Lr) (Indonesia). Y→C(Sr,Lr), :E↔Y(Sr,Lr), E↔C(Lr), C→E(Sr) (Malaysia). :E↔C(Sr), Y→E(Sr), C→Y(Sr) (Philippines). :E↔C(Sr,Lr), Y↔C(Sr,Lr), Y→C(Sr), E→Y(Lr) (Thailand). :C↔Y(Sr), E→Y(Sr) (Singapore). |

References

- International Energy Agency (IEA). World Energy Outlook; International Energy Agency: Paris, France, 2004. [Google Scholar]

- Chontanawat, J.; Hunt, L.C.; Pierse, R. Does energy consumption cause economic growth?: Evidence from a systematic study of over 100 countries. J. Policy Model. 2008, 30, 209–220. [Google Scholar] [CrossRef]

- Chontanawat, J.; Hunt, L.C.; Pierse, R. Causality between Energy Consumption and GDP: Evidence from 30 OECD and 78 Non-OECD Countries; Surrey Energy Economics Centre (SEEC), School of Economics, University of Surrey: Guildford, UK, 2006. [Google Scholar]

- Stern, D.I. Economic Growth and Energy. Encycl. Energy 2004, 2, 35–51. [Google Scholar]

- Jones, C. Introduction to Economic Growth, 2nd ed.; W. W. Norton & Company: New York, NY, USA, 1998. [Google Scholar]

- Sørensen, P.B.; Whitta-Jacobsen, H.J. Introducing Advanced Macroeconomics: Growth and Business Cycles; McGraw-Hill Education: New York, NY, USA, 2005. [Google Scholar]

- Ayres, R.U.; Warr, B. Accounting for growth: The role of physical work. Struct. Chang. Econ. Dyn. 2005, 16, 181–209. [Google Scholar] [CrossRef]

- Ayres, R.U. Eco-thermodynamics: Economics and the second law. Ecol. Econ. 1998, 26, 189–209. [Google Scholar] [CrossRef]

- Toman, M.T.; Jemelkova, B. Energy and economic development: An assessment of the state of knowledge. Energy J. 2003, 24, 93–112. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Southeast Asia Energy Outlook 2019; International Energy Agency: Paris, France, 2019. [Google Scholar]

- International Energy Agency (IEA). Southeast Asia Energy Outlook 2017, World Energy Outlook Special Report; 9789264285576 (PDF); International Energy Agency: Paris, France, 2017. [Google Scholar]

- Kraft, J.; Kraft, A. Note and comments: On the relationship between energy and GNP. J. Energy Dev. 1978, 3, 401–403. [Google Scholar]

- Payne, J.E. Survey of the international evidence on the causal relationship between energy consumption and growth. J. Econ. Stud. 2010, 37, 53–95. [Google Scholar] [CrossRef]

- Ozturk, I. A literature survey on energy-growth nexus. Energy Policy 2010, 38, 340–349. [Google Scholar] [CrossRef]

- Yu, E.S.; Choi, J.-Y. The causal relationship between energy and GNP: An international comparison. J. Energy Dev. 1985, 10, 249–272. [Google Scholar]

- Masih, A.M.; Masih, R. Energy consumption, real income and temporal causality: Results from a multi-country study based on cointegration and error-correction modelling techniques. Energy Econ. 1996, 18, 165–183. [Google Scholar] [CrossRef]

- Asafu-Adjaye, J. The relationship between energy consumption, energy prices and economic growth: Time series evidence from Asian developing countries. Energy Econ. 2000, 22, 615–625. [Google Scholar] [CrossRef]

- Soytas, U.; Sari, R. Energy consumption and GDP: Causality relationship in G-7 countries and emerging markets. Energy Econ. 2003, 25, 33–37. [Google Scholar] [CrossRef]

- Altinay, G.; Karagol, E. Structural break, unit root, and the causality between energy consumption and GDP in Turkey. Energy Econ. 2004, 26, 985–994. [Google Scholar] [CrossRef]

- Wolde-Rufael, Y. Energy demand and economic growth: The African experience. J. Policy Model. 2005, 27, 891–903. [Google Scholar] [CrossRef]

- Huang, B.-N.; Hwang, M.J.; Yang, C.W. Causal relationship between energy consumption and GDP growth revisited: A dynamic panel data approach. Ecol. Econ. 2008, 67, 41–54. [Google Scholar] [CrossRef]

- Chang, T.; Chu, H.-P.; Chen, W.-Y. Energy consumption and economic growth in 12 Asian countries: Panel data analysis. Appl. Econ. Lett. 2013, 20, 282–287. [Google Scholar] [CrossRef]

- Yildirim, E.; Aslan, A.; Ozturk, I. Energy consumption and GDP in ASEAN countries: Bootstrap-corrected panel and time series causality tests. Singap. Econ. Rev. 2014, 59, 1450010. [Google Scholar] [CrossRef]

- Azam, M.; Khan, A.Q.; Bakhtyar, B.; Emirullah, C. The causal relationship between energy consumption and economic growth in the ASEAN-5 countries. Renew. Sustain. Energy Rev. 2015, 47, 732–745. [Google Scholar] [CrossRef]

- Destek, M.A.; Aslan, A. Renewable and non-renewable energy consumption and economic growth in emerging economies: Evidence from bootstrap panel causality. Renew. Energy 2017, 111, 757–763. [Google Scholar] [CrossRef]

- Tuna, G.; Tuna, V.E. The asymmetric causal relationship between renewable and NON-RENEWABLE energy consumption and economic growth in the ASEAN-5 countries. Resour. Policy 2019, 62, 114–124. [Google Scholar] [CrossRef]

- Jumbe, C.B. Cointegration and causality between electricity consumption and GDP: Empirical evidence from Malawi. Energy Econ. 2004, 26, 61–68. [Google Scholar] [CrossRef]

- Yoo, S.-H. The causal relationship between electricity consumption and economic growth in the ASEAN countries. Energy Policy 2006, 34, 3573–3582. [Google Scholar] [CrossRef]

- Lee, C.-C.; Chang, C.-P. Energy consumption and GDP revisited: A panel analysis of developed and developing countries. Energy Econ. 2007, 29, 1206–1223. [Google Scholar] [CrossRef]

- Stern, D.I. Energy and economic growth in the USA: A multivariate approach. Energy Econ. 1993, 15, 137–150. [Google Scholar] [CrossRef]

- Stern, D.I. A multivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Econ. 2000, 22, 267–283. [Google Scholar] [CrossRef]

- Wolde-Rufael, Y. Disaggregated industrial energy consumption and GDP: The case of Shanghai, 1952–1999. Energy Econ. 2004, 26, 69–75. [Google Scholar] [CrossRef]

- Chandran, V.; Sharma, S.; Madhavan, K. Electricity consumption–growth nexus: The case of Malaysia. Energy Policy 2010, 38, 606–612. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, Y.; Zhou, J.; Zhu, X.; Lu, G. Energy consumption and economic growth in China: A multivariate causality test. Energy Policy 2011, 39, 4399–4406. [Google Scholar] [CrossRef]

- Borozan, D. Exploring the relationship between energy consumption and GDP: Evidence from Croatia. Energy Policy 2013, 59, 373–381. [Google Scholar] [CrossRef]

- Masih, A.M.; Masih, R. On the temporal causal relationship between energy consumption, real income, and prices: Some new evidence from Asian-energy dependent NICs based on a multivariate cointegration/vector error-correction approach. J. Policy Model. 1997, 19, 417–440. [Google Scholar] [CrossRef]

- Yang, H.-Y. A note on the causal relationship between energy and GDP in Taiwan. Energy Econ. 2000, 22, 309–317. [Google Scholar] [CrossRef]

- Hondroyiannis, G.; Lolos, S.; Papapetrou, E. Energy consumption and economic growth: Assessing the evidence from Greece. Energy Econ. 2002, 24, 319–336. [Google Scholar] [CrossRef]

- Paul, S.; Bhattacharya, R.N. Causality between energy consumption and economic growth in India: A note on conflicting results. Energy Econ. 2004, 26, 977–983. [Google Scholar] [CrossRef]

- Kuznets, S. Economic growth and income inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar]

- Dinda, S. Environmental Kuznets curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- Grossman, G.; Krueger, A. Environmental impacts of a North American Free Trade Agreement, 1991. In NBER Working Paper; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar]

- Selden, T.M.; Song, D. Environmental quality and development: Is there a Kuznets curve for air pollution emissions? J. Environ. Econ. Manag. 1994, 27, 147–162. [Google Scholar] [CrossRef]

- Stern, D.I.; Common, M.S.; Barbier, E.B. Economic growth and environmental degradation: The environmental Kuznets curve and sustainable development. World Dev. 1996, 24, 1151–1160. [Google Scholar] [CrossRef]

- Galeotti, M.; Lanza, A.; Pauli, F. Reassessing the environmental Kuznets curve for CO2 emissions: A robustness exercise. Ecol. Econ. 2006, 57, 152–163. [Google Scholar] [CrossRef]

- Dinda, S.; Coondoo, D. Income and emission: A panel data-based cointegration analysis. Ecol. Econ. 2006, 57, 167–181. [Google Scholar] [CrossRef]

- Coondoo, D.; Dinda, S. Carbon dioxide emission and income: A temporal analysis of cross-country distributional patterns. Ecol. Econ. 2008, 65, 375–385. [Google Scholar] [CrossRef]

- Managi, S.; Jena, P.R. Environmental productivity and Kuznets curve in India. Ecol. Econ. 2008, 65, 432–440. [Google Scholar] [CrossRef]

- Narayan, P.K.; Narayan, S. Carbon dioxide emissions and economic growth: Panel data evidence from developing countries. Energy Policy 2010, 38, 661–666. [Google Scholar] [CrossRef]

- Saboori, B.; Sulaiman, J.; Mohd, S. Economic growth and CO2 emissions in Malaysia: A cointegration analysis of the environmental Kuznets curve. Energy Policy 2012, 51, 184–191. [Google Scholar] [CrossRef]

- Kanjilal, K.; Ghosh, S. Environmental Kuznet’s curve for India: Evidence from tests for cointegration with unknown structuralbreaks. Energy Policy 2013, 56, 509–515. [Google Scholar] [CrossRef]

- Nasir, M.; Rehman, F.U. Environmental Kuznets curve for carbon emissions in Pakistan: An empirical investigation. Energy Policy 2011, 39, 1857–1864. [Google Scholar] [CrossRef]

- Fodha, M.; Zaghdoud, O. Economic growth and pollutant emissions in Tunisia: An empirical analysis of the environmental Kuznets curve. Energy Policy 2010, 38, 1150–1156. [Google Scholar] [CrossRef]

- Iwata, H.; Okada, K.; Samreth, S. Empirical study on the environmental Kuznets curve for CO2 in France: The role of nuclear energy. Energy Policy 2010, 38, 4057–4063. [Google Scholar] [CrossRef]

- Holtz-Eakin, D.; Selden, T.M. Stoking the fires? CO2 emissions and economic growth. J. Public Econ. 1995, 57, 85–101. [Google Scholar] [CrossRef]

- Shafik, N. Economic development and environmental quality: An econometric analysis. Oxf. Econ. Pap. 1994, 46, 757–773. [Google Scholar] [CrossRef]

- Friedl, B.; Getzner, M. Determinants of CO2 emissions in a small open economy. Ecol. Econ. 2003, 45, 133–148. [Google Scholar] [CrossRef]

- Özokcu, S.; Özdemir, Ö. Economic growth, energy, and environmental Kuznets curve. Renew. Sustain. Energy Rev. 2017, 72, 639–647. [Google Scholar] [CrossRef]

- Ozturk, I.; Acaravci, A. CO2 emissions, energy consumption and economic growth in Turkey. Renew. Sustain. Energy Rev. 2010, 14, 3220–3225. [Google Scholar] [CrossRef]

- Alam, M.J.; Begum, I.A.; Buysse, J.; Rahman, S.; Van Huylenbroeck, G. Dynamic modeling of causal relationship between energy consumption, CO2 emissions and economic growth in India. Renew. Sustain. Energy Rev. 2011, 15, 3243–3251. [Google Scholar] [CrossRef]

- Alam, M.J.; Begum, I.A.; Buysse, J.; Van Huylenbroeck, G. Energy consumption, carbon emissions and economic growth nexus in Bangladesh: Cointegration and dynamic causality analysis. Energy Policy 2012, 45, 217–225. [Google Scholar] [CrossRef]

- Farhani, S.; Ben Rejeb, J. Energy consumption, economic growth and CO2 emissions: Evidence from panel data for MENA region. Int. J. Energy Econ. Policy (IJEEP) 2012, 2, 71–81. [Google Scholar]

- Hamit-Haggar, M. Greenhouse gas emissions, energy consumption and economic growth: A panel cointegration analysis from Canadian industrial sector perspective. Energy Econ. 2012, 34, 358–364. [Google Scholar] [CrossRef]

- Saboori, B.; Sapri, M.; Baba, M. Economic growth, energy consumption and CO2 emissions in OECD (Organization for Economic Co-operation and Development)’s transport sector: A fully modified bi-directional relationship approach. Energy 2014, 66, 150–161. [Google Scholar] [CrossRef]

- Alshehry, A.S.; Belloumi, M. Energy consumption, carbon dioxide emissions and economic growth: The case of Saudi Arabia. Renew. Sustain. Energy Rev. 2015, 41, 237–247. [Google Scholar] [CrossRef]

- Bastola, U.; Sapkota, P. Relationship among energy consumption, pollution emission and economic growth in Nepal. Energy 2015, 80, 254–262. [Google Scholar] [CrossRef]

- Chen, P.Y.; Chen, S.T.; Hsu, C.S.; Chen, C.C. Modeling the global relationships among economic growth, energy consumption and CO2 emissions. Renew. Sustain. Energy Rev. 2016, 65, 420–431. [Google Scholar] [CrossRef]

- Ahmad, A.; Zhao, Y.; Shahbaz, M.; Bano, S.; Zhang, Z.; Wang, S.; Liu, Y. Carbon emissions, energy consumption and economic growth: An aggregate and disaggregate analysis of the Indian economy. Energy Policy 2016, 96, 131–143. [Google Scholar] [CrossRef]

- Esso, L.J.; Keho, Y. Energy consumption, economic growth and carbon emissions: Cointegration and causality evidence from selected African countries. Energy 2016, 114, 492–497. [Google Scholar] [CrossRef]

- Wang, S.; Li, Q.; Fang, C.; Zhou, C. The relationship between economic growth, energy consumption, and CO2 emissions: Empirical evidence from China. Sci. Total Environ. 2016, 542, 360–371. [Google Scholar] [CrossRef]

- Wang, S.; Zhou, C.; Li, G.; Feng, K. CO2, economic growth, and energy consumption in China’s provinces: Investigating the spatiotemporal and econometric characteristics of China’s CO2 emissions. Ecol. Indic. 2016, 69, 184–195. [Google Scholar] [CrossRef]

- Ang, J.B. Economic development, pollutant emissions and energy consumption in Malaysia. J. Policy Model. 2008, 30, 271–278. [Google Scholar] [CrossRef]

- Etokakpan, M.U.; Solarin, S.A.; Yorucu, V.; Bekun, F.V.; Sarkodie, S.A. Modeling natural gas consumption, capital formation, globalization, CO2 emissions and economic growth nexus in Malaysia: Fresh evidence from combined cointegration and causality analysis. Energy Strategy Rev. 2020, 31, 100526. [Google Scholar] [CrossRef]

- Jafari, Y.; Othman, J.; Nor, A.H.S.M. Energy consumption, economic growth and environmental pollutants in Indonesia. J. Policy Model. 2012, 34, 879–889. [Google Scholar] [CrossRef]

- Hwang, J.-H.; Yoo, S.-H. Energy consumption, CO2 emissions, and economic growth: Evidence from Indonesia. Qual. Quant. 2014, 48, 63–73. [Google Scholar] [CrossRef]

- Odugbesan, J.A.; Rjoub, H. Relationship Among Economic Growth, Energy Consumption, CO2 Emission, and Urbanization: Evidence From MINT Countries. SAGE Open 2020, 10, 2158244020914648. [Google Scholar] [CrossRef]

- Saboori, B.; Sulaiman, J. CO2 emissions, energy consumption and economic growth in Association of Southeast Asian Nations (ASEAN) countries: A cointegration approach. Energy 2013, 55, 813–822. [Google Scholar] [CrossRef]

- Munir, Q.; Lean, H.H.; Smyth, R. CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: A cross-sectional dependence approach. Energy Econ. 2020, 85, 104571. [Google Scholar] [CrossRef]

- Chontanawat, J. Relationship between energy consumption, CO2 emission and economic growth in ASEAN: Cointegration and causality model. Energy Rep. 2020, 6, 660–665. [Google Scholar] [CrossRef]

- Lean, H.H.; Smyth, R. CO2 emissions, electricity consumption and output in ASEAN. Appl. Energy 2010, 87, 1858–1864. [Google Scholar] [CrossRef]

- Chandran, V.; Tang, C.F. The impacts of transport energy consumption, foreign direct investment and income on CO2 emissions in ASEAN-5 economies. Renew. Sustain. Energy Rev. 2013, 24, 445–453. [Google Scholar] [CrossRef]

- Granger, C.W. Investigating causal relations by econometric models and cross-spectral methods. Econom. J. Econom. Soc. 1969, 424–438. [Google Scholar] [CrossRef]

- Dickey, D.; Fuller, W. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econom. J. Econom. Soc. 1981, 1057–1072. [Google Scholar] [CrossRef]

- Granger, C.W. Some properties of time series data and their use in econometric model specification. J. Econom. 1981, 16, 121–130. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W. Cointegration and error correction: Representation, estimation and testing. Econometrica. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econom. J. Econom. Soc. 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Chontanawat, J. Driving Forces of Energy-Related CO2 Emissions Based on Expanded IPAT Decomposition Analysis: Evidence from ASEAN and Four Selected Countries. Energies 2019, 12, 764. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). World Energy Statistics and Balances (Database); International Energy Agency: Paris, France, 2020. [Google Scholar]

- Solow, R.M. Applying growth theory across countries. World Bank Econ. Rev. 2001, 15, 283–288. [Google Scholar] [CrossRef]

- Athukorala, P.; Sen, K. Saving Investment and Growth in India; Oxford University Press: New York, NY, USA, 2002. [Google Scholar]

- Pesaran, M.H.; Smith, R. Estimating long-run relationships from dynamic heterogeneous panels. J. Econom. 1995, 68, 79–113. [Google Scholar] [CrossRef]

- Robertson, D.; Symons, J. Some strange properties of panel data estimators. J. Appl. Econom. 1992, 7, 175–189. [Google Scholar] [CrossRef]

- Bekhet, H.A.; Othman, N.S. The role of renewable energy to validate dynamic interaction between CO2 emissions and GDP toward sustainable development in Malaysia. Energy Econ. 2018, 72, 47–61. [Google Scholar] [CrossRef]

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Renewable Energy Market Analysis: Southeast Asia; IRENA: Abu Dhabi, UAE, 2018; ISBN 978-92-9260-056-3. [Google Scholar]

- ASEAN Centre for Energy (ACE). Asean Energy Cooperation Report; ACE: Jakarta, Indonesia, 2017; ISBN 978-979-8978-36-4. [Google Scholar]

- ASEAN Centre for Energy (ACE). Policy Brief ASEAN Energy Cooperation for Shaping a Low-Carbon Energy Transition: A Baseline Assessment of the Alignment between Energy and Climate Policies; No. 1/2020; ACE: Jakarta, Indonesia, 2020. [Google Scholar]

| Causality | SR | |

|---|---|---|

| Equation (6): Ct = f (Et,Yt) | C ← E | all b1i ≠ 0 |

| C ← Y | all c1i ≠ 0 | |

| Equation (7): Et = f (Ct,Yt) | E ← C | all a2i ≠ 0 |

| E ← Y | all c2i ≠ 0 | |

| Equation (8): Yt = f (Ct,Et) | Y ← C | all a3i ≠ 0 |

| Y ← E | all b3i ≠ 0 |

| Causality | SR | LR | SR and LR | |

|---|---|---|---|---|

| Equation (9): Ct = f (Et,Yt) | C ← E | b1i ≠ 0 | ɸ1 ≠ 0 | all b1i ≠ ɸ1 ≠ 0 |

| C ← Y | c1i ≠ 0 | ɸ1 ≠ 0 | all c1i ≠ ɸ1 ≠ 0 | |

| Equation (10): Et = f (Ct,Yt) | E ← C | a2i ≠ 0 | ɸ2 ≠ 0 | all a2i ≠ ɸ2 ≠ 0 |

| E ← Y | c2i ≠ 0 | ɸ2 ≠ 0 | all c2i ≠ ɸ2 ≠ 0 | |

| Equation (11): Yt = f (Ct,Et) | Y ← C | a3i ≠ 0 | ɸ3 ≠ 0 | all a3i ≠ ɸ3 ≠ 0 |

| Y ← E | b3i ≠ 0 | ɸ3 ≠ 0 | all b3i ≠ ɸ3 ≠ 0 |

| Variables | ADF | |||||||

|---|---|---|---|---|---|---|---|---|

| Indonesia | Malaysia | Philippines | Thailand | |||||

| Level | 1st Diff. | Level | 1st Diff. | Level | 1st Diff. | Level | 1st Diff. | |

| Ct | −1.281 | −6.171 ** | −0.131 | −6.034 ** | −1.104 | −5.842 ** | −0.852 | −4.143 ** |

| Et | −0.993 | −6.372 ** | −1.743 | −5.858 ** | −2.021 | −4.862 ** | −1.766 | −5.356 ** |

| Yt | −2.612 | −5.019 ** | −2.329 | −5.867 ** | −0.784 | −3.409 * | −1.726 | −4.066 ** |

| Indonesia | Malaysia | Philippines | Thailand | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Hypothesized No. of Cointegrating Vectors | Eigen Value | Trace | Max-Eigen Value | Eigen Value | Trace | Max-Eigen Value | Eigen Value | Trace | Max-Eigen Value | Eigen Value | Trace | Max-Eigen Value |

| None * | 0.611 | 45.017 | 38.718 | 0.483 | 40.727 | 27.691 | 0.452 | 34.339 | 25.828 | 0.474 | 41.298 | 26.971 |

| At most 1 | 0.119 | 6.299 | 5.178 | 0.205 | 13.036 | 9.658 | 0.135 | 8.510 | 6.229 | 0.289 | 14.327 | 14.307 |

| At most 2 | 0.027 | 1.120 | 1.120 | 0.077 | 3.378 | 3.378 | 0.052 | 2.281 | 2.281 | 0.001 | 0.020 | 0.020 |

| Cointegrated Equations: | Φ |

|---|---|

| Indonesia: Ct = 0.97 + 1.72Et + 0.30Yt (12.311 ***) (3.215 ***) Et = −0.71 + 0.01Yt + 0.45Ct (0.211) (12.311 ***) Yt = 0.84 + 0.09Et + 0.64Ct (0.211) (3.215 ***) | −0.29 (−1.839 *) |

| Malaysia: Ct = 0.64 + 0.84Et + 0.39Yt (7.997 ***) (3.425 ***) Et = −1.22 + 0.16Yt + 0.71Ct (1.411) (7.997 ***) Yt = 1.05 + 0.27Et + 0.55Ct (1.411) (3.425 ***) | −0.38 (−2.196 **) |

| Philippines: Ct = −0.15 + 0.51Et + 0.88Yt (2.867 ***) (7.967 ***) Et = −0.80 − 0.56Yt + 0.31Ct (−5.404 ***) (2.867 ***) Yt = −0.12 − 0.71Et + 0.67Ct (−5.404 ***) (7.967 ***) | −0.07 (−1.498) |

| Thailand: Ct = −0.43 + 0.24Et + 1.01Yt (1.823 *) (7.717 ***) Et = −1.22 + 0.62Yt + 0.30Ct (3.049 ***) (1.823 *) Yt = 0.86 + 0.28Et + 0.57Ct (3.049 ***) (7.717 ***) | −0.15 (−1.914 **) |

| Dependent Variables | Short-Run F−Stat | Long-Run t−Stat | Short-Run and Long-Run F−Stat | ||||

|---|---|---|---|---|---|---|---|

| ∑∆Ct−i | ∑∆Et−i | ∑∆Yt−i | ECMt−1 | ∑∆Ct−i and ECMt−1 | ∑∆Et−i and ECMt−1 | ∑∆Yt−i and ECMt−1 | |

| ∆Ct | − | −0.868 (0.390) | 0.746 (0.460) | −0.854 (0.398) | − | 0.718 (0.494) | 0.950 (0.395) |

| ∆Et | 0.324 (0.748) | − | −0.309 (0.760) | −1.839 * (0.073) | 1.804 (0.178) | − | 1.835 (0.173) |

| ∆Yt | −0.414 (0.681) | 0.576 (0.568) | − | −0.004 (0.997) | 0.086 (0.920) | 0.172 (0.842) | − |

| Dependent Variables | Short-Run F−Stat | Long-Run t−Stat | Short-Run and Long-Run F−Stat | ||||

|---|---|---|---|---|---|---|---|

| ∑∆Ct−i | ∑∆Et−i | ∑∆Yt−i | ECMt−1 | ∑∆Ct−i and ECMt−1 | ∑∆Et−i and ECMt−1 | ∑∆Yt−i and ECMt−1 | |

| ∆Ct | - | 0.381 (0.705) | 0.473 (0.639) | −1.082 (0.286) | - | 0.955 (0.394) | 0.928 (0.404) |

| ∆Et | −1.267 (0.213) | - | 0.952 (0.347) | −2.196 ** (0.034) | 2.519 * (0.093) | - | 2.771 * (0.075) |

| ∆Yt | −0.547 (0.587) | 0.045 (0.964) | - | −0.846 (0.403) | 0.404 (0.67) | 0.358 (0.701) | − |

| Dependent Variables | Short-Run F−Stat | Long-Run t−Stat | Short-Run and Long-Run F−Stat | ||||

|---|---|---|---|---|---|---|---|

| ∑∆Ct−i | ∑∆Et−i | ∑∆Yt−i | ECMt−1 | ∑∆Ct−i and ECMt−1 | ∑∆Et−i and ECMt−1 | ∑∆Yt−i and ECMt−1 | |

| ∆Ct | - | 1.102 (0.277) | 1.521 * (0.136) | −0.418 (0.678) | - | 0.909 (0.411) | 1.165 (0.322) |

| ∆Et | 0.025 (0.980) | - | 0.532 (0.598) | −0.586 (0.561) | 0.191 (0.826) | - | 0.316 (0.731) |

| ∆Yt | −0.578 (0.567) | 0.750 (0.458) | - | −1.498 * (0.142) | 1.123 (0.335) | 1.127 (0.334) | - |

| Dependent Variables | Short-Run F−Stat | Long-Run t−Stat | Short-Run and Long-Run F−Stat | ||||

|---|---|---|---|---|---|---|---|

| ∑∆Ct−i | ∑∆Et−i | ∑∆Yt−i | ECMt−1 | ∑∆Ct−i and ECMt−1 | ∑∆Et−i and ECMt−1 | ∑∆Yt−i and ECMt−1 | |

| ∆Ct | - | 1.479 * (0.147) | 0.517 (0.608) | −1.097 (0.279) | - | 1.440 (0.249) | 1.246 (0.298) |

| ∆Et | 0.305 (0.762) | - | 0.571 (0.571) | −1.914 ** (0.063) | 2.295 * (0.114) | - | 1.949 * (0.154) |

| ∆Yt | −0.651 (0.519) | 0.232 (0.818) | - | 0.986 (0.330) | 0.404 (0.67) | 0.119 (0.888) | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chontanawat, J. Dynamic Modelling of Causal Relationship between Energy Consumption, CO2 Emission, and Economic Growth in SE Asian Countries. Energies 2020, 13, 6664. https://doi.org/10.3390/en13246664

Chontanawat J. Dynamic Modelling of Causal Relationship between Energy Consumption, CO2 Emission, and Economic Growth in SE Asian Countries. Energies. 2020; 13(24):6664. https://doi.org/10.3390/en13246664

Chicago/Turabian StyleChontanawat, Jaruwan. 2020. "Dynamic Modelling of Causal Relationship between Energy Consumption, CO2 Emission, and Economic Growth in SE Asian Countries" Energies 13, no. 24: 6664. https://doi.org/10.3390/en13246664

APA StyleChontanawat, J. (2020). Dynamic Modelling of Causal Relationship between Energy Consumption, CO2 Emission, and Economic Growth in SE Asian Countries. Energies, 13(24), 6664. https://doi.org/10.3390/en13246664