Projecting the Price of Lithium-Ion NMC Battery Packs Using a Multifactor Learning Curve Model

Abstract

1. Introduction

2. Materials and Methods

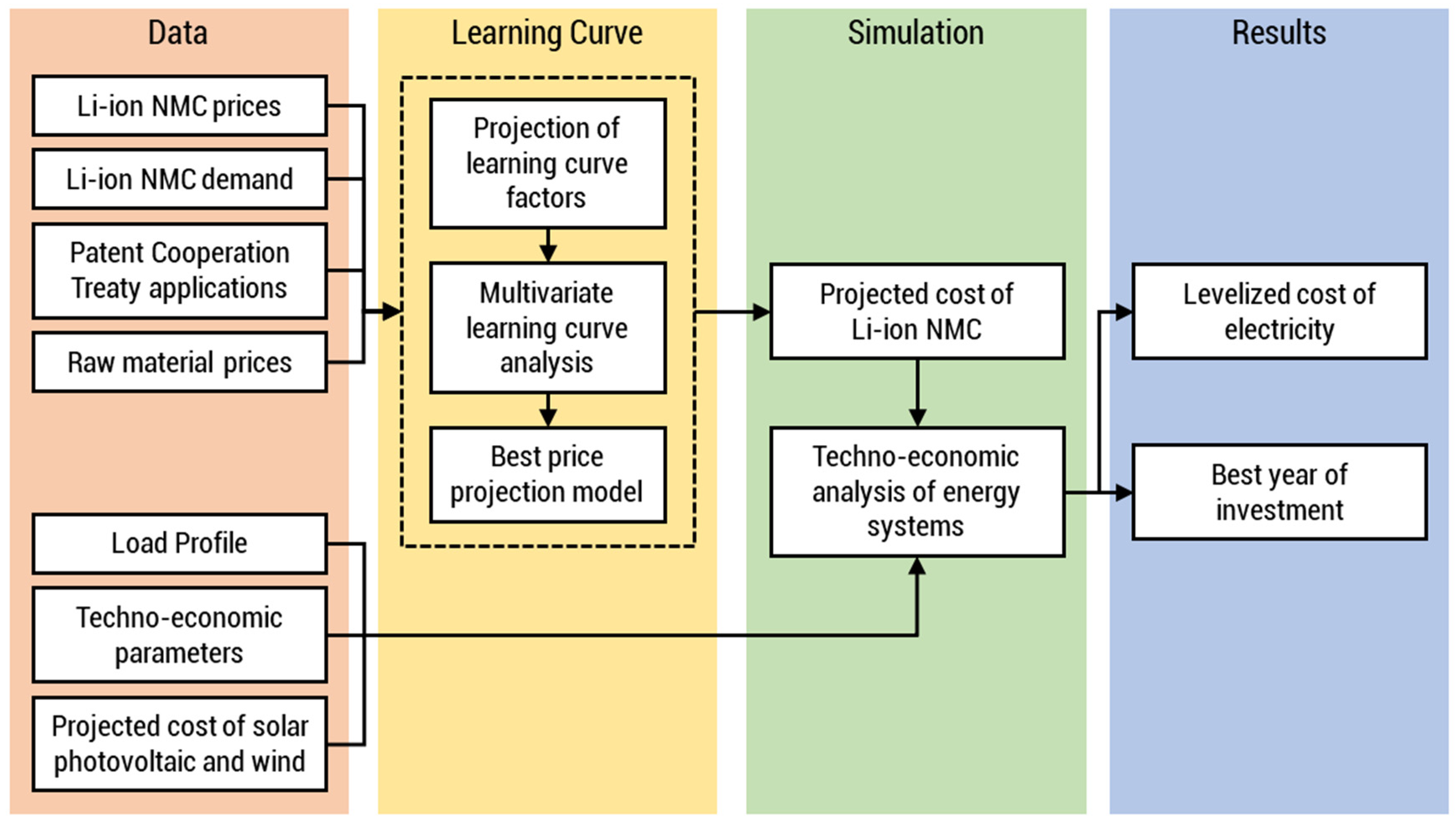

2.1. General Approach

2.2. Learning Curves

2.2.1. Single-Factor Learning Curve Models

2.2.2. Multi-Factor Learning Curve Models

2.2.3. Cost Projection

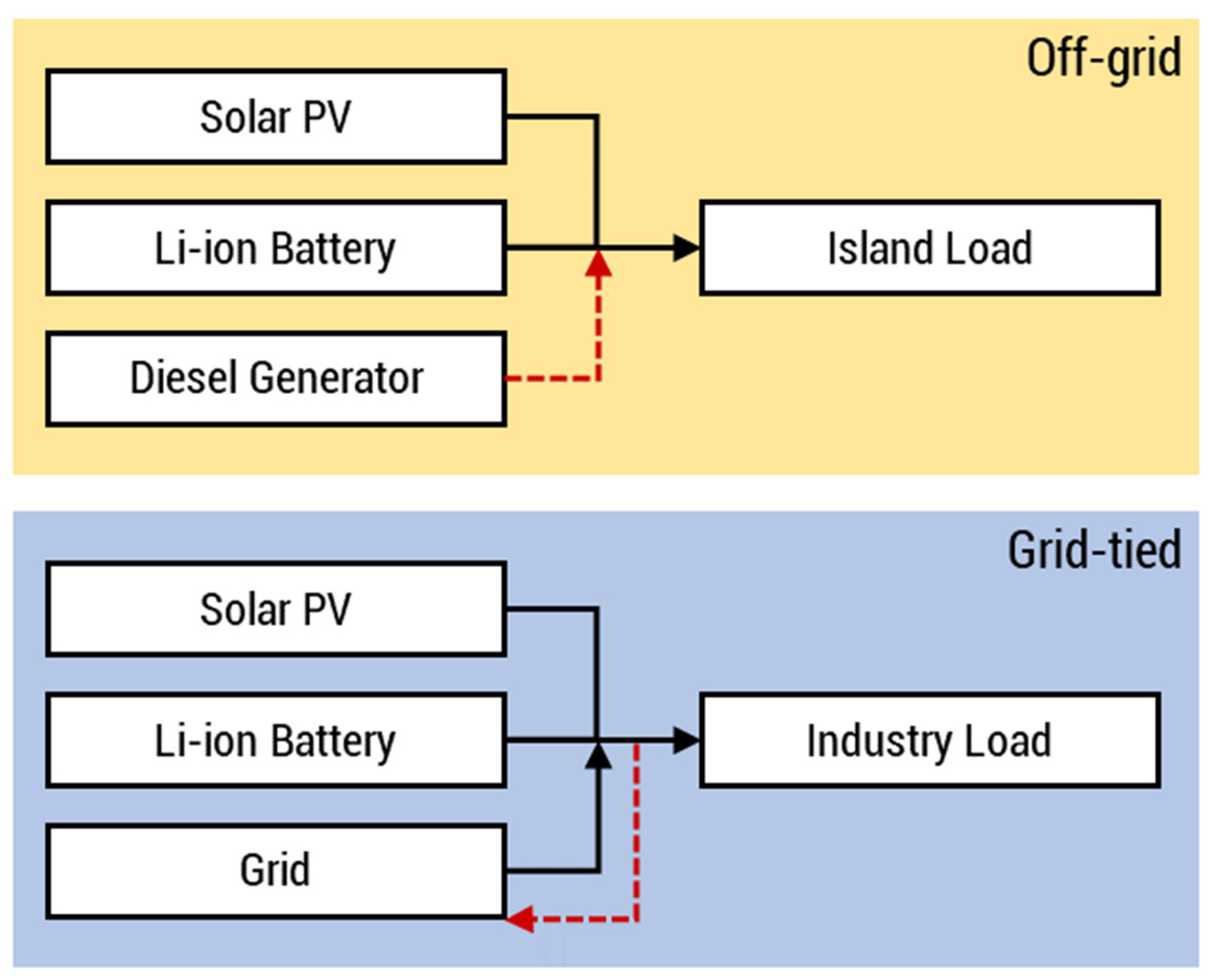

2.3. Techno-Economic Case Study

3. Results

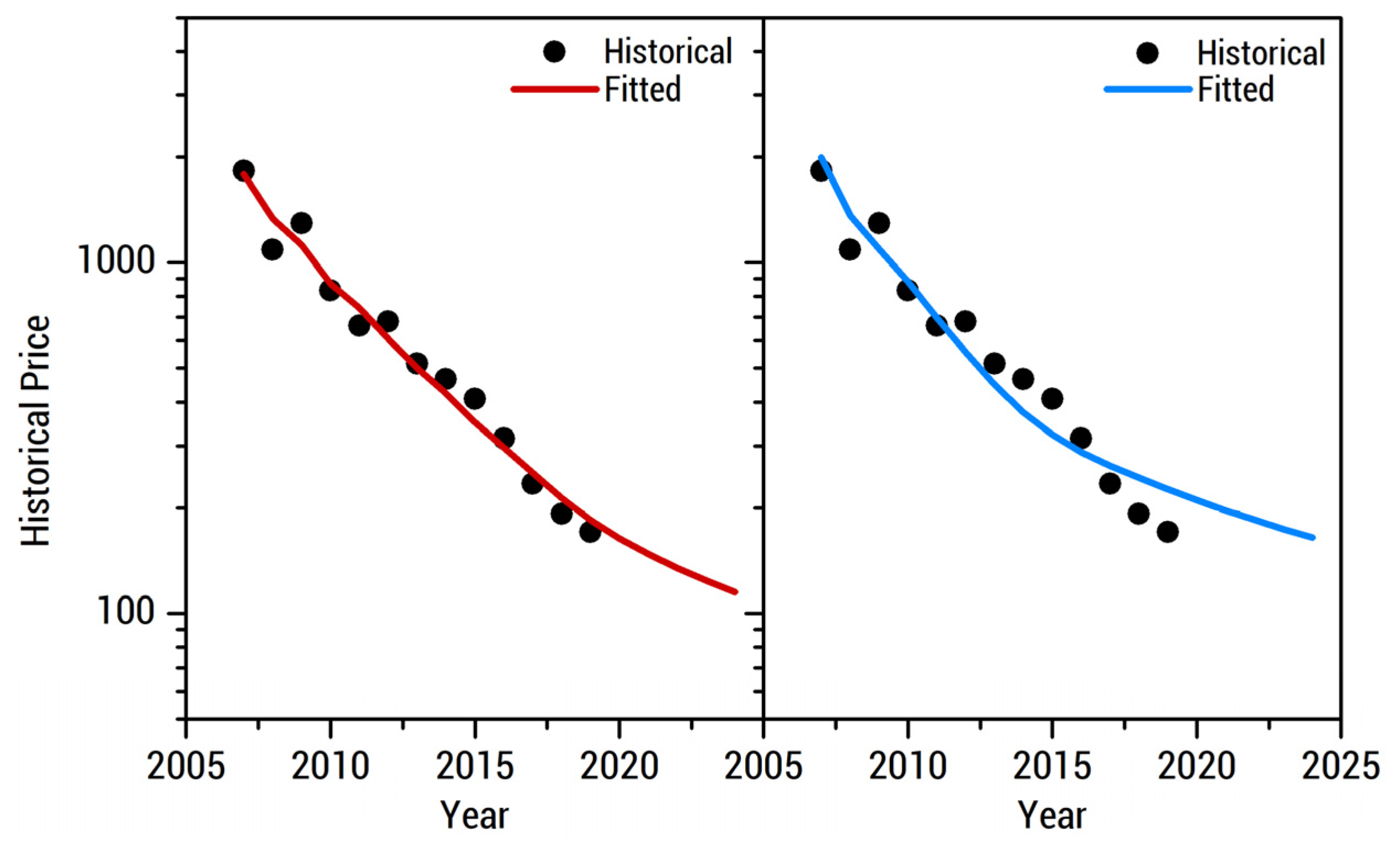

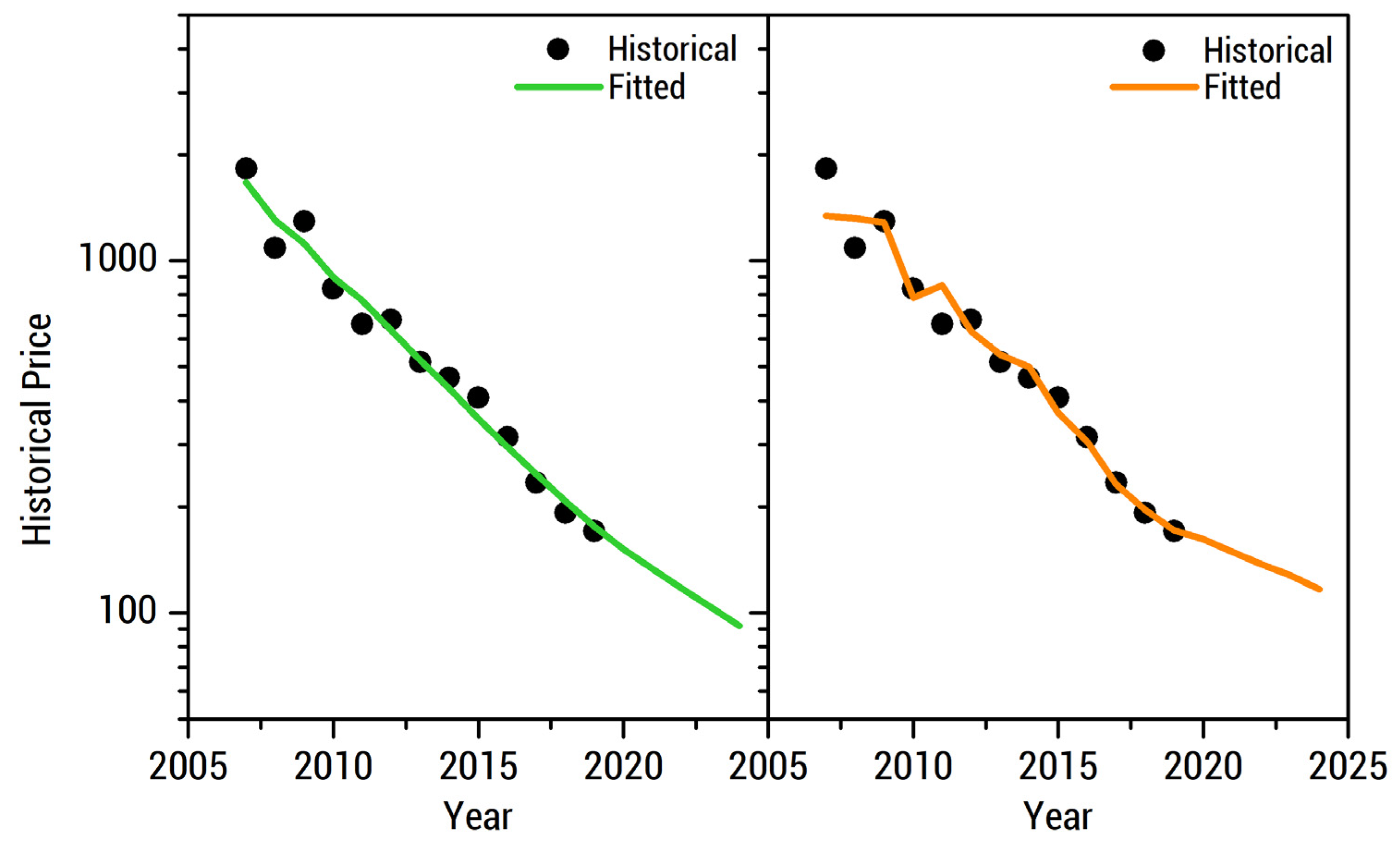

3.1. Learning Curves

3.1.1. Single-Factor Learning Curve Models

3.1.2. Multi-Factor Learning Curve Models

3.2. Case Studies

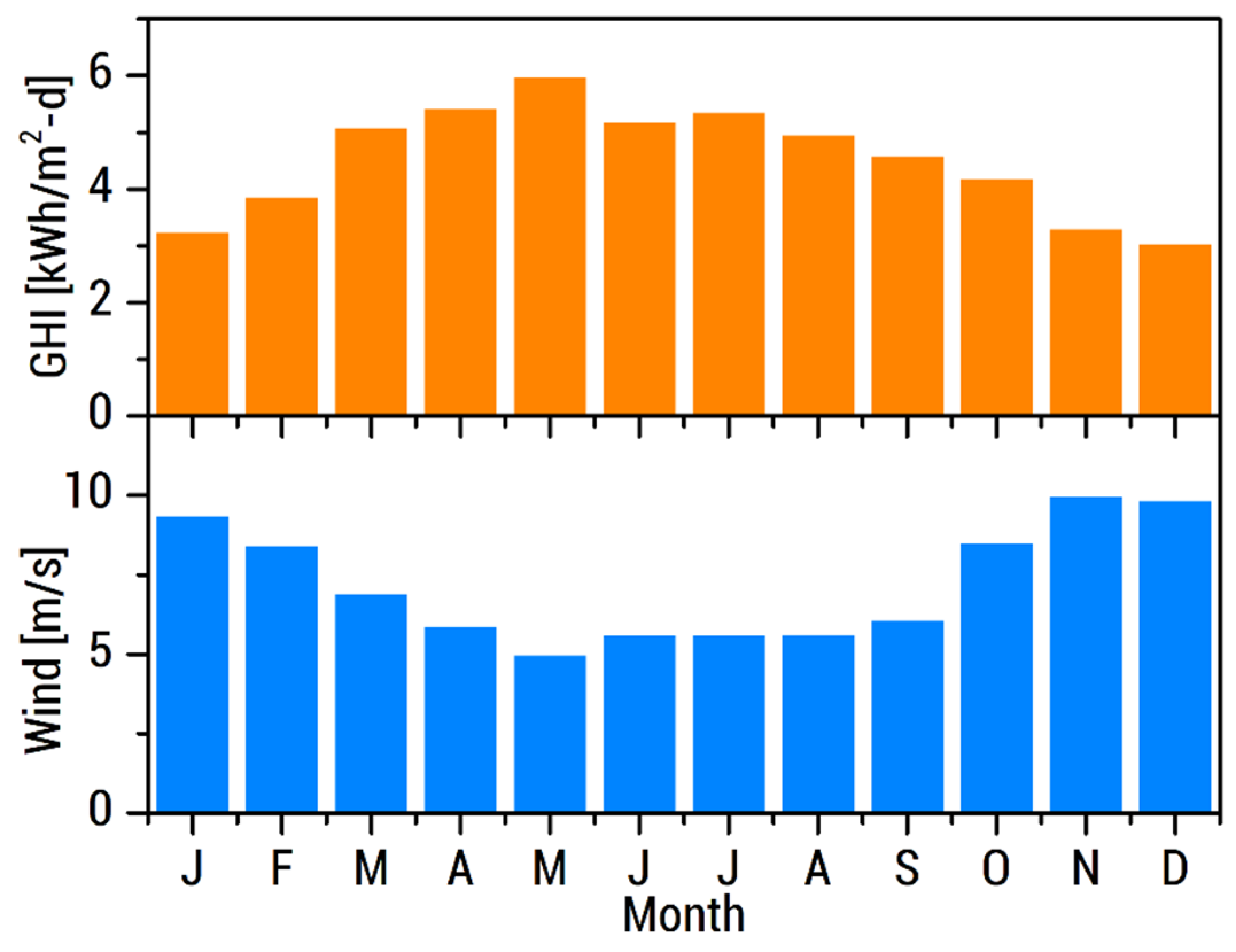

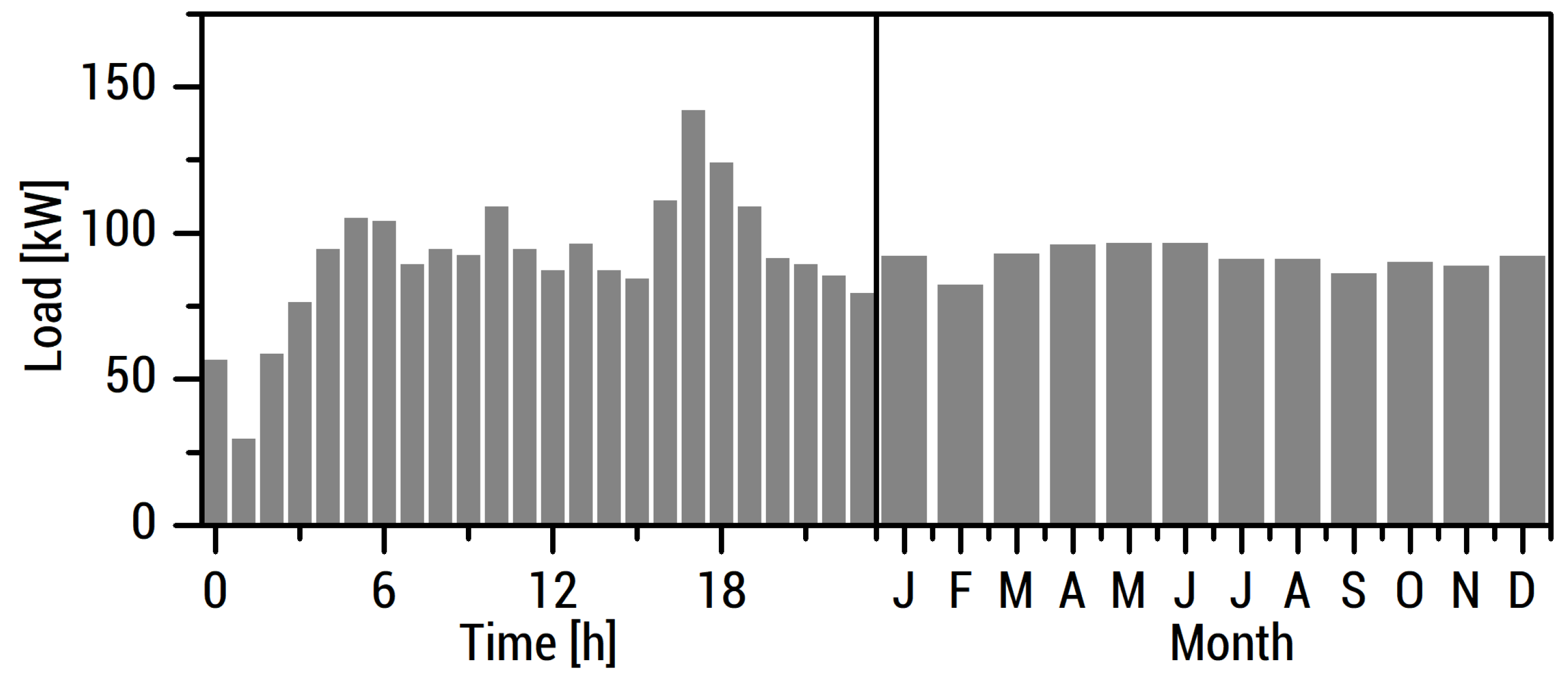

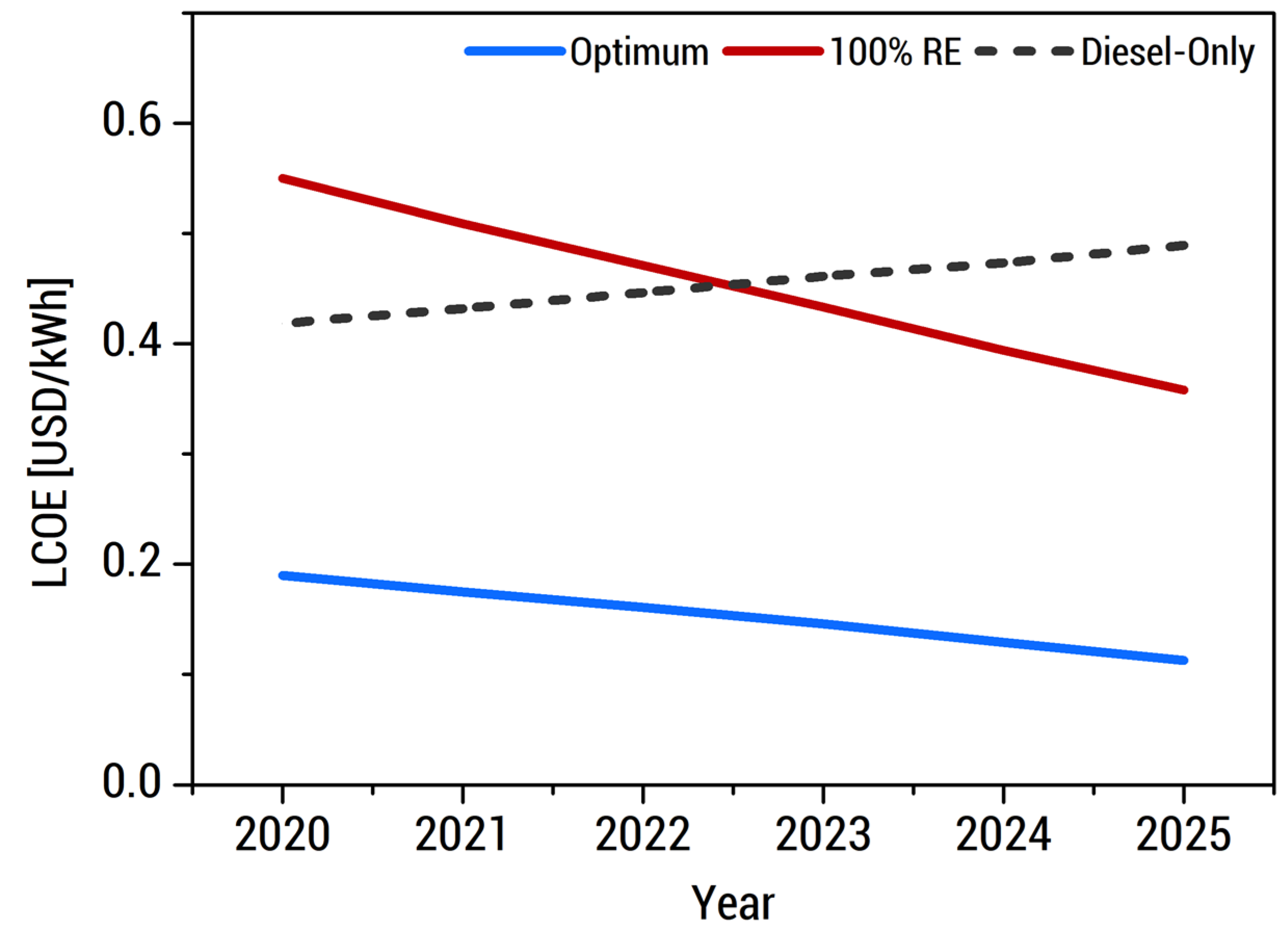

3.2.1. Off-Grid Electrification of Sabtang Island

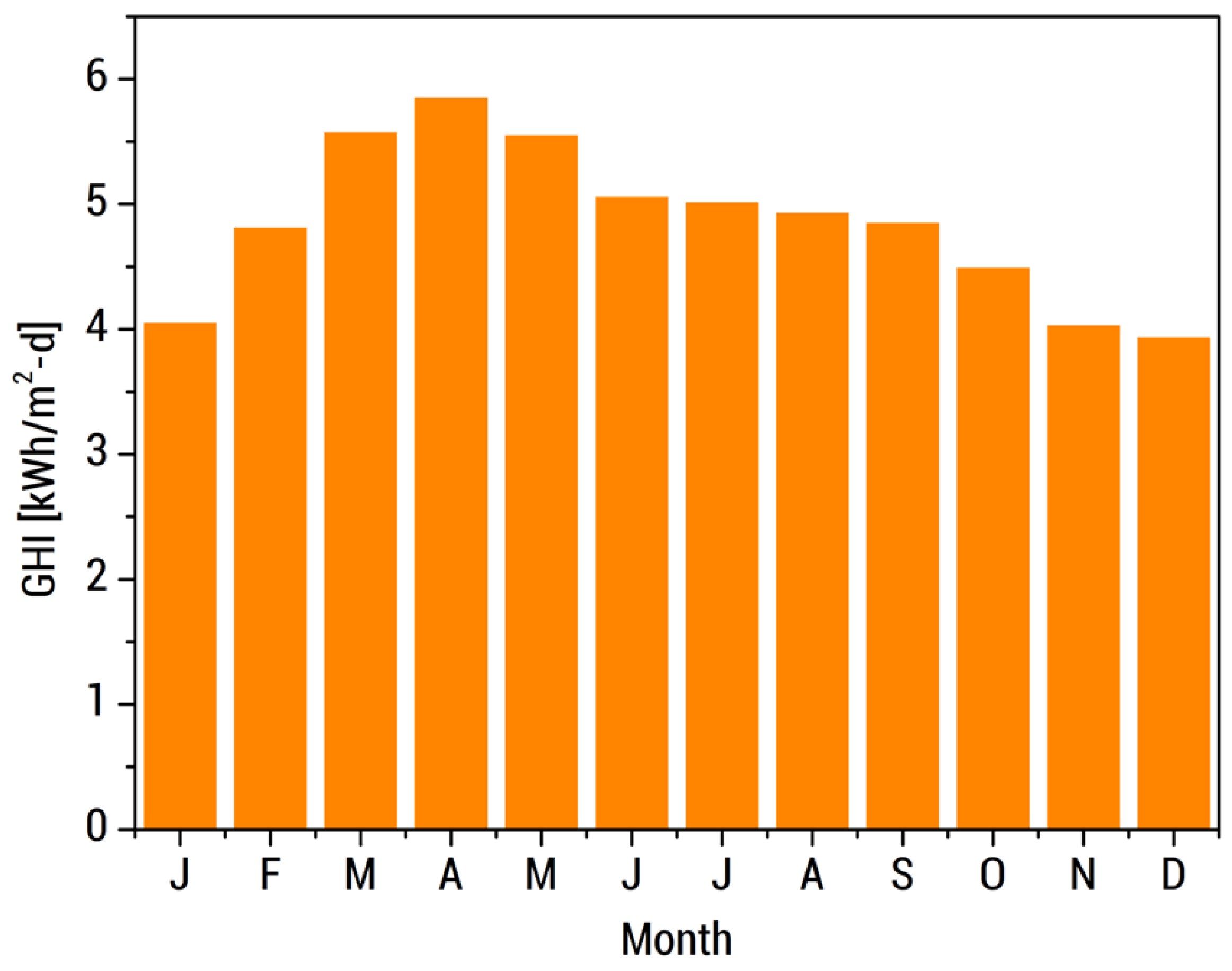

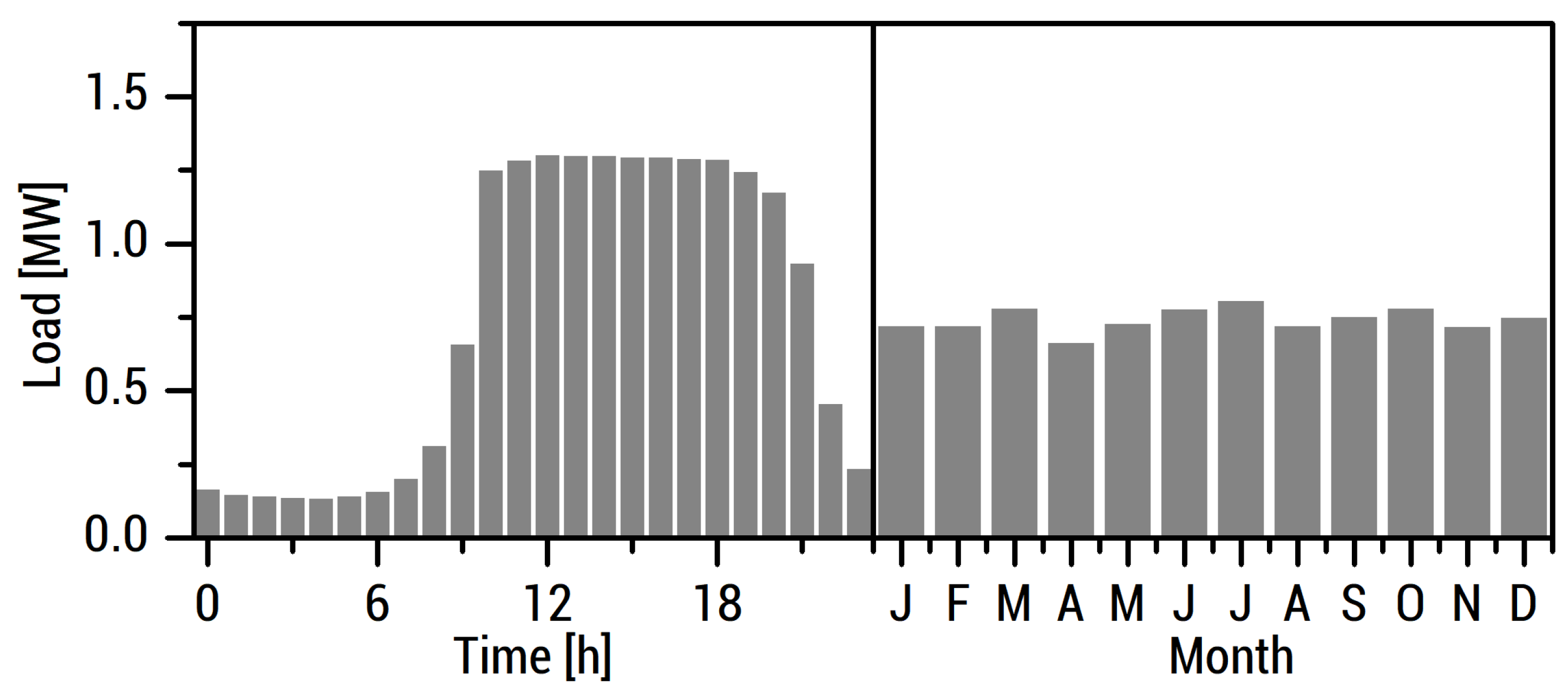

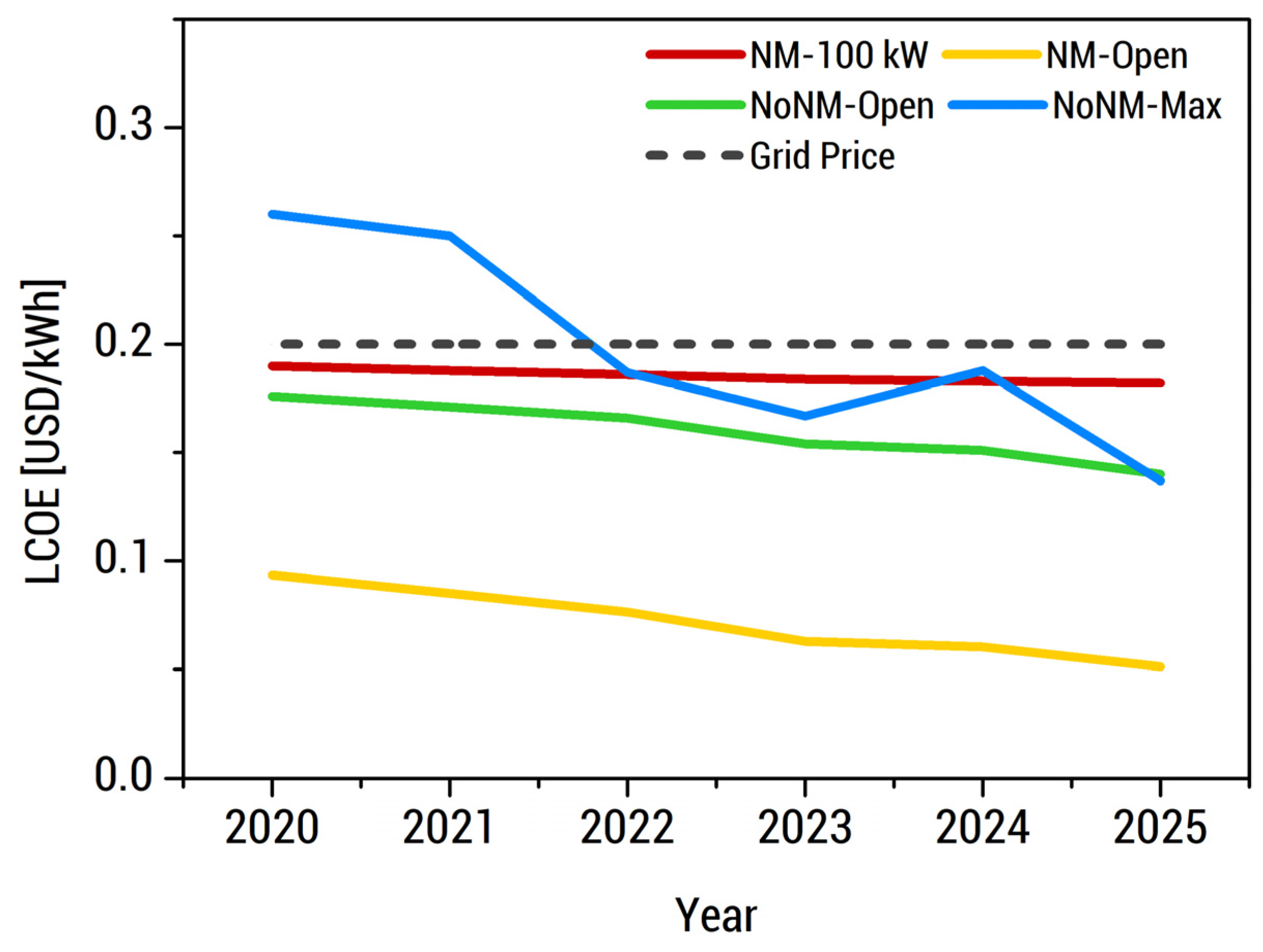

3.2.2. Grid-Tied Electrification of a Commercial Mall in the City of Manila

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Year | Price [USD2018/kWh] | NMC Cumulative Demand [GWh] | Cumulative PCT Count | Li Metal Price [USD/t] | Co Metal Price [USD/t] |

|---|---|---|---|---|---|

| 2007 | 1824.41 | 2 | 142 | 4321.91 | 74,832.08 |

| 2008 | 1087.22 | 4 | 258 | 5237.05 | 109,980.50 |

| 2009 | 1294.06 | 6 | 363 | 5364.66 | 96,238.51 |

| 2010 | 834.42 | 11 | 506 | 5070.37 | 54,760.50 |

| 2011 | 661.17 | 16 | 730 | 4371.01 | 43,291.51 |

| 2012 | 680.23 | 26 | 1046 | 4668.29 | 34,552.50 |

| 2013 | 514.50 | 41 | 1450 | 4784.58 | 26,618.75 |

| 2014 | 464.92 | 61 | 1931 | 5417.22 | 29,072.89 |

| 2015 | 407.95 | 96 | 2418 | 6965.70 | 36,290.42 |

| 2016 | 314.99 | 141 | 2900 | 7830.45 | 24,996.06 |

| 2017 | 234.05 | 211 | 3323 | 9318.40 | 38,243.72 |

| 2018 | 192.49 | 311 | 3770 | 16,500.00 | 80,490.68 |

| 2019 | 170.62 | 441 | 4240 | 10,492.27 | 35,993.58 |

| 2020 | 585 | 4757 | 11,060.97 | 34,089.25 | |

| 2021 | 745 | 5233 | 11,629.67 | 32,184.92 | |

| 2022 | 923 | 5756 | 12,198.37 | 30,280.58 | |

| 2023 | 1121 | 6332 | 12,767.07 | 28,376.25 | |

| 2024 | 1340 | 6965 | 13,335.77 | 26,471.92 | |

| 2025 | 1583 | 7661 | 13,904.47 | 24,567.59 |

| Data | Methodology |

|---|---|

| Historical Li-ion NMC Price | Converted prices from journals and market reports [20,50] to USD2018 using the consumer price index (CPI), then averaged. |

| Historical Cumulative Demand | From [63]. |

| Historical PCT Count | Data from 2007 to 2016 was obtained from [64]. Data from 2017 to 2019 was extrapolated using simple regression analysis. |

| Historical Raw Material Cost | From [65]. |

| Projected Cumulative Demand | Based on the compound annual growth rate of 11% in demand of Li-ion battery in the EV market [63]. |

| Projected PCT Count | Based on the average growth rate (10%) of PCT applications form 2007–2017 [64]. |

| Projected Material Cost | Based on regression analysis. |

Appendix B

| Component | Parameter | Unit | Value |

|---|---|---|---|

| Solar PV | CapEx | USD/kW | Variable |

| OpEx | USD/kW-y | 140 | |

| Derating | % | 80 | |

| Lifetime | y | 25 | |

| Wind | CapEx | USD/kW | Variable |

| OpEx | USD/kW-y | 140 | |

| Lifetime | y | 20 | |

| Li-ion | CapEx | USD/kW | Variable |

| OpEx | USD/kW-y | 0.10 | |

| Min. SOC | % | 20 | |

| C-rate | kW/kWh | 1 | |

| Lifetime | y | 15 | |

| Diesel | CapEx | USD/kW | 0 |

| (Island only) | OpEx | USD/kWh | 0.11 |

| RepEx | USD/kW | 600 | |

| Fuel Cost | USD/L | 0.9 | |

| Lifetime | h | 15,000 | |

| Project | CapEx | USD | Footnote 1 |

| Inflation | % | 3.19 | |

| Lifetime | y | 25 |

| Year | Solar PV 1 [USD/kW] | Wind 2 [USD/kW] |

|---|---|---|

| 2020 | 2000 | 3051 |

| 2021 | 1810 | 3147 |

| 2022 | 1620 | 3462 |

| 2023 | 1430 | 3635 |

| 2024 | 1240 | 3817 |

| 2025 | 1050 | 4007 |

Appendix C

Appendix C.1. Sabtang Island

Appendix C.2. Commercial Mall

References

- Phuangpornpitak, N.; Tia, S. Opportunities and challenges of integrating renewable energy in smart grid system. Energy Procedia 2013, 34, 282–290. [Google Scholar] [CrossRef]

- Panwar, N.L.; Kaushik, S.C.; Kothari, S. Role of renewable energy sources in environmental protection: A review. Renew. Sustain. Energy Rev. 2011, 15, 1513–1524. [Google Scholar] [CrossRef]

- Singh, D.; Sharma, N.K.; Sood, Y.R.; Jarial, R.K. Global status of renewable energy and market: Future prospectus and target. IET Conf. Publ. 2011, 2011, 171–176. [Google Scholar] [CrossRef]

- Tafarte, P.; Kanngießer, A.; Dotzauer, M.; Meyer, B.; Grevé, A.; Millinger, M. Interaction of electrical energy storage, flexible bioenergy plants and system-friendly renewables in wind- or solar PV-dominated Regions. Energies 2020, 13, 1133. [Google Scholar] [CrossRef]

- Denholm, P.; Ela, E.; Kirby, B.; Milligan, M. The Role of Energy Storage with Renewable Electricity Generation; Technical Report NREL/TP-6A2-47187; National Renewable Energy Laboratory: Golden, CO, USA, 2010. [Google Scholar] [CrossRef]

- Mehr, T.H.; Masoum, M.A.S.; Jabalameli, N. Grid-connected Lithium-ion battery energy storage system for load leveling and peak shaving. In Proceedings of the Australas. Universities Power Engineering Conference AUPEC, Hobart, Australia, 29 September–3 October 2013. [Google Scholar] [CrossRef]

- Buchmann, I. Types of Lithium-Ion Batteries. 2019. Available online: https://batteryuniversity.com/learn/article/types_of_lithium_ion (accessed on 30 April 2020).

- Tsiropoulos, I.; Tarvydas, D.; Lebedeva, N. Li-Ion Batteries for Mobility and Stationary Storage Applications; Publications Office of the European Union: Petten, The Netherlands, 2018; ISBN 978-92-79-97254-6. [Google Scholar]

- Jürgens, J. This Is Why NCM Is the Preferable Cathode Material for Li-Ion Batteries. 2019. Available online: https://lghomebatteryblog.eu/en/this-is-why-ncm-is-the-preferable-cathode-material-for-li-ion-batteries (accessed on 30 April 2020).

- Hsieh, I.Y.L.; Pan, M.S.; Chiang, Y.M.; Green, W.H. Learning only buys you so much: Practical limits on battery price reduction. Appl. Energy 2019, 239, 218–224. [Google Scholar] [CrossRef]

- Baes, K.; Carlot, F.; Ito, Y.; Kolk, M.; Merhaba, A. Future of Batteries. Winner Takes All? 2018. Available online: https://www.adlittle.com/sites/default/files/viewpoints/adl_future_of_batteries-min.pdf (accessed on 30 April 2020).

- Ouyang, D.; Chen, M.; Huang, Q.; Weng, J.; Wang, Z.; Wang, J. A Review on the thermal hazards of the lithium-ion battery and the corresponding countermeasures. Appl. Sci. 2019, 9, 2483. [Google Scholar] [CrossRef]

- Ouyang, M.; Dueñas-Osorio, L. Multi-dimensional hurricane resilience assessment of electric power systems. Struct. Saf. 2014, 10, 933. [Google Scholar] [CrossRef]

- Scot, L. A Behind the Scenes Take on Lithium-Ion Battery Prices. 2019. Available online: https://about.bnef.com/blog/behind-scenes-take-lithium-ion-battery-prices/ (accessed on 30 April 2020).

- Li, B.M.; Lu, J. Cobalt in lithium-ion batteries. Science 2020, 367, 979–980. [Google Scholar] [CrossRef]

- Jacoby, M. It’s time to recycle lithium-ion batteries. CEn Glob. Enterp. 2019, 97, 29–32. [Google Scholar] [CrossRef]

- Schmidt, O.; Hawkes, A.; Gambhir, A.; Staffell, I. The future cost of electrical energy storage based on experience rates. Nat. Energy 2017, 2, 1–8. [Google Scholar] [CrossRef]

- Nykvist, B.; Nilsson, M. Rapidly falling costs of battery packs for electric vehicles. Nat. Clim. Chang. 2015, 5, 329–332. [Google Scholar] [CrossRef]

- Kittner, N.; Lill, F.; Kammen, D.M. Energy storage deployment and innovation for the clean energy transition. Nat. Energy 2017, 2, 1–6. [Google Scholar] [CrossRef]

- Bloomberg New Energy Finance. 2018 Lithium-ion battery price survey. Propr. Inf. 2019.

- Berckmans, G.; Messagie, M.; Smekens, J.; Omar, N.; Vanhaverbeke, L.; Mierlo, J. Van Cost projection of state of the art lithium-ion batteries for electric vehicles up to 2030. Energies 2017, 10, 1314. [Google Scholar] [CrossRef]

- Van pottelsberghe de la potterie, B. The quality factor in patent systems. Ind. Corp. Chang. 2011, 20, 1755–1793. [Google Scholar] [CrossRef]

- Lindman, Å.; Söderholm, P. Wind energy and green economy in Europe: Measuring policy-induced innovation using patent data. Appl. Energy 2016, 179, 1351–1359. [Google Scholar] [CrossRef]

- Margolis, R.M.; Kammen, D.M. Underinvestment: The energy technology and RandD policy challenge. Science 1999, 285, 690–692. [Google Scholar] [CrossRef]

- GlobeNewswire. Research and Markets Global $94+ Bn Lithium-Ion Battery Market by Type, Power Capacity, Industry, Voltage and Region—Forecast to 2025. 2020. Available online: https://www.globenewswire.com/news-release/2020/04/21/2019319/0/en/Global-94-Bn-Lithium-Ion-Battery-Market-by-Type-Power-Capacity-Industry-Voltage-and-Region-Forecast-to-2025.html (accessed on 11 May 2020).

- Wiesenthal, T.; Dowling, P.; Morbee, J.; Thiel, C.; Schade, B.; Russ, P.; Simoes, S.; Peteves, S.; Schoots, K.; Londo, M. Technology Learning Curves for Energy Policy Support; European Commisson: Seville, Spain, 2012; ISBN 9789279256769. [Google Scholar]

- Qiu, Y.; Anadon, L.D. The price of wind power in China during its expansion: Technology adoption, learning-by-doing, economies of scale, and manufacturing localization. Energy Econ. 2012, 34, 772–785. [Google Scholar] [CrossRef]

- Zheng, C.; Kammen, D.M. An innovation-focused roadmap for a sustainable global photovoltaic industry. Energy Policy 2014, 67, 159–169. [Google Scholar] [CrossRef]

- International Renewable Energy Agency. Renewables Readiness Assessment: The Philippines; IREA: Abu Dhabi, UAE, 2017; ISBN 9789292600037. [Google Scholar]

- Congress of the Philippines Republic Act No. 9513—Renewable Energy Act of 2008. Available online: https://www.officialgazette.gov.ph/2008/12/16/republic-act-no-9513/ (accessed on 13 May 2020).

- Department of Energy Omnibus Guidelines on Enhancing Off-Grid Power Development and Operation 2019. Available online: https://www.doe.gov.ph/sites/default/files/pdf/issuances/dc2019-01-0001.PDF (accessed on 13 May 2020).

- Jara, P.G.; Castro, M.; Esparcia, E.; Odulio, C.M.; Ocon, J.D. Cost Saving Potential of Grid-tied Solar Photovoltaic-based Hybrid Energy System in the Philippine Industrial Sector. Chem. Eng. Trans. 2019, 76, 937–942. [Google Scholar] [CrossRef]

- Shirouzu, N.; Lienert, P. Tesla’s Secret Batteries Aim to Rework the Math for Electric Cars and the Grid. 2020. Available online: https://www.reuters.com/article/us-autos-tesla-batteries-exclusive/exclusive-teslas-secret-batteries-aim-to-rework-the-math-for-electric-cars-and-the-grid-idUSKBN22Q1WC (accessed on 6 June 2020).

- Shi, R.; Conrad, S.A. Correlation and regression analysis. Ann. Allergy Asthma Immunol. 2009, 103, 35–41. [Google Scholar] [CrossRef]

- Hirschauer, N.; Grüner, S.; Mußhoff, O.; Becker, C. Pitfalls of significance testing and p-value variability: An econometrics perspective. Stat. Surv. 2018, 12, 136–172. [Google Scholar] [CrossRef]

- Bloomberg NEF. Lithium Price Spike Has Moderate Effect on Batteries. 2017. Available online: https://about.bnef.com/blog/lithium-price-spike-has-moderate-effect-on-batteries/ (accessed on 5 June 2020).

- National Power Corporation. True Cost of Generation Rate of NPC-SPUG per Area. 2019. Available online: https://www.foi.gov.ph/requests/aglzfmVmb2ktcGhyIQsSB0NvbnRlbnQiFE5BUE9DT1ItMjM2Mjc1MzY0NzU1DA (accessed on 30 April 2020).

- Ocon, J.D.; Bertheau, P. Energy transition from diesel-based to solar photovoltaics-battery-diesel hybrid system-based island grids in the Philippines—Techno-economic potential and policy implication on missionary electrification. J. Sustain. Dev. Energy Water Environ. Syst. 2019, 7, 139–154. [Google Scholar] [CrossRef]

- Hong, Y.Y.; Lai, Y.M.; Chang, Y.R.; Lee, Y.D.; Liu, P.W. Optimizing capacities of distributed generation and energy storage in a small autonomous power system considering uncertainty in renewables. Energies 2015, 8, 2473–2492. [Google Scholar] [CrossRef]

- Laminar Smooth Transitions. Solar Panel Energy Flow to Grid—Net Metering. Available online: https://www.laminar.com/utility-interaction (accessed on 15 June 2020).

- Glenn, H. Can I Use Solar Panels without A Battery? 2018. Available online: https://www.solar.com/learn/can-i-use-solar-panels-without-a-battery/ (accessed on 15 June 2020).

- Nagy, B.; Farmer, J.D.; Bui, Q.M.; Trancik, J.E. Statistical Basis for Predicting Technological Progress. PLoS ONE 2013, 8, e52669. [Google Scholar] [CrossRef] [PubMed]

- Dang, J.; Motohashi, K. Patent statistics: A good indicator for innovation in China? Assessment of impacts of patent subsidy programs on patent quality. China Econ. Rev. 2015, 35, 137–155. [Google Scholar] [CrossRef]

- Farmer, J.D.; Lafond, F. How predictable is technological progress? Res. Policy 2016, 45, 647–665. [Google Scholar] [CrossRef]

- Yoo, W.; Mayberry, R.; Bae, S.; Singh, K.; He, Q.; Lillard, J. A Study of Effects of Multicollinearity in the Multivariable Analysis. Int. J. Appl. Sci. Technol. 2014, 4, 9–19. [Google Scholar] [PubMed]

- Fazal, R.; Rehman, S.A.U.; Rehman, A.U.; Bhatti, M.I.; Hussain, A. Energy-environment-economy causal nexus in Pakistan: A graph theoretic approach. Energy 2021, 214, 118934. [Google Scholar] [CrossRef]

- Ghojogh, B.; Crowley, M. The Theory Behind Overfitting, Cross Validation, Regularization, Bagging, and Boosting: Tutorial. arXiv 2019, arXiv:1905.127.87. [Google Scholar]

- Babyak, M. What You See May Not Be What You Get: A Brief, Nontechnical Introduction to Overfitting in Regression-Type Models. Psychosom Med. 2004, 66, 411–421. [Google Scholar] [CrossRef]

- Chaianong, A.; Bangviwat, A.; Menke, C.; Breitschopf, B.; Eichhammer, W. Customer economics of residential PV–battery systems in Thailand. Renew. Energy 2020, 146, 297–308. [Google Scholar] [CrossRef]

- Nykvist, B.; Sprei, F.; Nilsson, M. Assessing the progress toward lower priced long range battery electric vehicles. Energy Policy 2019, 124, 144–155. [Google Scholar] [CrossRef]

- World Energy Council. Energy Storage Monitor—Latest Trend in Energy Storage. 2019. Available online: https://www.worldenergy.org/assets/downloads/ESM_Final_Report_05-Nov-2019.pdf (accessed on 12 May 2020).

- Hertzke, P.; Müller, N.; Schaufuss, P.; Schenk, S.; Wu, T. Expanding Electric-Vehicle Adoption Despite EV Market Growing Pains. 2019. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/expanding-electric-vehicle-adoption-despite-early-growing-pains (accessed on 12 May 2020).

- International Renewable Energy Agency. Renewable Energy Now Accounts for a Third of Global Power Capacity. 2019. Available online: https://www.irena.org/newsroom/pressreleases/2019/Apr/Renewable-Energy-Now-Accounts-for-a-Third-of-Global-Power-Capacity (accessed on 12 May 2020).

- International Energy Agency. Renewables 2019. 2019. Available online: https://www.iea.org/reports/renewables-2019# (accessed on 12 May 2020).

- Smekens, J.; Gopalakrishnan, R.; Van den Steen, N.; Omar, N.; Hegazy, O.; Hubin, A.; Van Mierlo, J. Influence of electrode density on the performance of Li-ion batteries: Experimental and simulation results. Energies 2016, 9, 104. [Google Scholar] [CrossRef]

- Dahn, J.; Hall, D.; Hynes, T. Dioxazolones and nitrile sulfites as electrolyte additives for lithium-ion batteries. J. Electrochem. Soc. 2019, 165, A2961–A2967. [Google Scholar] [CrossRef]

- LeVine, S. A New Battery Breakthrough That Could Save Electric Vehicles During a Recession. 2020. Available online: https://marker.medium.com/a-new-battery-breakthrough-that-could-save-electric-vehicles-during-a-recession-c193ebdd3a5d (accessed on 12 May 2020).

- Zubi, G.; Dufo-López, R.; Carvalho, M.; Pasaoglu, G. The lithium-ion battery: State of the art and future perspectives. Renew. Sustain. Energy Rev. 2018, 89, 292–308. [Google Scholar] [CrossRef]

- Pascasio, J.D.A.; Esparcia, E.J.A.; Odulio, C.M.F.; Ocon, J.D. High Renewable Energy (Solar Photovoltaics and Wind) Penetration Hybrid Energy Systems for Deep Decarbonization in Philippine Off-grid Areas. Chem. Eng. Trans. 2019, 76, 1135–1140. [Google Scholar] [CrossRef]

- Agua, O.F.B.; Basilio, R.J.A.; Pabillan, M.E.D.; Castro, M.T.; Blechinger, P.; Ocon, J.D. Decentralized versus clustered microgrids: An energy eystem etudy for reliable off-grid electrification of small islands. Energies 2020, 13, 4454. [Google Scholar] [CrossRef]

- Meschede, H.; Esparcia, E.J.A.; Holzapfel, P.; Bertheau, P.; Ang, R.C.; Blanco, A.C.; Ocon, J.D. On the transferability of smart energy systems on off-grid islands using cluster analysis—A case study for the Philippine archipelago. Appl. Energy 2019, 251, 113290. [Google Scholar] [CrossRef]

- Castro, M.T.; Alcanzare, M.; Esparcia, E.J.A.; Ocon, J.D. A comparative techno-economic analysis of different desalination technologies in off-grid islands. Energies 2020, 13, 2261. [Google Scholar] [CrossRef]

- Pillot, C. Current Status and Future Trends of the Global Li-ion Battery Market. Avicenne Energy 2018, 4. Available online: https://www.charles-hatchett.com/public/images/documents/2018/dr_christophe_pillot_current_status_and_future_trends_of_the_global_li-ion_battery_market.pdf (accessed on 30 April 2020).

- KnowMade. NMC Lithium-Ion Batteries Patent Landscape Analysis. 2017. Available online: https://www.knowmade.com/wp-content/uploads/2017/07/NMC-Li-ion-Batteries-Patent-Landscape-2017-SAMPLE.pdf (accessed on 30 April 2020).

- Metalary. Price History of Lithium and Cobalt Metals. Available online: https://www.metalary.com (accessed on 30 April 2020).

- van der Leun, K. Solar PV Shows a Record Learning Rate: 28.5% Reduction in Cost per Watt for Every Doubling Cumulative Capacity. 2018. Available online: http://www.rapidshift.net/solar-pv-shows-a-record-learning-rate-28-5-reduction-in-cost-per-watt-for-every-doubling-of-cumulative-capacity/ (accessed on 12 May 2020).

- Totaro, P. Wind Turbine Prices to Recover 5% in the Next 2 Years. 2019. Available online: https://renewablesnow.com/news/analysis-wind-turbine-prices-to-recover-5-in-next-2-years-673526/ (accessed on 12 May 2020).

| Case Study | Scenario | Description |

|---|---|---|

| Off-grid | Optimum Case |

|

| 100% RE |

| |

| Grid-tied | NM-100 kW |

|

| NM-Open |

| |

| NoNM-Open |

| |

| NoNM-Max |

|

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Penisa, X.N.; Castro, M.T.; Pascasio, J.D.A.; Esparcia, E.A., Jr.; Schmidt, O.; Ocon, J.D. Projecting the Price of Lithium-Ion NMC Battery Packs Using a Multifactor Learning Curve Model. Energies 2020, 13, 5276. https://doi.org/10.3390/en13205276

Penisa XN, Castro MT, Pascasio JDA, Esparcia EA Jr., Schmidt O, Ocon JD. Projecting the Price of Lithium-Ion NMC Battery Packs Using a Multifactor Learning Curve Model. Energies. 2020; 13(20):5276. https://doi.org/10.3390/en13205276

Chicago/Turabian StylePenisa, Xaviery N., Michael T. Castro, Jethro Daniel A. Pascasio, Eugene A. Esparcia, Jr., Oliver Schmidt, and Joey D. Ocon. 2020. "Projecting the Price of Lithium-Ion NMC Battery Packs Using a Multifactor Learning Curve Model" Energies 13, no. 20: 5276. https://doi.org/10.3390/en13205276

APA StylePenisa, X. N., Castro, M. T., Pascasio, J. D. A., Esparcia, E. A., Jr., Schmidt, O., & Ocon, J. D. (2020). Projecting the Price of Lithium-Ion NMC Battery Packs Using a Multifactor Learning Curve Model. Energies, 13(20), 5276. https://doi.org/10.3390/en13205276