Forks in the Road to E-Mobility: An Evaluation of Instrument Interaction in National Policy Mixes in Northwest Europe

Abstract

:1. Introduction

2. Policy Mixes for Low-Carbon Innovation and Transition

2.1. Policy Mixes

2.2. Methods and Data

2.2.1. Interviews

2.2.2. Interview Analysis

2.2.3. Written Sources and Analysis

3. Divergent Policy Paths in Norway, the Netherlands and Denmark

3.1. Policy Mixes

3.1.1. ICE Car Demand-Side Policies

3.1.2. Renewable Energy Policies

3.1.3. FBEV Demand-Side Policies

3.1.4. FBEV Infrastructure Policies

3.1.5. FBEV Supply-Side Policies

3.1.6. Embedding Governance

3.2. Policy Outcomes

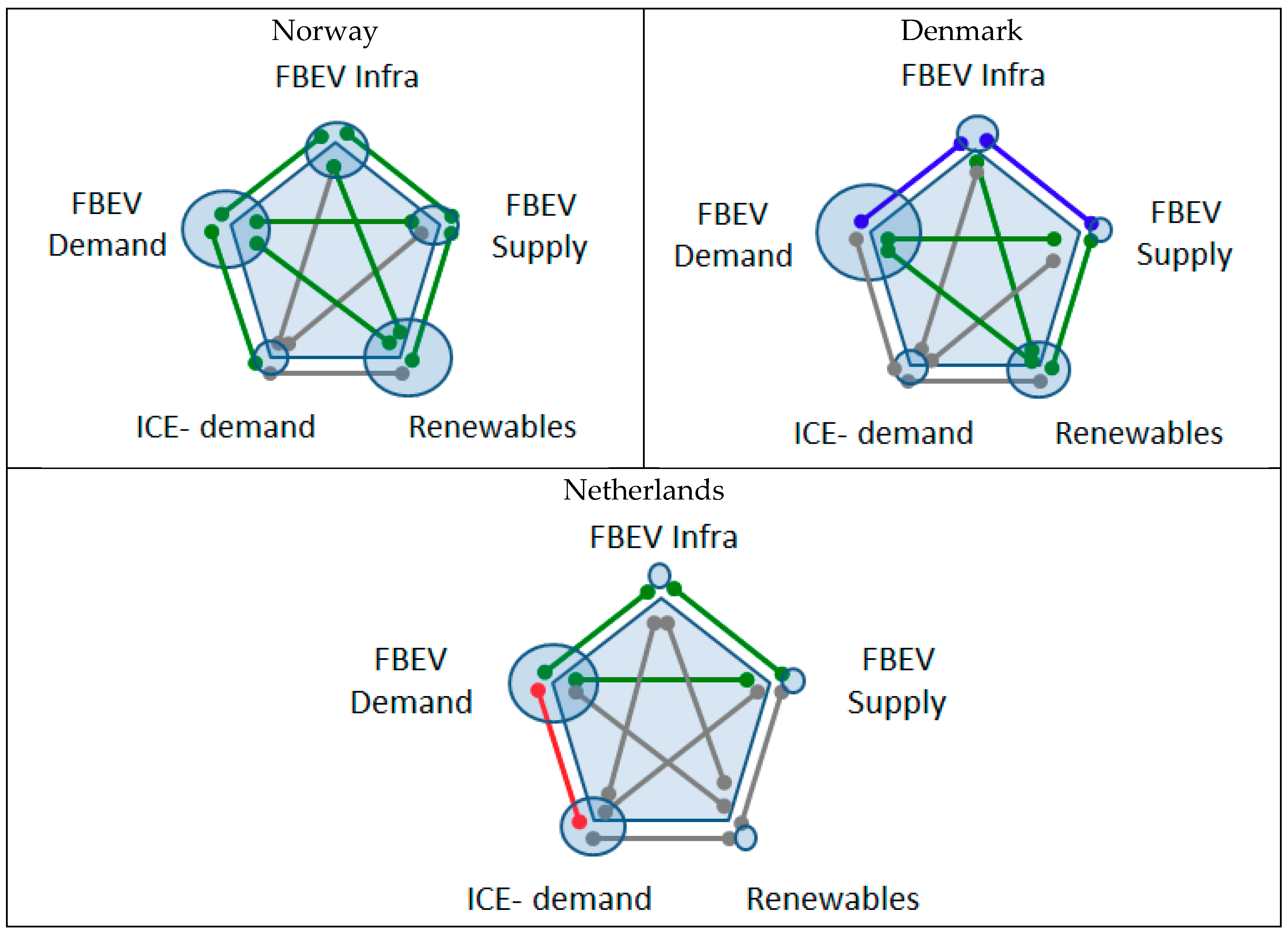

4. Policy Interaction Effects and Discussion

5. Conclusions and Policy Implications

- Fiscal incentives that mirror the actual carbon footprint of the respective vehicles

- Non-fiscal demand-side incentives, such as free use of toll roads, free parking or free use of bus lanes

- Centrally financed and/or coordinated charging infrastructure

- Clarity regarding the choice of technology that will be supported

Limitations and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A1. Interview Format

- What do you consider the policy instruments shaping sales of FBEV, and how (i.e., what was its effect)?

- How do the policy instruments (see previous question) influence each other? (specify each pair). For example, do they work together or against each other?

- Was the amount of resources, efforts, activities, etc. that was invested in the policy instrument? (specify for each policy instrument).

- What do you consider the most relevant stakeholders and policy or other reports regarding electric mobility?

Appendix A2. List of Policy or Other Reports Included in the Analysis, but not Cited in the Text:

- ○

- ○

- ○

- ○

References

- Althaus, H.-J. Modern individual mobility. Int. J. Life Cycle Assess. 2011, 17, 267–269. [Google Scholar] [CrossRef] [Green Version]

- DCCC. Hvor Klimavenlige er Elbiler Sammenlignet Med Benzin- og Dieselbiler; Danish Council for Climate Change: Copenhagen, Denmark, 2018. Available online: www.klimaraadet.dk (accessed on 1 July 2019).

- Geels, F.W. Understanding the Dynamics of Technological Transitions. Ph.D. Thesis, Twente University, Enschede, The Netherlands, 2002. [Google Scholar]

- Rip, A.; Kemp, R. Technological change. In Human Choice and Climate Change; Rayner, S., Malone, E.L., Eds.; Battelle Press: Columbus, OH, USA, 1998; pp. 327–399. [Google Scholar]

- Cowan, R.; Hulten, S. Escaping lock-in: The case of the electric vehicle. Technol. Forecast. Soc. Chang. 1996, 53, 61–79. [Google Scholar] [CrossRef]

- Klitkou, A.; Bolwig, S.; Hansen, T.; Wessberg, N. The role of lock-in mechanisms in transition processes: The case of energy for road transport. Environ. Innov. Soc. Transit. 2015, 16, 22–37. [Google Scholar] [CrossRef] [Green Version]

- Dijk, M.; Wells, P.; Kemp, R. Will the momentum of the electric car last? Testing an hypothesis on disruptive innovation. Technol. Forecast. Soc. Chang. 2016, 105, 77–88. [Google Scholar] [CrossRef] [Green Version]

- Sierzchula, W.; Bakker, S.; Maat, K.; Van Wee, B. The influence of financial incentives and other socio-economic factors on electric vehicle adoption. Energy Policy 2014, 68, 183–194. [Google Scholar] [CrossRef]

- Wesseling, J.H. Explaining Variance in National Electric Vehicle Policies. Environ. Innov. Soc. Transit. 2016, 21, 28–38. [Google Scholar] [CrossRef]

- Flanagan, K.; Uyarra, E.; Laranja, M. Reconceptualising the ‘policy mix’ for innovation. Res. Policy 2011, 40, 702–713. [Google Scholar] [CrossRef]

- Veugelers, R. Which policy instruments to induce clean innovating? Res. Policy 2012, 41, 1770–1778. [Google Scholar] [CrossRef]

- Rogge, K.S.; Reichardt, K. Policy Mixes for Sustainability Transitions: An extended concept and framework for analysis. Res. Policy 2016, 45, 1620–1635. [Google Scholar] [CrossRef]

- Rogge, K.S.; Kern, F.; Howlett, M. Conceptual and empirical advances in analyzing policy mixes for energy transitions. Energy Res. Soc. Sci. 2017, 33, 1–10. [Google Scholar] [CrossRef]

- Borrás, S.; Edquist, C. The choice of innovation policy instruments. Technol. Forecast. Soc. Chang. 2013, 80, 1513–1522. [Google Scholar] [CrossRef] [Green Version]

- Dijk, M.J.; Backhaus, H.; Wieser, R. Kemp Policies tackling the ‘web of constraints’ on resource efficient practices: The case of mobility. Sustain. Sci. Pract. Policy 2019, 15, 62–81. [Google Scholar]

- Howlett, M.; Rayner, J. Design principles for policy mixes: Cohesion and coherence in ‘New Governance Arrangements’. Policy Soc. 2007, 26, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Kern, F.; Howlett, M. Implementing transition management as policy reforms: A case study of the Dutch energy sector. Policy Sci. 2009, 42, 391–408. [Google Scholar] [CrossRef]

- Nauwelaers, C.; Boekholt, P.; Mostert, B.; Cunningham, P.; Guy, K.; Hofer, R.; Rammer, C. Policy Mixes for R & D in Europe; UNU-MERIT, University of Maastricht and United Nations University: Maastricht, The Netherlands, 2009. [Google Scholar]

- Oikonomou, V.; Jepma, C. A framework on interactions of climate and energy policy instruments. Mitig. Adapt. Strateg. Glob. Chang. 2008, 13, 131–156. [Google Scholar] [CrossRef] [Green Version]

- Sorrell, S.; Smith, A.; Betz, R.; Walz, R.; Boemare, C.; Quirion, P.; Sijm, J.; Konidari, D.M.P.; Vassos, S.; Haralampopoulos, D.; et al. Interaction in EU Climate Policy: Final Report; SPRU: Brighton, UK, 2003. [Google Scholar]

- Painter, M. Central agencies and the coordination principle. Aust. J. Public Adm. 1981, 40, 265–280. [Google Scholar] [CrossRef]

- Braun, D. Organising the political coordination of knowledge and innovation policies. Sci. Public Policy 2008, 35, 227–239. [Google Scholar] [CrossRef] [Green Version]

- Del Río, P. Interactions between climate and energy policies: The case of Spain. Clim. Policy 2009, 9, 119–138. [Google Scholar]

- Gunningham, N.; Grabosky, P.N.; Sinclair, D. Smart Regulation: Designing Environmental Policy; Oxford University Press: Oxford, UK, 1998. [Google Scholar]

- Guerzoni, M.; Raiteri, E. Demand-side vs. supply-side technology policies: Hidden treatment and new empirical evidence on the policy mix. Res. Policy 2015, 44, 726–747. [Google Scholar] [CrossRef]

- Del Río González, P. The interaction between emissions trading and renewable electricity support schemes: An overview of the literature. Mitig. Adapt. Strateg. Glob. Chang. 2006, 12, 1363–1390. [Google Scholar] [CrossRef]

- IEA. Interactions of Policies for Renewable Energy and Climate; IEA: Paris, France, 2011.

- Antonioli, D.; Borghesi, S.; D’Amato, A.; Gilli, M.; Mazzanti, M.; Nicolli, F. Analysing the interactions of energy and climate policies in a broad policy ‘optimality’ framework: The Italian case study. J. Integr. Environ. Sci. 2014, 11, 205–224. [Google Scholar] [CrossRef] [Green Version]

- Palmer, K.; Paul, A.; Woerman, M.; Steinberg, D. Federal policies for renewable electricity: Impacts and interactions. Energy Policy 2011, 39, 3975–3991. [Google Scholar] [CrossRef]

- Kivimaa, P.; Kangas, H.-L.; Lazarevic, D. Client-oriented Evaluation of ‘Creative Destruction’ in Policy Mixes: Finnish Policies on Building Energy Efficiency Transition. Energy Res. Soc. Sci. 2017, 33, 115–127. [Google Scholar] [CrossRef]

- Albrecht, J.; Arts, B. Climate Policy Convergence in Europe: An Assessment Based on National Communications to the UNFCCC. J. Eur. Public Policy 2005, 12, 885–902. [Google Scholar] [CrossRef]

- Schaffrin, A.; Sewerin, S.; Seubert, S. Toward a comparative measure of climate policy output. Policy Stud. J. 2015, 43, 257–282. [Google Scholar] [CrossRef]

- Givoni, M.; Macmillen, J.; Banister, D.; Feitelson, E. From policy measures to policy packages. Transp. Rev. 2013, 33, 1–20. [Google Scholar] [CrossRef]

- DCCC. Mål og Virkemidler på Elbilområdet i Udvalgte Lande; Danish Council for Climate Change: Copenhagen, Denmark, 2018. Available online: www.klimaraadet.dk (accessed on 1 July 2019).

- Vasseur, V. A Sunny Future for Photovoltaic Systems in The Netherlands? An Analysis of the Role of Government and Users in the Diffusion of an Emerging Technology. Ph.D. Thesis, Maastricht University, Maastricht, The Netherlands, 2014. [Google Scholar]

- Christensen, T.B.; Wells, P.; Cipcigan, L. Can innovative business models overcome resistance to electric vehicles? Better Place and battery electric cars in Denmark. Energy Policy 2012, 48, 498–505. [Google Scholar] [CrossRef]

- McKinsey. Electric Vehicles in Europe: Gearing Up for a New Phase? Report of Amsterdam Roundtables Foundation and McKinsey & Company; McKinsey: Maastricht, The Netherlands, 2014. [Google Scholar]

- Kley, F.; Wietschel, M.; Dallinger, D. Evaluation of European Electric Vehicle Support Schemes. In Paving the Road to Sustainability: Governance and Innovation in Low-Carbon Vehicles; Nilsson, M., Hillman, K., Rickne, A., Magnusson, T., Eds.; Routledge: London, UK, 2012. [Google Scholar]

- Excise Duty Tables January 2016. Available online: http://ec.europa.eu/taxation_customs/index_en.htm (accessed on 18 February 2016).

- EU Energy Prices. Available online: https://www.energy.eu/fuelprices/ (accessed on 18 February 2016).

- Norway Gasoline Prices. Available online: http://www.globalpetrolprices.com/Norway/gasoline_prices/ (accessed on 18 February 2016).

- RVO. Elektrisch Rijden in de Versnelling: Plan van Aanpak 2011–2015 [Electric Driving in Acceleration: Work Plan 2011–2015]; Netherlands Enterprise Agency/Rijksdienst voor Ondernemend Nederland (RVO): Utrecht, The Netherlands, 2011. [Google Scholar]

- Transnova. Prosjektrapport: Etter 3 år; Transnova: Oslo, Norway, 2012. [Google Scholar]

- Danish Energy Agency. Forsøgsordning for Elbiler. 2016. Available online: http://www.ens.dk/klima-co2/transport/elbiler/forsogsordning-elbiler (accessed on 18 February 2016).

- Handlingsplan. Handlingsplan for Elektrifisering av Veitransport: Rapport fra Ressursgruppe Nedsatt av Samferdselsdepartementet; Samferdselsdepartementet: Oslo, Norway, 2009; p. 52. [Google Scholar]

- Grønn Bil. 2015. Available online: www.gronnbil.no (accessed on 18 November 2015).

- Available online: https://www.theguardian.com/environment/2017/dec/25/norway-leads-way-electric-cars-green-taxation-shift (accessed on 1 July 2018).

- DCCC. Flere Elbiler på de Danske Veje. Forslag til Pejlemærker og Virkemidler til Elektrificering af Personbilerne; Danish Council for Climate Change, 2018. Available online: www.klimaraadet.dk (accessed on 1 July 2019).

- Haugneland, P.; Kvisle, H. Norwegian electric car user experiences. Int. J. Automot. Technol. Manag. 2015, 15, 194–221. [Google Scholar] [CrossRef]

- Ekeland, A. The Electric Car Success in Norway: A Dead-End or a Way Forward for Climate Policy? Paper for the Colloque International Recherche & Regulation, Paris. 2015. Available online: https://www.eiseverywhere.com (accessed on 12 June 2015).

- Kok, R.; Van der Linden, F.; Smokers, R.; Verbeek, M. Evaluatie Autogerelateerde Belastingen 2008–2013 en Vooruitblik Automarktontwikkelingen tot 2020 [Evaluation of Car-Related Taxes 2008–2013) and Outlook Car Market Trends to 2020]; Report Commissioned by Ministry of Finance; Policy Research Corporation: Rotterdam, The Netherlands, 2014. [Google Scholar]

- Rodrik, D. Green industrial policy. Oxf. Rev. Econ. Policy 2014, 30, 469–491. [Google Scholar] [CrossRef]

- Van der Beesen, P.; Munnix, S.; Reitsma, S. Verzilvering Verdienpotentieel Elektrisch Vervoer in Nederland [Cashing the Revenue Potential of Electric Transport in The Netherlands]; Netherlands Enterprise Agency/Rijksdienst voor Ondernemend Nederland (RVO): Utrecht, The Netherlands, 2014. [Google Scholar]

- PBL. Belastingkortingen Voor Zuinige Auto’s: Afwegingen Voor Fiscaal Beleid [Tax Reduction for Fuel Efficient Cars: Trade-Offs for Fiscal Policy]; Planbureau voor de Leefomgeving: Den Haag, The Netherlands, 2014.

- Eurlings, C.; Van den Hoeven, M. Mobiliteitsbeleid [Mobility Policy], Letter to Parliament; Ministry of Traffic & Water and Ministry of Economic Affairs: The Hague, The Netherlands, 2009.

- Wiebes, E. Autobrief 2, Letter to Pariament; Ministry of Financial Affairs: The Hague, The Netherlands, 2015.

- Bakker, S.; Maat, K.; Van Wee, B. Stakeholders expectations, interests, and strategies regarding the development and implementation of electric vehicles. Transp. Res. A 2014, 66, 52–64. [Google Scholar] [CrossRef]

- DMT. Forslag til Lov om Ændring af Registreringsafgiftsloven, Brændstofforbrugsafgiftsloven og Forskellige Andre Love; Danish Ministry of Taxation: Copenhagen, Denmark, 2015.

- Borup, M. Electrical Mobility Case Study: Better Place–An Effort of Creating New Actor Roles and Infrastructure for Electric Car Mobility; TOP-NEST Working Paper; DTU: Lyngby, Denmark, 2013; p. 30. [Google Scholar]

- DE and Energinet.dk 2015: Smart Energy—Hovedrapport; Danish Energy Association: Copenhagen, Denmark, 2015.

- YouGov. Danskernes syn på Elbiler. The Survey was Administered to a Representative Sample of 1002 Respondents. 2014. Available online: www.danskelbilalliance.dk (accessed on 29 January 2014).

- Energistyrelsen. Vejledning til Beregning af Støtteberettigede Meromkostninger for Elbiler og Ladeinfrastruktur; Energistyrelsen: København, Denmark, 2013. [Google Scholar]

- Government of Norway. Alternative Drivstoff, Elbiler og Nullutslippsteknologi. 2014. Available online: https://www.regjeringen.no/no/tema/transport-og-kommunikasjon/veg_og_vegtrafikk/biler-og-lavutslippsteknologi/id2076451/ (accessed on 15 November 2017).

- Vergis, S.; Turrentine, T.S.; Fulton, L.; Fulton, E. Plug-In Electric Vehicles: A Case Study of Seven Markets, ITS Research Report; Institute of Transportation Studies, University of California: Davis, CA, USA, 2014; p. 35. [Google Scholar]

- EEO. European Electro-Mobility Observatory. 2015. Available online: http://ev-observatory.eu/norway-logs-50-000-ev-and-continues-incentives-up-to-2017/ (accessed on 15 November 2017).

- Michelin Nordic. Survey Results Data Files. The Survey was Conducted in 2014 by PFM Research Sweden on Behalf of Michelin and Included 1000 Respondents; Michelin Nordic Oslo: Oslo, Norway, 2014. [Google Scholar]

- Røste, R. Value Chain Analysis of the Norwegian Electric Vehicles Market: Think a First-Mover; TOP-NEST Project: Oslo, Norway, 2013. [Google Scholar]

- Jolly, D. Norway’s Electric Embrace. New York Times, 19 October 2015. [Google Scholar]

- For Renewable Energy Consumption and Generation Shares. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 13 April 2015).

- Hoogma, R.; Kemp, R.; Schot, J.; Truffer, B. Experimenting for Sustainable Transport Experimenting for Sustainable Transport: The Approach of Strategic Niche Management; Routledge: London, UK; New York, NY, USA, 2002. [Google Scholar]

| Norway |

|

| The Netherlands |

|

| Danmark |

|

| Type or Domain of Policy | Country | 1990s | 2000s | 2010–2015 |

|---|---|---|---|---|

| FBEV demand—Side | NO | Strong user benefits | Strong financial tax incentives + user benefits. | Strong financial tax incentives + user benefits. |

| NL | Medium to strong financial tax incentives | |||

| DK | Very strong financial tax incentives | |||

| FBEV supply-side | NO | Medium support to small domestic FBEV producers | Medium support to small domestic FBEV producers | Medium support to small domestic FBEV producers |

| NL | Weak: after 2009 mostly organization measures to stimulate domestic infrastructure and the grid sector. Since 2011, business development goals have gained in prominence after the responsibilities of the Ministry of Economic Affairs (EZ) took over responsibilities for the action plan. By 2012 the Formula E-team had identified twelve promising niches and a list of activities to trigger innovation. | |||

| DK | Weak: tax reduction for utilities after 2012. Efforts to standardize charging technology and data-exchange systems | |||

| FBEV infrastructure | NO | Demonstration projects | Demonstration projects | Public funds for wider (recharging) infrastructure development |

| NL | Formula E-team encouraging and coordinating organizations to implement infrastructure. Some co-funding available for businesses (‘green deals’) or residents (national air quality fund). | |||

| DK | Funds that cover part of the cost of recharging infrastructure. Regular dialogue between energy authorities, road authorities and municipalities on establishment and coordination (e.g., data exchange and standardization) of the further development of charging infrastructure. | |||

| ICE car demand-side | NO | (Tax scheme unrelated to CO2) | Norway has a relatively high car purchase tax based on vehicle weight, engine capacity and NOx emissions. Since 2007, the purchase tax has also been connected to CO2 emissions. To stimulate the introduction of cleaner ICE cars, the CO2 component in the car purchase tax is regularly adjusted. | |

| NL | (Tax scheme unrelated to CO2) | Car purchase (registration) tax was connected to an energy label in 2006 and to the CO2 emissions level after 2010. A ‘feebate’ system gave low-emission ICE vehicles a tax discount (or even exemption), while high-emission vehicles were taxed extra, so ICEs were taxed progressively according to their CO2 emissions. In the policy arena one informant spoke of the ‘greening of the tax regime’. | ||

| DK | (Tax scheme unrelated to CO2) | Denmark has the highest vehicle purchase tax in Europe. The tax is 105% on the first €8000 of the import price, and 180% of the price above €8000. The tax is calculated after adding VAT (25%), resulting in double taxation | ||

| Renewable energy policy | NO | Norway nurtures a vast hydropower-based electricity system and, together with Sweden, established a common market for certificates for renewable electricity production. | ||

| NL | Relative unambitious targets for renewable energy (in 2013 the target was 14% by 2020). Renewables were stimulated through an unstable subsidy regime that changed from year to year [35] and offered very little certainty for investors. In some years, the subsidies were very low or temporarily non-existent. | |||

| DK | Denmark aims to charge 200,000 electric vehicles at night (i.e., at a time of relative low electricity demand) by 2020 within the current capacity of the Danish energy system [36]. This ‘smart charging’ approach raises overall efficiency of the energy system, improves the economy of wind energy, and reduces pressure on local electric grids (Ibid). The share of renewable sources in electricity generation was about 43% in 2013. The goal is to have 70% of generated electricity from renewables by 2020 (50% wind power, 20% biomass). The long-term policy to become fossil-free by 2035 (excluding transport) and 2050 (including transport) is perceived as robust by industry actors, having been agreed by a broad coalition of political parties. It is also supported by major industrial actors who see it as a key leverage for ‘green’ business strategies. | |||

| Norway | Netherlands | Denmark | |

|---|---|---|---|

| Tax reduction on vehicle sales price | Yes | Yes | Yes |

| Reduction of annual road or vehicle tax | Yes | Yes | Yes |

| Tax reduction after purchase (company cars) | No | Yes | No |

| Purchase subsidies | No | No | No |

| Scrappage scheme | No | No | No |

| Fossil transport fuel taxes | Yes | Yes | Yes |

| Reduced or exemption from toll charges and parking fees, access to bus lanes, free ferries, free charging at public charging points | Yes | No | No |

| Excise Duty (euro/litre) 1 | VAT (%) 1 | Retail Price 2 | |

|---|---|---|---|

| Norway | 0.604 | 25 | 1.470 |

| Netherlands | 0.770 | 21 | 1.415 |

| Denmark | 0.611 | 25 | 1.379 |

| EU 28 Average | 0.546 | - | 1.132 |

| Norway | The Netherlands | Denmark | |

|---|---|---|---|

| Charging stations per 100,000 residents | 25 | 21 | 5 |

| FBEV market share (%) | 3.2 | 1.0 | 0.2 |

| Type or Domain of Policy | Norway | Denmark | Netherlands |

|---|---|---|---|

| FEV demand-side | Strong financial tax incentives + user benefits | Very strong financial tax incentives | Medium-strong financial tax incentives |

| FEV supply-side | Medium –support to small domestic FEV producer since 1990s | Weak– after 2012 support for smart charging infra. Tax reduction for charging/ electricity suppliers | Weak – after 2009 mostly organization measures to stimulate domestic infrastructure & grid sector |

| FEV infrastructure | Strong: large budgets for infra development | Medium: some innovation funds for infrastructure development | Weak: no targets, no budgets, but coordination |

| ICE -demand | Weak – high taxes for all (also clean) ICE | Medium level incentives for clean ICE | Very strong feebate system with tax exemption for clean ICE |

| Renewable energy | Very strong | Strong | Weak |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dijk, M.; Iversen, E.; Klitkou, A.; Kemp, R.; Bolwig, S.; Borup, M.; Møllgaard, P. Forks in the Road to E-Mobility: An Evaluation of Instrument Interaction in National Policy Mixes in Northwest Europe. Energies 2020, 13, 475. https://doi.org/10.3390/en13020475

Dijk M, Iversen E, Klitkou A, Kemp R, Bolwig S, Borup M, Møllgaard P. Forks in the Road to E-Mobility: An Evaluation of Instrument Interaction in National Policy Mixes in Northwest Europe. Energies. 2020; 13(2):475. https://doi.org/10.3390/en13020475

Chicago/Turabian StyleDijk, Marc, Eric Iversen, Antje Klitkou, René Kemp, Simon Bolwig, Mads Borup, and Peter Møllgaard. 2020. "Forks in the Road to E-Mobility: An Evaluation of Instrument Interaction in National Policy Mixes in Northwest Europe" Energies 13, no. 2: 475. https://doi.org/10.3390/en13020475

APA StyleDijk, M., Iversen, E., Klitkou, A., Kemp, R., Bolwig, S., Borup, M., & Møllgaard, P. (2020). Forks in the Road to E-Mobility: An Evaluation of Instrument Interaction in National Policy Mixes in Northwest Europe. Energies, 13(2), 475. https://doi.org/10.3390/en13020475