1. Introduction

Canada has one of the widest territories in the world, it has a dense population in the south but very scarce in the north. Northern regions count with many remote areas and isolated villages unconnected to the national grid. As a result, diesel gensets are used as main source of electricity. However, the main drawbacks of this solution include: the cost to generate a kilowatt-hour of electricity versus the associated fuel procurement cost [

1,

2,

3], the environmental impact of using fossil fuels [

4] versus the system efficiency [

5]. One way to tackle these issues is the use of renewable energy systems. The provinces of Quebec and Newfoundland and Labrador are filled with abundant wind resources making well suited for the deployment of hybrid systems. Wind–diesel hybrid system with compressed air energy storage (WDCAS) appears as a cost-effective alternative to supply electricity and to ensure diesel generator operational efficiency. The combination of these sources with an energy storage system (ESS) helps to balance variations in power supply and demand.

A wind–diesel hybrid system is a stand-alone power system with wind and diesel generators. These systems are recommended for medium scale applications when the use of diesel generators is unavoidable. ESS integration facilitates a hybrid stand-alone system to optimize energy usage while maintaining efficient demand response. Compressed air energy storage (CAES) appears as an economically mature technology. Cost, simplicity, lifespan, fuel consumption and greenhouse gas (GHG) emissions are all influential factors that determine the competitiveness of this technology for wind–diesel hybridization. Moreover, CAES represents a promising solution to store electricity derived from kinetic energy of air at a particular time for further utilization.

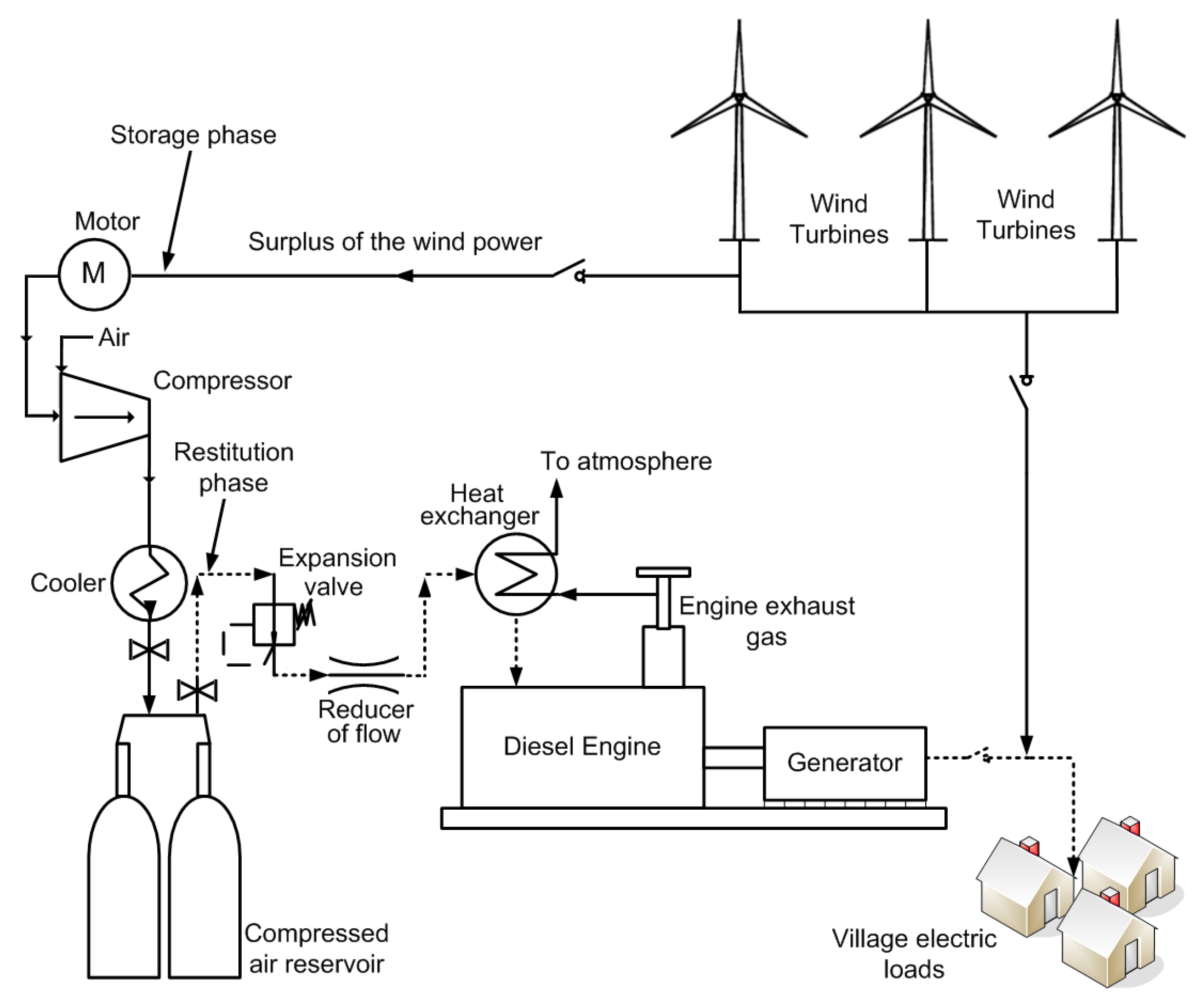

WDCAS operates according to compression-decompression cycles. The overall performance is subject to load power requirements, energy sources availability and energy storage level. The principle consists of two main phases. During high wind speed conditions, the excess of air is compressed and stored in a reservoir, when the energy is needed, the stored compressed air is released to drive a turbo-generator for electricity production. During low wind speed conditions, wind energy is also privileged by the system, thereby power is supplied by the WT and the diesel generator is used to make up for the difference.

Figure 1 presents the system overview, which includes the primary energy source (diesel), the renewable energy source (wind) and the compression and storage system (compressor and reservoir). Ancillary systems should be included to ensure safe operation and energy efficiency management in the hybrid system.

Zhang et al. [

6] proposed an adiabatic CAES system with variable configuration to cope with the large amplitude wind power fluctuations. Results suggest that after system integration the rate of wind power connected to the grid is increased from 26.29% to 70.62%. In addition, an economic analysis was done determining a net present value of 26.5 million USD and a payback period of about eight years. A similar study is presented in Reference [

7]. A techno-economic analysis was carried out to evaluate the potential profitability of developing a wind system with CAES for power generation.

A thermal-economic model was developed by Marano et al. [

8] using dynamic programming to optimize the operating strategy of a wind–solar hybrid system with CAES. Their study was focused on environmental and economic analysis with the purpose of minimize operational costs. The obtained results show an average reduction of 80% with respect to the conventional scenario wherein the user load is supplied by the power grid, while

emissions can be reduced by a factor of 74%.

Salvini [

9] conducted a techno-economic analysis of a CAES system integrated into a small-size gas steam combined cycle plant. The economic analysis focused on plant performance and investments costs. To determine the best CAES power configuration, the storage pressure and the pressure at the beginning of the charging phase were varied to further obtain storage efficiency values in a range of 58 to 65%. The results have shown that the initial investment is rather high and depends on the cost of the storage unit, which in turns is influenced by the storage capacity. However, the authors concluded that the proposed system may be considered of interest since it is a mature technology with a high durability.

Adefarati et al. [

10] studies the optimal configuration of key performance indicators such as fuel, operation and energy costs of a hybrid system composed of WT, PV, diesel generator and battery storage system. Simulation results from four system configurations are obtained by using HOMER software. Results suggest that incorporate WT and PV reduced the operating cost of the hybrid system. Kaabeche et al. [

11] analyze three configurations in a stand-alone hybrid system. A comparison between PV/wind/battery, PV/wind/diesel/battery and diesel generator only scenarios are presented. A techno-economic analysis was made by using the total energy deficit, the total net present cost and the energy cost as main criteria for optimization. Results suggest that PV/wind/diesel/battery exhibit the most economically suitable configuration to fulfill the load demands and minimize the cost of energy production. In Reference [

12], authors developed a model to study financial and environmental benefits in the use of a Vanadium Redox Battery as ESS in a wind farm.

Another study determining the profitability of a PV wind–diesel hybrid system is presented in Reference [

13]. The authors assess the impact on the optimal system design as a function of the daily electrical energy consumption and the meteorological data of the site. The final goal was to maximize the long-term savings in a ten years period for each proposed solution with respect to a diesel–only configuration.

In this work, a computer model has been developed. The model is composed of two parts: one part consisting of system design and technical analysis [

14], the other one consisting of financial, environmental and risk analysis. The scope of this paper is focused on the second part of the WDCAS software. The remaining sections are organized as follows: in

Section 2, the mathematical formulation of the proposed model is briefly presented. In

Section 3, an economic analysis and risk assessment of a WDCAS implementation is described. Simulation results obtained from WDCAS (Wind Energy Research Laboratory, Rimouski, QC, Canada), HOMER and RETScreen software are compared and discussed in

Section 4. In addition, the feasibility study applied to the particular case of a mining camp in a remote area in northeastern province in Canada is covered and discussed. Concluding remarks are presented in

Section 5.

3. WDCAS Software: Financial, Risk and Environmental Analysis

In this section, the set of indicators used for financial analysis, risk and environmental assessment of the studied WDCAS are presented. The developed software estimates the overall costs and revenues. It includes the feasibility study, the design and development of the hybrid system, as well as the annual fees for operation and maintenance (O&M).

3.1. Financial Analysis

This module provides financial information about the system. It helps the user to see annual revenues in a chart or graphically. It also provides financial indicators for decision making.

3.1.1. Net Present Value (NPV)

NPV is defined as the value updated to the present moment by means of an adequate rate of interest, of all future charges and payments that a project is expected to generate. Time value of money dictates that cash flows in different time periods cannot be accurately compared; they must be adjusted to reflect their equivalent value at the same period of time. Having in mind these concepts, the NPV can be calculated using Equation (

13):

where

corresponds to the cash flow during year

t,

r is the discount rate,

I is the initial capital or the initial investment and

n is the project life in years.

3.1.2. Internal Rate of Return (IRR)

IRR is defined as the discount rate that equates the present value of the investment in a project with the present value of the cash inflows from the project. The IRR is calculated based on Equation (

13) except that rather than solving for NPV, the NPV is set to zero, as result:

According to Equation (

15), IRR is calculated by iteration until the desired precision is reached. Since

n is the length of the analysis period, a rate of return for an investment greater than the time value of money is profitable.

3.1.3. Payback Period (PP)

It refers to the time period required for the cumulative cash flow expected from an investment in a project to recover the original cost of the investment. Unlike NPV and IRR, the PP does not take into account the time value of money.

In the discounted payback period (DPP), the interest rate is introduced to determine the present value of future costs and benefits. The interest rate is considered in the same way as described in Equation (

13).

3.1.4. Profitability Index (PI)

PI also known as the benefit-cost ratio for project investment, is defined as the present value of the future cash flows divided by the initial investment. An investment is acceptable if its PI is greater than one. PI is calculated according to the following expression:

3.1.5. Levelized Cost of Energy (LCOE)

It measures lifetime costs of power generation technology per unit of electricity. The discounted cost of an investment project, also called the net present cost (NPC), is the present value of the sequence of cash inflows associated with the project minus the present value of all costs of installing and operating each component in the system over the project lifetime. It includes the investment, O&M and fuel expenditures at year

t [

17,

18].

Since the principle of time value of money applies also to energy, the energy produced at a certain point in time has more value than if produced later. LCOE is calculated as the ratio of lifetime costs divided by the lifetime electricity generated by the hybrid system, both discounted back to a common year using a discount rate (see Equation (

18)).

where

is the outflow (sum of all costs) at year

t,

r is the discount rate and

is the energy generated at year

t.

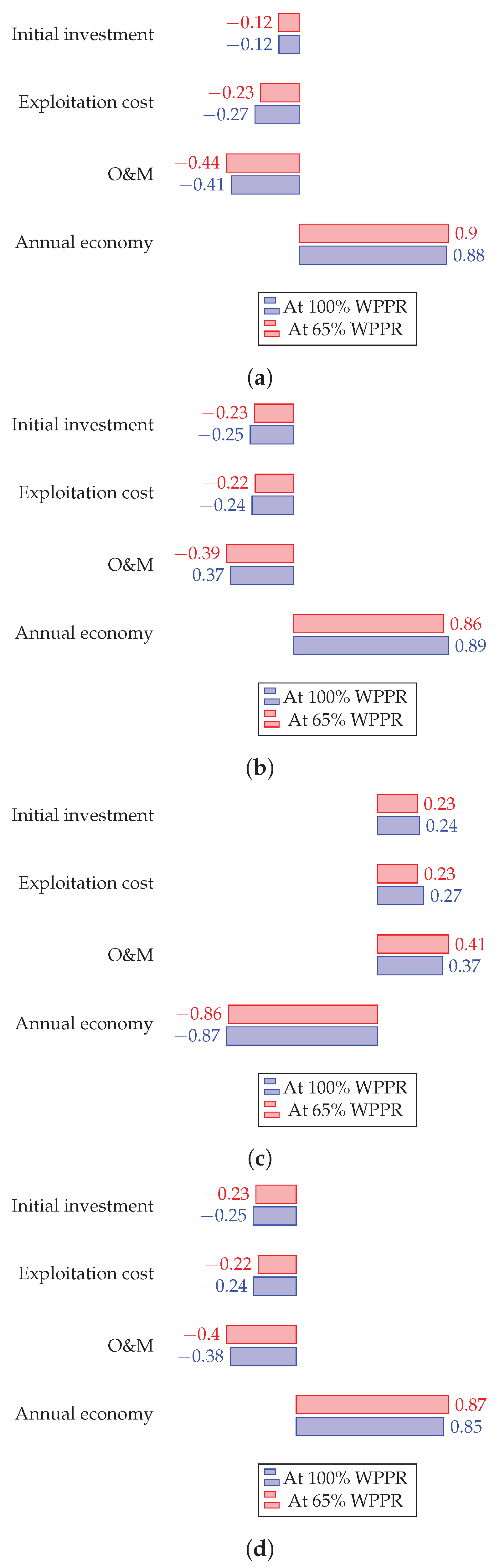

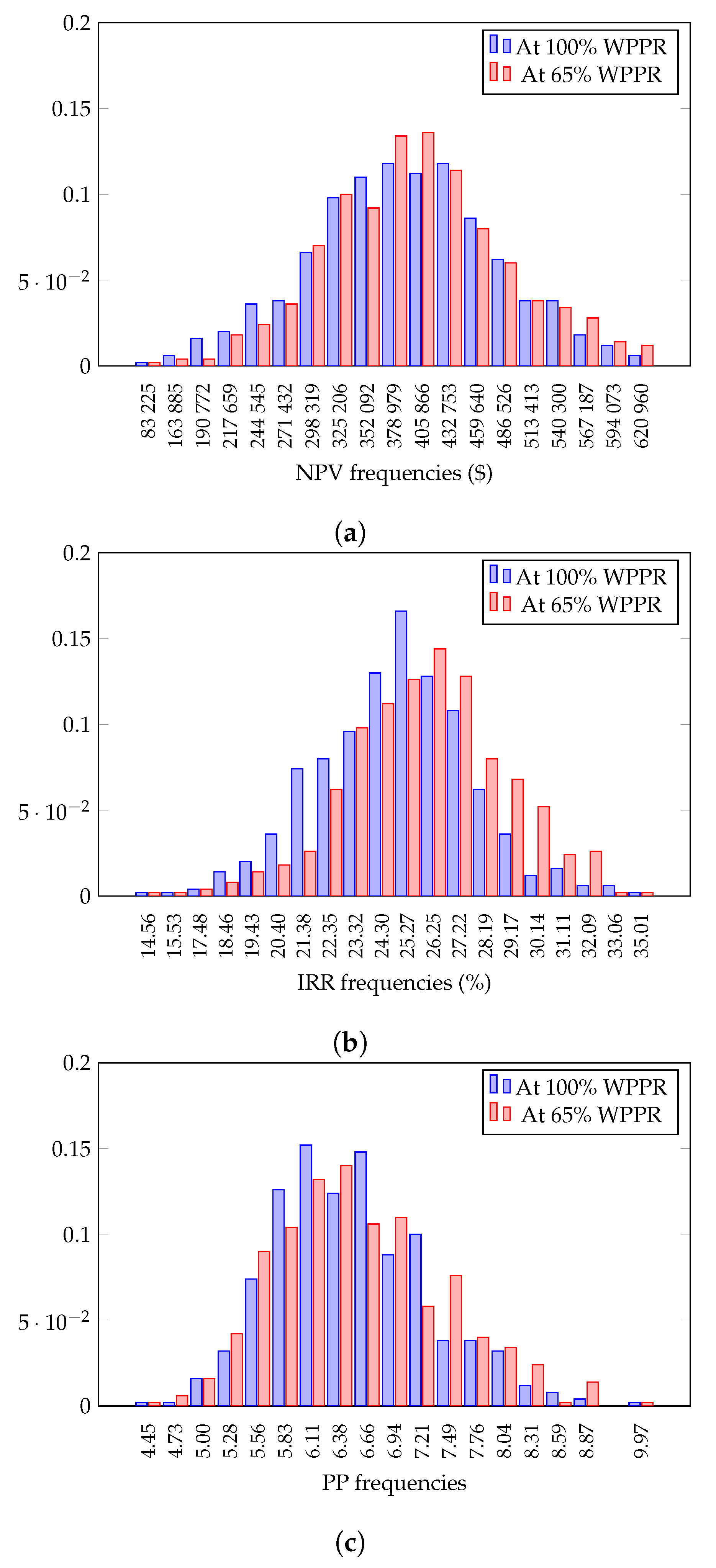

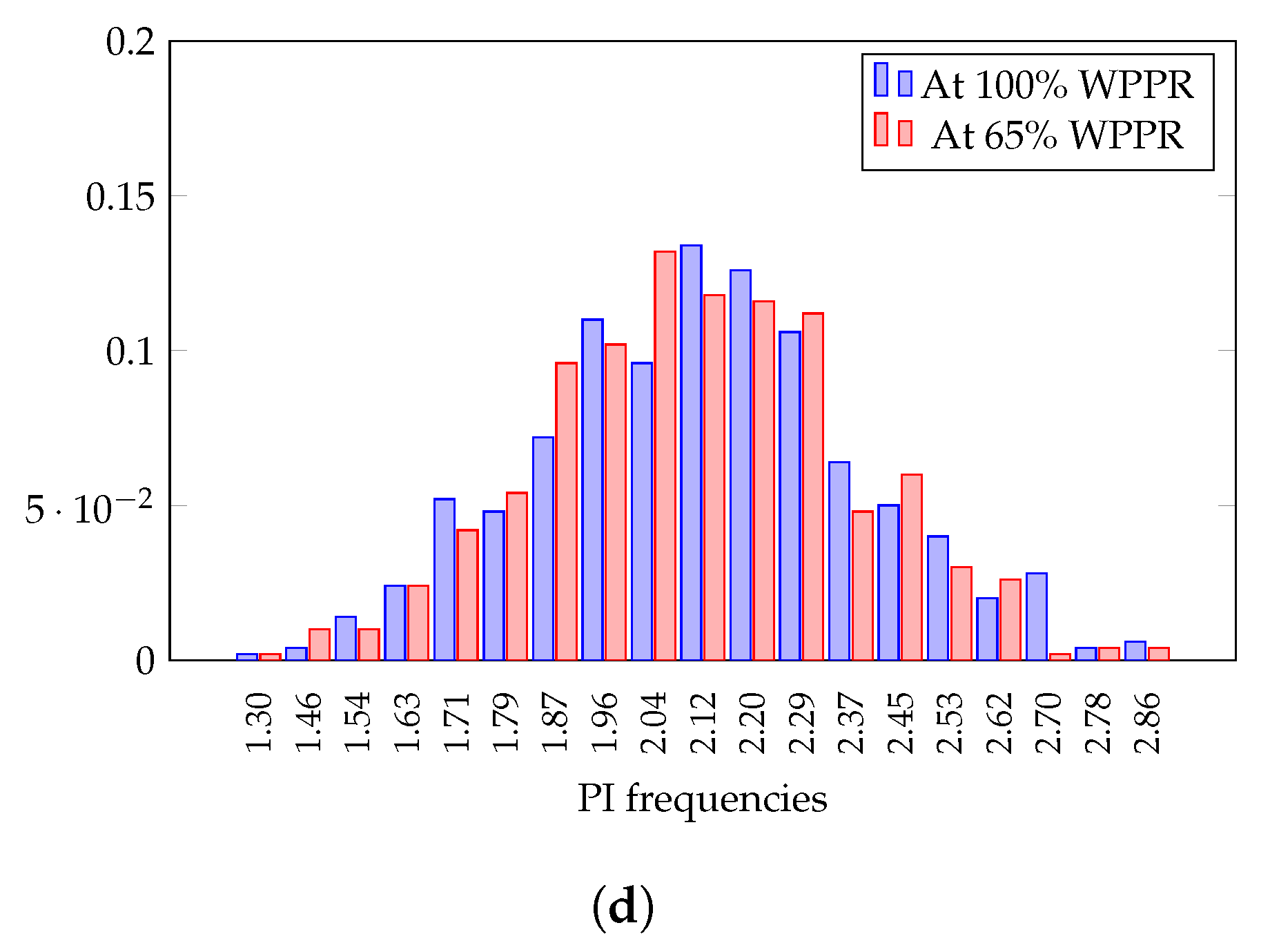

3.2. Risk Analysis

This module evaluates the robustness of the developed mathematical model by conducting a sensitivity analysis over a range of inputs parameters such as initial capital, project lifetime, cash flow and discount rate. The main interest is to determine the impact of such variations on NPV, IRR, PP and PI. The risk analysis model embedded within the WDCAS software is based on Monte Carlo simulations to assign probability distribution functions to each input variable.

Assume that each financial indicator

F is a function of the vector of parameters

in the form

. A one-dimensional analysis is performed by creating a vector

A composed of five feature values reflecting the impact on each term

of

. The impact is expressed according to a variation

v over the range

,

, 0,

and

. The variation

v can be translated as

, where

i varies from one to five. Thus, the vector

A can be mathematically expressed as:

where

i varies from one to five while

,

,

parameters remain fixed. The impact of each variation of

on

F is expressed as follows:

| Variation | Result |

| |

| |

| |

| |

| 0 | |

| |

| |

| |

| |

A two-dimensional analysis is performed by creating a matrix

B of size five by five. It reflects the combined impact of the variation of each pair

and

on

F. The impact is expressed according to a variation

v over the range

,

, 0,

and

. The variation

v can be translated as

, where

i varies from one to five for two parameters simultaneously. Thus, the elements of the matrix

B are:

With the index varying from one to five, while remain fixed. The impact is expressed according to a variation v in the form of matrix B, as follows:

| Variation | Result |

| | | | | |

| | | | | |

| 0 | | | | | |

| | | | | |

| | | | | |

The code generates a sequence of

m numbers according to the normal probability distribution and the standard deviation range from

to

. The risk of a variation

in a parameter

is considered and then multiplied by the corresponding value of

m. By default,

m is set to be 500.

Then, the financial indicator is calculated with respect to the new set of parameters:

Finally, the risk analysis includes a diagram to visualize the impact of certain parameter on a particular financial indicator. The financial indicator

F is subjected to a multi-linear regression based on the least square method. The resulting expression is presented in Equation (

23).

where

represents the slope of each simulation point,

is the error due to the regression,

corresponds to the financial parameter and

is the regressed financial indicator. The impact

in percentage terms can be represented by the contribution of each regressed parameter within the total variation, as follows:

A series of Monte Carlo simulations has been carried out to analyze the impact

of generated

values on

.

measures the impact more precisely since it deals with data resulting from a probability distribution. Ultimately,

values are plotted to obtain an impact diagram.

where

is the standard deviation of the inputs

and

is the standard deviation of the result given by Equation (

25).

In complement to this set of relations, the median and the confidence interval are calculated for each financial indicator. The median is obtained directly from the Monte Carlo simulations. The confidence interval estimates the area of uncertainty related to the risk assessment of the project itself, the lower limit of confidence is the percentile and the upper limit is percentile of the series.

3.3. Environmental Analysis

This module quantifies the number of tons of

emitted by the system. It also compares different system configurations and evaluates the profit associated with

emission reduction.

emissions can be calculated by using Equation (

26).

where

is the

emission in

,

is the energy produced by the system in kWh and

is the emission factor in

.

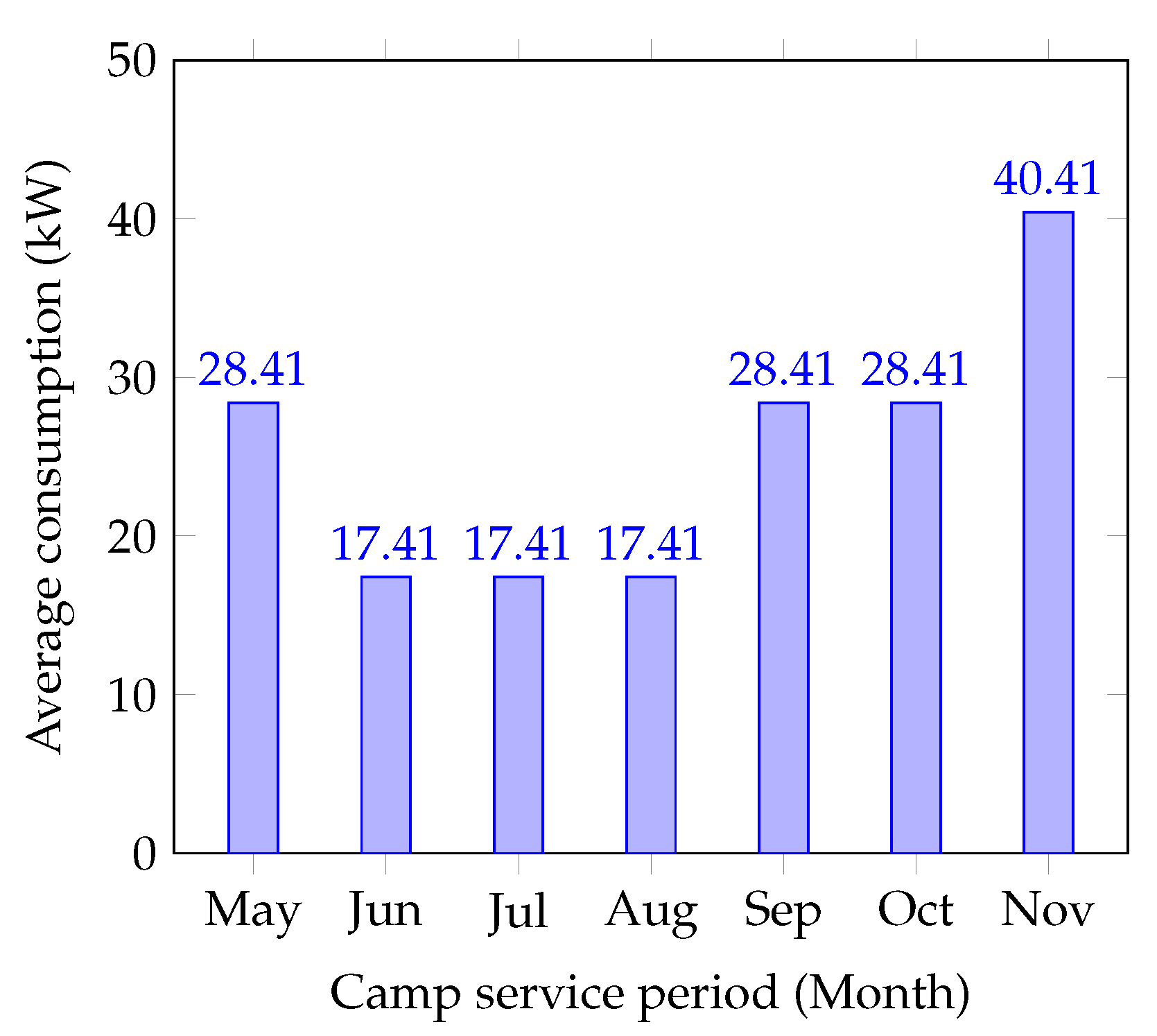

3.4. Case Study

The data for the case study corresponds to a mining camp located in a remote area in Newfoundland and Labrador, Canada. This site belongs to a company providing rail transportation services between the cities of Sept-Îles and Schefferville in Northern Quebec. The camp is open seven months per year, from May to November and it is unconnected to the main grid. Energy consumption varies according to daytime and season, the main loads are for lighting, heating, auxiliary equipment and water pumping station.

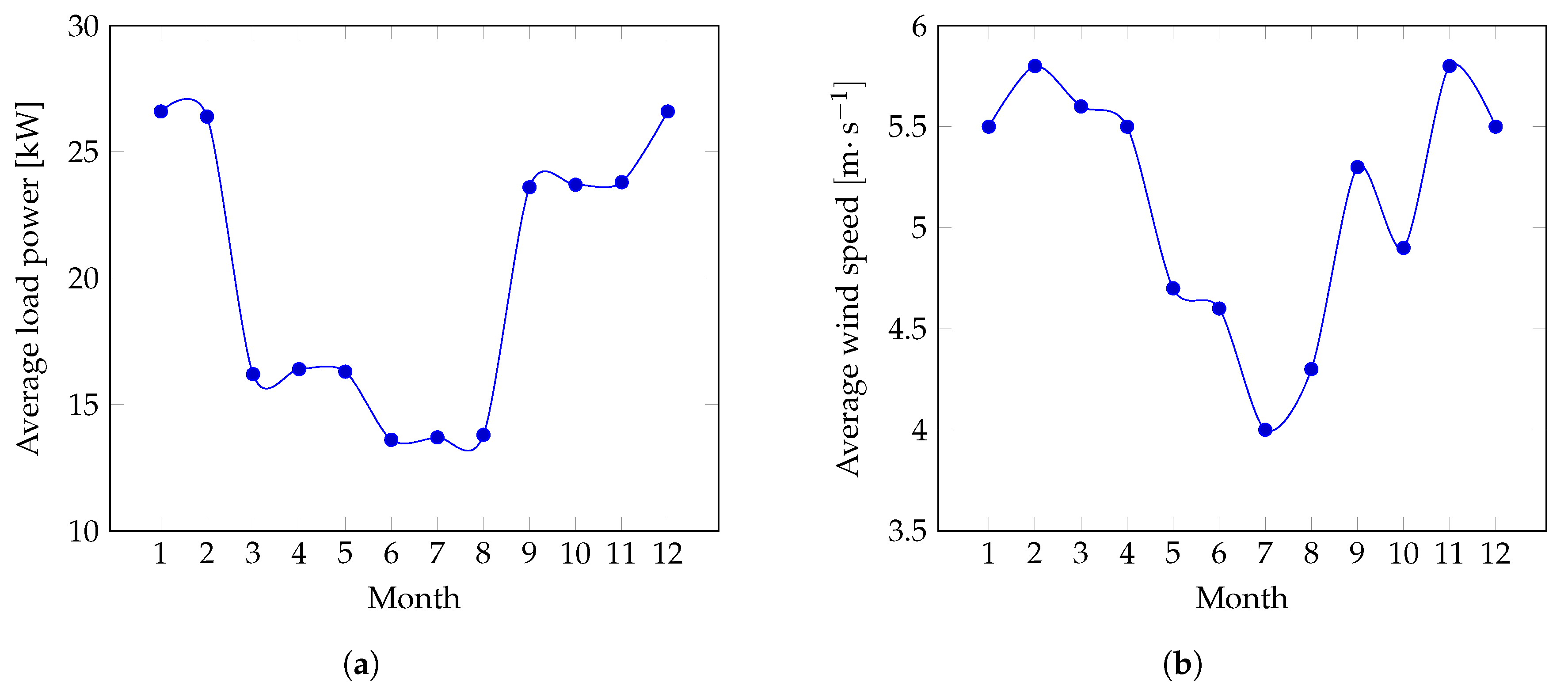

Figure 2 shows load and wind speed data under study.

Figure 2a illustrates the annual average load profile of Esker camp. Real power data is obtained directly from the stand-alone hybrid system. The average load power is 19.9 kW, the lowest and upper consumption levels are 7 kW and 50 kW, respectively. These values determine the wind–diesel system configuration used for comparison.

Figure 2b illustrates the monthly average wind speed data obtained from Environment Canada in a neighboring site of Esker camp. The annual average wind speed at 10 m above ground level is

. As wind speed probability distribution values are unknown, a Weibull probability distribution with a shape parameter of two (Rayleigh distribution) is considered.

5. Conclusions

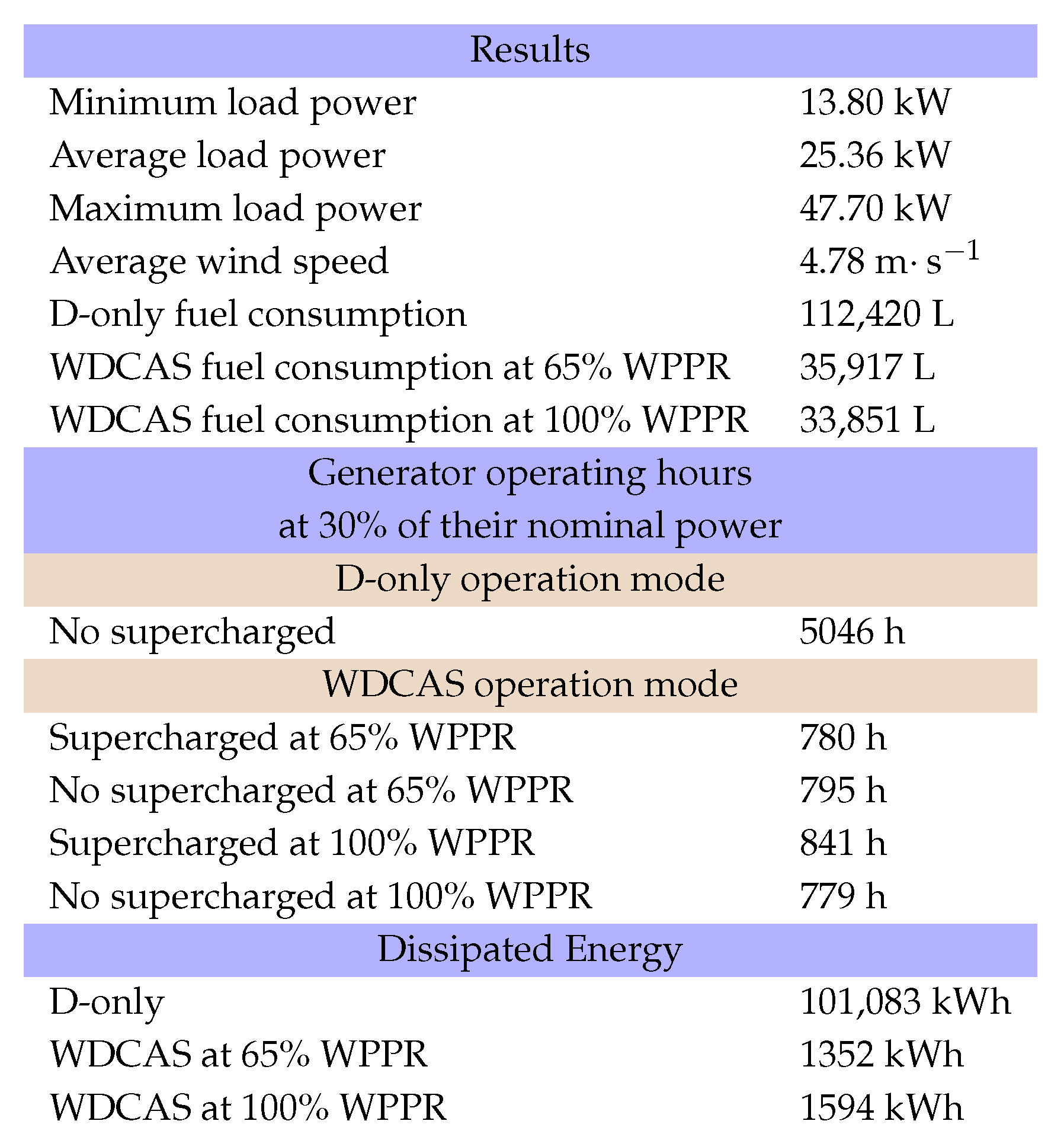

In this paper, a computer model for financial, environmental and risk analysis has been developed for a wind–diesel hybrid system with compressed air storage. First, the model has been validated by comparing a wind–diesel case study results against those obtained using HOMER and RETScreen software. Similar results were obtained by analyzing the impact on financial and environmental performances when using WDCAS software. Then, the proposed computer model has been applied to analyze the impact of adding compressed air energy storage on the wind–diesel hybrid system.

The use of wind–diesel power system associated with CAES appears as an optimal configuration to fulfil the needs of electrification in remote areas as the Esker mining camp in the northeastern province of Canada. One advantage of using the proposed software is that it allows to vary the size of all subsystems and to determine the design that provides optimal performance, through a general interface and based on a variety of results, respectively. Despite a non-optimal WPPR, significant economic savings can be obtained through the use of compressed air. Although a high initial capital investment is required, the proposed solution may not only reduce the exploitation of diesel engines in remote areas but also improve system life-cycle and reduce maintenance costs.