Co-Planning of Demand Response and Distributed Generators in an Active Distribution Network

Abstract

:1. Introduction

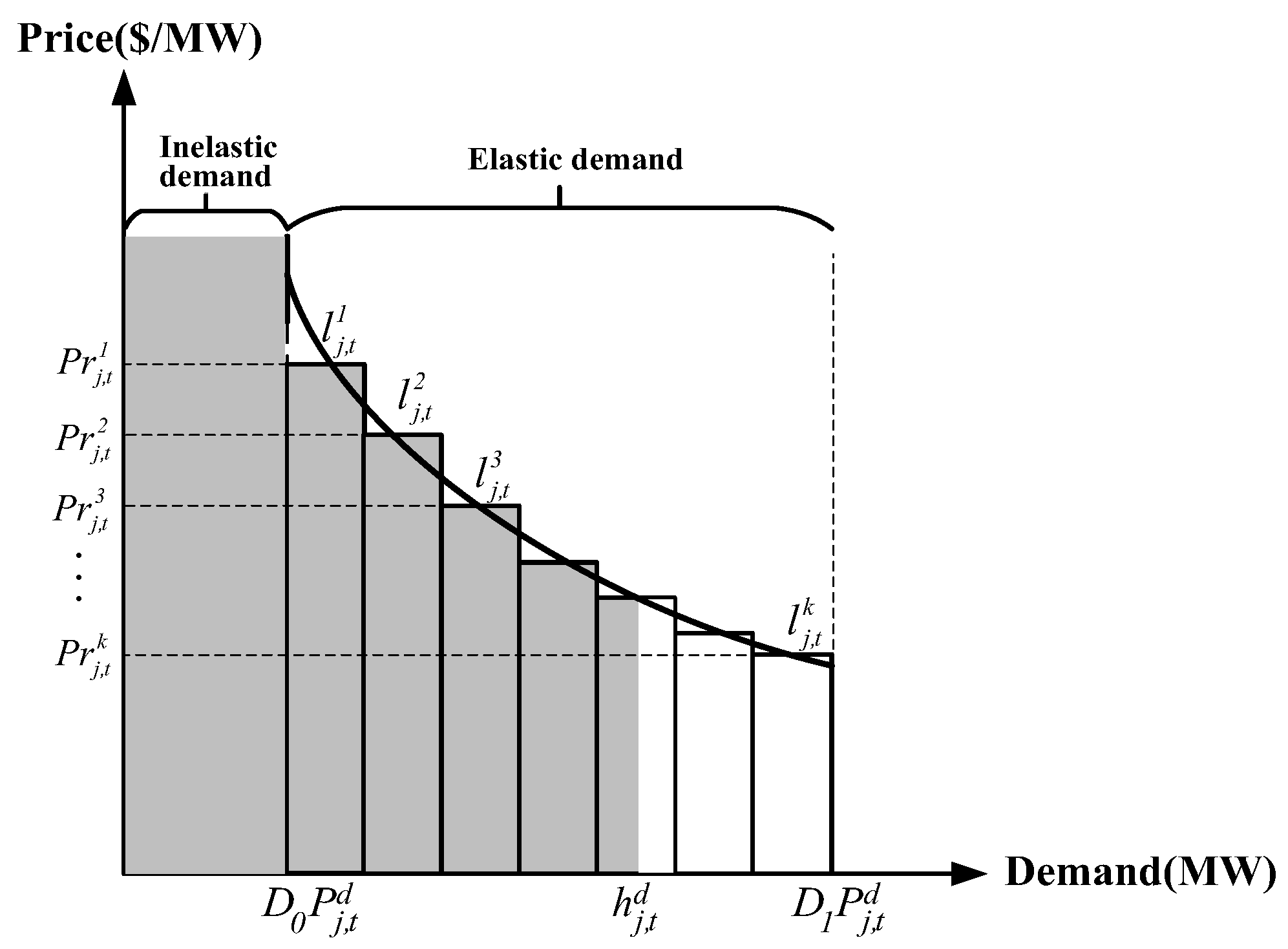

2. Demand Response Model

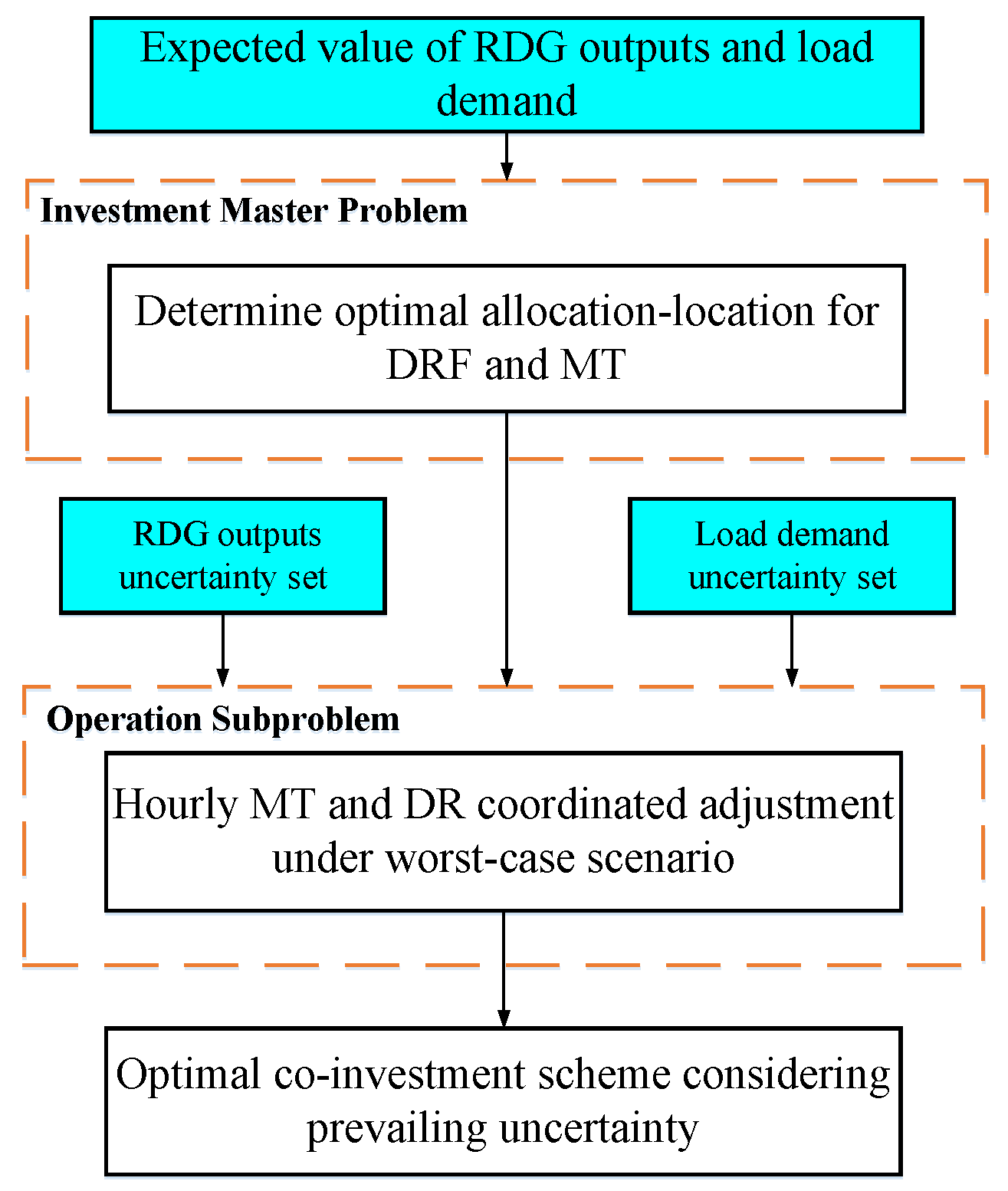

3. Mathematical Formulation

3.1. Objective Function

3.2. Constraint

3.3. Uncertainty Set

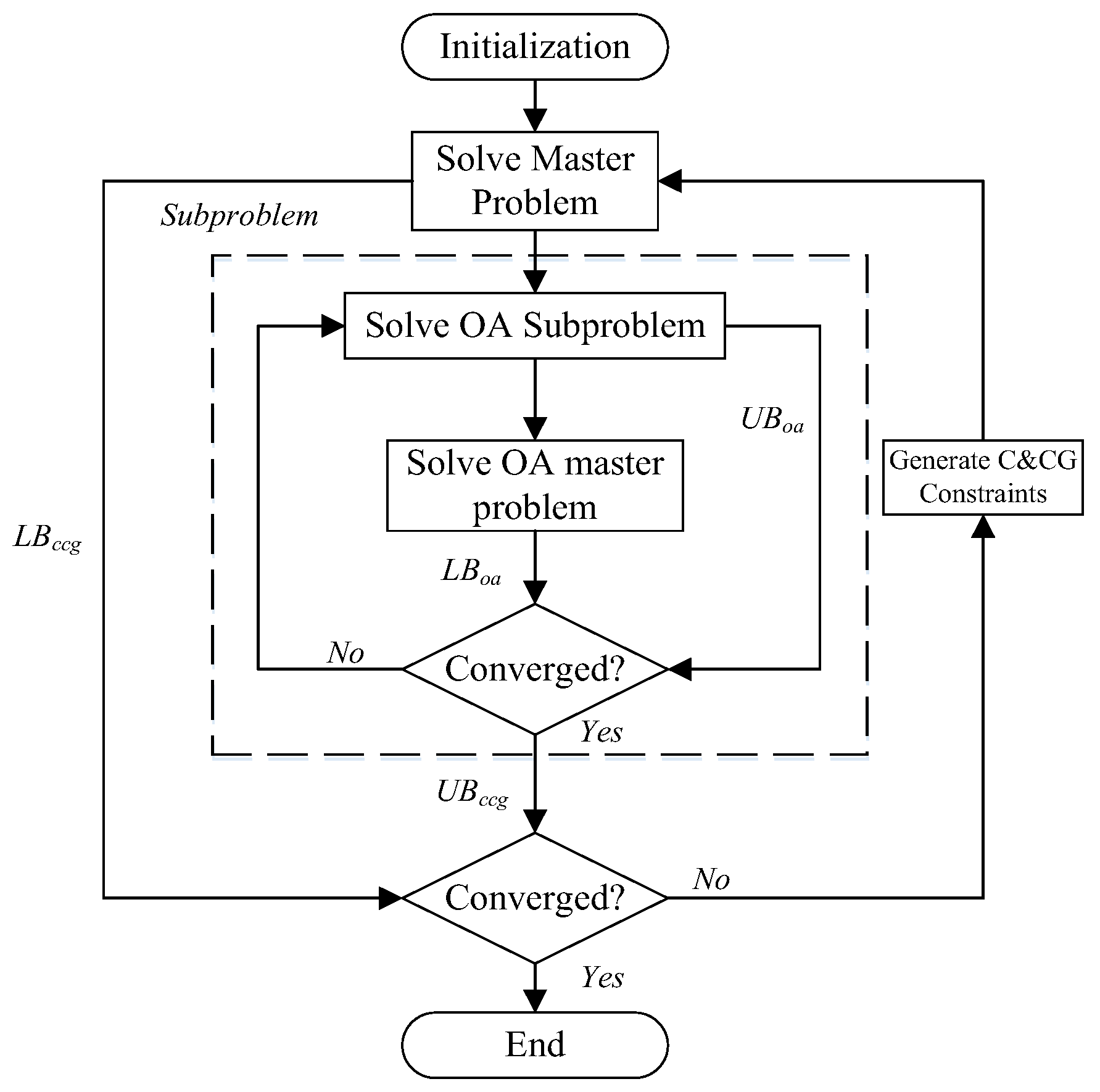

4. Solution Algorithm

4.1. Compact Formulation and Duality

4.2. Algorithm

- (1)

- Initialize LBccg = −∞, UBccg = +∞, g = 0 and set the sub-problem solution set soa = ∅.

- (2)

- Solve the master problem, obtain the optimal solution (, ), and let LBccg = max{LBccg, aT + }

- (3)

- Solve the sub-problem with fixed first stage decision variables and add to soa. Update UBccg = min{UBccg, aT + O(, )}

- (4)

- Check the convergence index. Return and stop if (UBccg − LBccg)/LBccg ≤ Δ. Otherwise, let g = g + 1 and go to step 2.

- (1)

- Initialize LBoa = −∞, UBoa = +∞, m = 1. Fix the first-stage decision variables. Find an initial

- (2)

- Solve the OA sub-problem , Let {, , } be the optimal solution. Set LBoa =

- (3)

- Linearize the bilinear terms at (, , , ), as follows:

- (4)

- Solve the OA master problem, which is the linearized version of the second stage problem, defined as below:Let be the optimal solution. Set LBoa =

- (5)

- Check the inner-level convergence. Return and stop if (UBoa − LBoa)/LBoa ≤ Δ. Otherwise, let m = m + 1 and go to step 2.

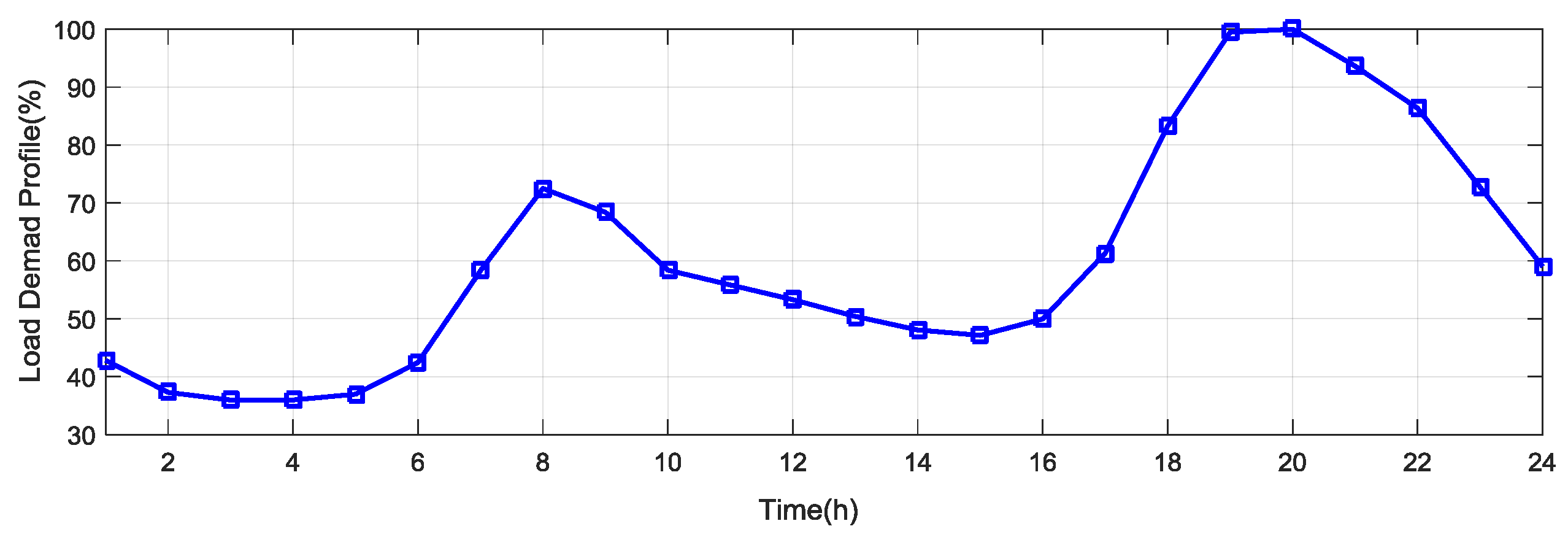

5. Case Studies

5.1. Modified IEEE 33-Node Distribution Network

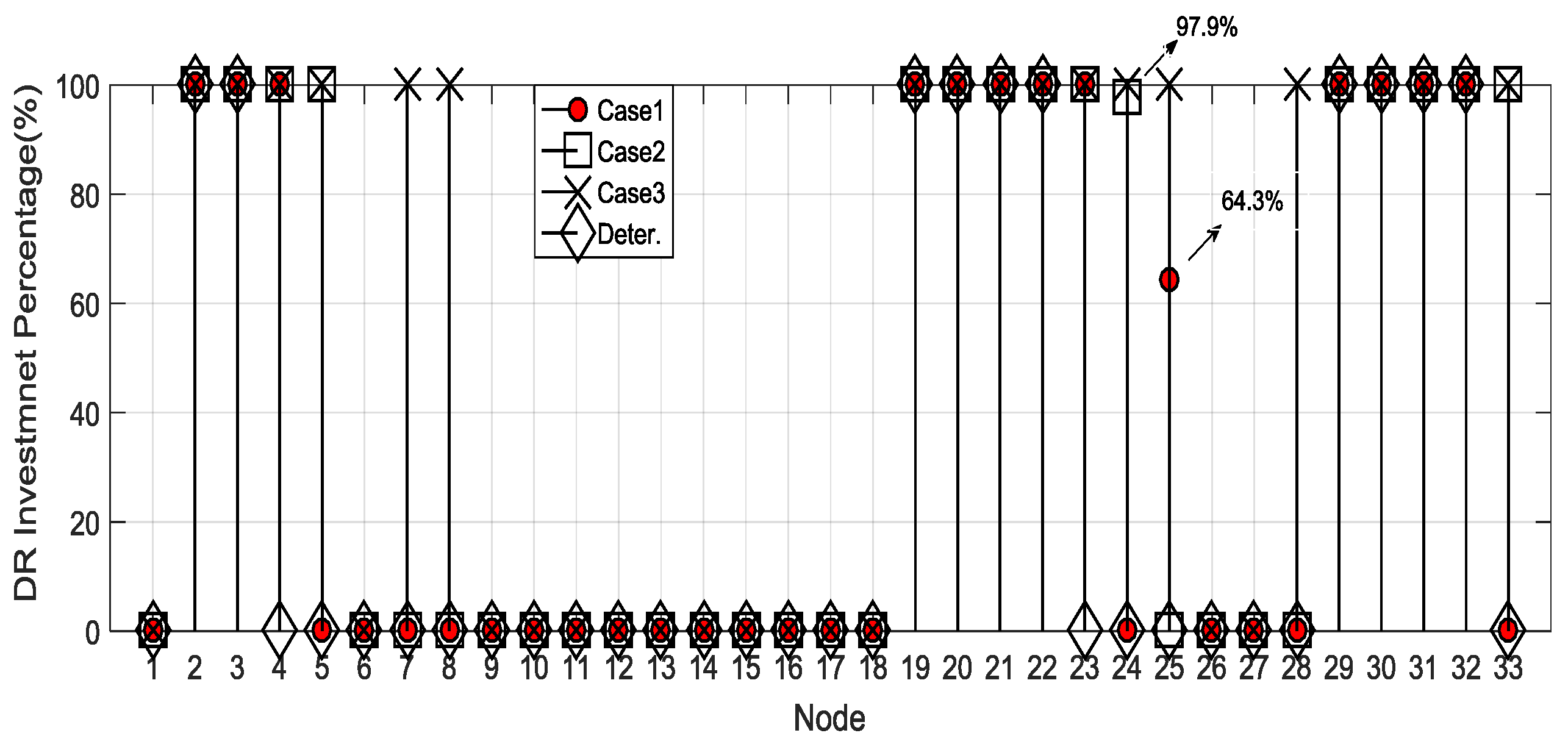

5.2. First-Stage Co-Investment Scheme in a Different Uncertainty Set

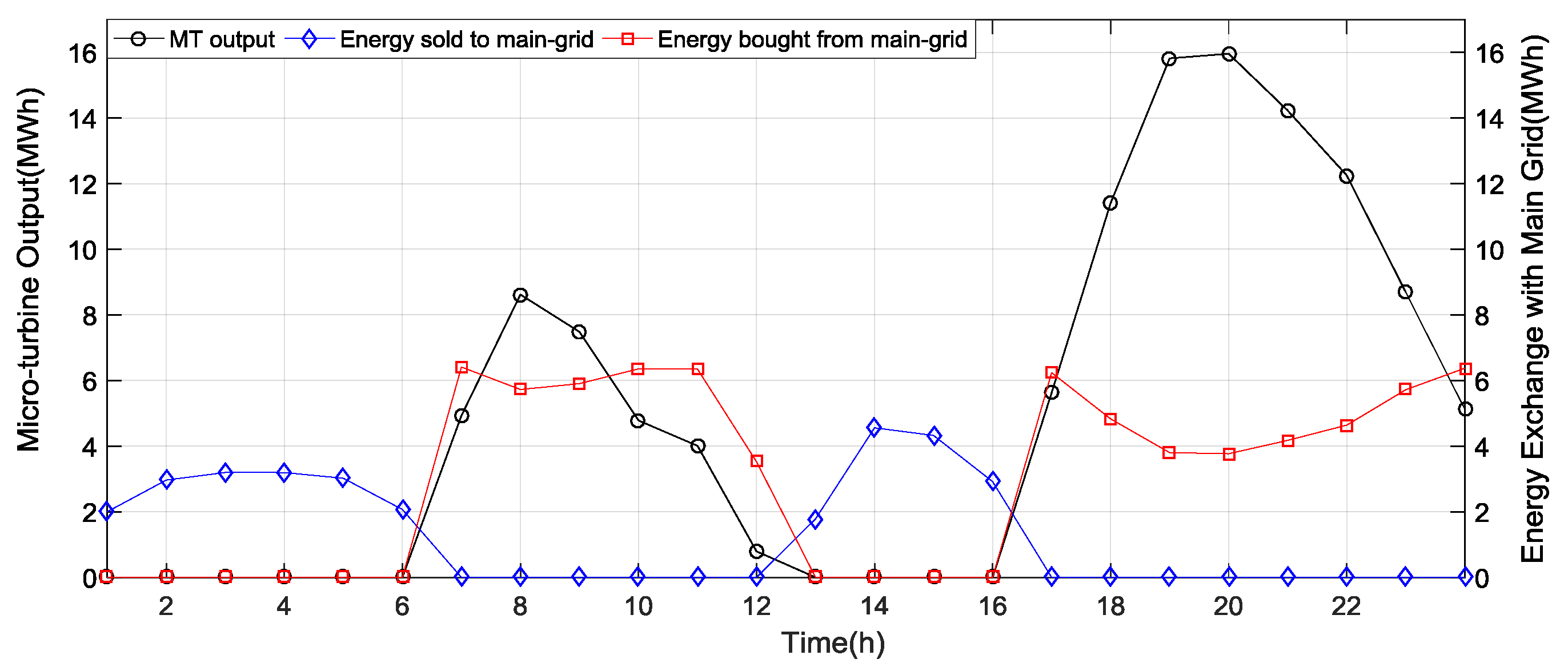

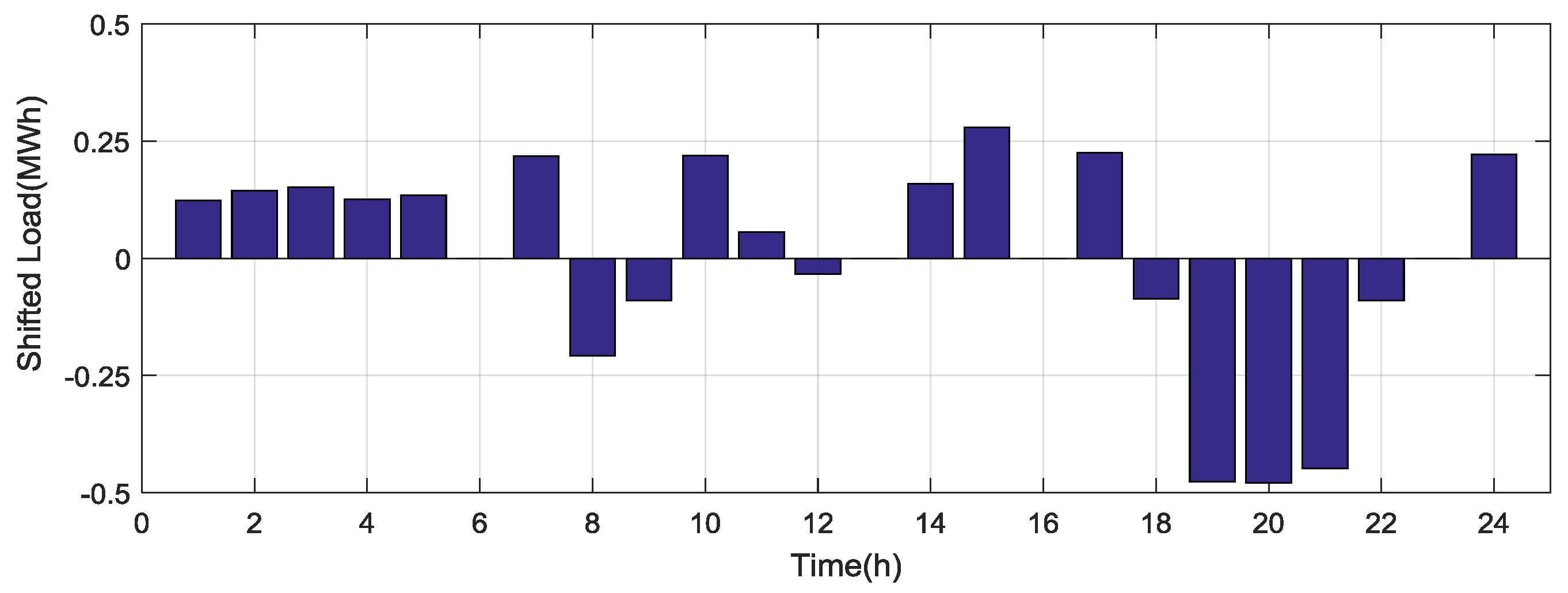

5.3. Second-Stage Operation Result

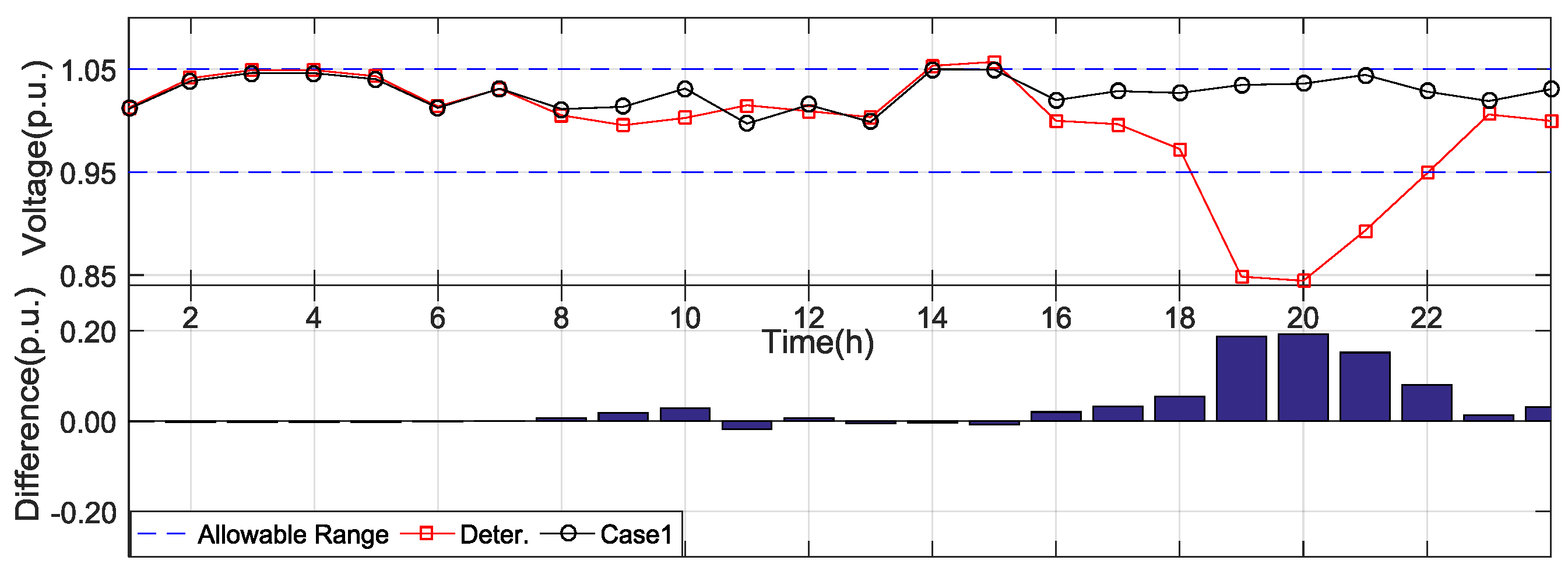

5.4. Voltage Profile with Different Demand Response Ability

5.5. Statistical Feasibility Check

5.6. Modified IEEE 123-Node Distribution Network

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Nomenclature

| A. Indices and Sets | |

| t/T | Index/set of time slots |

| j/J | Index/set of DN nodes |

| i/Ωj | Index/set of child nodes of node j |

| d/D | Index of load demand |

| dg/DG | Index of DG |

| n/Nwt, Npv | Index/set of the wind power/solar energy |

| sv/Nsv | Index/set of automatic voltage regulators (SVCs) |

| B. Parameters | |

| CClcs/CCami | Load control switch/advanced metering infrastructure procurement and installation cost |

| CCinc/CCedu | Financial incentive and education cost for DR program |

| CCdg | DG procurement and installation cost |

| ε | Capital recovery factor for day-based cost |

| θ | Weighting factor for transferring yearly cost to daily cost |

| Ns | Maximum number of nodes with DRF and DG installation |

| Maximum increment in size of DG at j | |

| // | Operation and maintenance cost of DG/WT/PV generations |

| Fuel cost of DG | |

| Prin/Prout | Electricity price for buying/selling energy to/from the main grid |

| Electricity price at step k in the linearized PEDR model at j,t | |

| kth length in the linearized PEDR curve at j,t | |

| / | Expected load demand from statistic data at j,t |

| D0/D1 | Coefficient for inelastic part and maximum of actual load demand at j,t |

| / | Lower/upper bound of power flow into/from substation |

| Capacity of the DN line ij | |

| Maximum SVC output at sv, t | |

| Capacity of the DN line ij | |

| Maximum SVC output at sv, t | |

| Mean value of WT/PV output | |

| / | Lower/upper bound of load demand rate at j,t (% of expected demand) |

| / | Lower/upper bound of WT/PV output rate at n,t (% of expected output) |

| rij/xij | Resistance/reactance of DN line ij |

| V0 | Voltage reference value, set as 1.0 p.u. |

| σ | Allowable value of voltage fluctuation |

| / | Uncertainty budget of load demand/wind power/solar energy |

| C. Variables | |

| / | Binary variable indicating if DRF/DG is installed at j |

| DR investment percentage indicating the load demand rate with DR ability (% of the peak load) at j | |

| Integer variable indicating bth increments in size of DG at j | |

| Pj,t/Qj,t | Active/reactive power flow at j,t |

| Vj,t | Voltage at j,t |

| / | DG/SVC output at j/sv, t |

| Auxiliary variable introduced at kth step in PEDR model at j,t | |

| Actual load demand at j,t | |

| Electricity payment of load demand with DR program at j,t | |

| Uncertain variation rate of load demand at j,t | |

| /, | Slack variables of voltage violation at j,t |

| / | Slack variables of line capacity limitation at ij,t |

| / | Slack variables of substation capacity limitation at j,t |

References

- Pepermans, G.; Driesen, J.; Haeseldonckx, D.; Belmans, R.; D’haeseleer, W. Distributed generation: Definition, benefits and issues. Energy Policy 2005, 33, 787–798. [Google Scholar] [CrossRef]

- Twidell, J.; Weir, T. Renewable Energy Resources, 3rd ed.; Routledge: New York, NY, USA, 2015. [Google Scholar]

- Xu, Z.; Xue, Y.; Wong, K.P. Recent advancements on smart grids in China. Electr. Power Compon. Syst. 2014, 42, 251–261. [Google Scholar] [CrossRef]

- Ackermann, T.; Andersson, G.; Söder, L. Distributed generation: A definition. Electr. Power Syst. Res. 2001, 57, 195–204. [Google Scholar] [CrossRef]

- Siano, P.; Mokryani, G. Probabilistic assessment of the impact of wind energy integration into distribution networks. IEEE Trans. Power Syst. 2013, 28, 4209–4217. [Google Scholar] [CrossRef]

- Catalão, J.P.S. Smart and Sustainable Power Systems: Operations, Planning, and Economics of Insular Electricity Grids; CRC Press: Boca Raton, FL, USA, 2015. [Google Scholar]

- Tonkoski, R.; Turcotte, D.; El-Fouly, T.H. Impact of high PV penetration on voltage profiles in residential neighborhoods. IEEE Trans. Sustain. Energy 2012, 3, 518–527. [Google Scholar] [CrossRef]

- Su, C.L.; Kirschen, D. Quantifying the effect of demand response on electricity markets. IEEE Trans. Power Syst. 2009, 24, 1199–1207. [Google Scholar]

- Medina, J.; Muller, N.; Roytelman, I. Demand response and distribution grid operations: Opportunities and challenges. IEEE Trans. Smart Grid 2010, 1, 193–198. [Google Scholar] [CrossRef]

- Palensky, P.; Dietrich, D. Demand side management: Demand response, intelligent energy systems, and smart loads. IEEE Trans. Ind. Inform. 2011, 7, 381–388. [Google Scholar] [CrossRef]

- Bitaraf, H.; Rahman, S. Reducing curtailed wind energy through energy storage and demand response. IEEE Trans. Sustain. Energy. 2018, 9, 228–236. [Google Scholar] [CrossRef]

- Bukhsh, W.A.; Zhang, C.; Pinson, P. An integrated multiperiod opf model with demand response and renewable generation uncertainty. IEEE Trans. Smart Grid 2016, 7, 1495–1503. [Google Scholar] [CrossRef]

- Zhao, C.; Wang, J.; Watson, J.P.; Guan, Y. Multi-stage robust unit commitment considering wind and demand response uncertainties. IEEE Trans. Power Syst. 2013, 28, 2708–2717. [Google Scholar] [CrossRef]

- Zhang, C.; Xu, Y.; Dong, Z.Y.; Wong, K.P. Robust coordination of distributed generation and price-based demand response in microgrids. IEEE Trans. Smart Grid. 2017. [Google Scholar] [CrossRef]

- Li, X.R.; Yu, C.W.; Xu, Z.; Luo, F.J.; Dong, Z.Y.; Wong, K.P. A multimarket decision-making framework for GENCO considering emission trading scheme. IEEE Trans. Power Syst. 2013, 28, 4099–4108. [Google Scholar] [CrossRef]

- US Department of Energy. Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them; US Department of Energy: Washington, DC, USA, 2006.

- Torriti, J.; Hassan, M.G.; Leach, M. Demand response experience in Europe: Policies, programmes and implementation. Energy 2010, 35, 1575–1583. [Google Scholar] [CrossRef]

- Saele, H.; Grande, O.S. Demand response from household customers: Experiences from a pilot study in norway. IEEE Trans. Smart Grid 2011, 2, 102–109. [Google Scholar] [CrossRef]

- Pourmousavi, S.A.; Patrick, S.N.; Nehrir, M.H. Real-time demand response through aggregate electric water heaters for load shifting and balancing wind generation. IEEE Trans. Smart Grid 2014, 5, 769–778. [Google Scholar] [CrossRef]

- Bradley, P.; Leach, M.; Torriti, J. A review of the costs and benefits of demand response for electricity in the UK. Energy Policy 2013, 52, 312–327. [Google Scholar] [CrossRef]

- Faruqui, A.; Harris, D.; Hledik, R. Unlocking the €53 billion savings from smart meters in the eu: How increasing the adoption of dynamic tariffs could make or break the EU’s smart grid investment. Energy Policy 2010, 38, 6222–6231. [Google Scholar] [CrossRef]

- Thimmapuram, P.R.; Jinho, K.; Botterud, A.; Youngwoo, N. Modeling and Simulation of Price Elasticity of Demand Using an Agent-Based Model. In Proceedings of the 2010 Innovative Smart Grid Technologies (ISGT), Gaithersburg, MD, USA, 19–21 January 2010; pp. 1–8. [Google Scholar]

- Wang, X.; McDonald, J.R. Modern Power System Planning; McGraw-Hill Companies: New York, NY, USA, 1994. [Google Scholar]

- Afgan, N.H.; Carvalho, M.G.; Hovanov, N.V. Energy system assessment with sustainability indicators. Energy Policy 2000, 28, 603–612. [Google Scholar] [CrossRef]

- Baran, M.; Wu, F.F. Optimal sizing of capacitors placed on a radial distribution system. IEEE Trans. Power Deliv. 1989, 4, 735–743. [Google Scholar] [CrossRef]

- Baran, M.E.; Wu, F.F. Optimal capacitor placement on radial distribution systems. IEEE Trans. Power Deliv. 1989, 4, 725–734. [Google Scholar] [CrossRef]

- Yeh, H.G.; Gayme, D.F.; Low, S.H. Adaptive var control for distribution circuits with photovoltaic generators. IEEE Trans. Power Syst. 2012, 27, 1656–1663. [Google Scholar] [CrossRef]

- Zhang, G.; Wu, Y.; Wong, K.P.; Xu, Z.; Dong, Z.Y.; Iu, H.H.C. An advanced approach for construction of optimal wind power prediction intervals. IEEE Trans. Power Syst. 2015, 30, 2706–2715. [Google Scholar] [CrossRef]

- Zeng, B.; Zhao, L. Solving two-stage robust optimization problems using a column-and-constraint generation method. Oper. Res. Lett. 2013, 41, 457–461. [Google Scholar] [CrossRef]

- Duran, M.A.; Grossmann, I.E. An outer-approximation algorithm for a class of mixed-integer nonlinear programs. Math. Program. 1986, 36, 307–339. [Google Scholar] [CrossRef]

- Ding, T.; Li, F.; Li, X.; Sun, H.; Bo, R. Interval radial power flow using extended distflow formulation and krawczyk iteration method with sparse approximate inverse preconditioner. IET Gener. Transm. Distrib. 2015, 9, 1998–2006. [Google Scholar] [CrossRef]

- Commercial and Residential Hourly Load Profiles for All TMY3 Locations in the United States. Available online: https://openei.org/doe-opendata/dataset/commercial-and-residential-hourly-load-profiles-for-all-tmy3-locations-in-the-united-states (accessed on 21 October 2017).

- Zou, K.; Agalgaonkar, A.P.; Muttaqi, K.M.; Perera, S. Distribution system planning with incorporating dg reactive capability and system uncertainties. IEEE Trans. Sustain. Energy. 2012, 3, 112–123. [Google Scholar] [CrossRef]

- NREL. Available online: https://www.nrel.gov/rredc/wind_resource (accessed on 20 June 2017).

- Hong Kong Observatory. Available online: http://www.hko.gov.hk (accessed on 8 July 2017).

- Zhao, J.; Wang, J.; Xu, Z.; Wang, C.; Wan, C.; Chen, C. Distribution network electric vehicle hosting capacity maximization: A chargeable region optimization model. IEEE Trans. Power Syst. 2017, 32, 4119–4130. [Google Scholar] [CrossRef]

| Location | Capacity | ||

|---|---|---|---|

| WT (MW) | PV (MW) | SVC (MVar) | |

| 17 | 3.675 | 1.125 | 3.250 |

| 19 | 2.625 | 1.575 | 3.250 |

| 24 | 2.625 | 0.675 | 3.250 |

| 33 | 1.575 | 1.125 | 3.250 |

| Parameter | Value | Parameter | Value |

|---|---|---|---|

| CClcs | 96$/KWh | 0.006$/KWh | |

| CCami | 100$ | 0.33$/KWh | |

| CCdg | 2293$/KWh | CCinc | 9.6$/unit |

| 0.02$/KWh | CCedu | 9.6$/unit | |

| 0.008$/KWh | CCpena | 1000$/p.u. |

| Budgets | μlow | μup | Γlow | Γup |

|---|---|---|---|---|

| WT | 0.20 | 1.80 | 0.90 | 1.10 |

| PV | 0.20 | 2.00 | 0.90 | 1.10 |

| Load demand | 0.90 | 1.10 | 0.98 | 1.02 |

| Case | Size (MW) | Location (Node) | ||

|---|---|---|---|---|

| 1 | 0.90 | 1.10 | 1.00 | 25 |

| 1.10 | 9 | |||

| 1.50 | 32 | |||

| 2.50 | 12, 14, 24, 29, 33 | |||

| 2 | 0.80 | 1.20 | 0.90 | 24 |

| 1.15 | 9 | |||

| 1.55 | 29 | |||

| 2.50 | 13, 14, 25, 30, 33 | |||

| 3 | 0.70 | 1.30 | 0.12 | 31 |

| 0.47 | 25 | |||

| 0.50 | 10 | |||

| 2.50 | 12, 13, 24, 29, 30, 32 | |||

| Deter. | - | - | 0.35 | 32 |

| 0.81 | 10 | |||

| 1.84 | 25 | |||

| 2.50 | 13, 29, 30 |

| Case | Cdr ($) | Cdg ($) | Cinv ($) |

|---|---|---|---|

| 1 | 185.72 | 6796.82 | 6982.55 |

| 2 | 214.12 | 6796.83 | 7010.94 |

| 3 | 317.83 | 6788.38 | 7106.21 |

| Deter. | 135.01 | 4432.71 | 4567.22 |

| Case | ($) | ($) | ($) | ($) | (%) | (%) | (%) |

|---|---|---|---|---|---|---|---|

| 1 | 28420.20 | 4137.84 | 338.00 | 19.74 | 0.006 | 95.89 | 98.99 |

| Deter | 26478.56 | 4472.54 | 341.06 | 290607.84 | 7.546 |

| Case | DGs Deployments | DR Investment | ||

|---|---|---|---|---|

| Size (MW) | Location (Node) | Percentage (%) | Location (Node) | |

| 1 | 0.03 | 151 | 100 | 7, 9, 11, 10, 19, 20, 28, 33, 29, 30 37, 42, 45, 47, 46, 48, 49, 50 51, 151, 55, 56, 60, 62, 63, 64 65, 68, 69, 70, 71, 76, 77, 86 79, 80, 82, 83, 87, 88, 94, 95 98, 99, 35, 1, 52 |

| 0.22 | 108 | |||

| 0.27 | 450, 80 | |||

| 0.36 | 46 | |||

| 0.60 | 82 | |||

| 0.82 | 65, 91 | |||

| 1.43 | 79, 49 | |||

| 2.50 | 93 | |||

| 2 | 0.10 | 34 | 100 | 7, 9, 11, 10, 19, 20, 28, 33, 29, 30 37, 42, 45, 46, 47, 48, 49, 50, 51 53, 55, 56, 60, 62, 63, 64, 65, 68 69, 70, 71, 76, 77, 86, 79, 80, 82 82, 83, 87, 88, 94, 95, 98, 99 100, 109, 113, 35, 1, 52 |

| 0.17 | 71 | |||

| 0.20 | 65 | |||

| 0.43 | 45 | |||

| 0.64 | 44 | |||

| 0.87 | 82 | |||

| 1.21 | 93 | |||

| 2.41 | 79 | |||

| 2.50 | 89 | |||

| 3 | 0.07 | 108 | 100 | 7, 9, 11, 10, 19, 20, 28, 33, 29, 30 37, 42, 45, 47, 46, 48, 49, 50, 51 53, 55, 56, 60, 62, 63, 64, 65, 68 69, 70, 71, 76, 77, 86, 79, 80, 82, 83, 87 88, 94, 95, 98, 99, 100, 109, 111, 112 113, 114, 35, 1 |

| 0.17 | 450 | |||

| 0.25 | 151 | |||

| 0.27 | 45 | |||

| 1.14 | 87 | |||

| 1.85 | 66 | |||

| 2.50 | 83, 93 | |||

| Deter. | 0.22 | 88 | 100 | 7, 9, 11, 10, 19, 20, 28, 33 30, 37, 48, 50, 87, 88, 94, 95 35, 1 |

| 0.41 | 66 | |||

| 1.10 | 82 | |||

| 2.50 | 93 | |||

| Case | Cdr ($) | Cdg ($) | Cinv ($) |

|---|---|---|---|

| 1 | 348.58 | 3693.93 | 4042.51 |

| 2 | 365.24 | 3693.93 | 4059.17 |

| 3 | 377.38 | 3693.93 | 4071.31 |

| Deter. | 157.65 | 2427.41 | 2585.06 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, Y.; Wen, X.; Zhao, J.; Xu, Z.; Li, J. Co-Planning of Demand Response and Distributed Generators in an Active Distribution Network. Energies 2018, 11, 354. https://doi.org/10.3390/en11020354

Yu Y, Wen X, Zhao J, Xu Z, Li J. Co-Planning of Demand Response and Distributed Generators in an Active Distribution Network. Energies. 2018; 11(2):354. https://doi.org/10.3390/en11020354

Chicago/Turabian StyleYu, Yi, Xishan Wen, Jian Zhao, Zhao Xu, and Jiayong Li. 2018. "Co-Planning of Demand Response and Distributed Generators in an Active Distribution Network" Energies 11, no. 2: 354. https://doi.org/10.3390/en11020354

APA StyleYu, Y., Wen, X., Zhao, J., Xu, Z., & Li, J. (2018). Co-Planning of Demand Response and Distributed Generators in an Active Distribution Network. Energies, 11(2), 354. https://doi.org/10.3390/en11020354