Evaluation of Financial Risk Management of Digital Services Companies Using Integrated Entropy-Weight TOPSIS Model

Abstract

1. Introduction

2. Materials and Methods

2.1. Research Development

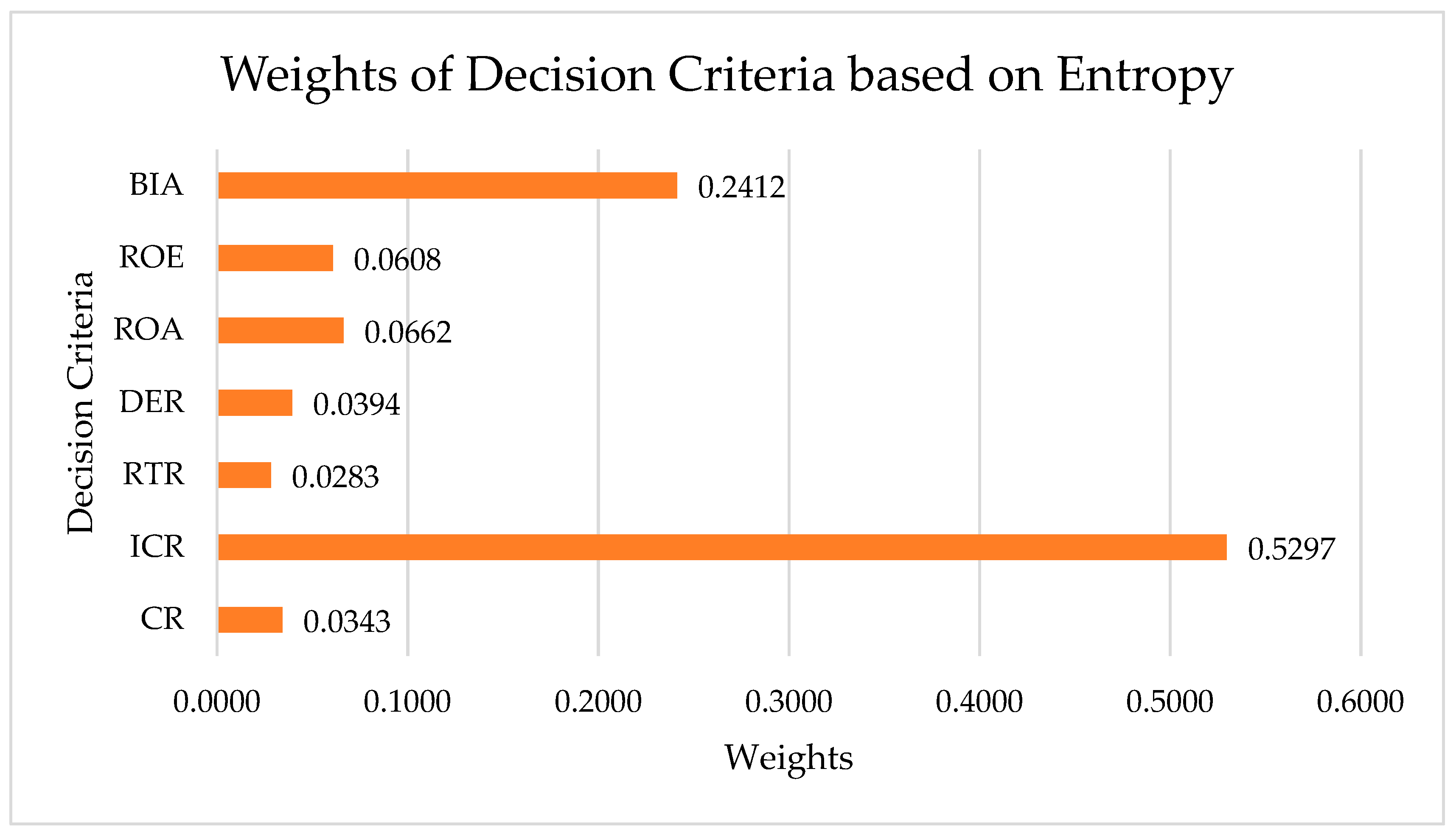

2.2. Entropy Weighting Method

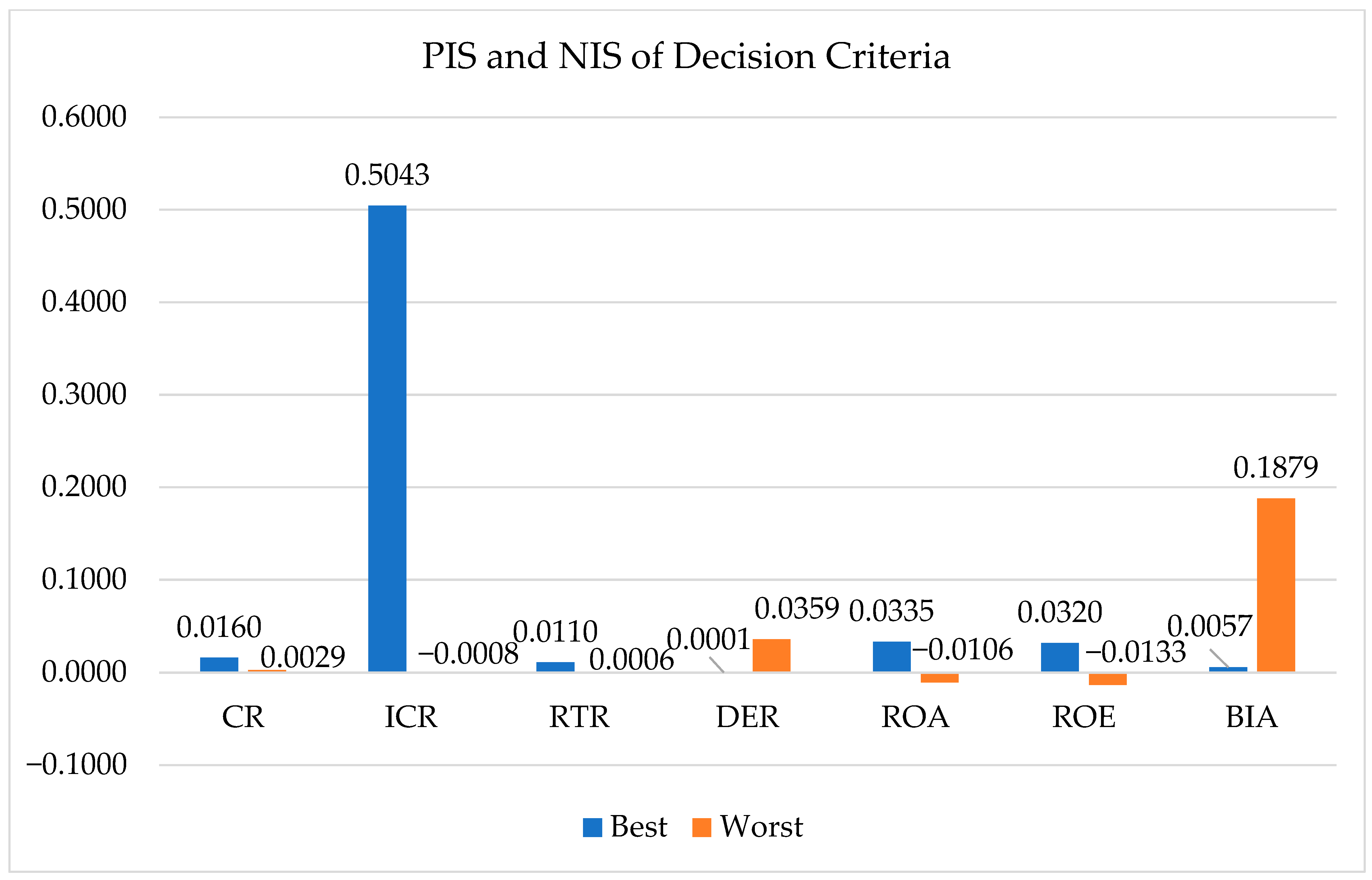

2.3. Technique for Order Preference by Similarity to Ideal Solution (TOPSIS)

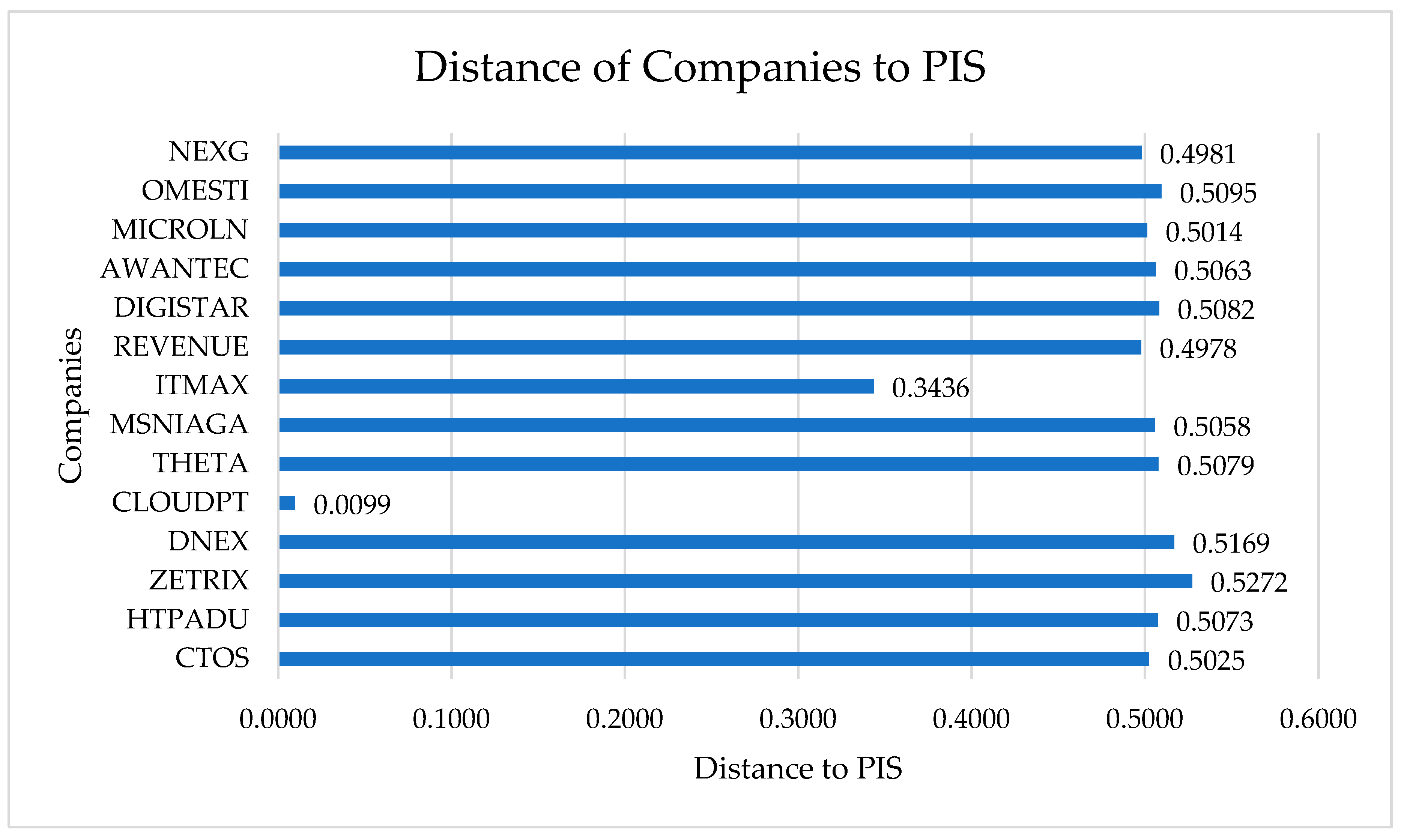

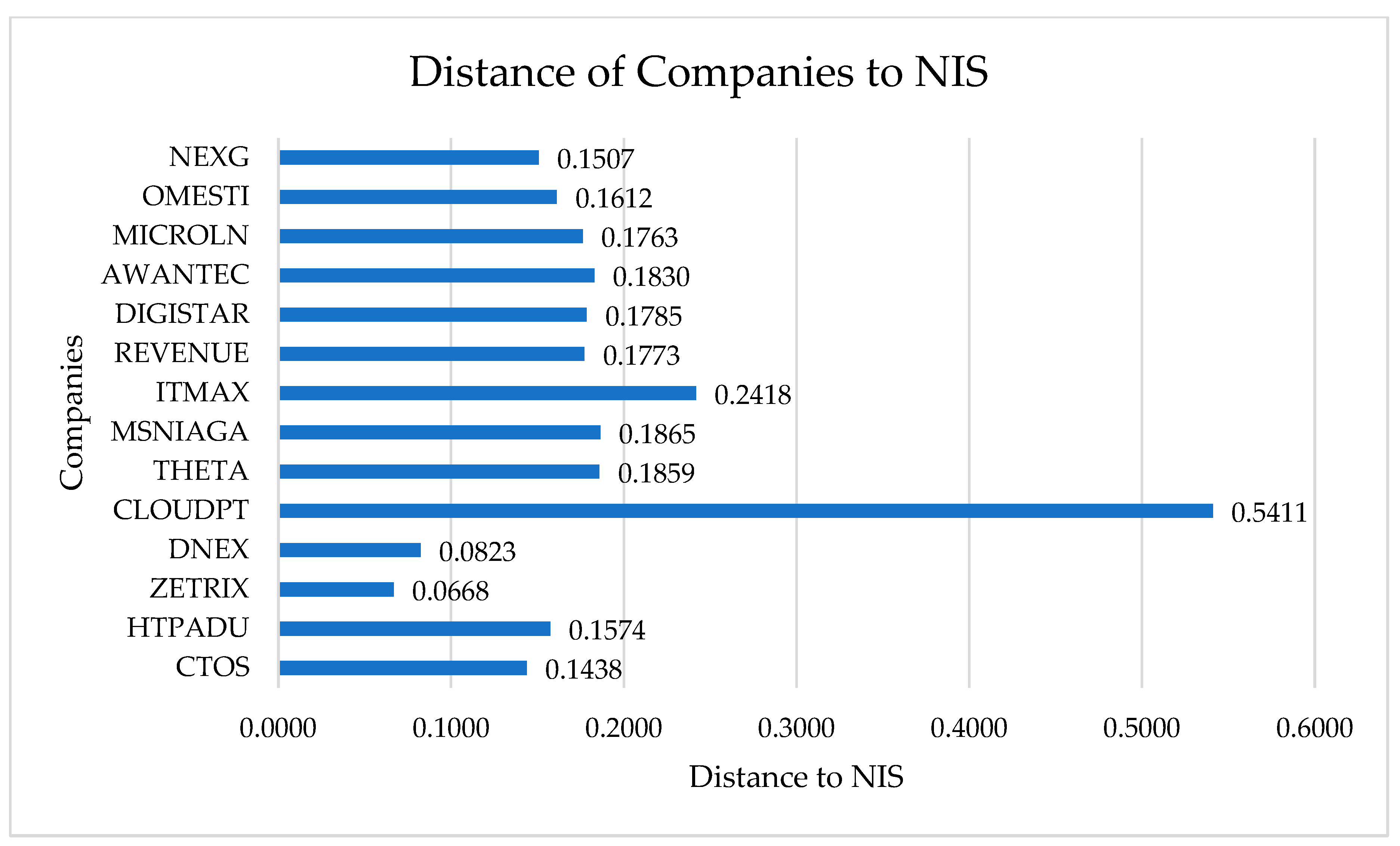

3. Empirical Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abdel-Basset, M., Ding, W., Mohamed, R., & Metawa, N. (2020). An integrated plithogenic MCDM approach for financial performance evaluation of manufacturing industries. Risk Management, 22(3), 192–218. [Google Scholar] [CrossRef]

- Abdel-Basset, M., & Mohamed, R. (2020). A novel plithogenic TOPSIS-CRITIC model for sustainable supply chain risk management. Journal of Cleaner Production, 247, 119586. [Google Scholar] [CrossRef]

- Abdullah, A. M. (2020). Identifying the determinants of financial distress for public listed companies in Malaysia. Jurnal Pengurusan, 59, 11–24. Available online: https://www.ukm.my/jurnalpengurusan/wp-content/uploads/2022/10/jp_59-3.pdf (accessed on 10 December 2025).

- Abughazalah, N., & Khan, M. (2025). A dual hesitant fuzzy entropy-TOPSIS framework for multi-criteria evaluation of medical E-learning systems. Scientific Reports, 15(1), 40752. [Google Scholar] [CrossRef] [PubMed]

- Al-Bayati, I. I., & Al-Zubaidy, S. S. (2020). Applying the analytical hierarichy process and weighted sum model for small project selection in Iraq. IOP Conference Series: Materials Science and Engineering, 671(1), 012158. [Google Scholar] [CrossRef]

- Alshahrani, H. M., Alotaibi, S. S., Ansari, M. T. J., Asiri, M. M., Agrawal, A., Khan, R. A., Mohsen, H., Hilal, A. M., Alshahrani, H. M., Alotaibi, S. S., Ansari, M. T. J., Asiri, M. M., Agrawal, A., Khan, R. A., Mohsen, H., & Hilal, A. M. (2022). Analysis and ranking of IT risk factors using fuzzy TOPSIS-based approach. Applied Sciences, 12(12), 5911. [Google Scholar] [CrossRef]

- An, D., & Wang, N. (2025). Application of multi-objective decision-making based on entropy weight-TOPSIS method and RSR method in the analysis of orthopedic disease. Discover Artificial Intelligence, 5(1), 208. [Google Scholar] [CrossRef]

- Barbat, S., Barkhordariahmadi, M., & Kermani, V. (2022). Extension of the TOPSIS Method for decision making problems under complex fuzzy data based on the central point index. Advances in Fuzzy Systems, 2022(1), 1477098. [Google Scholar] [CrossRef]

- BCBS. (2017). Basel III: Finalising post-crisis reforms. Available online: https://www.bis.org/bcbs/publ/d424.htm (accessed on 10 December 2025).

- Bursa Malaysia. (2024). Bursa Malaysia sector classification of applicants or listed issuers. Available online: https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/content_entry5ce3b50239fba2627b2864be/5ce3bda239fba262ff56e9e9/files/BURSA_MALAYSIA_SECTOR_CLASSIFICATION_OF_APPLICANTS_OR_LISTED_ISSUERS_Nov2024.pdf?1736733389 (accessed on 10 December 2025).

- Chen, C.-H. (2021). A hybrid multi-criteria decision-making approach based on ANP-entropy TOPSIS for building materials supplier selection. Entropy, 23(12), 1597. [Google Scholar] [CrossRef]

- Dasgupta, A., Sen, B., Dutta, P., Rachchh, N., Patil, N., Mahapatro, A., & Karthikeyan, A. (2025). Entropy-TOPSIS-based material selection for sustainable polymer composite: An MCDM framework promoting circular economy. Journal of Elastomers & Plastics, 57(5), 703–729. [Google Scholar] [CrossRef]

- Dehdasht, G., Ferwati, M. S., Zin, R. M., & Abidin, N. Z. (2020). A hybrid approach using entropy and TOPSIS to select key drivers for a successful and sustainable lean construction implementation. PLoS ONE, 15(2), e0228746. [Google Scholar] [CrossRef] [PubMed]

- Deloitte. (2025). 2025 gen Z and millennial survey. Available online: https://www.deloitte.com/content/dam/assets-shared/docs/campaigns/2025/2025-genz-millennial-survey.pdf (accessed on 10 December 2025).

- Duong, T. T. T., & Thao, N. X. (2021). TOPSIS model based on entropy and similarity measure for market segment selection and evaluation. Asian Journal of Economics and Banking, 5(2), 194–203. [Google Scholar] [CrossRef]

- Eng, H. K., Yee, O. J., Ting, Y. L., Tee, K. N. K., Yusof, Z. M., & Misiran, M. (2023). Prediction bankruptcy for technology sector company using Altman’s Z-score model. Data Analytics and Applied Mathematics (DAAM), 4, 25–32. [Google Scholar] [CrossRef]

- Fathina, A. (2025, October 13). Cloudpoint moves to main market, looks to capitalise on AI growth. The Edge Malaysia. Available online: https://theedgemalaysia.com/node/773859 (accessed on 10 December 2025).

- Ghazali, A. W., Suffian, M. T. M., Sanusi, Z. M., & Alsudairi, F. S. (2018). Managerial opportunism: Monitoring financial risk of Malaysian shariah-compliant companies. Global Journal Al-Thaqafah, 99–115. [Google Scholar] [CrossRef]

- Greenberg, A., Hamilton, J., Maltz, D. A., & Patel, P. (2009). The cost of a cloud: Research problems in data center networks. SIGCOMM Computer Communication Review, 39(1), 68–73. [Google Scholar] [CrossRef]

- Guan, C., Ding, D., Guo, J., & Teng, Y. (2023). An ecosystem approach to Web3.0: A systematic review and research agenda. Journal of Electronic Business & Digital Economics, 2(1), 139–156. [Google Scholar] [CrossRef]

- Huang, T., Huang, W., Zhang, B., Chen, W., & Pan, X. (2025). Optimizing energy consumption in centralized and distributed cloud architectures with a comparative study to increase stability and efficiency. Energy and Buildings, 333, 115454. [Google Scholar] [CrossRef]

- Huang, Y. (2025, July 25–27). Research on the entropy weight-TOPSIS evaluation management of corporate financial performance based on computer technology. ICEMBDA ’25: Proceedings of the 2025 International Conference on Economic Management and Big Data Application (pp. 918–924), Shenzhen, China. [Google Scholar] [CrossRef]

- Ichsani, S., & Suhardi, A. R. (2015). The effect of return on equity (ROE) and return on investment (ROI) on trading volume. Procedia—Social and Behavioral Sciences, 211, 896–902. [Google Scholar] [CrossRef]

- Jalil, A. (2025, September 12). Cloudpoint tipped to win bulk of RM230mil tenders—PublicInvest. NST Online. Available online: https://www.nst.com.my/business/corporate/2025/09/1273997/cloudpoint-tipped-win-bulk-rm230mil-tenders-%E2%80%94-publicinvest (accessed on 10 December 2025).

- Javaid, M., Haleem, A., Singh, R. P., & Sinha, A. K. (2024). Digital economy to improve the culture of industry 4.0: A study on features, implementation and challenges. Green Technologies and Sustainability, 2(2), 100083. [Google Scholar] [CrossRef]

- Ji, H. (2019). The impact of interest coverage ratio on value relevance of reported earnings: Evidence from South Korea. Sustainability, 11(24), 7193. [Google Scholar] [CrossRef]

- Jiang, S. (2025). Evaluation of new quality productive forces in Henan province based on improved entropy weight-TOPSIS method and deep learning. Scientific Reports, 15(1), 35434. [Google Scholar] [CrossRef]

- Kabassi, K. (2021a). Application of multi-criteria decision-making models for the evaluation cultural websites: A framework for comparative analysis. Information, 12(10), 407. [Google Scholar] [CrossRef]

- Kabassi, K. (2021b). Comparing multi-criteria decision making models for evaluating environmental education programs. Sustainability, 13(20), 11220. [Google Scholar] [CrossRef]

- Karim, M. R., Shetu, S. A., & Razia, S. (2021). COVID-19, liquidity and financial health: Empirical evidence from South Asian economy. Asian Journal of Economics and Banking, 5(3), 307–323. [Google Scholar] [CrossRef]

- Karim, Y. F. A., Syed-Noh, S. N., & Zaid, N. A. M. (2017). Financial risk and leverage relationship of oil and gas local companies in Malaysia. International Journal of Business, Economics and Law, 14(1), 13–17. [Google Scholar]

- Lee, C.-C. (2023). Analyses of the operating performance of information service companies based on indicators of financial statements. Asia Pacific Management Review, 28(4), 410–419. [Google Scholar] [CrossRef]

- Le Roux, D., Olivès, R., & Neveu, P. (2023). Combining entropy weight and TOPSIS method for selection of tank geometry and filler material of a packed-bed thermal energy storage system. Journal of Cleaner Production, 414, 137588. [Google Scholar] [CrossRef]

- Libório, M. P., Karagiannis, R., Diniz, A. M. A., Ekel, P. I., Vieira, D. A. G., Ribeiro, L. C., Libório, M. P., Karagiannis, R., Diniz, A. M. A., Ekel, P. I., Vieira, D. A. G., & Ribeiro, L. C. (2024). The use of information entropy and expert opinion in maximizing the discriminating power of composite indicators. Entropy, 26(2), 143. [Google Scholar] [CrossRef] [PubMed]

- Lin, T. T., Lee, C.-C., & Kuan, Y.-C. (2013). The optimal operational risk capital requirement by applying the advanced measurement approach. Central European Journal of Operations Research, 21(1), 85–101. [Google Scholar] [CrossRef]

- Marozva, R. R., Maloa, F., Marozva, R. R., & Maloa, F. (2026). The effects of fintech adoption on CEO compensation: Evidence from JSE-listed banks. Journal of Risk and Financial Management, 19(1), 56. [Google Scholar] [CrossRef]

- McCoy, J., Palomino, F., Perez-Orive, A., Press, C., & Sanz-Maldonado, G. (2020). Interest coverage ratios: Assessing vulnerabilities in nonfinancial corporate credit. Available online: https://www.federalreserve.gov/econres/notes/feds-notes/interest-coverage-ratios-assessing-vulnerabilities-in-nonfinancial-corporate-credit-20201203.html (accessed on 10 December 2025).

- Metwally, A. B. M., Yasser, M. M., Ahmed, E. A., Ali, M. A. S., Metwally, A. B. M., Yasser, M. M., Ahmed, E. A., & Ali, M. A. S. (2025). Financial and economic determinants of banks financial distress in MENA region. Economies, 13(2), 56. [Google Scholar] [CrossRef]

- Mitra, S. (2013). Operational risk of option hedging. Economic Modelling, 33, 194–203. [Google Scholar] [CrossRef]

- Mukherjee, S., De, A., & Roy, S. (2024). Supply chain risk prioritization: A multi-criteria based intuitionistic fuzzy TOPSIS approach. International Journal of Quality & Reliability Management, 41(6), 1693–1725. [Google Scholar] [CrossRef]

- Mulliner, E., Malys, N., & Maliene, V. (2016). Comparative analysis of MCDM methods for the assessment of sustainable housing affordability. Omega, 59, 146–156. [Google Scholar] [CrossRef]

- Osemudiamwen, O., Abdulwasiu, K., & Alamu, R. (2025). Interest coverage ratio as a mediator between leverage and profitability in retail firms. Available online: https://www.researchgate.net/publication/393793506_Interest_Coverage_Ratio_as_a_Mediator_Between_Leverage_and_Profitability_in_Retail_Firms (accessed on 10 December 2025).

- O’Shea, R., Deeney, P., Triantaphyllou, E., Diaz-Balteiro, L., & Armagan Tarim, S. (2026). Weight stability intervals for multi-criteria decision analysis using the weighted sum model. Expert Systems with Applications, 296, 128460. [Google Scholar] [CrossRef]

- Öztürk, B. C., & Gökçen, H. (2023). Ranking strategic goals with fuzzy entropy weighting and fuzzy TOPSIS methods: A case of the scientific and technological research council of Türkiye. Applied Sciences, 13(14), 8060. [Google Scholar] [CrossRef]

- Parry, R. (2021). An assessment of the risk of service supplier bankruptcies as a cybersecurity threat. In M. Sarfraz (Ed.), Cybersecurity threats with new perspectives. IntechOpen. [Google Scholar] [CrossRef]

- Parry, R., & Bisson, R. (2020). Legal approaches to management of the risk of cloud computing insolvencies. Journal of Corporate Law Studies, 20, 421–451. [Google Scholar] [CrossRef]

- Perilla, L. N. T. (n.d.). Financial valuation and systematic risk in technology and traditional firms. Journal of Corporate Accounting & Finance, 37, 144–153. [Google Scholar] [CrossRef]

- Qu, W., Li, J., Song, W., Li, X., Zhao, Y., Dong, H., Wang, Y., Zhao, Q., Qi, Y., Qu, W., Li, J., Song, W., Li, X., Zhao, Y., Dong, H., Wang, Y., Zhao, Q., & Qi, Y. (2022). Entropy-weight-method-based integrated models for short-term intersection traffic flow prediction. Entropy, 24(7), 849. [Google Scholar] [CrossRef]

- Roy, P., & Shaw, K. (2021). A multicriteria credit scoring model for SMEs using hybrid BWM and TOPSIS. Financial Innovation, 7, 77. [Google Scholar] [CrossRef]

- Saias, J., Rato, L., Gonçalves, T., Saias, J., Rato, L., & Gonçalves, T. (2022). An approach to churn prediction for cloud services recommendation and user retention. Information, 13(5), 227. [Google Scholar] [CrossRef]

- Santos, L. L., Gomes, C., Malheiros, C., Lucas, A., Santos, L. L., Gomes, C., Malheiros, C., & Lucas, A. (2021). Impact factors on Portuguese hotels’ liquidity. Journal of Risk and Financial Management, 14(4), 144. [Google Scholar] [CrossRef]

- Sengupta, U., & Sengupta, U. (2022). SDG-11 and smart cities: Contradictions and overlaps between social and environmental justice research agendas. Frontiers in Sociology, 7, 995603. [Google Scholar] [CrossRef] [PubMed]

- Slassi-Sennou, S., Es-salmani, M., Slassi-Sennou, S., & Es-salmani, M. (2025). Navigating financial risk in the digital age: The mediating role of performance and indebtedness. Journal of Risk and Financial Management, 18(6), 325. [Google Scholar] [CrossRef]

- Srivastava, P., & Singh, V. P. (2025). Optimization through combined compromise solution and weight determination through Shannon-entropy for multi criteria decision making in tribological testing of ultrahigh molecular weight polyethylene nano-composite in SBF environment and compression testing with it’s invitro analysis. Journal of Thermoplastic Composite Materials, 38(6), 2253–2280. [Google Scholar] [CrossRef]

- Tarawallie, F. A. B., Bein, M., Tarawallie, F. A. B., & Bein, M. (2025). The moderating effect of size on the relationship between liquidity management and sustainable profitability: Evidence from BRICS financial firms. Sustainability, 17(18), 8128. [Google Scholar] [CrossRef]

- Tian, C., Li, H., Tian, S., & Tian, F. (2020). Risk assessment of safety management audit based on fuzzy TOPSIS method. Mathematical Problems in Engineering, 2020(1), 1612538. [Google Scholar] [CrossRef]

- Times of India. (2025, November 19). How cloudflare outage may have cost financial service brokers $1.6 billion in trading volume. The Times of India. Available online: https://timesofindia.indiatimes.com/technology/tech-news/how-cloudflare-outage-may-have-cost-financial-service-brokers-1-6-billion-in-trading-volume/articleshow/125437080.cms (accessed on 10 December 2025).

- Tiwari, V., Jain, P. K., & Tandon, P. (2019). An integrated Shannon entropy and TOPSIS for product design concept evaluation based on bijective soft set. Journal of Intelligent Manufacturing, 30(4), 1645–1658. [Google Scholar] [CrossRef]

- Tunçay, C. M., Grzegorczyk-Akın, E., Tunçay, C. M., & Grzegorczyk-Akın, E. (2025). Credit rationing, its determinants and non-performing loans: An empirical analysis of credit markets in polish banking sector. Econometrics, 13(4), 51. [Google Scholar] [CrossRef]

- Tutcu, B., Kayakuş, M., Terzioğlu, M., Uyar, G. F. Ü., Talaş, H., Yetiz, F., Tutcu, B., Kayakuş, M., Terzioğlu, M., Uyar, G. F. Ü., Talaş, H., & Yetiz, F. (2024). Predicting financial performance in the IT industry with machine learning: ROA and ROE analysis. Applied Sciences, 14(17), 7459. [Google Scholar] [CrossRef]

- Wang, L., & Mao, G. (2023). Application of entropy weight TOPSIS method in financial risk assessment of liquor listed companies: Take Shanxi Fenjiu as an example. Frontiers in Business, Economics and Management, 9(2), 168–173. [Google Scholar] [CrossRef]

- Więckowski, J., & Sałabun, W. (2023). Sensitivity analysis approaches in multi-criteria decision analysis: A systematic review. Applied Soft Computing, 148, 110915. [Google Scholar] [CrossRef]

- Wu, C. H., & Pambudi, P. D. L. (2025). Digital transformation in fintech: Choosing between application and software as a service (SaaS). Asia Pacific Management Review, 30(2), 100342. [Google Scholar] [CrossRef]

- Wu, R. M. X., Zhang, Z., Yan, W., Fan, J., Gou, J., Liu, B., Gide, E., Soar, J., Shen, B., Fazal-e-Hasan, S., Liu, Z., Zhang, P., Wang, P., Cui, X., Peng, Z., & Wang, Y. (2022). A comparative analysis of the principal component analysis and entropy weight methods to establish the indexing measurement. PLoS ONE, 17(1), e0262261. [Google Scholar] [CrossRef] [PubMed]

- Yin, M., & Guo, M. (2026). Complex forecasting and investment strategy optimization via chain-of-thought of large language models. Expert Systems with Applications, 298, 129913. [Google Scholar] [CrossRef]

- Zainuddin, Z., Tapa, A., & Rahim, A. I. A. (2018). Examine the financial health of the listed technology companies in Malaysia using Altman’s Z-score test. In AIP conference proceedings (p. 020144). AIP Publishing LLC. [Google Scholar] [CrossRef]

- Zainul, E. (2025, July 14). Zetrix AI, formerly MyEG, reprimanded as seven directors fined over misleading announcements. The Edge Malaysia. Available online: https://theedgemalaysia.com/node/762569 (accessed on 10 December 2025).

- Zhao, D.-Y., Ma, Y.-Y., Lin, H.-L., Zhao, D.-Y., Ma, Y.-Y., & Lin, H.-L. (2022). Using the entropy and TOPSIS models to evaluate sustainable development of islands: A case in China. Sustainability, 14(6), 3707. [Google Scholar] [CrossRef]

- Zhu, H., & Mao, L. (2024). Research on financial performance evaluation of xiaoxiong electric appliance based on entropy weight-TOPSIS method. Academic Journal of Management and Social Sciences, 9, 125–133. [Google Scholar] [CrossRef]

- Zhu, Y., Tian, D., & Yan, F. (2020). Effectiveness of entropy weight method in decision-making. Mathematical Problems in Engineering, 2020(1), 3564835. [Google Scholar] [CrossRef]

| Levels | Description |

|---|---|

| Main Objective (First Level) | Evaluate financial risk of listed digital services companies in Malaysia using Entropy-Weight TOPSIS model. |

| Decision Criteria (Second Level) | Current ratio (CR) |

| Interest coverage ratio (ICR) | |

| Receivables turnover ratio (RTR) | |

| Debt-to-equity ratio (DER) | |

| Return on asset (ROA) | |

| Return on equity (ROE) | |

| Basic indicator approach (BIA) | |

| Decision Alternatives (Third Level) | CTOS |

| HTPADU | |

| ZETRIX | |

| DNEX | |

| CLOUDPT | |

| THETA | |

| MSNIAGA | |

| ITMAX | |

| REVENUE | |

| DIGISTAR | |

| AWANTEC | |

| MICROLN | |

| OMESTI | |

| NEXG |

| Companies | Relative Closeness | Ranking |

|---|---|---|

| CLOUDPT | 0.9820 | 1 |

| ITMAX | 0.4131 | 2 |

| MSNIAGA | 0.2694 | 3 |

| THETA | 0.2680 | 4 |

| AWANTEC | 0.2654 | 5 |

| REVENUE | 0.2626 | 6 |

| MICROLN | 0.2601 | 7 |

| DIGISTAR | 0.2600 | 8 |

| OMESTI | 0.2404 | 9 |

| HTPADU | 0.2369 | 10 |

| NEXG | 0.2323 | 11 |

| CTOS | 0.2225 | 12 |

| DNEX | 0.1374 | 13 |

| ZETRIX | 0.1125 | 14 |

| Companies | Entropy-TOPSIS | Entropy-WSM | ||

|---|---|---|---|---|

| Relative Closeness | Ranking | Score | Ranking | |

| CLOUDPT | 0.9820 | 1 | 0.8996 | 1 |

| ITMAX | 0.4131 | 2 | 0.4046 | 2 |

| MSNIAGA | 0.2694 | 3 | 0.2833 | 3 |

| THETA | 0.2680 | 4 | 0.2747 | 4 |

| AWANTEC | 0.2654 | 5 | 0.1709 | 5 |

| REVENUE | 0.2626 | 6 | 0.1639 | 7 |

| MICROLN | 0.2601 | 7 | 0.1612 | 8 |

| DIGISTAR | 0.2600 | 8 | 0.1444 | 11 |

| OMESTI | 0.2404 | 9 | 0.0230 | 14 |

| HTPADU | 0.2369 | 10 | 0.0722 | 13 |

| NEXG | 0.2323 | 11 | 0.1524 | 10 |

| CTOS | 0.2225 | 12 | 0.1540 | 9 |

| DNEX | 0.1374 | 13 | 0.0731 | 12 |

| ZETRIX | 0.1125 | 14 | 0.1643 | 6 |

| Companies | Entropy-TOPSIS | +10% | −10% | |||

|---|---|---|---|---|---|---|

| Relative Closeness | Rank | Relative Closeness | Rank | Relative Closeness | Rank | |

| CLOUDPT | 0.9820 | 1 | 0.9851 | 1 | 0.9785 | 1 |

| ITMAX | 0.4131 | 2 | 0.3876 | 2 | 0.4442 | 2 |

| MSNIAGA | 0.2694 | 3 | 0.2295 | 3 | 0.3126 | 3 |

| THETA | 0.2680 | 4 | 0.2283 | 4 | 0.3109 | 4 |

| AWANTEC | 0.2654 | 5 | 0.2260 | 5 | 0.3082 | 5 |

| REVENUE | 0.2626 | 6 | 0.2235 | 6 | 0.3052 | 6 |

| MICROLN | 0.2601 | 7 | 0.2211 | 8 | 0.3027 | 7 |

| DIGISTAR | 0.2600 | 8 | 0.2213 | 7 | 0.3019 | 8 |

| OMESTI | 0.2404 | 9 | 0.2039 | 9 | 0.2802 | 9 |

| HTPADU | 0.2369 | 10 | 0.2006 | 10 | 0.2766 | 10 |

| NEXG | 0.2323 | 11 | 0.1967 | 11 | 0.2716 | 11 |

| CTOS | 0.2225 | 12 | 0.1880 | 12 | 0.2607 | 12 |

| DNEX | 0.1374 | 13 | 0.1149 | 13 | 0.1626 | 13 |

| ZETRIX | 0.1125 | 14 | 0.0951 | 14 | 0.1314 | 14 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Lam, W.S.; Lam, W.H.; Lee, P.F. Evaluation of Financial Risk Management of Digital Services Companies Using Integrated Entropy-Weight TOPSIS Model. J. Risk Financial Manag. 2026, 19, 108. https://doi.org/10.3390/jrfm19020108

Lam WS, Lam WH, Lee PF. Evaluation of Financial Risk Management of Digital Services Companies Using Integrated Entropy-Weight TOPSIS Model. Journal of Risk and Financial Management. 2026; 19(2):108. https://doi.org/10.3390/jrfm19020108

Chicago/Turabian StyleLam, Weng Siew, Weng Hoe Lam, and Pei Fun Lee. 2026. "Evaluation of Financial Risk Management of Digital Services Companies Using Integrated Entropy-Weight TOPSIS Model" Journal of Risk and Financial Management 19, no. 2: 108. https://doi.org/10.3390/jrfm19020108

APA StyleLam, W. S., Lam, W. H., & Lee, P. F. (2026). Evaluation of Financial Risk Management of Digital Services Companies Using Integrated Entropy-Weight TOPSIS Model. Journal of Risk and Financial Management, 19(2), 108. https://doi.org/10.3390/jrfm19020108