Greenhouse Gas Emissions and the Financial Stability of Insurance Companies

Abstract

1. Introduction

2. Literature and Development of Hypotheses

3. Methods

4. Results

5. Discussion and Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | In the field of ecological research, Phelan et al. (2010) propose an approach to carbon pricing that better reflects the biogeophysical limits of the Earth system by drawing on aspects of insurance systems. |

| 2 | We acknowledge that insurance segments may behave quite differently due to differences in their business. However, focusing only on a specific segment (even the largest) among the available resulted in few observations that we could not use for a robust panel regression analysis. |

| 3 | Information on the data and the methodologies used by S&P Capital IQ to assess corporate carbon emissions can be found at https://www.spglobal.com/commodity-insights/en/products-solutions/carbon-scenarios/carbon-scenarios-market-insights (accessed on 5 May 2025). |

| 4 | The results have same quality also as the variable for reserves is computed with the ratio of policyholder reserves to total assets (Bressan & Du, 2024b). The results are omitted for the sake of brevity, but are available on request. |

| 5 | In general, the regressions are estimated in different subsamples due to differences in the number of firms for which we could not obtain missing values of dependent variables and all regressors. In particular, in the tests conducted as robustness, the control variables were omitted as their inclusion had significantly reduced the estimation sample size, thus harming the inference that we could make from the results. |

References

- Ali, M., Azmi, W., Kowsalya, V., & Rizvi, S. A. R. (2023). Interlinkages between stability, carbon emissions and the ESG disclosures: Global evidence from banking industry. Pacific-Basin Finance Journal, 82, 102154. [Google Scholar] [CrossRef]

- Bajic, A., Kiesel, R., & Hellmich, M. (2023). Handle with care: Challenges in company-level emissions data for assessing financial risks from climate change. Journal of Climate Finance, 5, 100017. [Google Scholar] [CrossRef]

- Bank of England. (2019). Climate change: What are the risks to financial stability? Available online: https://www.bankofengland.co.uk/explainers/climate-change-what-are-the-risks-to-financial-stability (accessed on 14 February 2025).

- BBC. (2024). Climate change is fuelling the US insurance problem. Available online: https://www.bbc.com/future/article/20240318-climate-change-is-fuelling-the-us-insurance-problem (accessed on 30 May 2025).

- Bharath, S. T., & Shumway, T. (2008). Forecasting default with the Merton distance to default model. The Review of Financial Studies, 21(3), 1339–1369. [Google Scholar] [CrossRef]

- Bolton, P., & Kacperczyk, M. (2021). Do investors care about carbon risk? Journal of Financial Economics, 142(2), 517–549. [Google Scholar] [CrossRef]

- Bolton, P., & Kacperczyk, M. (2024). Are carbon emissions associated with stock returns? Comment. Review of Finance, 28(1), 107–109. [Google Scholar] [CrossRef]

- Braun, A., Utz, S., & Xu, J. (2019). Are insurance balance sheets carbon-neutral? harnessing asset pricing for climate change policy. The Geneva Papers on Risk and Insurance-Issues and Practice, 44, 549–568. [Google Scholar] [CrossRef]

- Bressan, S. (2025). Banks’ greenhouse gas emissions and equity value. Pre-print. [Google Scholar] [CrossRef]

- Bressan, S., & Du, S. (2024a). (re) insurance and diversification inside P&C insurers. Journal of Applied Finance & Banking, 14(5), 1–5. [Google Scholar]

- Bressan, S., & Du, S. (2024b). The effect of environmental damage costs on the performance of insurance companies. Sustainability, 16(19), 8389. [Google Scholar] [CrossRef]

- Bressan, S., & Du, S. (2025). The market value of insurance companies and greenhouse gas emissions in the United States. Risk Governance and Control: Financial Markets & Institutions, 15(2), 123–133. [Google Scholar] [CrossRef]

- Brown, J. R., Farrell, A. M., & Weisbenner, S. J. (2016). Decision-making approaches and the propensity to default: Evidence and implications. Journal of Financial Economics, 121(3), 477–495. [Google Scholar] [CrossRef]

- Browne, M. J., & Hoyt, R. E. (1995). Economic and market predictors of insolvencies in the property-liability insurance industry. Journal of Risk and Insurance, 62(2), 309–327. [Google Scholar] [CrossRef]

- Bui, B., Moses, O., & Houqe, M. N. (2020). Carbon disclosure, emission intensity and cost of equity capital: Multi-country evidence. Accounting & Finance, 60(1), 47–71. [Google Scholar]

- Callery, P. J. (2023). The influence of strategic disclosure on corporate climate performance ratings. Business & Society, 62(5), 950–988. [Google Scholar]

- Chabot, M., & Bertrand, J.-L. (2023). Climate risks and financial stability: Evidence from the European financial system. Journal of Financial Stability, 69, 101190. [Google Scholar] [CrossRef]

- Chava, S., & Purnanandam, A. (2010). Is default risk negatively related to stock returns? The Review of Financial Studies, 23(6), 2523–2559. [Google Scholar] [CrossRef]

- Chen, R., & Wong, K. A. (2004). The determinants of financial health of Asian insurance companies. Journal of Risk and Insurance, 71(3), 469–499. [Google Scholar] [CrossRef]

- Chiaramonte, L., Liu, H., Poli, F., & Zhou, M. (2016). How accurately can Z-score predict bank failure? Financial Markets, Institutions & Instruments, 25(5), 333–360. [Google Scholar]

- Clarkson, P. M., Li, Y., Pinnuck, M., & Richardson, G. D. (2015). The valuation relevance of greenhouse gas emissions under the European Union carbon emissions trading scheme. European Accounting Review, 24(3), 551–580. [Google Scholar] [CrossRef]

- Dawson, C., Dargusch, P., & Hill, G. (2022). Assessing how big insurance firms report and manage carbon emissions: A case study of Allianz. Sustainability, 14(4), 2476. [Google Scholar] [CrossRef]

- Deloitte. (2023). A European perspective on insurance-associated emissions. Available online: https://www.deloitte.com/nl/en/Industries/insurance/blogs/a-european-view-on-insurance-associated-emissions-reporting.html (accessed on 14 May 2025).

- Dlugolecki, A. (2008). Climate change and the insurance sector. The Geneva Papers on Risk and Insurance-Issues and Practice, 33, 71–90. [Google Scholar] [CrossRef]

- Doherty, N. A., & Garven, J. R. (1995). Insurance cycles: Interest rates and the capacity constraint model. Journal of Business, 68(3), 383–404. [Google Scholar] [CrossRef]

- Dunn, O. J. (1964). Multiple comparisons using rank sums. Technometrics, 6(3), 241–252. [Google Scholar] [CrossRef]

- European Insurance and Occupational Pensions Authority. (2023). The role of insurers in tackling climate change: Challenges and opportunities. Available online: https://www.eiopa.europa.eu/publications/role-insurers-tackling-climate-change-challenges-and-opportunities_en (accessed on 28 April 2025).

- European Insurance and Occupational Pensions Authority. (2025). Insurance risk dashboard. Available online: https://www.eiopa.europa.eu/publications/financial-stability-report-june-2025_en (accessed on 10 June 2025).

- Financial Times. (2024). The uninsurable world: How the insurance industry fell behind on climate change. Available online: https://www.ft.com/content/b4bf187a-1040-4a28-9f9e-fa8c4603ed1b (accessed on 10 April 2025).

- Fiordelisi, F., & Marques-Ibanez, D. (2013). Is bank default risk systematic? Journal of Banking & Finance, 37(6), 2000–2010. [Google Scholar] [CrossRef]

- Fitch Ratings. (2024). Global reinsurers to stay cautious on secondary peril exposure. Available online: https://www.fitchratings.com/research/insurance/global-reinsurers-to-stay-cautious-on-secondary-peril-exposure-03-09-2024 (accessed on 2 April 2025).

- Gatzert, N., Reichel, P., & Zitzmann, A. (2020). Sustainability risks & opportunities in the insurance industry. Zeitschrift für die Gesamte Versicherungswissenschaft, 109, 311–331. [Google Scholar]

- Gheyathaldin Salih, L. (2024). Decarbonization and the obstacles to carbon credit accounting dis-closure in financial statement reports: The case of UAE. Asian Journal of Accounting Research, 9(2), 169–180. [Google Scholar] [CrossRef]

- Golnaraghi, M. (2023). Climate change and the insurance industry-risks and opportunities for transitioning to a resilient low carbon economy. In Handbook of business and climate change (pp. 145–186). Edward Elgar Publishing. [Google Scholar]

- Griffin, P. A., Lont, D. H., & Sun, E. Y. (2017). The relevance to investors of greenhouse gas emission disclosures. Contemporary Accounting Research, 34(2), 1265–1297. [Google Scholar] [CrossRef]

- Gupta, A., Owusu, A., & Wang, J. (2023). Assessing US insurance firms’ climate change impact and response. The Geneva Papers on Risk and Insurance-Issues and Practice, 49, 571–604. [Google Scholar] [CrossRef]

- Hágen, I., & Ahmed, A. M. (2024). Carbon footprint, financial structure, and firm valuation: An empirical investigation. Risks, 12(12), 197. [Google Scholar] [CrossRef]

- Ho, C.-C., Huang, C., & Ou, C.-Y. (2018). Analysis of the factors influencing sustainable development in the insurance industry. Corporate Social Responsibility and Environmental Management, 25(4), 391–410. [Google Scholar] [CrossRef]

- Jessen, C., & Lando, D. (2015). Robustness of distance-to-default. Journal of Banking & Finance, 50, 493–505. [Google Scholar] [CrossRef]

- Kabir, M. N., Rahman, S., Rahman, M. A., & Anwar, M. (2021). Carbon emissions and default risk: International evidence from firm-level data. Economic Modelling, 103, 105617. [Google Scholar] [CrossRef]

- Khoo, F., & Yong, J. (2023). Too hot to insure–avoiding the insurability tipping point. Financial Stability Institute (FSI) Insights on Policy Implementation, No. 54. Financial Stability Institute. [Google Scholar]

- Kim, Y.-B., An, H. T., & Kim, J. D. (2015). The effect of carbon risk on the cost of equity capital. Journal of Cleaner Production, 93, 279–287. [Google Scholar] [CrossRef]

- KPMG. (2022). Two degrees off: The implications of climate change for insurers. Available online: https://kpmg.com/mt/en/home/insights/2022/06/two-degrees-off-the-implications-of-climate-change-for-insurers.html (accessed on 20 March 2025).

- KPMG. (2023). ESG in insurance: Insured emissions. Available online: https://assets.kpmg.com/content/dam/kpmg/uk/pdf/2023/10/esg-in-insurance.pdf (accessed on 1 March 2025).

- Krueger, P., Sautner, Z., & Starks, L. T. (2020). The importance of climate risks for institutional investors. The Review of Financial Studies, 33(3), 1067–1111. [Google Scholar] [CrossRef]

- Lai, L.-H. (2006). Underwriting profit margin of P/L insurance in the fuzzy-ICAPM. The Geneva Risk and Insurance Review, 31, 23–34. [Google Scholar] [CrossRef]

- Leng, C.-C., & Meier, U. B. (2006). Analysis of multinational underwriting cycles in property-liability insurance. The Journal of Risk Finance, 7(2), 146–159. [Google Scholar] [CrossRef]

- Matsumura, E. M., Prakash, R., & Vera-Muñoz, S. C. (2014). Firm-value effects of carbon emissions and carbon disclosures. The Accounting Review, 89(2), 695–724. [Google Scholar] [CrossRef]

- Montzka, S. A., Dlugokencky, E. J., & Butler, J. H. (2011). Non-CO2 greenhouse gases and climate change. Nature, 476(7358), 43–50. [Google Scholar] [CrossRef] [PubMed]

- NASA. (2024). What’s the difference between climate change and global warming? Available online: https://science.nasa.gov/climate-change/faq/whats-the-difference-between-climate-change-and-global-warming/ (accessed on 17 February 2025).

- National Association of Insurance Commissioners. (2023). Iris ratios. Available online: https://www.surpluslines.org/wp-content/uploads/2024/05/IRIS-Ratios.pdf (accessed on 3 February 2025).

- Nguyen, T. P. T., & Nghiem, S. H. (2015). The interrelationships among default risk, capital ratio and efficiency: Evidence from Indian banks. Managerial Finance, 41(5), 507–525. [Google Scholar] [CrossRef]

- Oestreich, A. M., & Tsiakas, I. (2015). Carbon emissions and stock returns: Evidence from the EU emissions trading scheme. Journal of Banking & Finance, 58, 294–308. [Google Scholar] [CrossRef]

- Partnership for Carbon Accounting Financials. (2020). The global GHG accounting and reporting standard for the financial industry. Available online: https://carbonaccountingfinancials.com/files/downloads/PCAF-Global-GHG-Standard-2020.pdf (accessed on 4 March 2025).

- Partnership for Carbon Accounting Financials. (2022). GHG emissions associated to insurance and reinsurance underwriting portfolios. Available online: https://carbonaccountingfinancials.com/files/2022-03/pcaf-scoping-doc-insurance-associated-emissions.pdf (accessed on 30 January 2025).

- Perera, K., Kuruppuarachchi, D., Kumarasinghe, S., & Suleman, M. T. (2023). The impact of carbon disclosure and carbon emissions intensity on firms’ idiosyncratic volatility. Energy Economics, 128, 107053. [Google Scholar] [CrossRef]

- Phelan, L., Henderson-Sellers, A., & Taplin, R. (2010). Climate change, carbon prices and insurance systems. International Journal of Sustainable Development & World Ecology, 17(2), 95–108. [Google Scholar]

- Pitrakkos, P., & Maroun, W. (2020). Evaluating the quality of carbon disclosures. Sustainability Accounting, Management and Policy Journal, 11(3), 553–589. [Google Scholar] [CrossRef]

- Pranugrahaning, A., Donovan, J. D., Topple, C., & Masli, E. K. (2023). Exploring corporate sustainability in the insurance sector: A case study of a multinational enterprise engaging with un SDGS in Malaysia. Sustainability, 15(11), 8609. [Google Scholar] [CrossRef]

- Rejda, G. E. (2005). Risk management and insurance (Vol. 13, pp. 44–55). Person Education Inc. [Google Scholar]

- S&P. (2023). Catastrophe risk appetite varies among global reinsurers, report says. Available online: https://www.spglobal.com/ratings/en/research/articles/230824-catastrophe-risk-appetite-varies-among-global-reinsurers-report-says-12833493 (accessed on 5 May 2025).

- S&P. (2024). Global reinsurers grapple with climate change risks. Available online: https://www.spglobal.com/ratings/en/research/articles/210923-global-reinsurers-grapple-with-climate-change-risks-12116706 (accessed on 5 May 2025).

- The Greenhouse Gas Protocol Initiative. (2024). The greenhouse gas protocol. Available online: https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf (accessed on 5 May 2025).

- United Nations Environment Programme. (2023). About loss and damage. Available online: https://www.unep.org/topics/climate-action/loss-and-damage/about-loss-and-damage (accessed on 5 May 2025).

- Wen, F., Wu, N., & Gong, X. (2020). China’s carbon emissions trading and stock returns. Energy Economics, 86, 104627. [Google Scholar] [CrossRef]

| Segment | N |

|---|---|

| Financial Guaranty | 30 |

| Life and Health | 605 |

| Managed Care | 106 |

| Mortgage Guarantee | 48 |

| Multi-line | 349 |

| Property and Casualty | 856 |

| Title Insurance | 49 |

| Total | 2043 |

| Variables | Definition |

|---|---|

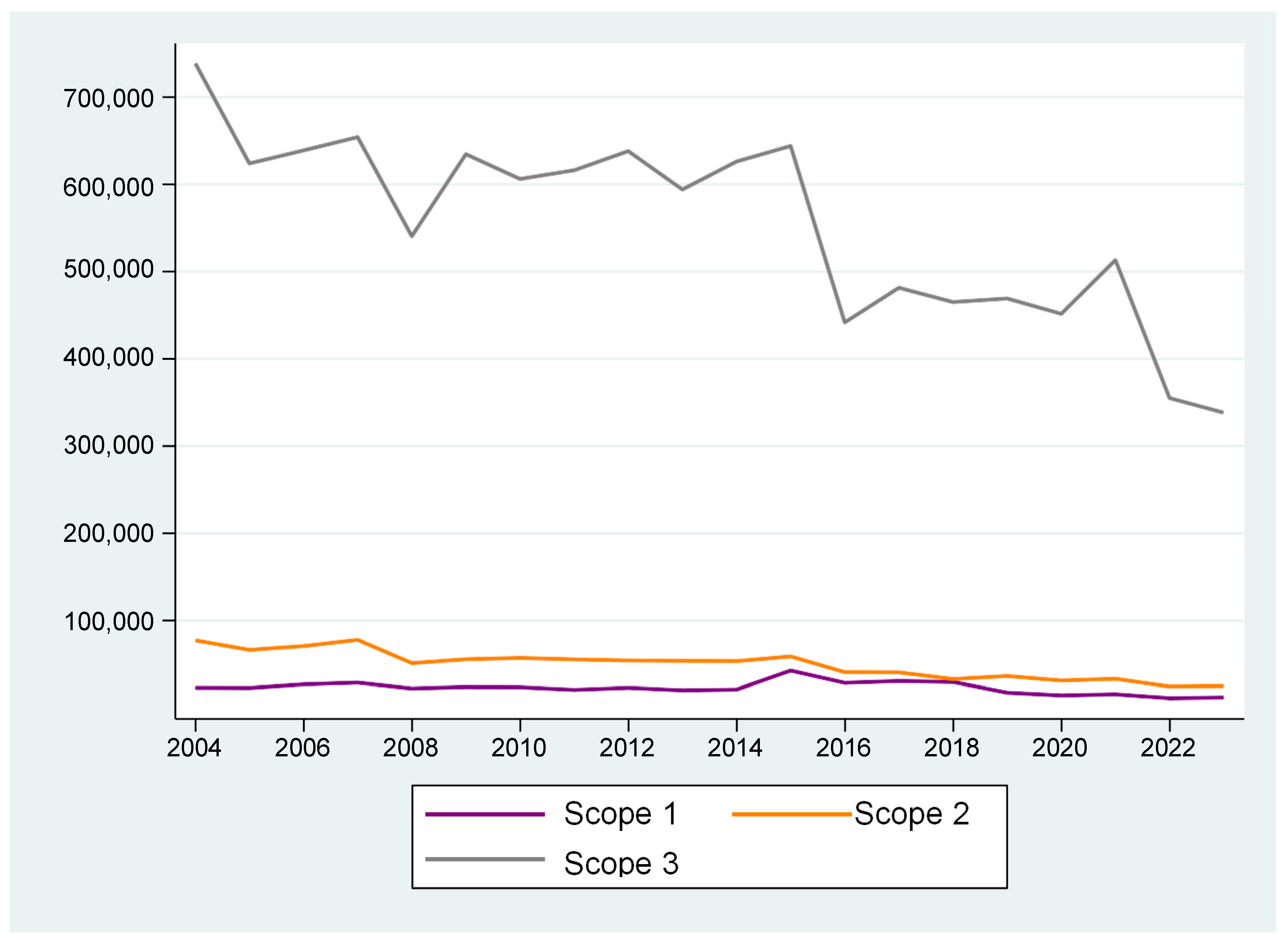

| GHG1 | Log of total scope 1 greenhouse gas emissions. |

| GHG2 | Log of total scope 2 greenhouse gas emissions. |

| GHG3 | Log of total scope 3 greenhouse gas emissions. |

| CR | Combined ratio, i.e., the sum of incurred losses, loss adjustment expenses, plus other underwriting expenses, divided by earned premiums. |

| PS | Premium-to-surplus ratio, i.e., the ratio of net premiums written to policyholder surplus. Policyholder surplus is total assets minus total liabilities. |

| RES | Ratio of reserves to policyholder surplus. |

| REINS | Ratio of ceded premiums to gross premiums. |

| DEBT | Ratio of total debt to total assets. |

| ROA | Ratio of net income to total assets. |

| GP | Ratio of gross premiums to total assets. |

| INV | Ratio of investment income to total assets. |

| ESG | ESG score of the company. |

| Mean | Min | Max | Std. Dev. | |

|---|---|---|---|---|

| Scope 1 emissions (tons CO2e) | 21,645 | 0 | 3,157,004 | 129,130 |

| Scope 2 emissions (tons CO2e) | 43,765 | 0.74 | 2,071,311 | 111,439 |

| Scope 3 emissions (tons CO2e) | 514,961 | 5.48 | 13,800,000 | 1,003,674 |

| CR | 92.8301 | 31.0756 | 184.2003 | 15.9115 |

| PS | 1.0817 | 0.0014 | 4.3780 | 0.7228 |

| RES | 5.6780 | 0.0000 | 37.0878 | 6.5525 |

| REINS | 14.1301 | 0.0000 | 74.3503 | 14.6476 |

| DEBT | 0.0830 | 0.0000 | 0.5569 | 0.1051 |

| ROA | 0.0198 | 0.0120 | 0.1591 | 0.0284 |

| GP | 0.2647 | 0.0000 | 1.0993 | 0.2086 |

| INV | 0.0274 | 0.0015 | 0.1532 | 0.0244 |

| ESG | 42.8500 | 2.0000 | 91.0000 | 20.2901 |

| GHG1 | GHG2 | GHG3 | CR | PS | RES | REINS | DEBT | ROA | GP | INV | ESG | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GHG1 | 1.000 | |||||||||||

| GHG2 | 0.8840 *** | 1.0000 | ||||||||||

| GHG3 | 0.8901 *** | 0.9074 *** | 1.0000 | |||||||||

| CR | 0.2191 *** | 0.2264 *** | 0.2124 *** | 1.0000 | ||||||||

| PS | 0.1724 *** | 0.1690 *** | 0.1741 *** | 0.2493 *** | 1.0000 | |||||||

| RES | 0.1461 *** | 0.1492 *** | 0.2008 *** | 0.1800 *** | 0.30501 *** | 1.0000 | ||||||

| REINS | −0.2540 *** | −0.2856 *** | −0.3347 *** | 0.0400 | −0.2334 *** | −0.0781 ** | 1.0000 | |||||

| DEBT | 0.1000 *** | 0.1080 *** | 0.0760 *** | −0.0651 * | −0.1581 *** | −0.2223 *** | −0.0863 *** | 1.0000 | ||||

| ROA | −0.0521 ** | −0.0360 | −0.0431 * | −0.4554 *** | −0.0880 *** | −0.3552 *** | −0.0890 *** | 0.0561 ** | 1.0000 | |||

| GP | −0.2567 *** | −0.2586 *** | −0.3041 *** | 0.0574 | 0.4165 *** | −0.4293 *** | 0.1941 *** | −0.1410 *** | 0.2060 *** | 1.000 | ||

| INV | 0.0370 | 0.0770 *** | 0.0720 *** | −0.0150 | −0.0160 | 0.1980 *** | −0.1841 *** | −0.0864 *** | 0.1051 *** | −0.1781 *** | 1.0000 | |

| ESG | 0.3680 *** | 0.4240 *** | 0.5590 *** | 0.0401 | −0.0241 | 0.2010 *** | −0.1944 *** | −0.0258 | −0.1119 *** | −0.2188 *** | −0.0315 | 1.0000 |

| GHG3 | CR | PS | RES | REINS |

|---|---|---|---|---|

| Low | 89.8252 | 0.9282 | 3.7338 | 19.1046 |

| Medium | 93.8303 | 1.110 | 6.1656 | 12.4263 |

| High | 97.5959 | 1.4910 | 8.1446 | 8.8308 |

| Dunn test (Low vs. High) | 35.6430 *** | 36.9988 *** | 67.6731 *** | 55.5707 *** |

| (1) CR | (2) CR | (3) CR | (4) CR | (5) CR | (6) CR | |

|---|---|---|---|---|---|---|

| GHG1 | 1.7106 *** | 0.9259 * | ||||

| (0.4591) | (0.4732) | |||||

| GHG2 | 1.9137 *** | 1.1961 ** | ||||

| (0.4982) | (0.4862) | |||||

| GHG3 | 1.8373 *** | 1.0286 * | ||||

| (0.552) | (0.552) | |||||

| DEBT | −0.0971 | −0.1132 | −0.0923 | |||

| (0.0883) | (0.0890) | (0.0871) | ||||

| ROA | −0.0489 *** | −0.0485 *** | −0.0487 *** | |||

| (0.0073) | (0.0073) | (0.0073) | ||||

| GP | 0.3415 *** | 0.3458 *** | 0.3506 *** | |||

| (0.0687) | (0.0687) | (0.0690) | ||||

| INV | 0.9824 * | 0.9391 | 0.9647 * | |||

| (0.5651) | (0.5725) | (0.5741) | ||||

| Constant | 79.2764 *** | 80.2902 *** | 75.4122 *** | 75.9698 *** | 71.2112 *** | 74.6378 *** |

| (4.3083) | (7.2181) | (5.1771) | (7.8864) | (7.1811) | (9.2711) | |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1154 | 939 | 1154 | 939 | 1154 | 939 |

| R-squared | 0.0483 | 0.5871 | 0.0511 | 0.5916 | 0.0453 | 0.5874 |

| (1) PS | (2) PS | (3) PS | (4) PS | (5) PS | (6) PS | |

|---|---|---|---|---|---|---|

| GHG1 | 0.0692 * | 0.1439 *** | ||||

| (0.0351) | (0.0271) | |||||

| GHG2 | 0.0735 ** | 0.1475 *** | ||||

| (0.0352) | (0.0300) | |||||

| GHG3 | 0.0762 ** | 0.1600 *** | ||||

| (0.0341) | (0.0309) | |||||

| DEBT | −0.0064 ** | −0.0083 ** | −0.0077 ** | |||

| (0.0031) | (0.0031) | (0.0032) | ||||

| ROA | −0.0006 *** | −0.0006 *** | −0.0006 *** | |||

| (0.000) | (0.000) | (0.000) | ||||

| GP | 0.0234 *** | 0.0233 *** | 0.0238 *** | |||

| (0.0022) | (0.0022) | (0.0030) | ||||

| INV | 0.0098 | 0.0102 | 0.0074 | |||

| (0.0115) | (0.0120) | (0.0120) | ||||

| Constant | 0.5517 ** | −0.0617 | 0.4246 | −0.3139 | 0.1987 | −0.8351 * |

| (0.2504) | (0.3097) | (0.2937) | (0.3683) | (0.3763) | (0.4289) | |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1397 | 1074 | 1397 | 1074 | 1397 | 1074 |

| R-squared | 0.0303 | 0.4261 | 0.0288 | 0.4204 | 0.0300 | 0.4311 |

| (1) RES | (2) RES | (3) RES | (4) RES | (5) RES | (6) RES | |

|---|---|---|---|---|---|---|

| GHG1 | 0.4844 * | 0.5716 * | ||||

| (0.2462) | (0.3041) | |||||

| GHG2 | 0.5123 ** | 0.6999 ** | ||||

| (0.2581) | (0.3252) | |||||

| GHG3 | 0.7417 ** | 0.7217 * | ||||

| (0.3061) | (0.3796) | |||||

| DEBT | −0.1538 *** | −0.1605 *** | −0.1545 *** | |||

| (0.0352) | (0.0341) | (0.0338) | ||||

| ROA | −0.0064 *** | −0.0064 *** | −0.0063 *** | |||

| (0.0011) | (0.0011) | (0.0011) | ||||

| GP | −0.1006 *** | −0.1004 *** | −0.0988 *** | |||

| (0.0354) | (0.0338) | (0.0338) | ||||

| INV | 0.5331 ** | 0.5165 ** | 0.5098 ** | |||

| (0.2581) | (0.2551) | (0.2474) | ||||

| Constant | 1.8239 | 4.1109 | 0.9367 | 1.9880 | −3.1554 | 0.3071 |

| (1.9435) | (3.7257) | (2.4062) | (4.2315) | (3.5746) | (5.4766) | |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2043 | 1292 | 2043 | 1292 | 2043 | 1292 |

| R-squared | 0.021 | 0.422 | 0.022 | 0.427 | 0.043 | 0.429 |

| (1) REINS | (2) REINS | (3) REINS | (4) REINS | (5) REINS | (6) REINS | |

|---|---|---|---|---|---|---|

| GHG1 | −1.8910 *** | −2.0774 *** | ||||

| (0.6423) | (0.6263) | |||||

| GHG2 | −2.2211 *** | −2.5145 *** | ||||

| (0.5431) | (0.6286) | |||||

| GHG3 | −2.7073 *** | −2.7977 *** | ||||

| (0.5464) | (0.6537) | |||||

| DEBT | −0.0092 | 0.0173 | −0.0016 | |||

| (0.0831) | (0.0816) | (0.0784) | ||||

| ROA | −0.0057 | −0.0061 | −0.0067 | |||

| (0.0063) | (0.0063) | (0.0063) | ||||

| GP | 0.0800 | 0.0845 | 0.0765 | |||

| (0.0756) | (0.0691) | (0.0641) | ||||

| INV | −1.0237 ** | −0.9368 * | −0.8796 * | |||

| (0.5086) | (0.5154) | (0.4955) | ||||

| Constant | 29.0578 *** | 23.0737 *** | 34.4906 *** | 30.3081 *** | 46.1347 *** | 38.7178 *** |

| (5.1553) | (7.4666) | (5.2071) | (7.4489) | (6.7525) | (8.3765) | |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1744 | 1182 | 1744 | 1182 | 1744 | 1182 |

| R-squared | 0.0654 | 0.1847 | 0.0819 | 0.1970 | 0.1124 | 0.2145 |

| (1) CR | (2) CR | (3) CR | (4) PS | (5) PS | (6) PS | |

|---|---|---|---|---|---|---|

| GHG1t−1 | 1.5988 *** | 0.0834 ** | ||||

| (0.4445) | (0.0384) | |||||

| GHG2t−1 | 1.8221 *** | 0.0871 ** | ||||

| (0.4711) | (0.0407) | |||||

| GHG3t−1 | 2.0444 *** | 0.0945 ** | ||||

| (0.5352) | (0.0391) | |||||

| Constant | 78.0731 *** | 68.1910 *** | 64.1601 *** | 0.3889 | −0.0660 | −0.3139 |

| (5.0691) | (6.7496) | (7.7151) | (0.2597) | (0.4607) | (0.5108) | |

| Observations | 1083 | 1083 | 1083 | 1314 | 1314 | 1314 |

| R-squared | 0.0823 | 0.0842 | 0.0900 | 0.1390 | 0.1343 | 0.1408 |

| (1) CR | (2) CR | (3) CR | (4) PS | (5) PS | (6) PS | |

|---|---|---|---|---|---|---|

| Scope1/Assets | 0.0966 *** | −0.0016 | ||||

| (0.0283) | (0.0063) | |||||

| Scope2/Assets | 0.1559 | 0.0217 ** | ||||

| (0.1111) | (0.0108) | |||||

| Scope3/Assets | 0.0323 ** | 0.0054 *** | ||||

| (0.0164) | (0.0024) | |||||

| Constant | 90.7938 *** | 86.1059 *** | 88.5732 *** | 0.8802 *** | 0.8741 *** | 0.7593 *** |

| (3.1223) | (4.5971) | (3.4061) | (0.0996) | (0.0975) | (0.0932) | |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1154 | 1154 | 1154 | 1397 | 1397 | 1397 |

| R-squared | 0.0430 | 0.0461 | 0.0473 | 0.1067 | 0.1617 | 0.2316 |

| (1) CR | (2) CR | (3) CR | (4) PS | (5) PS | (6) PS | |

|---|---|---|---|---|---|---|

| ESG | −0.0316 | −0.0388 | −0.0824 ** | −0.0043 | −0.0044 | −0.0067 |

| (0.0368) | (0.0370) | (0.0410) | (0.0040) | (0.0040) | (0.0051) | |

| GHG1 | 1.4936 ** | 0.0797 * | ||||

| (0.7091) | (0.0496) | |||||

| GHG2 | 1.8049 ** | 0.0830 * | ||||

| (0.7486) | (0.0486) | |||||

| GHG3 | 2.1570 ** | 0.1028 * | ||||

| (0.9526) | (0.0537) | |||||

| Constant | 81.6760 *** | 77.4440 *** | 69.9026 *** | 0.5907 * | 0.4661 | 0.0867 |

| (6.9206) | (7.9767) | (11.7216) | (0.3206) | (0.3756) | (0.5339) | |

| Observations | 543 | 543 | 543 | 660 | 660 | 660 |

| R-squared | 0.0321 | 0.0426 | 0.0437 | 0.0387 | 0.0344 | 0.0400 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bressan, S. Greenhouse Gas Emissions and the Financial Stability of Insurance Companies. J. Risk Financial Manag. 2025, 18, 411. https://doi.org/10.3390/jrfm18080411

Bressan S. Greenhouse Gas Emissions and the Financial Stability of Insurance Companies. Journal of Risk and Financial Management. 2025; 18(8):411. https://doi.org/10.3390/jrfm18080411

Chicago/Turabian StyleBressan, Silvia. 2025. "Greenhouse Gas Emissions and the Financial Stability of Insurance Companies" Journal of Risk and Financial Management 18, no. 8: 411. https://doi.org/10.3390/jrfm18080411

APA StyleBressan, S. (2025). Greenhouse Gas Emissions and the Financial Stability of Insurance Companies. Journal of Risk and Financial Management, 18(8), 411. https://doi.org/10.3390/jrfm18080411