Abstract

Audit committees monitor the actions of managers as they pursue the goal of shareholder wealth maximization. The purpose of this study is to measure the impact of audit committee oversight on novel aspects of firm performance, including investor rationality, price expectations, human capital, and research and development expenses. It extends the literature to non-financial outcomes of audit committee oversight. The literature thus far has focused on the financial effects of audit committee oversight, such as return on assets, return on equity, risk, debt capacity, and firm value. Data was collected from 588 publicly traded firms in the U.S. pharmaceutical industry and energy industry from 2010 to 2022. Audit oversight was measured by the novel measurement of the frequency of the term ‘audit committee’ in annual reports and Form 10Ks from the SeekEdgar database. COMPUSTAT provided the remainder of the data. Panel Data fixed-effects models were used to analyze the data. Audit committee oversight significantly increased investor rationality, significantly reduced price expectations, and significantly increased human capital investment. An inverted U-shaped relationship occurred for audit committee oversight and research and development expenses, with audit oversight first increasing research and development expenses, then decreasing them. The study makes several contributions. First, the study uses a novel measure of audit oversight. Second, the study predicts the effect of audit committee oversight on unexplored non-financial measures, such as human capital and research and development expense. Third, the study offers a current test of the Miller model, as the last tests were performed over 20 years ago. Fourth, the study examines the impact of auditing on market measures that have not been explored in the literature, such as investor rationality and short selling.

1. Introduction

Corporate governance provides oversight of top management and firm operations by the Board of Directors. Governance consists of the Board’s ability to reduce conflicts of interest between managers and shareholders by activating monitoring devices of management conduct. One mechanism for monitoring is the audit committee, which is responsible for engaging audit firms to evaluate corporate financial statements and ensure their accuracy. For example, Jensen and Meckling (1976) observed the misuse of idle cash through agency costs. Examples included the misuse of cash to make non-synergistic mergers and the increase of discretionary expenses and accruals to mask spending to yield private benefit. It follows that audit committee oversight curbs agency costs. Another practice is earnings management, whereby earnings may be manipulated to conceal the firm’s true financial performance. It follows that the accurate reporting of earnings reduces asymmetric information between managers and shareholders (Arens et al., 2010). Alzoubi (2019) observed that audit committees and the internal audit function reduced discretionary accruals, the proxy for earnings management, for 86 industrial firms on the Amman Stock Exchange from 2007 to 2010.

Audit committee due diligence has been measured by audit committee characteristics. Measures of audit committee characteristics include independence (Baxter & Cottor, 2009), the financial expertise of audit committee members (Lisic et al., 2011), the size of the audit committee (Hamdan et al., 2013), and the frequency of meetings (DeZoort et al., 2002). This study uses a measure similar to frequency of meetings by measuring the frequency of the occurrence of ‘audit committee’ in annual reports, Form 10Ks, and other SEC filings. This study maintains that, like the frequency of audit committee meetings, the frequency of the occurrence of ‘audit committee’ in regulatory filings supports the notion that the audit committee is engaged and active if there is a high frequency of listings.

Intuitively, the increased accuracy of financial reporting provides firms with realistic values of income and expenses, which are inputs into strategic decisions yielding positive effects on financial performance. Likewise, monitoring curbs managerial excess, further suggesting positive effects on firm performance. Abraham et al. (2024) showed that audit committee oversight increased return on equity, reduced debt capacity, increased firm value, increased the price-to-sales ratio, reduced systematic risk, and reduced ROA volatility. Porumb et al. (2021) found reduced debt and reduced cost of capital due to the due diligence of audit committees. These results suggest that audit committee oversight encourages the prudent use of firm resources by reducing the propensity to acquire additional debt, reduce excessive equity investment, increase value, and reduce risk-taking. However, all of these measures are financial statement measures. Does audit oversight affect non-financial statement measures such as investor rationality, price expectations, human capital, and research and development expenses? We posit that these effects should be measured as a positive effect of audit oversight on investor rationality, which increases investor confidence in proposed equity investments, curbs irrational exuberance, provides compensation to hire talent, and adequately funds new product development. The supporting arguments are contained in the paragraphs below.

Investor behavior is worthy of assessment. As funds continue to flow into pension funds and non-pension investment portfolios, such as mutual funds and exchange-traded funds, institutions invest in equity securities with increasing long-term returns. Firms that have accurate financial reporting and prudent financial decision-making may be preferred by institutional investors, who conjecture that such firms make investments that boost revenue and limit wasteful spending. Al-Qadasi (2024) observed that firms with higher levels of institutional ownership invested in the internal audit function to facilitate the monitoring of managers.

The research question that this study pursues differs from Al-Qadasi (2024) in that, while that study’s concern was the influence of institutional investing on the audit function, this study is concerned with the impact of the results of the internal audit function, i.e., audit committee oversight on institutional investors and other investors. Does audit committee oversight lead investors to reduce trading volume? Does audit committee oversight increase pessimism by reducing price expectations? How does audit committee oversight influence CAPM returns? The literature does not offer studies that answer these questions, as it primarily considers the effects of personal characteristics on earnings management (Lyons, 2010; Ratu & Rahjang, 2024), cultural characteristics on audit committee effectiveness (Qi & Tian, 2012), and the ability of internal audit functions to meet Sarbanes–Oxley requirements (Hoi et al., 2007).

Miller (1977) proposed a price optimism model in which excessively optimistic investors trade to purchase securities whose prices are driven by irrational exuberance. In contrast, high short-sale costs prevent rational investors from trading. Consequently, this paper measures the impact of audit committee oversight on trading volume, share price, and short sale volume as measures of investor rationality and price expectations. Lower beta coefficients suggest less systematic risk. However, the Miller model has never been tested with audit oversight as a predictor of rational prices. Therefore, this study measures the impact of audit oversight on CAPM returns that employ beta coefficients, conjecturing that that audit oversight reduces CAPM returns by placing less demand on firms to increase returns due to their securities having lower risk.

As technology continues to proliferate in businesses by eliminating redundant and repetitive tasks, human capital may increasingly become the source of competitive advantage. Mavridis (2004) observed that intellectual capital increased bank performance among Japanese banks. Singh et al. (2016) reported an increase in return on assets from intellectual capital. Audit committee oversight provides accuracy in financial reporting so that firms can clarify the exact amount of funds available to pay competitive salaries for the talented labor needed to sustain competitive advantage. There is a paucity of research that relates audit committees to human capital. Buallay (2018) conducted one of the few studies relating audit committee characteristics to intellectual capital. She found that audit committee independence and the frequency of meetings increased intellectual capital, suggesting that independent, engaged audit committees encourage investment in the human and capital goods needed for growth. However, she did not directly measure audit committee oversight, as in this study.

Growth is also based on new product development. New products are needed for a firm to increase sales by attracting new customers while retaining existing customers. This study conjectures that accurate financial reports provided by audit committee oversight provide information on the amount of research and development expenditures possible from internal cash flows and the amount needed from the issuance of debt or equity. For example, audit committee oversight that cautions against increases in debt may limit the acquisition of additional capital from that source. Dividend payout ratios maintained at a high level may require the firm to seek external debt or equity financing. The literature does not yield studies of audit committee oversight on research and development.

This study measured the effect of audit committee oversight on investor rationality, price expectations, human capital, and research and development expense for a sample of U. S. pharmaceutical firms and energy firms from 2010 to 2022 using the same audit oversight measure as Abraham et al. (2024). Panel data fixed-effects models were created and regressed with audit committee oversight as the independent variable. Audit committee oversight significantly increased investor rationality, significantly reduced price expectations, and significantly increased human capital investment. An inverted U-shaped relationship occurred between audit committee oversight and research and development expenses, with audit oversight first increasing research and development expenses, then decreasing them.

This study contributes to knowledge in multiple ways. First, this study employs a novel measure of audit committee oversight. The SeekEdgar database measures the frequency with which the term ‘audit committee’ is mentioned in annual reports and Form 10Ks. This study reasons that the more frequently the term ‘audit committee’ is mentioned, the greater the audit committee oversight, as frequency of mention shows greater oversight activity by the audit committee. Three measures of audit oversight are used in the analysis. The first measure is the total frequency of instances of ‘audit committee.’ The second measure is the frequency of ‘audit committee’ in paragraphs with 300 words or more, which this study identifies as key audit findings. The third measure is the frequency of ‘audit committee’ in paragraphs with less than 300 words, representing less consequential decisions. The authors posit that three measurements are more comprehensive than a single measurement. Second, the study predicts the effect of audit committee oversight on unexplored non-financial measures, such as human capital and research and development expenses. Third, the study offers a test of the Miller model. The last tests of the Miller model were the Diether et al. (2002) study and the Jegadeesh and Titman (2001) study, both published over 20 years ago. Fourth, the study examines the impact of auditing on market measures such as investor rationality and short selling, which have not been explored in the literature.

2. Review of Literature and Hypotheses Development

2.1. Definition of Audit Committee Oversight

Audit committee oversight was defined by DeZoort et al. (2002, p. 4) as follows:

“An effective audit committee has qualified members with the authority and resources to protect shareholder interests by ensuring reliable financial reporting, internal controls, and risk management through its diligent oversight efforts.”

This definition requires skilled auditors with access to management, sufficient influence to make judgments of value, and the motivation to perform tasks with diligence.

Elmarzoukhy et al. (2023) identified critical audit matters (KAMs) as containing incremental information that reveals threats that can affect firm value. Such KAMs have been found to reduce the volatility of earnings forecasts (Bens et al., 2019) and decrease loan spreads (Porumb et al., 2021), suggesting that the audit function’s ability to identify and correct financial reports increases confidence on the part of creditors, who decrease estimates of volatility of earnings and reduce the cost of debt. As mentioned, Abraham et al. (2024) have shown that audit committee oversight increases return on equity, reduces debt capacity, increases firm value, increases the price-to-sales ratio, reduces systematic risk, and reduces ROA volatility. It follows that the ability of audit committee oversight to enhance financial reporting quality may have a positive impact on market measures of performance such as increased price-to-sales ratios, increased firm value, and reduced systematic risk. Market confidence in the firm’s financial viability is enhanced with the assurance that reports of financial viability are an authentic reflection of firm performance. Confidence results in the market increasing share price with respect to sales due to the market’s willingness to pay much more than sales for ownership of the firm. Confidence also has the effect of reducing the correlation of a firm’s prices with the market, which is a systematic risk. As a financially sound entity, a firm’s price trajectory may be less closely linked to the volatile movements of the broad market.

2.2. Audit Committee Oversight: Relationship with Prior Studies

Much of the literature on audit committees focuses on the impact of audit committee characteristics on financial performance and risk-taking. Audit committee characteristics include gender diversity on the audit committee, the financial expertise of audit committee members, audit committee independence, audit committee size, Big Six accounting firm presence on the audit committee, and the frequency of meetings. Buallay (2018) set forth that size, the frequency of meetings, independence, and financial expertise were key indicators of audit committee effectiveness. This study posits that audit committee oversight is important in curbing managerial opportunism as defined by agency theory. (Jensen & Meckling, 1976). Agency theory maintains that managers may seek private benefits at the expense of shareholder wealth maximization, as they are agents of owners, rather than owners. They may increase discretionary expenses and accruals or undertake nonsynergistic mergers and financially deleterious market expansions. This study aims to demonstrate that audit committee oversight, through accurate financial reporting, curbs managerial opportunism by facilitating the achievement of realistic security prices based on true firm performance. The novelty of the study lies in its linking of audit committee oversight to human capital and research and development expenses. There is a single study relating audit committee oversight to intellectual capital efficiency (which encompasses human capital) (Buallay, 2018), but there is a paucity of literature on the association of audit committee oversight with research and development expenses. This study extends Buallay’s (2018) findings, which related audit committee characteristics to intellectual capital efficiency, by focusing on one aspect of intellectual capital, i.e., human capital. This study is concerned with oversight rather than the characteristics of audit committees, as the authors reason that oversight constitutes specific actions by audit committees to increase investment in long-term growth. The study also relates audit committee oversight to research and development expenses. The authors feel that such investment is an input into long-term growth through the development of new products and processes. However, investment in research and development requires accurate financial reporting and restrictions on management. Accurate financial reports through audit committee oversight permit appropriate allocation of research funds. Oversight also keeps management from investing in too many low net present value projects, as accurate financial reports may show cost overruns.

2.3. Audit Committee Oversight and Investor Rationality

2.3.1. Audit Committee Oversight and Security Prices

This study sets forth that audit committee oversight reduces information asymmetry between managers and shareholders by increasing the flow of information about the firm to shareholders. Monitoring effectiveness increases transparency with positive effects on firm value, suggesting that equity prices may rise in response to effective audit committee oversight. A limited number of studies provide some empirical support for this position. Bronson et al. (2009) observed that market performance for financially distressed firms was significantly higher for firms in which partial audit committee independence existed. Yeh et al. (2011) obtained a similar result for the market performance of financial institutions with independent audit committees during crisis periods. This study posits that audit committee independence increases objectivity in monitoring management activities, increasing confidence that stock prices reflect true performance. Given the ability of audit committee oversight to increase the monitoring effectiveness of managers, idiosyncratic risk will be reduced, and firm value will be enhanced. Abraham et al. (2024) found a positive effect of audit committee oversight on firm value. The study used U.S. data with high levels of institutional ownership of securities. Institutions in the U.S. require that securities be fairly priced in order to permit them to make rational portfolio choices for their clients. These positive outcomes will be manifested in the form of increased security prices. In this study, a moving average of security prices was employed, as it provides a current measure of security prices over time as older data is discarded and newer data is included to compute the moving average.

Hypothesis 1.

Audit committee oversight significantly increases a three-period moving average of the security prices of securities under examination from 2010 to 2022.

2.3.2. Audit Committee Oversight and Trading Volume

Audit committee oversight suggests that financial reports will be accurate reflections of corporate performance. It follows that the securities of these firms will either reflect true value or be undervalued. They will not be overvalued, as overvaluation suggests overconfidence. Such securities will appeal to rational, cautious investors. The underlying theory emanates from the Miller (1977) model. Miller (1977) set forth that rational, pessimistic investors will not trade, as they believe in careful assessment of securities prior to purchase. Using U.S. securities, Jegadeesh and Titman (2001) observed that low trading volume represented rational investing, leading to superior financial performance. In support of Jegadeesh and Titman (2001), this study sets forth that audit committee oversight signals prudence in investing in a developed capital market such as that in the United States. Such prudence will result in the careful selection of securities among a vast number of investment choices, or lower trading volume will be the outcomes of audit committee oversight.

Hypothesis 2.

Audit committee oversight significantly reduces trading volumes of securities under examination, from 2010 to 2022.

2.4. Audit Committee Oversight and Price Expectations

2.4.1. Audit Committee Oversight and CAPM Returns

Audit committee oversight increases transparency about firm financial performance. Accurate reports of operating income, net profit, and cash flows provide investors with a realistic report of firm financial performance. Uncertainty about financial measures is reduced with the widespread dissemination of accurate financial statements. Abraham et al. (2024) found that audit committee oversight resulted in a decrease in systematic risk, or the sensitivity of firm risk to market price changes. As risk is uncertainty by definition, the reduction of firm risk reduces the risk of inaccurate correlations of future stock price movements with market prices. In the United States, investors demand higher threshold returns for holding securities with higher systematic risk to compensate themselves for losses with market downturns that reduce the value of such risky securities. Therefore, investors will not demand additional returns to compensate for high systematic risk, suggesting that the ability of audit committee oversight to increase the accuracy of reporting reduces the beta (measure of systematic risk), which reduces the expected returns of securities according to the CAPM equation listed below.

Reduced systematic risk is represented by a reduced beta coefficient in the Capital Asset Pricing Model (CAPM) (Sharpe, 1964), listed in Equation (1):

where

rj = return on security j;

rf = risk-free rate;

β = beta coefficient;

rm − rf = market risk premium.

The reduction in the beta coefficient in Equation (1) reduces rj, the return on security j, thus decreasing price expectations.

Hypothesis 3.

Audit committee oversight significantly reduces price expectations as measured by security returns in the Capital Asset Pricing Model (CAPM).

2.4.2. Audit Committee Oversight and Short Sale Volumes

Short sellers seek to make gains from stock with declining prices. They borrow stock, which they sell at high prices in the first round of trading. Then, they wait for anticipated price declines to be realized. In a subsequent round of trading, they repay the borrowed stock with reduced price stock, realizing a gain. Therefore, short sale volumes embed price expectations of declining stock values. Declining stock value expectations are impounded into prices by short sale volumes. Inherently, short sellers are pessimists. They attempt to short sell securities in which they have no expectation of rising prices. Rising prices will require repayment in more expensive stock. Abraham (2006) found that rational investors had higher short sale volumes, which led to short-term gains. In Section 2.3.2, we posit that audit oversight is related to prudent stock trading, or rational investing. The Miller (1977) model provides the theoretical underpinning for the relationship between rational investing and short selling. The Miller (1977) model maintained that rational investors have realistic expectations of future security prices. They do not have irrationally high expectations of security prices. As they expect the prices of certain securities to fall, they short sell those securities with the expectation of making a gain on stock with declining values.

Hypothesis 4.

Audit committee oversight significantly reduces price expectations as measured by increases in short sale volumes as a percentage of float or increases in short sale volumes as a percentage of shares outstanding.

2.5. Audit Committee Oversight and Human Capital

Buallay (2018) described human capital as intellectual capital that is partly provided by people. Intellectual capital is a business asset that is a source of competitive advantage. She considered human capital to be one component of intellectual capital. Intuitively, the skills and capabilities of employees that contribute to firm profitability is human capital. In the United States, industries with high wage labor, such as pharmaceuticals and technology, employ skilled human capital that must be employed efficiently.

Buallay (2018) found that the audit committee characteristics of the frequency of audit committee meetings and audit committee independence predicted the efficiency of intellectual capital. Greater audit committee independence resulted in the audit committee’s increased questioning of reported earnings figures. Baxter and Cottor (2009) showed that the increased scrutiny was instrumental in improving earnings quality. The frequency of meetings is representative of audit committees that carefully evaluate audit firms, ensuring a higher quality of service and resulting in future growth and profitability. Independence gives the audit committee autonomy in the selection of audit firms, whose ability to provide accurate financial reports permits the hiring of talent that increases the efficiency of intellectual capital. It follows that enhanced earnings quality and stringent assessment of audit firms increases human capital, in turn leading to future growth and profitability.

Hypothesis 5.

Audit committee oversight increases human capital investment. Specifically, audit oversight increases salaries and wages as proxies for human capital investment.

2.6. Audit Committee Oversight and Research and Development Expense

The aforementioned Buallay (2018) study defined intellectual capital as being composed of human capital and physical capital. Physical capital in this study is excluded, as it is presented as the control variable of tangibility, which is suppressed. However, capital investment in equipment and buildings has expenses, including rent and utilities for laboratories, salaries for technical staff, and materials. These items constitute research and development expenses.

Agency costs suggest the unproductive use of capital. The capital may be human in that human capital may not be employed efficiently by managers focused on furthering their own interests. Buallay (2018) found that the frequency of audit committee meetings and audit committee independence increased intellectual capital efficiency. This suggests that audit committee members who take their responsibilities seriously will meet frequently. Furthermore, audit committee independence suggests that audit committee members have the freedom to propose solutions to corporate concerns, be they ethical or financial. Buallay (2018) found that higher-quality financial statements and autonomy in decision-making increased the efficiency of human capital. Therefore, firms may first increase research and development expenditure. Audit committees with frequent meetings have been shown to carefully evaluate audit firms. It is likely that high-performing audit firms will audit research and development expenses with a view to establish projects with profit potential and discard projects with poor prospects. In the event that certain projects are discarded, research and development expenses may cease to increase monotonically. Such expenses may decline in an inverted U-shaped relationship with audit committee oversight, As the existence of such an inverted U-shaped relationship is based on an exploratory question, a research question rather than a hypothesis is stated below.

Research Question 1: Does audit committee oversight first increase research and development expense, followed by research and development expense leveling off and then declining?

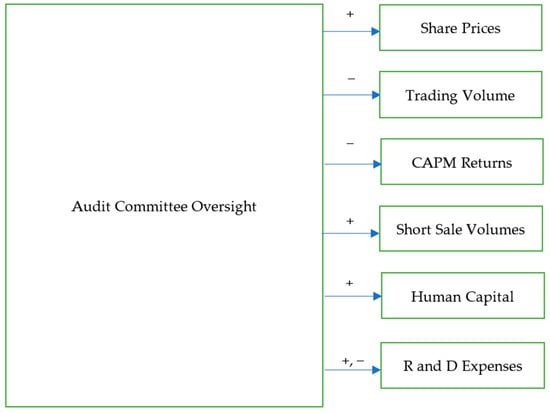

Figure 1 shows the hypothesized outcomes of audit committee oversight and the research question. Signs (positive or negative) on arrows show the direction of the prediction of audit committee oversight on the criteria. No signs are listed on the arrow from Audit Committee Oversight to Human Capital, which constitutes the research question.

Figure 1.

A diagram of hypothesized relationships.

Figure 1 shows the relationships that are stated in the hypotheses and Research Question 1. For the hypotheses, signs for the direction of relationships are provided. For the research question, no signs are listed.

3. Methodology

3.1. Data Collection

Table 1 presents a list of predictor variables, criterion variables, and control variables employed in this study. The sample consisted of 588 firms from the U. S. pharmaceutical industry and the U.S. energy industry, with data collected over the 2010–2022 time period. The study selected these two industries because they are heavily regulated. The authors reason that regulatory compliance is a form of governance, so firms that are subject to considerable regulation are likely to adopt audit oversight, as the regulatory standard requires accurate financial reporting. There were 548 pharmaceutical firms and 40 energy firms utilized. There were only 40 energy firms so that a subsample of such firms would not yield meaningful regression results. Data was collected from 2010 to 2022, as audit committee oversight frequencies could only be verified for accuracy until 2022. The SeekEdgar database was used to generate measures of audit committee oversight. SeekEdgar is a proprietary database that extracts frequencies based on corporate reports. Audit committee oversight was obtained by measuring the frequency with which the words ‘audit committee’ appeared in corporate annual reports and Form 10K reports. This study posits that the greater the frequency with which ‘audit committee’ is mentioned, the more active an audit committee is in monitoring management and creating quality financial reports. The justification for the use of frequency measures is as follows: The measures are sourced from SEC filings, which are subject to regulatory oversight. The authors selected frequencies as a novel measure because SEC filings contain such sparse mentions of audit committees that any mention indicates oversight activity. The authors question whether other measures of audit committee oversight, such as the frequency of meetings and audits by financial experts, have the same level of credibility as frequency measures. Audit committee meetings that may discuss non-oversight issues cannot be appropriate measures of audit committee oversight. Financial experts may reflect personal biases.

Table 1.

Description of Variables.

Three measures of audit committee oversight resulted. Audit Oversight Measure 1 measures the total frequency with which the term ‘audit committee’ is listed. Audit Oversight Measure 2 measures the frequency of mentions of ‘audit committee’ in paragraphs with >300 words. As such paragraphs carry a wealth of detail, this study views them as key strategic decisions. Audit Oversight Measure 3 captures the frequency of mentions of ‘audit committee’ in paragraphs with <300 words. The lesser detail of these paragraphs leads the authors to consider them to be regular decisions.

With the exception of short sale volumes and governance, which were extracted from proprietary databases, the remaining criterion variables and control variables were obtained from the COMPUSTAT database. They include trading volume, risk-free rate, beta coefficient, market risk premium, salary expenses, research and development expenses, leverage, firm size, tangibility, and COVID Dummy. Trading volume was scaled by total assets. The risk-fee rate, beta, and market return were used to compute CAPM returns. Leverage was used to suppress debt effects, with debt to assets as the measurement. Tangibility was determined by the ratio of fixed assets to total assets. COVID Dummy is a dichotomous variable applied to 2020–2021 data to account for price distortions during the COVID-19 lockdown period.

3.2. Data Analysis

Fixed effects regressions were performed on seven sets of panel data as listed in the Equations (2)–(8) below.

Investor Rationality regressions are listed in Equations (2) and (3):

Share Pricej = αj + β1j (Audit Oversight Measures 1–3) + β2j (Leverage) + β3j (Tangibility) + β4j (Firm Size) + β3j (COVID Dummy)

Trading Volumej = αj + β1j (Audit Oversight Measures 1–3) + β2j (Leverage) + β3j (Tangibility) + β4j (Firm Size) + β3j (COVID Dummy)

Regressions with price expectations as the dependent variable are listed in Equations (4)–(6) below:

CAPM Returnj = αj + β1j (Audit Oversight Measures 1–3) + β2j (Leverage) + β3j (Tangibility) + β4j (Firm Size) + β3j (COVID Dummy)

Short Sales as a Percentage of Floatj = αj + β1j (Audit Oversight Measures 1–3) + β2j (Leverage) + β3j (Tangibility) + β4j (Firm Size) + β3j (COVID Dummy)

Short Sales as a Percentage of Shares Issuedj = αj + β1j (Audit Oversight Measures 1–3) + β2j (Leverage) + β3j (Tangibility) + β4j (Firm Size) + β3j (COVID Dummy)

The regression with human capital as the dependent variable is listed in Equation (7) below:

Human Capitalj = αj + β1j (Audit Oversight Measures 1–3) + β2j (Leverage) + β3j (Tangibility) + β4j (Firm Size) + β3j (COVID Dummy)

The regression with research and development expenses as the dependent variable is listed in Equation (8) below:

Research and Development Expensej = αj + β1j (Audit Oversight Measures 1–3)2 + β2j (Audit Oversight Measures 1–3) + β3j (Leverage) + β4j (Tangibility) + β5j (Firm Size) + β6j (COVID Dummy)

4. Results

4.1. Results of Hypotheses Testing

Table 2 provides descriptive statistics for all variables. It includes the range of values, means, and standard deviations. Two additional moments of the mean, i.e., the skewness and kurtosis values, are presented. The values of skewness and kurtosis are sufficiently low to eliminate the presence of nonnormal leptokurtic distributions for the predictors and criteria. Specifically, all skewness values are <100, and all kurtosis values are <1000. Panel B provides a correlation matrix of the variables under consideration. Table 2, Panel B shows the close relationship among the three audit committee oversight measures, which are significantly intercorrelated (correlation coefficients < 0.001). Audit committee oversight measures exhibit significant correlations with price and human capital, suggesting that increases in audit committee oversight increases security prices and human capital investment.

Table 2.

Descriptive statistics and correlations.

All five hypotheses were supported. Research Question 1 was answered. Hypotheses 1 and 2 measured the influence of audit committee oversight on investor rationality. Audit committee oversight increased investor rationality. Hypothesis 1 stated that audit committee oversight would significantly increase the three-period moving average for the security prices under consideration. Table 3 shows that Hypothesis 1 was supported for all three measures of audit oversight. Audit Oversight Measure 1 significantly increased the three-period moving average of share prices (Coefficient = 0.001, p < 0.001). Audit Oversight Measure 2 significantly increased the three-period moving average of share prices (Coefficient = 0.43, p < 0.001). Audit Oversight Measure 3 significantly increased the three-period moving average of share prices (Coefficient = 0.03, p < 0.001). Hypothesis 2 stated that audit committee oversight would significantly reduce the trading volumes of the securities under consideration. Table 3 shows that Hypothesis 2 was partially supported, with Audit Oversight Measure 1 and Audit Oversight Measure 3 significantly reducing trading volume (Coefficient = −0.0001, p < 0.05; Coefficient = −0.002, p < 0.05).

Table 3.

Audit oversight as a predictor of investor rationality.

Hypotheses 3 and 4 tested the influence of audit committee oversight on price expectations (particularly, irrational exuberance). Audit committee oversight was found to restrain irrationally optimistic price expectations. Table 4 shows that Hypotheses 3 and 4 were partially supported. Hypothesis 3 stated that audit committee oversight would significantly reduce CAPM security returns. Audit Oversight Measure 1 significantly reduced CAPM security returns (Coefficient = −0.0001, p < 0.05). Audit Oversight Measure 2 significantly reduced CAPM security returns (Coefficient = −0.19, p < 0.001). Hypothesis 4 stated that audit committee oversight would significantly increase short sales volumes as a percentage of float and short sale volumes as a percentage of shares outstanding. Hypothesis 4 was partly supported in that two audit oversight measures increased either measure of short sale volumes. Audit Oversight Measure 1 increased short sale volume as a percentage of float (Coefficient = 0.0004, p < 0.05). Audit Oversight Measure 3 increased short sale volume as a percentage of float (Coefficient = 0.001, p < 0.05) and increased short sale volume as a percentage of shares issued (Coefficient = 0.0007, p < 0.05).

Table 4.

Audit oversight as a predictor of price expectations.

Table 5 shows the effects of audit committee oversight on human capital. Hypothesis 5 stated that audit committee oversight would increase human capital investment. Hypothesis 5 was supported for all three measures of audit oversight. Audit Oversight Measure 1 significantly increased salaries and wages expenses (Coefficient = 0.00002, p < 0.001), Audit Oversight Measure 2 showed a positive association with human capital (Coefficient = 0.009, p < 0.001), and Audit Oversight Measure 3 significantly increased salaries and wages expenses (Coefficient = 0.0003, p < 0.001).

Table 5.

Audit oversight as a predictor of human capital.

Table 6 shows the influence of audit committee oversight on research and development expenses. Research Question 1 questioned the relationship between audit committee oversight and research and development expenses. Audit Oversight Measure 3 showed a nonlinear relationship with research and development expenses (Coefficient for Audit Oversight Measure 32 = 0.000003, p < 0.01; Coefficient for Audit Oversight Measure 3 = −0.011, p < 0.001). The opposite signs suggest that as audit committee oversight increases, research and development expenses first increase (positive coefficient) and then decrease (negative coefficient).

Table 6.

Audit oversight as a predictor of research & development expenditures.

Certain results involving control variables are of interest. Table 4 shows that tangibility significantly negatively predicted two measures of short sale volumes. Perhaps firms with substantial investment in buildings and equipment generated optimism among investors. The opposite was true for firm size. Large firms had investors who were more pessimistic in that firm size positively predicts short sales volumes. Non-tangible assets may drive investors from optimism to pessimism, a conclusion that should be examined in future studies. The COVID dummy variable showed a strong negative relationship with human capital and research and development expenses. It is conceivable that restrictions on human interaction during COVID lockdowns reduced investment in both human capital and physical capital for new product development.

4.2. Robustness Check

Table 7 shows the results of all regressions in this study using a global measure of governance designed to act as a robustness check on the audit committee oversight measures employed. The governance measure is used by Institutional Shareholder Services, a leading provider of corporate governance data in 15 countries with an international roster of institutional clients (ISS, 2025). The measure rates firms’ levels of governance on a scale of 1 (lowest level of governance) to 10 (highest level of governance). The governance measure yielded similar results to the results contained in Table 4, Table 5, Table 6 and Table 7, suggesting that the audit committee oversight measures used were indeed measures of governance.

Table 7.

Robustness check using governance measure’s impact on outcomes.

4.3. Discussion of Results

The results of the study will be discussed in this section. First, audit committee oversight supports investor rationality by increasing security prices and reducing trading volume. According to the Miller (1977) model, excessively optimistic investors trade to locate new securities that they falsely assume will generate abnormal gains. Audit committee oversight is effective in providing quality financial reporting and monitoring management’s commitment to upholding shareholder interests. This paper has provided evidence to support the effectiveness of audit committee oversight in multiple areas that have not been examined in the literature. The first area is investor rationality. Both the Bronson et al. (2009) study and the Yeh et al. (2011) study need to be updated for the current business environment. This study fulfills that purpose in that it shows that audit committee oversight’s increased accuracy of financial reporting and transparency in disseminating information about management’s financial performance instills confidence in investors to the extent that share prices increase.

Audit committee oversight curbs such expectations, as it reduces the volume of securities traded. This increases investor rationality. The result of this study is identical to Jegadeesh and Titman’s (2001) finding that low trading volume is associated with rational investors who fail to trade on the basis of irrational security price forecasts. Future research may find it useful to replicate this result for financially constrained firms to determine if audit committee oversight’s ability to reduce information asymmetry is upheld for firms with extreme information asymmetry arising from management’s desire to conceal information about acute financial distress.

Second, audit committee oversight curbs price expectations, as it was found to reduce CAPM returns and increase short sale volumes. Following the Miller (1977) model, investors in securities with high audit committee oversight will have realistic expectations of CAPM returns, believing that certain securities will have continuously declining prices. They will short sell those securities to earn gains upon negatively priced securities. Blau and Brough (2012) observed concentrated periods of short selling that increased with the heterogeneity of investor price expectations. The more heterogeneous the price expectations, the more likely that investors would have expectations of declining security prices. These investors short sell securities to achieve gains from falling stock prices.

Third, audit committee oversight increases human capital investment. This result complements Buallay’s (2018) finding that audit committee characteristics, including the number of audit committee meetings and audit committee independence, increase intellectual capital efficiency. Given that audit committee oversight is associated with accurate financial reporting that reduces earnings manipulation (Abraham et al., 2024), the accuracy in financial reporting may lead to greater investment in human capital through the hiring of productive employees. Fourth, audit committee oversight first increases research and development expenses, as accurate financial reports indicate the appropriate amount of research and development expenses. Such investment provides an impetus for new product development. At a peak level of R&D investment, additional audit committee oversight reduces research and development expenses. Future research should explore the reasons for this outcome.

5. Conclusions

5.1. Theoretical Implications

Audit committee oversight is associated with investor rationality. Rational investors will be unmoved by unrealistic price projections, preferring to evaluate securities based on the accurate final reports of performance that are within the purview of audit committees. Investors must seek out securities issued by firms with rigorous audit committee oversight. Both corporate debt and equity valuations will be fairly priced. Fairly priced bonds can be easily compared to alternative fixed-income investments. Farly priced bonds will earn higher bond ratings, as their values reflect a record of regular bond payments with a return of bond par value upon maturity. Investors can trust claims of the investment of funds from debt capital into producing new products, market expansion, and other pursuits to increase the value of the firm, as these claims have been investigated and approved by audit committees. Equities will be priced at their true values, boosting the confidence of mutual fund managers, hedge fund managers, and retirement planners, who may include these equities in their portfolios because their performance has been verified by audit committees.

In accordance with the Miller (1977) model, investors who are swayed by irrationally optimistic expectations of security prices will trade, as they lack clarity about winning stock. To find winners, they trade excessively, purchasing securities that they expect to have elevated prices. Excessive trading leads to a wide variety of stock purchases. Diether et al. (2002) observed that the wide variety of stocks purchased could be effectively proxied by the dispersion of analysts’ forecasts of security prices. The greater the dispersion, the poorer the performance of the securities. Conversely, audit committee oversight restrains unrealistic price expectations by reducing systematic risk or the risk attributed to the correlation of the security movements with the general market. Using the Capital Asset Pricing Model, systematic risk reduction reduces the required return for stock.

In the Miller (1977) model, rational investors have the intent to sell overpriced stock. Audit committee oversight increases prudence and rationality, stimulating short selling as rational investors divest themselves of securities that may have financial misreporting or inflated prognostications. Such securities use earnings management and material misstatements to mask financial underperformance. As audit reports reveal these financial irregularities, investors express skepticism about future price projections, opting to short sell the securities.

The increased transparency from the dissemination of high-quality financial reports contributes to market efficiency. If we accept that U.S. markets are semi-strong form efficient, security prices reflect publicly available information. The addition of securities with audit committee oversight increases the flow of publicly available information that will be reflected in security prices. Increased information availability reduces the potential for trading for private benefit and abnormal returns for a few investors. Increased audit committee oversight increases the potential for wealth creation, as all investors may use public information to increase wealth through the acquisition of utilities.

Human capital investment, as presented in this study, is the monetary investment in salaries and wages needed to attract top talent. Talented employees are viewed as conferring significant competitive advantage upon the firm, as they use their creativity for new product development. For example, technological breakthroughs in artificial intelligence, drone technology, self-driving vehicles, and robots have ushered a stream of new products. Likewise, managerial capability in locating supply chains, finding suppliers, and finding scarce production inputs confers human capital-based competitive advantages upon a firm.

How does audit committee oversight increase investment in the conceptualization of human capital as talent acquisition? This study surmises that as audit committees disseminate accurate financial reports, management becomes more knowledgeable about cash flows available for the hiring of talented employees, allowing management to proceed with the payment of competitive wages for talent acquisition. Reduced earnings figures may be used to compute realistic cash flows. Reduced accruals will reduce current liabilities, boosting working capital. The combination of realistic cash flows and increased working capital will free up cash for the payment of competitive wages.

This linkage of audit committee oversight to human capital is unique to this study, as the literature’s explanation of audit committees’ effects on human capital has been confined to the effect of audit committee independence and audit committee size on structural capital (Dashtbayaz et al., 2020) and the ability of corporate governance processes to increase structural capital (Keenan & Aggestam, 2001). Structural capital, as defined in these studies, is based on organizational processes, in contrast with this study’s definition of human capital as talent acquisition.

5.2. Practical Implications

Rational investing is recommended, as an investor can evaluate a firm’s performance based on true financial figures contained in financial statements. The investor does not have to adjust expectations based on manipulated earnings figures and inflated accruals. Thus, audit committee oversight can have a positive influence on investor portfolio choices. Investors can restrict trades to a few securities with the knowledge that they are avoiding securities with unrealistic price expectations. Investors may engage in the short selling of stock which has been assessed by audit committees, secure in the knowledge that such securities will yield short-sale gains, as they will decline continuously in value. Investors will be able to identify securities that have been issued by companies with strong audit committee oversight as worthwhile investments that supersede unscientific recommendations from the popular press. Investors may use CAPM to identify securities with high CAPM returns from high systematic risk, which should be avoided, as they will significantly increase portfolio risk.

The most intriguing practical implications are for audit committee oversight on human capital. Firms may increase investment in employee talent to promote long-term growth provided that their additional salary expense is based on salary projections from audited financial reports rather than mere speculation. Managers should assess research and development expenditures carefully and reject less promising projects so that the increased monitoring of expenses over time does not reduce investment in research and new product development, i.e., so that the inversion of the U-shape in the results does not occur.

5.3. Research Limitations and Future Research

The sample under consideration consisted of U.S. pharmaceutical companies and energy firms, both of which are regulated industries. Future research should repeat the study for less regulated industries.

Non-U.S. samples could add valuable insights to corporate governance. A few studies have examined the influence of audit committee characteristics such as independence, gender diversity among audit committee members, and the financial expertise of board committee members for non-U.S. samples (see Dashtbayaz et al., 2020, for a review). It would enrich the literature to determine the impact of audit committee oversight on unexplored outcomes such as investor rationality, price expectations, human capital, and research and development expenses.

The study did not include capitalized development expenses such as intangible assets in the analysis involving research and development expenses. Future studies must include this variable.

The nonlinearity of the results needs to be explored through an in-depth analysis. The quadratic functional form was validated in this study, but it is only one of the nonlinear functional forms. Future research must consider the relationship of audit committee oversight in logarithmic or hyperbolic functional forms to determine if these forms yield more optimal fits with research and development expenses.

The human capital variable was not deflated by the number of employees due to concerns about the accuracy of data. Future studies should overcome this limitation.

Author Contributions

Conceptualization, R.A. and V.M.B.; Methodology, R.A. and H.E.-C.; Software, R.A. and V.M.B.; Validation, H.E.-C.; Formal Analysis, V.M.B.; Investigation, R.A. and V.M.B.; Resources, V.M.B.; Data Creation V.M.B.; Writing—Original Draft Preparation, R.A.; Writing—Review & Editing, R.A. and V.M.B.; Visualization, H.E.-C.; Supervision, V.M.B.; Project Administration, V.M.B. and H.E.-C.; Funding Acquisition, R.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Dataset available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abraham, R. (2006). An exploration of earnings whispers forecasts as predictors of stock returns. Journal of Economic Studies, 32, 524–539. [Google Scholar] [CrossRef]

- Abraham, R., El-Chaarani, H., & Deari, F. (2024). Does audit oversight quality reduce bankruptcy risk, systematic risk, and ROA volatility?: The role of institutional ownership. Journal of Risk and Financial Management, 17, 335. [Google Scholar] [CrossRef]

- Al-Qadasi, A. A. (2024). The power of institutional investors: Empirical evidence on their role in investment in the internal audit function. Managerial Auditing Journal, 39, 166–190. [Google Scholar] [CrossRef]

- Alzoubi, E. S. S. (2019). Audit committee, internal audit function and earnings management: Evidence from Jordan. Meditari Accounting Research, 27, 72–90. [Google Scholar] [CrossRef]

- Arens, A., Elder, R., Beasley, M., III, & Hogan, C. (2010). Auditing and assurance services: An integrated approach. Prentice-Hall. [Google Scholar]

- Baxter, P., & Cottor, J. (2009). Audit committee and earnings quality. Accounting and Finance, 49, 267–290. [Google Scholar] [CrossRef]

- Bens, D., Cheng, W. J., & Huang, S. (2019). The association between the expanded audit report and financial quality. Working Paper. Singapore National University. [Google Scholar]

- Blau, B., & Brough, T. (2012). Concentrated short selling activity: Bear raids or contrarian trading? International Journal of Managerial Finance, 8, 187–203. [Google Scholar] [CrossRef]

- Bronson, S., Carcello, J., Hollingsworth, C., & Neal, T. (2009). Are fully independent audit committees really necessary? Journal of Accounting and Public Policy, 28, 265–280. [Google Scholar] [CrossRef]

- Buallay, A. (2018). Audit committee characteristics: An empirical investigation of the contribution to intellectual capital efficiency. Measuring Business Excellence, 22, 183–200. [Google Scholar] [CrossRef]

- Dashtbayaz, M. L., Salehi, M., Mirzaei, A., & Nazaridaraji, H. (2020). The impact of corporate governance on intellectual capital’s efficiency in Iran. International Journal of Islamic and Middle Eastern Finance and Management, 13, 749–766. [Google Scholar] [CrossRef]

- DeZoort, T., Hermanson, D. R., Archambeault, D. S., & Reed, S. A. (2002). Audit committee effectiveness: A synthesis of the empirical audit committee literature. Journal of Accounting Literature, 21, 38–75. [Google Scholar]

- Diether, K. B., Malloy, C. J., & Scherbina, A. (2002). Differences of opinion and the cross section of stock returns. Journal of Finance, 57, 2113–2141. [Google Scholar] [CrossRef]

- Elmarzoukhy, M., Hussainey, K., & Abdulfattah, T. (2023). The key audit matters and the audit cost: Does governance matter? International Journal of Accounting and Information Management, 31, 195–217. [Google Scholar] [CrossRef]

- Hamdan, A., Serea, A., & Peyaci, S. (2013). The impact of audit committee characteristics on the performance: Evidence from Jordan. International Management Review, 19, 32–42. [Google Scholar]

- Hoi, C.-K., Ashok, R., & Tessoni, D. (2007). Sarbanes-Oxley: Are independent auditors up to the task? Managerial Auditing Journal, 22, 255–267. [Google Scholar]

- Institutional Shareholder Services (ISS). (2025). Available online: https://www.issgovernance.com/ (accessed on 1 May 2025).

- Jegadeesh, N., & Titman, S. (2001). Profitability of momentum strategies: An evaluation of alternative explanations. Journal of Finance, 56, 699–720. [Google Scholar] [CrossRef]

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3, 305–360. [Google Scholar] [CrossRef]

- Keenan, J., & Aggestam, M. (2001). Corporate governance and intellectual capital; some conceptualisations. Corporate Governance: An International Review, 9, 259–275. [Google Scholar] [CrossRef]

- Lisic, L. L., Neal, T., & Zhang, Y. (2011). Audit committee financial expertise and restatements: The moderating effect of CEO power. School of Management, George Mason University. [Google Scholar]

- Lyons, J. M. (2010). Reporting independent directors after Sarbanes-Oxley. Business Law Today, 19, 53–57. [Google Scholar]

- Mavridis, D. (2004). The intellectual capital performance of Japanese banking sector. Journal of Intellectual Capital, 5, 92–111. [Google Scholar] [CrossRef]

- Miller, E. (1977). Risk, uncertainty, & divergence of opinion. Journal of Finance, 32, 1151–1168. [Google Scholar]

- Porumb, V. A., Zengin-Karairaghimoglu, Y., & Lobo, P. H. (2021). Expanded auditors’ report disclosures and loan contracting. Contemporary Accounting Research, 38, 3214–3253. [Google Scholar] [CrossRef]

- Qi, B., & Tian, G. (2012). The impact of audit committees personal characteristics on earnings management: Evidence from China. Journal of Applied Business Research, 28, 1331–1343. [Google Scholar] [CrossRef]

- Ratu, D. M., & Rahjang, D. K. (2024). Anti-corruption policy and earnings management: Do women in monitoring roles matter? Asian Journal of Accounting Research, 9, 340–357. [Google Scholar] [CrossRef]

- Sharpe, W. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425–442. [Google Scholar]

- Singh, S., Sidhu, J., Joshi, M., & Karnsal, M. (2016). Measuring intellectual capital performance of Indian banks: A public and private sector performance. Managerial Finance, 42, 635–655. [Google Scholar] [CrossRef]

- Yeh, Y.-H., Chung, H., & Liu, C.-L. (2011). Committee independence and financial institution performance during the 2007–2008 credit crunch: Evidence from a multi-country study. Corporate Governance: An International Review, 19, 437–458. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).