Abstract

This study presents a bibliometric analysis, using spatial approach, of 943 articles from 2003 to March 2025 showing the growing importance of CDSs in the literature and their role in credit risk management. The Web of Science’s Core Collection database was used for bibliometric mapping. The bibliographic data were grouped and analyzed using VOSviewer to create network visualization maps that included country-wise, document-wise, and source-wise citations analysis, bibliographic coupling, and the co-occurrence of keywords. Subsequently, significant terms were identified through the analyses where risk assessment, risk management, and credit derivatives were found to be the most used keywords. Further, USA turns out to be the country where the most research was published on CDSs with maximum citations, highlighting the growing popularity of this research topic in this region. In addition, bibliographic coupling appears to capture information from 13 clusters formed during the analysis on bibliographically linked documents with their link strength. The bibliometric analysis of the CDS literature illustrates the intellectual framework of research on this topic, traces the progression of the research topic over time, and identifies the areas where this research field might develop in the future.

1. Introduction

Credit default swaps (CDSs), invented by JP Morgan in the United States, have proven to be the pervasively marketed credit derivatives for transferring credit risk (Lai et al., 2025; Tabassum & Yameen, 2024; Zhao & Zhu, 2024). The company devised a way in the form of a financial product in 1997 to mitigate heavy capital adequacy requirements and protect itself from the default of loans offered to banks, companies, and foreign governments (Y. Wang et al., 2025; Klieber, 2012). Historically, they have been used to alleviate the problem of credit defaults (Meng & Ap Gwilym, 2007). In 2007, CDS contracts achieved a notional outstanding amount of USD 62.2 trillion (Beyhaghi et al., 2017), making them the third-largest swap market as well as the most popular credit derivatives (Ghosh, 2017). The onset of the global financial crisis, however, caused the market to collapse and plummet to its present level of roughly USD 10 trillion. The use of CDSs as a risk transfer instrument remained valuable in the post-crisis era as well. The growing importance of CDSs can be seen in the uprising volume in their trading (McNally, 2009). CDS transactions remained on an upward trend, according to Bank for International Settlements (BIS) statistics, indicating a moderate but constant increase in CDS contracts. However, market participants and policymakers have noted a downward inclination in CDS credit market activity since the global financial crisis of 2007–2008 (Coughlan et al., 2019). They are currently showing a trend of around USD 10 trillion (ISDA, 2021). The CDS market consists of (i) single-name and (ii) multi-name CDS contracts. Single-name CDS contracts are the most liquid form of credit derivatives, with 1, 3, and 5-year periods of maturity. As an additional point to mention, single-name CDS contracts are based on a relatively transparent underlying market. As a result of the growth of the CDS market, the literature on CDSs also emerged in parallel. For instance, Ashraf et al. (2007) provided evidence that credit derivatives are used by a small number of large US bank holding companies (BHCs) as a part of their overall risk management strategy. González et al. (2012) examined the use of credit derivatives by European Banks, which meets the hedging hypotheses, and they have a greater net buying position, which means they mainly use credit derivatives for hedging purposes. There are some studies that reviewed the literature in the CDS domain. In this respect, the seminal review of Alnassar and Chin (2015) on credit derivative studies investigated factors that influence the use of credit derivatives for banks. Augustin et al. (2016) reviewed the extant literature that focuses on four aspects: (i) benefits and cost of CDSs; (ii) post-crisis market structure; (iii) agency conflicts and financial intermediation in CDSs; and (iv) CDSs in international finance. Tabassum and Yameen (2024) reviewed the extant literature and outlined the factors that affect the use of CDSs in banks. Even with a wealth of literature, we still lack a comprehensive view on the development and trends that happened in the field of the CDS literature. As a result, it becomes critical to examine the CDS literature in terms of bibliographic expansion. In this setting, this study attempts to answer the following questions:

- RQ1:

- How has the global CDS market developed?

- RQ2:

- How has the research on CDSs evolved over time?

- RQ3:

- Which keywords appear more frequently in the publications and which topics receive less attention?

- RQ4:

- What is the publication and citation pattern in the CDS literature?

- RQ5:

- Who is the most influential author in terms of publications and citations in the field of credit derivatives?

To address the above research questions, this study performed a bibliometric analysis using the popular Web of Science database, covering the period from 2003 to March 2025. In order to determine the most significant clusters of articles and keywords based on the research on CDS in finance, the study used network analysis tools like VOSviewer to create a bottom-up clustering of scholarly publications. This bibliometric analysis showed gaps in the field of CDS that need to be addressed by academicians. It is interesting to notice that the United States of America and China are among the countries that have a towering number of publications. Further, the term ‘credit derivatives’ and ‘risk management’ are the most used terms in the literature on credit default swaps, emphasizing the crucial importance of evaluating credit default swaps to minimize credit risk. As a result, this study contributes to the burgeoning literature on CDSs that discusses the growing importance of CDSs in financial institutions.

The rest of this article proceeds as follows. In Section 2, this article provides a review of the vast literature. Section 3 of this article highlights the research methodology and data collection process adopted in this article. Section 4 describes the data analysis process in detail. Results and implications are covered in Section 5. Section 6 marks the conclusion of this article.

2. Literature Review

CDSs have been the subject of prolonged discussion among academic scholars and policymakers. With an emphasis on the foundation of CDSs, Batten and Hogan (1999) evaluated a novel class of financial instruments known as credit derivatives in order to establish their precise definition and appropriate application. Batten and Hogan (2002) provided another theoretical perspective on important features and difficulties associated with the various instruments available in the credit derivatives market in 2002. Similarly, a theoretical description of several types of credit derivatives was given by Dufey and Rehm (2002). Of all the different kinds of credit derivatives that are offered in the world’s financial markets, CDSs make up 70% of the market, with total return swaps (TRSs) coming in second at 15%. In a similar vein, Freeman et al. (2006) reviewed several theoretical and empirical works and offered some simple numerical illustrations of the application of credit derivatives, such as credit default swaps and interest rate swaps. To empirically examine the significance of credit derivatives for banks, Ashraf et al. (2007) demonstrated that credit derivatives are used as a part of the overall risk management strategy of a small number of large US bank holding companies (BHCs).

A strand of the academic literature shows the importance of CDSs in financial markets around the globe. For example, Hirtle (2009) found that the use of credit derivatives leads to a decrease in banks’ credit supply. Credit derivatives facilitate credit risk transfer within the banking industry and between banks and other financial institutions. When banks have a lending relationship with CDS firms, Caglio et al. (2019) discovered that banks are more inclined to sell than buy CDS. Further, Angelini (2012) investigated the potential functions of CDSs and the developments of the CDS market in diversifying credit risk. Weistroffe (2009) found that the wider economic advantages of this innovative instrument should not be neglected because of the past confronted issues. It is concluded from this study that the CDS market is approaching towards a more stable system with more sophisticated rules and regulations to establish a sound market structure and to enhance market transparency along with ensuring the stability and integrity of the CDS market.

Young et al. (2010) proposed a three-pronged approach to CDSs: good, bad, and ugly. These sides reflect the positive approach (showing CDSs as a beneficial mechanism), the bad approach (how this idea went wrong in terms of predatory methods of operation), and the ugly approach (how they were mishandled and happened to be the reason for the burst of the financial crisis). Similarly, credit derivatives such as CDSs have been shown to be an important tool for managing underwriters’ and investors’ credit risk, as demonstrated by Calistru (2012). As highlighted by the global credit crunch, the overuse of CDSs may pose a financial threat to the whole economic system; therefore, CDS transactions must be regulated through central counterparties and clearinghouses in order to protect the large players of the credit derivatives market. In the same vein, Parlour and Winton (2013) exhibited a theoretical model which elucidated that the existence of the credit risk transfer market allows banks to choose between loan sales and buying CDSs to shift their credit risk.

One thread of the literature focuses on the studies that performed bibliometric analysis; among them, Flostrand et al. (2020) analyzed the literature using a bibliometric technique that used the delphi technique in forecasting and found that bibliometric analysis helps assess whether the delphi technique is still used in different sectors. In the similar line of research, Lin et al. (2020) demonstrated that bibliographic coupling analysis helps to unveil the recent trends in the research area of corporate social responsibility. Further, Keshari and Gautam (2023) highlighted the development of asset pricing models through bibliometric analysis. In addition, Lardo et al. (2022) explored the trends in blockchain technology through the use of bibliometric mapping. Correspondingly, Rahman et al. (2025) examined the literature and performed bibliometric analysis including citation, co-citation, bibliographic coupling, co-authorship, and the co-occurrence of terms.

3. Research Methodology and Data Collection

3.1. Methodology

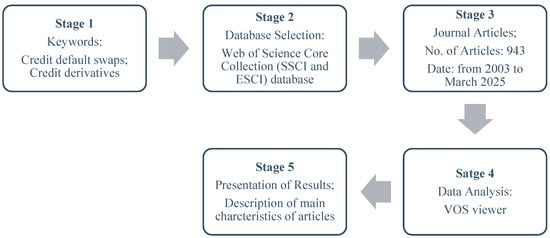

This study conducted a literature review to examine the role of credit default swaps (CDSs) in credit risk management, with a focus on post-crisis dynamics. To ensure methodological rigor, the research design follows the framework proposed by Tranfield et al. (2003) for conducting literature reviews. This framework includes three main stages: planning the review, conducting the review, and reporting the review. In the first stage, the objectives of research were defined. In the second stage, data for this research were collected from various sources, including academic databases such as Google Scholar, PubMed, Web of Science, and Scopus. Additionally, the gray literature, which includes reports from reputable financial authorities such as the International Swaps and Derivatives Association (ISDA) and the Bank for International Settlements (BIS), have been utilized. This study further proceeded to conduct a bibliometric analysis. Bibliometric analysis is a widespread and thorough approach to discovering and analyzing vast amounts of scientific information. It helps us comprehend the nuances of the evolution of a given topic, while also illuminating further directions in the discipline. However, its use in corporate research is still relatively young and frequently lacking. In the reporting stage, all the findings from the literature review and bibliometric analysis were integrated to identify research trends and recent developments in order to lay down the avenues for future work. Figure 1 depicts the stages involved in bibliometrics analysis.

Figure 1.

Stages for bibliometric analysis. Source: Authors’ own creation.

3.2. Data Collection

A systematic search was conducted using relevant keywords such as “credit default swaps,” “CDS”, “hedging”, “global financial crisis”, “credit risk management”, “bibliometric”, “financial crisis”, “counterparty risk”, “clearing house”, and “systemic risk” for the literature review. A comprehensive search in databases yielded scholarly works, conference proceedings, and peer-reviewed articles on credit default swaps (CDSs) and credit risk management. The search was filtered to include studies published within the last decade to ensure relevance and timeliness. Moreover, reports and publications issued by the ISDA and BIS were accessed from their official websites. These include market surveys, quarterly reviews, and research papers related to CDS trading volumes, market trends, and regulatory developments. Data on the CDS market size, trading activity, and risk management practices were extracted from these reports.

For bibliometric analysis, the Web of Science (WoS) has been used to extract data because it is a highly utilized database among scholars (Mongeon & Paul-Hus, 2016; van Nunen et al., 2018), providing them with access to top journals and comprehensive publication details (Falagas et al., 2008). As a result, WoS provided the literature data for this study, and the following retrieval algorithms were used: keywords search = credit default swaps and credit derivatives; database = Social Science Citation Index (SSCI) and Emerging Source Citation (ESCI). The data were collected from the WoS Core Collection. The WoS allows up to 1000 full record downloads at a time (Web of Science, 2022); however, to maintain consistency in metadata and avoid potential formatting issues from merging multiple batches, we extracted 943 relevant documents at one time by excluding 12 non-English articles and 45 articles which were not within the scope of this study. Therefore, we extracted articles with the title, keywords, authors, sources, year of publications, etc.

4. Data Analysis

The purpose of this section is to analyze and provide insights from data that have been collected for the bibliometric analysis and literature review.

4.1. Bibliometric Analysis

Bibliometric mapping dissects multiple sources of data, including scientific journals, conference papers, patents, books etc., to build visual landscapes for scientific knowledge (Donthu et al., 2021; Ellegaard & Wallin, 2015). To investigate the trends, patterns, and networks that emerge from the examined literature, bibliometric research employs a quantitative research methodology (Zupic & Čater, 2015; Levovnik et al., 2025; Broadus, 1987). The maps produced through the process of bibliometric research assist in the interpretation of research topic evolution, articulating the key contributors and landmark studies and revealing collaborations and knowledge transfers and more.

Bibliometric analysis, using a spatial approach, offers a diagrammatical visualization of couplings based on geographical locations for keyword co-occurrence, sources, and documents to examine the research trends and patterns (Kumar et al., 2024; Callon et al., 1983). VOSviewer version 16.20.0 was used for bibliometric analysis (van Eck & Waltman, 2011).

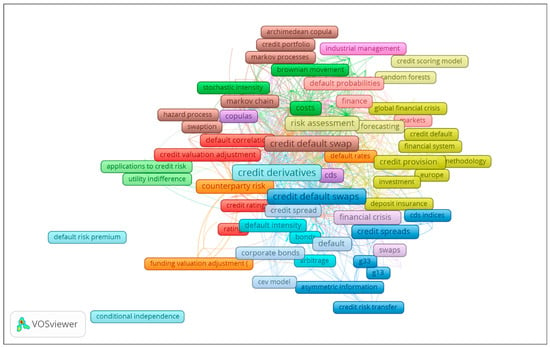

4.1.1. Keywords Co-Occurrence Analysis

The keywords co-occurrence analysis helps in mapping the research trends and emerging topics through the frequency of the occurrence of keyword pairs in the same article (Burton et al., 2020; Liu et al., 2019). As a result, keyword analysis can help establish the scope of the study field. For the analysis, a minimum of two occurrences of a keyword were selected to gauge the importance of the keyword. The analysis reveals that 447 keywords have a two-time minimum co-occurrence. The analysis formed 29 clusters of keywords. As per Table 1, the terms “credit derivatives”, “credit default swap/swaps”, “credit risk”, “risk assessment”, “risk management”, and “default risk”, among others, are the most frequently occurring and have the strongest links in the literature. Figure 2 shows the cloud of all the key terms in the CDS literature.

Table 1.

List of co-occurring keywords.

Figure 2.

Word cloud of all keywords. Source: VOSviewer.

4.1.2. Citation Analysis

In bibliometrics, citation analysis is a research approach used to assess the influence of academic works (Appio et al., 2014). It entails monitoring and evaluating the frequency with which a publication, author, or paper is referenced in other works (Podsakoff et al., 2005). In this study, three types of citation analysis have been performed; document-wise, source-wise, and country-wise citation analysis.

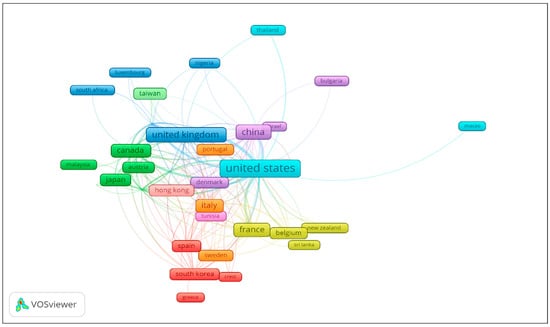

Country-Wise Citation Analysis

Country-wise citation analysis shows the maximum number of documents cited in a country with the number of citations (Biju et al., 2024). Table 2 shows the country-wise strength of the citation count and frequency of document publications. Our analysis shows that the USA has the highest frequency of publications with 141 articles, followed by the United Kingdom with 60, and China with 54 articles. This is a clear indication of the fact that the field of credit derivatives and risk management has spread globally within the financial discipline. Italy (29), Canada (38), France (42), Germany (49), and other nations are also thought to have made noteworthy contributions to this body of literature.

Table 2.

Number of documents in a country.

According to the total number of citations received from researchers, the United States has the highest number of citations (4196), followed by the United Kingdom (1360), Canada (1317), and China (940). The number of citations demonstrates that articles published by these countries are highly regarded around the world due to their quality. Further, Figure 3 offers a visual representation of country-wise citation analysis, which shows interconnections of countries where documents were published.

Figure 3.

Network diagram of country-wise citation analysis. Source: VOSviewer.

Author-Wise Citation Analysis

Author-wise citation analysis helps locate the most influential authors in the field as per the citations they receive (Keshari & Gautam, 2023), reflecting the influence and relevance of their research (Rahman et al., 2025). Biju et al. (2024) performed an author-based analysis to locate the top authors in their field, which shows the significance of the most influential authors in the given research arena. Table 3 reflects the impact of authors in terms of the number of citations they receive. The articles of the authors provide a comprehensive development in this field by illustrating the evolution of credit default swaps from an alternative viewpoint. These authors have strengthened the basis for future research by contributing to the development and expansion of credit derivatives through a variety of empirical tests and results. Table 2 demonstrates that Jarrow, Robert is the most influential author in the field of credit derivatives, with the highest citation count of 2145 from three documents and an average of 715 citations per article. Turnbull comes in second with a total citation count of 1780 from two documents and an average of 840 citations per article.

Table 3.

Most influential authors in terms of citations.

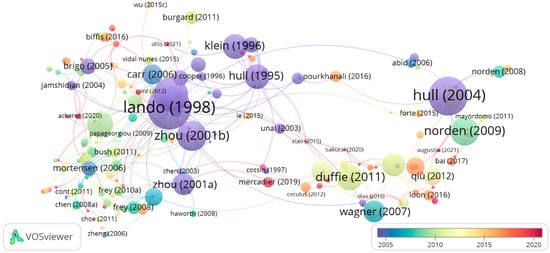

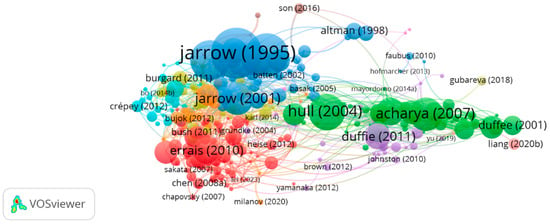

Document-Wise Citation Analysis

The academic world commonly uses citation counts to evaluate both the impact and scholarly value of research papers. Table 4 lists the documents with at least 200 citations. Document-wise citation analysis shows that the highest number of citations was received by Jarrow and Turnbull (1995) with 1072 citations. Figure 4 represents the popularity of the most seminal works through the overlay visualization, which shows the interconnections of articles with the scholarly literature. Based on its extensive number of citations, Jarrow’s document likely contains foundational approaches or concepts that many other researchers have incorporated into their work.

Table 4.

Citation counts received by a document.

Figure 4.

Document-wise citation analysis. Note: visualization of interconnectedness of articles. Source: VOSviewer.

4.1.3. Bibliographic Coupling

A bibliographic coupling happens when the bibliographies of two works mention a third work that they both used (Phan Tan, 2022). It gives rise to the possibility that the two pieces address an identical subject matter. If two documents cite the same document or papers together, they are considered bibliographically linked (Konjore, 2024; Rahman et al., 2025). In the present study, bibliographic coupling was performed and 13 clusters of documents were formed. Table 5 shows the most influential publications of bibliographic coupling analysis. Duffee and Zhou (2001) demonstrates the highest number of link strength, i.e., 77, with the highest citations, i.e., 77. Further, the mapping of bibliographic coupling is presented in Figure 5.

Table 5.

The most influential publications of bibliographic coupling analysis.

Figure 5.

Bibliographic coupling. Note: bibliographic coupling network showing linkages between documents based on shared references. Source: VOSviewer.

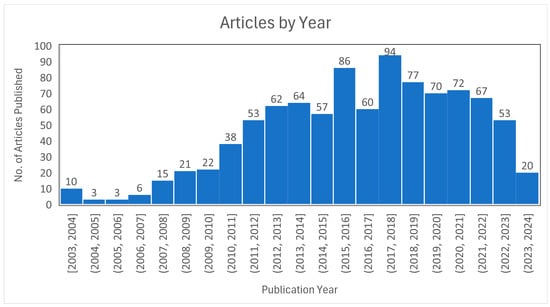

4.1.4. Evolution of CDS Research

Figure 6 shows the CDS publishing trend. A small number of papers were published in the initial years of the search. However, there were significantly fewer research papers produced between 2007 and 2011. The rate of research publications increased gradually during these years; however, after 2011, the trend picked up speed. CDS publications have steadily increased, indicating a growing interest of academicians and researchers in the literature related to the CDS market. This demonstrates that the CDS literature has evolved over the years.

Figure 6.

Documents published over the years. Note: the chart shows the number of articles published in different years. Source: Web of Science database.

4.2. Insights from Literature Review

This section attempts to gauge insights from the extensive review of the literature in terms of the application of CDSs as a mechanism of risk management and the various risk management challenges that the CDS market encounters.

4.2.1. Credit Default Swaps (CDSs): A Mechanism for Credit Risk Management

CDSs have been extensively used to transfer credit risk since they were first introduced. Credit derivatives are financial instruments that transfer credit risk from one counterparty to another, without engaging the underlying asset in any manner (Byström, 2008). Contracts like these do not reduce risk, and they do not raise it either. The prime purpose of such contracts is to transfer the risk from one party to another (Klieber, 2012). A global credit derivatives survey conducted by Fitch ratings reveals that the global motivation to use CDSs was to hedge/manage the credit risk of entities (Fitch Ratings, 2010). CDSs are preferred by banks and other institutions to hedge their credit risk over any other risk transfer method (Tabassum & Yameen, 2024). Financial institutions should be precisely the agents who use CDSs and take advantage of credit protection. According to the study of Bedendo and Bruno (2012), around 10% of credit risk transfer users have positions in credit derivatives, the majority of which (85%) are used in conjunction with financed tools. A large number of banks use credit derivatives for the purpose of hedging credit risk. Therefore, this section of our study contributes to the ongoing debate which supports CDSs as an efficient tool for financial and non-financial institutions for the mitigation of their credit risk. In this debate, Beyhaghi et al. (2017) supports the hypothesis that banks use CDSs to lay-off the credit risk of banks.

4.2.2. CDS Spread: The Cost of Insuring Against a Credit Event

The International Swaps and Derivatives Association (ISDA) devised credit derivatives definitions that codified the term “credit event” in the following ways: (a) bankruptcy, (b) the restructuring of any of the contract terms (e.g., postponement of payment, reduction of interest or principal), (c) failure to pay one or more obligations following any applicable grace period, (d) payment acceleration on obligations due to the violation of restrictive covenants, and (e) moratoriums (Kijima & Muromachi, 2000; Parker & Brown, 2003). The CDS spread or the premium that must be paid to the protection seller can be viewed as the cost of insuring against a credit event (Hull et al., 2004). The CDS spread is considered a measure of credit risk (Galil et al., 2014). The CDS spread is generally correlated with market estimates of default risk; the higher the market estimate of the default risk, the higher the spread (Wengner et al., 2015).

4.2.3. Risk Management Challenges Under CDS Contracts

Over the past decade, counterparty credit risk and systemic risk have emerged as a potential contributors to the systemic aspect of the global financial crisis as a result of the interconnectedness of the CDS market.

Counterparty Risk

A counterparty risk arises when a counterparty fails to hold its contractual obligations on the occurrence of a credit event (Frei et al., 2022). The buyer of the initial protection bears the risk of not receiving a notional payment if the counterparty experiences financial difficulties concurrent with the reference entity. However, a counterparty risk exists not only during a credit event with the reference firm, but also whenever the counterparty is experiencing financial difficulties (Gündüz, 2021). The lessons from the failure of the American Insurance Group (AIG) highlight the information and incentives that can be used to address the problem of a counterparty risk. The example of the AIG can be taken as the ability to poorly manage the counterparty risk (Al-shakrchy & Almsafir, 2014; Shadab, 2009).

Systemic Risk

The episode of the 2007–2008 financial crisis demonstrated that the interconnectivity of large financial institutions, facilitated by CDSs, continued to be a source of systemic risk. Financial institutions do not keep the risk with themselves but transfer it to the financial system, which results in a systemic risk (Nijskens & Wagner, 2011). However, the intervention of the central clearing house to have surveillance on the market may protect from the severity of the systemic risk (Cont & Minca, 2016).

5. Findings and Implications

Exploring the results of the research, this study unveils intriguing findings with far-reaching implications. The result of bibliometric analysis indicates that 447 keywords emerge in the keyword co-occurrence analysis, painting a vivid picture of the research field, with 29 distinct clusters. Among these, the keyword “credit derivatives” shines bright with 111 occurrences, showcasing its pivotal role in the literature. The terms “credit risk” and “credit default swaps” emerge frequently with 69 occurrences, indicating their important role. Additionally, risk assessment, risk management, and default risk also appear to be prominent keywords in the literature. Research in both finance and risk management fields consider “credit default swaps” as the key topic of investigation. M. Wang and Chai (2018) indicate that keyword clustering functions as a thematic exploration tool to enable researchers to find valuable insights, guiding scholars towards deeper insights and uncovering emerging trends and gaps in the CDS literature (Kim & Kim, 2021). The popularity of these keywords is a reflection of the systemic and instrumental role credit derivatives have played in contemporary financial markets, particularly when it comes to debates about complexity, innovation, and regulation. Their prevalence indicates that a large portion of CDS research is focused on comprehending the pricing, hedging, and transfer of credit risk. Since CDSs were first presented as instruments for controlling credit exposure, it is not surprising that these ideas are at the heart of almost every literary subtext.

The citation analysis observes a rich tapestry of influence across four dimensions—country-wise, author-wise, documents-wise, and source-wise. The analysis shows that the United States takes the lead in publications and citations, both demonstrating its robust scientific infrastructure and intellectual vibrancy. The nation’s leadership has probably been aided by its sophisticated data infrastructure, reputable academic networks, and close proximity to important financial institutions (such as JPMorgan). Cross-border cooperation has unrealized potential, particularly with nations like China, Germany, and the UK leading the way in CDS research output. Such dominance invites reflection on benchmarking and potential collaborative opportunities with other leading nations (Pandey et al., 2024; Pečiulis et al., 2024). Documents-wise citation analysis honors the work of Jarrow as the most influential study based on its high number of citations. The depth and clarity of a select group of influential authors’ contributions are reflected in their prominence. This seminal research guides budding scholars toward productive research directions, which enhances their influence throughout the academic domain (Mohamad et al., 2024).

Through bibliographic coupling, interconnected clusters of research papers are revealed, forming a web of reference links that reveal how critical topics and themes have evolved over time (H. K. Baker et al., 2020; Gazni & Didegah, 2016). By means of mapping these links, researchers can pinpoint significant publications, promote teamwork, and obtain a better awareness of the research scene. In summation, the synergistic blend of keyword co-occurrence, citation analysis, and bibliographic coupling offers a panoramic view of the research terrain (Khan et al., 2022; Maseda et al., 2022; Padilla-Ospina et al., 2018). These research methodologies drive important steps such as decision-making and funding distribution choices and partnership formation to resolve critical problems and elevate knowledge transmission (Bhaskar & Bansal, 2022; H. K. Baker et al., 2021).

This research shows that CDSs function as a strong instrument to move credit risks among financial entities, especially within the banking sector (Hu & Zhong, 2024). Controlling counterparty risks requires diligent management because improper management creates potential financial losses (Bo & Capponi, 2015; Arora et al., 2012). Financial institutions that interact throughout the system need ongoing market monitoring and regulatory control because CDSs represent a significant systemic risk (Berndsen, 2021). Central clearinghouses should play a critical part in market surveillance improvements and the reduction of systemic risks according to research by Bellia et al. (2024), Boissel et al. (2017), and C. M. Baker (2015). These findings indicate that policymakers need to develop strategies which address the effects of CDSs on financial stability through enhanced transparency and strict capital requirements linked with sound risk management practices. The benefits of CDSs, such as risk mitigation and increased profitability, need to be evaluated thoughtfully by parties against risks, including counterparty and systemic risks, when considering their usage.

Policy Implications

This study explains the development of CDS research. This study has several implications for policymakers. First, the development of CDS research shows the progression of the CDS market in the major financial markets of the world. This implies that policymakers and regulators should enhance surveillance around the CDS market in order to improve transparency in over-the-counter (OTC) markets and promote central clearing mechanisms to mitigate systemic risk. Second, the analysis reveals the dominance of some countries in research. Policymakers and research councils should promote research initiatives among countries to foster global knowledge-sharing on complex financial instruments like CDSs. To enhance market practices, governments and financial institutions ought to encourage more study into CDS pricing models, the effects of systemic risk, and hedging techniques. Third, there is an ongoing debate regarding the complexity and innovation of CDS. To help institutional and retail investors better understand the risks and rewards of credit derivatives, policymakers should support financial literacy initiatives.

6. Conclusions

Since their introduction, credit default swaps have proven to be a valuable tool for mitigating the credit risk of reference entities. However, they attracted the attention of investors, policymakers, regulators, and researchers and contributed to the boom in the literature, particularly during and after the financial crisis of 2007–2008 and the European debt crisis of 2010. Through this process, scholars started evaluating the role of CDSs in the credit crisis to look at their role in hedging credit risk. The CDS market has expanded over the past few years to become a multi-trillion-dollar notional market, with participation from essentially every sector of the financial industry. The success of CDSs has resulted in a market worth of roughly USD 60 trillion. CDSs are a tool that is widely used by financial and non-financial institutions for the mitigation of their credit risk. The market for CDSs has developed enormously in USA and China, which shows the significance of using CDSs for hedging, financial stability, and the larger dynamics of credit risk. This article provided a thorough analysis, and a very comprehensive summary of the publications published in the CDS field until March 2025. This study examined the emerging trends in the CDS literature, given the importance of CDSs as a significant credit risk management tool. This study concludes by noting that in the last two decades, the CDS literature has grown enormously with the continuous growth of the CDS market. The largest contributing country to the CDS literature is the US, followed by the UK. Moreover, the findings reveal that the biggest players in this market include banks, insurance companies, hedge funds, and asset managers. When it comes to instrument types, single-name CDSs have expanded faster than index products in terms of gross notional amounts. Therefore, CDSs, as a tool for credit risk transfer, should be viewed as a safeguard that prevents their users from losing credit risk in an unanticipated way. The findings of this study provide a compass guiding policymakers, funders, and institutions towards a future that is rich with impactful research and scholarly collaboration.

The current study has some limitations that researchers may explore as potential avenues for future research. First, we analyzed articles written on single-name corporate CDSs. Future researchers may also consider research published on multi-name CDSs, sovereign CDSs, and indexed CDSs, to gain a comprehensive understanding on CDS use. Second, this study delineated and emphasized the paramount research articles, authors, and keywords derived from a literature review and bibliometric analysis of 943 documents published over the last two decades (2004–2024), sourced from the WOS database, to establish a novel trajectory for future research on the utilization of credit default swaps. Further, this study showed that CDSs as a topic is well established in countries like USA, China, UK, Germany, and other European countries; this shows that there is a large scope for research in emerging markets to investigate the performance of CDSs in developing markets.

Author Contributions

Conceptualization, T.; methodology, T. and N.L.; software, T.; validation, T.; formal analysis, T.; investigation, N.L. and J.S.; resources, T.; data curation, T. and N.L.; writing—original draft preparation, T.; writing—review and editing, N.L. and J.S.; visualization, T.; supervision, T. and J.S.; project administration, T. and N.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the first authors on request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Alnassar, W. I., & Chin, O. B. (2015). Why banks use credit derivatives? Review paper. Procedia Economics and Finance, 26, 566–574. [Google Scholar] [CrossRef]

- Al-shakrchy, E., & Almsafir, M. K. (2014). Credit derivatives: Did they exacerbate the 2007 global financial crisis? AIG: Case study. Procedia-Social and Behavioral Sciences, 109, 1026–1034. [Google Scholar]

- Angelini, E. (2012). Credit Default Swaps (CDS) and their role in the credit risk market. International Journal of Academic Research in Business and Social Sciences, 2(1), 584–593. [Google Scholar]

- Appio, F. P., Cesaroni, F., & Di Minin, A. (2014). Visualizing the structure and bridges of the intellectual property management and strategy literature: A document co-citation analysis. Scientometrics, 101(1), 623–661. [Google Scholar] [CrossRef]

- Arora, N., Gandhi, P., & Longstaff, F. A. (2012). Counterparty credit risk and the credit default swap market. Journal of Financial Economics, 103(2), 280–293. [Google Scholar] [CrossRef]

- Ashraf, D., Altunbas, Y., & Goddard, J. (2007). Who transfers credit risk? Determinants of the use of credit derivatives by large US banks. The European Journal of Finance, 13(5), 483–500. [Google Scholar] [CrossRef]

- Augustin, P., Subrahmanyam, M. G., Tang, D. Y., & Wang, S. Q. (2016). Credit default swaps: Past, present, and future. Annual Review of Financial Economics, 8(1), 175–196. [Google Scholar] [CrossRef]

- Baker, C. M. (2015). When regulators collide: Financial market stability, systemic risk, clearinghouses, and CDS. Virginia Law & Business Review, 10, 343. [Google Scholar]

- Baker, H. K., Kumar, S., & Pandey, N. (2021). Thirty years of the global finance journal: A bibliometric analysis. Global Finance Journal, 47, 100492. [Google Scholar] [CrossRef]

- Baker, H. K., Kumar, S., & Pattnaik, D. (2020). Twenty-five years of review of financial economics: A bibliometric overview. Review of Financial Economics, 38(1), 3–23. [Google Scholar] [CrossRef]

- Batten, J., & Hogan, W. (1999). Credit derivatives: An appraisal for Australian financial institutions. Economic Papers: A Journal of Applied Economics and Policy, 18(2), 19–41. [Google Scholar] [CrossRef]

- Batten, J., & Hogan, W. (2002). A perspective on credit derivatives. International Review of Financial Analysis, 11(3), 251–278. [Google Scholar] [CrossRef]

- Bedendo, M., & Bruno, B. (2012). Credit risk transfer in U.S. commercial banks: What changed during the 2007–2009 crisis? Journal of Banking & Finance, 36(12), 3260–3273. [Google Scholar] [CrossRef]

- Bellia, M., Girardi, G., Panzica, R., Pelizzon, L., & Peltonen, T. (2024). The demand for central clearing: To clear or not to clear, that is the question! Journal of Financial Stability, 72, 101247. [Google Scholar] [CrossRef]

- Berndsen, R. (2021). Fundamental questions on central counterparties: A review of the literature. Journal of Futures Markets, 41(12), 2009–2022. [Google Scholar] [CrossRef]

- Beyhaghi, M., Massoud, N., & Saunders, A. (2017). Why and how do banks lay off credit risk? The choice between retention, loan sales and credit default swaps. Journal of Corporate Finance, 42, 335–355. [Google Scholar] [CrossRef]

- Bhaskar, R., & Bansal, S. (2022). Nineteen years of emerging markets finance and trade: A bibliometric analysis. Emerging Markets Finance and Trade, 58(14), 4120–4135. [Google Scholar] [CrossRef]

- Biju, A. K. V. N., Thomas, A. S., & Thasneem, J. (2024). Examining the research taxonomy of artificial intelligence, deep learning & machine learning in the financial sphere—A bibliometric analysis. Quality & Quantity, 58(1), 849–878. [Google Scholar]

- Bo, L., & Capponi, A. (2015). Counterparty risk for CDS: Default clustering effects. Journal of Banking & Finance, 52, 29–42. [Google Scholar]

- Boissel, C., Derrien, F., Ors, E., & Thesmar, D. (2017). Systemic risk in clearing houses: Evidence from the European repo market. Journal of Financial Economics, 125(3), 511–536. [Google Scholar] [CrossRef]

- Broadus, R. N. (1987). Toward a definition of “bibliometrics”. Scientometrics, 12(5–6), 373–379. [Google Scholar] [CrossRef]

- Burton, B., Kumar, S., & Pandey, N. (2020). Twenty-five years of the European Journal of Finance (EJF): A retrospective analysis. The European Journal of Finance, 26(18), 1817–1841. [Google Scholar] [CrossRef]

- Byström, H. (2008). Credit risk management in greater China. Journal of Futures Markets: Futures, Options, and Other Derivative Products, 28(6), 582–597. [Google Scholar] [CrossRef]

- Caglio, C., Darst, R. M., & Parolin, E. (2019). Half-full or half-empty? Financial institutions, CDS use, and corporate credit risk. Journal of Financial Intermediation, 40, 100812. [Google Scholar] [CrossRef]

- Calistru, R. A. (2012). The credit derivatives market—A threat to financial stability? Procedia Social and Behavioral Sciences, 58, 552–559. [Google Scholar] [CrossRef]

- Callon, M., Courtial, J., Turner, W., & Bauin, S. (1983). From translations to problematic networks: An introduction to co-word analysis. Social Science Information, 22(2), 191–235. [Google Scholar] [CrossRef]

- Cont, R., & Minca, A. (2016). Credit default swaps and systemic risk. Annals of Operations Research, 247(2), 523–547. [Google Scholar] [CrossRef]

- Coughlan, J., Richard, H., Lau, M., & Tuckman, B. (2019). Recent trends in CDS markets. OCE staff papers and reports, number 2019–015. Available online: https://cftc.gov/sites/default/files/2019-11/Trends%20in%20CDS_11252019_ada.pdf (accessed on 15 March 2025).

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Dufey, G., & Rehm, F. (2002). An introduction to credit derivatives. The Journal of Risk Finance, 3(3), 65–71. [Google Scholar] [CrossRef]

- Duffee, G. R., & Zhou, C. (2001). Credit derivatives in banking: Useful tools for managing risk? Journal of Monetary Economics, 48(1), 25–54. [Google Scholar] [CrossRef]

- Ellegaard, O., & Wallin, J. A. (2015). The bibliometric analysis of scholarly production: How great is the impact? Scientometrics, 105, 1809–1831. [Google Scholar] [CrossRef] [PubMed]

- Falagas, M. E., Pitsouni, E. I., Malietzis, G. A., & Pappas, G. (2008). Comparison of PubMed, Scopus, web of science, and Google scholar: Strengths and weaknesses. The FASEB Journal, 22(2), 338–342. [Google Scholar] [CrossRef] [PubMed]

- Fitch Ratings. (2010). Global credit derivatives survey: Respondents opine on public perceptions, regulations, sovereigns and more. Credit Policy, Fitch Ratings. Available online: https://asianbondsonline.adb.org/publications/external/2010/global_credit_derivatives_survey_FR_Sep2010.pdf (accessed on 28 March 2022).

- Flostrand, A., Pitt, L., & Bridson, S. (2020). The Delphi technique in forecasting–A 42-year bibliographic analysis (1975–2017). Technological Forecasting and Social Change, 150, 119773. [Google Scholar] [CrossRef]

- Freeman, M. C., Cox, P. R., & Wright, B. (2006). Credit risk management The use of credit derivatives by non-financial corporations. Managerial Finance, 32(9), 761–773. [Google Scholar] [CrossRef]

- Frei, C., Capponi, A., & Brunetti, C. (2022). Counterparty risk in over-the-counter markets. Journal of Financial and Quantitative Analysis, 57(3), 1058–1082. [Google Scholar] [CrossRef]

- Galil, K., Shapir, O. M., Amiram, D., & Ben-Zion, U. (2014). The determinants of CDS spreads. Journal of Banking & Finance, 41, 271–282. [Google Scholar]

- Gazni, A., & Didegah, F. (2016). The relationship between authors’ bibliographic coupling and citation exchange: Analyzing disciplinary differences. Scientometrics, 107, 609–626. [Google Scholar] [CrossRef]

- Ghosh, A. (2017). How do derivative securities affect bank risk and profitability? Evidence from the US commercial banking industry. The Journal of Risk Finance, 18(2), 186–213. [Google Scholar] [CrossRef]

- González, O. L., Rodriguez Gil, L. I., Fernandez Lopez, S., & Vivel Búa, M. (2012). Determinants of credit risk derivatives use by the European banking industry. Journal of Money, Investment and Banking, (25), 36–58. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2578516 (accessed on 25 February 2025).

- Gündüz, Y. (2021). Mitigating counterparty risk. SSRN 2654591. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2654591 (accessed on 17 March 2025).

- Hirtle, B. (2009). Credit derivatives and bank credit supply. Journal of Financial Intermediation, 18(2), 125–150. [Google Scholar] [CrossRef]

- Hu, X., & Zhong, Z. (2024). Developments in CDS markets: A review on recent CDS studies. In Handbook of investment analysis, portfolio management, and financial derivatives: In 4 volumes (pp. 2643–2681). World Scientific. [Google Scholar]

- Hull, J., Predescu, M., & White, A. (2004). The relationship between credit default swap spreads, bond yields, and credit rating announcements. Journal of Banking & Finance, 28(11), 2789–2811. [Google Scholar] [CrossRef]

- ISDA. (2021). SwapsInfo full year 2020 and the fourth quarter of 2020 review. ISDA. [Google Scholar]

- Jarrow, R. A., & Turnbull, S. M. (1995). Pricing derivatives on financial securities subject to credit risk. The Journal of Finance, 50(1), 53–85. [Google Scholar] [CrossRef]

- Keshari, A., & Gautam, A. (2023). Asset pricing in global scenario: A bibliometric analysis. IIM Ranchi Journal of Management Studies, 2(1), 48–69. [Google Scholar] [CrossRef]

- Khan, A., Goodell, J. W., Hassan, M. K., & Paltrinieri, A. (2022). A bibliometric review of finance bibliometric papers. Finance Research Letters, 47, 102520. [Google Scholar] [CrossRef]

- Kijima, M., & Muromachi, Y. (2000). Credit events and the valuation of credit derivatives of basket type. Review of Derivatives Research, 4, 55–79. [Google Scholar] [CrossRef]

- Kim, J. S., & Kim, S. (2021). Thirty years of the journal of derivatives and quantitative studies: A bibliometric analysis. Journal of Derivatives and Quantitative Studies, 29(4), 258–279. [Google Scholar] [CrossRef]

- Klieber, D. S. (2012). Credit default swaps–weapon of mass destruction or reliable indicator? Economic Affairs, 32(1), 72–74. [Google Scholar] [CrossRef]

- Konjore, M. J. (2024). Two decades of evaluating evaluation capacity building: A bibliographic coupling review. New Directions for Evaluation, 2024(183), 11–28. [Google Scholar] [CrossRef]

- Kumar, A., Sharma, S., Vashistha, R., Srivastava, V., Tabash, M. I., Munim, Z. H., & Paltrinieri, A. (2024). International Journal of Emerging Markets: A bibliometric review 2006–2020. International Journal of Emerging Markets, 19(4), 1051–1089. [Google Scholar] [CrossRef]

- Lai, S., Liu, S., Pu, X., & Zhang, J. (2025). The real effect of CDS trading: Evidence from corporate employment. International Review of Finance, 25(1), e12464. [Google Scholar] [CrossRef]

- Lardo, A., Corsi, K., Varma, A., & Mancini, D. (2022). Exploring blockchain in the accounting domain: A bibliometric analysis. Accounting, Auditing & Accountability Journal, 35(9), 204–233. [Google Scholar]

- Levovnik, D., Aleksić, D., & Gerbec, M. (2025). Exploring the research on managers’ safety commitment through the prism of leadership. Part 1: A bibliometric analysis. Journal of Loss Prevention in the Process Industries, 94, 105527. [Google Scholar] [CrossRef]

- Lin, Y. C., Padliansyah, R., & Lin, T. C. (2020). The relationship and development trend of corporate social responsibility (CSR) literature: Utilizing bibliographic coupling analysis and social network analysis. Management Decision, 58(4), 601–624. [Google Scholar] [CrossRef]

- Liu, Y., Mai, F., & MacDonald, C. (2019). A big-data approach to understanding the thematic landscape of the field of business ethics, 1982–2016. Journal of Business Ethics, 160(1), 127–150. [Google Scholar] [CrossRef]

- Maseda, A., Iturralde, T., Cooper, S., & Aparicio, G. (2022). Mapping women’s involvement in family firms: A review based on bibliographic coupling analysis. International Journal of Management Reviews, 24(2), 279–305. [Google Scholar] [CrossRef]

- McNally, D. (2009). From financial crisis to world-slump: Accumulation, financialisation, and the global slowdown. Historical Materialism, 17(2), 35–83. [Google Scholar] [CrossRef]

- Meng, L., & Ap Gwilym, O. (2007). The characteristics and evolution of credit default swap trading. Journal of Derivatives & Hedge Funds, 13(3), 186–198. [Google Scholar]

- Mohamad, A. H. H., Zainuddin, M. R. K., Esa, M. S. M., & AB-Rahim, R. (2024). The COVID-19 and malaysia economy: A bibliometric analysis. Universiti Malaysia Terengganu Journal of Undergraduate Research, 6(1), 23–46. [Google Scholar] [CrossRef]

- Mongeon, P., & Paul-Hus, A. (2016). The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics, 106(1), 213–228. [Google Scholar] [CrossRef]

- Nijskens, R., & Wagner, W. (2011). Credit risk transfer activities and systemic risk: How banks became less risky individually but posed greater risks to the financial system at the same time. Journal of Banking & Finance, 35(6), 1391–1398. [Google Scholar]

- Padilla-Ospina, A. M., Medina-Vásquez, J. E., & Rivera-Godoy, J. A. (2018). Financing innovation: A bibliometric analysis of the field. Journal of Business & Finance Librarianship, 23(1), 63–102. [Google Scholar]

- Pandey, D. K., Hassan, M. K., Kumari, V., Zaied, Y. B., & Rai, V. K. (2024). Mapping the landscape of FinTech in banking and finance: A bibliometric review. Research in International Business and Finance, 67, 102116. [Google Scholar] [CrossRef]

- Parker, E., & Brown, M. (2003). The 2003 ISDA credit derivatives definitions. PLC Finance. [Google Scholar]

- Parlour, C. A., & Winton, A. (2013). Laying off credit risk: Loan sales versus credit default swaps. Journal of Financial Economics, 107(1), 25–45. [Google Scholar] [CrossRef]

- Pečiulis, T., Ahmad, N., Menegaki, A. N., & Bibi, A. (2024). Forecasting of cryptocurrencies: Mapping trends, influential sources, and research themes. Journal of Forecasting, 43(6), 1880–1901. [Google Scholar] [CrossRef]

- Phan Tan, L. (2022). Bibliometrics of social entrepreneurship research: Cocitation and bibliographic coupling analyses. Cogent Business & Management, 9(1), 2124594. [Google Scholar]

- Podsakoff, P. M., MacKenzie, S. B., Bachrach, D. G., & Podsakoff, N. P. (2005). The influence of management journals in the 1980s and 1990s. Strategic Management Journal, 26(5), 473–488. [Google Scholar] [CrossRef]

- Rahman, S. M., Saif, A. N. M., Kabir, S., Bari, M. F., Alom, M. M., Rayhan, M. J., Zan, F., Chu, M., & Talukder, A. (2025). Blockchain in the banking industry: Unravelling thematic drivers and proposing a technological framework through systematic review with bibliographic network mapping. IET Blockchain, 5(1), e12093. [Google Scholar] [CrossRef]

- Shadab, H. B. (2009). Counterparty regulation and its limits: The evolution of the credit default swaps market. New York Law School Law Review, 54, 689. [Google Scholar]

- Tabassum, & Yameen, M. (2024). Why do banks use credit default swaps (CDS)? A systematic review. Journal of Economic Surveys, 38(1), 201–231. [Google Scholar] [CrossRef]

- Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, 14(3), 207–222. [Google Scholar] [CrossRef]

- van Eck, N. J., & Waltman, L. (2011). Text mining and visualization using VOSviewer. arXiv, arXiv:1109.2058. [Google Scholar] [CrossRef]

- van Nunen, K., Li, J., Reniers, G., & Ponnet, K. (2018). Bibliometric analysis of safety culture research. Safety Science, 108, 248–258. [Google Scholar] [CrossRef]

- Wang, M., & Chai, L. (2018). Three new bibliometric indicators/approaches derived from keyword analysis. Scientometrics, 116, 721–750. [Google Scholar] [CrossRef]

- Wang, Y., Fang, R., Hu, N., & Huang, R. (2025). Credit default swaps and borrowers’ real earnings management: Evidence from credit default swap initiation. Journal of Accounting, Auditing & Finance, 40(1), 3–36. [Google Scholar]

- Web of Science. (2022). Web of Science: Limit on exporting. Clarivate. Available online: https://support.clarivate.com/ScientificandAcademicResearch/s/article/Web-of-Science-Limit-on-exporting?language=en_US (accessed on 17 March 2025).

- Weistroffe, C. (2009). Credit default swaps. Deutsche Bank Research. [Google Scholar]

- Wengner, A., Burghof, H. P., & Schneider, J. (2015). The impact of credit rating announcements on corporate CDS markets—Are intra-industry effects observable? Journal of Economics and Business, 78, 79–91. [Google Scholar] [CrossRef]

- Young, T., McCord, L., & Crawford, P. J. (2010). Credit default swaps: The good, the bad and the ugly. Journal of Business & Economics Research (JBER), 8(4). Available online: https://core.ac.uk/download/pdf/268111348.pdf (accessed on 17 March 2025).

- Zhao, R., & Zhu, L. (2024). Credit default swaps and corporate ESG performance. Journal of Banking & Finance, 159, 107079. [Google Scholar]

- Zupic, I., & Čater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18(3), 429–472. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).