1. Introduction: Bridging AI and Social Entrepreneurship

Social entrepreneurship has emerged as a crucial response to complex social challenges such as poverty, health disparities, and educational inequity—issues that traditional for-profit markets and government interventions have struggled to resolve effectively (

Dees, 2012). Social entrepreneurs operate at the intersection of innovation and altruism, seeking not just financial return but systemic social value creation (

Porter & Kramer, 2011).

This dual mission requires balancing efficiency and equity while navigating environments that are typically resource-constrained and institutionally underdeveloped (

Santos, 2012). Multiple definitions of social entrepreneurship have emerged, each capturing different dimensions of the field.

Dees (

2012) highlights it as a process of pursuing opportunities to create social value through innovation;

Peredo and Chrisman (

2006) define it as a community-based approach focused on collective benefit; and

Mort et al. (

2003) emphasize social entrepreneurs’ ability to balance innovation, proactiveness, and social mission. These perspectives illustrate that social entrepreneurship can range from nonprofit initiatives to hybrid ventures and market-based enterprises.

Despite the promising growth of social ventures worldwide, scalability remains one of the most persistent challenges in the field. Unlike traditional startups, social enterprises must operate under a dual logic—achieving impact while sustaining operations—and do so often without access to venture capital, elite networks, or favorable policy infrastructure (

Austin et al., 2006). The tension between social mission and market logic presents unique trade-offs in resource allocation, stakeholder management, and long-term sustainability (

Townsend & Hart, 2008).

Meanwhile, the rise of artificial intelligence (AI) has disrupted nearly every sector of economic life, offering new avenues for process automation, predictive analytics, stakeholder engagement, and strategic decision-making (

Chalmers et al., 2021). AI has already shown significant promise in optimizing operations in the private sector, from precision marketing to supply chain management. However, its integration into social entrepreneurship remains nascent and poorly understood. Few theoretical models have emerged to explain how AI might be applied to the hybrid goals of social ventures or how it might affect the traditional constraints faced by these organizations (

Chalmers et al., 2021;

Shepherd & Majchrzak, 2022). As noted by

Shepherd and Majchrzak (

2022), while AI is transforming commercial ventures, its application in hybrid or socially oriented ventures remains largely conceptual and under-theorized.

Chalmers et al. (

2021) similarly observed that few models currently explain how AI can be integrated into resource-constrained, mission-driven environments.

This paper seeks to bridge that gap by extending the resource-based view (RBV) of the firm—a dominant theory in strategic management—into the realm of AI-driven social entrepreneurship. We introduce a novel AI-augmented RBV framework, theorizing that AI can act not merely as a tool or asset but as a dynamic capability that enhances four foundational forms of capital: human, social, political, and financial. These forms of capital, previously identified as critical to social venture success (

Day & Jean-Denis, 2016), are often under-optimized due to information asymmetries, coordination costs, or lack of scale.

Through the development of theoretical propositions and a conceptual model, this paper proposes that AI technologies enable more efficient resource allocation, stronger stakeholder alignment, enhanced advocacy efforts, and better financial decision-making. By doing so, AI not only improves operational effectiveness but also fundamentally reshapes the strategic capacity of social ventures to scale their impact.

While artificial intelligence (AI) is increasingly used across sectors, including by for-profit firms to achieve scalability and operational efficiency, the contribution of this paper is not in presenting AI as merely a new tool. Rather, it lies in positioning AI as a meta-capability that transforms how social ventures acquire, integrate, and dynamically coordinate scarce resources. In contrast to traditional applications of AI focused on automation or productivity, our conceptual model demonstrates how AI reconfigures core strategic functions—especially under resource-constrained, mission-driven conditions typical of social enterprises. This framing extends the RBV by showing that AI can catalyze synergistic resource orchestration that was previously unachievable within the constraints of conventional nonprofit operations.

To support the development of our conceptual model and theoretical propositions, we employed an illustrative case methodology rooted in theory-building traditions. Each case was purposefully selected to exemplify how AI is currently being leveraged by leading-edge social ventures to enhance a specific form of capital—human, social, political, or financial. These organizations were chosen based on their recognized leadership in AI application, the availability of public data (e.g., reports, interviews, organizational metrics), and their alignment with the strategic objectives outlined in each proposition. While not intended to test hypotheses, the illustrative cases serve as grounded, real-world anchors that support conceptual clarity and plausibility, consistent with established practices in conceptual research.

In addition to selecting cases based on relevance and public accessibility, we adopted a conceptual methodology rooted in theory elaboration, rather than empirical testing. By using illustrative cases to develop theoretical propositions, we followed an abductive logic often used in strategic management literature, where emerging phenomena (such as AI in social entrepreneurship) warrant exploratory frameworks rather than variable-driven hypothesis testing. This positions our study as a foundation for future empirical research, rather than a test of causal relationships.

This work contributes to three core debates in literature: (1) how to scale social ventures without compromising mission; (2) how to integrate emerging technologies into resource-constrained environments; and (3) how to reconceptualize RBV in light of digital transformation and organizational hybridity. In doing so, we provide a new lens for both scholars and practitioners to understand the evolving role of AI in social innovation ecosystems. This is a conceptual paper that uses illustrative case logic to generate theory, not to test it. Our intent is to offer a structured framework that researchers can empirically examine through future data collection and analysis.

2. Conceptual Foundation

The resource-based view (RBV) remains one of the most influential theories in strategic management, built on the foundational premise that firms gain and sustain competitive advantage through the possession and effective use of valuable, rare, inimitable, and non-substitutable (VRIN) resources (

Barney, 1991;

Wernerfelt, 1984).

Barney’s (

2001) later work reaffirmed RBV’s influence by reflecting on its evolution and theoretical durability in explaining firm-level advantage. Traditionally, RBV has focused on tangible assets, human capital, and organizational capabilities that drive performance in commercial contexts. However, in the realm of social entrepreneurship—where ventures pursue dual goals of financial sustainability and social impact—the RBV must be extended to capture a broader range of intangible, mission-aligned resources (

Day & Jean-Denis, 2016;

B. Cohen et al., 2008).

Social ventures typically rely on a combination of human, social, political, and financial capitals, each of which functions differently from its commercial counterpart. Human capital in social enterprises often includes passion-driven labor with deep local knowledge; social capital emphasizes trust-based partnerships; political capital enables systemic influence; and financial capital comes from non-traditional sources such as donations, impact investors, or government grants (

Bloom & Smith, 2010;

Santos, 2012). Unlike conventional firms, these ventures must continuously adapt their resource base while maintaining legitimacy among diverse stakeholders.

Meanwhile, artificial intelligence (AI) has emerged as a transformative force across industries, influencing how organizations acquire knowledge, make decisions, and respond to their environments (

Chalmers et al., 2021). AI encompasses a variety of technologies, including machine learning, natural language processing, predictive analytics, and intelligent automation. In entrepreneurial settings, these tools enhance the ability to detect opportunities, optimize resource allocation, and learn from real-time data (

Shepherd & Majchrzak, 2022). However, the intersection of AI and social entrepreneurship remains underexplored, and its integration into RBV frameworks is limited.

This paper argues for a reconceptualization of the RBV in the context of AI-enhanced social entrepreneurship. We posit that AI acts not simply as a resource but as a meta-capability—a dynamic mechanism that enhances the acquisition, deployment, and orchestration of existing capitals. AI improves the effectiveness of human capital by supporting personalized training and predictive recruitment; it strengthens social capital by mapping networks and optimizing stakeholder communication; it increases political capital by analyzing legislative trends and simulating advocacy strategies; and it boosts financial capital by forecasting fundraising outcomes and reducing budgetary inefficiencies.

In short, AI allows social ventures to do more with less by amplifying the strategic use of their constrained resources. Integrating AI into RBV represents an evolution from static resource ownership to dynamic resource augmentation, better reflecting the turbulent, data-driven environments in which modern social enterprises operate (

Teece et al., 1997;

Raisch & Fomina, 2024). This expanded framework is especially timely, as many social ventures seek to scale in the wake of global crises, such as the COVID-19 pandemic, climate change, and economic inequality—all of which demand both innovation and agility. The following sections introduce and develop an AI-augmented RBV framework through four theoretical propositions, each mapping AI’s enhancement of a critical form of capital. The propositions are supported by literature and conceptual logic and culminate in a comprehensive model of dynamic resource interaction powered by AI.

3. Theoretical Framework and Propositions: AI-Enhanced Capitals in Social Ventures

This section presents the central theoretical framework of this paper. We propose that artificial intelligence (AI), when integrated into the operations of social ventures, acts as a dynamic capability that strengthens the management and deployment of four key forms of capital: human, social, political, and financial. These capitals, previously identified as foundational to social enterprise growth (

Day & Jean-Denis, 2016), are often difficult to optimize due to institutional voids, resource scarcity, and mission complexity (

Austin et al., 2006).

Our framework introduces four propositions, each demonstrating how AI technologies can improve the strategic application of these resources and thereby support the scalability, resilience, and impact of social ventures. AI is not framed as an isolated tool but as an enabler of organizational learning, stakeholder engagement, and continuous adaptation—characteristics essential to the sustainability of hybrid organizations (

Davidsson et al., 2020).

3.1. AI-Augmented Human Capital

Human capital in social enterprises encompasses the experience, knowledge, emotional intelligence, and value alignment of staff, volunteers, and leadership. Social ventures frequently face challenges in attracting and retaining top talent, as they often cannot compete with private-sector compensation packages. Furthermore, human resource development is complicated by the need to balance technical skills with deep community understanding and a commitment to social justice (

Mair & Martí, 2006).

AI can alleviate these challenges by transforming how ventures source, evaluate, and nurture talent. Recruitment platforms that use AI-driven natural language processing and machine learning can analyze applicant data to identify candidates whose values and competencies align with the organizational mission. These tools can also remove unconscious bias, a persistent issue in nonprofit hiring, by anonymizing demographic markers and emphasizing objective performance predictors (

Chalmers et al., 2021).

In terms of training, AI-enabled learning management systems (LMS) can deliver personalized development programs based on individual learning styles, task proficiency, and career goals. Predictive analytics can assess employee engagement, forecast attrition risk, and offer interventions to retain high-potential individuals. These applications are particularly useful in remote or decentralized ventures where traditional human resource practices are less feasible.

Proposition 1. AI-driven human resource management systems will improve the acquisition, development, and retention of talent in social enterprises, thereby enhancing organizational capacity and scalability.

Wendy Kopp’s Teach For All offers a compelling example of AI-enhanced human capital in global education. The organization partners with country-based programs to recruit, train, and support teachers in underserved areas. Increasingly, AI is used to streamline recruitment pipelines by identifying mission-aligned candidates through predictive analytics and improving training efficacy through adaptive e-learning tools. These technologies help personalize content for diverse learners and assess teaching performance, allowing for scalable teacher development across contexts (Teach For All, 2023). Teach For All demonstrates how AI can lower the cost of talent development while increasing retention and alignment with the social mission. It embodies Proposition 1 by showing that when AI is embedded in talent strategy, social ventures gain greater agility in mobilizing, supporting, and scaling human capital.

CodePath is a nonprofit organization co-founded by Michael Ellison to democratize access to high-quality tech education for students from underrepresented backgrounds. In partnership with universities, CodePath offers computer science training while integrating AI-based diagnostics that assess student knowledge gaps, learning preferences, and skill development over time. These adaptive learning tools ensure tailored pathways for each learner, helping to scale personalized instruction across diverse educational settings.

Beyond pedagogy, CodePath leverages AI to provide employers with structured insights into student performance, reducing bias in recruitment and enhancing alignment with organizational needs. Recruiters use AI-generated dashboards to identify promising candidates based on skills, participation, and mission fit. The model highlights how social ventures can build scalable, equitable talent ecosystems with AI at the center. CodePath illustrates Proposition 1 by demonstrating that AI-enabled human capital development can reduce structural inequalities in hiring and education.

3.2. AI-Enabled Social Capital

Social capital refers to the relational resources embedded in an organization’s networks—trust, reciprocity, shared norms, and institutional legitimacy. It allows ventures to access new opportunities, mobilize supporters, and enhance credibility with funders, communities, and governments (

Hoang & Antoncic, 2003;

Austin et al., 2006). However, building and maintaining these relationships is labor-intensive and often dependent on informal, tacit knowledge that is difficult to scale or replicate.

AI offers several tools that can formalize, analyze, and optimize social capital processes. For instance, AI-powered customer relationship management (CRM) systems can track engagement metrics across donor interactions, community feedback, and social media platforms. Network analysis algorithms can identify influential connectors or “nodes” in a venture’s ecosystem, suggesting new partnerships or identifying stakeholder risks before they materialize (

Lebovitz et al., 2022).

Moreover, natural language generation tools can customize communication across segments, ensuring culturally competent, mission-aligned messaging for different audiences. This automation supports ventures in maintaining a consistent voice and building trust with a broader constituency. AI can also detect shifts in public sentiment—useful for advocacy and brand positioning.

Proposition 2. AI-augmented stakeholder analysis and engagement strategies will enhance the social capital of social enterprises, increasing their access to resources, legitimacy, and collaborative opportunities.

Tara Chklovski’s Technovation exemplifies how AI can scale social capital through global networks. The organization empowers girls from underrepresented backgrounds to develop AI-driven tech solutions for community challenges, pairing them with mentors from tech firms and NGOs worldwide. AI tools are central to how participants manage projects, communicate with mentors, and showcase solutions. These digital tools enhance peer collaboration, track engagement, and foster long-term mentorship relationships (Technovation, 2022). Technovation reflects Proposition 2 by revealing how AI strengthens relational infrastructure and cross-border trust among stakeholders—deepening legitimacy and expanding a venture’s ability to scale. DataKind, founded by data scientist Jake Porway, bridges the gap between expert technologists and high-impact social organizations by facilitating AI-driven humanitarian collaborations. At its core is a platform that intelligently matches data science volunteers with nonprofit projects based on skills, cause alignment, and location. The organization uses machine learning to manage this matchmaking at scale, ensuring optimal resource use and effective cross-sector partnerships.

DataKind also uses AI tools to analyze impact data from past collaborations, feeding insights back into the ecosystem and building institutional memory. These mechanisms enhance the organization’s ability to foster trust and sustained engagement across stakeholders. DataKind exemplifies Proposition 2 by showing how AI can formalize and amplify social capital through inclusive, data-informed network building and collective problem-solving.

3.3. AI-Enhanced Political Capital

Political capital refers to the capacity of organizations to engage with, influence, or reform institutional structures, particularly through public policy. For social ventures seeking systemic change, this form of capital is essential. However, policy advocacy requires nuanced knowledge of bureaucratic processes, shifting political winds, and coalition dynamics—capabilities that most ventures lack in-house (

Dees, 2012;

Santos, 2012).

AI enhances political capital through its ability to scan and synthesize vast amounts of political data. Predictive analytics can identify upcoming legislation, forecast voting behaviors of policymakers, and assess the likelihood of policy adoption. AI-powered media monitoring tools can track how issues evolve in public discourse, allowing ventures to time their campaigns more strategically (

Raisch & Fomina, 2024).

For coalitional politics, AI can map influence networks—identifying not just visible legislators but behind-the-scenes stakeholders, such as lobbyists, journalists, and donors. This strategic intelligence allows social ventures to build alliances with actors whose values align with their mission, thereby amplifying their political influence with relatively fewer resources.

Proposition 3. AI-enhanced political analysis and forecasting capabilities will increase the ability of social ventures to engage in effective advocacy, policy influence, and institutional change.

Rikin Gandhi’s Digital Green uses AI to enhance political capital through data-driven agricultural advocacy. The initiative partners with governments to deliver customized farming advice to smallholder farmers via

community-led videos. AI systems analyze these videos and user feedback to inform public policy and extension service decisions. By translating grassroots needs into structured insights, the organization informs public-sector planning and resource allocation (Digital Green, 2022). This case illustrates Proposition 3 by showing how AI can serve as a translator between grassroots voices and institutional frameworks—elevating a venture’s political influence despite limited lobbying capacity.

Pol.is, co-founded by Colin Megill, is a civic technology platform designed to enhance democratic deliberation using natural language processing and clustering algorithms. It was successfully deployed by Taiwan’s Digital Ministry to support participatory governance on sensitive issues like same-sex marriage and ride-sharing regulations. The platform allows citizens to submit open-ended input, which is then processed by AI to detect patterns, agreements, and consensus clusters in real time.

By enabling governments to visualize and act on public opinion transparently, Pol.is provides a low-cost alternative to traditional lobbying or survey mechanisms. It also helps reduce polarization by showing users where consensus already exists. This example supports Proposition 3 by illustrating how AI can empower social ventures and public institutions to engage in ethical, scalable, and inclusive policy influence—expanding political capital even without financial or institutional leverage.

3.4. AI-Driven Financial Capital Management

Access to financial capital is one of the most pressing challenges for social enterprises. Unlike commercial ventures, social enterprises often cannot offer financial returns to investors and must instead rely on grants, philanthropy, social bonds, or hybrid financing models (

Bloom & Smith, 2010). These streams are typically constrained, irregular, and subject to donor fatigue or shifting priorities.

AI offers tools to address these challenges in several ways. Predictive models can forecast donation patterns, helping ventures anticipate seasonal trends and segment donors based on giving behavior. AI-driven platforms can personalize donor outreach, improving engagement and retention. In financial operations, machine learning algorithms can flag inefficiencies, budget variances, or risks in real time, allowing managers to course-correct before problems escalate (

Chalmers et al., 2021).

Furthermore, AI can aid in impact measurement—an increasingly important requirement for funders—by analyzing qualitative data (e.g., interviews, surveys) to extract insights about program efficacy. This supports ventures in communicating their value proposition to funders, thereby attracting additional capital and building long-term financial resilience.

Proposition 4. AI-enabled financial analytics will enhance fundraising efficiency, financial planning, and impact reporting, thereby improving the financial sustainability and scalability of social ventures.

Premal Shah’s Kiva demonstrates AI-enhanced financial capital in action. The platform uses machine learning to assess creditworthiness for underserved borrowers and uses blockchain to create digital identities. Through the Kiva Protocol, lenders gain transparency into borrower risk, while borrowers gain faster access to capital. AI streamlines the donor-matching process, forecasts repayment rates, and reduces loan default risks (Kiva, 2023). Kiva aligns with Proposition 4, showing how AI strengthens financial planning, reduces friction in fundraising, and supports scale in the global microlending space.

GiveDirectly, co-founded by economists Michael Faye and Paul Niehaus, is a nonprofit that provides unconditional cash transfers to impoverished individuals in developing countries. To ensure efficient and ethical targeting, the organization uses AI models that analyze satellite imagery and phone usage data to identify households in extreme poverty. This method replaces traditional door-to-door assessments, enabling the rapid, large-scale deployment of funds.

In addition to targeting, GiveDirectly employs AI to generate real-time impact reports, monitor transfer effectiveness, and provide donors with transparent dashboards. These systems boost trust and credibility while reducing operational costs. GiveDirectly exemplifies Proposition 4 by showing how AI can enhance financial capital management, particularly in contexts where transparency, scale, and impact reporting are vital to funder engagement.

4. Conceptual Model

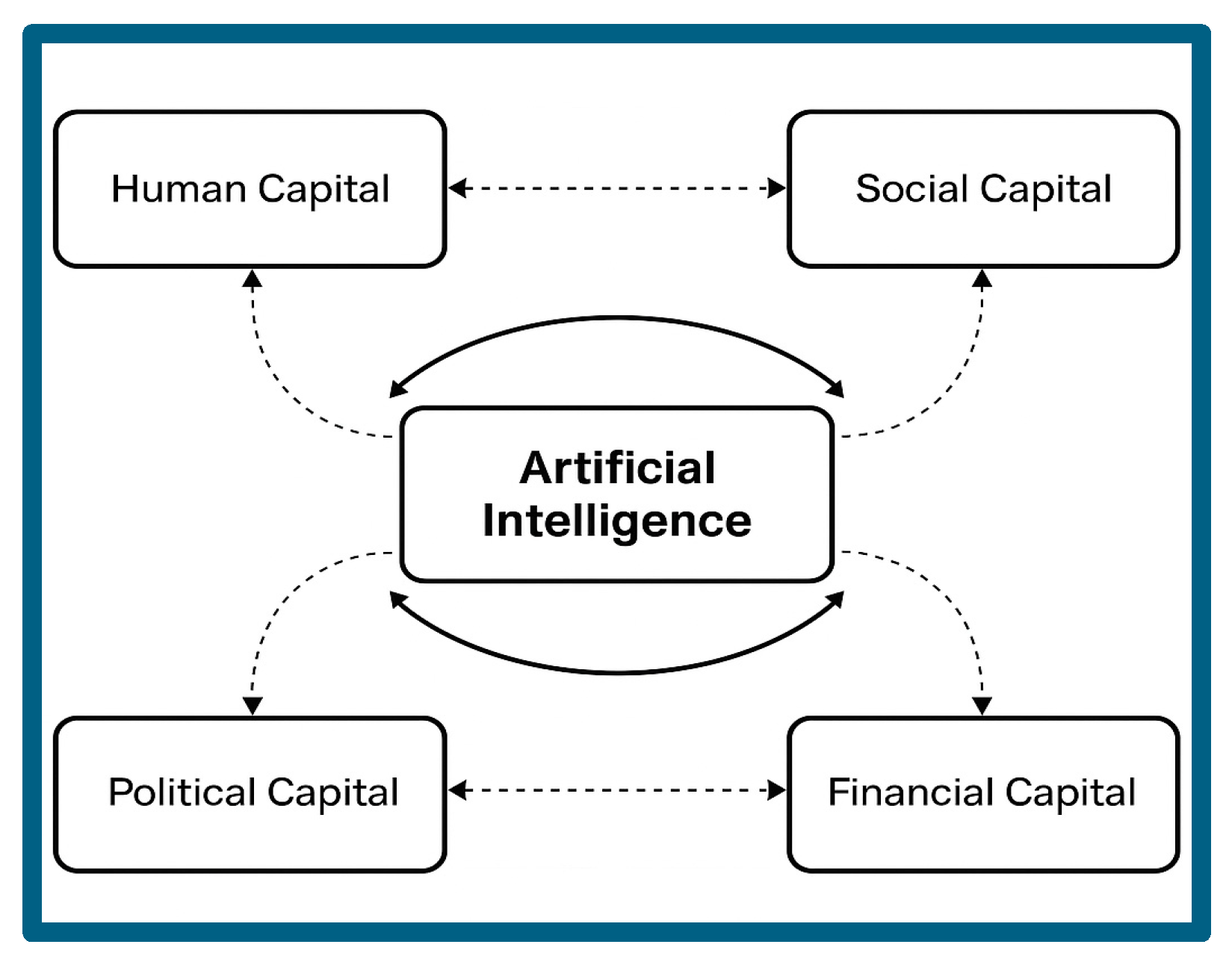

The model positions artificial intelligence (AI) as a central, integrative force that enhances the acquisition, optimization, and dynamic interaction of four key capitals—human, social, political, and financial. These capitals, essential to social venture performance, are interconnected through AI-enabled feedback loops that promote adaptability, efficiency, and scalability. The model underscores AI’s role not only in strengthening individual resource domains but also in orchestrating synergistic relationships among them, ultimately supporting sustained social impact and organizational resilience.

4.1. Dynamic Resource Interactions and Feedback Loops

While the four forms of capital—human, social, political, and financial—can be examined independently, they are deeply interconnected in the operational reality of social ventures. One of the key contributions of this paper is recognizing that artificial intelligence (AI) not only optimizes each individual capital but also amplifies the synergistic interactions among them. These interactions form dynamic feedback loops that compound over time, strengthening a venture’s ability to scale and sustain impact.

4.2. Interconnectedness of Capitals in Social Ventures

In traditional RBV models, resources are typically analyzed as isolated strategic inputs. However, in the context of social entrepreneurship, a systems-level view is essential. For example, the development of human capital through AI-enhanced recruitment and training processes can directly influence the quality of social capital. Mission-aligned, well-trained staff are better equipped to build authentic relationships with stakeholders, enhance community trust, and foster cross-sector partnerships (

Austin et al., 2006). In turn, improved social capital can attract additional human capital, as engaged networks often act as informal recruiters or sources of referrals.

Similarly, social capital can significantly reinforce political capital. Ventures with strong networks are more likely to be embedded in coalitions, advocacy groups, and participatory governance structures, which increases their capacity to influence policy. AI enables these connections by mapping ecosystem actors, identifying potential allies, and supporting targeted communication efforts (

Lebovitz et al., 2022). When deployed strategically, AI enhances this political influence by guiding ventures on when and how to engage with key decision-makers.

Financial capital also interacts with other resources in meaningful ways. Increased financial capacity allows ventures to invest in better technology, hire more specialized staff, and develop stronger stakeholder relationships through enhanced communications or expanded services. AI plays a key role here by identifying areas where financial inputs can be most effectively deployed for return on a mission. Predictive analytics inform budget allocations, resource planning, and scenario modeling, allowing for more agile and data-driven decision-making (

Chalmers et al., 2021).

4.3. The Role of AI as a Catalyst in Resource Feedback Loops

AI acts as an orchestrator across these interdependencies by enabling real-time responsiveness, continuous learning, and precision targeting. Unlike static resource utilization, AI facilitates a feedback-rich environment where ventures can assess how a shift in one resource domain affects others. For example, an AI tool that identifies gaps in volunteer engagement may trigger additional training (human capital), community outreach (social capital), or resource reallocation (financial capital).

These feedback loops create what scholars have described as “second-order capabilities”—the ability to reconfigure resource portfolios dynamically in response to internal and external changes (

Teece et al., 1997). This is particularly important for social enterprises operating in volatile or uncertain environments, such as post-disaster zones, emerging markets, or politically contested regions.

Additionally, AI strengthens the organization’s absorptive capacity—the ability to recognize the value of new information, assimilate it, and apply it to organizational goals (

W. M. Cohen & Levinthal, 1990). This positions social ventures to not only react to environmental shifts but to proactively shape their strategies, refine their interventions, and capitalize on emergent opportunities for growth.

4.4. Implications of Resource Synergies for Scalability

The cumulative effect of these AI-enhanced interactions is a more robust and resilient venture model. Organizations that can simultaneously optimize across multiple forms of capital are more likely to sustain their mission over time, scale their operations, and deepen their social impact. These synergies shift the conversation from “resource scarcity” to “resource orchestration”—a more generative paradigm that reflects the real complexity and potential of social entrepreneurship in the AI era.

By conceptualizing AI as a strategic integrator rather than a siloed tool, this paper offers a new lens on how hybrid organizations can maximize their capital resources. This model encourages ventures to think beyond short-term optimization and move toward long-term systems design, where every resource decision is embedded within a broader logic of strategic synergy and social value creation.

5. Ethical Considerations in AI Deployment for Social Ventures

While artificial intelligence (AI) presents remarkable opportunities for enhancing the efficiency and impact of social ventures, it also introduces a range of ethical challenges that must be carefully addressed. Social enterprises, by virtue of their mission to serve marginalized communities and promote equity, are held to high ethical standards. The deployment of AI technologies—often built on large datasets, probabilistic reasoning, and opaque algorithms—can run counter to these values if not implemented responsibly (

Shepherd & Majchrzak, 2022;

Lebovitz et al., 2022).

This section examines the ethical implications of AI use in the social sector, highlighting risks such as algorithmic bias, surveillance, data privacy violations, and technological exclusion. It also offers guiding principles for the ethical governance of AI in resource-constrained, impact-driven contexts.

5.1. Algorithmic Bias and Social Justice

One of the most pressing ethical concerns associated with AI is the potential for algorithmic bias—discriminatory outcomes resulting from biased training data or flawed model assumptions. In social entrepreneurship, where AI might be used to identify beneficiaries, allocate services, or guide advocacy campaigns, biased models can perpetuate inequalities rather than alleviate them (

Gigerenzer, 2022). For example, an AI model used to prioritize educational access might inadvertently underrepresent low-income or rural populations if the training data lacks sufficient diversity.

Given the social mission of these ventures, such outcomes are not just operational failures—they are ethical breaches. To mitigate bias, organizations must ensure that datasets used for training AI models are representative of the populations they aim to serve. Furthermore, explainable AI (XAI) tools can be deployed to increase transparency in decision-making, allowing stakeholders to understand how and why certain recommendations are made (

Raisch & Fomina, 2024).

5.2. Data Privacy and Consent

Many social ventures work with vulnerable populations, such as refugees, survivors of domestic violence, or individuals with disabilities. These groups face heightened risks from data breaches or surveillance practices. The collection, storage, and use of personal data must therefore be governed by strict ethical protocols, even in cases where consent is technically obtained.

Informed consent in AI contexts must be reimagined to account for power imbalances, limited digital literacy, and the potential for unintended consequences. Ventures should adopt privacy-by-design principles, anonymize data whenever possible, and provide opt-out mechanisms that are clear, accessible, and consequence-free (

Chalmers et al., 2021). Regulatory compliance (e.g., with GDPR or HIPAA) is necessary but insufficient—ethical leadership requires going beyond minimum legal standards.

5.3. Technological Exclusion and Access Inequities

The digital divide poses another ethical dilemma. Many of the communities served by social ventures lack reliable access to the internet, smartphones, or digital training. AI-enabled tools that assume consistent connectivity or digital proficiency can inadvertently exclude the very populations they are meant to empower (

Davidsson et al., 2020). For instance, a chatbot designed to deliver mental health support may fail if users cannot access it in their native language or on low-bandwidth devices.

To counteract this, social enterprises must invest in inclusive design, ensuring that AI tools are linguistically, culturally, and technologically accessible. Human-centered design approaches and participatory technology development can also help ventures co-create tools with end users, thereby aligning innovation with lived experience (

Dimov et al., 2023).

5.4. Toward Ethical Governance in AI

Ethical AI governance requires more than ad hoc safeguards; it demands a systemic and proactive framework. Ventures should establish interdisciplinary ethics boards, involve affected communities in design and testing phases, and conduct regular audits of algorithmic performance. Embedding ethics into the AI lifecycle—from design to deployment—ensures that social values are reflected at every stage.

Furthermore, funders and policymakers should support ventures in this endeavor by providing resources for ethical training, incentivizing responsible innovation, and building collaborative ecosystems where best practices can be shared. As AI becomes increasingly embedded in social innovation ecosystems, governance will emerge as a key differentiator between ventures that merely deploy technology and those that use it to genuinely empower and uplift communities.

6. Theoretical Contributions

This paper makes several important contributions to academic literature at the intersection of strategic management, social entrepreneurship, and emerging technologies. Most notably, it extends the resource-based view (RBV) to include artificial intelligence (AI) as a dynamic capability that enhances both the acquisition and orchestration of core organizational resources. In doing so, it addresses long-standing limitations in RBV theory related to technological disruption, strategic adaptability, and resource interdependence. Additionally, the paper contributes to the evolving field of social entrepreneurship by offering a framework that supports scalability and sustainability through advanced analytics and data-driven decision-making—without sacrificing the social mission.

6.1. Reconceptualizing the Resource-Based View with Dynamic AI Capabilities

Historically, the RBV has focused on the static possession of resources that are valuable, rare, inimitable, and non-substitutable (

Barney, 1991;

Wernerfelt, 1984). While this approach has proven robust in explaining firm-level competitive advantage, it is less equipped to address dynamic environments characterized by rapid technological change and uncertainty. Scholars such as

Teece et al. (

1997) have responded with the concept of dynamic capabilities—the ability of firms to integrate, build, and reconfigure internal and external competencies in response to shifting conditions.

This paper builds on that evolution by positioning AI not just as a resource but as a meta-capability—a force multiplier that enhances the organization’s ability to leverage its other resources (

Lavie, 2007). AI transforms human capital by enabling customized training and predictive hiring; it activates social capital by revealing hidden network value and optimizing engagement; it deepens political capital by simulating advocacy scenarios and mapping influence ecosystems; and it fortifies financial capital by forecasting risk and enhancing donor targeting. As recent discussions suggest, AI may not provide a fundamentally new source of competitive advantage on its own but can amplify existing capabilities when strategically aligned with firm resources (

Barney & Reeves, 2024). These effects are not static but recursive—AI learns and improves over time, introducing continuous improvement into the resource optimization process.

In doing so, the paper contributes to the theoretical refinement of RBV in three key ways:

From Resource Possession to Resource Orchestration: AI allows ventures to dynamically rebalance and coordinate resources in real time.

From Static VRIN to Contextual Value: AI enhances the context-specific value of resources, especially in mission-driven or resource-poor environments.

From Internal Capabilities to Networked Intelligence: AI extends the boundary of the firm by integrating insights from external ecosystems (e.g., social media, public policy, donor networks).

These contributions encourage RBV scholars to move beyond inventory metaphors of strategy and embrace computational, real-time models of competitive advantage in social contexts.

6.2. Advancing Social Entrepreneurship Theory in the Digital Age

This paper also contributes to social entrepreneurship theory by introducing a structured approach to integrating AI into ventures that aim for both social impact and financial viability. Some traditional models of social entrepreneurship emphasize mission drift, hybridity, and resource constraints as core tensions (

Peredo & Chrisman, 2006;

Mort et al., 2003). This paper addresses these tensions by showing how AI can mitigate resource scarcity, improve mission alignment, and support systemic change—making the hybrid model more scalable and resilient. In line with

Ramoglou and McMullen’s (

2024) process theory of opportunity actualization, this framework positions AI as an enabler that helps social entrepreneurs not only identify but also actualize latent opportunities within volatile and resource-scarce contexts.

In particular, this framework strengthens the field by the following:

Offering a conceptual model that aligns with emerging digital infrastructure in the social sector.

Demonstrating how technology can be deployed in ways that complement, rather than compromise, human-centered and ethical practices.

Encouraging empirical inquiry into AI-enabled innovation within nonprofit, cooperative, and grassroots enterprise forms.

The addition of AI as a strategic variable opens new theoretical questions about legitimacy, accountability, and impact measurement in socially oriented ventures—questions that will define the next generation of research in this domain.

6.3. Bridging Technology and Strategic Ethics

Finally, this paper contributes to a broader understanding of ethics in entrepreneurship by showing how strategic frameworks must evolve to include technological responsibility. While most strategic models have treated ethics as an external constraint or reputational concern, this paper embeds it within the design and deployment of AI itself.

By positioning AI as both an enabler of efficiency and a potential source of harm, the paper advances a dual-use theory of technological tools in entrepreneurship. This invites future research into ethical design, stakeholder governance, and algorithmic accountability as core components of strategic entrepreneurship (

Gigerenzer, 2022;

Raisch & Krakowski, 2021).

7. Practical Implications

The integration of artificial intelligence (AI) into social entrepreneurship is not merely a theoretical exercise—it holds significant implications for practitioners seeking to improve operational efficiency, deepen stakeholder engagement, and scale impact in a sustainable and ethical manner. This section outlines how the proposed AI-augmented resource-based view (RBV) framework translates into actionable strategies for social entrepreneurs, philanthropic funders, and policy institutions. By providing specific, real-world applications of the conceptual model, we offer a roadmap for implementation that bridges the gap between theory and practice.

For social entrepreneurs, AI can be a transformative lever when deployed with strategic intentionality. Human capital—often constrained by limited financial resources—can be optimized through AI-enhanced recruitment platforms that screen for mission alignment, skills fit, and retention potential. Tools like predictive hiring and adaptive training systems allow ventures to build capacity without incurring the overhead costs typical of traditional HR systems (

Chalmers et al., 2021). These systems are particularly impactful for organizations working in rural areas, marginalized communities, or virtual environments where labor pools are diverse and decentralized.

In the realm of stakeholder engagement, AI offers unprecedented precision. Ventures can use customer relationship management (CRM) systems powered by natural language processing to tailor outreach to donors, partners, and community members. These systems not only automate communications but analyze sentiment, timing, and engagement likelihood, thus allowing social entrepreneurs to deploy their time and effort where they are most likely to yield value (

Lebovitz et al., 2022). AI also empowers community listening, enabling ventures to adjust messaging based on real-time feedback from constituents across languages, geographies, and platforms.

AI’s capacity to support political capital may be especially valuable for organizations pursuing systemic change. Social ventures can use AI tools to monitor legislative developments, simulate policy scenarios, and identify key policy actors aligned with their mission. For instance, ventures working on environmental justice may track carbon pricing bills, analyze voting behaviors of key legislators, and identify public sentiment on related issues, thus informing a data-driven advocacy strategy (

Raisch & Fomina, 2024). These applications are critical for organizations that lack traditional lobbying power but still seek to influence public discourse and institutional reform.

Financial capital also benefits from AI-enabled efficiencies. Forecasting tools can help social enterprises anticipate donor behavior, track budget adherence, and model multi-year sustainability scenarios. This allows organizations to better manage liquidity, plan for contingencies, and communicate value more effectively to funders and investors. AI can also support impact measurement by synthesizing data from surveys, case studies, and financial reports, helping ventures align outcomes with funder expectations while maintaining transparency and accountability (

Bloom & Smith, 2010).

For funders—especially foundations, impact investors, and development banks—the implications are twofold. First, supporting the adoption of AI tools within social ventures can significantly improve grantee performance. Providing grants for technological infrastructure, technical assistance, or AI consultants may yield a high return in terms of impact per dollar. Second, funders can use AI themselves to evaluate portfolios, identify scalable innovations, and optimize funding cycles. Funders should also play a role in incentivizing ethical AI adoption by requiring transparency and governance mechanisms as part of grant or investment terms.

Finally, policymakers can enable more equitable AI integration in the social sector by investing in digital infrastructure, supporting open-source platforms, and ensuring that AI innovation is accessible to small, grassroots organizations. Public–private partnerships can play a critical role in this space, creating regional innovation hubs where social ventures can test new technologies in low-risk environments. Governments can also develop ethical AI guidelines specific to the nonprofit sector, incorporating community voice and equity considerations into regulatory design.

Ultimately, the practical value of this paper lies in offering a blueprint for how social ventures—often resource-constrained and mission-critical—can use AI to navigate complexity, expand capacity, and achieve durable social change. By translating the theoretical insights of the AI-augmented RBV framework into actionable strategies, this paper empowers actors across the ecosystem to build more resilient, adaptive, and impactful ventures in an increasingly data-driven world.

8. Conclusions

This paper proposed an innovative extension of the resource-based view (RBV) by incorporating artificial intelligence (AI) as a dynamic, integrative capability in social entrepreneurship. We presented a conceptual framework grounded in illustrative cases that demonstrate how AI enhances the acquisition and orchestration of four foundational forms of capital. Our results were not empirical findings but were instead presented as theory-building propositions, intended to generate new inquiry and practical experimentation. We used these cases to develop a visual model (

Figure 1) that captures the dynamic interactions and synergies that AI enables across organizational resources. The model’s logic was woven throughout the propositions and revisited in our discussion of feedback loops and scalability in

Section 4.

Through our AI-augmented RBV framework, we examined how AI can strengthen four foundational forms of capital—human, social, political, and financial—each of which is essential for the success of mission-driven organizations. For human capital, AI enables more strategic recruitment, customized training, and predictive performance management. For social capital, AI supports stakeholder engagement, network optimization, and personalized communication. Political capital is enhanced through AI-powered policy monitoring, influence mapping, and advocacy modeling, allowing even resource-poor organizations to engage in systemic reform. Financial capital, meanwhile, benefits from AI’s ability to forecast donor behavior, identify funding trends, and streamline budgeting—all while providing real-time insights that improve sustainability and transparency.

Importantly, this paper recognized that these four capitals are not siloed. They form an integrated ecosystem, wherein improvements in one area can compound benefits in another. AI acts as the connective tissue across this ecosystem, enabling feedback loops and facilitating strategic agility. A venture that uses AI to optimize financial planning may free up resources to invest in community engagement, which, in turn, strengthens political legitimacy and improves talent recruitment. Such dynamic interdependencies mark a significant departure from static models of strategy, requiring a systems-thinking approach to both research and practice.

At the same time, we emphasized the ethical dimensions of AI integration. Social ventures, by nature of their work with marginalized populations and high-stakes outcomes, must ensure that AI is deployed responsibly. This includes addressing algorithmic bias, safeguarding data privacy, promoting equitable access, and developing inclusive design practices. AI in the social sector must be guided not only by innovation but also by justice, transparency, and trust.

Our framework makes several contributions to the fields of strategic management and social entrepreneurship. Theoretically, it expands RBV to reflect real-time, technology-enabled adaptability in resource-scarce environments. Practically, it provides guidance for how entrepreneurs, funders, and policymakers can implement AI tools in ways that support, rather than compromise, their social mission. Conceptually, it offers a roadmap for future empirical research on how AI shapes entrepreneurial cognition, stakeholder engagement, and venture scalability in diverse contexts.

Looking forward, the AI-augmented RBV provides an opportunity to reshape not only how we understand social entrepreneurship but how we design it. As social problems grow more complex and globalized, the ventures that survive and scale will be those that combine mission integrity with adaptive intelligence. By embedding AI into the very DNA of how resources are managed, social entrepreneurs can move from reactive problem-solving to proactive system-building—transforming isolated interventions into scalable, systemic solutions.

In this light, AI is not a departure from the values of social entrepreneurship; it is a means of advancing them. When deployed ethically and strategically, AI can help ventures honor their commitments to equity, innovation, and human flourishing while simultaneously unlocking new frontiers of scale and sustainability. This convergence represents not just an evolution of entrepreneurial strategy but a revolution in how social change is imagined, resourced, and realized.

While this paper presents AI as a catalytic enabler of resource orchestration, we recognize that it is not the only pathway. Historically, social ventures have achieved scale through mechanisms such as visionary leadership, community mobilization, and adaptive governance. What distinguishes AI, however, is its capacity to automate decision-making, predict resource flows, and optimize stakeholder interactions at a speed and scale that traditional approaches cannot easily match. Thus, AI should be seen not as a replacement for human-centered orchestration but as a complementary force that enhances strategic agility in complex environments.

It is important to recognize, as some critics have rightly noted, that AI is not inherently a novel resource—many firms use it to support various strategic functions. However, our contribution lies not in the technology itself but in theorizing its transformative impact on the configuration of resource capital in hybrid organizations. By embedding AI within the RBV as a dynamic, systemic enabler, we offer a fresh theoretical lens that is both responsive to current realities and grounded in strategic management logic. For social ventures operating with complex dual missions and limited resources, this reconceptualization opens new possibilities for a sustainable, mission-aligned scale, thereby justifying AI’s role as a legitimate extension of the RBV framework in social entrepreneurship.

9. Future Research Directions

While this paper provides a comprehensive theoretical framework for the integration of artificial intelligence (AI) into the resource-based view (RBV) of social entrepreneurship, several promising directions remain for future research. These avenues are vital to empirically validating the framework, deepening theoretical understanding, and supporting the ethical and effective application of AI in socially impactful ventures.

One pressing need is the empirical testing of the theoretical propositions outlined in this study. Future research should explore how AI integration influences the acquisition, deployment, and interplay of human, social, political, and financial capital within diverse social ventures. Future studies should employ robust empirical methodologies, such as longitudinal data analysis, comparative case study designs, and mixed-methods research, to test the propositions and evaluate the practical utility of the AI-augmented RBV framework. Future research should empirically test the theoretical propositions outlined here. Sectoral comparisons could explore how AI integration influences capital deployment and organizational impact. Given the inherent uncertainty in deploying emerging technologies within impact-driven ventures, future research could benefit from frameworks like the one from

McMullen and Shepherd (

2006), which emphasizes how entrepreneurs act under conditions of uncertainty—a perspective particularly relevant for AI integration. Additionally, participatory studies and measurement tool development are recommended to examine AI’s practical and ethical dimensions in social ventures.

Longitudinal studies could examine the evolution of resource strategies over time, while comparative studies could contrast AI-using and non-AI-using organizations to better understand causal relationships. For example, researchers could assess whether AI-enabled recruitment systems lead to higher staff retention or whether AI-powered CRMs improve donor conversion rates across different regions and organizational types.

Cross-sectoral and cross-national comparisons also offer fertile ground for study. The effects of AI integration are likely to vary depending on contextual factors such as digital infrastructure, regulatory frameworks, and cultural attitudes toward technology. Future works could explore how ventures in emerging markets adapt AI differently than those in advanced economies. Studies comparing AI adoption in healthcare, education, or environmental justice could shed light on sector-specific dynamics and scalability challenges. These comparisons will help scholars and practitioners tailor strategies for responsible AI integration into diverse settings.

Another important direction involves developing robust ethical and governance frameworks for AI in the social sector. While this paper outlines key ethical considerations, deeper investigations into how ventures ensure fairness, transparency, and community engagement in AI deployment are urgently needed. Qualitative research, such as ethnographies or stakeholder interviews, could uncover the lived experiences of users interacting with AI-enabled services. Researchers should also examine participatory design methods and data governance practices that prioritize inclusivity, particularly when serving marginalized or vulnerable populations.

In addition, future studies could explore the influence of AI on entrepreneurial imagination and opportunity recognition. As social entrepreneurs increasingly use AI tools to generate insights and detect emerging needs, questions arise about how these tools shape creativity, innovation, and venture ideation. Experimental designs might test whether AI enhances or constrains cognitive diversity, while case studies could illuminate how AI informs entrepreneurial decision-making under uncertainty.

The development of measurement tools is another area where research is needed. Traditional impact metrics may not fully capture the nuanced benefits or trade-offs associated with AI use in social ventures. Scholars should design and validate new instruments to assess AI’s contribution to resource efficiency, stakeholder alignment, and mission achievement. Mixed-method approaches—combining quantitative performance data with qualitative evaluations of impact—will be critical for capturing the full value of AI-enhanced strategies.

Finally, future work should investigate the ecosystem-level implications of AI adoption in social entrepreneurship. Beyond individual ventures, AI may reshape how organizations coordinate, share knowledge, and innovate collectively. Researchers could examine whether AI facilitates new forms of collaboration among funders, accelerators, governments, and communities or whether it risks concentrating power among larger, better-resourced actors. Ecosystem-level studies can inform the development of inclusive digital infrastructures that empower grassroots innovation and equitable resource distribution.

Together, these directions outline a robust research agenda that integrates empirical rigor, ethical inquiry, and contextual sensitivity. Advancing the AI-augmented RBV framework through interdisciplinary, cross-contextual, and impact-oriented research will be essential for realizing the full promise of AI in social entrepreneurship. By building on the theoretical foundation established here, scholars can generate actionable insights that guide the responsible evolution of technology-enhanced social ventures around the world.