1. Introduction

Our empirical findings move beyond a simple confirmation that trade rhetoric impacts markets; they offer a deeper understanding of how these aperiodic shocks are processed by financial systems and the crucial feedback loop that exists between political communication and market stability. The observed short-term volatility and sharp market reactions, particularly in the S&P 500, suggest a significant challenge to the core tenets of the Efficient Market Hypothesis (EMH). The EMH posits that all information, once made public, is rapidly and fully incorporated into asset prices, making it impossible for investors to consistently earn abnormal returns. However, our results show that the market’s response to non-legislated tariff announcements is anything but smooth or immediate. The abrupt price movements and surges in volatility indicate that this type of information—which is unstructured, unpredictable, and often contradictory political rhetoric—is not perfectly anticipated or instantly priced in. This suggests that these policy shocks may exploit a form of market inefficiency, as investors and automated trading algorithms struggle to parse political rhetoric for its true economic and geopolitical implications. This is further complicated by the fact that the legal basis for these tariffs is often challenged, as seen in the ongoing court cases against President Trump’s use of the International Emergency Economic Powers Act (IEEPA), adding another layer of legal uncertainty to the economic equation.

This phenomenon is not isolated to the recent political landscape; it is a recurring theme throughout economic history. One of the most famous examples is the Smoot–Hawley Tariff Act of 1930 in the United States. Originally intended to protect American farmers, the act ultimately raised tariffs on over 20,000 imported goods. Far from its intended effect, Smoot–Hawley triggered a wave of retaliatory tariffs from other nations, leading to a dramatic contraction in global trade. Between 1929 and 1934, world trade plummeted by an estimated 65%. While not the sole cause of the Great Depression, this cascade of protectionism exacerbated the economic downturn, contributing to bank failures, rising unemployment, and a general loss of confidence that deepened the financial crisis. The markets, rather than being shielded, were thrown into turmoil, illustrating that trade policy, even in its formal, legislative form, can have profoundly negative and unpredictable effects on financial stability.

More recent examples of protectionism around the globe further highlight the complexity and far-reaching effects of these policies. While less dramatic than a full-blown trade war, measures like China’s use of anti-dumping duties or the EU’s Common Agricultural Policy (CAP) have created significant trade barriers. China has frequently imposed anti-dumping duties on products ranging from steel to wine, often in response to similar measures from other nations. These duties, while formally aimed at preventing unfair trade practices, often act as a de facto form of protectionism, causing uncertainty for foreign exporters and prompting shifts in global supply chains. Similarly, the EU’s CAP, through a combination of subsidies and import levies, has protected European farmers but has also been criticized for distorting global agricultural markets and affecting food prices in developing countries. These examples demonstrate that trade protectionism is not a monolith; it takes many forms and its impacts, while sometimes intended to be localized, ripple through interconnected financial markets in ways that are difficult to predict.

The asymmetric volatility captured by our EGARCH models provides further theoretical grounding in behavioral finance. The classic leverage effect in the S&P 500 and US bonds, where negative news has a larger impact on volatility than positive news, aligns with investor loss aversion. This is a well-documented psychological bias where individuals feel the pain of a loss more acutely than the pleasure of an equivalent gain. Consequently, negative news regarding trade, which implies a potential loss of market access or reduced profits for companies, triggers a disproportionately strong emotional and financial reaction among investors, leading to a sharp increase in volatility. However, the atypical positive asymmetry observed in the Chinese CSI 300 is particularly noteworthy. This finding suggests that for Chinese stocks, both negative and positive tariff news from the U.S.—a major trading partner—can be a source of uncertainty. Negative news signals a direct threat to exports and economic growth, while positive news (e.g., a potential de-escalation or a temporary truce) may still be viewed with suspicion. It could be a fleeting reprieve in an ongoing geopolitical conflict, not a sign of a fundamental shift. This indicates that market reactions are not a simple, rational response to a news headline; they are filtered through a complex lens of political and economic uncertainty, reflecting the unique sensitivities of different markets. For instance, a “positive” announcement might be met with a muted response in the Chinese market because investors are weary of the unpredictable nature of U.S. policy and fear that any gains will be quickly reversed by another sudden pronouncement.

The most critical implication of our study is for policymaking. Our findings suggest that tariff rhetoric functions as a new type of shock, one that is not a scheduled, predictable event like a Federal Reserve interest rate announcement, but an unpredictable, aperiodic event. The immediate, market-moving power of this rhetoric, as evidenced by the impulse response functions showing S&P 500 movements preceding tariff rhetoric, underscores a crucial feedback loop between financial markets and policy. Policymakers must recognize that their public statements on trade policy have an immediate and measurable impact on financial stability. The casual use of tariff threats, as seen in recent years, can trigger significant volatility and investor uncertainty. For example, the stock market losses following the April 2025 “Liberation Day” tariffs and subsequent relief rallies after the announcement of preliminary agreements with various countries highlight how sensitive markets have become to this type of rhetoric. This is a profound shift from a period when markets were primarily concerned with formal, long-negotiated trade agreements. The market has learned to react to the prospect of tariffs, not just their implementation.

These recent developments, including the negotiations that led to specific, but not fully liberalizing, agreements with allies and the ongoing legal challenges to the tariffs, underscore the high degree of uncertainty that has become a permanent feature of global trade. The market’s reaction to these announcements—or lack thereof—reveals a deepening skepticism among investors. The temporary nature of some agreements and the continued threat of new tariffs on other sectors (e.g., aircraft, drones, and wind turbines) means that the underlying uncertainty persists.

In light of this, we recommend that policymakers adopt a communication strategy for trade policy that is more akin to the carefully scripted, transparent, and consistent approach used by central banks. Monetary policy announcements are choreographed to minimize market disruption, with every word chosen to convey a clear message and forward guidance. Our research provides strong empirical evidence that political rhetoric is a significant economic force in its own right, capable of disrupting financial stability and reshaping risk perception. The era of treating tariff threats as mere negotiating tactics is over; their financial market impact is real and must be managed. Ultimately, our findings suggest that trade policy announcements should be treated with the same level of caution and careful phrasing typically reserved for monetary policy, as both can send powerful, and at times disruptive, signals to global markets.

2. Literature

In recent times, the international landscape has witnessed a dramatic surge in the willingness of major global powers to leverage their trade and financial relationships for geopolitical objectives. This phenomenon, termed “Geoeconomics,” holds the potential to fundamentally reshape global trade and financial architecture. Geoeconomic strategies extend beyond traditional sanctions to include the strategic deployment of export controls, initiatives to restructure supply chains for security imperatives, the provision of foreign aid to foster political alignment, and the encouragement or coercion of domestic and foreign firms to alter their business relationships.

While a nation’s geoeconomic power is intrinsically linked to its economic strength, sheer size and extensive connections do not automatically translate into effective geoeconomic influence. Governments aiming to project geoeconomic power abroad must possess the credible capacity to co-opt or coerce their domestic firms and citizens, and potentially critical foreign allies, into participating in these power projection efforts (

Clayton et al., 2025). This endeavor necessitates navigating a complex array of domestic political economic constraints, including legal frameworks, national political objectives, influential interest groups, and other forces that can limit a government’s ability to exert its influence. A critical inquiry in the realm of geoeconomic power projection revolves around the extent to which a government can compel its own firms or allies to act against their private interests in pursuit of broader geopolitical objectives.

Amiti et al. (

2019) analyzed and measured the effects of the trade war between the United States and its trading partners in 2018 on prices and welfare. As a result of the implemented import tariffs, they found a significant increase in the prices of intermediate and final goods, while estimating a loss in real income. The study revealed a monthly welfare loss of

$1.4 billion and determined that the 10% tariff imposed led to a 10.4% increase in prices. This process of de-globalization and the implementation of protectionist trade policies, even in the short term and with full pass-through, proved detrimental to the domestic economy. Unilateral protectionist actions also heightened uncertainty in financial markets.

Caldara et al. (

2020) aimed to examine the effects of uncertainty in international trade policies on the U.S. economy. They identified the damage caused by protectionist policy tendencies on global economies. While the study measured the impact on investment using panel regression and time series methods, it employed a macro-level VAR model to estimate the effects on total investment and output. According to the findings, sudden changes in trade policy (such as tariff increases) significantly reduce business investments. The uncertainty shock was found to lower the level of fixed capital investment by 1–2% and to adversely affect overall economic activity.

Baker et al. (

2013) developed a new index measuring economic policy uncertainty (EPU) and analyzed its economic impacts. In a study conducted on twelve major economies, uncertainty indices were created, enabling international comparisons. The study also investigated the impact of policy uncertainty during highly volatile periods on stock prices, investment, and employment. It concluded that economic uncertainty is a quantifiable concept with a substantial effect on the economy. The EPU index has become an important tool for measuring the effects of uncertainties arising from developments such as protectionism, wars, and financial crises on financial markets.

In their 2023 study, Ang and Wang examined the impact of political uncertainties triggered by the enactment and subsequent repeal of the Smoot–Hawley Tariff Act on financial markets. Focusing on how trade policy uncertainty is reflected in financial markets, the study analyzed market responses on 16 key event dates. Covering the period from 1929 to 1935, it was found that the U.S. stock market experienced an average loss of 3.6% on each key event date, alongside significant increases in stock return volatility.

Financial news originating from the United States has demonstrably global implications, particularly concerning macroeconomic news, including trade policy. This influence extends to major global markets such as Japan, the United Kingdom, Germany, the Asia-Pacific region, and Finland (

Becker et al., 1995a,

1995b;

Connolly & Wang, 2003).

Research by

Kang and Yoon (

2018) identified Chinese economic policy uncertainty as a significant driver of spillovers during financial crises. While

Zhang et al. (

2019),

Li and Zhong (

2020) concluded that economic policy uncertainty (EPU) from the United States exerts a greater influence on global markets than Chinese EPU, the extent of this influence regarding trade policy uncertainty (TPU) remains an open question. This is especially pertinent given China’s substantial trade volume. Furthermore, China’s significant role as a global commodity consumer, including being the world’s largest oil consumer, and its substantial economic growth over the past decade necessitate an assessment of whether uncertainties in its trade policies significantly impact global markets.

Ma et al. (

2019) demonstrated that Chinese trade policy is a net recipient of spillovers from other policy areas within its economy. While uncertainty broadly influences the macroeconomic environment (

Leduc & Liu, 2016), it also has potential implications for global financial markets (

Zhang et al., 2019). More recently,

Riaz et al. (

2024) highlighted that total, directional, and net spillovers “to” and “from” the stock market are major contributors to contagion, closely followed by the commodity market.

Boer and Rieth (

2024) investigated the macroeconomic effects of import tariffs and trade policy uncertainty in the United States, identifying their impact on growth, trade, investment, and employment. The study employed a DSGE model and used data on gross domestic product (GDP), imports, exports, investment, the consumer price index, and the nominal effective exchange rate for the period 1960–2019. Based on the analysis conducted using the SVAR method, the study found persistent negative effects on GDP, a depreciation in the exchange rate, and a decrease in import and investment rates, while export levels increased. It is projected that reversing protectionist policies would lead to a cumulative output increase of 4% over three years. The protectionist measures implemented particularly in 2018–2019 resulted in a 2% decline in output.

In this context, our study aims to contribute to the literature by utilizing recent tariff negotiations and their impact on asset markets.

3. Methodology

Our study employs a Vector Autoregression (VAR) model because it is uniquely suited to capture the dynamic, multi-directional relationships between our variables: market volatility and tariff rhetoric. Unlike simple regression, VAR treats all variables as endogenous, allowing us to analyze how a shock to one variable, such as a change in tariff rhetoric, affects all other variables over time, and vice versa. This is crucial for our research question, which investigates whether stock market movements can influence policy rhetoric, and not just the other way around.

The Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) model is the ideal complement to the VAR because our core focus is on volatility. EGARCH is superior to other GARCH models for this study as it can capture the asymmetric impact of shocks. This is critical for financial markets, where negative shocks (bad news) often have a larger impact on volatility than positive shocks (good news) of the same magnitude. The EGARCH model, therefore, allows us to test if tariff rhetoric, whether positive or negative, has a disproportionate effect on market volatility.

Moreover, we selected the optimal lag length for our VAR model using established information criteria, including the Akaike Information Criterion (AIC) and Schwarz-Bayesian Information Criterion (SBIC). These criteria balance model fit with parsimony, helping to avoid overfitting and ensuring our model captures the true underlying dynamics without incorporating noise. The chosen lag length, consistently supported by these criteria, ensures that our model adequately accounts for the temporal dependencies between tariff rhetoric and market variables.

A key concern in our analysis is endogeneity, which we explicitly address. The relationship between tariff announcements and market volatility is not necessarily one-way. It is plausible that negative market movements (e.g., a sudden drop in the S&P 500) could precede and even influence the timing or tone of a subsequent tariff-related announcement, as policymakers might react to economic signals. Conversely, a tariff announcement can directly cause market volatility. Our VAR framework allows us to explore this bi-directional relationship, and our impulse response functions, in particular, are designed to trace the causal-like effects of a shock from one variable to another over time, providing valuable insights into this complex feedback loop.

Using VAR models with impulse response analysis and EGARCH models with news impact curves in the same academic paper is relevant, as they address different, but related, aspects of the relationship between variables. These methodologies are often used together in financial and economic research to provide a comprehensive analysis.

A Vector Autoregressive (VAR) model is used to analyze the linear interdependencies among multiple time series variables. It treats all variables as endogenous and is particularly useful for studying how one variable’s changes affect other variables over time. Impulse Response Analysis (IRA) is a key component of VAR modeling. It traces the effect of a one-time shock to one variable on the current and future values of all other variables in the system. This analysis is focused on the mean of the series, showing the direction and magnitude of the short-term and medium-term dynamics.

An Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) model is designed to capture volatility clustering and asymmetric volatility. Volatility clustering is the tendency for large changes to be followed by large changes and small changes to be followed by small changes. Asymmetric volatility, also known as the “leverage effect,” refers to the observation that negative shocks (bad news) tend to have a larger impact on volatility than positive shocks (good news) of the same magnitude. The News Impact Curve (NIC) is a graphical representation derived from GARCH-type models like EGARCH. It illustrates the relationship between the size and sign of a shock (news) and the resulting conditional volatility. For EGARCH, the NIC is asymmetric and non-linear, highlighting how negative shocks can lead to a greater increase in volatility compared to positive shocks. This provides a detailed look at the conditional variance of a single series. In this context, the combined use of these models is highly effective because they investigate different dynamics. VAR/IRA focuses on the transmission of shocks across different variables and their impact on the meaning of those series. We use VAR to understand the general relationships and dynamic responses between, say, asset returns and tariff issues. Then we use an EGARCH model for each individual asset to analyze the specific volatility dynamics, such as the leverage effect, in response to new information. This dual approach provides a comprehensive view of both the inter-variable dynamics (VAR) and the intra-variable volatility behavior (EGARCH), making our analysis robust and thorough.

3.1. VAR Models

The temporal restriction of definitions in the simultaneous equation system and the temporary classification of endogenous/exogenous variables are criticized in the literature. In this context, VAR assumes that all variables under study are endogenous. It presents the vector of endogenous variables as an autoregressive function of their lagged values. As per the existing literature, the VAR method has been demonstrated as a coherent and credible approach (

Stock & Watson, 2001). The VAR model can be presented as follows:

This equation models how an asset’s return Yt depends on its past performance Yt−1, Yt−2, Yt−3. The coefficients β1, β2, β3 capture the influence of these past returns. In Vector Autoregression (VAR) models, each variable is predicted by its own history, similar to Yt here. VAR models are best suited for stable data (stationary series) and require choosing the most impactful lags Yt−1, Yt−2 and etc.

The VAR model has many advantages and disadvantages (

Brooks, 2008, pp. 292–293). The Vector Autoregression (VAR) model offers several distinct advantages over traditional econometric techniques. Notably, its endogenous treatment of all variables enables the simultaneous estimation of their interdependencies, a crucial feature for understanding complex economic systems. Furthermore, the VAR model’s multivariate nature allows for a more nuanced examination of the dynamic relationships between variables, capturing intricate patterns and features that may be overlooked in univariate models. This increased flexibility often leads to more accurate and informative forecasts compared to traditional structural models. However, the VAR model is not without its limitations. One significant drawback is its lack of theoretical underpinnings. While it can effectively describe the empirical relationships between variables, it provides little insight into the underlying economic mechanisms driving these interactions. Additionally, the VAR model can be susceptible to spurious relationships, where correlations between variables appear statistically significant but lack meaningful economic causation. This can complicate the interpretation of model results and make it challenging to estimate accurate coefficients. Moreover, the assumption of stationarity at the same level is essential for hypothesis testing within the VAR framework. While some researchers argue for analyzing non-stationary data without differencing to preserve information about long-run relationships, this approach can introduce challenges and potential biases in the estimation and interpretation of results. Once we estimate the VAR model, we can use variance decomposition to analyze the sources of variability in the dependent variable. This technique helps us quantify how much of the future forecast errors (how much the actual values deviate from the predictions) for each variable are explained by its lagged values, compared to the influence of other variables in the model. Moreover, impulse response analysis and variance decomposition are often used in conjunction. IRFs reveal the dynamic nature of the response, while variance decomposition helps quantify the relative importance of each shock in explaining the variability. Variance decompositions offer a different way to examine variable structures in the VAR method.

Briefly, variance decomposition is a statistical technique that allows researchers to break down the variance of a variable (such as the return of a stock index) into the contributions of different factors. This is useful for understanding what factors are most important for driving the movement of the variable. This combined approach provides a comprehensive understanding of how shocks propagate through the system and influence the behavior of individual variables.

3.2. News Impact Curves

One model that allows for asymmetric effect of news is the EGARCH model. One problem with a standard GARCH model is that it is necessary to ensure that all of the estimate coefficients are positive.

Nelson (

1991) proposed a specification that does not require non-negativity constraints.

Equation (2) is called the exponential-GARCH or EGARCH model. There are three interesting features to notice about EGARCH model:

The equation for the conditional variance is in log-linear form. Regardless of the magnitude of ln(ht), the implied value of ht can never be negative. Hence, it is permissible for the coefficients to be negative.

Instead of using the value of , the EGARCH model uses the level of standardized value of [i.e., divided by ]. Nelson argues that this standardization allows for a more natural interpretation of the size and persistence of shocks. After all, the standardized value of is a unit-free measure.

The EGARCH model allows the leverage effect. If / is positive, the effect of the shock on the log of conditional variance is . If / is negative, the effect of the shock on the log of the conditional variance is .

The trade-off between future risks and asset returns is the essence of most financial decisions. Risk is mainly composed of two factors, such as volatility and correlations of financial assets. Since the economy changes frequently and new information is distributed in the markets, second moments evolve over time. Consequently, if methods are not carefully established to update estimates rapidly then volatilities and correlations measured using historical data may not be able to catch differentiation in risk (

Cappiello et al., 2006).

If we consider EGARCH models, the news impact curve has its minimum at ԑt − 1 = 0 and is exponentially increasing in both directions but with different parameters. The news impact curves are made up by using the estimated conditional variances equation for the related model as such the given coefficient estimates and with the lagged conditional variance set to the unconditional variance.

Consider EGARCH (1,1)

where

. The news impact curve is

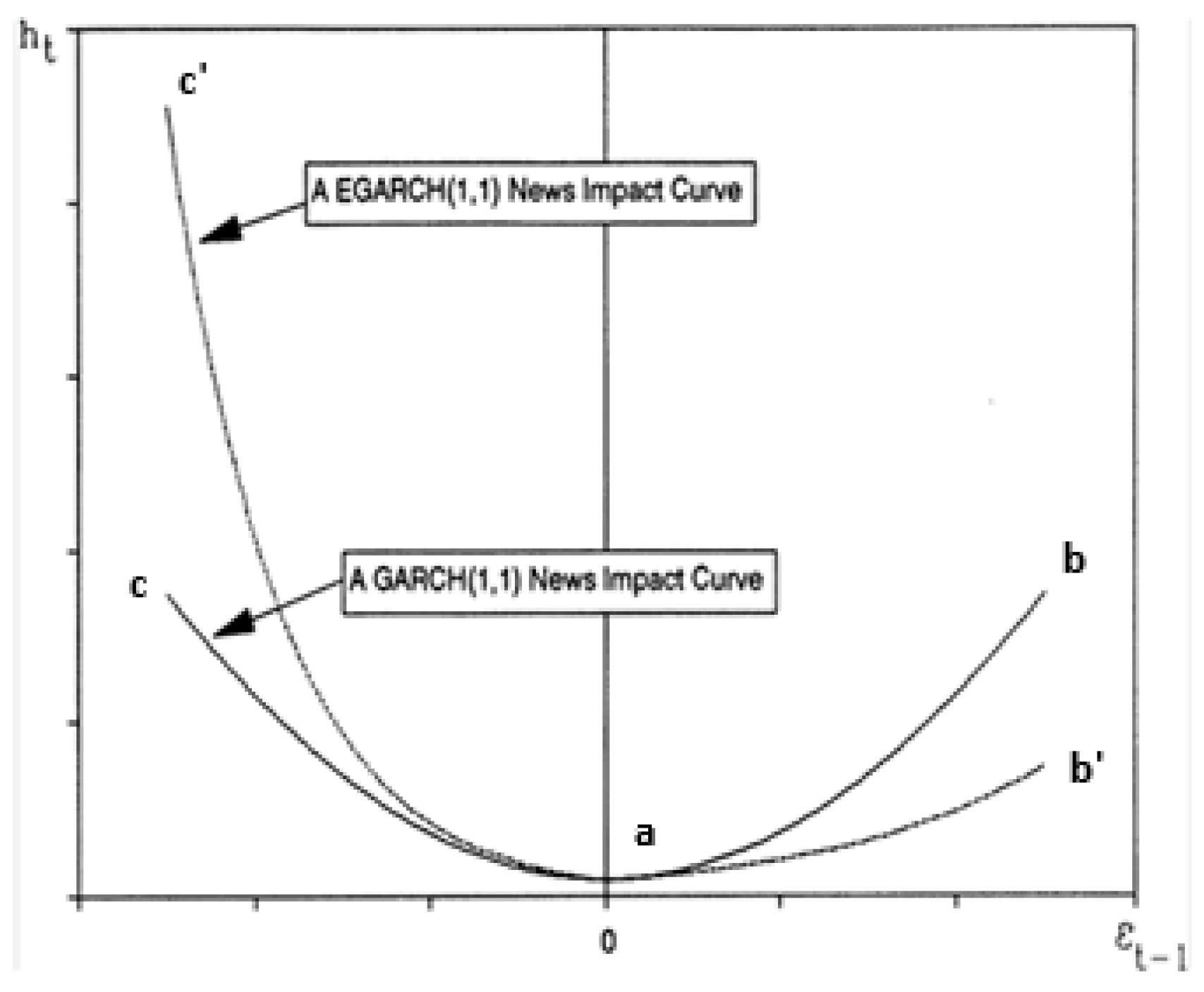

An important characteristic of asset prices is that “bad” news has more persistent impact on volatility than “good” news has. Most of the stocks have a strong negative correlation between the current return and the future volatility. In this context we can define the leverage effect, as such volatility tends to decrease when returns increase and to increase when returns decrease. The idea of the leverage effect is exhibited in the figure below, where “new information” is defined and measured by the size of

ԑt − 1. If

ԑt − 1 = 0, expected volatility (

ht) is 0. Actually, any news increases volatility, but if the news is “good” (i.e., if

ԑt is positive), volatility rises from point a to point b along the ab curve (or abᶦ for the EGARCH model). However, if the news is “bad”, volatility rises from point a to point c along the ac curve (or acᶦ for the EGARCH model). Since ac and acᶦ are steeper than ab and

abᶦ, a positive

ԑt shock will have a lower impact on volatility than a negative shock of this same magnitude (

Figure 1).

Asymmetric volatility models are the most interesting approaches in the literature since good news and bad news have different predictability for future volatility. Overall,

Chen and Ghysels (

2010) found that partly good (intra-daily) news decreases volatility (the next day), while both very good news which is unusually high leads to intra-daily positive returns, and bad news which is negative returns increased volatility. However, the latter has a more severe impact over longer horizons as asymmetries fade away. The news impact curve illustrates the impact of previous return shocks on the return volatility which is implicit in a volatility model.

4. Data

The data period from 1 August 2024 to 24 April 2025 is selected due to the convergence of impactful events hypothesized to drive market volatility. Commencing with posts about the identified “Japan fall,” the period captures initial market adjustments to this exogenous shock. Subsequently, it encompasses rising concerns regarding potential regime changes in various regions, introducing political instability and economic policy uncertainty, factors known to elevate market fluctuations. Crucially, this timeframe also witnessed an intensification of tariff-related activities and trade policy shifts. The imposition or threat of tariffs disrupts trade, alters competition, and generates uncertainty about economic growth and corporate earnings, acting as established catalysts for market volatility. Therefore, this specific period allows for the analysis of the interconnected effects of the “Japan fall’s” aftermath, heightened regime change concerns, and escalating tariff periods on market volatility.

To maintain consistency between the U.S. and Chinese markets, all data, including market prices and the tariff rhetoric variable, were synchronized to a single time zone: U.S. Eastern Time (ET). This decision was crucial for accurately aligning the timing of events, particularly since the U.S. markets are the focal point of the tariff rhetoric. For days when a particular market was closed due to a holiday or weekend, we employed a “next-open” data treatment. This means that any event—such as a tariff-related announcement—that occurred during a non-trading period was assigned to the next available trading day for that specific market. This ensures that the market’s first opportunity to react to the news is accurately captured in the analysis. We acknowledge that other macroeconomic news can drop on the same day. While we cannot control for all of them, our focus on high-frequency data and the inclusion of other major macroeconomic variables in the VAR model helps isolate the effect of tariff rhetoric from other, less frequent news events.

Examining this confluence aims to disentangle their individual and combined impacts on financial market fluctuations during a time of heightened global uncertainty, offering valuable insights for policymakers and investors. Our daily dataset is as exhibited in

Table 1.

Variables in the models starting with capital

R means returns of the relevant variable. All returns are calculated as follows:

Analyzing Donald Trump’s Twitter (now X) usage during his second presidency (starting January 2025) compared to his first (2017–2021) regarding tariffs, trade wars, China, and Europe requires examining available data on his posting behavior. Given the lack of direct access to his full tweet history, this analysis relies on web sources, logical inference, and patterns from provided search results to estimate changes and reasons. This investigation will also address the “why” behind any observed reduction in his X activity. In his first presidency (2017–2021), Trump exhibited high activity on Twitter, posting thousands of tweets annually, with studies estimating approximately 22,000 tweets over his term, averaging 15–20 tweets daily

1. He frequently used Twitter to announce, defend, or comment on trade policies, especially tariffs and trade wars with China and the EU

2.

A 2019 analysis indicated that roughly 10–15% of his tweets focused on trade, economy, or China, peaking during key trade war escalations, such as the 2018–2019 China tariffs. For instance, in 2018, he tweeted about China tariffs or trade deficits approximately 200–300 times, often framing them as wins for U.S. workers. Trump mentioned “China” in approximately 500 tweets during 2018–2019, frequently tied to trade war rhetoric, intellectual property theft, or negotiations. EU-related tweets were less frequent, around 50–100 annually, focusing on trade imbalances, NATO spending, or tariffs, such as steel/aluminum in 2018.

His tweets were direct, often inflammatory, and used to rally supporters or pressure adversaries, with real-time updates during trade talks, like the 2019 G20 summit. In contrast, during his second presidency (2025), Trump’s overall X activity appears reduced, with sources suggesting a decrease to 5–10 posts daily, possibly due to strategic shifts or platform changes. Recent tariffs, such as the 145% on China and 20% on the EU in April 2025, are less discussed on X compared to 2018–2019, with only a few key posts noted, including his 9 April 2025, Truth Social/X announcement pausing reciprocal tariffs for 90 days, except for China. Estimated tariff/trade posts are around 20–50 since January 2025, compared to 200–300 annually in 2018–2019.

China remains a focus, but mentions are fewer, approximately 10–20 posts in 2025 versus 500 in 2018–2019, emphasizing escalating tariffs but with less frequent real-time updates. EU tariff mentions are sparse, around 5–10 posts, despite 20% tariffs announced in April 2025, focusing on broader trade policy rather than specific EU critiques. Trump’s X engagement remains high per post, but overall reach decreased in his second term due to fewer posts (5500–7300 to 1800–3600 annually) and X’s algorithm changes. Specifically, tariff/trade, China, and EU mentions significantly declined. This shift reflects a strategic communication change, favoring Truth Social, controlled messaging, and using tariffs for negotiation. Platform changes, audience fatigue, policy context (swift tariff implementation), and personal/political factors (learning from past controversies, time constraints) also contributed. While critics deemed his tariffs reckless, reduced X usage indicates a shift to calculated negotiation, not necessarily less commitment. This may limit public support rallying but avoids market panic. Given the reduced role of X in Trump’s communication, research should focus on the objective realities of his trade policies, specifically tariff implementation and the tariff calendar, for a more precise understanding of economic consequences, moving beyond social media discourse.

In this context, we created our own TARIFF dummy variable based on the tariff calendar (

Atlantic Council Tracker, n.d.)

3 data (

Table 2) which gets the value of 1 when an important event occurs for tariff and 0 on the other days. This table outlines a series of trade-related actions, primarily tariffs, attributed to “President Donald J. Trump” spanning from 2024 to 2035. The events reveal an aggressive protectionist stance, with tariffs imposed on a wide range of goods from various countries including Canada, Mexico, China, and EU nations, often citing “fair and reciprocal” trade as justification. Tariff rates fluctuate, some are delayed, and the scope covers steel, aluminum, agricultural products, and automobiles, suggesting a broad trade war. Threats and sanctions accompany the tariffs, indicating potential international disputes. The table lacks information on the economic impact, raising questions about long-term effects and the accuracy of the events presented.

Based on the descriptive statistics (

Table 3), RBOND2Y and RBRENT show a slight negative trend with negative mean and median values. RBRENT is the most volatile with the highest standard deviation of 0.019606, while RS_P500 is the least volatile with the lowest standard deviation of 0.014009. The distributions for RBOND2Y and RBRENT are negatively skewed, indicating a longer tail to the left, while RCSI_300 and RS_P500 are positively skewed with a longer tail to the right. All four variables exhibit high kurtosis, significantly greater than 3, which suggests their distributions have heavier tails and sharper peaks than a normal distribution, implying a high probability of extreme values or outliers. The Jarque–Bera test results, with probability values close to 0.00000 for all variables, strongly indicate that none of the distributions are normal. All variables have a sample size of 170 observations. In this context we preferred Student’s t distribution in our models.

5. Empirical Results

The group unit root tests conducted on the panel series (

Appendix A) RBond2Y, RBrent, RCSI 300, and RS&P 500 consistently indicate that all series are stationary. These comprehensive tests were performed over a sample period from 1 August 2024 to 25 April 2025, across four distinct cross-sections, utilizing individual effects as exogenous variables and an automatic lag length selection based on the SIC criterion ranging from 0 to 3. Furthermore, Newey–West automatic bandwidth selection with a Bartlett kernel was applied to ensure robustness of the results. The Levin, Lin & Chu t* test, which assumes a common unit root process across all panels, yielded a t*-statistic of −23.3147 with an associated probability value of 0.0000. This highly significant p-value leads to a strong rejection of its null hypothesis that all panels contain a common unit root, thereby confirming the stationarity of the panel. Complementing this, tests that account for individual unit root processes across the panels also presented compelling evidence of stationarity. The Im, Pesaran and Shin W-stat test produced a W-statistic of −24.9475 with a probability value of 0.0000. Similarly, the ADF–Fisher Chi-square test resulted in a statistic of 337.674 and a probability value of 0.0000, while the PP–Fisher Chi-square test gave a statistic of 391.091 with its probability also reported as 0.0000. For all three of these individual unit root tests, the null hypothesis is that each individual series within the panel contains a unit root. The consistent reporting of 0.0000 for all probability values across these diverse tests unequivocally signifies a robust rejection of the unit root hypothesis for each series. This collective evidence firmly establishes that RBond2Y, RBrent, RCSI 300, and RS&P 500 are stationary series, an essential prerequisite for valid time series econometric modeling, ensuring that subsequent analyses will not be plagued by issues of spurious regression.

In

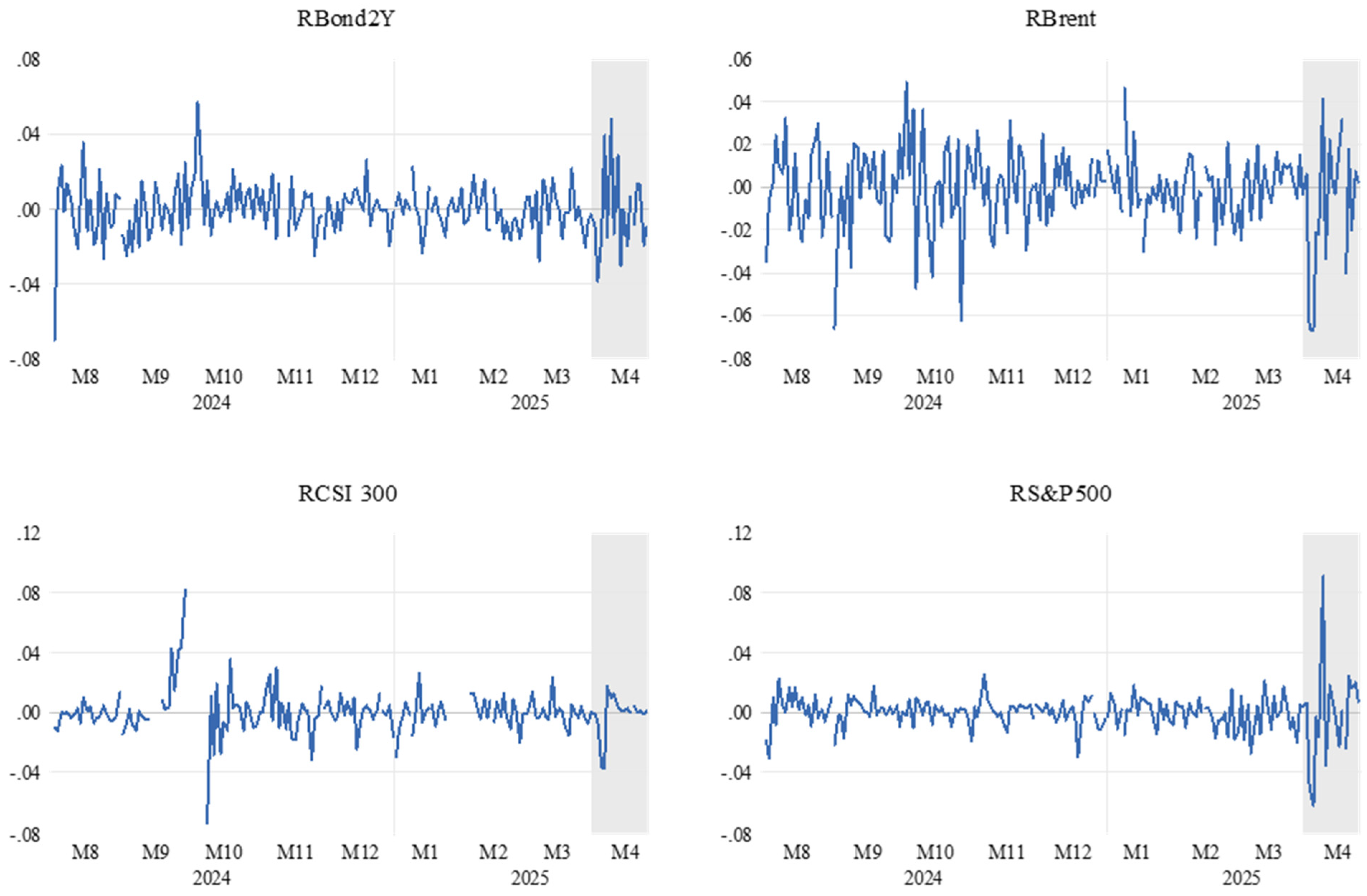

Figure 2, RBond2Y, RBrent, RCSI 300, and RS&P 500 show notable reactions during April 2025, the period coinciding with tariff calendar events. Bond returns (RBond2Y) exhibit increased volatility, with initial rises followed by declines, suggesting market uncertainty. Brent crude oil returns (RBrent) display a downward spike, potentially reflecting concerns about reduced global demand due to tariffs. The Chinese stock market index (RCSI 300) shows a downward trend and heightened volatility, likely due to the negative impact of tariffs on Chinese trade. Overall, the tariff events appear to trigger short-term market reactions characterized by increased volatility and shifts in asset prices, reflecting concerns about economic growth, trade disruptions, and a preference for safe-haven assets.

Based on the VAR model results, the analysis provides some valuable insight into the interdependencies of the variables, but these insights require careful interpretation. While many of the individual coefficients lack statistical significance at conventional levels, the overall model fit, as indicated by the various information criteria (AIC, BIC, etc.), suggests it has some merit as a descriptive tool. The low R-squared values for certain equations indicate that a significant portion of the variance remains unexplained by the model’s structure, which can be a common issue in financial time series data where volatility is a key characteristic.

The limited statistical significance in the coefficients suggests that the linear relationships captured by this VAR model may be insufficient to fully describe the data’s dynamics. This points to a need for a more sophisticated approach. The lack of robust significance makes the standard impulse response and variance decomposition analyses less definitive.

To get a more complete picture and to address the issues with statistical significance, it would be highly beneficial to support this analysis with an EGARCH (Exponential Generalized Autoregressive Conditional Heteroskedasticity) model. EGARCH models are specifically designed to capture and analyze the time-varying volatility, or heteroskedasticity, which is a key feature of financial data. By modeling the conditional variance, an EGARCH model can help explain the unexplained variance from the VAR model and provide more robust insights into the effects of shocks, as well as the asymmetry in volatility responses to positive versus negative news. This combined approach would provide a more comprehensive and statistically sound understanding of the relationships between the variables.

In

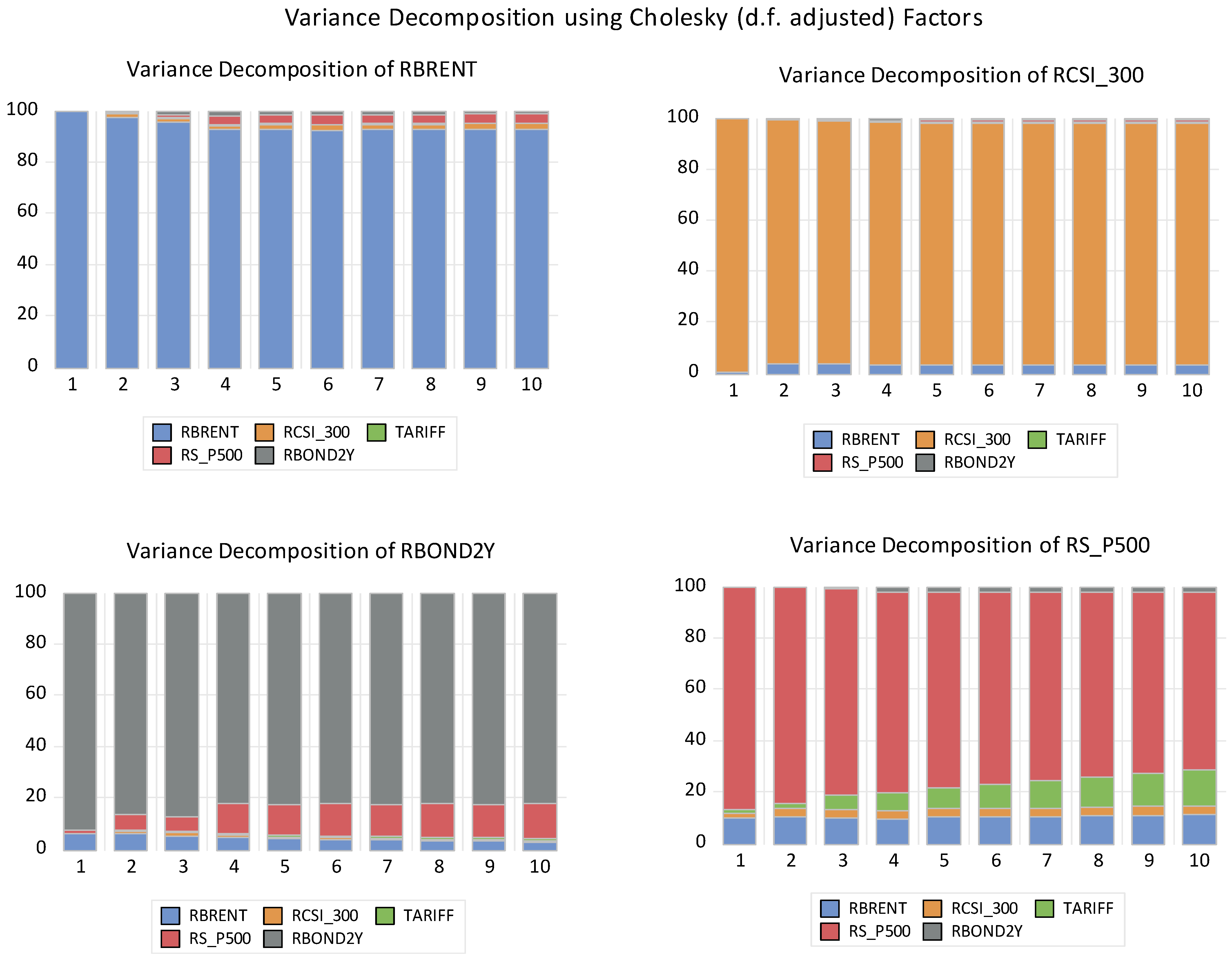

Figure 3, the provided variance decomposition graphs, which use Cholesky decomposition to analyze the forecast error variance, offer a detailed look at the sources of market volatility for four key variables: Brent oil returns (RBRENT), the Shanghai Shenzhen CSI 300 Index returns (RCSI_300), 2-year US bond returns (RBOND2Y), and the S&P 500 Index returns (RS_P500). This analysis is based on data from 1 August 2024 to 24 April 2025, a period characterized by a combination of a “Japan fall,” regime change concerns, and intensified tariff-related activities. The graphs show the contribution of shocks to each variable over a 10-day forecast horizon.

The graph for RBRENT (Brent oil returns) indicates a high degree of exogeneity. The variance of Brent oil returns is almost exclusively explained by its own shocks, as evidenced by the large blue bars that account for nearly 100% of the variance across all 10 periods. The contributions from the other variables—RCSI_300, RTARIFF, RS_P500, and RBOND2Y—are consistently negligible. This suggests that the volatility of Brent oil prices is predominantly driven by factors specific to the oil market, such as supply-and-demand dynamics, geopolitical events in oil-producing regions, and decisions by OPEC+. The “Japan fall” and rising tariff tensions appear to have a minimal direct impact on the day-to-day volatility of oil prices, which are more susceptible to fundamental market shocks within the energy sector itself.

Similarly, the RCSI_300 (Shanghai Shenzhen CSI 300 Index returns) graph reveals a strong internal-driven dynamic. The majority of the CSI 300’s variance is attributed to its own shocks, as shown by the large orange bars. The influence of other variables is very small, remaining close to zero throughout the 10-day period. This finding implies that the volatility of the Chinese stock market is primarily a function of domestic factors, including China’s economic policies, domestic investor sentiment, and corporate performance within the Chinese economy. Even with the intensification of tariffs and trade policy shifts during this period, the variance decomposition suggests that these external shocks have a limited impact on the Chinese market’s overall volatility. The market’s reaction to these events is more likely to be an internalized adjustment rather than a direct response to foreign market shocks.

The RBOND2Y (2-year US bond returns) graph also shows a high degree of self-sufficiency in volatility. Most of the variance in the 2-year US bond is explained by its own shocks, as indicated by the tall gray bars. While there is a slight, but consistently small, contribution from other variables, particularly the S&P 500, the overall picture is one of minimal external influence. This points to the fact that the volatility of US government bonds is primarily driven by domestic monetary policy, inflation expectations, and actions by the Federal Reserve. The “Japan fall,” tariff events, and foreign stock market performance have little direct effect on the variance of US bond returns, which are more sensitive to macroeconomic fundamentals within the United States.

In contrast, the RS_P500 (S&P 500 Index returns) graph demonstrates a more interconnected and complex relationship with other markets. While the S&P 500’s variance is still largely explained by its own shocks (the red bar), the contributions from other variables are more pronounced and significant than in the other three cases. Specifically, shocks from the Chinese market (RCSI_300) and the TARIFF dummy variable (RTARIFF) have a noticeable and sustained impact. The presence of the green TARIFF bar, which represents tariff-related events, is particularly important. This indicates that US stock market volatility is not just a function of domestic factors but is also influenced by international trade policies and the performance of major foreign markets like China. The S&P 500 appears to be the most susceptible of the four variables to the external shocks that defined this period, reflecting the globalized nature of the US economy and the sensitivity of its corporate earnings to international trade dynamics and geopolitical tensions. This graph underscores the interconnectedness of global markets and how external shocks can spill over into a major domestic index.

Furthermore, we employ an impulse response function (IRF) framework, derived from a Vector Autoregression (VAR) model, to examine the impact of unexpected shocks (innovations) in one asset’s return on the future returns of other assets within the system (

Figure 4).

The impulse response graphs reveal that while all variables have a strong, significant positive response to their own shocks, there is a general lack of significant cross-variable impacts. This suggests the variables are largely independent of each other. The solid black line in each graph shows the impulse response, while the dashed orange lines represent the 95% confidence intervals. For a response to be statistically significant, the confidence intervals must not include the zero line.

Starting with the top row, a shock to RBOND2Y has a sharp positive effect on itself, which is significant. However, its effect on RBRRENT, RCSI 300, RSP_500, and TARIFF is not statistically significant, as the confidence intervals all cross the zero line. This indicates that a change in the 2-year bond yield doesn’t reliably affect the other variables.

The second row shows that a shock to RBRRENT has a similar pattern. It creates a significant positive response in itself, but its impact on all other variables (RBOND2Y, RCSI 300, RS_P500, and TARIFF) is statistically insignificant.

In the third row, a shock to RCSi_300 causes a significant and prolonged positive response in itself. However, just like the previous cases, its effect on the other variables is not statistically significant. This suggests that the stock market index moves independently of the other variables in the system.

The fourth row presents the most interesting and significant finding. A shock to RS_P500 has a powerful and significant positive impact on itself. Most notably, this shock also causes a significant and sustained positive response in TARIFR. This is the only clear, statistically robust cross-variable relationship found in the analysis. This implies that RS_P500 movements can reliably predict or influence the behavior of TARIFR over several periods. The responses of RBOND2Y, RBRRENT, and RCSI 300 to the RS_P500 shock are not significant.

In conclusion, the impulse response analysis confirms that most of the variables in this model are not causally linked in a statistically significant way. The only exception is the relationship between RS_P500 and TARIFF, which shows a clear and lasting positive effect. This finding suggests that while the overall model might be weak, there are specific, meaningful dynamics between certain variable pairs that can be exploited for further analysis. The widespread insignificance aligns with the previous observation of low R-squared values and suggests a need for a more complex model, such as one incorporating volatility dynamics, to fully capture the underlying relationships.

Table 4 presents the results of four EGARCH (Exponential Generalized Autoregressive Conditional Heteroskedasticity) models, each corresponding to a different “Return Equation” and its associated “Variance Equation.” An EGARCH model is used to capture the time-varying volatility of a financial time series, and it’s particularly useful because it accounts for the asymmetric effect of shocks (i.e., bad news vs. good news) on volatility.

A key observation across all models is the very low R-squared values, which are typical for financial return data, indicating that the past values of the variables explain very little of the current returns. However, the models provide valuable insights into the volatility dynamics. In the RS P500 model, the return equation shows a significant negative relationship with RBOND2Y. Its variance equation, however, reveals more. The λ coefficient suggests a leverage effect, where negative shocks increase volatility more than positive ones. The high β1 coefficient indicates that volatility shocks are extremely persistent.

For the RCSI 300 model, the return equation coefficients are not statistically significant. In the variance equation, the λ coefficient is positive and nearly significant, suggesting that positive shocks increase volatility more than negative shocks, an atypical finding. The β1 coefficient is very high and highly significant, showing strong persistence in volatility.

The RBRENT model is unique in that multiple variables have a significant impact on its returns, specifically RBOND2Y and RS P500. However, its variance equation shows no significant asymmetry, ARCH effect, or persistence, as all the key coefficients are statistically insignificant.

Finally, the RBOND2Y model shows a significant negative autocorrelation in its return equation and a significant negative relationship with RCSI 300. Its variance equation provides strong evidence of the leverage effect, as the λ coefficient is highly significant and negative. The β1 coefficient is also significant but negative, which is an unusual result for volatility persistence.

In conclusion, these EGARCH models effectively capture the distinct volatility characteristics of each series. They highlight the presence of the leverage effect in some series (RS P500 and RBOND2Y) and an atypical positive asymmetry in another (RCSI 300), while showing no significant volatility dynamics for RBRENT

4.

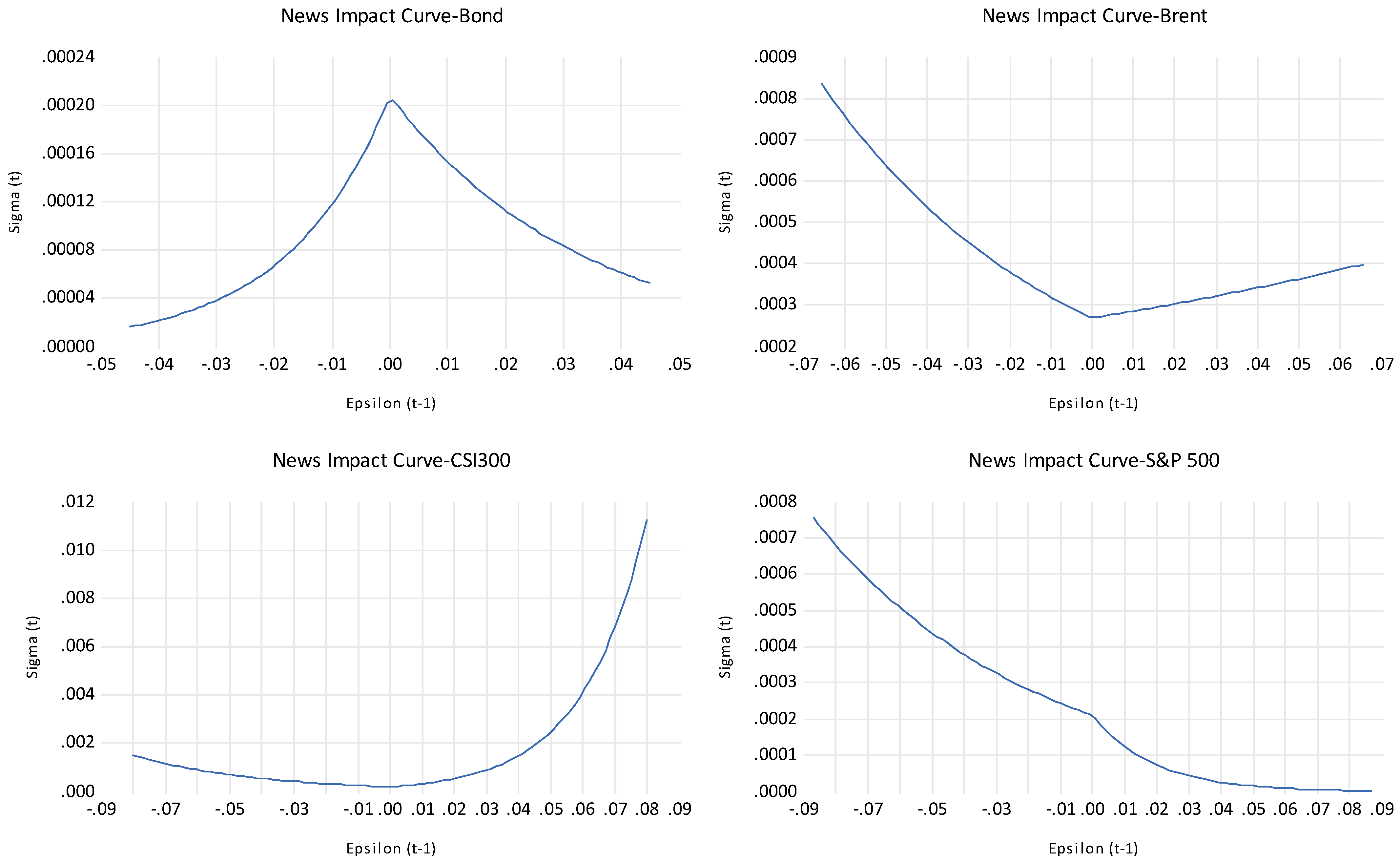

Based on the GARCH model and news impact curves (

Figure 5), the data shows that tariff issues have a statistically significant negative impact on the S&P 500’s price. The coefficient for the TARIFF variable is negative and its p-value is significant, indicating that tariff-related news, which could be generated by a political leader, directly pushes down asset values. Furthermore, the news impact curve for the S&P 500 reveals that negative shocks—like a market’s adverse reaction to tariff news—lead to a disproportionately large increase in market volatility.

This is a classic leverage effect, where bad news generates more uncertainty and risk than good news. Therefore, the results support the view that tariff issues are a key factor influencing both the price and volatility of the S&P 500. A leader who uses tariffs as a policy tool can be seen as having a measurable impact on asset markets, as their actions lead to predictable negative price movements and heightened market uncertainty. This effect, while not a direct manipulation of a private holding, is a demonstrable influence on market dynamics.

While our study offers novel insights, it’s crucial to acknowledge the inherent limitations of this type of analysis. These include the potential for anticipation effects, where markets may react to unconfirmed rumors or leaks before a public announcement, complicating the precise timing of shocks. We mitigate this by using a high-frequency daily dataset, which captures a substantial portion of pre-event price movements. Furthermore, the issue of endogeneity is a central concern. While our VAR framework treats all variables as endogenous, our impulse response functions suggest a unique causality where the S&P 500 can influence the tariff variable, demonstrating that policy announcements may, in fact, respond to market conditions. This bidirectional relationship is a core finding, not simply a limitation.

We also recognize the possibility of measurement error in our sentiment-based tariff variable, as political rhetoric can be ambiguous, time zones can conflict, and social media posts (like those on Truth Social) may be less formal than press releases. Our use of a broad media-sourced sentiment index helps to average out these inconsistencies, providing a more robust measure than a single data point. Finally, the presence of confounding variables—other significant macroeconomic news dropping on the same day—is a persistent challenge. While we cannot control for every possible confounder, the use of a VAR model and our focus on high-frequency data help to isolate the immediate impact of tariff rhetoric from other, less frequent macroeconomic announcements. We are transparent about these limitations and believe our methodological choices, particularly the use of VAR and EGARCH models, provide the most effective means of mitigating them within the scope of this study.

6. Conclusions

Our multi-model analysis provides a comprehensive view of the market dynamics, revealing a complex web of relationships and volatilities that extends far beyond a simple cause-and-effect framework. The initial VAR model, while limited in its explanatory power—a common feature of financial time series—served as a foundational descriptive tool. It revealed a significant, and perhaps counterintuitive, relationship: shocks to the S&P 500 have a statistically robust and lasting positive effect on our tariff variable. This suggests that movements in the US market, rather than being solely reactive to tariff news, may actually influence or even precede policy rhetoric. This one-way influence underscores a critical, though often overlooked, feedback loop in the political economy, where market sentiment and performance could serve as a signal to policymakers.

To move past the limitations of the linear VAR model, we employed EGARCH models to capture the crucial element of time-varying volatility. These models confirmed the low explanatory power of past returns on current returns but provided deeper insights into volatility dynamics. We found distinct asymmetric volatility responses: the S&P 500 and US bonds both exhibit a classic leverage effect, where negative shocks increase volatility more than positive ones. The Chinese CSI 300, in contrast, showed an atypical positive asymmetry, where positive shocks contributed more to volatility, potentially reflecting market overheating or a deep-seated suspicion that “good news” on tariffs is temporary and will be followed by further conflict. Notably, Brent oil showed no significant volatility dynamics, indicating its stability is driven by factors external to our model, likely related to its fundamental supply and demand mechanics.

Finally, our analysis of the news impact curves provided a visual and conclusive synthesis of these findings. The curves powerfully illustrated that while shocks to Brent, CSI 300, and US bonds are primarily explained by their own internal dynamics, the S&P 500 is uniquely susceptible to external shocks, particularly those related to tariffs. This external influence, combined with the significant negative coefficient of the tariff variable in the GARCH model, demonstrates that tariff-related announcements lead to a direct and statistically significant negative impact on S&P 500 prices. This not only causes prices to drop but, due to the leverage effect, also dramatically increases market volatility.

In conclusion, our integrated approach reveals that while most of the markets studied operate in relative isolation from one another, the S&P 500 is demonstrably influenced by tariff issues. This influence is twofold: a direct negative price effect and a heightened increase in market volatility. The analysis provides strong empirical evidence that policy actions, such as those related to tariffs, can have a measurable impact on asset markets and contribute to market uncertainty.

For investors, these findings underscore a crucial lesson: macroeconomics extends far beyond central bank interest rate decisions. The traditional focus on monetary policy, while important, is insufficient in an era where geoeconomic considerations, trade policy shifts, and political interventions profoundly impact financial markets. The rise of protectionist rhetoric and its demonstrated effect on market volatility necessitates a fundamental shift in investment strategy. Investors can no longer afford to view political discourse as mere background noise. Our research reveals that geopolitical risk, particularly in the form of trade policy announcements, is a quantifiable driver of market movements and must be factored into risk models.

Therefore, we recommend investors cultivate a deeper and more comprehensive understanding of these new macroeconomic policy drivers. This involves diligently analyzing the interplay of trade policies, geopolitical tensions, and domestic political-economic constraints. Rather than solely relying on conventional indicators like GDP growth or inflation, investors should adopt a more holistic risk assessment framework. Diversifying across geographies and sectors is essential to mitigate risks associated with protectionist policies. Prioritizing companies with resilient business models, robust supply chains, and diversified customer bases is paramount. Additionally, considering hedging strategies against currency volatility, which often arises from trade disputes, is advisable. Finally, adopting a long-term perspective and engaging in robust scenario planning is essential for navigating the inherent unpredictability of geoeconomic shifts and their implications for various asset classes. By developing a playbook for different outcomes—such as a full-blown trade war versus a period of contained tensions—investors can position their portfolios to withstand shocks and potentially capitalize on opportunities.

For policymakers, the implications are equally profound. Our study provides strong empirical evidence that political rhetoric is a significant economic force in its own right, capable of disrupting financial stability and reshaping risk perception. The era of treating tariff threats as mere negotiating tactics is over; their financial market impact is real and must be managed. Policymakers should recognize the immediate, market-moving power of their rhetoric and the need for careful communication to avoid unintentionally triggering financial market instability. Our findings suggest that tariff policy rhetoric acts as a new type of shock, similar in its impact to monetary policy announcements, and should be treated with the same level of caution. A more deliberate and consistent communication strategy for trade policy, akin to the carefully scripted approach used by central banks, is now a necessity. This would help to reduce uncertainty, foster market stability, and ensure that policy goals are achieved without causing undue financial turmoil.

In this evolving global landscape, macroeconomics is not just about Fed rates; it encompasses the broader dynamics of power, politics, and the enduring tension between national interests and global integration. The findings of this paper serve as a cautionary tale and a guide, demonstrating the critical link between political communication and market volatility and providing a framework for both investors and policymakers to navigate this new era of geoeconomic risk.