1. Introduction

Stock liquidity is a cornerstone of capital market efficiency, shaping transaction costs, facilitating price discovery, and underpinning financial stability. Its relevance becomes especially pronounced during episodes of acute market distress. The COVID-19 crisis in early 2020 exemplifies this dynamic: global equity markets experienced one of the most severe and synchronized downturns in modern history, accompanied by a sharp deterioration in liquidity conditions. Bid-ask spreads widened markedly, market depth declined precipitously, and even high-grade securities were subject to forced sales. The pandemic elevated equity market margins by over 300% almost overnight, and the abrupt increase in margin requirements was associated with a significant withdrawal of global liquidity provision (

Foley et al., 2022). In parallel, a report from Amundi Asset Management highlights that the COVID-19 liquidity squeeze triggered systemic disruptions across equity, bond, and funding markets, requiring massive and coordinated central bank interventions to prevent a broader financial collapse.

1 These developments underscore that stock liquidity is not merely a microstructure concern but a macro-critical condition for market stability. Accordingly, firm-level drivers of liquidity, particularly those linked to governance and managerial characteristics, merit rigorous empirical investigation.

Building on this, recent research has examined how firm-level governance structures, particularly top management team (TMT) characteristics, influence market outcomes.

Kline et al. (

2017) show that TMT compensation affects firm performance, and

Walters et al. (

2010) find that TMT board membership impacts holding-period returns.

C. Zhou (

2023) report that CEO multinationality reduces downside risk. In addition, the delegation structure within TMTs has recently attracted attention as a governance mechanism that shapes internal oversight and disclosure quality. For example,

Ponomareva (

2019) shows that transparent delegation improves monitoring effectiveness, while

Qiao (

2025) finds that unclear authority structures undermine disclosure quality and investor confidence. Among TMT characteristics, educational background has received increasing attention for its role in shaping managerial quality and strategic decision-making. For instance,

Díaz-Fernández et al. (

2014) document a negative link between TMT education-level diversity and firm performance in Spain.

Joh and Jung (

2016) show that TMT academic credentials from prestigious universities enhance firm value in South Korea. In China,

Cui et al. (

2019) find that overseas and functional experience heterogeneity are positively associated with financial outcomes, while academic background heterogeneity is negatively related.

Wagdi and Fathi (

2024) demonstrate that TMT diversity across gender, education, and nationality influences firm value in emerging markets.

X. Zhang et al. (

2023) explore how TMT overseas background relates to corporate green innovation, and

Ahmed and Ali (

2017) link gender-diverse boards to stock liquidity. Despite these findings, little is known about the impact of TMT educational attainment on stock liquidity, a central feature of market efficiency and a primary mechanism for mitigating information asymmetry.

This study investigates the relationship between TMT educational attainment and stock liquidity. The sample comprises 3515 unique Chinese A-share listed firms over the 2011–2023 period, yielding 28,545 firm–year observations. Employing ordinary least squares and fixed-effects regressions with controls for a comprehensive set of firm- and board-level characteristics, we construct a liquidity proxy based on

Amihud’s (

2002) illiquidity measure. The empirical findings reveal that higher TMT educational attainment enhances stock liquidity. We further explore the moderating roles of industry competition and information disclosure quality. In regions characterized by intense industry competition, the positive relation between TMT educational attainment and stock liquidity weakens. With respect to information disclosure, higher disclosure quality amplifies TMTs’ strategic and financial effectiveness, enabling improved investor engagement and thereby enhancing stock liquidity. Additional subsample analysis reveals that the positive linkage between TMT education and liquidity is evident during bullish markets, but not under bearish conditions. To address endogeneity concerns, we implement a reverse causality test, two-stage least squares (2SLS) estimations using industry-average TMT education as an instrument, propensity score matching (PSM), entropy balancing, the generalized propensity score (GPS), and the generalized method of moments. All procedures consistently support a causal interpretation from TMT education to stock liquidity. Lastly, robustness tests employing alternative measures of liquidity and TMT education corroborate the main findings.

This study makes several contributions to the literature. First, it enriches the body of research on the determinants of stock liquidity. Prior studies have primarily focused on firm-level characteristics, such as firm size, ownership concentration, dividend policy, media coverage, and option-implied volatility (

Cheng, 2007;

Taher & Al-Shboul, 2023;

Huang et al., 2024;

Chung & Chuwonganant, 2014). However, limited attention has been paid to the role of TMT attributes in shaping stock liquidity. Given that TMTs are central to strategic formulation and corporate decision-making, their actions can significantly influence firm performance. This study finds that TMT educational attainment has a positive effect on stock liquidity, thereby introducing a novel executive-level governance factor as a determinant of stock liquidity.

Second, this study contributes to the literature on the effects of TMT characteristics. While most prior research emphasizes the overall diversity of TMT attributes without isolating specific traits (

Tihanyi et al., 2000;

Yamauchi & Sato, 2023), only a limited number of studies explicitly examine the heterogeneity of TMT educational backgrounds and their implications for firm performance (

X. Zhou et al., 2023). Moreover, such studies remain scarce and largely concentrate on firm-level outcomes, with minimal attention to capital market consequences such as stock liquidity. Our analysis not only advances understanding of TMT composition but also demonstrates that higher educational attainment within the team improves stock liquidity, thereby supporting more efficient corporate financing.

Third, this study contributes to the literature on the moderating role of industry competition (

Hu et al., 2023;

Li et al., 2023;

Song et al., 2022;

Jia, 2020). The results indicate that industry competition weakens the positive association between TMT educational attainment and stock liquidity. This moderating effect offers a novel insight, implying that in highly competitive industries, TMTs are less able to capitalize on their educational advantages to improve stock liquidity.

Fourth, this study contributes to the literature on the moderating effect of information disclosure. While prior research has extensively examined the implications of information transparency for firms (

J. S. Lee et al., 2015;

Chen et al., 2007), our analysis emphasizes that information transparency, as a moderating factor, strengthens the positive link between TMT educational attainment and stock liquidity. In firms with high information transparency, the effective utilization of publicly disclosed information enables TMTs to leverage their educational background to improve information processing efficiency, thereby further enhancing stock liquidity.

The remainder of this study is organized as follows:

Section 2 formulates the relevant theories,

Section 3 reviews the related literature and develops hypotheses,

Section 4 outlines the data and methodology,

Section 5 presents the empirical results and discussion, and

Section 6 concludes.

2. Theoretical Framework

This study draws on multiple theoretical perspectives to explain how the educational attainment of TMTs influences stock liquidity. By integrating insights from Upper Echelons Theory, the Knowledge-Based View, Agency Theory, Signaling Theory, and Institutional Theory, we establish a comprehensive framework linking managerial education to capital market outcomes through information-related mechanisms.

Upper Echelons Theory (

Hambrick & Mason, 1984) argues that organizational outcomes are shaped by the demographic and cognitive characteristics of senior executives. Education is particularly important because it influences managers’ cognitive frames, problem-solving capacity, and strategic orientations (

Hambrick, 2007). TMTs with higher educational attainment are more likely to process complex information effectively, adopt transparent disclosure practices, and strengthen governance mechanisms that reduce uncertainty. By improving the corporate information environment, educated executives foster investor confidence and encourage trading activity, thereby enhancing stock liquidity.

The Knowledge-Based View (

Grant, 1996;

Kogut & Zander, 1992) extends the resource-based perspective by asserting that knowledge constitutes the firm’s most strategically significant asset. Executives with higher educational attainment embody superior human capital, reflected in analytical skills, combinative capabilities, and absorptive capacity that facilitate the creation, integration, and deployment of value-relevant knowledge (

Cohen & Levinthal, 1990;

Kogut & Zander, 1992). By improving the credibility, timeliness, and precision of corporate communication, such knowledge processes diminish information asymmetry in capital markets, which in turn narrows bid-ask spreads, deepens order books, and enhances liquidity (

Glosten & Milgrom, 1985). Within this framework, TMT education operates as a critical intangible asset that drives information efficiency and, consequently, trading outcomes.

Agency Theory (

Jensen & Meckling, 1976;

Fama & Jensen, 1983) provides another lens through which education may influence market outcomes. Agency conflicts arise when managers act in their own interests at the expense of shareholders, often through opportunistic disclosure or information withholding. Better-educated executives are more likely to internalize professional norms and value long-term reputation, making them less inclined to engage in opportunism (

Shleifer & Vishny, 1997). By pursuing transparent disclosure policies and stronger governance practices, they reduce adverse selection in equity markets, thereby improving liquidity. In this sense, managerial education functions as a governance-enhancing attribute that mitigates information asymmetry.

Signaling Theory (

Spence, 1973) provides a complementary external perspective. In information-asymmetric markets, observable managerial attributes serve as credible signals of firm quality. The educational attainment of TMT members conveys competence, professionalism, and governance commitment (

Spence, 2002). Investors interpret highly educated executives as indicators of reliability and reduced uncertainty, which enhances analyst coverage, increases investor attention, and stimulates trading activity. Unlike Agency Theory, which emphasizes internal governance channels, the signaling perspective highlights how education shapes external perceptions, thereby improving stock liquidity.

Institutional Theory (

Meyer & Rowan, 1977;

DiMaggio & Powell, 1983) emphasizes that organizational practices are shaped by institutional norms, regulatory pressures, and legitimacy concerns. In contexts such as China, where governance institutions are evolving, highly educated executives are more likely to conform to institutionalized expectations of transparency and responsible management (

North, 1990). By aligning disclosure and governance practices with societal and regulatory norms, firms led by educationally sophisticated TMTs enhance their legitimacy and attract investor trust. Improved legitimacy reduces informational frictions and contributes to greater stock liquidity.

Taken together, these five theories provide a cohesive conceptual framework for understanding why and how TMT education matters for stock liquidity. Upper Echelons Theory and the Knowledge-Based View establish that education enhances cognitive capacity and knowledge resources that improve decision-making and disclosure. Agency Theory highlights the role of education in mitigating managerial opportunism, while Signaling Theory explains how educational attainment conveys positive signals that attract investor attention. Institutional Theory situates these mechanisms within broader institutional environments, emphasizing the importance of legitimacy and conformity to governance norms. Collectively, these perspectives provide a solid theoretical foundation for the empirical analyses that follow.

5. Results and Discussion

5.1. Descriptive Statistics

Table 2 reports descriptive statistics for the variables. The mean

Liquidity is −4.268 with a standard deviation of 4.320, indicating considerable variation in stock liquidity. The average

TMTEdu score is 3.542, suggesting that most TMT members hold either a bachelor’s degree (

TMTEdu = 3) or a master’s degree (

TMTEdu = 4). For firm characteristics, the mean log of firm size is 22.177, and the mean log of firm age is 0.793. The average leverage ratio is 43.7%. The mean value of the

SOE dummy is 37.7%, indicating that approximately one-third of listed firms are state-owned. The average institutional ownership is 43.7%. The average

ROA is 3.4%, reflecting moderate profitability. The mean book-to-market ratio is 0.618. The average log of board size is 2.126, with independent directors accounting for 17.3% of board members. Lastly, 26.2% of CEOs also serve as board chairmen, and the average TMT age is 49.6 years.

Table 3 reports pairwise correlations among the variables.

Liquidity is significantly positively correlated with

TMTEdu at the 1% level, suggesting that higher TMT educational attainment is associated with greater stock liquidity. Among the control variables, firm size, firm age, leverage, SOE status, institutional ownership,

ROA, board size, and TMT age all show significant positive correlations with stock liquidity at the 1% level. Conversely,

BTM, board independence, and the CEO-chairman duality dummy are significantly negatively related to stock liquidity at the 1% level. Most explanatory variables exhibit correlation coefficients below 0.5, indicating that multicollinearity is unlikely to be a major concern.

5.2. Baseline Regressions

Table 4 presents the results of multivariate regressions of stock liquidity on the educational level of TMT members, as specified in Equation (3). The estimates indicate that TMT education has a significantly positive effect on stock liquidity at the 1% level. This finding is robust across specifications, including ordinary least squares (Column 1), firm fixed effects (Column 2), year fixed effects (Column 3), and firm and year fixed effects (Column 4). This finding supports Hypothesis 1 and is consistent with recent evidence that more educated TMTs enhance firm performance and innovation while mitigating firm risk (

Joh & Jung, 2016;

Yang et al., 2019;

J. Zhang et al., 2023). The results also align with the theoretical framework: they are consistent with Upper Echelons Theory and the Knowledge-Based View, which emphasize the role of education in shaping managerial cognition and knowledge capacity, as well as with Agency and Signaling Theories, which highlight how education improves transparency and conveys positive signals to investors, thereby reducing information asymmetry. The coefficient on TMT education is also economically meaningful. For instance, based on the multivariate estimate in Column 2, a one-standard-deviation increase in TMT education is associated with a 0.269 (=0.591 × 0.456) increase in

Liquidity, representing approximately 6% (=0.269/4.320) of the standard deviation of

Liquidity.

Regarding the control variables, firm size, firm age, and ROA show a significantly positive relation with stock liquidity across all four specifications, implying that stocks of larger, more mature, and high-performing firms are more liquid, as expected. In contrast, firm leverage, institutional ownership, and the book-to-market ratio are negatively related to stock liquidity, suggesting that lower leverage, lower institutional ownership, and lower book-to-market ratios (indicative of greater growth opportunities) are associated with higher stock liquidity.

5.3. Moderating Effect of Industry Competition

In this section, we examine whether industry competition moderates the relationship between TMT educational attainment and stock liquidity. The HHI, a commonly utilized measure of industry concentration, is calculated as the sum of squared market shares across all firms within an industry. A higher HHI indicates greater concentration and reduced competitive intensity (

Rhoades, 1993). We obtain HHI data from CSMAR, where the index captures industry concentration by summing the squared revenue shares of firms. We further construct the variable

IndusComp as the reciprocal of the HHI; thus, a higher value reflects more intense industry competition. Following

Hu et al. (

2023) and

Li et al. (

2023), we incorporate

IndusComp and its interaction with TMT education into the regression model:

Table 5 presents the results on the moderating effects of industry competition. The interaction term coefficient is negative and statistically significant at the 5% level. As industry competition intensifies, the positive effect of TMT educational attainment on stock liquidity diminishes. Furthermore, we compute the annual median of

IndusComp and divide firms into low- and high-competition subsamples. Following Equation (3), we re-estimate fixed-effects regressions for these subsamples and report the results in Columns 2 and 3 of

Table 5. The findings indicate that the positive impact of TMT education on stock liquidity is significant in the low-competition subsample but not in the high-competition subsample. Overall, the results support Hypothesis 2 and align with prior research on the moderating effects of industry competition (

Hu et al., 2023;

Jia, 2020;

Acquaah, 2003). Coefficients on control variables and adjusted

R-squared values are consistent with those reported in the baseline regressions in

Table 4.

When product-market rivalry intensifies, the proprietary costs of disclosure rise and firms optimally scale back or homogenize firm-specific revelations to avoid revealing strategies to rivals. In such settings, the incremental informativeness of signals produced by better-educated TMTs is partially crowded out: managers disclose less idiosyncratic detail, analysts substitute toward sector-level signals, and investors place greater weight on common (industry) information. The result is a lower marginal return to managerial information production in high-competition environments and, therefore, a weaker translation of TMT education into liquidity improvements, which is precisely the negative interaction we document. This mechanism is consistent with Agency Theory, which emphasizes that competitive pressures constrain managerial discretion and thereby attenuate the transparency benefits of education. It also accords with Upper Echelons Theory, under which the influence of managerial characteristics is more pronounced when executives have greater discretion; in highly competitive settings, such discretion is diminished, reducing the marginal impact of TMT education. Consistent with prior evidence that competition compresses cross-firm variation in disclosures and diminishes the scope for firm-level information to affect trading frictions (

Verrecchia, 1983;

Darrough & Stoughton, 1990;

Yen et al., 2016), our findings suggest that stronger industry competition weakens the positive effect of TMT education on stock liquidity.

5.4. Moderating Effect of Information Disclosure Quality

In this section, we investigate how information transparency moderates the relationship between TMT educational attainment and stock liquidity.

Kim and Verrecchia (

2001) and

Ascioglu et al. (

2005) propose a KV index derived from stock price and trading volume to assess the quality of information disclosure.

S. Xu and Xu (

2015) further refine the KV index as follows:

where

Pt denotes the stock closing price on day

t,

Volt is the daily trading volume in shares on day

t, and

Vol0 is the average trading volume in shares over the 6-month sample period. The KV index is constructed based on the estimated value of

λ. A smaller

λ implies higher information disclosure quality. Accordingly, we define

Disclosure as −

λ, such that

Disclosure inversely reflects the KV index, and higher

Disclosure indicates greater information disclosure quality. Next, following

Li et al. (

2023), we include

Disclosure and its interaction with TMT educational attainment in the regression specification:

Table 6 reports the results on the moderating effects of information disclosure quality. The interaction term coefficient is positive and statistically significant at the 1% level. As disclosure quality increases, the positive effect of TMT educational attainment on stock liquidity becomes more pronounced. Furthermore, we calculate the annual median of

Disclosure and classify firms into low- and high-disclosure subsamples. Following Equation (3), we re-estimate fixed-effects regressions for these subsamples and present the results in Columns 2 and 3 of

Table 6. The results reveal that the positive effect of TMT education on stock liquidity is significant in the high-disclosure subsample but not in the low-disclosure subsample. Overall, these findings support Hypothesis 3 and are consistent with prior research on the moderating effects of information transparency (

J. S. Lee et al., 2015;

Chen et al., 2007;

Ng, 2011).

To understand these results, it is important to consider how disclosure quality shapes the transmission of managerial information into prices. When disclosures are more credible, timely, and comparable, the processing cost and noise surrounding firm-specific signals fall, so the informational content produced by better-educated TMTs is more readily intermediated by analysts and impounded into prices. In such settings, investors face lower adverse-selection risk, trading frictions decline, and the education–liquidity link steepens. This mechanism is consistent with Signaling Theory, which suggests that credible disclosure amplifies the positive signals conveyed by highly educated executives, thereby increasing investor attention. From the perspective of Agency Theory, strong disclosure environments constrain opportunism and magnify the transparency benefits of education. Moreover, Institutional Theory implies that educated managers are more likely to conform to normative and regulatory disclosure expectations, further reinforcing legitimacy and investor trust. These mechanisms are consistent with the literature showing that greater disclosure reduces information asymmetry and improves market liquidity, and that richer disclosure environments amplify analyst intermediation (

Diamond & Verrecchia, 1991;

Leuz & Verrecchia, 2000;

Lang & Lundholm, 1996).

5.5. Additional Moderating Effects

To further address the institutional context of the Chinese market, we examine whether corporate culture, SOE status, and ownership structure moderate the effect of TMT educational level on stock liquidity. We follow Equations (4) and (6) to make these variables interact with

TMTEdu. ESG ratings, obtained from the Chindices ESG Rating database of Shanghai Chindices Index Information Service Co., Ltd., serve as a proxy for corporate culture and range from 0 to 100, with higher scores indicating stronger ESG performance. The results In

Table 7 show that ESG ratings significantly weaken the positive impact of TMT education on liquidity, consistent with the notion that firms emphasizing social responsibility and stakeholder orientation may attenuate the role of managerial human capital in shaping market outcomes. Likewise, SOE status strongly reduces the effectiveness of TMT education, reflecting the institutional and political objectives of state ownership that may crowd out the benefits of managerial skills. Moreover, higher institutional ownership weakens the effect of TMT education, suggesting that institutional investors may impose additional monitoring or prioritize other firm attributes, thereby diminishing the marginal contribution of managerial education to stock liquidity. These findings underscore the importance of corporate culture, state ownership, and ownership structure in conditioning the relationship between managerial education and stock market performance in China.

5.6. Mediation Analysis

To better understand the mechanism through which the TMT educational level influences stock liquidity, a three-step regression approach is employed to examine the mediating effect (

Baron & Kenny, 1986):

where

Mediator denotes information disclosure quality (

Disclosure), analyst coverage (

Analyst), R&D investment (

RD), ESG rating (

ESG), digital transformation (

DigitTrans), or return on assets (

ROA), respectively. The analyst coverage data are obtained from the “Analyst Forecasts” sub-dataset in CSMAR.

Analyst is defined as the natural logarithm of the number of analysts providing coverage of the firm in a year. The firm innovation data are obtained from the “Listed Firm’s R&D and Innovation” sub-dataset in CSMAR.

RD is defined as the ratio of R&D expenditures relative to operating revenues. The Digital Transformation Index (

DigitTrans) is sourced from CSMAR’s partner database “Firm’s Digital Transformation,” and constructed as a weighted average of six dimensions identified through textual analysis of annual reports.

Table 8 presents the mediation analysis based on the three-step approach. In Column 1, the coefficient on

TMTEdu is 0.190 and significant at the 1% level, capturing the total effect on stock liquidity. Columns 2–7 indicate that

TMTEdu significantly increases analyst coverage (

Analyst, 0.053) and raises R&D investment (

RD, 0.310), whereas

TMTEdu does not significantly affect information disclosure quality (

Disclosure), ESG ratings (

ESG), digital transformation (

DigitTrans), or firm performance (

ROA). Column 8 shows that

Analyst is significantly related to stock liquidity at the 1% level, whereas

RD is not significantly associated with stock liquidity. The estimated indirect effects suggest that

TMTEdu promotes stock liquidity by increasing analyst coverage (0.053 × 0.271/0.190 = 7.6% of the total effect). These results indicate that only analyst coverage offers a weak channel through which TMT educational level affects stock liquidity. Information disclosure quality, firm innovation, ESG ratings, digital transformation, and firm performance are not effective channels.

The mediation results provide additional theoretical insights into the education–liquidity relationship. The finding that analyst coverage constitutes the only effective channel is consistent with Signaling Theory, under which the educational attainment of executives conveys positive signals about firm quality that are more readily amplified when external analysts intermediate these signals to investors. Higher analyst coverage translates the informational advantage of educated TMTs into broader market attention, thereby enhancing liquidity. The result also resonates with Upper Echelons Theory, which emphasizes that managerial characteristics shape firm-level outcomes indirectly by influencing external perceptions and stakeholder engagement. By contrast, the absence of significant mediation through disclosure quality, ESG ratings, R&D, digital transformation, or firm performance suggests that education does not primarily operate through internal operational channels, but rather through the external information environment. This pattern offers weak support for Agency Theory, which highlights that managerial attributes reduce information asymmetry most effectively when they interact with monitoring and intermediation mechanisms, such as analysts, that discipline managerial behavior and disseminate credible information to capital markets.

5.7. Bull vs. Bear Market Periods

We partition the sample into bull and bear market subperiods to examine whether the effect of TMT educational attainment on stock liquidity varies with market conditions. Investor behavior and liquidity dynamics differ significantly across market regimes, and the influence of managerial human capital may become more salient during periods of heightened uncertainty. This approach enables us to assess both the robustness and the state-contingent nature of the observed relationship. To this end, we use the annual return of the China Securities Index 300, classifying years with returns below zero as bear markets and those above zero as bull markets. The bull market years include 2012, 2013, 2014, 2015, 2019, 2020, 2021, and 2023, while the bear market years are 2011, 2016, 2017, 2018, and 2022.

Table 9 reports the results of fixed-effects regressions based on Equation (3) for the two subperiod samples. Column 1 shows that TMT educational level has a positive and significant effect on stock liquidity during bull market years. In contrast, Column 2 indicates that the positive effect of TMT education on stock liquidity vanishes during bear market years. While one might expect liquidity improvements to be especially valuable during downturns, our evidence indicates that the incremental effect of TMT education on liquidity is state contingent and materializes primarily in bull markets. In bear markets, liquidity formation is dominated by systemic forces, including funding constraints, heightened inventory risk, and flight to quality and liquidity, so market makers widen spreads and cut depth, analysts and investors shift attention toward macro signals, and commonality in liquidity rises, leaving limited scope for firm-specific characteristics to explain cross-sectional variation (

Acharya & Pedersen, 2005;

Brunnermeier & Pedersen, 2009;

Chung & Chuwonganant, 2014). By contrast, in expansions, greater risk-bearing capacity and more active trading allow the superior information processing and disclosure associated with better-educated TMTs to be more fully impounded into prices, yielding observable improvements in market liquidity. Thus, the liquidity benefits of TMT education are visible when firm-level signals can be differentiated and muted when aggregate frictions overwhelm firm heterogeneity.

5.8. Reverse Causality Tests

Endogeneity concerns arise in the baseline regression specified in Equation (3). Reverse causality is plausible, as firms with higher stock liquidity may attract TMT members with greater educational attainment. Alternatively, unobserved third-party factors may simultaneously affect both TMT education and stock liquidity, resulting in a spurious positive association. Following

L. Wang et al. (

2024), we employ

TMTEdu to predict one-year-ahead

Liquidity and then employ

Liquidity to predict one-year-ahead

TMTEdu, to differentiate causal directions as specified below.

In Equation (10), the dependent variable,

Liquidity, is led by one year. In Equation (11), we then switch the roles of the dependent variable and the key independent variable, with

TMTEdu led by one year. The results in Column 1 of

Table 10, based on Equation (10), indicate that

TMTEdu at year

t significantly predicts

Liquidity at year

t + 1. In contrast, the results in Column 2 of

Table 10, based on Equation (11), show that

Liquidity at year

t does not predict

TMTEdu at year

t + 1. Since causality typically runs from past to future, these findings support the conclusion that causality flows from TMT education to stock liquidity, rather than in the opposite direction.

5.9. Two-Stage Least Squares Regressions

To further address the endogeneity concern, we implement a 2SLS regression. Following

Y. Liu et al. (

2024) and

Hu et al. (

2023), we use the annual industry-average value of the independent variable (

TMTEdu) as the instrumental variable.

In the first stage, Equation (12) regresses

TMTEdu on the industry-average

TMTEdu (

MeanTMTEdu), which serves as the instrumental variable. The second stage then employs the predicted value (

PredTMTEdu) from the first stage to estimate stock liquidity in Equation (13). Prior studies suggest that industry-average independent variables serve as valid instruments (

Y. Liu et al., 2024;

Hu et al., 2023). The rationale is that firms within the same industry tend to exhibit similar

TMTEdu, making a firm’s

TMTEdu more influenced by industry-level factors than by firm-specific characteristics. This instrumental variable is also assumed to be exogenous, as stock liquidity is unlikely to be correlated with industry-average

TMTEdu, given that liquidity is a firm-level rather than industry-level outcome. The exclusion restriction assumes that peer human-capital supply and credential norms within an industry-year shift a firm’s

TMTEdu but, conditional on year fixed effects and rich firm controls, have no direct effect on firm-level trading frictions or investor clientele; stock liquidity is a firm-level outcome and common industry shocks are absorbed by fixed effects. Similarly, prior work indicates that the lagged independent variable can serve as a valid instrument (

Lu et al., 2025;

C. Ye & Zhang, 2025). In Equation (12), the instrument,

MeanTMTEdu, can be replaced by a one-year-lagged TMT education measure (

LagTMTEdu), which satisfies relevance because it is strongly correlated with current education due to serial correlation. It also satisfies exogeneity because, given the temporal gap, it is, in practice, unlikely to be directly related to the current dependent variable, firm-level stock liquidity, except through its correlation with current TMT education.

Columns 1–2 of

Table 11 presents the results of the 2SLS regression, using industry-average

TMTEdu as the instrument. The first-stage estimates, consistent with Equation (12), show that the coefficient on industry-average

TMTEdu is 0.845 and statistically significant at the 1% level, alleviating concerns about weak instruments. It also shows that the instrument,

MeanTMTEdu, is strongly correlated with the firm’s own

TMTEdu (Cragg–Donald Wald

F-statistic = 2154.54), far above the

Stock and Yogo’s (

2002) 10% maximal IV size critical value of 16.38, indicating no weak-instrument concern. The Kleibergen–Paap rank LM-statistic (χ

2 = 1298.75,

p < 0.001) rejects the null of underidentification, further confirming the instrument’s relevance. In the second stage, following Equation (13), the results in Column 2 reveal a statistically significant positive relationship between the predicted

TMTEdu and stock liquidity, with a coefficient of 0.669 at the 1% level.

Columns 3–4 of

Table 11 report the 2SLS results using one-year-lagged TMT education as the instrument. The estimates are similar to those obtained with industry-average TMT education. The coefficient on lagged one-year TMT education in the first-stage regression is 0.918 and statistically significant at the 1% level. The large

F-statistic and

LM-statistic confirm that the lagged TMT education is not a weak instrument. The second-stage coefficients remain positive and statistically significant at the 1% level. Overall, the instrumental variable regression results align with the baseline regression estimates, providing additional support for Hypothesis 1. These findings strengthen the causal interpretation that TMT educational attainment influences stock liquidity, rather than the reverse.

5.10. Additional Endogeneity Tests

To address concerns that the observed relationship between TMT education and stock liquidity may be driven by third-party observable factors, we implement a PSM procedure. By matching firms with similar characteristics but differing TMT educational profiles, we aim to isolate the effect of education from confounding covariates. To facilitate the implementation of PSM, we convert the continuous measure of TMT education into a binary treatment variable (

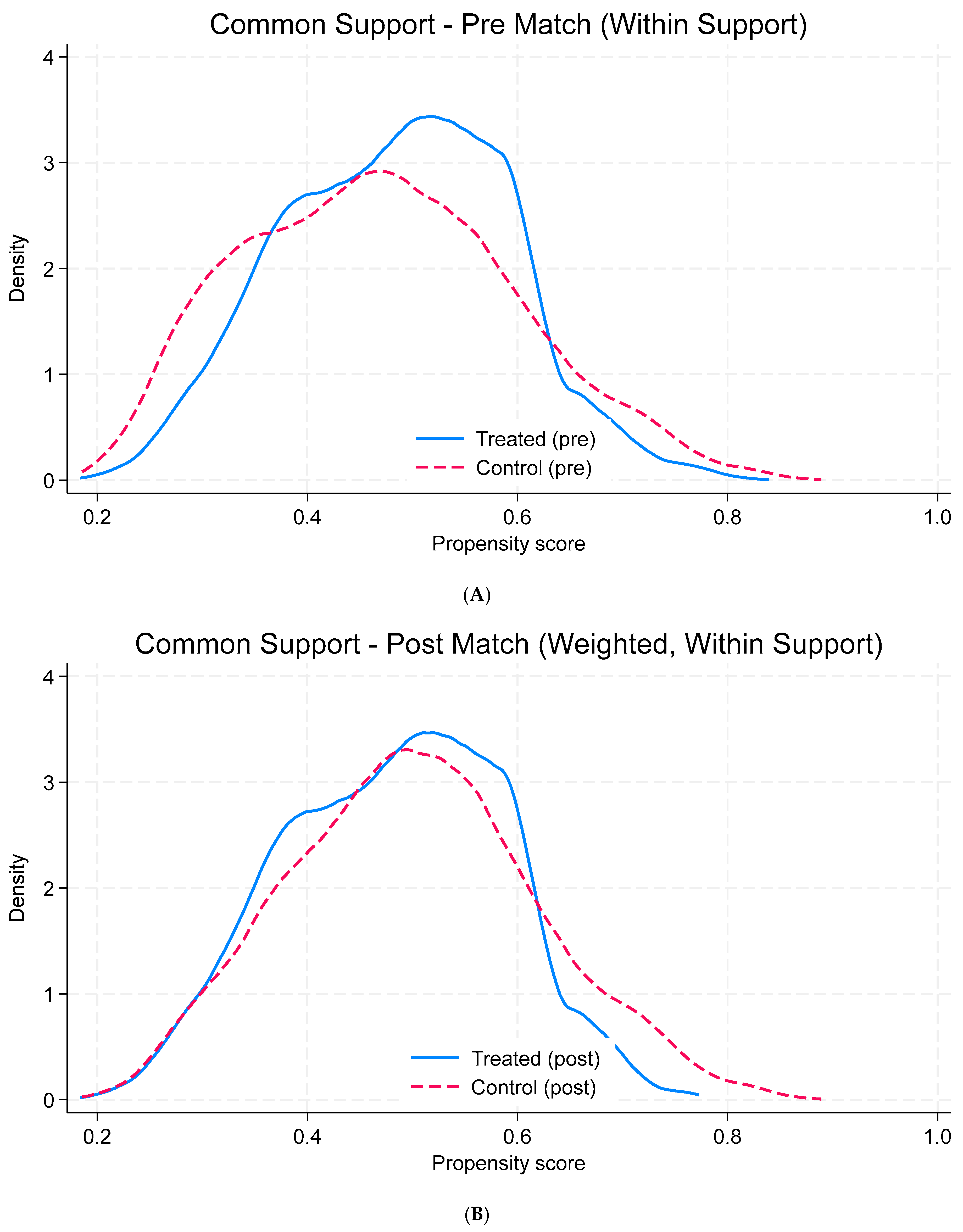

TMTEduDum). Specifically, we assign a value of one to firms whose TMT educational level exceeds the yearly median TMT education level, and zero otherwise. This binary indicator captures relative differences in TMT educational attainment across firms and years. Propensity scores are estimated using a logit model that includes all baseline control variables such as firm size, firm age, leverage, and others, to ensure that matched subsamples are comparable in observable characteristics aside from treatment status. To verify this comparability, we report covariate balance diagnostics in

Table 12 and common support plots in

Figure 1.

Table 12 shows that, prior to matching, treated and control firms differ substantially across several covariates, as indicated by large standardized mean differences. After matching, the mean differences for all covariates fall well below the conventional threshold of 0.1, suggesting that the matched sample achieves satisfactory covariate balance.

Figure 1 further illustrates that the propensity score distributions of treated and control firms exhibit limited overlap before matching (Panel A), but become substantially more comparable after matching (Panel B), indicating that the common support condition is satisfied. Together, these diagnostics confirm that the PSM procedure effectively balances observed firm characteristics between treated and control groups.

The regressions before and after PSM using the newly constructed treatment dummy (

TMTEduDum) are estimated as follows.

Columns 1–2 of

Table 13 presents the fixed-effects regression results before and after PSM. Column 1 reports the result prior to matching, where the coefficient on

TMTEduDum is 0.153 and statistically significant at the 5% level. Column 2 presents the result after PSM, where the subsamples exhibit comparable firm size, firm age, leverage, and other characteristics but differ in TMT educational level. The coefficient on

TMTEduDum is 0.220 and becomes statistically significant at the 1% level. This finding alleviates endogeneity concerns that third-party firm characteristics drive the positive relationship between TMT education and stock liquidity.

In addition to PSM, we further adopt two continuous reweighting approaches to address potential sample imbalance without substantially reducing the effective sample size. First, we apply entropy balancing, which reweights the control group such that its covariate distribution exactly matches that of the treated group across moments of the baseline covariates. This method retains the full sample while ensuring balance on observable characteristics. Column 3 of

Table 13 reports the entropy balancing estimates, showing that the coefficient on

TMTEduDum is 0.137 and statistically significant at the 5% level, thereby reinforcing the causal effect of TMT education on liquidity. Second, we implement a GPS approach, which extends the binary treatment setting to the continuous treatment of TMT education. Following the standard specification, we estimate the conditional density of

TMTEdu given covariates, construct the GPS, and include both the GPS and its interaction with

TMTEdu in the regression. The results in Column 4 indicate that the coefficient on

TMTEdu is 0.178 and statistically significant at the 5% level, supporting the robustness of the education–liquidity link when treatment intensity is modeled continuously.

Finally, Column 5 of

Table 13 reports results from the difference dynamic GMM estimator (

Arellano & Bond, 1991), which accounts for potential dynamic persistence in liquidity and endogeneity of regressors. In the differenced equation, levels of

Liquidity lagged two to four periods and levels of

TMTEdu lagged one period and longer are used as instruments, while in the levels equation, the first differences in

Liquidity and

TMTEdu that lagged one period are employed as instruments. Baseline controls and year dummies are included as standard instruments. The model is estimated by two-step GMM with robust finite-sample correction. Consistent with previous findings, the coefficient on

TMTEdu is 0.909 and statistically significant at the 5% level, indicating that higher TMT education improves stock liquidity even after addressing dynamics and endogeneity.

5.11. Alternative Stock Liquidity Measures

Amihud’s (

2002) measure is merely one of the most widely used proxies for stock illiquidity. Several alternative liquidity measures have also been commonly employed (

L. Xu et al., 2024). To ensure robustness, we obtain two additional widely used illiquidity measures from CSMAR.

Roll’s (

1984) price impact measure of illiquidity is defined as follows:

where ∆

Pt is the change in stock price on day

t, cov is the covariance of the price changes between two consecutive days.

Roll’s (

1984) price impact measure is derived from the negative serial covariance in price changes, capturing the bid-ask bounce that reflects trading frictions. A higher Roll value indicates a wider implicit spread and thus lower stock liquidity.

In addition, we obtain the daily normalized bid-ask spread data from CSMAR, defined as follows.

where

Ask denotes the stock’s ask price and

Bid denotes the stock’s bid price. The daily bid-ask spread is averaged to construct an annualized measure. If the bid-ask spread is large, it indicates that the stock is difficult to trade at a fair price and that market participation is limited, reflecting poor liquidity (

Copeland & Galai, 1983). Both Roll’s price impact measure and the bid-ask spread serve as proxies for stock illiquidity.

The baseline regression is re-estimated using two alternative liquidity measures. Specifically, the dependent variable,

Liquidity, in Equation (3) is replaced with Roll’s impact illiquidity measure as defined in Equation (15), or the bid-ask spread illiquidity measure as specified in Equation (16). The results reported in

Table 14 indicate that TMT educational level consistently exhibits a significantly negative effect on stock illiquidity. Higher TMT education is associated with lower values of Roll’s measure or the bid-ask spread, indicating higher stock liquidity. These findings provide further support for Hypothesis 1, confirming that the main conclusion holds under alternative illiquidity measures.

5.12. Alternative TMT Education Measures

The existing TMT educational level is measured as the average educational level of TMT members, each ranging from one (secondary vocational school) to six (doctoral). As a robustness test, we categorize individual education levels separately. This allows us to isolate the effect of distinct educational levels. For instance, the difference between elite doctoral and MBA degrees may be evaluated. Accordingly, we define TMTEdu1 as the ratio of TMT members holding a secondary vocational school degree (level 1) to the total number of TMT members. Similarly, TMTEdu2–TMTEdu6 represent the proportions of TMT members with education levels 2–6 (junior college to doctoral). We then re-estimate the baseline regression in Equation (3) using six alternative TMT education measures.

The results in

Table 15 indicate that a higher proportion of TMT members with secondary vocational school degrees (

TMTEdu1) is negatively associated with stock liquidity, whereas greater proportions of master’s (

TMTEdu4) or MBA (

TMTEdu5) degrees are positively related to stock liquidity. The proportion of TMT members with junior college (

TMTEdu2), bachelor’s (

TMTEdu3), or doctoral (

TMTEdu6) degrees show no significant relation with stock liquidity. Among significant results, the coefficients switch from negative to positive and then rise in magnitude. These findings strongly align with the baseline results. As TMT educational level increases, the effect on stock liquidity becomes more positive and significant. The negative coefficient on

TMTEdu1 indicates that lower educational attainment actually reduces stock liquidity. Among elite degrees, MBAs appear more effective in enhancing stock liquidity than doctoral degrees.

6. Conclusions

Using a sample of 3515 publicly listed Chinese firms from 2011 to 2023, this study finds that TMT educational levels positively affect stock liquidity, as measured by Amihud’s illiquidity metric. The results are robust across ordinary least squares regressions and various firm- and year-fixed effects specifications. The positive effect of TMT education on stock liquidity is more pronounced under low industry competition and high information disclosure quality. In addition, the effect holds in bull market years but not during bear market periods. The mediation analysis shows that analyst coverage is a weak channel through which TMT education affects stock liquidity, and this channel accounts for an indirect effect of 7.6%. To address endogeneity concerns, we conduct reverse causality tests, 2SLS with industry-average and lagged TMT education as instruments, PSM, entropy balancing, GPS, and dynamic GMM. All approaches support the causal interpretation that TMT education drives stock liquidity. Finally, the baseline results remain robust when using two alternative illiquidity measures, Roll’s price impact and the bid-ask spread, or when applying six alternative TMT education measures based on degree types.

This study contributes to several strands of the literature. First, it extends the research on the determinants of stock liquidity by identifying TMT educational attainment as a novel executive-level governance factor influencing market liquidity. While prior studies emphasize firm-level attributes, our findings highlight the relevance of managerial human capital in shaping capital market outcomes. Second, this study advances the literature on TMT characteristics by isolating educational background as a key trait and demonstrating that higher TMT education improves stock liquidity, a primary market-based outcome. Third, by documenting that the effect of TMT education is weakened in highly competitive industries and amplified under greater information transparency, this study deepens understanding of the boundary conditions under which managerial attributes affect market liquidity. Fourth, the analysis reveals that this effect holds in bull markets but disappears in bear markets, highlighting the importance of market conditions in determining the strength of managerial influence on liquidity. Finally, from a theoretical perspective, these findings are most consistent with Upper Echelons Theory, which posits that managerial backgrounds shape strategic and financial outcomes, and with Signaling Theory, whereby education-driven decisions provide credible signals that attract investor attention.

Our findings yield several practical implications for corporate executives, investors, and regulators. For corporate executives, the results highlight the importance of human capital at the top of the organization. Recruiting and retaining highly educated managers enhances the credibility and informativeness of disclosures, which in turn improves stock liquidity. This implication is particularly relevant for firms in capital-intensive or rapidly growing industries where liquidity facilitates external financing. For investors, TMT education provides a credible signal that attracts greater analyst coverage and facilitates the dissemination of firm-specific information. More educated teams are better able to engage with external intermediaries and support the production of timely and reliable insights, thereby lowering trading frictions and adverse selection risks. Investors who prioritize liquidity may therefore incorporate the educational profile of executives into portfolio allocation and firm evaluation, particularly in markets where analyst resources are limited and coverage varies widely. For regulators and policymakers, the evidence suggests an indirect channel through which managerial qualifications promote market efficiency. Disclosure requirements that highlight the educational and professional backgrounds of executives, alongside policies that support managerial training and continuing education, can strengthen the informational environment and enhance investor confidence.

This study has several limitations that also provide promising directions for future research. First, our analysis focuses on Chinese A-share listed firms. Given China’s unique institutional and regulatory environment, caution is warranted in generalizing the results to other contexts. Future studies could examine whether the liquidity effects of TMT education persist in different institutional settings, such as developed markets or countries with alternative legal and governance systems. Second, while our empirical design addresses endogeneity concerns through multiple robustness checks, unobserved heterogeneity may still remain, suggesting opportunities for more advanced identification strategies such as natural experiments or policy shocks. Third, our measures of TMT education, while comprehensive, are necessarily coarse and may not capture dimensions such as the quality of education, international exposure, professional certifications, or ongoing managerial training. Finally, our study employs widely used stock liquidity measures; future work might consider alternative microstructure proxies or high-frequency data to validate the robustness of our findings. Addressing these limitations would deepen our understanding of how managerial human capital influences market outcomes across different contexts.