1. Introduction

In September 2016, the Wells Fargo account fraud scandal came to public attention. This was not merely a management lapse but a significant failure of board oversight and internal governance. The company’s inadequate risk management systems resulted in billions in market value loss and damaged long-term stakeholder trust. This incident echoes longstanding concerns in the governance literature about the limitations of formal board independence when oversight mechanisms are structurally weak or poorly enforced. Despite the growing reliance on governance ratings, many current tools operate as static compliance checklists and fail to capture the complex, interactive elements of board dynamics that can signal financial distress. Motivated by this gap, and inspired by

Harrison and Klein (

2007), our research proposes and empirically validates a granular, multi-dimensional measure of board structure—with independence, diversity, and power distribution—as a factor of firm profitability. While foundational studies demonstrated the link between firm value and broad, aggregate governance scores that bundle numerous provisions (

Gompers et al., 2003), our research moves toward greater granularity. Inspired by this gap, our approach introduces a data-driven, theoretically grounded Board Structure Influence (BSI) index composed of three structural pillars—Separation, Variety, and Disparity. We decompose board architecture into these measurable components and test whether such granular features impact financial profitability, especially under complex and uncertain conditions. This approach offers a new perspective on governance, reframing it as a strategic tool for corporate performance. The increasing emphasis on corporate sustainability and governance highlights the need for an integrated approach to evaluating board effectiveness and financial performance. Unlike prior studies, such as

Singh et al. (

2023), which analyze governance factors separately, this study introduces the Board Structure Influence (BSI) index. This novel composite measure consolidates board independence, diversity, and role distribution into a single metric. This framework provides a more comprehensive assessment of governance effectiveness.

Furthermore, this study extends the existing literature by examining the role of governance in ensuring financial stability and sustainability, particularly in the post-COVID-19 period. The COVID-19 pandemic exposed vulnerabilities in corporate governance structures and emphasized the importance of board efficiency. Firms with stronger governance mechanisms could better navigate economic disruptions and align with regulatory requirements.

The results of the study provide strong empirical support for our central thesis. Specifically, our analysis shows that firms with stronger board structures, as measured by the top quartile of our BSI index, experienced a significantly greater increase in their net profit margin in the post-COVID-19 period. This finding points to a causal link between enhanced board governance and improved firm outcomes during a crisis. The study also reveals that this positive impact is significantly magnified for larger firms. These findings, reinforced through rigorous placebo tests and robustness checks, confirm the argument that board structure causally drives financial performance, particularly for large corporations in uncertain environments.

The remainder of this paper is structured as follows:

Section 2 reviews the theoretical foundations linking board governance and firm profitability and introduces the hypotheses to be tested.

Section 3 provides a rigorous mathematical definition of the BSI index. Next,

Section 4 details the data sources and variable construction and presents the Board Structure Influence (BSI) index.

Section 5 describes the empirical strategy, including the Difference-in-Differences (DiD) framework and a suite of robustness tests.

Section 6 presents the main empirical findings, focusing on the post-COVID-19 period, examines the impact of the BSI index on firm profitability, and strengthens these results through placebo analyses and tests for parallel trends, SUTVA, and no-anticipation effects.

Section 7 offers practical insights for managers and policy recommendations. Finally,

Section 8 concludes with a summary of findings and outlines potential avenues for future research.

2. Theoretical Background and Related Studies

The scholarly literature often treats concepts like Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) as synonymous, referring to similar domains of study. As noted by

Waddock and Graves (

1997), both concepts fundamentally concern the commitment of companies to act as socially responsible entities within society. This section reviews the relevant literature on the impact of board structure on shaping financial outcomes. Based on this literature review, we will develop and present hypotheses that form the foundation for our empirical analysis.

2.1. Board Structure and Financial Profitability

The relationship between board structure and firm profitability is explained by several core governance theories. Agency Theory and Resource Dependence Theory primarily guide our framework. Agency Theory suggests that a separation of power on the board—a key component of our Separation score—is crucial for monitoring management (the agents) on behalf of shareholders (the principals), thereby reducing agency costs and improving financial efficiency (

Fama & Jensen, 1983). Resource Dependence Theory, on the other hand, suggests that the board of directors is a critical link between the firm and its external environment and provides essential resources such as advice, legitimacy, and strategic connections (

Hillman & Dalziel, 2003). This perspective directly supports our Variety score, as a diverse board is better equipped to provide a broader range of valuable resources and leads to enhanced strategic decision-making and performance.

Prior empirical research provides extensive evidence supporting these theoretical links. Studies have consistently shown that board independence is positively associated with firm performance, as it enhances monitoring and reduces the likelihood of value-destroying decisions by entrenched managers (

Bathala & Rao, 1995). Similarly, a growing body of research demonstrates a positive relationship between board diversity (in terms of gender, age, and expertise) and financial outcomes. Diverse boards are thought to improve decision-making quality by reducing groupthink and introducing a wider range of perspectives and solutions (

Carter et al., 2003;

Dong et al., 2023). Our study builds on this research by proposing a composite measure that simultaneously captures these distinct but complementary dimensions of board structure.

We incorporate firm-level fixed effects and robustness checks, including placebo tests and alternative specifications, to further strengthen the empirical validity of our results

Bathala and Rao (

1995);

Fama and Jensen (

1983). These methodological refinements provide more subtle information about post-crisis corporate governance, distinguishing firms with stronger governance mechanisms from those with weaker structures. Our findings contribute to the broader literature by reinforcing the role of governance in financial effectiveness and corporate adaptability in uncertain economic environments

Kassinis et al. (

2016).

While traditional governance metrics like the G-Index (

Gompers et al., 2003) or the Entrenchment Index (

Bebchuk et al., 2009) effectively measure shareholder rights and anti-takeover provisions, the BSI index offers a distinct and complementary perspective. Instead of focusing on external governance defenses, the BSI is designed to capture the internal decision-making dynamics of the board. More specifically, the BSI index integrates the separation of power, the cognitive diversity of members, and the distribution of influence to measure the board’s capacity for effective oversight and strategic guidance, which is particularly relevant for assessing operational resilience during crises.

2.2. Post-COVID-19 Impacts

The COVID-19 pandemic introduced significant financial and operational uncertainty for firms, highlighting the necessity of effective governance structures. Research suggests that firms with stronger governance frameworks were better positioned to withstand economic shocks (

Broadstock et al., 2021;

Gregory, 2022). Given the heightened role of governance in ensuring effectiveness, we propose our first hypothesis.

The crisis has spotlighted the boards’ capabilities to provide strategic oversight, foster innovation, and maintain stakeholder trust (

Zhao, 2021). Studies conducted during the pandemic have shown that firms with strong governance structures have demonstrated greater efficiency and better financial profitability. For example,

Garcia-Castro et al. (

2010) and

Koutoupis et al. (

2021) highlight how diverse and independent boards have effectively provided strategic oversight and guided firms through the uncertainties posed by the pandemic.

The strategic guidance, risk oversight, and access to resources provided by a well-structured board become critically important when firms must navigate unprecedented market volatility and operational disruptions. Therefore, we expect that firms with stronger, more resilient governance frameworks are better positioned to adapt and maintain profitability during a crisis.

We further posit that this effect is conditional on firm size, leading to our second hypothesis. Larger firms are characterized by greater operational and strategic complexity. The benefits of a well-structured board—in terms of efficient oversight, managing agency problems, and providing diverse expertise—are likely to have a greater marginal impact in overcoming these complexities. Moreover, larger firms are subject to more intense scrutiny from institutional investors, who may reward signals of strong governance more significantly during a crisis.

H1. Firms with a higher BSI index will experience a more significant improvement in net profit margin (NPM) in the post-COVID-19 period.

H2. The positive causal impact of a high BSI index on NPM is more pronounced for larger firms.

3. Board Structure Influence (BSI) Index

3.1. Conceptual Framework

In our approach, we move away from a single composite index and instead use its underlying, granular components as distinct factors in our models. These pillars are designed to quantify the key structural characteristics of a corporate board. Our factors are designed to evaluate board effectiveness in Separation, Variety, and Disparity, following the qualitative framework proposed by

Harrison and Klein (

2007), who identified various aspects of diversity in organization design

Harrison and Klein (

2007). However, while the original approach was developed for general organizational structures using theoretical and qualitative frameworks, our board measurement components are built quantitatively, tailoring them to the domain of corporate board governance using granular data from our sample.

The three pillars capture different aspects of board architecture. First, the Separation pillar represents the degree of independence and segregation of duties within the board, which is critical for ensuring effective oversight and mitigating agency conflicts (

Hillman & Dalziel, 2003). Second, the Variety pillar addresses the diversity in board demographics, expertise, and perspectives. A higher degree of variety enhances decision-making quality and reduces the risk of groupthink (

Dong et al., 2023). Third, the Disparity pillar is used to measure the distribution of influence and power within the board. While a disaggregated analysis of each of the three pillars is a valuable avenue for future research, our primary objective in this study is to test the effect of a holistically strong board structure. Therefore, the pillars are aggregated into a single Board Structure Influence (BSI) index, which we define for conceptual clarity and use in our main empirical tests. The composite BSI index for a firm

j is calculated as the simple average of its three pillar scores:

This equal-weighting scheme follows the precedent of influential governance indices, where transparency and ease of reproduction are prioritized over complex, subjective weightings (

Gompers et al., 2003). While this approach ensures simplicity and objectivity, we acknowledge that alternative weighting schemes could be explored in future research. In Equation (

1),

represents the composite Board Structure Influence score for firm

i, averaged across the time period of our sample. The terms

,

, and

represent the firm’s average score for each of the three structural components.

Conceptually, these three pillars are complementary and mutually reinforcing. Effective governance is not achieved by excelling in one dimension alone. For example, a board with high Separation (independence) but low Variety may still suffer from groupthink and make suboptimal strategic decisions. Similarly, a diverse and independent board where influence is heavily concentrated in a single individual (high Disparity) cannot leverage its full potential. Therefore, it is the joint strength across these three distinct structural dimensions that creates a truly robust governance framework capable of navigating complex crises, justifying their aggregation into a single composite index.

In the next section, we identify a set of specific, granular governance indicators from our data source and then construct each of these three pillars for a given firm in a given year. Each indicator is then normalized to a scale of 0 to 1 for comparability. The score for each pillar is then calculated as the average of its constituent normalized indicators.

3.2. Construction from Granular Data

The BSI index is constructed from 12 granular governance indicators provided by Bloomberg. Each indicator is first normalized to a [0, 1] scale across the entire sample to ensure comparability before being averaged into its respective pillar score. This process ensures that the original scale of an indicator does not unduly influence the final index. For transparency and methodological rigor, we provide a comprehensive description of each indicator—including its definition, theoretical justification, quantification, and descriptive statistics—in

Appendix A (

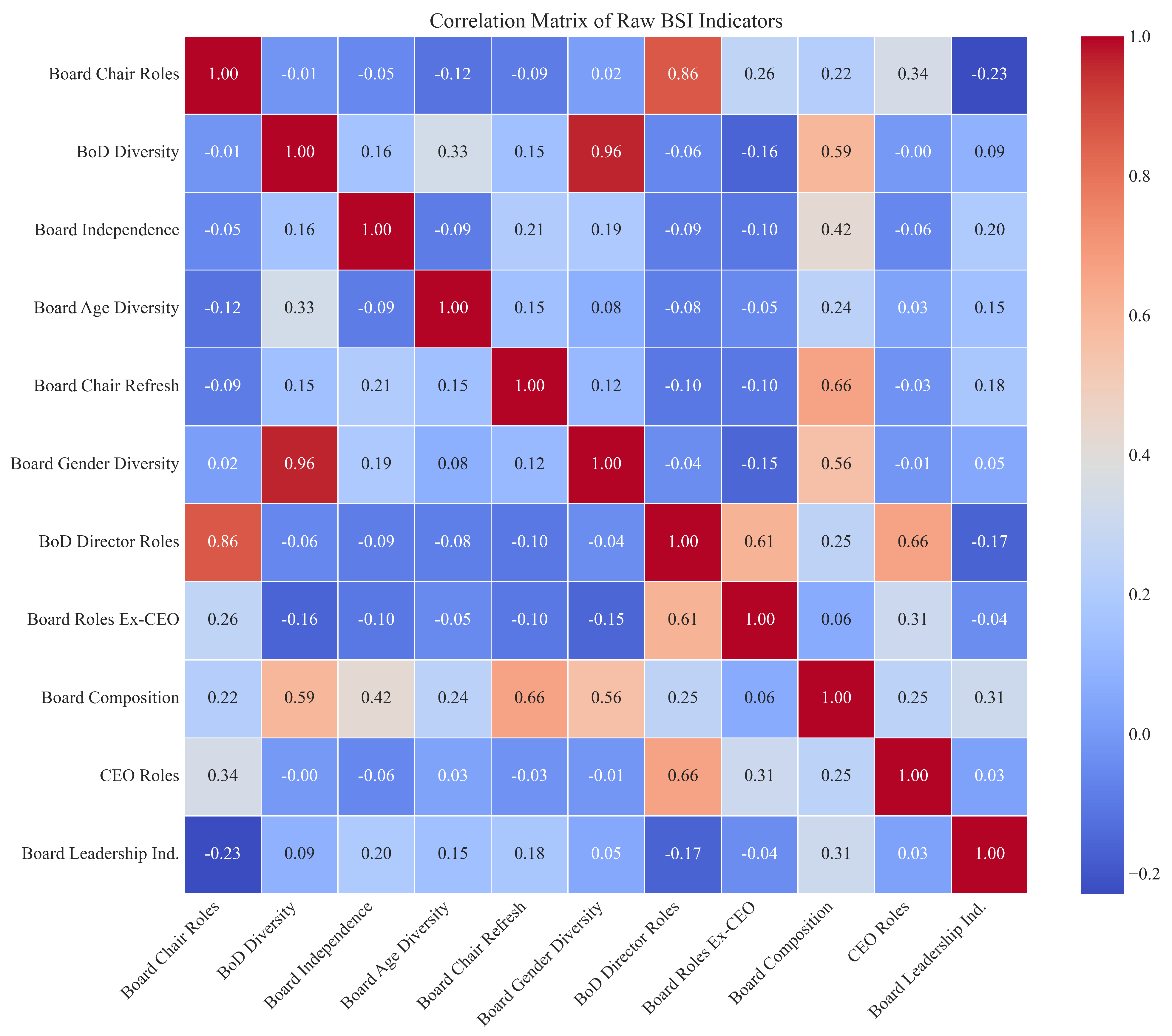

Table A1). A correlation matrix of all 12 indicators is also provided in

Appendix A (

Figure A1) to illustrate their interrelationships.

3.2.1. The Separation Score

The specific granular indicators used to construct each of the three pillars are detailed in

Table 1. The first pillar, the Separation Score, is designed to quantitatively measure the board’s structural independence from the firm’s management. A higher score indicates a greater degree of separation, which is theorized to enhance oversight and reduce potential conflicts of interest. To construct this score, we use a set of five specific governance indicators provided by Bloomberg. These indicators assess the overall independence of the board and the separation of key leadership roles. Specifically, we use the

Board Independence Score, which measures the proportion of independent directors; the

Board Leadership Independence Score, which evaluates the independence of board leadership; and a group of indicators assessing role duality, including the

CEO Roles Score, the

Board Chair Roles Score, and the

Board Roles Excluding CEO Score. The score is calculated as the average of these five indicators after each has been normalized across the entire panel, as specified by the following formula:

In Equation (

2), the term

is the score for firm

i at time

t. The parameter

is the number of indicators used for this pillar, which is five in our case. The variable

represents the raw value for each of the five specific Separation indicators listed above for firm

i at time

t. The terms

and

are the minimum and maximum values of that specific indicator

k across all firms and years in our dataset.

3.2.2. The Variety Score

The second pillar we construct is the Variety Score, which aims to capture the diversity of the board across multiple dimensions, including demographics, experience, and tenure. The conceptual basis for this score is that a greater variety of perspectives can lead to more robust, innovative strategic decisions. To compute this score, we use four specific indicators from Bloomberg that measure different aspects of board diversity. These are the Board Composition Score, which provides a comprehensive measure of the board’s mix of skills and backgrounds; the Board of Directors Diversity Score, which evaluates overall diversity policies and outcomes; and the more specific Board Age Diversity Score and Board Gender Diversity Score. The score represents the panel-normalized average of these four indicators, calculated as follows:

In Equation (

3), the term

represents the Variety Score for firm

i at time

t. The parameter

is the number of indicators used, which is four for this pillar. The variable

corresponds to the raw value for each of the four specific Variety indicators mentioned above for firm

i at time

t. The normalization terms

and

are the minimum and maximum values of that specific indicator

k observed across the entire panel of firms and years, which standardizes the score to a consistent [0, 1] range.

3.2.3. The Disparity Score

The Disparity Score is intended to capture the distribution of power and influence among the members of the board. A lower disparity, represented by a higher score in our framework, suggests that power is more evenly distributed and that mechanisms are in place to prevent the entrenchment of key individuals. To construct this measure, we use three granular indicators from our data source that relate to the concentration of roles and board refreshment. These specific indicators are the

Board of Directors Roles Score, which evaluates the assignment of roles across the board; the

Board Chair Roles Score, focusing on the responsibilities of the chair; and the

Board Chair Refreshment Score, which assesses policies related to the tenure and turnover of the board chair. The score is computed as the normalized average of these three indicators, according to the formula

In this equation, the parameter

represents the number of indicators used for this pillar, which in this case is three. The variable

corresponds to the raw value for each of the three specific Disparity indicators listed previously for firm

i at time

t. Finally, the terms

and

are the minimum and maximum values of that specific indicator

k found across the entire sample of firms and years.

Table 2 presents the descriptive statistics for the key variables used in our analysis. The summary highlights the distributional properties of our dependent profitability metrics, the governance scores, and the primary financial controls.

Unlike the original framework by

Harrison and Klein (

2007), which measures general organizational diversity, our adapted BSI index focuses explicitly on board governance rather than overall team or employee structures. In addition, it incorporates granular governance indicators and uses financial data from Bloomberg to

measure governance effectiveness quantitatively. Finally, our BSI index weights the three components (Separation, Variety, Disparity) based on corporate governance relevance, whereas

Harrison and Klein (

2007) used a theoretical framework without empirical weighting and quantitative measurement.

4. Data and Research Design

4.1. Data and Sample Selection

This study uses firm-level financial and governance data from Bloomberg, focusing on firms listed in the S&P 500 index from 2016 to 2022. The S&P 500 firms were selected due to their diverse industry representation, market influence, and the high quality of available governance data. However, we acknowledge that this focus on large, U.S.-based public companies may limit the generalizability of our findings to smaller, private, or non-U.S. firms. The study period (2016–2022) was chosen to capture both pre-COVID-19 and post-COVID-19 governance dynamics. The primary financial metric used in this study is net profit margin (NPM), calculated as net profit divided by total revenue. NPM was selected because it directly measures operational efficiency and profitability, providing a standardized metric for cross-firm comparisons (

Brigham, 1982). To examine the impact of governance, this study introduces the Board Structure Influence (BSI) index, a composite measure that captures board independence, diversity, and role distribution. The BSI index is constructed from governance-related indicators from Bloomberg (

Diab & Adams, 2021;

Dillian, 2020;

Rajesh & Rajendran, 2020).

4.2. Variable Definition and Measurement

We examine the relationship between governance structures and financial performance by defining the key variables outlined below.

4.2.1. Dependent Variable

The primary financial metric used in this study is NPM, calculated as

We chose NPM as the dependent variable because it is a standardized measure of financial profitability and offers a measure of cross-company and cross-industry comparisons. Unlike return on assets (ROA) or return on equity (ROE), NPM is not distorted by differences in asset structures or capital leverage (

Brigham, 1982). Additionally, prior studies have demonstrated that corporate governance mechanisms significantly influence profitability by improving operational decision-making and reducing inefficiencies (

Giese et al., 2019;

Hamdan et al., 2017). By using the level of NPM as the dependent variable within our Difference-in-Differences framework, our model directly estimates the differential change—or growth—in profitability following the shock, which is the causal effect of interest.

4.2.2. Independent Variables

The key independent variable in this study is the BSI index. The BSI index is a composite governance measure constructed using the granular governance-related indicators from Bloomberg, detailed in

Section 3. Unlike prior studies that separately assess board independence, diversity, and role distribution, the BSI index integrates these factors into a comprehensive metric to evaluate board effectiveness (

Diab & Adams, 2021;

Rajesh & Rajendran, 2020).

4.2.3. Control Variables

To isolate the effect of the BSI index, the following control variables are included, consistent with the prior literature: We control for firm size, measured as the natural logarithm of total assets, as larger firms may benefit from economies of scale, positively affecting NPM but may also suffer from bureaucratic inefficiencies; its effect is thus an empirical question, making it a crucial control. We also include key financial policy variables, namely interest expense, capital expenditure, and tax expense, all scaled by total assets. These variables reflect a firm’s financing, investment, and tax strategies, respectively, and are expected to be directly related to net profitability. Including them allows us to isolate the effect of board governance from these operational financial decisions. Firm fixed effects () are included in the regression model to account for any unobserved time-invariant heterogeneity, and time fixed effects () account for macroeconomic shocks common to all firms in a given year.

5. Empirical Methodology

5.1. Difference-in-Differences (DiD) Approach

To estimate the causal impact of the BSI index on firm profitability, we use the DiD methodology. The DiD approach is widely used in policy evaluation and corporate finance studies to compare changes in outcomes between a treatment group and a control group before and after an external shock (

Schiozer et al., 2020). For an exogenous treatment assignment, we define our treatment and control groups based on a pre-crisis characteristic. The treatment group comprises firms in the top quartile (top 25%) of the BSI index, averaged over the pre-pandemic period of 2018–2019. The control group consists of firms in the bottom quartile (bottom 25%) of the BSI index over the same 2018–2019 period. This pre-assignment results in a key requirement for causal inference: a firm’s treatment status is not determined by its response to the COVID-19 shock. Furthermore, to address the potential concern that firm size may confound the relationship between BSI and profitability, our model includes both firm size as a direct control variable and firm-level fixed effects. This combination robustly controls for time-invariant heterogeneity and other observable and unobservable factors correlated with firm size. The DiD model is specified as follows:

where

represents NPM for firm

i at time

t,

is a binary variable equal to 1 if firm

i belongs to the treatment group (top 25% BSI index), and zero otherwise,

is a binary variable indicating the post-COVID-19 period (2020–2022),

is the DiD interaction term and captures the causal effect of governance improvements on profitability after COVID-19,

includes firm-level control variables (interest expense, capital expenditure, tax expense),

captures firm fixed effects, controlling for time-invariant firm characteristics,

accounts for time-specific shocks affecting all firms, and

is the error term.

5.1.1. Parallel Trends Assumption (PTA) Test

The PTA guarantees that in the absence of treatment, our pair of sets follows similar trajectories over time. To validate this assumption, we examine the pre-treatment trends of the outcome variable. Formally, the PTA can be tested using the following regression model:

The variable

represents time and captures the temporal dynamics. The interaction term

allows us to assess whether the pre-treatment trends between the treatment and control groups are statistically different. The coefficient

on this interaction term is particularly interesting; a non-significant

indicates that the pre-treatment trends are parallel and supports the PTA. Additionally, we will visually inspect pre-treatment trends through graphical analysis to provide an intuitive understanding of parallel trends.

5.1.2. Methodological Choice: Why DiD?

The DiD method was selected due to its advantages in estimating causal effects by controlling for unobserved firm characteristics and macroeconomic shocks. We considered alternative methods, including Propensity Score Matching (PSM and Instrumental Variables (IVs). The former controls for observable characteristics but does not eliminate unobserved heterogeneity, and the latter requires a strong instrument, which is challenging to identify in governance studies. We also considered Fixed Effects Regression. This method accounts for unobserved heterogeneity but cannot capture treatment effects explicitly. Therefore, compared to these approaches, DiD provides a more robust causal identification strategy when parallel trends hold, which makes it the best choice for a causal framework on governance research (

Wooldridge, 2010).

Further, we acknowledge that our application of the DiD methodology evaluates the causal impact of a pre-existing firm characteristic, strong board governance, on performance following an exogenous shock that affects all firms. This approach is widely used in financial research to test for resilience, where the shock itself does not assign the treatment but interacts with it. Our causal claim is therefore precisely focused on whether strong board structures causally lead to better financial resilience during a crisis. Therefore, we emphasize that the DiD framework is ideal for this question because it isolates the differential change in profitability between the treatment and control groups that is attributable to the shock, thereby identifying the causal effect of governance on crisis performance. Nevertheless, we recognize that our model cannot entirely rule out the influence of unobserved time-varying confounders that may be correlated with both governance and crisis performance, such as shifts in corporate culture or specific management strategies adopted during the pandemic. Our comprehensive set of robustness checks is designed to build confidence that such confounders do not drive our results, but we acknowledge it as a potential limitation.

5.1.3. Constructing the BSI Index

Having calculated the individual ingredients—Separation, Variety, and Disparity scores—from Equation (

2), Equation (

3), and Equation (

4), respectively, we construct the overall BSI index for firm

j as the average of these three components (Equation (

1)). The economic rationale behind the BSI index lies in its ability to capture multiple dimensions of board governance to offer a comprehensive and detailed assessment compared to traditional single-dimensional metrics. The BSI index integrates independence, diversity, and power distribution and provides a robust indicator of a board’s effectiveness in overseeing management and alignment with shareholder interests. The histogram of the BSI index for our set of firms from Bloomberg data is displayed in

Figure 1.

The concept and components of the BSI are discussed in various research papers that explore the relationship between board characteristics, sustainability, and profitability (

Anyigbah et al., 2023). For instance, CEO turnover highlights the importance of board independence and diversity, which are also components of the BSI calculation (

Guo & Masulis, 2015). Other board structure classifications, including board composition, size, and independence, have been studied to show the relevance of board characteristics in enhancing long-term corporate performance (

Uadiale, 2010).

5.2. Robustness Checks

Beyond the Parallel Trends Assumption (PTA) outlined in

Section 5.1.1, the validity of the DiD approach relies on two other key assumptions. First, the No-Anticipation Effect Assumption (NAEA) states that Firms in the treatment group do not anticipate the treatment and change their behavior before the treatment period begins. Second, the Stable Unit Treatment Value Assumption (SUTVA) states that the treatment effect on one firm does not spill over to other firms. Below, we outline the methodology of these two assumptions to show the robustness of our conclusions in

Section 6.

5.2.1. Placebo and No-Anticipation Effect Assumption (NAEA) Tests

The NAEA indicates that firms in the treatment group do not change their behavior in anticipation of the treatment before the treatment period begins. This assumption can be violated if firms foresee the treatment and adjust their actions accordingly, contaminating the pre-treatment period. In our case, we anticipate that the NAEA test will confirm the DiD assumptions, as firms did not predict the COVID-19 outbreak in 2019 and 2020, which significantly impacted the global economy. To test the NAEA, we introduce a placebo treatment period before the actual treatment period and estimate the following regression model:

where

is a binary indicator that equals 1 for the placebo treatment period and zero otherwise. The interaction term

captures any potential anticipatory effects. A non-significant coefficient

suggests no anticipatory effects, thus supporting the NAEA. Furthermore, we also conduct other placebo tests using different pre-treatment periods to strengthen the robustness of the NAEA test. Consistent non-significant results across various placebo periods reinforce the validity of the NAEA.

5.2.2. Stable Unit Treatment Value Assumption (SUTVA) Test

The second robustness check we perform is the SUTVA, which states that the treatment effect on one firm does not spill over to affect other firms. This assumption confirms that the treatment and control groups are isolated from each other regarding the treatment’s effects. To test the SUTVA, we examine the correlation between pairwise differences in treatment status and pairwise differences in the outcome variable. The steps involved are as follows: First, we calculate the pairwise differences in treatment status between firms:

Second, we estimate the pairwise differences in the outcome variable between firms:

Finally, we derive the correlation between the pairwise differences in treatment status and the pairwise differences in the outcome variable:

. A non-significant correlation indicates that the treatment effect on one firm does not spill over to affect other firms, thereby supporting the SUTVA.

6. Empirical Results and Robustness Tests

The empirical analysis presented in this section evaluates the causal impact of improved board governance, as measured by the BSI index, on firm profitability and complements these findings with robustness checks and placebo tests. To begin, we document the evolution of the BSI index for treatment and control groups, providing visual evidence of post-COVID-19 divergence that motivates a causal framework. We then assess the PTA through a pre-treatment comparison of financial performance and formal regression tests. The DiD results reveal a statistically and economically significant increase in net profit margins for firms that improved their BSI index, supporting the view that stronger board structures enhance financial resilience during periods of economic stress. To further strengthen our conclusions, we implement placebo tests across alternative treatment years and confirm the absence of spurious effects.

6.1. Pre-Treatment Mean Trends and Parallel Trends Assumption

In this section, we analyze the pre-treatment and control groups’ pre-treatment mean trends and test the assumption of parallel trends. To formally test the parallel trends assumption, we ran a regression in Equation (

7) outlined in

Section 5.1.1.

Table 3 shows the results of this test. The regression results show that the interaction term

has a coefficient of −1.1086 with a standard error of 1.2649, which is not statistically significant (

p-value = 0.3813). This indicates no significant difference in the pre-treatment trends between the treatment and control groups. The results of this test suggest that any divergence in net profit margin post-treatment can be more confidently attributed to the treatment itself rather than pre-existing trends.

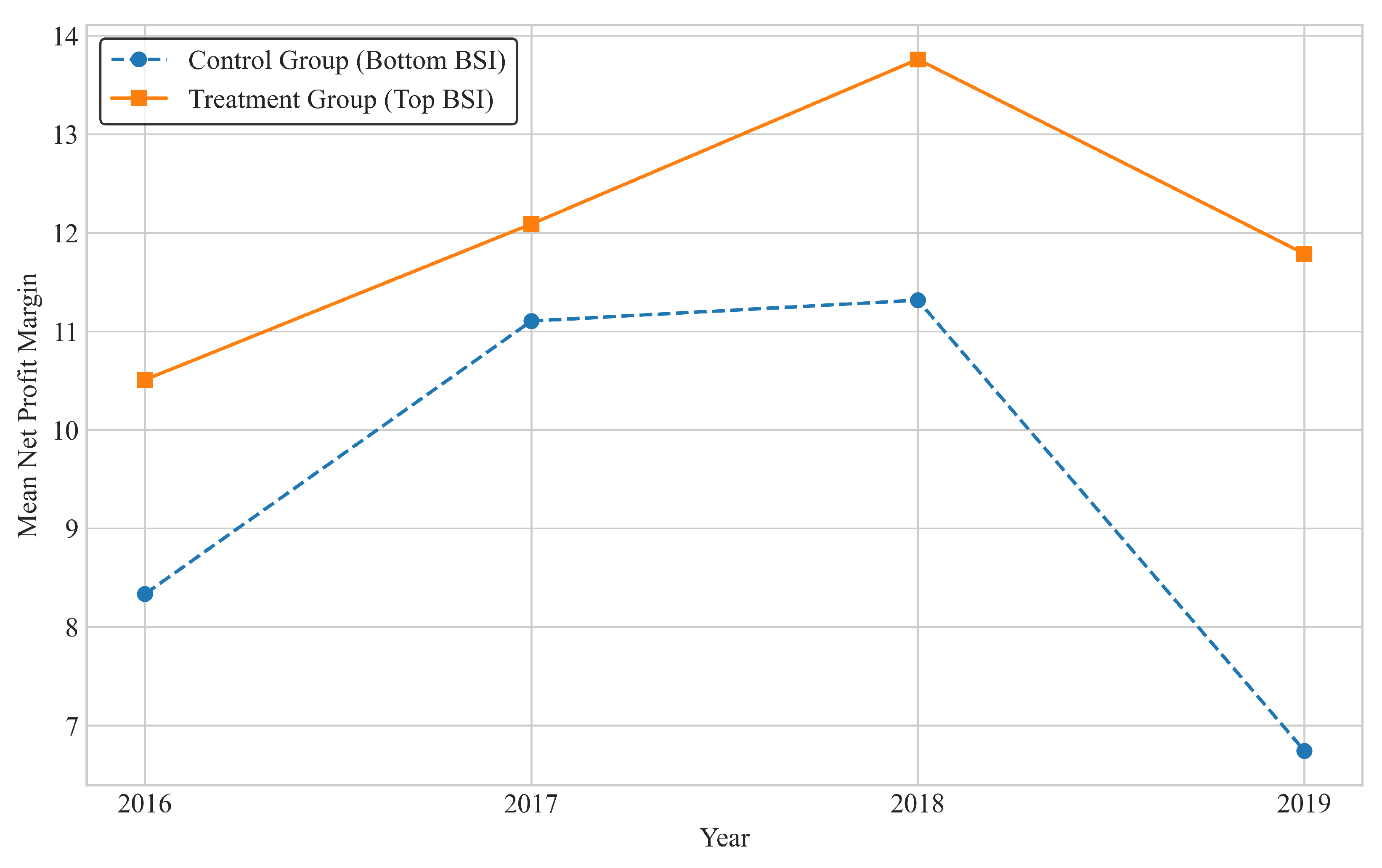

In addition to the formal regression test, we visually inspect the pre-treatment trends in

Figure 2. The graph shows that while the levels of net profit margin differ, the trends for both the high-BSI (treatment) and low-BSI (control) groups are parallel in the years leading up to the pandemic. Both groups exhibit a similar pattern of rising profitability until 2018, followed by a decline in 2019. This provides strong visual support for the parallel trends assumption, suggesting that any post-2020 divergence is likely attributable to the treatment effect rather than pre-existing trends.

6.2. Post-Treatment Analysis of Net Profit Margin

In line with Hypothesis H1, we test whether firms with higher BSI scores experienced a greater increase in profitability following the COVID-19 shock. For the stability of our estimates, we conducted a Variance Inflation Factor (VIF) test on the control variables. The VIF values for interest expense (1.002), capital expenditure (1.001), and tax expense (1.002) were all substantially below the conventional threshold of 5 and indicate that multicollinearity is not a concern in our model.

To quantify the impact of the BSI index and other factors on net profit margin, we performed a regression analysis using Equation (

6). The results are outlined in

Table 4. The results indicate that the interaction term

is positive (3.4577) and highly significant (

p-value = 0.0068). This suggests the treatment group experienced a substantial increase in their net profit margin post-COVID-19, relative to the control group. The significant positive interaction term reinforces the idea that improvements in board structure, as captured by the BSI index, contribute to enhanced financial performance, particularly during COVID-19. The lack of significance for the control variables suggests that the governance reforms had a more pronounced effect on profitability than the traditional financial expenditures during this period. The significant positive interaction term indicates that firms that took proactive steps to enhance their board governance were better positioned to navigate the challenges posed by the COVID-19 pandemic. This likely reflects better strategic decisions, more effective risk management, and improved operational efficiency.

6.3. Interpreting Economic Significance

The coefficient of 3.4577 for BSI Treatment × Post Treatment suggests that firms in the top 25% of the BSI index experience, on average, a 3.46 percentage point increase in NPM post-COVID-19. Consider a firm with a pre-COVID-19 NPM of 10% to provide a clearer financial perspective. A 3.46 percentage point increase implies that its post-COVID-19 NPM rises to 13.46%, which translates to a 34.6% increase in profitability. This suggests that governance reforms can yield substantial financial gains, especially during economic crises.

Furthermore, our findings align with prior research demonstrating that firms with strong governance structures exhibit better crisis resilience and financial performance recovery (

El-Chaarani et al., 2022;

Giese et al., 2019). The lack of significance for traditional financial control variables, such as capital expenditure and tax expense, suggests that board effectiveness played a more critical role in driving profitability than direct financial policies during the COVID-19 period.

These results have strong managerial and investment implications. Corporate leaders should prioritize board independence, role diversity, and governance transparency to improve financial performance. Additionally, investors should incorporate robust governance scores, such as the BSI, as a key metric in their investment strategies.

6.4. Placebo Test Analysis

Next, we perform a placebo test to verify the robustness of our DiD methodology. The objective is to confirm that our model does not estimate a significant effect when no true treatment has occurred. To do this, we assign a fake shock year before the actual pandemic, assuming the event occurred in 2019. The results are presented in

Figure 3 and

Table 5. The coefficient on the placebo interaction term is −2.0954 and is statistically insignificant (

p = 0.3929), with the confidence interval in the figure clearly containing zero. This non-result is the desired outcome, as it demonstrates that our model does not spuriously find an effect, strengthening our confidence in the main DiD estimate.

6.5. SUTVA Test Results

We test the Stable Unit Treatment Value Assumption (SUTVA) to check that the treatment applied to one unit does not affect the outcome of other units. We test for potential spillovers by examining the correlation between pairwise differences in treatment status and pairwise differences in the outcome variable, net profit margin, for the post-treatment year 2021. Our analysis yields a Pearson correlation coefficient of −0.0015 with a p-value of 0.8809. The statistically insignificant result indicates the absence of spillover effects, thus supporting the SUTVA.

6.6. Heterogeneous Treatment Effects with Causal Forests

Our Difference-in-Differences analysis provides a robust estimate of the ATE, but it assumes the causal impact of a strong board structure is constant across all firms. This assumption may hide variations in how different firms benefit from improved governance. To test our second hypothesis (H2) and explore this potential heterogeneity, we use a Generalized Random Forest (GRF) model, as proposed by

Athey et al. (

2019). The GRF is a machine learning method designed to estimate Conditional Average Treatment Effects (CATE). This approach helps us understand how the causal impact of a high BSI score on profitability changes based on firm characteristics like size. The DiD model provides a single average effect for the entire treated population. The GRF, in contrast, partitions the data to estimate tailored treatment effects for subgroups of firms, which provides a more granular view of the treatment’s impact.

To estimate these heterogeneous effects, we first need to understand the Conditional Average Treatment Effect (CATE),

. This coefficient represents the expected treatment effect for a subpopulation of firms with specific characteristics

. We formally define the CATE as

In Equation (

11),

is the potential net profit margin for firm

i if it has a high BSI score, and

is its potential NPM if it has a low BSI score. The vector

contains pre-treatment firm-specific characteristics that may influence the treatment effect, which in our analysis is firm size. The GRF method estimates

by building a forest of causal trees. Causal trees differ from traditional random forests because they are grown to find subgroups with the largest differences in treatment effects.

The GRF algorithm uses honest estimation to achieve this goal. The data is split into two subsamples: a splitting sample to determine the tree’s structure and an estimating sample to provide treatment effect estimates within the tree’s leaves. This separation prevents the model from using the same observations to both build the structure and estimate the effects, which reduces bias. Each tree in the forest recursively splits the covariate space X to maximize the heterogeneity in treatment effects between the new nodes. The splitting criterion is designed to find partitions that best explain this variance. After the forest is grown, the CATE for a new observation with characteristics x is the average of treatment effects from all trees where the observation falls into a specific leaf.

The GRF estimates

with a local regression where weights are derived from the forest structure. The CATE for a test point

x is estimated as

In Equation (

12),

is the estimated CATE for a firm with characteristics

x. The term

is the treatment assignment for firm

i, which is 1 for firms in the top BSI quartile and 0 for those in the bottom quartile. The outcome

is the change in NPM between 2019 and 2021. The weights

are determined by the forest structure. A weight

is positive if observation

i and test point

x frequently fall in the same terminal leaf across the forest. This method guarantees the estimate for

is based on the outcomes of similar firms. We use this framework to examine how

varies with firm size.

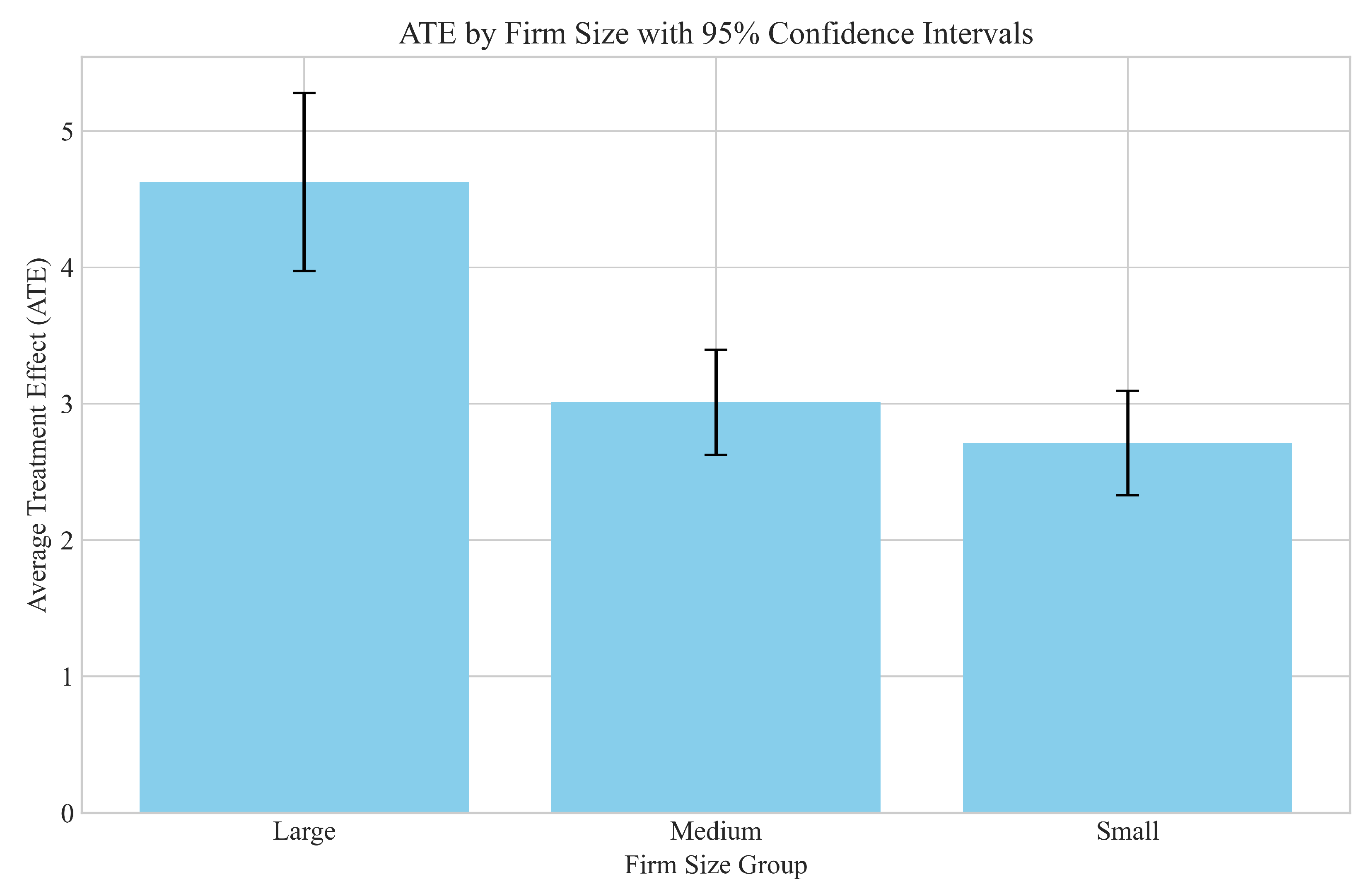

The results, visualized in

Figure 4, show significant heterogeneity in the treatment effect. We find a strong and statistically significant positive causal effect of a high BSI score on the profitability of large firms. In contrast, the effects for medium and small firms are smaller. This suggests that the financial benefits of superior board structures are most pronounced in larger corporations for a number of potential reasons. First, larger firms may possess the resources to more effectively implement governance directives; second, their complex operations may derive greater efficiency gains from structured oversight, and third, they may be under greater scrutiny from institutional investors who disproportionately reward strong governance signals. This confirms our main conclusion that board structure is a key driver of financial performance, and further shows that its impact is conditional on firm size.

7. Managerial Insights and Policy Suggestions

Our study highlights the critical impact of the BSI on corporate profitability and strategic planning. The findings show the necessity for firms to refine their board structures and governance practices to enhance financial performance.

The BSI index, which reflects the independence, diversity, and power distribution within a board, significantly influences a firm’s financial performance. Firms with higher BSI scores exhibit better net profit margins and indicate that robust board structures contribute to enhanced profitability.

From a managerial perspective, fostering board independence, promoting diversity, and ensuring balanced power distribution are crucial strategies. Independent directors are essential for providing objective oversight and mitigating conflicts of interest. Board diversity, encompassing gender, age, and professional background, enriches decision-making by introducing varied perspectives. Furthermore, distributing power equitably among board members, with clear separation of roles such as CEO and board chair, enhances governance quality and accountability.

Policy Suggestions to Improve Board Structures

To promote better board structures and governance practices, several policy measures can be recommended. Regulatory bodies should consider setting minimum standards for board independence, such as requiring a certain percentage of independent directors.

Policies to enhance board diversity are also critical. Implementing diversity quotas can drive the inclusion of underrepresented groups, bringing in diverse perspectives that improve decision-making. Policymakers can set specific targets for gender and demographic representation on boards.

Furthermore, guidelines on power distribution within boards can prevent the concentration of authority in a few individuals. Clear separation of roles, particularly between the CEO and board chair, should be mandated to enhance accountability and governance quality.

8. Conclusions and Future Research

This study contributes to the growing discourse on corporate sustainability by examining the impact of board structure on the financial profitability of firms listed in the S&P 500 from 2016 to 2022. Applying the DiD methodology provides clear evidence of the causal relationship between robust governance frameworks and enhanced financial outcomes, precisely measured through net profit margins.

A key innovation of this study is the introduction of the BSI index, a multifaceted measure of board effectiveness that captures the interplay between independence, diversity, and role distribution. Our results support Hypothesis H1 and indicate that companies with higher BSI scores significantly outperform their peers in terms of profitability. This shows the growing importance of comprehensive governance structures in driving sustainable financial success—an insight that offers theoretical and practical relevance.

The study also highlights the effectiveness of strong governance structures in the face of global disruptions, particularly during the COVID-19 pandemic. The significant post-COVID-19 impact of governance suggests that firms with resilient board structures were better equipped to navigate the unprecedented challenges posed by the pandemic. This finding validates the importance of adaptive governance in times of crisis and sets a precedent for how companies should prepare for future uncertainties. We acknowledge, however, that our post-treatment window (2020–2022) is relatively short. Future research should revisit this relationship to determine whether the positive effects of strong governance on profitability persist in the long term.

Implications and Pathways for Future Research

From a practical perspective, this study provides actionable insights for a wide range of stakeholders. Investors would do well to consider governance quality as a critical factor in their decision-making processes, particularly when evaluating firms for long-term effectiveness. Policymakers should focus on promoting policies that enhance board diversity, independence, and overall governance as levers for broader economic stability. For corporate leaders, the message is clear: investing in board effectiveness and sustainability is not just a matter of compliance but a strategy for enhancing profitability and mitigating future risks.

Further, future research could build on this study by exploring several promising avenues. A natural next step would be to disaggregate the BSI index to analyze the individual causal impacts of its three pillars—Separation, Variety, and Disparity. Furthermore, future work could develop and test alternative weighting schemes for the BSI pillars, such as those derived from principal component analysis (PCA) or expert surveys, to assess whether a weighted index provides greater explanatory power. Additionally, the impact of board structure could be explored across different contexts; future studies could conduct sector-specific analyses to determine whether the BSI is more impactful in industries with high regulatory oversight, such as finance and healthcare, or extend the analysis globally to compare the governance-profitability relationship in European, Asian, or emerging markets where corporate governance structures vary. Expanding the analysis to include small and medium-sized enterprises would also be a valuable extension to test the external validity of our findings. Finally, researchers could examine the BSI’s influence on a broader set of outcomes beyond net profit margin, such as Return on Assets (ROA), Tobin’s Q, and innovation output. Such studies could also explore the specific channels through which strong board structures deliver value during a crisis. For instance, future work might investigate whether high-BSI firms demonstrated more effective risk management, maintained higher levels of investment in innovation, exercised more disciplined cost control, or were better able to preserve stakeholder trust, and how these intermediate actions translated into superior financial performance. Acknowledging that good governance fosters more than just immediate profitability, future studies could also investigate impacts on long-term shareholder value, risk reduction, and non-financial stakeholder outcomes.

Author Contributions

Conceptualization, L.S., S.Z. and A.S.; methodology, L.S., S.Z. and A.S.; software, S.Z. and A.S.; validation, L.S., S.Z. and A.S.; formal analysis, S.Z. and A.S.; investigation, L.S., S.Z. and A.S.; resources, L.S., S.Z. and A.S.; data curation, S.Z. and A.S.; writing—original draft preparation, L.S., S.Z. and A.S.; writing—review and editing, L.S., S.Z. and A.S.; visualization, L.S. and A.S.; supervision, L.S., S.Z.; project administration, L.S., S.Z. and A.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Restrictions apply to the availability of these data. Data were obtained from Bloomberg and are available authors with the permission of Bloomberg.

Acknowledgments

We sincerely thank RiskLab members for their invaluable contributions to our research paper. Their insights, feedback, and support have been instrumental in developing and refining our ideas. Without their help, this research would not have been possible.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. BSI Indicator Details and Diagnostics

This appendix provides detailed information on the granular indicators used to construct the BSI index.

Table A1 presents the descriptive statistics for each raw indicator, revealing considerable variation in governance practices across firms. For example, while board independence scores are consistently high, policies on board chair refreshment vary widely.

Figure A1 shows the correlation matrix of these indicators. The generally low-to-moderate correlations suggest that the indicators capture distinct aspects of board structure and are not redundant, supporting their aggregation into a composite index.

Table A1.

Descriptive statistics of raw BSI indicators.

Table A1.

Descriptive statistics of raw BSI indicators.

| Indicator | Mean | Std | Min | 25% | 50% | 75% | Max |

|---|

| Board Chair Roles Score | 7.46 | 3.14 | 0.00 | 7.00 | 7.00 | 10.00 | 10.00 |

| BOD Diversity Score | 4.94 | 1.60 | 0.00 | 3.83 | 4.75 | 5.83 | 9.54 |

| Board Independence Score | 9.16 | 1.30 | 3.43 | 8.60 | 10.00 | 10.00 | 10.00 |

| Board Age Diversity Score | 6.18 | 1.41 | 1.81 | 5.22 | 6.13 | 7.16 | 10.00 |

| Board Chair Refresh Score | 6.29 | 4.00 | 0.00 | 0.88 | 8.06 | 10.00 | 10.00 |

| Board Gender Diversity Score | 4.46 | 2.15 | 0.00 | 3.00 | 3.92 | 5.96 | 10.00 |

| Board Director Roles Score | 7.56 | 1.81 | 0.77 | 6.54 | 7.83 | 8.81 | 10.00 |

| Board Roles Excluding CEO Score | 7.04 | 1.67 | 0.73 | 5.75 | 6.70 | 8.49 | 10.00 |

| Board Composition Score | 6.52 | 1.15 | 2.34 | 5.72 | 6.64 | 7.38 | 9.38 |

| CEO Roles Score | 8.56 | 2.01 | 0.25 | 7.00 | 10.00 | 10.00 | 10.00 |

| Board Leadership Independence Score | 6.90 | 2.46 | 0.00 | 5.00 | 7.00 | 10.00 | 10.00 |

Figure A1.

Correlation matrix heatmap of raw BSI indicators.

Figure A1.

Correlation matrix heatmap of raw BSI indicators.

References

- Anyigbah, E., Kong, Y., Edziah, B. K., Ahoto, A. T., & Ahiaku, W. S. (2023). Board characteristics and corporate sustainability reporting: Evidence from Chinese listed companies. Sustainability, 15, 3553. [Google Scholar] [CrossRef]

- Athey, S., Tibshirani, J., & Wager, S. (2019). Generalized random forests. The Annals of Statistics, 47(2), 1148–1178. [Google Scholar] [CrossRef]

- Bathala, C. T., & Rao, R. P. (1995). The determinants of board composition: An agency theory perspective. Managerial and Decision Economics, 16, 59–69. [Google Scholar] [CrossRef]

- Bebchuk, L., Cohen, A., & Ferrell, A. (2009). What matters in corporate governance? The Review of Financial Studies, 22, 783–827. [Google Scholar] [CrossRef]

- Brigham, E. F. (1982). Financial management: Theory and practice. Atlantic Publishers & Distri. [Google Scholar]

- Broadstock, D. C., Chan, K., Cheng, L. T., & Wang, X. (2021). The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance Research Letters, 38, 101716. [Google Scholar] [CrossRef] [PubMed]

- Carter, D. A., Simkins, B. J., & Simpson, W. G. (2003). Corporate governance, board diversity, and firm value. Financial Review, 38, 33–53. [Google Scholar] [CrossRef]

- Diab, A., & Adams, G. M. (2021). ESG assets may hit $53 trillion by 2025, a third of global AUM. Bloomberg Intelligence. Available online: https://www.bloomberg.com/professional/insights/markets/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum (accessed on 1 October 2025).

- Dillian, J. (2020). ESG investing looks like just another stock bubble. Bloomberg Intelligence. Available online: https://www.bloomberg.com/opinion/articles/2020-10-05/esg-investing-looks-like-just-another-stock-bubble (accessed on 1 October 2025).

- Dong, Y., Liang, C., & Wanyin, Z. (2023). Board diversity and firm performance, Impact of ESG activities in China. Economic Research-Ekonomska Istravzivanja, 36, 1592–1609. [Google Scholar] [CrossRef]

- El-Chaarani, H., Abraham, R., & Skaf, Y. (2022). The impact of corporate governance on the financial performance of the banking sector in the MENA (Middle Eastern and North African) region: An immunity test of banks for COVID-19. Journal of Risk and Financial Management, 15, 82. [Google Scholar] [CrossRef]

- Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26, 301–325. [Google Scholar] [CrossRef]

- Garcia-Castro, R., Ariño, M. A., & Canela, M. A. (2010). Does social performance really lead to financial performance? Accounting for endogeneity. Journal of Business Ethics, 92, 107–126. [Google Scholar] [CrossRef]

- Giese, G., Lee, L. E., Melas, D., Nagy, Z., & Nishikawa, L. (2019). Foundations of ESG investing: How ESG affects equity valuation, risk, and performance. The Journal of Portfolio Management, 45, 69–83. [Google Scholar] [CrossRef]

- Gompers, P., Ishii, J., & Metrick, A. (2003). Corporate governance and equity prices. The Quarterly Journal of Economics, 118, 107–156. [Google Scholar] [CrossRef]

- Gregory, R. P. (2022). ESG scores and the response of the S&P 1500 to monetary and fiscal policy during the COVID-19 pandemic. International Review of Economics & Finance, 78, 446–456. [Google Scholar]

- Guo, L., & Masulis, R. W. (2015). Board structure and monitoring: New evidence from CEO turnovers. The Review of Financial Studies, 28, 2770–2811. [Google Scholar] [CrossRef]

- Hamdan, A. M., Buallay, A. M., & Alareeni, B. A. (2017). The moderating role of corporate governance on the relationship between intellectual capital efficiency and firm’s performance: Evidence from Saudi Arabia. International Journal of Learning and Intellectual Capital, 14, 295–318. [Google Scholar] [CrossRef]

- Harrison, D. A., & Klein, K. J. (2007). What’s the difference? Diversity constructs as separation, variety, or disparity in organizations. Academy of Management Review, 32, 1199–1228. [Google Scholar] [CrossRef]

- Hillman, A. J., & Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Academy of Management Review, 28, 383–396. [Google Scholar] [CrossRef]

- Kassinis, G., Panayiotou, A., Dimou, A., & Katsifaraki, G. (2016). Gender and environmental sustainability: A longitudinal analysis. Corporate Social Responsibility and Environmental Management, 23, 399–412. [Google Scholar] [CrossRef]

- Koutoupis, A., Kyriakogkonas, P., Pazarskis, M., & Davidopoulos, L. (2021). Corporate governance and COVID-19: A literature review. Corporate Governance: The International Journal of Business in Society, 21, 969–982. [Google Scholar] [CrossRef]

- Rajesh, R., & Rajendran, C. (2020). Relating environmental, social, and governance scores and sustainability performances of firms: An empirical analysis. Business Strategy and the Environment, 29, 1247–1267. [Google Scholar] [CrossRef]

- Schiozer, R. F., Mourad, F. A., & Martins, T. C. (2020). A tutorial on the use of differences-in-differences in management, finance, and accounting. Revista de Administração Contemporânea, 25, e200067. [Google Scholar] [CrossRef]

- Singh, S., Esser, I. M., & MacNeil, I. (2023). Board decision-making and stakeholder protection. NLS Business Law Review, 9(2), 3. [Google Scholar] [CrossRef]

- Uadiale, O. M. (2010). The impact of board structure on corporate financial performance in Nigeria. International Journal of Business and Management, 5(10), 155. [Google Scholar] [CrossRef]

- Waddock, S. A., & Graves, S. B. (1997). The corporate social performance–financial performance link. Strategic Management Journal, 18, 303–319. [Google Scholar] [CrossRef]

- Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. MIT Press. [Google Scholar]

- Zhao, J. (2021). Reimagining corporate social responsibility in the era of COVID-19: Embedding resilience and promoting corporate social competence. Sustainability, 13, 6548. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).