Dynamic Transmissions and Volatility Spillovers between Global Price and U.S. Producer Price in Agricultural Markets

Abstract

1. Introduction

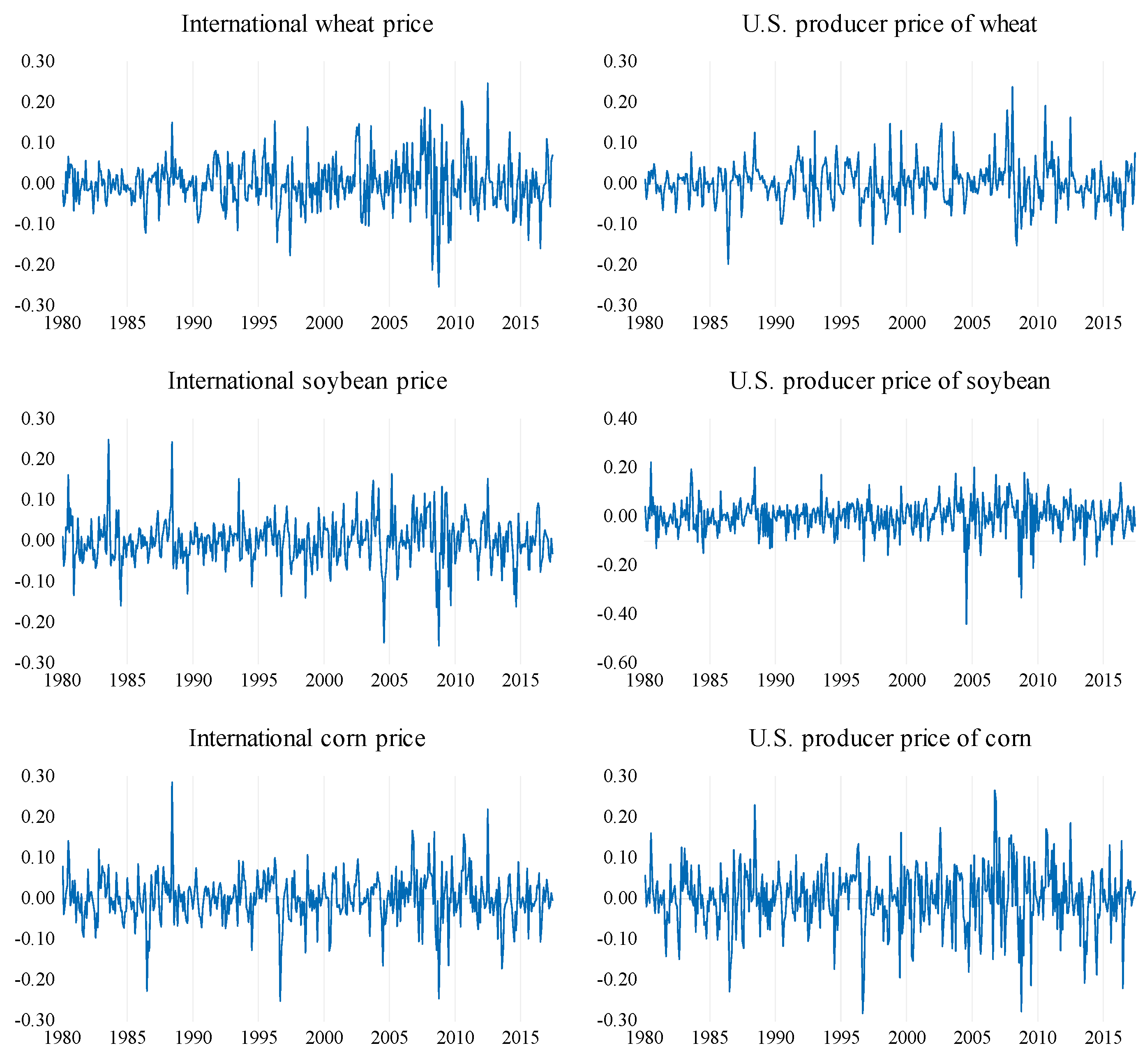

2. Data and Sample Statistics

3. Methodology

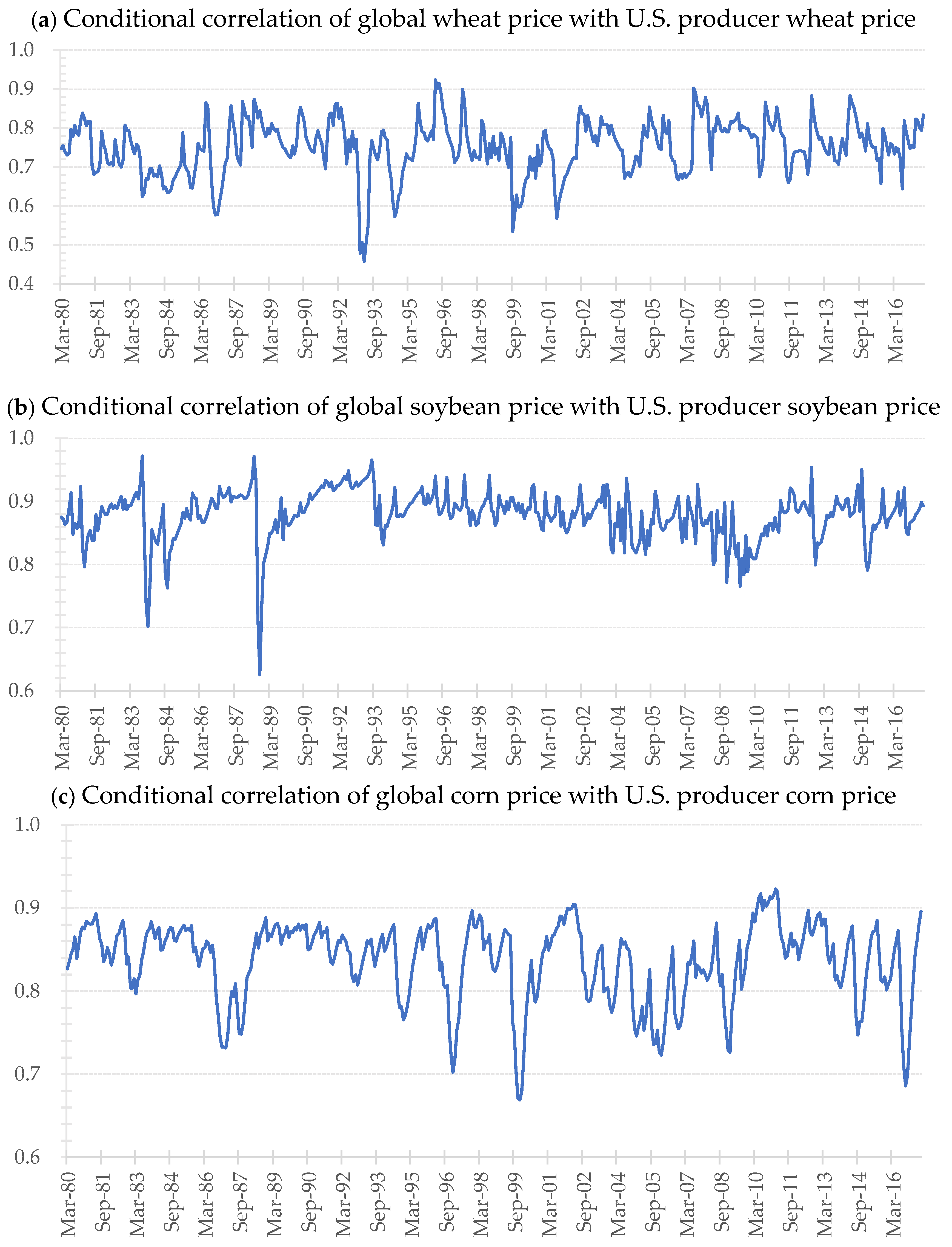

4. Empirical Results

5. Robustness Check

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Data Availability

Appendix A

| Null Hypothesis | Maximum Eigenvalue Test | Trace Test | ||||

|---|---|---|---|---|---|---|

| Statistic | 5% Critical Value | p-Value | Statistic | 5% Critical Value | p-Value | |

| None | 20.503 | 15.892 | 0.009 | 25.305 | 20.262 | 0.009 |

| At most 1 | 4.802 | 9.165 | 0.306 | 4.802 | 9.165 | 0.306 |

| Null Hypothesis | Maximum Eigenvalue Test | Trace Test | ||||

|---|---|---|---|---|---|---|

| Statistic | 5% Critical Value | p-Value | Statistic | 5% Critical Value | p-Value | |

| None | 65.685 | 15.892 | 0.000 | 71.169 | 20.262 | 0.000 |

| At most 1 | 5.485 | 9.165 | 0.234 | 5.485 | 9.165 | 0.234 |

| Null Hypothesis | Maximum Eigenvalue Test | Trace Test | ||||

|---|---|---|---|---|---|---|

| Statistic | 5% Critical Value | p-Value | Statistic | 5% Critical Value | p-Value | |

| None | 65.685 | 15.892 | 0.000 | 71.169 | 20.262 | 0.000 |

| At most 1 | 5.485 | 9.165 | 0.234 | 5.485 | 9.165 | 0.234 |

References

- Abdulai, Awudu. 2000. Spatial Price Transmission and Asymmetry in the Ghanaian Maize Market. Journal of Development Economics 63: 327–49. [Google Scholar] [CrossRef]

- Abdulai, Awudu. 2002. Using Threshold Cointegration to Estimate Asymmetric Price Transmission in the Swiss Pork Market. Applied Economics 34: 679–87. [Google Scholar] [CrossRef]

- Akerman, Anders. 2010. A Theory on the Role of Wholesalers in International Trade based on Economies of Scope. Working Paper. Stockholm: Department of Economics, Stockholm University. [Google Scholar]

- An, Henry, Feng Qiu, and Yanan Zheng. 2016. How Do Export Controls Affect Price Transmission and Volatility Spillovers in the Ukrainian Wheat and Flour Market? Food Policy 62: 142–50. [Google Scholar] [CrossRef]

- Bai, Jushan, and Pierre Perron. 2003. Computation and Analysis of Multiple Structural Change Models. Journal of Applied Econometrics 18: 1–22. [Google Scholar] [CrossRef]

- Basher, Syed Abul, and Perry Sadorsky. 2016. Hedging Emerging Market Stock Prices with Oil, Gold, VIX and Bonds: A Comparison between DCC ADCC and GO-GARCH. Energy Economics 54: 235–47. [Google Scholar] [CrossRef]

- Baulch, Bob. 1997. Transfer Costs, Spatial Arbitrage and Testing for Food Market Integration. American Journal of Agricultural Economics 79: 477–87. [Google Scholar] [CrossRef]

- Bauwens, Luc, Sébastien Laurent, and Jeroen VK Rombouts. 2006. Multivariate GARCH Models: A Survey. Journal of Applied Econometrics 21: 79–109. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bollerslev, Tim, and Jeffrey M. Wooldridge. 1992. Quasi-Maximum Likelihood Estimation and Inference in Dynamic Models with Time-Varying Covariances. Econometric Reviews 11: 143–72. [Google Scholar] [CrossRef]

- Cappiello, Lorenzo, Robert F. Engle, and Kevin Sheppard. 2006. Asymmetric Correlations in the Global Equity and Bond Returns. Journal of Financial Econometrics 4: 537–72. [Google Scholar] [CrossRef]

- Ceballos, Francisco, Manuel A. Hernandez, Nicholas Minot, and Miguel Robles. 2017. Grain Price and Volatility Transmission from International to Domestic Markets in Developing Countries. World Development 94: 305–20. [Google Scholar] [CrossRef]

- Cheung, Yin-Wong, and Lilian K. Ng. 1996. A Causality in Variance Test and its Application to Financial Market Prices. Journal of Econometrics 72: 33–48. [Google Scholar] [CrossRef]

- Conforti, Piero. 2004. Price Transmission in Selected Agricultural Markets. Commodity and Trade Policy Research Working Paper No 7. Rome: Food and Agriculture Organization. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Engle, Robert. 2002. Dynamic Conditional Correlation: A Simple Class of Multivariate Generalized Autoregressive Conditional Heteroscedasticity Models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Ghoshray, Atanu. 2008. Asymmetric Adjustment of Rice Export Prices: The Case of Thailand and Vietnam. International Journal of Applied Economics 5: 80–91. [Google Scholar]

- Grier, Kevin B., Ólan T. Henry, Nilss Olekalns, and Kalvinder Shields. 2004. The Asymmetric Effects of Uncertainty on Inflation and Output Growth. Journal of Applied Econometrics 19: 551–65. [Google Scholar] [CrossRef]

- Guo, Jin. 2018. Co-Movement of International Copper Prices, China’s Economic Activity and Stock Returns: Structural Breaks and Volatility Dynamics. Global Finance Journal 36: 62–77. [Google Scholar] [CrossRef]

- Guo, Jin, and Tetsuji Tanaka. 2019. Determinants of International Price Volatility Transmissions: The Role of Self–Sufficiency Rates in Wheat–Importing Countries. Palgrave Communications 5: 124. [Google Scholar] [CrossRef]

- Haile, Mekbib G., Matthias Kalkuhl, Bernardina Algieri, and Samuel Gebreselassie. 2017. Price Shock Transmission: Evidence from the Wheat-Bread Market Value Chain in Ethiopia. Agricultural Economics 48: 769–80. [Google Scholar] [CrossRef]

- Hong, Yongmiao. 2001. A Test for Volatility Spillover with Applications to Exchange Rates. Journal of Econometrics 103: 183–224. [Google Scholar] [CrossRef]

- Huang, Yiyu, Wenjing Su, and Xiang Li. 2010. Comparison of GARCH-BEKK and GARCH-DCC models: An empirical study. Advanced Data Mining and Applications. ADMA 2010. In Lecture Notes in Computer Science. Berlin/Heidelberg: Springer, pp. 99–110. [Google Scholar]

- Johansen, Søren, and Katarina Juselius. 1990. Maximum Likelihood Estimation and Inference on Cointegration––With Applications to the Demand for Money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Kouyaté, Carolin, and Stephan von Cramon-Taubadel. 2016. Distance and Border Effects on Price Transmission: A Meta-Analysis. Journal of Agricultural Economics 67: 255–71. [Google Scholar] [CrossRef]

- Kwiatkowski, Denis, Peter CB Phillips, Peter Schmidt, and Yongcheol Shin. 1992. Testing the Null Hypothesis of Stationarity Against the Alternative of a Unit Root. Journal of Econometrics 54: 159–78. [Google Scholar] [CrossRef]

- Ljung, Greta M., and George E. P. Box. 1978. On Measuring of Lag of Fit in Time Series Models. Biometrics 67: 297–303. [Google Scholar] [CrossRef]

- Lutz, Clemens, W. Erno Kuiper, and Aad van Tilburg. 2006. Maize Market Liberalisation in Benin: A Case of Hysteresis. Journal of African Economies 16: 102–33. [Google Scholar] [CrossRef]

- Mackinnon, Andrew, Anthony F. Jorm, Helen Christensen, Ailsa E. Korten, Patricia A. Jacomb, and Bryan Rodgers. 1999. A Short Form of the Positive and Negative Affect Schedule: Evaluation of Factorial Validity and Invariance Across Demographic Variables in a Community Sample. Personality and Individual Differences 27: 405–16. [Google Scholar] [CrossRef]

- McLaren, Alain. 2015. Asymmetry in Price Transmission in Agricultural Markets. Review of Development Economics 19: 415–33. [Google Scholar] [CrossRef]

- Minot, Nicholas. 2011. Transmission of World Food Price Changes to Markets in Sub–Saharan Africa. IFPRI Discussion Paper 1059. Washington, DC: International Food Policy Research Institute. [Google Scholar]

- Mundlak, Yair, and Donald F. Larson. 1992. On the Transmission of World Agricultural Prices. The World Bank Economic Review 6: 399–422. [Google Scholar] [CrossRef]

- Myers, Robert J. 2008. Evaluating the Efficiency of Inter-Regional Trade and Storage in Malawi Maize Markets. Report for the World Bank. East Lansing: Michigan State University. [Google Scholar]

- Nelson, Daniel B. 1991. Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica 59: 347–70. [Google Scholar] [CrossRef]

- Newburger, Emma. 2019. “Trump is ruining our markets”: Struggling farmers are losing a huge customer to the trade war—China. CNBC. Available online: https://www.cnbc.com/2019/08/10/trump-is-ruining-our-markets-farmers-lose-a-huge-customer-to-trade-war----china.html (accessed on 28 August 2019).

- Newey, Whitney K., and Kenneth D. West. 1994. Automatic Lag Selection in Covariance Matrix Estimation. Review of Economic Studies 61: 631–53. [Google Scholar] [CrossRef]

- Osterwald-Lenum, Michael. 1992. A Note with Quantiles of the Asymptotic Distribution of the Maximum Likelihood Cointegration Rank Test Statistics. Oxford Bulletin of Economics and Statistics 54: 461–72. [Google Scholar] [CrossRef]

- Phillips, Peter CB, and Pierre Perron. 1988. Testing for a Unit Root in Time Series Regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Plume, Karl. 2019. On the front lines: Trade war sinks North Dakota soybean farmers. Reuters. Available online: https://www.reuters.com/article/us-usa-trade-china-soybean/on-the-front-lines-trade-war-sinks-north-dakota-soybean-farmers-idUSKCN1VC0ZX (accessed on 28 August 2019).

- Quiroz, Jorge, and Raimundo Soto. 1995. International Price Signals in Agricultural Prices: Do Governments Care? Documento de Investigacion 88. Santiago: ILADES Postgraduate Economics Program, Georgetown University. [Google Scholar]

- Rashid, Shahidur. 2004. Spatial Integration of Maize Markets in Post–Liberalised Uganda. Journal of African Economies 13: 102–33. [Google Scholar] [CrossRef]

- Reimer, Jeffrey J., and Man Li. 2009. Yield Variability and Agricultural Trade. Agricultural and Resource Economics Review 38: 258–70. [Google Scholar] [CrossRef]

- Rezitis, Anthony N., and Mike Tsionas. 2019. Modeling Asymmetric Price Transmission in the European Food Market. Economic Modeling 76: 216–30. [Google Scholar] [CrossRef]

- Robles, Miguel, and Máximo Torero. 2010. Understanding the Impact of High Food Prices in Latin America. Economia 10: 117–64. [Google Scholar]

- Tanaka, Tetsuji, and Jin Guo. 2020. How Does the Self-Sufficiency Rate Affect International Price Volatility Transmissions in the Wheat Sector: Evidence from Wheat-Exporting Countries. Palgrave Communications. forthcoming. [Google Scholar]

- Tanaka, Tetsuji, Nobuhiro Hosoe, and Huanguang Qiu. 2012. Risk Assessment of Food Supply: A Computable General Equilibrium Approach. Newcastle upon Tyne: Cambridge Scholars Publishing. [Google Scholar]

- Ünal, Gözde Erhan, Baris Karapinar, and Tetsuji Tanaka. 2018. Welfare-at-Risk and Extreme Dependency of Regional Wheat Yields: Implications of a Stochastic CGE Model. Journal of Agricultural Economics 69: 18–34. [Google Scholar] [CrossRef]

- Usman, Muhammed A., and Mekbib G. Haile. 2017. Producer to Retailer Price Transmission in Cereal Markets of Ethiopia. Food Security 9: 815–29. [Google Scholar] [CrossRef]

- Van Campenhout, Bjorn. 2007. Modeling Trends in Food Market Integration: Method and an Application to Tanzanian Maize Markets. Food Policy 32: 112–27. [Google Scholar] [CrossRef]

- Van Dijk, Dick, Denise R. Osborn, and Marianne Sensier. 2005. Testing for causality in variance in the presence of breaks. Economics Letters 89: 193–99. [Google Scholar] [CrossRef]

- Welton, George. 2011. The Impact of Russia’s 2010 Grain Export Ban. Oxfam Research Reports. Available online: http://pantheon-live.oxfam.org.nz/sites/default/files/reports/Impact-of-russia-grain-2010-280611-en.pdf (accessed on 22 November 2019).

- Worako, Tadesse Kumma, Herman D. van Schalkwyk, Zerihun Gudeta Alemu, and Gezahegne Ayele. 2008. Producer Price and Price Transmission in a Deregulated Ethiopian Coffee Market. Agrekon 47: 492–508. [Google Scholar] [CrossRef]

- Zingbagba, Mark, Rubens Nunes, and Muriel Fadairo. 2019. The Impact of Diesel Price on Upstream and Downstream Food Prices: Evidence from São Paulo. Energy Economics 85: 1–45. [Google Scholar] [CrossRef]

| 1 | The Federal Reserve Economic Data also quotes the dataset as world prices. |

| 2 | |

| 3 | |

| 4 | The ADF and KPSS unit root tests indicate that all the variables have unit root processes in their levels. We do not report these results for the sake of brevity. The results can be obtained from the authors upon request. |

| 5 | See Bai and Perron (2003). |

| 6 | The characteristic of price series allows for the possibility that there is a station ary long-run equilibrium relationship (cointegrating relationship) between individual price series. If there are no cointegrating relationships among the variables, after n (n is equal to the order of integrated variables) differences, then the standard vector autoregressive (VAR) model is employed. In contrast, if cointegrating relationships are identified, the vector error-correction model (VECM) can be used for the empirical analysis. Given that all the price series are nonstationary I (1) series, we will use the Johansen-Juselius procedure (Johansen and Juselius 1990) to examine the cointegrating relationship between international prices and U.S. producer prices for wheat, soybean, and corn. |

| 7 | |

| 8 | |

| 9 | The GARCH model was developed by Bollerslev (1986) and the exponential GARCH (EGARCH) model by Nelson (1991). |

| 10 | The A-DCC model modified the original DCC model by including asymmetries in the correlation dynamics. See Cappiello et al. (2006) for an extensive analysis of these models’ advantages. |

| 11 | The estimated results of the DCC coefficients were not reported for the sake of brevity. The results can be obtained from the authors upon request. |

| 12 | See Bollerslev and Wooldridge (1992). |

| 13 | BFGS (Broyden, Fletcher, Goldfarb, and Shanno) is a quasi-Newton optimization method that uses information about the gradient of the function at the current point to calculate where to find a better point. |

| 14 | The Ljung-Box and ARCH tests show that there is no autocorrelation up to order 10 for the standard residuals and squared standard residuals and no further ARCH effect in all of the models. |

| 15 |

| Mean | Median | Std. Dev. | ADF Test | KPSS Test | Structural Break Tests | |

|---|---|---|---|---|---|---|

| International wheat price | 0.000 | −0.002 | 0.060 | −13.718 *** (1) | 0.087 (3) | No break |

| U.S. producer price of wheat | 0.000 | 0.000 | 0.050 | −11.296 *** (0) | 0.048 (10) | No break |

| International soybean price | 0.001 | 0.001 | 0.057 | −15.497 *** (0) | 0.041 (2) | No break |

| U.S. producer price of soybean | 0.001 | 0.006 | 0.069 | −12.185 *** (2) | 0.040 (10) | No break |

| International corn price | 0.001 | 0.001 | 0.058 | −15.910 *** (0) | 0.042 (2) | No break |

| U.S. producer price of corn | 0.001 | 0.001 | 0.075 | −16.719 *** (0) | 0.034 (7) | No break |

| Parameter | International Price (i = 1) | U.S. Producer Price (i = 2) | ||

|---|---|---|---|---|

| Estimate | SE | Estimate | SE | |

| 0.124 *** | 0.024 | −0.130 *** | 0.034 | |

| 0.003 *** | 0.001 | −0.003 *** | 0.001 | |

| 0.213 *** | 0.073 | 0.217 *** | 0.062 | |

| 0.129 * | 0.072 | 0.255 *** | 0.062 | |

| 0.011 *** | 0.003 | 0.017 | 0.003 | |

| 0.005 * | 0.003 | |||

| 0.492 *** | 0.075 | −0.276 *** | 0.096 | |

| 0.422 *** | 0.077 | −0.074 | 0.129 | |

| 0.978 *** | 0.031 | −0.192 *** | 0.065 | |

| 0.086 ** | 0.035 | 0.659 *** | 0.065 | |

| 0.016 | 0.120 | 0.232 * | 0.122 | |

| −0.351 *** | 0.120 | 0.721 *** | 0.118 | |

| 6.712 | 15.053 | |||

| Mcleod-Li (10) | 11.939 | 11.370 | ||

| LM test | 1.345 | 1.077 | ||

| Causality in Mean | Causality in Variance | ||||

|---|---|---|---|---|---|

| Null Hypothesis | Chi-Squared | p-Value | Null Hypothesis | Chi-Squared | p-Value |

(GP LP) | 122.570 (4) | 0.000 | (GP LP) | 57.277 (6) | 0.000 |

(GP LP) | 28.141 (2) | 0.000 | (GP LP) | 49.630 (3) | 0.000 |

(LP GP) | 31.411 (2) | 0.000 | (LP GP) | 24.549 (3) | 0.000 |

| Joint Wald tests for asymmetry effects | |||||

| 65.677 (4) | 0.000 | ||||

| Parameter | International Price (i = 1) | U.S. Producer Price (i = 2) | ||

|---|---|---|---|---|

| Estimate | SE | Estimate | SE | |

| −0.139 *** | 0.048 | −0.474 *** | 0.051 | |

| −0.004 *** | 0.001 | −0.014 *** | 0.001 | |

| 0.778 *** | 0.099 | 1.065 *** | 0.103 | |

| −0.503 *** | 0.071 | −0.760 *** | 0.079 | |

| 0.033 *** | 0.004 | 0.031 *** | 0.004 | |

| −0.000 | 0.003 | |||

| 0.708 *** | 0.193 | −0.234 | 0.209 | |

| 0.477 ** | 0.204 | −0.140 | 0.218 | |

| 0.329 ** | 0.129 | 0.211 ** | 0.094 | |

| −0.621 *** | 0.121 | 0.959 *** | 0.087 | |

| 0.717 *** | 0.224 | −0.599 *** | 0.213 | |

| 0.835 *** | 0.218 | −0.717 *** | 0.186 | |

| 9.140 | 11.548 | |||

| Mcleod-Li (10) | 3.491 | 4.724 | ||

| LM test | 0.378 | 0.426 | ||

| Causality in Mean | Causality in Variance | ||||

|---|---|---|---|---|---|

| Null Hypothesis | Chi-Squared | p-Value | Null Hypothesis | Chi-Squared | p-Value |

(GP LP) | 383.601 (4) | 0.000 | (GP LP) | 45.141 (6) | 0.000 |

(GP LP) | 323.960 (2) | 0.000 | (GP LP) | 39.103 (3) | 0.000 |

(LP GP) | 88.770 (2) | 0.000 | (LP GP) | 15.950 (3) | 0.001 |

| Joint Wald tests for asymmetry effects | |||||

| 20.490 (4) | 0.000 | ||||

| Parameter | International Price (i = 1) | U.S. Producer Price (i = 2) | ||

|---|---|---|---|---|

| Estimate | SE | Estimate | SE | |

| −0.025 *** | 0.005 | −0.037 *** | 0.006 | |

| −0.015 *** | 0.002 | −0.023 *** | 0.003 | |

| 0.159 * | 0.083 | 0.518 *** | 0.100 | |

| 0.086 | 0.064 | −0.109 | 0.077 | |

| 0.010 *** | 0.003 | 0.018 *** | 0.005 | |

| 0.008 *** | 0.002 | |||

| −0.147 * | 0.083 | 0.155 ** | 0.064 | |

| −0.355 *** | 0.126 | 0.475 *** | 0.098 | |

| 0.928 *** | 0.005 | −0.161 *** | 0.009 | |

| 0.293 *** | 0.040 | 0.672 *** | 0.063 | |

| 0.215 ** | 0.107 | −0.076 | 0.084 | |

| 0.390 ** | 0.186 | 0.008 | 0.170 | |

| 3.620 | 10.207 | |||

| Mcleod-Li (10) | 4.040 | 8.591 | ||

| LM test | 0.405 | 0.881 | ||

| Causality in Mean | Causality in Variance | ||||

|---|---|---|---|---|---|

| Null Hypothesis | Chi-Squared | p-Value | Null Hypothesis | Chi-Squared | p-Value |

(GP LP) | 190.032 (4) | 0.000 | (GP LP) | 397.089 (6) | 0.000 |

(GP LP) | 132.134 (2) | 0.000 | (GP LP) | 66.346 (3) | 0.000 |

(LP GP) | 37.197 (2) | 0.000 | (LP GP) | 369.807 (3) | 0.000 |

| Joint Wald tests for asymmetry effects | |||||

| 20.250 (4) | 0.000 | ||||

| Wheat AR (1)-EGARCH (1, 1) | Soybean AR (1)-EGARCH (1, 1) | Corn AR (1)-GARCH (1, 2) | |

|---|---|---|---|

| 0.000 | 0.002 | 0.001 | |

| 0.258 *** | 0.264 *** | 0.233 *** | |

| −0.099 * | −0.245 * | 0.001 *** | |

| 0.054 | 0.036 | 0.013 *** | |

| 0.078 *** | 0.140 *** | - | |

| 0.990 *** | 0.964 *** | 1.655 *** | |

| - | - | −0.969 *** | |

| GED parameter | 1.354 *** | 1.195 *** | 1.156 *** |

| 9.087 | 8.270 | 9.707 | |

| 13.521 | 2.028 | 5.763 | |

| ARCH test (10) | 8.367 | 0.225 | 0.552 |

| BIC | −2.964 | −3.085 | −3.038 |

| Wheat AR (1)-EGARCH (1, 2) | Soybean AR (1)-EGARCH (1, 1) | Corn AR (1)-GARCH (1, 1) | |

|---|---|---|---|

| −0.001 | 0.004 | 0.003 | |

| 0.431 *** | −0.001 | 0.197 *** | |

| −2.119 *** | −0.153 * | 0.003 ** | |

| 0.299 *** | 0.040 | 0.157 * | |

| −0.076 ** | 0.114 *** | ||

| 1.529 *** | 0.977 *** | 0.324 | |

| −0.829 *** | |||

| GED parameter | 1.155 *** | 1.324 *** | 1.189 *** |

| 14.561 | 15.320 | 11.486 | |

| 13.521 | 8.479 | 14.163 | |

| ARCH test (10) | 1.294 | 0.882 | 1.416 |

| BIC | −3.477 | −2.575 | −2.414 |

| Wheat | Soybean | Corn | |

|---|---|---|---|

| Model | Log-likelihood | Log-likelihood | Log-likelihood |

| DCC | 1572.289 | 1571.507 | 1471.103 |

| A-DCC | 1573.073 | 1573.501 | 1480.206 |

| BEKK | 1651.099 * | 1743.960 * | 1559.138 * |

| Lag k | Mean Causality | Variance Causality | ||

|---|---|---|---|---|

| International Price → U.S. Price | U.S. Price → International Price | International Price → U.S. Price | U.S. Price → International Price | |

| 1 | 2.394 ** | 1.293 | 0.019 | −0.093 |

| 2 | −0.292 | −0.330 | 1.422 | 1.956 * |

| 3 | −0.730 | −1.763 * | 0.345 | 0.093 |

| 4 | 0.256 | 1.048 | −0.959 | 0.226 |

| 5 | 1.183 | 0.353 | 1.649 * | 0.066 |

| 6 | −1.217 | −0.540 | 0.794 | −0.288 |

| 7 | 0.631 | −1.041 | −0.574 | 0.796 |

| 8 | −0.411 | −1.162 | 1.215 | 0.453 |

| 9 | −0.800 | −0.210 | 1.448 | −0.506 |

| 10 | −0.059 | 0.364 | 0.749 | −1.035 |

| 11 | 1.179 | 1.911 * | 0.409 | 1.484 |

| 12 | 0.745 | −1.674 * | 0.478 | 3.141 *** |

| Lag k | Mean Causality | Variance Causality | ||

|---|---|---|---|---|

| International Price → U.S. Price | U.S. Price → International Price | International Price → U.S. Price | U.S. Price → International Price | |

| 1 | 5.776 *** | −2.821 *** | 1.325 | 0.157 |

| 2 | 1.890 * | 0.773 | 0.794 | 0.677 |

| 3 | −1.441 | −1.867 * | −0.150 | −0.148 |

| 4 | −0.400 | 0.210 | −0.764 | −0.809 |

| 5 | −0.938 | −1.812 * | −0.036 | 0.436 |

| 6 | −0.256 | 0.764 | −0.002 | −0.506 |

| 7 | −0.127 | −1.035 | 0.377 | 1.609 |

| 8 | 0.222 | −0.133 | −0.557 | −1.549 |

| 9 | −0.282 | −0.779 | −0.525 | -0.203 |

| 10 | −2.222 ** | −0.616 | 0.356 | 0.984 |

| 11 | 1.118 | 0.402 | 2.620 *** | 1.651 * |

| 12 | 0.019 | −0.034 | 1.564 | 1.854 * |

| Lag k | Mean Causality | Variance Causality | ||

|---|---|---|---|---|

| International Price → U.S. Price | U.S. Price → International Price | International Price → U.S. Price | U.S. Price → International Price | |

| 1 | 3.348 *** | 0.237 | −0.694 | −0.182 |

| 2 | 1.441 | −0.510 | −0.377 | 0.392 |

| 3 | 0.436 | 0.275 | 0.275 | −0.787 |

| 4 | −1.090 | −0.032 | 1.456 | 0.135 |

| 5 | −0.607 | −2.982 *** | −0.428 | −0.519 |

| 6 | −1.816 | −0.946 | −0.099 | −0.176 |

| 7 | 0.392 | 1.035 | −1.236 | 0.436 |

| 8 | −2.170 ** | −1.966 ** | −0.351 | −0.707 |

| 9 | 0.152 | 0.324 | 2.038 ** | 2.951 *** |

| 10 | −0.660 | 0.533 | −1.012 | −0.345 |

| 11 | 2.277 ** | 1.577 | 0.881 | 2.570 ** |

| 12 | 0.106 | −1.314 | 0.618 | 0.070 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, J.; Tanaka, T. Dynamic Transmissions and Volatility Spillovers between Global Price and U.S. Producer Price in Agricultural Markets. J. Risk Financial Manag. 2020, 13, 83. https://doi.org/10.3390/jrfm13040083

Guo J, Tanaka T. Dynamic Transmissions and Volatility Spillovers between Global Price and U.S. Producer Price in Agricultural Markets. Journal of Risk and Financial Management. 2020; 13(4):83. https://doi.org/10.3390/jrfm13040083

Chicago/Turabian StyleGuo, Jin, and Tetsuji Tanaka. 2020. "Dynamic Transmissions and Volatility Spillovers between Global Price and U.S. Producer Price in Agricultural Markets" Journal of Risk and Financial Management 13, no. 4: 83. https://doi.org/10.3390/jrfm13040083

APA StyleGuo, J., & Tanaka, T. (2020). Dynamic Transmissions and Volatility Spillovers between Global Price and U.S. Producer Price in Agricultural Markets. Journal of Risk and Financial Management, 13(4), 83. https://doi.org/10.3390/jrfm13040083