Construction of Macroeconomic Uncertainty Indices for Financial Market Analysis Using a Supervised Topic Model †

Abstract

1. Introduction

1.1. Measurement of the Macroeconomic Uncertainty

1.2. Our Contributions

2. Related Works

2.1. Research Related to Volatility

2.2. Research Using Text Data

2.3. Topic Model

2.4. Topic Model Applying to Uncertainty Index

3. Datasets

3.1. Text Data

3.2. Numeric Data

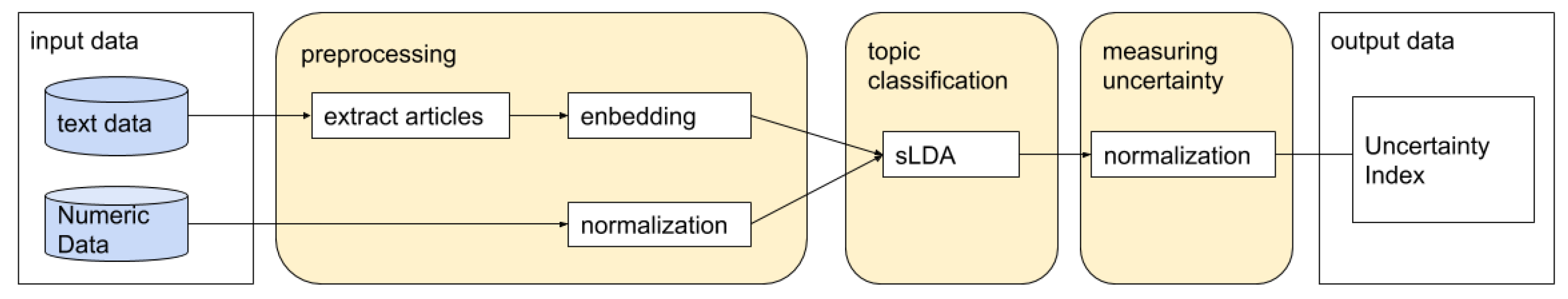

4. Materials and Methods

4.1. Text Data Preprocessing

4.2. Numeric Data Prepossessing

4.3. Topic Classification

4.4. Uncertainty Measurement

5. Topic Model

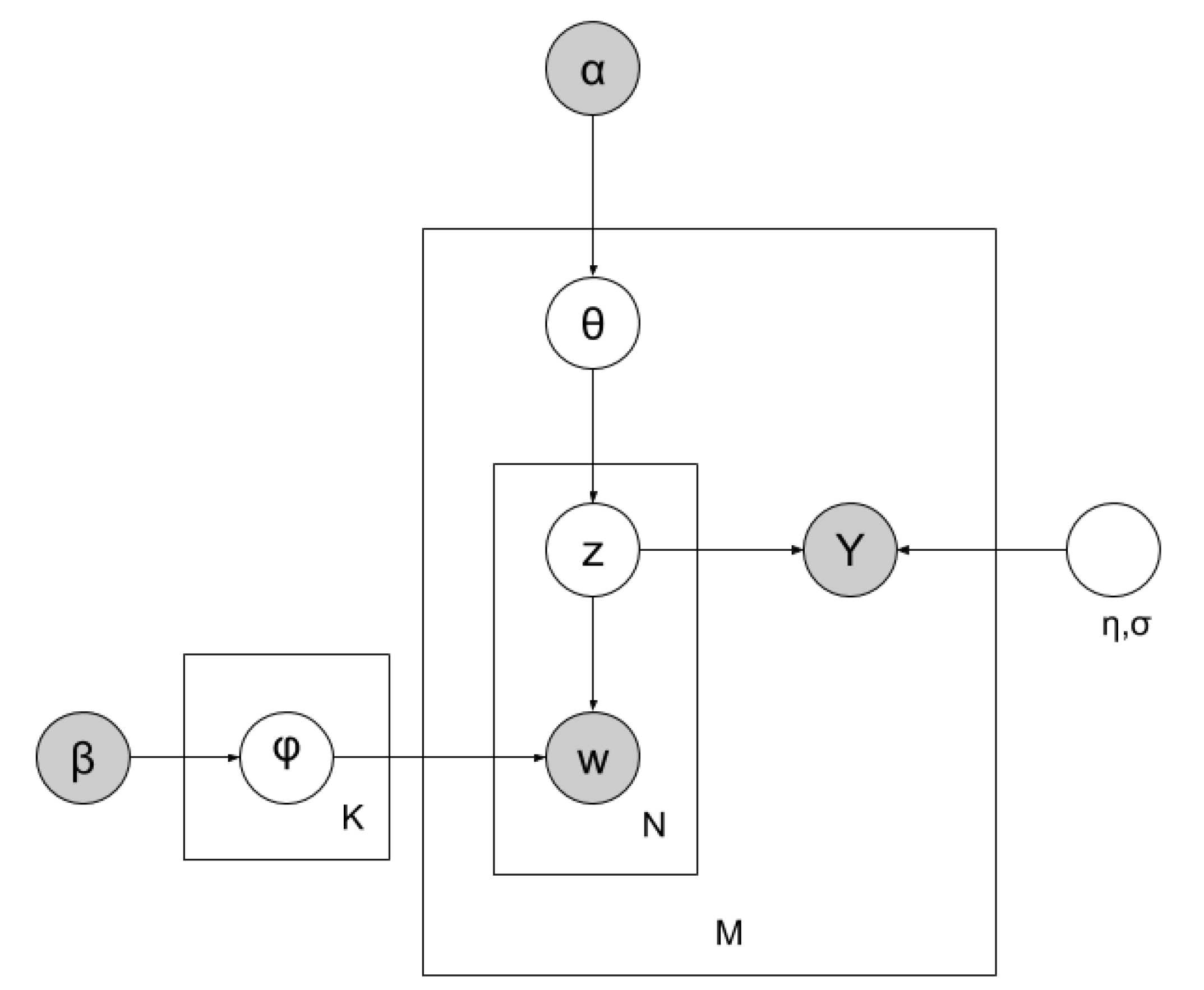

Supervised Latent Dirichlet Allocation

- For each document d, topic distribution determined by the following equation, where is the hyperparameter of Dirichlet distribution.

- For each topic k, word distribution determined by the following equation, where is the hyperparameter of Dirichlet distribution.

- For each word in document d

- -

- topic is sample from distribution by the following equation.

- -

- word is a sample from distribution by the following equation.

- For each document d, response variable is sample from distribution by the following equation, where .

6. Results

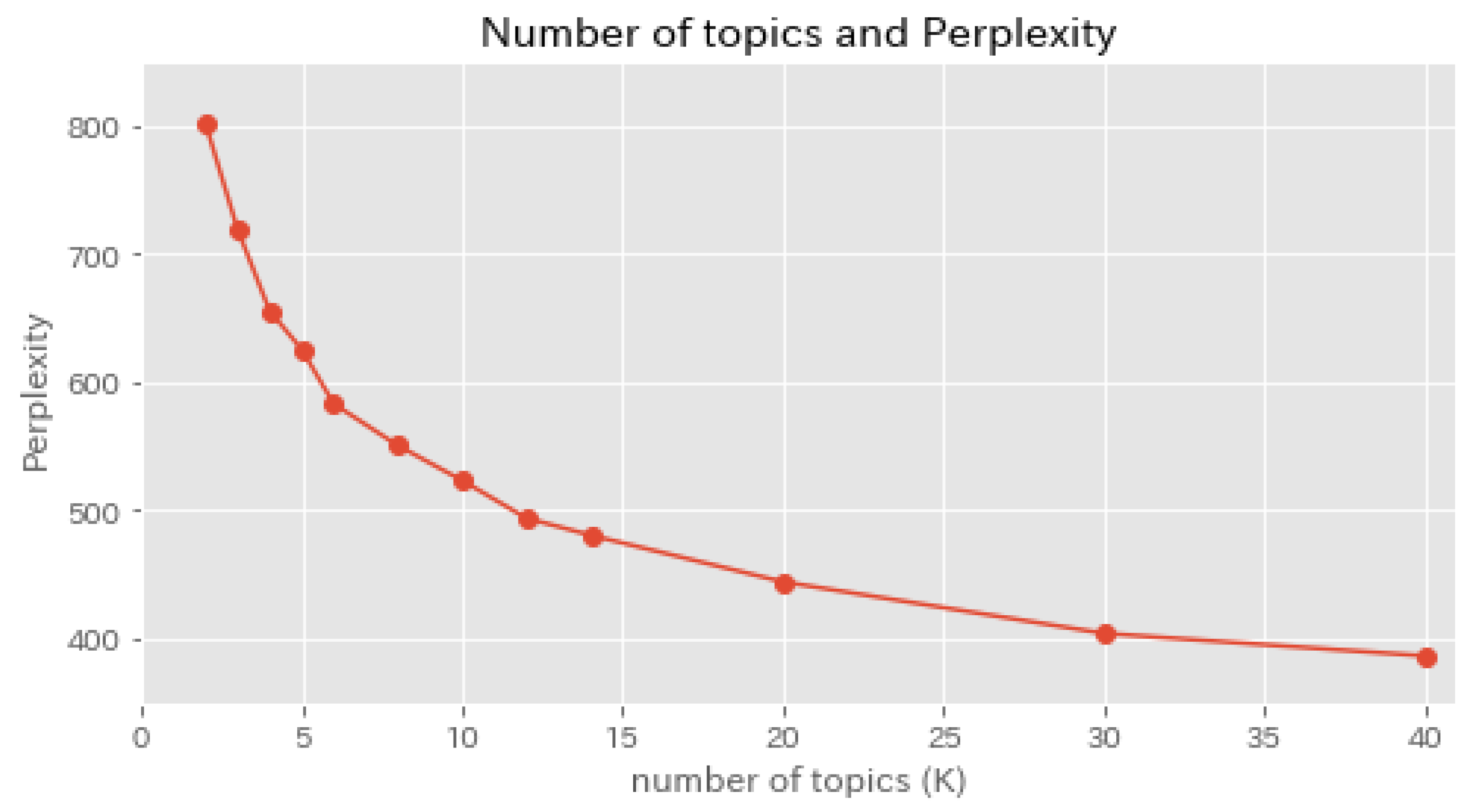

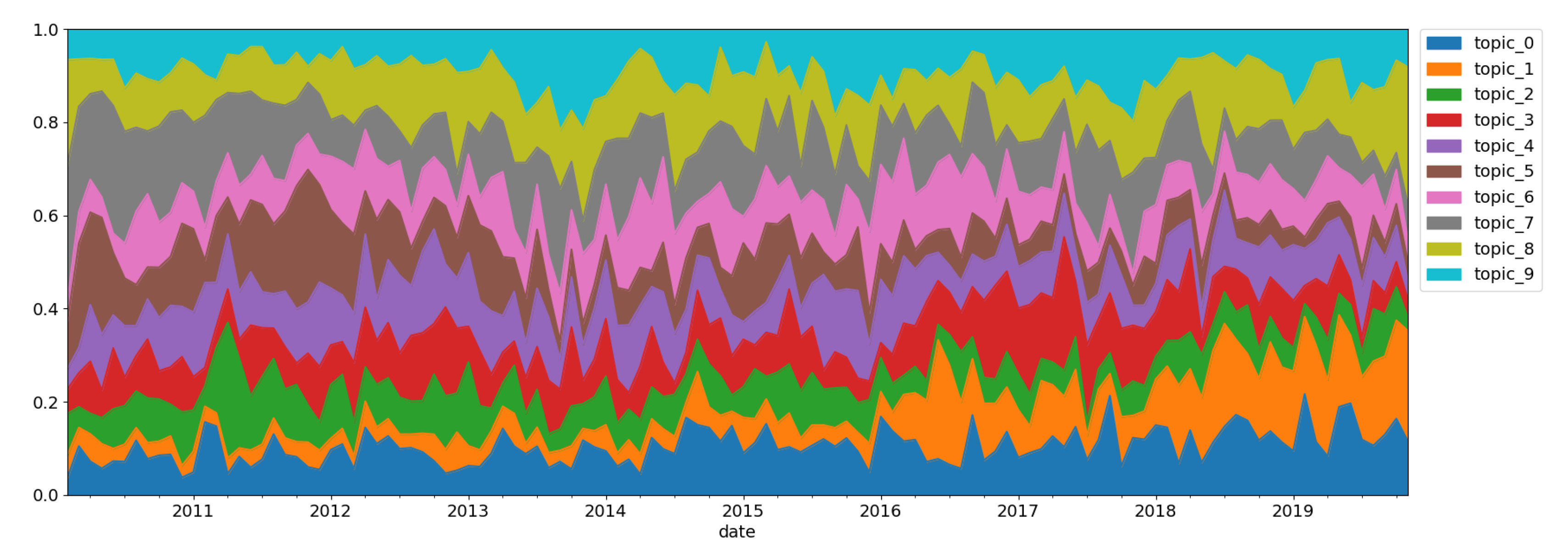

6.1. Topic Classification

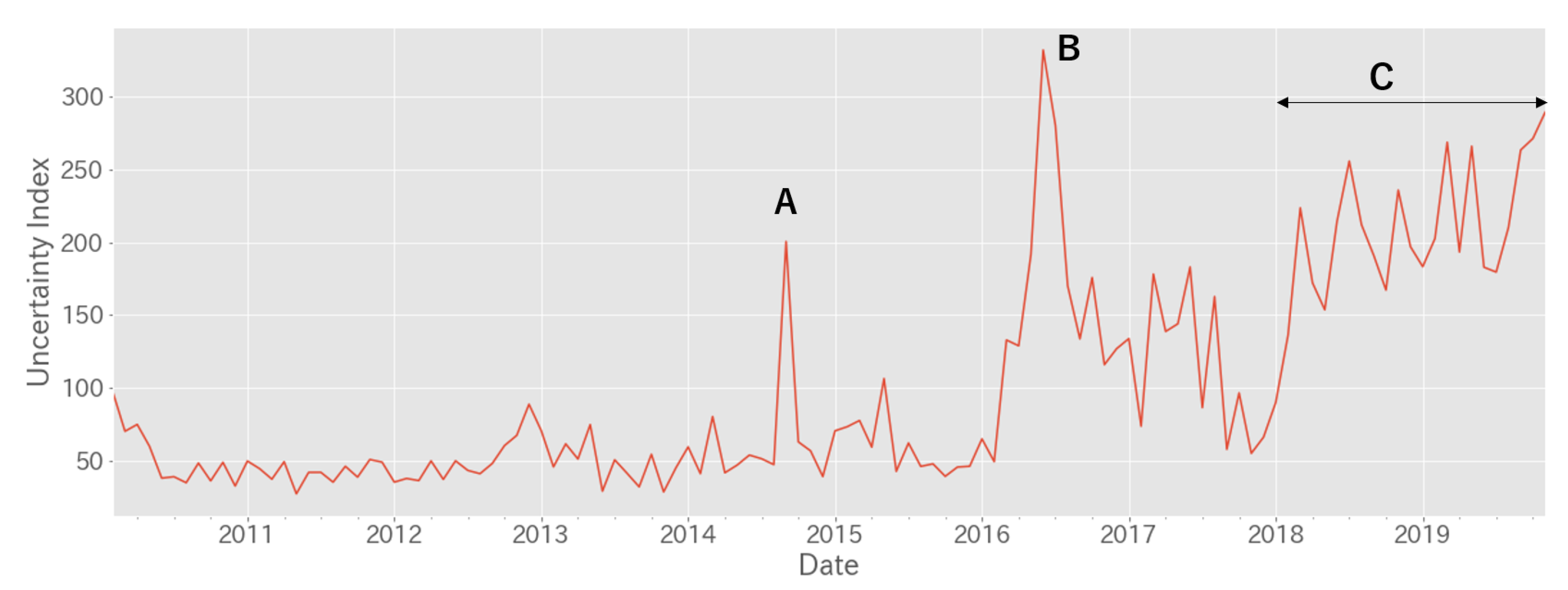

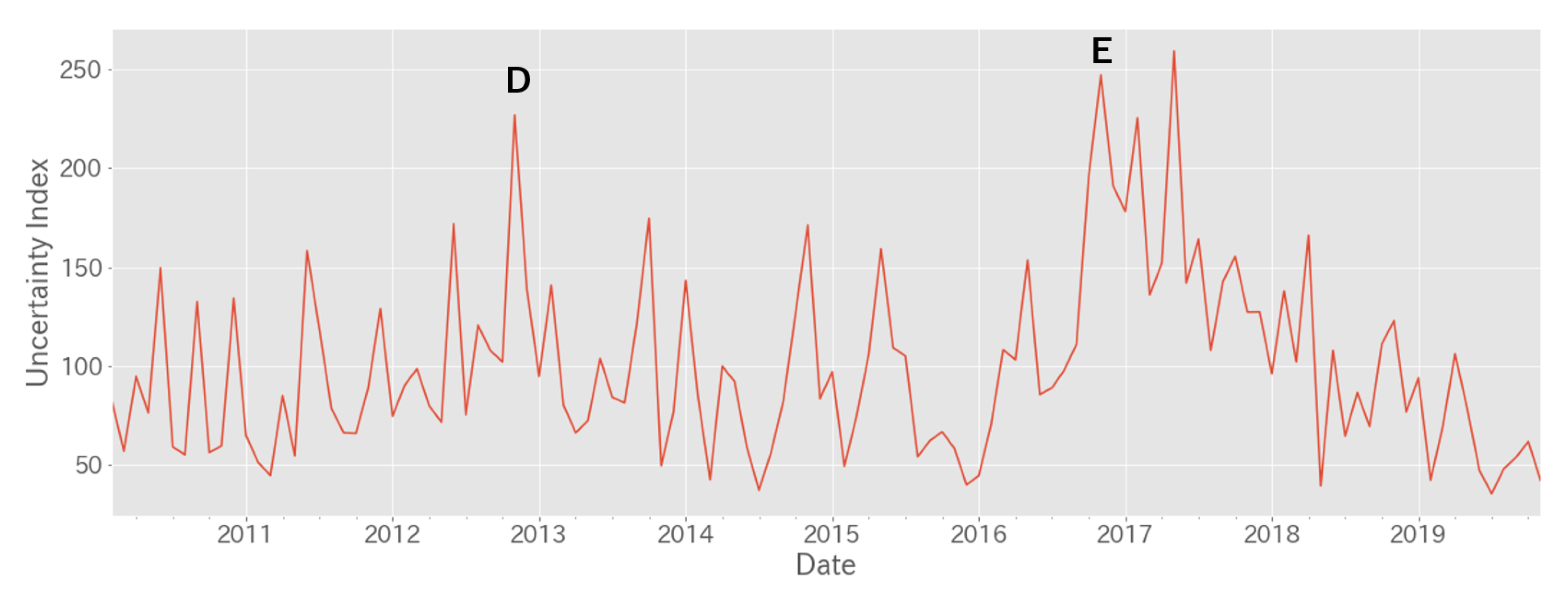

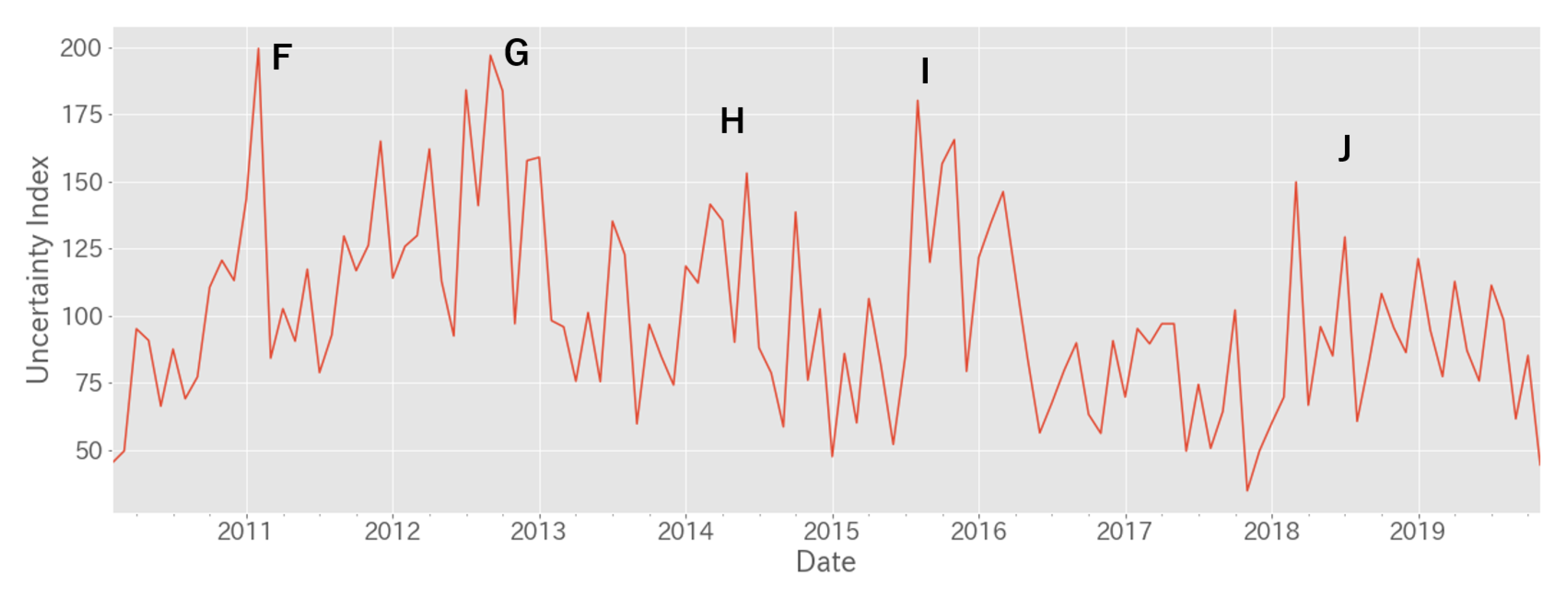

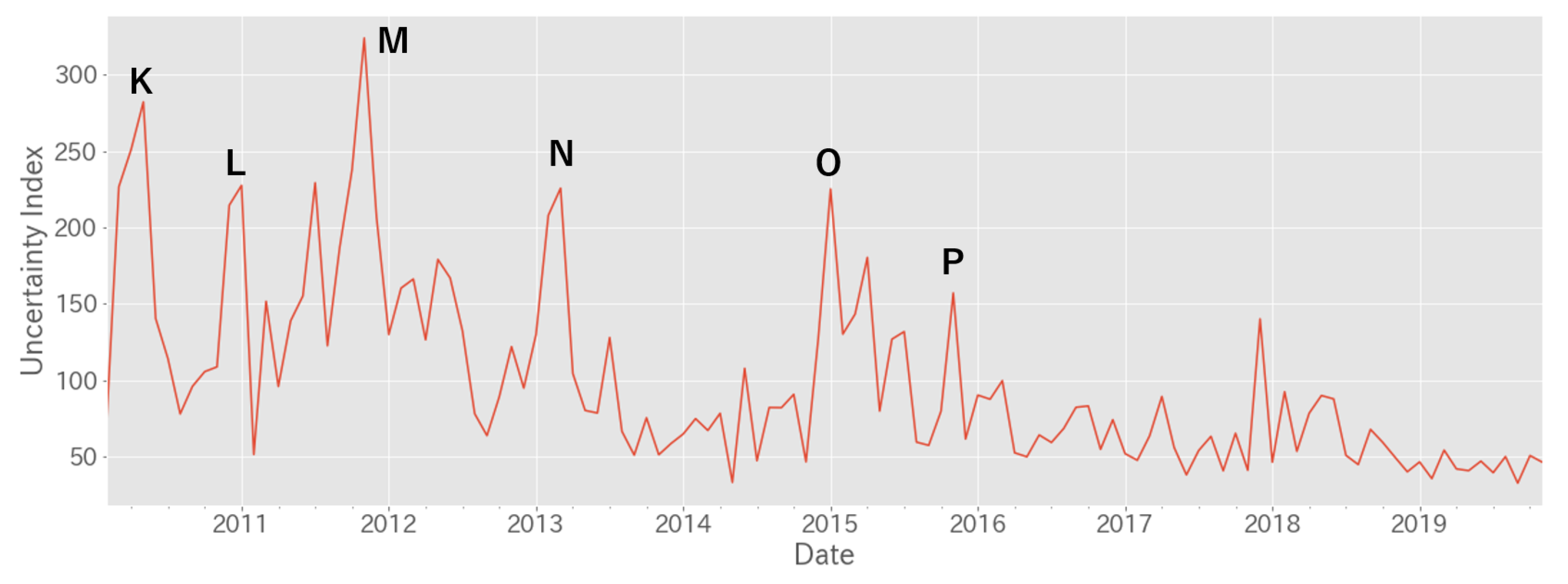

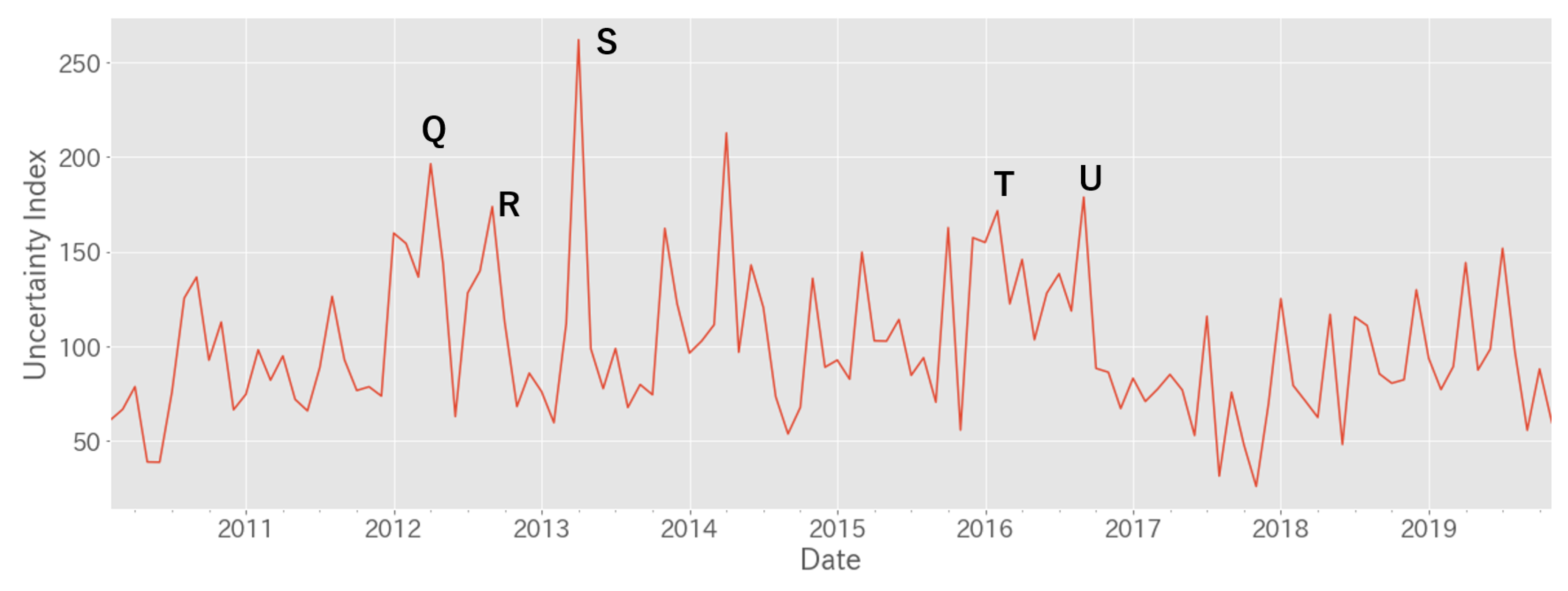

6.2. Uncertainty Indices with Macroeconomic Event

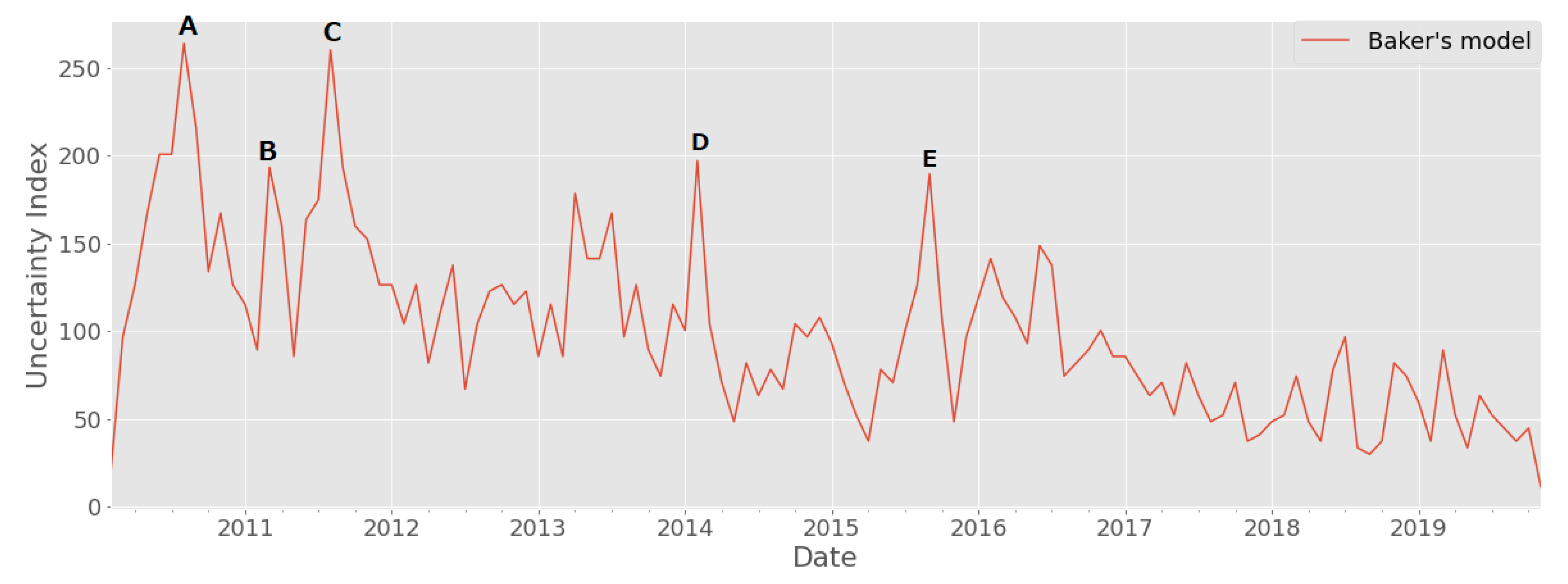

6.3. Comparison with Baker’s Model

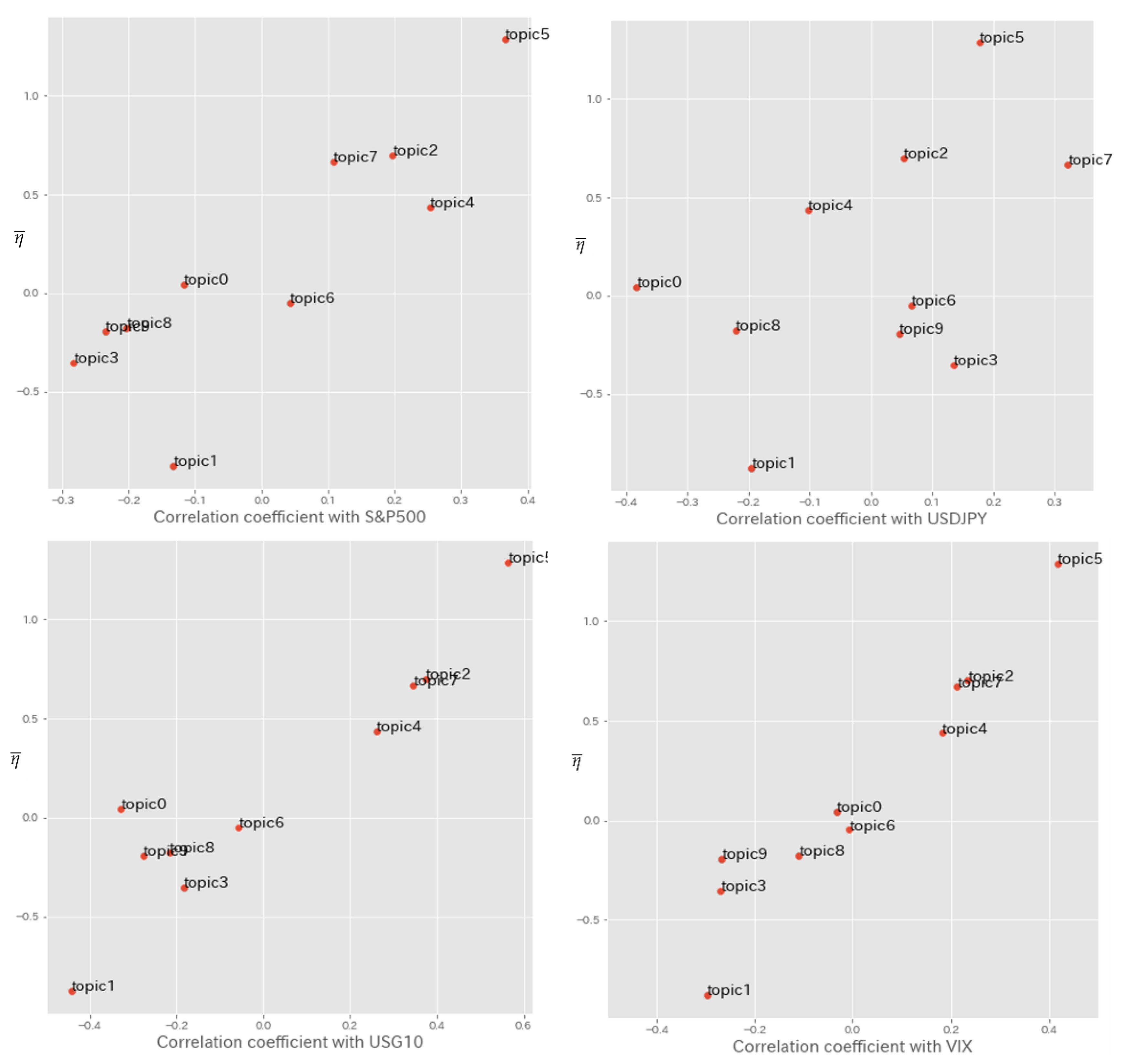

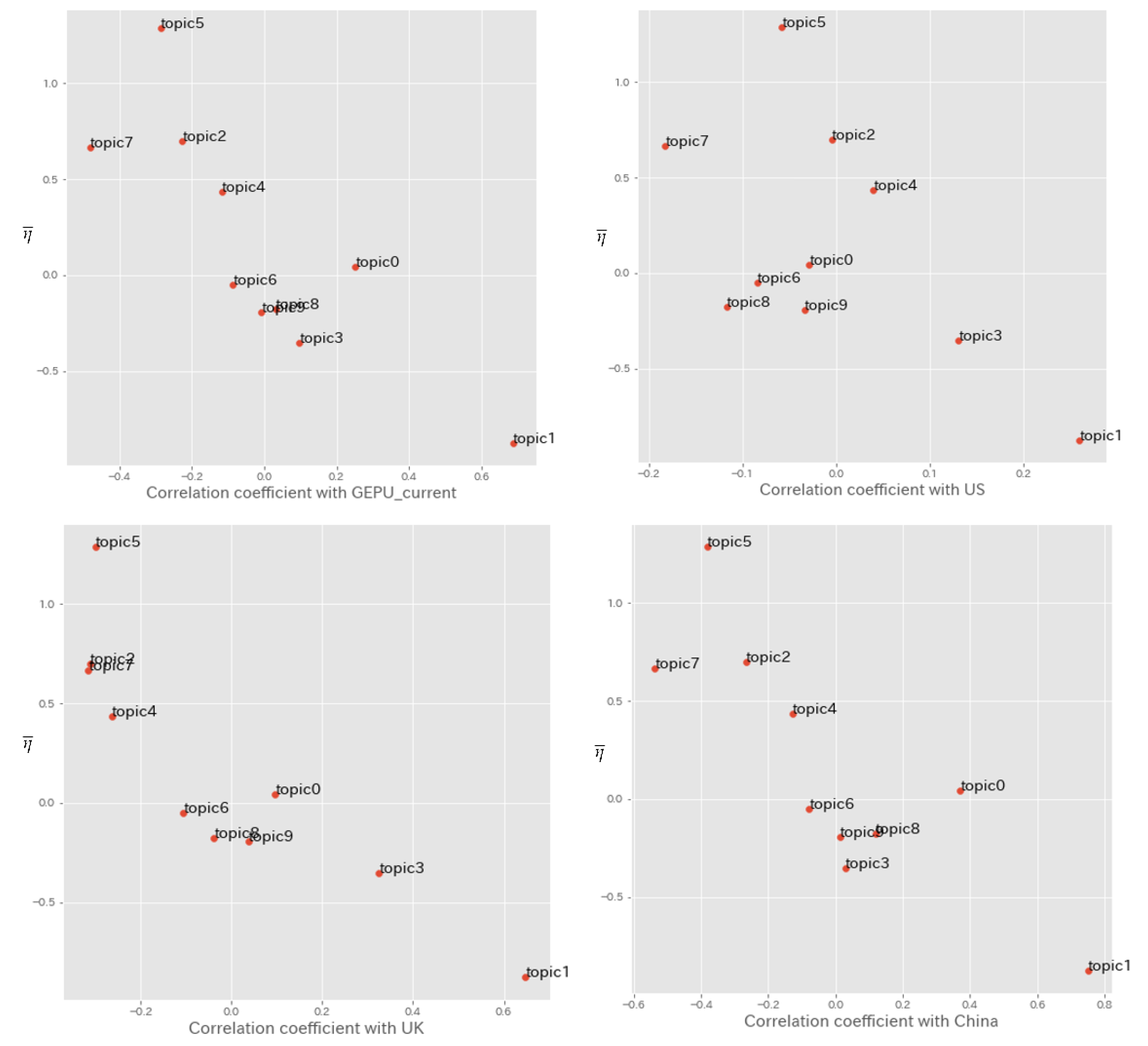

6.4. Correlation with Other Indices

- by applying sLDA model which uses normalized VIX index as a supervised signal, the model can extract topics highly linked to market volatility (topics 2, 5 and 7).

- extracted topics that are not closely related to the market volatility are highly correlated with the existing uncertainty index (TOPIC 1, TOPIC 3). The market impact of these topics is limited because the market is already been factored into the market.

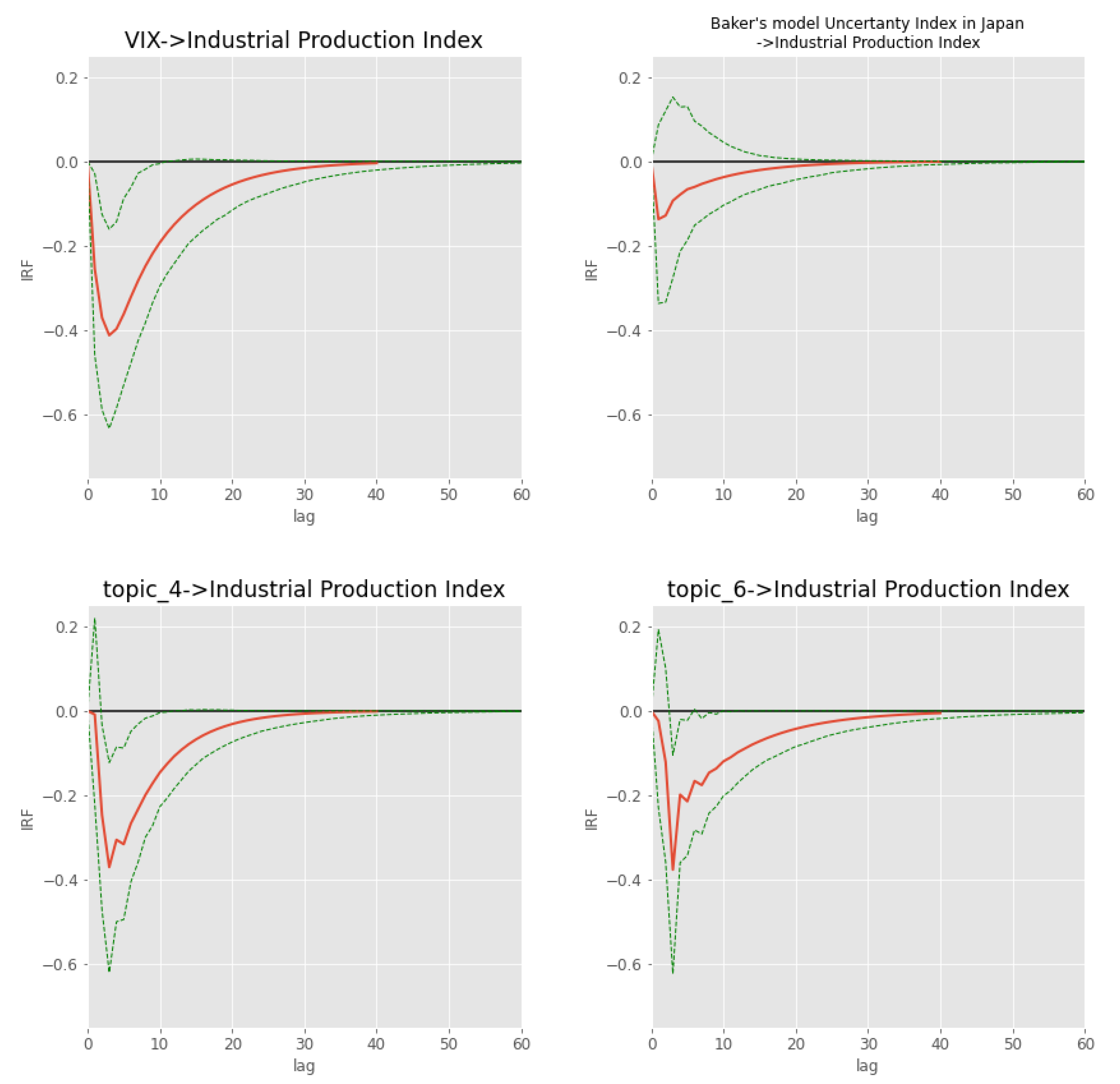

6.5. Impulse Response Analysis

- bivariate VAR with one variable being VIX index and the other variable being Japanese Industrial Production

- bivariate VAR with one variable being Japanese uncertainty index based on Baker’s model which we build in Section 6.3 and the other variable being Japanese Industrial Production

- bivariate VAR with one variable being the topic-specific indices by our we proposed model and the other variable being Japanese Industrial Production

7. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Arbatli, Elif C. 2017. Policy Uncertainty in Japan. Working Paper 23411. Cambridge, MA, USA: National Bureau of Economic Research. [Google Scholar]

- Azqueta-Gavaldon, Andres. 2017. Financial investment and economic policy uncertainty in the uk. In Proceedings of the 1st International Conference on Internet of Things and Machine Learning, IML ’17. New York: Association for Computing Machinery. [Google Scholar] [CrossRef]

- Azqueta-Gavaldón, Andrés. 2017. Developing news-based economic policy uncertainty index with unsupervised machine learning. Economics Letters 158: 47–50. [Google Scholar] [CrossRef]

- Bachmann, Rüdiger, Steffen Elstner, and Eric R. Sims. 2013. Uncertainty and economic activity. American Economic Journal 5: 217–49. [Google Scholar]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, and Kyle J. Kost. 2019. Policy News and Stock Market Volatility. Working Paper 25720. Cambridge, MA, USA: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Blei, David M., Andrew Y. Ng, and Michael I. Jordan. 2003. Latent dirichlet allocation. Journal of Machine Learning Research 3: 993–1022. [Google Scholar]

- Bloom, Nicholas. 2014. Fluctuations in uncertainty. Journal of Economic Perspectives 28: 153–76. [Google Scholar] [CrossRef]

- Brogaard, Jonathan, and Andrew Detzel. 2015. The asset-pricing implications of government economic policy uncertainty. Management Science 61: 3–18. [Google Scholar] [CrossRef]

- Castelnuovo, Efrem, and Trung Duc Tran. 2017. Google it up! a google trends-based uncertainty index for the united states and australia. Economics Letters 161: 149–53. [Google Scholar] [CrossRef]

- Chuliá, Helena, Montserrat Guillén, and Jorge M. Uribe. 2017. Measuring uncertainty in the stock market. International Review of Economics and Finance 48: 18–33. [Google Scholar] [CrossRef]

- Fernández-Villaverde, Jesús, Pablo Guerrón-Quintana, Keith Kuester, and Juan Rubio-Ramírez. 2015. Fiscal volatility shocks and economic activity. American Economic Review 105: 3352–84. [Google Scholar] [CrossRef]

- Gulen, Huseyin, and Mihai Ion. 2016. Policy uncertainty and corporate investment. Review of Financial Studies 29: 523–64. [Google Scholar] [CrossRef]

- Hamid, Alain. 2015. Forecasting volatility with empirical similarity and google trends. Journal of Economic Behavior & Organization 117: 62–81. [Google Scholar]

- Hisano, Ryohei, Didier Sornette, Takayuki Mizuno, Takaaki Ohnishi, and Tsutomu Watanabe. 2013. High Quality Topic Extraction from Business News Explains Abnormal Financial Market Volatility. PLoS ONE 8: e64846. [Google Scholar] [CrossRef] [PubMed]

- Husted, Lucas, John Rogers, and Bo Sun. 2019. Monetary policy uncertainty. Journal of Monetary Economics. [Google Scholar] [CrossRef]

- Jin, Xuejun, Ziqing Chen, and Xiaolan Yang. 2019. Economic policy uncertainty and stock price crash risk. Accounting and Finance 58: 1291–318. [Google Scholar] [CrossRef]

- Kanungsukkasem, Nont, and Teerapong Leelanupab. 2019. Financial Latent Dirichlet Allocation (FinLDA): Feature Extraction in Text and Data Mining for Financial Time Series Prediction. IEEE Access 7: 71645–64. [Google Scholar] [CrossRef]

- Larsen, Vegard H., and Leif A. Thorsrud. 2019. The value of news for economic developments. Journal of Econometrics 210: 203–18. [Google Scholar] [CrossRef]

- Manela, Asaf, and Alan Moreira. 2017. News implied volatility and disaster concerns. Journal of Financial Economics 123: 137–62. [Google Scholar] [CrossRef]

- Mcauliffe, Jon D., and David M. Blei. 2008. Supervised topic models. In Advances in Neural Information Processing Systems. Red Hook: Curran Associates Inc., pp. 121–28. [Google Scholar]

- Mueller, Hannes, and Christopher Rauh. 2018. Reading between the lines: Prediction of political violence using newspaper text. American Political Science Review 112: 358–75. [Google Scholar] [CrossRef]

- Pástor, Ľuboš, and Pietro Veronesi. 2013. Political uncertainty and risk premia. Journal of Financial Economics 110: 520–45. [Google Scholar] [CrossRef]

- Rauh, Christopher. 2019. Measuring Uncertainty at the Regional Level Using Newspaper Text. Montreal: Université de Montréal. [Google Scholar]

- Saltzman, Bennett, and Julieta Yung. 2018. A machine learning approach to identifying different types of uncertainty. Economics Letters 171: 58–62. [Google Scholar] [CrossRef]

- Shirota, Yukari, Takako Hashimoto, and Tamaki Sakura. 2014. Extraction of the financial policy topics by latent dirichlet allocation. Paper presented at IEEE Region 10 Annual International Conference, Proceedings/TENCON, Bangkok, Thailand, October 22–25. [Google Scholar]

- Thorsrud, Leif Anders. 2018. Words are the New Numbers: A Newsy Coincident Index of the Business Cycle. Journal of Business and Economic Statistics 38: 393–409. [Google Scholar] [CrossRef]

| Uncertainty Terms |

|---|

| “Uncertainty” or “Uncertain” |

| “Indetermination” or “Indeterminate” |

| Notation | Definition |

|---|---|

| Hyperparameters | |

| The distribution over words | |

| K | The number of topics |

| The document specific topic distribution | |

| Z | A topic |

| w | A word in the document |

| N | The number of words |

| M | The number of documents |

| Y | Response variable |

| Hyperparameters for the response variable |

| TOPIC 0 | TOPIC 1 | TOPIC 2 | TOPIC 3 | TOPIC 4 |

|---|---|---|---|---|

| Central bank | EU | Action | policy | risk |

| Inflation | Brexit | Thomson | Trump | China |

| President | UK | we | finance | World economy |

| Anticipation | European Union | Norm | government | Point out |

| interest rate | Trade | Principle of trust | administration | Europe |

| Point out | USA | Influence | reform | growth |

| growth | risk | recovery | Parliament | Emerging countries |

| policy | Influence | production | Prime Minister | Influence |

| Inflation | Point out | Economy | Politics | Deceleration |

| Financial policy | investment | Supply | Tax increase | USA |

| TOPIC 5 | TOPIC 6 | TOPIC 7 | TOPIC 8 | TOPIC 9 |

| Greece | BOJ | Dollar | Company | FRB |

| Europe | prices | market | GDP | Rate hike |

| Bank | Relaxation | Euro | economist | FOMC |

| Euro zone | add to | Rise | quarter | Chairman |

| market | Committee | Decline | investment | Shrink |

| support | President | Market price | Anticipation | President |

| Euro | Influence | USA | export | Federal Reserve Board |

| debt | policy | Stock price | Point out | Relaxation |

| Finance | monetary easing | Strategist | Elongation | policy |

| Point out | necessary | Investor | View | market |

| A | B | C | D | E |

|---|---|---|---|---|

| Future View | Market | Market | Economy | Rate hike |

| Yen Appreciation | Japan | Europe | Emerging countries | Financial market |

| Business condition | Influences | Financial | Market | Stock Price |

| Dollar | Bank of Japan | Yen Appreciation | View | Slow down |

| Market | Rising | Future | Pointing out | Market |

| Economy | Possibility | Business | USA | World economy |

| Downside | Crude oil price | Economy | Business | Future |

| Enterprise | President | World economy | Movement | China economy |

| Countermeasure | FRB | Financial | Mitigation | China |

| Europe | Middle East | USA | Japanese economy | Economy |

| Keywords Related to the Country | Keywords Related to Other Countries | Keywords Related to Financial Market | |

|---|---|---|---|

| our model | 75.56% | 12.22% | 12.22% |

| baker model | 14.22% | 40.85% | 44.93% |

| TOPIC | Pearson Correlation Coefficient | ||||

|---|---|---|---|---|---|

| k | USG10 | S&P500 | USD/JPY | VIX | |

| 0 | 0.044 | −0.328 | −0.118 | −0.383 | −0.033 |

| 1 | −0.876 | −0.442 | −0.133 | −0.195 | −0.297 |

| 2 | 0.700 | 0.374 | 0.197 | 0.053 | 0.235 |

| 3 | −0.354 | −0.183 | −0.283 | 0.134 | −0.269 |

| 4 | 0.436 | 0.261 | 0.253 | −0.102 | 0.183 |

| 5 | 1.286 | 0.565 | 0.366 | 0.177 | 0.417 |

| 6 | −0.048 | −0.056 | 0.043 | 0.065 | −0.007 |

| 7 | 0.667 | 0.346 | 0.108 | 0.322 | 0.213 |

| 8 | −0.177 | −0.216 | −0.203 | −0.221 | −0.110 |

| 9 | −0.194 | −0.277 | −0.235 | 0.046 | −0.267 |

| TOPIC | Pearson Correlation Coefficient | ||||

|---|---|---|---|---|---|

| k | Global | China | UK | US | |

| 0 | 0.044 | 0.251 | 0.372 | 0.096 | −0.028 |

| 1 | −0.876 | 0.687 | 0.752 | 0.648 | 0.260 |

| 2 | 0.700 | −0.226 | −0.266 | −0.312 | −0.005 |

| 3 | −0.354 | 0.098 | 0.029 | 0.325 | 0.131 |

| 4 | 0.436 | −0.117 | −0.127 | −0.263 | 0.040 |

| 5 | 1.286 | −0.285 | −0.381 | −0.300 | −0.058 |

| 6 | −0.048 | −0.086 | −0.078 | −0.105 | −0.084 |

| 7 | 0.667 | −0.481 | −0.537 | −0.315 | −0.182 |

| 8 | −0.177 | 0.032 | 0.120 | −0.038 | −0.117 |

| 9 | −0.194 | −0.007 | 0.014 | 0.038 | −0.034 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yono, K.; Sakaji, H.; Matsushima, H.; Shimada, T.; Izumi, K. Construction of Macroeconomic Uncertainty Indices for Financial Market Analysis Using a Supervised Topic Model. J. Risk Financial Manag. 2020, 13, 79. https://doi.org/10.3390/jrfm13040079

Yono K, Sakaji H, Matsushima H, Shimada T, Izumi K. Construction of Macroeconomic Uncertainty Indices for Financial Market Analysis Using a Supervised Topic Model. Journal of Risk and Financial Management. 2020; 13(4):79. https://doi.org/10.3390/jrfm13040079

Chicago/Turabian StyleYono, Kyoto, Hiroki Sakaji, Hiroyasu Matsushima, Takashi Shimada, and Kiyoshi Izumi. 2020. "Construction of Macroeconomic Uncertainty Indices for Financial Market Analysis Using a Supervised Topic Model" Journal of Risk and Financial Management 13, no. 4: 79. https://doi.org/10.3390/jrfm13040079

APA StyleYono, K., Sakaji, H., Matsushima, H., Shimada, T., & Izumi, K. (2020). Construction of Macroeconomic Uncertainty Indices for Financial Market Analysis Using a Supervised Topic Model. Journal of Risk and Financial Management, 13(4), 79. https://doi.org/10.3390/jrfm13040079