1. Introduction

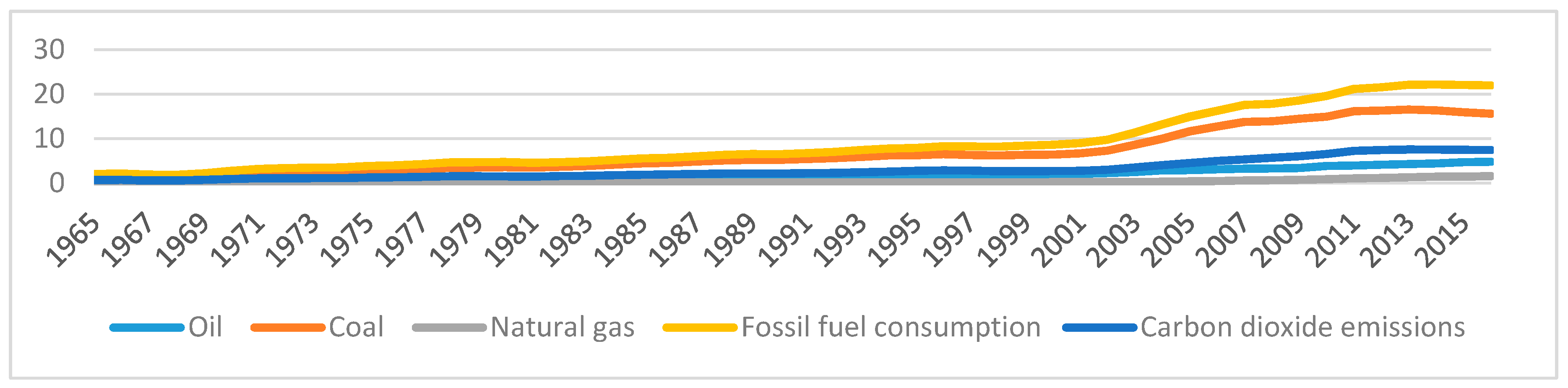

Fossil fuel consumption is an important topic because it is a symbol of modern civilization. Nonetheless, fossil fuel consumption could increase pollution and make a significant impact on the global natural ecosystem. On the other hand, overuse of fossil energy could make the problems of both energy shortage and climate change becomes more serious, threatening the sustainability of the Earth, and the development of humankind. Thus, to reduce fossil fuel consumption, control carbon dioxide emissions, and retain economic growth is a common task for countries worldwide.

In addition, academics have demonstrated the relationships between environmental pollutants and economic growth nexus. For example, Kuznets [

1] has postulated that environmental degradation increases with per capita income at the beginning of economic growth, and decrease thereafter, which is known as the environmental Kuznets Curve (EKC). The emissions of

have been used as a proxy for environmental pollution because

emissions have been increasing sharply every year, thereby resulting in greenhouse gas effects and global warming, which affects the environment (see, for example, References [

2,

3,

4,

5]). Thus, it is interesting to study the relationships among fossil fuel consumption, environmental pollutants, and economic growth.

Many developed countries have been taking a lead on mitigating carbon emissions, providing financial resources, and transferring technology to developing countries to address

emissions and climate change in recent decades. Tol [

6,

7] study the marginal cost and damage costs of

emissions. To date, China has been cooperating with other countries and making an effort to control

emissions and contribute to mitigating climate change.

In 2007, China introduced the National Climate Change Program, the first national policy to address climate change, and the first national program for developing countries in this field, to integrate climate change policies into the national development strategy. In 2009, the China State Council set the target of reducing 40–45% of its carbon intensity (unit GDP

emissions) before 2020 [

8]. In the “Thirteenth Five-Year Plan”, the Chinese Government introduced a range of targets and policies related to reducing both

emissions and fossil fuel consumption, including reducing its carbon intensity by 18%, reducing energy intensity by 15%, increasing non-fossil energy accounts by 15%, and reducing a coal consumption cap target of 4.2 billion tons by 2020 (National Program on Climate Change, 2014–2020 [

9].

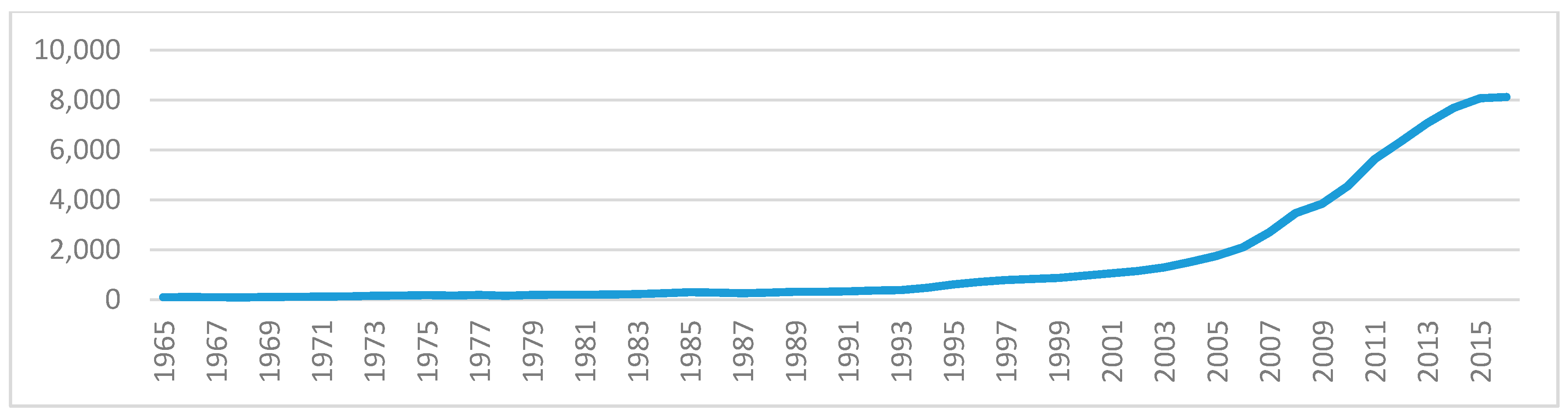

Meanwhile, the Chinese Government confirmed that it will reach the peak of emissions by 2030 and undertake best efforts to reduce it. However, as a country with development via the path of “high energy consumption, high greenhouse gas emissions”, and once the highest total emissions in the world, China is now facing a huge challenge to reduce its fossil fuel consumption and emissions. In addition, as the per capita GDP in China is still quite low, the Chinese Government will continue to emphasize economic development as a top priority task for a long time. Thus, to realize the targets of energy conservation and emission reduction, while ensuring its economic development, it is important for the Chinese Government to examine the relationships among fossil fuel consumption, environmental pollutants, and economic growth, and look for new and alternative development paths.

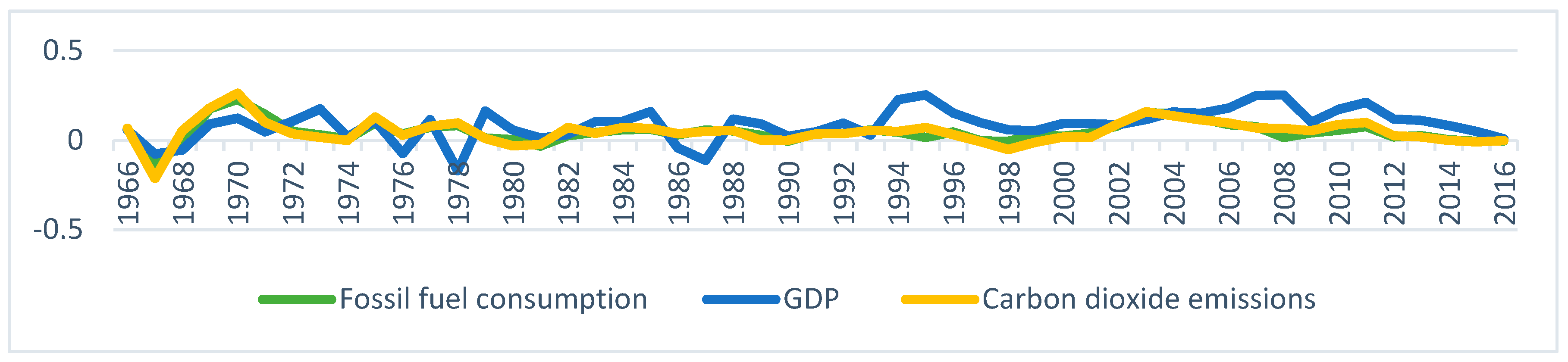

There are many papers using different methodologies to study the relationships among fossil fuel consumption, emissions, and economic growth. To the best of our knowledge, the literature has applied the following methods, including the Toda and Yamamoto procedure, bivariate linear causality, multivariate linear causality, and vector error correction model (VECM) to study the relationships among fossil fuel consumption, emissions, and economic growth.

However, there are some limitations to the approaches that have been used in the literature. First, the tests may not be able to detect any nonlinear causal relationship among the variables. Second, the tests may not be able to measure the independent, dependent, and joint effects together, so that testing a series of single hypotheses is different from testing all hypotheses jointly. Even though some research in the literature has studied the joint effects among the variables and/or the error-correction terms by constructing the F-statistic, if the variables do not have any cointegration relationship, determining the joint effects can become problematic.

Nonethelss, there is evidence supporting the existence of nonlinear behaviour among fossil fuel consumption,

emissions, and economic growth. For example, according to the changes in economic environment, changes in energy policies, and fluctuations in energy prices, Lee and Chang [

10], show that economic events and regime changes can lead to structural changes in energy consumption patterns for a given time period, which creates a nonlinear rather than linear relationship between energy consumption and economic growth.

In order to circumvent these limitations, we use the Granger test proposed by Hiemstra and Jones [

11], Bai et al. [

12,

13,

14], and others to examine multivariate linear and nonlinear Granger causal relationships among fossil fuel consumption,

emissions, and economic growth for China. This approach not only enables obtaining linear and nonlinear, but also examines the independent, dependent, and joint effects among fossil fuel consumption,

emissions, and economic growth for China. These multivariate linear and nonlinear Granger causality findings are not only more interesting and thought-provoking than in the existing literature, but are also useful to government and independent policy makers in their decision making related to fossil fuel consumption,

emissions, and economic growth.

In order to draw a better picture regarding the issue, together with using linear and nonlinear Granger causality analysis, we conduct the cointegration analysis by applying both the Johansen cointegration and ARDL bounds tests to examine the cointegration relationships among fossil fuel consumption,

emissions, and economic growth for China. In addition, we strongly recommend that academics and practitioners use the multivariate nonlinear causality tests proposed by Bai et al. [

12,

13,

14], as these methods can examine the multivariate nonlinear causality tests regardless of whether the cointegration relationship exists or not, while the other literature checks the multivariate causality depending on the existence of cointegration.

This paper provides many novel findings and inferences for China. For example, as shown in

Table A1, only considering these three variables, we can conclude that if the government expands fossil fuel consumption, it will have two impacts on economic: first, it will expand GDP with immediate effect and, second, the increase in the rate of fossil fuel consumption will expand China’s economy to grow both linearly and nonlinearly in the future. The inference is useful for government and independent policy makers in their consideration of which policy they should choose to reduce fossil fuel consumption or carry out any policy regarding energy conservation so that its economy will be damaged as little as possible.

We also conclude that if the government carries out policies of energy conservation and emission reduction, it will significantly slow down economic growth with immediate effect, cause it to fall nonlinearly and not linearly in the future. We note that the current research is the first paper to draw such a significant conclusion. In addition, these conclusions show the advantages of combining cointegration and linear and nonlinear causality at the multivariate level. Thus, we recommend that academics, practitioners, and policy makers use both cointegration and causality analysis in multivariate settings in their analysis. The novel findings in the paper are useful for policy makers in relation to fossil fuel consumption, emissions, and economic growth. Using the novel findings, governments can reach better decisions regarding energy conservation and emissions reduction without undermining the pace of economic growth in the long run.

The remainder of the paper is organized as follows.

Section 2 provides a review of the related extant literature.

Section 3 presents the theoretical foundation.

Section 4 describes the data and empirical methodology.

Section 5 discusses the empirical results. Finally,

Section 6 draws inference from the novel empirical findings, and proposes some policy implications.

Section 7 concludes the paper.

2. Literature Review

In this section, we review research directions, methodologies, and findings in the literature on the relationships among energy consumption, emissions, and economic growth. The first strands in the literature focus on investigating the relationships between emissions and economic growth.

The relationship between

emissions and economic growth is one of the most important research areas that have become the focus of numerous theoretical developments and many empirical applications. For example, Apergis and Payne [

15], Soytas and Sari [

16], Zhang and Cheng [

17], and Menyah and Wolde-Rufael [

18] examine the relationships between economic growth and

emissions. They examine the relationships between environmental pollutants and economic growth nexus as the environmental Kuznets Curve (EKC). Selden and Song [

19], Grossman and Krueger [

20], List and Gallet [

21], Stern and Common [

22] and Song et al. [

23] point out that the Kuznets Curve fits empirical cases well in many developed countries. However, Harbaugh et al. [

24] and List et al. [

25] show that the relationships between economic growth and environmental pollutants may be not robust for several emission pollutants.

In addition, different methods of analysis have been used to investigate the relationship between

emissions and economic growth in different countries and regions. For example, Holtz-Eakin and Selden [

26] and Heil and Selden [

27] obtain a U-shaped EKC for

per capita emissions by using parametric models with pooled data. Bertinelli and Strobl [

28], Azomahou et al. [

29], Bertinelli et al. [

30], and Saboori et al. [

31] investigate the relationships between

emissions and economic growth by using nonparametric estimation techniques. Recently, Yeh and Liao [

32] use an analytical tool of stochastic impacts on population, affluence, and technology to investigate the relationships between

emissions and economic growth in Taiwan. Sadorsky [

33], Heidari et al. [

34], and Saidi and Hammami [

35] apply the panel regression techniques to investigate the relationships between

emissions and economic growth in other countries.

Many recent papers investigate the causality between

emissions and economic growth, and obtain mixed results. For example, Salahuddin [

36] finds no significant causality between

emissions and economic growth in Gulf Cooperation Council countries. Alshehry and Belloumi [

37] show bidirectional causality between

emissions and economic growth in Saudi Arabia. Using the Granger-VECM approach, Ahmad et al. [

38] show bidirectional causality between

emissions and economic growth in the short run, and unidirectional causality from economic growth to

emissions in the long run in Croatia. Cowan et al. [

39], Wang et al. [

40], Kasman and Duman [

41], Bento and Moutinho [

42], and Antonakakis et al. [

43] include other variables in the analysis to investigate the causality between

emissions and economic growth.

The relationship between energy consumption and economic growth is also one of the most important research areas in climatology, environmental science, and other areas after Kraft and Kraft [

44] and others established the relationship between energy consumption and economic growth. For example, Tugcu et al. [

45] show the renewable and non-renewable energy consumption and economic growth relationships for G7 countries. Bhattacharya et al. [

46] investigate the effect of renewable energy consumption on economic growth for the top 38 countries. Empirical evidence shows that the relationships could be uni-directional, bi-directional causality, or no causality at all. For example, Stern [

47,

48], Masih and Masih [

49], Soytas and Sari [

50], Wolde-Rufael [

51,

52], Lee [

53], Tsani [

54], and Alam et al. [

55] show that energy consumption causes economic growth. On the other hand, Mozumder and Marathe [

56], Erdal et al. [

57], and Payne [

58] conclude that there exists bi-directional causal relationship between energy consumption and economic growth. Nonetheless, Altinay and Karagol [

59], Jobert and Karanfil [

60], Chiou-Wei et al. [

61], Chontanawat et al. [

62], and Halicioglu [

63] conclude that there is no causality between energy consumption and economic growth for some countries.

In addition, global warming and the energy crunch have become very important topics in recent decades. This extends the relationship between energy consumption and

emissions that has become a topical subject for academics and practitioners. Many studies have investigated the relationships and obtained mixed results. For example, Soytas et al. [

64], Soytas and Sari [

16], Lean and Smyth [

65], and Alshehry and Belloumi [

37] find the uni-directional causal relationships from

emissions to energy consumption. Using simultaneous-equations models with panel data of 14 MENA (Middle East and North Africa) countries, Omri [

66] documents uni-directional causality from energy consumption to

emissions without any feedback effects. However, Halicioglu [

63] finds bi-directional causality between

emissions and energy consumption in Turkey, while Zhang and Cheng [

17] find uni-directional causal relationships from energy consumption to

emissions in China. Using the panel smooth transition regression (PSTR) model, Heidari et al. [

34] show that energy consumption increases

emissions when GDP capita exceeds 4686 USD or falls below 4686 USD in five ASEAN (Association of Southeast Asian Nations) countries. Other studies for the causal relationships include Ang [

67], Apergis and Payne [

15], Menyah and Wolde-Rutael [

18], Alam et al. [

55], and Pao and Tsai [

68].

In the energy literature discussed above, cointegration and causality tests have been widely adopted to examine the underlying relationships among fossil fuel consumption,

emissions, and economic growth. There are two principal cointegration tests: the Johansen cointegration test and the autoregressive distribution lag (ARDL) bounds test proposed by Pesaran et al. [

69]. Fatai et al. [

70], Narayan and Smyth [

71], Wolde-Rufael [

72], Narayan and Singh [

73], Odhiambo [

74], Acaravci and Ozturk [

75] and Begum et al. [

76] apply the ARDL bounds test, while Halicioglu [

63], Odhiambo [

77], and Chang [

78] prefer to use Johansen’s maximum likelihood test in their analyses. Ang [

3], Chandran et al. [

79], and Lean and Smyth [

65] use both approaches in their analyses. There are advantages and disadvantages for each method. For example, Gonzalo [

80] uses the Monte Carlo approach to investigate the Johansen test, and concludes that the Johansen test performs better with the full information maximum likelihood procedure, and the test is appropriate when the identification of the exogenous variable is not possible a priori.

However, Odhiambo [

77] finds that the Johansen test is sensitive to different sample sizes and different lag lengths. On the other hand, Narayan and Narayan [

81,

82] and Narayan and Smyth [

83,

84] demonstrate the advantages of using the ARDL test for small sample sizes and different lag lengths in that it does not demand all variables to be integrated of the same order. In addition, Harris and Sollis [

85] point out that the approach always provides, not only unbiased estimates of the long-run model, but also valid t-statistics even when some of the regressors are endogenous. There are two widely-used causality tests, namely the Toda–Yamamoto procedure (TY procedure) and the error-correction modelling (ECM) procedure. The ECM procedure investigates causality from the short-run and long-run perspectives. Belloumi [

86], Odhiambo [

77], Chang [

78], and Alam et al. [

5] apply the ECM procedure, while Zhang and Chang [

17], Tsani [

54] and Rahman [

87] use the TY procedure to examine the causality among economic growth, environmental pollutants, and energy consumption.

Similar to different cointegration tests, there are advantages and disadvantages between the TY method and ECM procedure. Toda [

88] argues that the causality test employing Johansen-type ECM may suffer from severe pre-test biases as the pre-tests for cointegration ranks of this model are very sensitive to the values of the nuisance parameters in the finite sample. Toda and Yamamoto [

89] propose a VAR (Vector autoregression) approach applied to any arbitrary level of integration. Zapata and Rambaldi [

90] point out that the TY procedure has high power of the test in moderate to large samples. However, Yamada and Toda [

91] show the FM-VAR test proposed by Phillips [

92] and the ECM procedures are more powerful than the TY procedure.

However, in all related studies for China, as shown in

Table A1 and

Table A2 in the appendices, there are only a few papers that have investigated the relationships for China. In addition, there are some limitations on the approaches, including the TY and ECM procedures that examine the causality relationship in the literature. First, the tests may not be able to detect any nonlinear causal relationship among the variables. Second, the tests may not be able to measure the independent, dependent, and joint effects together. Testing a series of single hypotheses is different from testing all hypotheses jointly. Even though a few studies in the literature have considered the joint effects among the variables and/or the error-correction terms by constructing the F-statistic, if the variables do not have any cointegration relationship, determining the joint effects could become problematic.

Nonetheless, many studies, for example, Lee and Chang [

10], support the existence of nonlinear behaviour among fossil fuel consumption,

emissions, and economic growth, because economic events and regime changes can lead to structural changes in energy consumption patterns for a given time period. Consequently, this could create a nonlinear rather than linear relationship between energy consumption and economic growth. In order to circumvent these limitations, we use the Granger test proposed by Hiemstra and Jones [

11], and Bai et al. [

12,

13,

14] to examine multivariate linear and nonlinear Granger causal relationships among fossil fuel consumption,

emissions, and economic growth for China. This approach not only enables linear and nonlinear relationships among the variables, but also examines the independent, dependent, and joint causalty effects among fossil fuel consumption,

emissions, and economic growth for China.

In order to draw a more accurate analysis of the issue, together with linear and nonlinear Granger causality, we conduct cointegration analysis by applying both the Johansen cointegration and ARDL bounds tests to examine the cointegration relationships among fossil fuel consumption, emissions, and economic growth for China. The empirical findings are not only more interesting and thought-provoking than those obtained in the existing literature, but also more useful for government and independent private policy makers in their decision making related to fossil fuel consumption, emissions, and economic growth.

In addition, we strongly recommend academics and practitioners to use the multivariate nonlinear causality tests proposed by Bai et al. [

12,

13,

14] because the methods allow scholars to examine the multivariate nonlinear causality tests regardless of the existence of cointegration relationships, while the other studies in the literature check the multivariate causality depending on the existence of cointegration relationships.

7. Conclusions

Energy crunch and global warming have become very serious issues in recent decades. In order to circumvent the problem, some countries have developed new technology in order to reduce both emissions and energy consumption, while not restricting economic growth. Thus, controlling emissions, reducing fossil fuel consumption, and encouraging economic growth is an important task for all countries worldwide, including China.

In order to work in this direction, many studies in the literature of energy have used either a cointegration test or causality test to investigate the relationships among fossil fuel consumption, emissions, and economic growth in China. To the best of our knowledge, the literature has applied methods, such as the Toda and Yamamoto procedure, bivariate linear causality, multivariate linear causality, and VECM test to examine the causal relationships among fossil fuel consumption, emissions, and economic growth.

However, there are some limitations to these testing approaches. First, the tests may not be able to detect any multivariate nonlinear causal relationship among the variables. Second, the tests do not measure the independent, dependent and joint effects together, so that testing series of single hypothesis is different from testing all the hypotheses jointly. Even though some research in the literature has examined the joint effect and/or the error-correction term of the variables by constructing appropriate F-statistics, if the variables do not have cointegration relationships, the joint effects and long-term causality cannot be determined.

In order to circumvent the limitations of the approaches that have been used in the literature, this paper recommends applying multivariate nonlinear causality tests, together with cointegration and bivariate linear and nonlinear causality tests, to capture more inclusive information. The empirical findings are more interesting and thought-provoking than those in the extant literature.

In this paper, we have obtained many novel findings that are useful to government and public policy makers in their decision making related to fossil fuel consumption,

emissions, and economic growth. For example, we find that there exists causality from the rate of

emissions to economic growth for China. This finding is consistent with Halicioglu [

63] for Turkey and Ghosh [

116] for India.

A second new finding is that there exist not only linear joint causality from the rates of both fossil fuel consumption and emissions to economic growth and from both the rate of emissions and economic growth to the rate of fossil fuel consumption, but also nonlinear joint causality from both fossil fuel consumption and emissions to economic growth, and from both the rate of emissions and economic growth to the rate of fossil fuel consumption. These empirical findings lead to the conclusion that there exist joint causality from the rates of both fossil fuel consumption and emissions to economic growth, and from the rate of emissions and economic growth to the rate of fossil fuel consumption, more pervasive.

A third novel empirical finding is that there exists joint causality from the rates of both fossil fuel consumption and

emissions to economic growth, and from both the rate of

emissions and economic growth to the rate of fossil fuel consumption. However, there is no linear joint causality from both the rate of

emissions and fossil fuel consumption to economic growth. The findings are consistent with those in Wang et al. [

117].

A new fourth finding is that there exists nonlinear causality from the rate of

emissions and fossil fuel consumption to economic growth, though there is no linear causality from the rate of

emissions and fossil fuel consumption to economic growth. Chiou-Wei et al. [

61] provide evidence from linear and nonlinear bivariate Granger causality testing about energy consumption and economic growth, but they did not include

emissions in their analysis.

In addition, the cointegration analysis provides solid support in favour of the development path of “high fossil fuel consumption, high emissions, and high economic growth” over the past decade in China, by showing the long-run co-movement between fossil fuel consumption and GDP, and long-run term co-movement between fossil fuel consumption and emissions. The empirical findings in the paper provide public policymakers with a better understanding of the relationships among fossil fuel consumption, emissions, and economic growth, so that they could formulate improved energy and climate policies for China.

Discussion 1. If the government regulates any policy for energy conversation, will it significantly cause China’s economy to slow down with immediate or future effect?

According to the scope and analysis in the paper, applying both bivariate cointegration and causality analyses to examine the relationship between fossil fuel consumption and economic growth, we conclude that fossil fuel consumption and GDP move together positively, and the rate of fossil fuel consumption causes economic growth, both linearly and nonlinearly. This further implies that if the government expands fossil fuel consumption, it will have two impacts on economic growth: first, it will expand GDP with immediate effect, and second, an increase the rate of fossil fuel consumption will significantly lead China’s economy to grow both linearly and nonlinearly in the future.

On the other hand, if the government reduces fossil fuel consumption or carries out any policy of energy conversation, it will significantly cause China’s economy to slow down with immediate effect, and its rate will significantly lead China’s economy to fall further, both linearly and nonlinearly, in the future. The empirical findings also suggest that it is necessary to increase sustainable fossil fuel consumption to expand economic growth. The lack of smooth fossil fuel supply could become a serious constraint and undermine the pace of economic growth. This inference is useful for the government and public policy makers in their consideration of which policies they should choose to reduce fossil fuel consumption or regulate any policy of energy conversation so that economic growth will be retarded as little as possisble.

It might be argued that there are many other factors, such as rebound effect and energy, as inputs in order to power the economy. A strong trend in the reduction of energy consumption does not hamper economic development in China, with late-2015 to early-2019 providing a good empirical example. The findings only suggest that using our data and analysis support the conjecture and these conclusions. In recent years, China has experienced a transition period of economic development. It is obvious that China is developing a new economic path to replace the development path of “high fossil fuel consumption, high emission and high growth”. However, it could also be because, for example, our data set does not contain data with and without the development of new technology and advanced products, and/or our tools cannot analyze the effects of the development of new technology and advanced products.

Discussion 2. If one conducts cointegration analysis and concludes that there is no significant cointegration relationship among fossil fuel consumption, emissions, and economic growth, could this finding imply that it is possible to reduce both emissions and fossil fuel consumption without leading to restricting economic growth in China?

Our answer is that it cannot do so. It is essential to conduct causality analysis. If causality analysis concludes that reducing both fossil fuel consumption and

emissions simultaneously will not cause economic growth, then we cannot conclude that the government could reduce both

emissions and fossil fuel consumption without leading to retardation of economic growth in China. However, the results of the causality analysis reported in

Table 10 suggest that reducing the rates of both fossil fuel consumption and

emissions simultaneously will nonlinear but not linear cause economic growth.

Even if we were to apply cointegration analysis and conclude that there is a significant cointegration relationship among fossil fuel consumption, emissions, and economic growth, as shown above, it will still be necessary to conduct causality analysis because the inferences drawn from the cointegration analysis are different from those drawn from the causality analysis, as discussed above.

The use of both cointegration and causality analysis in both bivariate and multivariate settings could not conclude that it is possible to reduce both emissions and fossil fuel consumption, while simultaneously not economic growth in China. However, there could be other analyses that might be used to draw the conclusion that it is possible to reduce both emissions and fossil fuel consumption without retarding economic growth. This is beyond the scope of the present paper, and is left foir future research.

Discussion 3. Might it be possible to reduce both emissions and fossil fuel consumption without retarding economic growth?

By applying both multivariate cointegration and causality analysis to examine the relationships among fossil fuel consumption, emissions, and economic growth, we conclude that if the government reduces both fossil fuel consumption and emissions simultaneously, there are two impacts on economic growth: first, it will affect economic growth with immediate effect, and second, the rates of both fossil fuel consumption and emissions will cause economic growth to drop nonlinearly rather than linearly in the future. In other words, if the government regulates policies for both energy conservation and emissions reduction, it will significantly retard the economy with immediate effect and cause economic growth to fall nonlinearly and not linearly in the future.

The above discussion could draw several policy implications that are very important for public and private policy makers. For example, if the government reduces fossil fuel consumption or carries out any public policy relating to energy conservation, it will significantly cause China’s economy to slow down with immediate effect. In turn, the reduced rate of growth will significantly lead China’s economy to decline both linearly and nonlinearly in the future. This inference is useful for government and public policy makers in their decisions at to which policies they should choose: to reduce fossil fuel consumption, or carry out any policies to get energy conservation, so that the economy will have small negative repercussions as possible.

Therefore, when applying both multivariate cointegration and causality analysis to examine the relationships among fossil fuel consumption, emissions, and economic growth, we conclude that if the government reduces both fossil fuel consumption and emissions simultaneously, there are two impacts on economic growth: first, it will affect economic growth with immediate effect, and second, the rates of both fossil fuel consumption and emissions will cause economic growth to fall nonlinearly rather than linearly in the future. In other words, if the government carries out public policies regarding both energy conservation and emission reduction, it will significantly retard the economy with immediate effect, and cause economic growth to fall nonlinearly, though not linearly, in the future.

In addition, there have some arguments regarding the policies relating to both energy conservation and emission reduction. Some academics, practitioners, and public policy makers may suggest that consumers use energy more efficiently so that the government can reduce both emissions and fossil fuel consumption, without restricting economic growth in the long run. Some might also suggest that the Chinese Government should seek alternative clean energy sources, including solar, wind, hydro, wave, geothermal, bio-mass, bio-agricultural, aquacultural, and renewable energy that have fewer polluting effects, and do not harm the environment, while maintaining economic growth in the long run.

Others have suggested that the Chinese Government should develop new technologies and advanced products, and change from low technology production patterns to high technology production patterns. In so doing, China can reduce both emissions and fossil fuel consumption, and not restrict economic growth in the long run. However, the empirical findings in the paper do not support the conjecture that reducing both emissions and fossil fuel consumption does not lead to a reduction in economic growth. This does not imply that it is impossible to reduce both emissions and fossil fuel consumption and yet restrict any slowdown in economic growth.

On the contrary, the empirical findings suggest that, based on the data used in this paper, the empirical analysis does not support the conjecture. However, it could be because the data set either does not contain appropriate data that include the development of new technology and advanced products, or the present techniques that were used in this paper do not include the effects of the development of new technology and advanced products in the analysis, because such information is not contained in the dataset used for the empirical analysis.

In the paper, we investigated long-run equilibrium, short-run impacts, and causality relationships among fossil fuel consumption, emissions, and economic growth, by applying the cointegration test, and linear and nonlinear causality tests in the bivariate and multivariate settings.

Extensions of these empirical results would include other related variables. We note that sensitivity and uncertainty analyses examine how the uncertainty in the output of a mathematical model or system can be decomposed and allocated to different sources of uncertainty in its inputs [

118]. As we only have one input of data, we did not conduct sensitivity and uncertainty analyses in this paper. Further research might be able to access different sources of data so that one could include sensitivity and uncertainty analyses in the empirical analysis.

Further research could also include other tools, for example, portfolio optimization (see, for example, References [

119,

120,

121]), stochastic dominance (see, for example, References [

122,

123,

124,

125]), and risk measures (see, for example, References [

126,

127,

128,

129,

130,

131]) to analyze the relationships among fossil fuel consumption,

emissions, and economic growth for China as well as other countries.