Green Technology Investment with Data-Driven Marketing and Government Subsidy in a Platform Supply Chain

Abstract

:1. Introduction

2. Literature Review

2.1. ESG and Green Supply Chain Management

2.2. Platform Supply Chain Management

2.3. Research Gaps

3. Model Description and Assumptions

4. The Basic Models: Results and Discussions

4.1. Agency Selling Mode

- When the potential market demand of green products increases, it can be known from the market demand function of green products that the number of consumers willing to buy green products will increase, and the manufacturer should raise the unit selling price of green products. It will also encourage the manufacturer to invest more in green technology level, which will make more potential consumers willing to buy green products. At this point, although the cost of green technology investment increases, the increases of market demand and unit selling price of green products will bring more revenue to the manufacturer than the increase in the cost of green technology investment, so the manufacturer’s profit increases. At the same time, the potential market demands of green products increase, which inspires the smart platform to improve the data-driven marketing level, this will make the market demands of green products increase, and with the increase in the unit selling price of green products, the smart platform can get more revenue from the service commission fee than the increasing cost of data-driven marketing. Therefore, the profit gained by the smart platform under the agency selling strategy will also increase. When the sensitivity coefficients of consumers to green products attributes and the data analysis technology increase, it can be seen from the market demand function of green products that the number of consumers willing to buy green products directly increases and the same result will be produced. Therefore, through publicity and promotion, the government and enterprises can popularize the concept of green consumption to more consumers and improve their awareness of green consumption, which will help the manufacturer better carry out green technology investment activities and the smart platform enterprises more effectively promote green products to consumers through data analysis technology.

- When the service commission rate charged by the smart platform increases, in order to obtain more service commission, she should increase the market demand of green products by improving her data-driven marketing level. At this point, the increase in her service commission fee is greater than the increase in the cost of data analysis technology, so her profit increases. At the same time, for the manufacturer, he should raise the unit selling price of green products, and in order to neutralize more service commission fee, the manufacturer should reduce the green technology level to lower related cost. However, if consumers are insensitive to data analysis technology, the improvement of data-driven marketing level of smart platform will not make the market demand of green products increase, so the increase in the manufacturer’s income is less than the increase in the service commission fee, so his profit decrease. If consumers are sensitive to data analysis technology, the improvement of data-driven marketing level of smart platform will make the market demand of green products increase greatly, so the increase in the manufacturer’s income is greater than the increase in the service commission fee, so his profit increases. Therefore, it can be seen that the manufacturer can better conduct green investment activities by avoiding the high service commission rate charged by the smart platform and improving consumers’ sensitivity to data analysis technology of smart platform.

4.2. Reselling Mode

4.3. Selling Strategy Analysis

5. The Government Subsidy Models

5.1. Agency Selling Mode

5.2. Reselling Mode

5.3. The Service Commission Rate and Government Subsidy Analysis

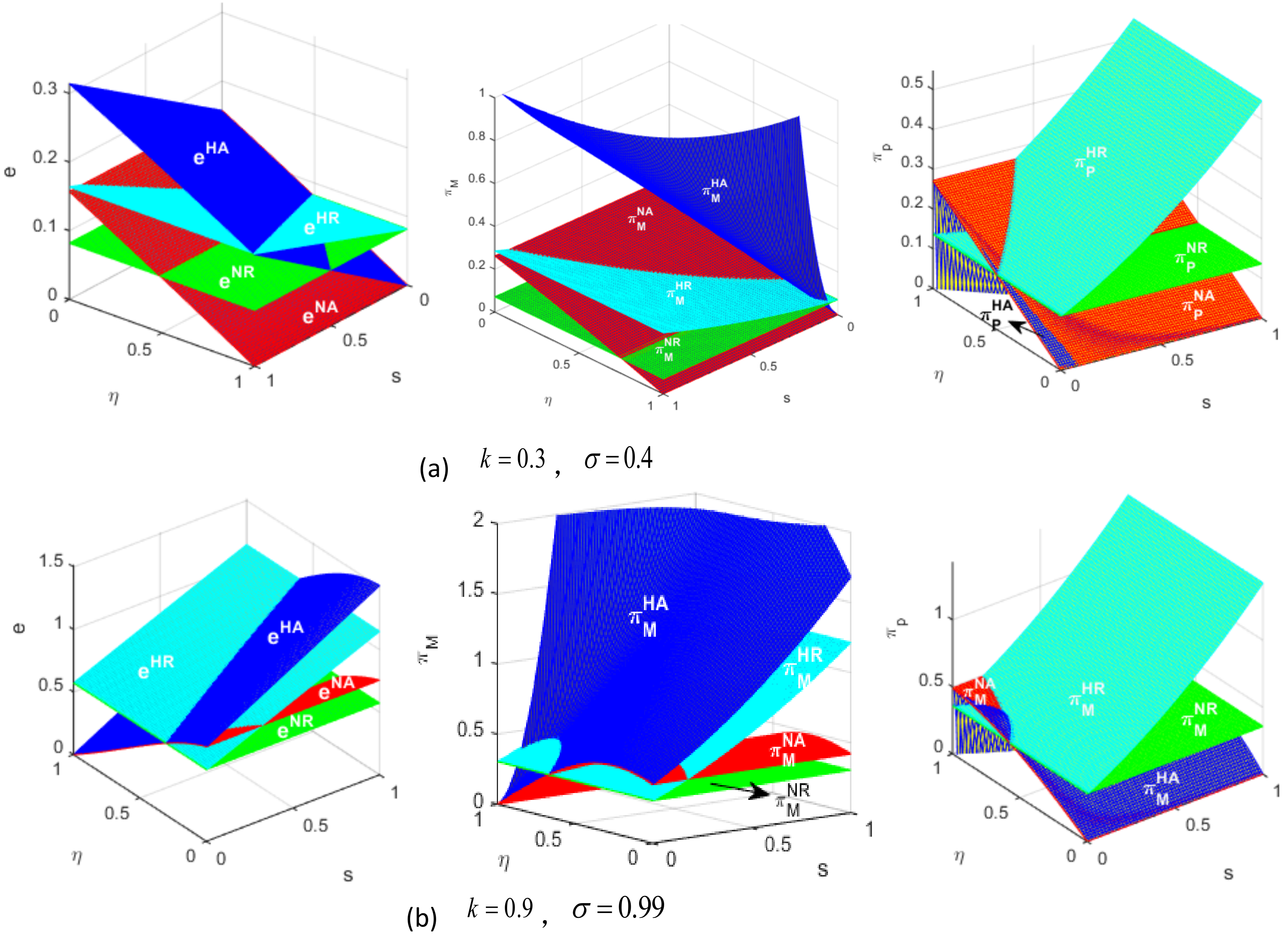

- In the platform supply chain without government subsidy, if consumers are not sensitive to the data-driven marketing technology (see Figure 3a), with the increase in the service commission rate, the manufacturer’s green technology level and profit decreases under the agency selling strategy, while the smart platform’s profit increases. If consumers are sensitive to data-driven marketing technology invested by the smart platform (see Figure 3b), with the increase in the service commission rate, the manufacturer’s green technology level under the agency selling strategy decreases and his profit increases, while the smart platform’s increases, which conforms to conclusion 1. If the service commission rate is low, the manufacturer chooses an agency selling strategy that can obtain more profit, but at this moment, the green technology level is not necessarily higher than that in the reselling system, therefore the smart platform should choose the reselling strategy. If the service commission rate is high (see Figure 3a,b), and the manufacturer chooses the reselling strategy and can obtain more profit, the green technology level under this strategy would also be higher, while the smart platform should choose the agency selling strategy, which conforms to theorem 1.

- In the agency selling platform supply chain with government subsidy, with the increase in government subsidy, the green technology level and the manufacturer’s profit increase, while the smart platform’s profit increases first and then decrease, which is consistent with conclusions 4. If consumers are insensitive to data-driven marketing technology (see Figure 3a), the manufacturer’s green technology level and profit are higher than those in the system without government subsidy, but the smart platform’s profit is lower than that in the system without government subsidy. If consumers are sensitive to data-driven marketing technology (see Figure 3b), the manufacturer’s green technology level and profit, and the smart platform’s profit are higher than those in the system without government subsidy, in line with theorem 2.

- In the reselling platform supply chain with government subsidy, with the increase in government subsidy, the green technology level increases, and the profits of the manufacturer and the smart platform increase, which is consistent with conclusions 6. The manufacturer’s green technology level and profit, and the smart platform’s profit are higher than those in the system without government subsidy, in line with theorem 3.

- With or without government subsidy, if the service commission rate charged by the platform is low, the manufacturer chooses an agency selling strategy that can obtain more profits, but at this moment, the green technology level would not necessarily be higher than that in the reselling system, therefore the smart platform should choose the reselling strategy. If the service commission rate charged by the smart platform is higher, the manufacturer chooses the reselling strategy and can obtain high profits, and the green technology level under the reselling strategy is also higher than that in the agency selling system, while the smart platform chooses the agency selling strategy, the same as theorem 1. However, when the service commission rate charged by the smart platform falls into a certain range of threshold value, if government has no subsidy or less subsidy, the unit selling price that the manufacturer directly selling in agency selling system will be too low, so the smart platform can benefit more from the service commission, she should choose agency selling strategy. Now, her selling strategy reaches an agreement with the manufacturer. However, the manufacturer’s green technology level is not high. Along with the increase in government subsidy, and the manufacturer greatly reducing the unit selling price of green products, this will reduce the commission fee and profit earned by the smart platform under the agency selling strategy. When the government subsidy is larger than the threshold in conclusion 3, but fails to reach the threshold in conclusion 5, the smart platform’s profit is negative, so both the smart platform and the manufacturer should turn to the reselling strategy. At this time, the manufacturer’s green technology level is also high.

6. Conclusions

- In the smart platform supply chain with agency selling or reselling strategy, when the potential market demand of green products, and the sensitivities of consumers to green product attributes and data analysis increases, the manufacturer’s green technology level, the smart platform’s data-driven marketing level, the market demand and selling price of green products increases, which are beneficial to the ecological benefit of the smart platform supply chain and all members’ profits.

- In the agency selling platform supply chain with government subsidy, the manufacturer’s green R&D activities can be effectively motivated, he is willing to improve the green technology investment level while reducing the unit selling price of green products, which is conducive to both encouraging consumers to buy more green products and benefiting the manufacturer to obtain more profit. However, along with the government subsidy increases, the platform’s profit increases first. When the government subsidy increases to a certain degree that motivates the manufacturer to reduce the unit selling price of the green products more, the platform’s profit will be damaged for lower service commission income, which is bad for her participation in agency selling platform supply chain. Therefore, the government should set appropriate subsidies for the manufacturer’s R&D activities in agency selling system. In the reselling platform supply chain with government subsidy, the manufacturer’s green R&D activities can be effectively motivated, and he is willing to improve the green technology investment level while reducing the unit wholesale price of green products. On this basis, the smart platform is willing to improve the data-driven marketing level while reducing the unit selling price of green products. These behaviors of the manufacturer and the smart platform can make them more profit by increasing consumer quantities. Thus, the more government subsidies, the more conducive to better achieve win-win economic and ecological benefits in reselling platform supply chain. Therefore, in order to ensure that the platform makes better use of data driven marketing technology to promote products, the government subsidy should be moderated in the agency selling platform supply chain, e.g., Amazon sellers, while being increased in the reselling platform supply chain, e.g., JD.COM sellers.

- The service commission rate charged by the smart platform and government subsidy plays a major role in the choice of green product selling strategy. If the service commission rate is low, the manufacturer should choose an agency selling strategy, but now the manufacturer’s green technology level is not necessarily the highest. With the improvement of the service commission rate, the manufacturer should choose a reselling strategy, and the green technology level is higher than it in the agency selling system. However, when the smart platform charge service commission rate in a certain range, if the government subsidy is less, the manufacturer and the smart platform should also choose agency selling strategy, but the green technology level is not high. When the government subsidy increases to a certain extent, the manufacturer and the platform should also choose a reselling strategy, and the green technology level is high. It also means that all members agree on a selling strategy, and the economic and ecological benefits are well realized.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

Appendix C

- The Comparison of the equilibrium decisions of agency selling and reselling platform supply chain in Theorem 1.

- (1)

- Because , therefore, it can be obtained , so when , ; when , .

- (2)

- Because , when ,; when , .

- (3)

- Because , when , find the solution of quadratic inequality of one variable for that is: , when , ; when , .

- (4)

- .

- (5)

- Because , when , . So, when , ; when , .

- (6)

- . Because and , so .

- The comparison of the equilibrium decisions of agency selling platform supply chain with and without government subsidy in Theorem 2.Because . When , therefore, it can be obtained , namely . Similarly, when , . ,,,,.

- The comparison of the equilibrium decisions of reselling platform supply chain with and without government subsidy in Theorem 3.; ; ; ; ; ; ; When , ; when , .

References

- Wright, J.; Hagiu, A. Marketplace or reseller? Manag. Sci. 2015, 61, 184–203. [Google Scholar]

- Braverman, S. Global review of data-driven marketing and advertising. J. Direct Data Digit. Mark. Pract. 2015, 16, 181–183. [Google Scholar] [CrossRef]

- Cohen, M.C. Big data and service operations. Prod. Oper. Manag. 2018, 27, 1709–1723. [Google Scholar] [CrossRef]

- Ghoshal, A.; Kumar, S.; Mookerjee, V. Dilemma of data sharing alliance: When do competing personalizing and non-personalizing firms share data. Prod. Oper. Manag. 2020, 29, 1918–1936. [Google Scholar] [CrossRef]

- Husted, B.W.; De, S.J. The impact of sustainability governance, country stakeholder orientation, and country risk on environmental, social, and governance performance. J. Clean. Prod. 2016, 155 Pt 2, 93–102. [Google Scholar] [CrossRef]

- Wang, Z.; Sarkis, J. Corporate social responsibility governance, outcomes, and financial performance. J. Clean. Prod. 2017, 162, 1607–1616. [Google Scholar] [CrossRef]

- Yang, Q.; Du, Q.; Razzaq, A. How volatility in green financing, clean energy, and green economic practices derive sustainable performance through ESG indicators? A sectoral study of G7 countries. Resour. Policy 2022, 75, 102526. [Google Scholar] [CrossRef]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- Zhu, Q.H.; Sarkis, J. Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. J. Oper. Manag. 2004, 22, 265–289. [Google Scholar] [CrossRef]

- Chiou, T.Y.; Chan, H.K. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Handfield, R.B.; Walton, S. Green supply chain: Best practices from the furniture industry. In Proceedings of the Proceedings Annual Meeting of the Decision Sciences Institute, Orlando, FL, USA, 24–26 November 1996; pp. 1295–1297. [Google Scholar]

- Nagel, M.H. Environmental supply-chain management versus green procurement in the scope of a business and leadership perspective. In Proceedings of the IEEE International Symposium on Electronics and the Environment, San Francisco, CA, USA, 10 May 2000; pp. 219–224. [Google Scholar]

- Hall, J. Environmental supply chain dynamics. J. Clean. Prod. 2000, 8, 455–471. [Google Scholar] [CrossRef]

- Zsidisin, G.A.; Siferd, S.P. Environmental purchasing: A framework for theory development. Eur. J. Purch. Supply Manag. 2001, 7, 61–73. [Google Scholar] [CrossRef]

- Tachizawa, E.M.; Gimenez, C. Green supply chain management approaches: Drivers and performance implications. Int. J. Oper. Prod. Manag. 2015, 35, 1546–1566. [Google Scholar] [CrossRef]

- Rahmani, K.; Yavari, M. Pricing policies for a dual-channel green supply chain under demand disruptions. Comput. Ind. Eng. 2018, 127, 493–510. [Google Scholar] [CrossRef]

- Nekmahmud, M.; Rahman, S.; Sobhani, F.A.; Olejniczak, S.K.; Fekete, F.M. A systematic literature review on development of green supply chain management. Pol. J. Manag. Stud. 2020, 22, 351–370. [Google Scholar] [CrossRef]

- Hariharasudan, A.; Kot, S.; Sangeetha, J. The decades of research on SCM and its advancements: Comprehensive framework. Acta Logist. 2021, 8, 455–477. [Google Scholar] [CrossRef]

- Astawa, I.K.; Pirzada, K.; Budarma, I.K.; Widhari, C.I.S.; Suardani, A.A.P. The effect of green supply chain management practices on the competitive advantages and organizational performance. Pol. J. Manag. Stud. 2021, 24, 45–60. [Google Scholar] [CrossRef]

- Kot, S.; Ul Haque, A.; Baloch, A. Supply chain management in SMEs: Global perspective. Montenegrin J. Econ. 2020, 16, 87–104. [Google Scholar] [CrossRef]

- Liu, Z.; Lang, L.; Hu, B. Emission reduction decision of agricultural supply chain considering carbon tax and investment cooperation. J. Clean. Prod. 2021, 294, 126305. [Google Scholar] [CrossRef]

- Ma, S.; He, Y.; Gu, R. Sustainable supply chain management considering technology investments and government intervention. Transp. Res. Part E Logist. Transp. Rev. 2021, 149, 102290. [Google Scholar] [CrossRef]

- Zhu, W.; He, Y.J. Green product design in supply chains under competition. Eur. J. Oper. Res. 2017, 258, 165–180. [Google Scholar] [CrossRef]

- Hong, Z.F.; Wang, H.; Gong, Y.M. Green product design considering functional-product reference. Int. J. Prod. Econ. 2019, 210, 155–168. [Google Scholar] [CrossRef]

- Drake, D.F. Carbon tariffs: Effects in settings with technology choice and foreign production cost advantage. Manuf. Serv. Oper. Manag. 2018, 20, 667–686. [Google Scholar] [CrossRef]

- Wu, H.Q.; Hu, S.M. The impact of synergy effect between government subsidies and slack resources on green technology innovation. J. Clean. Prod. 2020, 274, 122682. [Google Scholar] [CrossRef]

- Li, Y. Research on supply chain CSR management based on differential game. J. Clean. Prod. 2020, 268, 122171. [Google Scholar] [CrossRef]

- Yang, R.; Tang, W.S. Technology improvement strategy for green products under competition: The role of government subsidy. Eur. J. Oper. Res. 2021, 289, 553–568. [Google Scholar] [CrossRef]

- Gao, J.; Xiao, Z.; Wei, H. Dual-channel green supply chain management with eco-label policy: A perspective of two types of green products. Comput. Ind. Eng. 2020, 146, 106613. [Google Scholar] [CrossRef]

- Xue, J.; Gong, R.F. A green supply-chain decision model for energy-saving products that accounts for government subsidies. Sustainability 2019, 11, 2209. [Google Scholar] [CrossRef] [Green Version]

- Li, C.F.; Liu, Q.L. Optimal innovation investment: The role of subsidy schemes and supply chain channel power structure. Comput. Ind. Eng. 2021, 157, 107291. [Google Scholar] [CrossRef]

- Chen, J.Y.; Stanko, D. The impact of government subsidy on supply chains’ sustainability innovation. Omega 2019, 86, 42–58. [Google Scholar] [CrossRef]

- Bi, G.; Jin, M.; Ling, L. Environmental subsidy and the choice of green technology in the presence of green consumers. Ann. Oper. Res. 2017, 255, 547–568. [Google Scholar] [CrossRef]

- Cohen, M.C.; Lobel, R.; Perakis, G. The impact of demand uncertainty on consumer subsidies for green technology adoption. Manag. Sci. 2016, 62, 1235–1258. [Google Scholar] [CrossRef]

- Jung, S.H.; Feng, T. Government subsidies for green technology development under uncertainty. Eur. J. Oper. Res. 2020, 286, 726–739. [Google Scholar] [CrossRef]

- Yang, D.Y.; Xiao, T.J. Pricing and green level decisions of a green supply chain with governmental interventions under fuzzy uncertainties. J. Clean. Prod. 2017, 149, 1174–1187. [Google Scholar] [CrossRef]

- Fu, J.F.; Chen, X.F. Subidizing strategies in a sustainable supply chain. J. Oper. Res. Soc. 2018, 69, 283–295. [Google Scholar] [CrossRef]

- Yu, J.J.; Tang, C.S.; Shen, Z.J.M. Improving consumer welfare and manufacturer profit via government subsidy programs: Subsidizing consumers or manufacturers? Manuf. Serv. Oper. Manag. 2018, 20, 752–766. [Google Scholar] [CrossRef]

- Bian, J.S.; Zhang, G.Q. Manufacturer vs. consumer subsidy with green technology investment and environmental concern. Eur. J. Oper. Res. 2020, 287, 832–843. [Google Scholar] [CrossRef]

- Lu, Q.; Shi, V.; Huang, J. Who benefit from agency model: A strategic analysis of pricing models in distribution channels of physical books and e-books. Eur. J. Oper. Res. 2017, 264, 25–29. [Google Scholar] [CrossRef]

- Zhang, J.; Cao, Q.; He, X. Contract and product quality in platform selling. Eur. J. Oper. Res. 2018, 272, 928–944. [Google Scholar] [CrossRef]

- Du, S.F.; Wang, L.; Hu, L. Platform-led green advertising: Promote the best or promote by performance. Transp. Res. Part E Logist. Transp. Rev. 2019, 128, 115–131. [Google Scholar] [CrossRef]

- Li, X. Reducing channel costs by investing in smart supply chain technologies. Transp. Res. Part E Logist. Transp. Rev. 2020, 137, 101927. [Google Scholar] [CrossRef]

- Liu, W.H.; Yan, X.Y.; Li, X. The impacts of market size and data-driven marketing on the sales mode selection in an Internet platform based supply chain. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101914. [Google Scholar] [CrossRef]

- Wan, X.L.; Qie, X.Q. Poverty alleviation ecosystem evolutionary game on smart supply chain platform under the government financial platform incentive mechanism. J. Comput. Appl. Math. 2020, 372, 112595. [Google Scholar] [CrossRef]

- Liu, W.; Long, S.; Liang, Y. The influence of leadership and smart level on the strategy choice of the smart logistics platform: A perspective of collaborative innovation participation. Ann. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Liu, W.; Wang, S.; Wang, J. Evaluation method of path selection for smart supply chain innovation. Ann. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Xiao, D.; Kuang, X.; Chen, K. E-commerce supply chain decisions under platform digital empowerment-induced demand. Comput. Ind. Eng. 2020, 150, 106876. [Google Scholar] [CrossRef]

- Hao, L.; Fan, M. An analysis of pricing models in the electronic book market. MIS Quart. 2014, 38, 1017–1032. [Google Scholar] [CrossRef]

- Young, K.; Chen, J.; Raghunathan, S. Online product reviews: Implications for retailers and competing manufacturers. Inf. Syst. Res. 2014, 25, 93–110. [Google Scholar]

- Abhishek, V.; Jerath, K.; Zhang, Z.J. Agency selling or reselling? channel structures in electronic retailing. Manag. Sci. 2016, 62, 2259–2280. [Google Scholar] [CrossRef] [Green Version]

- Tan, Y.; Carrillo, J.E.; Cheng, H.K. The agency model for digital goods. Decis. Sci. 2016, 47, 628–660. [Google Scholar] [CrossRef]

- Tan, Y.L.; Carrillo, J.E. Strategic analysis of the agency model for digital goods. Prod. Oper. Manag. 2017, 26, 724–741. [Google Scholar] [CrossRef]

- Tian, L.; Vakharia, A.J.; Tan, Y.L. Marketplace, reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Prod. Oper. Manag. 2018, 27, 1595–1610. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, J. Agency selling or reselling: E-tailer information sharing with supplier offline entry. Eur. J. Oper. Res. 2020, 280, 134–151. [Google Scholar] [CrossRef]

- Chen, P.P.; Zhao, R.Q.; Yan, Y.C. Promotional pricing and online business model choice in the presence of retail competition. Omega 2020, 94, 102085. [Google Scholar] [CrossRef]

- Tan, Y.L.; Carrillo, J. The agency model for digital goods: Strategic analysis of dual channels in electronic publishing industry. In Proceedings of the PICMET ′14 Conference: Portland International Center for Management of Engineering and Technology; Infrastructure and Service Integration, Kanazawa, Japan, 27–31 July 2014; pp. 646–657. [Google Scholar]

- Geng, X.J.; Tan, Y.L. How add-on pricing interacts with distribution contracts. Prod. Oper. Manag. 2018, 27, 605–623. [Google Scholar] [CrossRef]

- Wei, J.; Lu, J.; Zhao, J. Interactions of competing manufacturers’ leader-follower relationship and sales format on online platforms. Eur. J. Oper. Res. 2019, 280, 37–48. [Google Scholar] [CrossRef]

- Xu, Y.M.; Zhang, P. Decision-making in dual-channel green supply chain considering market structure. J. Serv. Sci. Manag. 2018, 11, 116–141. [Google Scholar] [CrossRef] [Green Version]

- Yang, D.; Xiao, T.; Huang, J. Dual-channel structure choice of an environmental responsibility supply chain with green investment. J. Clean. Prod. 2019, 210, 134–145. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, K.; Dai, G.; Xia, Y.; Mu, Z.; Zhang, G.; Shi, Y. Green Technology Investment with Data-Driven Marketing and Government Subsidy in a Platform Supply Chain. Sustainability 2022, 14, 3992. https://doi.org/10.3390/su14073992

Li K, Dai G, Xia Y, Mu Z, Zhang G, Shi Y. Green Technology Investment with Data-Driven Marketing and Government Subsidy in a Platform Supply Chain. Sustainability. 2022; 14(7):3992. https://doi.org/10.3390/su14073992

Chicago/Turabian StyleLi, Ke, Gengxin Dai, Yanfei Xia, Zongyu Mu, Guitao Zhang, and Yangyan Shi. 2022. "Green Technology Investment with Data-Driven Marketing and Government Subsidy in a Platform Supply Chain" Sustainability 14, no. 7: 3992. https://doi.org/10.3390/su14073992