Financial Network Analysis on the Performance of Companies Using Integrated Entropy–DEMATEL–TOPSIS Model

Abstract

1. Introduction

2. Materials and Methods

2.1. Research Development

2.2. Proposed Entropy–DEMATEL–TOPSIS Model

2.3. Application of the Proposed Model in Portfolio Investment

- n is the number of assets,

- is the covariance between assets i and j,

- is the weight invested in asset j,

- is the weight invested in asset i,

- is a parameter representing the target rate of return required by an investor,

- is the expected return of asset j per period.

- is the portfolio mean return,

- is the weight invested in asset j,

- is the expected return of asset j per period.

3. Empirical Results

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Aktan, B.; Bulut, C. Financial performance impacts of corporate entrepreneurship in emerging markets: A case of Turkey. Eur. J. Econ. Financ. Adm. Sci. 2008, 12, 69–79. [Google Scholar]

- Adongo, K.O.; Jagongo, A. Budgetary control as a measure of financial performance of state corporations in Kenya. Int. J. Account. Tax. 2013, 1, 38–57. [Google Scholar]

- Visalakshmi, S.; Lakshmi, P.; Shama, M.S.; Vijayakumar, K. An integrated fuzzy DEMATEL-TOPSIS approach for financial performance evaluation of GREENEX industries. Int. J. Oper. Res. 2015, 23, 340–362. [Google Scholar] [CrossRef]

- Chen, K.H.; Shimerda, T.A. An empirical analysis of useful financial ratios. Financ. Manag. 1981, 10, 51–60. [Google Scholar] [CrossRef]

- Malacka, C.M.; Wang, R.T. Performance evaluation for airlines including the consideration of financial ratios. J. Air Transp. Manag. 2000, 6, 133–142. [Google Scholar]

- Xidonas, P.; Mavrotasb, G.; Psarras, J. A multi criteria methodology for equity selection using financial analysis. Comput. Oper. Res. 2009, 36, 3187–3203. [Google Scholar] [CrossRef]

- Halkos, G.E.; Tzeremes, N.G. Industry performance evaluation with the use of financial ratios: An application of bootstrapped DEA. Expert Syst. Appl. 2012, 39, 5872–5880. [Google Scholar] [CrossRef]

- Abdel Basset, M.; Ding, W.; Mohamed, R.; Metawa, N. An integrated plithogenic MCDM approach for financial performance evaluation of manufacturing industries. Risk Manag. 2020, 22, 192–218. [Google Scholar] [CrossRef]

- Dalfard, V.M.; Sohrabian, A.; Najafabadi, A.M.; Alvani, J. Performance evaluation and prioritization of leasing companies using the super efficiency Data Envelopment Analysis model. Acta Polytech. Hung. 2012, 9, 183–194. [Google Scholar]

- Hasanloo, S.; Karim, E.; Mehregan, M.R.; Tehrani, R. Evaluating performance of companies by new management tools. J. Nat. Soc. Sci. 2013, 2, 165–169. [Google Scholar]

- Zamani, L.; Beegam, R.; Borzoian, S. Portfolio selection using Data Envelopment Analysis (DEA): A case of select Indian investment companies. Int. J. Curr. Res. Acad. Rev. 2014, 2, 50–55. [Google Scholar]

- Pradesyah, R.; Putri, S. Trend of Sharia banking financial performance in the pandemic time COVID-19. Proc. Int. Semin. Islamic Stud. 2021, 2, 36–46. [Google Scholar]

- Ali, A.; Faisal, S. Capital structure and financial performance: A case of Saudi petrochemical industry. J. Asian Financ. Econ. Bus. 2020, 7, 105–112. [Google Scholar] [CrossRef]

- Delvia, Y.; Alexander, N. The effect of size, firm age, growth, audit reputation, ownership and financial ratio on intellectual capital disclosure. J. Bisnis Dan Akunt. 2018, 20, 69–76. [Google Scholar] [CrossRef][Green Version]

- Otekunrin, A.O.; Nwanji, T.I.; Olowookere, J.K.; Egbide, B.C.; Fakile, S.A.; Lawal, A.I.; Ajayi, S.A.; Falaye, A.J.; Eluyela, F.D. Financial ratio analysis and market price of share of selected quoted agriculture and agro-allied firms in Nigeria after adoption of international financial reporting standard. J. Soc. Sci. Res. 2018, 4, 736–744. [Google Scholar]

- Shamsuddin, Z.; Ismail, A.G.; Mahmood, S.; Abdullah, M.F. Determinants of agricultural cooperative performance using financial ratio. Int. J. Bus. Technopreneurship 2017, 7, 385–396. [Google Scholar]

- Myskova, R.; Hajek, P. Comprehensive assessment of firm financial performance using financial ratios and linguistic analysis of annual reports. J. Int. Stud. 2017, 10, 96–108. [Google Scholar] [CrossRef]

- Daryanto, W.M.; Nurfadilah, D. Financial performance analysis before and after the decline in oil production: Case study in Indonesian oil and gas industry. Int. J. Eng. Technol. 2018, 7, 10–15. [Google Scholar] [CrossRef]

- Nugraha, N.M.; Puspitasari, D.M.; Amalia, S. The effect of financial ratio factors on the percentage of income increasing of automotive companies in Indonesia. Int. J. Psychosoc. Rehabil. 2020, 24, 2539–2545. [Google Scholar]

- Amalia, S.; Nugraha, N.M. The impact of financial ratio indicators on banking profitability in Indonesia. Turk. J. Comput. Math. Educ. 2021, 12, 580–588. [Google Scholar]

- Yalcin, N.; Bayrakdaroglu, A.; Kahraman, C. Application of fuzzy multi-criteria decision making methods for financial performance evaluation of Turkish manufacturing industries. Expert Syst. Appl. 2012, 39, 350–364. [Google Scholar] [CrossRef]

- Chang, S.C.; Tsai, P.H. A hybrid financial performance evaluation model for wealth management banks following the global financial crisis. Technol. Econ. Dev. Econ. 2016, 22, 21–46. [Google Scholar] [CrossRef]

- Erdoğan, M.; Yamaltdinova, A. Financial performance analysis of BIST tourism companies with TOPSIS for 2011–2015 period. Optim. J. Econ. Manag. Sci. 2018, 5, 19–36. [Google Scholar]

- Shannon, C.E.; Weaver, W. The Mathematical Theory of Communication; The University of Illinios Press: Urbana, AL, USA, 1947. [Google Scholar]

- Hwang, C.L.; Yoon, K. Multiple Attribute Decision Making: Methods and Applications; Springer: Berlin, Germany, 1981. [Google Scholar]

- Zhu, J.; Sun, H.; Liu, N.; Zhou, D.; Taghizadeh-Hesary, F. Measuring carbon market transaction efficiency in the power industry: An entropy-weighted TOPSIS approach. Entropy 2020, 22, 973. [Google Scholar] [CrossRef]

- Guo, L.L.; Wu, C.Y.; Yu, J.T. Influencing factors identification of green growth in China based on entropy-DEMATEL model. In Proceedings of the 2015 AASRI International Conference on Industrial Electronics and Applications (IEA 2015), London, UK, 27–28 June 2015; pp. 568–571. [Google Scholar]

- Zhao, Q.; Chen, J.; Li, F.; Li, A.; Li, Q. An integrated model for evaluation of maternal health care in China. PLoS ONE 2021, 16, e0245300. [Google Scholar] [CrossRef]

- Furtan, W.H. Entropy, information and economics in firm decision-making. Int. J. Syst. Sci. 1977, 8, 1105–1112. [Google Scholar] [CrossRef]

- Dhar, V.; Chou, D.; Provost, F. Discovering interesting patterns for investment decision making with GLOWER—A genetic learner overlaid with entropy reduction. Data Min. Knowl. Discov. 2000, 4, 251–280. [Google Scholar] [CrossRef]

- Yang, J.P.; Qiu, W.H. A measure of risk and a decision-making model based on expected utility and entropy. Eur. J. Oper. Res. 2005, 164, 792–799. [Google Scholar] [CrossRef]

- Muley, A.A.; Bajaj, V.H. Fuzzy multiple attribute decision making by utilizing entropy-based approach. Int. J. Agric. Stat. Sci. 2009, 5, 613–621. [Google Scholar]

- Zhao, H.; Yao, L.; Mei, G.; Liu, T.; Ning, Y. A fuzzy comprehensive evaluation method based on AHP and entropy for landslide susceptibility map. Entropy 2017, 19, 396. [Google Scholar] [CrossRef]

- Dong, X.; Lu, H.; Xia, Y.; Xiong, Z. Decision-making model under risk assessment based on entropy. Entropy 2016, 18, 404. [Google Scholar] [CrossRef]

- Liang, J.; Shi, Z.D.; Wierman, M.J. Information entropy, rough entropy and knowledge granulation in incomplete information systems. Int J. Gen. Syst. 2006, 35, 641–654. [Google Scholar] [CrossRef]

- Wu, D.; Wang, N.; Yang, Z.; Li, C.; Yang, Y. Comprehensive evaluation of coal-fired power units using grey relational analysis and a hybrid entropy-based weighting method. Entropy 2018, 20, 215. [Google Scholar] [CrossRef]

- Wang, Z.X.; Li, D.D.; Zheng, H.H. The external performance appraisal of China energy regulation: An empirical study using a TOPSIS method based on entropy weight and Mahalanobis distance. Int. J. Environ. Res. Public Health 2018, 15, 236. [Google Scholar] [CrossRef] [PubMed]

- Lin, C.W.; Chen, S.H.; Tzeng, G.H. Constructing a cognition map of alternative fuel vehicles using the DEMATEL method. J. Multi-Crit. Decis. Anal. 2009, 16, 5–19. [Google Scholar] [CrossRef]

- Tzeng, G.H.; Chiang, C.H.; Li, C.W. Evaluating intertwined effects in e-learning programs: A novel hybrid MCDM model based on factor analysis and DEMATEL. Expert Syst. Appl. 2007, 32, 1028–1044. [Google Scholar] [CrossRef]

- Fontela, E.; Gabus, A. DEMATEL, Innovative Methods; Report No. 2 Structural Analysis of the World Problematique; Battelle Geneva Research Institute: Geneva, Switzerland, 1974. [Google Scholar]

- Fontela, E.; Gabus, A. The DEMATEL Observer; Battelle Institute, Geneva Research Center: Geneva, Switzerland, 1976. [Google Scholar]

- Tseng, M.L. Green supply chain management with linguistic preferences and incomplete information. Appl. Soft Comput. 2011, 11, 4894–4903. [Google Scholar] [CrossRef]

- Gabus, A.; Fontela, E. World Problems, an Invitation to Further Thought within the Framework of DEMATEL; Battelle Geneva Research Center: Geneva, Switzerland, 1972. [Google Scholar]

- Zhan, Y.; Liu, J.; Ma, X. The Evaluation on the Suppliers of Prefabricated Housing Components Based on DEMATEL Method; Springer: Singapore, 2017. [Google Scholar]

- Büyüközkan, G.; Çifçi, G. A novel hybrid MCDM approach based on fuzzy DEMATEL, fuzzy ANP and fuzzy TOPSIS to evaluate green suppliers. Expert Syst. Appl. 2012, 39, 3000–3011. [Google Scholar] [CrossRef]

- Jassbi, J.; Mohamadnejad, F.; Nasrollahzadeh, H. A Fuzzy DEMATEL framework for modeling cause and effect relationships of strategy map. Expert Syst Appl. 2011, 38, 5967–5973. [Google Scholar] [CrossRef]

- Sangaiah, A.K.; Subramaniam, P.R.; Zheng, X. A combined fuzzy DEMATEL and fuzzy TOPSIS approach for evaluating GSD project outcome factors. Neural Comput. Appl. 2015, 26, 1025–1040. [Google Scholar] [CrossRef]

- Govindan, K.; Khodaverdi, R.; Vafadarnikjoo, A. Intuitionistic fuzzy based DEMATEL method for developing green practices and performances in a green supply chain. Expert Syst. Appl. 2015, 42, 7207–7220. [Google Scholar] [CrossRef]

- Abdel-Basset, M.; Manogaran, G.; Gamal, A.; Smarandache, F. A hybrid approach of neutrosophic sets and DEMATEL method for developing supplier selection criteria. Des. Autom. Embed. Syst. 2018, 22, 257–278. [Google Scholar] [CrossRef]

- Yazdi, M.; Khan, F.; Abbassi, R.; Rusli, R. Improved DEMATEL methodology for effective safety management decision-making. Saf. Sci. 2020, 127, 104705–104721. [Google Scholar] [CrossRef]

- Seker, S.; Zavadskas, E.K. Application of fuzzy DEMATEL method for analyzing occupational risks on construction sites. Sustainability 2017, 9, 2083. [Google Scholar] [CrossRef]

- Frances-Chust, J.; Brentan, B.M.; Carpitella, S.; Izquierdo, J.; Montalvo, I. Optimal placement of pressure sensors using fuzzy DEMATEL-based sensor influence. Water 2020, 12, 493. [Google Scholar] [CrossRef]

- Lee, P.T.W.; Lin, C.W. The cognition map of financial ratios of shipping companies using DEMATEL and MMDE. Marit. Policy Manag. 2013, 40, 133–145. [Google Scholar] [CrossRef]

- Yüksel, S.; Dinçer, H.; Emir, Ş. Comparing the performance of Turkish deposit banks by using DEMATEL, Grey Relational Analysis (GRA) and MOORA approaches. World J. Appl. Econ. 2017, 3, 26–47. [Google Scholar] [CrossRef]

- Chang, M.Y.; Cui, X.; Liu, C.C.; Lai, Y.T. Evaluating the criteria for financial holding company operating ability based on the DEMATEL approach—The case of Taiwan. Econ. Res. Ekon. Istraživanja 2019, 32, 2972–2988. [Google Scholar] [CrossRef]

- Nosratabadi, H.E.; Pourdarab, S.; Nadali, A. Credit risk assessment of bank customers using DEMATEL and fuzzy expert system. Econ. Financ. Res. 2011, 4, 255–259. [Google Scholar]

- Ho, W.R.J.; Tsai, C.L.; Tzeng, G.H.; Fang, S.K. Combined DEMATEL technique with a novel MCDM model for exploring portfolio selection based on CAPM. Expert Syst. Appl. 2011, 38, 16–25. [Google Scholar]

- Chen, L.; Li, Z.; Deng, X. Emergency alternative evaluation under group decision makers: A new method based on entropy weight and DEMATEL. Int. J. Syst. Sci. 2020, 51, 570–583. [Google Scholar] [CrossRef]

- Dong, H.; Yang, K. Application of the entropy-DEMATEL-VIKOR multicriteria decision-making method in public charging infrastructure. PLoS ONE 2021, 16, e0258209. [Google Scholar] [CrossRef]

- Liu, T.; Deng, Y.; Chan, F. Evidential supplier selection based on DEMATEL and game theory. Int. J. Fuzzy Syst. 2018, 20, 1321–1333. [Google Scholar] [CrossRef]

- Roszkowska, E.; Kusterka-Jefmańska, M.; Jefmański, B. Intuitionistic fuzzy TOPSIS as a method for assessing socioeconomic phenomena on the basis of survey data. Entropy 2021, 23, 563. [Google Scholar] [CrossRef] [PubMed]

- Tang, H.M.; Shi, Y.; Dong, P.W. Public blockchain evaluation using entropy and TOPSIS. Expert Syst. Appl. 2019, 117, 204–210. [Google Scholar] [CrossRef]

- Vidal, R.; Sanchez-Pantoja, N. Method based on life cycle assessment and TOPSIS to integrate environmental award criteria into green public procurement. Sustain. Cities Soc. 2019, 44, 465–474. [Google Scholar] [CrossRef]

- Zamani, R.; Berndtsson, R. Evaluation of CMIP5 models for west and southwest Iran using TOPSIS-based method. Theor. Appl. Climatol. 2019, 137, 533–543. [Google Scholar] [CrossRef]

- Li, M.; Sun, H.; Singh, V.P.; Zhou, Y.; Ma, M. Agricultural water resources management using maximum entropy and entropy-weight-based TOPSIS methods. Entropy 2019, 21, 364. [Google Scholar] [CrossRef] [PubMed]

- Karabiyik, C.; Kutlu, K.B. Benchmarking international trade performance of OECD countries: TOPSIS and AHP approaches. Gaziantep Univ. J. Soc. Sci. 2018, 17, 239–251. [Google Scholar] [CrossRef][Green Version]

- Li, W.; Yi, P.; Zhang, D. Sustainability evaluation of cities in northeastern China using dynamic TOPSIS-entropy methods. Sustainability 2018, 10, 4542. [Google Scholar] [CrossRef]

- Stecyk, A. The AHP-TOPSIS model in the analysis of the counties sustainable development in the West Pomeranian Province in 2010 and 2017. J. Ecol. Eng. 2019, 20, 233–244. [Google Scholar] [CrossRef]

- Sielska, A. Comparison of healthcare performance and its determinants in European countries using TOPSIS approach. Wars. Forum Econ. Sociol. 2019, 10, 71–94. [Google Scholar]

- Chen, P. Effects of normalization on the entropy-based TOPSIS method. Expert Syst. Appl. 2019, 136, 33–41. [Google Scholar] [CrossRef]

- Khrawish, H.A. Determinants of commercial banks performance: Evidence from Jordan. Int. J. Financ. Econ. 2011, 81, 148–159. [Google Scholar]

- Woo, S.H.; Kwon, M.S.; Yuen, K.F. Financial determinants of credit risk in the logistics and shipping industries. Marit. Econ. Logist. 2021, 23, 268–290. [Google Scholar] [CrossRef]

- Vaezi, F.; Sadjadi, S.J.; Makui, A. A portfolio selection model based on the knapsack problem under uncertainty. PLoS ONE 2019, 14, e0213652. [Google Scholar] [CrossRef]

- Hu, Y.; Lindquist, W.B.; Rachev, S.T. Portfolio optimization constrained by performance attribution. J. Risk Financ. Manag. 2021, 14, 201. [Google Scholar] [CrossRef]

- Glabadanidis, P. Portfolio strategies to track and outperform a benchmark. J. Risk Financ. Manag. 2020, 13, 171. [Google Scholar] [CrossRef]

- Li, X.X.; Wang, K.S.; Liu, L.W.; Xin, J.; Yang, H.R.; Gao, C.Y. Application of the entropy weight and TOPSIS method in safety evaluation of coal mines. Procedia Eng. 2011, 26, 2085–2091. [Google Scholar] [CrossRef]

- Onar, S.C.; Oztaysi, B.; Kahraman, C. Strategic decision selection using hesitant fuzzy TOPSIS and interval type—2 Fuzzy AHP: A case study. Int. J. Comput. Intell. Syst. 2014, 7, 1002–1021. [Google Scholar] [CrossRef]

- Kim, A.R. A study on competitiveness analysis of ports in Korea and China by entropy weight TOPSIS. Asian J. Shipp. Logist. 2016, 32, 187–194. [Google Scholar] [CrossRef]

- Kijewska, K.; Torbacki, W.; Iwan, S. Application of AHP and DEMATEL methods in choosing and analysing the measures for the distribution of goods in Szczecin region. Sustainability 2018, 10, 2365. [Google Scholar] [CrossRef]

- Markowitz, H. Mean–variance approximations to expected utility. Eur. J. Oper. Res. 2014, 234, 346–355. [Google Scholar] [CrossRef]

- Tayali, H.A.; Tolun, S. Dimension reduction in mean-variance portfolio optimization. Expert Syst. Appl. 2018, 92, 161–169. [Google Scholar] [CrossRef]

- Huang, X. Mean–variance models for portfolio selection subject to experts’ estimations. Expert Syst. Appl. 2012, 39, 5887–5893. [Google Scholar] [CrossRef]

- Pinasthika, N.; Surya, B.A. Optimal portfolio analysis with risk-free assets using index-tracking and Markowitz mean-variance portfolio optimization model. J. Bus. Manag. 2014, 3, 737–751. [Google Scholar]

- Spaseski, N. Portfolio management: Mean-variance analysis in the US asset market. Eur. J. Bus. Soc. Sci. 2014, 3, 242–248. [Google Scholar]

- Markowitz, H.M. Foundations of portfolio theory. J. Financ. 1991, 46, 469–477. [Google Scholar] [CrossRef]

- Fernandez-Navarro, F.; Martinez-Nieto, L.; Carbonero-Ruz, M.; Montero-Romero, T. Mean squared variance portfolio: A mixed-integer linear programming formulation. Mathematics 2021, 9, 223. [Google Scholar] [CrossRef]

- Song, R.; Chan, Y. A new adaptive entropy portfolio selection model. Entropy 2020, 22, 951. [Google Scholar] [CrossRef]

- Mercurio, P.J.; Wu, Y.; Xie, H. An entropy-based approach to portfolio optimization. Entropy 2020, 22, 332. [Google Scholar] [CrossRef] [PubMed]

- Peng, Y.; Albuquerque, P.H.M.; do Nascimento, I.F.; Machado, J.V.F. Between nonlinearities, complexity, and noises: An application on portfolio selection using kernel principal component analysis. Entropy 2019, 21, 376. [Google Scholar] [CrossRef] [PubMed]

- Novais, R.G.; Wanke, P.; Antunes, J.; Tan, Y. Portfolio optimization with a mean-entropy-mutual information model. Entropy 2022, 24, 369. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Bodie, Z.; Kane, A.; Marcus, A. Investments, 12th ed.; McGraw-Hill: New York, NY, USA, 2021. [Google Scholar]

| Description | Field of Study | Method |

|---|---|---|

| Evaluate the financial performance of Islamic banks [12] | Bank | Least square method |

| Investigate the financial performance of the business organization [13] | Business organization | Financial ratio analysis |

| Measure the financial performance of the listed companies [14] | Listed companies in Indonesia Stock Exchange | Multiple regression analysis |

| Analyze the financial performance of agriculture and agro-allied firms [15] | Agriculture and agro-allied firms | Multiple regression analysis |

| Examine the financial performance of agricultural cooperatives [16] | Agricultural cooperatives | Regression analysis |

| Assess the financial performance of the listed companies [17] | Listed companies in the New York Stock Exchange | Financial ratios analysis and linguistic analysis |

| Measure the financial performance of oil and gas industry [18] | Oil and gas industry | Financial ratio analysis |

| Analyze the financial performance of the automotive companies [19] | Automotive companies | Multiple regression analysis |

| Assess the financial performance of banks [20] | Bank | Panel data regression analysis |

| Evaluate the financial performance of manufacturing industries [21] | Manufacturing industries | Fuzzy AHP–VIKOR, Fuzzy AHP–TOPSIS |

| Evaluate the financial performance of wealth management banks [22] | Bank | AHP–VIKOR |

| Investigate the financial performance of tourism companies [23] | Tourism companies | TOPSIS |

| Our study: Analyze the causal relationship of financial ratios towards the financial performance of the companies for portfolio investment. | Listed companies of DJIA (Integration of the proposed model in portfolio investment) | Integration of Entropy–DEMATEL–TOPSIS model in portfolio optimization |

| Level | |

|---|---|

| Objective | Analysis on the Causal Relationship of Financial Ratios towards the Financial Performance of the Companies |

| Decision Criteria | Earnings per share (EPS) |

| (Financial Ratios) | Debt to assets ratio (DAR) |

| Return on equity (ROE) | |

| Current ratio (CR) | |

| Return on asset (ROA) | |

| Debt to equity ratio (DER) | |

| Decision Alternatives | 3M (MMM) |

| (Companies) | American Express (AXP) |

| Amgen (AMGN) | |

| Apple (AAPL) | |

| Boeing (BA) | |

| Caterpillar (CAT) | |

| Chevron (CVX) | |

| Cisco (CSCO) | |

| Coca-Cola (KO) | |

| Dow (DOW) | |

| Goldman Sachs (GS) | |

| Home Depot (HD) | |

| Honeywell (HON) | |

| IBM (IBM) | |

| Intel (INTC) | |

| Johnson & Johnson (JNJ) | |

| JPMorgan Chase (JPM) | |

| McDonald’s (MCD) | |

| Merck (MRK) | |

| Microsoft (MSFT) | |

| Nike (NKE) | |

| Procter & Gamble (PG) | |

| Salesforce (CRM) | |

| Travelers (TRV) | |

| UnitedHealth (UNH) | |

| Verizon (VZ) | |

| Visa (V) | |

| Walgreens Boots Alliance (WBA) | |

| Walmart (WMT) | |

| Disney (DIS) |

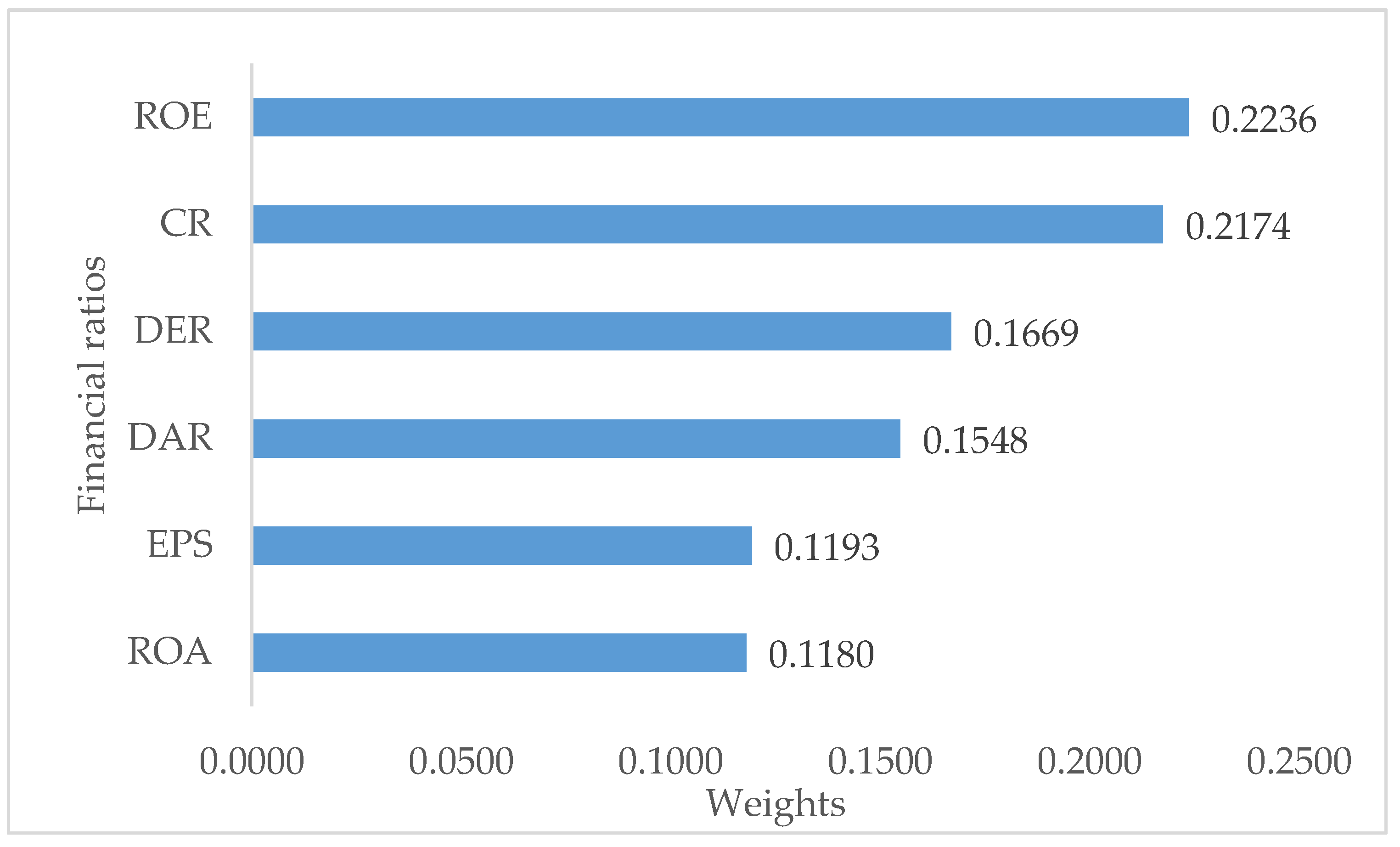

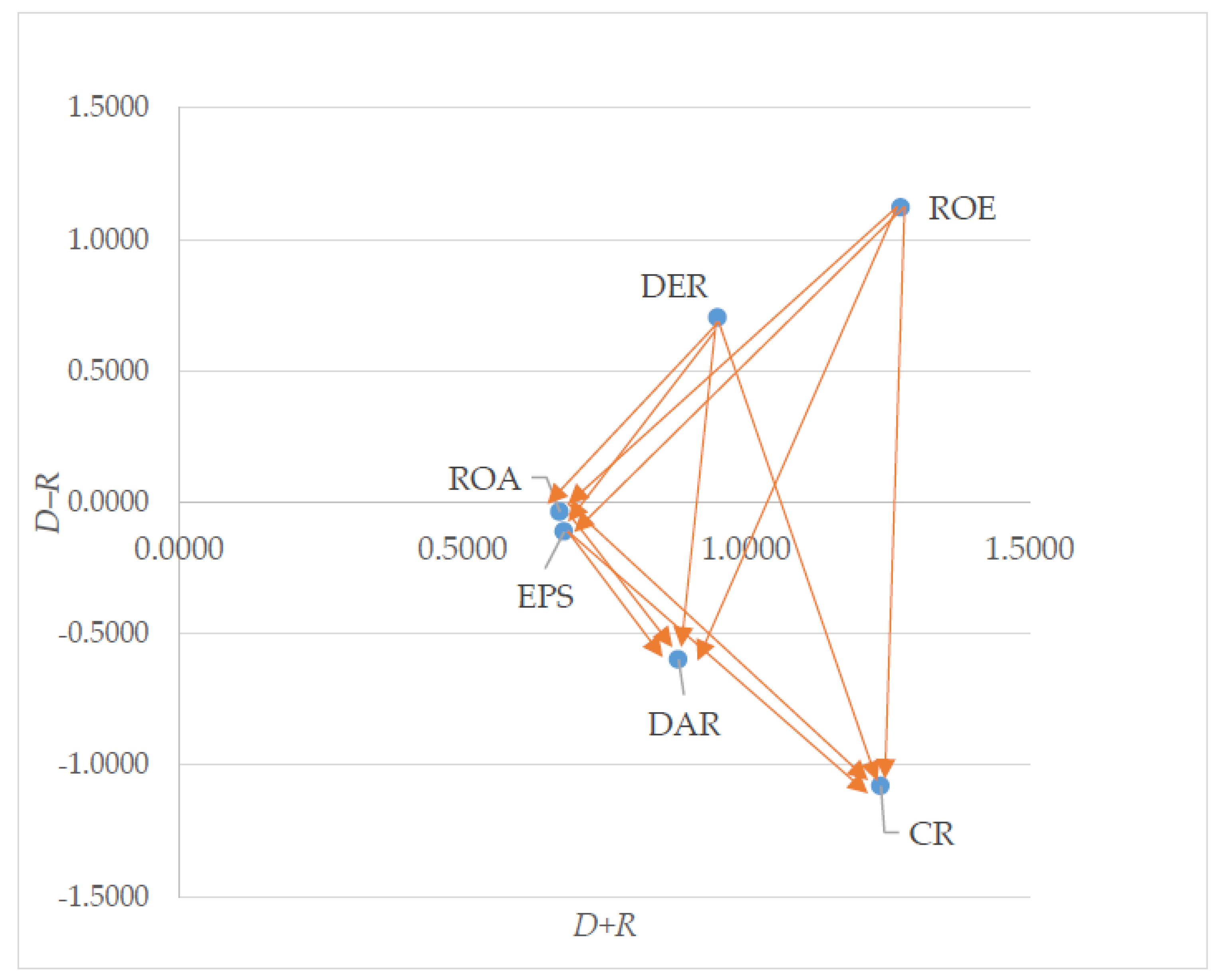

| Financial Ratios | |||

|---|---|---|---|

| CR | 1.2382 | −1.0797 | Effect |

| DAR | 0.8813 | −0.5976 | Effect |

| DER | 0.9503 | 0.7026 | Cause |

| EPS | 0.6794 | −0.1120 | Effect |

| ROA | 0.6719 | −0.0355 | Effect |

| ROE | 1.2733 | 1.1221 | Cause |

| Company | EPS | DAR | ROE | CR | ROA | DER |

|---|---|---|---|---|---|---|

| MMM | 0.0280 | 0.0313 | 0.0192 | 0.0438 | 0.0317 | 0.0130 |

| AXP | 0.0185 | 0.0249 | 0.0098 | 0.0285 | 0.0066 | 0.0245 |

| AMGN | 0.0334 | 0.0384 | 0.0176 | 0.0839 | 0.0228 | 0.0202 |

| AAPL | 0.0089 | 0.0241 | 0.0210 | 0.0325 | 0.0383 | 0.0096 |

| BA | 0.0141 | 0.0143 | 0.2044 | 0.0304 | 0.0076 | 0.1233 |

| CAT | 0.0178 | 0.0382 | 0.0090 | 0.0344 | 0.0091 | 0.0240 |

| CVX | 0.0075 | 0.0126 | 0.0012 | 0.0285 | 0.0038 | 0.0025 |

| CSCO | 0.0062 | 0.0183 | 0.0077 | 0.0625 | 0.0187 | 0.0048 |

| KO | 0.0049 | 0.0415 | 0.0131 | 0.0275 | 0.0170 | 0.0197 |

| DOW | 0.0054 | 0.0230 | 0.0007 | 0.0487 | 0.0001 | 0.0106 |

| GS | 0.0609 | 0.0383 | 0.0039 | 0.0277 | 0.0019 | 0.0476 |

| HD | 0.0244 | 0.0464 | 0.0627 | 0.0306 | 0.0466 | 0.0678 |

| HON | 0.0215 | 0.0235 | 0.0112 | 0.0334 | 0.0202 | 0.0087 |

| IBM | 0.0324 | 0.0280 | 0.0234 | 0.0296 | 0.0172 | 0.0234 |

| INTC | 0.0116 | 0.0177 | 0.0093 | 0.0462 | 0.0298 | 0.0036 |

| JNJ | 0.0161 | 0.0153 | 0.0086 | 0.0418 | 0.0206 | 0.0043 |

| JPM | 0.0262 | 0.0186 | 0.0049 | 0.0278 | 0.0026 | 0.0221 |

| MCD | 0.0214 | 0.0703 | 0.0191 | 0.0412 | 0.0328 | 0.0316 |

| MRK | 0.0071 | 0.0239 | 0.0078 | 0.0338 | 0.0148 | 0.0081 |

| MSFT | 0.0113 | 0.0237 | 0.0120 | 0.0670 | 0.0253 | 0.0075 |

| NKE | 0.0067 | 0.0140 | 0.0128 | 0.0639 | 0.0342 | 0.0046 |

| PG | 0.0124 | 0.0208 | 0.0077 | 0.0226 | 0.0188 | 0.0055 |

| CRM | 0.0012 | 0.0093 | 0.0007 | 0.0235 | 0.0021 | 0.0024 |

| TRV | 0.0325 | 0.0050 | 0.0047 | 0.0327 | 0.0061 | 0.0025 |

| UNH | 0.0375 | 0.0203 | 0.0095 | 0.0181 | 0.0175 | 0.0068 |

| VZ | 0.0153 | 0.0361 | 0.0265 | 0.0232 | 0.0170 | 0.0303 |

| V | 0.0141 | 0.0173 | 0.0128 | 0.0451 | 0.0326 | 0.0042 |

| WBA | 0.0120 | 0.0215 | 0.0057 | 0.0250 | 0.0131 | 0.0074 |

| WMT | 0.0138 | 0.0191 | 0.0069 | 0.0214 | 0.0143 | 0.0057 |

| DIS | 0.0166 | 0.0194 | 0.0072 | 0.0251 | 0.0190 | 0.0044 |

| Financial Ratios | PIS | NIS |

|---|---|---|

| CR | 0.0839 | 0.0181 |

| DAR | 0.0050 | 0.0703 |

| DER | 0.0024 | 0.1233 |

| EPS | 0.0609 | 0.0012 |

| ROA | 0.0466 | 0.0001 |

| ROE | 0.2044 | 0.0007 |

| Company | Distance from the NIS | Distance from the PIS |

|---|---|---|

| MMM | 0.1281 | 0.1950 |

| AXP | 0.1111 | 0.2127 |

| AMGN | 0.1335 | 0.1940 |

| AAPL | 0.1311 | 0.1987 |

| BA | 0.2122 | 0.1458 |

| CAT | 0.1076 | 0.2133 |

| CVX | 0.1345 | 0.2216 |

| CSCO | 0.1383 | 0.2076 |

| KO | 0.1100 | 0.2131 |

| DOW | 0.1261 | 0.2199 |

| GS | 0.1021 | 0.2202 |

| HD | 0.1017 | 0.1739 |

| HON | 0.1284 | 0.2062 |

| IBM | 0.1170 | 0.1958 |

| INTC | 0.1377 | 0.2058 |

| JNJ | 0.1358 | 0.2072 |

| JPM | 0.1168 | 0.2160 |

| MCD | 0.1038 | 0.2074 |

| MRK | 0.1264 | 0.2132 |

| MSFT | 0.1373 | 0.2015 |

| NKE | 0.1439 | 0.2007 |

| PG | 0.1299 | 0.2141 |

| CRM | 0.1355 | 0.2252 |

| TRV | 0.1418 | 0.2120 |

| UNH | 0.1333 | 0.2097 |

| VZ | 0.1048 | 0.2001 |

| V | 0.1382 | 0.2019 |

| WBA | 0.1272 | 0.2162 |

| WMT | 0.1298 | 0.2154 |

| DIS | 0.1320 | 0.2128 |

| Company | Ranking | |

|---|---|---|

| MMM | 0.3965 | 10 |

| AXP | 0.3432 | 26 |

| AMGN | 0.4075 | 3 |

| AAPL | 0.3975 | 9 |

| BA | 0.5926 | 1 |

| CAT | 0.3353 | 28 |

| CVX | 0.3776 | 15 |

| CSCO | 0.3998 | 8 |

| KO | 0.3406 | 27 |

| DOW | 0.3644 | 23 |

| GS | 0.3168 | 30 |

| HD | 0.3690 | 22 |

| HON | 0.3838 | 13 |

| IBM | 0.3739 | 19 |

| INTC | 0.4008 | 6 |

| JNJ | 0.3960 | 11 |

| JPM | 0.3510 | 24 |

| MCD | 0.3335 | 29 |

| MRK | 0.3721 | 20 |

| MSFT | 0.4052 | 5 |

| NKE | 0.4175 | 2 |

| PG | 0.3775 | 16 |

| CRM | 0.3756 | 18 |

| TRV | 0.4007 | 7 |

| UNH | 0.3887 | 12 |

| VZ | 0.3437 | 25 |

| V | 0.4064 | 4 |

| WBA | 0.3703 | 21 |

| WMT | 0.3760 | 17 |

| DIS | 0.3827 | 14 |

| Optimal Portfolio | Value |

|---|---|

| Portfolio mean return | 0.0125 |

| Portfolio risk | 0.0375 |

| Portfolio performance ratio | 0.3347 |

| DJIA index return (Benchmark) | 0.0096 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liew, K.F.; Lam, W.S.; Lam, W.H. Financial Network Analysis on the Performance of Companies Using Integrated Entropy–DEMATEL–TOPSIS Model. Entropy 2022, 24, 1056. https://doi.org/10.3390/e24081056

Liew KF, Lam WS, Lam WH. Financial Network Analysis on the Performance of Companies Using Integrated Entropy–DEMATEL–TOPSIS Model. Entropy. 2022; 24(8):1056. https://doi.org/10.3390/e24081056

Chicago/Turabian StyleLiew, Kah Fai, Weng Siew Lam, and Weng Hoe Lam. 2022. "Financial Network Analysis on the Performance of Companies Using Integrated Entropy–DEMATEL–TOPSIS Model" Entropy 24, no. 8: 1056. https://doi.org/10.3390/e24081056

APA StyleLiew, K. F., Lam, W. S., & Lam, W. H. (2022). Financial Network Analysis on the Performance of Companies Using Integrated Entropy–DEMATEL–TOPSIS Model. Entropy, 24(8), 1056. https://doi.org/10.3390/e24081056