Spillover Network Features from the Industry Chain View in Multi-Time Scales

Abstract

:1. Introduction

2. Data and Methodology

2.1. Data

2.2. Methodology

2.2.1. Time Scale Decomposition by Maximal Overlap Discrete Wavelet Transformation (MODWT)

2.2.2. Spillover Relationship Estimation Using the GARCH-BEKK Model

2.2.3. Heterogeneous Spillover Network of an Industry Chain

3. Empirical Results and Discussion

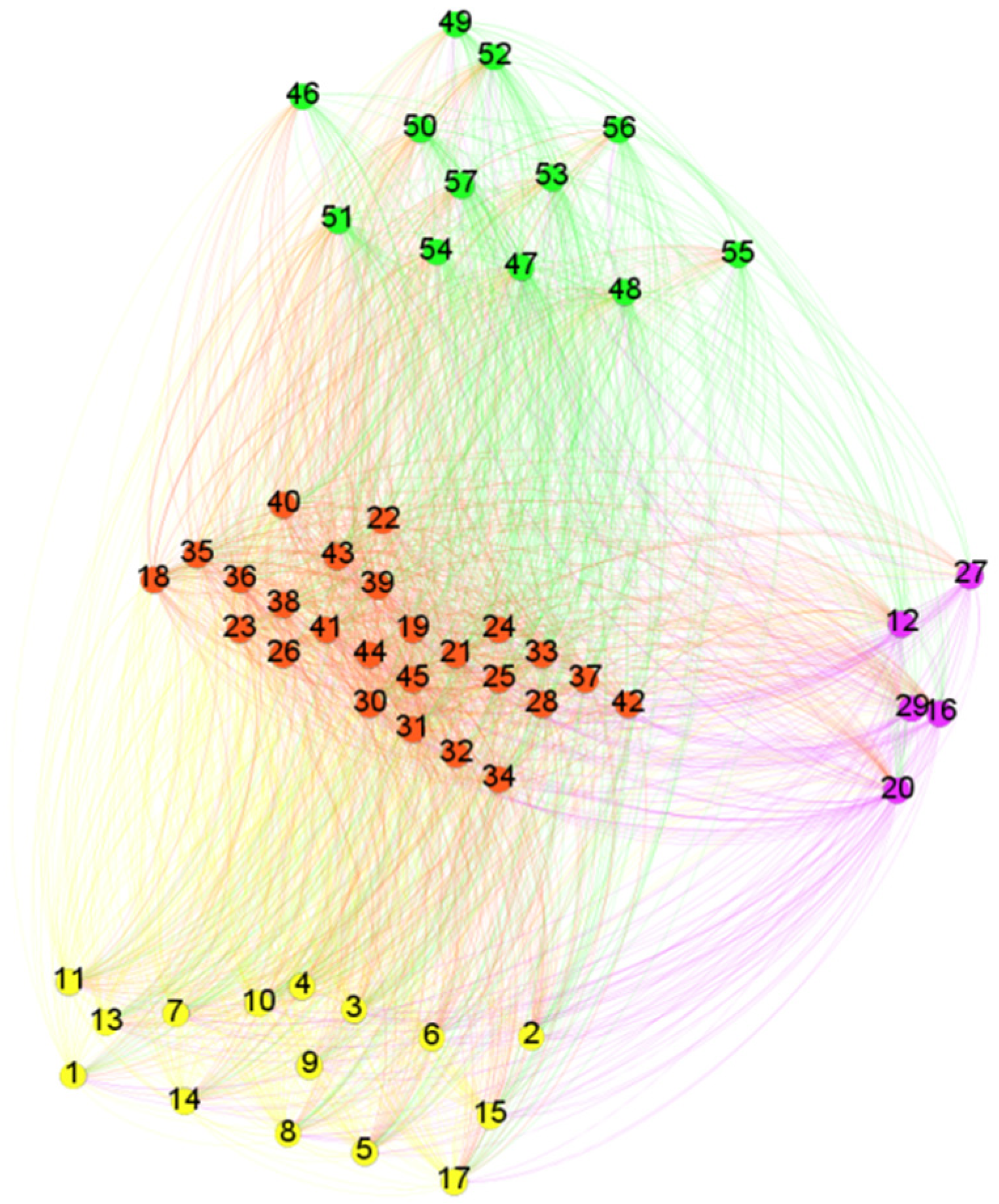

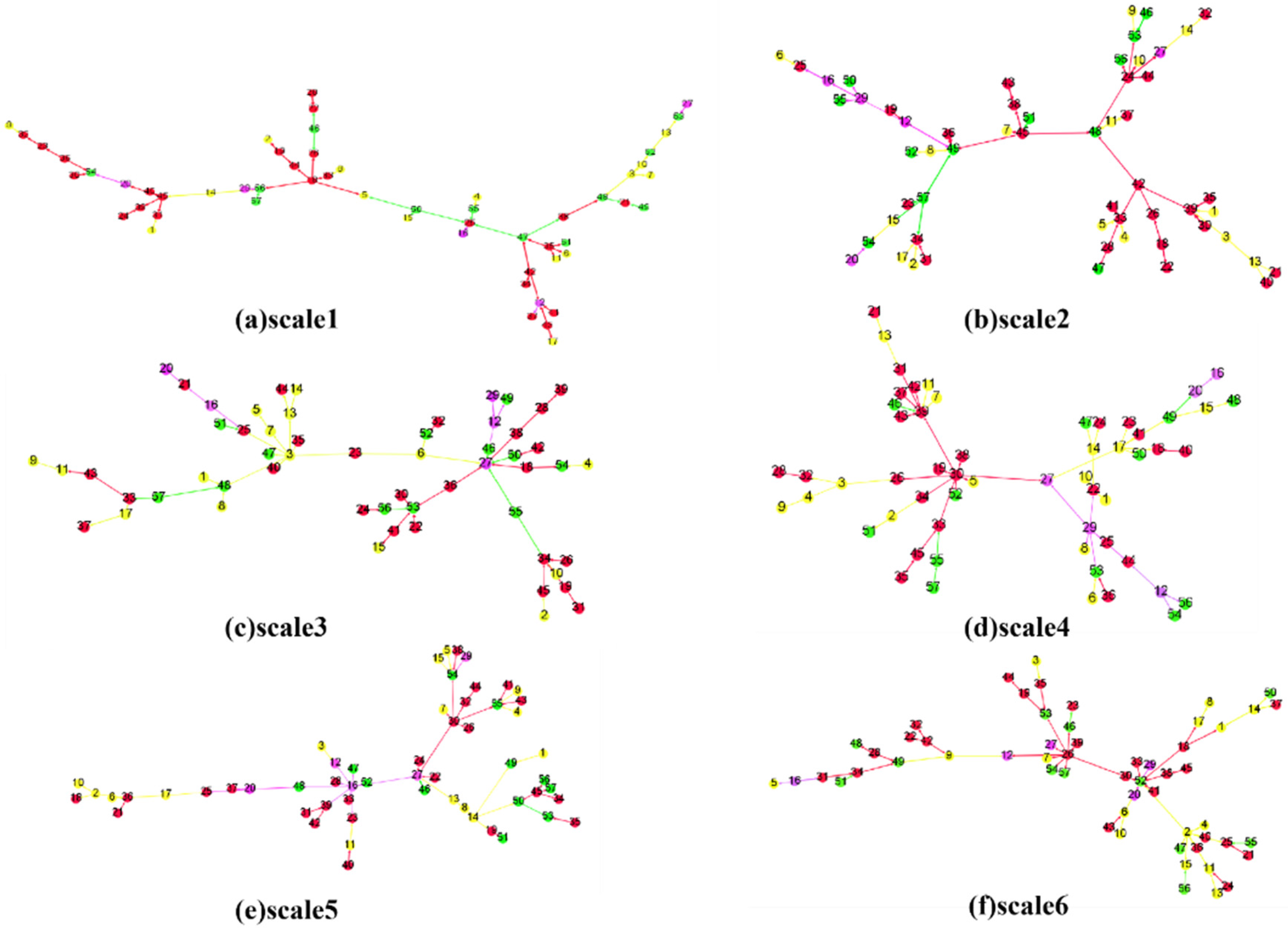

3.1. Overall Spillover Network Features on Distinct Time Scales

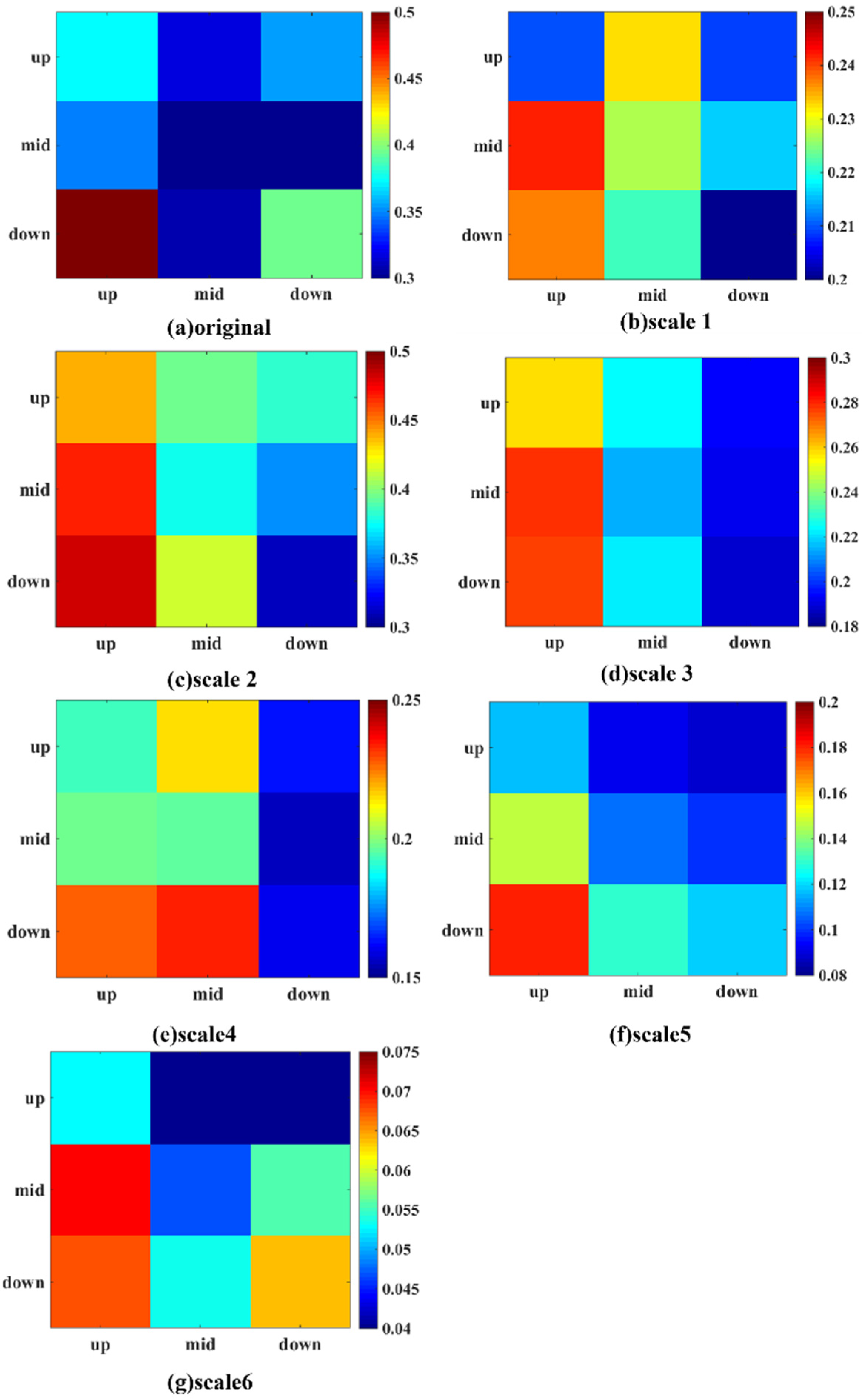

3.2. Influence between Two Links on Distinct Time Scales

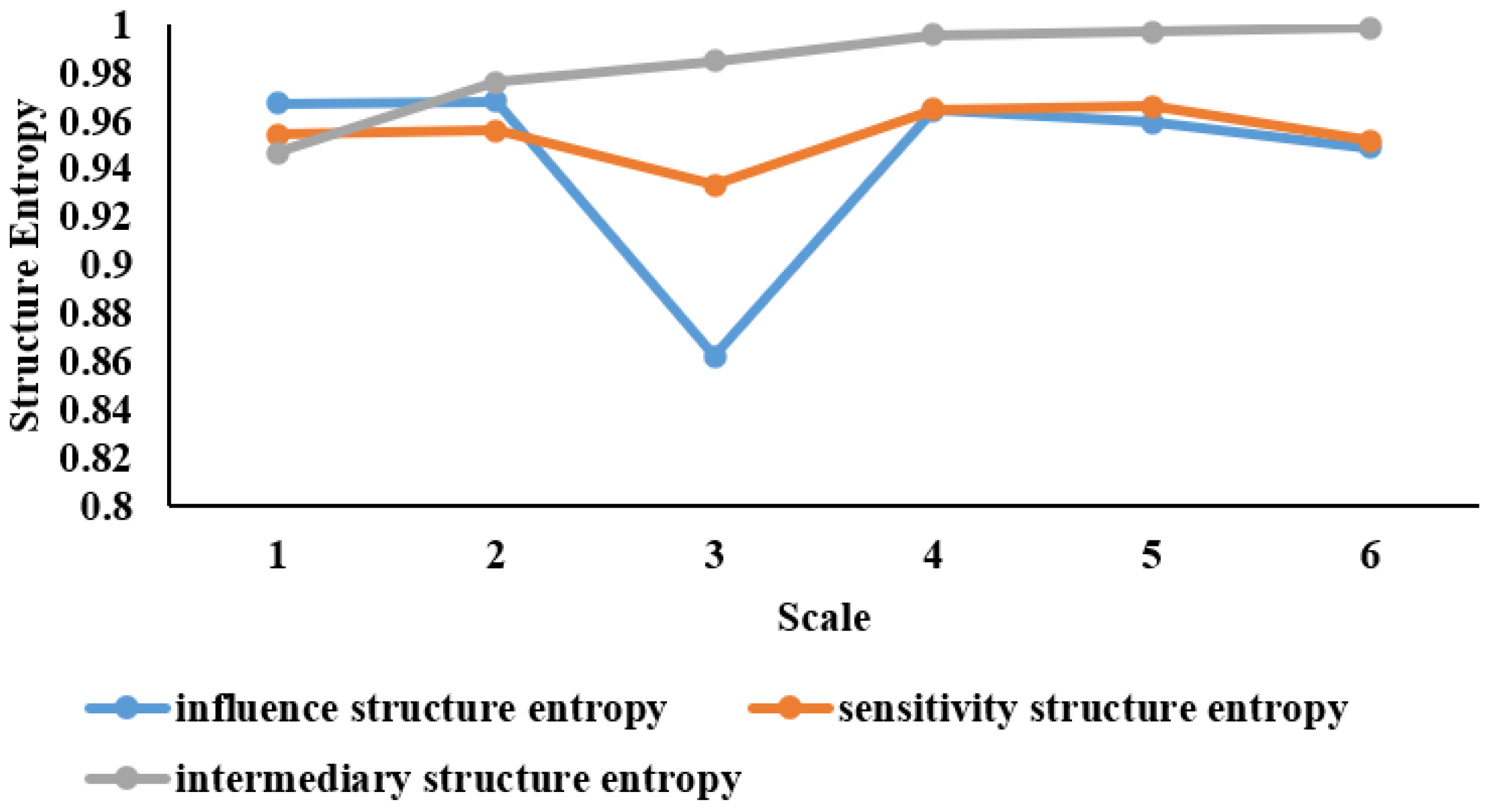

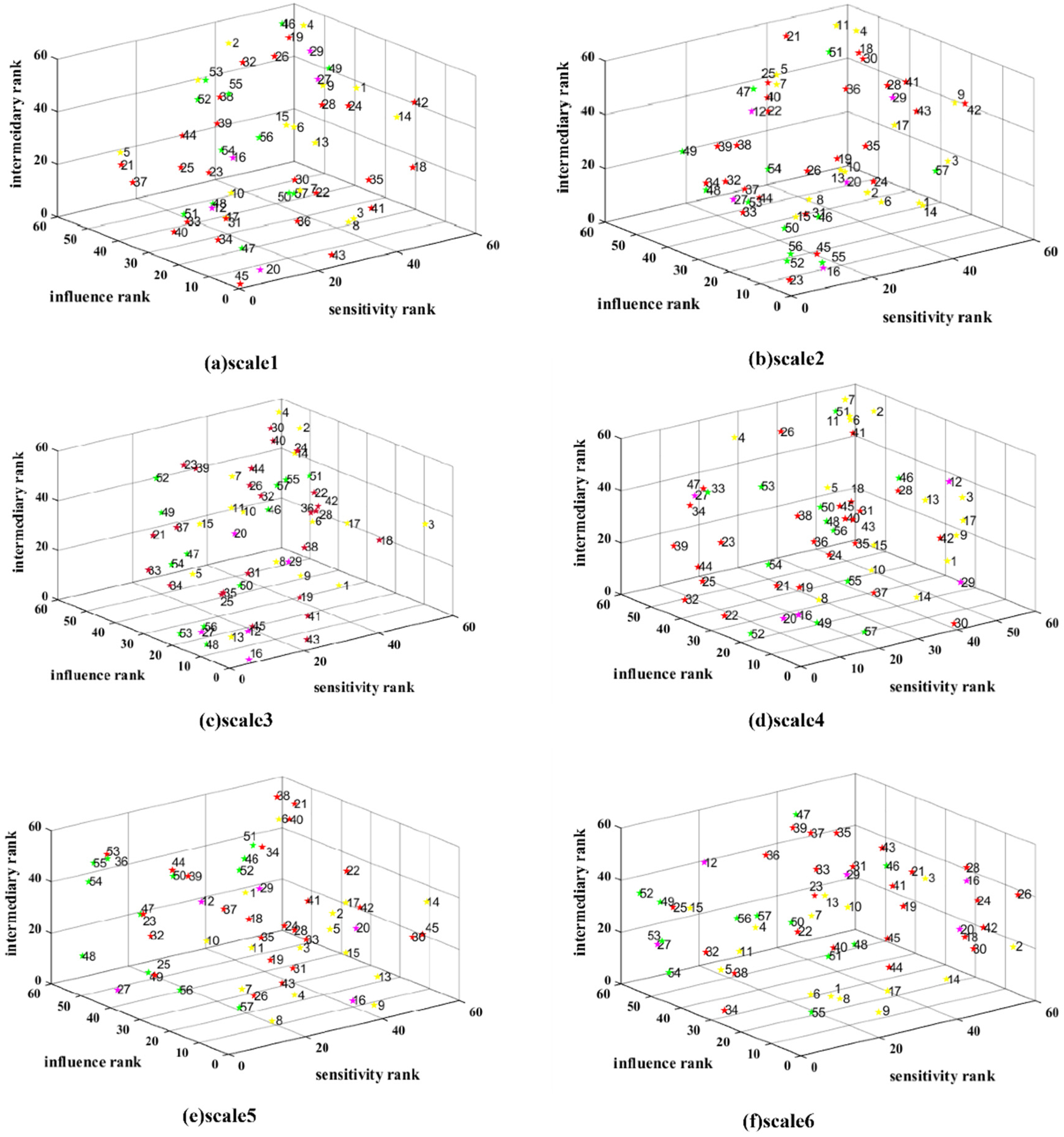

3.3. Influence, Sensitivity, and Intermediary of Stocks on Distinct Time Scales

3.4. Main Transmission Paths on Different Time Scales

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| ID | Name | Industry Chain Attribute | Stock Code |

|---|---|---|---|

| 1 | GGEC | downstream | 002045.SZ |

| 2 | BAOLI NEW | downstream | 300116.SZ |

| 3 | CAMEL GROUP | downstream | 601311.SH |

| 4 | DESAYBATTERY | downstream | 000049.SZ |

| 5 | GREAT POWER | downstream | 300438.SZ |

| 6 | TOPBAND | downstream | 002139.SZ |

| 7 | AUCKSUN | downstream | 002245.SZ |

| 8 | GXHT | downstream | 002074.SZ |

| 9 | VISION GROUP | downstream | 002733.SZ |

| 10 | SUNWODA | downstream | 300207.SZ |

| 11 | JIAWEI ENERGY | downstream | 300317.SZ |

| 12 | GANFENGLITHIUM | upstream & downstream | 002460.SZ |

| 13 | CATL | downstream | 300750.SZ |

| 14 | SMARTER ENERGY | downstream | 600869.SH |

| 15 | EVE | downstream | 300014.SZ |

| 16 | DFD | midstream & downstream | 002407.SZ |

| 17 | NARADA POWER SOURCE | downstream | 300068.SZ |

| 18 | JSGT | midstream | 002091.SZ |

| 19 | CAPCHEM | midstream | 300037.SZ |

| 20 | NBSS | up & mid & downstream | 600884.SH |

| 21 | TINCI | midstream | 002709.SZ |

| 22 | YONGTAI TECHNOLOGY | midstream | 002326.SZ |

| 23 | SHANDONG SHIDA SHENGHUA CHEMICAL GROUP | midstream | 603026.SH |

| 24 | ZJJH | midstream | 600160.SH |

| 25 | TONZE | midstream | 002759.SZ |

| 26 | FULIN PM | midstream | 300432.SZ |

| 27 | JIANGTE MOTOR | upstream & midstream | 002176.SZ |

| 28 | XTEMD | midstream | 002125.SZ |

| 29 | GEM | upstream & midstream | 002340.SZ |

| 30 | GHKJ | midstream | 002741.SZ |

| 31 | EASPRING | midstream | 300073.SZ |

| 32 | FENGYUAN | midstream | 002805.SZ |

| 33 | DYNANONIC | midstream | 300769.SZ |

| 34 | RONBAY TECHNOLOGY | midstream | 688005.SH |

| 35 | BEIT RUI | midstream | 835185.BJ |

| 36 | NATIONS | midstream | 300077.SZ |

| 37 | XFH | midstream | 300890.SZ |

| 38 | KEDA | midstream | 600499.SH |

| 39 | HNZK ELECTRIC | midstream | 300035.SZ |

| 40 | PUTAILAI | midstream | 603659.SH |

| 41 | SINOMATECH | midstream | 002080.SZ |

| 42 | GREAT SOUTHEAST | midstream | 002263.SZ |

| 43 | CANGZHOU MINGZHU | midstream | 002108.SZ |

| 44 | SENIOR | midstream | 300568.SZ |

| 45 | CHUANGXIN | midstream | 002812.SZ |

| 46 | ZANGGE MINING | upstream | 000408.SZ |

| 47 | SINOMINE | upstream | 002738.SZ |

| 48 | WEIHUA | upstream | 002240.SZ |

| 49 | YONGXING MATERIALS | upstream | 002756.SZ |

| 50 | YAHUA GROUP | upstream | 002497.SZ |

| 51 | ZHEJIANG TIANTIE INDUSTRY | upstream | 300587.SZ |

| 52 | TLC | upstream | 002466.SZ |

| 53 | YOUNGY | upstream | 002192.SZ |

| 54 | TMD | upstream | 000762.SZ |

| 55 | CTM | upstream | 600711.SH |

| 56 | HUAYOU COBALT | upstream | 603799.SH |

| 57 | HANRUI COBALT | upstream | 300618.SZ |

References

- Shi, Y.; Zheng, Y.; Guo, K.; Jin, Z.; Huang, Z. The Evolution Characteristics of Systemic Risk in China’s Stock Market Based on a Dynamic Complex Network. Entropy 2020, 22, 614. [Google Scholar] [CrossRef] [PubMed]

- Ji, Q.; Fan, Y. How does oil price volatility affect non-energy commodity markets? Appl. Energy 2012, 89, 273–280. [Google Scholar] [CrossRef]

- Strohsal, T.; Weber, E. Time-varying international stock market interaction and the identification of volatility signals. J. Bank. Financ. 2015, 56, 28–36. [Google Scholar] [CrossRef]

- Liu, X.; Jiang, C. Multi-scale features of volatility spillover networks: A case study of China’s energy stock market. Chaos 2020, 30, 033120. [Google Scholar] [CrossRef] [PubMed]

- Ben Abdallah, M.; Farkas, M.F.; Lakner, Z. Analysis of meat price volatility and volatility spillovers in Finland. Agric. Econ.-Zemed. Ekon. 2020, 66, 84–91. [Google Scholar] [CrossRef]

- Baumohl, E.; Kocenda, E.; Lyocsa, S.; Vyrost, T. Networks of volatility spillovers among stock markets. Phys. A-Stat. Mech. Appl. 2018, 490, 1555–1574. [Google Scholar] [CrossRef]

- Lv, Q.N.; Han, L.Y.; Wan, Y.P.; Yin, L.B. Stock Net Entropy: Evidence from the Chinese Growth Enterprise Market. Entropy 2018, 20, 805. [Google Scholar] [CrossRef]

- Feng, S.D.; Huang, S.P.; Qi, Y.B.; Liu, X.Y.; Sun, Q.R.; Wen, S.B. Network features of sector indexes spillover effects in China: A multi-scale view. Phys. A-Stat. Mech. Appl. 2018, 496, 461–473. [Google Scholar] [CrossRef]

- Geng, J.B.; Du, Y.J.; Ji, Q.; Zhang, D.Y. Modeling return and volatility spillover networks of global new energy companies. Renew. Sustain. Energy Rev. 2021, 135, 110214. [Google Scholar] [CrossRef]

- Zhang, P.P.; Sun, M.; Zhang, X.L.; Gao, C.X. Who are leading the change? The impact of China’s leading PV enterprises: A complex network analysis. Appl. Energy 2017, 207, 477–493. [Google Scholar] [CrossRef]

- Feng, S.D.; Li, H.J.; Qi, Y.B.; Jia, J.J.; Zhou, G.Q.; Guan, Q.; Liu, X.Y. Detecting the interactions among firms in distinct links of the industry chain by motif. J. Stat. Mech.-Theory Exp. 2019, 2019, 123403. [Google Scholar] [CrossRef]

- Jia, Y.J.; Ding, C.; Dong, Z.L. Transmission Mechanism of Stock Price Fluctuation in the Rare Earth Industry Chain. Sustainability 2021, 13, 12913. [Google Scholar] [CrossRef]

- Xu, Q.H.; Yan, H.Y.; Zhao, T.Y. Contagion effect of systemic risk among industry sectors in China’s stock market. N. Am. J. Econ. Financ. 2022, 59, 101576. [Google Scholar] [CrossRef]

- Qi, Y.J.; Li, H.J.; Liu, Y.X.; Feng, S.D.; Li, Y.; Guo, S. Granger causality transmission mechanism of steel product prices under multiple scales-The industrial chain perspective. Resour. Policy 2020, 67, 29. [Google Scholar] [CrossRef]

- Huang, S.P.; An, H.Z.; Huang, X.; Wang, Y. Do all sectors respond to oil price shocks simultaneously? Appl. Energy 2018, 227, 393–402. [Google Scholar] [CrossRef]

- Wang, X.X.; Xu, L.Y.; Yu, J.; Xu, H.Y.; Yu, X. Detection of correlation characteristics between financial time series based on multi-resolution analysis. Adv. Eng. Inform. 2019, 42, 101576. [Google Scholar] [CrossRef]

- Huang, S.P.; An, H.Z.; Gao, X.Y.; Huang, X. Identifying the multiscale impacts of crude oil price shocks on the stock market in China at the sector level. Phys. A-Stat. Mech. Appl. 2015, 434, 13–24. [Google Scholar] [CrossRef]

- Aloui, C.; Jammazi, R. Dependence and risk assessment for oil prices and exchange rate portfolios: A wavelet based approach. Phys. A-Stat. Mech. Appl. 2015, 436, 62–86. [Google Scholar] [CrossRef]

- Pascoal, R.; Monteiro, A.M. Market Efficiency, Roughness and Long Memory in PSI20 Index Returns: Wavelet and Entropy Analysis. Entropy 2014, 16, 2768–2788. [Google Scholar] [CrossRef]

- Liu, H.G.; Ji, P.; Jin, J. Intra-Day Trading System Design Based on the Integrated Model of Wavelet De-Noise and Genetic Programming. Entropy 2016, 18, 435. [Google Scholar] [CrossRef]

- Fernandez, V. Time-scale decomposition of price transmission in international markets. Emerg. Mark. Financ. Trade 2005, 41, 57–90. [Google Scholar] [CrossRef]

- Liu, X.Y.; Jiang, C. The dynamic volatility transmission in the multiscale spillover network of the international stock market. Phys. A-Stat. Mech. Appl. 2020, 560, 125144. [Google Scholar] [CrossRef]

- Engle, R.F.; Kroner, K.F. Multivariate Simultaneous Generalized ARCH. Econom. Theory 1995, 11, 122–150. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econom. Econom. Soc. 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Karali, B.; Ramirez, O.A. Macro determinants of volatility and volatility spillover in energy markets. Energy Econ. 2014, 46, 413–421. [Google Scholar] [CrossRef]

- Zhang, W.; Zhuang, X.; Lu, Y. Spatial spillover effects and risk contagion around G20 stock markets based on volatility network. N. Am. J. Econ. Financ. 2020, 51, 101064. [Google Scholar] [CrossRef]

- An, S.; Gao, X.; An, H.; An, F.; Sun, Q.; Liu, S. Windowed volatility spillover effects among crude oil prices. Energy 2020, 200, 117521. [Google Scholar] [CrossRef]

- Ferland, R.; Lalancette, S. Dynamics of realized volatilities and correlations: An empirical study. J. Bank. Financ. 2006, 30, 2109–2130. [Google Scholar] [CrossRef]

- Feng, S.; Magee, C.L. Technological development of key domains in electric vehicles: Improvement rates, technology trajectories and key assignees. Appl. Energy 2020, 260, 114264. [Google Scholar] [CrossRef]

- Blomgren, G.E. The development and future of lithium ion batteries. J. Electrochem. Soc. 2017, 164, A5019–A5025. [Google Scholar] [CrossRef]

- Huang, X.; An, H.Z.; Gao, X.Y.; Hao, X.Q.; Liu, P.P. Multiresolution transmission of the correlation modes between bivariate time series based on complex network theory. Phys. A-Stat. Mech. Appl. 2015, 428, 493–506. [Google Scholar] [CrossRef]

- Ghosh, I.; Jana, R.K.; Sanyal, M.K. Analysis of temporal pattern, causal interaction and predictive modeling of financial markets using nonlinear dynamics, econometric models and machine learning algorithms. Appl. Soft Comput. 2019, 82, 17. [Google Scholar] [CrossRef]

- Percival, D.B.; Walden, A.T. Wavelet Methods for Time Series Analysis; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Dajcman, S. Interdependence between some major European stock markets—A wavelet lead/lag analysis. Prague Econ. Pap. 2013, 22, 28–49. [Google Scholar] [CrossRef]

- Guo, S.; Li, H.J.; Feng, S.D.; Liu, X.Y.; Jiang, M.H. Correlations of stock price fluctuations under multi-scale and multi-threshold scenarios. Phys. A-Stat. Mech. Appl. 2018, 490, 1501–1512. [Google Scholar] [CrossRef]

- Weiping, Z.; Zhuang, X.; Dongmei, W. Spatial connectedness of volatility spillovers in G20 stock markets: Based on block models analysis. Financ. Res. Lett. 2020, 34, 101274. [Google Scholar] [CrossRef]

- Zhang, W.; Zhuang, X.; Lu, Y.; Wang, J. Spatial linkage of volatility spillovers and its explanation across G20 stock markets: A network framework. Int. Rev. Financ. Anal. 2020, 71, 101454. [Google Scholar] [CrossRef]

- Liu, X.; An, H.; Li, H.; Chen, Z.; Feng, S.; Wen, S. Features of spillover networks in international financial markets: Evidence from the G20 countries. Phys. A-Stat. Mech. Appl. 2017, 479, 265–278. [Google Scholar] [CrossRef]

- Zheng, W.; Yao, X.M. How to Measure a Two-Sided Market. Entropy 2021, 23, 962. [Google Scholar] [CrossRef]

- Zhou, C.; Guo, H.Y.; Cao, S.J. Gene Network Analysis of Alzheimer’s Disease Based on Network and Statistical Methods. Entropy 2021, 23, 1365. [Google Scholar] [CrossRef]

- Zhang, L.; Lu, J.; Fu, B.-B.; Li, S.-B. Dynamics analysis for the hour-scale based time-varying characteristic of topology complexity in a weighted urban rail transit network. Phys. A-Stat. Mech. Appl. 2019, 527, 121280. [Google Scholar] [CrossRef]

- Bai, J.; Fang, S.L.; Xu, X.; Tang, R.Z. LMPF: A novel method for bill of standard manufacturing services construction in cloud manufacturing. J. Manuf. Syst. 2022, 62, 402–416. [Google Scholar] [CrossRef]

- Huang, W.Q.; Yao, S.; Zhuang, X.T.; Yuan, Y. Dynamic asset trees in the US stock market: Structure variation and market phenomena. Chaos Solitons Fractals 2017, 94, 44–53. [Google Scholar] [CrossRef]

- Sensoy, A.; Tabak, B.M. Dynamic spanning trees in stock market networks: The case of Asia-Pacific. Phys. A-Stat. Mech. Appl. 2014, 414, 387–402. [Google Scholar] [CrossRef]

- Yang, C.X.; Shen, Y.; Xia, B.Y. Evolution of Shanghai stock market based on maximal spanning trees. Mod. Phys. Lett. B 2013, 27, 1350022. [Google Scholar] [CrossRef]

- Yang, C.X.; Zhu, X.S.; Li, Q.; Chen, Y.H.; Deng, Q.Q. Research on the evolution of stock correlation based on maximal spanning trees. Phys. A-Stat. Mech. Appl. 2014, 415, 1–18. [Google Scholar] [CrossRef]

- Dias, J. Spanning trees and the Eurozone crisis. Phys. A-Stat. Mech. Appl. 2013, 392, 5974–5984. [Google Scholar] [CrossRef]

- Kalyagin, V.A.; Koldanov, A.P.; Koldanov, P.A. Reliability of maximum spanning tree identification in correlation-based market networks. Phys. A Stat. Mech. Appl. 2022, 599, 127482. [Google Scholar] [CrossRef]

- Securities Times. Yunnan Energy New Material Co., Ltd. and Contemporary Amperex Technology Co., Limited Invested in the Construction of Battery Diaphragm Base Film Production Line; Securities Times: Shenzhen, China, 2022. [Google Scholar]

- Yin, Y.J.; Wang, Q.F. Leading Company in Solvent Invests Lithium Material to Create a Matrix of New Energy Products; Huaan Securities: Hefei, China, 2022. [Google Scholar]

- Shandong Shida Shenghua Chemical Group Co., Ltd. About Group. Available online: http://www.sinodmc.com/ (accessed on 25 July 2022).

- Mao, Z.; Yin, B.; Li, H.T. DFD (002407): The World’s Leading New Energy Battery Electrolyte Company Creates the Second Long Pole; Huaxin Securities: Shenzhen, China, 2022. [Google Scholar]

- Dynanonic. About Group. Available online: https://www.dynanonic.com/about.aspx (accessed on 26 June 2022).

- Yongxing Materials. About Group. Available online: https://www.yongxingbxg.com/index.php?ac=Article&at=List&tid=2 (accessed on 26 June 2022).

- Chengxin Lithium. About Group. Available online: https://www.cxlithium.com/company.html (accessed on 26 June 2022).

- Blivex. About Group. Available online: https://www.blivex.com/CompanyProfile/index.aspx (accessed on 26 June 2022).

- Flush Financial Research Center. Shengtun Mining: Copper, Cobalt and Nickel in the Company’s Main Business Can Be Used in the Field of Ternary Materials. Available online: http://yuanchuang.10jqka.com.cn/20211029/c633807131.shtml (accessed on 26 June 2022).

| Time Scale | Time Horizon (days) | |

|---|---|---|

| D1 | 2–4 | Short-Term |

| D2 | 4–8 | |

| D3 | 8–16 | Medium-Term |

| D4 | 16–32 | |

| D5 | 32–64 | Long-Term |

| D6 | 64–128 |

| Chain Attribute | Scale 1 | Scale 2 | Scale 3 | Scale 4 | Scale 5 | Scale 6 |

|---|---|---|---|---|---|---|

| Upstream | 12.2 | 22.6 | 11.0 | 10.3 | 4.9 | 2.3 |

| Midstream | 12.8 | 21.8 | 11.6 | 10.1 | 6.1 | 3.1 |

| Downstream | 12.1 | 22.8 | 11.8 | 12.2 | 7.4 | 3.4 |

| More than one link | 13.3 | 24.0 | 16.4 | 12.7 | 8.3 | 3.1 |

| Influence | ||||||

| Scale 1 | Scale 2 | Scale 3 | Scale 4 | Scale 5 | Scale 6 | |

| rank | ID | ID | ID | ID | ID | ID |

| 1 | 45 | 45 | 16 | 30 | 16 | 2 |

| 2 | 43 | 24 | 3 | 17 | 14 | 26 |

| 3 | 47 | 57 | 43 | 14 | 30 | 20 |

| Sensitivity | ||||||

| Scale 1 | Scale 2 | Scale 3 | Scale 4 | Scale 5 | Scale 6 | |

| rank | ID | ID | ID | ID | ID | ID |

| 1 | 45 | 33 | 27 | 32 | 27 | 52 |

| 2 | 5 | 48 | 53 | 39 | 54 | 53 |

| 3 | 47 | 49 | 48 | 34 | 53 | 15 |

| 55 | 9 | 36 | 2 | 7 | 45 | 2 |

| 56 | 24 | 4 | 14 | 9 | 22 | 42 |

| 57 | 4 | 30 | 4 | 2 | 21 | 26 |

| Intermediary | ||||||

| Scale 1 | Scale 2 | Scale 3 | Scale 4 | Scale 5 | Scale 6 | |

| rank | ID | ID | ID | ID | ID | ID |

| 1 | 45 | 23 | 16 | 52 | 7 | 34 |

| 2 | 20 | 55 | 43 | 30 | 8 | 5 |

| 3 | 43 | 46 | 48 | 22 | 9 | 17 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Feng, S.; Sun, Q.; Liu, X.; Xu, T. Spillover Network Features from the Industry Chain View in Multi-Time Scales. Entropy 2022, 24, 1108. https://doi.org/10.3390/e24081108

Feng S, Sun Q, Liu X, Xu T. Spillover Network Features from the Industry Chain View in Multi-Time Scales. Entropy. 2022; 24(8):1108. https://doi.org/10.3390/e24081108

Chicago/Turabian StyleFeng, Sida, Qingru Sun, Xueyong Liu, and Tianran Xu. 2022. "Spillover Network Features from the Industry Chain View in Multi-Time Scales" Entropy 24, no. 8: 1108. https://doi.org/10.3390/e24081108

APA StyleFeng, S., Sun, Q., Liu, X., & Xu, T. (2022). Spillover Network Features from the Industry Chain View in Multi-Time Scales. Entropy, 24(8), 1108. https://doi.org/10.3390/e24081108