Quality Information Disclosure and Blockchain Technology Adoption of Competitive Suppliers on the Third-Party E-Commerce Platform

Abstract

1. Introduction

2. Literature Review

2.1. Quality Information Disclosure

2.2. Blockchain Adoption in the Supply Chain Management

3. Problem Description and Model Setting

4. Decisions Under Different Blockchain Adoption Strategies

4.1. Neither Supplier Applies Blockchain Service (Scenario NN)

- (1)

- The equilibrium decisions of suppliers are:

- (2)

- The equilibrium profits of suppliers and the platform are:

- (1)

- ; ; ;

- (2)

- . There exists a threshold on , when , ; otherwise, .

4.2. One Supplier Applies Blockchain Service (Scenario )

- (1)

- For the supplier who applies blockchain service: ; there exists a threshold , when , , otherwise, ; ; ;

- (2)

- ; ; ; ;

- (3)

- ; .

4.3. Both Suppliers Apply Blockchain Service (Scenario )

- (1)

- ; ; ; ;

- (2)

- ; .

5. Blockchain Service Adoption Strategy and Discussion

5.1. Blockchain Service Adoption Strategy

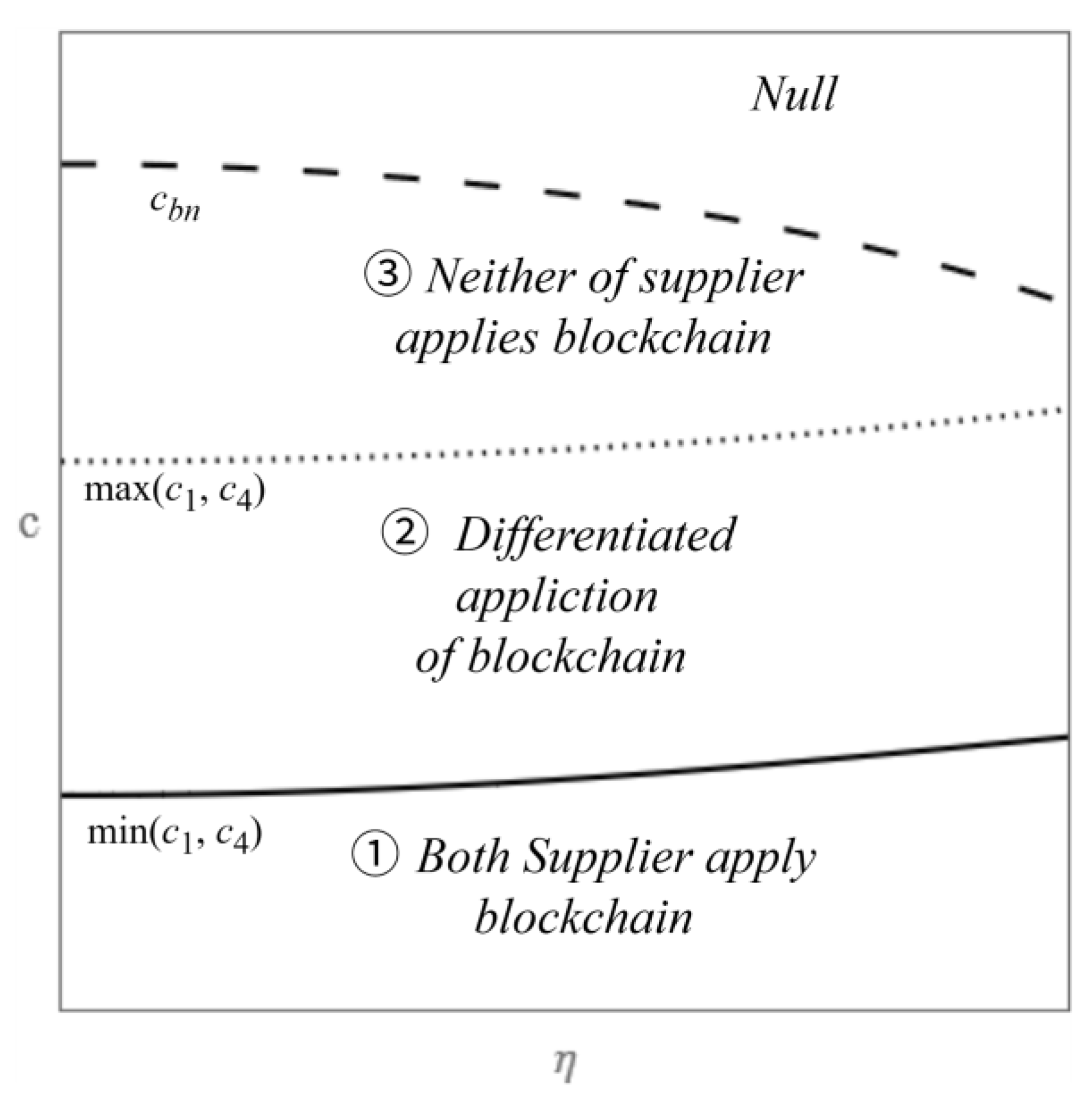

- (1)

- When , both suppliers apply blockchain service.

- (2)

- When , one supplier applies blockchain service.

- (3)

- When , neither of the suppliers applies blockchain service.

5.2. The Impact of Blockchain Adoption on the Quality Information Disclosure

- (1)

- Scenario - ScenarioFor supplier i who apply blockchain service: when , ; when , ;For supplier j who does not apply blockchain service: when , ; when , ;

- (2)

- Scenario - ScenarioWhen , ; when , ; where , .

5.3. The Impact of Blockchain Adoption on the Platform

- (1)

- When , . When , .

- (2)

- When , . When , .

- where and .

- (1)

- When , there exists a threshold , if , ; otherwise, .

- (2)

- When , there exists a threshold , if , ; otherwise, .

- (3)

- When , . Where and .

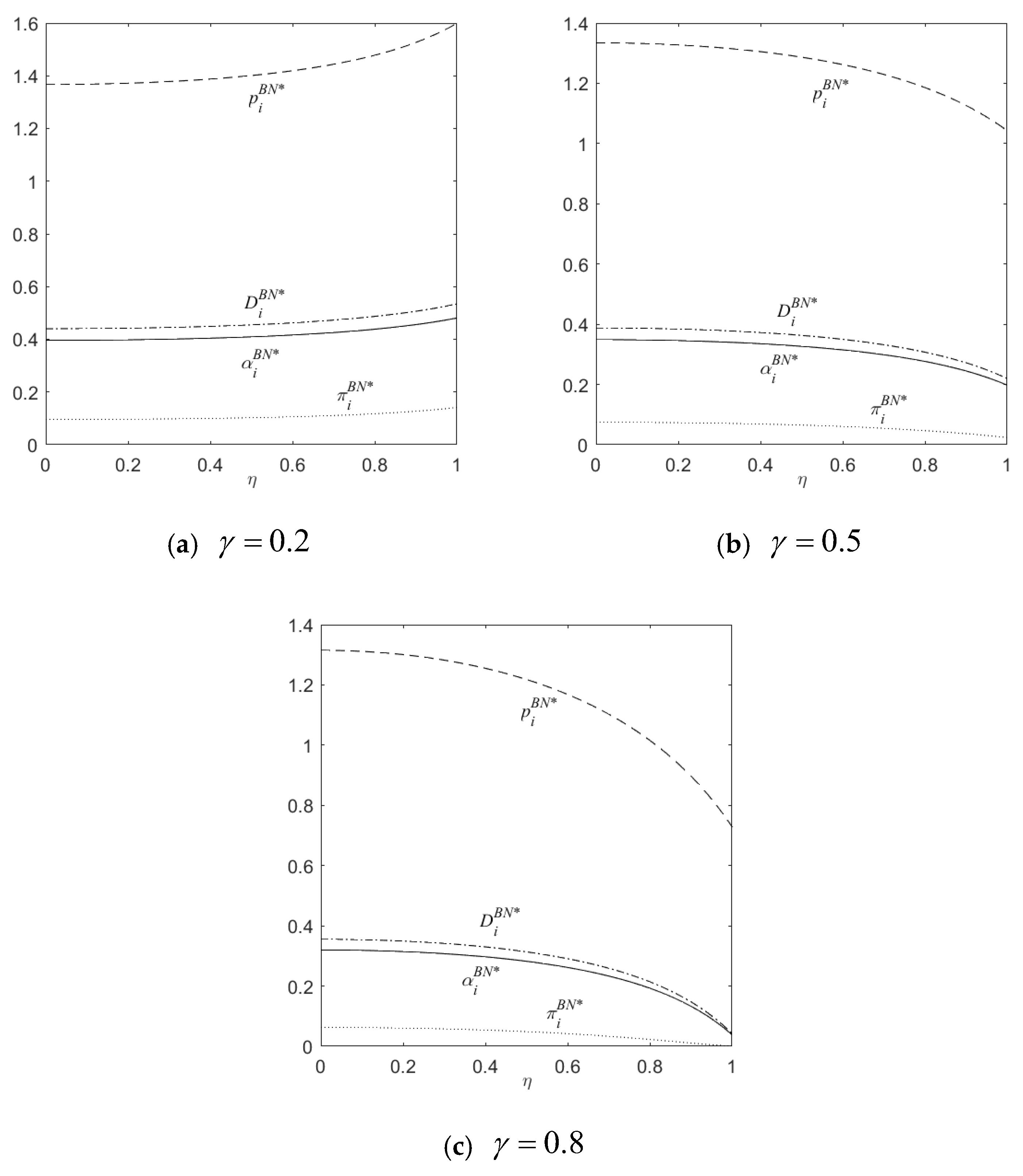

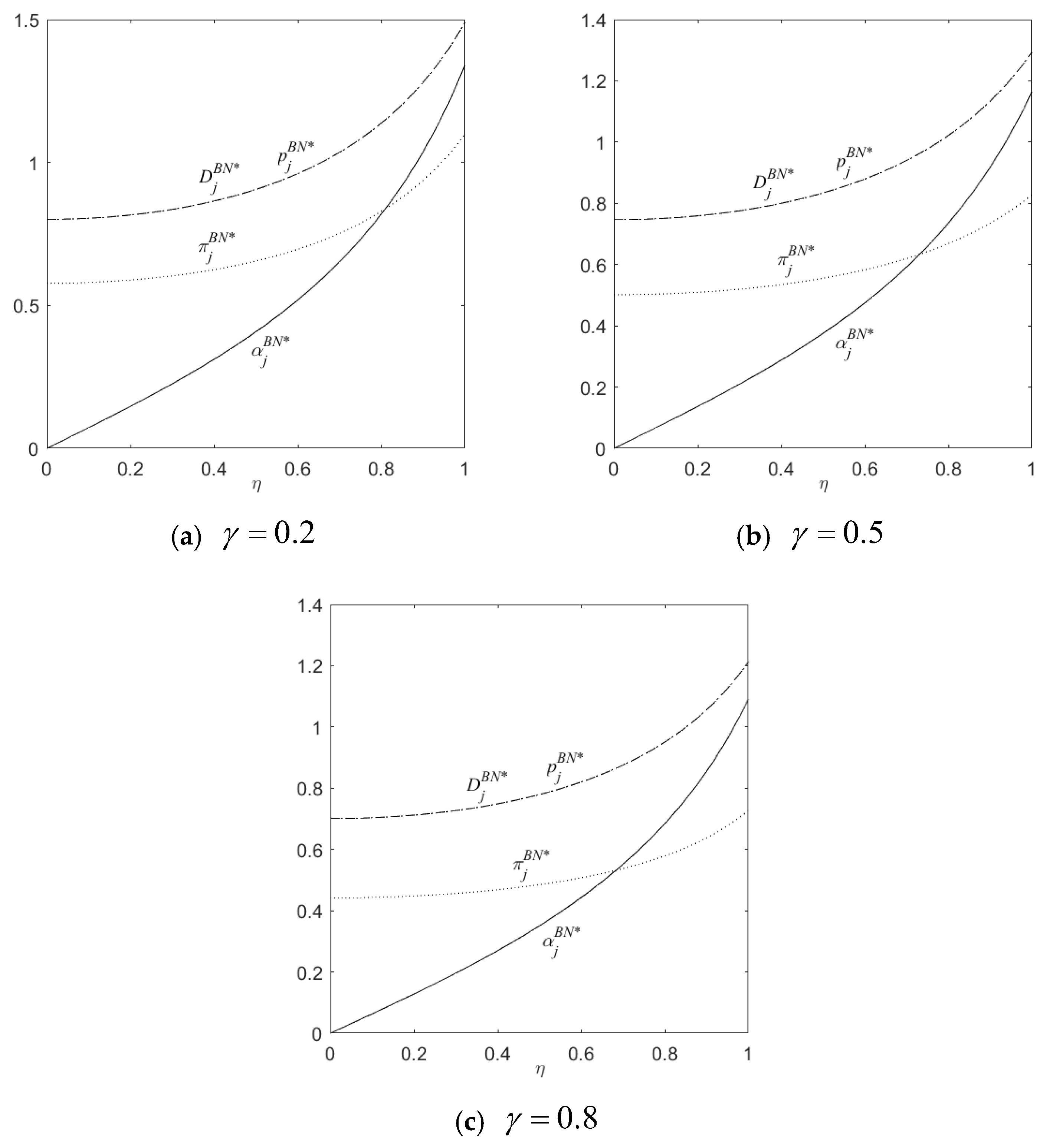

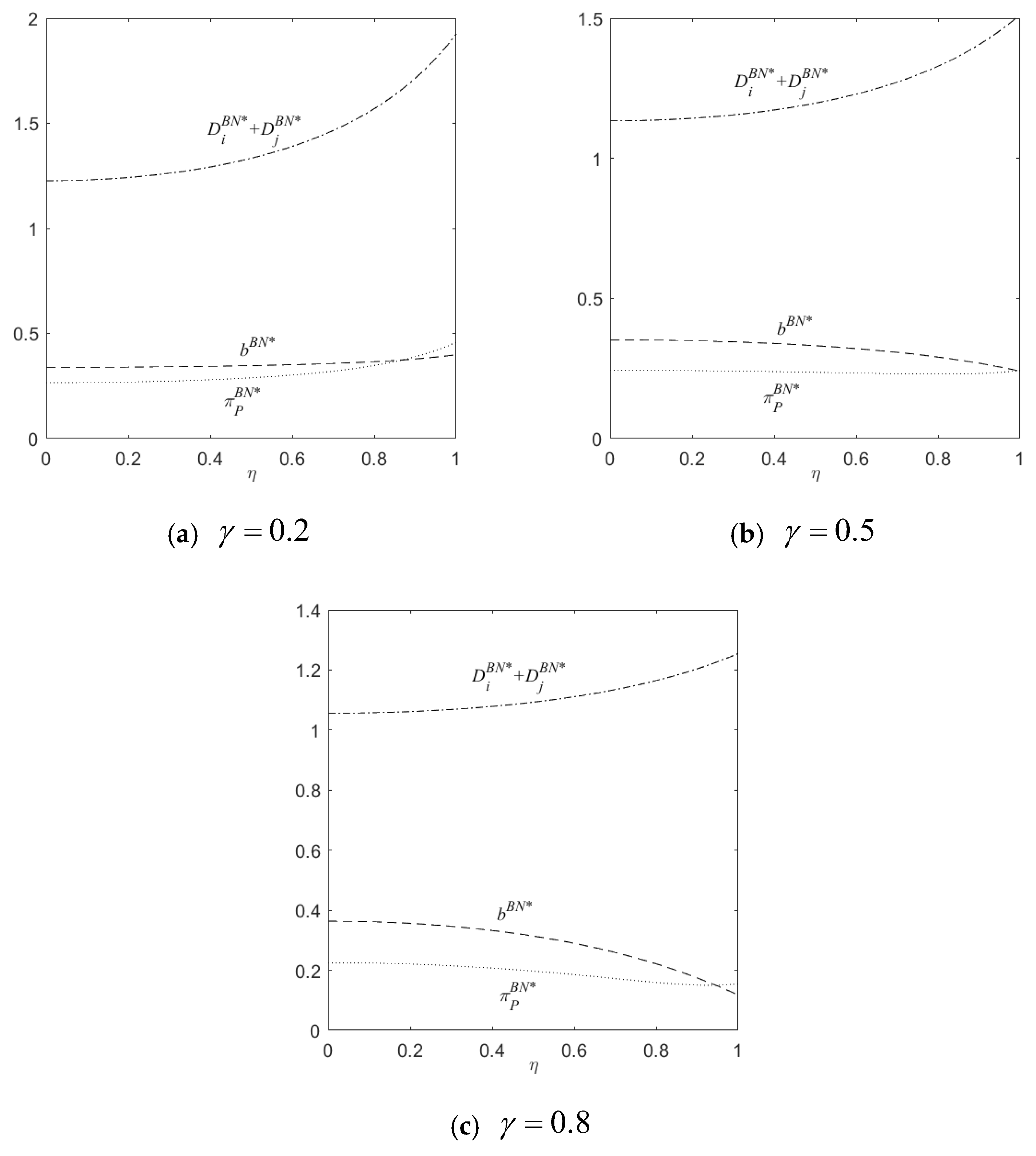

6. Numerical Analysis

7. Conclusions and Future Directions

7.1. Conclusions

7.2. Managerial Implications

7.3. Limitations and Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Basu, A.; Bhaskaran, S.; Mukherjee, R. An Analysis of Search and Authentication Strategies for Online Matching Platforms. Manag. Sci. 2019, 65, 2412–2431. [Google Scholar] [CrossRef]

- Li, W.; Zhang, Y.; Dan, B.; Zhang, X.; Sui, R. Simulation Modeling and Analysis on the Value-Added Service of the Third-Party E-Commerce Platform Supporting Multi-Value Chain Collaboration. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 846–862. [Google Scholar] [CrossRef]

- Deloitte. Using Blockchain to Drive Supply Chain Transparency. 2023. Available online: https://www2.deloitte.com/us/en/pages/operations/articles/blockchain-supply-chain-innovation.html (accessed on 15 May 2025).

- Li, J.; Wang, X.; Li, L.; Zhao, D. Using Blockchain Technology to Combat Counterfeits: The Optimal Pricing Scheme of Two Competitive Platforms. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 3253–3282. [Google Scholar] [CrossRef]

- Allied Analytics LLP. Blockchain in Supply Chain Traceability Solutions Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component, by Deployment Mode, by Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2024–2032. 2024. Available online: https://www.alliedmarketresearch.com/blockchain-in-supply-chain-traceability-solutions-market-A324170 (accessed on 15 May 2025).

- Wang, J. Quality Screening and Information Disclosure in Two-Sided Markets. Econ. Lett. 2018, 171, 183–188. [Google Scholar] [CrossRef]

- Fan, X.; Cheng, T.C.E.; Li, G. Opaque or Transparent: Quality Disclosure Strategy for Accommodation-Sharing Platforms. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 414–438. [Google Scholar] [CrossRef]

- Du, S.; Peng, X.; Nie, T.; Zhu, Y. Information Disclosure and Pricing in the Online Expert Service Platform. J. Oper. Res. Soc. 2024, 75, 1663–1680. [Google Scholar] [CrossRef]

- Xu, Q.; He, Y. Optimal Information Disclosure Strategies for a Retail Platform in the Blockchain Technology Era. Int. J. Prod. Res. 2023, 61, 3781–3792. [Google Scholar] [CrossRef]

- Huang, J.; Xu, B.; Yan, X. Selling Mode Choice and Blockchain Adoption in an E-Commerce Platform with Information Disclosure. Electron. Commer. Res. Appl. 2023, 62, 101331. [Google Scholar] [CrossRef]

- Wang, Y.-Y.; Tao, F.; Wang, J. Information Disclosure and Blockchain Technology Adoption Strategy for Competing Platforms. Inf. Manag. 2022, 59, 103506. [Google Scholar] [CrossRef]

- Hong, X.; Zhou, M.; Gong, Y.; Chen, W. Quality Information Disclosure and Advertising Strategy in a Supply Chain. Int. J. Prod. Res. 2023, 61, 6291–6307. [Google Scholar] [CrossRef]

- Sun, F.; Yang, H.; Chen, J.; Wang, F. Disclosure of Quality Preference-Revealing Information in a Supply Chain with Competitive Products. Ann. Oper. Res. 2023, 329, 689–715. [Google Scholar] [CrossRef]

- Tong, Y.; Li, L.; Yang, D.; Jiang, X. Impacts of Online Intermediary’s Platform Openness under Asymmetric Quality Information. Transp. Res. Part E Logist. Transp. Rev. 2023, 173, 103090. [Google Scholar] [CrossRef]

- Wang, Z.; Lei, X.; Ran, L.; Ye, S.; Yang, D. Interaction between Channel Characteristics and Quality Disclosure. Comput. Ind. Eng. 2023, 183, 109451. [Google Scholar] [CrossRef]

- Wu, J.; Lu, W.; Ji, X. The Interactions between Upstream Quality Disclosure and Downstream Entry. Eur. J. Oper. Res. 2023, 309, 545–559. [Google Scholar] [CrossRef]

- Guo, L. Quality Disclosure Formats in a Distribution Channel. Manag. Sci. 2009, 55, 1513–1526. [Google Scholar] [CrossRef]

- Guan, X.; Chen, Y.-J. The Interplay between Information Acquisition and Quality Disclosure. Prod. Oper. Manag. 2017, 26, 389–408. [Google Scholar] [CrossRef]

- Feng, Z.; Xiao, T.; Yu, Y.; Robb, D.J. Quality Disclosure Strategy in a Decentralized Supply Chain with Consumer Returns. Int. Trans. Oper. Res. 2020, 27, 2139–2156. [Google Scholar] [CrossRef]

- Guo, L.; Zhao, Y. Voluntary Quality Disclosure and Market Interaction. Mark. Sci. 2009, 28, 488–501. [Google Scholar] [CrossRef]

- Zhao, M.; Dong, C.; Cheng, T.C.E. Quality Disclosure Strategies for Small Business Enterprises in a Competitive Marketplace. Eur. J. Oper. Res. 2018, 270, 218–229. [Google Scholar] [CrossRef]

- Lan, Y.; Peng, J.; Wang, F.; Gao, C. Quality Disclosure with Information Value under Competition. Int. J. Mach. Learn. & Cyber. 2018, 9, 1489–1503. [Google Scholar] [CrossRef]

- Guan, X.; Wang, Y. Quality Disclosure in a Competitive Environment with Consumer’s Elation and Disappointment. Omega 2022, 108, 102586. [Google Scholar] [CrossRef]

- Pun, H.; Swaminathan, J.M.; Hou, P. Blockchain Adoption for Combating Deceptive Counterfeits. Prod. Oper. Manag. 2021, 30, 864–882. [Google Scholar] [CrossRef]

- Zhang, Q.; Li, Y.; Hou, P.; Wang, J. Price Signal or Blockchain Technology? Quality Information Disclosure in Dual-Channel Supply Chains. Eur. J. Oper. Res. 2024, 316, 126–137. [Google Scholar] [CrossRef]

- Xu, X.; Chen, J.; Liu, S.; Yu, Y.; Cheng, T.C.E. Should a Manufacturer Adopt Blockchain When Its Competitor Discloses Blockchain-Enabled Product Quality Information? Int. J. Prod. Res. 2025; Online ahead of print. [Google Scholar] [CrossRef]

- Klöckner, M.; Schmidt, C.G.; Wagner, S.M. When Blockchain Creates Shareholder Value: Empirical Evidence from International Firm Announcements. Prod. Oper. Manag. 2022, 31, 46–64. [Google Scholar] [CrossRef]

- Franke, B.; Fritz, Q.G.; Stenzel, A. The (Limited) Power of Blockchain Networks for Information Provision. Manag. Sci. 2023, 70, 971–990. [Google Scholar] [CrossRef]

- Hu, S.; Lu, J.; Jin, Y. Can Price Still Be an Honest Signal of Products’ Quality?—A Perspective of Blockchain Adoption. Comput. Ind. Eng. 2024, 189, 109945. [Google Scholar] [CrossRef]

- Tao, F.; Wang, Y.-Y.; Zhu, S.-H. Impact of Blockchain Technology on the Optimal Pricing and Quality Decisions of Platform Supply Chains. Int. J. Prod. Res. 2023, 61, 3670–3684. [Google Scholar] [CrossRef]

- Ji, G.; Zhou, S.; Lai, K.-H.; Tan, K.H.; Kumar, A. Timing of Blockchain Adoption in a Supply Chain with Competing Manufacturers. Int. J. Prod. Econ. 2022, 247, 108430. [Google Scholar] [CrossRef]

- Zhang, Y.; Liu, N. Blockchain Adoption in Serial Logistics Service Chain: Value and Challenge. Int. J. Prod. Res. 2023, 61, 4374–4401. [Google Scholar] [CrossRef]

- Ma, D.; Shao, W.; Zhang, K.; Hu, J. Marketplace, Wholesale or Hybrid: Considering the Role of Blockchain Implementation in Countering Consumer Mistrust. Electron. Commer. Res. 2025; Online ahead of print. [Google Scholar] [CrossRef]

- Li, Z.; Liu, A.; Li, J.; Xiong, J.; Lu, H. Manufacturer Encroachment Strategies and Decision Timing Considering the Product Traceability Preferences under E-Commerce. Manag. Decis. Econ. 2023, 44, 4041–4067. [Google Scholar] [CrossRef]

- Zhou, Z.; Liu, X.; Zhong, F.; Shi, J. Improving the Reliability of the Information Disclosure in Supply Chain Based on Blockchain Technology. Electron. Commer. Res. Appl. 2022, 52, 101121. [Google Scholar] [CrossRef]

- Song, Y.; Liu, J.; Zhang, W.; Li, J. Blockchain’s Role in e-Commerce Sellers’ Decision-Making on Information Disclosure under Competition. Ann. Oper. Res. 2023, 329, 1009–1048. [Google Scholar] [CrossRef]

- Li, Z.; Xu, X.; Bai, Q.; Chen, C. Optimal Joint Decision of Information Disclosure and Ordering in a Blockchain-Enabled Luxury Supply Chain. Ann. Oper. Res. 2023, 329, 1263–1314. [Google Scholar] [CrossRef]

- Zhang, H.; Lou, Z.; Hou, F. Incentive for Blockchain Technology Adoption in an Online Platform-based Co-opetitive Supply Chain. Comput. Ind. Eng. 2024, 194, 110323. [Google Scholar] [CrossRef]

- Zhou, Y.; Fu, Y.; Wang, K.; Min, J.; Zhang, X. Competition in the Online Platform: Impacts of Blockchain Technology Adoption. Int. Trans. Oper. Res. 2024, 31, 4105–4127. [Google Scholar] [CrossRef]

- Xu, B.; Li, H.; Zhang, X.; Alejandro, T.B. Equilibrium Blockchain Adoption Strategies for Duopolistic Competitive Platforms with Network Effects. J. Bus. Res. 2023, 164, 113953. [Google Scholar] [CrossRef]

| Notations | Definition |

|---|---|

| The amount of quality information disclosure | |

| The productive service or product price of the supplier | |

| Cross-information sensitivity | |

| Cross-price sensitivity | |

| Reliability of the quality information | |

| Platform’s proportional commissions | |

| Platform’s blockchain service fee | |

| Unit blockchain cost for the supplier | |

| Fixed blockchain cost for the platform | |

| Market demand for the productive service or product | |

| Profit of supply chain members | |

| Subscripts | |

| The supplier on the e-commerce platforms for manufacturing | |

| The e-commerce platforms for manufacturing | |

| Superscripts | |

| Neither supplier applies blockchain service | |

| One supplier applies blockchain service | |

| Both suppliers apply blockchain service |

| Price Decisions | Information Disclosure Decisions | Profits | |

|---|---|---|---|

| Supplier | |||

| Supplier | |||

| Platform | Null |

| Price Decisions | Information Disclosure Decisions | Profits | |

|---|---|---|---|

| Supplier (Supplier ) | |||

| Platform | Null |

| Scenarios | Supplier | Conditions | Profit Comparison |

|---|---|---|---|

| Scenario BN-NN | Supplier | ||

| Supplier | |||

| Scenario BB-BN | Supplier | ||

| Supplier | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, S.; Zhang, X.; Wang, B.; Dan, B. Quality Information Disclosure and Blockchain Technology Adoption of Competitive Suppliers on the Third-Party E-Commerce Platform. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 127. https://doi.org/10.3390/jtaer20020127

Zhang S, Zhang X, Wang B, Dan B. Quality Information Disclosure and Blockchain Technology Adoption of Competitive Suppliers on the Third-Party E-Commerce Platform. Journal of Theoretical and Applied Electronic Commerce Research. 2025; 20(2):127. https://doi.org/10.3390/jtaer20020127

Chicago/Turabian StyleZhang, Shengming, Xumei Zhang, Bo Wang, and Bin Dan. 2025. "Quality Information Disclosure and Blockchain Technology Adoption of Competitive Suppliers on the Third-Party E-Commerce Platform" Journal of Theoretical and Applied Electronic Commerce Research 20, no. 2: 127. https://doi.org/10.3390/jtaer20020127

APA StyleZhang, S., Zhang, X., Wang, B., & Dan, B. (2025). Quality Information Disclosure and Blockchain Technology Adoption of Competitive Suppliers on the Third-Party E-Commerce Platform. Journal of Theoretical and Applied Electronic Commerce Research, 20(2), 127. https://doi.org/10.3390/jtaer20020127