Abstract

The convergence of blockchain and metaverse technologies is poised to redefine how Global Value Chains (GVCs) create, capture, and distribute value, yet scholarly insight into their joint impact remains scattered. Addressing this gap, the present study aims to clarify where, how, and under what conditions blockchain-enabled transparency and metaverse-enabled immersion enhance GVC performance. A systematic literature review (SLR), conducted according to PRISMA 2020 guidelines, screened 300 articles from ABI Global, Business Source Premier, and Web of Science records, yielding 65 peer-reviewed articles for in-depth analysis. The corpus was coded thematically and mapped against three theoretical lenses: transaction cost theory, resource-based view, and network/ecosystem perspectives. Key findings reveal the following: 1. digital twins anchored in immersive platforms reduce planning cycles by up to 30% and enable real-time, cross-border supply chain reconfiguration; 2. tokenized assets, micro-transactions, and decentralized finance (DeFi) are spawning new revenue models but simultaneously shift tax triggers and compliance burdens; 3. cross-chain protocols are critical for scalable trust, yet regulatory fragmentation—exemplified by divergent EU, U.S., and APAC rules—creates non-trivial coordination costs; and 4. traditional IB theories require extension to account for digital-capability orchestration, emerging cost centers (licensing, reserve backing, data audits), and metaverse-driven network effects. Based on these insights, this study recommends that managers adopt phased licensing and geo-aware tax engines, embed region-specific compliance flags in smart-contract metadata, and pilot digital-twin initiatives in sandbox-friendly jurisdictions. Policymakers are urged to accelerate work on interoperability and reporting standards to prevent systemic bottlenecks. Finally, researchers should pursue multi-case and longitudinal studies measuring the financial and ESG outcomes of integrated blockchain–metaverse deployments. By synthesizing disparate streams and articulating a forward agenda, this review provides a conceptual bridge for international business scholarship and a practical roadmap for firms navigating the next wave of digital GVC transformation.

1. Introduction

Digitalization has entered a phase where convergent general-purpose technologies—notably blockchain and the metaverse—are beginning to reshape how value is created, captured, and distributed across global value chains (GVCs). Blockchain provides the secure, tamper-evident infrastructure required for fine-grained traceability and automated settlement [1,2], while metaverse platforms add an immersive layer that collapses geographical distance and enables real-time co-creation among globally dispersed actors [3,4]. Taken together, these technologies promise a shift from cost-driven optimization toward data-rich, experience-centric GVCs that foreground transparency, resilience, and customer engagement [5,6].

1.1. Limitations of the Extant Literature

The scholarly conversation, however, remains fragmented along the following three fault lines:

- Siloed treatment of blockchain and the metaverse. Most studies examine either chain-of-custody applications of blockchain (e.g., [7]) or metaverse use cases in marketing and training [8], leaving their joint orchestration in GVCs largely unexplored [4].

- Lack of empirical evidence on enterprise-scale integration. Conceptual pieces and pilot anecdotes dominate existing work; systematic evidence on performance outcomes—inventory turns, lead-time compression, ESG impact—remains scant [9,10].

- Under-specified governance and policy context. Rapidly evolving regulation (data localization, crypto-asset licensing, virtual-goods taxation) is often acknowledged only in passing, yet fundamentally conditions adoption decisions and cross-border scalability [1].

These gaps impede theory-building and managerial guidance. Without integrated frameworks and comparative evidence, firms and policymakers lack clear road maps for harnessing the combined potential of blockchain-enabled traceability and metaverse-enabled collaboration.

1.2. Purpose and Contributions of This Study

To address these shortcomings, we conducted the first systematic literature review (SLR) that explicitly crosses the three streams—blockchain, metaverse, and GVCs—and evaluated their intersection points. Screening 65 peer-reviewed articles from ABI Global, Business Source Premier, and Web of Science (PRISMA 2020 protocol), we carried out the following steps:

- Mapped the thematic landscape and identified where current research clusters (e.g., NFT provenance, digital twins, DeFi logistics) interact and do not interact.

- Identified five research gaps that persist after a decade of digital supply chain scholarship, ranging from token-based micro-monetization to cross-chain governance.

- Derived a testable agenda using five research questions (RQ1–RQ5) that link technological affordances to internalization choices, supply chain coordination, new monetization logic, cross-chain participation, and international standards.

- Advanced theory by revisiting transaction cost theory, the resource-based view, and network perspectives through a blockchain–metaverse lens, specifying how new digital capabilities (e.g., tokenized assets, immersive co-design) reconfigure classic IB constructs.

- Offered actionable insight for practitioners via comparative regulatory analysis and documented enterprise cases demonstrating measurable efficiency and resilience gains.

By stitching together these contributions, this article fills the empirical and conceptual void at the heart of the digital-GVC debate: it shows that blockchain and the metaverse can interact and how—and under which boundary conditions—their integration delivers verifiable value at scale.

1.3. Article Structure

Section 2 reviews foundational concepts and situates the study within extant theory. Section 3 details the SLR methodology and presents descriptive trends. Section 4 synthesizes the findings of the five RQs, integrating illustrative enterprise evidence and regulatory contrasts. Section 5 concludes with theoretical implications, managerial guidance, and a forward-looking research agenda.

2. Literature Review

2.1. Blockchain and Value Creation in GVCs

Integrating blockchain technology (BT) into GVCs has increasingly attracted scholarly and industry attention as firms seek to enhance global operations’ transparency, efficiency, and security [2,11]. Blockchain’s decentralized, immutable ledger is widely regarded as a transformative instrument for addressing long-standing challenges in GVCs, including trust deficits, information asymmetry, and inefficient data flow. Through its real-time, tamper-evident documentation capacity, blockchain ensures that all actors have immediate access to reliable, verified information.

Recent studies emphasize the alliance of blockchain with Internet of Things (IoT) devices, enabling seamless data collection, verification, and sharing across geographically dispersed supply chain partners [12,13]. For instance, [12] demonstrate how blockchain enhances the interoperability of IoT systems, thereby improving data flow and real-time decision-making in manufacturing and logistics. [14] provide evidence of blockchain’s effectiveness in agricultural supply chains, where it alleviates issues of information asymmetry through secure and transparent record-keeping. Beyond transparency, [15] highlight that blockchain technologies can reduce paperwork and administrative overheads, streamlining the management of complex value chain activities.

A recurring theme in the literature is blockchain’s scalability to GVCs. As supply chains grow in complexity and interconnectivity, scalable digital infrastructure becomes integral to maintaining operational resilience. Blockchain’s inherent design allows networks to handle increasing volumes of transactions without compromising on validation speed or security [12]. This scalability is crucial for multinational enterprises (MNEs) operating in volatile environments, where real-time coordination across multiple stakeholders is key to mitigating disruptions [7].

Blockchain also provides powerful tools for integrating sustainability principles into GVCs. By offering immutable records of environmental and social impacts, firms can monitor compliance with Sustainable Development Goals (SDGs) and circular economy objectives [7,16]. For instance, in the agricultural and textile sectors, blockchain-enabled systems can trace products from origin to end-consumption, verifying ethical sourcing and reducing carbon footprints [6]. These verifiable records help firms and regulators enforce environmental standards, aligning GVC operations with broader societal goals of responsible production and consumption [17].

Security challenges—from data tampering to cyberattacks—remain critical concerns in global supply chains. Blockchain mitigates these risks through decentralized validation, cryptographic hashing, and smart contract mechanisms [2,12]. Modifications are highly visible once data are recorded on a blockchain, reducing the scope for malicious activities. Nevertheless, questions remain regarding data governance and equitable value distribution among GVC actors, especially in systems where control over node participation and protocol updates may be concentrated [18].

Finally, [7] underscore how blockchain builds resilient value chains by enhancing visibility and enabling proactive risk management. Blockchain, coupled with smart contracts, automates transactional procedures (e.g., payments and quality checks) and expedites dispute resolution, further boosting the adaptability and efficiency of GVCs. This resilience becomes a competitive advantage for firms operating in dynamic global markets, where geopolitical, climatic, or pandemic-related disruptions can significantly impact the continuity of supply chain operations.

2.2. Blockchain in the Metaverse

Blockchain adoption is equally transformative in the metaverse, a rapidly expanding digital ecosystem that supports virtual worlds, social interactions, and economic transactions [4,6]. The metaverse reliance on shared virtual spaces, digital assets, and immersive experiences necessitates robust governance mechanisms, where trust and transparency become foundational. Using blockchain, value creation processes can be streamlined, ensuring that each transaction or asset transfer involving digital goods, NFTs, or virtual currency is securely recorded and indisputably tracked [19].

Ref. [6] elaborate on how blockchain mitigates metaverse-specific issues such as identity theft, unauthorized transactions, and illicit data manipulation. Meanwhile, [18] explore sustainable entrepreneurship in these virtual economies, demonstrating how blockchain-enabled decentralization fosters new business models characterized by equitable governance and resource use. Their findings show that effective metaverse frameworks integrate physical and virtual assets while maintaining sustainability commitments, a factor considered essential for long-term corporate viability in digital economies.

The evolution of Non-Fungible Tokens (NFTs) and other blockchain-based digital assets underscores the technology’s pivotal role in validating ownership, provenance, and transfer rights within the metaverse. This tokenization directly applies to GVCs, especially in scenarios where intangible assets (e.g., intellectual property, design prototypes) require secure, real-time tracking [20]. By extending the capabilities of traditional GVCs into virtual spaces, blockchain enables innovative forms of collaboration, co-creation, and multi-stakeholder engagement that transcend geographical constraints [4].

However, the metaverse also introduces unique security risks, including Distributed Denial of Service (DDoS) attacks and hacking attempts targeted at digital asset exchanges [18]. Researchers emphasize the importance of establishing new cybersecurity standards and robust data governance policies as metaverse platforms mature. Such measures are vital to safeguarding individual users, multinational enterprises, and small- and medium-sized enterprises (SMEs) that leverage the metaverse for global trade. [20] highlight how these technological shifts could decentralize traditional “linear” value chains, offering consumers and producers direct interfaces for co-creating products and reshaping global commerce.

2.3. Challenges in Blockchain and Metaverse and GVC Integration

Despite the promise of blockchain and metaverse convergence, significant barriers remain. These obstacles can be broadly divided into (1) the tension between anonymity and transparency in digital transactions and (2) the challenges related to digital transformation and sustainability in complex, globalized value chains [10,17].

Anonymity vs. Transparency: A core feature that has historically made virtual environments appealing is user anonymity. However, as [10] cautioned, anonymity can enable illicit activities such as fraud, money laundering, and tax evasion if not tightly regulated. Payment methods like prepaid cards and unverified wallets can circumvent standard checks and balances, posing critical challenges to integrating blockchain solutions in GVCs where verifiable and transparent data records are paramount [8]. Consequently, robust KYC (Know Your Customer) and CDD (Customer Due Diligence) protocols are necessary to maintain the integrity of GVC processes facilitated by blockchain.

Digital Transformation and Sustainability: Blockchain’s immutable ledger aligns with the resource-based view (RBV), which identifies resources that are valuable, rare, inimitable, and non-substitutable (VRIN) as sources of sustained competitive advantage [21]. When applied to GVCs, blockchain can function as a VRIN resource, offering unprecedented transparency and real-time visibility that reduce transaction costs and enhance stakeholder trust [12]. Moreover, the technology’s potential to track and report environmental impacts directly supports firms’ sustainability goals, particularly when complemented by IoT and artificial intelligence [16].

Research increasingly emphasizes the metaverse role in facilitating digital transformation within GVCs. [20] reveal how virtual environments enable real-time communication, collaborative product design, and efficient R&D processes, streamlining complex global operations. Digital twins—virtual replicas of physical supply chain processes—allow firms to simulate scenarios, reduce inefficiencies, and minimize resource consumption, aligning operational performance with sustainability imperatives [8]. Argue that metaverse-driven innovation can accelerate time-to-market cycles and enhance responsiveness to consumer trends, a crucial advantage in hypercompetitive industries [22].

Collectively, these advancements underscore the metaverse transformative potential for GVC integration. By merging blockchain’s strengths in security and transparency with immersive virtual environments, firms can reconfigure their value chains for heightened resilience, sustainability, and collaborative innovation [23]. However, tensions between privacy needs and regulatory demands persist, highlighting the necessity for coherent international standards that support secure, transparent digital transactions without stifling innovation [10,17].

2.4. Research Questions (RQs)

In a systematic literature review, well-crafted research questions are the foundation for a rigorous and insightful analysis of existing knowledge. They direct the search for relevant literature and shape the analytical framework by ensuring precision, clarity, and relevance. To maximize their effectiveness, research questions must be specific, well-defined, and empirically answerable, facilitating a comprehensive understanding of the current state of research within the field [24]. The primary research questions (RQs) for this study are as follows:

RQ1—How Does Metaverse Platformization Reconfigure Internalization Choices in Global Value Chains?

RQ2—What Is the Strategic Impact of Digital Twin Integration on Metaverse-Enabled Supply Chain Coordination?

RQ3—How Do Microtransactions, Barter, and New Monetization Models Reshape Value Creation and Distribution in Metaverse Commerce?

RQ4—In What Ways Do Cross-Chain Protocols and Blockchain Standards Enhance—or Hinder—MNE and SME Participation in Metaverse-Based GVCs?

RQ5—How Do Evolving Metaverse Technologies Prompt a Reassessment of Traditional IB Theories and the Need for Standardization?

This review is guided by carefully formulated research questions that explore the intersection of blockchain and metaverse indicators and their role in GVCs. Addressing these questions will yield critical insights into how technological advancements and GVCs imperatives reshape industrial ecosystems, informing academic discourse and practical applications.

3. Methodology

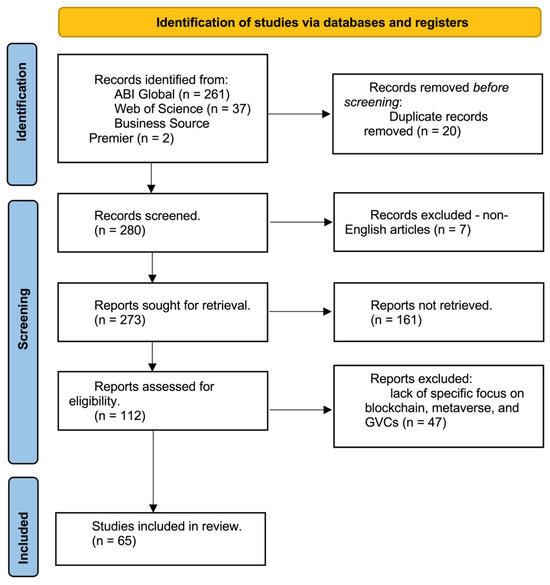

The research methodology involved a systematic literature review that was in full compliance with the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) 2020 guidelines [25] to investigate the intersection of blockchain technology, the metaverse, and their integration within GVCs. The detailed search strategy, inclusion/exclusion criteria, and stepwise filtering process, including identification, screening, eligibility assessment, and inclusion phases, were transparently documented according to PRISMA guidelines (as shown in Figure 1). The review protocol was not pre-registered. This approach is consistent with best practices for literature reviews in emerging technological fields, as outlined by previous studies on digital transformation in value chains (e.g., [26,27]). The review process was structured around developing specific search strings, followed by a multi-step filtering process to ensure relevance, quality, and focus on the research questions.

Figure 1.

PRISMA 2020 flow diagram (Source: [25]).

Transparent and pre-defined inclusion and exclusion criteria were established before screening to guide the selection process. These criteria specified the conditions a study must meet to be included in the review (e.g., relevance to the research topic, publication type, language) and the conditions under which a study would be excluded (e.g., lack of relevance, duplicate publication, non-English language). The reviewers applied these criteria consistently throughout the title and abstract screening and full-text eligibility assessment phases, ensuring that decisions about study inclusion were made objectively and uniformly, thereby minimizing the potential for subjective bias in the selection of studies for this review.

3.1. Search Strategy

The literature search was conducted across three major databases: ABI Global, Business Source Premier, and Web of Science. These databases were chosen for their comprehensive coverage of business, value chain, and technology-related research [28]. The search strings were designed to capture a broad range of studies exploring the following concepts:

- Blockchain in GVCs: “Blockchain” AND “Global Value Chains”, “Distributed Ledger Technology” AND “Value Chain Management”, and “Blockchain Technology”. Blockchain has been identified as a transformative force in value chains [29].

- Metaverse in GVCs: “Metaverse” AND “Global Value Chains”, “Virtual Reality” AND “Value Chain Networks”, and “Immersive Virtual Environments” AND “International Value Chains”. Recent studies suggest that the metaverse could revolutionize how value chains are modeled, monitored, and optimized through immersive environments [4].

- Integration Blockchain and Metaverse: “Blockchain” AND “Metaverse” AND “Global Value Chains”, “Distributed Ledger Technology” AND “Virtual Reality” AND “Value Chain Management”. This aligns with emerging discussions on how these two technologies can synergize to enhance both the virtual representation of physical supply chains and the management of digital assets [30].

Extended searches on sustainability and efficiency in GVCs within these technologies used the following search strings:

- “Blockchain” AND “Metaverse” AND “Sustainability” AND “Global Value Chains”. Blockchain’s ability to ensure transparency can significantly contribute to sustainability efforts in GVCs [26].

- “Blockchain” AND “Metaverse” AND “Efficiency” AND “Global Value Chains”. The combination of blockchain’s traceability and the metaverse’s immersive data environments is expected to enhance operational efficiency [27].

3.2. Filtering Process

A total of 300 articles were initially retrieved from ABI Global (261), Business Source Premier (2), and Web of Science (37). Following standard review protocols [31], 20 duplicate records were removed. Next, 7 non-English articles were excluded to ensure linguistic accessibility for the research team. Subsequently, a title-based relevance screening of the remaining 273 articles was conducted, yielding 161 shortlisted studies through a focused selection strategy emphasizing blockchain, metaverse, and global value chains [27]. A detailed examination of abstracts and content further refined this set to 65 articles (See Figure 1). The final corpus thus provides a robust and comprehensive foundation for analyzing current scholarship at the intersection of blockchain, metaverse, and global value chains.

3.3. Data Analysis

The selected articles were subjected to qualitative content analysis, an approach widely used in technology management studies to extract themes from textual data [32]. The focus was on identifying patterns and themes related to the integration of blockchain and metaverse technologies in GVCs, with particular emphasis on operational efficiency, sustainability practices, and their potential impact on the structure and management of GVCs [28].

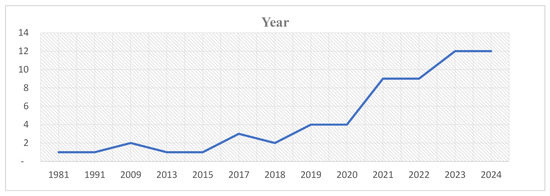

Publication Year: The increasing academic interest in blockchain and metaverse reflects a broader shift towards digital transformation in global trade and supply chain management. The sharp rise in publications during recent years, as shown in Figure 2, especially post-2020, aligns with the acceleration of digitalization due to the pandemic, which forced industries to explore decentralized and virtual solutions. However, while the literature highlights the transformative potential of these technologies, it remains critical to scrutinize their practical implementation. Many studies emphasize theoretical benefits but lack empirical validation, particularly regarding blockchain’s scalability and regulatory challenges or the metaverse’s integration into business ecosystems. Furthermore, ethical and environmental concerns, such as the high energy consumption of blockchain networks and the social implications of metaverse-based economies, require deeper investigation.

Figure 2.

Publication by years/source: Author’s own work.

Analysis of the papers: The analysis of the papers (shown in Table 1) highlights that research on these topics is dispersed across multiple academic disciplines. The main themes reflect a mix of technological innovation (e.g., blockchain, smart contracts), business transformation (e.g., digitalization, e-commerce models), and strategic concerns (e.g., platform ecosystems, value creation). Leading authors cited in the table include scholars from both business and technology backgrounds, suggesting a growing interdisciplinary approach to studying these emerging technologies. However, closer scrutiny reveals some inconsistencies. For instance, while blockchain and metaverse research are discussed, they remain distinct in application—blockchain focuses on secure transactions and decentralized networks and in contrast, the metaverse emphasizes virtual interactions and digital economies. This imbalance could indicate a need for more precise research frameworks that clarify how and when these technologies intersect meaningfully rather than grouping them simply because they are both part of digital innovation trends.

Table 1.

Paper analysis.

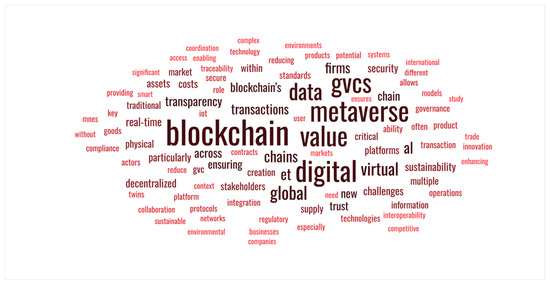

Word Cloud: The Word Cloud analysis (Figure 3) of selected papers highlights key concepts in the intersection of blockchain, the metaverse, and GVCs, with dominant terms such as blockchain, metaverse, digital, value, data, GVCs, and virtual indicating the central themes of decentralization, digital transformation, and technological integration in global trade and business networks. Words like security, transparency, transactions, smart contracts, interoperability, and governance suggest a focus on blockchain’s role in enhancing trust and efficiency in supply chains. At the same time, terms such as virtual environments, platforms, AI, and digital assets indicate the metaverse’s growing relevance in shaping digital economies and business operations. The presence of sustainability, regulatory, and environmental highlights concerns about these technologies’ long-term impact and governance challenges.

Figure 3.

Word Cloud/source: Author’s own work.

4. Discussion

4.1. The Metaverse and the Future of Global Value Chains (RQ1)

Reframing Internalization with Digital Platforms: Internalization theory traditionally highlights how multinational enterprises (MNEs) prefer to retain certain activities “in-house” to exploit and protect their firm-specific advantages (FSAs)—notably proprietary technologies, intellectual property, and tacit knowledge [40,41]. Building on these classic ideas, the new internalization theory expands the focus to include country-specific advantages (CSAs). This means that an MNE’s success often depends on how effectively it can coordinate its own FSAs with each host country’s distinctive resources and market conditions [33].

These dynamics become more complex in the metaverse because key knowledge assets—such as AI-driven design, VR/AR-enhanced manufacturing insights, and real-time supply chain intelligence—must be embedded in digital platforms that span multiple national borders. Traditional methods of protecting and exploiting knowledge, such as licensing or in-house R&D centers, may no longer suffice when users, suppliers, and partners can interact instantaneously online. Moreover, platformization [42] offers new ways to reduce market-entry costs and accelerate global expansion—for both global giants and smaller “born-digital” firms—by enabling more flexible partnerships and collaborations.

However, with these new opportunities come heightened challenges in safeguarding proprietary know-how. Collaborating in virtual ecosystems can inadvertently expose sensitive intellectual property to a broader network of users or third-party developers. Thus, MNEs must strike a delicate balance: leveraging the open, borderless connectivity of metaverse platforms to tap into diverse talents and local advantages while ensuring appropriate governance structures so that their FSAs are not diluted or misappropriated.

The Metaverse reframes internalization theory by raising new questions about the costs and benefits of retaining knowledge in-house versus sharing it with external partners. Firms must consider not only market imperfections and transaction costs in the physical world but also digital risks and uncertainties—including data breaches, IP leakage, and platform dependency. As a result, internalization choices evolve to include virtual platform alliances, digital ecosystems, and co-creation communities that can amplify FSAs while remaining attuned to local market conditions and user demands.

Digital Twins and Data-Driven Coordination: Global value chains increasingly rely on real-time data to plan and manage everything from raw material procurement to final product distribution [43]. This reliance on data has paved the way for digital twins—virtual replicas of physical operations—to bridge the gap between the physical and digital worlds. Digital twins take on an even more significant role in the metaverse era, providing unprecedented visibility and fine-grained control over complex international supply chains.

For instance, the Port of Rotterdam (Netherlands) has announced plans to create a digital twin by 2030 [44,45]. Real-time feeds from hydrological sensors, AIS vessel tracking, and meteorological stations already allow harbour masters to simulate berth occupancy and tidal windows, cutting unplanned vessel waiting time by an estimated 20% and laying the foundation for autonomous tug operations. Because every stakeholder—terminal operator, pilot, dredging contractor—interacts inside the same virtual domain, rescheduling decisions propagate instantly through the chain, reducing knock-on delays far beyond the port gate.

Meanwhile, companies like Merck and Mercedes-Benz (in Stuttgart, Baden-Württemberg, Germany) and major urban centers like Singapore and Shanghai (China) have also adopted digital twin technology to streamline tasks ranging from pharmaceutical production to urban planning. BMW models entire plants in NVIDIA’s Omniverse platform; planners on three continents co-edit the same scene graph, walk a VR line-side audit and push code that automatically updates physical robots. The company reports a 30% reduction in production-planning time and similar gains in resource-utilization efficiency for the forthcoming EUR 2 billion Debrecen EV plant. Those savings arise because layout clashes, AGV traffic jams and ergonomic risks are resolved in the twin—well before steel is cut or suppliers are locked-in.

By integrating these digital replicas directly into the metaverse, MNEs can effectively operate virtual command centers where supply chain decisions and strategic planning take place with live data from every corner of the world. The borderless nature of metaverse platforms allows transport providers, suppliers, and end customers to collaborate and share data instantaneously, cutting down on response times and reducing inefficiencies. This synchronized orchestration can evolve into a firm-specific advantage [46], especially when organizations leverage advanced analytics to predict supply chain disruptions or swiftly reconfigure production routes in response to market shifts.

In practical terms, an MNE using a metaverse-based digital twin might test different shipping routes, labor allocations, or warehouse layouts before rolling them out in the real world—similar to running a flight simulator for global logistics. This capability minimizes trial-and-error costs, improves decision-making, and enables firms to innovate continuously. When combined with blockchain-based traceability or AI-powered demand forecasting, such digital twins could significantly enhance multinational supply networks’ efficiency, security, and responsiveness.

Ultimately, the power of digital twins in the metaverse is about real-time coordination. By extending the physical boundaries of production into immersive digital simulations, MNEs gain a competitive edge in risk mitigation, speed to market, and adaptation to local nuances. As these technologies mature, companies that effectively merge data analytics, virtual prototyping, and global stakeholder engagement will likely redefine best practices for GVC management in the 21st century.

4.2. Metaverse Commerce and Value Creation (RQ2)

Microtransactions, Barter, and Monetization: The Fourth Industrial Revolution (Industry 4.0) has ushered in a suite of technologies—from IoT and AI to advanced analytics and 3D printing—that profoundly transform how businesses create, capture, and deliver value. New commerce models emerge when these technologies intersect with metaverse platforms, characterized by microtransactions, barter, and countertrade.

4.2.1. Microtransactions as the New Normal

Microtransactions constitute around 85% of virtual entertainment transactions [44,47]. This model involves selling low-cost digital goods (e.g., in-game items or cosmetic enhancements) in large volumes. Because microtransactions can be processed globally at a minimal cost, even small firms or “micro-multinationals” can reach millions of consumers worldwide. For instance, a small developer of in-game assets or digital art can operate on a global scale through online marketplaces, leveraging Industry 4.0 technologies (e.g., AI-driven personalization) to produce niche digital products efficiently. Many platforms incentivize frequent user engagement—offering virtual goods that enhance experiences or bestow status. This dynamic fosters recurring revenue streams and brand loyalty for companies that master microtransaction-based commerce.

4.2.2. Barter and Countertrade in Virtual Worlds

Barter or countertrade reportedly accounts for 30–40% of global transactions [48]. While historically tied to physical goods, it now extends into digital and intangible assets, such as user data, AI models, and tokenized IP. In the metaverse, a firm could barter its specialized software code in return for high-quality user data or trade an AI module for complementary technology. As more value becomes digitized, ownership and barter mechanics in virtual domains become a core strategic consideration. Microtransactions and barter-based exchanges are shifting traditional revenue models—placing digital assets at the center of value creation. Firms that adapt to these changing monetization methods can capitalize on the metaverse’s scalability and instant access to global consumer segments.

Taxation and Regulatory Implications: While Industry 4.0 and the metaverse unlock unprecedented commercial opportunities, they also introduce complex regulatory challenges. Governments worldwide are still calibrating how to tax and oversee digital transactions, especially those involving intangible assets or emerging token economies. Crucially, the pressures are not uniform: each major jurisdiction is pursuing its own blend of licensing, consumer-protection, and tax rules, forcing multinational enterprises (MNEs) to abandon the notion of a single “global” roll-out strategy.

- European Union—licence first, then scale. The Markets in Crypto-assets Regulation (MiCA) entered its final phase on 30 December 2024, requiring every crypto-asset service provider—including in-world marketplaces—to obtain a CASP licence and publish detailed white papers before passporting services across 30 states. Parallel obligations under the Digital Services Act (DSA) expose “very large online platforms” to algorithm-audit and systemic-risk requirements, with fines up to 6% of global turnover for non-compliance. Together, MiCA and the DSA make the EU the world’s strictest jurisdiction for metaverse infrastructure [49].

- United States—enforcement first, clarity later. The SEC continues to classify many in-world utility or governance tokens as securities, while Form 1099-DA obliges brokers to report every disposal of a digital asset—no de-minimis threshold—from 1 January 2025. That shift converts even USD 0.99 micro-sales of virtual goods into taxable events and raises the audit risk for U.S.-facing platforms [50].

- China—industrial metaverse, real-name rules. Provincial “metaverse action plans” promote virtual-twin applications in manufacturing, but NFTs must sit on state-approved chains and all users undergo real-name verification, effectively fencing off public-chain commerce.

- Singapore—sandbox friendliness, stablecoin discipline. The Monetary Authority of Singapore’s 2024 framework demands that any MAS-regulated single-currency stablecoin (SCS) be 100% reserve-backed and redeemable at par within five business days; vendors exceeding SGD 100 k annual turnover must charge 9% GST on B2C virtual goods from 2025.

- India—revenue-grab on micro-spends. From 1 October 2023, all deposits into online gaming or metaverse pay-to-play platforms attract a 28% GST, plus 30% income tax on net winnings, making India the costliest mainstream market for virtual goods.

- United Arab Emirates (Dubai)—tiered licensing and advertising rules. Dubai’s Virtual Assets Regulatory Authority (VARA) now issues activity-specific rulebooks covering issuance, custody, brokerage and marketing; all metaverse platforms reaching UAE residents must hold a VARA licence and comply with strict marketing disclosures.

Some countries have proposed or enacted DSTs targeting large platform companies. However, these regimes often do not consider microtransactions or do so inconsistently. Policymakers may create new guidelines for virtual asset taxation or an expanded version of the Global Tax Agreement to address intangible asset appreciation and “virtual supply chains”. To mitigate risk, MNEs increasingly engage with policymakers and industry coalitions, helping shape digital trade agreements that are future-proof and conducive to innovation. In the process, they reduce the risk of abrupt or contradictory regulations and maintain constructive relationships with tax authorities. A strategic approach necessitates prioritizing the phased roll-out of licenses and tax frameworks ahead of product features, proactively engaging with EU, MAS, and OECD working groups to influence policy, architecting ledgers with built-in auditability, employing a prudent tokenization strategy that utilizes off-chain entitlements for complex jurisdictions and fully backed stablecoins where regulations are clear, and proactively conducting scenario testing for potential MiCA-driven stablecoin delistings or SEC re-classifications while integrating kill switches into susceptible assets.

4.3. Blockchain as the Backbone for Trust, Security, and Interoperability (RQ3)

Decentralized Operations in Metaverse GVCs: An essential feature of the metaverse is that it serves as a convergent space where virtual and physical worlds interact at scale. This space requires secure, transparent, and efficient mechanisms for handling data, assets, and transactions to function smoothly. Blockchain technology (or distributed ledgers) provides the foundational infrastructure for these activities by offering the following:

- Asset Tokenization: Blockchain allows both fungible tokens (e.g., ERC-20) and non-fungible tokens (NFTs) (e.g., ERC-721, ERC-1155) to represent digital or physical assets. In a GVC context, these tokens can range from supply chain documents (bills of lading, certificates of origin) to virtual real estate in the metaverse, enabling verifiable ownership and traceability. Tokenization ensures that items—goods, services, or even rights and privileges—can be transferred and traded securely across multiple parties without relying on a single centralized authority [51,52].

- Decentralized Finance (DeFi): Using cryptocurrencies and decentralized financial applications, GVC stakeholders can engage in near-instant cross-border payments, peer-to-peer lending, and automated settlement processes. DeFi solutions eliminate many friction points associated with traditional banking for metaverse-based commerce, such as slow clearance times or high remittance fees. This speed and cost-effectiveness can be especially valuable in fast-moving global supply chains, reducing payment bottlenecks and enabling smaller suppliers or micro-multinationals to participate more easily in international trade [53].

- Smart Contracts: Smart contracts are self-executing programs encoded on the blockchain that trigger specific actions (e.g., payment release, goods shipment) when predefined conditions are met. By removing the need for intermediaries—such as brokers, escrow services, or specific legal checks—smart contracts reduce transaction costs and the risk of opportunistic behavior. In GVC operations, these contracts can automate tasks such as B2B supply chain coordination (e.g., automatically updating inventory, enforcing quality checks, or verifying delivery milestones). This level of automation bolsters trust between partners because the contract’s code enforces the rules transparently and consistently for all parties involved.

Blockchain’s decentralized structure ensures that no single entity can monopolize or secretly alter the ledger of transactions. This property addresses many market imperfections and information asymmetries that internalization theory [40] has historically associated with global expansion—particularly those arising from complex, cross-border operations in the metaverse environment.

Cross-Chain Protocols and Digital Twin Integration: As the metaverse expands, multiple blockchains and virtual platforms will inevitably emerge, each with its rules, token standards, and consensus mechanisms. Ensuring that these various systems can seamlessly communicate is vital for achieving true interoperability and scaling up global value chains within virtual environments. Cross-chain protocols and bridging solutions provide the technological glue needed to unite these disparate ecosystems:

- Connecting Digital Twins to Multiple Blockchains: A digital twin is a real-time virtual replica of a physical asset or system, such as a port, factory, or supply network. By linking digital twins to several supply chain blockchains simultaneously, enterprises can monitor and synchronize operational data—like sensor readings, shipping manifests, and production metrics—in a unified, secure manner. For example, the Port of Rotterdam might use cross-chain bridges to aggregate IoT data from its local blockchain solution with global shipping information stored on partner blockchains. This end-to-end visibility helps enterprises forecast disruptions, optimize shipping routes, and manage inventory more effectively.

- Enhancing GVC Data Convergence Across Borders: Cross-chain interoperability ensures that data originating in one country or on one blockchain can be verified, shared, and acted upon by stakeholders on an entirely different chain or in a different jurisdiction. Such convergence minimizes the complexities of dealing with varying regulatory frameworks and data standards across countries, making it easier for multinational enterprises (MNEs) to coordinate, track, and audit global goods or assets. This streamlined flow of verified data supports the creation of unified records, preventing data silos that often lead to errors or fraud.

- Fostering Network Effects for MNEs and SMEs: By linking user bases and provider bases across multiple platforms [46], cross-chain protocols enable MNEs and digital-first SMEs to expand their reach and participate in broader networks of partners, customers, and suppliers. Network effects arise when each new participant in the metaverse ecosystem amplifies its overall value—imagine a global marketplace where suppliers, logistics providers, and customers can seamlessly transact or collaborate, regardless of the underlying blockchain. Such an integrated environment allows firms of all sizes to scale globally faster while sharing resources, knowledge, and data without the barriers imposed by incompatible systems.

Cross-chain protocols and digital twin integration are key to ensuring the metaverse remains cohesive and efficient. These technological solutions empower MNEs and smaller digital firms to streamline operational processes, reduce the risk of errors or fraud in cross-border transactions, and lower compliance and coordination costs across multiple platforms and international markets.

As a result, blockchain emerges not simply as a transactional tool but as the underlying backbone for trust, security, and interoperability within the metaverse—a critical enabler for reshaping and optimizing the future of global value chains.

4.4. Revisiting IB Theories in a Metaverse World (RQ4)

Transaction Cost Theory (TCT): TCT traditionally explains why firms prefer specific governance structures—such as internalizing operations rather than relying on the market—to minimize costs related to negotiating, monitoring, and enforcing contracts. These costs arise due to opportunistic behavior, information asymmetry, and the need for intermediaries [38]. In a metaverse-driven context, TCT’s foundational logic still applies but evolves in two significant ways:

- Reduced Traditional Costs: In the metaverse, digital platforms and smart contracts can streamline interactions that once required physical intermediaries. For instance, rather than hiring export agents or third-party logistics providers, an MNE could connect directly with foreign customers or suppliers via decentralized applications (dApps), where smart contracts automatically enforce agreed-upon terms (e.g., payment upon delivery or quality checks). This reduction in dependency on intermediaries lowers search and negotiation costs—one of the core areas of concern in TCT. Information asymmetry also decreases because blockchain-based ledgers and immersive digital twins can offer real-time data transparency, making it easier for all parties to verify product quality, shipping times, or contract fulfillment status [54].

- New Cost Centers: Although the metaverse reduces some traditional frictional costs, firms inevitably encounter new expenditure forms. For example, to partake in virtual marketplaces or 3D immersive meetings, firms might require AR/VR hardware—headsets, haptic devices, or high-performance computers—for employees or key partners. Additionally, there can be platform usage fees on popular metaverse platforms or cross-chain transaction fees if the business leverages multiple blockchains (e.g., Ethereum, Polygon, Solana) for asset transfers or payments [39]. Firms must also navigate an evolving digital tax environment, where microtransactions, barter transactions, and cryptocurrency-based payments may incur new or region-specific regulations. These compliance obligations can introduce fresh complexities and costs for MNEs.

Transaction Cost Theory: This provides a valuable lens to understand the trade-offs between leveraging digital marketplaces and the potentially rising expenses of new technology adoption, platform fees, and regulatory compliance [34]. Firms that manage these trade-offs effectively can reduce inefficiencies in their global operations and remain competitive in foreign markets.

Resource-Based View (RBV): RBV posits that a firm’s long-term competitive advantage comes from leveraging unique, valuable, and hard-to-imitate internal resources and capabilities. In the metaverse era, specific digital capabilities are emerging as core drivers of success:

- Emergence of Digital Capabilities: Skills in data analytics, AI-driven personalization, and VR/AR software development can be pivotal resources that enable firms to engage global customers in immersive, highly interactive ways. Mastering metaverse-related technologies (e.g., creating 3D content, using blockchain-based security protocols, integrating IoT data for real-time digital twins) can become a distinct firm-specific advantage (FSA), particularly in rapidly digitizing industries like retail, entertainment, manufacturing, or logistics [35,55]. For instance, a firm with robust AI models recommending products in a virtual showroom may outperform competitors lacking such capabilities.

- Continuing Relevance of Traditional Strengths: While cutting-edge digital competencies are increasingly indispensable, they do not negate the need for traditional capabilities, especially in markets with limited internet infrastructure or slower technology adoption. Physical production expertise, well-established logistics networks, and culturally attuned local relationships can still differentiate an MNE—even in the metaverse—by ensuring products and services are delivered efficiently to those regions where immersive digital tools are not yet mainstream. This reality underscores the need for dual-capability orchestration: Successful international firms must integrate digital assets (for markets and segments that are ready) alongside traditional competencies (for regions still reliant on physical channels).

The RBV highlights that firms that invest in metaverse-related technology and talent while retaining core capabilities in physical operations will likely enjoy a sustainable edge as they navigate diverse global contexts.

Network and Ecosystem Perspectives: Drawing on revisited internationalization process models [56], the network perspective underscores how firms build and leverage relationships to access critical resources, knowledge, and market opportunities. In the metaverse, these relationships become even more dynamic.

- Born-Digital Firms and Mini-MNEs: Born-digital start-ups and other technology-forward SMEs can rapidly become “mini-MNEs”, expanding to serve customers worldwide without making significant investments in physical infrastructure. They capitalize on network effects as virtual communities, platform subscribers, or game users quickly adapt their products or services—potentially scaling up in months rather than years. For example, an indie game developer whose VR product gains traction on a central metaverse platform can sell globally from day one, leveraging direct user feedback and digital word-of-mouth to refine offerings and penetrate new foreign markets.

- Ecosystem Coherence for Large MNEs: Established multinational enterprises face a different challenge: maintaining a coherent ecosystem across multiple markets, each with potentially different technology standards, consumer preferences, and regulatory policies. They might partner with local VR content creators, digital marketing agencies, or software developers to localize immersive metaverse experiences, ensuring those experiences resonate with foreign consumers [57]. Achieving alignment among these ecosystem partners—who may be both complementary and potential competitors—requires deliberate co-governance of platform rules (e.g., revenue-sharing contracts, data privacy norms, or brand guidelines).

From an IB perspective, the metaverse amplifies the importance of networks: user communities, third-party developers, social media influencers, and other stakeholders can accelerate or inhibit a firm’s global expansion [58]. Successful IB strategies in metaverse environments often revolve around cultivating trust within these virtual ecosystems and adapting to local digital norms faster than traditional foreign market entry.

4.5. The Need for Standardization (RQ5)

The rapid expansion of metaverse-driven GVCs brings many technological and regulatory challenges. Chief among them is the lack of standardized protocols, governance frameworks, and legal guidelines that can reliably manage cross-border digital transactions, diverse blockchain networks, and evolving metaverse applications. In the absence of a shared roadmap, businesses face high levels of fragmentation and uncertainty—obstacles that can significantly hamper adoption, scalability, and innovation [36,37].

Overcoming Fragmentation: Metaverse environments rely heavily on blockchain infrastructures for tasks such as tokenizing assets, verifying user identities, and facilitating secure transactions. However, the use of multiple blockchain protocols and token standards (e.g., ERC-20, ERC-721, ERC-1155), combined with varying governance models (e.g., proof-of-work, proof-of-stake, private enterprise blockchains), has created a patchwork ecosystem that lacks seamless interoperability [36]. This fragmentation intensifies as firms attempt to integrate digital twins, AR/VR commerce, and user-generated content into their GVC operations. Without common technical and legal standards, data exchange between these systems becomes cumbersome, forcing businesses to invest in custom “bridges” or intermediaries—adding extra costs and complexity [59].

Moreover, regulatory inconsistencies across national boundaries magnify these challenges. As governments grapple with microtransaction taxation, barter-based trading, and digital asset classification, businesses must track and comply with a widening web of rules. For instance, a metaverse platform operating in Europe may have to meet the GDPR’s stringent data privacy requirements, while another in Asia could face entirely different data localization mandates [36]. The resulting lack of global alignment increases the risks and costs for firms, especially those with extensive cross-border supply chains.

International standard-setting bodies such as the International Organization for Standardization (ISO) and the Institute of Electrical and Electronics Engineers (IEEE) have intensified their efforts since around 2017–2018 to provide universal frameworks for blockchain interoperability, token management, and data governance. These initiatives aim to help organizations align their technical choices—for instance, how to format blockchain transactions or structure smart contracts—so that the metaverse can operate more cohesively across platforms and jurisdictions [36,60]. As digital twins, AR/VR marketplaces, and other advanced applications proliferate, establishing these standard protocols will become increasingly critical to preserve trust and transparency, reduce friction, and spur large-scale adoption of metaverse-based GVC solutions.

Benefits of GVC Management: Standardizing how digital assets are classified and exchanged enables firms to navigate legal requirements more efficiently. When intangible assets—such as non-fungible tokens or virtual goods—are defined consistently across national boundaries, cross-chain transfers and data privacy measures can be managed more transparently. This uniformity helps reduce the regulatory burden on companies, cutting down on the administrative and legal complexities that otherwise arise from divergent frameworks. Consequently, compliance becomes more predictable, enabling MNEs, SMEs, and born-digital firms to expand global operations more confidently.

Clear standards can level the playing field for smaller businesses or firms from emerging markets. Standardized protocols can minimize entry barriers because these entities often have fewer resources to invest in complex integrations or hire specialized blockchain and legal experts. For example, if cross-chain operations follow a single accepted standard, an SME looking to tokenize its products would only need to adopt one set of rules rather than building bespoke solutions for multiple platforms. By granting equal technical footing, standardization fosters a more inclusive metaverse economy, where companies of varying sizes and from different regions can participate in advanced digital supply chains and marketplaces.

When platform developers and blockchain engineers are no longer preoccupied with constantly retrofitting their systems for interoperability and compliance, they can direct more energy toward value-added innovations [61]. Such innovations include AI-driven supply chain optimization, fully immersive VR-based product customization, or the integration of IoT data into metaverse platforms. By establishing standard protocols, standardization effectively removes the friction of reinventing fundamental processes for each application, thus encouraging the following:

- Collaborative Ecosystem Growth: Developers and businesses can seamlessly build on each other’s work, driving faster experimentation and the creation of more sophisticated metaverse use cases.

- Reliable User Experiences: With consistent interfaces and data standards, end-users can move across platforms without facing technical barriers or inconsistent product features.

- Global Scalability: As solutions are built on shared standards from the outset, scaling across regions and markets becomes far more straightforward, accelerating the pace at which metaverse platforms can achieve critical mass.

Standardization is not merely a technical formality; it is a foundational mechanism that bridges multiple platforms, eases regulatory compliance, and democratizes participation in digital commerce [61]. By reducing fragmentation and encouraging standard protocols, the metaverse ecosystem can unlock its full potential for real-time collaboration, innovative business models, and dynamic value creation—all while managing the complexities inherent to global, cross-border operations.

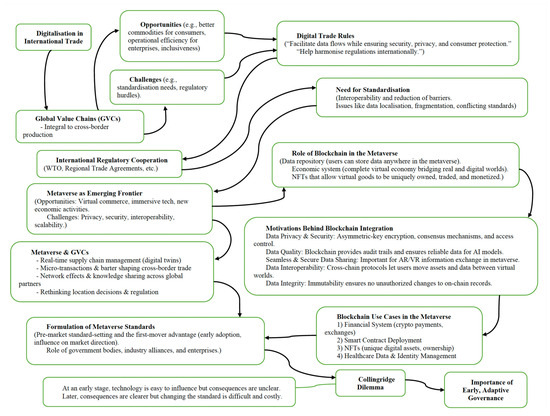

A Flowchart for Standardizing GVCs in the Metaverse: Unlike previous industrial revolutions, in which regulations and norms often lagged behind technological development, the digital economy compels a forward-looking approach. Without clear, interoperable frameworks, businesses face fragmented markets, costly technical redundancies, and data security vulnerabilities. National and international regulators must address questions about data localization, the role of intermediaries, intellectual property rights in virtual spaces, and cross-border governance of digital platforms. Such harmonization is particularly urgent as microtransactions, non-fungible tokens (NFTs), and decentralized finance (DeFi) proliferate, each requiring consistent protocols to ensure the integrity of trade in both physical and virtual domains [56,61].

The Standardizing GVCs in the Metaverse Flowchart (shown as Figure 4) presented here synthesizes these core issues—from digitalizing international trade and evolving GVCs to integrating metaverse technologies and blockchain. By illustrating how these components interlink and feed into one another, the chart underscores why standardization is the lynchpin that can unlock the full potential of global digital commerce. It shows how early cooperation on technical and policy standards can prevent fragmentation, reduce transaction costs, and encourage innovation. Ultimately, the flowchart highlights that bridging the gap between real-world production and virtual ecosystems will require the latest digital tools, robust governance frameworks, and stakeholder collaboration.

Figure 4.

Standardizing GVCs in the metaverse flowchart.

Why This Matters for Standardization and Regulation: Digitalization and the rise of the metaverse introduce complexities that cannot be addressed through traditional or static frameworks. Interoperability across borders and technologies requires consistent standards to reduce technical mismatches and encourage broad participation in global markets. As governments experiment with regulatory sandboxes and flexible legal regimes, the concept of “dynamic oversight” is coming to the fore. Rather than issuing one-time laws, regulators must engage in ongoing dialogue with innovators, adjusting policy tools as technologies evolve. This approach helps manage both security and economic risks.

The Role of GVCs in the Metaverse and Why It Is Important: GVCs are cross-border networks of firms that contribute to producing and delivering goods and services, from raw materials to finished products. In a metaverse-driven environment, these networks can be enhanced by real-time data exchange and immersive collaboration, allowing for faster decision-making, more responsive supply chains, and the potential to bypass intermediaries.

This convergence of the metaverse and GVCs also prompts new business models. Microtransactions and NFTs expand the range of exchange mechanisms, while network effects allow smaller firms to achieve rapid international reach. However, this also raises regulatory concerns: government oversight must adapt to transactions that transcend conventional borders, ensuring compliance with tax rules, privacy regulations, and anti-fraud measures. As such, firms that incorporate metaverse-based solutions can build firm-specific advantages and reach new markets at scale, making the early alignment with standardization processes strategically valuable.

Using the Flowchart in Practice: Taken as a whole, the flowchart serves multiple audiences. For business leaders and strategists, it highlights where standardization issues or regulatory milestones may disrupt expansion plans—particularly in areas like data flows, transaction security, and supply chain transparency. Policymakers can pinpoint the specific nodes where interventions, such as new legislation or international agreements, might be most impactful, whether that involves harmonizing blockchain protocols or clarifying tax obligations for cross-border microtransactions.

Academics and researchers gain a clear structure for comparing existing international business theories—such as the transaction cost theory, resource-based view, or U-model—and how they might need revisiting in the context of emerging technologies and digital trade. Standard-setting bodies benefit from a roadmap that elucidates the interplay between blockchain, GVCs, and the metaverse, illustrating why iterative revisions are essential. Ultimately, the flowchart offers a bird’s-eye view of how technology, trade, and governance converge, guiding all stakeholders in crafting adaptive approaches that balance innovation with security and equity.

5. Conclusions

This study offers significant insights into how the integration of blockchain and the metaverse is reshaping GVCs, presenting transformative opportunities for enhancing transparency, security, and innovation. Blockchain’s decentralized ledger technology has emerged as a critical enabler of value creation by addressing long-standing challenges such as information asymmetry, trust deficits, and operational inefficiencies. When combined with other technologies like IoT, Blockchain offers scalable, transparent, and immutable records of transactions, which are essential in navigating the complexities of GVCs.

First, internalization theory takes on new dimensions in the metaverse, where FSAs extend from conventional R&D capabilities to digital assets such as AI models and immersive user experiences. This reframing requires MNEs to reconsider how they safeguard proprietary knowledge, especially when collaborating in borderless virtual ecosystems. At the same time, micro-multinationals or “born-digital” firms leverage emerging digital platforms to gain immediate international reach—revisiting the earlier view that significant physical investments are prerequisites for global expansion.

Second, digital twins have emerged as a critical capability for real-time coordination and risk mitigation in supply chains, revealing how merging physical operations with immersive simulations can streamline global logistics, improve decision-making, and enhance organizational agility. This data-driven approach paves the way for decentralized operations, reinforced by blockchain as the backbone for trust, security, and interoperability. The interplay of AI, blockchain, and digital twins offers rich opportunities for reshaping GVCs, from optimizing shipment routes in smart ports to verifying quality standards via automated contracts.

Third, metaverse commerce models—such as microtransactions, digital barter, and token-based exchanges—challenge traditional value-creation and revenue models. Microtransactions allow smaller firms to tap into international audiences with minimal overhead, while digital assets in the form of NFTs, tokenized IP, and data become a new frontier for barter and countertrade. However, as novel forms of digital exchange proliferate, taxation and regulatory complexities become increasingly evident. The legal classification of intangible assets, the treatment of microtransactions, and the diversity of rules across jurisdictions underscore the importance of effective governance structures to ensure compliance without stifling innovation.

Fourth, the review highlights theoretical refinements in light of metaverse-driven changes. Transaction cost theory now accounts for reduced and newly emergent costs stemming from immersive technologies. The resource-based view underscores the rising strategic importance of digital capabilities—such as data analytics, AI personalization, and VR content creation—in combination with still-relevant traditional strengths (e.g., logistics networks and market knowledge). Additionally, network and ecosystem perspectives emphasize how partnerships, platform alliances, and user communities shape the speed and reach of international expansion in immersive virtual contexts.

Finally, standardization emerges as a crucial pivot. Without shared protocols for blockchain interoperability and consistent regulatory frameworks, cross-border data exchanges and token transfers remain fragmented, raising transaction costs and compliance risks. The push for commonly accepted technical and policy guidelines—through bodies like ISO or IEEE—aims to harmonize metaverse activities, lower barriers for SMEs, and facilitate sustainable, equitable growth across digital ecosystems.

These insights highlight a rapidly evolving interplay between technology, strategy, and international business theory. As the metaverse develops, future studies should further explore how emerging digital assets can redefine traditional concepts of value, governance, and competitive advantage. The five research questions identified in this review offer a structured agenda for examining these complex but promising frontiers, where immersive virtual platforms, blockchain infrastructures, and real-time data analytics combine to reshape GVCs for the 21st century and beyond.

Future Research Avenues: Looking ahead, future research can delve deeper into the cross-pollination of emerging technologies such as AI-driven analytics, edge computing, and quantum security within metaverse ecosystems to illuminate novel pathways for coordinating complex, border-spanning value chains. For instance, comparative studies could highlight best practices in digital twin implementation across varying industry sectors or focus on real-time data governance and the role of decentralized financing models (DeFi) in reducing trade barriers for micro-multinationals. Researchers may also explore multidisciplinary perspectives, integrating consumer behavior insights—through virtual reality user tracking or ethnographic studies in metaverse environments—to refine IB theories on global expansion and network formation. Lastly, regulatory harmonization remains a fertile arena for inquiry: examining how transnational organizations and industry alliances develop standardized frameworks for tokenized assets, cross-chain interoperability, and data privacy will be paramount in shaping a secure, inclusive, and vibrant global metaverse economy.

Author Contributions

Conceptualization, S.M.S. and M.M.; Methodology, S.M.S.; Software, S.M.S.; Validation, S.M.S. and M.M.; Formal analysis, S.M.S.; Investigation, S.M.S.; Resources, S.M.S.; Data curation, S.M.S.; Writing—original draft preparation, S.M.S.; Writing—review and editing, S.M.S. and M.M.; Visualization, S.M.S.; Supervision, M.M.; Project administration, S.M.S.; Funding acquisition, M.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Angelopoulos, J.; Panopoulos, N. Blockchain Integration in the Era of Industrial Metaverse. Appl. Sci. 2023, 13, 1353. [Google Scholar] [CrossRef]

- Kshetri, N. Blockchain’s Role in Enhancing Quality and Safety and Promoting Sustainability in the Food and Beverage Indus-try. Sustainability 2023, 15, 16223. [Google Scholar] [CrossRef]

- Johnston, A. Blockchain and the Metaverse, Part 1: Opportunities. S&P Global Market Intelligence. 2023. Available online: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/blockchain-and-the-metaverse-part-1-opportunities-65618767 (accessed on 1 March 2023).

- Dwivedi, Y.K.; Hughes, L.; Baabdullah, A.M.; Ribeiro-Navarrete, S.; Giannakis, M.; Al-Debei, M.M.; Dennehy, D.; Metri, B.; Buhalis, D.; Cheung, C.M.; et al. Metaverse beyond the hype: Multidisciplinary perspectives on emerging challenges, opportu-nities, and agenda for research, practice and policy. Int. J. Inf. Manag. 2022, 66, 102542. [Google Scholar] [CrossRef]

- Nikolakis, W.; John, L.; Krishnan, H. How Blockchain Can Shape Sustainable Global Value Chains: An Evidence, Verifiability, and Enforceability (EVE) Framework. Sustainability 2018, 10, 3926. [Google Scholar] [CrossRef]

- Wang, M.; Guo, W. The Potential Impact of ChatGPT on Education: Using History as a Rearview Mirror. ECNU Rev. Educ. 2023, 8, 41–48. [Google Scholar] [CrossRef]

- Mukherjee, A.A.; Singh, R.K.; Mishra, R.; Bag, S. Application of blockchain technology for sustainability development in agri-cultural supply chain: Justification framework. Oper. Manag. Res. 2021, 15, 46–61. [Google Scholar] [CrossRef]

- Calandra, D.; Oppioli, M.; Sadraei, R.; Jafari-Sadeghi, V.; Biancone, P.P. Metaverse meets digital entrepreneurship: A practi-tioner-based qualitative synthesis. Int. J. Entrep. Behav. Res. 2023, 30, 666–686. [Google Scholar] [CrossRef]

- Ediriweera, A.; Wiewiora, A. Barriers and enablers of technology adoption in the mining industry. Resour. Policy 2021, 73, 102188. [Google Scholar] [CrossRef]

- Jacob, N.R.; Thomas, N.M.; Agarwal, S.; Saini, N.; Vasa, L. What Facilitates and Impedes the Adoption of Sustainability in Global Value Chains? A Grey-DEMATEL Analysis. In Environment, Development and Sustainability; Springer: Dordrecht, Netherlands, 2023; pp. 1–29. [Google Scholar] [CrossRef]

- Yang, Q.; Zhao, Y.; Huang, H.; Xiong, Z.; Kang, J.; Zheng, Z. Fusing Blockchain and AI With Metaverse: A Survey. IEEE Open J. Comput. Soc. 2022, 3, 122–136. [Google Scholar] [CrossRef]

- Egwuonwu, A.; Mordi, C.; Egwuonwu, A.; Uadiale, O. The influence of blockchains and internet of things on global value chain. Strateg. Change 2022, 31, 45–55. [Google Scholar] [CrossRef]

- Agi, M.A.N.; Jha, A.K. Blockchain technology in the supply chain: An integrated theoretical perspective of organizational adoption. Int. J. Prod. Econ. 2022, 247, 108458. [Google Scholar] [CrossRef]

- Singh, C.; Wojewska, A.N.; Persson, U.M.; Bager, S.L. Coffee producers’ perspectives of blockchain technology in the context of sustainable global value chains. Front. Blockchain 2022, 5, 955463. [Google Scholar] [CrossRef]

- Menon, S.; Jain, K. Blockchain Technology for Transparency in Agri-Food Supply Chain: Use Cases, Limitations, and Future Directions. IEEE Trans. Eng. Manag. 2024, 71, 106–120. [Google Scholar] [CrossRef]

- Voas, J.; Kshetri, N. Adapting to Generative Artificial Intelligence: Approaches in Higher Education Institutions. Computer 2024, 57, 128–133. [Google Scholar] [CrossRef]

- Mohamed, S.K.; Haddad, S.; Barakat, M. Does blockchain adoption engender environmental sustainability? The mediating role of customer integration. Bus. Process Manag. J. 2024, 30, 558–585. [Google Scholar] [CrossRef]

- Gupta, B.B.; Gaurav, A.; Albeshri, A.A.; Alsalman, D. New paradigms of sustainable entrepreneurship in metaverse: A mi-cro-level perspective. Int. Entrep. Manag. J. 2023, 19, 1449–1465. [Google Scholar] [CrossRef]

- Reyes, P.M.; Gravier, M.J.; Jaska, P.; Visich, J.K. Blockchain Impacts on Global Supply Chain Operational and Managerial Business Value Processes. IEEE Eng. Manag. Rev. 2022, 50, 123–140. [Google Scholar] [CrossRef]

- Gupta, R.; Rathore, B.; Biswas, B.; Jaiswal, M.; Singh, R.K. Are we ready for metaverse adoption in the service industry? Theoretically exploring the barriers to successful adoption. J. Retail. Consum. Serv. 2024, 79, 103882. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Latino, M.E.; De Lorenzi, M.C.; Corallo, A.; Petruzzelli, A.M. The impact of metaverse for business model innovation: A re-view, novel insights and research directions. Technol. Forecast. Soc. Change 2024, 206, 123571. [Google Scholar] [CrossRef]

- Abumalloh, R.A.; Nilashi, M.; Ooi, K.B.; Wei-Han, G.; Cham, T.-H.; Dwivedi, Y.K.; Hughes, L. The adoption of metaverse in the retail industry and its impact on sustainable competitive advantage: Moderating impact of sustainability commitment. Ann. Oper. Res. 2023, 342, 5–46. [Google Scholar] [CrossRef]

- van Dinter, R.; Tekinerdogan, B.; Catal, C. Automation of systematic literature reviews: A systematic literature review. Inf. Softw. Technol. 2021, 136, 106589. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. J. Clin. Epidemiol. 2021, 134, 178–189. [Google Scholar] [CrossRef] [PubMed]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain man-agement. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef]

- Queiroz, M.M.; Telles, R.; Bonilla, S.H. Blockchain and supply chain management integration: A systematic review of the lit-erature. Supply Chain. Manag. Int. J. 2020, 25, 241–254. [Google Scholar] [CrossRef]

- Lim, M.K.; Tseng, M.L.; Tan, K.H.; Bui, T.D. Knowledge management in sustainable supply chain management: Improving performance through an integration of information systems and supply chain management. Int. J. Logist. Res. Appl. 2021, 24, 147–165. [Google Scholar] [CrossRef]

- Lee, J.; Lim, C.; Yoon, J.; Kim, K.; Kim, M.S. The role of blockchain in the metaverse: A conceptual model and future research directions. Sustainability 2021, 13, 11651. [Google Scholar] [CrossRef]

- Kitchenham, B.; Brereton, P.; Budgen, D.; Turner, M.; Bailey, J.; Linkman, S. Systematic literature reviews in software engineer-ing—A systematic literature review. Inf. Softw. Technol. 2009, 51, 7–15. [Google Scholar] [CrossRef]

- Flick, U. An Introduction to Qualitative Research, 6th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2018. [Google Scholar]

- Buckley, P.J.; Casson, M.C. The internalisation theory of the multinational enterprise: A review of the progress of a research agenda after 30 years. J. Int. Bus. Stud. 2009, 40, 1563–1580. [Google Scholar] [CrossRef]

- Nambisan, S.; Zahra, S.A.; Luo, Y. Global platforms and ecosystems: Implications for international business theories. J. Int. Bus. Stud. 2019, 50, 1464–1486. [Google Scholar] [CrossRef]

- Brouthers, K.D.; Chen, L.; Li, S.; Shaheer, N. Charting new courses to enter foreign markets: Conceptualization, theoretical framework, and research directions on non-traditional entry modes. J. Int. Bus. Stud. 2022, 53, 2088–2115. [Google Scholar] [CrossRef] [PubMed]

- Hennart, J.-F. How much is new in Brouthers et al.’s new foreign entry modes, and do they challenge the transaction cost theo-ry of entry mode choice? J. Int. Bus. Stud. 2022, 53, 2116–2132. [Google Scholar] [CrossRef]

- Queiroz, M.M.; Wamba, S.F.; Pereira, S.C.F.; Jabbour, C.J.C. The mateaverse as a breakthrough for operations and supply chain management: Implications and call for action. Int. J. Oper. Prod. Manag. 2023, 43, 1539–1553. [Google Scholar] [CrossRef]

- Lee, S.; Kim, T.; Lee, H.; Park, S.-H. A study on development direction of metaverse and six issues to promote metaverse. J. Inf. Technol. Serv. 2022, 21, 41–59. [Google Scholar] [CrossRef]

- Büchel, H.; Spinler, S. The impact of the metaverse on e-commerce business models–A delphi-based scenario study. Technol. Soc. 2024, 76, 102465. [Google Scholar] [CrossRef]

- Teece, D.J. Big Tech and Strategic Management: How Management Scholars Can Inform Competition Policy. Acad. Manag. Perspect. 2023, 37, 1–15. [Google Scholar] [CrossRef]

- Rugman, A.M. Inside the Multinationals: The Economics of Internal Markets; Columbia University Press: New York, NY, USA, 1981. [Google Scholar]

- Narula, R.; Verbeke, A. Making internalization theory good for practice: The essence of Alan Rugman’s contributions to in-ternational business. J. World Bus. 2015, 50, 612–622. [Google Scholar] [CrossRef]

- Kano, L.; Tsang, E.W.K.; Yeung, H.W.-C. Global value chains: A review of the multi-disciplinary literature. J. Int. Bus. Stud. 2020, 51, 577–622. [Google Scholar] [CrossRef]

- Stephens, M.; Mathana; Morrow, M.J.; McBride, K.; Mangina, E.; Havens, J.C.; Vashishtha, H.; Hajeri, S.A. The Emerging “Metaverse” and Its Implications for International Business. AIB Insights 2024, 24, 118572. [Google Scholar] [CrossRef]

- Port of Rotterdam. The Digital Port. 2024. Available online: https://www.portofrotterdam.com/en/to-do-port/futureland/the-digital-port (accessed on 26 October 2024).

- Stallkamp, M.; Schotter, A.P. Platforms without borders? The international strategies of digital platform firms. Glob. Strategy J. 2021, 11, 58–80. [Google Scholar] [CrossRef]

- L’Atelier BNP Paribas. The Virtual Economy. 2024. Available online: https://atelier.net/virtual-economy/ (accessed on 26 October 2024).

- Uyan, O. Barter as an alternative trading and financing tool and its importance for businesses in times of economic crisis. J. Econ. Financ. Account. 2017, 4, 282–295. [Google Scholar] [CrossRef]

- European Union. Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 on Markets in Crypto-Assets, and Amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EU and (EU) 2014/65/EU (MiCA). Off. J. Eur. Union 2023, 150, 40–205. Available online: https://data.europa.eu/eli/reg/2023/1114/oj (accessed on 26 October 2024).

- Internal Revenue Service. Instructions for Form 1099-DA Digital Asset Proceeds from Broker Transactions. 2025. Available online: https://www.irs.gov/instructions/i1099da?utm_source=chatgpt.com (accessed on 26 October 2024).

- Huynh-The, T.; Gadekallu, T.R.; Wang, W.; Yenduri, G.; Ranaweera, P.; Pham, Q.-V.; da Costa, D.B.; Liyanage, M. Blockchain for the metaverse: A Review. Future Gener. Comput. Syst. 2023, 143, 401–419. [Google Scholar] [CrossRef]

- Nadini, M.; Laura, A.; Flavio, D.G.; Mauro, M.; Luca, M.; Andrea, B. Mapping the NFT revolution: Market trends, trade net-works, and visual features. Sci. Rep. 2021, 11, 20902. [Google Scholar] [CrossRef]

- Ante, L. Smart contracts on the blockchain—A bibliometric analysis and review. Telemat. Inform. 2021, 57, 101519. [Google Scholar] [CrossRef]

- Kshetri, N.; Dwivedi, Y.K. How can virtual and augmented reality facilitate international business? Thunderbird Int. Bus. Rev. 2024, 66, 201–210. [Google Scholar] [CrossRef]

- Ahi, A.A.; Sinkovics, N.; Shildibekov, Y.; Sinkovics, R.R.; Mehandjiev, N. Advanced technologies and international business: A multidisciplinary analysis of the litersature. Int. Bus. Rev. 2022, 31, 101967. [Google Scholar] [CrossRef]