Barriers to the Expansion of Sugarcane Bioelectricity in Brazilian Energy Transition

Abstract

:1. Introduction

2. Materials and Methods

2.1. Competitiveness of Bioelectricity in Energy Auctions

2.2. Evaluation of the Systemic Benefit Produced by Sugarcane Bioelectricity

3. Results

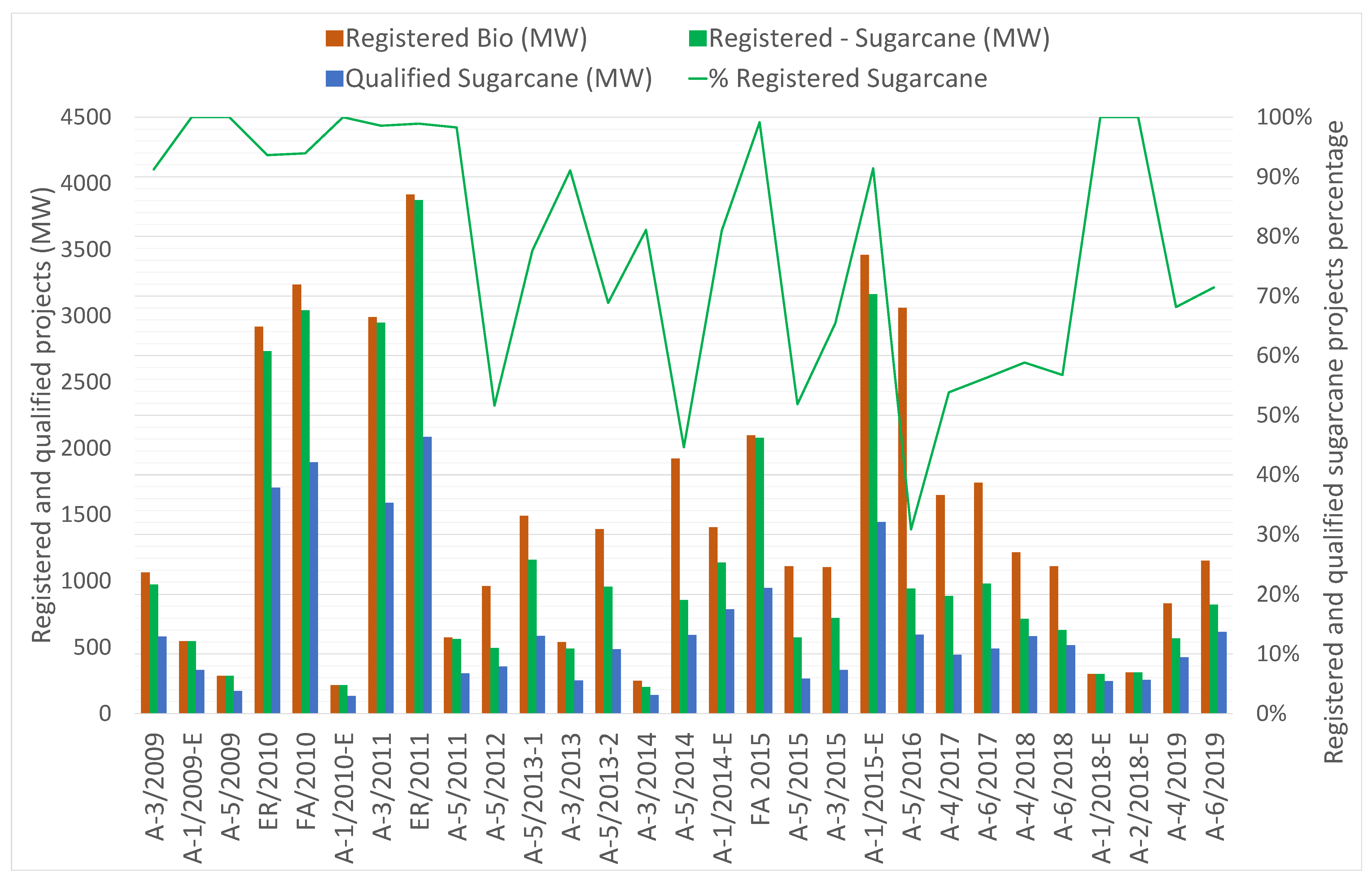

3.1. Performance of Sugarcane Bioelectricity in Energy Auctions

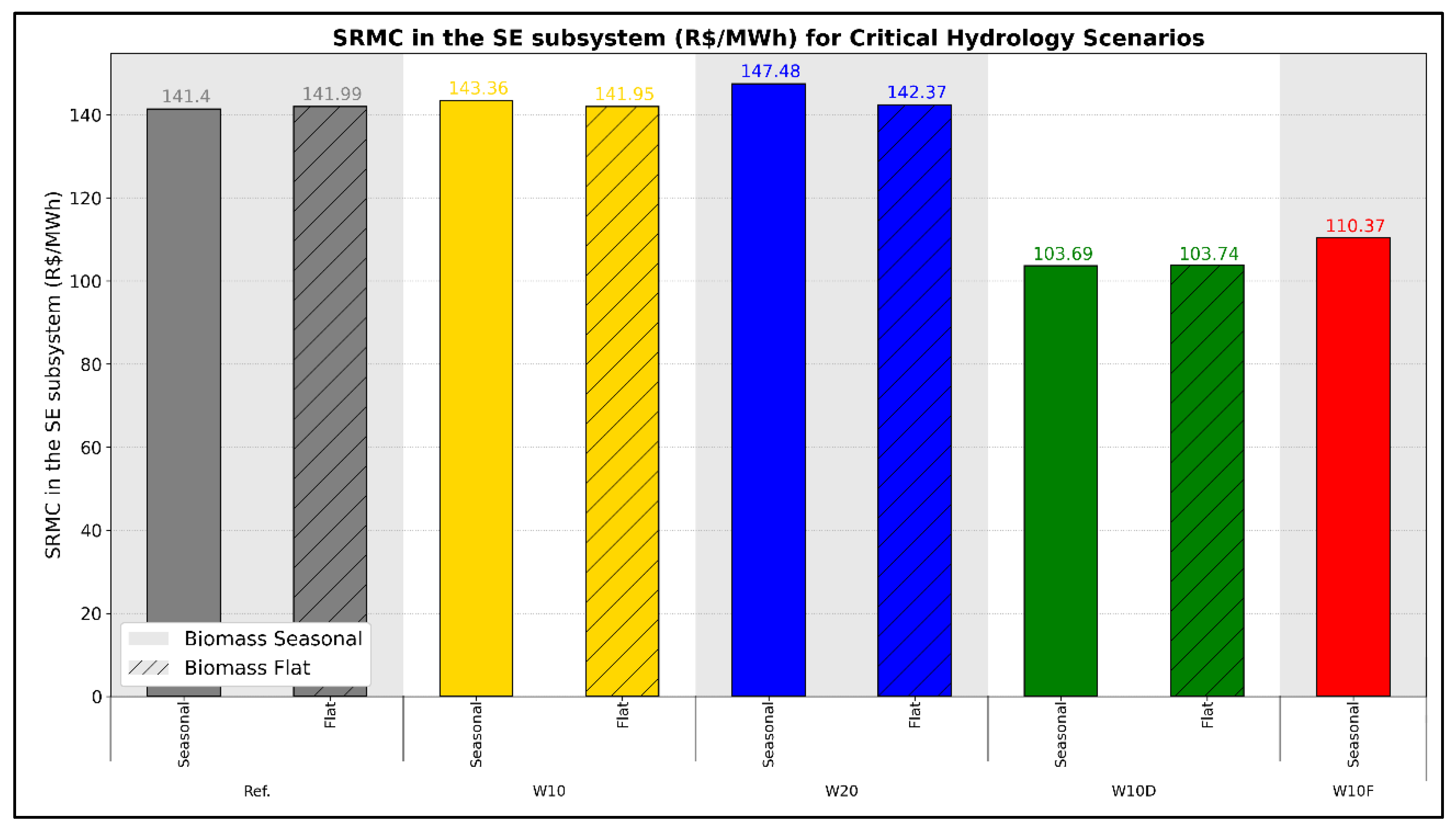

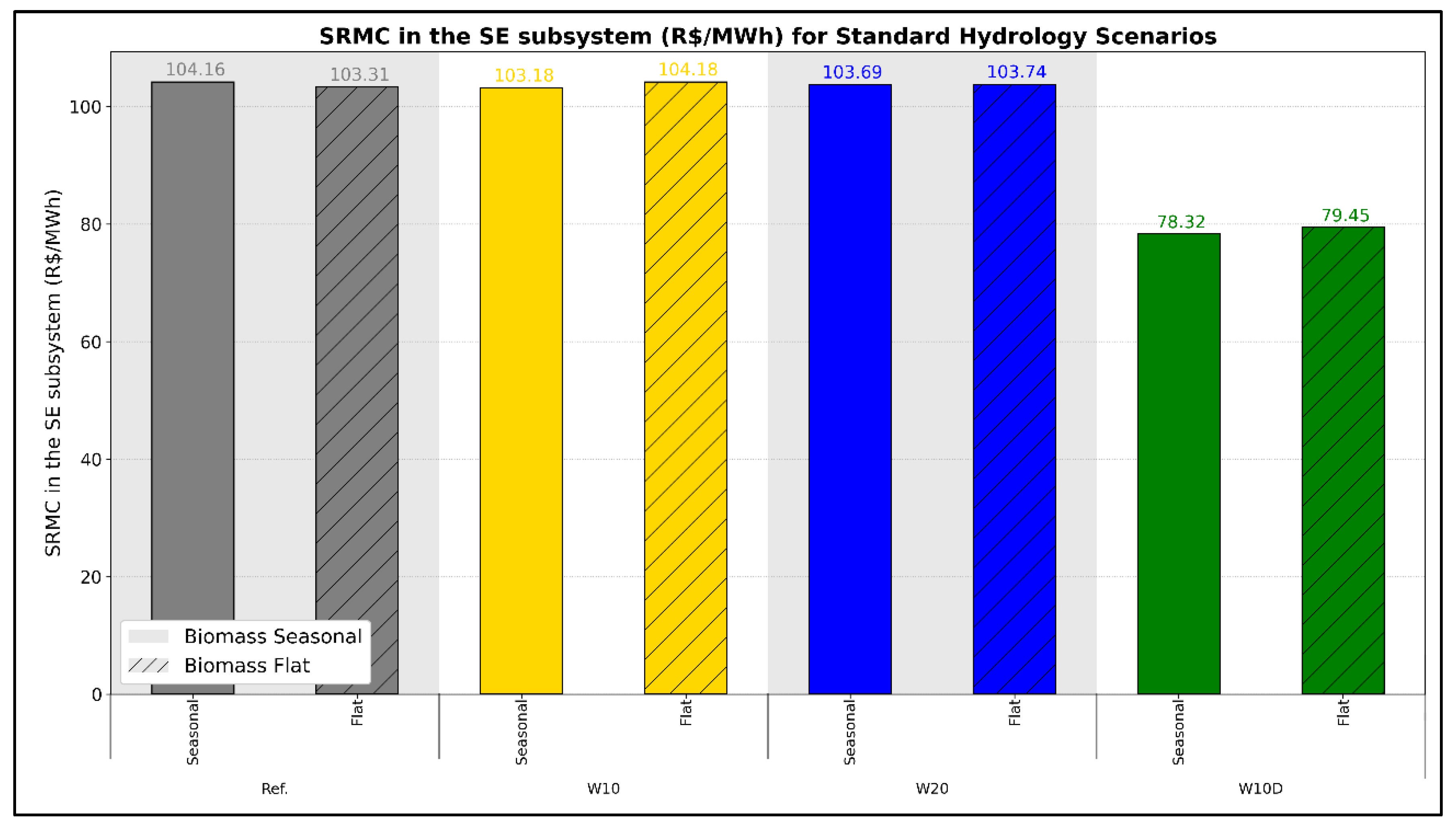

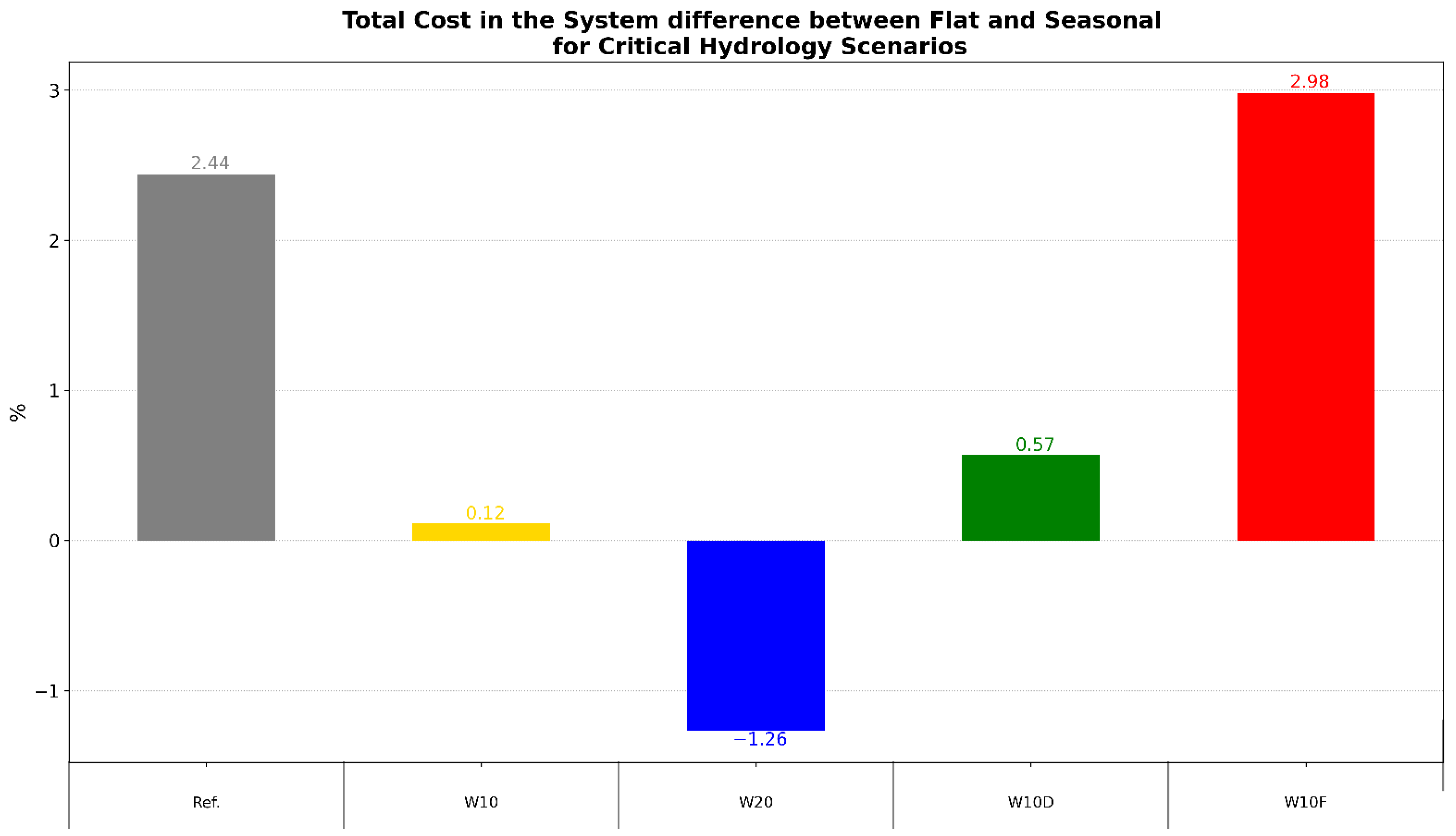

3.2. Systemic Benefits of Sugarcane Bioelectricity

4. Discussion

The Brazilian Experience: The Need for Integrated Bioelectricity Policies

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- EPE. Balanço Energético Nacional; EPE: Rio de Janeiro, Brazil, 2021. [Google Scholar]

- EPE. 2021 Statistical Yearbook of Electricity; EPE: Rio de Janeiro, Brazil, 2021; p. 255. [Google Scholar]

- CCEE. Câmara de Comercialização de Energia Elétrica InfoMercado Dados Gerais; EPE: Rio de Janeiro, Brazil, 2020. [Google Scholar]

- Coelho, S.T. Mecanismos Para Implementação da Co-Geração de Eletricidade a Partir de Biomassa. Um Modelo Para o Estado de São Paulo; Universidade de São Paulo: São Paulo, Brazil, 1999. [Google Scholar]

- Khatiwada, D.; Seabra, J.; Silveira, S.; Walter, A. Power Generation from Sugarcane Biomass–A Complementary Option to Hydroelectricity in Nepal and Brazil. Energy 2012, 48, 241–254. [Google Scholar] [CrossRef]

- Tomaz, W.L. Viabilidade e Perspectiva da Cogeração e Da Geração Termelétrica Junto Ao Setor Sucro-Alcooleiro; UNICAMP: Rio de Janeiro, Brazil, 1994. [Google Scholar]

- International Renewable Energy Agency. Renewable Energy Benefits: Understanding the Socio-Economics. IRENA 2017, 1–16. [Google Scholar]

- Laureti, L.; Rogges, M.G.L.; Costantiello, A. Evaluation of Economic, Social Effects of Renewable Energy Technologies. J. Environ. Prot. 2018, 9, 1143–1154. [Google Scholar] [CrossRef] [Green Version]

- Shoaib, A.; Ariaratnam, S. A Study of Socioeconomic Impacts of Renewable Energy Projects in Afghanistan. Procedia Eng. 2016, 145, 995–1003. [Google Scholar] [CrossRef] [Green Version]

- IEA. Bioenergy Implementation of Bioenergy in Brazil–2021 Update. IEA Bioenergy 2021, 10, 1–15. [Google Scholar]

- Bhandari, R.; Sessa, V. Energy in Agriculture in Brazil. Rev. Cienc. Agron. 2020, 51, 1–11. [Google Scholar] [CrossRef]

- Philp, J. Biomass for a Sustainable Bioeconomy: Technology and Governance; Organisation for Economic Co-operation and Development: Paris, France, 2016.

- Carneiro, P.; Ferreira, P. The Economic, Environmental and Strategic Value of Biomass. Renew. Energy 2012, 44, 17–22. [Google Scholar] [CrossRef] [Green Version]

- da Silva, A.J.R. Project SUCRE Sustainable Bioelectricity; Terminal Evaluation Report; LNBR: Campinas, Brazil, 2020. [Google Scholar]

- Ruiz, B.J.; Rodríguez, V.; Bermann, C. Analysis and Perspectives of the Government Programs to Promote the Renewable Electricity Generation in Brazil. Energy Policy 2007, 35, 2989–2994. [Google Scholar] [CrossRef]

- Nakao Cavaliero, C.K.; Da Silva, E.P. Electricity Generation: Regulatory Mechanisms to Incentive Renewable Alternative Energy Sources in Brazil. Energy Policy 2005, 33, 1745–1752. [Google Scholar] [CrossRef]

- Eletrobras PROINFA. Available online: https://eletrobras.com/pt/Paginas/Proinfa.aspx (accessed on 1 April 2021).

- MME. PROINFA–Diagnóstico e Perspectivas; MME: Brasilia, Brazil, 2008. [Google Scholar]

- IEMA. Energia Eólica No Brasil; IEMA: São Paulo, Brazil, 2015. [Google Scholar]

- IEMA. Energia Solar Fotovoltaica No Brasil; IEMA: São Paulo, Brazil, 2015. [Google Scholar]

- Nascimento, R.L. Energia Solar No Brasil: Situação e Perspectivas; Câmara dos Deputados: Brasília, Brazil, 2017. [Google Scholar]

- CCEE. Regras de Comercialização–Cáclulo Do Desconto Aplicado a TUSD/TUST. 2019. Available online: https://www.ccee.org.br/ccee/documentos/CCEE_054272 (accessed on 17 November 2022).

- Rego, E.E.; de Oliveira Ribeiro, C. Successful Brazilian Experience for Promoting Wind Energy Generation. Electr. J. 2018, 31, 13–17. [Google Scholar] [CrossRef]

- Lopez Soto, D.; Mejdalani, A.; Nogales, A.; Tolmasquim, M.; Hallack, M. Advancing the Policy Design and Regulatory Framework for Renewable Energies in Latin America and the Caribbean for Grid-Scale and Distributed Generation; IDB: Washington, DC, USA, 2019. [Google Scholar] [CrossRef]

- ONS. Operador Nacional do Sistema Numbers of the System. Available online: http://www.ons.org.br/paginas/sobre-o-sin/o-sistema-em-numeros/ (accessed on 17 November 2022).

- EPE. Brazilian Energy Balance: Base Year 2014; EPE: Rio de Janeiro, Brazil, 2015. [Google Scholar]

- ONS. Histórico da Operação–Installed Capacity. Available online: http://www.ons.org.br/Paginas/resultados-da-operacao/historico-da-operacao/capacidade_instalada.aspx (accessed on 17 November 2022).

- EPE. Anuário Estatístico de Energia Elétrica Ano Base 2018; EPE: Rio de Janeiro, Brazil, 2019. [Google Scholar]

- EPE. Anuário Estatístico de Energia Elétrica 2018 No Ano Base de 2017; EPE: Rio de Janeiro, Brazil, 2018. [Google Scholar]

- Szczygielski, J.J.; Brzeszczyński, J.; Charteris, A.; Bwanya, P.R. The COVID-19 Storm and the Energy Sector: The Impact and Role of Uncertainty. Energy Econ. 2021, 109, 105258. [Google Scholar] [CrossRef]

- Magazzino, C.; Mele, M.; Morelli, G. The Relationship between Renewable Energy and Economic Growth in a Time of COVID-19: A Machine Learning Experiment on the Brazilian Economy. Sustainability 2021, 13, 1285. [Google Scholar] [CrossRef]

- Marinho, P.R.D.; Cordeiro, G.M.; Coelho, H.F.C.; Cabral, P.C. The COVID-19 Pandemic in Brazil: Some Aspects and Tools. Epidemiologia 2021, 2, 243–255. [Google Scholar] [CrossRef]

- Carvalho, M.; Delgado, D.B.d.M.; Lima, K.M.; Cancela, M.; dos Siqueira, C.A.; Silva, D.L.B. Effects of the COVID-19 Pandemic on the Brazilian Electricity Consumption Patterns. Int. J. Energy Res. 2020, 45, 3358–3364. [Google Scholar] [CrossRef]

- Khatiwada, D.; Leduc, S.; Silveira, S.; McCallum, I. Optimizing Ethanol and Bioelectricity Production in Sugarcane Biorefineries in Brazil. Renew. Energy 2016, 85, 371–386. [Google Scholar] [CrossRef]

- Dantas, G.A.; Legey, L.F.L.; Mazzone, A. Energy from Sugarcane Bagasse in Brazil: An Assessment of the Productivity and Cost of Different Technological Routes. Renew. Sustain. Energy Rev. 2013, 21, 356–364. [Google Scholar] [CrossRef]

- Antonio Bizzo, W.; Lenço, P.C.; Carvalho, D.J.; Veiga, J.P.S. The Generation of Residual Biomass during the Production of Bio-Ethanol from Sugarcane, Its Characterization and Its Use in Energy Production. Renew. Sustain. Energy Rev. 2014, 29, 589–603. [Google Scholar] [CrossRef]

- EPE. Plano Decenal de Expanção de Energia 2029; EPE: Rio de Janeiro, Brazil, 2020. [Google Scholar]

- Brazil Intended Nationally Determined Contribution Towards Achieving the Objective of the United Nations Framework Convention on Climate Change; United Nations Framework Convention on Climate Change (UNFCCC): Bonn, Germany, 2015.

- Araujo, A.; Gross, A.; Molleta, C.F. Fourth Nacional Communication of Brazil to the UNFCC; United Nations Framework Convention on Climate Change (UNFCCC): Bonn, Germany, 2020. [Google Scholar]

- SEEG. Sistema de Estimativa de Emissões de Gases de Efeito Estufa; IEMA: São Paulo, Brazil, 2020. [Google Scholar]

- Santos, M.J.; Ferreira, P.; Araújo, M.; Portugal-Pereira, J.; Lucena, A.F.P.; Schaeffer, R. Scenarios for the Future Brazilian Power Sector Based on a Multi-Criteria Assessment. J. Clean. Prod. 2017, 167, 938–950. [Google Scholar] [CrossRef]

- Herreras Martínez, S.; Koberle, A.; Rochedo, P.; Schaeffer, R.; Lucena, A.; Szklo, A.; Ashina, S.; van Vuuren, D.P. Possible Energy Futures for Brazil and Latin America in Conservative and Stringent Mitigation Pathways up to 2050. Technol. Forecast Soc. Change 2015, 98, 186–210. [Google Scholar] [CrossRef] [Green Version]

- Dantas, G.d.A.; de Castro, N.J.; Brandão, R.; Rosental, R.; Lafranque, A. Prospects for the Brazilian Electricity Sector in the 2030s: Scenarios and Guidelines for Its Transformation. Renew. Sustain. Energy Rev. 2017, 68, 997–1007. [Google Scholar] [CrossRef]

- Grangeia, C.; Santos, L.; Lazaro, L.L.B. The Brazilian Biofuel Policy (RenovaBio) and Its Uncertainties: An Assessment of Technical, Socioeconomic and Institutional Aspects. Energy Convers. Manag. X 2022, 13, 100156. [Google Scholar] [CrossRef]

- EPE. Expansão Da Geração: Termelétricas a Biomassa Nos Leilões de Energia No Brasil; EPE: Rio de Janeiro, Brazil, 2019. [Google Scholar]

- Souza, G.F. De Avaliação Termodinâmica e Econômica de Alternativas de Diversificação da Produção No Setor Sucroalcooleiro Brasileiro; Universidade Federal De Itajubá: Itajubá, Brazil, 2013. [Google Scholar]

- Mutran, V.M.; Ribeiro, C.O.; Nascimento, C.A.O.; Chachuat, B. Risk-Conscious Optimization Model to Support Bioenergy Investments in the Brazilian Sugarcane Industry. Appl. Energy 2020, 258, 113978. [Google Scholar] [CrossRef]

- Filho, L.C.D. Estudo De Viabilidade Do Uso Do Palhiço Para Geração De Energia Na Entressafra De Uma Usina Sucroenergética, Fundação Getúlio Vargas Escola. 2013. Available online: https://bibliotecadigital.fgv.br/dspace/handle/10438/10958 (accessed on 17 November 2022).

- Redígolo, S.C.R. Recuperação Da Palha De Cana-De-Açúcar Para A Produção De Energia Elétrica E Etanol Celulósico; Universidade Estadual Paulista: São Paulo, Brazil, 2014. [Google Scholar]

- Lacerda, K.A. Remodelagem De Uma Usina Sucroalcooleira Para Incremento Da Cogeração De Energia Com Aproveitamento Do Palhiço; Universidade Estadual Paulista: São Paulo, Brazil, 2015. [Google Scholar]

- Contreras-Lisperguer, R.; Batuecas, E.; Mayo, C.; Díaz, R.; Pérez, F.J.; Springer, C. Sustainability Assessment of Electricity Cogeneration from Sugarcane Bagasse in Jamaica. J. Clean. Prod. 2018, 200, 390–401. [Google Scholar] [CrossRef]

- Mohammed, Y.S.; Mustafa, M.W.; Bashir, N.; Ogundola, M.A.; Umar, U. Sustainable Potential of Bioenergy Resources for Distributed Power Generation Development in Nigeria. Renew. Sustain. Energy Rev. 2014, 34, 361–370. [Google Scholar] [CrossRef]

- Alexis Sagastume Gutiérrez, Juan, J. Cabello Eras, Donald Huisingh, Carlo Vandecasteele, L.H. The Current Potential of Low-Carbon Economy and Biomass-Based Electricity in Cuba. J. Clean. Prod. 2018, 172, 2108–2122. [Google Scholar] [CrossRef]

- Hiloidhari, M.; Araújo, K.; Kumari, S.; Baruah, D.C.; Ramachandra, T.V.; Kataki, R.; Thakur, I.S. Bioelectricity from Sugarcane Bagasse Co-Generation in India—An Assessment of Resource Potential, Policies and Market Mobilization Opportunities for the Case of Uttar Pradesh. J. Clean. Prod. 2018, 182, 1012–1023. [Google Scholar] [CrossRef]

- Bryman, A. Integrating Quantitative and Qualitative Research: How Is It Done? Qual. Res. 2006, 6, 97–113. [Google Scholar] [CrossRef] [Green Version]

- Goldblatt, D.L.; Hartmann, C.; Dürrenberger, G. Combining Interviewing and Modeling for End-User Energy Conservation. Energy Policy 2005, 33, 257–271. [Google Scholar] [CrossRef]

- MME. Portaria no 514, de 27 de Dezembro de 2018; MME: Sao Paolo, Brazil, 2018. [Google Scholar]

- Rego, E.E. Proposta de Aperfeiçoamento da Metodologia Dos Leilões de Comercialização de Energia Elétrica No Ambiente Regulado: Aspectos Conceituais, Metodológicos e Suas Aplicações. Ph.D. Thesis, Universide de Sao Paolo, Sao Paolo, Brazil, 2012. [Google Scholar]

- Maurer, L.; Barroso, L. Electricity Auctions. 2011. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/978-0-8213-8822-8 (accessed on 1 February 2021).

- IRENA. Renewable Energy Auctions–A Guide to Design. IRENA CEM 2015, 123–156. [Google Scholar]

- Tolmasquim, M.T.; de Barros Correia, T.; Addas Porto, N.; Kruger, W. Electricity Market Design and Renewable Energy Auctions: The Case of Brazil. Energy Policy 2021, 158. [Google Scholar] [CrossRef]

- CCEE. Câmara de Comercialização de Energia Elétrica Leilões de Mercado. Available online: https://www.ccee.org.br/mercado/leilao-mercado (accessed on 17 November 2022).

- Instuto Acende Brasil. Análise de Leilões. Available online: https://acendebrasil.com.br/leiloes/ (accessed on 17 November 2022).

- Maceira, M.E.P.; Duarte, V.S.; Penna, D.D.J.; Moraes, L.A.M.; Melo, A.C.G. Ten Years of Application of Stochastic Dual Dynamic Programming in Official and Agent Studies in Brazil–Description of the NEWAVE Program. Power Syst. Comput. Conf. 2008, 1–7. [Google Scholar]

- CEPEL. Manual de Referência–Newave; CEPEL: Rio De Janeiro, Brazil, 2012. [Google Scholar]

- de Freitas, R.A.; Vogel, E.P.; Korzenowski, A.L.; Oliveira Rocha, L.A. Stochastic Model to Aid Decision Making on Investments in Renewable Energy Generation: Portfolio Diffusion and Investor Risk Aversion. Renew. Energy 2020, 162, 1161–1176. [Google Scholar] [CrossRef]

- Ribeiro, G.B.d.D.; Batista, F.R.S.; de Magalhães, M.A.; Valverde, S.R.; Carneiro, A.d.C.O.; Amaral, D.H. Techno-Economic Feasibility Analysis of a Eucalyptus-Based Power Plant Using Woodchips. Biomass Bioenergy 2021, 153, 106218. [Google Scholar] [CrossRef]

- Maceiral, M.E.P.; Penna, D.D.J.; Diniz, A.L.; Pinto, R.J.; Melo, A.C.G.; Vasconcellos, C.V.; Cruz, C.B. Twenty Years of Application of Stochastic Dual Dynamic Programming in Official and Agent Studies in Brazil-Main Features and Improvements on the NEWAVE Model. Power Syst. Comput. Conf. 2018, 1–7. [Google Scholar] [CrossRef]

- Ferreira, P.G.C.; Oliveira, F.L.C.; Souza, R.C. The Stochastic Effects on the Brazilian Electrical Sector. Energy Econ. 2015, 49, 328–335. [Google Scholar] [CrossRef]

- Mummey, J.F.C. Uma Contribuição Metodológica Para a Otimização Da Operação E Expansão Do Sistema Hidrotérmico Brasileiro Mediante a Representação Estocástica Da Geração Eólica. Ph.D. Thesis, Universide de Sao Paolo, Sao Paolo, Brazil, May 2017. [Google Scholar]

- ONS. Sumário Do Programa Mensal de Operação (PMO); ONS: Rio de Janeiro, Brazil, 2019. [Google Scholar]

- ANEEL. Resolução Normativa No 843, de 2 de Abril de 2019; ANEEL: Rio de Janeiro, Brazil, 2019.

- ONS. Plano de Operação Energética 2019–2023; ONS: Rio de Janeiro, Brazil, 2019. [Google Scholar]

- ANEEL. Agência Nacional de Energia Elétrica Editais Dos Leiloes de Energia. Available online: https://www2.aneel.gov.br/aplicacoes_liferay/editais_geracao/edital_geracao.cfm (accessed on 17 November 2022).

- EPE. Plano Decenal de Expanção de Energia 2026; EPE: Rio de Janeiro, Brazil, 2017. [Google Scholar]

- EPE. Plano Decenal de Expansão de Energia 2024; EPE: Rio de Janeiro, Brazil, 2015. [Google Scholar]

- EPE. Plano Decenal de Expanção de Energia 2016; EPE: Rio de Janeiro, Brazil, 2007. [Google Scholar]

- IRENA. Future of Wind: Deployment, Investment, Technology, Grid Integration and Socio-Economic Aspects; IRENA: Abu Dhabi, United Arab Emirates, 2019; ISBN 9789292601553. [Google Scholar]

- IRENA. Renewable Power Generation Costs in 2020; IRENA: Abu Dhabi, United Arab Emirates, 2020; ISBN 978–92–9260–244–4. [Google Scholar]

- Schmidt, J.; Cancella, R.; Pereira, A.O. An Optimal Mix of Solar PV, Wind and Hydro Power for a Low-Carbon Electricity Supply in Brazil. Renew. Energy 2016, 85, 137–147. [Google Scholar] [CrossRef]

- Watanabe, M.D.B.; Morais, E.R.; Cardoso, T.F.; Chagas, M.F.; Junqueira, T.L.; Carvalho, D.J.; Bonomi, A. Process Simulation of Renewable Electricity from Sugarcane Straw: Techno-Economic Assessment of Retrofit Scenarios in Brazil. J. Clean. Prod. 2020, 254, 120081. [Google Scholar] [CrossRef]

- de Cássia Oliveira Pavan, M.; Ramos, D.S.; Soaresa, M.Y.; Barufi, C.; de Carvalho, M.M. Barriers to Broaden the Electricity Production from Biomass and Biogas in Brazil. Production 2021, 31, 1–20. [Google Scholar] [CrossRef]

- Project SUCRE. Sugarcane Straw Processing and Burning, 2013.

- CTC PALHA DE CANA: Desafios, Benefícios e Perspectivas. 2017. Available online: https://esalqlog.esalq.usp.br/upload/kceditor/files/2017/SILA14/Francisco%20Antonio%20Barba%20Linero.pdf (accessed on 1 December 2022).

- da Silva, J.B.S.; Villa-Vélez, H.A.; Júnior, J.B.; Conconi, C.C.; Cruz, G. Perspectives and Challenges of Sugarcane Straw for Bioenergy Production. In Sugarcane: Production, Properties and Uses; Nova Science Publishers: Hauppauge, NY, USA, 2020. [Google Scholar]

- UNICA. Histórico da Produção e Moagem 2019. Available online: https://unica.com.br/ (accessed on 1 June 2021).

- PSR. Custos e Benefícios Das Fontes de Geração Elétrica; PSR: São Paulo, Brazil, 2018. [Google Scholar]

| Measure | Description | Applies to Bioelectricity |

|---|---|---|

| Program for Alternative Sources of Electric Power (PROINFA) | Created by Law 10.438 of 26 April 2002; had as its first objective the procurement of 3300 MW (1100 MW each of wind, biomass, small hydro), with the second objective of renewables reaching 10% of electric energy consumption in 20 years through a feed-in tariff mechanism; only the first goal was met [15,16]. | Yes. Bioelectricity was procured at only 62% of the initial goal; the result was associated with the low reference value used for this source and with the weak structure of the equipment supply chain [17,18]. |

| Tax incentives | Federal and state tax exemption for equipment production; in the North and North-East regions, generating companies are exempt from income tax, and project up to 30 MW of installed capacity are under a special income taxation regime [19,20,21]. | Yes |

| Subsidised financing | The Brazilian National Bank for Economic and Social Development (BNDES) provided funding for renewable energy projects with interest rates lower than the private financing market; almost all renewable sources projects use this financing option. | Yes |

| Discount on tariff from the use of the transmission (TUST) and distribution systems (TUSD) | Discount higher than 50% on tariffs for using the transmission (TUST, in its Portuguese acronym) and distribution systems (TUSD) for renewable generation undertakings: wind, solar, biomass, and qualified combined cycle [22]. | Yes |

| Special consumers (load between 500 kW and 2.5 MW) | Consumers can buy energy from renewable generators that inject power of less than 50–300 MW [22]. | Yes |

| Net-metering system | Resolution 482 of 2012 and 687/2015 allows consumers to generate up to 5 MW to compensate for the electric energy consumed using the power injected in the distribution grid. | Yes |

| Exemption from investing in R&D and energy efficiency | Renewable energy investments were made exempt from the mandatory investment in the Research and Development program (R&D) and Energy Efficiency program. | Yes |

| Distributed generation contracts | Electric energy operators can buy distributed generation projects through an official call for bids up to 10% of their loads. | Yes |

| Renewable energy source auctions | The government has used the regulated contracting environment and reserve auctions to procure variable renewable sources [23,24]. | Yes |

| Scenario | Wind Generation | Load Addition | Hydrology | Biomass Generation |

|---|---|---|---|---|

| Reference | Stochastic | 0 | Standard/critical | Seasonal/flat |

| W10 | Stochastic | 10% | Standard/critical | Seasonal/flat |

| W20 | Stochastic | 20% | Standard/critical | Seasonal/flat |

| W10D | Deterministic | 10% | Standard/critical | Seasonal/flat |

| W10F | Flat | 10% | Critical | Seasonal |

| System Condition or Characteristic | Definition |

|---|---|

| Reservoir level | January 2019 (standard) or January 2015 (severe). |

| Hydrologic tendency | January 2019 (standard) flow rate from July to December 2014 (severe). |

| South-East/Mid-West load | 10/20% addition to the South-East/Mid-West gross load preserving its behaviour profile. |

| Sugarcane bioelectricity | Additional generation was added to the South-East/Mid-West submarket to supply additional load and adjust levels similar to wind power generation. |

| Bioelectricity generation profile curve | Seasonal average generation per month [71,73]. Average generation per month with a flat pattern. |

| Wind generation profile curve | Transformed wind power generations in uniform quantities throughout the months—flat curve. |

| Indicator | System | Percentage Comparison |

|---|---|---|

| Marginal operational cost (SRMC) | South-East/Mid-West subsystem | the higher, the worse |

| Thermal generation | South-East/Mid-West subsystem | the greater, the worse |

| Total cost | Interconnected system | the greater, the worse |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Soares, M.Y.; Ramos, D.S.; de Oliveira Pavan, M.; Diuana, F.A. Barriers to the Expansion of Sugarcane Bioelectricity in Brazilian Energy Transition. Energies 2023, 16, 955. https://doi.org/10.3390/en16020955

Soares MY, Ramos DS, de Oliveira Pavan M, Diuana FA. Barriers to the Expansion of Sugarcane Bioelectricity in Brazilian Energy Transition. Energies. 2023; 16(2):955. https://doi.org/10.3390/en16020955

Chicago/Turabian StyleSoares, Munir Younes, Dorel Soares Ramos, Margareth de Oliveira Pavan, and Fabio A. Diuana. 2023. "Barriers to the Expansion of Sugarcane Bioelectricity in Brazilian Energy Transition" Energies 16, no. 2: 955. https://doi.org/10.3390/en16020955