1. Introduction

Significant changes in agricultural commodities’ future prices can result from, among other factors, a new supply situation perceived as a consequence of government production reports released. The magnitude of price movements indicates how surprised market participants are by new information. This uncertainty may originate in the tone conveyed in its content, given the market conditions.

Overdependence on agricultural commodity exports is a growing concern for governments and market participants in Brazil and the United States, both due to the recognized volatility of this product group, which often exhibits severe bubbles and declines [

1], and due to the versatility in the production process, consequently displaying information about the economy state [

2]. To keep market participants updated on progress and harvest conditions, the government publishes reports, for example, through the United States Department of Agriculture (USDA) and the National Supply Company (CONAB), containing information collected using careful methodologies. Their information is based on transparency and good governance, becoming a reference in the market. Given that the announcement origin matters [

3], their objective is to make information about foreseeable future events public, a trend that could influence future market operations.

Estimates presented in government crop reports are sufficient to trigger a change in market expectations, since they are kept confidential until the moment of disclosure. This is because there is an increase in information asymmetry before the announcements, given the private information involved [

4]. Thus, investors, over time, can tilt their portfolios according to their views on the adaptation investment scenario. Assuming that the information disclosed affects returns, it is expected that the magnitude of this impact will vary according to the market context, whether bullish or bearish, in the financial market direction. The effect of reports on market prices can also be studied based on the behavioral bias literature. For example, market participants can be influenced by narratives due to cognitive biases [

5].

Bull and bear markets were introduced as longer periods of rising and falling prices [

6], generally lasting months or even years. At these market extremes [

7], asset prices are expected to rise (fall) and, as a result, there is a greater likelihood of gains (losses) in trades. A rising (bullish) market indicates an expected upward movement in asset prices, resulting from investor optimism. On the other hand, a falling (bearish) market indicates an expected downward movement in prices, resulting from pessimism. Investor reactions can also represent responses related to beliefs and anchors, as studied in the behavioral finance literature [

8,

9].

Underreaction and overreaction are driven by surprise levels [

10]. Surprise plays an important role in how people update their judgments after a new event [

10], whether positive or negative events, whose most evident characteristic is unpredictability [

11]. Although market participants react differently to new events, overreaction (positive or negative) occurs when the event is extremely surprising [

10]. Such reactions indicate that the content of the information presented influences the direction of market participation. In addition to quantitative information, qualitative factors incorporate explanations for commodity price movements. This makes an association between the information tone, measured, for example, by words categorized as positive or negative, and surprise levels. Reference [

12] shows that increases in negative words used in

The Wall Street Journal and Dow Jones News Service columns about S&P 500 companies, relative to previous stories, predict larger negative shocks in response to future earnings. On the other hand, the framing of negative information is so often filled with positive words that the measured positive sentiment is ambiguous [

13].

Texts are used to convey fundamental information that is not reflected in quantitative results. Words are more elastic than numbers in conveying an impression. Government officials can influence crop data by inflating their narrative tone in releases to steer the agricultural commodity market. The question is how investors can react to this tonal emphasis in an extreme market context. Therefore, to properly assess reports’ impact on the market, it is necessary to consider the unexpected (“surprise”) component [

14].

At the same time, as information is extracted from the document text, it is necessary to determine how much context is inserted, that is, how much the content has already absorbed about market conditions, since words are not independent units. Since reactions occur before and after announcements [

3], the context experienced by the market (high or low) can influence the proportion of tone. Rapid fluctuations in agricultural commodity prices, as well as periods of greater market volatility, represent a threat to participants, which can be explained, in part, by the tone of the information presented. Thus, this study aims to analyze the informational content in the market context with future price fluctuations. Specifically, this study seeks to determine the relationship between the tone of information disclosed by government crop reports in extreme market conditions (high and low) and agricultural commodity price behavior. To this end, the study investigates how agricultural commodities respond to the content disclosed for the Brazilian market, compared to the content disclosed for the USA market, involving agricultural production.

This research is justified by the relevance of agricultural commodity markets in the global economic context, especially due to their representativeness in the Brazilian trade balance, despite there being few studies involving the price behavior of commodities traded on the Brazilian market [

15], especially agricultural ones. Since foreign markets can transmit information content beyond domestic market dynamics [

16], the present study focuses on a developing market and a developed market for comparison purposes. The question is whether, and to what extent, financial frictions influence investment decisions.

The contributions of this work include the refinement and evolution of studies on financial markets, specifically on directions and trends, adding to the literature on asymmetric information processing for positive and negative news. In addition, it enables an understanding of the scope of information transmission by the government from a qualitative perspective for greater pricing efficiency. Finally, it delves into extreme market conditions and their impact on investor decision-making, analyzing the existence of directions in decision-making. In short, this study can improve our understanding of a series of financial anomalies: overreaction, underreaction, and pricing limits.

2. Study Hypotheses

Beliefs and anchors can drive many decisions in the financial market [

17], especially when these decisions are related to new events. Turbulence and declines in financial markets require investors to diversify assets to reduce risks of market instability. For this reason, significant public resources are invested in the development of crop projection reports, which have the role of informing decisions throughout the supply chain.

Any investor will make their portfolio formation decisions using information up to that point in time, and portfolio returns will be obtained at the end of their investment horizon, in the future. The key to making optimal investment decisions is in the available information and cognitive value of investors [

18]. However, the magnitude of price change indicates how “surprised” participants are by new information.

The impact of the component of surprise in crop reports on agricultural commodity markets has rarely been studied. The fact is that commodity market movements increase in extreme situations [

19], impacting the market liquidity level, due to the investor surprise level. This is evidenced by significantly larger price adjustments after the release of a government crop report compared to adjustments prior to the report or some other control period, implying that it contained unforeseen information [

20]. Previous tests have shown that the unforeseen component of government agricultural production forecasts significantly affects future prices [

21].

The current literature presents different directions for the impact of surprise on the financial market. When it occurs late, a surprise announcement during the current trading session for a specific commodity has an effect during the trading session the following day [

20]. With an indifferent response, regarding differential impact between positive and negative surprises, no disproportion is evidenced [

4]. A strong immediate market reaction tends to occur two minutes after a good news announcement and approximately five minutes after bad news [

3]. In general, surprise is related to the information asymmetry degree surrounding the announcement [

4], with the impacts on prices still observable on the day when the report is released [

22].

High surprise rates are associated with low probabilities and vice versa, but not all low probability outcomes are necessarily surprising [

10]. Not all low (high) probability outcomes are equally surprising, since market complexity tends to drive participants. For example, institutional investors obtain higher rates of return during a recession, due to the protected condition of commodities during market boom/bust periods [

22]. This is because the environment provides the conditions for the creation of expectations, which, in turn, encourage the exaggerated or not exaggerated movement of asset prices. Such reasoning is aligned with the behavioral finance literature, since psychological anchors can influence investor beliefs [

8,

9]; therefore, investors’ reaction can affect market volatility after new information is released.

Commodity price variations depend on market reactions [

23]. This behavior is evident in exceptional moments, when the calming effect of news contained in USDA crop reports is greater in periods of pessimistic markets [

24]. In a surprise event, extreme market movements are experienced in low-probability events, leading to an exaggerated reaction [

8,

25]. Therefore, some pieces of information can affect judgements and decisions [

26], also affecting market prices. Depending on the reaction, it is possible to apply profitable commodity trading strategies, enabling diversification.

In the commodity market, most investors fail to determine the accurate fundamental value of information, and the expected value may differ in bearish and bullish conditions. In a bearish market, investors underestimate the value out of caution. When investors are pessimistic, they are more disturbed by extreme market movements, believing that their previous beliefs were grossly misleading [

25]. Ref. [

27] provides evidence that this information asymmetry is more pronounced in a bearish market. A highly correlated portfolio of assets, such as those tied to commodities, may suffer significant losses during uncertain periods and bearish market conditions [

28]. On the other hand, in a bullish market, investors overestimate value due to a tendency to be less risk-averse. Ref. [

29] found that investor sentiment is negatively correlated with asset portfolio returns and is less responsive to information in bull markets. Thus, overreaction is more pronounced when investor sentiment is low rather than high [

25].

Extreme market conditions (optimism versus pessimism) can also affect the rational risk–return profile of investors, and these extreme conditions may further interact with investors’ behavioral biases, influencing the decision-making process [

30]. During bullish periods, investors are more willing to take risks, while during bearish periods, investors flee from higher-risk investments, such as stocks [

31]. The difference in sensitivity to gradual and abrupt changes is due to the surprise factor [

32]. These conditions guide information issuers to avoid negative surprises and even mitigate them. Furthermore, a heterogeneous structure of commodity markets offers better opportunities for portfolio diversification during calm periods compared to turbulent periods [

33]. In particular, it is possible that being in a bullish or bearish market provides information about the alignment of crop reports’ textual tone for a given agricultural commodity.

Tone can be used to opportunistically inflate audience perceptions [

34,

35], with intentional or unintentional characteristics conveyed by the text [

12]. In a corporate environment, negative words are rarely used except in extremely necessary conditions, whereas positive words are thrown around, including to soften the context of negative impacts [

36]. Because they are less direct in their contextual meaning, positive words require a look at the context involved [

36].

Positivity can refer to some misleading context [

37]. In this sense, Ref. [

38] identified that as the content became more positivist, the return on assets tended to decrease. On the other hand, an optimistic tone can refer to higher returns, above forecasts [

39]. Since the disclosure tone has the power to predict future risk, a less optimistic tone suggests greater risk [

34]. Previous studies have found that investors focus on pessimistic language, paying less attention to positive words [

36,

40]. Additionally, textual language can inflate bubbles and incite panic in the market in extreme bullish and bearish conditions [

41]. In other words, language can exacerbate bubbles by influencing the judgment of agents who still hold positions contrary to the information content. Investors frequently operate in environments characterized by asymmetric information and are subject to behavioral biases [

5]. Changes in uncertain conditions can cause price volatility [

42,

43], as commodity behavior varies according to the market situation. This impact involves investors’ decisions, as they may follow a long-position strategy in a bull market and a neutral or short-position strategy in a bear market [

44]. Consequently, it becomes more difficult to enter and exit positions. This loss of flexibility will inevitably hurt portfolio performance [

45]. In this context, the impact of a surprise in a bear market is significantly greater than the impact of surprise in a bull market [

28]. Regarding good news during pessimism, there is no price reaction evidence in post-announcement periods [

46].

As uncertainty increases, investor sentiment becomes polarized [

47], revising commodity market expectations regarding price trajectory. This cognitive dissonance is temporary for bad news under optimism but quite persistent for good news under pessimism [

46]. In this sense, investors value positive news that contradicts their market context, thus causing an extreme price reaction on the announcement date, that is, with an impact amplification. Positive information tends to be more weighted, while greater weight is given to negative information. When the sentiment is pessimistic, only negative surprises are quickly reflected in the price. Focusing on commodity assets can improve the returns of several strategies based on bull or bear markets. Announcements with information that contradicts market sentiment trigger dissonance, causing investors to consider such information in order to reconcile this inconsistency. Given that the positivity or negativity degree in harvest report texts produced by the Brazilian Government objectively captures market conditions and its economy context based on agricultural commodities leads to a certain reaction, the following hypothesis arises:

H1a. The tone of crop reports published in Brazil by CONAB in extreme market conditions (high and low) has an effect on the price behavior of agricultural commodities.

The efficient market hypothesis basis, in its various forms, postulates that asset prices reflect information dispersed throughout the market [

48]. The traditional pricing model, the Capital Asset Pricing Model (CAPM) [

49,

50,

51], is able to measure some components and their impact on the expected rate of return on investment, although it is still questioned in the literature. Within the finance theory, the effort to determine the value of an asset, particularly its intrinsic value, has been a longstanding focus, relying on all available information as its basis [

52]. Therefore, financial asset prices aggregate information from different participants to reflect their collective expectations regarding the economic fundamentals of assets [

53].

Although the context of a bear or bull market has a global impact, this may be different in a developed economy compared to a developing economy. Thus, the linguistic intonation adopted by the government may present relevant discrepancies regarding investor’ analysis and, consequently, in their surprise level, which should be analyzed for comparative purposes. Thus, the following hypothesis is in place:

H1b. The crop reports tone published in the United States by USDA in extreme market conditions (high and low) has an effect on price behavior of agricultural commodities.

3. Methodological Aspects

3.1. Data

The research objective is to analyze the relationship between reports published by the Brazilian and US government and market conditions (both rising and falling). The information from the report published by National Supply Company (CONAB) and United States Department of Agriculture (USDA) was analyzed in a qualitative and quantitative context. Given Brazil’s notoriety in the production and supply of agricultural commodities in a global context, soybeans, corn, coffee, and sugarcane were defined as the focus of the analysis, corresponding to highlights in exports.

Regarding the data temporal dimension, this study covers daily data between January 2017 and February 2023, given the data availability and with the aim of covering high and low periods, capturing the market context heterogeneity. For analysis purposes, the release of reports by CONAB and USDA on a given date is considered an “event”. Regarding the commodities under study (soybean, corn, coffee, and sugarcane), their information is released in separate reports and at different intervals. The agencies issue monthly reports on grains, while coffee has its information released quarterly in the case of CONAB and biannually by USDA. Regarding the commodity of sugarcane, CONAB issues an exclusive report quarterly, and USDA includes the information in grain reports. The publication date of these reports served as a basis for the creation, for each commodity, of two scalar variables (one for CONAB publications and another for USDA publications).

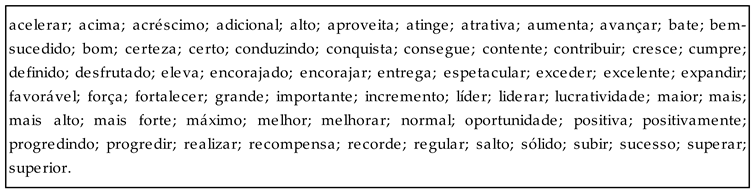

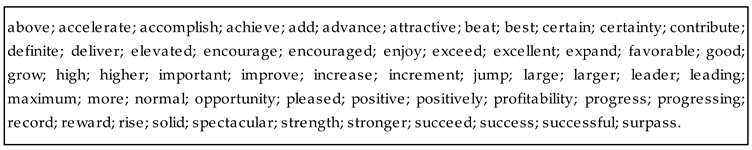

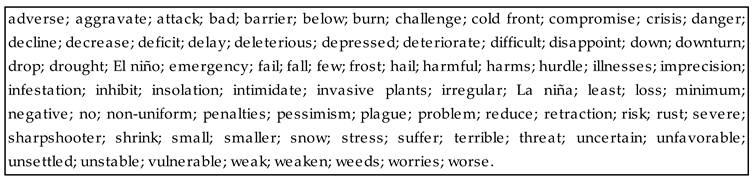

In addition to scalar variables related to days of report publication, the quantitative analysis used reports’ informational tone. In order to perform tone assessment, tools for content analysis were used in each report, i.e., specific dictionaries and software. The content analysis involved the use of keywords in CONAB and USDA report analysis, based on the dictionary in

Appendix A, containing words selected according to content of harvest reports.

A matrix is constructed by categorizing positive and negative words based on their meaning, forming a dictionary that can be used to define the information’s positive or negative tone. Using a widely used textual analysis program, KH Coder, it was possible to extract this content and measure it, as per [

54]. The dictionary words identified in reports are measured by their sum, according to the frequency captured [

55,

56,

57].

In Equations (1) and (2), the positive tone (POS) and negative tone (NEG) are calculated, respectively [

58].

Equations (1) and (2) were applied to content of reports specifically related to commodities of interest. For each tone, both the positive variable (POS) and the negative variable (NEG), we evaluated the report content through scalar variables, generated after processing in KH Coder software. On the respective date of report publication, each variable receives an index calculated based on Equations (1) and (2), receiving the value 0 for other dates.

For information related to commodity prices, the Thomson Reuters/Refinitiv Eikon database was used to access future contracts traded on the North American market via the Chicago Board of Trade and the Chicago Mercantile Exchange. The contracts used are (a) ICE-US Coffee C Futures Electronic Commodity Future Continuation 1; (b) ICE-US Sugar No. 11 Futures Electronic Commodity Future Continuation 1; (c) CBoT Corn Composite Commodity Future; (d) and CBoT Soybeans Composite Commodity Future Continuation 1.

Selected commodity futures are a global benchmark for the commodity market, with continuous price time series extracted directly from Thomson Reuters/Refinitiv Eikon. Daily futures contract returns for each commodity between 2017 and 2023 are used to measure the market reaction. Information impact is assessed by comparing future return variability with the release of reports in pre- and post-release conditions.

Tone analysis was performed in different financial market scenarios. Specifically, bull and bear markets were defined by periods of financial uncertainty in the change return of the S&P 500 index, with increases above 1% as a bull market and decreases below 1% as a bear market, as per [

59]. Thus, the dummy S&P(Bull) was created, which receives 1 for months in which S&P500 presented a return greater than or equal to 1%, and 0 for other months, representing a bull market scenario. The dummy S&P(Bow) receives 1 for months in which S&P500 presented a return less than or equal to 1%, and 0 for other months, establishing a bear market context.

To identify the surprise/contrast element in information, we chose to analyze contrasting positions between tone and market condition, as suggested by [

10]. Thus, the bull market was tested with negative tone, but not with positive tone and opposite order. A well-founded news sequence, in a market growth context, tends to sustain growth already experienced, while not providing characteristics necessary to identify the market perplexity degree. Likewise, a market with pessimism predominance, when receiving negative information, tends to remain at crisis level. Therefore, if a difference is caused by unexpected events, it seems unnecessary to investigate this relationship, since, in fact, it boils down to an existing trend confirmation.

3.2. Analysis Method

The commodity market reaction is measured in terms of price changes. In constructing time series, the return rate (log-return) of prices series, as per Equation (3), was considered as a proxy for price behavior. Returns are usually a manifestation of fickle sentiments of investors [

56].

where

is the return rate (log-return);

is the commodity price at time

t; and

corresponds to the commodity price at time

t−1.

By obtaining daily return of all series, it is possible to estimate an autoregressive moving average (ARMA) model to determine the data-generating process. The ARMA (

p,

q) model, where

p is the autoregressive term number and

q is the number of moving average terms, is widely used in time series modeling and can be described as per Equation (4).

where

is the constant term;

is the autoregressive coefficient; and

is the moving average coefficient.

This research aims to test the hypothesis that new information released to the market under extreme conditions can be attributed to crop outlook reports released by CONAB and USDA. Measuring market volatility, a proxy used to measure price behavior, we have the dispersion of asset returns with statistical parameters such as standard deviation or variance [

60]. To achieve the research objective, this study uses a generalized autoregressive conditional heteroscedasticity (GARCH) approach [

61], derived from the autoregressive conditional heteroscedasticity (ARCH) approach proposed by [

62] to capture volatility persistence in inflation. Thus, volatility was examined by variations in ARMA-GARCH models that present adequate modeling for market predictability [

63,

64]. GARCH is best suited for financial time series data as it can discover volatility clusters and capture leptokurtosis effects in distribution [

65]. Therefore, time series analysis is used, using generalized autoregressive conditional heteroscedasticity (ARCH) models or GARCH alone.

Using the volatility estimates generated by ARCH and GARCH models as a dependent variable, we analyzed the hypothesis that estimated volatility can be explained by variables in tone related to information effects contained in CONAB and USDA crop reports. Variables for reports tone were considered as follows: a positive tone when the market is down and a negative tone when the market is up.

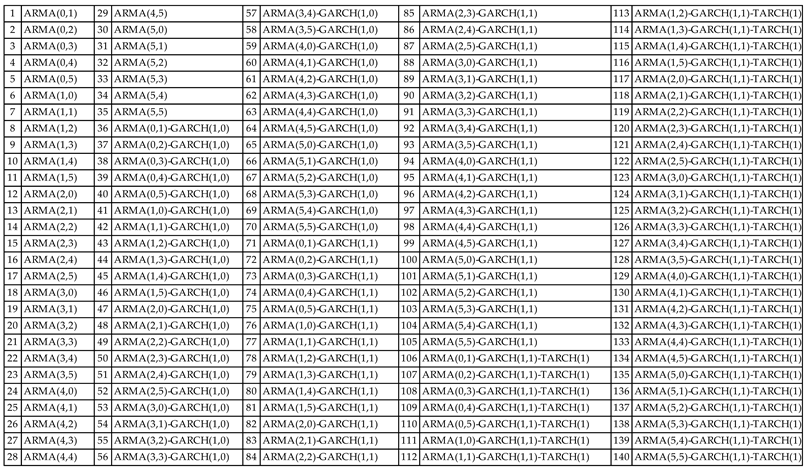

After collecting price series of futures contracts, a descriptive analysis of log-return series was performed for all commodities. The Dickey–Fuller test was applied to log-return series for each commodity, indicating that they are non-stationary. A single time series can be described by several econometric models. Therefore, researchers must select the model that best fits the data, often using statistical criteria such as the Akaike Information Criterion (AIC). To select the most suitable time series model, we ran 140 different models for each commodity, as shown in

Appendix B.

Specifically, for each commodity, 140 models were estimated to select which one presented the best fit, using a positive word index as an explanatory variable for return volatility. This procedure was repeated, with another 140 models estimated using a negative word index. These steps were followed for all commodities. The tests were also extended by using return as a dependent variable (replacing volatility).

4. Results

Below are descriptive statistics of variables used in this study. Daily data on asset returns from January 2017 to February 2023 were considered in relation to the tone of reports issued periodically by CONAB and USDA.

Table 1 provides a detailed view of descriptive statistics, including mean, standard deviation, and maximum and minimum values.

Regarding the tone variable, broken down into positive and negative forms,

Table 2,

Table 3,

Table 4 and

Table 5 present its descriptive statistics, such as the mean, standard deviation, maximum, and minimum in relation to the CONAB or USDA report. When establishing a sample with periodic reports of CONAB and USDA, the sample size of each variable is delimited, with variation between 12 and 74, depending on the publication number of each report for each commodity.

Table 6 and

Table 7 summarize the main results of the study. Initially, the analysis focused on coffee future price behavior, based on results for models containing an analysis of the effects of the CONAB and USDA report tone on the volatility and returns of coffee future contracts, as well as the effects when markets move upwards and downwards.

After estimating parameters related to CONAB reports, it is observed that positive narrative content does not present statistical significance in price volatility for the coffee commodity. When the market is down, there is also no significance in relation to volatility. However, when considering negative tone, there was significance at 5% and a negative coefficient, indicating a reduction in volatility of coffee prices. In a bull market, there is statistical significance and a positive coefficient, indicating an increase in price fluctuation. Regarding parameters estimated for USDA reports, there is a lack of statistical significance, both for positive (negative) tone and for the extreme bear market condition (bullish).

Furthermore, for the main interest variable related to coffee, interaction between a positive tone (negative tone) and a bearish (bullish) market was not significant in CONAB reports in relation to volatility and price returns. In general, hypothesis H1a, that coffee prices respond to the narrative context in extreme market conditions, was not supported by the data. In relation to the content of reports published by USDA, the tonal exposure (positive and negative) is not significant in any market condition (bullish or bearish), nor is the effect of the interaction variable. Therefore, there is no support for hypothesis H1b.

Regarding the sugarcane commodity, considering volatility and return, CONAB reports show a lack of significance when volatility is used. On the other hand, there are negative and significant coefficients for a positive (negative) tone with a bearish (bullish) market, as pointed out in a previous study [

41], when considering asset returns as a dependent variable, obtaining results that support hypothesis H

1a. The emphasis is only on CONAB reports, since it is not possible to make inferences in any test for USDA reports; thus, we could not use these results to support hypothesis H

1b.

Regarding the results for corn commodity price behavior, measurement of volatility and return reveals a positive influence of the tonal words (positive and negative) used by CONAB and USDA. However, under extreme market conditions, only the bullish period presented statistical significance, with a negative coefficient affecting corn price volatility.

For the variable of interest, a 10% significance was observed for positive tone in a bearish market, positively impacting volatility, and this suggests that the belief prior to new information released by CONAB was redefined, in line with previous studies [

26,

28]. In addition, a 10% significance was found for negative tone in a bullish market, also positively impacting volatility, indicating that by taking more risks in a bullish context, agents are sensitive to negative tone presented by CONAB, corroborating the literature [

31,

32]. In this sense, it is not possible to refute hypothesis H

1a.

When considering corn price behavior through returns, it is observed that the variable of interest was significant only for content provided by USDA, thus not rejecting hypothesis H1b. The positive (negative) tone in a bearish (bullish) market was significant at 10%, with a negative (positive) coefficient. Thus, an impact on corn contracts returns is identified when disclosing tonal information in moments of extreme market uncertainty.

The results for soybean commodity price behavior, measured by volatility and return, were also analyzed, given the narrative tone and extreme market conditions. Regarding the content of CONAB, there was no statistical significance in variables. Thus, there is no support for hypothesis H1a. For the content released by USDA, positive tone demonstrated strong significance in both the volatility and return of soybean future contracts. Regarding the main variable of interest, there was no support for hypothesis H1b.

In general, most of the coefficients for the variable of interest were not statistically significant. However, the research hypotheses cannot be completely refuted, given that some findings associated with tonal effect, in extreme market conditions, achieved statistical significance in terms of affecting price behavior, as summarized in

Table 6 and

Table 7. As previously mentioned, when trading in the financial market, investors are guided not only by factors like increased risk–return levels, risk mitigation, and/or diversification but also by beliefs and anchors [

20,

22]. Therefore, the main results of this paper suggest that the qualitative content of crop reports, under extreme market conditions, may not to be the primary factor driving decisions influenced by anchors and beliefs or that such behavioral biases were affected by other variables.

Although there is little evidence that prices are affected, possible effects can be observed. In particular, there is evidence of changes in traders’ positions in the agricultural commodity market, as evidenced in previous studies [

47]. This framework suggests that the effect of tone degree differs at each moment, depending on announcement context. The market’s reaction depends on its ability to detect information, which in turn depends on investors’ sophistication and optimism (pessimism) in the market. Moreover, as investors are naturally subject to behavioral biases [

19], their decisions to buy or sell commodity futures may be influenced by factors other than the narratives presented in government crop reports. In this way, the findings reveal the behavior of investors who, when faced with different tone levels of information, develop strategies that are not aligned with a single direction. At a certain point, they may migrate assets, but it is likely that the condition of lower portfolio flexibility, mentioned previously [

45], helps to explain these results.

Depending on the informational weight, commodity, and market context, the impact is possible but remains uncertain. This divergent empirical evidence indicates a complicated relationship between tone and asset pricing. These findings can be attributed to the safe haven properties of commodities, as investors can use such assets to hedge against uncertainties and risks arising from the market context. The use of commodities as safe havens is also tied to investor beliefs, a factor that further highlights the relevance of the behavioral finance literature in understanding the financial market. These research findings shed light on the relationship, the surprise/contrast effect of which does not have the expected influence.

5. Final Considerations

Understanding the determinants of commodity price fluctuations is a matter of importance due to both its economic and social implications. There is some evidence of a relationship between the tone of information released in government crop reports in extreme market conditions (both high and low) and agricultural commodity price behavior. The power of the narrative’s tonal condition to resolve uncertainties surrounding crop reports is partial, since price responses are notably low.

The evidence suggests that investors may sometimes use this information to adjust their portfolios to balance risk and return, although only a few coefficients were statistically significant for the main variable of interest. However, the full impact of different tone levels of information is not immediately reflected, possibly requiring time for absorption. Furthermore, an additional contrast may be on the way, leading investors to remain in their previous positions. Results suggest that there is little evidence that periods of high and low financial uncertainty in relation to narrative tone are systematically related to commodity price behavior.

Price volatility is a major concern for investors when managing their portfolios and a major threat to policymakers when seeking to ensure food security for society. The search for better asset returns also depends on information disclosure, with strategic approaches varying based on the decision-maker’s level of sophistication and also being influenced by behavioral biases.

The commodity market heterogeneity, with particularities in supply and demand, provides a reasonable explanation for the divergence in the results. In this sense, future research can be conducted via case studies addressing related commodities, as well as other indicators of uncertainty. For further research, we also recommend an analysis considering sub-periods to understand price behavior at different moments (minutes, hours, days), since the market can react to new information within minutes.

The analysis conducted in this paper has some limitations. The first limitation is its focus on non-numerical information, since numerical data in government reports can also affect commodity prices. Another limitation of the study lies in the methodology, which used a dictionary-based approach that did not account for semantic context when categorizing tone. Therefore, future research could employ Natural Language Processing (NLP) methods, a type of Artificial Intelligence that can analyze words within their narrative context, to overcome this limitation. Finally, the number of observations in some report categories was also low, a factor that can affect the generalizability of the results.