1. Introduction

Understanding the dynamics of futures price volatility is very important for many aspects of risk management, such as hedging, portfolio construction, derivative pricing, etc. Samuelson was the first to investigate the relationship between volatility and time until contract expiration, stating the hypothesis that the volatility of futures price changes should increase as the delivery date nears. This prediction is very well-known and referred to as the

Samuelson hypothesis or

maturity effect [

1]. This backwardation of volatility of forward contracts arises across most markets, but this effect is especially pronounced in energy markets as a particular steep increase in volatility occurs in the last six (or less) months of the life of the contract. This is one of the most fascinating phenomena of commodity futures, which must be taken into account in pricing and managing of commodity contracts.

The primary objective of our article is to provide a method to parameterize and, more crucially, calibrate the rise in volatility as contract maturity approaches. We are not questioning the validity of the Samuelson effect for the examined commodity futures, nor do we model the entire volatility surface, which involves stochastic volatility models. We focus only on the Samuelson effect and seek a viable solution that yields stable results. Our primary objective is to identify a natural and practical way to integrate the Samuelson effect in the evaluation of path-dependent options, early-expiry options, CVA, and related matters. Consequently, we chose instantaneous variance of commodity futures as the focus of the study. This choice allows us to match the market information, such as option quotes on futures, perfectly (via implied volatilities).

We begin with a simple example that demonstrates the importance of the Samuelson effect and the consequences of ignoring it. We consider a future contract on WTI with expiration in

years priced at

USD 64 per barrel. Assume that the implied volatility quoted for this contract is

, and we consider an ATM call option on this future expiring

months before the contract expiration, thus in

years. Such options are called

early-exercise options. The total variance during the lifetime of the contract will be

. If we price the option using the quoted implied volatility, the price of the early-exercise ATM call option will be USD

per unit (no discount). However, under the Samuelson effect, the variance does not accumulate in a uniform fashion, so such a calculation will be wrong. Suppose we have a strong Samuelson such that half of the total variance happens in the last three months of the life of the contract. In such a case, to price the option, we have to use the following volatility:

The right option price is USD , and ignoring the presence of Samuelson leads to overpricing the option by .

Now, let us analyze the consequences of using a wrong variance for the second part of the time, the last three months of the lifetime of the contract. Since half of the total variance realizes during a short period of time of three months, the average volatility

corresponding to the last three months will be much higher:

Assume that in

years we have a right to buy a call option for premium

USD 10, and the strike

of the call option is equal to the current forward price

. Thus, we consider a compound option with payoff

where

is the Black call price with price

F of the underlying asset, strike

, volatility

, and time to expiration

. We can price the compound option by using standard numerical procedures (grid evaluation or Monte Carlo). Even though the right

with Samuelson is higher than with flat Samuelson, the expectation of the underlying call option

is the same in the two scenarios (we use risk-neutral pricing). However, the distribution of futures prices in

years with flat Samuelson is much wider (standard deviation of futures price of USD

vs. USD

), which makes the compound option more expensive under flat Samuelson

USD

vs. with Samuelson

USD

. Disregarding Samuelson results in overpricing the option by

.

Another example of an early-exercise option includes swaptions, which are widespread products in energy markets. Their evaluation is discussed in [

2]; see also the recent book on quantitative trading in the oil market by Bouchoev [

3]. The Samuelson effect must be taken into account in the evaluation of path-dependent options, such as extendibles, calculations of forward exposure of a portfolio (necessary for CVA computations), hedging decisions, etc.

We now provide a comprehensive summary of the current research on the subject, which includes the most recent developments.

Empirical analyses have been conducted on the Samuelson hypothesis in numerous studies, and it has been validated in a subset of markets. Many of them reach mixed conclusions. For example, Miller [

4] investigates live cattle, Barnhill et al. [

5] study U.S. Treasury bonds; Adrangi et al. [

6] consider selected energy; Adrangi and Chatrath [

7] analyze coffee, sugar, and cocoa. Andersen [

8] finds evidence in the agricultural markets, such as wheat, oats, soybean meal, and cocoa, but not for silver. Milonas [

9] finds strong support for the hypothesis in agricultural markets, but little or no support when using gold, copper, GNMA, T-bond, and T-bill prices. Rutledge [

10] finds support for the Samuelson hypothesis with silver and cocoa, but inconclusive evidence for wheat and soybean oil. Galloway and Kolb [

11] study the term structure of volatility in 45 markets, including agricultural and energy commodity futures, precious and industrial metal futures, and stock index, currency, and interest rate futures. Their findings provide support for the maturity effect in agricultural and energy commodities, but not in precious metals and financials. Liu [

12] employs almost stochastic dominance and the power spectrum to investigate the maturity effect for five groups of energy futures, such as crude oil, reformulated regular gasoline, RBOB regular gasoline, No. 2 heating oil, and propane. The outcome provides mixed results, ranging from supporting to being contrary to the hypothesis. Jaeck and Lautier [

13] find evidence of a Samuelson effect in various electricity markets, such as German, Nordic, Australian, and US, and show that storage is not a necessary condition for such an effect to appear. A recently published article by Castello [

14] examines the term structure dynamics in the natural gas futures market, specifically analyzing the daily futures price of the Dutch Title Transfer Facility (TTF) via a machine-learning-based methodology, providing evidence supporting the Samuelson hypothesis.

“Negative” papers rejecting the hypothesis include Grammatikos and Saunders [

15], who find no relationship between futures return volatility and time-to-maturity for currency futures prices, and a study by Park and Sears [

16] provides evidence to disprove the Samuelson hypothesis for stock indices. The well-known study by Bessembinder et al. [

17] suggests that the hypothesis will be generally supported in markets where spot price changes include a predictable temporary component, which is more likely to be met in real assets than for financial assets. They show that the hypothesis will generally be supported in markets where spot prices and convenience yields are positively correlated. The authors assume that the carry arbitrage model represents futures markets.

The carry arbitrage model is based on the notion that the underlying instrument can be “carried” (purchased) with

financing (borrowing) and delivered against a short futures position. Brooks [

18] identifies and explores the important link between the empirical Samuelson hypothesis and theoretical carry: the degree to which carry arbitrage is empirically validated is associated with the degree to which the Samuelson hypothesis is not supported. In the continuation of the research, Brooks and Teterin [

19] study the volatility-term structure in 10 futures markets comprising three categories: agriculture, energy, and metals. To estimate the slope of the volatility-term structure, they use the Nelson and Siegel [

20] functional form, borrowed from the literature on modeling the term structure of interest rates. The authors show that the slope of the volatility-term structure is more negative when inventories are low, and that the threshold for high/low inventory is specific to each market. The relationship between the Samuelson hypothesis and inventory levels is rooted in the cost-of-carry model.

The popular models in the academic literature arrive at the Samuelson effect of futures volatility by considering models formulated in terms of the spot energy price with mean reverting process; see Clewlow and Strickland [

21]. The Schwatz single-factor model [

22] results in the exponential decay of future volatility:

where

is the mean reversion rate, and

is the spot-price volatility. The long-term level of volatilities at

is zero, which is not realistic. Two-factor models with mean reverting processes for spot price and convenience yield (see Schwartz [

22]. Gibson and Schwartz [

23], and Pilipović [

24]) result in an exponential decay of futures volatility with non-zero long-term level volatility at long horizons.

The vital paper by Schwartz and Trolle [

25] expands the framework of spot models to accommodate unspanned stochastic volatility. In their approach, the volatility of both spot price and forward cost of carry depend on two volatility factors that follow a mean reverting process, resulting in the Samuelson effect for futures volatility. Crosby and Frau [

26] broaden the model in [

25] by incorporating multiple jump processes. They explore the valuation of plain vanilla options on futures prices when the spot price follows a log-normal process, the forward cost of carry curve and the volatility are stochastic variables, and the spot price and forward cost of carry allow for time-dampening jumps. Frau and Fanelli [

27] present a new term-structure model for commodity futures prices based on [

25], which they extend by incorporating seasonal stochastic volatility represented with two different sinusoidal expressions and price plain vanilla options on the Henry Hub natural gas futures contracts. Hillard and Hillard [

28] develop a jump-diffusion model for pricing and hedging with margined options on futures. They introduce a jump-diffusion process for spot prices, and mean reverting processes for interest rate and stochastic convenience yield. Under positive correlations between diffusion parts, futures volatility increases as maturity approaches. Model parameters are calibrated using data on Brent crude contracts.

Another class of models addresses the direct modeling of futures rather than relying on spot pricing and unobservable convenience yield. Chiarella et al. [

29] propose a model encompassing hump-shaped unspanned stochastic volatility, which entails a finite-dimensional affine model for the commodity futures curve and quasi-analytical prices for options on commodity futures. Schnieder and Tavin [

30] introduce a futures-based model capable of capturing the main features displayed by crude oil futures and options contracts, such as the Samuelson volatility effect and the volatility smile. They calculate the joint characteristic function of two futures contracts in the model in analytic form and use it to price calendar spread options.

In the contemporary analysis of commodity volatility, it is imperative to take into account both geopolitical and climate risks. For instance, a recent study by Özdemir et al. [

31] examines the influence of the Geopolitical Risk Index (GPR) on the volatility of commodity futures returns. It broadens the scope of the research to encompass industrial metals, energy, agricultural products, and precious metals. Another recent paper by Guo et al. [

32] introduces a climate change concern index to quantify climate risk and evaluate its impact on commodity futures volatility.

We will now delineate the fundamental concepts of our methodology and compare them with existing techniques.

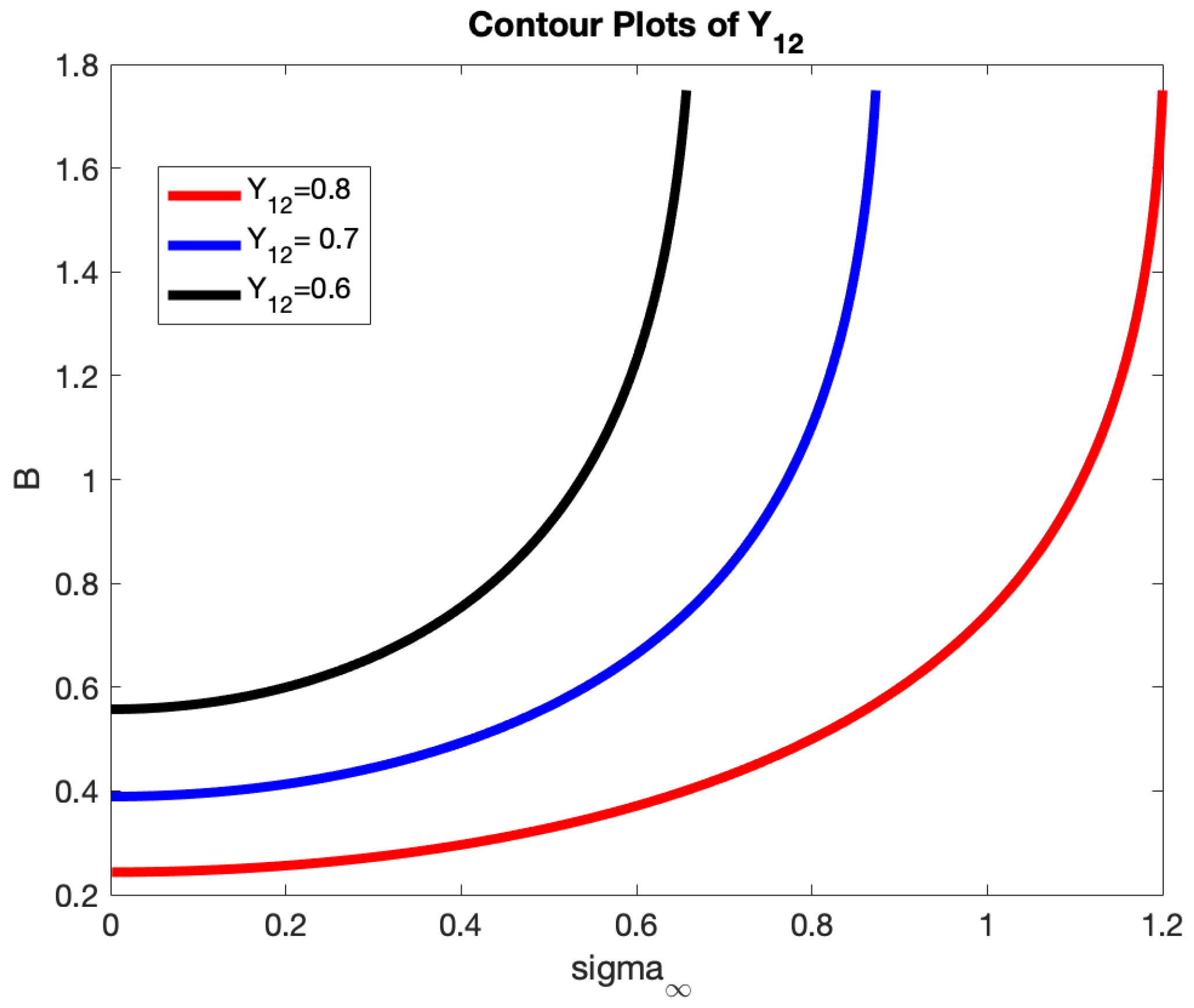

We opt to utilize futures data and model their instantaneous variance using exponential decay models as the majority of commodity trading happens in futures markets. A natural generalization of (

1), explicitly shown in many publications (see, for instance, [

30] or [

3]), is the following form of variance parameterization including two exponential decays:

where

B is the global decay and

is a long-term decay (much smaller than

B);

is the normalization factor to match the implied market volatility, and

is the level of a long-term volatility. Swindle [

33] uses this representation to model the total implied variance of commodity futures.

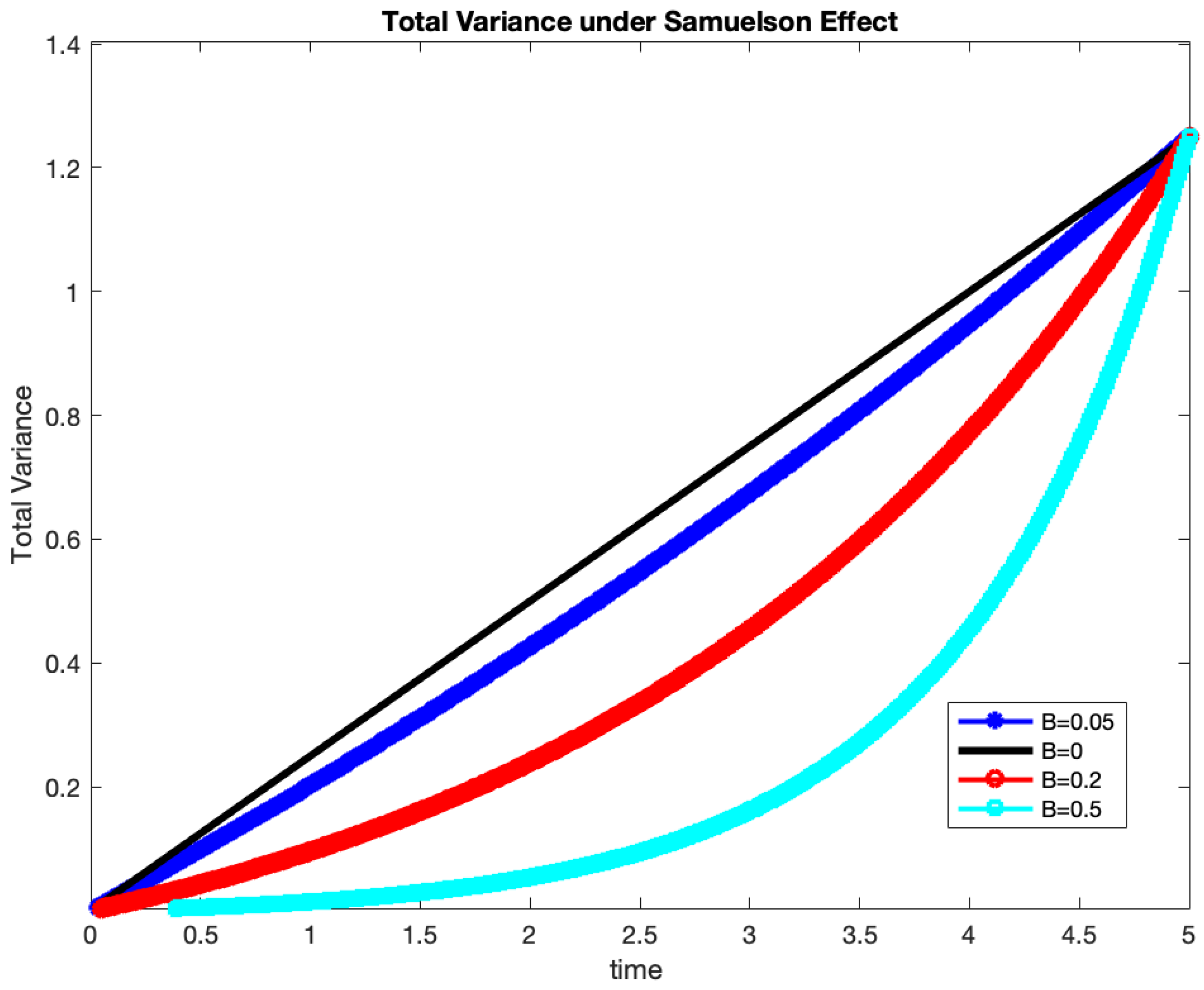

Introducing time-dependent instantaneous variance can be interpreted as a non-uniform clock: we treat the total realized variance as “time.” Under Samuelson, the clock ticks slowly regarding the distant future and accelerates as we approach expiry.

Figure 1 below depicts this concept. The example employs the simplest model (

1) for instantaneous variance (hence,

). We compute the total variance of a futures contract with maturity of five years and plot it as a function of time

t. The market-implied volatility of the future is set at

. We examine several decay values:

, from no Samuelson to slight, moderate, and very strong decay. In every instance, the total realized variance from

to expiry

T must correspond to the market-implied variance

, while the path used to achieve this is contingent upon

B. For a strong Samuelson with

, about

of the total variance occurs in the last year of the contract’s duration.

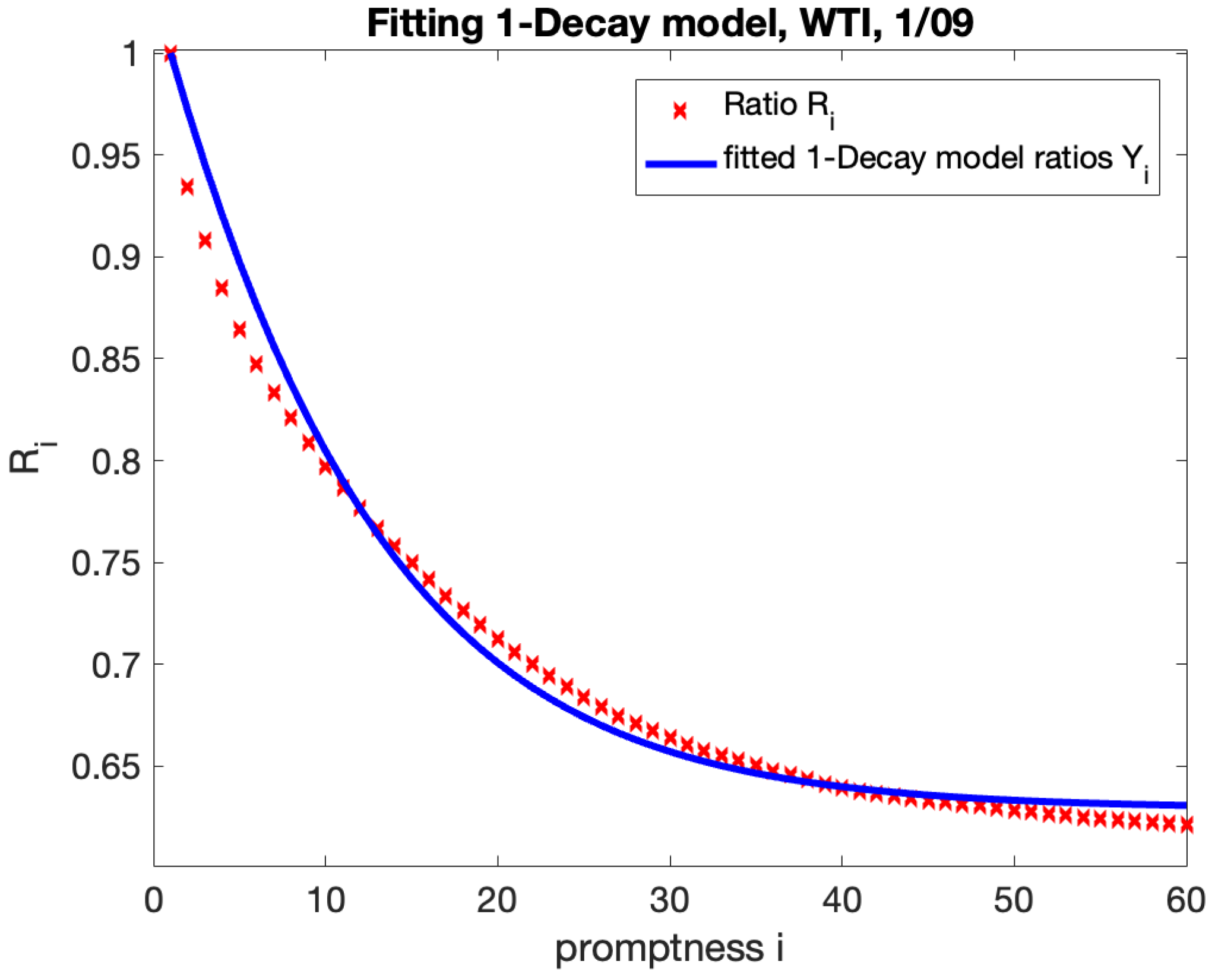

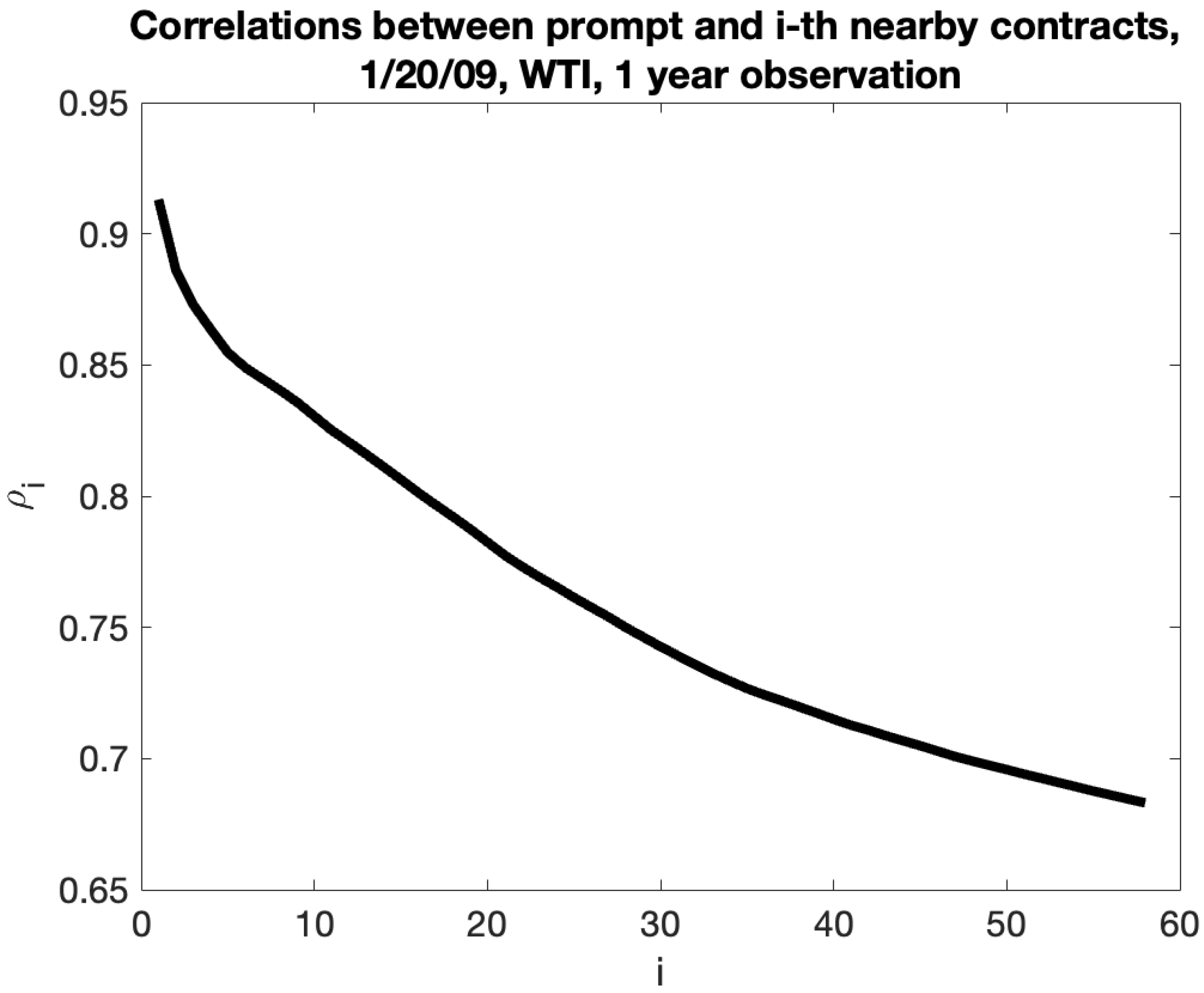

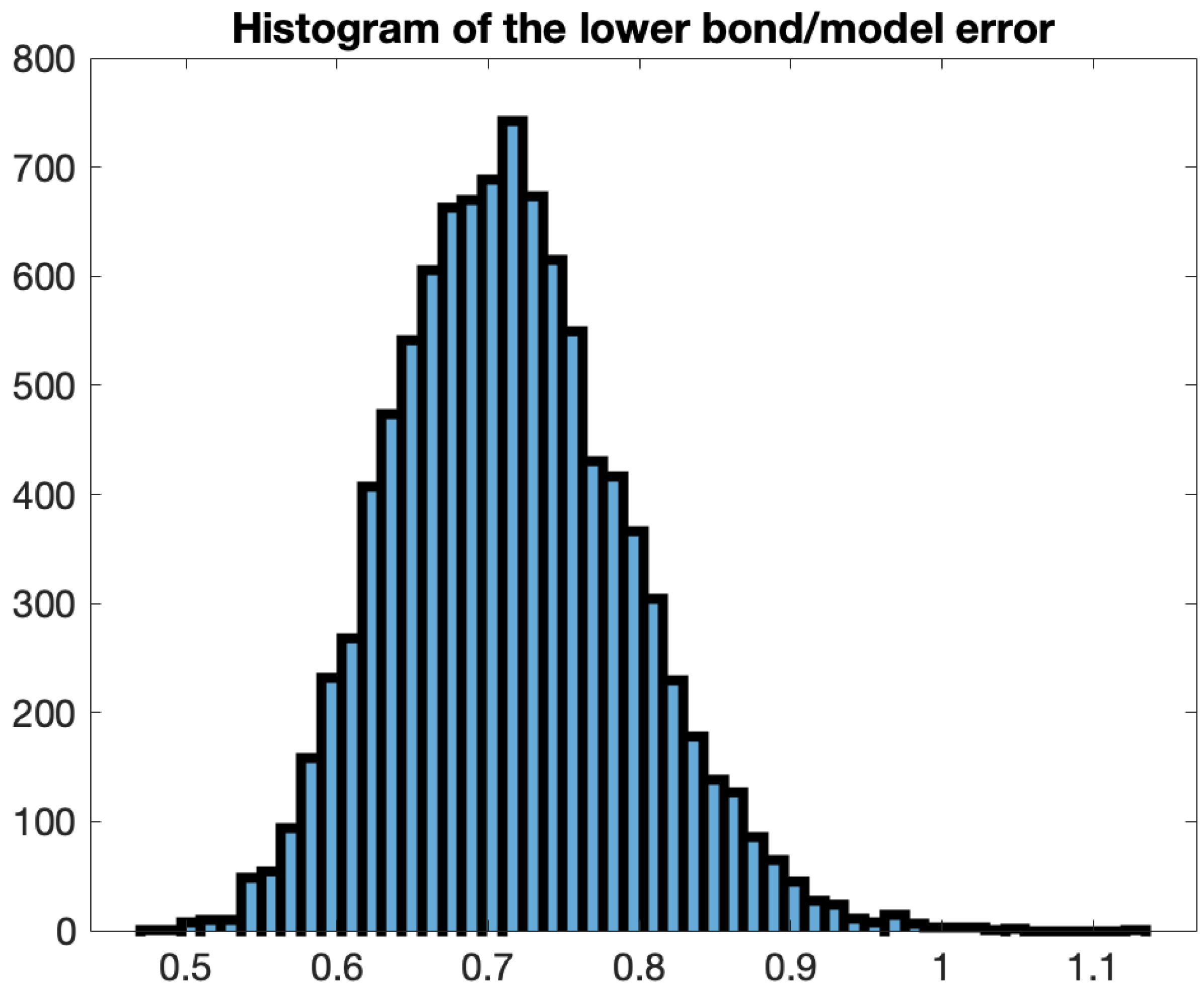

Our calibration technique involves capturing the instantaneous variance by computing variances of returns of nearby contracts. The closest research to our paper in the existing literature is the mentioned paper by Brooks and Teterin (“BT”) [

19]. They also use returns of nearby futures, calculate the their standard deviations, and fit a three-factor parametrization by Nelson and Siegel [

20] with exponential decay. However, there are key differences between our approaches. First, BT interpolate futures prices with a Nelson–Siegel curve [

20], resulting in a vector of pseudo-price time-series with each time-series corresponding to an exact maturity on every trading day (in industry, such contracts are called constant-maturity contracts and used for risk management purposes). We use the raw prices of nearby future contracts. Even though, as calendar time passes, the time to expiration of nearby futures indeed changes and drifts to zero (Brooks and Teterin [

19] called it “the maturity drift problem”), we deliver convincing results of the volatility–maturity relationship using raw prices.

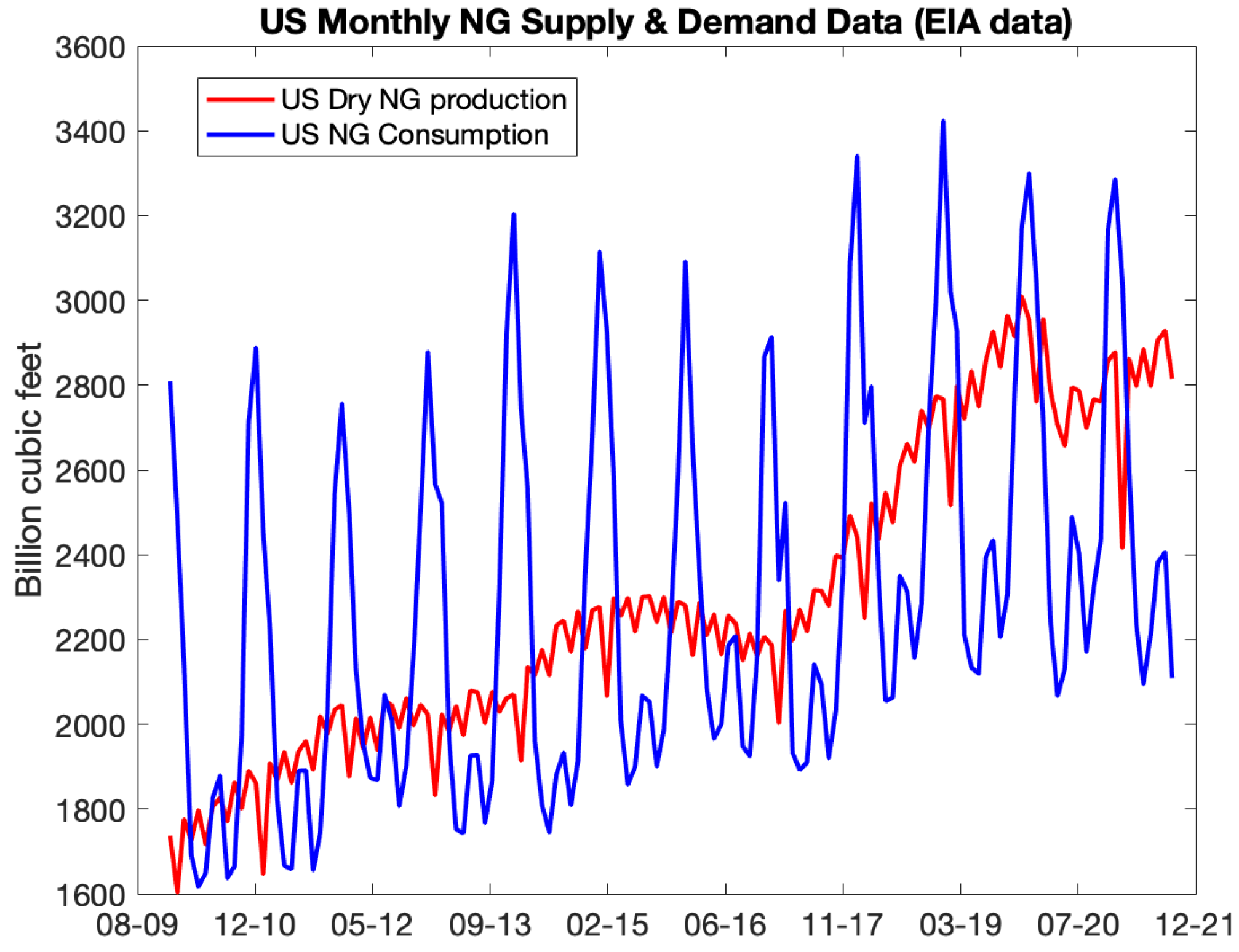

Second, BT employ only 12 nearby contracts, while we include all available information, 60 contracts. BT do not account for seasonality when considering term structure of NG volatility. Our data includes crisis period of Spring 2020, which is quite an interesting period to test models.

Third, the models and the targets of the fit are different. The NS model [

20] for yield curve

given by the parametric form

is based on the forward yield curve; see [

34]:

BT use (

3) to model

average volatility

of a synthetic forward contract with constant maturity

(in months). We fit instantaneous variance employing a representation (

2) similar to (

4) but with two exponential decays. The primary input in the model, which determines the Samuelson strength, is the exponential decay parameter

B. In BT’s methodology, the exponential decay parameter

is constant during the initial fitting stages, while the key parameter reflecting the Samuelson effect is represented by the slope of the volatility-term structure

.

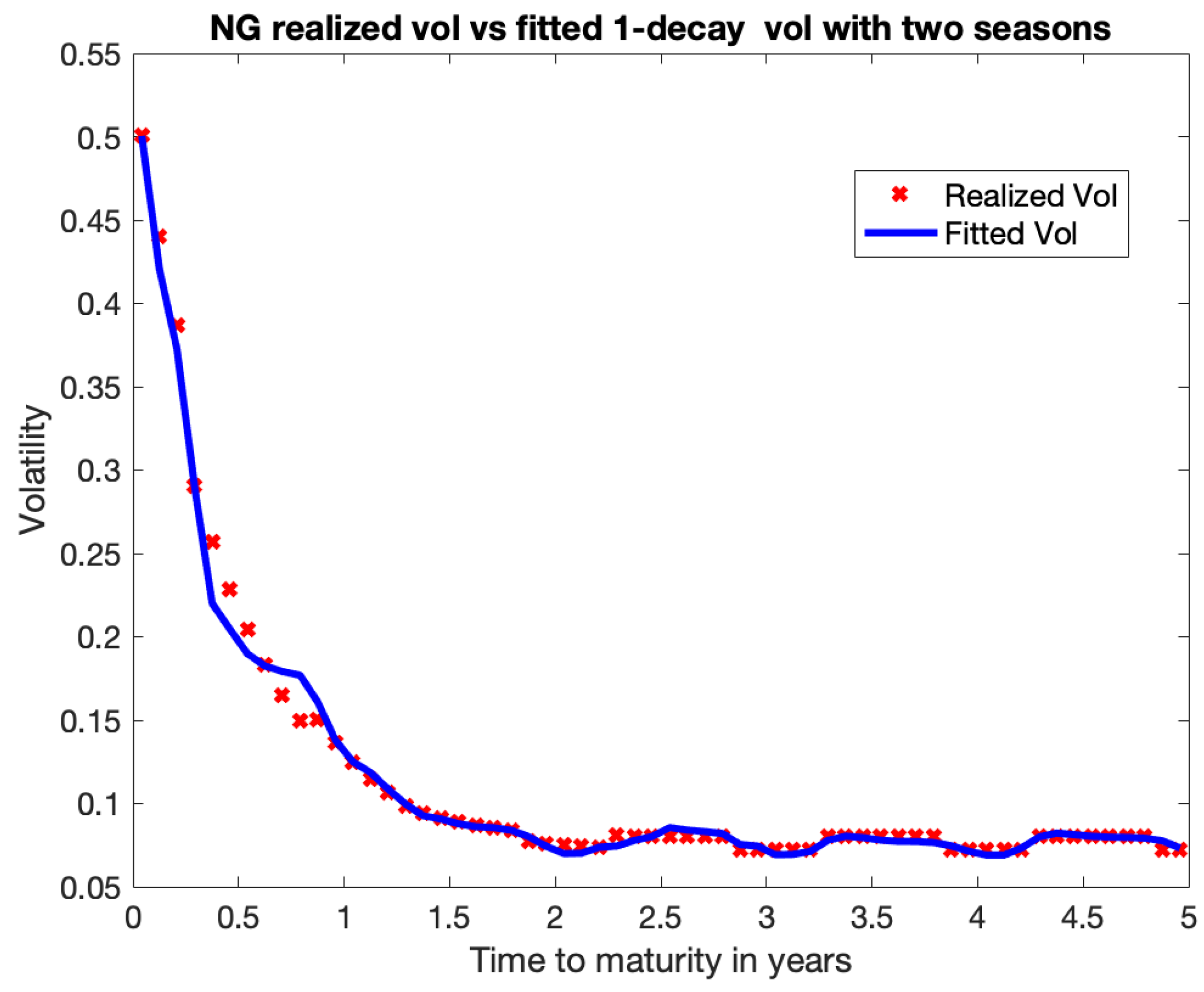

We generalize the calibration methodology to seasonal commodities such as natural gas. The natural gas term structure is defined by seasonality. Natural gas storage is a vital part of the natural gas delivery system and helps to balance supply and demand. During the winter season, from November to March (withdrawal season), gas consumption peaks as a result of increased heating demand. During the summer season, from April to October (injection season), gas demand decreases while production continues. Because of this, we fitted Samuelson independently after dividing the data for nearby futures into two periods: winter and summer. Due to our reliance on data regarding nearby contracts, this separation prevented us from combining returns from different periods, such as March and April. Consequently, we are compelled to employ only two months of the observation period data. Although the fitting findings were favorable, with errors remaining predominantly inside the statistical margin, the outcomes lack consistent stability due to the short observation period. Incorporating additional seasons might exacerbate the existing problems.

The next target is to find the methodology for the Samuelson effect for a more complicated case of seasonal commodities, in particular electricity futures. Electricity has always been the most fascinating commodity to study due to non-storability (at least in meaningful quantities), resulting in very high volatility and abundance of extreme events. Because supply and demand have to be in equilibrium at all times, the electricity seasonality is more refined than for any other seasonal commodity. Each hour in each weekday and month has its own pattern and can be traded separately. Therefore, using only two seasons would not be enough, and we need to come up with a more granular seasonal model. The previous seasonal model for natural gas implies that

is roughly the same for months in the same season, and the Samuelson parameters

B,

, and

are different for winter and summer months. Since we used only two months of nearby futures data, we were catching the Samuelson effect locally, at that particular period of time. The goal is to come up with a methodology that is applicable to long-term deals, such as popular power purchase agreements (“PPA”), which become increasingly more popular in view of growing use of renewable energy. We use the same model for the instantaneous variance (

2), with

; however, there are several differences between the two approaches. Firstly, we assume that the normalization constant

depends on a month in a year, and the Samuelson parameters

B and

are the same for all the months. We consider only the 1-decay model with

. Secondly, we use the real futures data and calculate the realized variance regarding a one-year observation period. As in the previous model, we calculate the ratios of variances, but now we use the variances of the same calendar month. We average the ratios for 12 moving observation periods and fit the model. The results are stable.

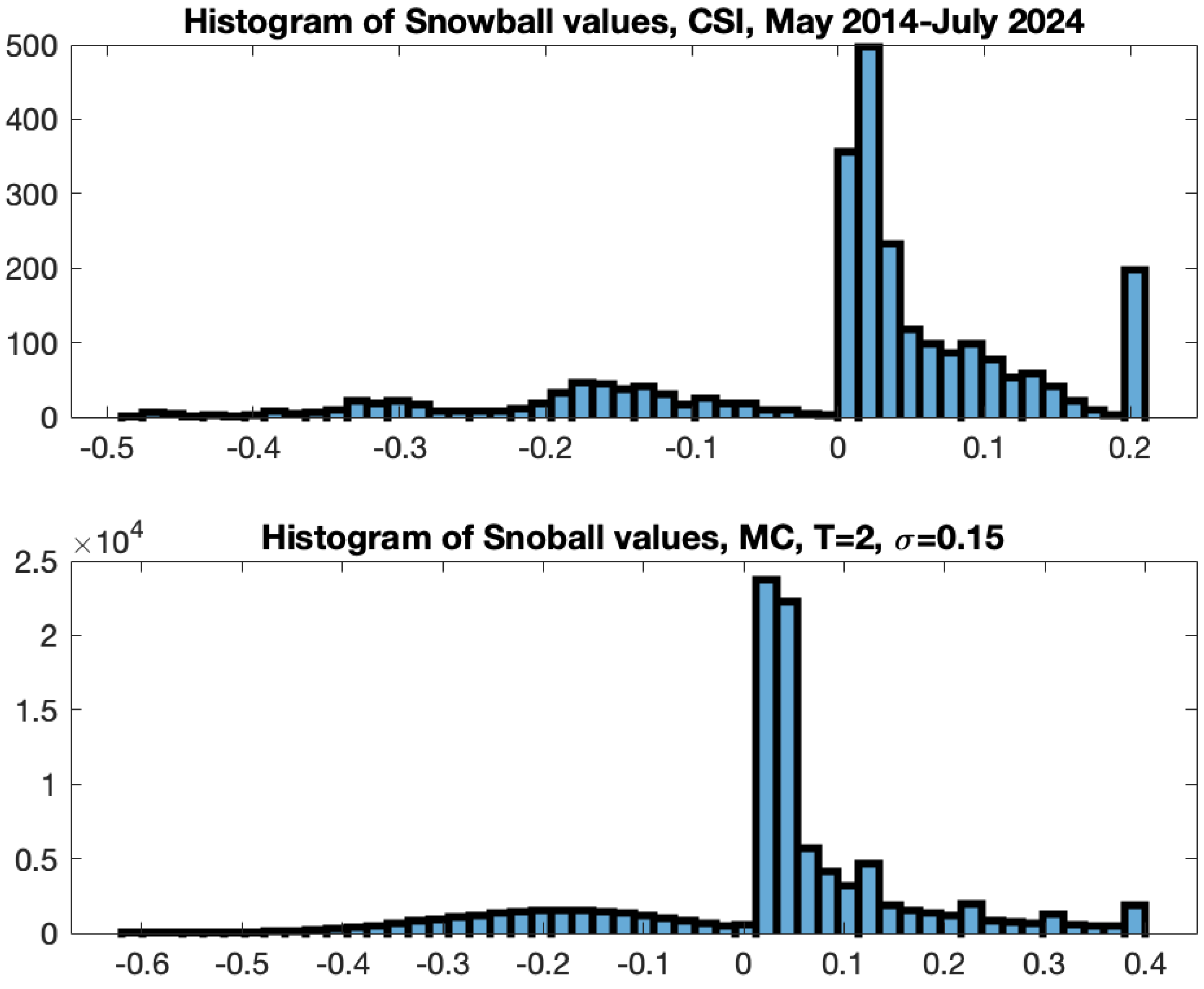

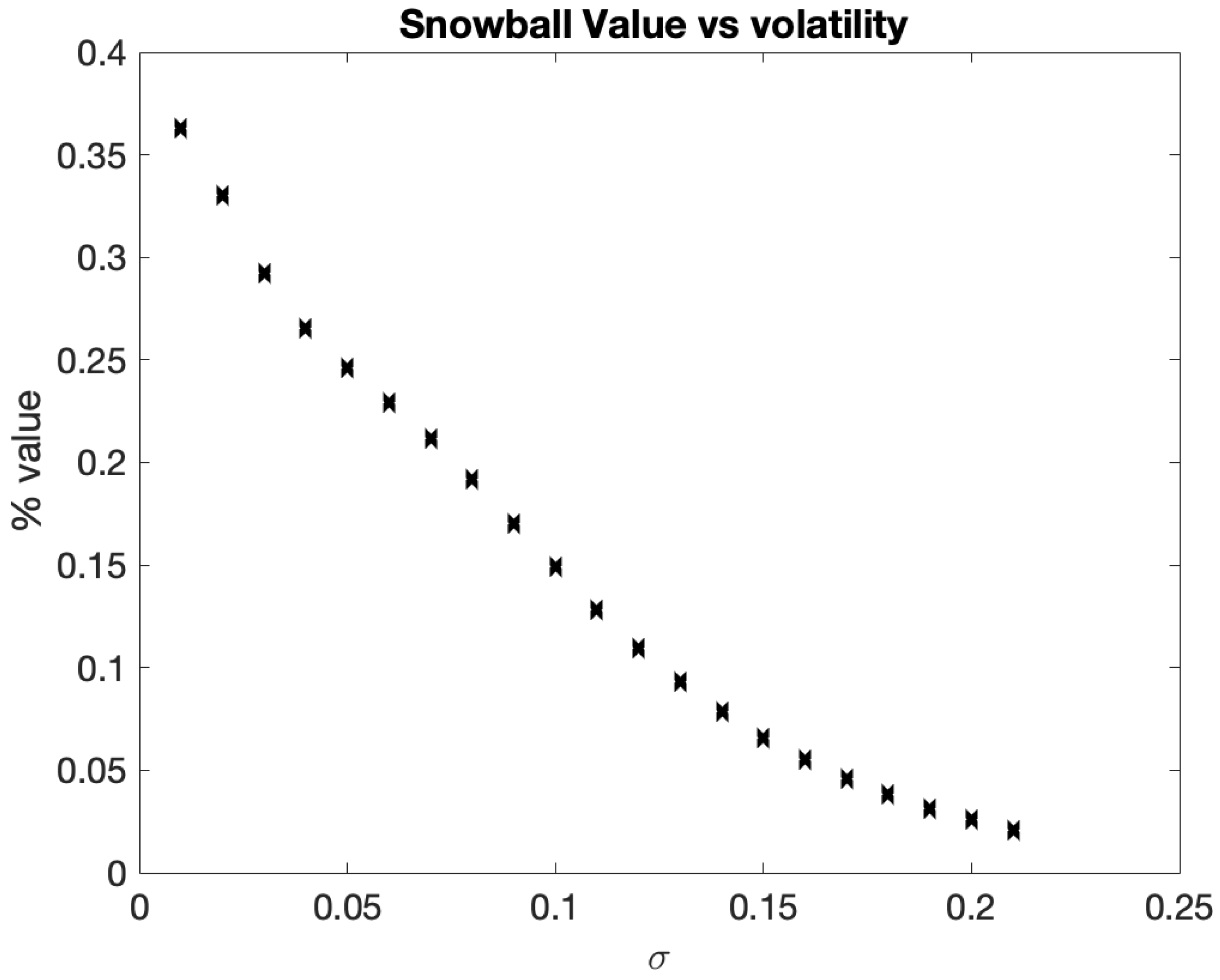

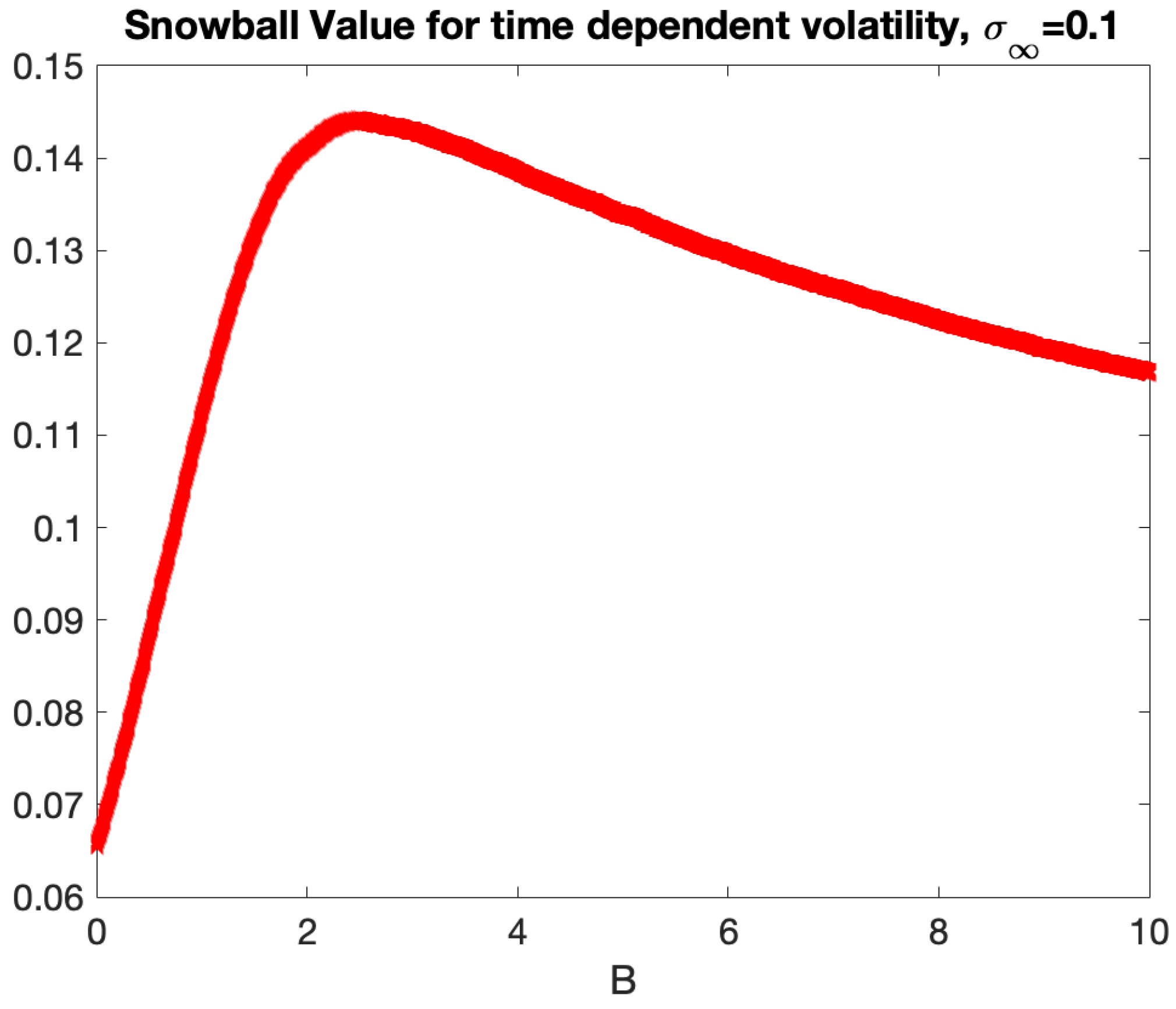

We demonstrate how the Samuelson effect can be used for commodity derivatives. Firstly, we outline the evaluation of early expiration options, such as swaptions. Secondly, we demonstrate how the calibrated model of the instantaneous variance can be used to extrapolate implied volatilities, which is crucially important in the evaluation of PPAs. Furthermore, we discovered an intriguing application of the Samuelson effect to a popular auto-callable equity derivative, the snowball; see [

35]. The term ”snowball” describes an investor’s potential for profit accumulation. A snowball is type of auto-callable structure with two barriers: knock-out and knock-in set up as percentages of the initial price. The longer the investor retains an income certificate, the greater the profit, provided the underlying does not drop precipitously. Consequently, the payment of the snowball is contingent upon the realized variance of the underlying asset and the rate of its accumulation. Issuing auto-callable derivatives on assets influenced by the Samuelson effect can be beneficial as initial low volatility may extend the duration of the asset remaining within barriers, hence yielding greater profit. Furthermore, we identified that, based on the structure of a snowball, keeping the realized variance constant, there is an optimal rate of variance growth that yields maximal profit.

We will now delineate the subsequent sections of the article.

Section 2 describes the calibration methodology, including generalization for seasonal commodities such as natural gas and electricity.

Section 3 examines the results of the calibration employing 15 years of data for WTI, Brent, natural gas, and ERCOT North Hub electricity futures. We discuss the optimal choice in observation period, the model selection, and the analytics of the statistical errors to assess the goodness-of-fit. In

Section 4, we demonstrate the application of the calibrated model of instantaneous variance for the evaluation of commodity derivatives, including swaptions, power purchase agreements (PPAs), and auto-callable derivatives linked to commodity futures. The main results of the article are presented in

Section 5, which also details the direction of future research. Some specifics are provided in

Appendix A and

Appendix B.