The Response of Global Oil Inventories to Supply Shocks

Abstract

1. Introduction

2. Methodology

2.1. Incorporating Oil Inventories into Global Oil Models: The Promise of Vector-Autoregression Models

2.2. The KAPSARC GVAR Model

| Countries Utilized in the World Oil and CM Model | ||

| Argentina | Indonesia | Russia |

| Australia | Iran | South Africa |

| Austria | Italy | Saudi Arabia |

| Belgium | Japan | Singapore |

| Brazil | Korea (South) | Spain |

| Canada | Malaysia | Sweden |

| China | Mexico | Switzerland |

| Chile | Netherlands | Thailand |

| Finland | Norway | Turkey |

| France | New Zealand | United Kingdom |

| Germany | Peru | USA |

| India | Philippines | Venezuela |

| Regions and subregions accounted for in the world oil and rare earth metal model | ||

| Net oil exporters | Europe | Latin America |

| Euro area | Net oil importers | Asia Pacific |

| Rest of world | ||

| Global variables in the world oil and rare earth metal model | ||

| World oil price | Rare earth metal price | |

| Country-specific variables in the world oil and rare earth metal model | ||

| Real GDP | Oil inventories | Real exchange rates |

| Inflation | Crude oil production | Short-term interest rates |

| Real equity prices | Long-term interest rates | |

- vector of global variables

- follows an AR(1) process

2.3. Empirical Analysis and Model Specifications

2.3.1. Trade and Aggregation Weights

2.3.2. Empirical Estimation, Unit Root, Weak Exogeneity and Stability Tests

2.3.3. Scenarios

3. Results and Discussion

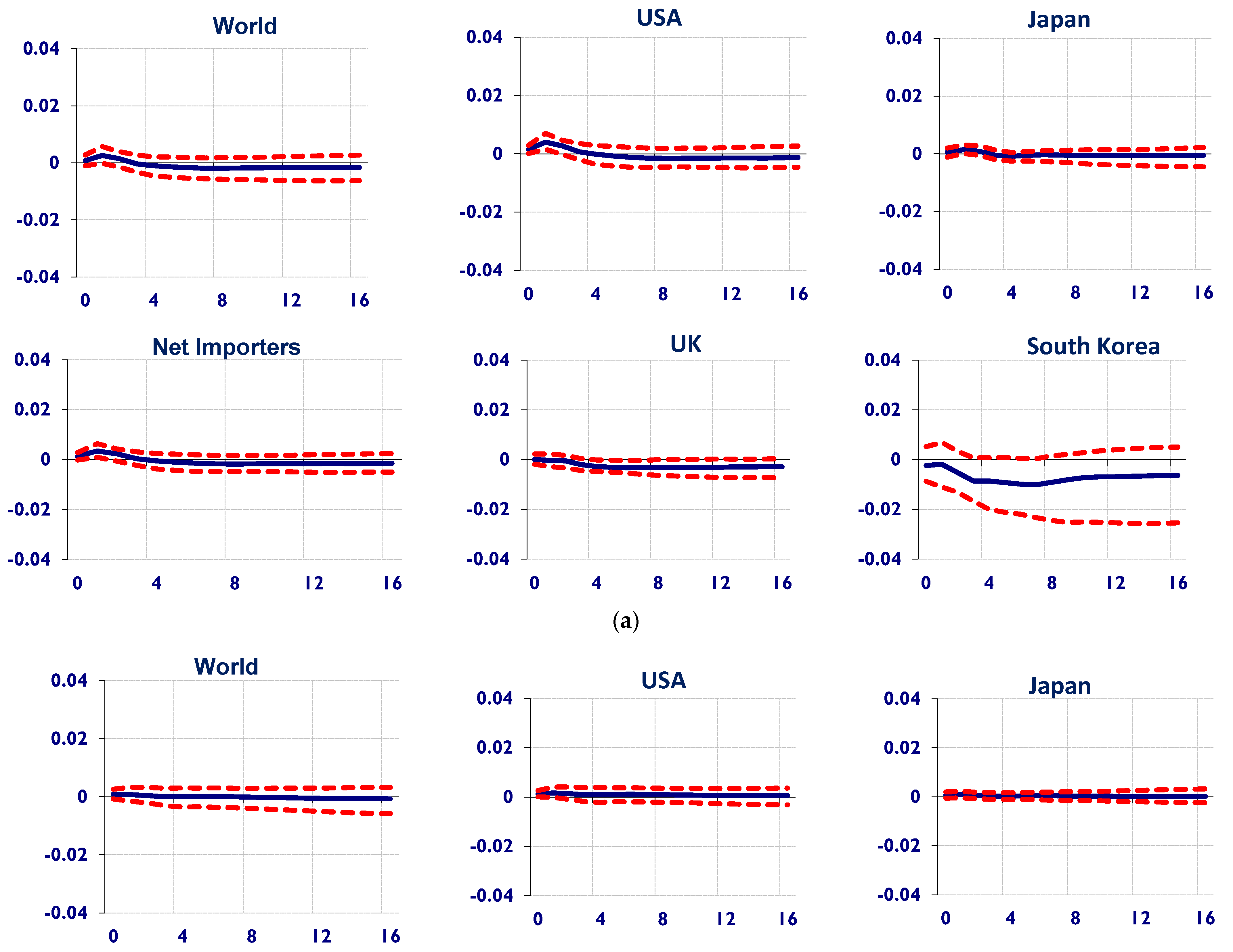

3.1. Global Supply Shock Scenario

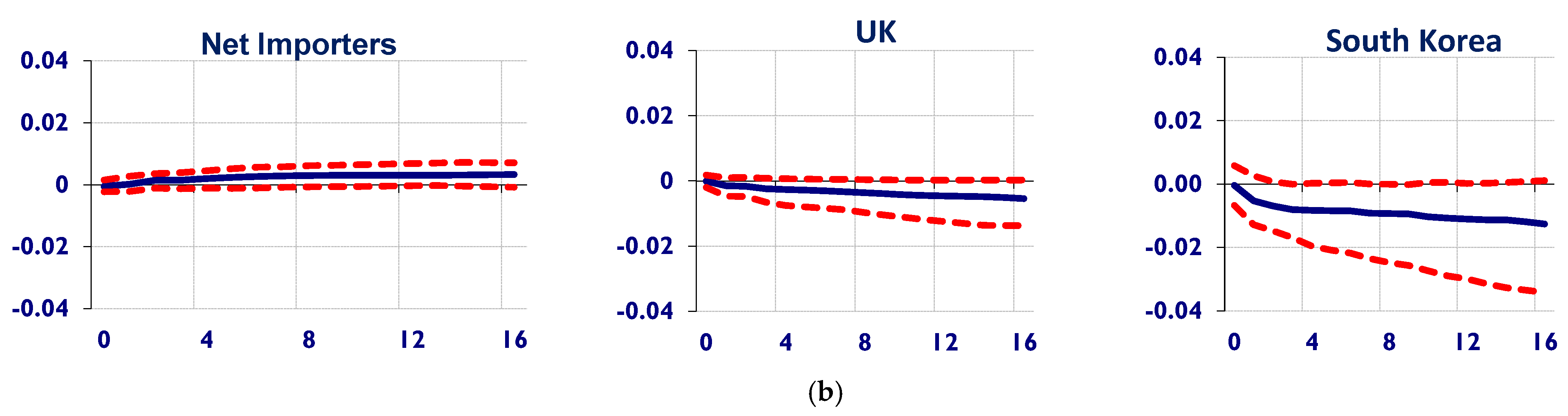

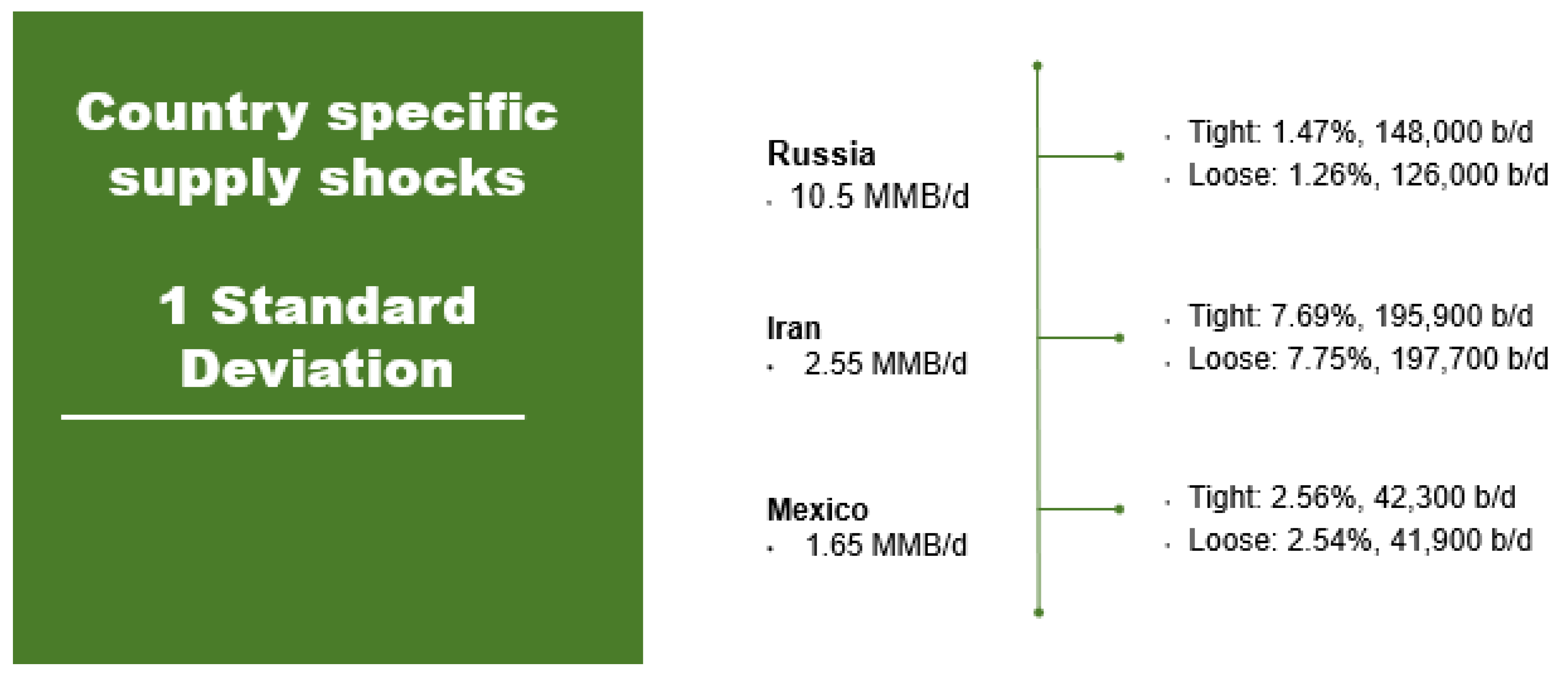

3.2. Impacts of Country-Specific Shocks

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Pindyck, R.S. Volatility and Commodity Price Dynamics. J. Futures Mark. 2004, 24, 1029–1047. [Google Scholar] [CrossRef]

- Kilian, L.; Murphy, D.P. The Role of Inventories and Speculative Trading in the Global Market for Crude Oil. J. Appl. Econom. 2014, 29, 454–478. [Google Scholar] [CrossRef]

- Herrera, A.M. Oil Price Shocks, Inventories, and Macroeconomic Dynamics. Macroecon. Dyn. 2018, 22, 620–639. [Google Scholar] [CrossRef]

- Hamilton, J. Understanding Crude Oil Prices. Energy J. 2009, 30, 179–206. [Google Scholar] [CrossRef]

- Bu, H. Effect of Inventory Announcements on Crude Oil Price Volatility. Energy Econ. 2014, 46, 485–494. [Google Scholar] [CrossRef]

- Reuters. Factbox: U.S. Taps Oil Reserve in First Test Release Since 1990. Available online: https://www.reuters.com/article/us-usa-oil-reserves-factbox-idUSBREA2B1RF20140312 (accessed on 12 March 2014).

- Statistica. Commodity Price Growth due to Russia-Ukraine War 2022. Available online: https://www.statista.com/statistics/1298241/commodity-price-growth-due-to-russia-ukraine-war/ (accessed on 29 August 2023).

- IEAc. IEA Confirms Member Country Contributions to Second Collective Action to Release Oil Stocks in Response to Russia’s Invasion of Ukraine—News. 2023. Available online: https://www.iea.org/news/iea-confirms-member-country-contributions-to-second-collective-action-to-release-oil-stocks-in-response-to-russia-s-invasion-of-ukraine (accessed on 12 April 2023).

- IEAa. Oil Stocks of IEA Countries—Data Tools. Available online: https://www.iea.org/data-and-statistics/data-tools/oil-stocks-of-iea-countries (accessed on 16 August 2023).

- Caffarra, C. The Role and Behavior of Oil Inventories. In Gulf and World Oil Issues Series 4; Oxford Institute for Energy Studies: Oxford, UK, 1990. [Google Scholar]

- OPEC. OPEC Monthly Oil Market Report; OPEC: Vienna, Austria, 2021. [Google Scholar]

- Reuters. Low U.S. Oil Inventories Imply Deeper Economic Slowdown Will Be Needed. Available online: https://www.reuters.com/business/energy/low-us-oil-inventories-imply-deeper-economic-slowdown-will-be-needed-kemp-2022-07-28/ (accessed on 30 July 2022).

- Ye, M.; Zyren, J.; Shore, J. Forecasting short-run crude oil price using high- and low-inventory variables. Energy Policy 2006, 34, 2736–2743. [Google Scholar] [CrossRef]

- Gong, X.; Guan, K.; Chen, L.; Liu, T.; Fu, C. What drives oil prices?—A Markov switching VAR approach. Resour. Policy 2021, 74, 102316. [Google Scholar] [CrossRef]

- Benk, S.; Gillman, M. Identifying money and inflation expectation shocks to real oil prices. Energy Econ. 2023, 126, 106878. [Google Scholar] [CrossRef]

- Geman, H.; Ohana, S. Forward curves, scarcity and price volatility in oil and natural gas markets. Energy Econ. 2009, 31, 576–585. [Google Scholar] [CrossRef]

- Du, X.; Cindy, L.Y.; Hayes, D.J. Speculation and volatility spillover in the crude oil and agricultural commodity markets: A Bayesian analysis. Energy Econ. 2011, 33, 497–503. [Google Scholar] [CrossRef]

- Plante, M.; Dhaliwal, N. Inventory shocks and the oil-ethanol-grain price nexus. Econ. Lett. 2017, 156, 58–60. [Google Scholar] [CrossRef]

- Gupta, R.; Sheng, X.; van Eyden, R.; Wohar, M.E. The impact of disaggregated oil shocks on state-level real housing returns of the United States: The role of oil dependence. Financ. Res. Lett. 2021, 43, 102029. [Google Scholar] [CrossRef]

- Maghyereh, A.; Abdoh, H.; Al-Shboul, M. Oil structural shocks, bank-level characteristics, and systemic risk: Evidence from dual banking systems. Econ. Syst. 2022, 46, 101038. [Google Scholar] [CrossRef]

- Wei, Y.; Yu, B.; Guo, X.; Zhang, C. The impact of oil price shocks on the U.S. and Chinese stock markets: A quantitative structural analysis. Energy Rep. 2023, 10, 15–28. [Google Scholar] [CrossRef]

- Tumala, M.M.; Salisu, A.A.; Gambo, A.I. Disentangled oil shocks and stock market volatility in Nigeria and South Africa: A GARCH-MIDAS approach. Econ. Anal. Policy 2023, 78, 707–717. [Google Scholar] [CrossRef]

- Sheng, X.; Gupta, R.; Ji, Q. The impacts of structural oil shocks on macroeconomic uncertainty: Evidence from a large panel of 45 countries. Energy Econ. 2020, 91, 104940. [Google Scholar] [CrossRef]

- Geman, H.; Li, Z. An analysis of intraday market response to crude oil inventory shocks. J. Energy Mark. 2018, 11, 1–35. [Google Scholar] [CrossRef]

- Alsahlawi, M. Dynamics of oil inventories. Energy Policy 1998, 26, 461–463. [Google Scholar] [CrossRef]

- Pirrong, C. Commodity Price Dynamics. A Structural Approach; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Gao, L.; Hitzemann, S.; Shaliastovich, I.; Xu, L. Oil Volatility Risk. J. Financ. Econ. 2022, 144, 456–491. [Google Scholar] [CrossRef]

- Kim, S.; Baek, J.; Heo, E. Crude oil inventories: The two faces of Janus? Empir. Econ. 2020, 59, 1003–1018. [Google Scholar] [CrossRef]

- Zhao, L.-T.; Zheng, Z.-Y.; Wei, Y.-M. Forecasting oil inventory changes with Google trends: A hybrid wavelet decomposer and ARDL-SVR ensemble model. Energy Econ. 2023, 120, 106603. [Google Scholar] [CrossRef]

- Mohaddes, K.; Pesaran, M.H. Oil Prices and the Global Economy: Is It Different This Time Around? Energy Econ. 2017, 65, 315–325. [Google Scholar] [CrossRef]

- Hashimzade, N.; Thornton, M. Handbook of Research Methods and Applications in Empirical Macroeconomics; Edward Elgar Publishing: Cheltehnham, UK, 2013. [Google Scholar] [CrossRef]

- Ryan, S.P. The Costs of Environmental Regulation in a Concentrated Industry. Econometrica 2012, 80, 1019–1061. [Google Scholar]

- Economou, A.; Agnolucci, P. Oil Price Shocks: A Measure of the Exogenous and Endogenous Supply Shocks of Crude Oil. In Proceedings of the SPE Annual Technical Conference and Exhibition, Dubai, United Arab Emirates, 26–28 September 2016. [Google Scholar] [CrossRef]

- D’Agostino, A.; Gambetti, L.; Giannone, D. Macroeconomic Forecasting and Structural Change. J. Appl. Econom. 2013, 28, 82–101. [Google Scholar] [CrossRef]

- Bragoli, D.; Modugno, M. A Nowcasting Model for Canada: Do, U.S. Variables Matter? 2016. FEDS Working Paper 2016-036. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2772899 (accessed on 14 June 2023).

- Shabri, A.; Samsudin, R. Daily Crude Oil Price Forecasting Using Hybridizing Wavelet and Artificial Neural Network Model. Math. Probl. Eng. 2014, 2014, e201402. [Google Scholar] [CrossRef]

- Green, K.; Armstrong, J. Simple Versus Complex Forecasting: The Evidence. J. Bus. Res. 2015, 68, 1678–1685. [Google Scholar] [CrossRef]

- Beckers, B.; Beidas-Strom, S. Forecasting the Nominal Brent Oil Price with VARs: One Model Fits All? In IMF Working Papers; International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

- De Albuquerquemello, V.; Medeiros, R.; Besarria, C.; Maia, S. Forecasting Crude Oil Price: Does Exist an Optimal Econometric Model? Energy 2018, 155, 578–591. [Google Scholar] [CrossRef]

- De Medeiros, K.R.; da Nóbrega Besarria, C.; de Jesus, D.P.; de Albuquerquemello, V.P. Forecasting Oil Prices: New Approaches. Energy 2022, 238, 121968. [Google Scholar] [CrossRef]

- Banerjee, A.; Marcellino, M.; Masten, I. Forecasting with Factor-Augmented Error Correction Models. Int. J. Forecast. 2014, 30, 589–612. [Google Scholar] [CrossRef]

- Ratti, R.; Vespignani, J. Oil Prices and Global Factor Macroeconomic Variables; Working Paper 2015-08; University of Tasmania, Tasmanian School of Business and Economics: Sandy Bay, Australia, 2015; Available online: https://econpapers.repec.org/paper/taswpaper/22665.htm (accessed on 15 May 2023).

- Pesaran, M.H.; Schuermann, T.; Weiner, S.M. Modeling Regional Interdependencies Using a Global Error-Correcting Macroeconometric Model. J. Bus. Econ. Stat. 2004, 22, 129–162. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Schuermann, T.; Treutler, B.J.; Weiner, S.M. Macroeconomic Dynamics and Credit Risk: A Global Perspective. CESifo Working Paper 995. 2006. Available online: https://www.econstor.eu/bitstream/10419/76354/1/cesifo_wp995.pdf (accessed on 22 July 2023).

- Bussiere, M.; Chudik, A.; Sestieri, G. Modelling Global Trade Flows: Results from a GVAR Model. In ECB Working Paper 1087; European Central Bank: Frankfurt am Main, Germany, 2009. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Schuermann, T.; Smith, L.V. Forecasting Economic and Financial Variables with Global VARs. Int. J. Forecast. 2009, 25, 642–675. [Google Scholar] [CrossRef]

- Chudik, A.; Pesaran, M.H. Theory and Practice of GVAR Modelling. J. Econ. Surv. 2016, 30, 165–197. [Google Scholar] [CrossRef]

- Smith, R.P. The GVAR Approach to Structural Modelling. In The GVAR Handbook: Structure and Applications of a Macro Model of the Global Economy for Policy Analysis; di Mauro, F., Pesaran, M.H., Eds.; Oxford University Press: Oxford, UK, 2013. [Google Scholar]

- Hoyn, K. International Spillovers of Shocks and Economic Relationships: A Structural GVAR Approach. Ph.D. Thesis, University of Colorado Boulder, Boulder, CO, USA, 2021. [Google Scholar]

- Kwok, C. Estimating structural shocks with the GVAR-DSGE model: Pre- and post-pandemic. Mathematics 2022, 10, 1773. [Google Scholar] [CrossRef]

- Sznajderska, A. The role of China in the world economy: Evidence from a global VAR model. Appl. Econ. 2019, 51, 1574–1587. [Google Scholar] [CrossRef]

- Kempa, B.; Khan, N.S. Spillover Effects of Debt and Growth in the Euro Area: Evidence from a GVAR Model. Int. Rev. Econ. Financ. 2017, 49, 102–111. [Google Scholar] [CrossRef]

- Salisu, A.A.; Gupta, R.; Demirer, R. The financial U.S. uncertainty spillover multiplier: Evidence from a GVAR Model. Int. Financ. 2022, 25, 313–340. [Google Scholar] [CrossRef]

- Considine, J.; Hatipoglu, E.; Aldayel, A. The Sensitivity of Oil Price Shocks to Preexisting Market Conditions: A Global VAR Analysis. J. Commod. Mark. 2022, 27, 100225. [Google Scholar] [CrossRef]

- Hatipoglu, E.; Considine, J.; AlDayel, A. Unintended transnational effects of sanctions: A global vector autoregression simulation. Def. Peace Econ. 2022, 34, 863–879. [Google Scholar] [CrossRef]

- Mohaddes, K.; Raissi, M. Compilation, Revision and Updating of the Global VAR (GVAR) Database, 1979Q2–2019Q4; Apollo—University of Cambridge Repository: Cambridge, UK, 2020. [Google Scholar] [CrossRef]

- Considine, J.; Galkin, P.; Aldayel, A.; Hatipoglu, E. World Oil and Critical Minerals Study: A GVAR Analysis. In KAPSARC Methodology Paper; KAPSARC: Riyadh, Saudi Arabia, 2023. [Google Scholar] [CrossRef]

- Dees, S.; di Mauro, F.; Pesaran, M.H.; Smith, L.V. Exploring the International Linkages of the Euro Area: A Global VAR Analysis. J. Appl. Econ. 2007, 22, 1–38. [Google Scholar] [CrossRef]

- IEA. Oil Market Report—March 2018—Analysis. Available online: https://www.iea.org/reports/oil-market-report-march-2018 (accessed on 31 March 2018).

- George, B. Russia Ban Creates Ice Gasoil Contango | Argus Media. Available online: https://www.argusmedia.com/en/news/2395726-russia-ban-creates-ice-gasoil-contango (accessed on 29 November 2022).

- IEA. Oil Market Report—March 2022—Analysis. Available online: https://www.iea.org/reports/oil-market-report-march-2022 (accessed on 31 March 2022).

- IEA. Korea Oil Security Policy—Analysis. Available online: https://www.iea.org/articles/korea-oil-security-policy (accessed on 28 August 2023).

- Vahn, P.; Lee, C.; Tang, I.; Chiam, C. South Korea’s Reliance on Saudi Crude on Track to Reach 18-Year High in 2023. Available online: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/032923-south-koreas-reliance-on-saudi-crude-on-track-to-reach-18-year-high-in-2023 (accessed on 29 March 2023).

- International Trade Centre (ITC). Trade Map. Available online: https://www.trademap.org/ (accessed on 28 August 2023).

- European Council. EU Sanctions Against Russia Explained. Available online: https://www.consilium.europa.eu/en/policies/sanctions/restrictive-measures-against-russia-over-ukraine/sanctions-against-russia-explained/ (accessed on 26 June 2023).

- S&P Global. South Korea to Release Record 7.23 Million Barrels of Strategic Petroleum Reserves. Available online: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/040822-south-korea-to-release-record-723-million-barrels-of-strategic-petroleum-reserves (accessed on 8 April 2022).

- Trading Economics. Iran Crude Oil Production. Available online: https://tradingeconomics.com/iran/crude-oil-production (accessed on 8 September 2023).

- Smith, L.V.; Galesi, A. Global VAR Toolbox 2.0. 2014. Available online: https://sites.google.com/site/gvarmodelling/gvar-toolbox/download (accessed on 20 March 2022).

- IMF. International Financial Statistics. 2022. Available online: https://legacydata.imf.org/?sk=4c514d48-b6ba-49ed-8ab9-52b0c1a0179b (accessed on 16 June 2023).

- IMF. Primary Commodity Prices. 2022. Available online: https://www.imf.org/en/Research/commodity-prices (accessed on 16 June 2023).

- Inter-American Development Bank (IADB). InterAmerican Development Bank Specialized Database. 2017. Available online: https://data.iadb.org/dataset/?type=indicator&vocab_indicator_categories=Economics+and+finance (accessed on 16 June 2023).

- FocusEconomics. Venezuela Economy-GDP, Inflation, CPI and Interest Rate. 2018. Available online: https://www.focus-economics.com/countries/venezuela (accessed on 20 June 2023).

- Bloomberg. Venezuela’s 2018 Inflation to Hit 1.37 million percent, IMF Says. 2018. Available online: https://www.bloomberg.com/news/articles/2018-10-09/venezuela-s-2018-inflation-to-hit-1-37-million-percent-imf-says (accessed on 20 June 2023).

- Slavic Research Center. Soviet Economic Statistical Series. 2022. Available online: https://src-h.slav.hokudai.ac.jp/database/SESS.html (accessed on 22 July 2022).

- FRED. Import Price Index (Harmonized System): Inorganic Chemicals; Organic or Inorganic Compounds of Precious Metals, of Rare-Earth Metals, of Radioactive Elements or of Isotopes (IP28). 2022. Available online: https://fred.stlouisfed.org/series/IP28 (accessed on 20 July 2022).

- CEIC. Russia Short Term Interest Rate, 2000–2022. CEIC Data. 2022. Available online: https://www.ceicdata.com/en/indicator/russia/short-term-interest-rate (accessed on 3 July 2022).

- Statistics Canada. Gross Domestic Product by Income and Expenditure: Interactive Tool. 2022. Available online: https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2021015-eng.htm (accessed on 10 July 2022).

- Bloomberg. Bloomberg Terminal. 2022.

- DoSM (Malaysia Department of Statistics). Department of Statistics Malaysia Official Portal. 2022. Available online: https://www.dosm.gov.my (accessed on 7 July 2022).

- Trading Economics. Argentina GDP Growth Rate—2022 Data—2023 Forecast—1993–2021 Historical. 2022. Available online: https://tradingeconomics.com/argentina/gdp-growth (accessed on 12 July 2022).

- Shleifer, A.; Vishny, R.W. Reversing the Soviet Economic Collapse. Brook. Pap. Econ. Act. 1992, 2, 341–360. [Google Scholar] [CrossRef][Green Version]

- Filatochev, I.; Bradshaw, R. The Soviet hyperinflation: Its origins and impact throughout the former republics. Sov. Stud. 1992, 44, 739–759. [Google Scholar] [CrossRef]

- CEIC. Thailand Short Term Interest Rate, 2005–2022. CEIC Data. 2022. Available online: https://www.ceicdata.com/en/indicator/thailand/short-term-interest-rate (accessed on 7 July 2022).

- OECD. Interest Rates-Short-Term Interest Rates Forecast—OECD Data. 2022. Available online: http://data.oecd.org/interest/short-term-interest-rates-forecast.htm (accessed on 17 July 2022).

- Bank of Canada. Banking and Financial Statistics. 2022. Available online: https://www.bankofcanada.ca/rates/banking-and-financial-statistics (accessed on 17 July 2022).

- Countryeconomy.com. Brazil Central Bank Key Rates. 2022. Available online: https://countryeconomy.com/key-rates/brazil (accessed on 17 July 2022).

- Sidaleev, D.K.; Kuzmina, I.G. Retrospective Analysis of the Dynamics of the Dollar to Ruble Exchange Rates. Economics and Management: Analysis of Trends and Development Perspectives 2014, 17. Available online: https://cyberleninka.ru/article/n/retrospektivnyy-analiz-dinamiki-kursa-dollara-za-rubl/viewer (accessed on 17 July 2022).

- RBI (Reserve Bank of India). 2022. Available online: https://www.rbi.org.in (accessed on 7 July 2022).

- Eurostat. Statistics. 2022. Available online: https://ec.europa.eu/eurostat/databrowser/view/IRT_LT_MCBY_Q__custom_3012440/default/table?lang=en (accessed on 7 July 2022).

- FRED. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis. 2022. Available online: https://fred.stlouisfed.org/series/DGS10 (accessed on 17 July 2022).

- FRED. Import Price Index (End Use): Agricultural Products Used for Industrial Supplies and Materials. 2022. Available online: https://fred.stlouisfed.org/series/IR120 (accessed on 30 June 2022).

- Kilian, L. Index of Global Real Economic Activity in Industrial Commodity Markets. 2009. Available online: https://www.dallasfed.org/research/igrea (accessed on 30 June 2022).

- EIA (U.S. Energy Information Administration). International Data. 2022. Available online: https://www.eia.gov/international/data/world (accessed on 5 July 2022).

- Trading Economics. Indonesia Crude Oil Production. 2022. Available online: https://tradingeconomics.com/indonesia/crude-oil-production (accessed on 5 July 2022).

- World Bank. World Development Indicators|DataBank. 2022. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 25 June 2022).

- Park, H.; Fuller, W. Alternative estimators and unit root tests for the autoregressive process. J. Time Ser. Anal. 1995, 16, 415–429. [Google Scholar] [CrossRef]

- Akaike, H. Likelihood of a Model and Information Criteria. J. Econom. 1981, 16, 3–14. [Google Scholar] [CrossRef]

- MacKinnon, J.G. Critical Values for Co-Integration Tests. In Long Run Economic Relationships: Readings in Co-Integration; Engle, R.F., Granger, C.W.J., Eds.; Oxford University Press: Oxford, UK, 1990; pp. 267–276. [Google Scholar]

| Location | Tight Market | Loose Market | ||||||

|---|---|---|---|---|---|---|---|---|

| Median Cumulative Changes, % | Significance * | Median Cumulative Changes, % | Significance * | |||||

| Year 1 | Year 2 | 4 Years | Year 1 | Year 2 | 4 Years | |||

| World | 0.46% | −0.59% | −1.50% | A | 0.22% | 0.02% | −0.11% | - |

| Japan | 0.23% | −0.21% | −0.42% | A | 0.24% | 0.16% | 0.57% | - |

| South Korea | −1.81% | −3.78% | −11.38% | - | −2.07% | −3.44% | −14.05% | D |

| UK | −0.27% | −1.23% | −3.94% | G | −0.57% | −1.19% | −5.32% | - |

| USA | 0.90% | −0.36% | −0.62% | B | 0.55% | 0.43% | 1.55% | A |

| Location of Shock | Tight Market | Loose Market | ||||||

|---|---|---|---|---|---|---|---|---|

| Median Cumulative Changes, % | Significance * | Median Cumulative Changes, % | Significance * | |||||

| Year 1 | Year 2 | 4 Years | Year 1 | Year 2 | 4 Years | |||

| Mexico | 1.13% | 1.44% | 5.24% | 1.45% | 1.24% | 5.30% | A | |

| Russia | −0.68% | −0.58% | −1.50% | 0.36% | 2.32% | 6.39% | ||

| Iran | −1.33% | −1.49% | −5.50% | A | −0.97% | −0.92% | −2.73% | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Galkin, P.; Considine, J.; Al Dayel, A.; Hatipoglu, E. The Response of Global Oil Inventories to Supply Shocks. Commodities 2025, 4, 10. https://doi.org/10.3390/commodities4020010

Galkin P, Considine J, Al Dayel A, Hatipoglu E. The Response of Global Oil Inventories to Supply Shocks. Commodities. 2025; 4(2):10. https://doi.org/10.3390/commodities4020010

Chicago/Turabian StyleGalkin, Philipp, Jennifer Considine, Abdullah Al Dayel, and Emre Hatipoglu. 2025. "The Response of Global Oil Inventories to Supply Shocks" Commodities 4, no. 2: 10. https://doi.org/10.3390/commodities4020010

APA StyleGalkin, P., Considine, J., Al Dayel, A., & Hatipoglu, E. (2025). The Response of Global Oil Inventories to Supply Shocks. Commodities, 4(2), 10. https://doi.org/10.3390/commodities4020010