Abstract

This research paper examines the risks posed by the MIH EV Open platform to German automotive suppliers, in particular, the risk of commoditization and falling into a commodity trap. The term commodity trap describes a situation in which companies dealing with standardized products or services face intense price and margin pressure and struggle to differentiate themselves from competitors. The MIH EV Open platform, established by Foxconn, also known as Hon Hai Precision Industry Co. Ltd., headquartered in Tucheng, Taipei, Taiwan, aims to create a collaborative platform for the comprehensive development of key software, hardware components, and services in the electric vehicle (EV) industry. It unites over 2700 companies from more than 70 countries and fosters collaboration to accelerate the development and market entry of new EV products. This paper analyzes the MIH EV Open business ecosystem model and assesses the strengths and weaknesses of German suppliers in addressing these challenges. This study highlights strategic approaches, including innovation, portfolio adaptation, customer relationships, and sustainability practices, that can enable German suppliers to mitigate commodity trap risks. The findings underscore the importance of proactive, segment-specific strategies amidst the transformation of the automotive industry. Key insights are provided on the potential impact of open platform ecosystems and recommendations for German automotive suppliers to maintain competitiveness. This research fills a gap in the literature by examining the commoditization risks posed by the MIH EV Open platform for German automotive suppliers. Unlike previous studies that focus on traditional market structures, this study explores the novel dynamics introduced by platform ecosystems and provides strategic insights to mitigate these risks.

1. Introduction

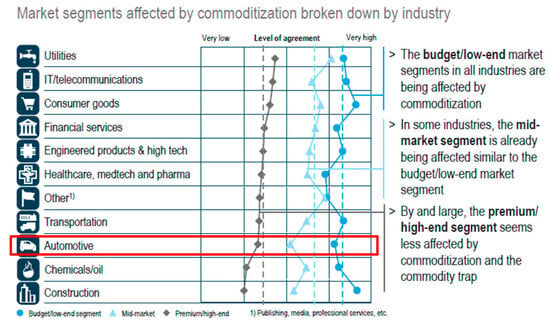

The combination of the transition to electrification, fluctuating volumes, rising costs, and economic uncertainty is a major challenge for many automotive suppliers today [1] (p. 4). Another challenge within the automotive supplier market is the replication of innovations by competitors, which makes products increasingly substitutable [2] (p. 21). Many industries today are affected by increasing product homogeneity, combined with intense competition and stagnating market segments, leading to higher price and margin pressures [3] (p. 1). This phenomenon is referred to as commoditization and poses the risk of companies falling into a commodity trap, as they find it difficult to differentiate their products from those of competitors [3] (pp. 1–10).

In addition, changing customer preferences within the mobility sector are shifting from traditional technologies, such as chassis and engine development, to new technologies, such as electrification, autonomous driving, diverse mobility, and connectivity [4] (pp. 1–2). As a result, automotive suppliers are competing with new players from the software and consumer electronics sectors [5] (p. 58). The authors Beiker et al. argue that this technological shift will transform the currently vertically structured value chain within the automotive industry into a horizontally structured ecosystem [4] (pp. 1–2).

To foster collaboration within the mobility industry, the MIH Consortium was established in 2021 to develop such an ecosystem for electric vehicles (EVs). The main goals of the MIH Open EV Ecosystem are to develop key technologies, standards, and reference designs for EVs, lower barriers to entry, and accelerate innovation for new automotive suppliers within the ecosystem [6].

With 300,000 employees, the German automotive supply industry is an important economic sector in Germany [7]. In 2022, German automotive suppliers generated cumulative sales of 230 billion euros and held a 25 percent share of the global market [8] (p. 4). However, according to a study by Strategy&, the global strategy consulting arm of PwC, the German automotive supply industry showed the lowest revenue growth in 2022 compared to other regions in the world [8] (p. 4). In addition, the profitability of German suppliers declined in 2022 due to unfavorable cost structures [8] (p. 4). Profitability and high market share are crucial for economic success in the automotive supply industry, as economies of scale and scope are necessary to remain competitive [8] (p. 4).

Therefore, this research aims to provide a theoretical overview of commodity traps and business ecosystems. Furthermore, it aims to investigate the risks or potentials of Foxconn’s MIH EV Open platform for the German automotive supplier industry. In addition, this study will determine whether German automotive suppliers are at risk of falling into a commodity trap due to the business ecosystem.

This paper is organized as follows: Section 2 outlines the research methodology used in this study. Section 3 provides the theoretical background, including key concepts such as a commodity, commoditization, the commodity trap, and the platform economy. Section 4 analyzes the business model of the MIH EV Open platform, including its technological innovations, partnerships, and value propositions. Section 5 examines the strengths and weaknesses of German automotive suppliers, focusing on current trends, competitive strategies, and regulatory challenges. Section 6 assesses the risk of a commodity trap for German automotive suppliers based on specific product categories and market dynamics. Section 7 offers a critical evaluation of the findings and provides recommendations for mitigating the risk of a commodity trap. Finally, Section 8 summarizes the key findings and offers a perspective on strategies for navigating the rapidly evolving automotive landscape

2. Data and Methodology

The following section provides a detailed explanation of the methodology selected for this study.

Research Model Overview:

This research paper aims to provide a theoretical overview of commodity traps and business ecosystems, with a specific focus on the potential risks and opportunities presented by Foxconn’s MIH EV Open platform for the German automotive supplier industry. The objective of this study is to ascertain whether German automotive suppliers are susceptible to becoming enmeshed in a commodity trap as a result of their participation in the evolving business ecosystem.

Research Objectives:

- Theoretical Framework: The objective is to examine and elucidate pivotal concepts, including commodities, commoditization, commodity traps, and the platform economy.

- MIH EV Open Platform Analysis: The objective of this analysis is to examine the business model of Foxconn’s MIH EV Open platform, with a particular focus on its technological innovations, strategic partnerships, and value propositions.

- German Automotive Suppliers Evaluation: The objective is to evaluate the strengths and weaknesses of German automotive suppliers, with a particular focus on trends, competitive strategies, and regulatory challenges.

- Commodity Trap Risk Assessment: The objective is to evaluate the risk of German automotive suppliers being caught in a commodity trap, with a particular focus on specific product categories and market dynamics.

- Recommendations: The objective is to provide strategic recommendations for the mitigation of risks associated with commoditization within the context of the rapidly evolving automotive landscape.

Research Methodology:

The research methodology employed in this study is as follows: This study employs a comprehensive literature review as its primary methodology. To identify pertinent literature, databases such as ScienceDirect, SpringerLink, and Google Scholar were consulted in order to locate relevant sources. Moreover, an analysis was conducted using the website and materials of Foxconn’s MIH EV Open platform. To refine the search, a number of keywords were employed, including “MIH EV Open”, “Foxconn”, “commoditization”, “automotive supply industry”, “ecosystem”, “platform economy”, and “commodity trap”.

The research process was conducted in accordance with the following steps:

- The data collection process entailed the gathering of information from a variety of sources deemed relevant to the research question. The relevant literature was identified and selected based on specific criteria, including an analysis of titles, abstracts, and keywords.

- A comprehensive analysis of the MIH EV Open platform was undertaken. The business model was subjected to an analysis employing the Business Model Canvas framework proposed by Osterwalder et al. [9].

- An assessment of German automotive suppliers was conducted. The strengths and weaknesses of German automotive suppliers, with a particular focus on MAHLE, were examined in order to assess the risk of a commodity trap.

Central Research Question (RQ): The RQ is as follows: What potential risks may the MIH EV Open platform pose for German automotive suppliers in terms of commoditization?

Research Approach: The research approach is presented in Figure 1, which provides a visual representation of the methodology employed, from the initial literature review to the final analysis of the strengths and weaknesses of German automotive suppliers. This structured approach guarantees a comprehensive assessment of the risks posed by the MIH EV Open platform, thereby furnishing the German automotive supplier industry with actionable insights.

Figure 1.

Flowchart of applied research methodology.

This research paper employs a case study as its primary method of analysis. The case study of Foxconn’s MIH EV Open platform provides the basis for the formulation of the research conclusions. This method entails a comprehensive analysis of the business model, technological innovations and market implications of the platform, with a particular focus on their relevance within the context of the German automotive supplier industry. The case study approach enables an in-depth examination of potential risks and opportunities within a real-world context.

However, it should be noted that the methodological approach has a potential limitation. It should be stated that no statistical methods were employed to support the conclusions presented in this paper. Although the case study analysis offers valuable insights, the absence of statistical techniques renders the research conclusions less robust from a scientific perspective. The incorporation of statistical methods could serve to reinforce the research by furnishing empirical evidence to validate the findings and ensuring that the conclusions are not only based on qualitative analysis but are also supported by quantitative data. Such an approach would serve to enhance the overall scientific rigor of this study.

3. Theoretical Background

3.1. Commodity, Commoditization, and Commodity Trap

3.1.1. Commodity

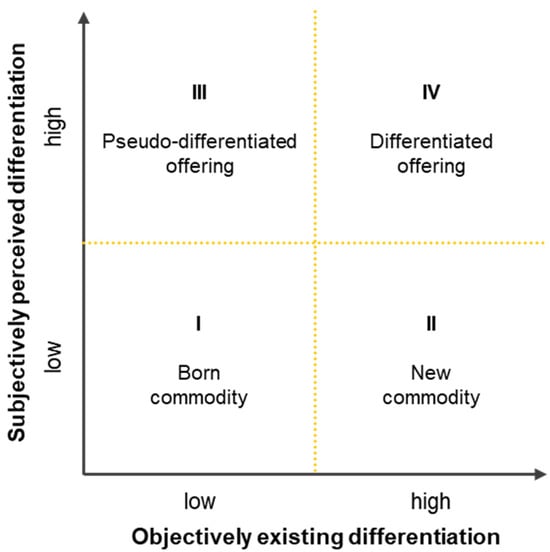

A product or service can be classified as a commodity if the majority of customers perceive the core of the product, which includes the features necessary to satisfy the customer’s minimum needs, as substitutable [3] (p. 2). Even if products have differentiating features, they may be considered identical and substitutable by the customer [10] (p. 5). Therefore, Enke et al. distinguish four types of commodities, as shown in Figure 2, based on the differentiation of a product from other offerings, according to objectively existing and subjectively perceived differentiation [10] (p. 5).

Figure 2.

Types of Commodities [10] (p. 5).

The first category includes products that are perceived by customers as heterogeneous and undifferentiated and, therefore, have a low degree of subjective and objective differentiation and are referred to as born commodities. The second category, new commodities, has objectively distinguishable characteristics but is perceived by customers as substitutable because it is subjectively undifferentiated from other competing offerings. This category includes products with a fading unique value proposition or an eroding competitive advantage. Pseudo-differentiated offerings have a low degree of objective differentiation but are still perceived by customers as different from other offerings. The final category, differentiated offerings, includes products that are both objectively and subjectively differentiated from the competition [10] (p. 5).

3.1.2. Commoditization

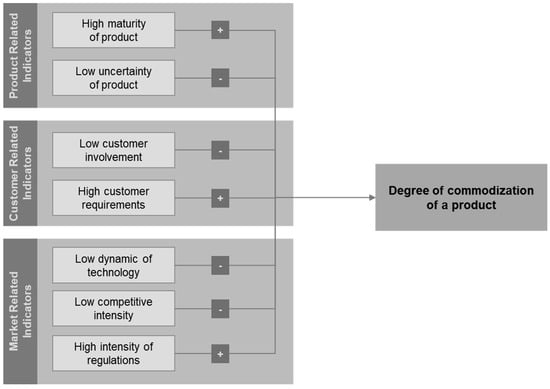

The categories of pseudo-differentiated and differentiated offerings are particularly exposed to the threat of commoditization, i.e., the transformation of once-distinctive products into commodities [10] (p. 6). As shown in Figure 3, various indicators contribute to the commoditization of a product [3] (pp. 4–7). These indicators can be divided into three categories: market-related, product-related and customer-related factors for commoditization [10] (p. 7) [3] (p. 4).

Figure 3.

Drivers of commoditization [3] (p. 4).

Product-related factors include product maturity and product uncertainty. Product maturity has a significant impact on the degree of commoditization. Younger markets characterized by innovation are less susceptible to commoditization than mature markets. Product reliability also has a significant impact on the commoditization of a product, as the failure of safety- and performance-relevant products can result in economic damage. Therefore, safety and performance products tend to have a lower degree of commoditization [3] (p. 5).

Customer involvement and the evolution of customer expectations are two indicators of customer-related commoditization. Customer involvement refers to a customer’s interest in a product, i.e., highly involved customers are very interested in the product and its benefits. Consequently, low customer involvement in a product leads to increased commoditization. In addition, high customer expectations of an offering contribute to commoditization. This is because customers expect more value from products, which leads companies to offer additional services [3,11] (p. 6).

Market-related factors, such as the degree of regulation, the dynamics of technology, and the intensity of competition, also influence commoditization. Regulation influences commoditization because standards increase product similarity and make differentiation more difficult. In addition, high technological dynamism reduces the risk of commoditization [3] (pp. 6–7).

In a dynamic environment, product innovation cycles are shortened, which prevents the harmonization of products in the market. Finally, commoditization is also more dominant in markets with low competitive intensity. In stable, traditional commodity markets, competition is often weak because products are subject to a long-term improvement process, and there is no incentive to outperform the competition [3] (pp. 6–7).

3.1.3. Commodity Trap

Commoditization leads companies to fall into the commodity trap [11] (p. 3). A commodity trap describes a situation in which producers of commoditized products or services compete with escalating prices and margins, new competitors creating overcapacity, and price-driven competition without traditional methods of differentiation [12] (p. 5). The lack of product differentiation leads to higher price and margin pressure for companies that find themselves in a commodity trap [3] (p. 9). According to a Roland Berger study, global megatrends such as globalization and the accelerating pace of technology and innovation are the root causes of companies falling into the commodity trap [12] (p. 17).

Also, established standards, such as the German Industrial Standard, often lead industries to conform to these standards rather than develop innovative products that could set new standards. This reluctance may be due to concerns about market acceptance and the success of new offerings. Aligning products and services with industry standards often leads to increased similarity and interchangeability. This can lead companies to fall into the commodity trap, where they struggle to differentiate their offerings from those of their competitors [13] (p. 29).

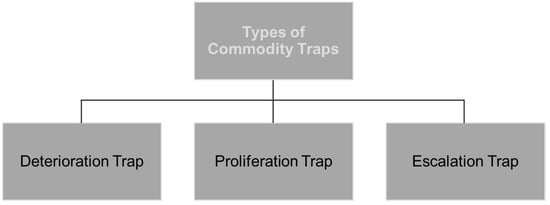

D’Aveni (2010) distinguishes three types of commodity traps, as shown in Figure 4.

Figure 4.

Types of commodity traps [14] (pp. 10–15) [13] (pp. 30–31).

The deterioration trap is caused by a decline in the perceived value of products, often due to cheaper offerings and a customer focus on price rather than quality. In the proliferation trap, multiple companies imitate a unique product, leading to niche markets without price competition. The escalation trap occurs when companies offer free additional features, which then leads to the expectation of more free features without accepting higher prices [14] (pp. 10–15) [13] (pp. 30–31).

3.2. Platform Economy

According to a study by e-mobility BW, the application of digital technologies and platform approaches is fundamentally changing the automotive industry, enabling more efficient processes, new business models, and cost reductions [5] (p. 10).

According to Pidun, Reeves, and Schüssler, a business ecosystem is defined as a set of economically independent companies that collaborate to offer their products and services, which together form a common solution. Furthermore, the ecosystem is defined by a unique value proposition and its composition of several alternating participating entities with different responsibilities, such as manufacturing, logistics, or organization [15] (pp. 13–14).

The development of an ecosystem is particularly effective in markets that are unpredictable and volatile. In addition, ecosystems are useful for exploring new business opportunities, especially when companies lack necessary capabilities, such as developing autonomous driving systems for vehicles. In addition, scaling up and collaborating with the ecosystems of existing players enables the disruption of industries [16] (pp. 6–7).

- The authors Pidun, Reeves, and Schüssler (2022) also point out that ecosystems have the following characteristics compared to vertically integrated or open market models [15] (pp. 14–15):Modularity: Business ecosystems combine independently developed components into an integrated offering, providing customers with flexibility in selection and combination.

- Customization: Participants tailor their offerings to the specific needs of the ecosystem, which requires special investments from the ecosystem participants.

- Multilateralism: Ecosystems involve interconnected relationships, which creates the risk that a single contract failure can affect multiple parties within the ecosystem.

- Coordination: Unlike the hierarchical control systems of a supply chain approach, ecosystems use mechanisms such as standards and processes to coordinate.

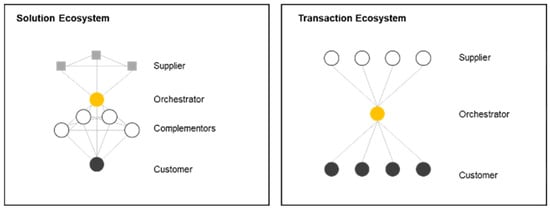

As shown in Figure 5, there are two types of business ecosystems. First, there are solution ecosystems, which coordinate contributors to create and deliver products or services. In this type of ecosystem, various complementary parties and their offerings are coordinated by a core firm. Suppliers become part of the ecosystem during the solution development process but take on a role in the hierarchical supply chain after the finished product is developed. In addition, while customers have a high degree of influence on the selection and combination of solution options offered by complementors, customers are usually not members of the ecosystem. Second, transactional ecosystems are applicable in two-sided markets and aim to connect producers and customers via a platform. They, therefore, benefit from both direct and indirect network effects [15] (pp. 15–17).

Figure 5.

Ecosystem Types [17].

The platform economy represents a conceptual framework for understanding the interactions between actors within an ecosystem, where a platform serves as a conduit for market formation. Ecosystems are frequently shaped by the network effect, whereby an augmented number of users enhances the value of each individual consumer. As the number of consumers utilizing a given product or service increases, the appeal of that product or service to both existing and new users concomitantly rises. To illustrate, a social network may be perceived as less valuable to a user if their acquaintances are not engaged with the platform. Nevertheless, as more users become active or join at a later stage, the platform becomes increasingly attractive. Accordingly, the network effect represents a pivotal element in a user’s determination to utilize a product or service. Consequently, a customer-oriented platform is a prerequisite for the success of an ecosystem, as the network effect can also have negative consequences [18].

The successful development and operation of a digital platform hinge on two pivotal criteria. First, it is essential to determine the user groups and their number. This can be achieved by consulting the following sources: [5] (p. 33), [19] (p. 11), and [20] (pp. 40–45).

Second, it is essential to reach a sufficient user base and a critical mass. Without sufficient user numbers, the frequency of interaction decreases, and trust in the platform declines. This necessitates the implementation of marketing measures during the initial phase to prevent user attrition and ensure the platform’s sustainability [5] (p. 33) [20] (pp. 29–36).

4. Analysis of the Business Model of MIH Open EV

The automotive industry is currently undergoing a significant shift towards electromobility, marking a profound revolution in the industry. In 2023, sales of EVs increased by over 60 percent, with approximately 12 million newly registered units and a corresponding market value of 351 billion euros. China emerged as the primary market leader, with 6.55 million cars sold, followed by the American market, with approximately 1 million cars sold, and Europe, where Germany stands out as the dominant market. A synthesis of projections from various studies indicates that the market will continue to expand, with forecasts anticipating a market volume of up to 1.44 billion EVs by 2030. It is anticipated that China will continue to account for a significant proportion of the overall market volume at that time [21,22]. In view of the evolving landscape of the automotive industry and its ramifications for the supplier sector, Foxconn made a strategic decision in 2021 to launch the collaborative platform known as MIH. This initiative is designed to establish Foxconn as a prominent figure in the EV and supplier industry, with a particular focus on defining benchmarks for software and hardware standards [6]. The question thus arises as to what precisely constitutes “Mobility in Harmony”? What are the specific objectives being actively pursued? Furthermore, what is the structure of the product portfolio? The following sections will address these questions.

4.1. Introduction to MIH Open EV

In 2021, Foxconn, a prominent Taiwanese electronics manufacturer and the largest contract electronics manufacturer in the world, established the MIH initiative. The objective of MIH is to facilitate a collaborative platform dedicated to the comprehensive advancement of crucial software, hardware components, and services within the EV industry [6]. MIH is an international, open-platform alliance consisting of over 2700 companies from over 70 countries and regions. This includes prominent entities such as NVIDIA, ZF, and Continental, which operate independently as a consortium. Guided by Founder Terry Gou, Hon Hai Technology Group has devised a corporate strategy, designated as the 3 + 3 Transformation, which prioritizes a shift from a focus on tangible assets to one centered on intangible assets. This strategic pivot entails optimizing existing business operations, embracing digital transformation, and venturing into new domains, including EVs, digital health, and robotics. Foxconn’s extensive global supply chain, component manufacturing capabilities, and R&D proficiency position it to play a leading role in the EV ecosystem [23]. MIH, for its part, emphasizes the platform’s role in fostering collaboration, preventing redundancy, and accelerating the development and market entry of EV products [24].

Foxconn, also known as Hon Hai Precision Industry Co. Ltd., is the inventor of the open EV platform and has a longstanding presence in the automotive industry. The company serves as a supplier to Tesla and a manufacturer of a diverse range of automotive components, including electronic components, mechanical components, batteries, battery cells, and battery packs [25]. With an approximate revenue of USD 222 billion, Foxconn is the 27th largest company in the global electronics and electrical equipment industry. As an experienced original equipment manufacturer (OEM), Foxconn focuses on the rapidly growing market for EVs in order to increase sales and margins. The company aims to revolutionize this market with MIH [26].

A principal objective of the MIH platform is to develop an open EV platform specifically tailored for Software-Defined Vehicles (SDV). In order for an SDV to be constructed, it is necessary to incorporate a hardware abstraction layer (HAL) between the hardware platform and the software platform. This hardware abstraction layer (HAL) permits the software layer to be situated above it, thereby defining the entire vehicle as a comprehensive system with software application programming interfaces (APIs).

This approach enables the definition and development of future vehicle user experiences (UX) through the use of software applications. The software platform is designed to be compatible with multiple skateboards, thereby allowing for flexibility in replacing them with newer generations. The Open EV platform API is designed to be adaptable for both mission-critical and non-mission-critical control functions. This adaptability allows developers to provide and integrate a variety of solutions’ capabilities through common interfaces. Following the completion of the development stage, developers may proceed with module-in-the-loop (MiL), software-in-the-loop (SiL), hardware-in-the-loop (HiL), vehicle-in-the-loop (ViL), as well as closed field pre-verification and public road verification. These comprehensive testing phases ensure the achievement of functional safety and real-time predictive reactions. The MIH community and ecosystem facilitate the perpetuation of innovations based on the same platform, obviating the need for a complete software rebuild. This approach yields substantial cost savings and reduced development time. Contributor members of MIH are actively engaged in working groups, contributing to the establishment of standards and reference designs for the Open EV platform [27,28].

With regard to MIH membership, three distinct membership levels are in place, each delineating the roles of participants. The EV hardware chassis and software stack provide the blueprint for the activities within each working group. The lowest-tier level of membership is designated as the “Community”. This tier offers certain industry engagement and paid services, including activity updates and active participation in discussions at interest groups and/or MIH events. However, members at this level have limited influence on the consortium’s innovation process and restricted access to ecosystem resources. Community members are required to pay fees of up to $600 in order to gain access to optional additional services, such as market trend insights or various courses.

The M+ Service Subscription, the second-lowest tier, is priced at $1000 per year and provides access to a variety of educational resources, including seminars, courses, participation in public meetings, and monthly newsletters. Contributor members occupying the highest tier are required to make an annual contribution of at least $10,000. They play a pivotal role by making substantial annual contributions, leading working groups, and actively shaping MIH’s technological standards and innovations in EV technology and standards production. Three interest groups are dedicated to the evaluation of EV technology and policy. Community members are permitted to participate in these groups, although only Contributor members are eligible for chair positions [29,30]. Consequently, MIH generates revenue from membership subscriptions, with current membership exceeding 2700 entities [31].

4.2. Technological Innovations and the Role of Commodity Hardware in the MIH Consortium

The adoption of commodity hardware in battery electric vehicles (BEVs), facilitated by initiatives such as the MIH EV open networks, is transforming the EV industry, driving innovation and affordability. It is crucial to comprehend the influence of commodity hardware on BEVs in order to effectively navigate the evolving landscape of electric mobility.

In the context of BEVs, the term “commodity hardware” refers to readily available, low-cost, and easily replaceable components that form the core infrastructure of EVs. This is analogous to the computer industry, where standardized components facilitate the mass production of personal computers and notebooks [32]. The advent of commodity hardware marks the beginning of a revolutionary shift in the design and manufacturing processes of BEVs.

The Evolution of Commodity Hardware in BEVs:

In the nascent stages of EV development, proprietary hardware solutions were a prevalent phenomenon. Each manufacturer designed and manufactured custom components tailored to their specific vehicle models. However, with the advent of open-source initiatives such as MIH EV, which standardizes numerous components of BEVs, the transition towards commodity hardware is becoming increasingly evident within the EV industry.

The Role of Commodity Hardware Components in BEVs:

The development and operation of BEVs are contingent upon the utilization of commodity hardware components, as evidenced by reference to the extant literature [33]. Such components include the following:

- Battery packs: Battery packs constitute a significant component of EVs, playing a pivotal role in their development and operation. Lithium-ion battery packs, which are available from open-market suppliers, serve as the primary energy storage solution in BEVs [34].

- Electric motors: The use of off-the-shelf electric motors, such as those employed in MIH EV open networks, provides the drive system for BEVs, offering efficiency and reliability at a competitive cost.

- Power Electronics: Standardized power electronics components, including inverters and motor controllers, regulate the flow of electricity between the battery pack and the electric motor, thereby optimizing performance and efficiency [33].

- Charging Infrastructure: The use of standard charging infrastructure, such as charging stations and connectors that are compatible with MIH EV standards, allows BEV owners to charge their vehicles in a convenient and efficient manner [35].

- As with commodity hardware in computing, the use of standardized components in BEVs presents both advantages and disadvantages [36].

The use of commodity hardware in the production of BEVs has the effect of reducing manufacturing costs, thereby increasing the affordability and accessibility of these vehicles to consumers. The use of standardized components allows for easy interchangeability and compatibility between different BEV models and manufacturers. Furthermore, these components can be sourced from open networks such as MIH EV, which are readily available from multiple suppliers, thereby reducing supply chain constraints.

Disadvantages:

The disadvantages of this approach include the following:

- Performance limitations: Although standardized components may offer cost benefits, they may not consistently provide optimal performance compared to proprietary solutions.

- Complexity of troubleshooting: The use of components from multiple suppliers can result in compatibility issues and present significant challenges to troubleshooting.

- Limited support: In contrast to fully integrated proprietary systems, commodity hardware may be subject to a lack of support from the original equipment manufacturer.

4.3. Partner and Customers: MIH Open Working Groups

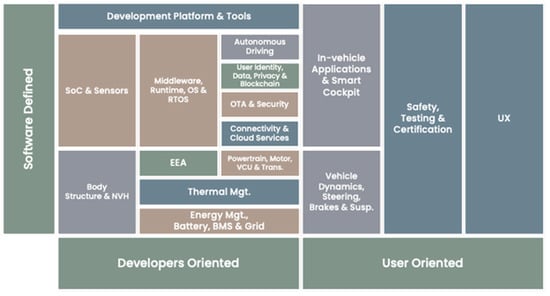

In order to fulfill Foxconn’s corporate strategy, MIH has established working groups with specific focus areas and has defined a timeline for standardization and reference design development. The objective of these working groups is to set the global market standard in the automotive industry and to facilitate the advancement of the next generation of mobility, thereby transforming the automotive industry as a whole [37]. Figure 6 illustrates the composition of the working groups and their respective key areas of focus.

Figure 6.

MIH working groups [37].

The typical output of working groups within the field of MIH is a series of deliverables, including technical recommendations, specifications, reference designs, and sample codes. The objective of these deliverables is to provide guidance for the development of products and technologies within the EV industry. To guarantee the practical and relevant nature of the working groups’ work, it is imperative that they demonstrate the implementation of their proposed changes in at least two products by two distinct implementers. Additionally, each working group is furnished with a charter that delineates the group’s stated goals and objectives.

Typically, working groups are small and composed of experts in the relevant area, which facilitates rapid progress and ensures that the group has a strong foundation of knowledge and expertise [38].

The following is a brief description of each working group:

The remit of the Powertrain Working Group is the advancement of EV powertrains, with a particular emphasis on enhancing efficiency and performance, reducing weight, optimizing packaging layout, and developing sophisticated electrical controls. They endeavor to identify and address challenges and opportunities inherent to the design and development of powertrain systems for EVs [39].

The Body Structure Working Group acknowledges the inherent complexity that arises from the combination of diverse materials. Notwithstanding the difficulties, the objective is to identify the most suitable materials for various components. This strategy facilitates the development of a lightweight body structure that is characterized by flexibility and configurability, thereby enabling the application of multiple materials in vehicle designs. The pursuit of a mixed construction approach represents a pivotal direction in addressing the dual objectives of achieving structural efficiency and cost-effectiveness in EV manufacturing [38].

The objective of the Thermal Management Working Group is to develop a highly efficient thermal management system that is aligned with the current requirements of EV OEMs (original equipment manufacturers). The proposed system incorporates technologies such as positive temperature coefficient (PTC) heaters, forced air cooling, and liquid cooling to interface with the battery system and powertrain, thereby forming a comprehensive battery thermal management system [40].

The Energy Management Working Group is tasked with defining and designing advanced energy management systems. This encompasses Battery Management Systems (BMSs), Vehicle-to-Grid (V2G), Vehicle-to-Home (V2H), and a Smart City adapter layer for Smart Grid management. Furthermore, the working group is engaged in the exploration of battery technologies, addressing aspects such as energy density, charging profiles, and the 5R principles (reduce, reuse, recycle, recover, and remanufacture). The overarching objective is to contribute to the advancement and optimization of energy-related technologies within the context of EVs and their integration into smart and sustainable energy ecosystems [38].

The objective of the Vehicle Dynamics Working Group is to facilitate the integration of vehicle dynamics within a cloud-based framework. The principal objective is to establish realistic conditions for autonomous virtual simulation. This entails the development and implementation of technologies and methodologies that facilitate the simulation of vehicle dynamics within a cloud-based environment. The objective of the working group is to enhance the accuracy and realism of virtual simulations related to autonomous vehicles, thereby contributing to the advancement of autonomous driving technologies. The objective of the Cloud Services, Development Platform, and Tools Working Group is to define and develop cloud services within the automotive sector. Their primary objective is to develop tools for the creation of EV components and software applications, including equipment and software development kits (SDKs), with the intention of facilitating and streamlining the development process.

The Connectivity Working Group’s primary objective is to define and develop both wired and wireless high-speed peripherals. The primary objective is to implement Quality of Service (QoS), real-time communication, and the seamless integration of 5G technology [38].

The Electric Electronic Architecture (EEA) Working Group serves as the central nervous system for EVs, facilitating the construction and interconnection of various components, including the Central Compute Unit (CCU), Zone Compute Unit (ZCU), computing platforms, power delivery systems, and data exchange networks. In the context of the increasing prevalence of Software-Defined Vehicles (SDV), the centralized EEA architecture introduces complexities in data transmission and network typology, which present challenges for the development of new applications across different vehicle segments. The principal objective of the EEA Working Group is to address these challenges by developing a layered design architecture [41].

The objective of the Middleware & Runtime Working Group is to define and design middleware and runtime solutions that are both operating system (OS) agnostic and deterministic in their processing. The principal objective is to develop technologies that support mission-critical applications, ensuring both reliability and determinism in processing [38].

The Autonomy Working Group is tasked with the development of requirements and specifications for autonomous driving (AD) and advanced driver assistance systems (ADAS) within the MIH Open EV platform. The objective of this group is to establish standards and guidelines for the development and implementation of these technologies in EV [42].

The Security and Over-the-Air (OTA) Working Group (Security/OTA WG) is tasked with developing security-by-design requirements throughout the vehicle lifecycle management process and establishing specifications for the MIH EV Kit platforms. The overarching objective is to enhance security throughout the MIH EV ecosystem by establishing standardized protocols, fostering collaboration with solution partners, and ensuring compliance with international regulations [43].

The Smart Cabin Working Group is dedicated to the advancement of applications for a smart vehicle ecosystem, as well as the investigation of novel use cases for the interior experience of EVs. The group may engage in research pertaining to a multitude of subjects related to the design and functionality of the vehicle cabin, including comfort, convenience, and entertainment features [44].

The UX Working Group is dedicated to study the user experience (UX) of EVs, with a specific emphasis on the influence of emerging technologies on UX. Their objective is to comprehend the expectations of users and to devise and implement solutions that either meet or exceed these expectations. This may entail the formulation of guidelines and standards for user interfaces, user-centered design, and usability in the context of EVs [38].

The Testing and Certification Working Group is responsible for establishing standards and processes related to quality management, qualification, and testing within the automotive industry and the MIH ecosystem [45].

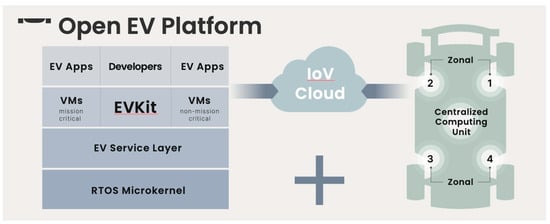

4.4. Prospective Role of Software-Defined Vehicles

The forthcoming generation of mobility will supersede traditional internal combustion engine (ICE) vehicles through the advancement of software-defined vehicles (SDVs). Tesla was the first to develop the concept of SDVs, centralizing the EEA architecture into a zonally organized system that resembles a modern computer system. This forthcoming generation of mobility will facilitate over-the-air (OTA) software updates, thereby paving the way for SDVs. As vehicles become increasingly software-defined, new applications and user experiences can be introduced and upgraded throughout the vehicle’s lifecycle, analogous to the manner in which smartphones are updated with new applications from an app store. The advent of open platforms, exemplified by the MIH Open EV platform, follows a trajectory analogous to that of the evolution of smartphone ecosystems. As illustrated in Figure 7, the MIH Open EV platform is distinguished by the independent development of an EV chassis platform and a software development stack that incorporates an integrated input/output virtualization (IoV) cloud. The software stack operates with a real-time operating system (RTOS) as the base, followed by an EV service layer that enables capabilities such as telematics and a controller area network (CAN) bus [46].

Figure 7.

Open EV platform for SDV [28].

The EVKit represents the fundamental software stack, providing a standardized platform for developers to customize applications for both mission-critical and non-mission-critical virtual machines (VMs) in EVs.

The EVKit offers a number of significant advantages, including a reduction in the time required for development through the concurrent development of both hardware and software stacks, as well as the lowering of barriers to entry that foster a dynamic ecosystem and an innovative user experience. This “underlying vehicle platform” integrates essential controls like steering and power output, complemented by Hon Hai’s research and development in crucial components such as unibody e-powertrains, heat dissipation technology, and solid-state battery development. These form the basis of MIH’s value proposition across the EV supply chain. The operating system of EVKits is based on a service-oriented architecture (SOA) runtime and middleware, which allows it to cater to both mission-critical and non-mission-critical domains. The system is designed with security as a primary consideration, employing a Zero Trust Architecture that ensures end-to-end encryption and a decentralized universal identifier approach [46].

4.5. Product Portfolio

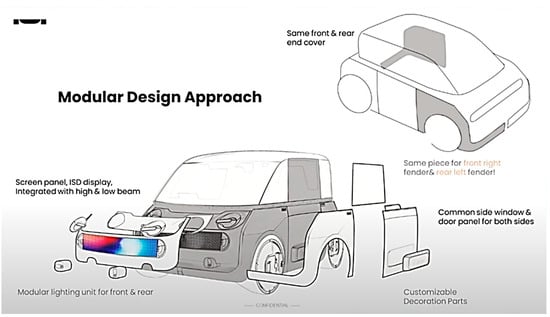

In November 2022, during MIH’s inaugural “Demo Day” conference, the company’s CEO, Jack Cheng, revealed Project X, which represents MIH’s inaugural foray into EV production. MIH is uniting innovators with an open and adaptable EV platform, thereby facilitating the shaping of the future of urban mobility. As illustrated in Figure 8, Project X’s modular design and standardized interfaces enable the creation of customized vehicles through a “build your own vehicle” approach. This flexible architectural framework is applicable to all vehicle segments, thereby enabling mobility service providers, fleet operators, and mobility brands to customize vehicles in accordance with their particular requirements. The plug-and-play design approach allows for the rapid and cost-effective introduction of innovative products, thereby meeting the diverse needs of a variety of audiences [47].

Figure 8.

MIH EV modular design [47].

As indicated by MIH, the inaugural prototype was unveiled at the 2023 Japan Mobility Show in Tokyo in October. Additionally, the company anticipates the launch of six-seater and nine-seater prototypes within the subsequent two years [48].

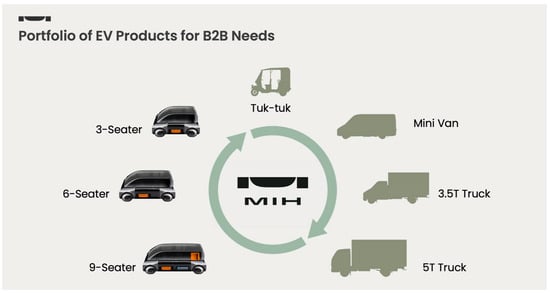

In addition to Project X, which includes a three-seater, a six-seater, and a nine-seater, the product portfolio in the EV market for business-to-business (B2B) and business-to-consumer (B2C) customers must be expanded to include a tuk-tuk, a minivan, a 3.5-ton truck, and a 5-ton truck (Figure 9). The three-seater is designed to offer a range of innovative features, including 2 + 1 adaptive seating, a swappable battery system, level 2 to level 4 autonomous driving capabilities, sliding doors, and a durable and resilient interior. The objective of MIH is to provide a luxurious, enjoyable, and stress-free experience with their automobiles [30].

Figure 9.

MIH EV product portfolio [48].

Project Y represents another initiative by MIH that is focused on addressing the needs of goods transportation. This comprehensive initiative encompasses the development of electric trucks and vans, sophisticated fleet and energy management software, consultation on energy infrastructure, and the establishment of a carbon tracking platform. Project Y represents a commitment to more than mere improvements in transportation efficiency. It also serves as an exemplar of the alliance’s dedication to assisting logistics providers in reaching their carbon reduction goals and promoting environmentally friendly transportation solutions [30].

In the EuroBrake 2021 Q&A, CTO William Wei drew parallels between MIH’s initiative to open the EV ecosystem and the Android open-source platform for smartphones. MIH employs an agnostic strategy, analogous to that of Android OS, to develop universal, cross-platform interfaces compatible with diverse hardware models from various manufacturers. In official press releases, the aspiration to be the “Android system of the EV industry”, encompassing both the software stack and the hardware stack (chassis and skateboards), was underscored, with parallels drawn to Android’s transformative influence on the smartphone sector [49]. In response to the complexities inherent in the manufacturing of EVs, Hon Hai has established collaborative endeavors, such as Foxtron, and has formed partnerships with international counterparts. The introduction of MIH as an open EV platform represents an effort to establish a vertically integrated supply chain with standardized production for EV contract manufacturing [50].

4.6. Value Proposition of MIH Open EV

The transition of the automotive industry towards EVs presents challenges for suppliers seeking to adapt their business models to accommodate electrification. The main challenges faced by suppliers are high development costs and long lead times resulting from the lack of standardization in the industry [31]. Furthermore, they must contend with a scarcity of resources [49]. As they enter an emerging market, another barrier is the field of existing and upcoming patents for new technologies and innovations, as well as the necessity to construct a new network of partners [6].

A key value proposition of the MIH Open EV platform is to address existing market barriers in order to expand business opportunities and facilitate the growth of the entire EV market [31]. In contrast to the construction of obstacles, the objective is to engage a dynamic community in order to facilitate ecosystem growth [51]. By addressing issues such as high development costs, lengthy lead times, and inadequate resources through the use of reference designs and standards, MIH should be accessible to third-party developers as well [49]. Third-party contributions are welcomed in order to facilitate the evolution of the website and the provision or enhancement of new functionalities.

The separation of hardware and software allows for an open-source approach, which in turn encourages a reduction in R&D costs [52]. To mitigate the risk of investing in a venture that may be impeded by existing patents, the MIH Open EV platform has established a patent policy that requires all platform members to disclose any essential patents or applications pertaining to the reference designs and standards.

Another area in which MIH Open EV facilitates market entry for automotive suppliers in the EV sector is through its partner network. As mentioned previously, the platform currently boasts in excess of 2700 members, with a strong emphasis placed on fostering collaboration among them. The platform offers a database of all MIH partner members, which can be utilized to identify potential business partners with whom connections may be made [31].

5. Critical Examination of the Strengths and Weaknesses of German Automotive Suppliers

5.1. Trends and Challenges of the German Automotive Supplier Industry

The discussion surrounding the significant and disruptive transformation of the automotive industry, driven by the growing global adoption of EVs, has emerged as a pivotal topic in scientific, political, and industrial domains in recent years. A substantial body of research attests to the inevitability of this transformation and its consequent impact on suppliers, both directly and indirectly associated with the automotive industry. The entire supply and value chain are poised for change, although the precise outcome remains uncertain. As discussed in Chapter 4, the EV market is undergoing rapid development, with a growth rate exceeding 60 percent. To play a pivotal role in this burgeoning market, whether as an automotive manufacturer or a supplier, requires a profound overhaul of product portfolios and value chains. This entails positioning oneself as a trailblazer in the development, production, and assembly of automobiles and their component parts while also establishing industry standards. This transformation extends beyond considerations of the physical hardware of vehicles and instead acknowledges the growing significance of software. This is due to the contemporary characterization of cars as sophisticated computerized entities on wheels. In light of the prevailing uncertainties, those responsible for decision-making in the automotive sector must adopt a proactive approach to investment, with a view to acquiring expertise, enhancing production capabilities, and establishing resilient supply chains. This is essential to ensure that the sector is equipped to respond effectively to future market demands [53].

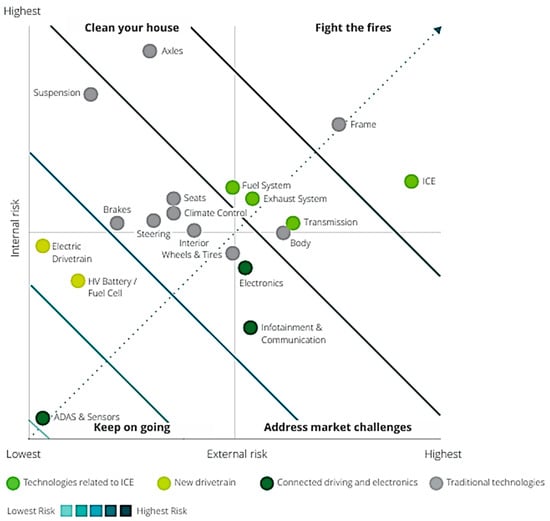

The current economic climate is characterized by elevated energy prices and logistics costs, which are intensifying existing cost pressures. This creates further complexity in the planning process, particularly in light of ongoing uncertainty surrounding future sales and raw material costs. The advent of alternative drivetrains has accentuated the necessity for transformation, underscoring the imperative for sustainability. The financial burden of transformation costs falls significantly on the supplier industry, which is consequently affected in terms of its financial resilience. The confluence of transformation challenges, fluctuations in ICE-related supplier components, rising costs, and persistent uncertainties is creating a challenging period for many suppliers. It is of the utmost importance to identify and address the various corporate and market risks present in this environment in order to implement timely countermeasures and navigate a targeted transformation. It should be noted that not all suppliers are equally affected by these conditions. As illustrated in Figure 10 of the Deloitte study on the future of the automotive value chain, the component clusters posing the greatest risks in the German automotive industry are ICE and Frame, followed by Transmission, Exhaust System, and Body. The component cluster facing the greatest external risk is the ICE due to a combination of factors, including a projected low future market share in passenger cars, substantial adverse impacts from legislation, and a decrease in market volume. The driving forces behind this prominence are the combined influences of demands for carbon-neutral propulsion systems from policymakers and the public, along with substantial internal (controllable) risks such as diminished profitability and increased indebtedness. It is unsurprising that clusters centered around new drivetrain technologies and connected driving and electronics exhibit a comparatively lower overall risk profile [1].

Figure 10.

Component cluster risk map [1].

In the wake of the 2020 coronavirus and semiconductor crisis, automotive manufacturers and suppliers are encouraged to observe a sustained resurgence in demand and volumes, accompanied by a favorable long-term outlook. Deloitte’s projections indicate an anticipated overall growth of up to 40 percent by 2030. It is noteworthy that substantial expansion is foreseen in electromobility and its associated supplier components and technologies. In contrast, traditional combustion engines and their corresponding supplier parts are expected to undergo a decline of approximately −20 percent by 2030. In light of the impact of the coronavirus and semiconductor crisis, OEMs are undertaking a strategic reevaluation, seeking to diminish their reliance on suppliers in the Eastern hemisphere. Consequently, there is an emerging trend among OEMs to encourage their regional suppliers to evolve into comprehensive suppliers, diversifying their product portfolios to encompass a broad spectrum of products. This transition is particularly evident in the context of traditional combustion vehicles and their associated components. However, it is also becoming increasingly prominent in the context of electric mobility, where factors such as the extraction of raw materials, digitalization, and the transition to electric powertrains and battery systems are gaining greater significance [1].

The transition towards electrification has propelled Chinese automakers to a prominent position within the global automotive industry, challenging the long-standing dominance of Western manufacturers. The EV market is undergoing a period of significant transformation, with implications for both Western and Chinese automotive companies. While Western companies have historically dominated the traditional ICE vehicle sector, the EV sector has provided a level playing field where Chinese automakers have demonstrated remarkable proficiency, particularly in their domestic market. In 2021, the top 10 EV models in China, based on sales volume, featured only Tesla from Western brands, which highlights the significant influence of Chinese brands within the country. On a global scale, eight of the twenty-five largest automakers by market capitalization are now Chinese entities. The collective market share of major Chinese automakers worldwide increased from 19 percent in 2020 to 24.3 percent in 2021, with industry leader BYD at the forefront of this growth.

This surge in success has posed a formidable challenge to Tesla, which historically held a dominant position. Increased competition has impacted Tesla’s market share as Chinese automakers capitalize on the flourishing EV market in China, supported by government initiatives. German automakers must develop strategies and positioning approaches to establish a notable presence in the Chinese EV market. This, in turn, has substantial implications for the supplier industry [54].

The role of automotive suppliers is undergoing a transformation as a result of their active participation in the development of EVs and autonomous driving technologies. The formation of collaborative and partnership arrangements between suppliers and automakers, as exemplified by the prominent position of CATL (Contemporary Amperex Technology Co. Limited, Ningde, China) in the EV battery sector, serves to illustrate this evolving dynamic. Prominent entities such as CATL, a leading Chinese manufacturer of lithium-ion batteries for EVs and energy storage systems, leverage their influence to form advantageous partnerships with automakers, thereby extending their reach beyond China. Concurrently, major internet companies, including Baidu, Tencent, Alibaba, and Huawei, are making significant investments in EV manufacturers, thereby contributing to the emergence of innovative business models focused on intelligent and interconnected EVs. It is noteworthy that their interests extend beyond individual vehicle components to encompass charging infrastructure. This is evidenced by the fact that industry giants such as Shell and BP are venturing into the EV charging and battery-swapping market. The Tier 0.5 cooperation model is transforming the traditional automotive industry chain, enabling suppliers to play a more prominent role in the development of intelligent and interconnected EVs [55]. MIH EV Open has set itself the objective of becoming a leading 0.5-tier supplier while also seeking to transform the future EV market and establish pioneering standards for the industry.

Foxconn, with a background in supplying parts to Tesla and manufacturing camera modules for various automakers, has formed a joint venture with Stellantis, a multinational automotive manufacturer formed by the merger of Fiat Chrysler Automobiles and the PSA Group. The venture, called SiliconAuto, is focused on advanced semiconductor development for EVs. The objective of this collaboration is to revolutionize the manner in which automotive value is created. This will be achieved by introducing semiconductors that have been tailored to align with industry requirements, with this process set to commence in 2026 [56]. By forming alliances with Stellantis and other prominent figures in the automotive industry, Foxconn is able to contribute resources and expertise to the advancement of electromobility solutions. This is achieved through the utilization of the platform economy and the MIH EV platform, which facilitate the efficient development of EVs. Foxconn and Stellantis, as industry pioneers, seek to reshape the automotive industry, driving electromobility advancements globally and gaining a competitive advantage through collaboration and platform-driven approaches. The ongoing transformation in the automotive sector underscores the interconnected and platform-driven future, wherein Foxconn and Stellantis occupy pivotal roles in shaping the industry’s evolution [57].

It is imperative to understand the following point: It is imperative that German traditional automotive suppliers, who have performed admirably thus far, undergo a transformation and adapt to the evolving landscape. It is evident that innovations, collaborations, and operational excellence will play an even more significant role than previously observed. The question thus arises as to the conditions under which progress towards electromobility can be successful. The case of MAHLE, a German automotive supplier specializing in engine components and systems for both combustion and electric vehicles, illustrates the potential for a significant transformation towards electromobility (see subsequent sections).

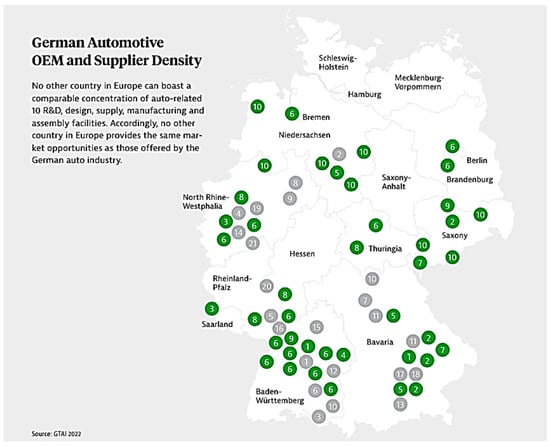

5.2. Competing against the Competition: Strategies and Examples for Success Practices

The German automotive supplier industry, comprising a diverse landscape of family businesses, SMEs, and global corporations, employs over 300,000 individuals and has over 900 suppliers, including numerous tier 2 and 3 suppliers (Figure 11). Approximately 85 percent of automotive suppliers are medium-sized companies, contributing up to 70 percent of the total value added within the domestic automotive sector. This diversity provides the German automobile industry with a competitive advantage in both domestic and international markets. Germany is distinguished as a global leader in OEM suppliers, with 15 of the world’s top 75 automotive OEM suppliers headquartered in the country. In 2021, automotive suppliers contributed EUR 79.7 billion to the total turnover of the German automotive industry, which reached EUR 410.9 billion—an 8 percent increase from the previous year. To maintain this leadership position, a significant focus on research and development (R&D) is essential. In 2021, OEMs invested approximately EUR 28.3 billion in research and development (R&D), representing over one-third of the global automotive industry’s total R&D expenditure [58].

Figure 11.

German automotive OEM and supplier density [58].

Although Germany continues to serve as a pivotal center for manufacturing and innovation, the industry is confronted with formidable challenges and a profound transformation, largely driven by the advent of electromobility, autonomous driving, and digitalization. It is of paramount importance for manufacturers and suppliers to internationalize in order to enhance their global competitiveness [59]. The German automotive industry is undergoing a multidimensional transformation driven by factors such as autonomous and connected driving, alternative powertrains, and shifts in customer behavior. The industry is confronted with a multitude of disparate global mobility requirements and a vast array of disparate transport infrastructures, thereby necessitating bespoke responses. For the supplier industry, the transformation signifies a profound and distinctive upheaval. The German supplier landscape has traditionally been characterized by a multitude of specialized SMEs, which have frequently established themselves as global leaders in their respective niche markets. These hidden champions, typically situated in rural areas, constitute a vital component of Germany’s extensive industrial foundation. However, the ongoing transformation requires a comprehensive reassessment of their entire product portfolios within a relatively short timeframe, necessitating significant investments that these companies can only undertake with considerable effort. It is worth noting that there are ongoing success stories within the supplier industry, such as MAHLE, which has demonstrated a notable commitment to the electromobility sector, with over half of its companies actively engaged in this field. Moreover, German suppliers are at the vanguard of innovation in autonomous and connected driving, as evidenced by their dominant position in global patent registrations. This achievement positions Germany as a global leader in these domains, laying the foundation for continued success in the future [60].

Another crucial strategy for competing in a saturated market is to identify untapped sales opportunities and form strategic alliances with new business partners. This can result in corporate growth and is an essential component for ensuring the company’s long-term sustainability [61].

An illustrative case study of successful transformation is MAHLE. The following section provides a more detailed examination of MAHLE’s transformation, strategic approach, and product portfolio, with illustrative examples.

MAHLE, the sixth-largest automotive supplier in Germany, aims to establish itself as a system champion in e-mobility, underscoring the importance of systems expertise in the increasingly complex domain of electric drives. During Tech Day, Arnd Franz, Chairman of the MAHLE Management Board and CEO, emphasized the intricacy of the interaction between individual components in electric drives, noting that this is a more complex process than in ICEs [62].

To illustrate, the company has identified three strategic fields as the focus of its 2030+ strategy:

- Electrification: MAHLE’s strategic focus is on electric drives and intelligent charging systems, with the objective of making e-mobility more cost-effective, user-friendly, and dependable [63].

- Thermal Management: This is a fundamental aspect of the electrification process and represents a significant area of expertise. In this area, MAHLE will seek to consolidate its leading position as the largest provider of modular and highly efficient thermal management systems for batteries, efficient drives, and sophisticated interior comfort [63].

- ICEs: As long as there is global demand, MAHLE will continue to be a reliable partner [63].

In the field of electrification, MAHLE has introduced a groundbreaking technology kit for electric motors, which is designed to create the “perfect motor” by combining features from the Superior Continuous Torque (SCT) and Magnet-free Contactless (MCT) electric motors. The resulting motor offers high peak power, contactless and wear-free power transmission, rare earth elimination, and maximum efficiency.

Furthermore, the company has developed a new thermal management module that consolidates essential components, thereby reducing the space required for installation, the effort expended on development, and the costs incurred. The integrated system enhances efficiency, providing a 20 percent increase in cruising range and, consequently, a reduction in the frequency of battery charging. MAHLE’s global partnership with automobile manufacturers is oriented towards open technology approaches, with the objective of meeting the needs of global markets. Strategic areas of focus include electrification, thermal management, and highly efficient, sustainable ICEs [62].

Effective thermal management is a fundamental aspect of successful e-mobility, and MAHLE recognizes it as a core business area of paramount importance for the advancement of electrification. Jumana Al-Sibai, a member of the MAHLE Group Management Board, posits that the sales potential for thermal management in EVs is three times greater than that for combustion engine vehicles. It is anticipated that the market for thermal management products will experience a considerable expansion in conjunction with the growth of e-mobility, reaching a valuation of over 50 billion euros by 2030, up from approximately 35 billion euros in 2021.

In 2022, thermal management, which generated approximately 4.5 billion euros (a 16% increase from 2021), represented the supplier’s most robust area in terms of sales and growth. The fields of electrification and thermal management are inextricably linked, and the company’s comprehensive expertise in both domains enables it to provide optimal solutions for a diverse range of vehicles, including BEVs, hybrids, and conventional vehicles.

Key factors influencing customer acceptance of EVs, such as battery service life, cruising range, drive system performance, and fast charging capability, are heavily dependent on thermal management. As previously stated, MAHLE has devised a novel thermal management module that consolidates multiple components into a single unit, thereby reducing installation space, engineering effort, and costs while markedly enhancing efficiency. When integrated into a system network with a heat pump, this module has the potential to achieve up to 20 percent more cruising range than a pure electric heater architecture.

MAHLE’s innovations also encompass electric fans for efficient cooling during charging, powerful air-conditioning compressors, and battery cooling plates that facilitate fast charging and extend battery life. Consequently, the company is a significant supplier of innovative heat pump systems, which contribute to a reduction in energy consumption and facilitate the utilization of smaller, more cost-effective batteries in EVs [64].

The issue of interoperability and international cooperation is becoming increasingly significant for German automotive suppliers, including MAHLE, as a means of establishing new standards and driving innovation. MAHLE and ProLogium, a Taiwan-based battery manufacturer, have entered into a Memorandum of Understanding (MOU) to collaborate on the development and evaluation of thermal management solutions for next-generation solid-state batteries. It is anticipated that solid-state cells will offer advantages in terms of safety and energy density, which will contribute to increased driving ranges and enhanced safety standards for battery systems. The objective of the collaboration is to develop tailored thermal management solutions that take into account the distinctive characteristics of ProLogium’s solid-state battery technology. The objective is to develop competitive battery systems that offer high efficiency, energy density, lifetime, and fast charging capabilities. It is anticipated that the partnership will influence the future development of battery technologies, resulting in the creation of superior products that will facilitate the commercialization of reliable and efficient solid-state battery solutions for EVs [65].

5.3. Innovative Strength for the Future: Illustrative Example

MAHLE projects that the sales potential for EVs will be approximately three times that of ICE vehicles. In the 2022 financial year, the supplier company achieved a 14 percent increase in sales, reaching €12.4 billion, and recorded a positive operating profit. Notwithstanding the aforementioned challenges, which include cost increases and supply chain disruptions, the company is adapting through the implementation of cost-saving measures, productivity enhancements, and adjustments. The company is dedicated to its technological transformation, with a particular emphasis on the field of electrification. It is committed to investing in research and development and to securing a diverse financing portfolio. It is noteworthy that MAHLE is making significant advancements in the fields of electric drives, smart charging, and thermal management systems for EVs, with the objective of becoming a leading entity in the evolving automotive landscape [66].

One of the most significant and recent advancements is the company’s wireless charging system for EVs. SAE International, a global association of engineers and technical experts in the aerospace, automotive, and commercial vehicle industries, has selected MAHLE’s positioning system as the global standard solution for wireless charging of EVs. This positioning system addresses a significant deficiency in the standardization of inductive charging, facilitating a cross-manufacturer solution for the expeditious adoption of this wireless charging alternative. The MAHLE positioning method, designated as the Differential-Inductive-Positioning-System (DIPS), employs a magnetic field to accurately align the EV over the charging coil. The decision by SAE International is regarded as a significant catalyst for the advancement of electromobility. MAHLE intends to make its solution accessible to the entire industry through a licensing model that adheres to the principles of fairness, reasonableness, and non-discrimination (FRAND). The system facilitates not only wireless charging while the vehicle is stationary but also dynamic applications such as wireless charging while the vehicle is in motion. MAHLE engages in collaborative endeavors with esteemed partners such as Siemens, a prominent German multinational conglomerate and one of the world’s largest industrial manufacturing companies, and Witricity, an American company that specializes in wireless energy transfer technology, with the objective of advancing the integration of wireless charging into the charging infrastructure [67].

Another significant advancement in the field of automotive engineering is MAHLE’s innovative “perfect motor” and the accompanying motor cooling concept.

MAHLE has introduced a pioneering technology platform for electric motors that fuses the capabilities of its SCT and MCT electric motors. This “perfect motor” integrates several innovative features, including continuous high peak power, contactless and wear-free power transmission, the elimination of rare earth elements, and exceptional efficiency. Arnd Franz, the Chief Executive Officer of MAHLE, emphasizes the distinctive nature of the platform in terms of its capacity to provide tailored electrification solutions for a diverse array of vehicle categories, applications, and brand philosophies. In alignment with MAHLE’s 2030+ corporate strategy, this platform is designed to facilitate the company’s focus on electrification alongside thermal management and efficient combustion engines. At the 2023 IAA Mobility, MAHLE presented this technology.

The MCT (Magnet-free Contactless Transmitter) and SCT (Superior Continuous Torque) electric motors, which do not use rare earth elements and feature enduring capabilities, represent recent innovations by MAHLE. The MCT motor, with its contactless and wear-free power transmission, is notable for its environmental friendliness, cost advantages, and suitability for various applications. The SCT motor, which has been identified as the most durable electric motor, is capable of continuous operation at high power levels due to an innovative integrated oil cooling system. This system enhances the motor’s robustness while enabling the effective utilization of heat within the vehicle system. These motors provide efficiency across speed/torque ranges, rendering them suitable for a variety of EVs, including those operating in challenging scenarios such as mountainous terrain for trucks or repeated acceleration for battery-electric cars [68].

Additionally, the company has developed a novel battery cooling plate with a bi-ionic structure, which draws inspiration from the natural world, particularly the intricate patterns observed in coral structures. This innovative design optimizes cooling channels, thereby enhancing thermodynamic performance and structural–mechanical properties. The cooling plate enhances cooling efficiency by 10 percent and mitigates pressure loss by 20 percent, thereby facilitating more efficient and expeditious charging, augmented battery lifespan, and a 15 percent reduction in CO2 emissions due to diminished material usage. The bionic cooling plate is capable of adapting coolant flow rates based on demand, thereby achieving a 50 percent reduction in temperature range and significant decreases in peak temperatures. These features contribute to the battery’s overall longevity and performance. In addition to the advantages in performance, the bionic structure provides enhanced rigidity, enabling the utilization of thinner materials for the cooling plate without any loss of efficacy. Dr. Uli Christian Blessing, MAHLE’s Head of Global Development Thermal Management, underscores the departure from traditional geometries in favor of leveraging natural structures. These innovations align with MAHLE’s corporate strategy for 2030+, which focuses on electrification and aims to set new benchmarks in e-mobility technology [69].

With regard to battery technologies, MAHLE has established a state-of-the-art testing and development center in Stuttgart. The facility encompasses the entirety of the battery development process, from the initial prototyping stage to the production of smaller-scale batteries. The facility is equipped with the capability to test low-voltage and high-voltage battery packs up to 1200 V and 2000 A or 550 kW. Two climatic chambers are capable of simulating temperatures ranging from −40 to +90 °C, thereby enabling comprehensive aging tests of batteries to be conducted, including driving cycles under a variety of climatic conditions [70].

As stated in Section 5.2, strategic partnerships and collaborations are essential for sustainable corporate success. Consequently, MAHLE has formed a partnership with Midtronics Inc. that is headquartered in Willowbrook, USA and specializes in battery management solutions and diagnostic equipment for various industries, with the objective of developing service equipment for BEVs. The objective of the partnership is to provide workshops with comprehensive, safe, and user-friendly service solutions for Li-ion batteries throughout their entire life cycle, covering diagnostics, maintenance, and other services for BEVs of any brand [71].

5.4. Company-Related Factors for Commoditization

As posited by Enke et al., company-related indicators, including standardization and the risk of imitation, can also contribute to the commoditization of a product. This assertion is supported by evidence presented on pp. 7–8 of reference [10] and on p. 14 of reference [72]. As a result of standardization and the increasing imitation of offerings by competitors, customers are encountering mounting difficulties in differentiating the products on the market. This has led to a situation in which the value proposition is becoming increasingly indistinguishable [10] (pp. 7–8). The success of German suppliers in the past can be attributed to a combination of innovation, product depth, and a high level of adaptability [8] (p. 8). This enabled German automotive suppliers in the past to rapidly attain economies of scale [8] (p. 8). This approach allows for the differentiation of offerings compared to competitors on the basis of cost leadership [10] (p. 12) [73]. Strategy& has determined that product launches are becoming increasingly delayed in 2022 and that product engineering is not progressing at a sufficient rate to allow for the commencement of production. This results in additional costs for German automotive suppliers, which subsequently reduce their capacity for investment in innovation in the context of global competition [8] (p. 8). A significant vulnerability for German automotive suppliers, particularly those in the Tier-n category, is the dearth of digitalization in their production processes. This hampers the realization of the prospective potential of their product portfolio [5] (p. 60). In particular, small and medium-sized suppliers (SMEs) are at risk due to their limited financial resources and the low degree of digitalization in their operations [5] (p. 61). Furthermore, the current shortage of skilled labor represents an additional challenge for suppliers in Germany [5] (p. 61). Conversely, business ecosystems offer a number of advantages over vertical supply chains. One such advantage is the ability to access the capabilities of all participants, which fosters economies of scale and enhances flexibility [15] (pp. 21–22). In addition, the MIH EV Open platform exploits these advantages [6].

However, the authors, Beiker et al., posit that in the complex environment of ecosystems, no company will be able to establish a monopoly in a single sector. Nevertheless, technology companies possess a strategic advantage within software-centric sectors. Given the substantial investments made by traditional suppliers in the construction of manufacturing facilities and the expansion of production capabilities, it would be prudent for such entities to concentrate their efforts on the hardware sector, thereby leveraging their existing advantages [4] (p. 3).

5.5. Thriving through Relationships: Enhancing Customer Relationships to Achieve Optimal Excellence

The quality of the customer relationship is contingent upon the geographical distance of the supplier in question. Selecting a local German automotive supplier facilitates the establishment of a personal relationship, which in turn fosters transparency and trust and encourages close collaboration [74]. Such issues can be identified and resolved in a more expedient manner, thereby ensuring the optimal efficiency in the production process.