Digital Gold or Digital Security? Unravelling the Legal Fabric of Decentralised Digital Assets

Abstract

1. Introduction

2. Literature Review

3. Methodology

4. An Overview of Blockchain Technology and Consensus Mechanisms

4.1. Distributed Ledger Technology

4.2. Consensus Mechanisms

4.2.1. Proof of Work

4.2.2. Proof of Stake

5. Discussion

5.1. Describing the Asset Class: Cryptocurrency, Virtual Assets, Digital Assets, or DDAs

5.2. When Assets Are a Foreign Currency: The Principle of Comity

5.3. When an Asset Is a Security

- There is an investment of money;

- Into a common enterprise;

- Where there is an expectation of profits;

- From the efforts of a promoter or other identifiable third party.

LBRY

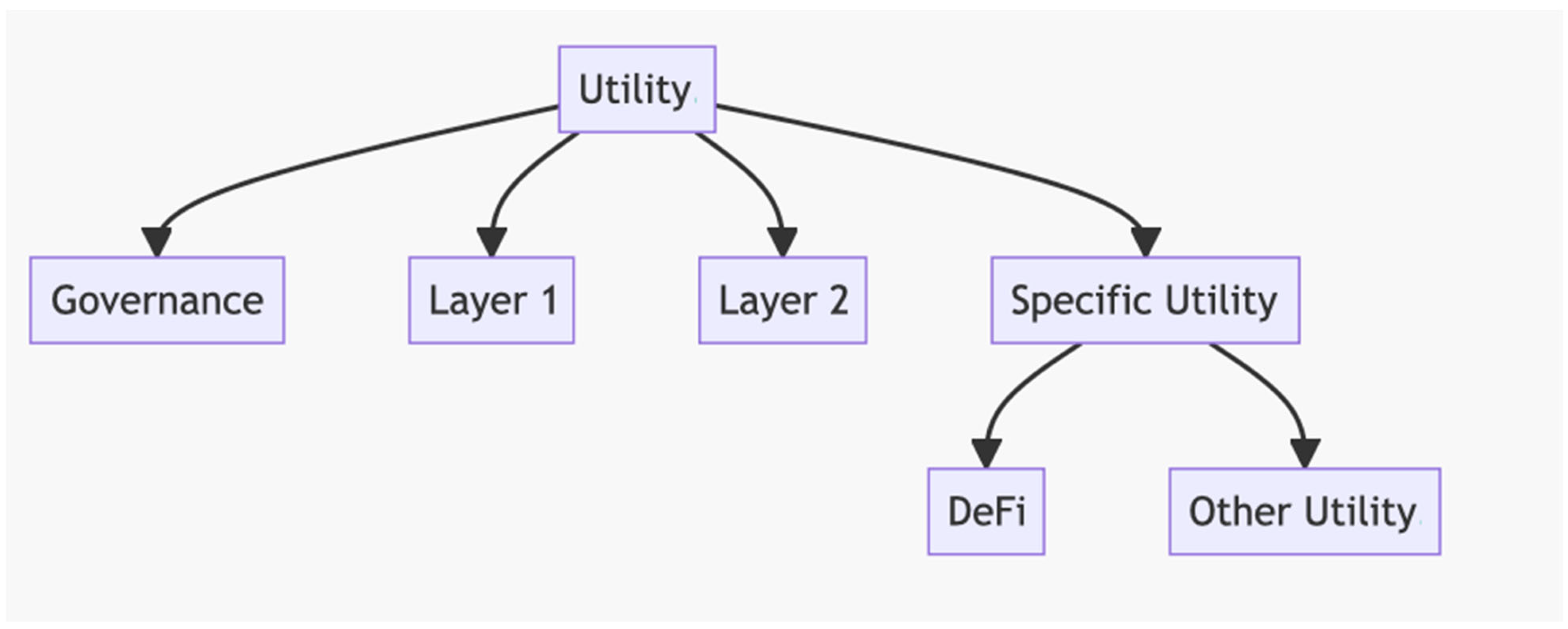

5.4. Establishing a Presumption Based on an Asset’s Purpose

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Przytarski, D.; Stach, C.; Gritti, C.; Mitschang, B. Query Processing in Blockchain Systems: Current State and Future Challenges. Future Internet 2022, 14, 1. [Google Scholar] [CrossRef]

- Kshetri, N. The nature and sources of international variation in formal institutions related to initial coin offerings: Preliminary findings and a research agenda. Financ. Innov. 2023, 9, 9. [Google Scholar] [CrossRef]

- Ali, A.; Al-Rimy, B.A.S.; Alsubaei, F.S.; Almazroi, A.A.; Almazroi, A.A. HealthLock: Blockchain-Based Privacy Preservation Using Homomorphic Encryption in Internet of Things Healthcare Applications. Sensors 2023, 23, 6762. [Google Scholar] [CrossRef]

- Batista, D.; Mangeth, A.L.; Frajhof, I.; Alves, P.H.; Nasser, R.; Robichez, G.; Silva, G.M.; de Miranda, F.P. Exploring Blockchain Technology for Chain of Custody Control in Physical Evidence: A Systematic Literature Review. J. Risk Financ. Manag. 2023, 16, 360. [Google Scholar] [CrossRef]

- Sultana, S.A.; Rupa, C.; Malleswari, R.P.; Gadekallu, T.R. IPFS-Blockchain Smart Contracts Based Conceptual Framework to Reduce Certificate Frauds in the Academic Field. Information 2023, 14, 446. [Google Scholar] [CrossRef]

- Li, S.; Zhou, T.; Yang, H.; Wang, P. Blockchain-Based Secure Storage and Access Control Scheme for Supply Chain Ecological Business Data: A Case Study of the Automotive Industry. Sensors 2023, 23, 7036. [Google Scholar] [CrossRef] [PubMed]

- Uddin, M.; Selvarajan, S.; Obaidat, M.; Arfeen, S.U.; Khadidos, A.O.; Khadidos, A.O.; Abdelhaq, M. From Hype to Reality: Unveiling the Promises, Challenges and Opportunities of Blockchain in Supply Chain Systems. Sustainability 2023, 15, 12193. [Google Scholar] [CrossRef]

- Singh, A.; Ganesh, A.; Patil, R.R.; Kumar, S.; Rani, R.; Pippal, S.K. Secure Voting Website Using Ethereum and Smart Contracts. Appl. Syst. Innov. 2023, 6, 70. [Google Scholar] [CrossRef]

- Metelski, D.; Sobieraj, J. Decentralized Finance (DeFi) Projects: A Study of Key Performance Indicators in Terms of DeFi Protocols’ Valuations. Int. J. Financ. Stud. 2022, 10, 108. [Google Scholar]

- Miglo, A. STO vs. ICO: A Theory of Token Issues under Moral Hazard and Demand Uncertainty. J. Risk Financ. Manag. 2021, 14, 232. [Google Scholar] [CrossRef]

- Cumming, D.J.; Johan, S.; Pant, A. Regulation of the Crypto-Economy: Managing Risks, Challenges, and Regulatory Uncertainty. J. Risk Financ. Manag. 2019, 12, 126. [Google Scholar] [CrossRef]

- Bobovich, N. Analyzing Key Events & Causal Factors Impacting Cryptocurrency Lending Rates. Wharton Research Scholars. Program Thesis, University of Pennsylvania, Philadelphia, PA, USA, 2023. [Google Scholar]

- Forehand, A. Coin Rush in the Virtual Wild West: The SEC as the New Sheriff in Town. Seton Hall L. Rev. 2022, 53, 387. [Google Scholar]

- De Koker, L.; Ocal, T.; Casanovas, P. Where’s Wally? FATF, virtual asset service providers, and the regulatory jurisdictional challenge. In Financial Technology and the Law: Combating Financial Crime; Springer: Berlin/Heidelberg, Germany, 2022; pp. 151–183. [Google Scholar]

- Force, F.A.T. Guidance for a risk-based approach to virtual assets and virtual asset service providers. Retrieved. 2019, 12, 2023. [Google Scholar]

- Waheed Muhammad, U.Z.W. Legal Insights of Crypto-currency Market and State of Crypto-currency in Pakistan. Super. Law Rev. 2022, 2, 77–104. [Google Scholar]

- Elzweig, B.; Trautman, L.J. When Does a Non-Fungible Token (NFT) Become a Security? Ga. St. UL Rev. 2022, 39, 295. [Google Scholar]

- Guseva, Y.; Hutton, I. Digital Asset Innovations and Regulatory Fragmentation: The SEC versus the CFTC. Boston Coll. Law Rev. 2023; forthcoming. [Google Scholar]

- Moffett, T.A. CFTC & SEC: The Wild West of Cryptocurrency Regulation. U. Rich. L. Rev. 2022, 57, 713. [Google Scholar]

- Shurr, T.E. A False Sense of Security: How Congress and the SEC are Dropping the Ball on Cryptocurrency. Dickinson L Rev. 2020, 125, 253. [Google Scholar]

- Fokri, W.N.I.W.M. Classification of cryptocurrency: A review of the literature. Turk. J. Comput. Math. Educ. TURCOMAT 2021, 12, 1353–1360. [Google Scholar]

- Andersen, P. Will the FTX Collapse Finally Force US Policymakers to Wake up?: Regulatory Solutions for Cryptocurrency Tokens Not Classified as Securities under the Supreme Court’s Howey Analysis. J. Bus. Tech. L. 2022, 18, 251. [Google Scholar]

- Henderson, M.T.; Raskin, M. A regulatory classification of digital assets: Toward an operational Howey test for cryptocurrencies, ICOs, and other digital assets. Colum. Bus. L. Rev. 2019, 2019, 443–493. [Google Scholar] [CrossRef]

- Trotz, E.D. The Times They Are a Changin’: Surveying How the Howey Test Applies to Various Cryptocurrencies. Elon L. Rev. 2019, 11, 201. [Google Scholar]

- Van Adrichem, B. Howey Should be Distributing New Cryptocurrencies: Applying the Howey Test to Mining, Airdropping, Forking, and Initial Coin Offerings. Colum. Sci. Tech. L. Rev. 2018, 20, 388. [Google Scholar]

- Alshater, M.M.; Joshipura, M.; Khoury, R.E.; Nasrallah, N. Initial coin offerings: A hybrid empirical review. Small Bus. Econ. 2023, 1–18. [Google Scholar] [CrossRef]

- Di Matteo, G.; Za, S.; Ulrich, K. Initial Coin Offering: A Taxonomy Based Approach to Explore the Field. In Proceedings of the MENACIS2021, Agadir, Morocco, 11–14 November 2021. [Google Scholar]

- Holden, R.; Malani, A. An examination of velocity and initial coin offerings. Manag. Sci. 2022, 68, 9026–9041. [Google Scholar] [CrossRef]

- Momtaz, P.P. Token sales and initial coin offerings: Introduction. J. Altern. Invest. 2019, 21, 7–12. [Google Scholar] [CrossRef]

- Zhai, Y. Safeguarding Innovation: Exploring the Role of Criminal Justice Systems in Protecting Intellectual Property Rights, Combating Piracy, and Promoting Socio-Economic Stability. Int. J. Crim. Justice Sci. 2023, 18, 317–347. [Google Scholar]

- Wronka, C. Anti-money laundering regimes: A comparison between Germany, Switzerland and the UK with a focus on the crypto business. J. Money Laund. Control. 2022, 25, 656–670. [Google Scholar] [CrossRef]

- Watters, C. When Criminals Abuse the Blockchain: Establishing Personal Jurisdiction in a Decentralised Environment. Laws 2023, 12, 33. [Google Scholar] [CrossRef]

- Oliveira, L.; Zavolokina, L.; Bauer, I.; Schwabe, G. (Eds.) To Token or Not to Token: Tools for Understanding Blockchain Tokens; ICIS: Sutton, UK, 2018. [Google Scholar]

- Ankenbrand, T.; Bieri, D.; Cortivo, R.; Hoehener, J.; Hardjono, T. (Eds.) Proposal for a comprehensive (crypto) asset taxonomy. In Proceedings of the 2020 Crypto Valley Conference on Blockchain Technology (CVCBT), Rotkreuz, Switzerland, 11–20 June 2020; IEEE: Piscataway, NJ, USA, 2020. [Google Scholar]

- Roy, U. Doctrinal and Non-Doctrinal Methods of Research: A Comparative Analysis of Both within the Field of Legal Research. Issue 2 Indian JL Leg. Rsch 2023, 5, 1. [Google Scholar]

- Samuel, G. Can Doctrinal Legal Scholarship Be Defended? Amic. Curiae 2022, 4, 43. [Google Scholar] [CrossRef]

- Taekema, S.; van der Burg, W. Legal philosophy as an enrichment of doctrinal research–part II: The purposes of including legal philosophy. Law Method 2022, 1–19. [Google Scholar] [CrossRef]

- Adams, M. Doing what doesn’t come naturally. On the distinctiveness of comparative legal research. In Methodologies of Legal Research Which Kind of Method for What Kind of Discipline? Hart Publishing: Oxford, UK, 2011; pp. 229–240. [Google Scholar]

- Brand, O. Conceptual comparisons: Towards a coherent methodology of comparative legal studies. Brook J. Int. L. 2006, 32, 405. [Google Scholar]

- Gordley, J. Comparative legal research: Its function in the development of harmonized law. Am. J. Comp. L. 1995, 43, 555. [Google Scholar] [CrossRef][Green Version]

- Yntema, H.E. Comparative Legal Research: Some Remarks on" Looking out of the Cave". Mich. Law Rev. 1956, 54, 899–928. [Google Scholar] [CrossRef]

- Van Hoecke, M. Methodology of comparative legal research. Pravovedenie 2013, 121, 1–35. [Google Scholar] [CrossRef]

- Gawas, V.M. Doctrinal legal research method a guiding principle in reforming the law and legal system towards the research development. Int. J. Law 2017, 3, 128–130. [Google Scholar]

- Soltani, R.; Zaman, M.; Joshi, R.; Sampalli, S. Distributed Ledger Technologies and Their Applications: A Review. Appl. Sci. 2022, 12, 7898. [Google Scholar] [CrossRef]

- Pinto, F.; da Silva, C.F.; Moro, S. People-centered distributed ledger technology-IoT architectures: A systematic literature review. Telemat. Inform. 2022, 70, 101812. [Google Scholar] [CrossRef]

- Allenotor, D.; Oyemade, D. An Optimized Parallel Hybrid Architecture for Cryptocurrency Mining. Adv. Multidiscip. Sci. Res. J. Publ. 2021, 12, 95–104. [Google Scholar]

- Liu, Y.; Li, R.; Liu, X.; Wang, J.; Zhang, L.; Tang, C.; Kang, H. (Eds.) An efficient method to enhance Bitcoin wallet security. In Proceedings of the 2017 11th IEEE International Conference on Anti-Counterfeiting, Security, and Identification (ASID), Xiamen, China, 27–29 October 2017; IEEE: Piscataway, NJ, USA, 2017. [Google Scholar]

- Suratkar, S.; Shirole, M.; Bhirud, S. (Eds.) Cryptocurrency wallet: A review. In Proceedings of the 2020 4th International Conference on Computer, Communication and Signal Processing (ICCCSP), Virtual, 28–29 September 2020; IEEE: Piscataway, NJ, USA, 2020. [Google Scholar]

- Nijsse, J.; Litchfield, A. A taxonomy of blockchain consensus methods. Cryptography 2020, 4, 32. [Google Scholar] [CrossRef]

- Xie, M.; Liu, J.; Chen, S.; Lin, M. A survey on blockchain consensus mechanism: Research overview, current advances and future directions. Int. J. Intell. Comput. Cybern. 2023, 16, 314–340. [Google Scholar] [CrossRef]

- Yadav, A.K.; Singh, K.; Amin, A.H.; Almutairi, L.; Alsenani, T.R.; Ahmadian, A. A comparative study on consensus mechanism with security threats and future scopes: Blockchain. Comput. Commun. 2023, 201, 102–115. [Google Scholar] [CrossRef]

- Zheng, Q.; Wang, L.; He, J.; Li, T. KNN-Based Consensus Algorithm for Better Service Level Agreement in Blockchain as a Service (BaaS) Systems. Electronics 2023, 12, 1429. [Google Scholar] [CrossRef]

- Bailey, A.M.; Warmke, C. Bitcoin is King; J. Liebowitz: London, UK; New York, NY, USA, 2023; pp. 175–197. [Google Scholar]

- Rudd, M.A. 100 Important Questions about Bitcoin’s Energy Use and ESG Impacts. Challenges 2023, 14, 1. [Google Scholar]

- Sapra, N.; Shaikh, I.; Dash, A. Impact of Proof of Work (PoW)-Based Blockchain Applications on the Environment: A Systematic Review and Research Agenda. J. Risk Financ. Manag. 2023, 16, 218. [Google Scholar] [CrossRef]

- Rudd, M.A. Bitcoin Is Full of Surprises. Challenges 2023, 14, 27. [Google Scholar] [CrossRef]

- Auhl, Z.; Chilamkurti, N.; Alhadad, R.; Heyne, W. A Comparative Study of Consensus Mechanisms in Blockchain for IoT Networks. Electronics 2022, 11, 2694. [Google Scholar] [CrossRef]

- Zhou, S.; Li, K.; Xiao, L.; Cai, J.; Liang, W.; Castiglione, A. A Systematic Review of Consensus Mechanisms in Blockchain. Mathematics 2023, 11, 2248. [Google Scholar] [CrossRef]

- Chen, R.; Wang, L.; Zhu, R. Improvement of Delegated Proof of Stake Consensus Mechanism Based on Vague Set and Node Impact Factor. Entropy 2022, 24, 1013. [Google Scholar] [CrossRef] [PubMed]

- Hafid, A.; Hafid, A.S.; Makrakis, D. Sharding-Based Proof-of-Stake Blockchain Protocols: Key Components & Probabilistic Security Analysis. Sensors 2023, 23, 2819. [Google Scholar]

- Bachani, V.; Bhattacharjya, A. Preferential Delegated Proof of Stake (PDPoS)—Modified DPoS with Two Layers towards Scalability and Higher TPS. Symmetry 2023, 15, 4. [Google Scholar] [CrossRef]

- Kapengut, E.; Mizrach, B. An Event Study of the Ethereum Transition to Proof-of-Stake. Commodities 2023, 2, 96–110. [Google Scholar] [CrossRef]

- Liang, Y.; Watters, C.; Lemański, M.K. Responsible Management in the Hotel Industry: An Integrative Review and Future Research Directions. Sustainability 2022, 14, 17050. [Google Scholar] [CrossRef]

- Khezami, N.; Gharbi, N.; Neji, B.; Braiek, N.B. Blockchain Technology Implementation in the Energy Sector: Comprehensive Literature Review and Mapping. Sustainability 2022, 14, 15826. [Google Scholar] [CrossRef]

- Aloini, D.; Benevento, E.; Stefanini, A.; Zerbino, P. Transforming healthcare ecosystems through blockchain: Opportunities and capabilities for business process innovation. Technovation 2023, 119, 102557. [Google Scholar] [CrossRef]

- Wenhua, Z.; Qamar, F.; Abdali, T.-A.N.; Hassan, R.; Jafri, S.T.A.; Nguyen, Q.N. Blockchain technology: Security issues, healthcare applications, challenges and future trends. Electronics 2023, 12, 546. [Google Scholar] [CrossRef]

- Zanghi, E.; Do Coutto Filho, M.B.; de Souza, J.C.S. Collaborative smart energy metering system inspired by blockchain technology. Int. J. Innov. Sci. 2023; ahead of print. [Google Scholar]

- Mololoth, V.K.; Saguna, S.; Åhlund, C. Blockchain and machine learning for future smart grids: A review. Energies 2023, 16, 528. [Google Scholar] [CrossRef]

- Hall, W.E. A Treatise on International Law, 7th ed.; Clarendon Press: Oxford, UK, 1917. [Google Scholar]

- Garner, B.A. Black’s Law Dictionary; Thomson West: Eagan, MN, USA, 2014. [Google Scholar]

- Paul, J.R. Comity in International Law. Harv. Int. Law J. 1991, 31, 1–80. [Google Scholar]

- Maier, H. Extraterritorial Jurisdiction at a Crossroads: The Intersection Between Public and Private International Law. Am. J. Int. Law 1982, 76, 280. [Google Scholar] [CrossRef]

- Gianviti, F. Current Legal Aspects of Monetary Sovereignty. In Current Developments in Monetary and Financial Law; International Monetary Fund: Washington, DC, USA, 2004. [Google Scholar]

- Weiss, B. How the Pepe coin, ‘fueled by pure memetic power,’ soared past a $1.6 billion market cap in 3 weeks—And then tumbled. Fortune. 9 May 2023. Available online: https://fortune.com/crypto/2023/05/09/how-the-pepe-token-fueled-by-pure-memetic-power-soared-past-a-1-6-billion-market-cap-in-3-weeks-and-then-tumbled/ (accessed on 28 September 2023).

- Zarifis, A.; Castro, L. The NFT Purchasing Process and the Challenges to Trust at Each Stage. Sustainability 2022, 14, 16482. [Google Scholar] [CrossRef]

| Crypto Asset Categories | Types of Assets |

|---|---|

| Commodities | Utility tokens, store of value assets |

| Currencies | Assets meant as a medium of exchange |

| Securities | Assets with an expectation of profits from the actions of others |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Watters, C. Digital Gold or Digital Security? Unravelling the Legal Fabric of Decentralised Digital Assets. Commodities 2023, 2, 355-366. https://doi.org/10.3390/commodities2040020

Watters C. Digital Gold or Digital Security? Unravelling the Legal Fabric of Decentralised Digital Assets. Commodities. 2023; 2(4):355-366. https://doi.org/10.3390/commodities2040020

Chicago/Turabian StyleWatters, Casey. 2023. "Digital Gold or Digital Security? Unravelling the Legal Fabric of Decentralised Digital Assets" Commodities 2, no. 4: 355-366. https://doi.org/10.3390/commodities2040020

APA StyleWatters, C. (2023). Digital Gold or Digital Security? Unravelling the Legal Fabric of Decentralised Digital Assets. Commodities, 2(4), 355-366. https://doi.org/10.3390/commodities2040020