Abstract

This paper proposes a family of first order bivariate integer-valued autoregressive (BINAR(1)) with Poisson Lindley innovations (BINAR(1)PL). The model parameters are estimated using the conditional maximum likelihood (CML) estimation approach. The proposed models are applied on some real life crime data.

1. Introduction

New first-order autoregressive models (INAR(1)) with various innovation and marginal distributions are constantly being added to the literature on integer-valued time series. Inspired by McKenzie’s work [1] on discrete-valued ARIMA models, a number of INAR(1) models put out that are based on generalized thinning techniques, such as the binomial [2] for overdispersed series counting. Livio et al.’s introduced an INAR(1) with the Poisson–Lindley (PL) innovations (INAR(1)PL) [3] to model overdispersed series because INAR(1)PL produces better AICs than some of their peers, including PLINAR(1) in Mohammadpour et al. [4] and NGINAR(1) in Ristic et al. [5]. As for the bivariate INAR(1) (BINAR(1)) models, we have the work by Mamode Khan et al. [6] which introduce a class of BINAR(1)PL models under different cross-correlation functions and show that their models provide superior model fitness criteria than other competing INAR(1) models. However, all the above models have been developed under stationary assumptions, which is not applicable to real life situations.

The PL distribution is appropriate for unimodality, overdispersion, and infinite divisibility since it is a member of the compound Poisson distribution family (for further information, see Mohammadpour et al. [4]). The superiority of the AICs under the integer-valued bilinear time series model with the PL distribution under the binomial thinning and Pegram operations was recently observed by Mohammadpour et al. [7]. The INAR(1)PL is a promising model for analyzing bivariate integer-valued autoregressive series of order 1 (BINAR(1)) with PL innovations (BINAR(1)PL) because of these characteristics. Hence, this paper proposed a new class of constrained and unconstrained BINAR(1)PL models under non-stationary assumptions. The conditional maximum likelihood (CML) approach is used to estimate the model parameters.

The organisation of the paper is as follows: Section 2 provides the model construction of the proposed class of constrained and unconstrained BINAR(1) PL models. The moments are derived under non-stationary assumptions. In Section 3, the CML method is used to estimate the model parameters. A simulation experiment is presented in Section 4 and the conclusion in Section 5.

2. Model Development

2.1. INAR(1)PL Model

Consider

where [0, 1] and indicates the binomial thinning operation [8]. In the above INAR(1) model, , where and Var, where .

Based on the above assumptions, it is proved that

For , we assume , we have

For , is computed iteratively using Equation (2).

For , we assume , we have

For , is computed iteratively using Equation (4).

2.2. Constrained BINAR(1)PL Model

The constrained BINAR(1) model is specified as

where [0, 1], for k ∈. Once again, indicates the binomial thinning operation such that [8,9,10]. The distribution of the innovation terms are as follows: , where and Var, where .

Based on the above conditions, it can be shown that

For , we assume , we have

For , is computed iteratively using Equation (10).

For , we assume , we have

For , is computed iteratively using Equation (13).

The forecasting equation for the constrained BINAR(1)PL model is given by

2.3. The Unconstrained BINAR(1)PL Model

Consider the unconstrained BINAR(1)PL Model with full correlation structure:

with similar assumptions of the model paramters as the constrained BINAR(1)PL model in Section 2.2. , where and Var, where .

Based on the above conditions, the moments are derived as follows:

For , we assume , we have

By solving Equations (19) and (20), we obtain

For , is computed iteratively using Equations (17) and (18).

For , we assume , , we have

Explicit expressions for and are obtained by solving Equations (25) and (26). For , is computed iteratively using Equations (23) and (24).

For , we assume , , we have

For , is computed iteratively using Equation (27).

The forecasting equations for the unconstrained BINAR(1)PL model are given by

3. Estimation Method

This section proposes the CML approach to estimate the unknown parameters of the model. Using the convolution property [11], the conditional distribution function is given by

where and . Here, we define

Then, we can write the conditional likelihood function as . The maximization of is done using the standard routine in R with quasi-Newton approaches (BFGS).

4. Data Application

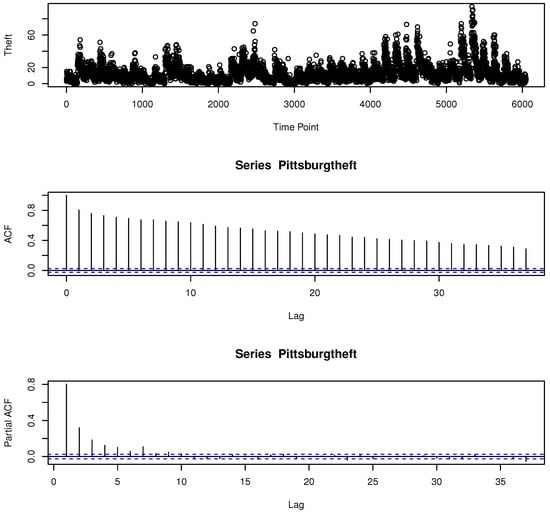

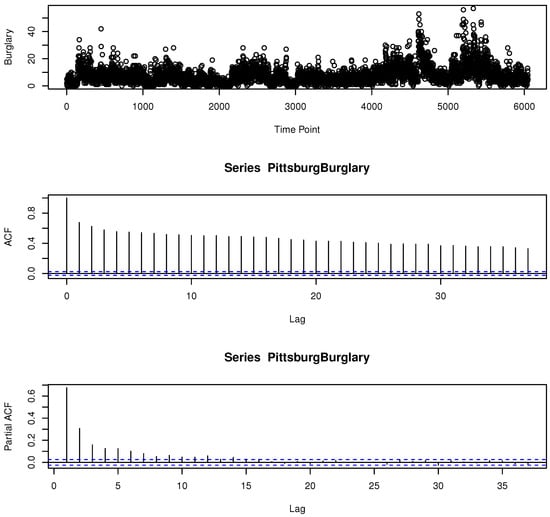

In this section, the constrained and unconstrained BINAR(1)PL model is applied on a monthly series of theft and burglary for the period January 1990 to December 2001 (available at https://www.pittsburghpa.gov/Safety/Police/Police-Data-Portal/PBP-Annual-Reports), accessed on 1 February 2024. The count data consists of 144 observations for each type of offence. The descriptive statistics are provided in Table 1 and the time series plots in Figure 1 and Figure 2:

Table 1.

Descriptive Statistics for the number of crimes from January 1990 to December 2001.

Figure 1.

Time series, ACF and PACF plots of the monthly thefts from January 1990 to December 2001.

Figure 2.

Time series, ACF and PACF plots of the monthly burglary from January 1990 to December 2001.

Table 2 clearly indicates that the bivariate time series data for theft and burglary are over-dispersed and the cross-correlation coefficient confirms the existence of cross-dependence between the two series. Hence, we fit both the constrained and unconstrained BINAR(1)PL models and the estimates are provided in Table 2:

Table 2.

Thefts and Robbery: Estimates of the model parameters.

Using the forecasting Equations (14), (29) and (30), we compute the one-step ahead forecasts for the number of monthly theft and robbery, with corresponding root mean square errors (RMSEs) as shown in Table 3:

Table 3.

RMSE values for number of theft and robbery.

5. Conclusions

This paper introduces two types of BINAR(1)PL model, namely the constrained and unconstrained BINAR(1)PL. The moments of the proposed models are derived and the CML approach is used to estimate the model parameters. Both models are applied on a real theft and burglary time series data and the two proposed BINAR are commendable models for the bivariate time series modelling.

Author Contributions

Conceptualization, N.M.K.; Methodology, Y.S.; Software, N.M.K.; Validation, M.R.I. and H.W.P.; Formal Analysis, N.M.K.; Investigation, Y.S.; Resources, N.M.K.; Data Curation, N.M.K.; Writing—Original Draft Preparation, M.R.I.; Writing—Review and Editing, N.M.K. and Y.S.; Visualization, Y.S.; Supervision, H.W.P.; Project Administration, Y.S. All authors have read and agreed to the published version of the manuscript.

Funding

The authors hereby declare that there is no funding statement to disclose for this research.

Institutional Review Board Statement

Not Applicable.

Informed Consent Statement

Not Applicable.

Data Availability Statement

Data are available in this manuscript.

Conflicts of Interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

References

- McKenzie, E. Some ARMA models for dependent sequences of Poisson counts. Adv. Appl. Probab. 1988, 20, 822–835. [Google Scholar] [CrossRef]

- Weiss, C. Thinning Operations for modelling time series of counts-a survey. AStA Adv. Stat. Anal. 2008, 92, 319–341. [Google Scholar] [CrossRef]

- Livio, T.; Mamode Khan, N.; Bourguignon, M. An inar(1) model with Poisson–Lindley innovations. Econ. Bull. 2018, 38, 1503–1513. [Google Scholar]

- Mohammadpour, M.; Bakouch, H.S.; Shirozhan, M. Poisson–Lindley INAR (1) model with applications. Braz. J. Probab. Stat. 2018, 32, 262–280. [Google Scholar] [CrossRef]

- Ristić, M.M.; Bakouch, H.S.; Nastić, A.S. A new geometric first-order integer-valued autoregressive (NGINAR (1)) process. J. Stat. Plan. Inference 2009, 139, 2218–2226. [Google Scholar] [CrossRef]

- Khan, N.M.; Oncel Cekim, H.; Ozel, G. The family of the bivariate integer-valued autoregressive process (BINAR (1)) with Poisson–Lindley (PL) innovations. J. Stat. Comput. Simul. 2020, 90, 624–637. [Google Scholar] [CrossRef]

- Mohammadpour, M.; Bakouch, H.S.; Ramzani, S. An integer-valued bilinear time series model via two random operators. Math. Comput. Model. Dyn. Syst. 2019, 25, 429–446. [Google Scholar] [CrossRef]

- Steutel, F.; van Harn, K. Discrete analogues of self-decomposability and statibility. Ann. Probab. 1979, 7, 3893–3899. [Google Scholar] [CrossRef]

- Yuvraj, S.; Naushad, M.K. A Novel Unconstrained Geometric BINAR (1) Model. Eng. Proc. 2023, 39, 52. [Google Scholar]

- Sunecher, Y.; Mamode Khan, N. Comparison of Inferential Methods for a Novel CMP Model. Eng. Proc. 2024, 68, 18. [Google Scholar]

- Pedeli, X.; Karlis, D. Some properties of multivariate INAR (1) processes. Comput. Stat. Data Anal. 2013, 67, 213–225. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).