1. Introduction

Financial technology (FinTech) has emerged as a rapidly evolving financial business model in recent years, playing a crucial role in driving the transformation of global FinTech [

1]. According to data from the “FinTech Ecology Blue Book 2024” published by the China Academy of Information and Communications Technology, the total global FinTech investment and financing volume in 2023 amounted to USD 40.8 billion, with 4113 investment and financing transactions. Furthermore, the financial industry continues to acknowledge the technical advantages and application value demonstrated by FinTech. The overall industry revenue of global FinTech has been steadily increasing, reaching an average annual growth rate of 14% over the past 2 years. Additionally, based on the “China FinTech and Digital Finance Development Report 2024”, by the end of 2023, the scale of China’s FinTech market reached CNY 618.3 billion. In the first three quarters of 2023, the total amount of China’s FinTech investment and financing was CNY 118.126 billion, with a total of 907 financing events. China’s FinTech sector remains at the forefront globally, with both the market size and investment and financing continuing to expand.

Commercial banks, as the primary financial institutions that dominate and lead the financial industry, play a crucial role in institutions’ integration and innovative development with FinTech, especially against the backdrop of the rapid and large-scale advancement of FinTech [

2]. Since 2017, following the establishment of the Financial Technology Committee by the People’s Bank of China (PBOC), various departments nationwide have successively introduced a series of policies to support the growth of the FinTech industry while continuously enhancing top-level planning in this field. In 2019, the PBOC released the “Development Plan for Financial Technology (2019–2021)”, which explicitly emphasized the necessity of promoting the innovative integration of FinTech products and services. It also encouraged commercial banks to optimize and refine traditional financial products and service models. The “14th Five-Year Plan”, announced in 2020, further proposed steadily advancing the development of FinTech and accelerating the digital transformation of financial institutions. In 2022, the PBOC highlighted, in the “Development Plan for Financial Technology (2022–2025)”, the importance of deepening reform and innovation within the financial sector to facilitate the widespread application of advanced technologies in finance. These policies and plans collectively demonstrate China’s strong commitment to fostering FinTech development and promoting the deep integration of the financial industry with emerging technologies.

In recent years, following the implementation of interest rate marketization reform in China, the deposit–loan interest rate spread for commercial banks has been continuously narrowing, leading to a decline in profit margins [

3]. As shown in

Figure 1, the return on assets (ROA), return on equity (ROE), and net interest margin (NIM) of commercial banks have generally exhibited a downward trend. This indicates that commercial banks can no longer rely solely on the deposit–loan interest rate spread to achieve high profits. Instead, they must transform their business models and explore new profit growth areas. The rise of FinTech has provided certain opportunities for this transformation [

4]. FinTech has facilitated the innovation of traditional service models and content, breaking time and space constraints and making banking services more convenient and diversified [

5,

6]. This not only enriches the service offerings and revenue channels of banking operations but also enhances bank service efficiency. Furthermore, commercial banks can employ technologies such as big data and cloud computing to comprehensively mine customer information and preferences, strengthen customer information management, and offer targeted, personalized financial services [

7]. By paying attention to long-tail customers who have traditionally been overlooked, banks can increase their revenue sources and optimize their income structure. Additionally, the widespread application of FinTech can significantly reduce information asymmetry between transaction parties, thereby lowering transaction costs [

8].

Nevertheless, in the meantime, the rise of FinTech has also exerted significant impacts on the traditional operations of commercial banks. A growing number of FinTech companies, using their cutting-edge technologies and cost-efficient operations, have captured market share from commercial banks by providing more efficient and convenient payment, lending, and wealth management services to customers [

2,

9,

10]. These FinTech firms have also tapped into the underserved small- and medium-sized customer segments that were often overlooked by commercial banks, further eroding the profitability of traditional banking institutions [

11]. The heightened competition in the market may lead commercial banks to excessively prioritize business expansion and growth rates, thereby increasing credit risks [

12]. Moreover, the integration and application of emerging technologies in financial services could potentially result in information leaks, technical failures, and operational risks [

13].

The widespread adoption of FinTech has a dual impact on the development of traditional commercial banks. On the one hand, it challenges the traditional profit model of commercial banks, which is predominantly based on interest income, due to the necessity of business transformation. On the other hand, the advancement of FinTech also offers a new opportunity for the digital transformation of China’s banking sector. Consequently, an in-depth analysis of the relationship between FinTech development and the profitability of commercial banks holds significant practical value. Grounded in the catfish effect theory, financial disintermediation theory, and technology spillover theory, this paper first examines the mechanism through which FinTech influences the profitability of commercial banks. Subsequently, using balanced panel data from 50 Chinese listed commercial banks between 2012 and 2013 as the research sample, it employs a fixed effects model combined with a U-shaped test to investigate the nonlinear relationship between FinTech development and bank profitability. This analysis aims to provide theoretical insights and practical recommendations for the digital transformation and phased strategic development of commercial banks.

This paper is structured in five sections.

Section 1 serves as the introduction, offering an overview of the current landscape of profitability and FinTech of Chinese commercial banks.

Section 2 provides a comprehensive review of the existing literature concerning FinTech and bank profitability.

Section 3 explores the mechanisms through which FinTech affects the profitability of Chinese banks and outlines the research hypothesis. Moreover, it details the research methodology and data sources.

Section 4 presents the empirical results along with their interpretation and discussion.

Section 5 summarizes the main findings and proposes recommendations for the strategic development of commercial banks.

2. Literature Review

Financial technology represents the convergence of finance and technology, enabling innovative solutions that transform traditional financial services. The origins of FinTech date back to the early 1990s, when Citigroup launched a project as part of the Financial Services Technology Alliance. Nevertheless, to date, no unified standard has been established for the definition of FinTech. The Financial Stability Board highlighted in 2016 that the emergence of FinTech stemmed from the rise of network information technology, which facilitated innovation and advancement in the operational models, products, and services within the financial sector. In 2017, the People’s Bank of China further elaborated that FinTech represents a technology-driven financial innovation model integrating functions such as financing, settlement, and information intermediation through the convergence of Internet technology and mobile communication technology.

With the continuous advancement of digital transformation, the impact of FinTech development on commercial banks has garnered significant scholarly attention. Some scholars argue that FinTech exerts a positive influence on commercial banks. Cheng and Qu [

14] highlighted that FinTech can mitigate credit risks for commercial banks, with this effect being less pronounced in large and listed banks. Wang et al. [

15] noted that the effective integration of FinTech by commercial banks can lead to reduced operating costs, enhanced operational efficiency, improved risk management capabilities, and better customer service, ultimately boosting overall competitiveness. Muthaura et al. [

16] examined the effects of FinTech on Kenyan commercial banks, demonstrating that FinTech enhances business performance by transforming operational models and channels. Li et al. [

6] empirically concluded that the revenue-enhancing effects of FinTech outweigh its cost implications, suggesting profitability improvements through measures such as optimizing settlement processes and innovating business models. Baker et al. [

17] contended that FinTech adoption increases total deposits and net profits for commercial banks. According to Karim and Lucey [

18], although BigTech and FinTech have led to a reduction in personal loans and changed credit risk characteristics, they have also promoted the integration of technology and fostered innovation, which has enhanced the operational effectiveness of banks. Tong and Yang [

19] emphasized that leveraging advanced technologies such as big data and cloud computing enables commercial banks to focus more on segmented customer needs, to innovate financial products, and to extend loans to small- and medium-sized enterprises, thereby enhancing asset return rates. Additionally, utilizing big data and blockchain technology strengthens risk identification, reduces risks, and improves bank resilience, further enhancing profitability. Kayed et al. [

20] argued that advancements in FinTech have substantially boosted banks’ profitability while concurrently exerting a moderating influence on their risk-taking behavior. This suggests that FinTech has played a pivotal and constructive role in enhancing both the performance and stability of financial institutions.

However, some scholars argue that FinTech may exert a negative influence on commercial banks. For instance, Xiong et al. [

21] demonstrated that the crowding-out effect of FinTech on commercial banks outweighs the technology spillover effect, leading to a notable decline in banks’ operational performance. Moreover, the detrimental impact of FinTech on the operational performance of urban and rural commercial banks appears to be more pronounced. The research by Lee et al. [

22] indicated that the integrated progress of FinTech has caused a certain negative influence on bank efficiency. More specifically, the development of FinTech has significantly impacted the debt structure of commercial banks. The rise in debt-related costs has consequently contributed to the decline in banks’ operational efficiency. According to Mansour [

23] and Hijazin and Badwan [

24], the competitive pressure imposed by FinTech on commercial banks outweighs its technology spillover effect, ultimately leading to a reduction in the profitability of commercial banks. Chen and Shen [

25] argued that FinTech has not only elevated the risk levels faced by banks but also intensified their contribution to systemic risks. These effects are particularly pronounced for local commercial banks, institutions with relatively lower profitability, and banks located in regions where FinTech development remains underdeveloped. A study by Elmahdy et al. [

26] indicated that the substantial allocation of funds toward digital investments, coupled with a challenging macroeconomic environment, has led to a significant negative impact on the profitability of commercial banks in Egypt due to the application of FinTech.

Furthermore, a limited number of existing studies have demonstrated that the relationship between FinTech and its impact on commercial banks may be nonlinear. Li and He [

27] argued that FinTech intensifies competition between banks and other financial institutions, which does not necessarily lead to the anticipated profits for banks, while increasing their risks. However, as FinTech becomes more deeply integrated with banking operations, it can enhance both the revenue situation and risk management capabilities of banks. Lv et al. [

28] revealed that the influence of FinTech on the profitability of the Industrial and Commercial Bank of China exhibits a U-shaped trend, characterized by initial suppression followed by growth. Wu and Zhang [

29] similarly found that the effect of FinTech on the profitability of joint-stock commercial banks, urban commercial banks, and rural commercial banks also follows a U-shaped pattern. Tang et al. [

12] conducted an empirical analysis using fixed-effect and threshold effect models, demonstrating that due to competitive pressures and technology spillover effects, the impact of FinTech on the credit risk of commercial banks follows an inverted U-shaped trajectory, initially rising and then declining.

The existing literature on the impact of FinTech on commercial banks has achieved significant advancements. However, when examining the influence of FinTech on the profitability of commercial banks, prior studies predominantly relied on single indicators, such as ROA and ROE, to measure profitability. This paper proposes a factor analysis method to construct a comprehensive profitability index by integrating three dimensions of commercial banks: profitability, security, and liquidity. Regarding the selection of FinTech indicators, many studies utilize the Digital Inclusive Finance Index developed by Peking University but directly apply the data from the provinces or cities where bank headquarters are located. In contrast, this paper introduces the count of bank branches of every province as a weighting element into the analytical framework to calculate the provincial digital inclusive finance index, thereby providing a more precise depiction of the FinTech environment in which banks operate. Additionally, this paper incorporates the quadratic term of FinTech into the model to investigate the nonlinear impact of FinTech on the profitability of commercial banks and to identify the turning point in FinTech development levels, thus enabling a deeper exploration of the relationship between FinTech and bank profitability.

4. Results and Discussion

4.1. Construction of an Integrated Profitability Index

Based on the three core operating principles of Chinese commercial banks—profitability, security, and liquidity—this paper constructs a comprehensive index to evaluate profitability. Specifically, four indicators are selected: return on assets, return on equity, cost-to-income ratio, and the proportion of non-interest income. Return on assets is defined as the ratio of net profit to average total assets, while return on equity represents the ratio of net profit to average shareholders’ equity. The cost-to-income ratio measures the efficiency of bank operations by calculating the proportion of administrative expenses to operating income. Additionally, the proportion of non-interest income reflects the diversification of revenue sources through its ratio of non-interest income to total operating income. To assess liquidity, the loan-to-deposit ratio is chosen, which indicates the percentage of customer deposits utilized for lending activities. For security, two key indicators are adopted: the provision coverage ratio and the non-performing loan ratio. The provision coverage ratio quantifies the adequacy of loan loss provisions relative to non-performing loans, thereby reflecting the risk-resistance capability of commercial banks. The non-performing loan ratio, calculated as the proportion of non-performing loans in total loan assets, serves as a critical measure of asset quality.

On the basis of selecting these indicators, factor analysis is employed to synthesize the final index. Prior to conducting factor analysis, Bartlett’s sphericity test is performed to validate the data suitability for factor analysis. The results indicate that the KMO value is 0.651, which exceeds the threshold of 0.6, and the

p-value is 0.000, which is less than 0.05. These findings confirm that the selected variables meet the requirements for factor analysis. In applying the factor analysis method, factors with eigenvalues greater than 1 are extracted. As shown in

Table 2, the eigenvalues of the first three factors exceed 1, leading to the selection of three factors. Moreover, the cumulative contribution rate of these three factors reaches 77.86%, suggesting that they account for 77.86% of the information contained in the original seven indicators, with minimal data loss.

To enhance the representation of the common factors’ significance, the factor loadings will undergo rotation in the next step. As presented in

Table 3, Factor 1 exhibits high loadings on ROA and ROE, which contribute the most to this factor. Consequently, Factor 1 is primarily interpreted through these two variables. For Factor 2, NPLR and PCR demonstrate the highest contribution rates, making them the primary indicators for explaining this factor. Factor 3 shows significant loadings on LTDR and NIIR, suggesting that these variables can be grouped together to account for Factor 3. Moreover, all variables have uniqueness values below 0.6, indicating a strong explanatory power of the factor model for the observed variables. Thus, it can be concluded that three key factors collectively influence the overall profitability of commercial banks.

Additionally, as shown in

Table 4, based on the rotation results, the variance contribution rates for the three factors are as follows: 29.27% for factor 1, 25.32% for factor 2, and 23.27% for factor 3. The cumulative contribution rate remains at 77.86%. Consequently, the comprehensive profitability index is obtained through a weighted summary as Formula (2), with the variance contribution rates of each factor serving as the weights:

4.2. Descriptive Statistics

Table 5 provides the descriptive statistics for the main variables. As indicated in the table, the explained variable, which represents the comprehensive profitability of commercial banks, has a maximum value of 3.686, a minimum value of 0.578, and a mean value of 2.500. This suggests that there are substantial differences in profitability across a wide variety of banks. For the explanatory variable FinTech, its mean value is 2.890, maximum value is 4.519, and minimum value is 0.942. The highest value is approximately 4.8 times greater than the lowest value, suggesting that while the overall level of FinTech in China is increasing, significant disparities still exist in its development across regions.

Regarding macro-control variables, the minimum value of GGDP is only 2.740, reflecting relatively low economic growth due to the impact of the COVID-19 pandemic. The year-on-year growth rate in CPI during the sample period shows mild fluctuations, aligning with the common inflation target range established by monetary policy. For the micro-control variable LTA, the standard deviation is 9.020, demonstrating considerable variation in the loan-to-assets ratio among different banks. Additionally, it has a minimum value of 25.441 and a maximum value of 65.241, further confirming that the sample includes banks of diverse scales and varying risk inclinations. For the bank SIZE, after logarithmic transformation, the mean value is 3.979, and the standard deviation is 0.709, suggesting relatively stable changes in this variable and a concentrated scale distribution among the sampled banks. Furthermore, it is observed that the NIM mean stands at 2.329. In the current low-interest-rate environment, the NIM of banks tends to remain relatively low, and there are substantial variations in NIM across different commercial banks.

4.3. Correlation Analysis and Multicollinearity Test

In order to investigate whether there is a correlation among the variables, this paper employs the Pearson correlation coefficient for testing and uses the variance inflation factor (VIF) to assess multicollinearity. The results of these tests are presented in

Table 6 and

Table 7. From the analysis of the correlation matrix in the subsequent table, it can be observed that apart from the correlation coefficient between FinTech and its square term, all other pairwise correlation coefficients remain below 0.8. Since the square term of FinTech inherently exhibits a certain degree of correlation with the original variable, this finding aligns with the expectations outlined in the research design. Furthermore, based on the VIF test results, aside from the interaction term between FinTech and its squared term, the VIF values for all variables are less than 10, which collectively suggests that the constructed regression model does not suffer from significant multicollinearity issues. The quadratic component of the FinTech variable demonstrates an inherent correlation with its linear form, consistent with the theoretical structure of the study [

33].

4.4. The Results of Basic Regression

Table 8 presents the regression results regarding the impact of FinTech on the overall profitability of commercial banks. The first column displays the estimation results of the pooled ordinary least squares (POLS) model, the second column shows the estimation results of the random effects (RE) model, and the third column illustrates the estimation results of the fixed effects (FE) model. For model selection, the F-test is first utilized to determine whether the POLS model or the FE model should be selected. Following this, this paper conducts the Breusch–Pagan Lagrangian multiplier (BPLM) test to choose between the POLS model and the RE model. Lastly, the Hausman test is performed to decide whether to adopt the FE model or the RE model. As shown in

Table 8, the

p-value of the F-test is 0.0000, strongly rejecting the null hypothesis and indicating that the FE model outperforms the POLS model. The

p-value of the BPLM test is also 0.0000, strongly rejecting the null hypothesis and suggesting that the RE model is superior to the POLS model. Furthermore, the

p-value of the Hausman test is 0.0015, which is less than 0.05, leading to the rejection of the null hypothesis and confirming that the FE model is preferable to the RE model. Consequently, this paper selects the RE model for analysis.

According to the model selection results presented in the preceding text, this paper focuses on analyzing the FE model results in the third column and specifically examines the signs and economic significance of the regression coefficients for the linear and quadratic terms of FinTech. The findings indicate that the regression coefficient of the linear term of FinTech is negative at the 1% significance level, while the coefficient of the quadratic term is positive at the same significance level. From an economic significance perspective, during the early stages of FinTech development, a one percentage point increase leads to a 1.362% decrease in the profitability of commercial banks. However, as the level of FinTech advances further, the profitability of commercial banks increases by 0.238%. This suggests a U-shaped relationship between FinTech and the overall profitability of commercial banks, which aligns with the prior hypothesis. Specifically, in the early stages of FinTech development, intensified market competition due to the “catfish effect” causes a decline in bank profitability. In contrast, during later stages, the spillover effects of technological advancements gradually enhance bank profitability. Regarding macro-control variables, the regression coefficients of GGDP and GCPI are both positive at the 1% significance level, indicating that a favorable macroeconomic environment and moderate inflation contribute to the growth in bank interest income, thereby improving profitability. Concerning micro-control variables, the regression coefficients of LSIZE and NIM are significantly positive at the 1% significance level. This suggests that a larger asset size of banks is associated with more pronounced scale effects and stronger profitability. Additionally, a higher net interest margin indicates greater interest income, which improves the bank’s profit situation. Conversely, the regression coefficient of LTA is significantly negative at the 1% significance level, implying that an elevated loan-to-asset ratio increases the likelihood of non-performing loans, thereby negatively affecting the profitability of commercial banks.

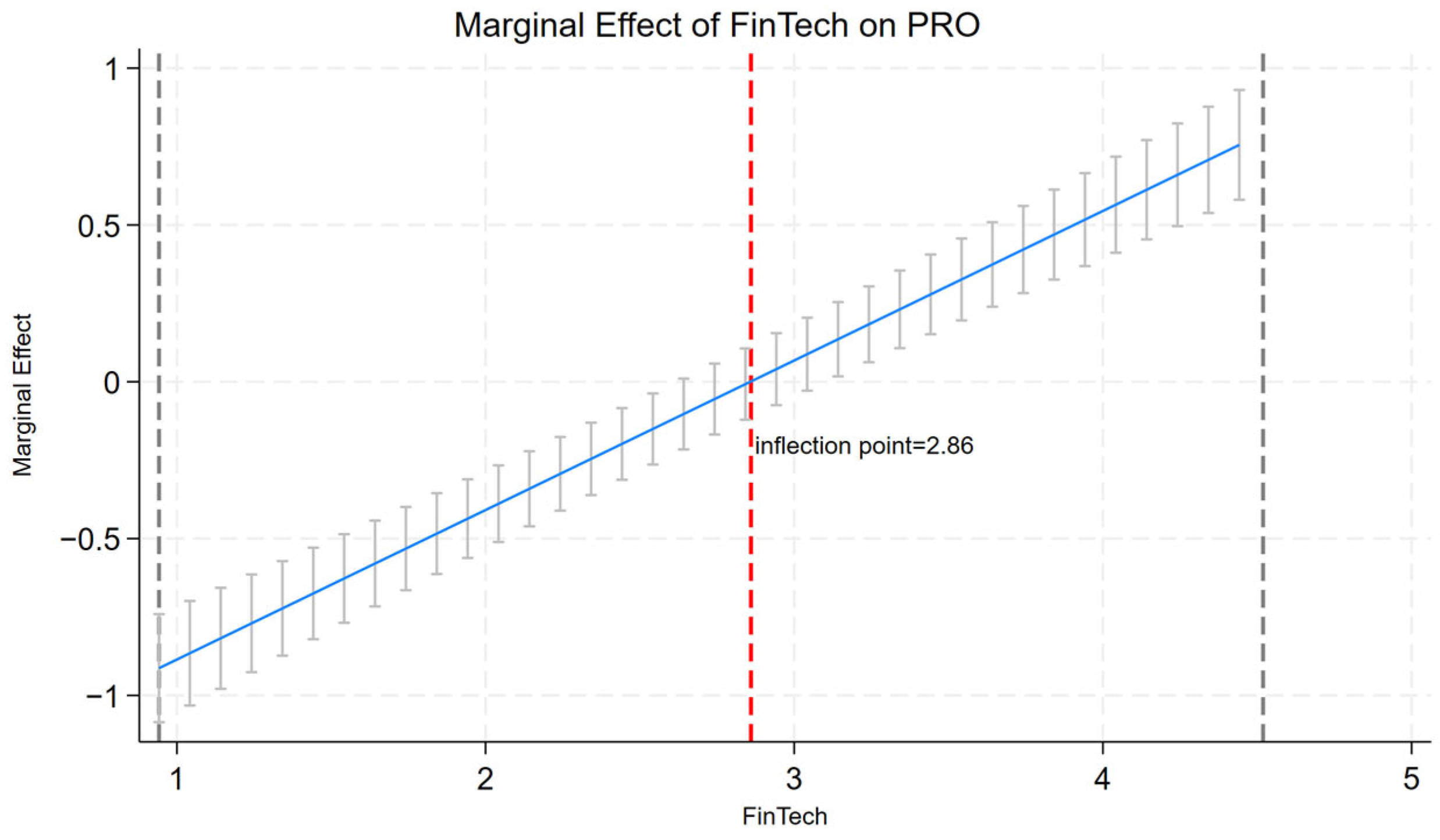

Furthermore, this paper employs Stata software 18 and incorporates the quadratic term parameter estimation of the FinTech variable and its marginal effect analysis to systematically examine the nonlinear effect mechanism between FinTech and the overall profitability of commercial banks. As shown in

Figure 2, a significant U-shaped relationship exists between FinTech and bank profitability (PRO), with the inflection point occurring when the FinTech value equals 2.86. Moreover, by constructing the marginal effect graph, the instantaneous impact of the explanatory variable on the explained variable under varying conditions can be visually illustrated, thereby clearly demonstrating the dynamic characteristics of the nonlinear relationship. It can be observed in

Figure 3 that the marginal effect line slopes upward from the lower left to the upper right, indicating a continuously increasing trend. Prior to the turning point, the line lies below the horizontal axis, where the marginal utility is negative, suggesting that each additional unit of FinTech leads to a reduction in PRO. At the intersection of the marginal effect line and the horizontal axis, the marginal utility equals zero, meaning that each additional unit of FinTech results in no change in PRO. Above the horizontal axis, the marginal utility becomes positive, implying that each additional unit of FinTech contributes to an increase in PRO. This finding further substantiates the U-shaped relationship between FinTech and PRO, with the lowest point of the U-shaped curve occurring when the marginal effect equals zero.

In order to more rigorously examine whether a U-shaped relationship exists between FinTech and PRO, this paper adopts the research methodology of Yu and Li [

41] and applies the U-test for further validation. The results are presented in

Table 9 and

Table 10. The U-test results reveal that the

p-value is equal to zero, which rejects the monotonic or inverted U-shaped relationships hypothesized in the original model, thereby confirming the significant U-shaped relationship. Moreover, the estimated inflection point from the U-test is 2.86, falling within the 99% Fieller confidence interval. This suggests that the position of the inflection point is statistically robust and accurate, aligning with prior analyses. Furthermore, the slope bounds are −0.91 for the lower bound and 0.79 for the upper bound, with the sign transitioning from negative to positive. This change exhibits a characteristic of initially decreasing and then increasing.

4.5. Robustness Test

To examine the robustness and adaptability of the model, the dependent variable—comprehensive profitability (PRO)—was replaced with three alternative metrics: return on total assets (ROA), return on equity (ROE), and the natural logarithm of net profit (lnNP). Each of these metrics was used individually in separate regression analyses, and the results are summarized in

Table 11. As indicated by the findings across the three regression columns, the coefficient for the primary FinTech variable remains significantly negative at the 1% significance level, whereas the coefficient for the quadratic term is significantly positive at the same level. These results exhibit strong consistency with the results presented earlier in the text. Furthermore, the regression coefficients for the control variables retain their original signs without any alterations. Thus, by employing the method of substituting the dependent variable to conduct a robustness test, the results continue to exhibit strong robustness.