1. Introduction

Financial technology (fintech) lenders have rapidly emerged as influential competitors to traditional banks, transforming consumer credit markets by leveraging digital platforms, advanced analytics, and alternative data sources. Their success is well documented in unsecured personal lending, where fintech lenders have demonstrated superior default prediction and risk-based pricing relative to conventional methods [

1,

2]. Such advantages often translate into broader access to credit for previously underserved borrowers, without increasing loan default rates significantly [

3,

4].

However, the U.S. conforming mortgage market, a large segment representing trillions of dollars annually and tightly controlled by government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac, presents a fundamentally different environment. Unlike unsecured lending, mortgage lending in this market faces stringent underwriting standards, uniform documentation requirements, and high securitization rates. These features potentially constrain fintech firms’ flexibility in leveraging alternative data and advanced analytics, thereby calling into question their purported advantages

This study specifically examines whether fintech lenders demonstrate superior predictive accuracy and better alignment of loan pricing with borrower risk in the U.S. 30-year fixed-rate conforming mortgage market. Using an extensive dataset of Fannie Mae and Freddie Mac loans originated from 2012 to early 2020, we assess lender performance through rigorous ROC/AUC analyses and risk-pricing regressions. Our findings contribute to current debates by highlighting how regulatory constraints and market structures in conforming mortgage lending may limit fintech lenders’ capacity to exploit their analytical advantages. These insights have significant implications for policymakers, fintech firms, and traditional lenders regarding competitive strategies, consumer protection, and risk management.

The remainder of the paper is structured as follows.

Section 2 reviews relevant literature and formulates our hypotheses.

Section 3 describes the methodology, including the data, sample, variables, and empirical models.

Section 4 presents empirical findings from descriptive statistics, risk discrimination assessments (using AUC and ROC curves), and regression analyses.

Section 5 discusses the findings in relation to existing literature and implications for industry and policy. Finally,

Section 6 summarizes the main conclusions and identifies potential avenues for future research.

2. Literature Review and Hypothesis Development

2.1. Fintech and Algorithmic Underwriting

Fintech firms have rapidly become prominent actors in consumer credit markets by leveraging digital platforms, advanced analytics, and non-traditional data sources to reduce information asymmetries in lending practices. A substantial body of evidence shows that fintech lenders outperform traditional banks and non-fintech lenders in default prediction and risk-based pricing [

1,

2,

4,

5,

6,

7,

8]. Even minimal digital-footprint variables significantly improve default-prediction accuracy, enabling more precise loan terms and lower borrowing costs [

1]. Advanced machine-learning techniques further enhance accuracy and fairness by reducing misclassification and rejection rates among borrowers underserved by standard credit scoring [

2].

The adoption of advanced analytics has also facilitated broader credit access for historically underserved segments without materially increasing default risk [

3,

9,

10,

11,

12,

13,

14]. Nevertheless, a persistent gap remains between estimated default probabilities and the interest rates actually charged, indicating incomplete alignment of risk-based pricing incentives [

15].

2.2. Risk-Based Pricing in Mortgage Markets

Successes in unsecured credit naturally raise the question of whether fintech advantages transfer to mortgage lending. Conforming mortgages are secured, highly regulated, and subject to standardized underwriting, making effective risk-based pricing dependent on precisely aligning interest rates with borrower risk profiles [

16]. Evidence suggests that fintech mortgage lenders often continue to rely on conventional credit metrics, creating cross-subsidization within borrower segments [

16]. Despite their analytical capabilities, fintech mortgage lenders frequently employ traditional pricing strategies, reflecting only partial integration of sophisticated risk models [

17].

Fintech originators do exhibit operational efficiency—faster application processing and stream-lined workflows—without noticeably higher default rates [

18]. Yet it remains unclear whether they can deliver superior risk discrimination and pricing efficiency within the conforming mortgage segment. A critical empirical examination is therefore required.

2.3. GSE Constraints and Conforming-Loan Regulation

The conforming mortgage market is dominated by government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac, whose rigorous underwriting standards, standardized documentation, and extensive securitization practices tightly constrain lender flexibility [

4,

19,

20,

21,

22,

23]. Rapid risk transfer through securitization can weaken incentives for detailed borrower screening and granular risk-based pricing [

19,

20,

21]. In particular, quick loan sales to GSEs encourage originators to prioritize volume over careful risk assessment [

21]. Standardized GSE guidelines further limit the use of alternative data, restricting fintech lenders’ ability to deploy their full analytical toolkits [

18]. These structural features may prevent fintechs from realizing their theoretical advantages in predictive accuracy and risk-aligned pricing.

2.4. Literature Gaps and Objectives of the Present Study

Although fintech advantages in unsecured lending are well documented, rigorous evaluation of their effectiveness in the highly regulated conforming-mortgage context is scarce. Existing studies emphasize fintech strengths in innovative data use and analytics, yet few investigate whether these benefits persist when underwriting standards are rigid and risk is rapidly securitized. This study fills that gap by examining fintech lenders’ predictive accuracy and risk-pricing alignment in U.S. conforming mortgages.

We test two hypotheses:

H1: Fintech lenders differ from traditional banks and non-fintech non-banks in predictive accuracy for delinquency risks in the conforming mortgage market.

H2: Fintech lenders’ pricing strategies differ from traditional lenders in alignment with borrower risk profiles. Employing ROC/AUC analysis and detailed risk-pricing regressions, we assess whether fintech lenders maintain predictive and pricing advantages under regulatory conditions that restrict the flexible use of alternative data and advanced analytics.

3. Methodology

3.1. Data and Sample

This study relies on publicly available mortgage performance datasets from Fannie Mae and Freddie Mac (the “GSEs”), consistent with prior literature on conforming mortgages [

18,

24,

25,

26]. We focus on 30-year fixed-rate residential mortgages originated from 2012 onward to capture the period in which fintech lenders began to meaningfully participate in the conforming mortgage market. To avoid distortions from COVID-19-related forbearance policies, we truncate our sample at Q1 2020 [

23,

24,

25,

26].

We restrict the sample to first-lien, fully amortizing loans without negative amortization or interest-only features, as these non-standard loans introduce distinct underwriting and pricing processes [

19]. We further exclude loans with missing or erroneous records (e.g., negative loan balances or implausible interest rates). We exclude adjustable-rate mortgages, which are rare in the GSE-conforming space post-2012. Our sample falls within a low-interest rate environment, which limits variability in absolute interest rate and supports our use of standardized interest rate percentiles to normalize for temporal shifts. After these screens, our final dataset includes 7,197,204 loan observations.

For lender type classification, we build on prior work including research on shadow banks and fintech lending [

4,

18,

22]. Specifically, Banks are institutions with a valid bank charter or RSSD ID (Research, Statistics, Supervision, and Discount ID). Non-banks are originators without a bank charter, further split into: (1) Fintech lenders refer to non-bank lenders whose mortgage process (up to preapproval) can be completed fully online; (2) non-fintech lenders are the other non-bank originators. This classification approach follows recognized industry and academic definitions [

20]. Our final sample includes 41 banks and 71 non-banks, of which 12 are fintech lenders. The top 20 GSE mortgage lenders are reported in

Table 1.

Table 1 presents the top 20 lenders ranked by origination volume from 2012 to 2019. Fintech lenders like Quicken Loans (ranked 3rd) and LoanDepot.com LLC (ranked 14th) hold significant market positions, highlighting the substantial penetration of fintech firms in the conforming mortgage market. Their large volumes underscore their relevance to our analysis of risk assessment practices.

3.2. Variables and Measurements

Below are the main variables employed in our analysis:

Interest Rate: The interest rate at loan origination, serving as our proxy for the lender’s risk-based pricing. To control for broader interest-rate fluctuations, we standardize interest rates by ranking them relative to all other loans originated in the same quarter, following prior methodology [

25].

Delinquency: We define serious delinquency as a borrower reaching at least 90 days past due (90 + DPD) at any point within the specified performance window (12, 36, or 60 months). This threshold is widely used in mortgage performance literature [

19,

20].

Prepayment: An indicator variable equal to 1 if the loan is prepaid (i.e., refinanced or fully paid off) within the corresponding performance horizon, consistent with prior literature [

18].

The borrower and loan controls in our analysis include the primary borrower’s FICO credit score at origination, the debt-to-income ratio (defined as monthly debt obligations over monthly income), and the loan-to-value ratio (the ratio of the loan amount to the property’s appraised value at origination). We also account for loan purpose, distinguishing purchase loans from non-cash-out and cash-out refinances, an indicator variable for mortgage insurance, and the origination channel (retail, broker, or correspondent). In addition, we include local economic indicators, such as the unemployment rate in the Metropolitan Statistical Area (MSA) at origination, MSA-level real personal income, changes in the MSA home price index (HPI), and changes in the MSA unemployment rate over the 12 months prior to origination. These controls mirror the standard practice in analyzing mortgage performance and underwriting [

2,

22], ensuring comparability with related studies. Detailed variable definitions are provided in

Appendix A Table A1.

3.3. Model Construction

This study’s empirical design aligns with our two main hypotheses. First, we examine whether fintech lenders demonstrate superior risk assessment relative to banks and non-fintech non-banks (Hypothesis 1). Second, we investigate whether fintech lenders’ interest rates are more (or less) aligned with actual borrower risk (Hypothesis 2).

3.3.1. ROC/AUC Analysis

To evaluate Hypothesis 1, we employ ROC/AUC methods following established approaches [

1,

7]. We standardize each loan’s interest rate by its monthly percentile rank, treating this as the ex-ante risk score. Let

indicate whether loan

becomes 90 days or more past due (90 + DPD) within a specified horizon (e.g., 12 or 36 months). For a threshold

(ranging from 0 to 1), we define:

and

where 1{⋅} is an indicator function. The true positive rate (TPR) is the fraction of actual delinquencies correctly classified (interest rate above τ), and the false positive rate (FPR) is the fraction of non-delinquent loans wrongly flagged as high-risk. Plotting TPR(τ) against FPR(τ) for all τ yields the ROC curve. We summarize ROC performance by the area under the curve (AUC):

which ranges from 0.5 (no discrimination) to 1.0 (perfect classification). We compute AUC separately for fintech lenders, non-fintech non-banks, and banks to compare their ability to align ex ante interest rates with ex post delinquency. Since our goal is to assess in-sample pricing-based risk differentiation rather than predictive modeling, no hold-out sample is used.

3.3.2. Risk-Pricing Regressions

To test Hypothesis 2 regarding the alignment of interest rates with borrower risk profiles, we estimate the following loan-level regression:

where:

is the interest rate (or standardized interest rate) on loan , originated in period .

is an indicator equal to 1 if loan was originated by a fintech lender, and 0 otherwise.

equals 1 if loan becomes 60 or 90 days past due within months of origination (where = 12, 36, or 60), and 0 otherwise.

equals 1 if loan is prepaid (fully paid off or refinanced) within the same window ; 0 otherwise.

is a vector of borrower- and loan-level controls (e.g., credit score, debt-to-income ratio, loan-to-value ratio).

is a vector of local market controls at time ttt (e.g., MSA-level unemployment rate, personal income).

is the error term.

We include quarter-by-zip code fixed effects to absorb local economic shocks within each period [

18]. Standard errors are clustered at the MSA level to account for spatial correlation in mortgage performance [

26].

The key interaction terms and capture whether fintech lenders charge higher (or lower) interests rate specifically to delinquent or prepaying borrowers compared to other lenders. A significantly negative interaction suggests fintech lenders underprice risk (i.e., they charge less to those who eventually default or prepay), while a positive interaction would indicate more robust risk-based pricing.

4. Results

4.1. Descriptive Analysis

Table 2 (Panel A) provides summary statistics of loan-level characteristics by lender type—banks, non-fintech non-banks, and fintech lenders. Overall, fintech loans have slightly higher average interest rate, lower average LTV, and somewhat lower credit scores than bank-originated loans. Fintech lenders also have a higher share of refinance loans, particularly non-cash-out and cash-out refinances.

Turning to performance outcomes (Panel B of

Table 2), the raw delinquency rates (90+ DPD) are marginally higher for non-bank loans, including fintechs, compared to banks. Prepayment rates are considerably higher for fintech loans within the first 12–24 months. While suggestive, these raw rates do not control for differences in loan or borrower characteristics, motivating our subsequent regression and matching analyses.

The combination of lower average credit scores and higher refinance prevalence in fintech originations suggests these lenders actively target segments overlooked by banks. Slightly lower LTV ratios imply stricter collateral requirements, possibly offsetting higher borrower risk. These descriptive patterns foreshadow our main finding: fintech pricing signals borrower risk less effectively despite selective borrower outreach.

4.2. ROC and AUC Analysis

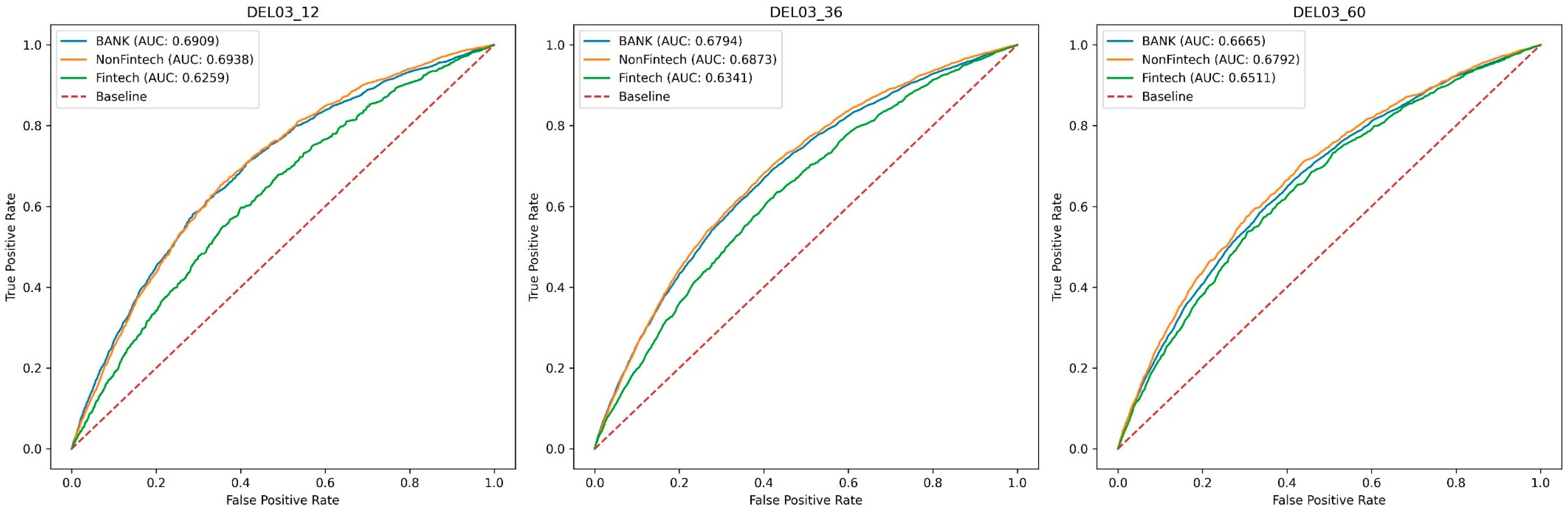

Figure 1 and

Figure 2 compare ROC curves for delinquency and prepayment at 12, 36, and 60 months. According to standard guidelines, AUC values in the 0.60–0.70 range are considered “fair” [

27]. For delinquency (

Figure 1), fintech lenders’ ROC curves generally lie below those of banks and non-fintech non-banks (AUC range 0.625–0.651), indicating weaker alignment between ex ante interest rates and ex post defaults.

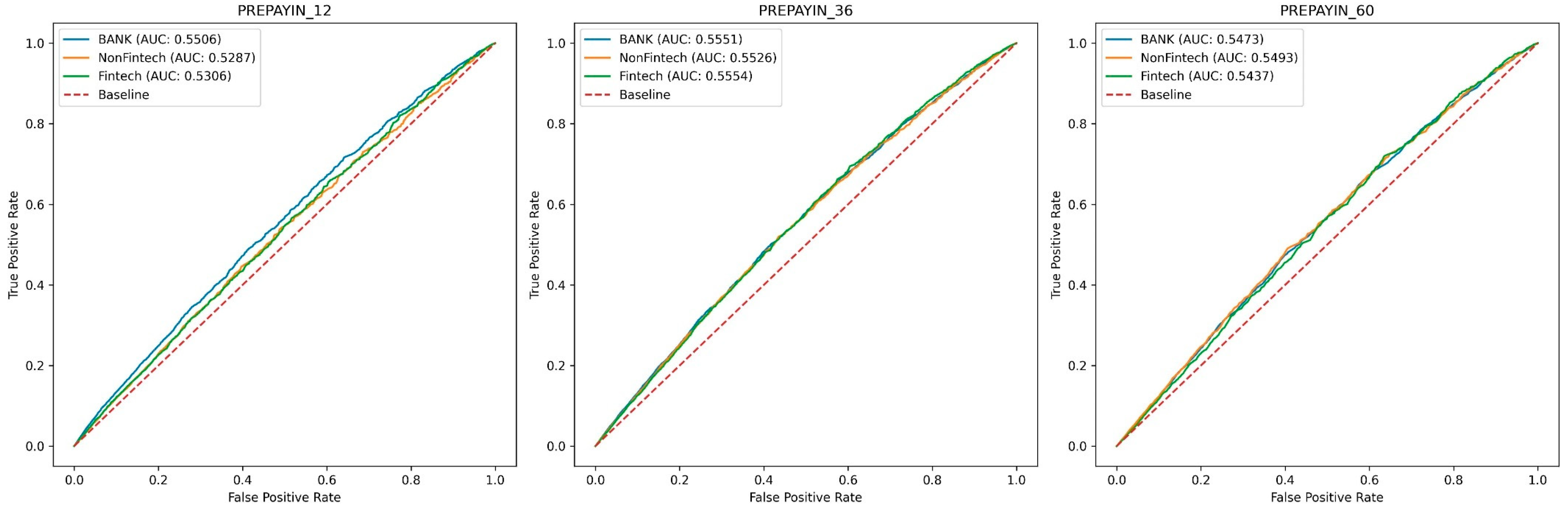

For prepayment (

Figure 2), however, the ROC scores usually range between 0.50 and 0.60—classified as “poor.” This gap partly arises because the number of prepayments is significantly larger than delinquencies, heightening classification errors (i.e., more frequent false positives/negatives) and thus lowering the overall AUC. Additionally, interest rates primarily capture default risk rather than a borrower’s propensity to refinance or prepay, further reducing predictive power for prepayment outcomes. Nevertheless, fintechs display only slightly poorer discrimination at 12 months and converge more closely with other lenders by 36 and 60 months.

Figure 1 and

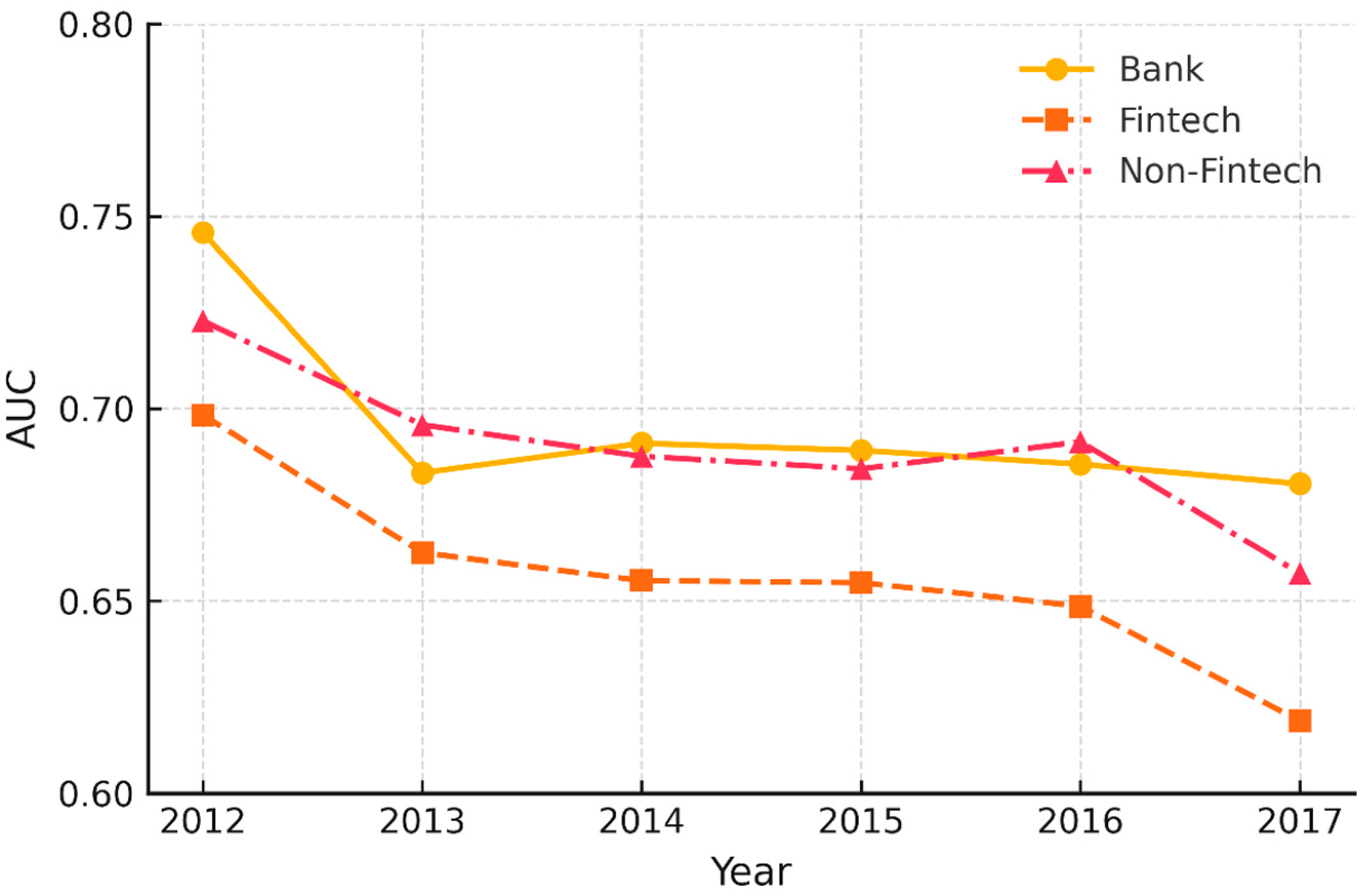

Figure 2 illustrate that interest-rate-based risk signals show fair discrimination for delinquency but poor discrimination for prepayment, particularly at early horizons. Fintech lenders consistently lag behind banks and non-fintech lenders in delinquency prediction, a gap most visible at 12 months. To examine whether this disadvantage is temporary or persistent,

Figure 3 presents annual AUC scores for delinquency. The year-by-year trends confirm fintech lenders’ underperformance is systematic rather than cyclical. Specifically, the time-series perspective confirms that fintech lenders lag every single year, reinforcing the notion that underperformance is systematic rather than cyclical. The persistence of the gap points to structural frictions—most plausibly, standardized GSE underwriting guidelines and rapid post-origination securitization—which blunt fintechs’ incentive to fine-tune risk-based pricing.

Why do fintechs underperform? Two mechanisms stand out. First, GSE underwriting mandates restrict use of non-traditional variables—diluting the incremental value of fintech analytics. Second, because securitization off-loads credit risk rapidly, fintechs can prioritize origination speed and market share over granular risk differentiation. Both forces weaken the link between fintech interest-rate schedules and subsequent default outcomes.

To strengthen the ROC/AUC evidence, we report two complementary checks—Gini/KS statistics (

Table 3) and bootstrap AUC gaps (

Table 4). The ROC curve is a global, threshold-free metric, but it can mask differences in discriminatory power at specific sections of the score distribution. The Gini coefficient (a linear rescaling of AUC) and the Kolmogorov–Smirnov statistic (the maximum vertical distance between cumulative default and non-default distributions) zoom in on separation between high- and low-risk borrowers at the most informative cut-off. If fintech pricing were merely “shifted” yet still ordered borrowers correctly, Gini and KS would remain high even though AUC fell; conversely, simultaneous weakness across all three metrics signals a genuine ranking problem. Hence

Table 3 provides a sharper lens on whether interest-rate tiers truly differentiate ex-post outcomes. The fact that

Table 3 shows consistently lower Gini and KS values for fintechs across every horizon signals a genuine ranking deficiency: interest-rate tiers issued by fintech lenders do a poorer job of distinguishing high- and low-risk mortgages.

Table 4 probes whether the AUC gaps could simply be sampling noise. We generate 1000 non-parametric bootstrap replications of the AUC difference between fintech lenders and each benchmark group. In every horizon the 95 percent confidence intervals are negative and never cross zero—for example, Bank vs. Fintech at 36 months: −0.1450 to −0.1242—yielding

p-values below 0.01. These results confirm that fintech lenders’ weaker risk discrimination is not a statistical artifact but a systematic and economically meaningful disadvantage.

Taken together, the ROC patterns (

Figure 1,

Figure 2 and

Figure 3), the consistently lower Gini/KS scores in

Table 3, and the bootstrap significance in

Table 4 all point in the same direction: fintech mortgage rates sort borrowers less effectively than the pricing of banks or traditional non-banks, reinforcing the conclusion that standardization and rapid securitization impede fintechs’ risk-based pricing in the conforming market.

4.3. Regression Analysis

Table 5 examines whether mortgage rates move with borrower risk and how that relationship differs across lender types. The positive Fintech main effect (≈ +0.052 percentage points) shows that, for loans that ultimately stay current, fintech lenders charge about 5 basis points (bp) more than banks or other non-fintech lenders—a convenience premium. For traditional lenders, the Delinquency coefficient (≈ +6.6 bp) indicates that borrowers who will become 60- or 90-days past due pay an ex-ante surcharge of roughly 6–7 bp. In contrast, the negative interaction terms (Fintech × Delinquency and Fintech × Prepayment) almost wipe out that surcharge for fintech loans, meaning fintechs raise rates far less for borrowers who will default or prepay early.

A concrete illustration clarifies the magnitude. Take two identical $250,000 mortgages originated today: one remains current for 24 months; the other becomes 60-days delinquent within the same window.

Bank/non-fintech lender: adds the full 6.6 bp risk premium, costing the delinquent borrower about $165 extra interest per year (0.00066 × $250,000).

Fintech lender: adds only 1.6 bp (6.6 bp minus the 4.95 bp interaction), or roughly $40 per year.

Thus fintech pricing is much flatter: the safest borrowers pay the 5-bp convenience premium, while higher-risk borrowers receive an implicit discount of about 5 bp relative to bank pricing. The result is a misaligned risk gradient—fintechs over-charge low-risk customers and under-charge high-risk ones—mirroring the weaker risk discrimination documented in the ROC and Gini analyses.

5. Discussion

5.1. Why Fintech Strengths in Unsecured Credit Do Not Translate to Conforming Mortgages

Fintechs have been celebrated for superior screening and pricing in unsecured consumer lending, where flexible data use and automated models materially improve default prediction and expand credit access [

1,

2,

4]. Conforming mortgages, however, operate under a very different institutional architecture. Four structural frictions emerge from our evidence:

Regulatory standardization. Fannie Mae and Freddie Mac impose uniform underwriting forms (e.g., the 1003) and automated approval engines that rely heavily on FICO, LTV, and DTI. These rules leave little room for alternative data that power fintech credit models [

4].

Securitization incentives. Originators quickly transfer credit risk to GSE pools, weakening any payoff from expending resources on granular borrower screening [

19,

20].

Borrower homogeneity. Conforming loans already meet tight credit thresholds; the resulting narrower variance in true default risk blunts gains from advanced analytics.

Price-compression from competition. A liquid TBA market and GSE LLPAs (loan-level price adjustments) compress spreads, reducing the scope for differentiated pricing even when better signals exist.

These constraints jointly explain why fintech lenders’ sophisticated toolkits yield little extra predictive power and why their rate sheets remain unusually flat across the risk spectrum—producing the “low-tech pricing” documented here.

5.2. Implications for Fintech Business Models and Market Efficiency

Our findings suggest that fintechs’ competitive edge is context-dependent. In domains where loans remain on balance sheet, analytics that sharpen risk differentiation translate directly into profit and/or lower borrower rates. In conforming mortgages, where credit risk is standardized, off-loaded, and tightly priced, the same analytics provide limited marginal value. Fintech lenders therefore pivot to speed, convenience, and customer experience, compensating for thinner risk-pricing spreads with origination volume. Whether that strategy is sustainable once incumbents match digital workflows deserves further inquiry.

5.3. Policy Considerations: Credit Availability, Fairness, and Algorithmic Accountability

Uniform GSE standards protect investors and borrowers, but they may also suppress innovation in risk assessment that could price mortgages more equitably and precisely [

26]. Balancing these goals invites three policy discussions:

Credit availability. If advanced data can safely identify overlooked prime borrowers, regulators might pilot “regulated sandboxes” that allow limited alternative-data use within GSE AUS (e.g., DU and LPA) guidelines.

Price fairness. A flatter fintech rate curve currently cross-subsidizes higher-risk borrowers with premiums paid by lower-risk ones. Transparency around LLPAs and lender add-ons would help borrowers understand whether such cross-subsidies are consistent with fair-lending norms.

Algorithmic responsibility. Any relaxation of data restrictions must be paired with auditing standards that document model inputs, monitor disparate-impact metrics, and provide recourse for borrowers adversely affected by automated decisions.

5.4. Limitations and Directions for Future Research

Our sample ends in Q1-2020 to avoid pandemic-era forbearance distortions; post-COVID performance may differ. In addition, we cannot directly observe non-traditional data feeds that fintechs might use during initial underwriting. Future work could compare conforming versus jumbo channels (where GSE rules do not apply), explore post-2020 cohorts, and test whether recent GSE pilots permitting cash-flow or rent-payment data alter the predictive and pricing landscape.

Overall, the evidence underscores that fintech advantages are not universal but shaped by the regulatory and market structures in which lenders operate [

19,

20,

21,

23]. Policymakers and market participants should therefore weigh both technological potential and institutional constraints when evaluating fintech’s role in the mortgage ecosystem.

6. Conclusions

This study set out to determine whether fintech lenders replicate their documented advantage in unsecured personal lending when originating conforming mortgages. Drawing on a large sample of loans from Fannie Mae and Freddie Mac, and employing both ROC/AUC methods and regression-based tests, we conclude that fintech lenders do not demonstrate superior predictive accuracy relative to traditional banks or other non-bank lenders. Their AUC scores tend to be lower, indicating weaker discrimination in interest-rate setting, and their pricing appears misaligned, with higher interest rates charged to borrowers who remain current and slightly lower rates applied to those who become delinquent or prepay early. These results imply that the structural features of the conforming mortgage market—particularly GSE securitization and standardized underwriting criteria—may limit the implementation of fintech’s innovative data-driven techniques, contrasting with the more flexible environment of unsecured lending.

From a policy perspective, the uniform standards of the conforming mortgage market may dilute fintech’s potential screening benefits, although refinements to GSE underwriting guidelines that allow responsible use of alternative data could enhance risk assessment. The findings also highlight that lenders, whether fintech or bank, operate within a highly standardized setting that constrains risk-based pricing. Future work could compare these outcomes to jumbo (non-conforming) mortgage markets, where fintech lenders may be able to deploy more flexible underwriting standards, and investigate loan performance post-2020 to understand how fintechs respond to widespread credit shocks such as pandemic-era forbearances.

Author Contributions

Conceptualization, Z.L. and H.L.; methodology, Z.L.; software, Z.L.; validation, Z.L. and H.L.; formal analysis, Z.L.; investigation, Z.L.; resources, H.L.; data curation, Z.L.; writing—original draft preparation, Z.L.; writing—review and editing, H.L.; visualization, Z.L.; supervision, H.L.; project administration, H.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Acknowledgments

We thank our research assistants and colleagues for their valuable feedback and support.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript.

| AUC | Area Under the Curve |

| ML | Machine Learning |

| GSE | Government-Sponsored Enterprise |

| TPR | True Positive Rate |

| FPR | False Positive Rate |

Appendix A

Table A1.

Variable Definition.

Table A1.

Variable Definition.

| Variable | Definition |

|---|

| Borrower and loan Characteristic | |

| Origination rate | The original interest rate on a mortgage loan as identified in the original mortgage note |

| Origination balance ($ thousand) | The dollar amount of the loan as stated on the note at the time the loan was originated |

| Original Loan-to-value Ratio (OLTV) | Loan amount divided by the value of property at origination |

| Original combined LTV(OCLTV) | The amount of all known outstanding loans (including home equity) at origination divided by the value of property |

| Debt-to-income ratio | Loan amount divided by borrower income at origination |

| FICO score | Borrower’s FICO score at origination |

| Refinance | Indicator variables for whether the loan is a home refinancing or not |

| Cash out Refinance | Indicator variables for whether the loan is a cash-out refinance or not |

| Non-cash out refinance | Indicator variables for whether the loan is a non cash-out (rate) refinance or not |

| Purchase | Indicator variables for whether the loan is a home purchase or not |

| First time home buyer | An indicator that denotes if the borrower or co-borrower qualifies as a first-time homebuyer |

| Number of borrowers | The number of individuals obligated to repay the mortgage loan |

| Has Mortgage Insurance | Indicator variables for whether the loan has mortgage insurance or not |

| Mortgage Insurance Unknown | Indicator variables for whether the loan’s mortgage insurance status is unknown |

| Primary residence | An indicator that denotes whether the property occupancy status is for primary residence or not |

| Investment or 2nd property | An indicator that denotes whether the property occupancy status is for secondary home/investment purpose or not |

| Correspondent channel | Indicator variables for whether the loan is originated through the correspondent channel or not |

| Retail channel | Indicator variables for whether the loan is originated through the retail channel or not |

| Broker channel | Indicator variables for whether the loan is originated through the broker channel or not |

| MSA macroeconomic indicators | |

| MSA unemployment rate | Unemployment rate by metropolitan statistical area, seasonally adjusted; obtained from the U.S. Bureau of Labor Statistics |

| MSA real personal income | Real per capita personal income (Chained 2012 dollars) by metropolitan statistical area; obtained from the Bureau of Economic Analysis |

| Loan Performance | |

| 30 (60/90) DPD in 12 (24/36) Month | Indicator variables for whether the loan is 30 (60/90) days past due within 12 (24/36) months after origination |

| Prepaid in 12 (24/36) Month | Indicator variables for whether the loan is prepaid within 12 (24/36) months after origination |

References

- Berg, T.; Burg, V.; Gombović, A.; Puri, M. On the rise of fintechs: Credit scoring using digital footprints. Rev. Financ. Stud. 2020, 33, 2845–2897. [Google Scholar] [CrossRef]

- Di Maggio, M.; Yao, V. Fintech borrowers: Lax-screening or cream-skimming? Rev. Financ. Stud. 2021, 34, 4565–4618. [Google Scholar] [CrossRef]

- Bartlett, R.; Morse, A.; Stanton, R.; Wallace, N. Consumer-lending discrimination in the FinTech era. J. Financ. Econ. 2022, 143, 30–56. [Google Scholar] [CrossRef]

- Jagtiani, J.; Lemieux, C. The roles of alternative data and machine learning in fintech lending: Evidence from LendingClub consumer platform. Financ. Manag. 2019, 48, 1009–1029. [Google Scholar] [CrossRef]

- Iyer, R.; Khwaja, A.I.; Luttmer, E.F.P.; Shue, K. Screening peers softly: Inferring the quality of small borrowers. Manag. Sci. 2016, 62, 1554–1577. [Google Scholar] [CrossRef]

- Ueda, K.; Zhang, Y.; Zhao, X. Fintech firms’ competition strategies: Evidence from the unsecured personal loan market. Off. Comptroller Curr. Work. Pap. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4106569 (accessed on 16 March 2025).

- Cornelli, G.; Frost, J.; Gambacorta, L.; Rau, P.R.; Wardrop, R.; Ziegler, T. Fintech and big tech credit: Drivers of the growth of digital lending. J. Bank. Financ. 2023, 148, 106742. [Google Scholar] [CrossRef]

- Di Maggio, M.; Ratnadiwakara, D.; Carmichael, D. Invisible primes: Fintech lending with alternative data. In NBER Working Papers; National Bureau of Economic Research: Cambridge, MA, USA, 2022; p. 29840. Available online: https://www.nber.org/papers/w29840 (accessed on 16 March 2025).

- Lin, M.; Prabhala, N.; Viswanathan, S. Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Manag. Sci. 2013, 59, 17–35. [Google Scholar] [CrossRef]

- Hughes, J.; Jagtiani, J.; Moon, C. Consumer lending efficiency: Commercial banks versus a fintech lender. Financ. Innov. 2022, 8, 38. [Google Scholar] [CrossRef]

- Janbek, K.-E.; Bancel, F. Fintech lenders and borrowers screening: Superior abilities or lax practices? Financ. Res. Lett. 2024, 63, 105323. [Google Scholar] [CrossRef]

- Chai, Y.; Sun, S. Can the development of Fintech mitigate non-performing loan risk? Financ. Res. Lett. 2024, 67, 105889. [Google Scholar] [CrossRef]

- Bazarbash, M.; Beaton, K. Filling the gap: Digital credit and financial inclusion. In IMF Working Papers; IMF: Washington, DC, USA, 2020; Volume 2020, p. 150. Available online: https://www.imf.org/en/Publications/WP/Issues/2020/08/07/Filling-the-Gap-Digital-Credit-and-Financial-Inclusion-49638 (accessed on 18 March 2025).

- Hodula, M. Does fintech credit substitute for traditional credit? Evidence from 78 countries. Financ. Res. Lett. 2022, 46, 102469. [Google Scholar] [CrossRef]

- Liu, Z.; Liang, H. Do fintech lenders align pricing with risk? Evidence from a model-based assessment of conforming mortgages. FinTech 2025, 4, 23. [Google Scholar] [CrossRef]

- Liu, Z.; Liang, H. Racial disparities in conforming mortgage lending: A comparative study of fintech and traditional lenders under regulatory oversight. FinTech 2025, 4, 8. [Google Scholar] [CrossRef]

- Johnson, M.J.; Ben-David, I.; Lee, J.; Yao, V. Fintech lending with lowtech pricing. In NBER Working Papers; NBER: Cambridge, MA, USA, 2023; p. 31154. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4396502 (accessed on 18 March 2025).

- Fuster, A.; Plosser, M.; Schnabl, P.; Vickery, J. The role of technology in mortgage lending. Rev. Financ. Stud. 2019, 32, 1854–1899. [Google Scholar] [CrossRef]

- Keys, B.J.; Mukherjee, T.; Seru, A.; Vig, V. Did securitization lead to lax screening? Evidence from subprime loans. Q. J. Econ. 2010, 125, 307–362. [Google Scholar] [CrossRef]

- Acharya, V.; Schnabl, P.; Suarez, G.; Vig, V. Securitization without risk transfer. J. Financ. Econ. 2013, 107, 515–536. [Google Scholar] [CrossRef]

- Choi, D.B.; Kim, J.-E. Does Securitization Weaken Screening Incentives? J. Financ. Quant. Anal. 2021, 56, 2934–2962. [Google Scholar] [CrossRef]

- Buchak, G.; Matvos, G.; Piskorski, T.; Seru, A. Fintech, regulatory arbitrage, and the rise of shadow banks. J. Financ. Econ. 2018, 130, 453–483. [Google Scholar] [CrossRef]

- Ouazad, A.; Kahn, M.E. Mortgage finance and climate change: Securitization dynamics in the aftermath of natural disaster. Rev. Financ. Stud. 2022, 35, 3617–3665. [Google Scholar] [CrossRef]

- Liu, Z.; Liang, H. Machine learning prediction of loss given default in government-sponsored enterprise residential mortgages. J. Risk Model Valid. 2024, 18, 2. [Google Scholar] [CrossRef]

- Liu, Z.; Liang, H.; Zhao, X. Do Non-Banks Bring Lower Prices for Borrowers in the Government-Sponsored Enterprise (GSE) Mortgage Market? SSRN Electron. J. 2024. [Google Scholar] [CrossRef]

- Liu, Z.; Liang, H. The prediction of mortgage prepayment risks in the early stages of loan origination: A machine learning approach. J. Risk 2024, 27, 14–43. [Google Scholar] [CrossRef]

- Hosmer, D.W.; Lemeshow, S.; Sturdivant, R.X. Applied Logistic Regression, 3rd ed.; Wiley: Hoboken, NJ, USA, 2013. [Google Scholar]

Figure 1.

ROC Curves for 12, 36, and 60-Month Loan Delinquency Prediction by Lender Type. This figure compares the ROC curves for banks, non-fintech non-banks, and fintech firms in predicting 90-day delinquencies at 12 (left), 36 (middle), and 60 (right) months post-origination. ROC curves are based on in-sample non-parametric analysis using interest rate percentiles as the scoring variable. No predictive model is estimated.

Figure 1.

ROC Curves for 12, 36, and 60-Month Loan Delinquency Prediction by Lender Type. This figure compares the ROC curves for banks, non-fintech non-banks, and fintech firms in predicting 90-day delinquencies at 12 (left), 36 (middle), and 60 (right) months post-origination. ROC curves are based on in-sample non-parametric analysis using interest rate percentiles as the scoring variable. No predictive model is estimated.

Figure 2.

ROC Curves for 12, 36, and 60-Month Loan Prepayment Prediction by Lender Type. This figure compares the ROC curves for banks, non-fintech non-banks, and fintech firms in predicting loan prepayments at 12 (left), 36 (middle), and 60 (right) months post-origination. ROC curves are based on in-sample non-parametric analysis using interest rate percentiles as the scoring variable. No predictive model is estimated.

Figure 2.

ROC Curves for 12, 36, and 60-Month Loan Prepayment Prediction by Lender Type. This figure compares the ROC curves for banks, non-fintech non-banks, and fintech firms in predicting loan prepayments at 12 (left), 36 (middle), and 60 (right) months post-origination. ROC curves are based on in-sample non-parametric analysis using interest rate percentiles as the scoring variable. No predictive model is estimated.

Figure 3.

Annual Area Under the Curve (AUC) Scores by Lender Type. This Figure presents the annual AUC scores for three types of lenders from 2012 to 2017. The AUC scores are used as a measure of the lenders’ ability to predict loan delinquency within 36 months post-origination. ‘Bank’ represents traditional banking institutions, ‘NonFintech’ denotes non-fintech shadow banks, and ‘Fintech’ refers to financial technology firms. The scores highlight the comparative predictive performance of each lender type over time.

Figure 3.

Annual Area Under the Curve (AUC) Scores by Lender Type. This Figure presents the annual AUC scores for three types of lenders from 2012 to 2017. The AUC scores are used as a measure of the lenders’ ability to predict loan delinquency within 36 months post-origination. ‘Bank’ represents traditional banking institutions, ‘NonFintech’ denotes non-fintech shadow banks, and ‘Fintech’ refers to financial technology firms. The scores highlight the comparative predictive performance of each lender type over time.

Table 1.

Top 20 Lenders Ranked by Origination Volume. This table reports the top 20 lenders in the confirming residential mortgage market based on the public Fannie and Freddie data. We can identify the originators of each loan from the public data, as long as the originator name is not listed as “other lender.” We check whether each lender is a bank or subsidiary of a bank. If a lender does not have a RSSD and a bank charter or it is does not have a bank parent, it is considered a non-bank. Classification of fintech lenders is more judgmental, and we follow the approach adopted by earlier studies [

18,

22].We check the mortgage lending process of the non-banks. If the lending process up till preapproval can be completed entirely on-line, and the lender’s business is generated predominantly online, the lender is deemed a fintech lender. The ranking is determined by the origination volume of the GSE residential mortgage issued by the lender from 2012 to 2019. Our final sample includes 41 banks and 71 non-banks, of which 12 are fintech lenders.

Table 1.

Top 20 Lenders Ranked by Origination Volume. This table reports the top 20 lenders in the confirming residential mortgage market based on the public Fannie and Freddie data. We can identify the originators of each loan from the public data, as long as the originator name is not listed as “other lender.” We check whether each lender is a bank or subsidiary of a bank. If a lender does not have a RSSD and a bank charter or it is does not have a bank parent, it is considered a non-bank. Classification of fintech lenders is more judgmental, and we follow the approach adopted by earlier studies [

18,

22].We check the mortgage lending process of the non-banks. If the lending process up till preapproval can be completed entirely on-line, and the lender’s business is generated predominantly online, the lender is deemed a fintech lender. The ranking is determined by the origination volume of the GSE residential mortgage issued by the lender from 2012 to 2019. Our final sample includes 41 banks and 71 non-banks, of which 12 are fintech lenders.

| Rank | Lender Name | Lender Type | 2012–2019 Origination Volume ($MM) | Market Share (%) |

|---|

| 1 | Wells Fargo Bank | Bank | 468,627 | 11.86 |

| 2 | JPMorgan Chase Bank | Bank | 184,085 | 4.66 |

| 3 | Quicken Loans | Fintech Non-Bank | 177,101 | 4.48 |

| 4 | U.S. Bank | Bank | 103,964 | 2.63 |

| 5 | United Shore Financial Services | Non-Fintech Non-Bank | 87,689 | 2.22 |

| 6 | PennyMac Loan Services | Non-Fintech Non-Bank | 66,860 | 1.69 |

| 7 | Caliber Home Loans | Non-Fintech Non-Bank | 53,824 | 1.36 |

| 8 | Flagstar Bank | Bank | 51,273 | 1.3 |

| 9 | AmeriHome Mortgage | Non-Fintech Non-Bank | 43,121 | 1.09 |

| 10 | SunTrust Mortgage | Bank | 40,587 | 1.03 |

| 11 | Franklin American Mortgage | Non-Fintech Non-Bank | 38,479 | 0.97 |

| 12 | Branch Banking and Trust | Bank | 37,310 | 0.94 |

| 13 | Stearns Lending | Non-Fintech Non-Bank | 36,770 | 0.93 |

| 14 | LoanDepot.com LLC | Fintech Non-Bank | 34,003 | 0.86 |

| 14 | Stearns Lending | Non-Fintech Non-Bank | 36,770 | 0.93 |

| 15 | CitiMortgage Inc | Bank | 30,663 | 0.78 |

| 16 | Nationstar Mortgage | Non-Fintech Non-Bank | 29,734 | 0.75 |

| 17 | Bank of America | Bank | 28,199 | 0.71 |

| 18 | Fairway Independent Mortgage | Non-Fintech Non-Bank | 25,070 | 0.63 |

| 19 | Provident Funding Associates | Non-Fintech Non-Bank | 23,661 | 0.6 |

| 20 | Freedom Mortgage | Non-Fintech Non-Bank | 16,790 | 0.42 |

Table 2.

Summary of statistics by lender types. This table shows the summary of statistics for the loan origination and performance variables by lender types. Panel A reports the loan characteristics at origination. Panel B reports the delinquency and prepayment rate.

Table 2.

Summary of statistics by lender types. This table shows the summary of statistics for the loan origination and performance variables by lender types. Panel A reports the loan characteristics at origination. Panel B reports the delinquency and prepayment rate.

| Panel A: Loan Origination Characteristic |

| | Banks | Non-Banks | Non-Fintech | Fintech |

| | Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. |

| Origination rate | 4.17 | 0.49 | 4.30 | 0.53 | 4.29 | 0.53 | 4.33 | 0.51 |

| Origination balance ($ thousand) | 242.96 | 126.93 | 262.68 | 131.98 | 268.07 | 130.43 | 251.21 | 134.51 |

| Original Loan-to-value Ratio (OLTV) | 74.99 | 16.20 | 75.25 | 15.85 | 76.29 | 15.66 | 73.05 | 16.02 |

| Original combined LTV(OCLTV) | 75.71 | 15.97 | 75.66 | 15.74 | 76.73 | 15.52 | 73.38 | 15.94 |

| Debt-to-income ratio | 34.08 | 9.26 | 35.47 | 9.09 | 35.38 | 9.10 | 35.68 | 9.05 |

| Credit score | 753.86 | 44.47 | 747.44 | 46.02 | 749.88 | 44.86 | 742.25 | 48.00 |

| Refinance | 0.48 | 0.50 | 0.54 | 0.50 | 0.46 | 0.50 | 0.70 | 0.46 |

| Cash out Refinance | 0.20 | 0.40 | 0.26 | 0.44 | 0.21 | 0.41 | 0.36 | 0.48 |

| Non-cash out refinance | 0.28 | 0.45 | 0.28 | 0.45 | 0.25 | 0.43 | 0.34 | 0.47 |

| Purchase | 0.52 | 0.50 | 0.47 | 0.50 | 0.54 | 0.50 | 0.30 | 0.46 |

| First time home buyer | 0.21 | 0.40 | 0.19 | 0.39 | 0.22 | 0.41 | 0.13 | 0.34 |

| Number of borrowers | 1.52 | 0.51 | 1.49 | 0.51 | 1.50 | 0.52 | 1.47 | 0.51 |

| Has Mortgage Insurance | 0.28 | 0.45 | 0.29 | 0.46 | 0.31 | 0.46 | 0.25 | 0.43 |

| Mortgage Insurance Unknown | 0.33 | 0.47 | 0.42 | 0.49 | 0.40 | 0.49 | 0.47 | 0.50 |

| Primary residence | 0.88 | 0.33 | 0.88 | 0.32 | 0.87 | 0.34 | 0.90 | 0.30 |

| Investment or 2nd property | 0.12 | 0.33 | 0.12 | 0.32 | 0.13 | 0.34 | 0.10 | 0.30 |

| MSA unemployment rate (UR) | 5.74 | 2.19 | 4.96 | 1.94 | 4.98 | 1.97 | 4.90 | 1.88 |

| MSA real personal income ($ thousand) | 48.25 | 7.13 | 49.23 | 7.49 | 49.10 | 7.36 | 49.51 | 7.75 |

| Change in MSA UR | −0.67 | 0.56 | −0.60 | 0.52 | −0.61 | 0.52 | −0.59 | 0.52 |

| Change in MSA HPI | 0.040 | 0.041 | 0.052 | 0.036 | 0.053 | 0.037 | 0.050 | 0.034 |

| Correspondent channel | 0.58 | 0.49 | 0.34 | 0.47 | 0.47 | 0.50 | 0.04 | 0.20 |

| Retail channel | 0.39 | 0.49 | 0.43 | 0.50 | 0.25 | 0.43 | 0.81 | 0.39 |

| Broker channel | 0.03 | 0.17 | 0.23 | 0.42 | 0.28 | 0.45 | 0.14 | 0.35 |

| Number of Loans | 4,124,281 | 3,072,923 | 2,091,903 | 981,020 |

| Panel B: Loan Performance Variables |

| | Banks | Non-Banks | Non-Fintech | Fintech |

| | Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. |

| 90 + DPD in 12 Month | 0.10% | 3.80% | 0.30% | 5.10% | 0.20% | 4.90% | 0.30% | 5.50% |

| 90 + DPD in 24 Month | 0.40% | 6.60% | 0.70% | 8.40% | 0.70% | 8.10% | 0.80% | 8.90% |

| 90 + DPD in 36 Month | 0.70% | 8.20% | 1.00% | 10.00% | 1.00% | 9.70% | 1.10% | 10.50% |

| Prepaid in 12 Month | 5.50% | 22.70% | 8.80% | 28.40% | 8.10% | 27.30% | 10.40% | 30.60% |

| Prepaid in 24 Month | 12.60% | 33.20% | 18.20% | 38.50% | 16.40% | 37.10% | 22.00% | 41.40% |

| Prepaid in 36 Month | 21.00% | 40.70% | 28.50% | 45.10% | 26.40% | 44.10% | 33.10% | 47.10% |

Table 3.

Gini Coefficient and KS Statistic by Lender Type and Horizon. This table reports Gini coefficients and Kolmogorov–Smirnov (KS) statistics that reflect the discriminatory power of lender pricing (interest rates) with respect to borrower outcomes. Higher values of Gini and KS indicate stronger separation between high- and low-risk borrowers. Results are shown separately for delinquency (del) and prepayment (pre) outcomes across 12-, 36-, and 60-month horizons.

Table 3.

Gini Coefficient and KS Statistic by Lender Type and Horizon. This table reports Gini coefficients and Kolmogorov–Smirnov (KS) statistics that reflect the discriminatory power of lender pricing (interest rates) with respect to borrower outcomes. Higher values of Gini and KS indicate stronger separation between high- and low-risk borrowers. Results are shown separately for delinquency (del) and prepayment (pre) outcomes across 12-, 36-, and 60-month horizons.

| Lender Type | Horizon | Gini (Del) | KS (Del) | Gini (Pre) | KS (Pre) |

|---|

| Bank | 12 mo | 0.3818 | 0.294 | 0.1012 | 0.0755 |

| Nonfintech | 12 mo | 0.3875 | 0.3 | 0.0574 | 0.0506 |

| Fintech | 12 mo | 0.2518 | 0.1967 | 0.0613 | 0.052 |

| Bank | 36 mo | 0.3588 | 0.2704 | 0.1102 | 0.0842 |

| Nonfintech | 36 mo | 0.3746 | 0.2822 | 0.1052 | 0.0847 |

| Fintech | 36 mo | 0.2682 | 0.2045 | 0.1107 | 0.0901 |

| Bank | 60 mo | 0.333 | 0.2498 | 0.0945 | 0.0746 |

| Nonfintech | 60 mo | 0.3584 | 0.2719 | 0.0985 | 0.0845 |

| Fintech | 60 mo | 0.3022 | 0.2304 | 0.0874 | 0.0842 |

Table 4.

Bootstrap AUC Comparisons Between Fintech and Other Lenders. This table reports 95% confidence intervals and p-values from nonparametric bootstrap tests comparing the AUC scores of fintech lenders with those of banks and non-fintech lenders. Each test uses 1000 bootstrap replications. AUC differences are reported separately for delinquency and prepayment outcomes. Statistically significant and negative differences indicate that fintech lenders underperform in risk discrimination relative to other lender types.

Table 4.

Bootstrap AUC Comparisons Between Fintech and Other Lenders. This table reports 95% confidence intervals and p-values from nonparametric bootstrap tests comparing the AUC scores of fintech lenders with those of banks and non-fintech lenders. Each test uses 1000 bootstrap replications. AUC differences are reported separately for delinquency and prepayment outcomes. Statistically significant and negative differences indicate that fintech lenders underperform in risk discrimination relative to other lender types.

| Comparison | Horizon | AUC Diff 95% CI (Del) | p-Value (Del) | AUC Diff 95% CI (Pre) | p-Value (Pre) |

|---|

| Bank vs. Fintech | 12 mo | [−0.1461, −0.1136] | 0 | [−0.0339, −0.0282] | 0 |

| Nonfintech vs. Fintech | 12 mo | [−0.1393, −0.1070] | 0 | [−0.0350, −0.0294] | 0 |

| Bank vs. Fintech | 36 mo | [−0.1450, −0.1242] | 0 | [−0.0575, −0.0526] | 0 |

| Nonfintech vs. Fintech | 36 mo | [−0.1388, −0.1163] | 0 | [−0.0598, −0.0550] | 0 |

| Bank vs. Fintech | 60 mo | [−0.1645, −0.1353] | 0 | [−0.0447, −0.0378] | 0 |

| Nonfintech vs. Fintech | 60 mo | [−0.1729, −0.1436] | 0 | [−0.0511, −0.0444] | 0 |

Table 5.

Loan Performance Regression. Please note that *** p < 0.01, ** p < 0.05, * p < 0.10. Robust standard errors clustered at the lender level are reported in parentheses.

Table 5.

Loan Performance Regression. Please note that *** p < 0.01, ** p < 0.05, * p < 0.10. Robust standard errors clustered at the lender level are reported in parentheses.

| | (1) | (2) | (3) | (4) |

| | 24 Months Since Loan Origination | 36 Months Since Loan Origination |

| | 60 DPD | 90 DPD | 60 DPD | 90 DPD |

| Dependent Variable: Interest Rate (%) | | | |

| Fintech firms | 0.0516 *** | 0.0515 *** | 0.0534 *** | 0.0533 *** |

| | (0.000) | (0.000) | (0.000) | (0.000) |

| Delinquency | 0.0655 *** | 0.0756 *** | 0.0553 *** | 0.0655 *** |

| | (0.000) | (0.000) | (0.000) | (0.000) |

| Delinquency × Fintech | −0.0495 *** | −0.0588 *** | −0.0315 *** | −0.0356 *** |

| | (0.000) | (0.000) | (0.000) | (0.000) |

| Prepayment | 0.0873 *** | 0.0874 *** | 0.0735 *** | 0.0735 *** |

| | (0.000) | (0.000) | (0.000) | (0.000) |

| Prepayment × Fintech | −0.0207 *** | −0.0208 *** | −0.00757 *** | −0.00766 *** |

| | (0.000) | (0.000) | (0.000) | (0.000) |

| Borrower and loan controls | Yes | Yes | Yes | Yes |

| Zip × Quarter FE | Yes | Yes | Yes | Yes |

| N | 3,975,222 | 3,975,222 | 3,352,100 | 3,352,100 |

| Adjust R-sq | 0.566 | 0.566 | 0.581 | 0.581 |

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).