Following the theoretical development of the AHP decision tool, the assessment of one case study is described in this work. The Chovdar gold mining project in Azerbaijan was selected for the application of the computational tool. Gold is the main product of this mine, and silver is a by-product. However, detailed exploration activities have revealed the presence of other minerals and metals in smaller concentrations.

The exploitation is scheduled in two phases; the first phase has already started, and surface mining is applied, while a feasibility study is also being prepared for the second phase, in which exploitation will transition to underground mining operations. The concentrations of all metals other than gold and silver are insignificant during the first phase. However, in the second phase, the resources to be mined include higher concentrations of metals such as copper, iron, and bauxite. It has not been clarified whether the mining company—Azergold—will exploit these additional elements as co- or by-products. Hence, applying the developed tool in this case study may significantly contribute to the actual decision making.

All authors’ calculations and assessments were made together and are based on publicly available data and information provided by the managers, engineers, and personnel of Azergold during a three-month internship (September–November 2019) of the first author at the mine site in Chovdar, Azerbaijan. Feasibility Study and Environmental Impact Assessment reports for the deposit are pending and, thus, not enough technical and economic data are available for a more precise assessment of the potential products. Nevertheless, existing data can yield a first good estimation for all commodities.

6.1. The Chovdar Polymetallic Deposit in Azerbaijan

Chovdar is known as a sizeable gold-sulfide deposit discovered relatively recently (in 1998) and run by Azergold in an area known for its several gold–silver–copper-low-sulfide occurrences and mineralization points. It is in western Azerbaijan’s northern part, approximately 45 km west of Ganja and 370 km west of Baku [

69]. The main exploration activities lasted until 2011, and mining operations commenced in 2012.

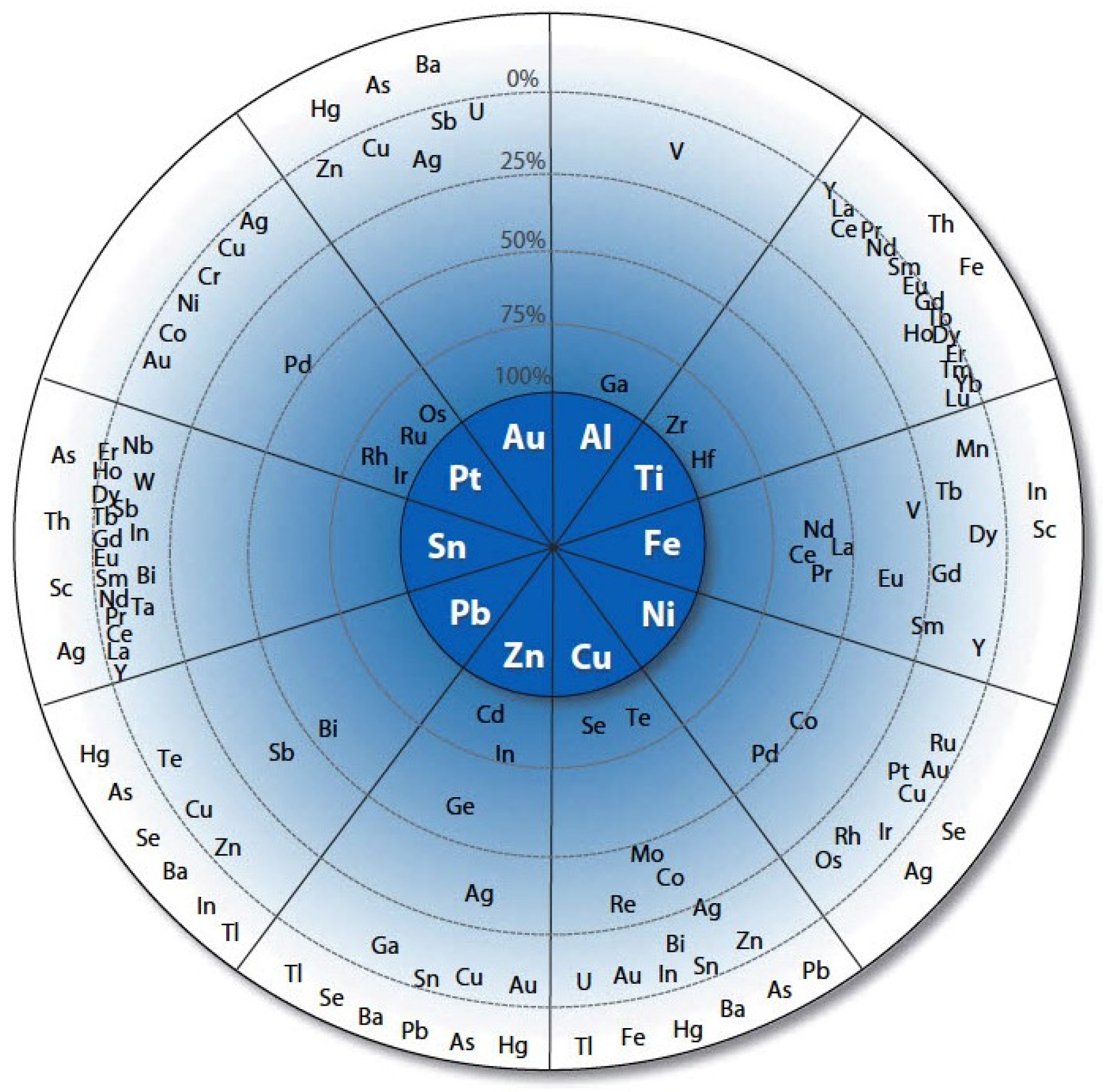

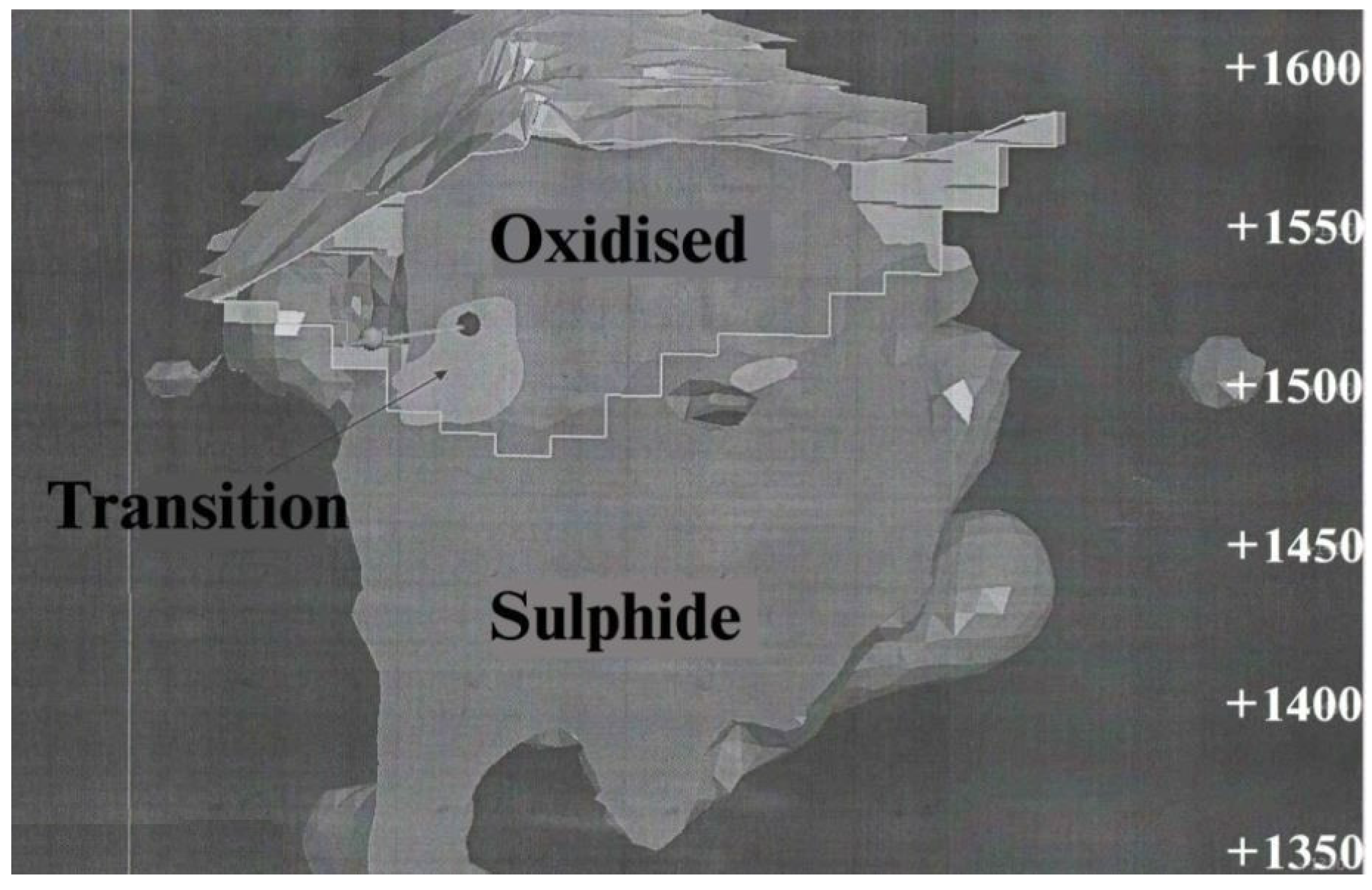

Two natural types of ores have been established in the Chovdar gold ore deposit: oxidized and primary sulfides distinguished by mixed semi-oxidized ores (

Figure 11). The oxide mineralization constitutes the upper section of the breccia deposit and varies in thickness from 60 to 80 m. Below the weathered material, the thickness of the primary sulfide mineralization ranges from 100 to 200 m, and extends to about 250 m below the surface.

The indicated and inferred mineral resources for the oxidized part of the deposit are estimated at 4.4 Mt. For the sulfide phase of the deposit, the resource estimate is 13.7 Mt [

69,

70]. The cut-off-grade for the mineral resource reporting is set at 0.5 gr/tonne of gold. The exploration results resulted in exploiting the mineralization in two phases. Phase One is to exploit the oxidized mineral reserves from an optimized open pit, and Phase Two is to develop an underground mine to subsequently exploit the remaining oxidized mineralization and sulfide mineralization [

69].

The Chovdar process plant is located approximately one kilometer south of the open pit. It comprises the entire treatment process from ore size reduction, beneficiation, heap leaching, carbon processing, electro-winning, refining, cyanide recovery, copper recovery, and, finally, cyanide destruction before tailings discharge [

69]. The end-product is in the form of gold–silver alloys, shipped to Switzerland for further processing [

71]. Although present in low concentrations, mercury cannot be disposed of as waste on-site; thus, it is also shipped off-site. Further mercury data are unavailable due to confidentiality restrictions of the company.

Exploration continues through the strategic phases of thorough assessment and evaluation during the life of a mine. Azergold has started geophysical and drilling operations to increase the reserves on the near and far flanks of the deposit. An interesting piece of information to note while transitioning from the oxide to the sulfide phase is the changing of concentration percentages in several metals found in the mineralization of Chovdar. Gold is the main product, silver is mined as a by-product, and mercury is extracted as waste. Various metals such as copper, iron, zinc, and aluminum, among others, are found in relatively low and uneconomic concentrations [

69,

71].

However, in the sulfide phase, the concentration of some minor metals is increasing to be significant enough, and should attract the attention of the project managers and make them reconsider their production. A detailed analysis was carried out for the chemical composition of the elements based on samples. The gold content ranges from 0.65 to 3.85 ppm, and is the leading commercially valuable component in all considered samples. Silver, having content ranging from 2.5 to 23.2 ppm, is particularly interesting for the following extraction. Moreover, a relatively high content of copper (0.825%) has been revealed in some samples. This suggests the possibility of the subsequent efficient extraction of the metal from the primary-sulfide ore types of the deposit [

70]. Similarly, increased grades of iron and aluminum indicate that further techno-economic analysis should be undertaken for the potential production of these elements. Raising iron and aluminum ore grades may not be as economically attractive as for copper, but it certainly should attract the interest of the project managers.

The transition from the oxide to sulfide phase will probably require a significant change in the processing method. Gold particles in the sulfide phase are mostly encapsulated in pyrite and, thus, are not amenable to cyanidation. Pre-oxidation of the pyrite was necessary to liberate gold particles or provide a path for cyanide to contact the gold. This will probably require the process plant to be modified before sulfide exploitation.

6.2. Evaluation of Products in the Chovdar Mining Project

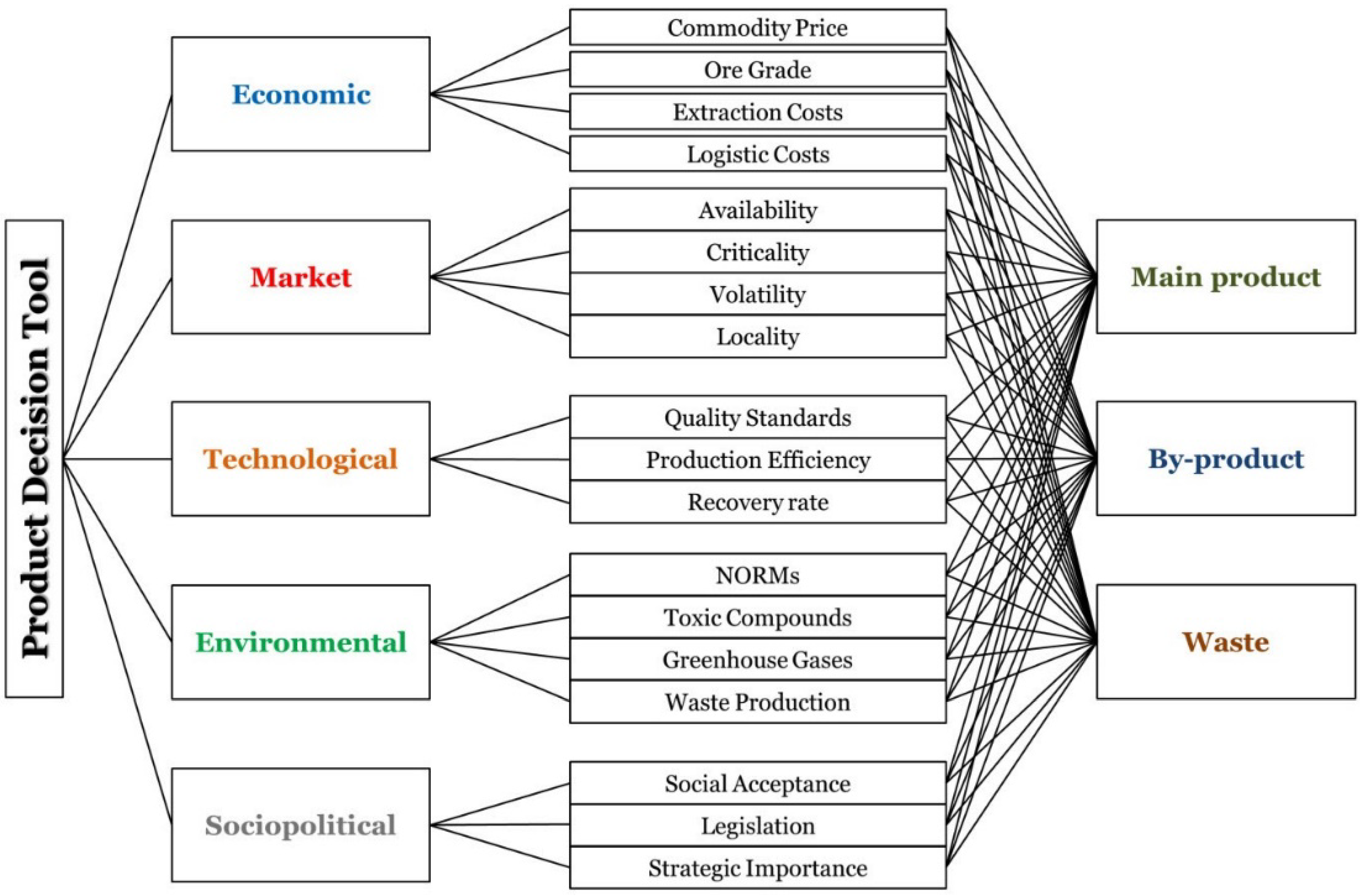

Six potential products were individually evaluated: gold, silver, copper, iron, aluminum, and mercury. Based on the history of production during the oxidized phase, gold was the first commodity to be evaluated, followed by silver. Assessments of copper, iron, aluminum, and mercury were then conducted. Once each metal was evaluated, the results were also considered for the following commodities’ assessment.

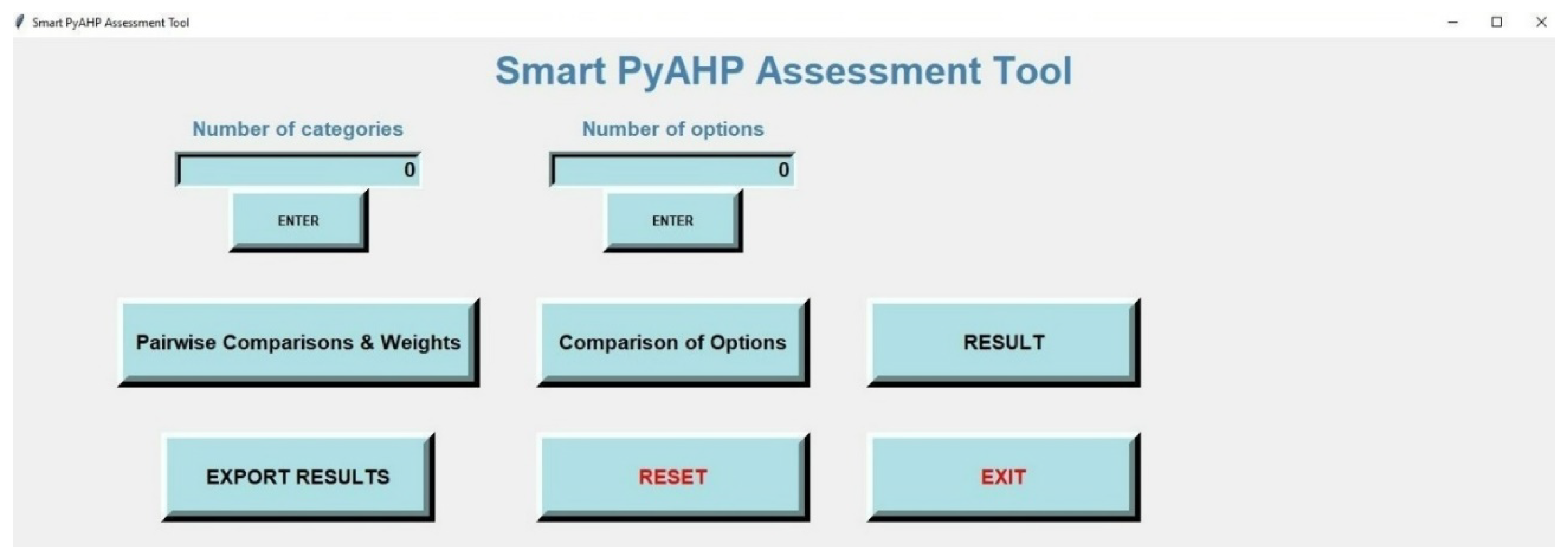

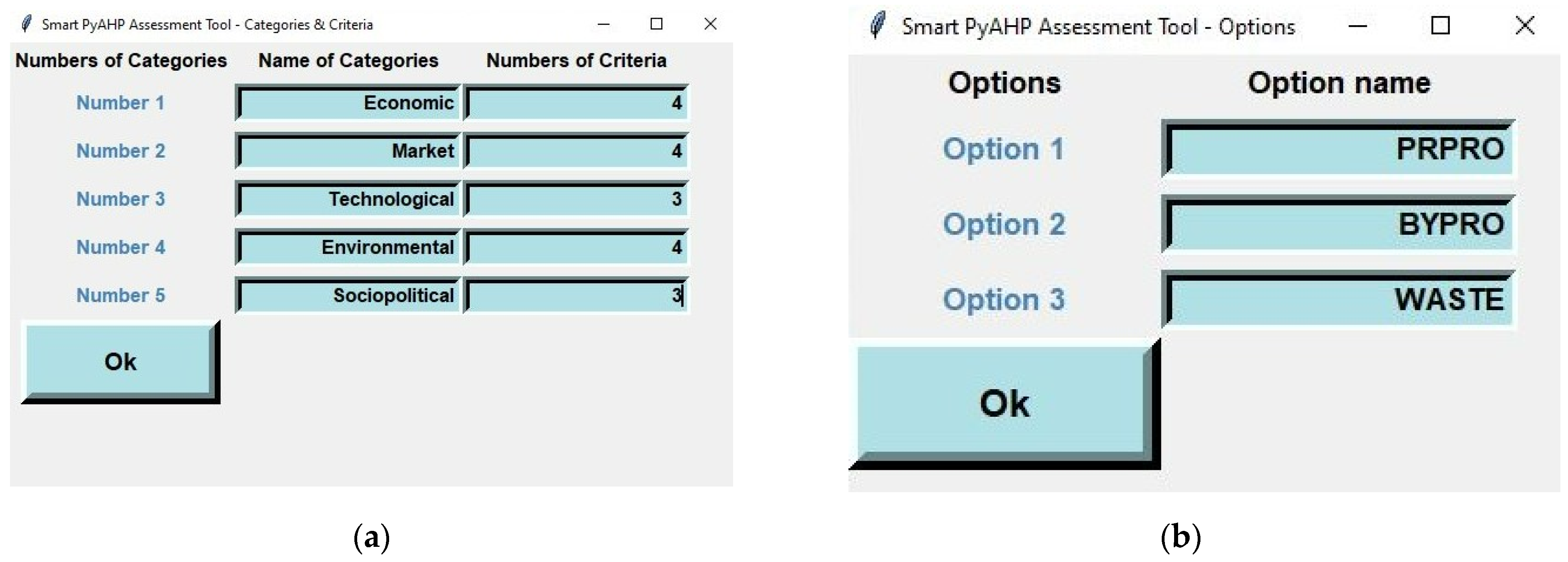

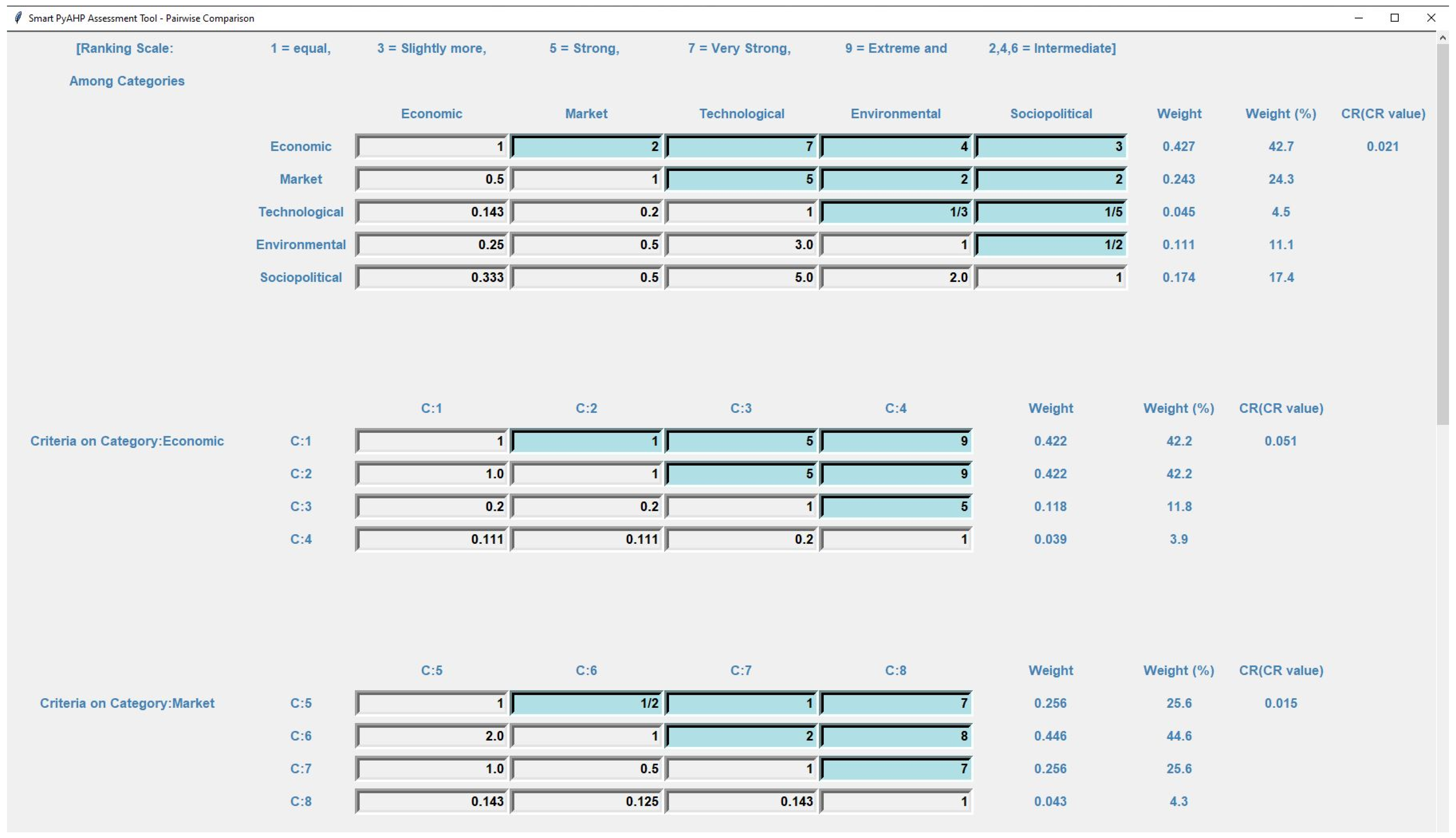

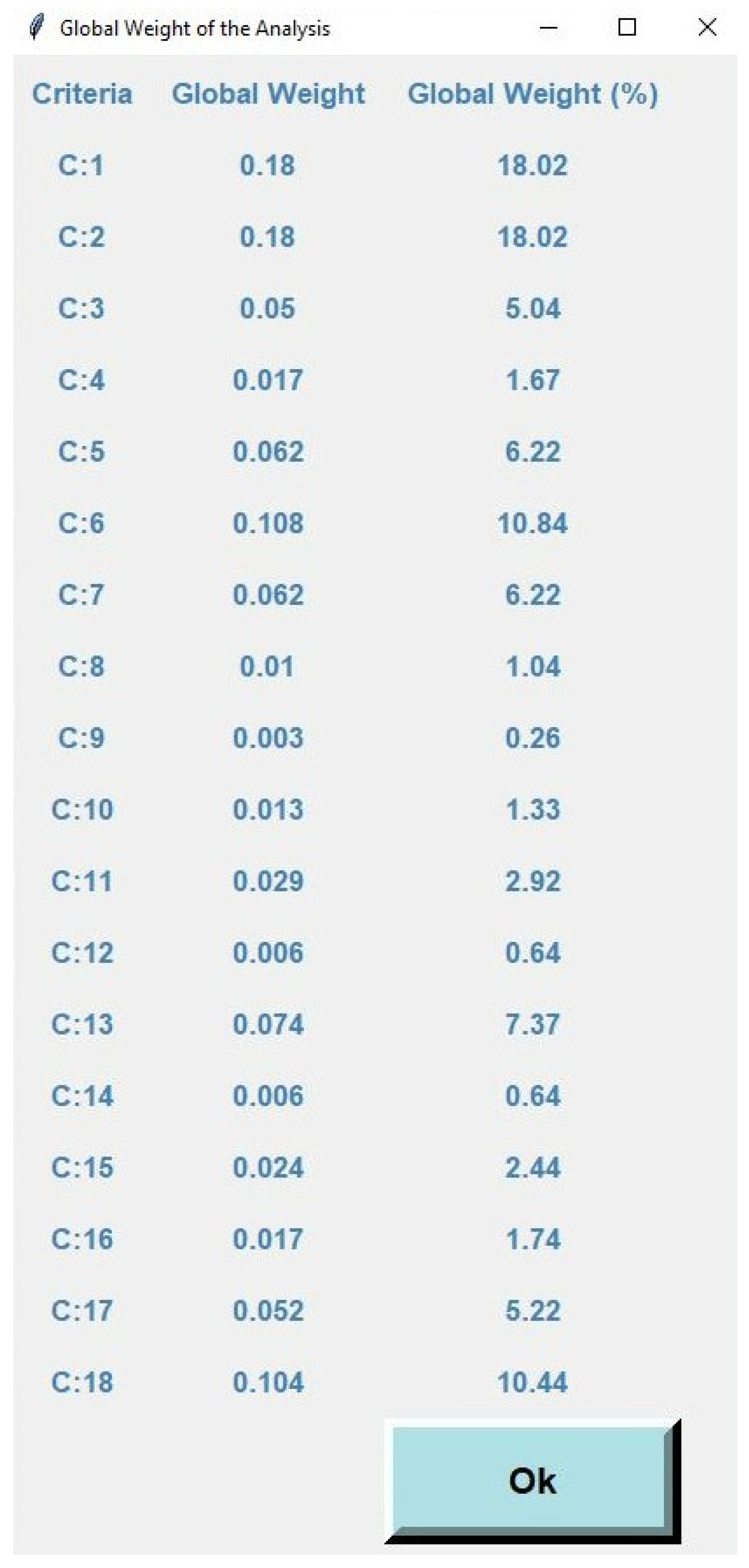

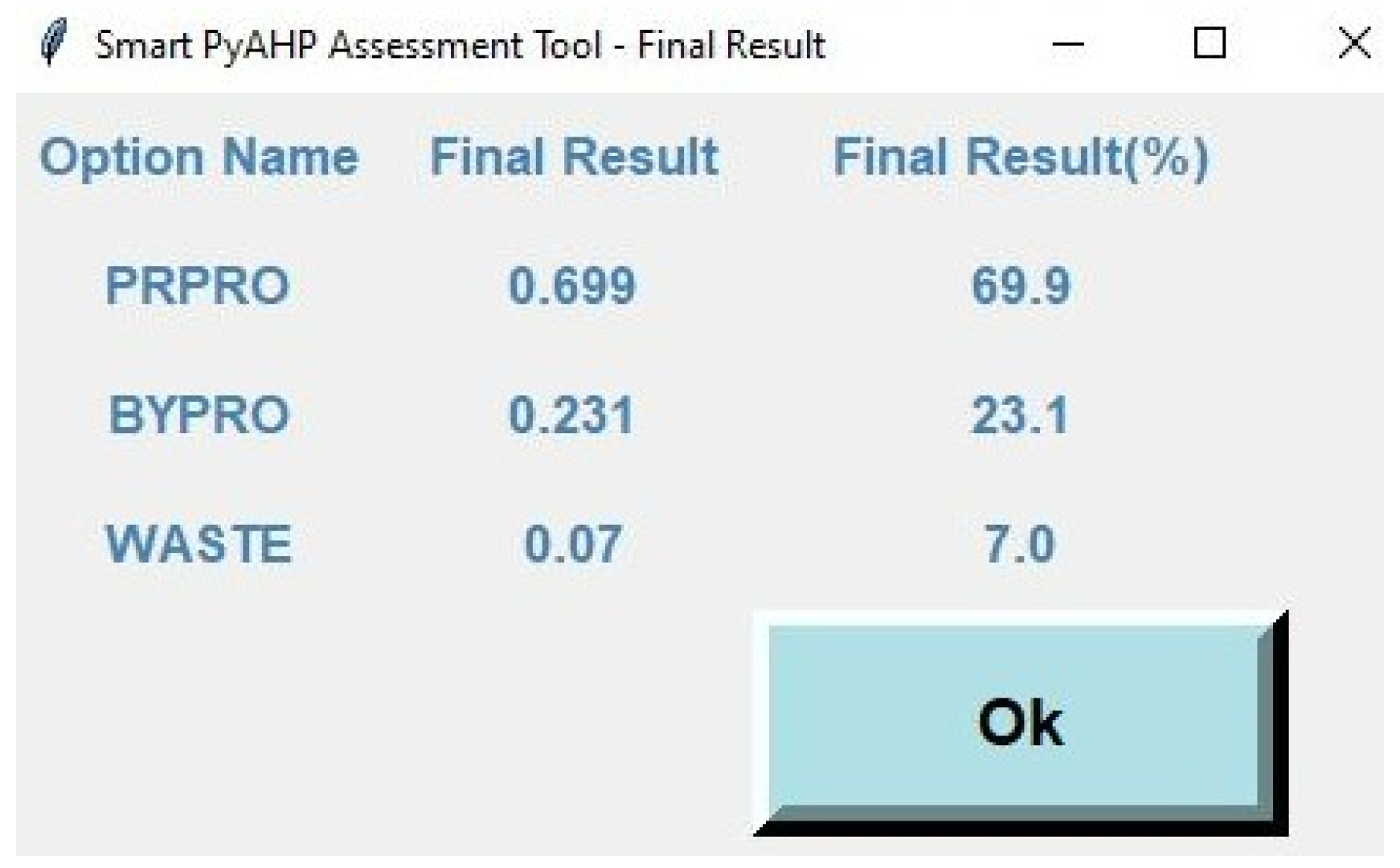

In each evaluation, the first action is to prioritize the categories between them and then separately make cross-comparisons of the criteria in each category. Hence the global weights are generated for all parameters. Then, the three options for each commodity (primary product, by-product, waste) are evaluated for suitability to the respective metal concerning every parameter. Finally, options preferences (in %) are calculated for each commodity.

Table 8 discusses the global weights calculated for all potential products.

The evaluation of gold indicates that the economic parameters are considered with the highest priority, and the market and sociopolitical factors follow in percentages. The environmental criteria are relatively less important, and the technological parameters are ranked last. The price and grade of gold in the deposit are the most significant factors, followed by its criticality and strategic importance. The toxic compounds used in the processing (cyanide) also seem to have a remarkable impact on the evaluation.

These results seem logical since the ore grade of gold in Chovdar (2.39 gr/tonne) can be characterized as high for an open-pit mining operation and the average grade for an underground mining operation. The criticality of gold is prioritized to be high enough; its value as a metal makes it always a critical commodity of great strategic importance. It is interesting to note that the technological parameters are low. This can be explained by the fact that the recovery rate is already high enough, and the metallurgical tests and evaluations for the extended processing plant show excellent results.

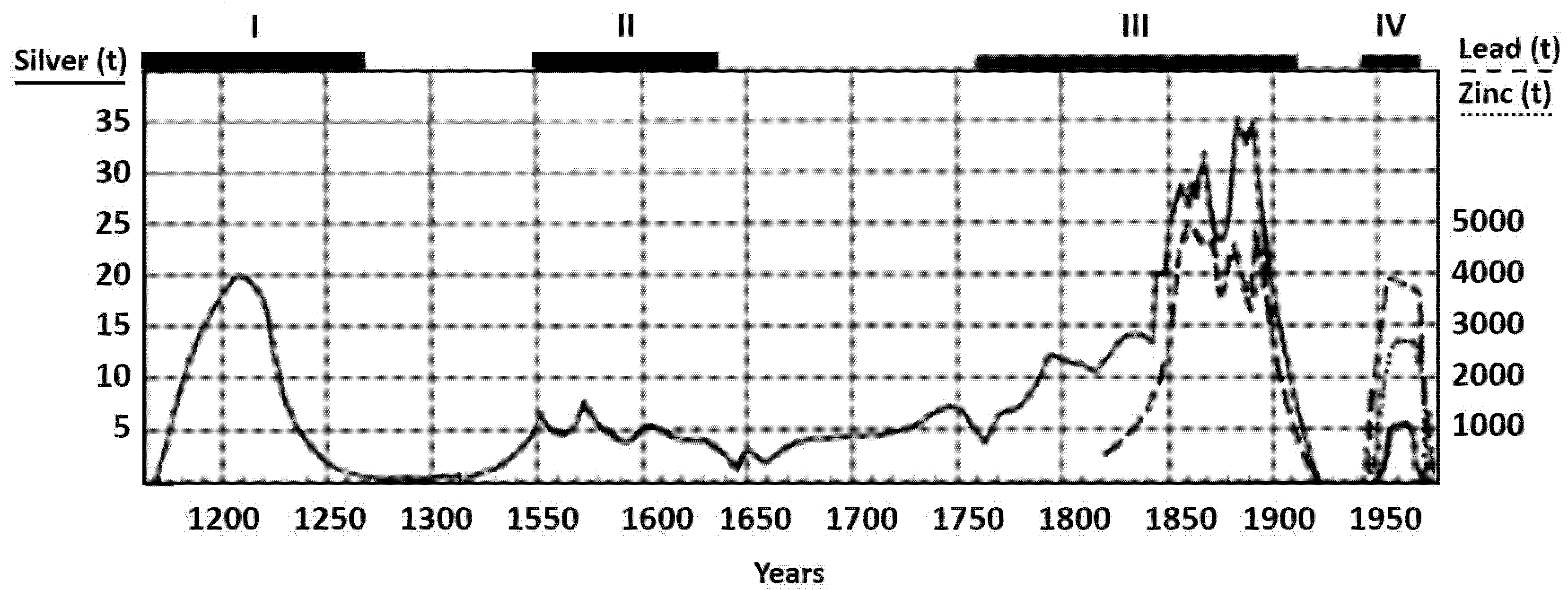

Data and information derived from the evaluation of gold were also considered for the assessment of silver. This kind of information includes the facts that gold will most probably remain the main product at Chovdar, all costs will be covered by gold production, and silver will continue being shipped together with gold for refinement to Switzerland. Like gold, silver’s price and ore grade are essential parameters to its criticality. The latter is higher than that of gold because of silver’s by-production dependence on gold. Nevertheless, the grade is high enough to make silver production efficient and is combined with the commodity’s importance. Silver may not be as powerful as gold, but it is also considered a strategic metal. The existence of toxic compounds during processing is also of notable priority.

Copper was the next metal to be evaluated as a potential product at Chovdar, considering the evaluation results of both gold and silver. Importance is given to the increased concentration of copper in the sulfide phase of the deposit and the fact that there is a high copper zone present in this phase.

In the oxidized phase of production, copper has been characterized as waste, rather than as a product. Hence, the economic parameters seem to be the most important, and the ore grade of the commodity is the most significant parameter by far. The price of copper will also play a role in the evaluation, whereas the extraction costs are mainly covered by the main product (gold) and are of less importance. The technological factors, and particularly the recovery rate, also have a significant weight. This makes sense since the higher the recovery of copper, the greater its chances of creating profit for the company.

Judging by the weights attributed to the parameters, it is evident that copper will be treated differently than gold and silver. Copper has low criticality and high availability as a metal worldwide, and its economic balance is the determining factor when deciding its production. The increase in concentration cannot go unnoticed, and is highlighted in the prioritization of the parameters.

The next metal, the concentration of which is increasing in the sulfide phase of the deposit, is iron. In this case, the ore grade elevation may not be as high as it is for copper, and there no high iron zone is identified. Nonetheless, the concentration is also high enough to attract interest and proceed with evaluating this commodity. The same procedure is followed for assessing iron, considering the boundary conditions at Chovdar, the market prices for iron, its importance and availability as a metal, and the potential environmental concerns that its production might raise.

Similarly, the most critical parameters for iron, as for copper, are the economic criteria, followed by the market criteria. The ore grade is the most significant factor, and the price of iron is ranked second. However, the third most crucial parameter is the impact that iron production is expected to have in the local markets.

This result is due to the wide variety and diversity of applications that iron has in daily products and services in local societies. The metallurgical process of iron is well known and can be applied near a mine site; thus, the produced iron could be channeled to the local markets, thus reducing the logistic costs. Nevertheless, the price and ore grade of iron combined with the additional extraction costs will be the main determining factors for its classification as a by-product or waste in this project.

Aluminum was assessed next. The resemblance to the properties of iron both as a commodity in general and as a potential product at Chovdar is remarkable, and so are the evaluation results. The increase in concentration for aluminum seems to be greater than that for iron, yet not significantly different.

Once again, the economic parameters seem to play a significant role when deciding whether to produce aluminum. The market conditions follow in percentage terms, and the remaining three categories (technological, environmental, and socio-political parameters) are of equally lower importance in this case. Following the same pattern, the essential parameters are the ore grade of aluminum and its price in global markets. The locality is also evaluated as a crucial parameter, followed by the additional extraction costs and the recovery rate of aluminum.

Generally, aluminum has a much higher price as a commodity than iron. In addition, the ore grade of aluminum at Chovdar is also higher than that of iron. Consequently, even though the evaluation parameters have the same weights, the evaluation of the options with respect to the parameters led to slightly different preference results.

Mercury was the last of the commodities to be evaluated in this case study using the multi-criteria decision tool. Unlike the previous metals discussed, mercury has a different treatment and production evaluation. The same group of parameters is implemented in the tool, to be evaluated concerning the properties of mercury in the Chovdar mining project, in addition to the general conditions that govern the treatment of this metal globally.

Contrary to the evaluation results in the previous paragraphs, the most important parameters, in this case, are the environmental parameters, followed by the sociopolitical parameters. The technological factors have an observable percentage. More specifically, the most significant parameters overall are the presence of toxic compounds, the production of waste, the legislation status that governs the production and treatment of mercury and, of course, the social acceptance of having it as a product or treating it as a waste.

These results are different from those discussed above regarding the other commodities. For example, the price of mercury and its marketability are not as important. The recovery rate is an essential factor, but not in terms of yielding more profit. In this scenario, the higher the recovery of mercury from the ore and tailings, the less the risk of environmental contamination. As already discussed in this work, mercury must be produced as a by-product to preserve the surrounding ecosystem, follow the rules, and meet the social requirements. In addition, when extracted and shipped off-site, the costs needed to treat mercury as waste in the tailings are eliminated, and thus can be considered an indirect profit.

6.3. Comparative Analysis of the Results

Overall, six commodities were evaluated individually but under the same circumstances and considering the same conditions of the Chovdar project. The results are rational and detailed enough, given the difficulties of deriving data when no actual economic assessments have been conducted to date for the second phase of exploitation at Chovdar.

Gold remains the leading product of the mine (

Table 9), since no other commodity is classified as a co-product or will cover all the extraction costs. The transition to underground mining operations will increase the operating costs; however, gold production is expected to yield a significant profit for the company. Its strategic importance is essential not only for the relatively remote area, but also for the state of Azerbaijan. Hence, the mining project enjoys the government’s trust and the society’s acceptance.

Silver will be produced again as a by-product and significantly contribute to the project’s revenues. Most likely, copper will be the second by-product after silver. Although the by-product option has the highest percentage, it does not have an absolute majority, indicating that a more detailed and careful evaluation must be made to decide whether copper can be feasibly extracted. Contrary to the results for copper, iron is preferably classified as waste. Nevertheless, a more detailed economic analysis is also needed for this commodity and market analysis should be undertaken to investigate the product sales prospects in the local markets. Aluminum is also not classified as a by-product or waste, although there is a slightly higher preference for it being produced as a by-product than iron. Accordingly, detailed economic and market analyses also need to be conducted for this potential product. Finally, mercury is treated differently, and the respective results justify its classification as a by-product, with a far more preferable 52%.

This last result justifies the scope for developing this production decision tool and the attempt to determine all the potential parameters, in addition to the economic parameters, that can affect the production of a commodity. The percentages of 4.9% in the preferences for gold as waste or 8.4% for mercury as a co-product are worth mentioning. These can be attributed to two reasons: the first is the using of all parameters, even the less relevant ones, in this evaluation. In these assessments, the options of co-product, by-product, or waste were equally important. Although these parameters have very low weights, their overall sum yields a higher-than-expected percentage for the option. The second reason is the lack of accurate data and information that would allow decision makers to make more precise cross-comparisons.

Compared to the Excel workbook outcomes, the results derived from the computational tool were very similar, if not identical. The insignificant differences may be attributed to the number of decimal places applied in the calculations. Nevertheless, the similarity of results justifies the efficiency of the computational tool. Python has gained traction over recent years and the quote that “Python is the new Excel” is becoming more frequent.