An Integrated Fuzzy Convolutional Neural Network Model for Stock Price Prediction †

Abstract

1. Introduction

2. Materials and Methods

2.1. Deep Learning

2.2. Principles and Concepts of Fuzzy Logic

2.3. Fuzzy Time Series

2.4. Evaluation

3. Results

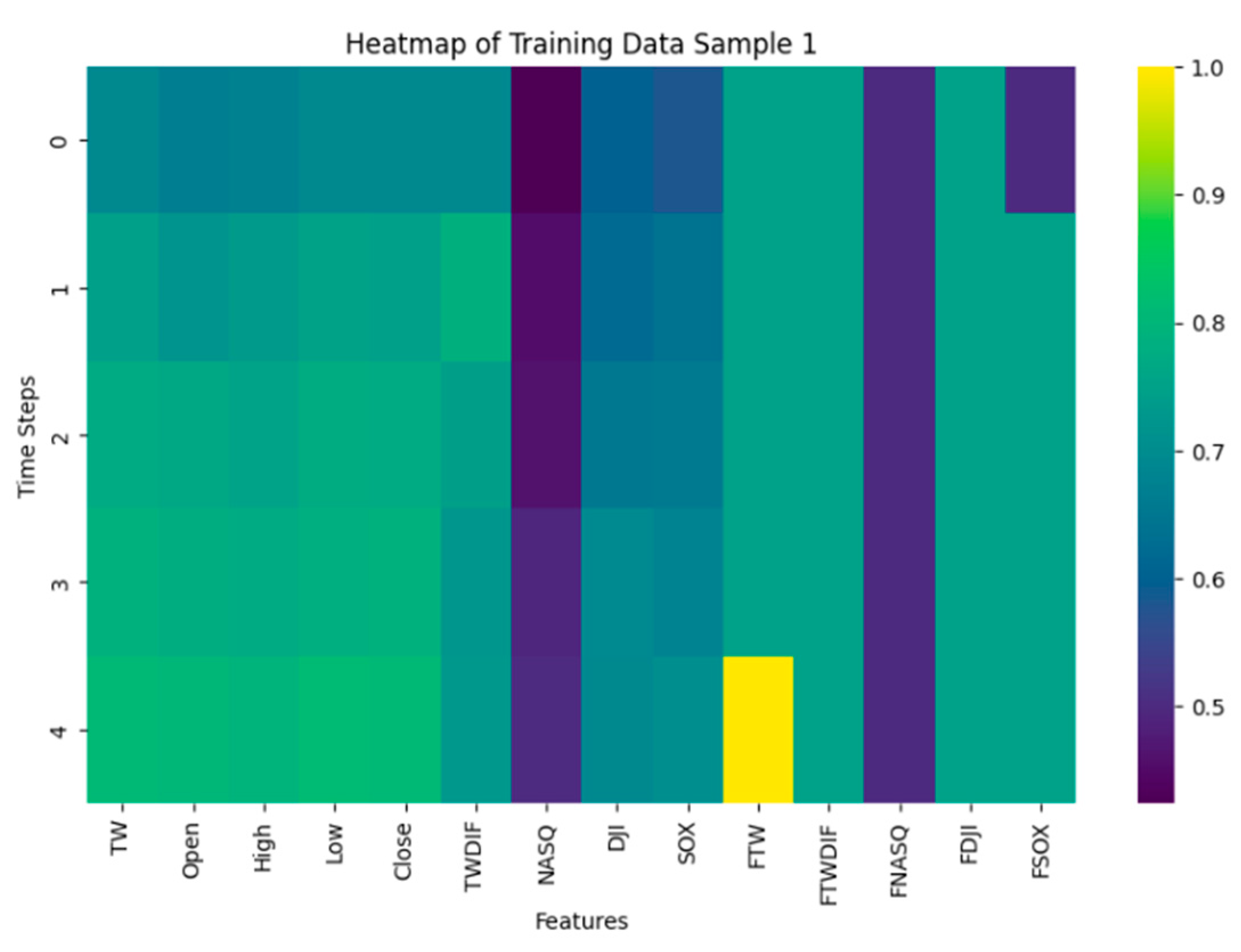

FCNN Model

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wisner, J.D.; Leong, G.D.; Tan, K.C. Principles of Supply Chain Management—A Balanced Approach; South-Western Cengage Learning: Boston, MA, USA, 2005. [Google Scholar]

- Wang, K.L.; Chen, M.L. The Dynamic Linkages of U.S. and Taiwan Stock Market Indices in the Pre- and Post-Asian Financial Crises Periods. Taiwan Econ. Rev. 2003, 31, 191–252. [Google Scholar]

- Gençay, R. Non-linear prediction of security returns with moving average rules. J. Forecast. 1996, 15, 165–174. [Google Scholar] [CrossRef]

- Song, Q.; Chissom, B.S. Fuzzy time series and its models. Fuzzy Sets Syst. 1993, 54, 269–277. [Google Scholar] [CrossRef]

- Song, Q.; Chissom, B.S. Forecasting enrollments with fuzzy time series—Part I. Fuzzy Sets Syst. 1993, 54, 1–9. [Google Scholar] [CrossRef]

- Song, Q.; Chissom, B.S. Forecasting enrollments with fuzzy time series—Part II. Fuzzy Sets Syst. 1994, 62, 1–8. [Google Scholar] [CrossRef]

- Chen, S.-M. Forecasting enrollments based on fuzzy time series. Fuzzy Sets Syst. 1996, 81, 311–319. [Google Scholar] [CrossRef]

- Chen, S.-M. Forecasting enrollments based on high-order fuzzy time series. Cybern. Syst. Int. J. 2002, 33, 1–16. [Google Scholar] [CrossRef]

- Aladag, C.H.; Basaran, M.A.; Egrioglu, E.; Yolcu, U.; Uslu, V.R. Forecasting in high order fuzzy times series by using neural networks to define fuzzy relations. Expert Syst. Appl. 2009, 36, 4228–4231. [Google Scholar] [CrossRef]

- Aladag, C.H.; Yolcu, U.; Egrioglu, E. A high order fuzzy time series forecasting model based on adaptive expectation and artificial neural networks. Math. Comput. Simul. 2010, 81, 875–882. [Google Scholar] [CrossRef]

- Cheng, C.H.; Cheng, G.W.; Wang, J.W. Multi-attribute fuzzy time series method based on fuzzy clustering. Expert Syst. Appl. 2007, 34, 1235–1242. [Google Scholar] [CrossRef]

- Cheng, C.H.; Chen, T.L.; Teoh, H.J.; Chiang, C.H. Fuzzy time-series based on adaptive expectation model for TAIEX forecasting. Expert Syst. Appl. 2008, 34, 1126–1132. [Google Scholar] [CrossRef]

- Bose, M.; Mali, K. Designing fuzzy time series forecasting models: A survey. Int. J. Approx. Reason. 2019, 111, 78–99. [Google Scholar] [CrossRef]

- Chung, J.; Gulcehre, C.; Cho, K.; Bengio, Y. Gated feedback recurrent neural networks. In Proceedings of the 32nd International Conference on International Conference on Machine Learning, Lille, France, 6 July 2015; pp. 2067–2075. [Google Scholar]

- Tran, N.; Nguyen, T.; Nguyen, B.M.; Nguyen, G. A Multivariate Fuzzy Time Series Resource Forecast Model for Clouds using LSTM and Data Correlation Analysis. Procedia Comput. Sci. 2018, 126, 636–645. [Google Scholar]

- Kocak, C.; Egrioglu, E.; Bas, E. A new deep intuitionistic fuzzy time series forecasting method based on long short-term memory. J. Supercomput. 2021, 77, 6178–6196. [Google Scholar] [CrossRef]

- Kimoto, T.; Asakawa, K.; Yoda, M.; Takeoka, M. Stock market prediction system with modular neural networks. In Proceedings of the 1990 IJCNN International Joint Conference on Neural Networks, San Diego, CA, USA, 17–21 June 1990; p. 137535. [Google Scholar]

- Lin, T.K.; Lin, Y.T.; Kuo, K.W. Application of Convolution Neural Network and Neural Network Entropy Algorithm for Structural Health Monitoring. Struct. Eng. 2022, 37, 64–85. [Google Scholar]

- Zadeh, L.A. Fuzzy sets. Inf. Control. 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Chen, T.L.; Cheng, C.H.; Teoh, H.J. Fuzzy time-series based on Fibonacci sequence for stock price forecasting. Phys. A 2007, 380, 377–390. [Google Scholar] [CrossRef]

| Experimental Groups | Feature Indicators |

|---|---|

| 1 | Adjusted Closing Price of the Taiwan Weighted Index, Differences, NASDAQ Index, DJI Index, and SOX Index. |

| 2 | Adjusted Closing Price of the Taiwan Weighted Index, Differences, NASDAQ Index, DJI Index, SOX Index + Fuzzified Indicators. |

| 3 | Adjusted Closing Price of the Taiwan Weighted Index, Opening Price, Daily High Price, Daily Low Price, Closing Price, Differences, NASDAQ Index, DJI Index, SOX Index |

| 4 | Adjusted Closing Price of the Taiwan Weighted Index, Opening Price, Daily High Price, Daily Low Price, Closing Price, Differences, NASDAQ Index, DJI Index, SOX Index + Fuzzified Indicators. |

| Experimental Groups (Training Data) | RMSE | MSE | MAE | MAPE |

|---|---|---|---|---|

| 1 | 184.57 | 34,065.49 | 148.09 | 1.37 |

| 2 | 114.30 | 13,064.77 | 71.91 | 0.68 |

| 3 | 210.90 | 44,478.79 | 176.97 | 1.63 |

| 4 | 212.36 | 45,096.97 | 181.75 | 1.68 |

| Experimental Groups (Test Data) | RMSE | MSE | MAE | MAPE |

|---|---|---|---|---|

| 1 | 654.34 | 428,164.45 | 644.63 | 6.61 |

| 2 | 624.48 | 389,969.79 | 612.10 | 6.28 |

| 3 | 486.26 | 236,452.19 | 478.98 | 4.91 |

| 4 | 224.54 | 50,418.47 | 194.24 | 1.99 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.-W.; Chen, J.-S. An Integrated Fuzzy Convolutional Neural Network Model for Stock Price Prediction. Eng. Proc. 2025, 98, 3. https://doi.org/10.3390/engproc2025098003

Wang J-W, Chen J-S. An Integrated Fuzzy Convolutional Neural Network Model for Stock Price Prediction. Engineering Proceedings. 2025; 98(1):3. https://doi.org/10.3390/engproc2025098003

Chicago/Turabian StyleWang, Jia-Wen, and Jr-Shian Chen. 2025. "An Integrated Fuzzy Convolutional Neural Network Model for Stock Price Prediction" Engineering Proceedings 98, no. 1: 3. https://doi.org/10.3390/engproc2025098003

APA StyleWang, J.-W., & Chen, J.-S. (2025). An Integrated Fuzzy Convolutional Neural Network Model for Stock Price Prediction. Engineering Proceedings, 98(1), 3. https://doi.org/10.3390/engproc2025098003