Abstract

Digital transformation is crucial for businesses to thrive in today’s rapidly evolving marketplace. It is a strategic choice that enables organizations to improve customer service, strengthen supplier relationships, and boost sales and business growth, ultimately enhancing their competitive stance. The Internet of Things (IoT) has become a transformative force across various domains, leveraging interconnected devices and sensors to gather and analyse data, thus enhancing decision making, efficiency, and innovation. This paper analyses the strategic competition between two 3PL firms integrating IoT technologies. Based on a game-theoretic model, the study uses Monte Carlo simulation and K-means clustering to identify distinct strategic groups and optimal adoption ranges. The findings highlight risks of over- or under-investments as well as asymmetric outcomes. Also, a set of recommendations and managerial insights are provided for better decision making in a tech-competitive setting.

1. Introduction

Supply chains remain one of the most challenging to manage considering their complex structure. In the era of globalisation, rapid economic expansions, and heightened customer expectations, there is a pressing need to adopt a fresh perspective on supply chain management by embracing the shift to digitalised sustainable operations [1]. Key supply chain operations are rapidly embracing digital transformation, reshaping the concept of supply chain management [2]. Thus, digital transformation has introduced the innovative concept of digital supply chain management, marking a paradigm shift towards interconnected, intelligent systems that streamline operations and enhance decision making.

Considering the increasing competitiveness and continuous demands of customers’ needs, 3PL companies were obliged to incorporate a wider range of services and specializations, such as cold chain transportation, smart warehousing, as well as the need to focus on developing their IT skills and widening their expertise and providing sustainable activities and strategies [1]. Thus, shifting to a smart-driven 3PL provider has become a must to survive in this digital competitive market.

The adoption of IoT technologies can yield multiple potential benefits in various areas of applications. The main benefit of implementing IoT is their tracking and traceability abilities. These solutions offer more transparency and visibility throughout the value chain as well as offer real-time information and thus better decision-making processes [3]. These latter capabilities have become essential in an increasingly competitive and service-oriented market. However, the decision to integrate the IoT technologies and at what rate remains a challenge and a strategic dilemma for 3PL providers, considering the numerous hurdles that come with their integration, especially the substantial operational and investment costs.

The strategic use of IoT in 3PL services goes beyond their technical capabilities and extends into being a pivotal component in the firm’s competitive position in the market. The firms need to decide whether to adopt IoT but also at what rate while considering the integration costs as well as various market-related parameters. In a previous study, a game-theoretic model was developed to analyse the implication of the integration of IoT technology on the competition and operational strategies of two 3PL firms within a duopolistic market [1].

This paper extends that work by adopting a simulation-based approach to investigate the strategic interactions between the firms by using Monte Carlo simulation to explore various parameter combinations and firm strategies. Furthermore, we aim to identify strategic clusters and assess the impact of IoT costs, market sensitivity, and other parameters on the profitability of the firms.

Our main contributions are to provide a simulation-driven analysis of strategic competitions in an IoT-enabled 3PL market, as well as insights on how several parameters influence their strategic decision-making process.

2. Literature Review and Background

Digital transformation is reshaping the logistics sector by integrating advanced digital technologies and reflecting broader economic trends. This shift demands supply chain managers transform their strategies from cost-cutting to embracing agility and connectivity through new processes and advanced technologies [4]. IoT is extensively utilised in supply chain operations due to its significant capabilities, revolutionizing how supply chains function and delivering substantial improvements in efficiency and visibility [3]. In the 3PL sector, IoT adoption can be seen as a competitive lever enabling enhanced service across various functions, from transportation to warehouse management. However, its implementation remains uneven considering the high investment costs and ongoing operational expenses as well as uncertain return on investments. These financial and strategic factors make IoT a complex decision rather than a simple technological upgrade.

Competition modelling within the game theory framework offers a powerful lens through which economists and strategists can analyse and predict the behaviour of firms in various market structures. Various models have been developed to describe and analyse different types of competition and market structures [5]. Game theory, a branch of applied mathematics, systematically examines decision-making scenarios involving two or more decision-makers. It is particularly favoured in supply chain optimization because the structure of supply chains naturally involves members who act as intelligent players [6]. Simulation-based optimisation is a valuable method used in supply chain management, supporting enhanced strategic decision making and a better understanding of the supply chain dynamics [7]. Monte Carlo simulation, in particular, is a mathematical tool for testing and investigating a broad range of scenarios. It is widely used in the supply chain optimisation scope [8]. Additionally, unsupervised learning, such as K-means clustering, has been increasingly used in operations and strategic management. This method enables enhanced insights by providing structure to complex simulation outputs, thus identifying behavioural patterns, strategic groups, etc.

While existing literature offers various tools to analyse the 3PL competition, few studies have integrated game theory, simulation, and clustering to explore IoT integration strategies. This paper addresses this gap by combining a game-theoretic foundation with data-driven methods to analyse the influence of related parameters on the firm’s strategic decisions and offers insights on strategic clustering in a competitive market.

3. Materials and Methods

3.1. Summary of the Game-Theoretic Model

The game-theoretic model assessed the influence of the integration of IoT technologies in the 3PL services on establishing competitive advantage [1]. Two 3PL firms compete in terms of service level and IoT adoption rate . The competition is modelled as a duopoly game, where each firm decides on its level of service and technology adoption to maximise profit.

The profit function depends on various market- and IoT-related parameters, namely IoT investment and operational costs, market sensitivity and government incentives. The government provides incentives to encourage IoT adoption, while firms face fixed and variable costs related to IoT investment and use. Table 1 summarises the main parameters and their respective symbols.

Table 1.

Description of model variables.

Each firm’s profit is given by:

where:

- Marginal cost function of a firm

- Government incentive function

The optimal equilibrium solution of was then calculated for both firms as presented in [1].

3.2. Monte Carlo Simulation

In the aim to further validate the model and derive more in-depth insights on the firms’ strategic decisions and the influence of the market related parameters, a Monte Carlo simulation approach was conducted. The objective was to explore a broad range of parameter combinations and competitive scenarios between competing 3PL firms by generating multiple combinations of parameter values and computing the corresponding profit outcomes.

The IoT integration rates () were randomly sampled between 0 and 1 to represent different adoption intensities. The summary of the full range of parameters is presented in Table 2.

Table 2.

Range of parameters.

The Monte Carlo simulation included 1000 runs, where key parameters such as fixed IoT costs (,), market sensitivity () and government incentives () were varied across predefined ranges informed by industry and literature. Each simulation run reflects a specific configuration of IoT integration rates, cost structures, and market conditions. Repeating this process across hundreds of scenarios allowed us to approximate the distribution of possible outcomes and assess the variability and robustness of firm strategies. This approach supports a deeper understanding of how strategic decisions perform under uncertainty and helps identify patterns that remain stable across different competitive environments.

3.3. K-Means Clustering

After simulating various scenarios within the 3PL duopoly competition, K-means clustering was used to analyse the results and explore the strategic dynamics of the market. The clustering has helped identify strategic groups and categories, revealing strategic decisions and patterns under varying market conditions based on the IoT integration rate of each firm and their profitability. This method will allow us to interpret how different combinations of adoption strategies influence the profitability.

4. Results and Strategic Insights

Cluster Interpretation

We selected some key plots to analyse the strategic interactions between the competing firms. These plots aim to capture the relationship between firms’ decisions, profitability, cost structure, and IoT adoption rate.

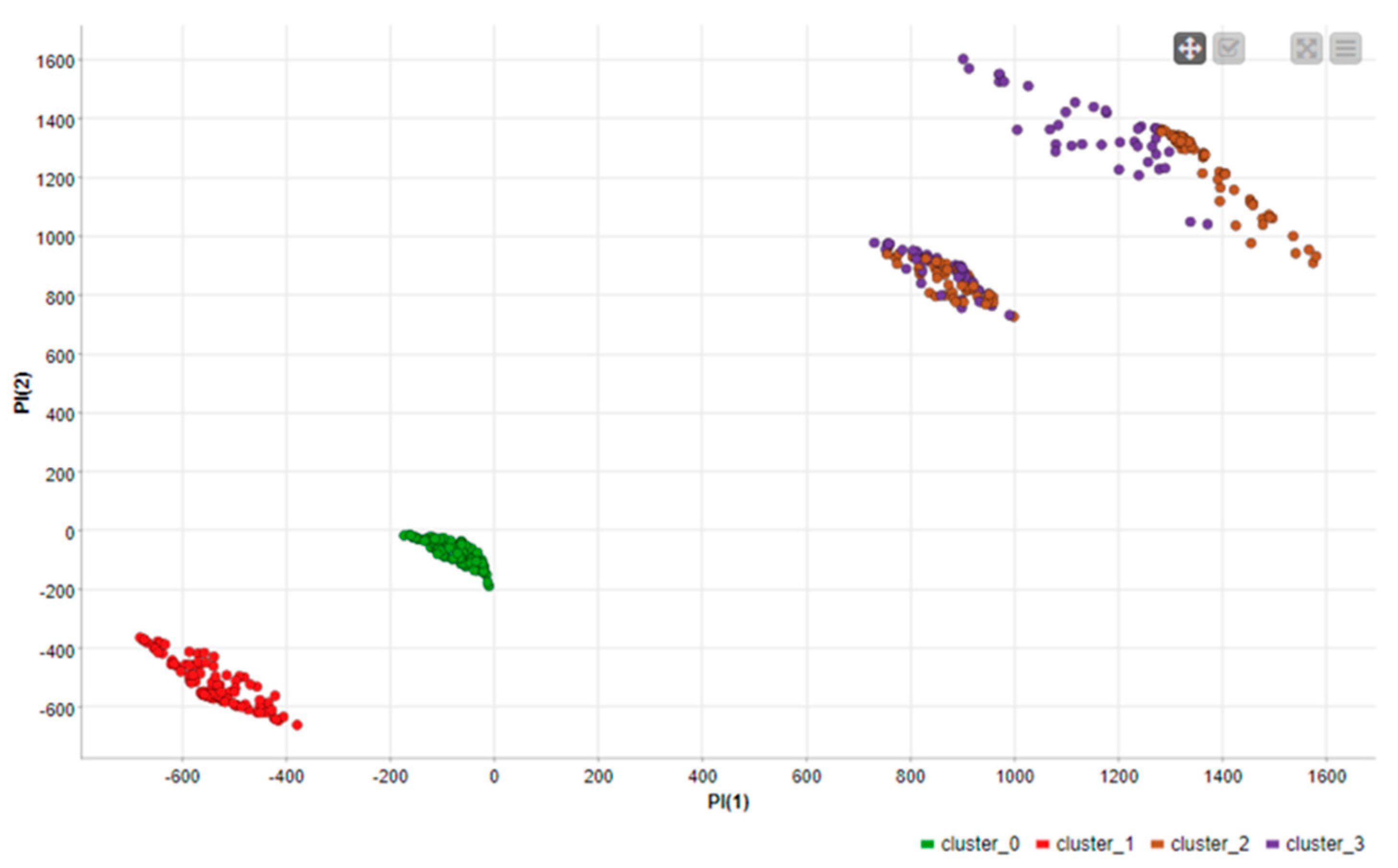

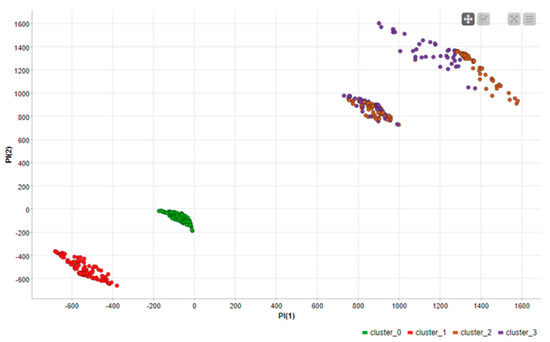

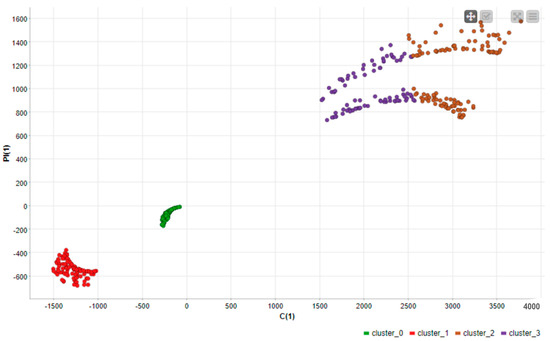

- Plot 1: Profit (Firm 1 vs. Firm 2)

The first plot in Figure 1 explores the profit of firm 1 against its competing form to identify possible clusters on the competitive landscape.

Figure 1.

Clustering of profit 1 vs. profit 2.

The profit analysis highlights four distinct strategic scenarios, each reflecting a different market dynamic.

- Cluster 1 (Red): loss for both firms, suggesting unfavourable conditions such as high costs or low demand.

- Cluster 0 (Green): firms are near break-even, suggesting balanced but low profitability strategies.

- Cluster 2 (Brown): High profitability for both firms. A win-win scenario suggesting well-aligned IoT adoption with market conditions.

- Cluster 3 (Purple): Asymmetric profitability suggesting a competitive edge or strategic imbalance.

Firms in clusters 0 and 1 need to optimise their costs or aim for a better differentiation strategy. Whereas clusters 2 and 3 need to consolidate their advantages and adjust their strategy ahead of competition.

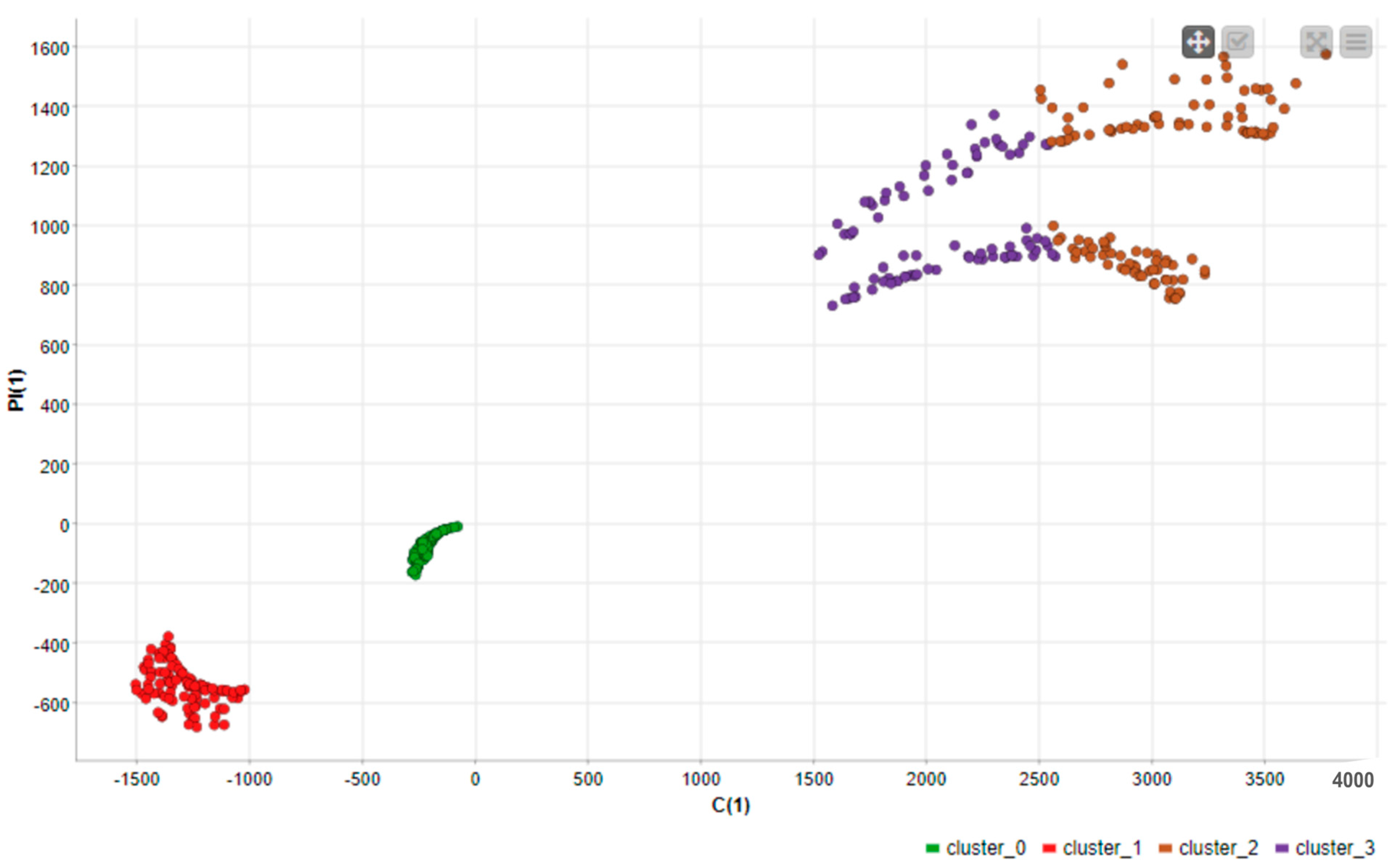

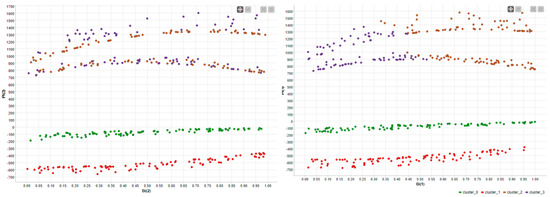

- Plot 2: Profit vs. IoT Cost

The plot in Figure 2 examines the relationship between the profit and its IoT-related cost in the aim to evaluate the effectiveness of different investment levels.

Figure 2.

Clustering of profit 1 vs. cost 1.

The clusters showcase different strategic scenarios based on the investment level and profitability.

- Cluster 1 (Red): Low costs and low profitability. Under-investment leads to weak market positioning.

- Cluster 0 (Green): Firms remain conservative in cost but are near break-even, suggesting stability without gain.

- Cluster 2 (Brown): Higher cost levels but also high profitability. This suggests a smart and well-managed investment strategy.

- Cluster 3 (Purple): High costs but with asymmetric and variable profitability, suggesting not all heavy investment strategies pay off or succeed equally.

We can observe a positive trend where higher costs lead to higher profits, but only with well-managed investment strategies (difference between clusters 2 and 3).

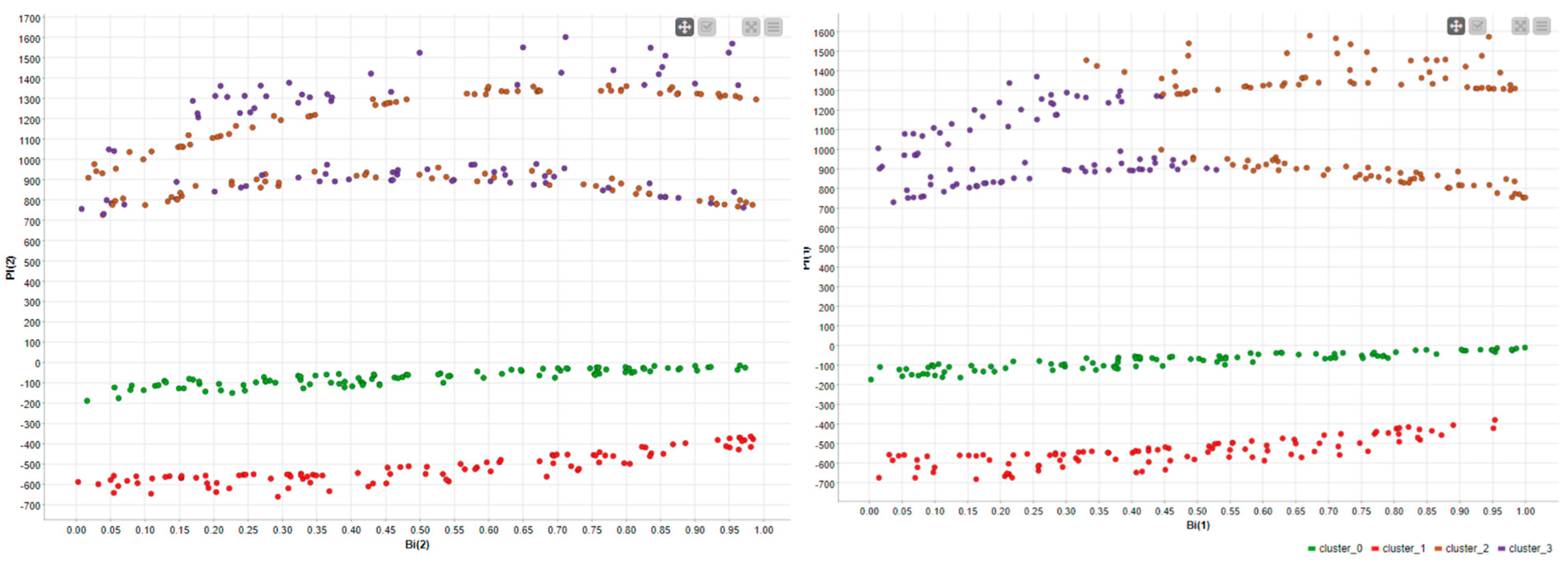

- Plot 3: Plot Profit vs. IoT adoption rate

Figure 3 examines the influence of various IoT integration rates on the profitability of the firms.

Figure 3.

Clustering of profit vs. IoT integration rate.

The plots reveal how the profitability increases with the adoption rate until a certain point where it stabilises or declines. This indicates the existence of an optimal range of IoT integration rate.

- Cluster 1 (Red): Negative profits even with higher IoT rates. This suggests an over investment scenario.

- Cluster 0 (Green): Regardless of the adoption level, profits remain low or near break-even. This indicates a limited sensitivity to IoT integration or high costs.

- Cluster 2 (Brown): Firms in this cluster achieve consistently high profitability within moderate to high IoT adoption rates.

- Cluster 3 (Purple): This cluster shows asymmetric outcomes where some firms benefit from certain rates while others do not. This reflects the influence of varying external parameters.

The above clustering has distinguished competitive patterns, underperforming traditionalists, over investors, balanced players, and optimal adopters.

5. Strategic and Managerial Implications

The simulation and clustering have highlighted several strategic insights and provided a comprehensive view of how different strategic choices and market conditions influence the firms’ profitability. Firstly, IoT investment alone does not guarantee higher profits. The strategic success depends on how well the investment aligns with other market conditions. Thus, low-cost strategies may avoid major losses but will fail to capitalise on competitive opportunities. These risk-averse strategies could be useful for the survival of firms in certain conditions; however, they might not lead to their growth.

The plots indicate that profitability is sensitive to costs and investment structures, which implies the existence of an optimal investment range that firms should aim to identify. Furthermore, an optimal IoT adoption zone was revealed, suggesting that firms should target an intermediate level of IoT integration; over-integration could lead to diminishing returns, while under-adoption would lead to lost opportunities. Hence, the adoption strategy should be cost-effective, but also calibrate it based on internal capabilities and external conditions and support, such as demand sensitivity and incentive support. For example, 3PL firms operating in asset-light environments with cost sensitivity should avoid high strategies unless they receive strong policy support. Conversely, firms in high-margin segments may benefit from partial or phased IoT integration. Static adoption strategies could turn out to be inefficient as conditions evolve. Moreover, situations where one firm achieves higher profitability than its competitor despite operating within the same market environment suggest the presence of strategic imbalances. This could be explained by the possibility of leveraging the first-mover advantage in IoT integration or a more efficient and strategic implementation of the technology in certain services.

Third-party logistics (3PL) firms face varying levels of readiness when it comes to IoT adoption due to differences in size, capital structure, digital maturity, and customer expectations. Firms with low IoT integration readiness, identified within the green cluster, typically focus on cost-efficiency and core functions with limited digital capabilities. These firms match the traditional 3PL providers’ conservative survivors. In this case, adopting modular IoT solutions gradually while leveraging incentives is advised. While digitally mature firms that are fully prepared or already integrated with IoT, identified in the brown cluster, should shift towards optimizing cost-performance ratios and explore advanced IoT-enabled services. These firms may act as innovation leaders in the sector.

6. Conclusions and Future Work

This paper analysed the strategic interactions between two competing firms by extending a previously developed game-theoretic model using Monte Carlo simulation and K-means clustering. The findings highlighted four distinct strategic groups, ranging from loss-making firms to profitable tech adopters. One of the key insights revealed the existence of an optimal range for IoT integration, which could lead to a strategic convergence where both firms converge to the profitable adoption level to stay competitive. Also, profitability of the firms is revealed to be IoT-related cost sensitive as well as a firm’s strategic response to competition. The asymmetric findings suggest risks of poor timing, execution quality, cost management, or inefficient implementation in a competitive setting.

This clustering provides valuable segmentation into strategic profiles, enabling better targeted managerial insights and recommendations. While the findings offer valuable strategic insights, the model is built on certain simplifying assumptions, such as static competition and idealised market parameters, which, although appropriate for exploratory analysis, may limit generalizability to more dynamic or multi-firm contexts.

Future research will deepen the investigation of other market variables such as demand elasticity, government incentives, etc., with the aim of capturing more dynamic and realistic competitive behaviours. Furthermore, an ANN model is planned to improve the identification of the non-linear relationships between the parameters and the profitability across larger simulation datasets

Author Contributions

Conceptualization, K.I.; methodology, K.I.; software, K.I.; validation, H.M., and J.E.A.; writing—K.I.; writing—K.I.; supervision, H.M., and J.E.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Izikki, K.; Hlyal, M.; Ait Bassou, A.; El Alami, J. Study of the Impact of the Internet of Things Integration on Competition Among 3PLs. Int. J. Adv. Comput. Sci. Appl. (IJACSA) 2023, 14, 426–434. [Google Scholar] [CrossRef]

- Attaran, M. Digital technology enablers and their implications for supply chain management. Supply Chain. Forum: Int. J. 2020, 21, 158–172. [Google Scholar] [CrossRef]

- Haddud, A.; DeSouza, A.; Khare, A.; Lee, H. Examining potential benefits and challenges associated with the Internet of Things integration in supply chains. J. Manuf. Technol. Manag. 2017, 28, 1055–1085. [Google Scholar] [CrossRef]

- Agrawal, P.; Narain, R. Digital supply chain management: An Overview. In IOP Conference Series: Materials Science and Engineering; Institute of Physics Publishing: Bristol, UK, 2018. [Google Scholar] [CrossRef]

- Lee, Y.H.; Golinska-Dawson, P.; Wu, J.Z. Mathematical models for supply chain management. Math. Probl. Eng. 2016, 2016, 6167290. [Google Scholar] [CrossRef]

- Vasnani, N.N.; Chua, F.S.L.; Ocampo, L.A.; Pacio, L.M.B. Game theory in supply chain management: Current trends and applications. Int. J. Appl. Decis. Sci. 2019, 12, 56–97. [Google Scholar] [CrossRef]

- Jmaa, Y.B.; Jerbi, A.; Ammar, M.H. Supply Chain Optimization via Simulation and Path Planning Algorithms: An Overview. Int. J. Comput. Inf. Syst. Ind. Manag. Appl. 2025, 17, 14. [Google Scholar] [CrossRef]

- Talwariya, A.; Singh, P.; Kolhe, M. A stepwise power tariff model with game theory based on Monte-Carlo simulation and its applications for household, agricultural, commercial and industrial consumers. Int. J. Electr. Power Energy Syst. 2019, 111, 14–24. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).