Modeling Energy Transition in US Commercial Real Estate: A Diffusion Comparison with the Industrial Sector †

Abstract

1. Introduction

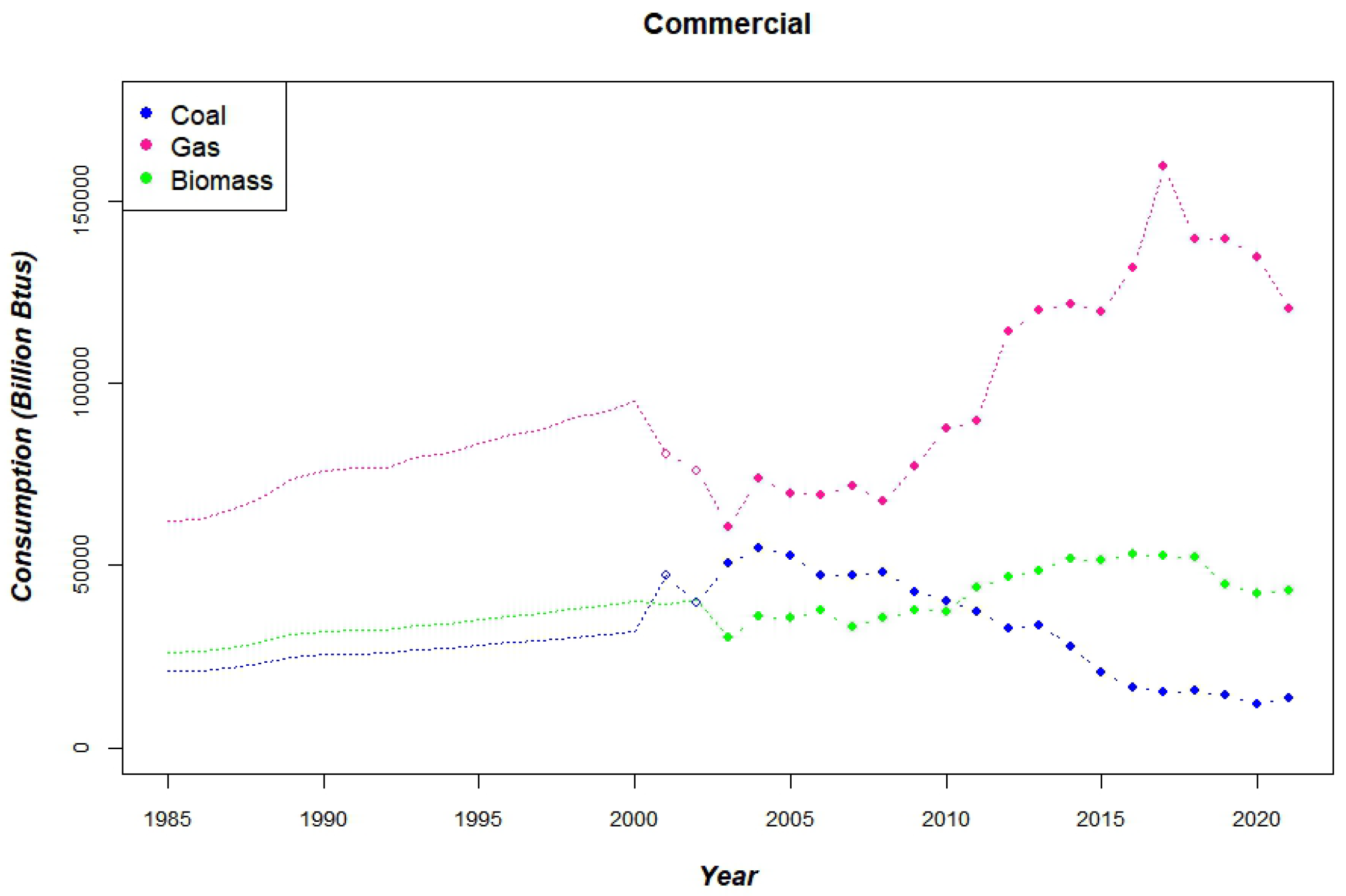

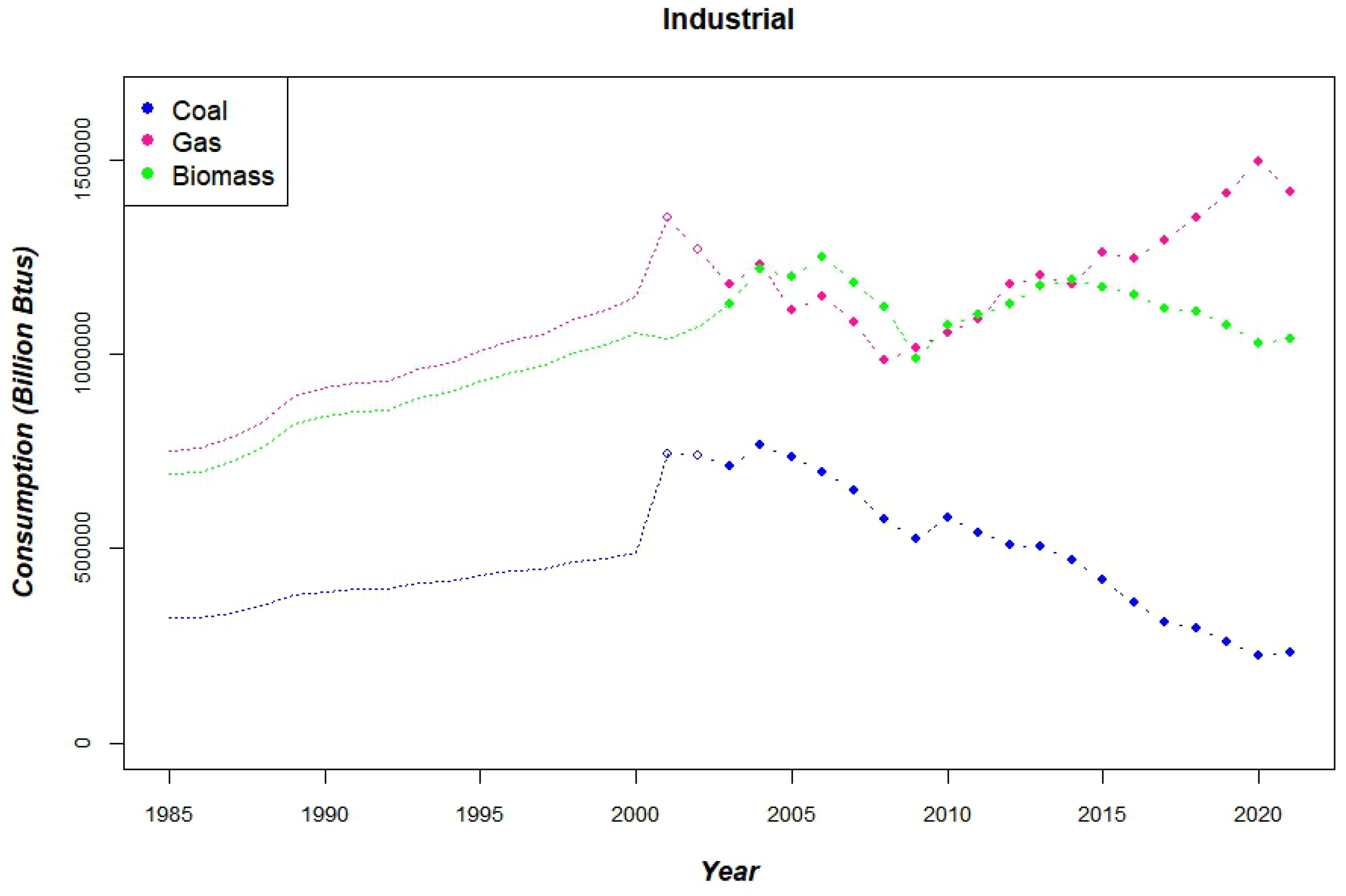

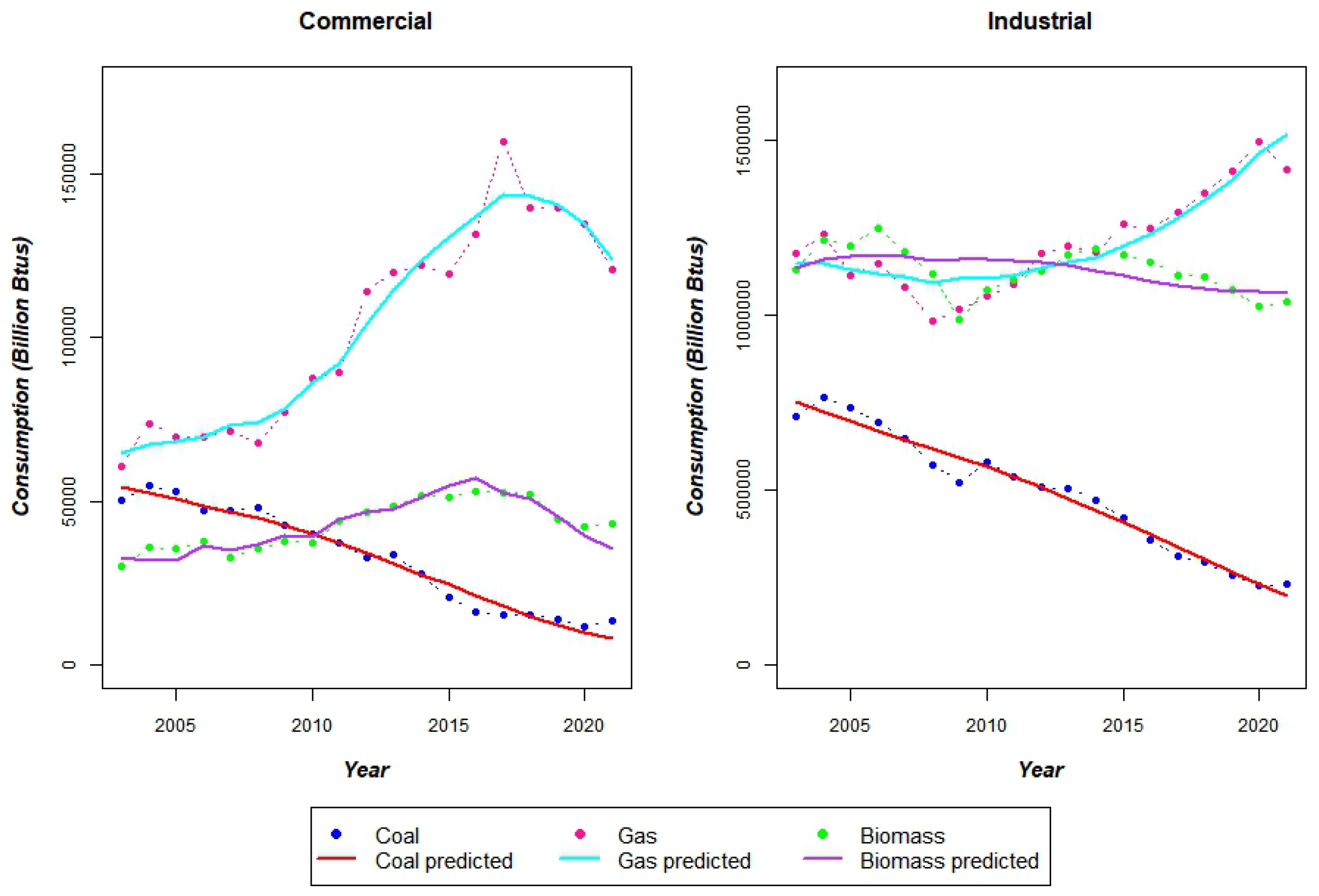

2. Materials and Methods

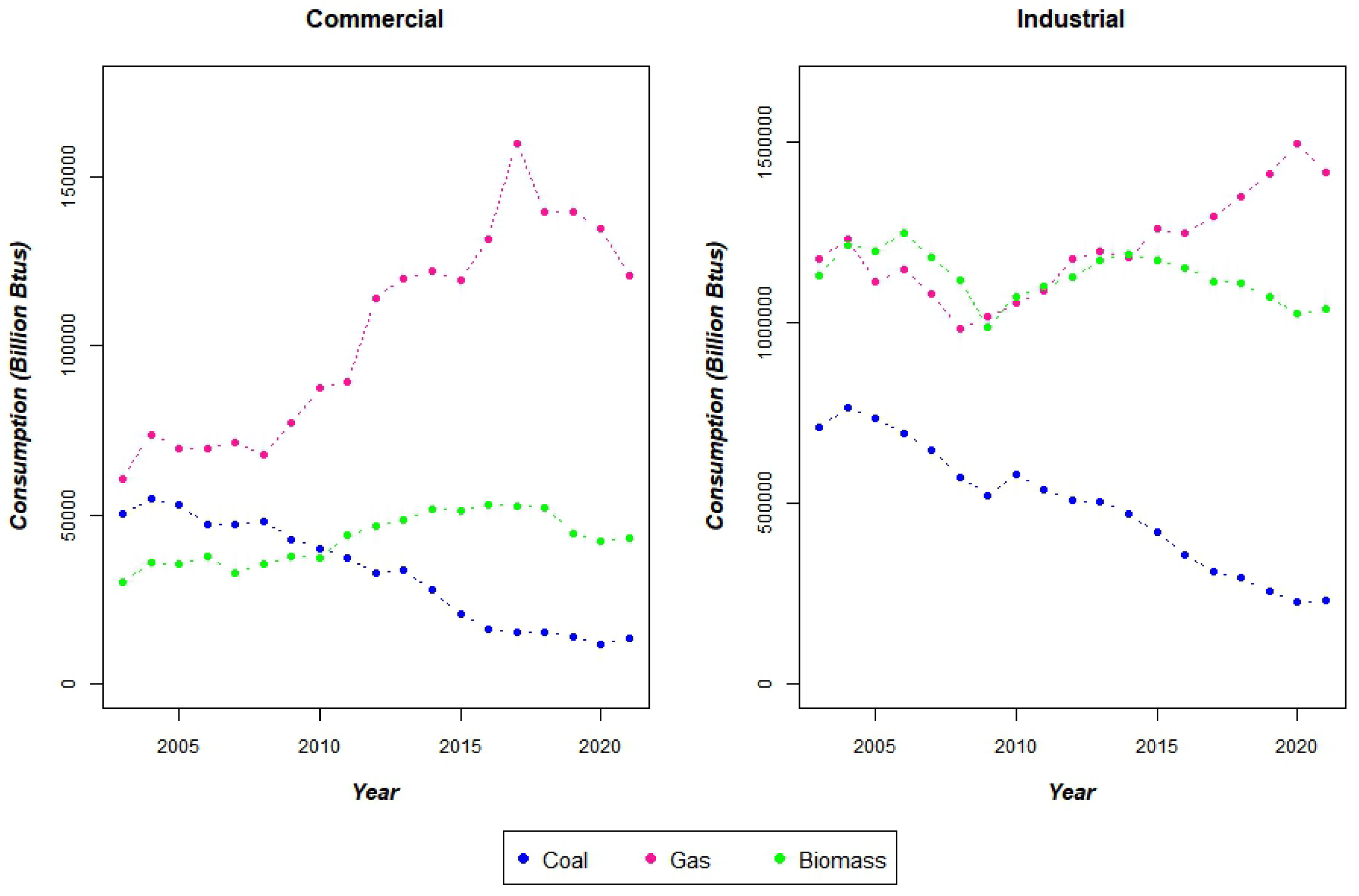

3. Model Application and Results

4. Discussion

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| Btu | British thermal unit |

| EIA | Energy Information Administration |

| GDP | Gross Domestic Product |

| ODEs | Ordinary Differential Equations |

| RET | Renewable Energy Technology |

| UCTT | Unbalanced Competition for Three Technologies |

Appendix A

- -

- Calculate the average of the observed yearly proportion:, for j = 2001, …, 2021.

- -

- Calculate the yearly approximate series:, for j = 1985, …, 2001.

Appendix B

| Estimate | Std.Error | Lower | Upper | p-Value | |

|---|---|---|---|---|---|

| 6,973,179 | 91,091 | 6,794,644 | 7,151,714 | 0.0000 | |

| 0.0156 | 0.0017 | 0.0123 | 0.0190 | 0.0000 | |

| −0.0539 | 0.0042 | −0.0622 | −0.0456 | 0.0000 | |

| −0.0132 | 0.0022 | −0.0175 | −0.0089 | 0.0000 | |

| −0.0234 | 0.0123 | −0.0476 | 0.0008 | 0.0642 | |

| 0.7508 | 0.0674 | 0.6188 | 0.8828 | 0.0000 | |

| 2.0332 | 0.4549 | 1.1416 | 2.9247 | 0.0000 | |

| 0.0748 | 0.0569 | −0.0366 | 0.1862 | 0.1950 | |

| 1.2720 | 0.1317 | 1.0139 | 1.5301 | 0.0000 | |

| 2.6007 | 0.5979 | 1.4288 | 3.7726 | 0.0001 |

| Estimate | Std.Error | Lower | Upper | p-Value | |

|---|---|---|---|---|---|

| 187,205,020 | 40,593,547 | 107,643,130 | 266,766,910 | 0.0000 | |

| 0.0075 | 0.0018 | 0.0040 | 0.0110 | 0.0001 | |

| 0.0012 | 0.0018 | −0.0024 | 0.0047 | 0.5270 | |

| 0.0034 | 0.0013 | 0.0009 | 0.0060 | 0.0107 | |

| −0.0291 | 0.0099 | −0.0485 | −0.0096 | 0.0051 | |

| 0.2801 | 0.0960 | 0.0919 | 0.4683 | 0.0054 | |

| −0.1861 | 0.0753 | −0.3336 | −0.0385 | 0.0170 | |

| 0.4354 | 0.1489 | 0.1437 | 0.7272 | 0.0052 | |

| −0.3327 | 0.1362 | −0.5996 | −0.0658 | 0.0183 |

References

- Jäger, J.; O’Riordan, T. The history of climate change science and politics. In Politics of Climate Change; Routledge: London, UK, 2019; pp. 1–31. [Google Scholar]

- Energy Transition. Available online: https://www.irena.org/energytransition (accessed on 8 February 2023).

- Alola, A.A.; Yildirim, H. The renewable energy consumption by sectors and household income growth in the United States. Int. J. Green Energy 2019, 16, 1414–1421. [Google Scholar] [CrossRef]

- Carmona, M.; Feria, J.; Golpe, A.A.; Iglesias, J. Energy consumption in the US reconsidered. Evidence across sources and economic sectors. Renew. Sustain. Energy Rev. 2017, 77, 1055–1068. [Google Scholar] [CrossRef]

- Omri, A. An international literature survey on energy-economic growth nexus: Evidence from country-specific studies. Renew. Sustain. Energy Rev. 2014, 38, 951–959. [Google Scholar] [CrossRef]

- Payne, J.E. On biomass energy consumption and real output in the US. Energy Sources Part B Econ. Plan. Policy 2011, 6, 47–52. [Google Scholar] [CrossRef]

- Kilinc-Ata, N. The evaluation of renewable energy policies across EU countries and US states: An econometric approach. Energy Sustain. Dev. 2016, 31, 83–90. [Google Scholar] [CrossRef]

- Ionescu, C.; Baracu, T.; Vlad, G.E.; Necula, H.; Badea, A. The historical evolution of the energy efficient buildings. Renew. Sustain. Energy Rev. 2015, 49, 243–253. [Google Scholar] [CrossRef]

- Starr, C.W.; Saginor, J.; Worzala, E. The rise of PropTech: Emerging industrial technologies and their impact on real estate. J. Prop. Invest. Financ. 2021, 39, 157–169. [Google Scholar] [CrossRef]

- Robinson, S.; McIntosh, M.G. A Literature Review of Environmental, Social, and Governance (ESG) in Commercial Real Estate. J. Real Estate Lit. 2022, 30, 54–67. [Google Scholar] [CrossRef]

- Basher, S.A.; Masini, A.; Aflaki, S. Time series properties of the renewable energy diffusion process: Implications for energy policy design and assessment. Renew. Sustain. Energy Rev. 2015, 52, 1680–1692. [Google Scholar] [CrossRef]

- Popp, D.; Hascic, I.; Medhi, N. Technology and the diffusion of renewable energy. Energy Econ. 2011, 33, 648–662. [Google Scholar] [CrossRef]

- Hirsch, J.; Spanner, M.; Bienert, S. The carbon risk real estate monitor—Developing a framework for science-based decarbonizing and reducing stranding risks within the commercial real estate sector. J. Sustain. Real Estate 2019, 11, 174–190. [Google Scholar] [CrossRef]

- Eleftheriadis, I.M.; Anagnostopoulou, E.G. Identifying barriers in the diffusion of renewable energy sources. Energy Policy 2015, 80, 153–164. [Google Scholar] [CrossRef]

- Norberg-Bohm, V. Creating incentives for environmentally enhancing technological change: Lessons from 30 years of US energy technology policy. Technol. Forecast. Soc. Chang. 2000, 65, 125–148. [Google Scholar] [CrossRef]

- Leskinen, N.; Vimpari, J.; Junnila, S. The impact of renewable on-site energy production on property values. J. Eur. Real Estate Res. 2020, 13, 337–356. [Google Scholar] [CrossRef]

- Bagheri, M.; Delbari, S.H.; Pakzadmanesh, M.; Kennedy, C.A. City-integrated renewable energy design for low-carbon and climate-resilient communities. Appl. Energy 2019, 239, 1212–1225. [Google Scholar] [CrossRef]

- Kiliccote, S.; Olsen, D.; Sohn, M.D.; Piette, M.A. Characterization of demand response in the commercial, industrial, and residential sectors in the United States. Adv. Energy Syst. Large-Scale Renew. Energy Integr. Chall. 2019, 425–443. [Google Scholar] [CrossRef]

- Bunea, A.M.; Guidolin, M.; Manfredi, P.; Della Posta, P. Diffusion of Solar PV Energy in the UK: A Comparison of Sectoral Patterns. Forecasting 2022, 4, 456–476. [Google Scholar] [CrossRef]

- Guidolin, M.; Manfredi, P. Innovation Diffusion Processes: Concepts, Models, and Predictions. Annu. Rev. Stat. Its Appl. 2023, 10. [Google Scholar] [CrossRef]

- Bessi, A.; Guidolin, M.; Manfredi, P. Diffusion of Renewable Energy for Electricity: An Analysis for Leading Countries. In Theory and Applications of Time Series Analysis and Forecasting: Selected Contributions from ITISE 2021; Springer International Publishing: Cham, Switzerland, 2022; pp. 291–305. [Google Scholar]

- Savio, A.; Ferrari, G.; Marinello, F.; Pezzuolo, A.; Lavagnolo, M.C.; Guidolin, M. Developments in Bioelectricity and Perspectives in Italy: An Analysis of Regional Production Patterns. Sustainability 2022, 14, 15030. [Google Scholar] [CrossRef]

- Bessi, A.; Guidolin, M.; Manfredi, P. The role of gas on future perspectives of renewable energy diffusion: Bridging technology or lock-in? Renew. Sustain. Energy Rev. 2021, 152, 111673. [Google Scholar] [CrossRef]

- Guidolin, M.; Alpcan, T. Transition to sustainable energy generation in Australia: Interplay between coal, gas and renewables. Renew. Energy 2019, 139, 359–367. [Google Scholar] [CrossRef]

- Savio, A.; De Giovanni, L.; Guidolin, M. Modelling energy transition in Germany: An analysis through Ordinary Differential Equations and System Dynamics. Forecasting 2022, 4, 438–455. [Google Scholar] [CrossRef]

- Malhotra, A.; Schmidt, T.S.; Huenteler, J. The role of inter-sectoral learning in knowledge development and diffusion: Case studies on three clean energy technologies. Technol. Forecast. Soc. Chang. 2019, 146, 464–487. [Google Scholar] [CrossRef]

- US Energy Information Admnistration: Electricity Power Annual 2021. 2013. Available online: https://www.eia.gov/electricity/annual/Last (accessed on 6 February 2023).

- Guseo, R.; Mortarino, C. Within-brand and cross-brand word-of-mouth for sequential multi-innovation diffusions. IMA J. Manag. Math. 2014, 25, 287–311. [Google Scholar] [CrossRef]

- Bass, F.M. A new product growth for model consumer durables. In Management Science 15-5; INFORMS: Catonsville, MD, USA, 1969; pp. 215–227. [Google Scholar]

- Pérez-Lombard, L.; Ortiz, J.; Pout, C. A review on buildings energy consumption information. Energy Build. 2008, 40, 394–398. [Google Scholar] [CrossRef]

- British Petroleum, Statistical Review of World Energy Full Report 2022. 2022. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/primary-energy.html (accessed on 1 April 2023).

| Market potential: | |

|---|---|

| max. consumption level in that market for the analyzed technologies | |

| Seed coefficient of each technology: | |

| initial dissemination of the technology | |

| Internal influence of each technology: | |

| technology-specific growth after the innovation phase | |

| Cross-influence of each technologies: | |

| competitors’ effect on the considered technology |

| Influence | Commercial | Industrial | |

|---|---|---|---|

| Coal | Internal | 0.0514 | 0.0737 |

| Cross | −0.0234 | −0.0291 | |

| Gas | Internal | 0.7508 | 0.2801 |

| Cross | −0.5212 | −0.1553 | |

| Biomass | Internal | 2.0332 | −0.1861 |

| Cross | −0.5675 | 0.1466 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Savio, A. Modeling Energy Transition in US Commercial Real Estate: A Diffusion Comparison with the Industrial Sector. Eng. Proc. 2023, 39, 15. https://doi.org/10.3390/engproc2023039015

Savio A. Modeling Energy Transition in US Commercial Real Estate: A Diffusion Comparison with the Industrial Sector. Engineering Proceedings. 2023; 39(1):15. https://doi.org/10.3390/engproc2023039015

Chicago/Turabian StyleSavio, Andrea. 2023. "Modeling Energy Transition in US Commercial Real Estate: A Diffusion Comparison with the Industrial Sector" Engineering Proceedings 39, no. 1: 15. https://doi.org/10.3390/engproc2023039015

APA StyleSavio, A. (2023). Modeling Energy Transition in US Commercial Real Estate: A Diffusion Comparison with the Industrial Sector. Engineering Proceedings, 39(1), 15. https://doi.org/10.3390/engproc2023039015