1. Introduction

The pandemic drove people to change the way they used financial services. On the other hand, it encouraged the financial industry to launch new financial services in response to the current situation so that the various developmental trends in progress could accelerate its evolution and magnify its effects, thus bringing a mindset to reshape future development [

1]. In other words, the epidemic not only promoted the financial industry to accelerate digital transformation but also expanded the scope of digital services. People were eager for zero contact and gradually developed the habit of using digital financial services. Technological advances spurred financial innovation and brought new opportunities. Unlike traditional banks based on branches, digital banks are fundamentally different in terms of their architecture, which is based on the Internet Protocol (IP) that facilitates the application of Buyology. Therefore, traditional banks must transform themselves into digital banks through Business Process Re-engineering (BPR). The core function of Fintech services is to help businesses and consumers better manage their financial operations and living consumption expenditures.

In addition, many empirical studies support the importance of Internet Word of Mouth (IWOM) in influencing consumer behavior or decision-making [

2,

3,

4]. Both positive and negative word-of-mouth have different impacts. Positive word-of-mouth can attract consumers to discover new service providers and reinforce the perception that consumers have made the right choice. On the other hand, positive word-of-mouth helps companies reduce marketing expenses, attract new customers, increase revenue, and promote products and services [

5].

The existing studies on the marketing value and importance of IWOM has attracted many scholars’ interests. The main research issues fall into three categories: (1) exploring how consumers process and receive messages and the factors that influence consumers’ processing of messages, (2) identifying the characteristics of word-of-mouth communicators and their motivations, and (3) focusing on how to measure the effectiveness of word-of-mouth [

6]. However, the specific content of IWOM has yet to be discussed and clarified. Clarifying the content of IWOM helps industry players and scholars better understand the information processing that influences consumers’ decision-making and guide industry players to improve their services or products. Hence, this study’s objective is to determine the positive and negative word-of-mouth on the Internet.

The factors that affect users’ willingness to adopt new technology and continue to use it are even more important in the current industry environment, where emerging smart businesses are becoming increasingly advanced. Many scholars have proposed theoretical models and related empirical evidence to understand whether users continue to use the new technology after adoption. Among them, the theoretical model proposed by Bhattacherjee [

7] has been cited or modified by many scholars and is regarded as a significant theoretical basis for the continuous adoption of new technology research.

Since in the information system (IS), the user’s decision of continuous usage is similar to the consumer decision of repurchase, Bhattacherjee [

7] proposed a Post-Acceptance Model of IS Continuance. The model emphasizes the discussion of the Post-Acceptance concept and argues that confirmation and satisfaction can already cover the effects of Pre-Acceptance. Additionally, it asserts that (1) confirmation has a positive effect on perceived usefulness after system acceptance, (2) user satisfaction is influenced by the degree of post-acceptance confirmation and perceived usefulness, and (3) user intention of IS continuance intention is influenced by post-acceptance satisfaction and perceived usefulness. In other words, confirmation, perceived usefulness, and satisfaction are important factors that influence IS continuance intention.

Unlike the previous quantitative validation method of the Post-Acceptance Model of IS Continuance which used questionnaires to examine the causal relationships among the concepts of confirmation, perceived usefulness, satisfaction, and continuance intention of using digital banking services, we focused more on the contents and meanings of the aforementioned research concepts in IWOM to identify the factors that influence users’ continued use of digital banking services.

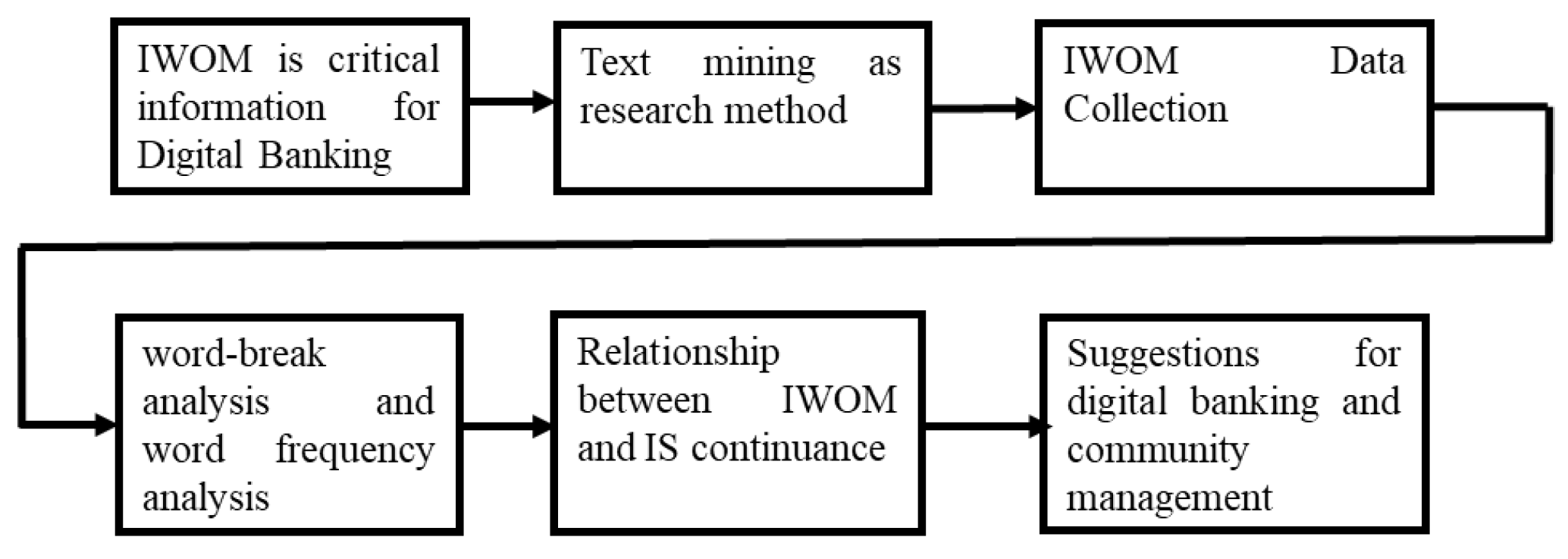

Based on the above, the objectives of this study are (1) to examine what digital banking services are the most popular among IWOM, (2) to explore what content issues are covered by positive and negative IWOM, and (3) to identify the importance of the factors that influence users’ continuous use of digital banking systems (confirmation, perceived usefulness, satisfaction, and other concepts). The results provide the basic information on customer experience design and customer relationship maintenance to increase customer life-cycle values. The research process in this study is shown in

Figure 1.

2. Research Methodology

2.1. Data Collection

The texts collected in this study included 2026 texts related to R digital banking obtained from the banking service section of “PTT Bulletin Board System”. The texts included article titles, posters’ IDs, times, replies, pictures, and so on. The exclusion criteria of the articles included content not related to R Digital Bank (advertisement) and comments with non-textual content (such as trendy cyber words and emoticons).

2.2. Operational Definitions

The operational definitions of the research concepts (confirmation, perceived usefulness, satisfaction, and continuance intention) are summarized, and examples of positive and negative descriptions for each research concept are presented in

Table 1.

2.3. Analysis Process

This study was conducted to understand the experience of digital-banking users in using digital services in online word-of-mouth and to analyze the text by using the Chinese word-breaking system (CRTC) for the concepts of Confirmation, Perceived Usefulness, Satisfaction, Continuance Intention, and Service Items. By deleting unrelated conjunctions, pronouns, and other superfluous words, the number of occurrences of those concepts was calculated to determine the frequency of various concepts and their importance. In the actual analysis, all the texts were analyzed by word-break analysis, and then the word frequency analysis of each service item was estimated. Secondly, each type of word break was divided into positive and negative comments, and the idea attribution and frequency analysis were conducted concerning their meanings. Finally, the word frequency analysis of each research idea was carried out to understand the important ideas disseminated in the R digital bank’s IWOM that influenced the IS continuance.

3. Results

3.1. Term Frequency Analysis of Popular Digital Banking Services in IWOM

To understand what services were more frequently discussed by the community in IWOM, we calculated their term frequency (TF). The results are summarized in

Table 2. The results show that the most mentioned digital banking services in order are digital services, traditional banking services, savings/foreign exchange, marketing activities, apps, cards, interest rates, and currency.

3.2. Term Frequency Analysis of Positive and Negative Comments in IWOM

To understand the relative importance of positive and negative comments on each research concept in IWOM, each research concept was classified into positive and negative comments, and the frequency and TF-IDF of the top three descriptors of positive and negative comments was calculated.

The analysis results showed that the descriptions of perceived usefulness appear most frequently in the positive comments, followed by satisfaction, confirmation, and continuance intention (

Table 3). Satisfaction was the most frequent description in the negative comments, followed by confirmation, perceived usefulness, and continuance intention (

Table 4). On the other hand, among the concepts, positive comments appeared more than negative comments regarding confirmation and perceived usefulness, while negative comments appeared more regarding satisfaction and continuance intention.

3.3. Term Frequency Analysis of Each Research Concept

To understand the relative importance of each research concept in IWOM, the frequency and TF-IDF of confirmation, perceived usefulness, satisfaction, and continuance intention are calculated in the study through word analysis (

Table 5). The results show that the frequency and TF-IDF of satisfaction were the highest, followed by perceived usefulness, confirmation, and continuance intention.

4. Conclusions

The research results show that the descriptions of perceived usefulness appeared most frequently in the positive comments, followed by satisfaction, confirmation, and continuance intention. Satisfaction was the most frequent description in the negative comments, followed by confirmation, perceived usefulness, and continuance intention. Moreover, positive comments appeared more than negative comments regarding confirmation and perceived usefulness, while negative comments appeared more than positive comments regarding satisfaction and continuance intention. Finally, satisfaction was the most frequent among the IWOM, followed by perceived usefulness, confirmation, and continuance intention.

This result is different from that of the previous research model of Post-Acceptance of IS Continuance. Most existing studies used questionnaires to collect data, and the research questions focused on the factors influencing the adoption of new technologies and the causal relationships among them to gain a deeper understanding of users’ technology-continuance behavior. However, we used text mining as the research method to explore the content of IWOM from the text obtained. IWOM was one reason that consumers adopted or continued to use new technology services. Therefore, the method of this study contributes to finding out users’ continued adoption of new technology and systems as well as the influence of the adoption or continuing use of new technology and systems by other users. Most survey methods used positive questions to explore the continuance experience of the respondents, while we included negative comments (i.e., negative experience). Thus, a complete description of the continuance experience was provided in this study.

Based on the study’s results, two suggestions were made, including redesigning the Frequently Asked Questions and Answers and developing a user-oriented digital financial platform system re-optimization.

Discussion services of digital banking need to be provided to explore the needs of consumers from a large amount of user data, thus optimizing digital banking services. For example, bankers can use it to redesign Frequently Asked Questions and Answers to reduce the cost of personalized customer service and improve the efficiency of customer service. Negative comments give negative experiences for users of digital-banking services to continuously use the services and for services to be improved in digital banking. The negative comments for perceived usefulness and confirmation help explore the problems or difficulties encountered by service users during the operation of the service system. Therefore, it is suggested that digital bankers use the comments to develop a user-oriented platform and for its re-optimization. In addition, sharing positive comments may help digital bankers attract potential users to become actual customers and, therefore, to have reference information for various communication strategies to improve their positive images.

Author Contributions

Conceptualization, S.-C.H., M.-L.S. and C.-M.Z.; methodology, S.-C.H.; writing—original draft preparation, S.-C.H., C.-M.Z. and M.-L.S.; writing—review and editing, S.-C.H. and M.-L.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Zhang, K.; Huang, C.Y. Trends in the Development of Financial Institutions in the Post-Epidemic Era. Financ. Inf. Q. 2022, 3, 154–196. [Google Scholar]

- Lin, Y.-T.; Chen, Y.-C. The Impact of the Positive and Negative E-WOM on Consumers’ Purchase Intention: The Moderation Effect of the Product Type and Product Involvement. Electron. Commer. Stud. 2015, 13, 167–193. [Google Scholar]

- Chevalier, J.; Mayzlin, D. The effect of word of mouth on sales: Online book reviews. J. Mark. Res. 2006, 43, 345–354. [Google Scholar] [CrossRef]

- Clemons, E.; Gao, G.; Hitt, L. When Online Reviews Meet Hyper Differentiation: A Study of the Craft Beer Industry. J. Manag. Inf. Syst. 2006, 23, 149–171. [Google Scholar] [CrossRef]

- Reichheld, F.F.; Sasser, W.E. Zero defections: Quality comes to services. Harv. Bus. Rev. 1990, 6, 105–111. [Google Scholar]

- Tsai, P.J.; Wu, Y.F.; Chuang, Y.H. Effect of internet interactivity on E-Word-of-Mouth: Comparison of Facebook and Youtube. Commer. Manag. Q. 2016, 17, 81–111. [Google Scholar]

- Bhattacherjee, A. Understanding Information Systems Continuance: An Expectation-Confirmation Model. MIS Q. 2001, 25, 351–370. [Google Scholar] [CrossRef]

- Mishra, A.; Shukla, A.; Rana, N.P.; Currie, W.L.; Dwivedi, Y.K. Re-examining post-acceptance model of information systems continuance: A revised theoretical model using MASEM approach. Int. J. Inf. Manag. 2023, 68, 102571. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).