1. Introduction

In agricultural economic evaluations, the inherent uncertainty of critical parameters such as input prices and product values necessitates the use of risk analysis methodologies. The literature provides various approaches for addressing uncertainty, including sensitivity analysis and scenario analysis [

1,

2,

3,

4]. Among these, scenario analysis is particularly effective due to its capability to simultaneously evaluate the profitability and sustainability of agricultural enterprises under multiple variations in critical parameters, thereby offering a more realistic assessment framework [

5].

Scenario analysis has been employed across diverse scientific fields to assess strategic decisions and policy impacts. Specifically, it has been utilized to manage uncertainty in agricultural production through fuzzy interval programming [

6], analyze the implications of urbanization on land-use changes [

7]. Moreover, recent studies underscore the increasing role of digital agricultural technologies in conjunction with decision-support tools [

8]. These tools facilitate key aspects of farm management, including input purchasing, pricing strategies, and overall business sustainability, further emphasizing the significance of economic data analysis in strategic agricultural planning [

9,

10,

11].

In this study, scenario analysis is applied to economic data obtained from a web-based platform which records financial metrics of agricultural enterprises. The primary objective is to investigate the impact of various scenarios on the economic outcomes of a farmer group and to evaluate the sustainability under uncertain conditions. By combining scenario analysis with real-world economic data, this study seeks to provide insights into the financial resilience of farming operations. This approach aims to determine how different scenarios influence the long-term resilience and sustainability of farmer groups.

Farmer groups can use the results to make informed adjustments to their strategies based on varying price conditions, while policymakers may consider these findings when designing support measures for agricultural sustainability. By providing a structured approach to evaluating uncertainty, this research offers insights into potential economic risks and opportunities, contributing to a more data-driven decision-making process in farm management.

2. Materials and Methods

In this study, the final economic data analyzed were derived from a web-based platform recording financial metrics [

12]. These data include various costs such as fertilizers, fuel, and the quantity of agricultural products and their respective prices. Scenario analysis was conducted to evaluate the impact of different economic conditions on farm profitability, considering varying input costs and revenue fluctuations.

To conduct this study, land use proposals were utilized from a Decision Support Model (DSM) developed using multicriteria weight goal programming, informed by similar research [

13]. This model was designed to align agricultural practices with multi-compliance regulations and optimize decision-making for farm management.

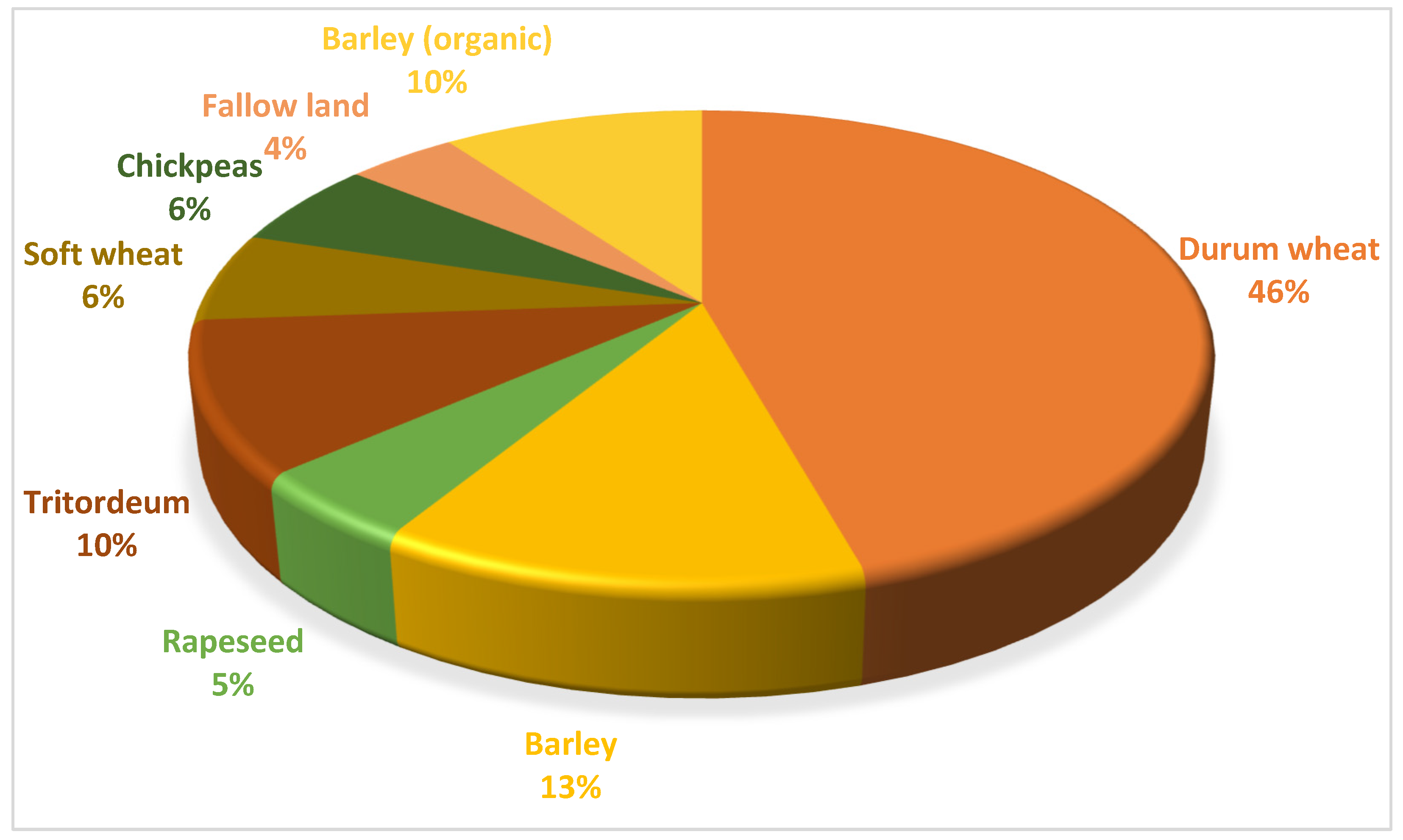

Following the model’s recommendations, a crop plan covering 10 hectares was established Agia Paraskevi, Western Macedonia, where economic and technical data were systematically collected and managed through a dedicated web-based platform for the 2023–2024 period. This database served as the foundation for evaluating the economic performance and sustainability of agricultural enterprises under different scenario conditions. The crops cultivated according to the proposed crop plan are presented in

Figure 1.

Scenario Analysis and Economic Variables

This study focuses on assessing agriculture farmer group risk through scenario analysis applied to economic data recorded by a group of producers from Agia Paraskevi in Kozani via a web-based data collection platform. The recorded data include various costs such as fertilizers, fuel, quantities of agricultural products produced, and corresponding selling prices.

Specifically, a scenario analysis was carried out at three distinct levels, which incorporate simultaneous, predetermined changes in critical economic variables. The primary objective was to evaluate how these variable changes impact profitability and to highlight the importance of scenario analysis as a risk management tool in agriculture.

To formulate the different scenarios, it was first necessary to identify the key economic variables significantly affecting final economic outcomes. The most crucial variables identified were as follows:

The baseline economic data, collected via the web-based platform for pilot fields covering an area of 100 acres (10 hectares), are summarized in the

Table 1 below:

To assess the impact of different economic conditions on farm profitability, three distinct scenarios were developed, each reflecting potential economic challenges and opportunities faced by agricultural farmer group. These scenarios were developed based on reasonable assumptions about financial uncertainties, incorporating simultaneous variations in revenue and production costs to represent potential economic challenges and opportunities.

- A.

The pessimistic scenario represents adverse economic conditions where farm revenues decline due to unfavorable market trends, reduced product demand, or lower market prices. Simultaneously, input costs—particularly for seeds, fertilizers, and fuel—increase, reflecting inflation, supply chain disruptions, or rising production expenses.

- B.

The moderate scenario assumes stable revenue conditions, where gross revenue remains unchanged but production costs rise at moderate levels. This scenario accounts for typical market fluctuations, policy adjustments, or shifts in input availability, allowing for an evaluation of profitability risks driven by cost increases.

- C.

The optimistic scenario reflects a favorable economic outlook, where increased market prices or improved productivity result in higher revenues. At the same time, reductions in input costs occur due to efficiency gains, technological advancements, policy incentives, or improved supply chain management, leading to overall lower expenses.

To quantify these conditions, specific percentage adjustments were applied to gross revenue and production costs in each scenario. The pessimistic scenario assumes a 5% decrease in gross revenue, a 10% increase in seed costs, and a 5% increase in fertilizer and fuel costs. The moderate scenario maintains revenue stability while increasing seed, fertilizer, and fuel costs by 5% each. Conversely, the optimistic scenario assumes a 5% increase in gross revenue, with simultaneous 5% reductions in seed, fertilizer, and fuel costs.

These scenarios were compared against a baseline scenario, which represents the actual recorded economic data for the crop year under examination. The baseline serves as the benchmark for quantifying the percentage changes in profitability under each alternative scenario. The specific percentage changes applied in each scenario are presented in

Table 2.

3. Results

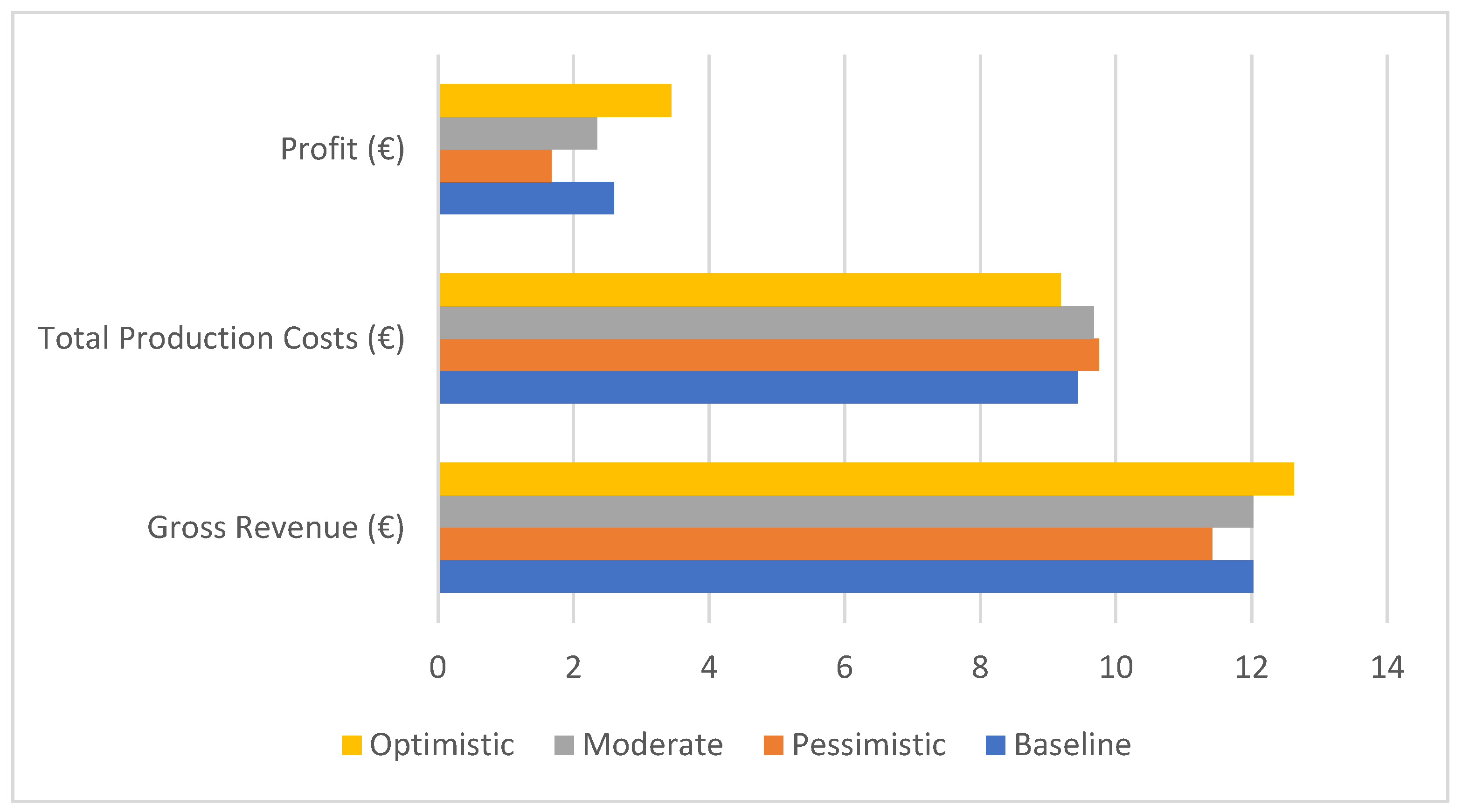

The results of the scenario analysis indicate significant variations in profitability under different economic conditions. As shown in

Table 3, the pessimistic scenario resulted in a substantial decrease in net profit, while the optimistic scenario led to a notable increase, highlighting the sensitivity of agricultural profitability to economic fluctuations.

More specifically, in the pessimistic scenario, gross revenue declined to €11,425.65, while total production costs increased to €9747.81, leading to a sharp reduction in net profit to €1677.84, representing a 35.36% decrease from the baseline. This outcome reflects the combined effect of lower revenue and higher input costs, demonstrating the financial vulnerability of farms under adverse economic conditions.

The moderate scenario maintained stable revenue (€12,027.00), but accounted for an increase in production costs, which rose to €9677.21. As a result, net profit decreased to €2349.79, marking a 9.48% reduction compared to the baseline. This scenario highlights the impact of rising production expenses, even in stable revenue conditions and underscores the importance of cost management in agricultural sustainability.

Conversely, the optimistic scenario resulted in an improved economic outlook, with gross revenue increasing to €12,628.35 and total production costs decreasing to €9185.21. This combination led to a significant profit rise to €3443.14, representing a 32.64% increase from the baseline. The results illustrate the positive impact of efficiency improvements, cost reductions, and favorable market conditions on farm profitability. The economic results for each scenario are summarized in

Table 3, providing insights into the profitability impact under varying cost and revenue conditions.

Figure 2 illustrates the variations in gross revenue, total production costs, and net profit across the four scenarios. The visual representation confirms the data presented in

Table 3, clearly showing how profit margins expand under optimistic conditions and contract under pessimistic and moderate scenarios.

4. Discussion and Conclusions

The scenario analysis conducted in this study clearly highlights the significance of evaluating agricultural profitability under varying economic conditions. The results underscore the sensitivity of agricultural enterprises’ profitability to fluctuations in critical economic parameters such as input costs (seeds, fertilizers, and fuel) and market prices. Specifically, even modest variations in costs or revenues can lead to significant shifts in overall profitability, as evidenced by the 35.36% decrease under the pessimistic scenario and the 32.64% increase under the optimistic scenario compared to the baseline. Importantly, the findings demonstrate that even under the most adverse scenario examined, the farms remained profitable, though profitability was substantially reduced. This observation emphasizes the underlying resilience of agricultural enterprises, provided appropriate strategic adjustments and risk management measures are implemented.

Moreover, these findings validate the effectiveness and practical utility of integrating scenario analysis as a complementary tool to decision support models (DSMs) within agricultural management. By quantifying economic risks and opportunities through various plausible future scenarios, producers gain critical insights into the potential economic impacts of changing market conditions and input prices. Consequently, they can proactively adapt their cultivation strategies and resource allocation to better manage risks.

In conclusion, this research reinforces the importance of scenario analysis as a crucial component of risk management in agriculture. Its incorporation into agricultural decision-making frameworks is strongly recommended, as it supports both producers and policymakers in anticipating and effectively responding to economic uncertainties. Building upon these findings, future research could enhance the risk assessment framework by incorporating stochastic methods to provide a probabilistic analysis of farm profitability. Furthermore, expanding this study to include diverse agricultural regions and different farming systems, as well as exploring the economic benefits of crop diversification strategies, would provide a more comprehensive understanding of farm resilience in Greece. Such analyses would offer valuable insights for developing more robust and targeted agricultural policies.

Author Contributions

Conceptualization, A.P. and T.B.; methodology, A.P.; software, A.P., A.T. and A.K.; validation, C.M., T.B. and E.D.; formal analysis, A.P.; investigation, A.P.; resources, A.P.; data curation, A.P.; writing—original draft preparation, A.P. and E.L.; writing—review and editing, T.B.; visualization, A.P.; supervision, T.B.; project administration, T.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Rural Development Program (RDP) and is co-financed by the European Agricultural Fund for Rural Development (EAFRD) and Greece, grant number M16ΣΥN2-00059.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article material. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Rezaei, M.; De Pue, J.; Seuntjens, P.; Joris, I.; Cornelis, W. Quasi 3D Modelling of Vadose Zone Soil-Water Flow for Optimizing Irrigation Strategies: Challenges, Uncertainties and Efficiencies. Environ. Model. Softw. 2017, 93, 59–77. [Google Scholar] [CrossRef]

- Kotir, J.H.; Smith, C.; Brown, G.; Marshall, N.; Johnstone, R. A System Dynamics Simulation Model for Sustainable Water Resources Management and Agricultural Development in the Volta River Basin, Ghana. Sci. Total Environ. 2016, 573, 444–457. [Google Scholar] [CrossRef] [PubMed]

- Romero-Gámez, M.; Antón, A.; Leyva, R.; Suárez-Rey, E.M. Inclusion of Uncertainty in the LCA Comparison of Different Cherry Tomato Production Scenarios. Int. J. Life Cycle Assess. 2017, 22, 798–811. [Google Scholar] [CrossRef]

- Zeng, X.; Zhao, J.; Wang, D.; Kong, X.; Zhu, Y.; Liu, Z.; Dai, W.; Huang, G. Scenario Analysis of a Sustainable Water-Food Nexus Optimization with Consideration of Population-Economy Regulation in Beijing-Tianjin-Hebei Region. J. Clean. Prod. 2019, 228, 927–940. [Google Scholar] [CrossRef]

- Zhang, Y.; Ren, C.; Zhang, H.; Xie, Z.; Wang, Y. Managing Irrigation Water Resources with Economic Benefit and Energy Consumption: An Interval Linear Multi-Objective Fractional Optimization Model under Multiple Uncertainties. Agric. Water Manag. 2022, 272, 107844. [Google Scholar] [CrossRef]

- Zuo, Q.; Wu, Q.; Yu, L.; Li, Y.; Fan, Y. Optimization of Uncertain Agricultural Management Considering the Framework of Water, Energy and Food. Agric. Water Manag. 2021, 253, 106907. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, X.; Shen, L. The Impact of Urbanization Policy on Land Use Change: A Scenario Analysis. Cities 2011, 28, 147–159. [Google Scholar] [CrossRef]

- Lialia, E.; Prentzas, A.; Tafidou, A.; Moulogianni, C.; Kouriati, A.; Dimitriadou, E.; Kleisiari, C.; Bournaris, T. Optimizing Agricultural Sustainability Through Land Use Changes Under the CAP Framework Using Multi-Criteria Decision Analysis in Northern Greece. Land 2025, 14, 1658. [Google Scholar] [CrossRef]

- Borrero, J.D.; Mariscal, J. A Case Study of a Digital Data Platform for the Agricultural Sector: A Valuable Decision Support System for Small Farmers. Agriculture 2022, 12, 767. [Google Scholar] [CrossRef]

- Gill, S.S.; Chana, I.; Buyya, R. IoT Based Agriculture as a Cloud and Big Data Service: The Beginning of Digital India. J. Organ. End User Comput. 2017, 29, 1–23. [Google Scholar] [CrossRef]

- Benami, E.; Carter, M. Can Digital Technologies Reshape Rural Microfinance? Implications for Savings, Credit, & Insurance. Appl. Econ. Perspect. Policy 2021, 43, 1196–1220. [Google Scholar] [CrossRef]

- Tafidou, A.; Lialia, E.; Prentzas, A.; Kouriati, A.; Dimitriadou, E.; Moulogianni, C.; Bournaris, T. Land Diversification and Its Contribution to Farms. Land 2023, 12, 911. [Google Scholar] [CrossRef]

- Kouriati, A.; Moulogianni, C.; Lialia, E.; Prentzas, A.; Tafidou, A.; Dimitriadou, E.; Bournaris, T. Decision Support Model for Integrating the New Cross-Compliance Rules and Rational Water Management. Proceedings 2024, 94, 42. [Google Scholar] [CrossRef]

- Lehmann, N.; Briner, S.; Finger, R. The Impact of Climate and Price Risks on Agricultural Land Use and Crop Management Decisions. Land Use Policy 2013, 35, 119–130. [Google Scholar] [CrossRef]

- Sands, R.D.; Westcott, P.C.; Price, J.M.; Beckman, J.; Leibtag, E.S.; Lucier, G.W.; McBride, W.D.; McGranahan, D.A.; Morehart, M.J.; Roeger, E.; et al. Impacts of Higher Energy Prices on Agriculture and Rural Economies; Economic Research Service: Washington, DC, USA, 2012. [Google Scholar] [CrossRef]

- Schaub, S.; El Benni, N. How Do Price (Risk) Changes Influence Farmers’ Preferences to Reduce Fertilizer Application? Agric. Econ. 2024, 55, 365–383. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |