1. Introduction

Blockchain has emerged as one of the most transformative and disruptive technologies of the 21st century owing to its decentralized, immutable, transparent, autonomous, and reliable features. It enables trustless peer-to-peer interactions by eliminating centralized intermediaries, thereby offering a secure and verifiable record of transactions [

1]. Initially popularized through cryptocurrencies like Bitcoin [

2], blockchain’s applicability has expanded into multiple domains, profoundly disrupting traditional processes in finance, gaming, and data management.

In the realm of decentralized finance (DeFi), blockchain introduces new forms of financial infrastructure that operate outside conventional banking channels [

3]. Conventional financial systems rely on intermediaries, including banks, brokers, and clearinghouses, to facilitate lending, trading, and asset transfers. Blockchain redefines this model by enabling peer-to-peer transactions through smart contracts, which automate processes such as borrowing, lending, and yield farming without third-party oversight [

4]. As a result, DeFi platforms built on blockchains like Ethereum are creating more open, accessible financial systems while introducing novel risk structures and regulatory considerations.

In digital gaming, blockchain disrupts the traditional publisher-controlled model, where in-game assets and player achievements remain confined within closed ecosystems. With blockchain-based gaming, players gain verifiable ownership of digital items via non-fungible tokens (NFTs), allowing for true asset portability, resale, and monetization across platforms [

5]. This transformation challenges the monopolistic control of game developers and shifts economic agency to the players themselves, giving rise to new paradigms such as play-to-earn (P2E) models and community-governed economies.

In data analytics, conventional systems are dependent on centralized data silos, which are susceptible to single-point failure, data tampering, and lack of transparency. Blockchain introduces a tamper-proof, time-stamped ledger that supports decentralized data collection, verification, and sharing [

6]. This is particularly impactful in multi-stakeholder environments such as supply chain analytics, healthcare, and finance, where data provenance and auditability are essential for regulatory compliance and informed decision-making [

7,

8]. By integrating blockchain, these sectors can ensure data trustworthiness while enabling federated analytics models that preserve contributor privacy.

Thus, blockchain not only offers technical improvements but also initiates fundamental shifts in intermediary roles, asset ownership paradigms, and data governance across DeFi, gaming, and data analytics. These disruptions justify a focused investigation into its mass adoption, which this study aims to provide by examining the challenges, trends, and converging applications within these three critical domains. While this manuscript primarily investigates blockchain adoption in DeFi, gaming, and data analytics, the integration of complementary technologies such as artificial intelligence and machine learning (AI/ML), cloud computing, and edge computing offers potential solutions to blockchain’s technical constraints. Cloud computing enhances scalability by offering an elastic infrastructure capable of handling large transaction volumes [

9]. Edge computing improves responsiveness by minimizing latency through decentralized, near-user data processing [

10]. AI/ML contributes to anomaly detection and security enhancement through predictive analytics and dynamic data modeling [

11]. However, to maintain a focused discussion on blockchain-driven transformation within specific application sectors, these technological integrations are acknowledged briefly here and proposed as important directions for future research.

1.1. Blockchain Foundations and Adoption Trends in DeFi

DeFi is a blockchain-based financial system that aims to overcome the limits of traditional banking, especially for people without easy access to financial services. It allows users to lend, borrow, trade, and save money online without needing banks or other intermediaries. This open-access model fosters financial inclusion, particularly for unbanked populations. For instance, platforms like Aave and Compound allow users to borrow or lend assets without traditional credit checks, while Stellar facilitates low-cost cross-border remittances [

12]. DeFi also reduces barriers to investment, and tokenization enables fractional ownership of high-value assets, such as real estate or fine art, thereby democratizing access to wealth-building opportunities. Built largely on Ethereum, DeFi applications benefit from smart contract automation, supporting innovation, transparency, and resistance to censorship [

13].

The breakthrough of DeFi has witnessed a significant surge in its adoption in recent years. Blockchain-based finance is expected to experience significant growth by 2030, supported by trends such as asset tokenization, the rise of NFTs, and increased institutional participation in DeFi ecosystems [

14]. This momentum is further driven by enhanced scalability, regulatory clarity, and the integration of blockchain into enterprise financial infrastructure. As NFT assets have gained momentum, they have become the most popular investment instruments. DeFi platforms now accept NFTs as collateral, integrating them into lending markets and reinforcing their role in blockchain-enabled financial services [

15]. The high total value locked (TVL) of DeFi illustrates the success and growing popularity of DeFi platforms and protocols [

16]. TVL also serves as a benchmark for evaluating the performance and adoption of DeFi systems. Market forecasts project that the DeFi sector will grow from USD 21.04 billion in 2024 to approximately USD 1.55 trillion by 2034 [

17], driven by tokenization, increasing institutional participation, and regulatory clarity.

Moreover, the mass adoption of blockchain in DeFi holds transformative potential to empower underprivileged populations by improving access to affordable financial services and reducing dependence on centralized institutions. In DeFi, blockchain creates a new financial ecosystem in which decentralization democratizes access, promotes transparency, and enables permissionless innovation. It introduces a decentralized framework for financial services, permitting individuals to bypass traditional intermediaries and access peer-to-peer lending, trading, and investment platforms. This creates new opportunities for inclusion, liquidity, and innovation. The successful adoption of blockchain has made financial services more autonomous and efficient, reducing burdens for users. DeFi has also revived broader interest in blockchain through novel applications. Decentralized exchanges (DEXs) using automated market maker (AMM) protocols have become highly influential due to their ability to reshape market dynamics [

18].

Flash loans and synthetic assets [

18] represent breakthrough innovations in DeFi. Flash loans allow users to borrow assets without collateral, provided the loan is repaid within the same transaction block. This functionality enables complex strategies such as arbitrage, collateral switching, and liquidation optimization [

19]. As Li et al. note, flash loans are powered by smart contracts that enable rapid execution but can also be misused for market manipulation or to exploit protocol vulnerabilities [

20]. Synthetic assets simulate the value of real-world financial instruments such as equities, commodities, or fiat currencies, enabling DeFi users to gain exposure to traditional markets without relying on centralized intermediaries [

21]. Platforms like Synthetix offer these assets through over-collateralized positions linked to price feeds, thus promoting asset diversification and liquidity in DeFi ecosystems [

22]. However, these innovations also introduce systemic risks. For instance, synthetic asset platforms depend heavily on external oracles for price data, creating a vulnerability to oracle manipulation. Additionally, extreme market conditions can trigger insolvency events and cascading liquidations [

23]. While flash loans and synthetic assets expand the utility and reach of decentralized finance, their safe and scalable adoption depends on robust auditing, secure oracle integration, and proactive risk mitigation strategies to ensure platform resilience and user protection.

1.2. Blockchain Applications and Adoption Trends in Gaming

Gaming, the fastest-growing sector in entertainment, presents a unique testing ground for blockchain technology. Its reliance on digital asset ownership, microtransactions, and strong community participation aligns directly with blockchain’s core capabilities, namely, decentralization, verifiable ownership, and programmable trust through smart contracts. Paajala et al. [

24] highlight how blockchain enhances player immersion by enabling true control over digital assets, while Stamatakis et al. [

25] demonstrate how smart contracts can establish secure, transparent, and self-governing game mechanics.

Unlike traditional games where in-game items are confined within centralized servers, blockchain enables genuine ownership and transferability of virtual assets through NFTs. Platforms like The Sandbox allow players to buy, sell, and trade virtual land and items as NFTs, extending their use across different environments and tying them to real-world value generation [

26]. This economic shift empowers players through asset monetization and decentralized economies, most notably in play-to-earn (P2E) models that reward participation and achievement. Blockchain networks such as Ethereum and Bitcoin support these ecosystems by enabling immutable, distributed transactions [

25].

The scale of this transformation is reflected in industry growth: the global games market generated USD 183.9 billion in 2023, with mobile gaming alone accounting for nearly USD 90 billion [

27]. Within this broader context, blockchain gaming is gaining substantial traction, with forecasts projecting growth from USD 8.5 billion in 2023 to USD 314.3 billion by 2030 [

28]. This market expansion reflects how blockchain is reshaping value creation and distribution through mechanisms such as true digital ownership, play-to-earn (P2E) models, and cross-platform interoperability [

29,

30]. Beyond asset ownership, blockchain fosters reusability and monetization of in-game items, land, and achievements via NFTs. Community-governed models such as decentralized autonomous organizations (DAOs) further enhance user agency, enabling players to participate in decision-making, rule-setting, and game updates. These dynamics shift games from static entertainment products into participatory digital economies.

However, adoption is not without challenges. Speculative trading and digital asset inflation can distort gameplay, while high initial token or NFT costs may exclude casual or low-income players. Ethical concerns also arise around financial risk exposure, especially for youth. Moreover, blockchain’s immutability limits post-deployment adjustments, restricting game evolution. Nevertheless, this same immutability offers benefits: smart contracts provide auditability and fairness in multiplayer settings, enhancing trust in-game logic [

31]. Technical hurdles persist as well. Chief among them is high transaction fees, especially on networks like Ethereum, which make everyday actions such as minting NFTs or executing trades costly and inaccessible for many users [

32]. Without broader adoption of Layer 2 scaling solutions or low-fee alternatives, such financial frictions will remain a major barrier to mainstream adoption.

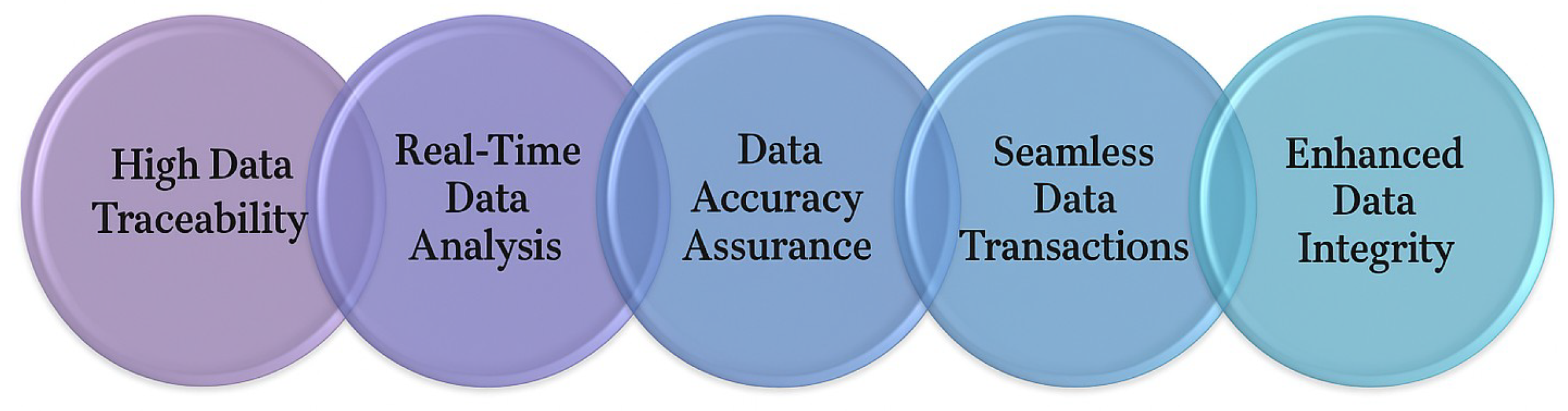

1.3. Blockchain Adoption and Challenges in Data Analytics

Blockchain-based analytics models derive insights from large datasets by leveraging the technology’s core advantages. Managing heterogeneous data is critical in decentralized finance and gaming systems. The mass adoption of blockchain in data analytics can enhance reliability by increasing trust in the accuracy of data inputs. This, in turn, improves the quality of insights derived from analytics, benefiting industries that rely on real-time and trustworthy data. In data analytics, the technology ensures data provenance, auditability, and secure decentralized exchange, which is critical for sectors such as healthcare, logistics, and finance where trust in data is paramount [

33,

34]. The global market value of blockchain is projected to grow from USD 7.18 billion in 2022 to USD 163.83 billion by 2029, reflecting a compound annual growth rate (CAGR) of 56.3%. During the same period, the broader data analytics market is expected to reach USD 329.8 billion by 2030, with a CAGR of 29.9% [

35]. These figures highlight the increasing relevance of blockchain in data-driven sectors that demand trust, traceability, and secure data exchange.

Blockchain contributes to data analytics by offering a distributed and immutable infrastructure. It ensures security across data acquisition, storage, processing, and privacy preservation [

36]. The technology enables decentralized, tamper-resistant data management, improving transparency, integrity, and trust. These attributes make blockchain especially attractive to industries where data security and traceability are critical. However, the widespread adoption of blockchain in data analytics remains constrained by challenges such as low transaction throughput, high storage costs, and the complexity of maintaining privacy across both public and private blockchains.

Blockchain also facilitates efficient, trustless collaboration between organizations, enabling secure information sharing without concerns about tampering or loss of data ownership [

37]. This capability strengthens cross-industry analytics and collaborative decision-making. However, the interoperability of real-time cross-chain data remains a major barrier. Additionally, the complexity of heterogeneous data structures and limited awareness or education about blockchain technologies hinder effective adoption. In contrast to centralized architectures, blockchain offers a decentralized and tamper-resistant framework that is particularly suited for managing the heterogeneous and large-scale data generated by intelligent devices. Ballandies et al. [

38] provide a detailed classification of blockchain system architectures, showing how different design choices affect data management capabilities in decentralized environments. Similarly, Agbo et al. [

39] demonstrate how blockchain can securely transmit and manage high-volume health data from mobile devices, reinforcing its suitability for complex and sensitive data flows. Its distributed ledger ensures that multi-source data can be validated, timestamped, and securely shared without reliance on a central authority. These capabilities are especially valuable in data-intensive domains such as decentralized finance, gaming, and smart city analytics, where trust, interoperability, and real-time traceability are essential.

A comprehensive understanding of distributed technologies is essential for organizations to use blockchain-based analytics tools safely and effectively. Large financial institutions are already leveraging blockchain to build lending platforms that validate transactions and generate reliable credit histories and asset classifications. Such platforms support data sharing for broader use in financial structure analysis. Moreover, blockchain contributes to the development of digital currency technologies that support innovative services, significantly impacting the financial and gaming sectors. While blockchain offers significant opportunities in data analytics, its mass adoption is impeded by complexity, performance constraints, and a lack of blockchain-related education among stakeholders.

1.4. Motivations and Contributions

Blockchain technology provides a secure, transparent, and decentralized framework for information exchange and value transfer. These attributes have encouraged adoption across finance, supply chains, energy, healthcare, education, and social media [

40,

41,

42,

43,

44]. Functionality continues to expand through smart contracts, non-fungible tokens (NFTs), and novel data structures [

45,

46]. Nevertheless, large-scale deployment remains constrained. Inefficient consensus, poorly designed smart contracts, and anonymity-driven abuse raise security concerns [

47,

48]. Broader obstacles include low throughput, limited interoperability, unclear regulation, and complex user interfaces that deter mainstream use.

The existing literature identifies a range of organizational, technological, and socio-economic constraints on blockchain adoption [

49,

50,

51,

52]. Technical studies highlight weaknesses in consensus mechanisms and smart contract design [

53,

54,

55,

56,

57,

58], while other work examines governance trade-offs, interoperability gaps, and the absence of shared standards [

59,

60,

61,

62,

63]. Researchers have also begun to analyze how these barriers manifest in high-growth niches, e.g., decentralized finance, blockchain gaming, and blockchain-based data analytics [

64,

65,

66]. Because these sectoral surveys are usually siloed, they reveal little about transferable solutions.

Table 1 visualizes this fragmentation and motivates the cross-sector synthesis developed in the remainder of this review.

As

Table 1 shows, few studies compare findings across domains. To close this gap, the present review focuses on three high-impact sectors, DeFi, blockchain gaming, and blockchain-based data analytics, which have been chosen for their advanced implementation levels, economic momentum, and contrasting technical requirements. Market forecasts underscore the stakes: DeFi could surpass USD 1.55 trillion by 2034 [

17], blockchain gaming is projected to reach USD 314.3 billion by 2030 [

28], and data-centric analytics contribute to an analytics market projected at USD 329.8 billion by 2030 [

35]. Together, these fields span financial, entertainment, and data-intensive ecosystems. By analyzing adoption barriers and innovations across all three, this review identifies common infrastructure needs and transferable design patterns that can accelerate blockchain deployment.

Mapping the main obstacles into each domain clarifies the rationale. DeFi suffers from limited throughput, congestion, and high gas fees [

75]. Blockchain gaming faces usability and interoperability hurdles, for example, high minting costs deter casual players, and assets moved across chains can lose utility [

60]. Data-analytics deployments must satisfy strict privacy, provenance, and cross-border regulations [

8,

76]. In all three, the lack of standardized cross-chain communication fragments ecosystems and complicates integration [

77].

These challenges map directly to blockchain’s architectural features. Decentralization removes intermediaries, enabling peer-to-peer finance in DeFi and player-owned economies in gaming. Immutability and auditability protect data integrity and contract execution. Transparency underpins accountability in financial settlements and multiplayer environments. Self-governance through DAOs allows community-driven upgrades, and dependability ensures continuous operation. Understanding how these attributes underpin token economies, NFT marketplaces, and blockchain-enabled analytics offers design guidance for scalable, interoperable solutions. Building upon this analysis, this review provides the following contributions:

Synthesizing adoption barriers and innovation drivers across DeFi, gaming, and data analytics;

Identifying research gaps and outlining future directions for technology deployment and ecosystem growth;

Highlighting under-explored intersections that inform system design and policy;

Comparing sector-specific and systemic challenges, i.e., scalability, governance, interoperability, and usability, to present an integrated view of the adoption potential;

Providing actionable guidance for developers, stakeholders, and regulators aiming to mainstream blockchain infrastructure.

1.5. Methodology

This review employs a three-stage process comprising planning, conducting, and reporting to investigate blockchain adoption in DeFi, gaming, and data analytics, as illustrated in

Figure 1.

1.5.1. Planning Phase

The planning phase establishes the review’s objective: to examine technical constraints, barriers, cross-industry synergies, and emerging use cases in three mature blockchain domains. It also frames two guiding questions:

RQ1: What are the key technological, economic, and regulatory drivers influencing the widespread adoption of blockchain in DeFi, gaming, and data analytics?

RQ2: What insights can be drawn from current strategies and sector-specific developments to guide future large-scale blockchain adoption across these domains?

1.5.2. Conducting Phase

Relevant literature was gathered from Scopus, Web of Science, ACM Digital Library, and Google Scholar, using terms such as “blockchain technology,” “mass adoption,” and domain-specific keywords. Titles, abstracts, and keywords in peer-reviewed journals and conferences were screened against the inclusion/exclusion criteria in

Table 2. Manual checks ensured thematic relevance to the research questions.

1.5.3. Reporting Phase

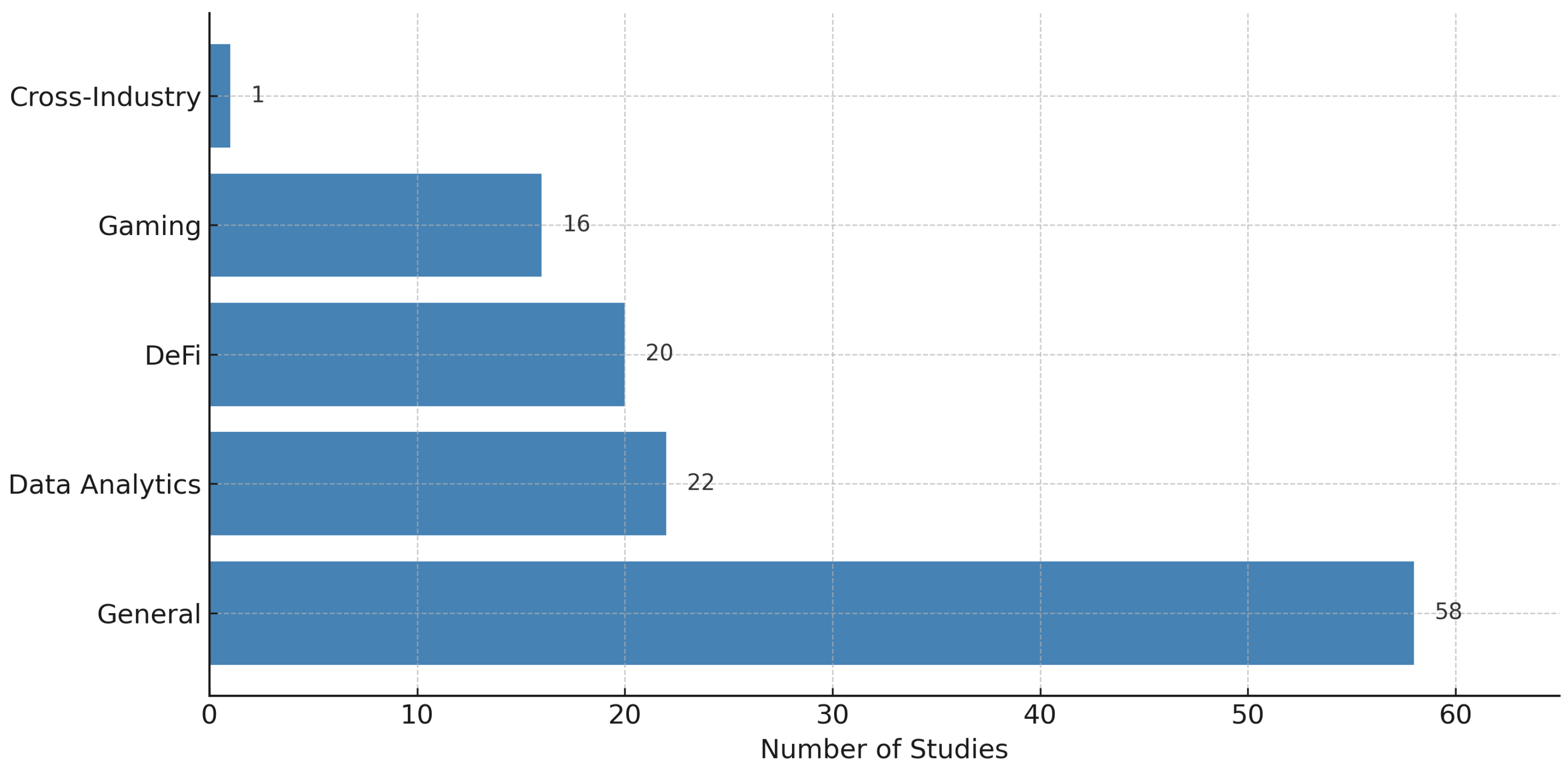

Figure 1 shows the screening flow. From 2525 initial records, 1553 were removed by preliminary checks, leaving 972. Title–abstract screening excluded 394, and full-text screening excluded 479, yielding 99 core papers. Reference mining added 18, providing 117 final studies. These were grouped as follows (

Figure 2): 58 general blockchain adoption papers, 20 on DeFi, 16 on gaming, 22 on data analytics, and 1 cross-domain study. This classification underpins the thematic discussion in

Section 2,

Section 3,

Section 4 and

Section 5, enabling both sector-specific and comparative insights.

1.6. Survey Organization

The remainder of this survey is organized thematically, reflecting the key research directions identified.

Figure 3 illustrates the overall structure, including major themes and corresponding sections.

Section 2 examines blockchain implementation in decentralized finance (DeFi), focusing on system architectures, adoption drivers, risks, and both regulatory and technical constraints.

Section 3 explores blockchain use in gaming, addressing application classifications, incentive structures, adoption barriers, and domain-specific risks.

Section 4 discusses blockchain’s role in data analytics, highlighting integration tools, enabling factors, project typologies, and emerging challenges.

Section 5 synthesizes findings through a cross-industry lens, identifying shared trends, sector-specific traits, and convergence opportunities among DeFi, gaming, and analytics.

Section 6 outlines the study’s contributions, limitations, and directions for future research. Finally,

Section 7 summarizes the key findings and reflects on broader implications for blockchain mass adoption across interconnected domains.

2. Blockchain-Driven Revolutions in Decentralized Finance (DeFi)

Decentralized finance (DeFi), enabled by blockchain technology, is reshaping global financial systems by offering open, permissionless alternatives to traditional banking infrastructures. Built primarily on public blockchains such as Ethereum, DeFi relies on smart contracts to remove intermediaries, lower transaction costs, improve transparency, and enhance security across financial services. These innovations are redefining user engagement with finance. Key activities now include lending, borrowing, trading, investing, and decentralized insurance.

The first phase of DeFi, often referred to as DeFi 1.0, established the foundational protocols and services that underpin the ecosystem. Core components include financial primitives such as stablecoins, decentralized exchanges, lending and borrowing platforms, and yield farming. In response to early limitations, DeFi 2.0 introduces more advanced features with a focus on long-term sustainability. Enhancements include scalable infrastructure, improved user interfaces, protocol-owned liquidity, decentralized governance, competitive oracle systems, cross-chain interoperability, and increased security and yield optimization [

78].

DeFi’s growth has been accelerated by the emergence of blockchain platforms competing to gain market share through differentiated features and developer-friendly ecosystems. These platforms evolve rapidly, introducing new services as user and developer preferences shift. By democratizing access to financial tools, enhancing transparency, and simplifying user interactions, DeFi holds the potential to foster financial inclusion and accelerate mainstream blockchain adoption.

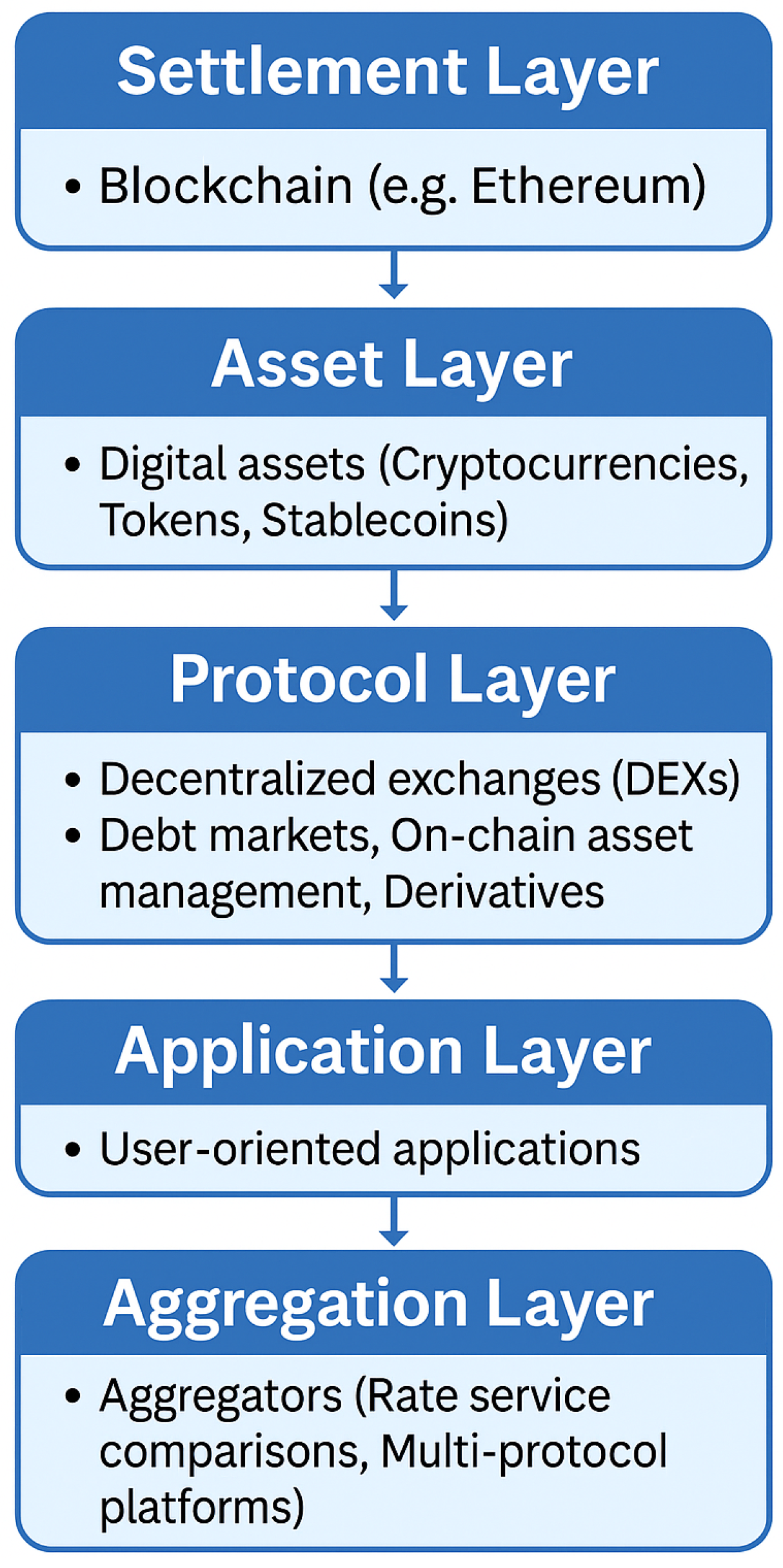

2.1. Multi-Layered Architecture of DeFi

The DeFi ecosystem is built on a modular, multi-layered architecture consisting of five interdependent layers: settlement, asset, protocol, application, and aggregation [

21]. Each layer serves a distinct function within the decentralized financial system, collectively enabling seamless, trustless financial operations without centralized intermediaries.

Figure 4 illustrates how these layers interact to form a scalable and cohesive infrastructure, ranging from blockchain-based transaction validation to user-facing aggregation platforms.

2.1.1. Layer 1: Settlement Layer

The foundational layer consists of distributed ledger technologies (DLTs), such as the Ethereum blockchain, which provides the core infrastructure for securely recording asset ownership and validating state changes. This layer supports the final settlement of transactions and serves as the trustless base for all higher layers.

2.1.2. Layer 2: Asset Layer

Built upon the settlement layer, the asset layer comprises digital assets, including cryptocurrencies, tokens, and stablecoins. These assets enable value exchange and collateralization within DeFi protocols.

2.1.3. Layer 3: Protocol Layer

This layer includes standardized smart contract implementations for specific financial functions, such as decentralized exchanges (DEXs), lending markets, asset management, and derivatives. These protocols provide composable and interoperable building blocks that are accessible to any DeFi participant.

2.1.4. Layer 4: Application Layer

The application layer provides user-facing interfaces, such as web applications or browser extensions, that abstract the complexity of interacting with smart contracts. This layer enhances usability and lowers entry barriers for non-technical users.

2.1.5. Layer 5: Aggregation Layer

The aggregation layer extends application functionality by integrating multiple protocols and platforms. It facilitates advanced use cases such as rate optimization, liquidity routing, and portfolio management by consolidating data and automating interactions across protocols.

2.2. DeFi Platforms

DeFi leverages secure distributed ledger technology to disrupt and reshape traditional financial systems [

79]. A crucial advancement of DeFi lies in its ability to establish the value of crypto assets as equivalent to real-world assets. Novel DeFi applications, such as decentralized exchanges (DEXs), flash loans, and synthetic assets, are entirely new and can only exist on blockchain models. Blockchain empowers the DeFi system by enhancing the security of financial transactions, increasing transparency, unlocking liquidity and novel opportunities, and supporting the construction of an integrated and standardized economic strategy.

Popular DeFi projects include DEXs, stablecoin DEXs, lending and borrowing platforms, stablecoin protocols, yield aggregators, and savings or borrowing protocols. This diversity allows DeFi users to select services tailored to their financial needs. Each DeFi project has unique features supporting the diversity of financial services. For instance, Uniswap is known for its automated market maker (AMM) mechanism, Aave offers innovative flash loan services, and Curve Finance enhances stablecoin trading with low slippage. DeFi protocols leverage various token types to enable services like lending, borrowing, decentralized exchanges, and synthetic assets. The dynamic and innovative DeFi space continues to develop novel token mechanisms and models, with tokens often serving multiple purposes across different categories. User experience, community support, liquidity flexibility, and efficiency are major benefits of these DeFi projects.

Table 3 presents a comparative analysis of major DeFi platforms, highlighting their key features, strengths, limitations, and supported use cases. While each platform offers distinct value propositions, they also face shared challenges to mass adoption, including technical scalability, regulatory uncertainty, and interface usability. Understanding these dynamics is essential for harnessing the transformative potential of DeFi within evolving digital economies. Each protocol has distinct advantages and limitations. For example, MakerDAO is recognized for its stability, while PancakeSwap benefits from lower transaction fees on the Binance Smart Chain. Despite their strengths, DeFi projects face several challenges that hinder broader adoption. High gas fees on Ethereum, for instance, affect the accessibility of platforms like Uniswap and Compound, while regulatory risks remain a concern across lending and savings protocols (e.g., Anchor). These factors significantly influence user trust, cost-efficiency, and scalability. The platforms listed support a variety of use cases, including token swapping, liquidity provision, yield optimization, and stablecoin issuance. For an effective DeFi experience, users must match each protocol’s strengths to their risk appetite, goals, and preferred blockchain.

2.3. Path to Mass Adoption of Blockchain in DeFi

As one of the most prominent blockchain applications, DeFi holds significant potential to reshape modern financial systems. However, numerous technical challenges and risk factors must be addressed through continued innovation, ecosystem collaboration, and adherence to established best practices. Smart contracts provide a foundational layer for DeFi platforms, making them essential to examine the synergy between the blockchain infrastructure and DeFi protocol design.

DeFi delivers financial services without intermediaries by leveraging blockchain-based smart contracts and stablecoins, effectively bridging various segments of the financial ecosystem, including traditional banking. Blockchain’s decentralized architecture enables DeFi to function without centralized oversight, offering an increasingly viable alternative to conventional finance. Through self-executing code and trustless transaction models, DeFi platforms reduce reliance on third parties while ensuring transparency and auditability. This disintermediation lowers costs and enhances openness and operational efficiency. The growing adoption of stablecoins, decentralized exchanges (DEXs), and lending protocols continues to drive sector expansion [

80].

Several factors contribute to DeFi’s increasing appeal, including global accessibility, permissionless innovation, cost efficiency, and reduced jurisdictional friction. The programmability and flexibility of blockchain technologies further support the sector’s evolution by enabling user anonymity and data privacy. While security remains a key concern, DeFi protocols strive to ensure tamper-resistant and transparent operations, positioning themselves as viable platforms for cross-border financial services. Financial inclusion is another critical motivator, opening new avenues for asset growth and income generation through crypto-economic incentives. The integration of stablecoins and decentralized governance, designed to eliminate single points of failure, enhances resilience and strengthens DeFi’s long-term viability within the global financial landscape. Nonetheless, achieving mass adoption will require sustained efforts to address scalability constraints, regulatory uncertainty, and technical complexity.

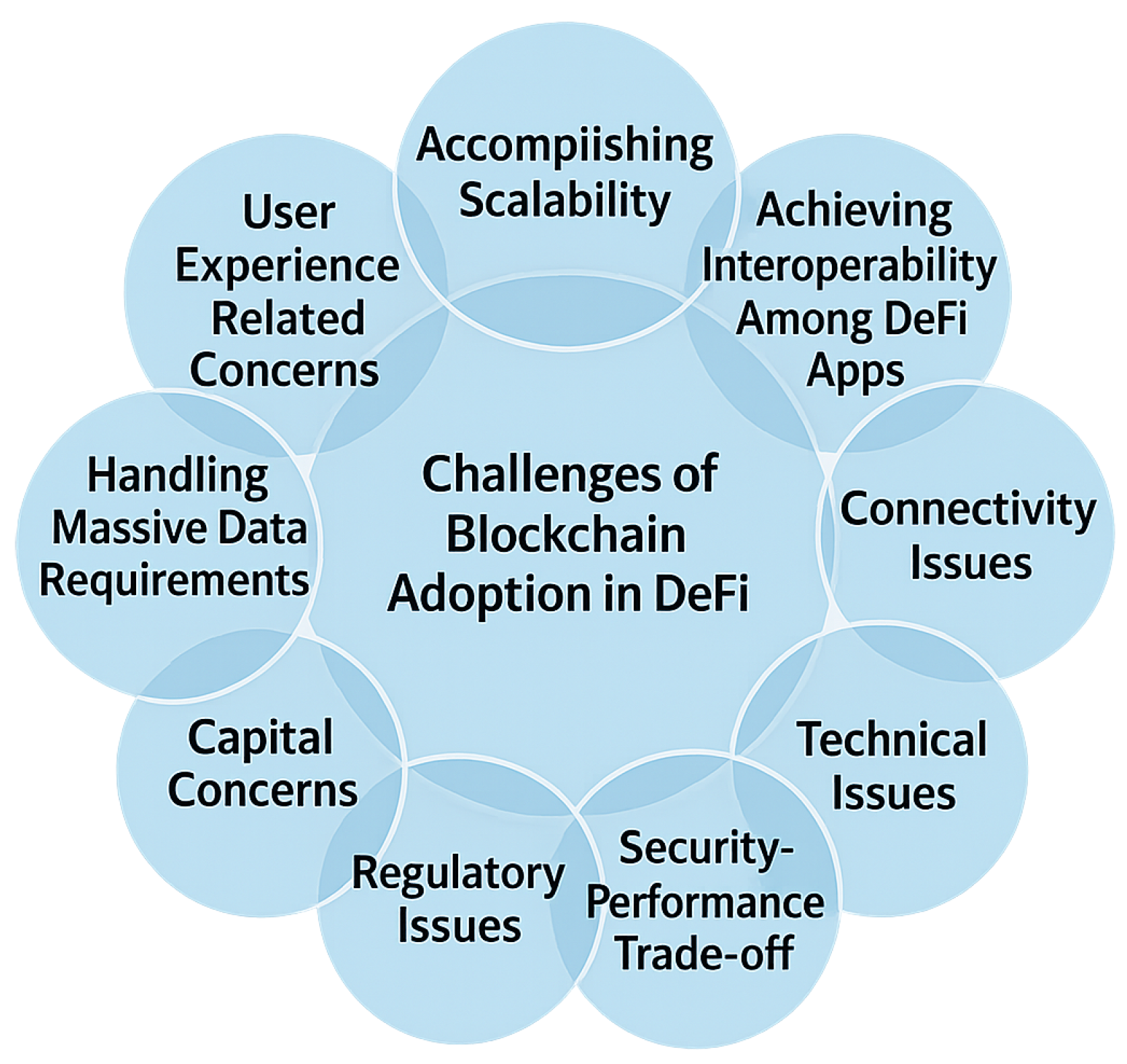

2.4. Challenges in the Mass Adoption of Blockchain in DeFi

DeFi protocols rely on decentralized exchange (DEX) mechanisms to support core financial functions such as lending, borrowing, and trading. Although blockchain technology offers notable advantages for DeFi, several persistent challenges must be addressed to enable mass adoption [

81,

82]. Tackling these limitations through technical innovation and strategic upgrades is critical to ensuring the scalability, accessibility, and long-term sustainability of blockchain-enabled financial services.

Figure 5 illustrates the key challenges that affect the widespread adoption of blockchain in the DeFi ecosystem.

2.4.1. Accomplishing Scalability

Scalability remains a fundamental bottleneck for blockchain-enabled DeFi and gaming platforms [

83]. Ethereum, one of the most widely used base-layer blockchains, continues to face throughput limitations due to its consensus mechanism (initially proof of work, now transitioned to proof of stake), fixed block dimensions, and high transaction latency. These restrictions lead to network congestion and high gas prices during peak periods [

84], negatively affecting the usability of transaction-intensive applications. In DeFi, scalability constraints restrict affordable access to financial tools; in gaming, they disrupt real-time responsiveness and smooth gameplay. During periods of high demand, Ethereum’s fee structure, which is based on variable block size and user bidding, results in volatile and often prohibitive gas prices. Empirical studies confirm a direct correlation between transaction volume and increased fees, with users sometimes paying higher gas fees than the transferred value [

84]. This dynamic fee deterrents both developers and users, particularly for applications involving frequent or low-value transactions [

85].

To address these limitations, a range of scalability solutions has emerged, including Layer 2 technologies (e.g., optimistic and zero-knowledge rollups), sidechains, and sharding. Alternative Layer 1 platforms like Solana have also been engineered with scalability as a core objective. Solana, for example, employs a hybrid proof of history (PoH) and proof of stake (PoS) mechanism to achieve high throughput and low latency, enabling the network to process over 65,000 transactions per second under optimal conditions [

86,

87]. This architecture reduces reliance on timestamp synchronization, facilitating rapid consensus and efficient block production. While these solutions enhance performance, they often involve trade-offs in decentralization and require extensive validation in real-world deployments. Nonetheless, scalable infrastructure remains a prerequisite for mainstream blockchain adoption in sectors such as DeFi and gaming [

88].

2.4.2. Achieving Interoperability Among DeFi Apps

In the context of DeFi, interoperability refers to the ability of decentralized applications (DApps) and protocols across different blockchains to communicate, share data, and transfer assets. This capability is essential for building integrated financial ecosystems in which users can seamlessly interact with lending platforms, decentralized exchanges, and other services across chains [

60,

89]. Without interoperability, liquidity becomes fragmented, user experience deteriorates, and the practical benefits of decentralization are diminished. Achieving such integration remains challenging due to differences in coding languages, data standards, and execution environments across blockchain platforms. While mechanisms such as token bridges and asset wrapping offer partial interoperability, they introduce additional complexity and pose significant security risks. Bartoletti et al. [

89] emphasize that composability between DeFi protocols is critical to usability and innovation. Similarly, Belchior et al. [

60] argue that scalable and secure cross-chain solutions are essential to mitigate ecosystem fragmentation. Until these challenges are overcome, limited interoperability will continue to constrain the broader adoption and functionality of DeFi systems.

2.4.3. Ensuring Reliable Connectivity

DeFi enables transactions among peer-to-peer network entities, but reliable connectivity remains a critical concern due to the decentralized nature of node operations [

90]. DeFi protocols often depend on oracles and bridges to interact with external data sources, such as asset prices and market feeds. However, unreliable connectivity in these components can lead to data delays, inaccuracies, and manipulation risks, potentially causing errors in smart contract execution and resulting in significant financial losses. Secure and dependable data feeds are therefore essential, particularly for time-sensitive applications such as lending, borrowing, and asset trading.

2.4.4. Addressing Technical Complexity and Volatility

DeFi’s reliance on interoperability introduces significant technical complexity, as systems must be compatible with sidechains, bridges, cross-chain protocols, and parachains. Each DeFi protocol often requires distinct software tools and bespoke code implementations, adding to the development and integration burden. Additionally, market liquidity presents a critical challenge: trading, lending, and investment operations in DeFi are highly sensitive to asset price fluctuations. As Spano [

91] notes, sudden changes in market value can lead to sharp declines in the worth of crypto tokens, thereby increasing risk and undermining user confidence.

2.4.5. Balancing Security and Performance

Security remains a critical concern in DeFi, where smart contract vulnerabilities and frequent exploits can undermine user confidence. While private blockchain models often employ large encryption keys and strict authorization mechanisms, they are not immune to attack. As Mohanta et al. [

92] note, technically skilled users may obtain encryption keys and exploit system weaknesses for personal gain. In the DeFi context, balancing performance with robust security requires continuous efforts, including rigorous smart contract audits, formal verification techniques, and the adoption of standardized development practices. Without such measures, concerns over fund loss and systemic risk will continue to hinder mass adoption.

2.4.6. Navigating Regulatory and Legal Barriers

DeFi benefits from blockchain’s core features (security, transparency, and immutability), which enhance protection against threats such as ransomware and denial-of-service attacks. However, the regulatory landscape for DeFi remains underdeveloped and fragmented. Traditional approaches such as “code is law” and “law is code” are challenged by the decentralized and autonomous nature of blockchain systems [

19,

93]. The absence of clear legal frameworks creates uncertainty for users, developers, and institutions, posing a significant barrier to mainstream adoption [

94]. Well-defined regulations addressing tax treatment, consumer protection, and anti-money laundering (AML) compliance could improve trust, reduce risk, and facilitate broader integration of DeFi into traditional financial ecosystems.

2.4.7. Addressing Capital and Liquidity Constraints

Capital is fundamental to the functioning and sustainability of the DeFi ecosystem. It underpins core services such as production, investment, and lending and is vital for supporting economic growth across decentralized platforms [

81,

82]. Innovative capital deployment schemes, particularly under-collateralized and trust-based lending, are gaining traction but remain inherently risky. Unlike traditional finance, which relies on collateral and credit assessments to manage lending risks, DeFi protocols often lack such safeguards. Under-collateralized loans, in particular, raise concerns regarding borrower credibility and default risk, especially in the absence of credit scoring or identity verification mechanisms [

95].

The absence of regulatory oversight further amplifies these risks. Without formal accountability mechanisms or standardized fund management practices, pooled capital remains vulnerable to liquidity crises, fraud, and systemic failure [

96]. Research highlights that feedback loops in DeFi lending, such as those triggered by price volatility or cascading liquidations, can destabilize entire platforms when risk controls are inadequate [

97]. Moreover, the inability to enforce collateral terms may incentivize risk-seeking borrowing behavior, eroding platform resilience to defaults [

98]. Addressing these capital and liquidity challenges is essential to unlocking the full potential of blockchain-based DeFi. As the ecosystem matures, solutions that improve capital efficiency, borrower vetting, and systemic risk management will be critical for strengthening trust, safeguarding liquidity, and enabling broader adoption.

2.4.8. Managing Large-Scale Data in DeFi

DeFi applications differ from other decentralized systems in their intensive data storage demands. As the DeFi user base expands, so too does the volume and complexity of transactional data. Blockchain infrastructure must be capable of managing and storing these large data volumes effectively [

19]. Data requirements vary by application type, further complicating the need for scalable, decentralized storage solutions. Managing heterogeneous data originating from diverse sources, formats, and structures is critical for ensuring DeFi’s scalability and usability. As DeFi continues to scale and intersect with traditional financial systems across global markets, the ability to process and interpret diverse data streams will be essential for sustaining adoption and performance.

2.4.9. Enhancing User Experience and Accessibility

User experience remains a critical barrier to the widespread adoption of DeFi. Navigating wallets, exchanges, and protocols can be technically demanding, often resulting in user errors and fund losses, especially among newcomers [

81]. Complex interfaces and unfamiliar processes may discourage non-technical users from engaging with DeFi platforms [

82]. To promote inclusivity and adoption, DeFi systems must prioritize usability by offering intuitive interfaces, simplified onboarding processes, and accessible educational resources. Streamlined tools and user-centric designs can significantly reduce entry barriers, making decentralized financial services more approachable for mainstream users.

2.5. Factors Impacting the Mass Adoption of DeFi

Mass adoption of DeFi is shaped by a range of factors, broadly categorized into three domains: institutional, market, and technical. Each domain encompasses specific elements that either support or constrain the widespread integration of DeFi solutions.

Table 4 summarizes these key factors.

Within the institutional domain, governance and regulatory clarity are central concerns [

64,

67]. The erosion of government oversight, the risk of unfair practices, and limited legal recourse for fraud remain critical barriers. Policymaker uncertainty surrounding cryptocurrencies adds to these constraints. Addressing them requires clear taxation policies, legally robust blockchain frameworks, and stronger institutional engagement.

From a market perspective, issues such as volatility, high computational costs, and the complexity of integrating smart contracts with legacy financial systems pose notable challenges [

80]. Ambiguity in smart contract applications, particularly confusion between smart contracts and electronic contracts, complicates mainstream adoption. In addition, financial processes often face steep implementation costs, which further discourage entry by enterprises and developers.

Technical challenges underpin many adoption hurdles. Effective management of crypto assets and distributed ledgers demands scalable, secure, and interoperable infrastructure. Enhancing performance, reducing latency, and standardizing modular DeFi components are essential. Security threats, including cyberattacks and code vulnerabilities, must be addressed proactively through resilient infrastructure and protective protocols. Addressing these institutional, market, and technical factors in a coordinated manner is crucial for unlocking the full potential of DeFi and supporting its integration into mainstream financial ecosystems.

2.6. Evaluation of Adoption Risks of Blockchain in DeFi

While DeFi unlocks new financial models, its adoption is constrained by a range of risks that span technical, operational, and regulatory domains [

67]. These risks must be addressed systematically to ensure safe and scalable participation.

Table 5 outlines major adoption risks in the DeFi ecosystem alongside targeted recommendations.

Several technical risks remain pressing. Smart contract vulnerabilities, consensus weaknesses, and scaling issues threaten both security and reliability. Mitigation strategies include robust contract design, optimized block sequencing, and consensus balancing. Similarly, the management of user growth and key security demands scalable authentication systems and multi-signature protection.

Interoperability-related risks, including dependencies between protocols and reliance on external oracles, can expose DeFi platforms to cascading failures [

68,

82]. Mitigating these risks requires enhancing oracle resilience and reducing unnecessary dependencies through modular design.

Governance presents its own risk profile. The potential for malicious actors to manipulate voting processes or exploit token distributions underscores the need for secure and transparent governance mechanisms. As DeFi evolves, stronger token management schemes will be essential.

Default risks in peer-to-peer DeFi lending are especially critical [

99]. Unlike traditional banks, which rely on regulatory oversight and credit histories, P2P platforms often lack effective credit assessment tools. Volatility in collateral assets can lead to liquidation or borrower insolvency. Smart contracts governing these arrangements may also fail to adapt to market shifts. To address this, MakerDAO’s ETH-A dataset represents a promising model for risk evaluation [

100], although newer programs like spark loans require updated datasets and monitoring mechanisms.

2.7. Solutions and Research Directions for DeFi Adoption

Blockchain’s core attributes offer the potential to fundamentally transform centralized financial markets [

8]. In particular, its application in finance enables the removal of centralized servers and intermediaries while supporting secure, low-cost transactions [

65]. However, despite these advantages, DeFi adoption continues to face significant challenges. This section outlines practical solutions and research directions to support broader blockchain integration within the DeFi ecosystem.

2.7.1. Scalable DeFi Blockchains

The proliferation of smart devices and applications has intensified scalability challenges in public blockchain-based DeFi systems, hindering mass adoption. These limitations stem primarily from the need for every node to validate transactions, which increases computational overhead and reduces throughput. Scalability can be improved through Layer 2 solutions, sharding, and high-performance blockchain architectures. Such innovations enhance data and asset transfer speeds while lowering transaction costs, making DeFi more accessible and efficient. Solana, for example, offers notable scalability advantages over earlier models like Bitcoin. By combining proof of history (PoH) and proof of replication (PoRep), Solana reduces both time and storage requirements, enabling higher transaction throughput [

86]. While private blockchains typically offer better performance and scalability than public ones [

83], their complexity, particularly around key management and computational requirements, limits their applicability in diverse DeFi contexts. Overall, adopting scalable blockchain infrastructures is essential for enabling DeFi to compete with traditional financial systems and achieve mainstream integration.

2.7.2. Interoperable DeFi Apps

Beyond scalability, interoperability represents a core requirement for the sustainable growth of DeFi. It enables seamless interaction between decentralized applications (DApps) across different blockchains, facilitating asset lending, margin trading, and shared utility through standardized interfaces. Blockchain interoperability in DeFi typically occurs across three levels: (1) between DeFi applications operating on different blockchains, (2) among applications on the same blockchain, and (3) across distinct blockchain-based financial systems [

60]. Tokenization-based interoperability plays a pivotal role in this landscape, fostering a sharing economy by enabling asset exchange and coordination across diverse blockchain infrastructures. Emerging cross-chain protocols such as Polkadot, Cosmos, and Chainlink’s Cross-Chain Interoperability Protocol (CCIP) aim to resolve interoperability challenges by providing secure, decentralized bridges that link heterogeneous blockchain networks. These mechanisms facilitate high-security asset transfers, reduce dependence on centralized exchanges, and enhance overall liquidity. By advancing interoperability, blockchain-driven DeFi can support a more integrated, user-centric, and accessible financial ecosystem. This capability is essential for realizing the mass adoption of DeFi across diverse platforms and user bases.

2.7.3. Regulation of DeFi

Alongside scalability and interoperability, regulatory clarity is essential to ensure the stable and sustainable growth of DeFi systems. Current blockchain-based DeFi platforms rely on smart contracts to automate compliance and encode regulatory logic [

93,

101]. As DeFi projects increasingly issue governance tokens and introduce novel financial instruments, the need for effective oversight becomes more pressing. Regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) continue to assess whether crypto assets in DeFi environments qualify as traditional securities or represent new asset classes. To facilitate mass adoption, it is vital to develop regulatory frameworks that strike a balance between fostering innovation and mitigating systemic risk. Clear, well-defined legal structures can enhance legitimacy, build trust, and encourage engagement from governments, institutional investors, and enterprises. A well-regulated DeFi ecosystem promises stronger asset protection, improved data privacy, and greater stability in decentralized financial markets. However, the optimal design of regulatory frameworks for DeFi remains an open research question and a critical direction for future policy development.

2.7.4. Peer-to-Peer (P2P) Connectivity

Enhancing P2P connectivity is critical for improving the performance and scalability of blockchain-based DeFi applications. Given DeFi’s intermediary-free architecture, reliable communication between network participants is essential. One promising approach to addressing connectivity limitations is the integration of mobile edge computing into sidechain models. This technique brings computational resources and network services closer to end users, thereby reducing latency and improving system responsiveness [

102]. In such models, edge devices are positioned near DeFi participants, minimizing data transfer delays and mitigating bottlenecks typically associated with large-scale decentralized networks. By incorporating edge computing into blockchain infrastructure, DeFi platforms can overcome key connectivity challenges, support seamless peer interactions, and enable scalable, real-time financial services. These enhancements are crucial for fostering mass adoption and ensuring robust, efficient system performance.

2.7.5. Extension of Default Risk Mitigation in P2P DeFi

Although the MakerDAO project introduced a novel dataset to support default risk mitigation in DeFi lending systems [

100], it primarily focuses on the ETH-A borrowing program. This narrow scope excludes other emerging borrowing mechanisms such as ETH-B, ETH-C, Spark loans, and real-world asset-backed loans. The absence of these programs limits comprehensive risk modeling and hinders the ability to analyze borrower behavior across diverse collateral types and loan structures. Expanding the dataset to incorporate these newer instruments could enable deeper insights into borrower dynamics, improve collateral assessment models, and enhance automated liquidation strategies for peer-to-peer DeFi lending.

2.7.6. Security and Privacy

Maintaining the credibility and operational resilience of DeFi platforms necessitates the implementation of robust security and privacy mechanisms. The open and transparent nature of blockchain networks, while enabling trustless interactions, also increases exposure to malicious activities and systemic vulnerabilities [

67]. Strengthening DeFi systems with advanced security strategies, such as attack vector stress testing and the integration of governance security modules, can safeguard user assets and protect decentralized decision-making processes. These enhancements are essential to building user confidence and achieving sustainable growth.

2.7.7. DeFi Financial Tokens

Tokenization is central to the DeFi ecosystem, transforming traditional asset ownership and transfer models through smart contract-enabled digital tokens. The evolution of Ethereum Request for Comments (ERC) token standards has facilitated greater operational efficiency and interoperability across platforms [

103]. Continued development of standardized, flexible, and scalable token formats will enhance liquidity, broaden asset support, and drive institutional integration, making tokenized financial instruments a cornerstone of future DeFi infrastructure.

2.7.8. Smart Contracts and Consensus Protocols

Reliable asset transfer and data integrity in DeFi rely heavily on the design of smart contracts and underlying consensus mechanisms [

90,

101]. Enhancing smart contract logic and developing consensus protocols that prioritize efficiency, security, and scalability are key to ensuring the robustness of blockchain-enabled financial services. As DeFi applications grow in complexity, consensus models must evolve to support diverse operational needs without compromising decentralization, laying the groundwork for secure and efficient next-generation DeFi ecosystems.

3. Blockchain-Powered Gaming Industries

Blockchain-powered gaming industries harness cryptocurrencies such as Bitcoin and Ethereum to build immutable ledger-based transactions distributed across various gaming platforms. These immutable ledgers make it challenging for players to modify transactions, data, or rules, resulting in high consistency, transparency, and reliability [

104]. Blockchain-enabled games, often referred to as NFT games, rely on non-fungible tokens (NFTs), which are unique digital assets with distinct metadata that cannot be replicated. These games span diverse formats, including play-to-earn (P2E), trading card games (TCGs), role-playing games (RPGs), and expansive metaverse environments.

Table 6 provides a comparative analysis of prominent blockchain-driven gaming projects. It outlines key aspects such as project types, underlying blockchain platforms, core features, strengths, limitations, and representative use cases. This comparative view underscores the diversity of blockchain gaming models. Ethereum remains the dominant platform due to its mature smart contract infrastructure, although alternative chains like Binance Smart Chain (BSC), Solana, and Hive offer advantages in scalability and transaction efficiency. Each project introduces distinctive features: Zed Run leverages BSC for cost-effective transactions, while Star Atlas capitalizes on Solana’s high throughput for complex space exploration mechanics.

Gameplay mechanics vary significantly. Axie Infinity’s breeding model fosters asset creation and ownership, whereas Decentraland emphasizes social interaction through user-generated virtual real estate. The Sandbox supports in-game economies by allowing developers to monetize voxel-based environments. Illuvium offers cinematic RPG experiences with advanced visual design, while CryptoBlades focuses on low-cost, combat-centric P2E loops.

Challenges differ by project. High entry costs and energy consumption limit Axie Infinity’s accessibility, and CryptoBlades suffers from gameplay repetitiveness. Regulatory ambiguity remains a common concern across TCGs like Gods Unchained. Moreover, balancing community-driven content (e.g., in Sandbox) with platform control presents ongoing development trade-offs. Scalability and user retention continue to influence long-term sustainability.

These projects support use cases ranging from asset trading and competitive gaming to social community-building and resource management. Understanding their strengths and weaknesses helps contextualize the opportunities and limitations blockchain introduces to the gaming ecosystem. As blockchain games evolve, refining gameplay, improving interoperability, and addressing technical and regulatory constraints will be essential for mainstream adoption.

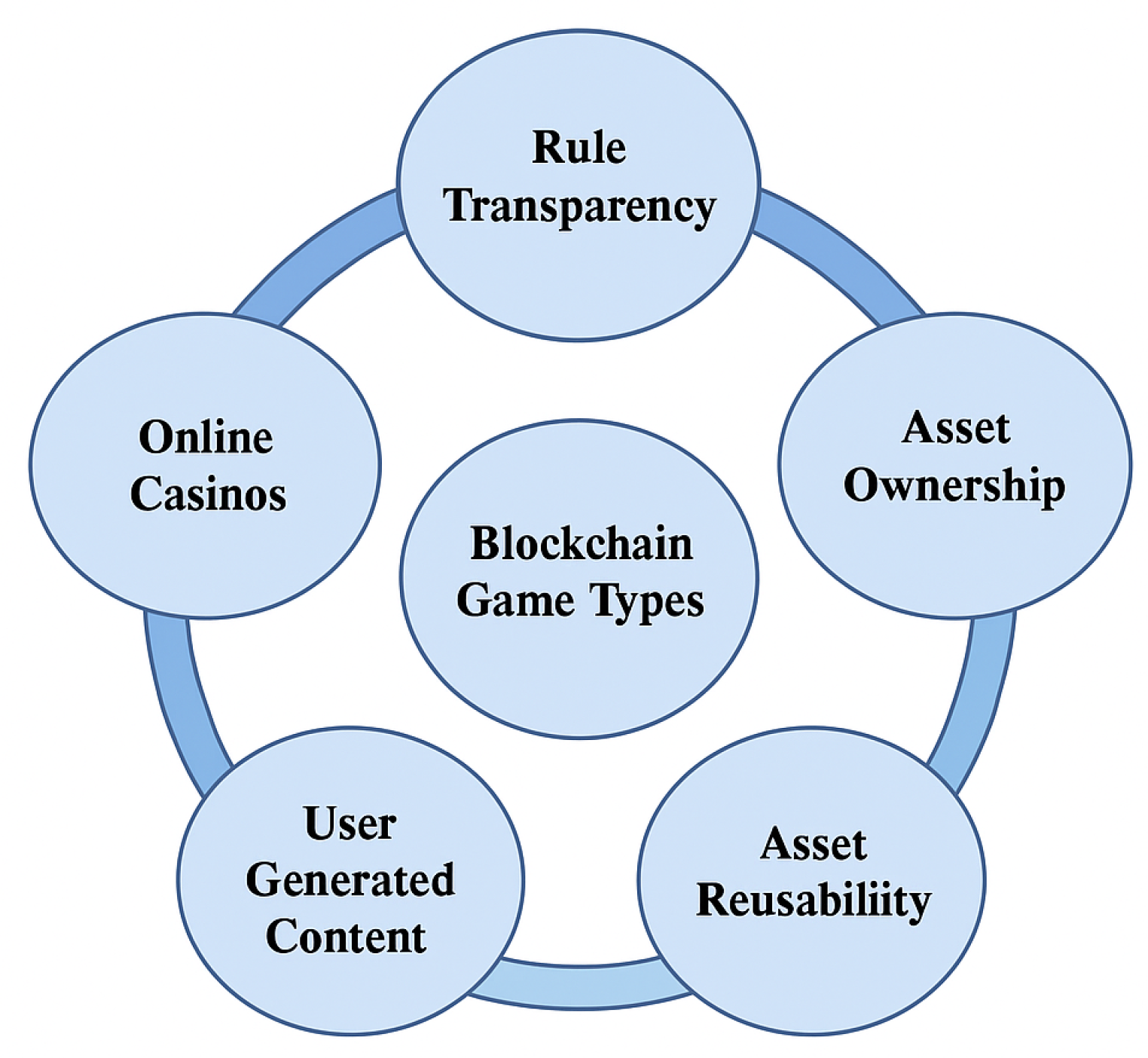

3.1. Classification of Blockchain Games

Various blockchain-based gaming models are being developed to transform conventional digital gaming ecosystems. As illustrated in

Figure 6, these models can be classified into five major categories: rule transparency, asset ownership, asset reusability, user-generated content, and online casinos.

3.1.1. Rule Transparency

Traditional gaming systems often store game rules on centralized servers, limiting player access and auditability. In contrast, blockchain technology enhances transparency by encoding rules in smart contracts that are publicly accessible and verifiable. This auditability fosters trust and operational fairness [

105]. By enabling provably fair gameplay, decentralized governance, and immutable rule enforcement, blockchain-based games can build strong user confidence and attract a broader player base.

3.1.2. Asset Ownership

In conventional games, virtual properties such as characters, credits, and items are stored and controlled by central game operators. Blockchain gaming shifts this paradigm by granting players verifiable ownership of in-game assets. Through tokenization, these assets can be securely traded, exchanged, or monetized across different platforms, enhancing liquidity and enabling new profit models for both users and developers [

106]. Non-fungible tokens (NFTs) ensure asset authenticity and transferability, allowing players to retain value beyond individual games.

3.1.3. Asset Reusability

The open and interoperable nature of blockchain enables digital assets, often represented as NFTs, to be reused across multiple games. This allows developers to create gaming ecosystems where characters, weapons, or items maintain value and utility beyond a single game instance [

107]. Asset reusability increases user engagement by extending asset lifespans and enhancing cross-game economic dynamics, thereby encouraging sustained participation.

3.1.4. User-Generated Content (UGC)

Unlike traditional game models where content creation is tightly controlled, blockchain technology empowers players to produce, own, and monetize content within decentralized gaming ecosystems. This approach encourages innovation and creativity while ensuring fair attribution and compensation [

108]. By securing creator rights through tokenization, blockchain fosters a vibrant community-driven environment where players and developers collaboratively shape gaming experiences.

3.1.5. Online Casinos

Blockchain is also transforming the online gambling industry by integrating cryptocurrencies and decentralized infrastructure. Bitcoin and other digital assets allow real-money investment in virtual gaming environments, while smart contracts and decentralized random number generators (RNGs) ensure fairness and transparency [

109]. Blockchain-based casino platforms offer enhanced security, provably fair mechanics, and rapid transaction settlements. These improvements strengthen trust and appeal, making such platforms more attractive to players and investors alike.

3.2. Mass Adoption of Blockchain in the Gaming Industry

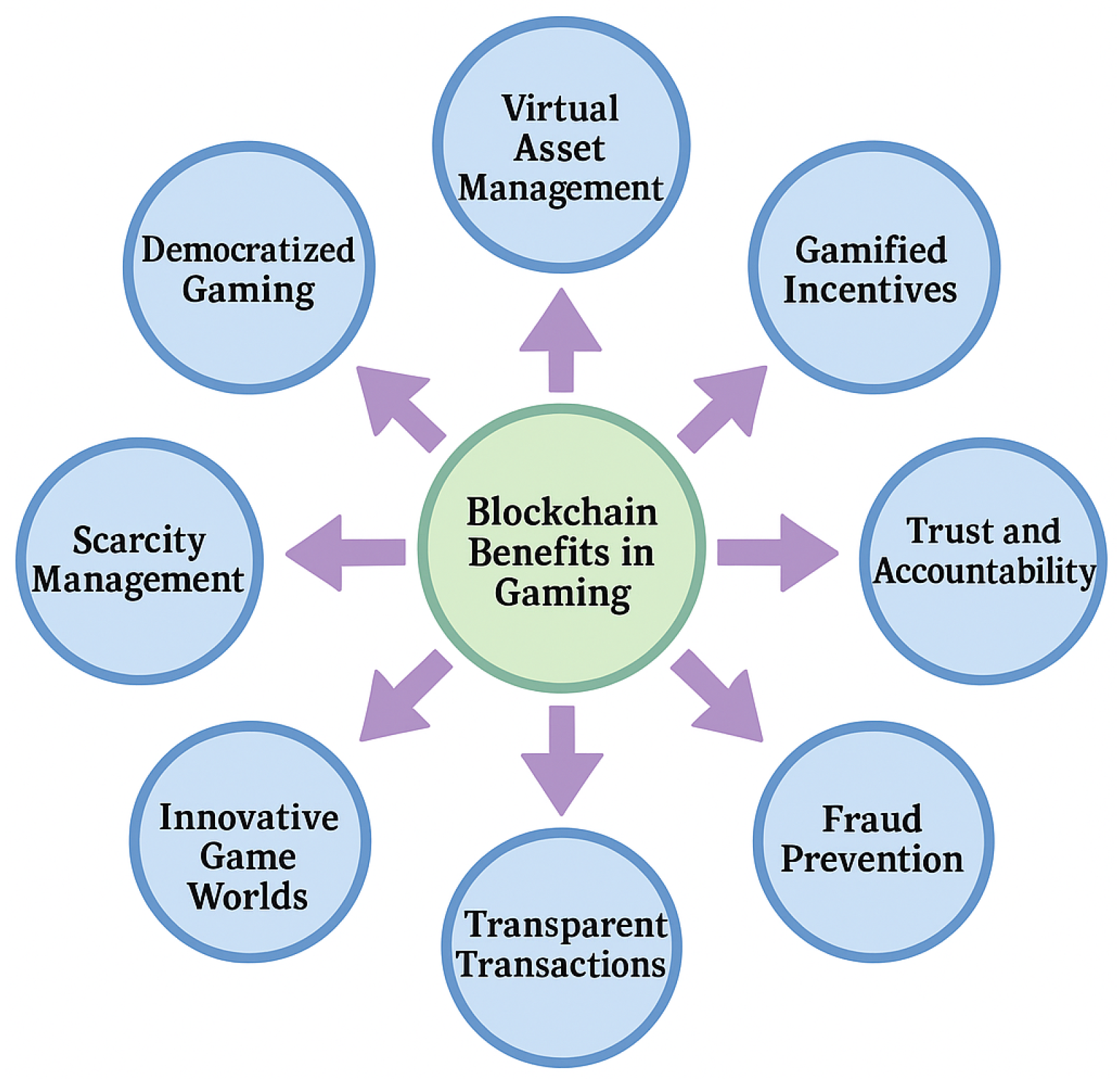

As the blockchain-enabled gaming industry shifts its focus to in-game assets, this transformative technology addresses critical challenges such as fraud prevention, scarcity management, and gamified incentives through the use of highly transferable digital assets across various platforms. Incorporating blockchain into gaming brings significant benefits, paving the way for its universal adoption [

110].

Figure 7 illustrates the potential benefits of blockchain mass adoption in gaming.

By adopting blockchain in gaming, players can monetize their time, skills, and efforts, creating gamified incentive models. For example, players may earn rewards in the form of cryptocurrencies, weapons, avatars, skins, and coins. Blockchain also enables players to retain full ownership of their digital assets, facilitating virtual asset management and allowing secure trade or transfer across platforms.

Furthermore, blockchain contributes to democratized gaming by enabling global participation in game-related economic opportunities. This aligns with blockchain’s decentralization ethos, making gaming more inclusive and accessible [

111]. It also introduces new forms of interaction, empowering players to control virtual assets and engage in real-world economic activity within game ecosystems.

The gaming industry is rapidly evolving, and blockchain is transforming it into a dynamic, decentralized application environment. Players, often early adopters of cryptocurrencies, are already familiar with virtual currencies, making them well-positioned to embrace blockchain integration [

112]. Blockchain-based architectures offer the potential to support expansive virtual environments by addressing longstanding challenges in traditional gaming, such as limited asset traceability and weak integration with the Internet of Things (IoT). Augustin et al. [

113], in their analysis of Decentraland, highlight how blockchain enables user-generated content and asset management in the Metaverse, contributing to more transparent and traceable digital ownership structures.

The non-fungible characteristics of blockchain, implemented through smart contracts, provide advantages such as enhanced trust, fraud resistance, transparent transactions, and improved scarcity control. While the integration of blockchain into gaming continues to evolve, current evidence suggests it can redefine gaming from a purely recreational activity into a secure and economically meaningful system of virtual asset ownership [

25].

3.3. Challenges of Blockchain Adoption in Gaming

The global adoption of blockchain in gaming continues to face several real-world challenges. A primary obstacle is the general lack of awareness and understanding regarding how blockchain technology functions and how crypto assets are utilized within gaming environments [

111]. Although interest in blockchain-powered gaming is increasing, many players and developers remain unfamiliar with its practical advantages and implications. Regulatory uncertainty surrounding cryptocurrencies and NFTs further deters widespread participation, especially in jurisdictions where digital assets are poorly understood or restricted. In addition, inadequate internet infrastructure in developing regions and language-related barriers within gaming interfaces hinder accessibility. As a result, blockchain gaming remains an emerging domain that must overcome multiple adoption barriers before achieving mainstream success.

3.3.1. Technical Challenges

Technical challenges in blockchain gaming stem from both infrastructure limitations and system design complexities. Among these, scalability-related issues, such as high transaction fees, latency, and low throughput, are particularly critical. These constraints undermine gameplay responsiveness and overall user experience, reflecting broader scalability concerns observed across blockchain systems. As Zhou et al. note, increased user activity can overwhelm network capacity, leading to delayed transaction processing and gameplay lag, both of which detract from the seamless responsiveness expected in modern games [

114].

Integrating blockchain with conventional gaming platforms also presents hurdles related to interoperability and technical alignment. These challenges primarily result from architectural mismatches between blockchain technologies and traditional game development environments. Most widely used game engines lack native support for decentralized asset models or smart contract execution, making integration complex [

115]. Likewise, mainstream distribution platforms often restrict blockchain features such as NFTs or cryptocurrency-based transactions, limiting deployment options. Furthermore, traditional account systems do not support decentralized identity frameworks or wallet connectivity, complicating secure asset management and cross-platform compatibility [

116]. Collectively, these limitations hinder the seamless incorporation of blockchain into existing gaming infrastructure and slow the adoption of decentralized models within mainstream ecosystems.

Ensuring a secure and user-friendly gaming experience while maintaining decentralization remains a key challenge. A persistent barrier is the need for players to create and manage crypto wallets for in-game assets. These wallets differ in design, functionality, and security, often posing usability challenges for new users. Player interaction also requires attention: although many blockchain gaming models incentivize activity with tokens, current feedback and reward systems are often ineffective, reducing engagement. Finally, the global gaming market is increasingly competitive, driven by mobile expansion and the rise of decentralized applications, which adds further pressure on developers aiming to implement blockchain across diverse gaming formats [

117].

3.3.2. Asset Management and Payment Challenges

Blockchain technology promises efficient control over players’ virtual assets through transparency and decentralization. However, managing these assets and processing payments remains challenging due to competition among various gaming platforms and ecosystems. While asset ownership and exchangeability are notable advantages for blockchain-based gamers, effective asset management is hindered by fragmented standards and inter-industry rivalry. Reward distribution presents an additional obstacle: although blockchain’s immutable ledgers can reliably record in-game transactions, current models lack robust, scalable mechanisms for automated and fair reward provisioning.

3.3.3. Security and Privacy Challenges

Security concerns remain prominent in blockchain gaming, particularly in models requiring linkability between player identities and blockchain addresses, which raises significant privacy issues [

118]. Although the immutable nature of blockchain offers a secure foundation, both web interfaces and smart contracts are still exposed to vulnerabilities. Blockchain-based games do protect virtual assets against duplication, theft, and tampering, yet the openness and decentralization of these systems also increase their attack surface. At the protocol level, smart contracts have the potential to democratize governance within gaming ecosystems. However, these contracts are susceptible to exploitation, underscoring the need for robust and proactive security measures to support safe and scalable blockchain gaming adoption.

3.3.4. Regulation Challenges

The rapid pace of blockchain innovation in gaming has outstripped the development of appropriate regulatory frameworks. Many blockchain gaming platforms employ cryptocurrencies such as Bitcoin to bypass regulatory constraints typical of traditional financial systems [

93]. However, this circumvention raises critical concerns about legal compliance, investor protection, and systemic stability. Regulatory ambiguity presents a barrier to entry for mainstream developers and investors. Furthermore, public understanding of blockchain’s intricacies remains limited, reducing trust and slowing adoption. Addressing these regulatory and awareness challenges is essential to unlocking the full potential of blockchain-based gaming models.

3.4. Evaluation of Adoption Risks of Blockchain in Gaming

The game server plays a central role in blockchain gaming architecture, functioning as an index engine, while smart contracts store substantial amounts of game logic and rules. Different blockchain gaming models employ varied smart contracts and governance protocols, which adds complexity to risk evaluation. The unpredictable state, openness, randomness generation, and timing constraints inherent to blockchain systems introduce additional risks to gaming applications [

119]. Evaluating these adoption risks is essential, given the persistent challenges the industry faces, namely scalability limitations, regulatory uncertainty, and security vulnerabilities. Understanding these risks is crucial for developers and stakeholders seeking to implement blockchain technology in gaming. A well-informed approach enables the development of strategies that enhance adoption potential while minimizing significant drawbacks. These risks can be broadly classified into three categories: consensus mechanism risks, smart contract risks, and web-related risks.

3.4.1. Consensus Mechanism Risks

A consensus mechanism is a rule-based protocol that ensures all participants in the blockchain gaming network adhere to agreed-upon rules [

120]. However, these mechanisms are susceptible to several security risks, including 51% attacks, long-range attacks, distributed denial of service (DDoS) attacks, and balance attacks. In a 51% attack, malicious actors gain control of over 51% of the network’s hashing power, enabling them to manipulate consensus protocols. Rather than attacking the current chain directly, they may exploit block information to alter network behavior.

Long-range attacks arise due to weak subjectivity in blockchain networks and, unlike 51% of attacks, typically rely on access to the genesis block rather than a few recent blocks. DDoS attacks aim to deny legitimate players access to gameplay services by leveraging a network of compromised nodes, often to monopolize rewards. Balance attacks target nodes with roughly equal mining power and are particularly relevant in proof-of-work consensus protocols that are vulnerable to double-spending exploits.

3.4.2. Smart Contract Risks

Smart contract risks in blockchain gaming arise when attackers inject malicious actions into contract execution. Common attack types include misuse of the tx.origin variable, integer overflow and underflow, use of predictable variables, denial of service (DoS), and re-entry vulnerabilities [

121]. The tx.origin variable returns the address that initiated a transaction. Some game developers mistakenly use it for authentication. In such cases, a malicious actor may deceive a player into interacting with an intermediary contract, which then exploits the target contract’s trust in tx.origin to bypass authentication. Integer overflow and underflow are serious vulnerabilities where numerical values exceed their limits. For example, if a value surpasses the maximum allowable number, it resets to zero, which can be exploited to manipulate game states or balances.

Certain smart contracts depend on predictable variables, such as timestamps or block heights. These can be exploited to manipulate game outcomes. For instance, in blockchain casino games, an attacker might use timestamps to predict random number generation and increase their chances of winning. Denial of service attacks often exploit fallback functions or revert mechanisms. An attacker may introduce infinite loops or force repeated reverts, thereby disrupting gameplay or halting core operations of the gaming network. Re-entry is another critical vulnerability, where an external contract repeatedly calls back into the original contract before previous operations are completed. This can allow an attacker to drain assets or interfere with game logic. While the specifics vary between gaming models, any external call during contract execution poses a potential risk and requires robust mitigation strategies.

3.4.3. Web Risks

Web-related security vulnerabilities in blockchain gaming primarily target player wallets and centralized game servers. These include cookie replay, injection attacks, cross-site scripting (XSS), and authentication broking [

122]. A comparative analysis of these web risks alongside consensus and smart contract risks is summarized in

Table 7.

In cookie replay attacks, malicious actors generate cookies without security flags, exploiting HTTP response timing to hijack sessions. While players can enable security flags within game applications, this is often optional, leaving systems exposed. Injection attacks are another major threat. Due to numerous input fields and complex user interaction paths in blockchain games, attackers can inject malicious payloads, such as environment variables or parameters targeting internal or external web services.

XSS remains one of the most common vulnerabilities in web applications. Despite the existence of filters, many sites still fail to fully protect against these attacks. Successful XSS exploits can be used to access users’ private keys and compromise wallet security. Authentication broking involves gaining unauthorized access through brute force or social engineering. Poor session management and weak password policies further increase the risk of broken authentication in blockchain-based games.

3.5. Solutions and Research Directions for Blockchain Adoption in Gaming

Blockchain technology holds transformative potential for the gaming industry through enhanced security, increased transparency, and innovative models of digital ownership. To facilitate wider adoption, current solutions and future research directions primarily target persistent challenges related to scalability, security, and regulatory compliance. Addressing these barriers involves the development of novel or optimized consensus mechanisms, the design of secure and auditable smart contracts, and the promotion of interoperability across platforms and networks. These initiatives are central to enabling efficient, transparent, and user-friendly blockchain-based gaming environments capable of supporting large-scale adoption. The following sections outline key solutions and research directions aimed at overcoming these challenges and advancing the integration of blockchain into mainstream gaming ecosystems.

3.5.1. Multi-Currency Wallet Design

Blockchain-driven gaming platforms commonly support multiple cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, to manage in-game assets and player wallets [

123]. However, the development and maintenance of multi-currency wallets introduce significant technical and user experience challenges. It is essential to define the project scope clearly, taking into account the needs of players and the specific cryptocurrencies most relevant to their gaming experience. Multi-currency wallets should prioritize convenience, usability, and robust security. The selected cryptocurrencies must align with player expectations and be intuitive for mainstream adoption.

3.5.2. Player–Industry Interactions

Effective interaction between players and the gaming industry is crucial for enhancing engagement and financial outcomes. User-friendly interfaces and responsive feedback mechanisms can significantly improve player participation and foster collaborative experiences [

124]. Game designs that promote interaction, such as community-driven challenges or cooperative modes, can enhance the value exchange between users and developers. Strategic planning during the design phase, including feedback loops and interaction incentives, can strengthen trust and expand the user base.

3.5.3. Asset Ownership and Payments

Blockchain enables verifiable ownership of in-game assets and supports decentralized payment mechanisms. However, implementing these features across diverse game models introduces design and operational complexities. Non-fungible tokens (NFTs) offer a compelling solution for enabling unique asset ownership in gaming environments [

125]. Additionally, play-to-earn (P2E) models provide players with real-world financial rewards for participation, creating further incentives. Ensuring immutable asset ownership also enhances the reliability and traceability of payments [

126]. Future directions should focus on integrating incentive systems with secure, scalable payment mechanisms to ensure sustainability.

3.5.4. Security and Privacy

Although blockchain provides inherent security advantages, threats related to smart contracts, consensus algorithms, and interface design persist. Enhancing security and privacy mechanisms is essential for protecting players and in-game assets [